EXTERNAL ENVIRONMENT &

BUSINESS FUNDAMENTALS

Matthew Marsh, EVP & CFO

Exhibit 99.3

PAGE 2

AGENDA

• U.S. Economic Conditions

• Housing Environment

• North America Capacity

PAGE 3

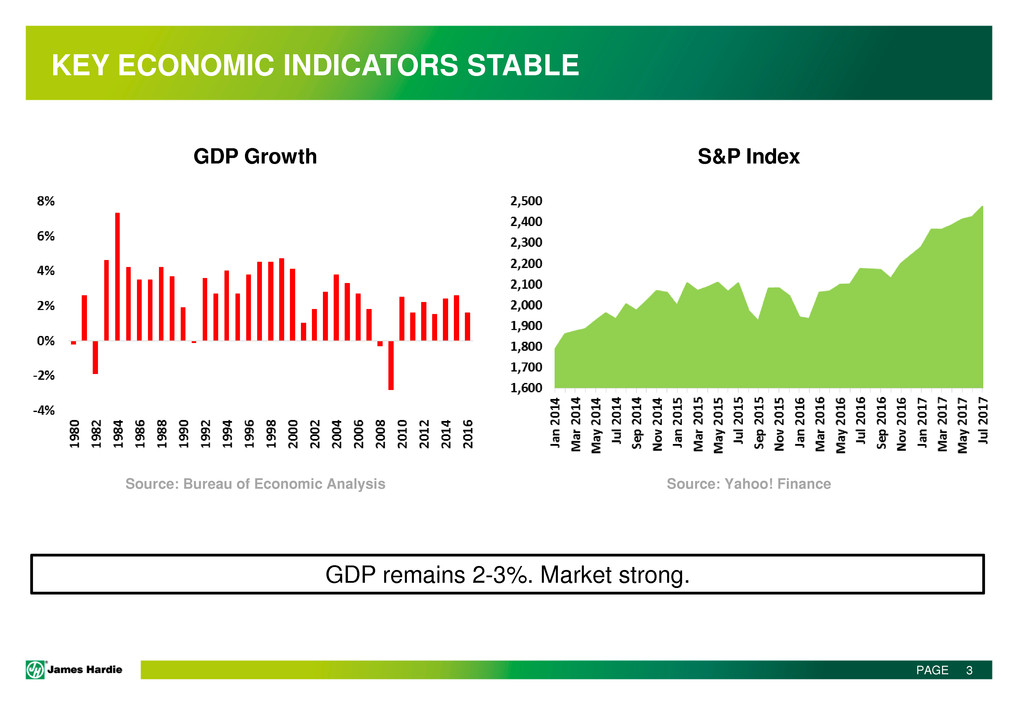

KEY ECONOMIC INDICATORS STABLE

GDP Growth

Source: Bureau of Economic Analysis

S&P Index

Source: Yahoo! Finance

GDP remains 2-3%. Market strong.

PAGE 4

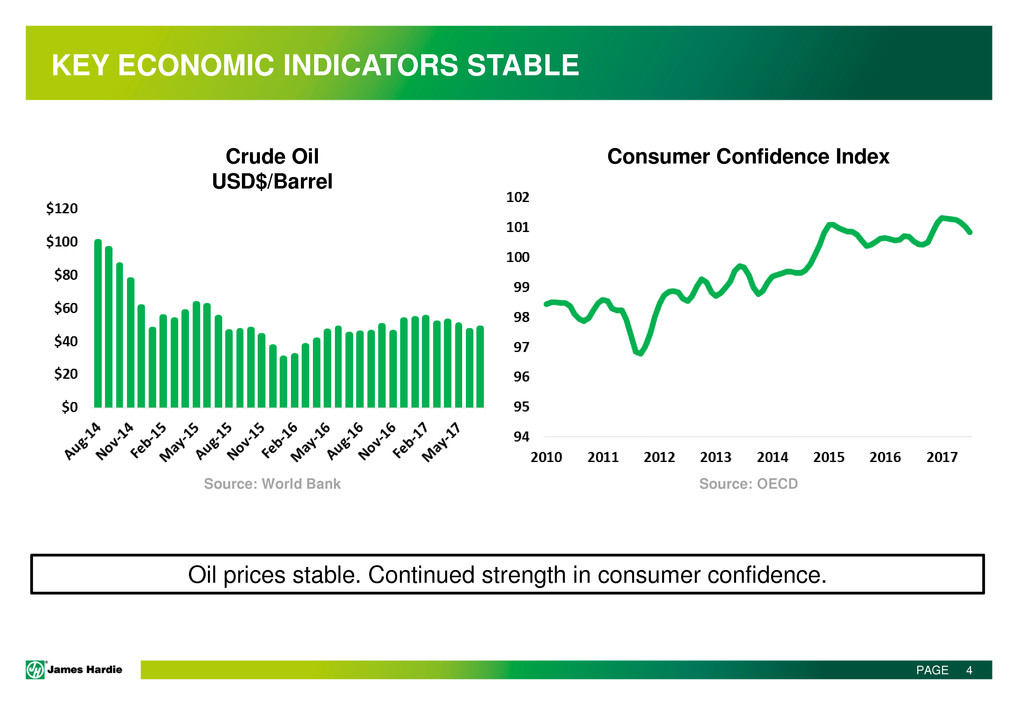

KEY ECONOMIC INDICATORS STABLE

Crude Oil

USD$/Barrel

Consumer Confidence Index

Source: World Bank

Oil prices stable. Continued strength in consumer confidence.

