Exhibit 99.3 James Hardie Australia John Arneil, Country Manager Asia Pacific Investor and Analyst Tour Sunshine Coast, Australia June 25-26, 2018

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward-looking statements. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: • statements about the Company’s future performance; • projections of the Company’s results of operations or financial condition; • statements regarding the Company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products; • expectations concerning the costs associated with the suspension or closure of operations at any of the Company’s plants and future plans with respect to any such plants; • expectations concerning the costs associated with the significant capital expenditure projects at any of the Company’s plants and future plans with respect to any such projects; • expectations regarding the extension or renewal of the Company’s credit facilities including changes to terms, covenants or ratios; • expectations concerning dividend payments and share buy-backs; • statements concerning the Company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges; • statements regarding tax liabilities and related audits, reviews and proceedings; • statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings; • expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims; • expectations concerning the adequacy of the Company’s warranty provisions and estimates for future warranty-related costs; • statements regarding the Company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the Asia Pacific region, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. PAGE 2

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS (continued) Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 22 May 2018, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; the continuation or termination of the governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the Company, or at all; acquisition or sale of businesses and business segments; changes in the Company’s key management personnel; inherent limitations on internal controls; use of accounting estimates; the integration of Fermacell into our business; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law. PAGE 3

AGENDA 1. AU Strategy 2. JH performance relative to the market 3. Market performance 4. How does JH outperform? PAGE 4

AU Strategy VISION: To transform the Australian way to build APPROACH: 1. Zero Harm : Accelerating our safety journey 2. Market Led : We are customer and consumer insights led with a unique go to market model 3. Innovative Solutions : Delivery of market valued systems and solutions 4. World class manufacturing : Serve market with the right quality and lowest cost 5. Smart, driven, real people : invest in developing all levels of the organisation PAGE 5

Zero Harm at the core of our strategy Safe People Safe Places Safe Systems • Everyone at JH is a Safety • 5S and housekeepingvisibly • Safety integrated into every Leader demonstrates ZeroHarm function across the business • Every employee in the • Engineering controls are business is empowered implemented to minimise • Safety systems providethe and authorised to stop exposure to risk structure to control critical unsafe acts risks • Continuous Improvement • Every leader in the through safety indesign • Systems arestandardised business takes action on and transferable unsafe acts and conditions PAGE 6

Zero Harm is our number one priority – 5S example 5S providing the platform for SAFE Plant, and standardised operations PAGE 7

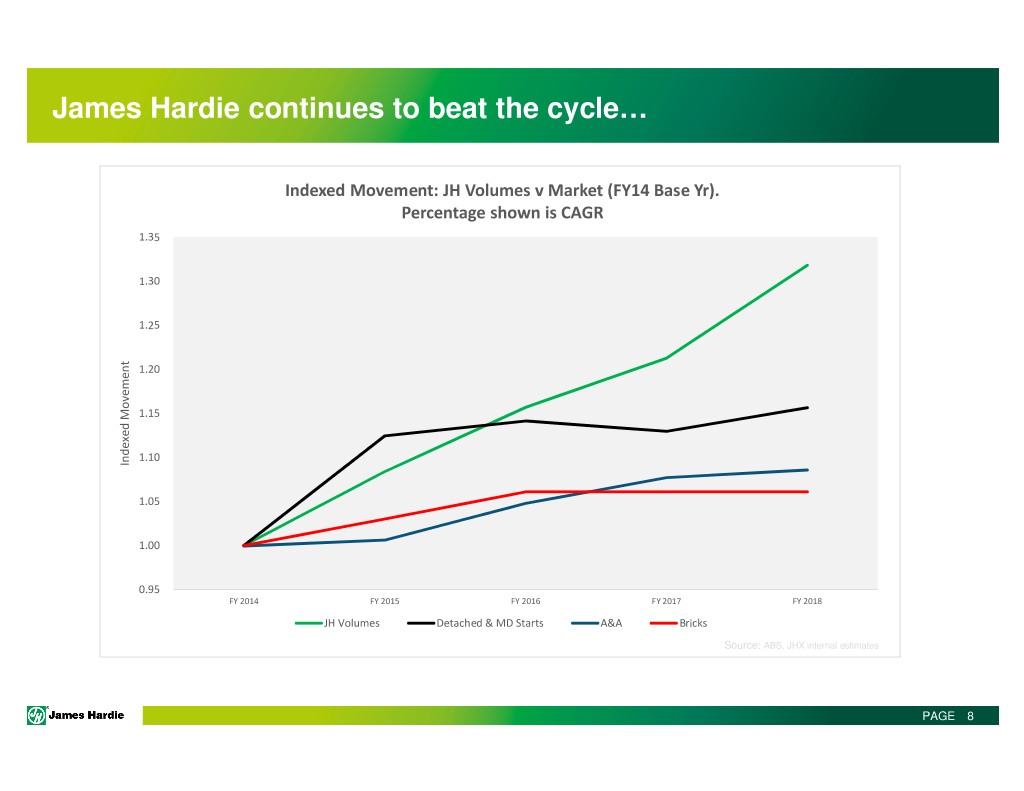

James Hardie continues to beat the cycle… Indexed Movement: JH Volumes v Market (FY14 Base Yr). Percentage shown is CAGR 1.35 1.30 1.25 1.20 1.15 1.10 Indexed Movement Indexed 1.05 1.00 0.95 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 JH Volumes Detached & MD Starts A&A Bricks Source: ABS, JHX internal estimates PAGE 8

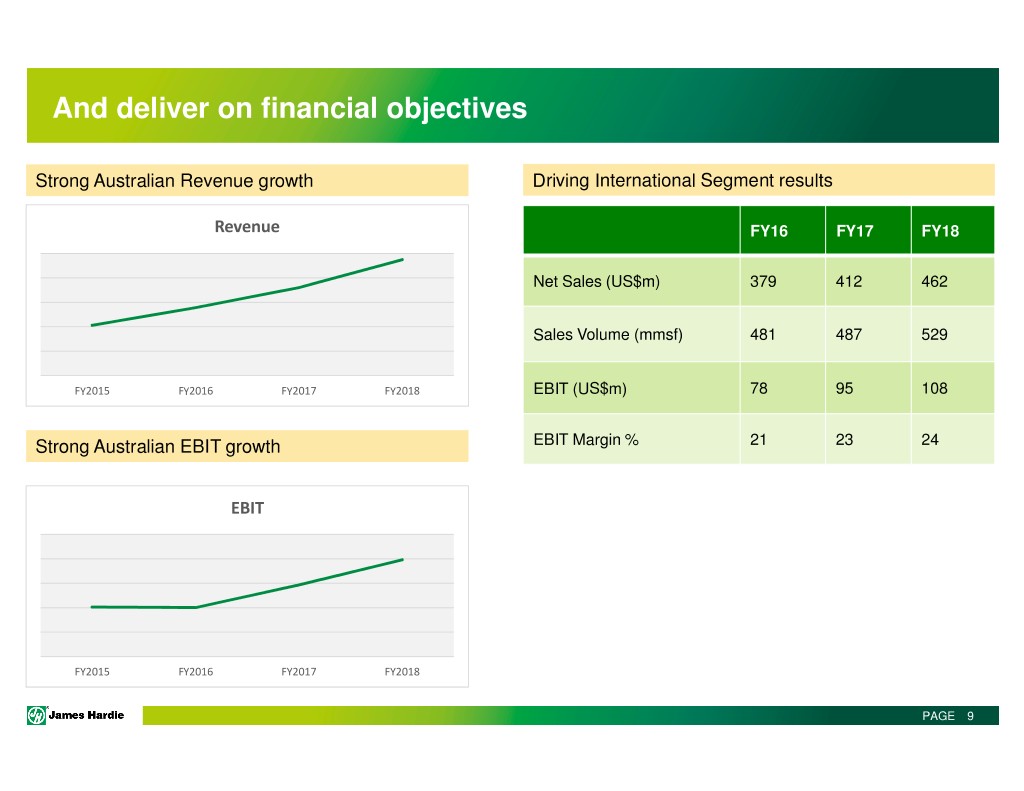

And deliver on financial objectives Strong Australian Revenue growth Driving International Segment results Revenue FY16 FY17 FY18 Net Sales (US$m) 379 412 462 Sales Volume (mmsf) 481 487 529 FY2015 FY2016 FY2017 FY2018 EBIT (US$m) 78 95 108 Strong Australian EBIT growth EBIT Margin % 21 23 24 EBIT FY2015 FY2016 FY2017 FY2018 PAGE 9

