JAMES HARDIE

INVESTOR UPDATE

Louis Gries

Exhibit 99.2

PAGE 2

AGENDA

• NA FC Organic Growth Strategy & Returns

• Beyond FC in North America

• Organization Capability to Deliver

PAGE 3

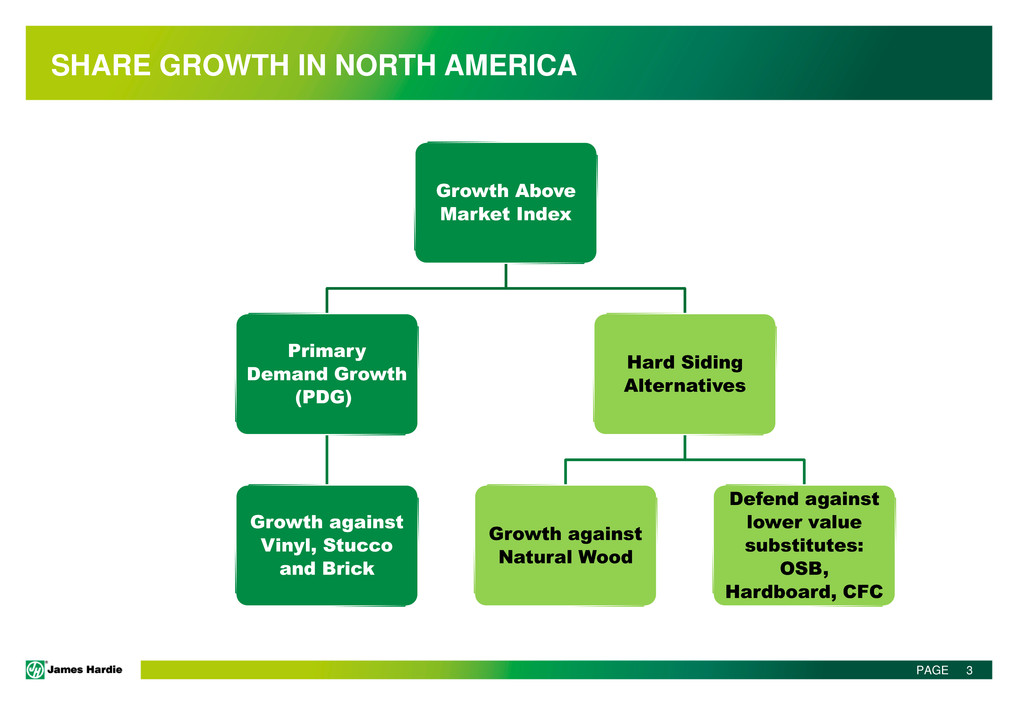

SHARE GROWTH IN NORTH AMERICA

Growth Above

Market Index

Primary

Demand Growth

(PDG)

Growth against

Vinyl, Stucco

and Brick

Hard Siding

Alternatives

Growth against

Natural Wood

Defend against

lower value

substitutes:

OSB,

Hardboard, CFC

PAGE 4

HOMEOWNER VALUE PROPOSITION

• Curb, porch & deck appeal

• Fire & abuse

• Low maintenance

• Affordable

PAGE 5

MARKET DEVELOPMENT TO CONVERT VINYL

New Construction

- Geography

- Category of home

- Builder profile

- Better home ↔ Better builder ↔ Better development

Segment / Target / Position Basics

Repair & Remodel

- Geography

- Neighborhoods

- Value proposition direct to home owner

PAGE 6

DEFEND AGAINST LOWER VALUE SUBSTITUTES

Homeowner Value Proposition

- Engineered for climate durability

- Lower maintenance

- Substrate

- Surface finish

- Full exterior wrap

Keys to defend against discounting

- Channel partners

- Homeowner awareness

- Contractor alignment

PAGE 7

SAFETY AT THE FOREFRONT

Safety culture evolving from 2&10 to Zero Harm

• Standard and sustainable systems

• Establish playbook and train employees

• Zero tolerance for unsafe behaviors

PAGE 8

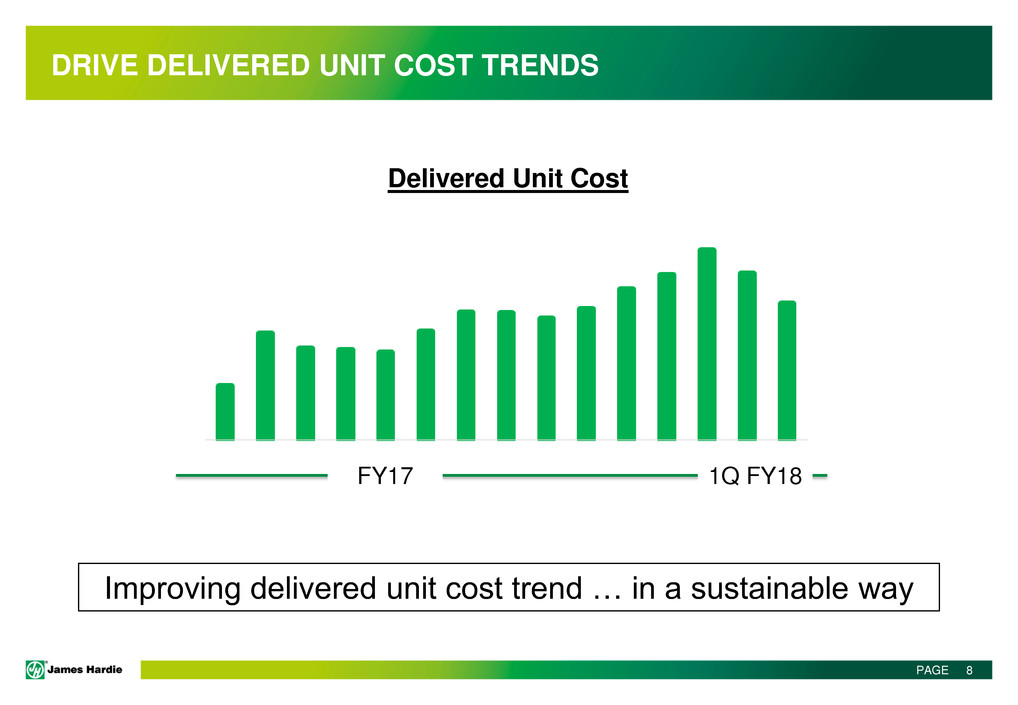

DRIVE DELIVERED UNIT COST TRENDS

Improving delivered unit cost trend … in a sustainable way

1Q FY18 FY17

Delivered Unit Cost

PAGE 9

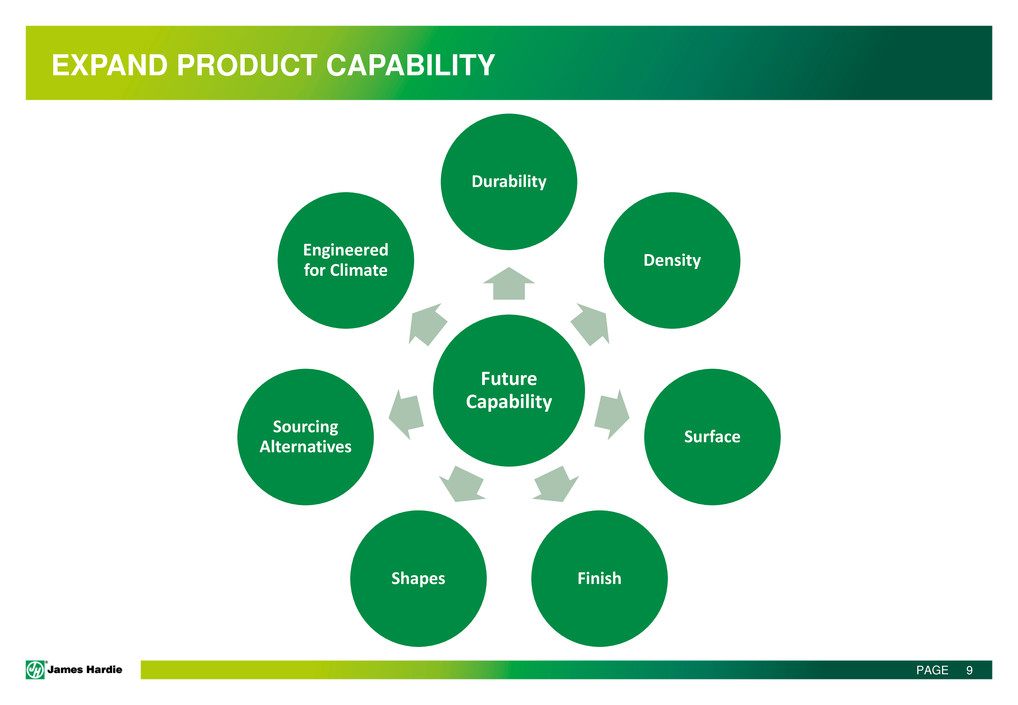

EXPAND PRODUCT CAPABILITY

Future

Capability

Durability

Density

Surface

Finish Shapes

Sourcing

Alternatives

Engineered

for Climate

PAGE 10

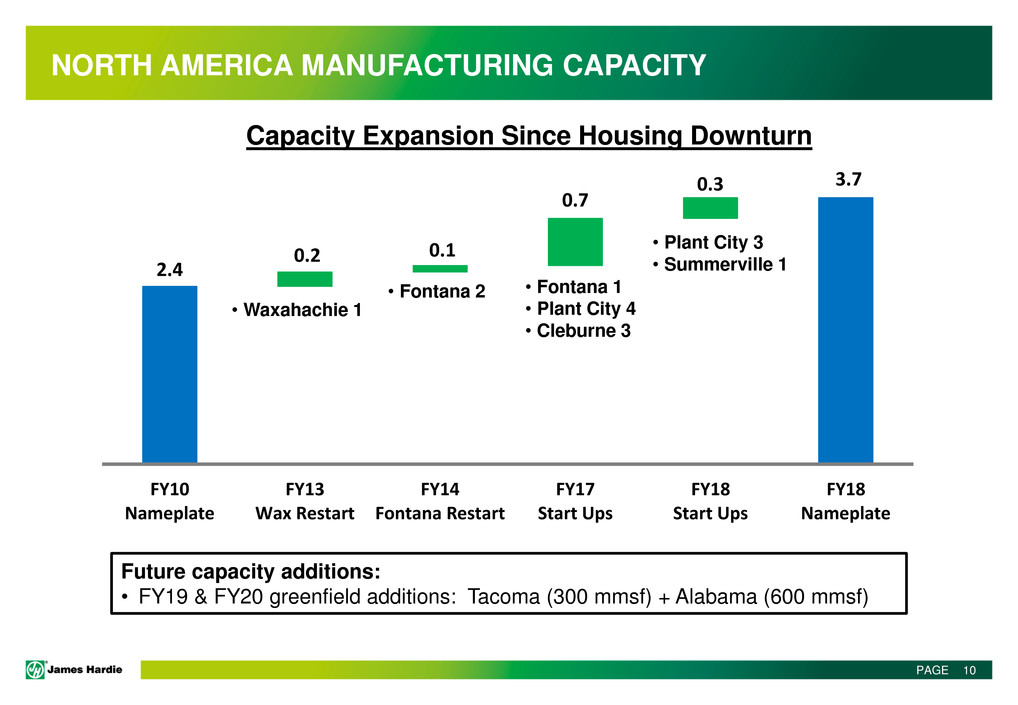

2.4

3.7

0.2 0.1

0.7

0.3

FY10

Nameplate

FY13

Wax Restart

FY14

Fontana Restart

FY17

Start Ups

FY18

Start Ups

FY18

Nameplate

NORTH AMERICA MANUFACTURING CAPACITY

Capacity Expansion Since Housing Downturn

• Fontana 1

• Plant City 4

• Cleburne 3

Future capacity additions:

• FY19 & FY20 greenfield additions: Tacoma (300 mmsf) + Alabama (600 mmsf)

