EXHIBIT 99.1

| High Growth From Unique Technology March 2003 |

| James Hardie Predecessor company established 1888 Listed on ASX 1951 Paid a dividend every year Developed fibre cement 1980s - world first Entered USA market late 1980s Restructured for growth 1996 - 2002 The World Leader In Fibre Cement |

| James Hardie Annual turnover US$800m Total assets US$800m 21 operations in 6 countries 2,400 employees Market cap US$1.6 billion (A$3 billion) ASX Top 50 company NYSE listed ADRs An Emerging Growth Company |

| Global Potential Net Sales (US$ million) FY03 YTD Asia Pacific (25%) USA (74%) Other (1%) |

| Focussed on Fibre Cement High growth Unique proprietary technology Sustainable competitive advantage Strong cashflows and balance sheet Low cyclical risk Strong execution through relentless will to win Attractive Investment Attributes |

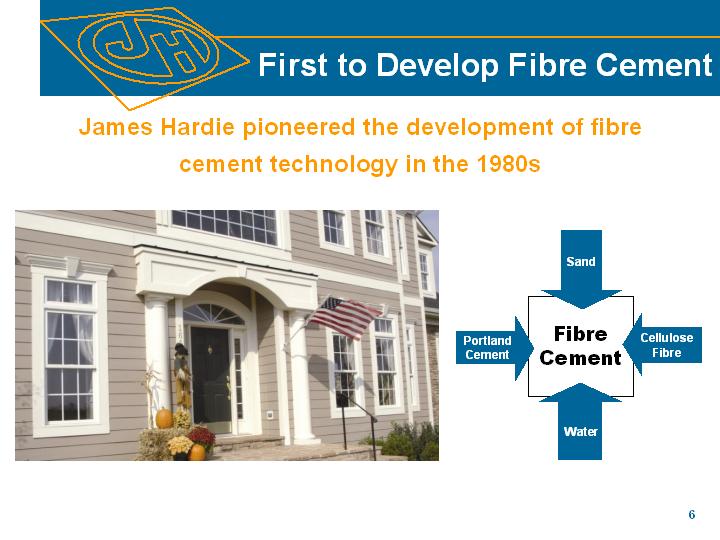

| First to Develop Fibre Cement James Hardie pioneered the development of fibre cement technology in the 1980s Fibre Cement Sand Cellulose Fibre Water Portland Cement |

| Many Product Applications External siding/soffit lining Internal wall/floor wet area lining Trim and fascia Ceiling lining and flooring External/internal wall systems Partitioning Commercial facades Decorative columns Fencing Drainage pipes |

| Unique Technology and Scale Sustainable Competitive Advantage Unique plant engineering and proprietary process technology and product formulations Superior capital cost efficiency - plant capital cost 1/2 that of competitors Largest, lowest cost manufacturer - plant operating cost 20-30% lower than competitors Only national producer in each market Superior economies of scale - plants 2-3 times larger than competitors Unique differentiated products, widest range and strongest brand |

| Capabilities and resources 120 scientists, engineers and technicians 30% increase in spend to US$21 million in FY03 - 3% of sales Core projects new proprietary engineered raw materials new proprietary product formulations new engineering and proprietary process technologies lightweight and durable products for all climates Creating the Future R&D is a Key Driver of Growth |

| Vision and Strategy Aggressively grow the market for fibre cement Secure differentiated positions by leveraging: technology products scale cost market position brand recognition Targets - rapid growth, high volume, largest share Sustain attractive margins Industry Leadership and Profitable Growth |