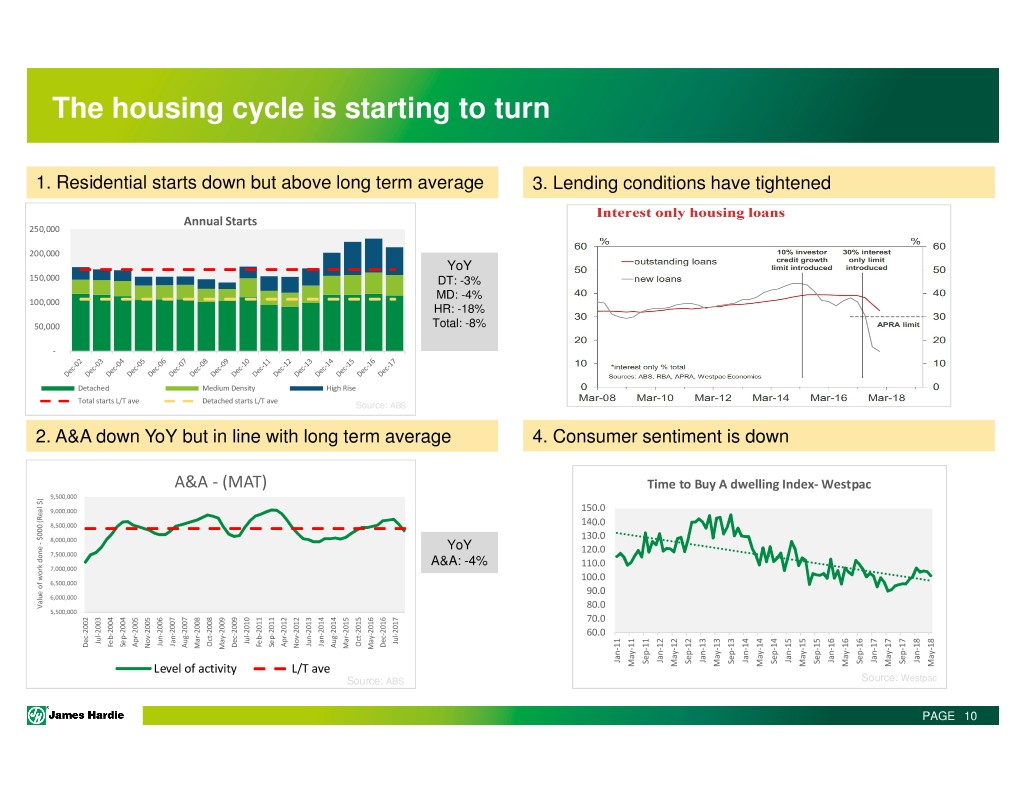

The housing cycle is starting to turn 1. Residential starts down but above long term average 3. Lending conditions have tightened Annual Starts 250,000 200,000 YoY 150,000 DT: -3% MD: -4% 100,000 HR: -18% 50,000 Total: -8% - Detached Medium Density High Rise Total starts L/T ave Detached starts L/T ave Source: ABS 2. A&A down YoY but in line with long term average 4. Consumer sentiment is down A&A - (MAT) Time to Buy A dwelling Index- Westpac 9,500,000 9,000,000 150.0 8,500,000 140.0 130.0 8,000,000 YoY 7,500,000 120.0 A&A: -4% 110.0 7,000,000 100.0 6,500,000 90.0 6,000,000 Value of work done -done ofwork Value $) (Real $000 80.0 5,500,000 70.0 60.0 Jul-2017 Jul-2010 Jul-2003 Jan-2014 Jan-2007 Jun-2013 Jun-2006 Oct-2015 Oct-2008 Apr-2012 Apr-2005 Feb-2011 Sep-2011 Feb-2004 Sep-2004 Dec-2016 Dec-2009 Dec-2002 Aug-2014 Aug-2007 Nov-2012 Nov-2005 Mar-2015 Mar-2008 May-2016 May-2009 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Level of activity L/T ave May-11 May-12 May-13 May-14 May-15 May-16 May-17 May-18 Source: ABS Source: Westpac PAGE 10