Source: OECD

PAGE 5

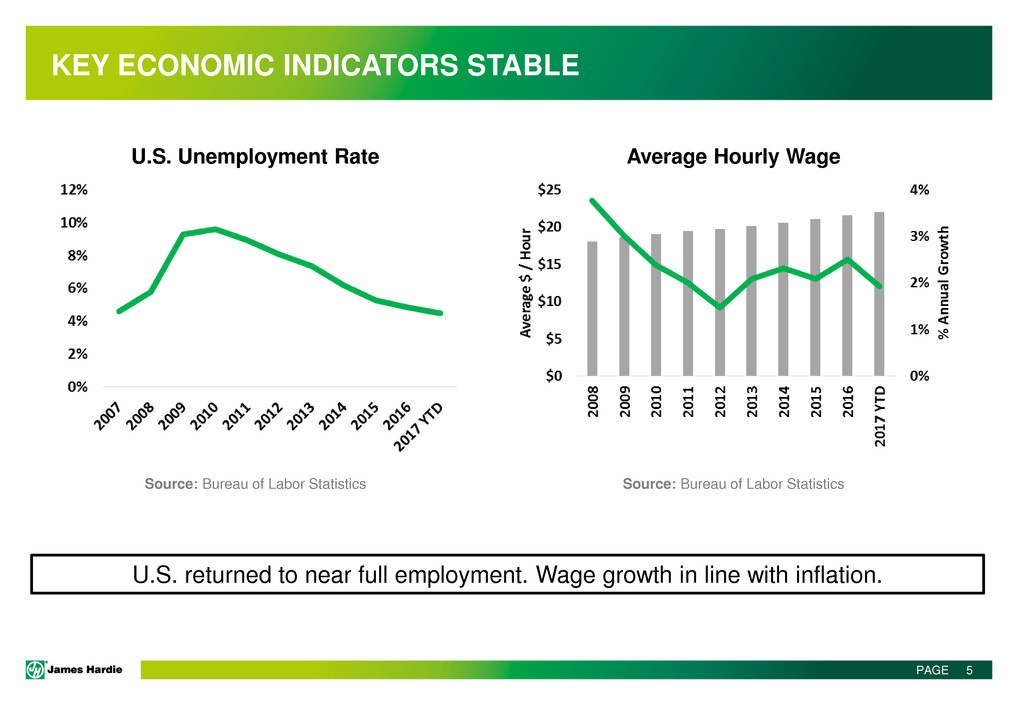

KEY ECONOMIC INDICATORS STABLE

U.S. Unemployment Rate Average Hourly Wage

Source: Bureau of Labor Statistics Source: Bureau of Labor Statistics

U.S. returned to near full employment. Wage growth in line with inflation.

