Exhibit 99.1 James Hardie International Jack Truong, President – International Asia Pacific Investor & Analyst Tour Sunshine Coast, Australia June 25-26, 2018

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward-looking statements. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: • statements about the Company’s future performance; • projections of the Company’s results of operations or financial condition; • statements regarding the Company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products; • expectations concerning the costs associated with the suspension or closure of operations at any of the Company’s plants and future plans with respect to any such plants; • expectations concerning the costs associated with the significant capital expenditure projects at any of the Company’s plants and future plans with respect to any such projects; • expectations regarding the extension or renewal of the Company’s credit facilities including changes to terms, covenants or ratios; • expectations concerning dividend payments and share buy-backs; • statements concerning the Company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges; • statements regarding tax liabilities and related audits, reviews and proceedings; • statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings; • expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims; • expectations concerning the adequacy of the Company’s warranty provisions and estimates for future warranty-related costs; • statements regarding the Company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the Asia Pacific region, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. PAGE 2

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS (continued) Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 22 May 2018, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; the continuation or termination of the governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the Company, or at all; acquisition or sale of businesses and business segments; changes in the Company’s key management personnel; inherent limitations on internal controls; use of accounting estimates; the integration of Fermacell into our business; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law. PAGE 3

AGENDA • International Strategy • James Hardie Europe • James Hardie Asia Pacific PAGE 4

INTERNATIONAL STRATEGY North America International R&D Centers Manufacturing Facilities PAGE 5