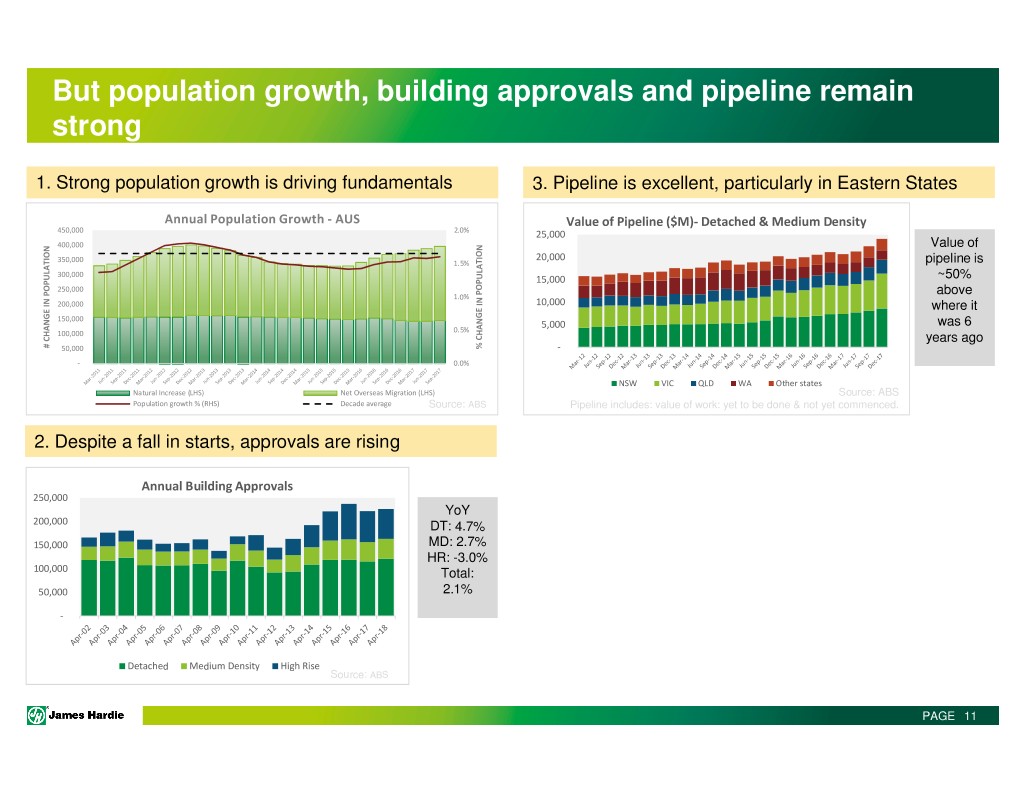

But population growth, building approvals and pipeline remain strong 1. Strong population growth is driving fundamentals 3. Pipeline is excellent, particularly in Eastern States Annual Population Growth - AUS Value of Pipeline ($M)- Detached & Medium Density 450,000 2.0% 25,000 400,000 Value of 20,000 350,000 1.5% pipeline is 300,000 15,000 ~50% 250,000 1.0% above 200,000 10,000 where it 150,000 5,000 was 6 0.5% 100,000 years ago # # CHANGEIN POPULATION 50,000 % CHANGEINPOPULATION - - 0.0% NSW VIC QLD WA Other states Natural Increase (LHS) Net Overseas Migration (LHS) Source: ABS Population growth % (RHS) Decade average Source: ABS Pipeline includes: value of work: yet to be done & not yet commenced. 2. Despite a fall in starts, approvals are rising Annual Building Approvals 250,000 YoY 200,000 DT: 4.7% 150,000 MD: 2.7% HR: -3.0% 100,000 Total: 50,000 2.1% - Detached Medium Density High Rise Source: ABS PAGE 11

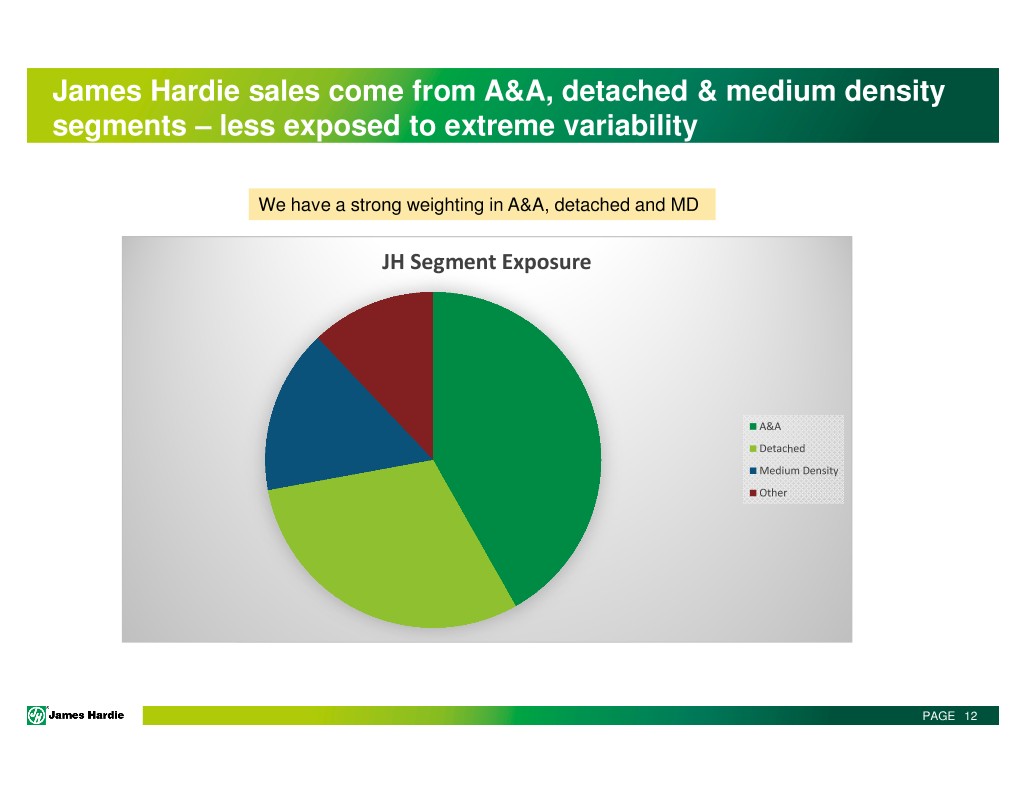

James Hardie sales come from A&A, detached & medium density segments – less exposed to extreme variability We have a strong weighting in A&A, detached and MD JH Segment Exposure A&A Detached Medium Density Other PAGE 12

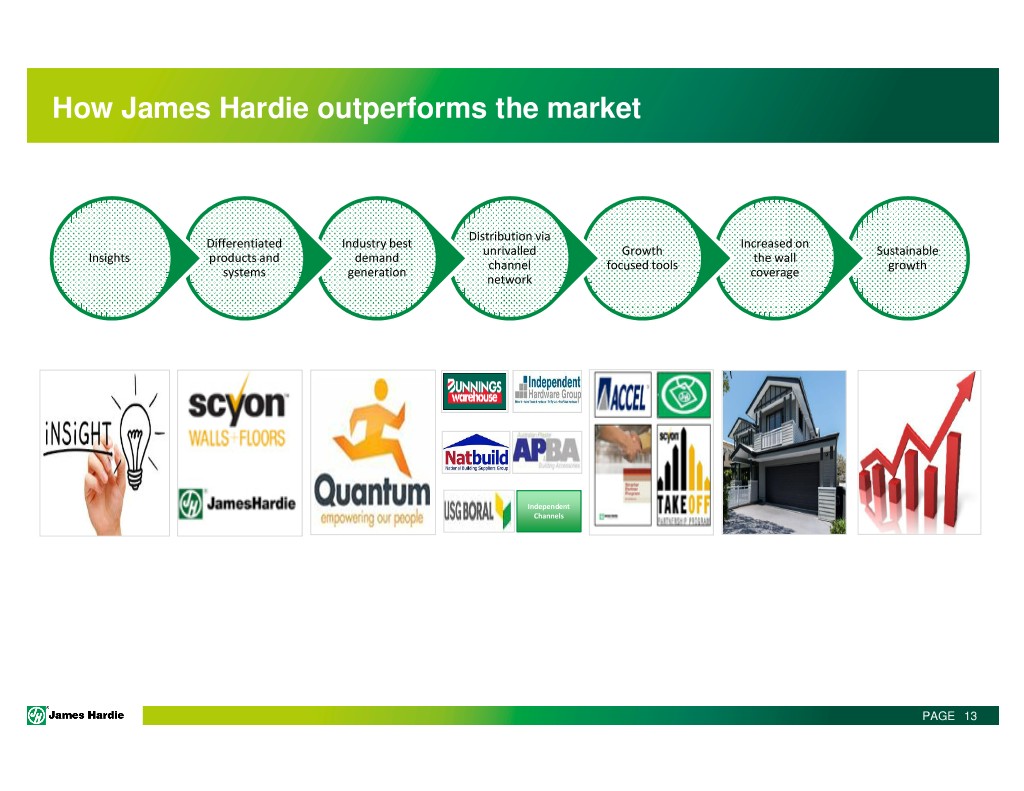

How James Hardie outperforms the market Distribution via Differentiated Industry best Increased on unrivalled Growth Sustainable Insights products and demand the wall channel focused tools growth systems generation coverage network Independent Channels PAGE 13