PAGE 6

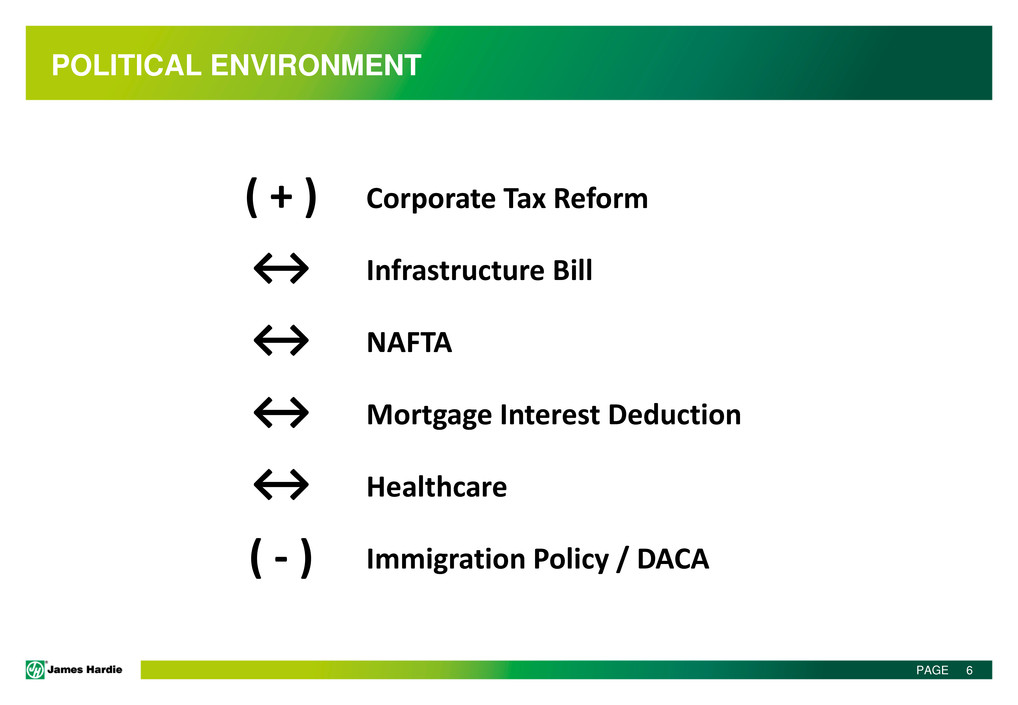

POLITICAL ENVIRONMENT

( + ) Corporate Tax Reform

↔ Infrastructure Bill

↔ NAFTA

↔ Mortgage Interest Deduction

↔ Healthcare

( - ) Immigration Policy / DACA

PAGE 7

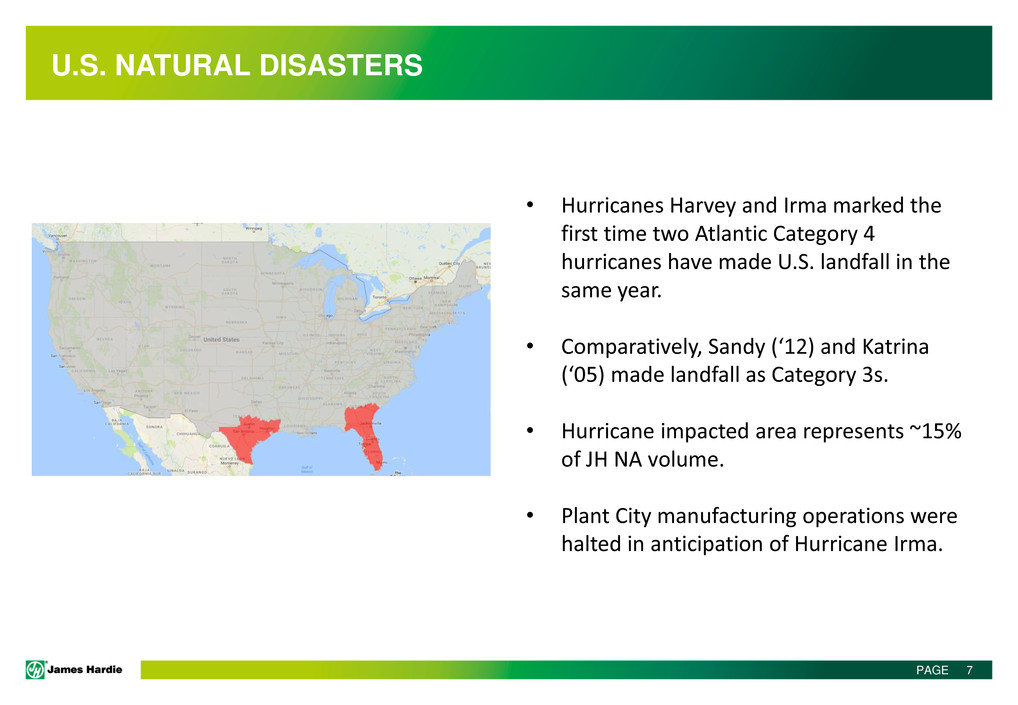

U.S. NATURAL DISASTERS

• Hurricanes Harvey and Irma marked the

first time two Atlantic Category 4

hurricanes have made U.S. landfall in the

same year.

• Comparatively, Sandy (‘12) and Katrina

(‘05) made landfall as Category 3s.

• Hurricane impacted area represents ~15%

of JH NA volume.

• Plant City manufacturing operations were

halted in anticipation of Hurricane Irma.

