| |

|

|

|

|

For media enquiries please contact James Rickards on |

|

|

Tel: 61 2 8274 5304 Mob: 0419 731 371. For |

|

|

investor/analyst enquiries please contact Steve Ashe on |

|

|

Tel: 61 2 8274 5246 or Mob: 0408 164 011 |

21 December 2004

James Hardie signs Heads of Agreement

James Hardie Industries NV (JHINV) today announced it had signed a Heads of Agreement with the

Australian Council of Trade Unions (ACTU), Unions New South Wales, asbestos support groups and the

New South Wales Government, to provide long-term funding of asbestos related personal injury claims

against former JHINV companies. James Hardie made a voluntary funding proposal to the Jackson

Commission in July 2004 and is pleased to have now reached agreement on the principles on which

James Hardie will provide voluntary funding. These include:

| |

• |

|

the establishment of a Special Purpose Fund (SPF) to compensate asbestos victims; |

| |

| |

• |

|

initial funding of the SPF by James Hardie on the basis of the November 2004 KPMG

Actuaries’ report (which provided a net present value central estimate of $1.5 billion in

present and future claims at 30 June 2004). The actuarial assessment is to be updated

annually; |

| |

| |

• |

|

a two year rolling cash ‘buffer’ in the SPF and an annual contribution in advance based

on actuarial assessments of expected claims for the next three years, revised annually; |

| |

| |

• |

|

a cap on the annual James Hardie payments to the SPF, initially set at 35% of annual net

operating cash flow of the JHINV Group for the immediately preceding financial year, with

provision for the percentage to decline over time depending on James Hardie’s financial

performance and the claims outlook; and |

| |

| |

• |

|

no cap on individual payments to proven claimants. |

The Heads of Agreement will form the basis of a Principal Agreement to be settled between JHINV and

the NSW Government which, in turn, will require the support of JHINV’s lenders and shareholders.

The Principal Agreement is to be a legally binding agreement.

Based on KPMG Actuaries’ assessment and expectations of James Hardie’s future financial

performance, the arrangement is intended to allow payments to be made by the SPF to all future

proven claimants against the former James Hardie subsidiaries for asbestos-related diseases.

However, it should be recognised that because the number of claimants and the amounts that the

courts may award is uncertain and James Hardie may not perform as currently projected, no absolute

assurance on this can be given.

James Hardie has already paid out some A$450 million in asbestos compensation. No legitimate

claimant to date has gone unpaid.

JHINV Chairman Meredith Hellicar said: “The ACTU, NSW Government and asbestos support groups have

worked with James Hardie to reach an agreement which we believe is in the best interests of

claimants, shareholders, employees and all other stakeholders.

“All parties involved in the recent negotiations have agreed it is in the interests of asbestos

claimants that James Hardie is, and remains, financially strong and able to continue to fund its

growth. The proposed funding arrangements allow this and James Hardie will be able to continue to

successfully grow its business.”

Ms Hellicar said the agreement was an important first step towards rebuilding the reputation of

James Hardie over the coming months and years.

“I regret any stress caused to asbestos disease sufferers and their families by the

unintentional funding shortfall of the MRCF, and hope that this announcement will ease the concern

of those sufferers and their families.

“I also commit myself to the task of rebuilding the reputation of James Hardie over the coming

months and years for the sake of our many employees, customers, shareholders and other

stakeholders.

“This agreement follows the original intention of the Board of James Hardie in setting up the

Medical Research and Compensation Foundation (MRCF) to properly fund the MRCF. It is expected to

provide claimants and their families with assurance that their claims will be met, based on all of

the data and estimates available to us.

“It is an historic agreement and our commitment reflects the fact — corroborated by the findings of

Commissioner Jackson — that James Hardie did not restructure its affairs nor move to the

Netherlands to avoid liability for asbestos claims. The Board is pleased with this agreement and

looks forward to finalising the Principal Agreement and taking it to our lenders and shareholders

for their consideration.”

Ms Hellicar said that the company and the NSW Government will now move to settle the terms of the

Principal Agreement whilst waiting on the outcome of the NSW Government’s Review of Legal and

Administrative Costs in Dust Diseases Compensation Claims. This Review is expected to have a

significant impact on the financial strength of the proposed Special Purpose Fund and the

affordability and sustainability of James Hardie’s funding proposal.

End

A briefing on the Heads of Agreement follows.

2

Heads of Agreement — Briefing

This document provides key facts about the Heads of Agreement reached between James Hardie

Industries NV (JHINV), The Australian Council of Trade Unions (ACTU), Unions New South Wales,

asbestos support groups and the New South Wales Government.

Before the funding arrangement can be finalised, the NSW Government Review of Legal and

Administrative Costs in Dust Diseases Compensation Claims (announced on 18 November 2004) will need

to be completed and considered and any resulting reforms adopted. James Hardie will need lender and

shareholder approval of the funding arrangement.

Key Principles

The two key principles underlying the Heads of Agreement are:

| |

1) |

|

James Hardie will provide funding on a long-term basis to a Special Purpose Fund which

will be applied to paying proven claims now and into the future, and in dealing with

claims; and |

| |

| |

2) |

|

That to achieve this, James Hardie has to remain profitable and strong and be able to

continue to successfully grow its business. |

The Heads of Agreement includes the following key financial terms:

Special Purpose Fund

| • |

|

A Special Purpose Fund (SPF) will be created to

compensate proven asbestos claimants. A majority of

directors of the SPF will be appointed by James Hardie. |

Annual Actuarial Assessment

| • |

|

There will be an annual actuarial assessment of the

liabilities of the SPF in order to take into account the

uncertainties associated with actuaries’ projections.

This will enable the projections to be regularly updated

in line with the actual claims experience and claims

outlook. |

| • |

|

Subject to the Annual Cash Flow Cap described below,

James Hardie will make contributions to the SPF based on

these annual actuarial assessments. |

Buffer

| • |

|

Subject to the Annual Cash Flow Cap described below, at

the start of each year James Hardie will ensure that the

SPF has a two-year rolling cash “buffer” and one year’s

contribution based on the annual actuarial assessment of

expected claims for the next three years. |

| • |

|

Assuming legal costs as a percentage of compensation paid

to claimants (currently running at approximately 36%)

fall to 20% over a three year period, the initial three

year amount is expected to be $239 million (based on KPMG

Actuaries’ estimate of liabilities as at 30 June 2004).