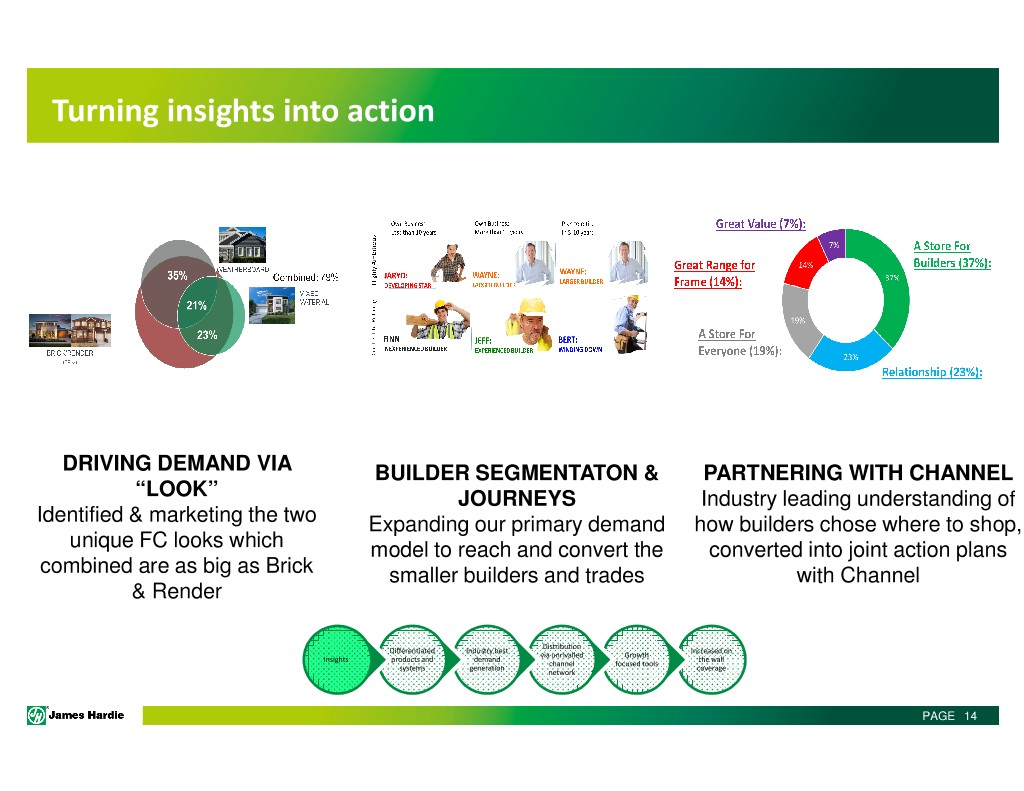

Turning insights into action DRIVING DEMAND VIA BUILDER SEGMENTATON & PARTNERING WITH CHANNEL “LOOK” JOURNEYS Industry leading understanding of Identified & marketing the two Expanding our primary demand how builders chose where to shop, unique FC looks which model to reach and convert the converted into joint action plans combined are as big as Brick smaller builders and trades with Channel & Render Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 14 Market Led

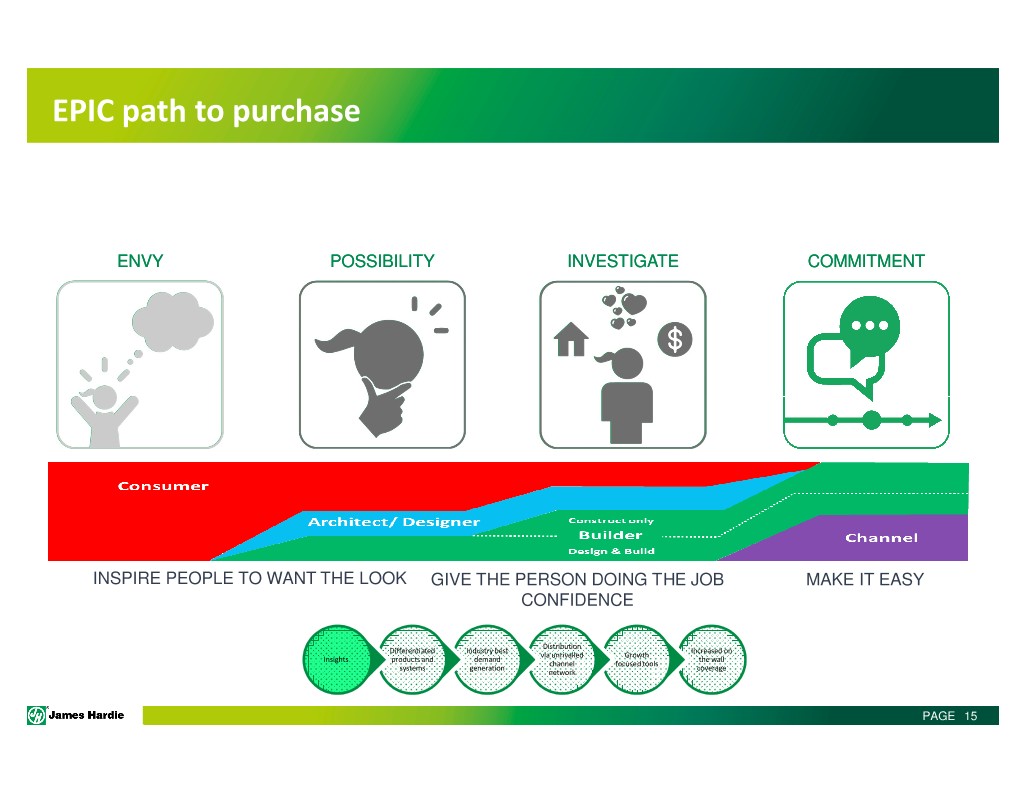

EPIC path to purchase ENVY POSSIBILITY INVESTIGATE COMMITMENT INSPIRE PEOPLE TO WANT THE LOOK GIVE THE PERSON DOING THE JOB MAKE IT EASY Scyon (Hamptons & Mixed) & HardieDeck CONFIDENCE Category Growth/ Brick Switch Out Education & tools Education , incentives & tools via Channel Consumers, Designers, D&C Builders Category Growth/Distribution Managing Risk Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall Builders & Channel Employees channel focused tools systems generation Designers & Builders coverage network PAGE 15 The Aspirational Consumer

Holistic marketing Leveraging all direct and co-marketing funds via builders and channel to drive holistic support Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 16 The Aspirational Consumer