PAGE 8

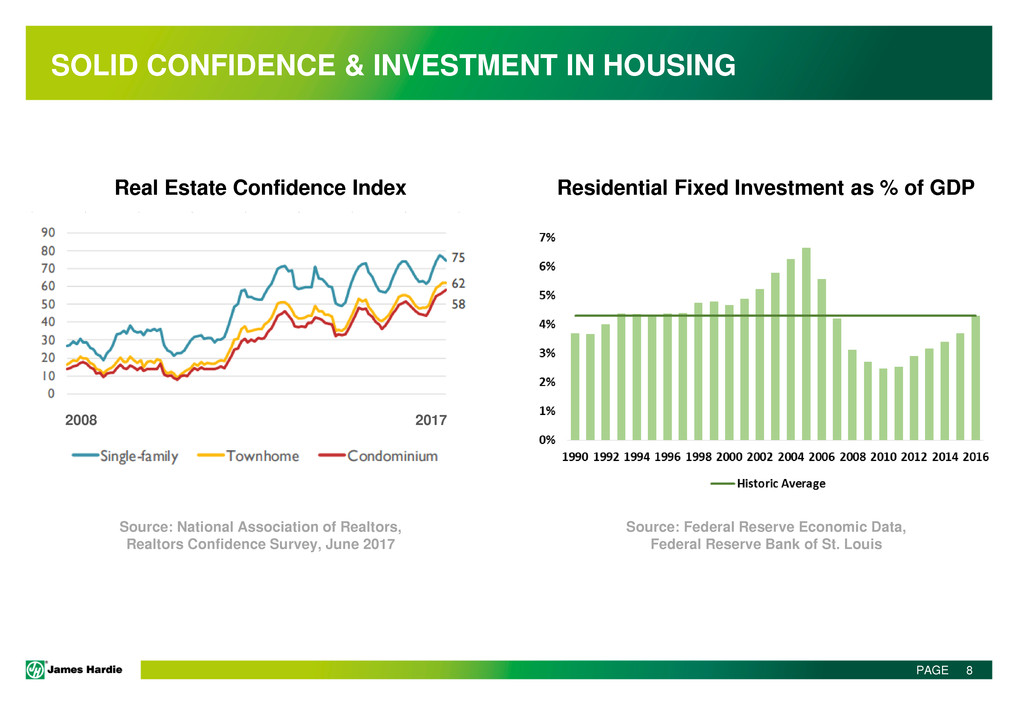

SOLID CONFIDENCE & INVESTMENT IN HOUSING

Residential Fixed Investment as % of GDP

Source: Federal Reserve Economic Data,

Federal Reserve Bank of St. Louis

Real Estate Confidence Index

Source: National Association of Realtors,

Realtors Confidence Survey, June 2017

2008 2017

PAGE 9

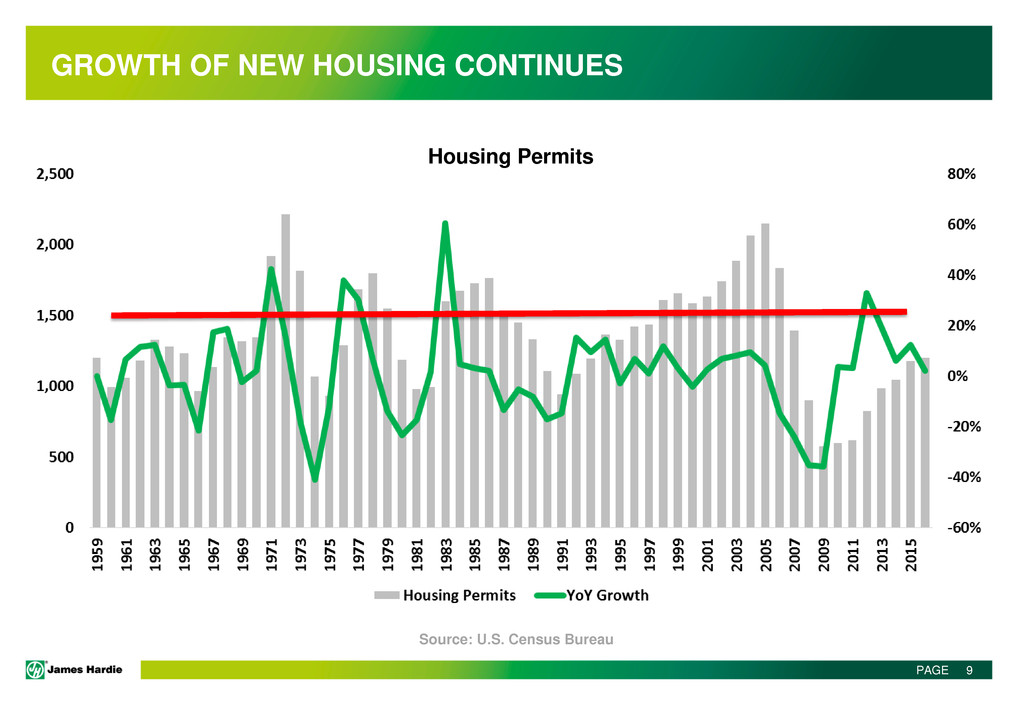

GROWTH OF NEW HOUSING CONTINUES

Housing Permits

Source: U.S. Census Bureau

PAGE 10

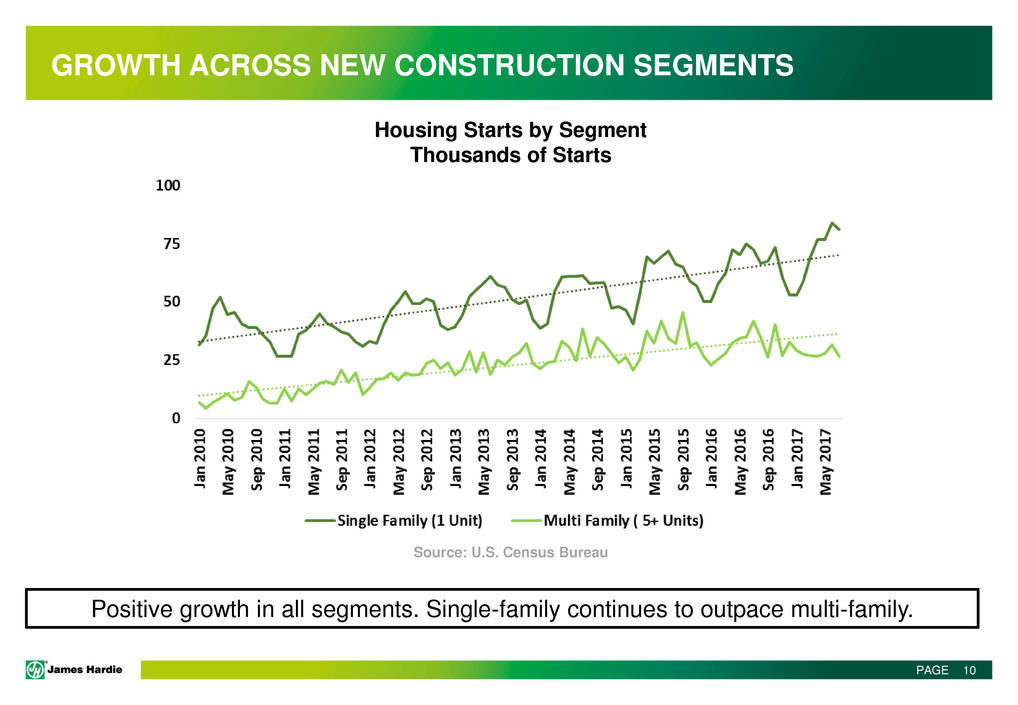

GROWTH ACROSS NEW CONSTRUCTION SEGMENTS

Housing Starts by Segment

Thousands of Starts

Positive growth in all segments. Single-family continues to outpace multi-family.

