Exhibit 99.5 James Hardie New Zealand Alan Bones, Country Manager Asia Pacific Investor and Analyst Tour Sunshine Coast, Australia June 25-26, 2018

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward-looking statements. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: • statements about the Company’s future performance; • projections of the Company’s results of operations or financial condition; • statements regarding the Company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products; • expectations concerning the costs associated with the suspension or closure of operations at any of the Company’s plants and future plans with respect to any such plants; • expectations concerning the costs associated with the significant capital expenditure projects at any of the Company’s plants and future plans with respect to any such projects; • expectations regarding the extension or renewal of the Company’s credit facilities including changes to terms, covenants or ratios; • expectations concerning dividend payments and share buy-backs; • statements concerning the Company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges; • statements regarding tax liabilities and related audits, reviews and proceedings; • statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings; • expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims; • expectations concerning the adequacy of the Company’s warranty provisions and estimates for future warranty-related costs; • statements regarding the Company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the Asia Pacific region, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. PAGE 2

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS (continued) Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 22 May 2018, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; the continuation or termination of the governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the Company, or at all; acquisition or sale of businesses and business segments; changes in the Company’s key management personnel; inherent limitations on internal controls; use of accounting estimates; the integration of Fermacell into our business; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law. PAGE 3

NZ OVERVIEW • Zero Harm: Is at the core of our strategy with investment in people, places and systems. • People: Continual focus on Smart, Driven and Real people to deliver a sustainable competitive advantage. • Market Performance: The New Zealand construction market is expected to remain strong in the medium term. Growth is flattening, but underlying demand drivers remain healthy. • Innovation: We remain focused on the innovation and development of new products and building solutions to further support growth. • Manufacturing Excellence: Invest in capability to deliver on local and regional capacity requirements. PAGE 4

Agenda – James Hardie New Zealand NZ strategy Smart Driven and Real People Performance relative to NZ market Customer segments – “Market Led” Products leadership – “Innovation” Manufacturing excellence PAGE 5

NZ Strategy VISION: To transform the way Kiwi’s build APPROACH 1. Zero Harm : Accelerating our safety journey. 2. Market Led : Through insights and primary stakeholder engagement we defend and expand our category leading position. 3. Innovative Solutions : Delivery of differentiated solutions that our customers demand and value. 4. Manufacturing Excellence : Optimize local output and leverage regional scale to meet market demand 5. Smart, driven, real people : Build and retain organisational capability to deliver a competitive advantage PAGE 6