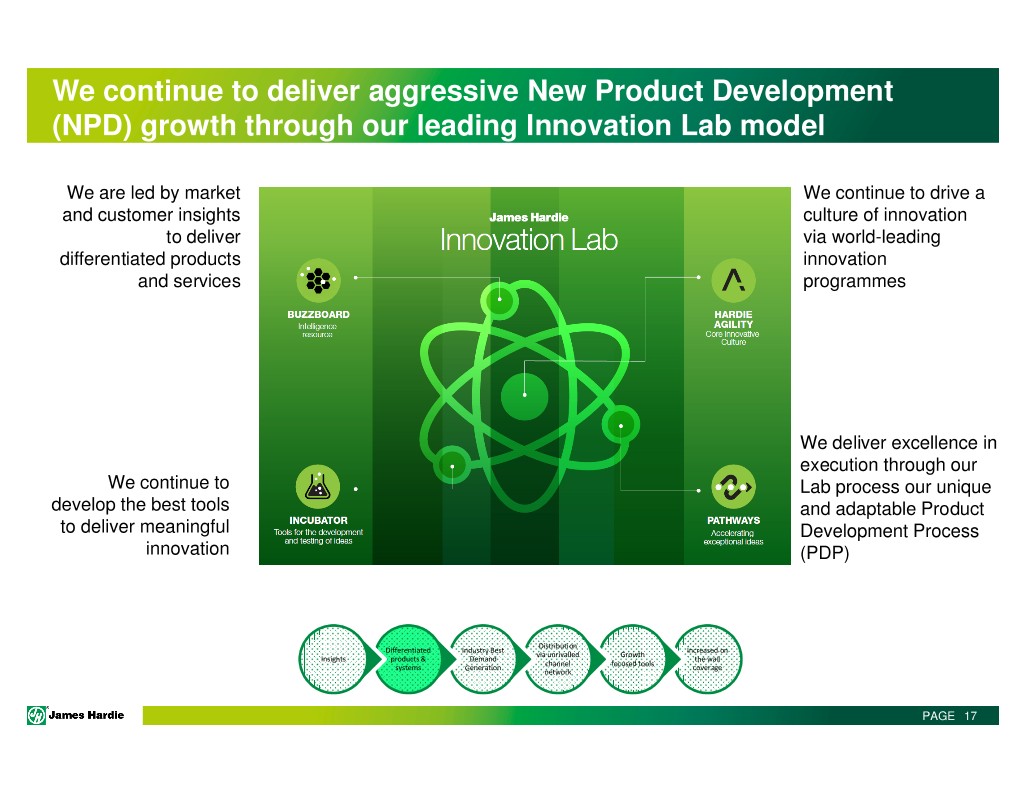

We continue to deliver aggressive New Product Development (NPD) growth through our leading Innovation Lab model We are led by market We continue to drive a and customer insights culture of innovation to deliver via world-leading differentiated products innovation and services programmes We deliver excellence in execution through our We continue to Lab process our unique develop the best tools and adaptable Product to deliver meaningful Development Process innovation (PDP) Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 17

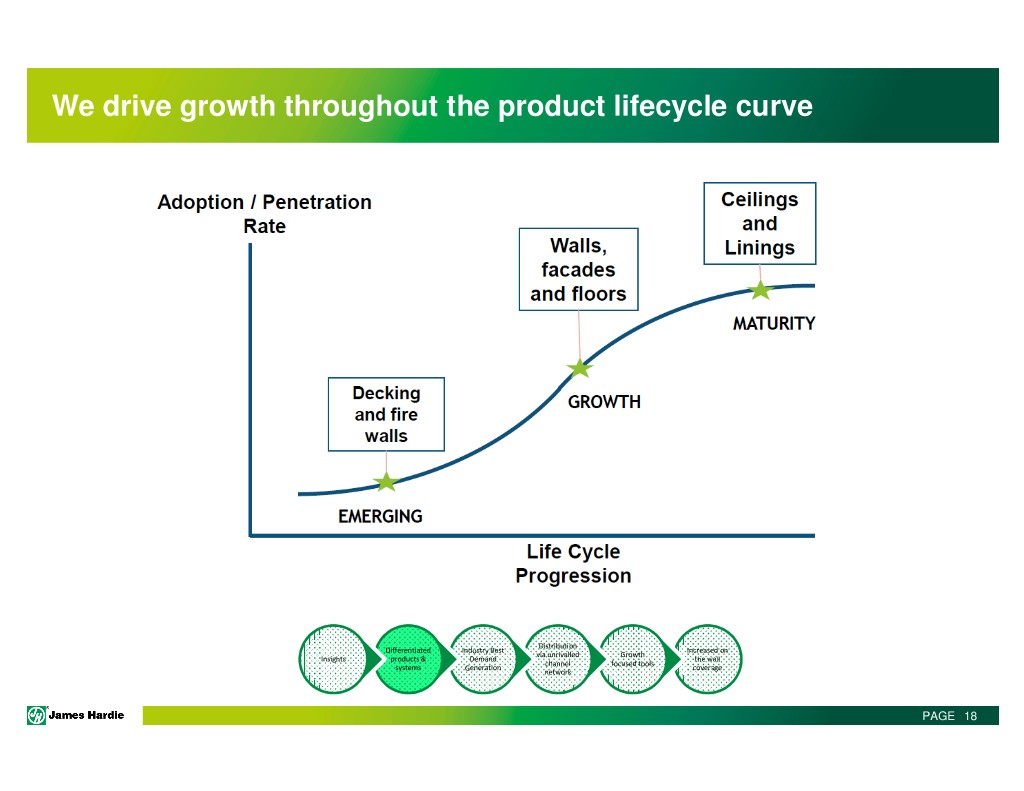

We drive growth throughout the product lifecycle curve Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 18

We have differentiated products & systems: walls Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 19

We have differentiated products & systems: ceilings & linings Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 20

We have differentiated products & systems: floors Scyon™ Secura™ interior flooring Scyon™ Secura™ exterior flooring Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 21

We have differentiated products & systems: decking Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products and demand the wall channel focused tools systems generation coverage network PAGE 22

We have differentiated products & systems: Hardie Smart Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 23

We have smart, driven and real people driving demand Sales Force Enablement: A strategic, collaborative discipline designed to increase sales results by leveraging intellectual property to provide consistent, scalable enablement services that allow customer-facing professionals and their managers to differentiate and add value in every customer interaction. Distribution Differentiated Industry best Increased on via unrivalled Growth Insights products & demand the wall channel focused tools systems generation coverage network PAGE 24

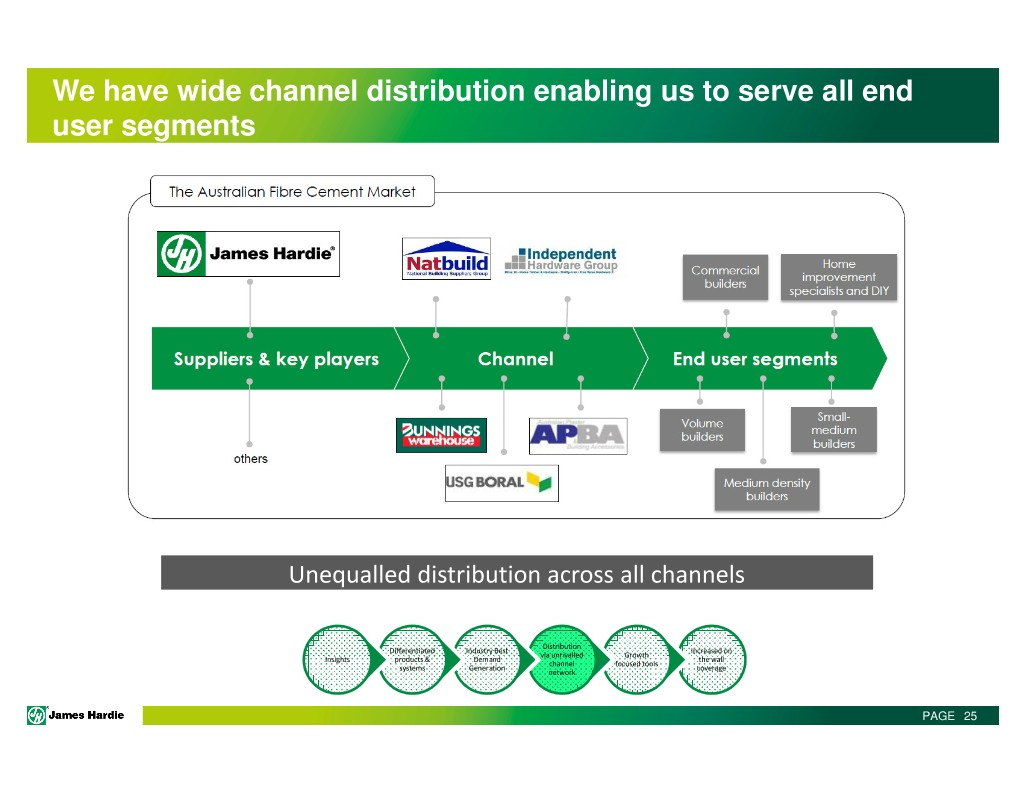

We have wide channel distribution enabling us to serve all end user segments Unequalled distribution across all channels Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 25