Source: U.S. Census Bureau

PAGE 11

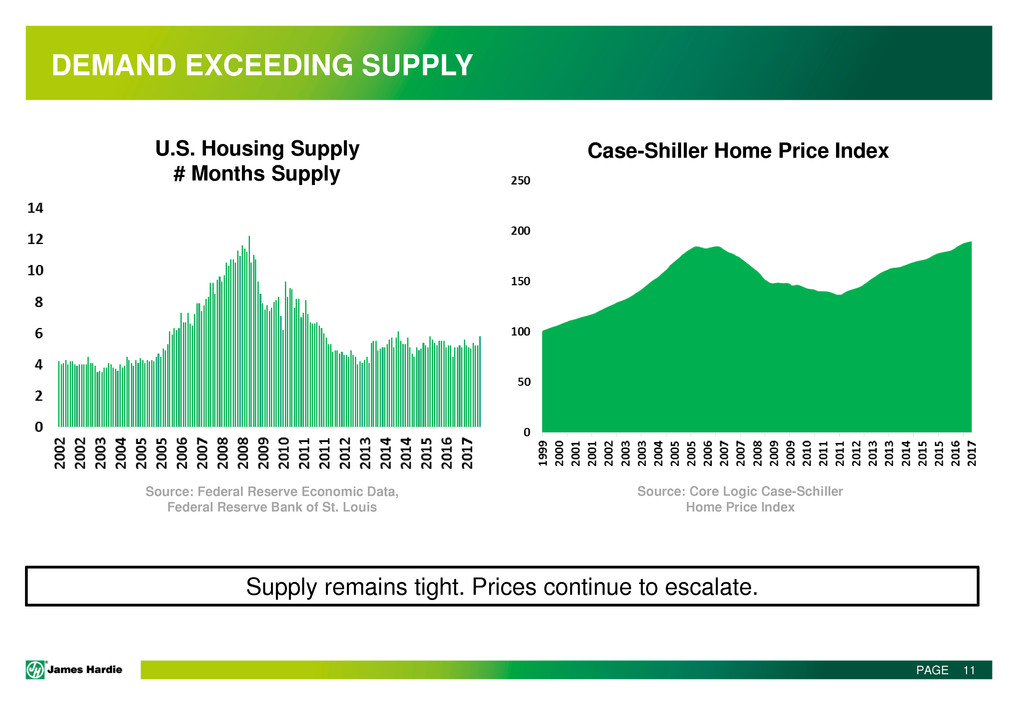

DEMAND EXCEEDING SUPPLY

Source: Core Logic Case-Schiller

Home Price Index

U.S. Housing Supply

# Months Supply

Case-Shiller Home Price Index

Supply remains tight. Prices continue to escalate.