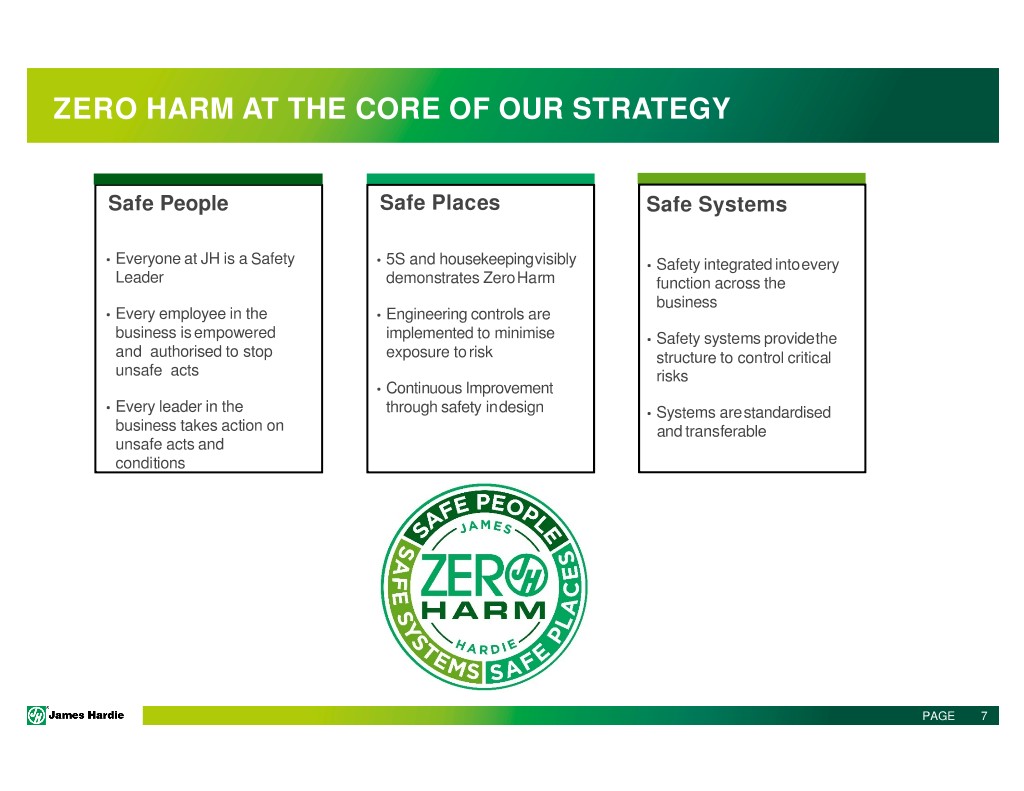

ZERO HARM AT THE CORE OF OUR STRATEGY Safe People Safe Places Safe Systems • Everyone at JH is a Safety • 5S and housekeepingvisibly • Safety integrated intoevery Leader demonstrates ZeroHarm function across the business • Every employee in the • Engineering controls are business is empowered implemented to minimise • Safety systems providethe and authorised to stop exposure to risk structure to control critical unsafe acts risks • Continuous Improvement • Every leader in the through safety indesign • Systems arestandardised business takes action on and transferable unsafe acts and conditions PAGE 7

We have Smart, Driven, and Real People Attract, Build, and Retain top talent that embodies the James Hardie culture for sustainable competitive advantage • New NZ Leadership team in place, focusing on improving the business in each function, and as a whole • Leverage regional functional capability to unlock the potential of people and teams • Investment in operational resource for effective transition to 24/7 manufacturing • Develop highly capable people to leadership thinking and capability PAGE 8