The contribution by James Hardie in the year ending 31

March 2006 will be reduced by assets to be contributed by

the Medical Research and Compensation Foundation which

are expected to be approximately $125 million. As

anticipated payments during the first three years of the

SPF are expected to exceed the Annual Cash Flow Cap

described below, James Hardie |

3

| |

|

expects to make an additional net payment of approximately $22 million in the year ending 31

March 2006 to cover the period to 31 March 2008. |

| • |

|

This means that (subject to the Annual Cash Flow

Cap) there should be a maximum of three years’

funding available in the SPF at the start of

each year which, during the course of the year,

should reduce to an estimated two years of

funding as claims are recognised and paid out.

The funding will then be topped up by James

Hardie (subject to the operation of the Annual

Cash Flow Cap) at the start of the next year so

that it again represents three years of

projected claims based on the then current

annual actuarial assessment. This dynamic

structure should provide greater security to

present and future claimants as the SPF should

be better able to reflect changes in the

incidence of claims and/or changes in the

financial performance of James Hardie. |

Annual Cash Flow Cap

| • |

|

There will be a Cash Flow Percentage Cap

(“CFPC”) on the annual James Hardie payments to

the SPF in all years except the first year. It

is not intended that there will be any caps on

payments by the SPF to individual claimants.

The CFPC will be initially set at 35% of James

Hardie’s net operating cash flow for the

immediate preceding financial year. Net

operating cash flow for the purposes of the cap

will be equivalent to James Hardie’s cash flow

provided by operating activities as set out in

its audited accounts and will therefore be after

taxes, interest, changes in working capital and

asbestos claims payments. |

| • |

|

The 35% level is designed to ensure that all

proven claimants can be paid whilst preserving

the financial health and growth prospects of

James Hardie. All parties recognise that James

Hardie’s continuing success is crucial to the

long term security of the future payments.

However, because the number of claimants and the

amounts that the courts may award is uncertain

and James Hardie may not perform as currently

projected, no absolute assurance on this can be

given. |

Changes in the level of Annual Cash Flow Cap

| • |

|

After the year ending 31 March 2011, the Heads

of Agreement provides that the CFPC may reduce

in increments of 5% (to a floor of 10%),

provided that the annual contributions are, on

average, lower than the reduced CFPC level for

the four years preceding the reduction, and that

the CFPC cannot reduce by more than 5% in any

four year period. There is also provision for

the CFPC to increase in certain circumstances,

although never above 35% and never by more than

one increase of 5% above a previously reduced

cap level. |

| • |

|

The practical impact of the above cap, and

conditions for changes in the level of the cap,

is that the earliest that the CFPC could step

down would be to 30% in the year ending 31 March

2012, to 25% for 2016, to 20% for 2020, to 15%

for 2024 and to 10% for 2028 depending on the

claims experience, anticipated claims payments

and the financial performance of James Hardie. |

| • |

|

Based on current actuarial estimates (KPMG

Actuaries’ central estimate of liabilities of

$1.5 billion as at June 30 2004) and

expectations of James Hardie’s future financial

performance, the proposed caps are intended to

allow payments to claimants to be properly

funded and to have the benefit of a significant

contingency provision. |

4

Legal Costs

All parties to the negotiations recognise the importance of achieving substantial legal and

administrative cost savings in the claims management process in order to improve the financial

position of the SPF, and therefore the security of future claimants, over the long-term.

Legal and administrative costs incurred in asbestos claims against the former James Hardie

companies now owned by the MRCF have an estimated net present value of approximately $410 million.

This high level of costs (equivalent to 36% of payments projected to be paid to claimants by the

SPF) has a major adverse effect on the long-term strength of any funding proposal over the lengthy

time period proposed by James Hardie (at least 40 years but potentially as long as 70 years).

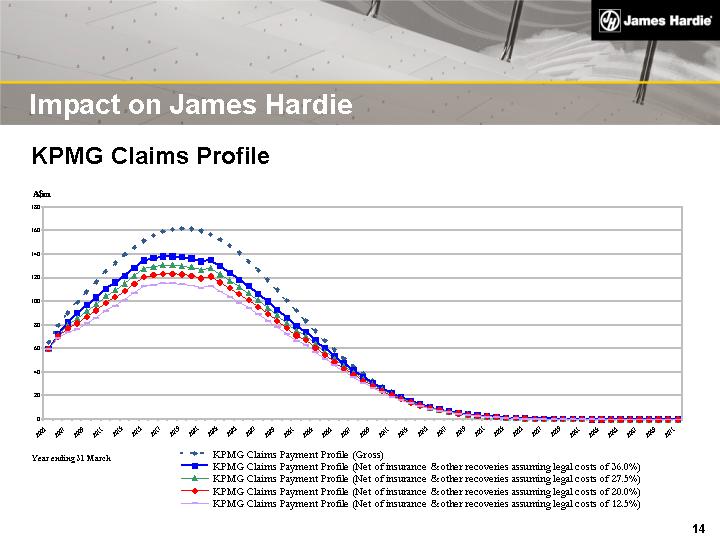

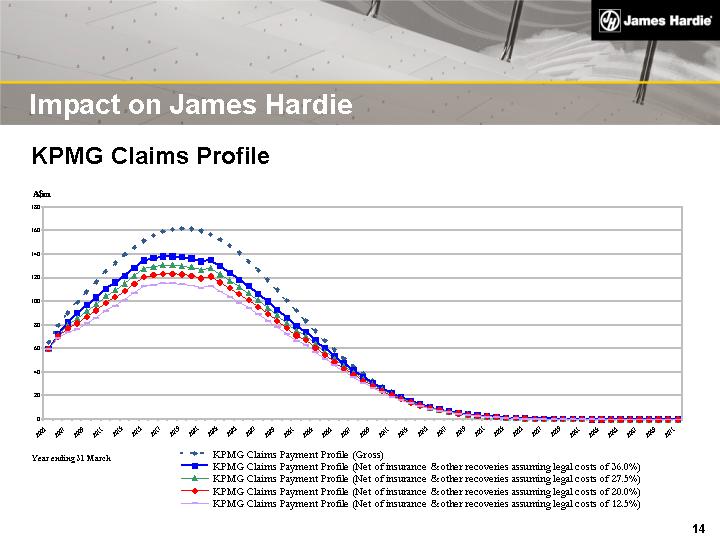

The expected claims (net of insurance and other recoveries) based on the KPMG Actuaries’ report as

at 30 June 2004 are set out below, together with the expected net claims assuming that legal costs

as a percentage of compensation paid to claimants is reduced from their extraordinarily high

current level of 36% to 27.5%, 20% and 12.5% per cent respectively.