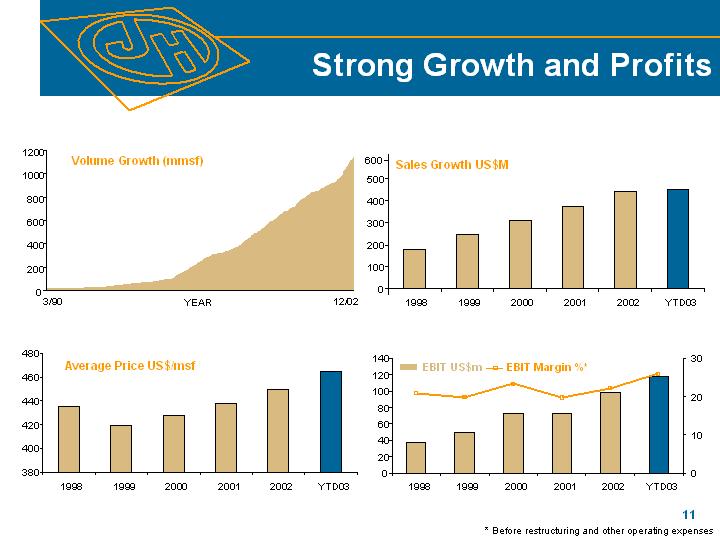

| Strong Growth and Profits * Before restructuring and other operating expenses 1000 1200 Volume Growth (mmsf) 0 200 400 600 800 3/90 12/02 YEAR Average Price US$/msf 380 400 420 440 460 480 1998 1999 2000 2001 2002 YTD03 Sales Growth US$M 0 100 200 300 400 500 1998 1999 2000 2001 2002 YTD03 600 0 20 40 60 80 100 120 140 1998 1999 2000 2001 2002 YTD03 0 10 20 30 EBIT US$m EBIT Margin %* |

| Largest and Lowest Cost James Hardie has a unique advantage in North America - the largest framed construction market in the world Plant Locations Flat Sheet Plants Capacity (mmsf) Fontana, California 180 Plant City, Florida 300 Cleburne, Texas 500 Tacoma, Washington 200 Peru, Illinois 400 Waxahachie, Texas 360 * Blandon, Pennsylvania 200 * Summerville, South Carolina 190 Flat Sheet Total 2,330 FRC Pipe Plant Plant City, Florida 100,000 tons Plant Capacity *Upgrade in progress - includes capacity being added Tacoma, WA Fontana, CA Plant City, FL Waxahachie, TX Cleburne, TX Peru, IL Blandon, PA Summerville, SC |

| High Category Share - Low Market Share USA - Total Siding Market Share 1994 Fibre Cement 1% Hardboard 13% Brick 9% Stucco 8% Cedar 7% OSB 7% Plywood/Other 6% Masonry 3% Vinyl 46% 2002 Brick 8% Stucco 7% Masonry 2% Hardboard 9% Fibre Cement 13% OSB 3% Plywood/Other 3% Cedar 5% Aluminium 1% Vinyl 49% |

| Superior Product Performance Fibre Cement is more durable than wood and engineered wood Fibre Cement Superior Durability Moisture Resistant Fire Resistant Weather Resistant Termite Proof Won't Warp Won't Crack Won't Rot Holds Paint Longer Won't Delaminate ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Engineered Wood |

| Superior Product Performance Fibre Cement looks and performs better than vinyl Vinyl Fire Resistant Hail Resistant Wind Resistant Won't Warp Won't Buckle Colour Lasts Longer Strong and Rigid Expands/Contracts Withstands Impact Dimensional Stability Won't Blister Won't Crack ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Fibre Cement |

| Superior Product Performance Sky Gray Natural Cedar Oak Brown Pewter Gray Chestnut Brown Sandstone Khaki Brown Monterey Gray Seclusion Sky Gray ColorPlusTM pre-painted siding Helps take share from vinyl Lifts selling prices Lifts margins |