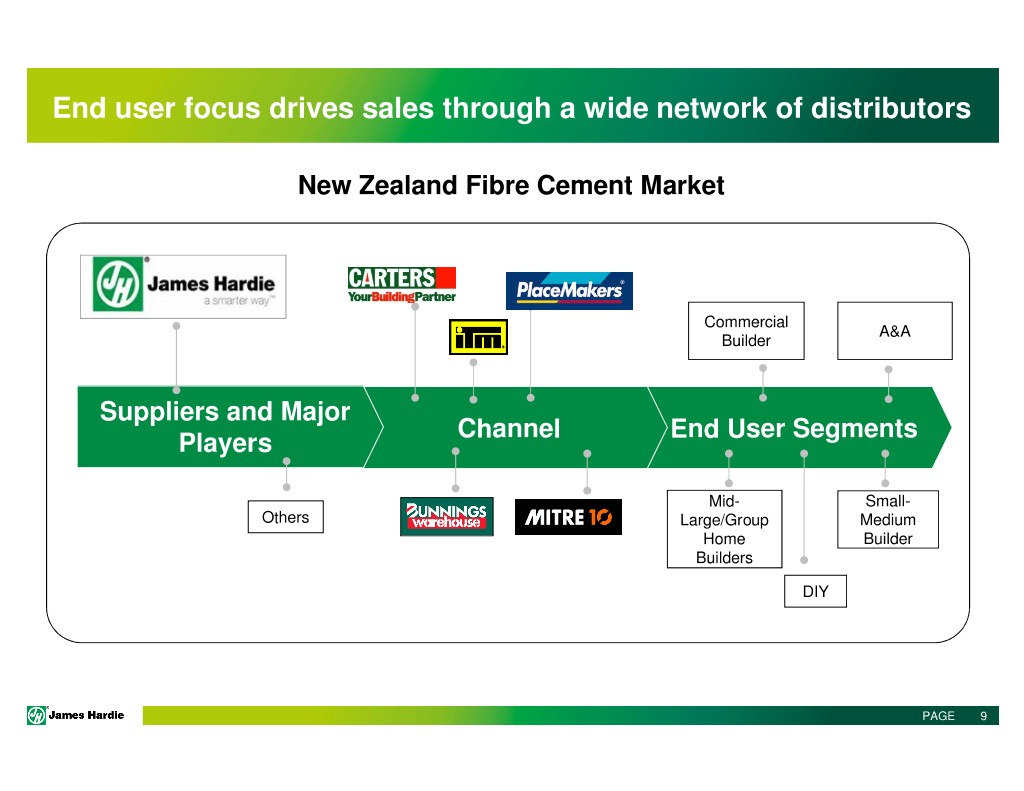

End user focus drives sales through a wide network of distributors New Zealand Fibre Cement Market Commercial A&A Builder Suppliers and Major Channel End User Segments Players Mid- Small- Others Large/Group Medium Home Builder Builders DIY PAGE 9

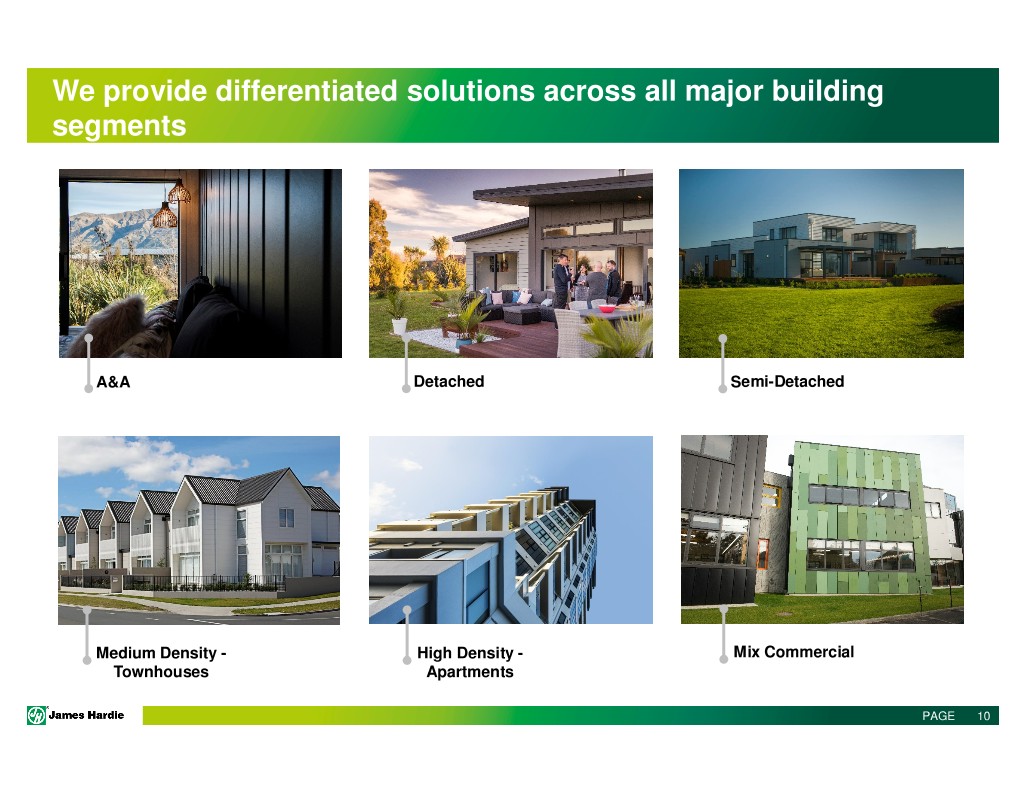

We provide differentiated solutions across all major building segments A&A Detached Semi-Detached Medium Density - High Density - Mix Commercial Townhouses Apartments PAGE 10