For this reason, the outcome of the recently-announced NSW Government Review of Legal Costs and

Administrative Costs in Dust Diseases Compensation Claims is expected to have a critical impact on

the long-term financial strength of the proposed Special Purpose Fund and the affordability and

sustainability of James Hardie’s funding proposal.

Timetable

The Principal Agreement contemplated by the Heads of Agreement is expected to be finalised

shortly after the outcome of the NSW Government Review is known (anticipated to be in early

5

March 2005). Whereas the Heads of Agreement is non-binding, the Principal Agreement will be a

legally binding and enforceable Agreement.

Subject to an assessment by the Board of JHINV of the affordability of the funding arrangement in

light of the likely financial impact of any proposed reforms flowing from the NSW Government

Review, and subject to receiving the support of its lenders and the findings of an independent

expert’s report (commenting on whether the voluntary funding proposal is in the interests of JHINV

shareholders), the Board intends that shareholders consider the proposal at a general meeting,

expected to be held mid-2005.

End

Media Enquiries:

James Rickards

Telephone: 61 2 8274 5304

Mobile: 0419 731 371

Email: [email protected]

Facsimile: 61 2 8274 5218

Investor and Analyst Enquiries:

Steve Ashe – Vice President, Investor Relations

Telephone: 61 2 8274 5246

Mobile: 0408 164 011

Email: [email protected]

www.jameshardie.com

Disclaimer

This Company Statement contains forward-looking statements. We may from time to time make

forward-looking statements in our periodic reports filed with the Securities and Exchange

Commission on Forms 20-F and 6-K, in our annual reports to shareholders, in offering circulars and

prospectuses, in media releases and other written materials and in oral statements made by our

officers, directors or employees to analysts, institutional investors, representatives of the media

and others. Examples of such forward-looking statements include:

| |

• |

|

Statements based on KPMG’s actuarial analysis of future claims on which we have relied; |

| |

| |

• |

|

projections of our operating results or financial condition; |

| |

| |

• |

|

statements of our plans, objectives or goals, including those relating to

competition, acquisitions, dispositions and our products; |

| |

| |

• |

|

statements about our future economic performance or that of the United States,

Australia or other countries in which we operate; and |

| |

| |

• |

|

statements about product or environmental liabilities. |

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,”

“predict,” “forecast,” “guideline,” “should,” “aim” and similar expressions are intended to

identify forward-looking statements but are not the exclusive means of identifying such statements.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number

of important factors could cause actual results to differ materially from the plans, objectives,

expectations, estimates and intentions expressed in such forward-looking statements. These factors

include but are not limited to: all matters relating to or arising out of the prior manufacture of

asbestos by ABN 60 and certain former subsidiaries; competition and product pricing in the markets

in which we operate; general economic and market conditions; compliance with and possible changes

in environmental and health and safety laws; the successful transition of new senior management;

the success of our research and development efforts; the supply and cost of raw materials; our

reliance on a small number of product distributors; the consequences of product failures or

defects; exposure to environmental, asbestos or other legal proceedings; risks of conducting

business internationally; compliance with and changes in tax laws and treatments; and foreign

exchange risks. We caution you that the foregoing list of factors is not exclusive and that other

risks and uncertainties may cause actual results to differ materially from those in forward-looking

statements. Forward-looking statements speak only as of the date they are made.

6

|

Long-term funding of personal injury claims

against former subsidiary companies

21 December 2004

|

|

Overview

Background

Heads of Agreement

Key Elements

Special Purpose Fund

Funding Arrangements

Other Matters

Impact on James Hardie

Other Matters

Conditions

Timing

|

|

Background

Special Commission of Inquiry into Establishment of Medical

Research and Compensation Foundation (MRCF) reported 21

September 2004

Establishment of MRCF legally effective

No legal liability for MRCF funding shortfall

Did not restructure nor move to Netherlands to avoid liability for asbestos

claims

However, as a practical matter, James Hardie would risk adverse

legislative, regulatory and customer responses unless adequate provision

is made for asbestos liabilities relating to former subsidiaries

James Hardie's voluntary proposal (made 14 July 2004) for funding future

claims under a scheme "an appropriate starting point for negotiations" -

not subsequently adopted

NSW Government delegated the initial negotiation phase to the

ACTU/Unions NSW

|

|

Heads of Agreement

Funding arrangement intended to allow James Hardie to

remain profitable, financially strong and to fund growth

Funding arrangement intended to allow payments to be

made by Special Purpose Fund (SPF) to all existing and

future proven claimants - but no absolute assurance can

be given that funding is sufficient

Heads of Agreement not binding but will form basis of

Principal Agreement (subject to shareholder approval and

consents from lenders)

|

|

Heads of Agreement

Key Elements

Non-binding Heads of Agreement for voluntary long-term funding signed 21st

December 2004

Key elements include:

Establishment of a SPF

Initial funding of SPF by James Hardie to be based on KPMG Actuaries report at

30 June 2004 - discounted central estimate A$1.5bn

James Hardie to make payments to SPF

Annual contribution by James Hardie to SPF based on annual actuarial

assessments

A rolling two year cash buffer is to be established in SPF

Cap on annual contributions after 1st year based on a percentage of net operating

cashflow - initial cap 35%, with phased reduction to 10% possible over time

|

|

Heads of Agreement - Special Purpose Fund

Structure of SPF under consideration

Majority of SPF Board to be appointed by James Hardie

SPF likely to be accounted for as a James Hardie

subsidiary in consolidated financials

|

|

Heads of Agreement - Funding Arrangements

Actuarial Data

Annual contribution to SPF to be based on latest actuarial

data - annual actuarial assessments

Initial funding based on KPMG Actuaries 30 June 2004

report. James Hardie and KPMG also to consider:

Outcome of NSW Government Review of legal and administrative

costs

Actual and expected claims experience

|

|

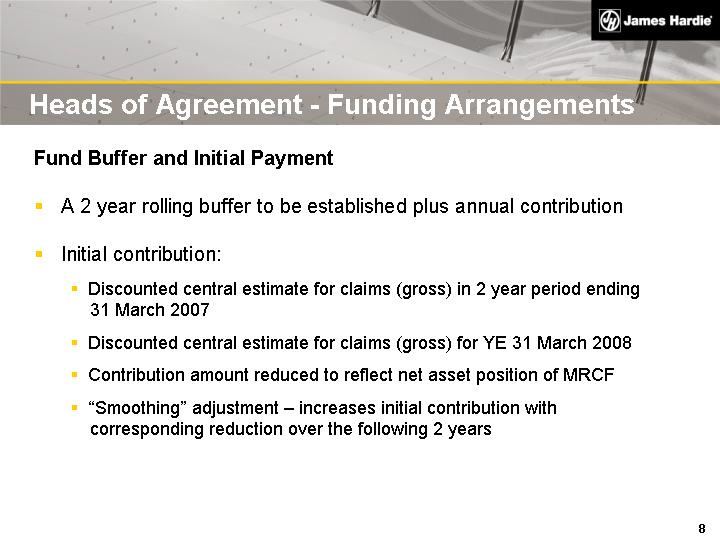

Heads of Agreement - Funding Arrangements

Fund Buffer and Initial Payment

A 2 year rolling buffer to be established plus annual contribution

Initial contribution:

Discounted central estimate for claims (gross) in 2 year period ending

31 March 2007

Discounted central estimate for claims (gross) for YE 31 March 2008

Contribution amount reduced to reflect net asset position of MRCF

"Smoothing" adjustment - increases initial contribution with

corresponding reduction over the following 2 years

|

|

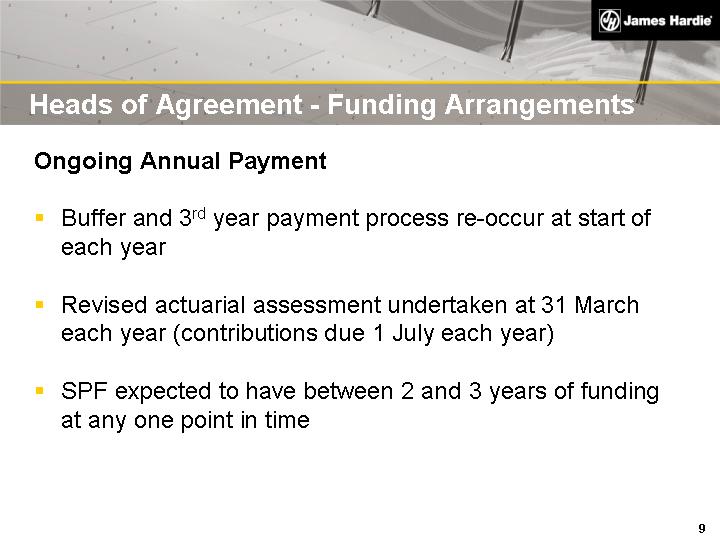

Heads of Agreement - Funding Arrangements

Ongoing Annual Payment

Buffer and 3rd year payment process re-occur at start of

each year

Revised actuarial assessment undertaken at 31 March

each year (contributions due 1 July each year)

SPF expected to have between 2 and 3 years of funding

at any one point in time

|

|

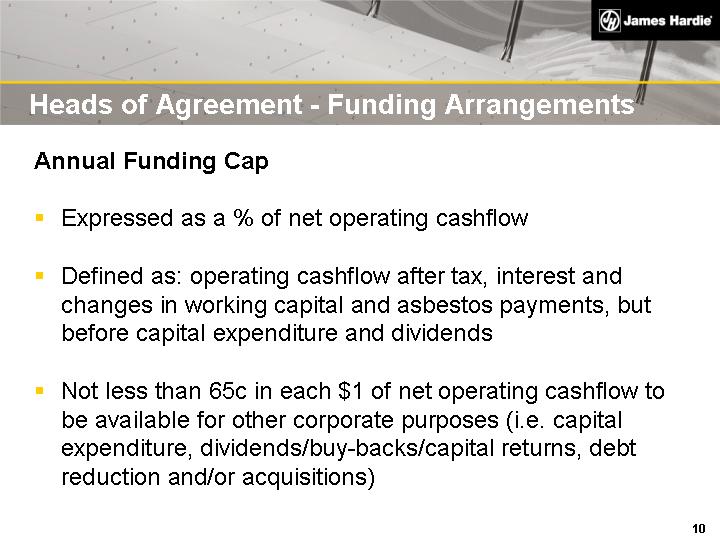

Heads of Agreement - Funding Arrangements

Annual Funding Cap

Expressed as a % of net operating cashflow

Defined as: operating cashflow after tax, interest and

changes in working capital and asbestos payments, but

before capital expenditure and dividends

Not less than 65c in each $1 of net operating cashflow to

be available for other corporate purposes (i.e. capital

expenditure, dividends/buy-backs/capital returns, debt

reduction and/or acquisitions)