Source: Federal Reserve Economic Data,

Federal Reserve Bank of St. Louis

PAGE 12

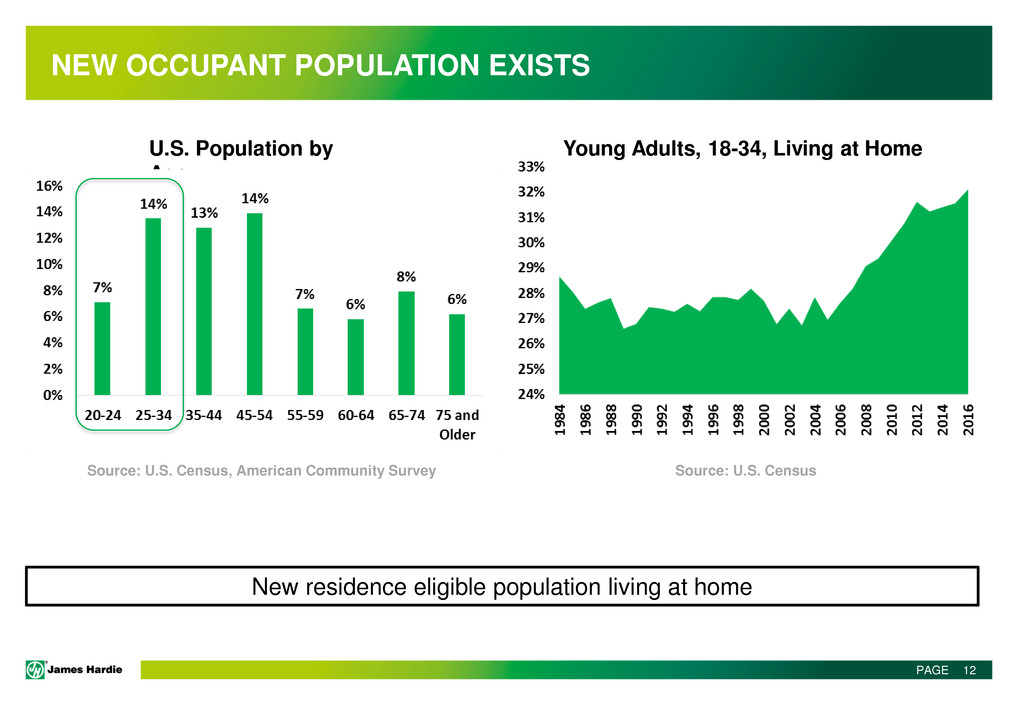

NEW OCCUPANT POPULATION EXISTS

U.S. Population by

Age

Young Adults, 18-34, Living at Home

Source: U.S. Census, American Community Survey Source: U.S. Census

New residence eligible population living at home

PAGE 13

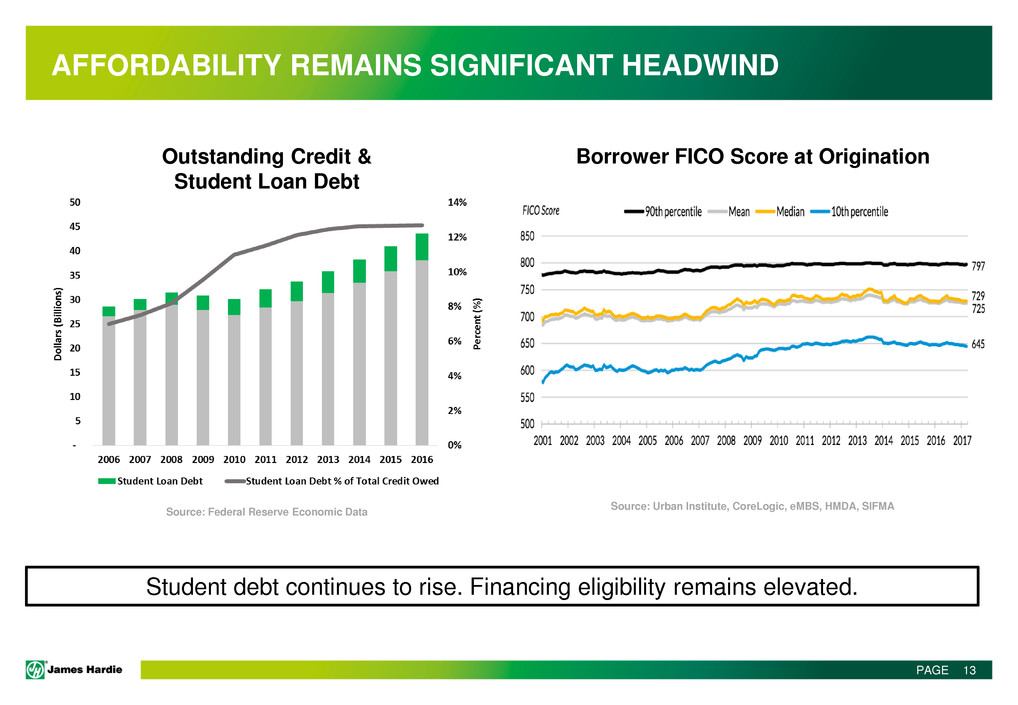

AFFORDABILITY REMAINS SIGNIFICANT HEADWIND

Source: Urban Institute, CoreLogic, eMBS, HMDA, SIFMA

Outstanding Credit &

Student Loan Debt

Borrower FICO Score at Origination

Student debt continues to rise. Financing eligibility remains elevated.