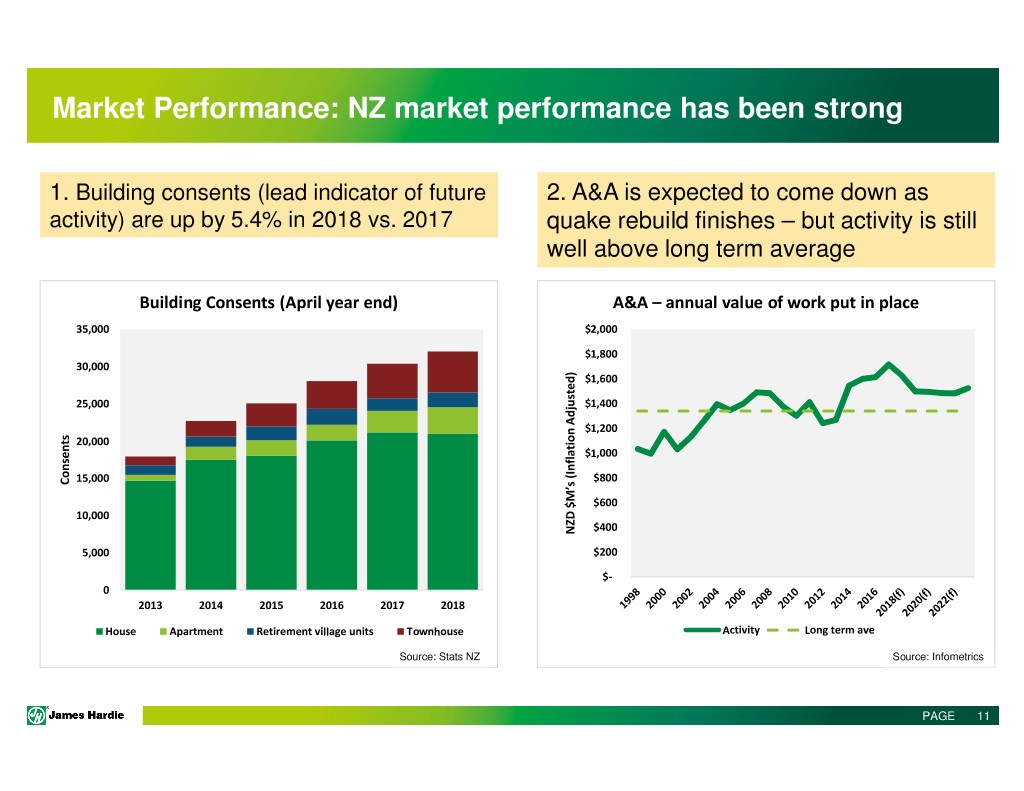

Market Performance: NZ market performance has been strong 1. Building consents (lead indicator of future 2. A&A is expected to come down as activity) are up by 5.4% in 2018 vs. 2017 quake rebuild finishes – but activity is still well above long term average Building Consents (April year end) A&A – annual value of work put in place 35,000 $2,000 $1,800 30,000 $1,600 25,000 $1,400 $1,200 20,000 $1,000 15,000 $800 Consents $600 10,000 $400 NZD $M’s (Inflation Adjusted) (Inflation $M’s NZD 5,000 $200 $- 0 2013 2014 2015 2016 2017 2018 House Apartment Retirement village units Townhouse Activity Long term ave Source: Stats NZ Source: Infometrics PAGE 11