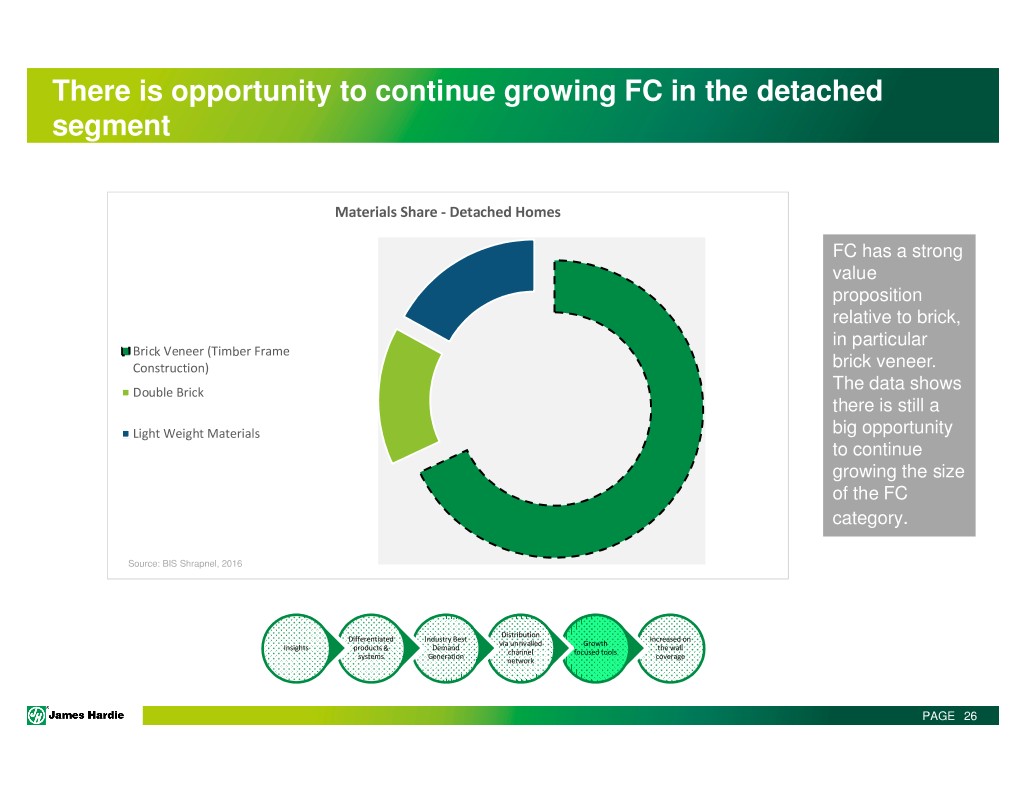

There is opportunity to continue growing FC in the detached segment Materials Share - Detached Homes FC has a strong value proposition relative to brick, in particular Brick Veneer (Timber Frame Construction) brick veneer. Double Brick The data shows there is still a Light Weight Materials big opportunity to continue growing the size of the FC category . Source: BIS Shrapnel, 2016 Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 26

FC has a compelling value proposition relative to bricks 1. 64% of consumers are demanding an FC look, as per our survey results Consumer survey: cladding preference (JH insights, n = 6574 June 2018) 10% Bricks Hamptons/Coastal 26% 44% 20% Hamptons/Coastal Modern mixed materials Plain render Brick Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage Render network Mixed materials PAGE 27

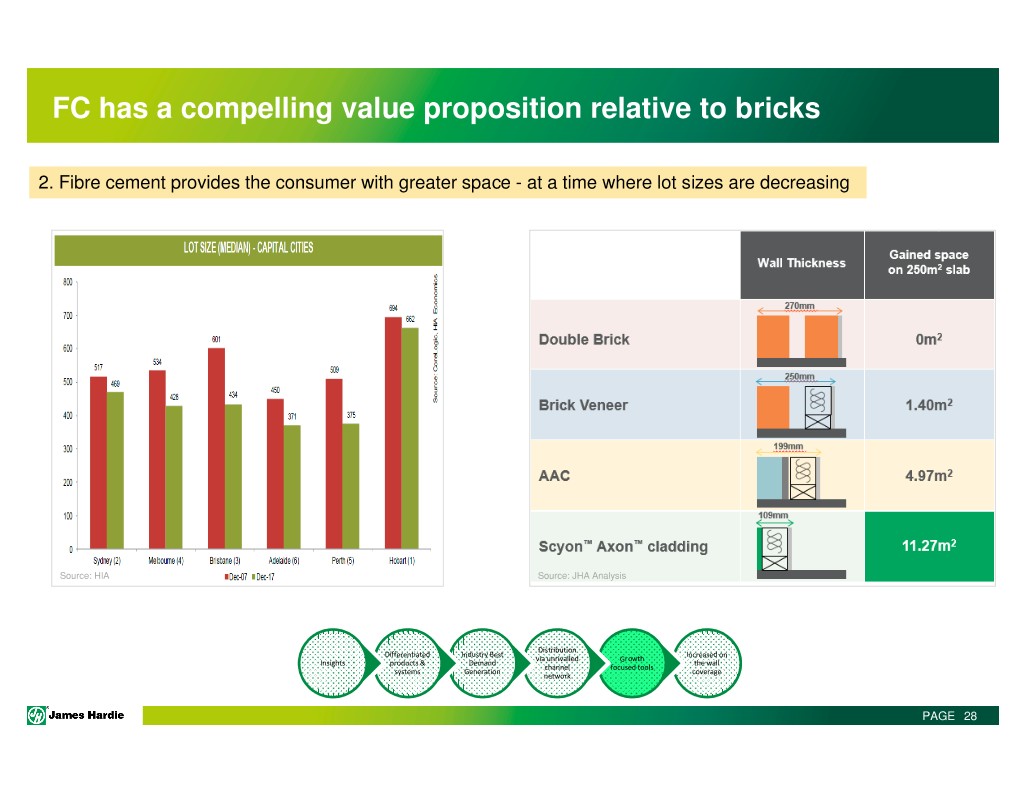

FC has a compelling value proposition relative to bricks 2. Fibre cement provides the consumer with greater space - at a time where lot sizes are decreasing Source: HIA Source: JHA Analysis Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 28