|

|

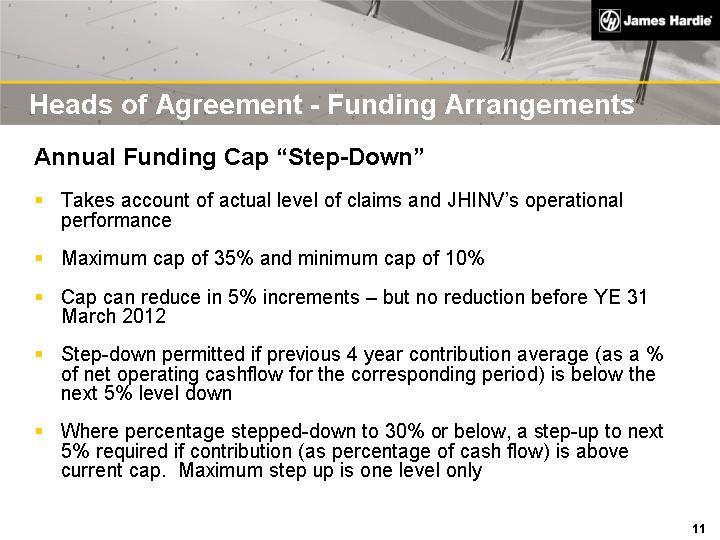

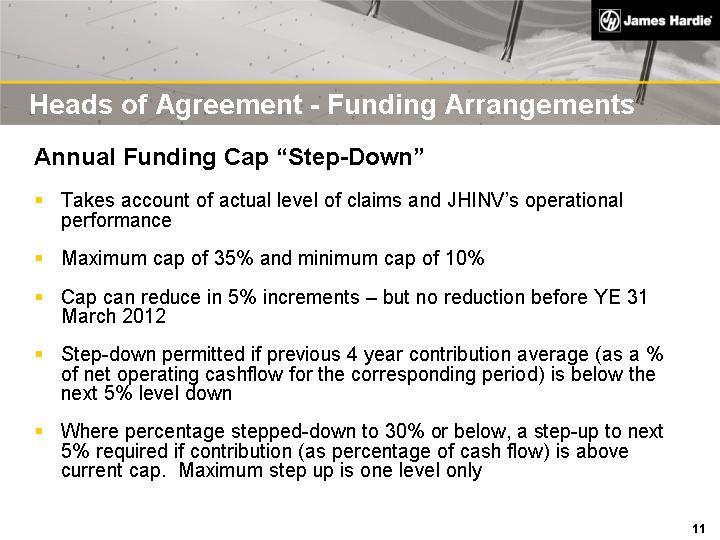

Heads of Agreement - Funding Arrangements

Annual Funding Cap "Step-Down"