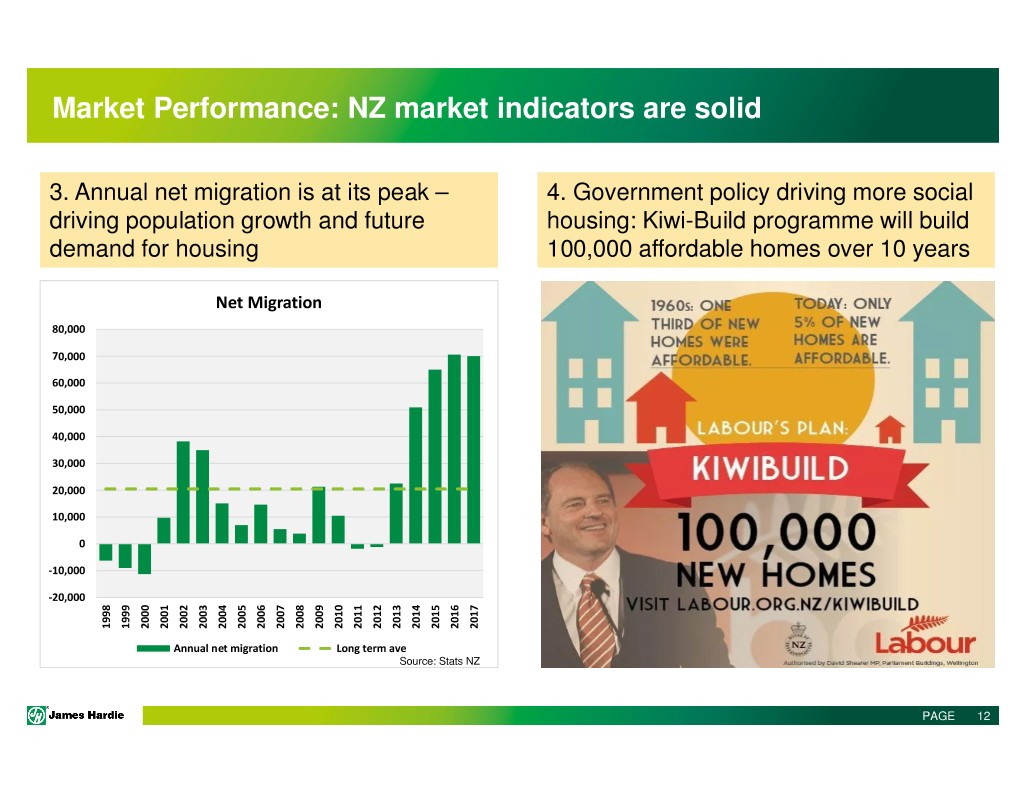

Market Performance: NZ market indicators are solid 3. Annual net migration is at its peak – 4. Government policy driving more social driving population growth and future housing: Kiwi-Build programme will build demand for housing 100,000 affordable homes over 10 years Net Migration 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 -10,000 -20,000 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Annual net migration Long term ave Source: Stats NZ PAGE 12

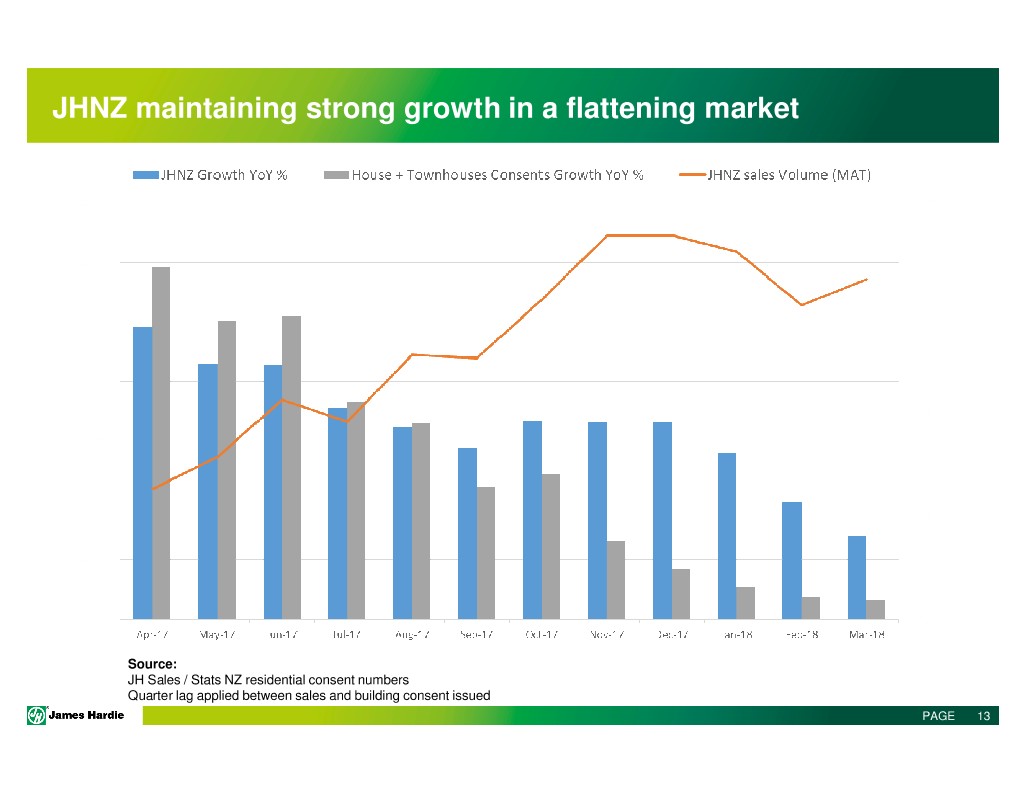

JHNZ maintaining strong growth in a flattening market Source: JH Sales / Stats NZ residential consent numbers Quarter lag applied between sales and building consent issued PAGE 13