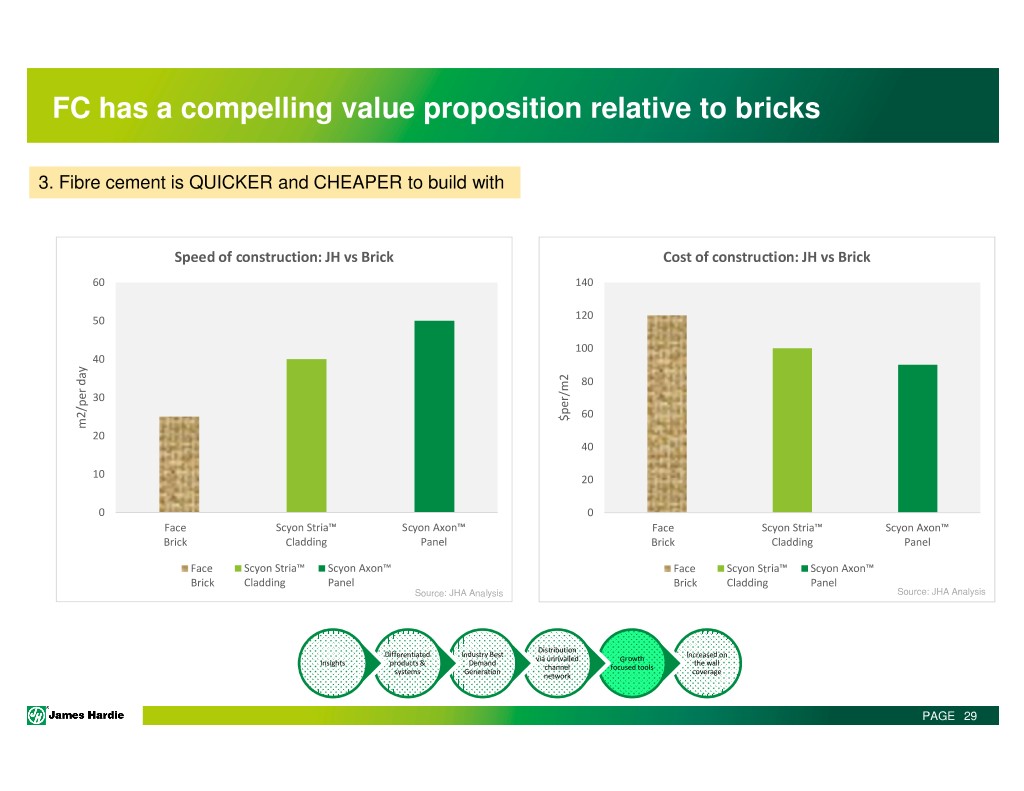

FC has a compelling value proposition relative to bricks 3. Fibre cement is QUICKER and CHEAPER to build with Speed of construction: JH vs Brick Cost of construction: JH vs Brick 60 140 50 120 100 40 80 30 60 $per/m2 m2/per day m2/per 20 40 10 20 0 0 Face Scyon Stria™ Scyon Axon™ Face Scyon Stria™ Scyon Axon™ Brick Cladding Panel Brick Cladding Panel Face Scyon Stria™ Scyon Axon™ Face Scyon Stria™ Scyon Axon™ Brick Cladding Panel Brick Cladding Panel Source: JHA Analysis Source: JHA Analysis Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 29

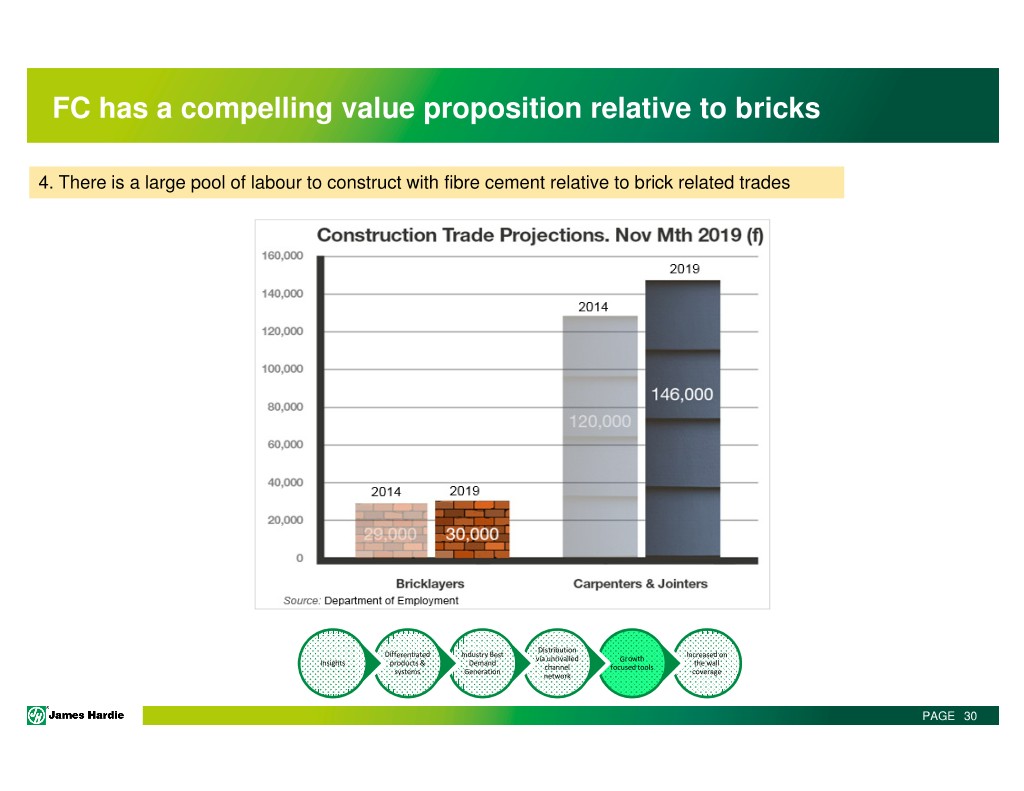

FC has a compelling value proposition relative to bricks 4. There is a large pool of labour to construct with fibre cement relative to brick related trades Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 30

The Australian landscape used to look like this… Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 31

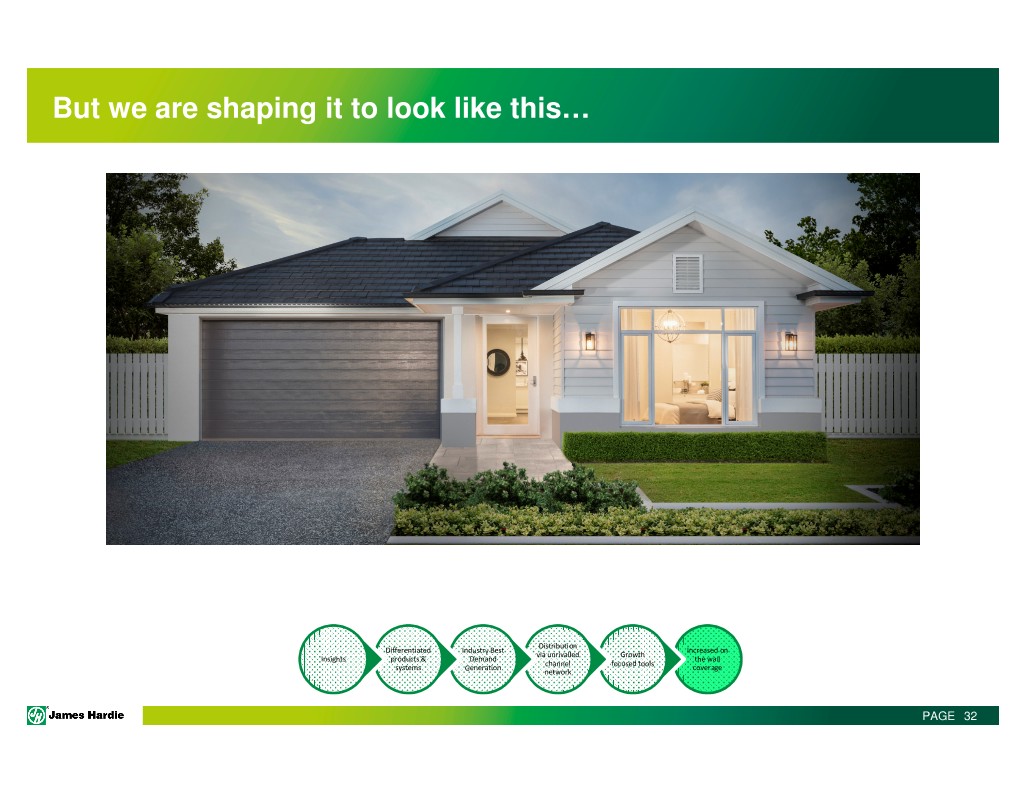

But we are shaping it to look like this… Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 32