Takes account of actual level of claims and JHINV's operational

performance

Maximum cap of 35% and minimum cap of 10%

Cap can reduce in 5% increments - but no reduction before YE 31

March 2012

Step-down permitted if previous 4 year contribution average (as a %

of net operating cashflow for the corresponding period) is below the

next 5% level down

Where percentage stepped-down to 30% or below, a step-up to next

5% required if contribution (as percentage of cash flow) is above

current cap. Maximum step up is one level only

|

|

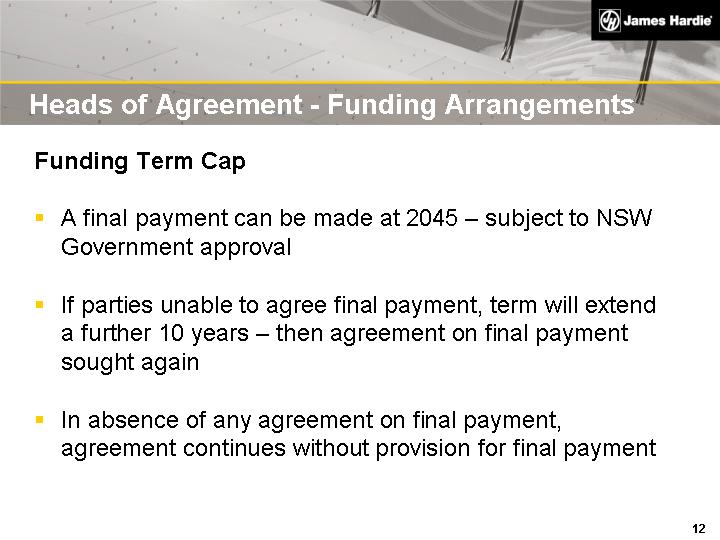

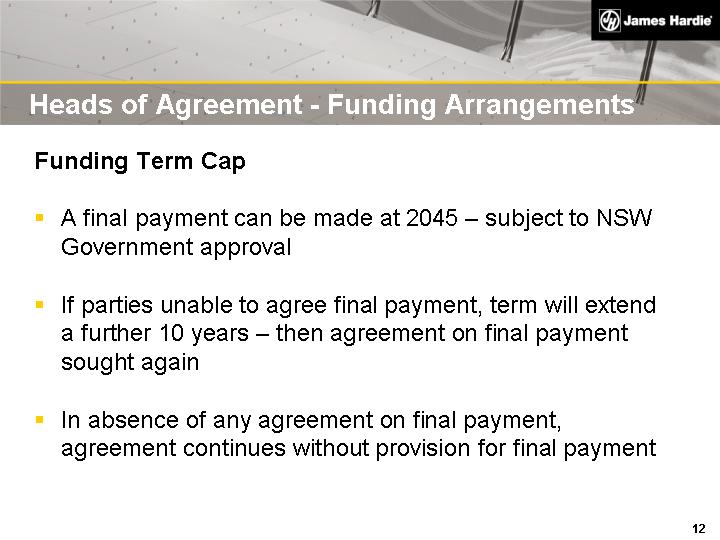

Heads of Agreement - Funding Arrangements

Funding Term Cap

A final payment can be made at 2045 - subject to NSW

Government approval

If parties unable to agree final payment, term will extend

a further 10 years - then agreement on final payment

sought again

In absence of any agreement on final payment,

agreement continues without provision for final payment

|

|

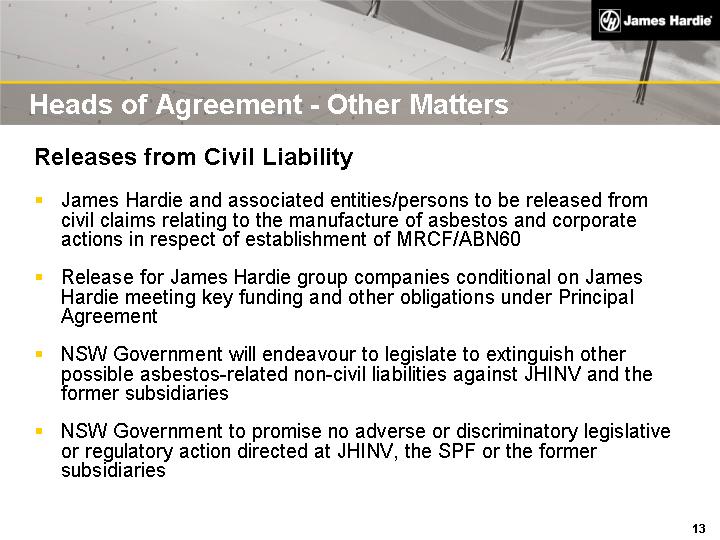

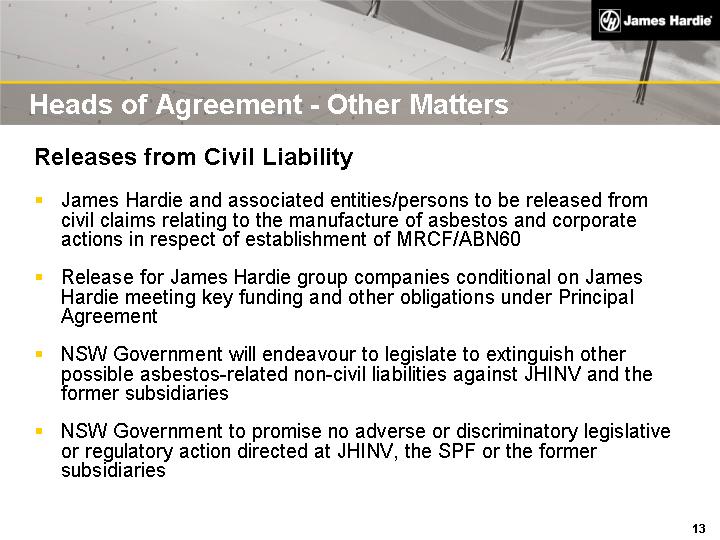

Heads of Agreement - Other Matters

Releases from Civil Liability

James Hardie and associated entities/persons to be released from

civil claims relating to the manufacture of asbestos and corporate

actions in respect of establishment of MRCF/ABN60

Release for James Hardie group companies conditional on James

Hardie meeting key funding and other obligations under Principal

Agreement

NSW Government will endeavour to legislate to extinguish other

possible asbestos-related non-civil liabilities against JHINV and the

former subsidiaries

NSW Government to promise no adverse or discriminatory legislative

or regulatory action directed at JHINV, the SPF or the former

subsidiaries

|

|

Impact on James Hardie

KPMG Claims Profile

0

20

40

60

80

100

120

140

160

180

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

2025

2027

2029

2031

2033

2035

2037

2039

2041

2043

2045

2047

2049

2051

2053

2055

2057

2059

2061

2063

2065

2067

2069

2071

KPMG Claims Payment Profile (Gross)

KPMG Claims Payment Profile (Net of insurance & other recoveries assuming legal costs of 36.0%)

KPMG Claims Payment Profile (Net of insurance & other recoveries assuming legal costs of 27.5%)

KPMG Claims Payment Profile (Net of insurance & other recoveries assuming legal costs of 20.0%)

KPMG Claims Payment Profile (Net of insurance & other recoveries assuming legal costs of 12.5%)

A$m

Year ending 31 March

|

|

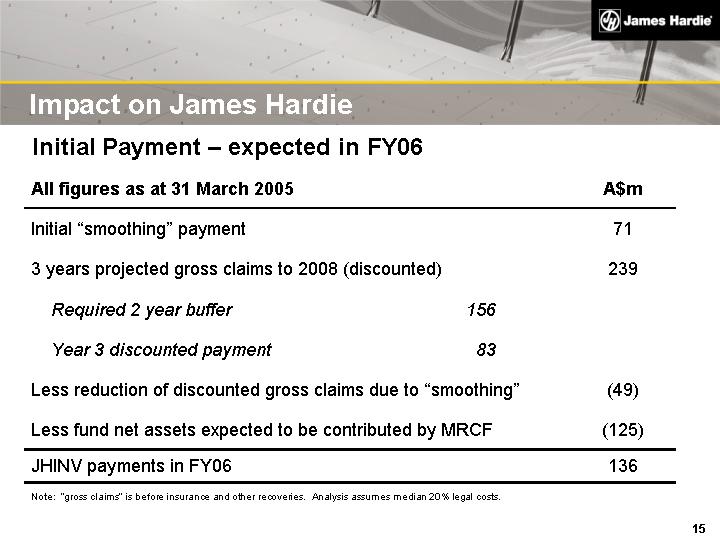

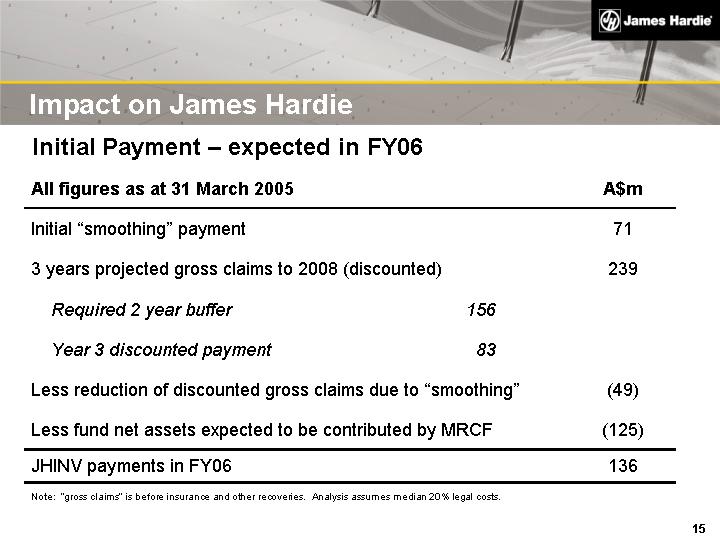

Impact on James Hardie

Initial Payment - expected in FY06

All figures as at 31 March 2005 A$m

Initial "smoothing" payment 71

3 years projected gross claims to 2008 (discounted) 239

Required 2 year buffer 156

Year 3 discounted payment 83

Less reduction of discounted gross claims due to "smoothing" (49)

Less fund net assets expected to be contributed by MRCF (125)

JHINV payments in FY06 136

Note: "gross claims" is before insurance and other recoveries. Analysis assumes median 20% legal costs.