Targeted demand generation is pivotal to our success… Defend & Grow Defend Grow Category Share Share of Addressable Position Value to Channel Detached Homes / A&A Innovate Differentiated solutions Emerging Markets Medium Density / New Audiences Fire, Acoustics and Pre Cladding New Products & Markets PAGE 14

… however our strength and opportunity lies in residential PAGE 15

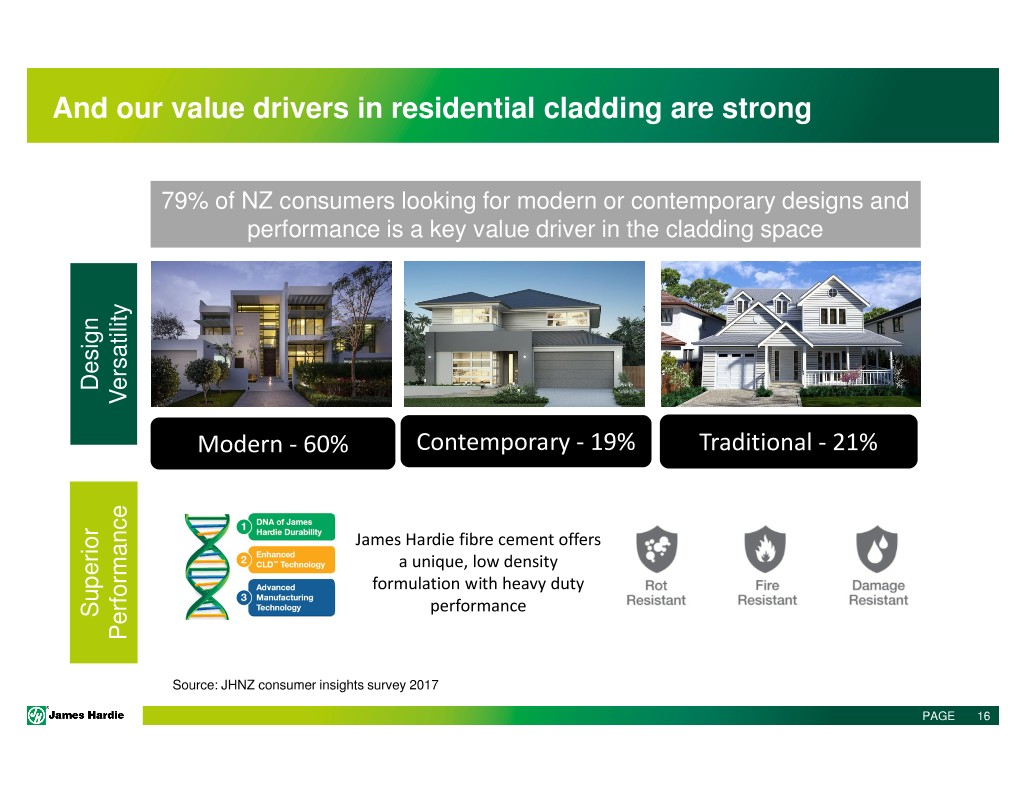

And our value drivers in residential cladding are strong 79% of NZ consumers looking for modern or contemporary designs and performance is a key value driver in the cladding space Design Versatility Modern - 60% Contemporary - 19% Traditional - 21% James Hardie fibre cement offers a unique, low density formulation with heavy duty performance Superior Performance Source: JHNZ consumer insights survey 2017 PAGE 16

Cladding: Leveraging vertical look trends in residential PAGE 17

…and transforming the built form in Residential Cladding LINEA™ WEATHERBOARD LINEA™ OBLIQUE WEATHERBOARD PAGE 18

…and transforming the built form in Residential Cladding STRIA™ CLADDING AXON™ / TITAN™ PANEL PAGE 19