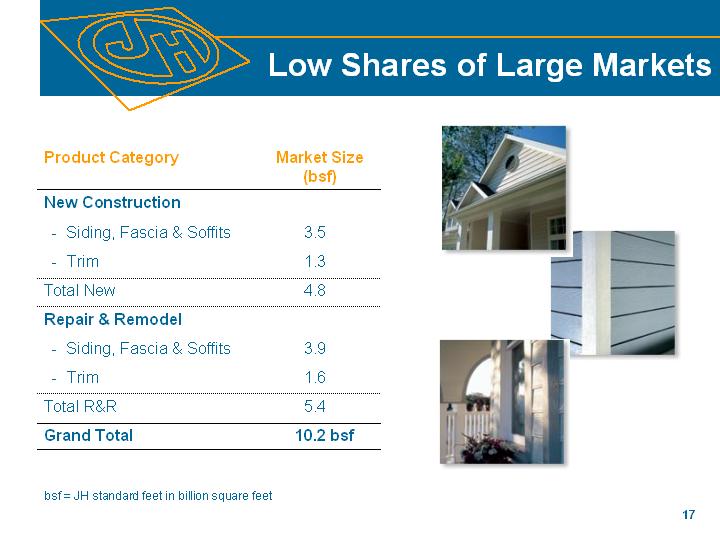

| Low Shares of Large Markets Product Category Market Size (bsf) New Construction - Siding, Fascia & Soffits 3.5 - Trim 1.3 Total New 4.8 Repair & Remodel - Siding, Fascia & Soffits 3.9 - Trim 1.6 Total R&R 5.4 Grand Total 10.2 bsf bsf = JH standard feet in billion square feet bsf = JH standard feet in billion square feet |

| 8% Market Growth - R&R Growing Faster USA Exterior Products Market 10.2 bsf Repair & Remodel 53% Repair & Remodel 53% New Construction 47% James Hardie - Sales Mix New vs R&R New Construction 80% Repair & Remodel 20% James Hardie - Sales Mix New vs R&R New Construction 70% Repair & Remodel 30% 2002 USA Exterior Products Market 11.0 bsf Repair & Remodel 55% New Construction 45% 2007 |

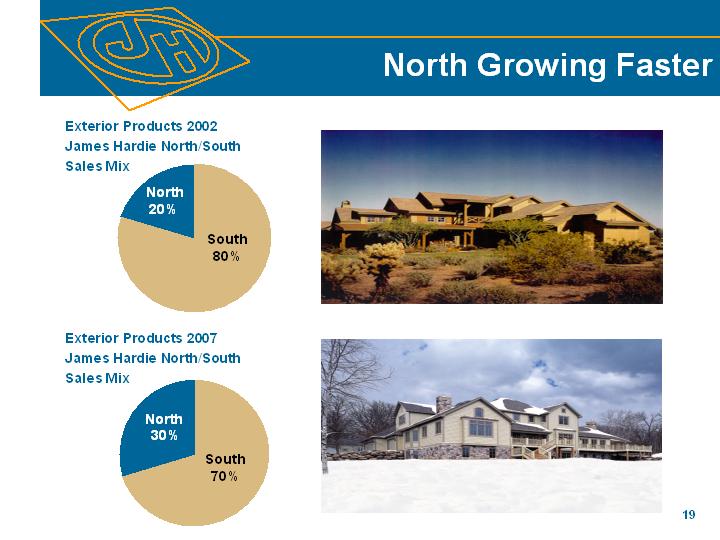

| North Growing Faster Exterior Products 2007 James Hardie North/South Sales Mix South 80% North 20% Exterior Products 2002 James Hardie North/South Sales Mix North 30% South 70% |

| Overall Share Could Double in 5 Years 2002 James Hardie Share USA Exterior Products Market 10.2 bsf 2007 James Hardie Share USA Exterior Products Market 11.0 bsf James Hardie 11% Other 89% James Hardie 20% Other 80% |