|

|

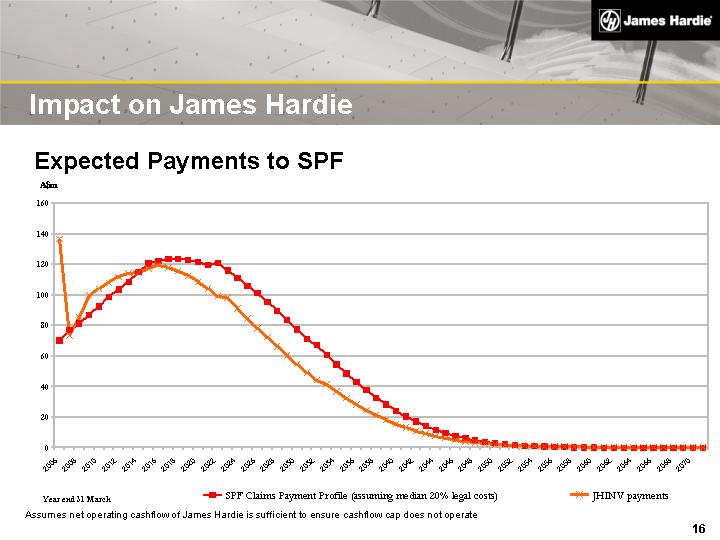

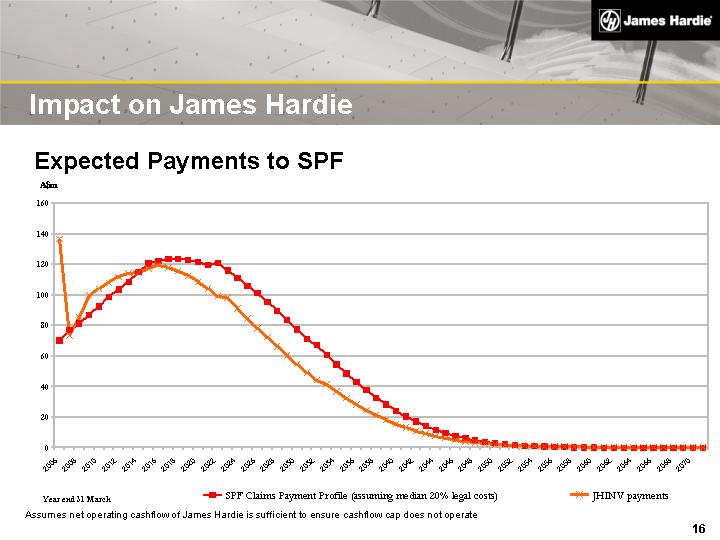

Impact on James Hardie

Expected Payments to SPF

Assumes net operating cashflow of James Hardie is sufficient to ensure cashflow cap does not operate

0

20

40

60

80

100

120

140

160

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

2028

2030

2032

2034

2036

2038

2040

2042

2044

2046

2048

2050

2052

2054

2056

2058

2060

2062

2064

2066

2068

2070

SPF Claims Payment Profile (assuming median 20% legal costs)

JHINV payments

A$m

Year end 31 March

|

|

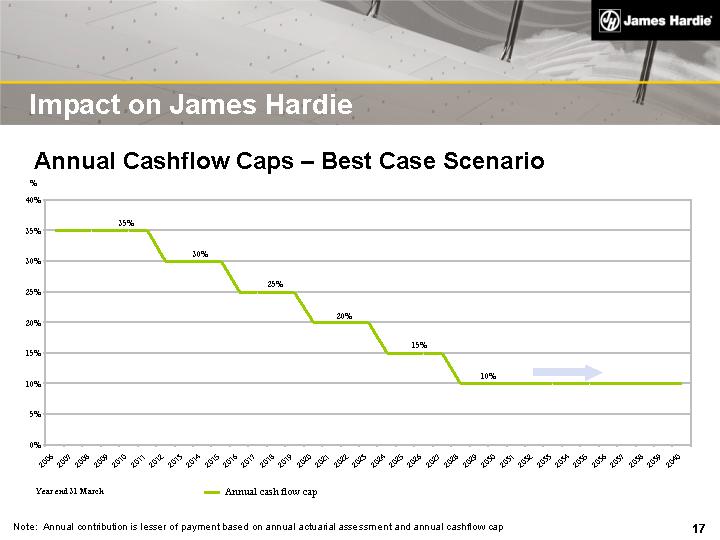

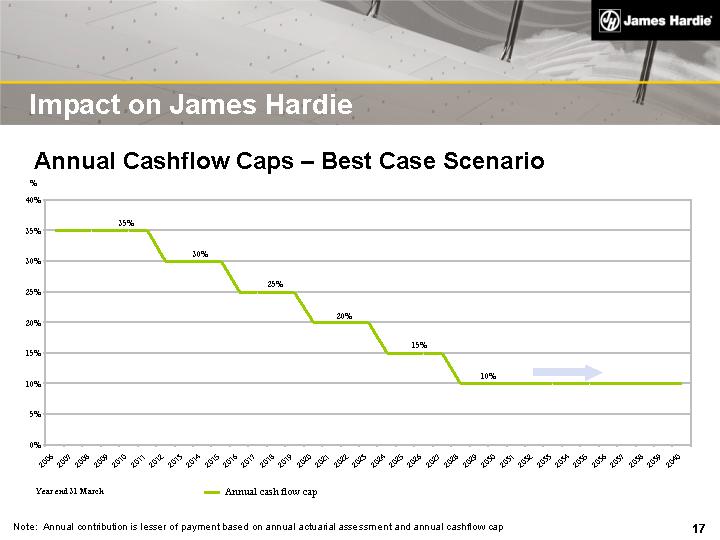

Impact on James Hardie

Annual Cashflow Caps - Best Case Scenario

Note: Annual contribution is lesser of payment based on annual actuarial assessment and annual cashflow cap