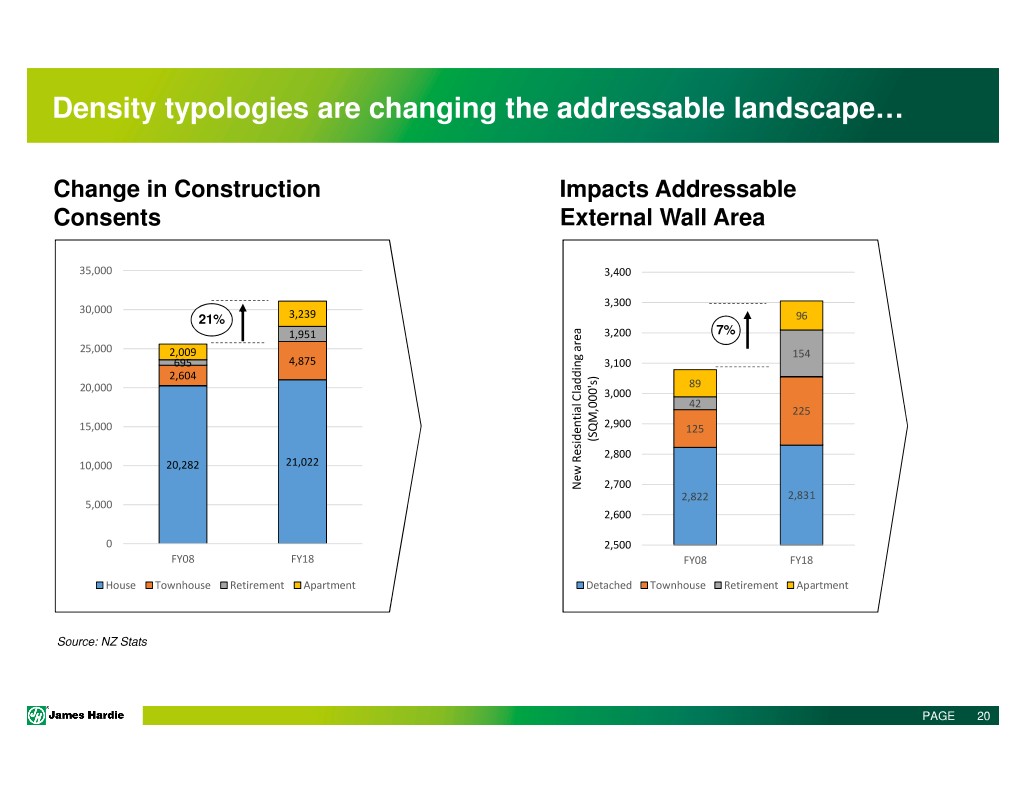

Density typologies are changing the addressable landscape… Change in Construction Impacts Addressable Consents External Wall Area 35,000 3,400 3,300 30,000 21% 3,239 96 1,951 3,200 7% 25,000 2,009 154 695 4,875 3,100 2,604 89 20,000 3,000 42 225 15,000 2,900 125 (SQM,000's) 2,800 10,000 20,282 21,022 New Residential Cladding area Cladding Residential New 2,700 2,822 2,831 5,000 2,600 0 2,500 FY08 FY18 FY08 FY18 House Townhouse Retirement Apartment Detached Townhouse Retirement Apartment Source: NZ Stats PAGE 20

...creates an opportunity for our differentiated systems James Hardie Fire and Acoustic rated floor Lightweight intertenancy solution F&A floor achieves above code: STC: Sound Transmission Class IIC: Impact Insulation Class PAGE 21

...creates an opportunity for our differentiated systems James Hardie Fire rated Walls Lightweight Exterior wall solutions FRR: Fire Resistance Rating PAGE 22

Growth above market is bolstered by investment in the Customer • Customer Insights - leverage insights capability in, as well as through the organization • Customer Excellence - go beyond product leadership to create value for all stakeholders • Sales Effectiveness - new systems and framework to position trusted advisory status • Marketing Effectiveness - focus to include end consumers to influence path to purchase Be Market Led. Know our audience Consumer Builder Specifier Channel PAGE 23

Insight led Innovation to strengthen and secure our position SQM volume 8% 11% 5% 2014 HomeRAB ® Pre- 2015 Linea ® Oblique Cladding Weatherboard 2016 2017 2018 2018 Secura ™ F&A 2019 RAB ™ New Product contribution under 5 years Flooring System Board 9mm PAGE 24