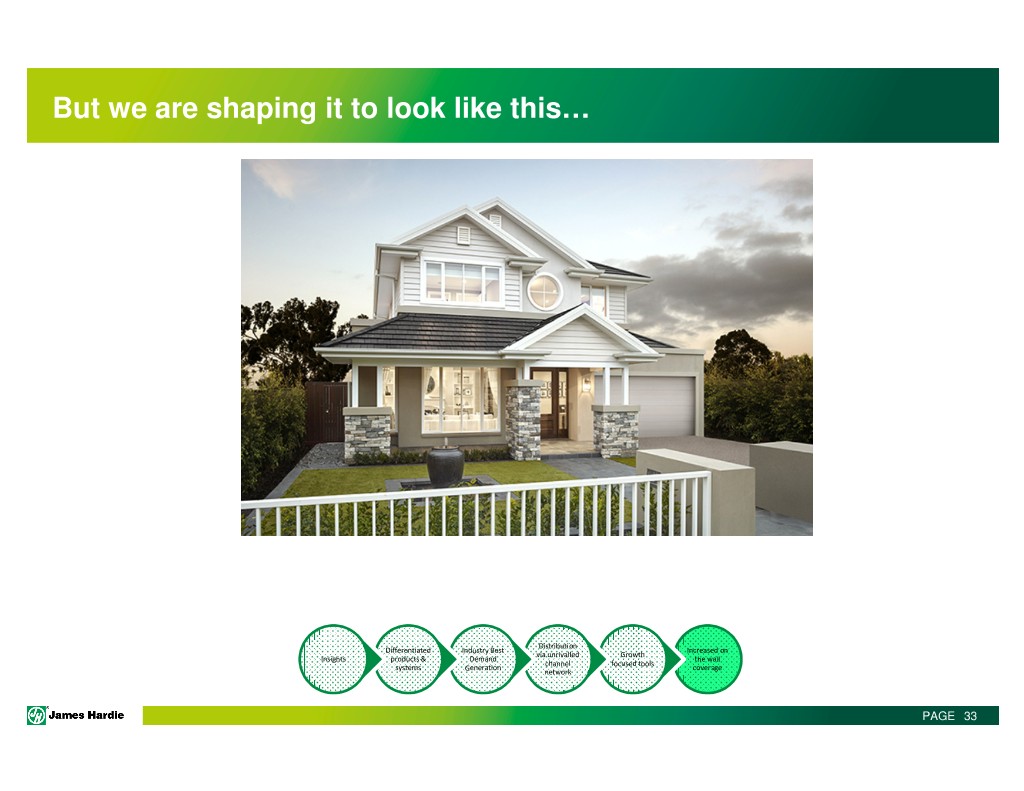

But we are shaping it to look like this… Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 33

But we are shaping it to look like this… Distribution Differentiated Industry Best Increased on via unrivalled Growth Insights products & Demand the wall channel focused tools systems Generation coverage network PAGE 34

Our manufacturing strategy aligns with our organisational objectives Deliver on Promise - Quality - DIFOT Organisational Capability - Safety first -People -Hardie Advantage Asset Lowest cost Utilisation -Maximise yield - Maximise - Eliminate waste availability & activity - Minimise input costs - Minimise defects PAGE 35

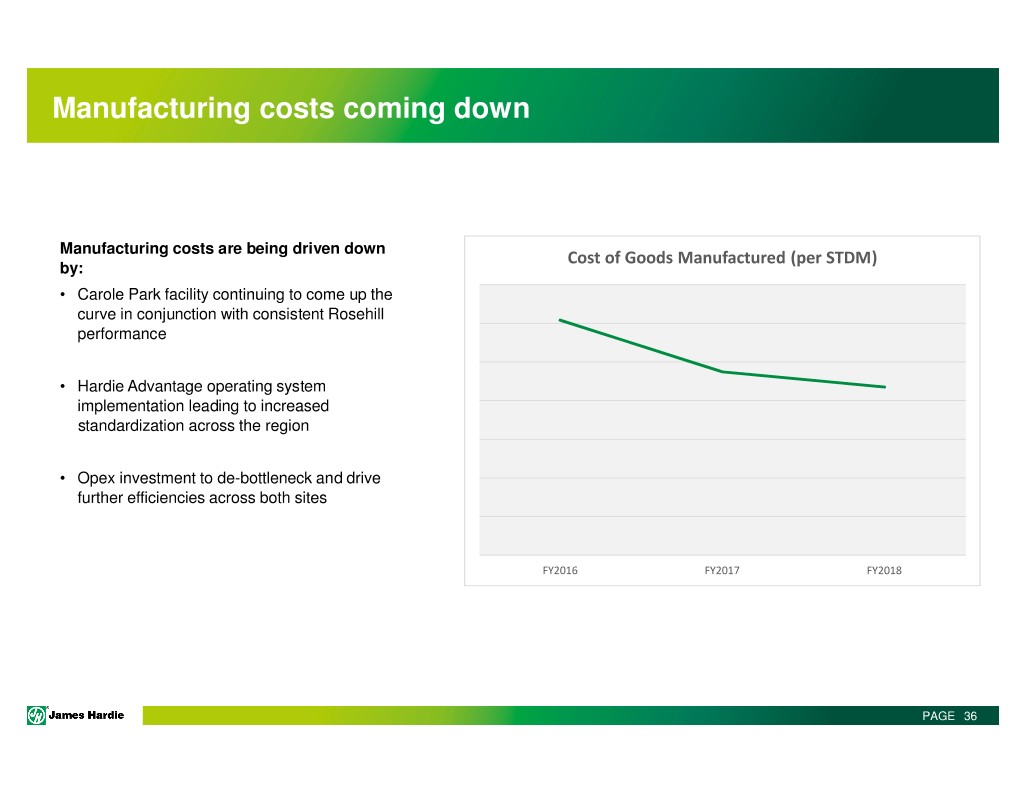

Manufacturing costs coming down Manufacturing costs are being driven down Cost of Goods Manufactured (per STDM) by: • Carole Park facility continuing to come up the curve in conjunction with consistent Rosehill performance • Hardie Advantage operating system implementation leading to increased standardization across the region • Opex investment to de-bottleneck and drive further efficiencies across both sites FY2016 FY2017 FY2018 PAGE 36

Carole Park phase 2: increasing capacity for the longer term Four Strategic Concepts: • Capacity to service local market growth and penetration • Support and expand product leadership strategy and capability • Minimizes business risk • Drive low cost manufacturing PAGE 37

Summary James Hardie is committed to “transforming the Australian way to build” using the below approach: Zero Harm : Accelerating our safety journey Market Led : We are customer and consumer insights led with a unique go to market model Innovative Solutions : Delivery of market valued systems and solutions World class manufacturing : Serve market with the right quality and lowest cost Smart, driven, real people : invest in developing all levels of the organisation PAGE 38

QUESTIONS