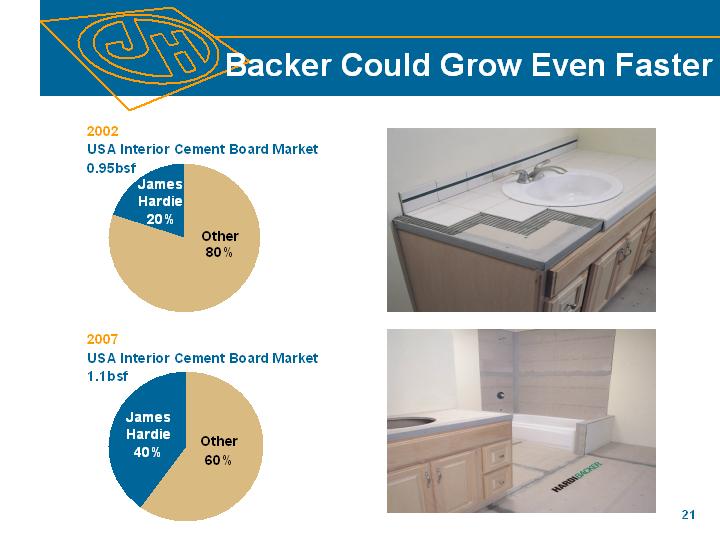

| Backer Could Grow Even Faster 2002 USA Interior Cement Board Market 0.95bsf 2007 USA Interior Cement Board Market 1.1bsf James Hardie 20% Other 80% James Hardie 40% Other 60% |

| Australia/New Zealand Grow the market Increase category share Higher value differentiated products Streamline the organisation Simplify the business Lower delivered cost Lower SG&A Improve quality consistency High performance culture Increase revenue and margins |

| Philippines and Asia Manufacturing plant commissioned 1999 YTD03 sales US$13.2 million Fibre cement as substitute for plywood 26% domestic market share Exports to Korea, Taiwan and Hong Kong Establishing low cost regional manufacturing hub New Growth Horizons |

| Chile and South America Manufacturing plant commissioned 2001 Low cost manufacturing, rapid market penetration From zero base, our target is market leadership 20% + share already achieved Longer term, regional business planned in South America Targeting US$100 - US$200 million in sales in the long term New Growth Horizons |

| Pipes USA manufacturing plant commissioned 2001 Product has advantages over reinforced steel concrete pipes Lower cost to make and install Long term targets national business 4-5 manufacturing plants large share of US$2 billion market New Growth Horizons |

| Roofing New Growth Horizons USA market entry planned Development of fibre cement roofing technology US roofing market 11 bsf (US siding market 10.2 bsf) Initial target market 1.5 bsf to compete with wood shake superior durability and fire performance US$12m pilot plant being commissioned |

| Longer Term Worldwide trend towards lightweight, framed construction and more energy-efficient materials Fibre cement replacing asbestos cement in the global cement board market (still 2/3rds asbestos cement) Wood based products becoming more expensive Oil based products (vinyl) becoming more expensive Long term trends support further strong growth of fibre cement New Growth Horizons |

| High Growth and Attractive Returns Targeted Long Term Financial Targets Revenue growth > 15% p.a. EBIT Margins > 15% ROA > 15% |

| Disclaimer This presentation contains forward-looking statements. Words such as "believe,'' "anticipate,'' "plan,'' "expect,'' "intend,'' "target,'' "estimate,'' "project,'' "predict,'' "forecast,'' "guideline,'' "should,'' "aim'' and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors, which are further discussed in our reports submitted to the Securities and Exchange Commission on Forms 20-F and 6-K and in our other filings, include but are not limited to: competition and product pricing in the markets in which we operate; general economic and market conditions; compliance with, and possible changes in, environmental and health and safety laws; dependence on cyclical construction markets; the supply and cost of raw materials; our reliance on a small number of product distributors; the consequences of product failures or defects; exposure to environmental or other legal proceedings; and risks of conducting business internationally. We caution you that the foregoing list of factors is not exclusive and that other risks and uncertainties may cause actual results to differ materially from those contained in forward-looking statements. Forward-looking statements speak only as of the date they are made. |

| High Growth From Unique Technology March 2003 |