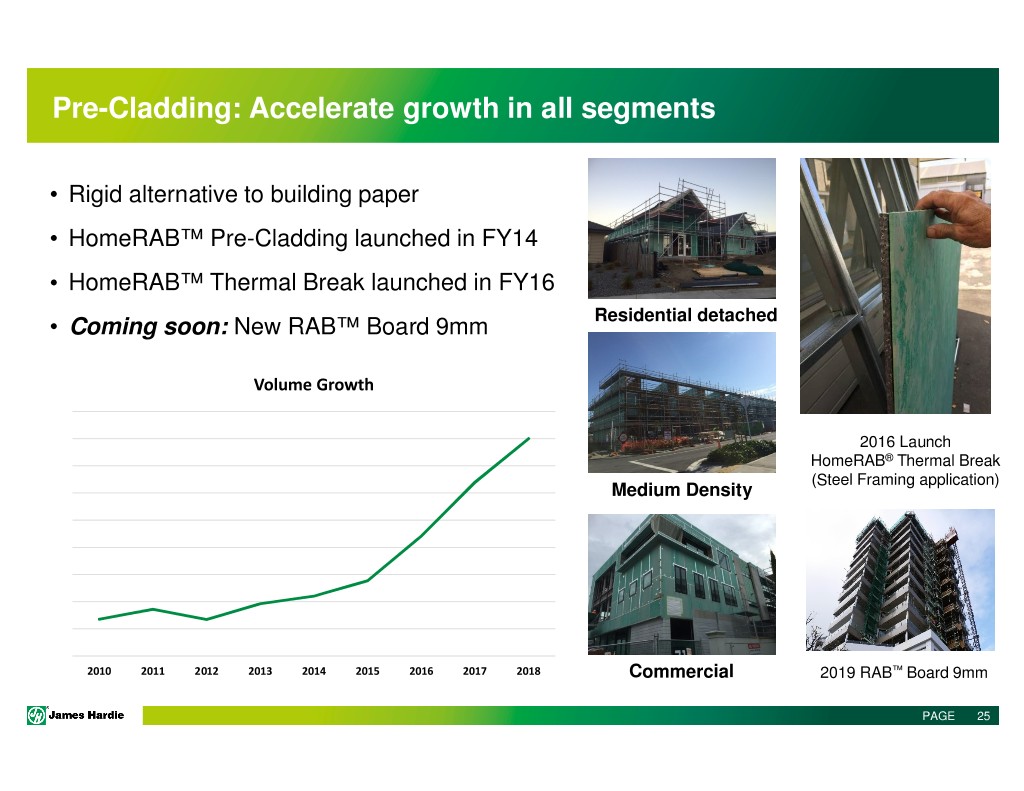

Pre-Cladding: Accelerate growth in all segments • Rigid alternative to building paper • HomeRAB™ Pre-Cladding launched in FY14 • HomeRAB™ Thermal Break launched in FY16 • Coming soon: New RAB™ Board 9mm Residential detached Volume Growth 2016 Launch HomeRAB ® Thermal Break (Steel Framing application) Medium Density 2010 2011 2012 2013 2014 2015 2016 2017 2018 Commercial 2019 RAB ™ Board 9mm PAGE 25

Transforming the way we build with Residential Pre-Cladding HOMERAB™ Pre-Cladding PAGE 26

…and transforming the way we build with Commercial Pre-Cladding RAB™ Board PAGE 27

PENROSE: Manufacturing Excellence to meet growing demand Investment in people, process and systems to create capacity and deliver on organisational objectives in response to significant growth above market both locally and regionally • 80 years manufacturing in New Zealand, for New Zealanders • May 2018: JHNZ Moved to a 24/7 operational model • Deployment of Hardie Advantage operating system PAGE 28

NZ Strategy VISION: To transform the way Kiwi’s build APPROACH 1. Zero Harm : Accelerating our safety journey. 2. Market Led : Through insights and primary stakeholder engagement we defend and expand our category leading position. 3. Innovative Solutions : Delivery of differentiated solutions that our customers demand and value. 4. Manufacturing Excellence : Optimize local output and leverage regional scale to meet market demand 5. Smart, driven, real people : Build and retain organisational capability to deliver a competitive advantage PAGE 29

QUESTIONS