0%

5%

10%

15%

20%

25%

30%

35%

40%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

Annual cash flow cap

35%

30%

25%

20%

15%

10%

%

Year end 31 March

|

|

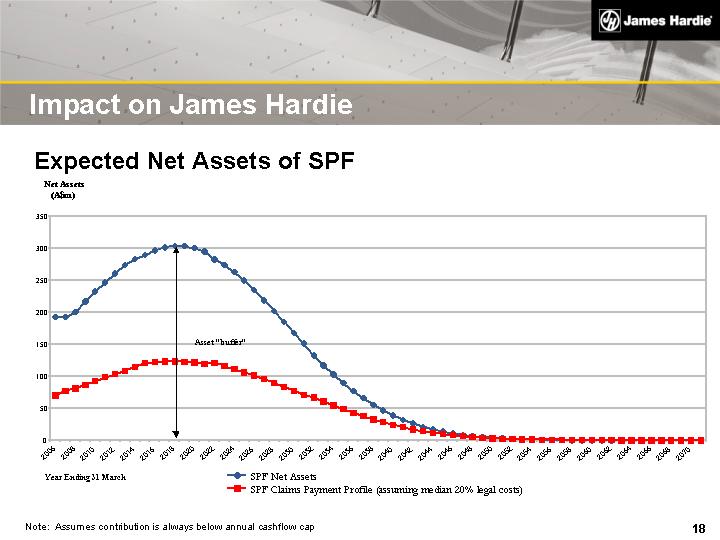

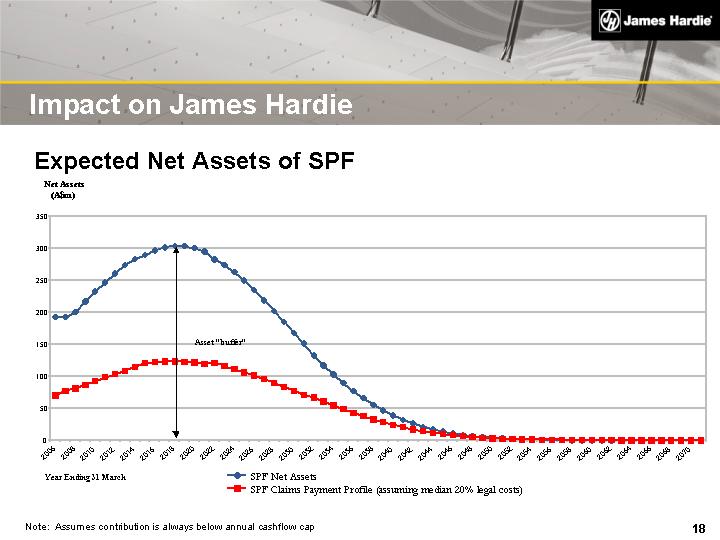

Impact on James Hardie

Expected Net Assets of SPF

Note: Assumes contribution is always below annual cashflow cap

0

50

100

150

200

250

300

350

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

2028

2030

2032

2034

2036

2038

2040

2042

2044

2046

2048

2050

2052

2054

2056

2058

2060

2062

2064

2066

2068

2070

SPF Net Assets

SPF Claims Payment Profile (assuming median 20% legal costs)

Net Assets

(A$m)

Year Ending 31 March

Asset "buffer"

|

|

Impact on James Hardie

Balance Sheet

FAS 5: probable and estimable

Provisions for 5 -15 year's of asbestos liabilities normal in US

Options under US GAAP to be assessed:

Amount

Timing

Discounted/undiscounted basis

James Hardie's funding obligations to SPF will rank behind senior

lenders

|

|

Impact on James Hardie

Taxation

Tax deductibility of payments by James Hardie to SPF

has been assumed

Confident of being achieved

|

|

Other Matters

Education Program and Medical Research

James Hardie will contribute to an asbestos education

program in Australia

James Hardie will commit to continue funding medical

research into asbestos-related diseases

|

|

Conditions

The voluntary long-term funding agreement is subject to:

Completion and implementation of NSW Government Review of

legal and administrative costs

The NSW Government to provide legislative change to adopt

efficiencies and facilitate implementation of agreement

JHINV Board determination that final agreement is in JHINV's

interests

Receipt of an independent expert's report confirming the proposal

Approval of lenders to JHINV

JHINV shareholder approval

|

|

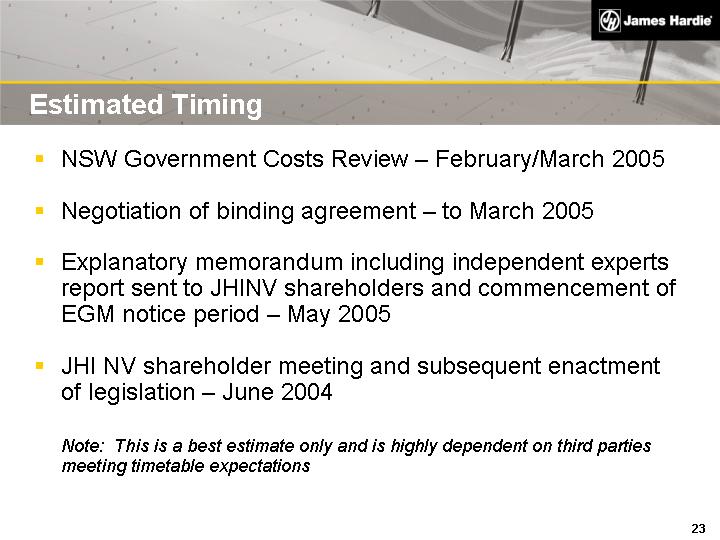

Estimated Timing

NSW Government Costs Review - February/March 2005

Negotiation of binding agreement - to March 2005

Explanatory memorandum including independent experts

report sent to JHINV shareholders and commencement of

EGM notice period - May 2005

JHI NV shareholder meeting and subsequent enactment

of legislation - June 2004

Note: This is a best estimate only and is highly dependent on third parties

meeting timetable expectations

|

|

Disclaimer

This presentation contains forward-looking statements. We may from time to time make forward-looking statements in our periodic reports filed with

the Securities and Exchange Commission on Forms 20-F and 6-K, in our annual reports to shareholders, in offering circulars and prospectuses, in

media releases and other written materials and in oral statements made by our officers, directors or employees to analysts, institutional investors,

representatives of the media and others. Examples of such forward-looking statements include:

Statements based on KPMG's actuarial analysis of future claims on which we have relied;

projections of our operating results or financial condition;

statements of our plans, objectives or goals, including those relating to competition, acquisitions, dispositions and our products;

statements about our future economic performance or that of the United States, Australia or other countries in which we operate; and

statements about product or environmental liabilities.

Words such as "believe," "anticipate," "plan," "expect," "intend," "target," "estimate," "project," "predict," "forecast," "guideline," "should," "aim" and

similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to

differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors

include but are not limited to: all matters relating to or arising out of the prior manufacture of asbestos by ABN 60 and certain former subsidiaries;

competition and product pricing in the markets in which we operate; general economic and market conditions; compliance with and possible

changes in environmental and health and safety laws; the successful transition of new senior management; the success of our research and

development efforts; the supply and cost of raw materials; our reliance on a small number of product distributors; the consequences of product

failures or defects; exposure to environmental, asbestos or other legal proceedings; risks of conducting business internationally; compliance with

and changes in tax laws and treatments; and foreign exchange risks. We caution you that the foregoing list of factors is not exclusive and that other

risks and uncertainties may cause actual results to differ materially from those in forward-looking statements. Forward-looking statements speak

only as of the date they are made.

|

|

Long Term Funding of Personal Injury Claims

Against Former Subsidiary Companies

|