Source: Federal Reserve Economic Data

PAGE 14

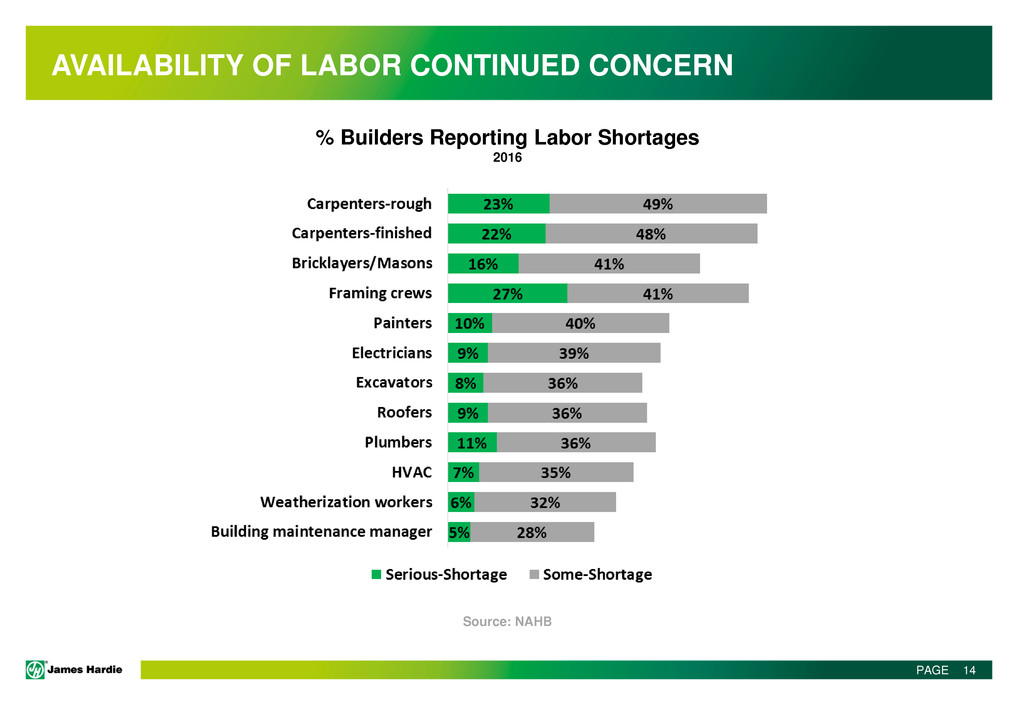

AVAILABILITY OF LABOR CONTINUED CONCERN

Source: NAHB

% Builders Reporting Labor Shortages

2016

PAGE 15

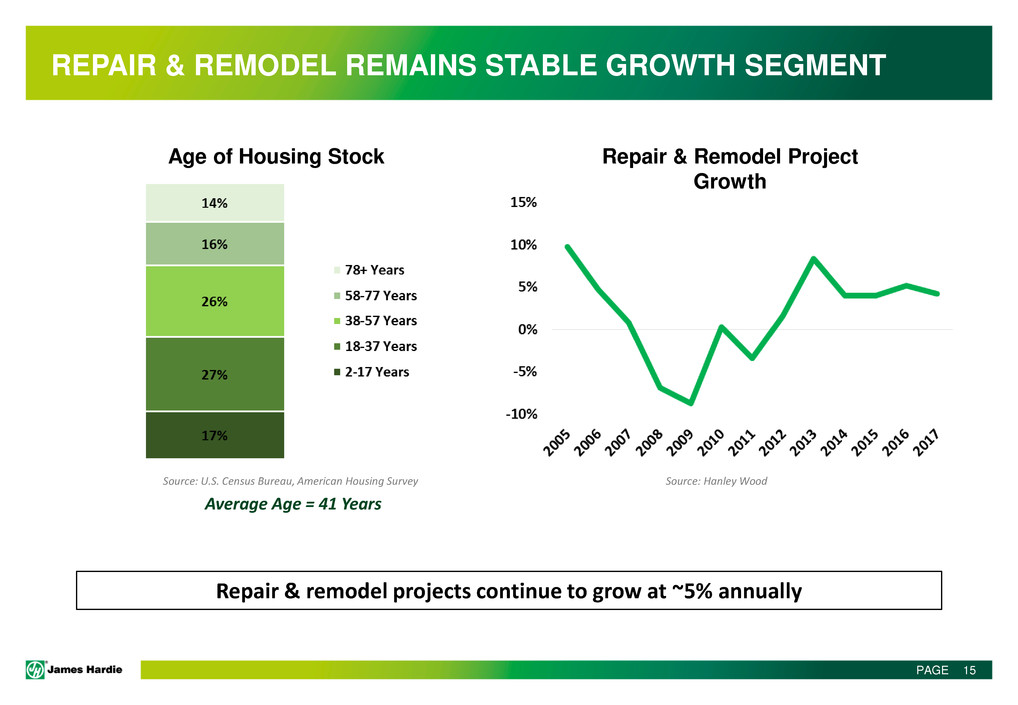

REPAIR & REMODEL REMAINS STABLE GROWTH SEGMENT

Source: U.S. Census Bureau, American Housing Survey Source: Hanley Wood

Repair & remodel projects continue to grow at ~5% annually

Average Age = 41 Years

Repair & Remodel Project

Growth

Age of Housing Stock

PAGE 16

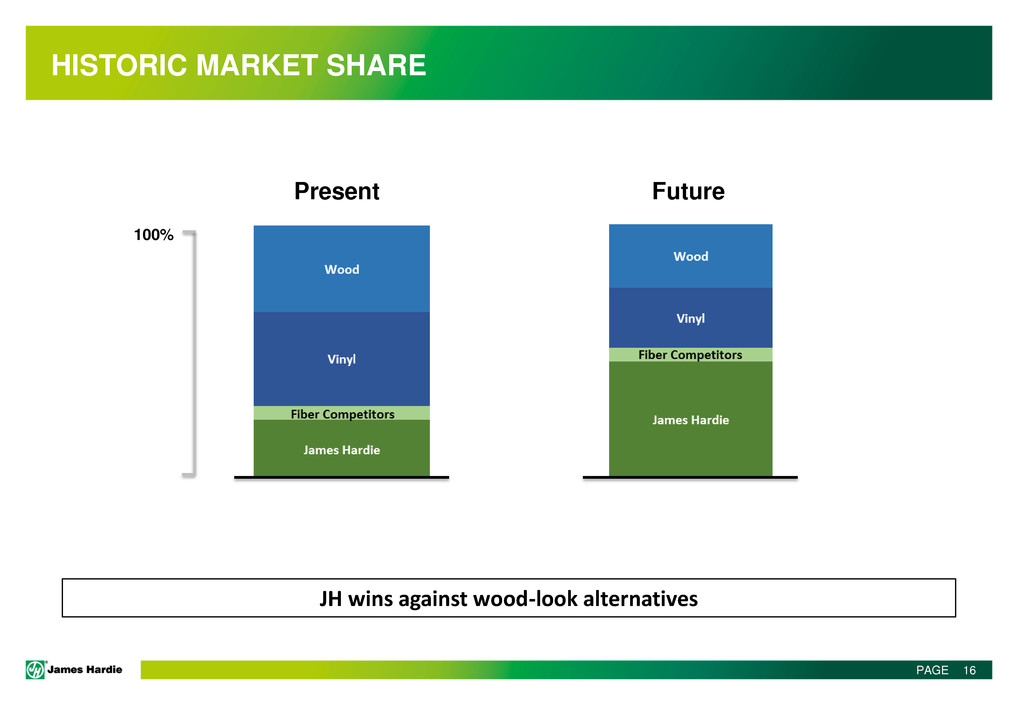

HISTORIC MARKET SHARE

Present Future

100%

JH wins against wood-look alternatives

PAGE 17

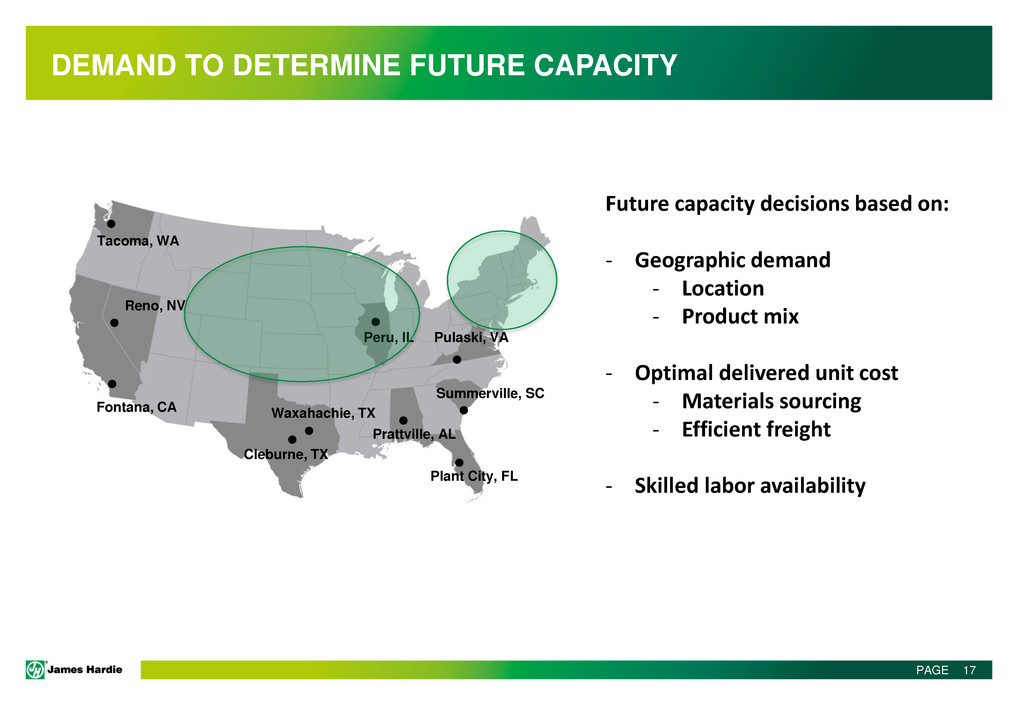

DEMAND TO DETERMINE FUTURE CAPACITY

Future capacity decisions based on:

- Geographic demand

- Location

- Product mix

- Optimal delivered unit cost

- Materials sourcing

- Efficient freight

- Skilled labor availability

Peru, IL Pulaski, VA

Summerville, SC

Plant City, FL

Prattville, AL

Waxahachie, TX

Cleburne, TX

Fontana, CA

Reno, NV

Tacoma, WA

PAGE 18