• Fontana 2

• Waxahachie 1

• Plant City 3

• Summerville 1

PAGE 11

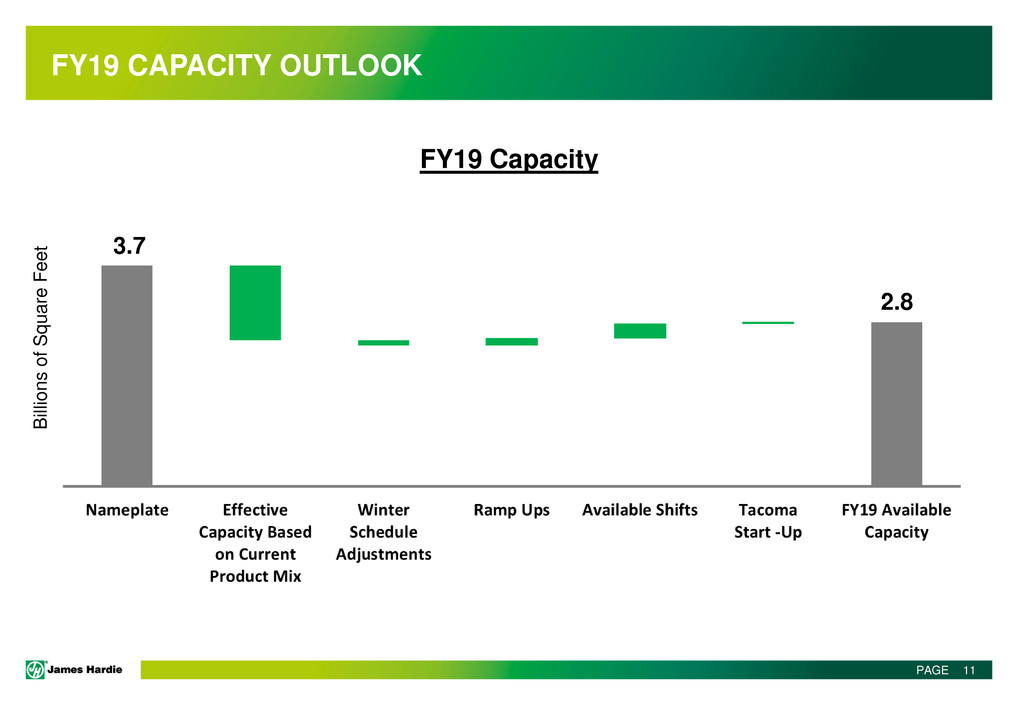

FY19 CAPACITY OUTLOOK

3.7

2.8

Bi

llio

ns

o

f S

qu

ar

e

Fe

e

t

FY19 Capacity

BEYOND CURRENT NORTH AMERICA

ORGANIC GROWTH STRATEGY

PAGE 13

INTERNATIONAL

• Steady share gains in APAC

• Reset game plan in Europe

• Further expansion with GDP per capita bias

PAGE 14

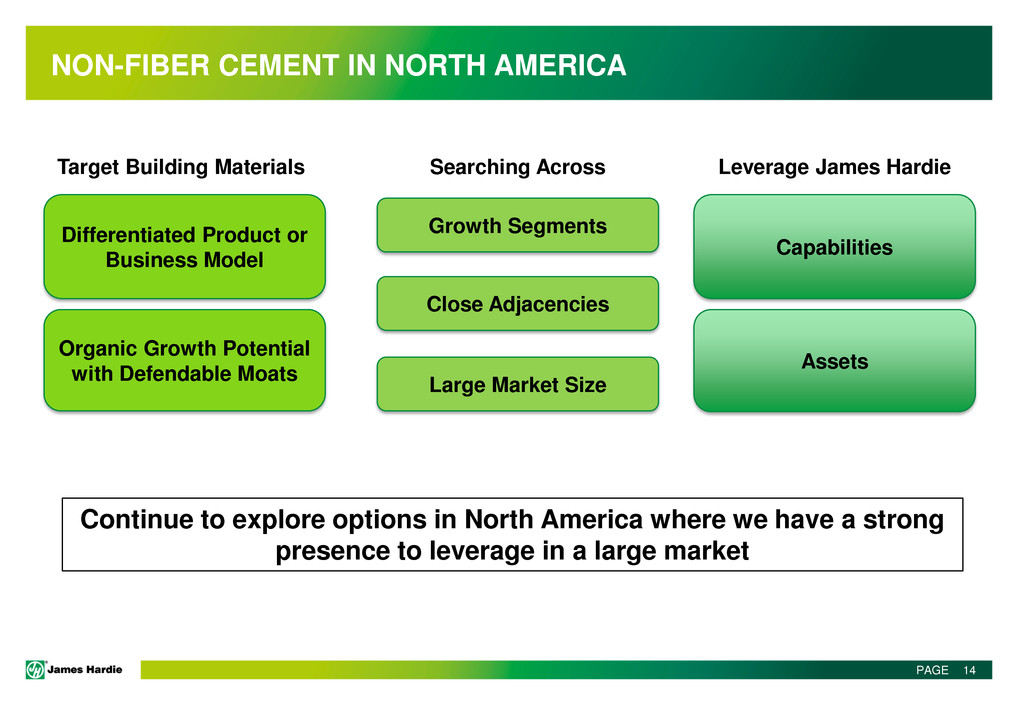

NON-FIBER CEMENT IN NORTH AMERICA

Capabilities

Assets

Differentiated Product or

Business Model

Target Building Materials

Organic Growth Potential

with Defendable Moats

Leverage James Hardie

Growth Segments

Searching Across

Close Adjacencies

Large Market Size

Continue to explore options in North America where we have a strong

presence to leverage in a large market

ORGANIZATIONAL CAPABILITY TO ENABLE

PAGE 16

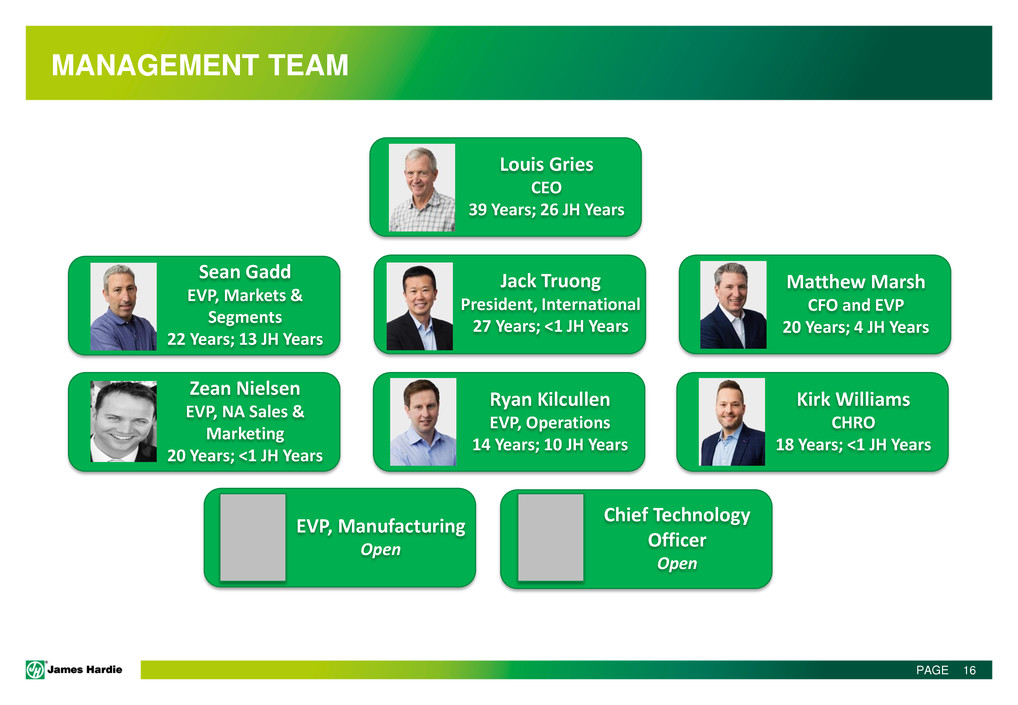

MANAGEMENT TEAM

Sean Gadd

EVP, Markets &

Segments

22 Years; 13 JH Years

Jack Truong

President, International

27 Years; <1 JH Years

Matthew Marsh

CFO and EVP

20 Years; 4 JH Years

Ryan Kilcullen

EVP, Operations

14 Years; 10 JH Years

Louis Gries

CEO

39 Years; 26 JH Years

Zean Nielsen

EVP, NA Sales &

Marketing

20 Years; <1 JH Years

Kirk Williams

CHRO

18 Years; <1 JH Years

EVP, Manufacturing

Open

Chief Technology

Officer

Open

FY17/18 SUPPLY ISSUES & RAMIFICATIONS

PAGE 18

SUPPLY ISSUES & RAMIFICATIONS

• Focus has shifted to building on traction in manufacturing now that

demand / supply equation has returned to balance

• Recapturing lost ground in the market … significant effort is required

• Improving delivered unit cost trend with network stabilization

PAGE 19

KEY MESSAGES

• Zero Harm safety commitment

• Manufacturing reset

• Regain market traction lost during supply shortage period

• International growth

• Non-FC opportunity scans

• Management team build

• Broad-based organizational capability build