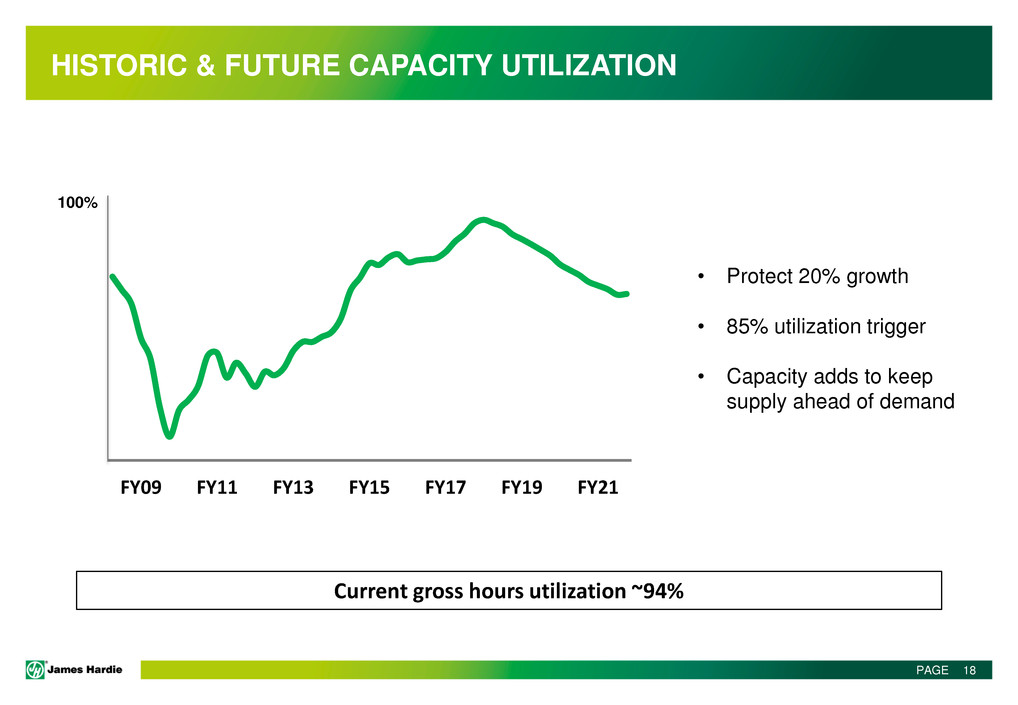

HISTORIC & FUTURE CAPACITY UTILIZATION

Current gross hours utilization ~94%

FY09 FY11 FY13 FY15 FY17 FY19 FY21

• Protect 20% growth

• 85% utilization trigger

• Capacity adds to keep

supply ahead of demand

100%

PAGE 19

TACOMA, WASHINGTON

• Currently under construction

• Expected commissioning Q1 FY19

• Nameplate capacity - 300 mmsqft/year

• Plank, Backer, Heritage, ColorPlus®

Technology

• ~130 employees at full production

• Site benefits

• Low input cost

• Proximity to growing markets

PAGE 20

PRATTVILLE, ALABAMA GREENFIELD

• Anticipate ground breaking Q3 FY18

• Expected commissioning Q1 FY20

• Minimum nameplate capacity – 600 mmsqft/year

• Plan for diverse product capability

• Plank, Trim, Backer, Heritage, ColorPlus®

Technology

• ~200 – 275 employees at full production

• Site benefits

• Low input cost

• Skilled manufacturing workforce

• Proximity to growing markets

• Rail accessibility

PAGE 21

KEY MESSAGES

• U.S. economy strong

• Housing recovery slow but steady

• Capacity in place to support growth