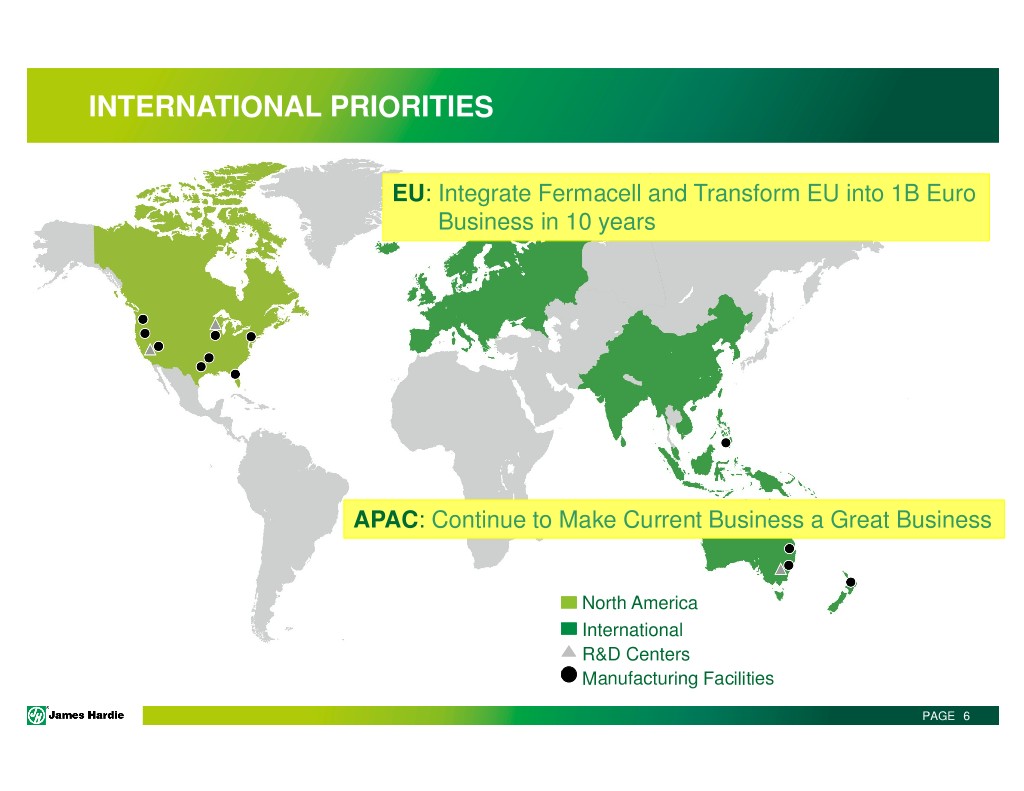

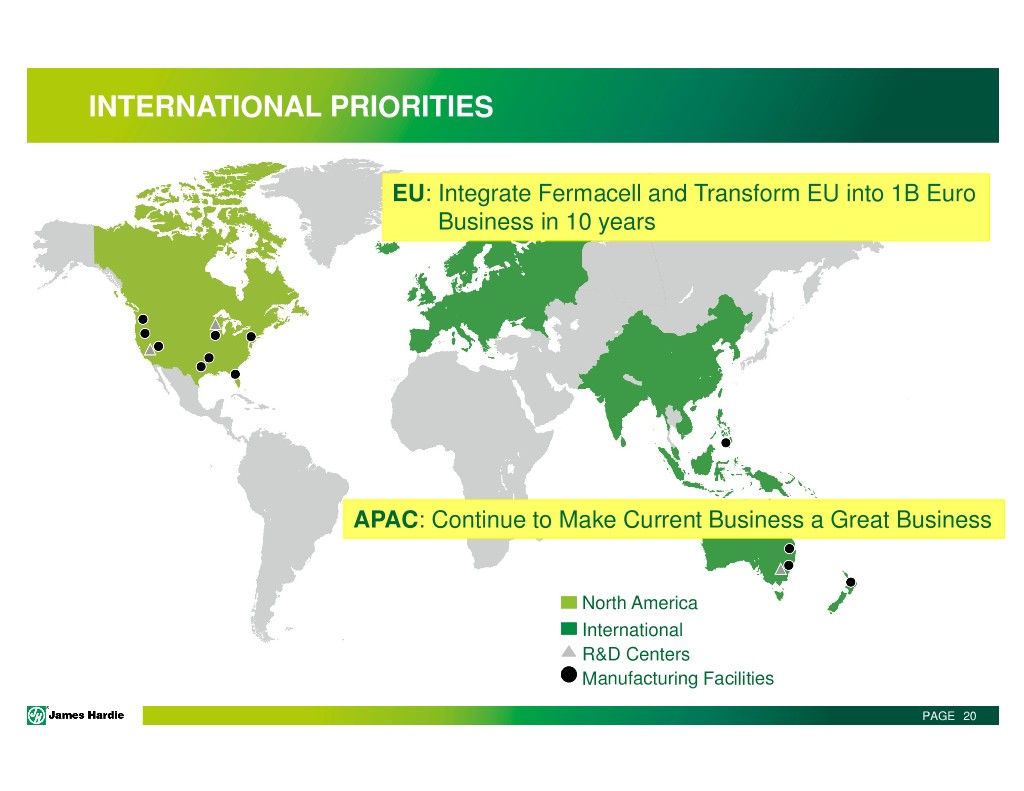

INTERNATIONAL PRIORITIES EU : Integrate Fermacell and Transform EU into 1B Euro Business in 10 years APAC : Continue to Make Current Business a Great Business North America International R&D Centers Manufacturing Facilities PAGE 6

AGENDA • International Strategy • James Hardie Europe • James Hardie Asia Pacific PAGE 7

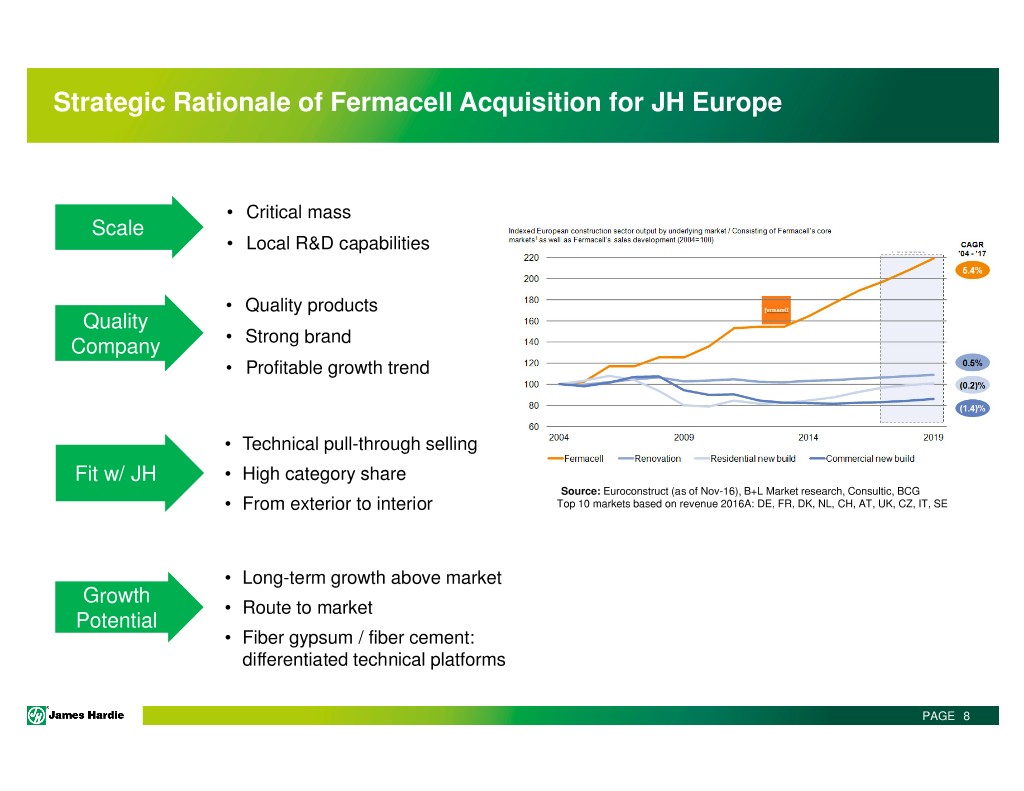

Strategic Rationale of Fermacell Acquisition for JH Europe • Critical mass Scale • Local R&D capabilities • Quality products Quality Company • Strong brand • Profitable growth trend • Technical pull-through selling Fit w/ JH • High category share Source: Euroconstruct (as of Nov-16), B+L Market research, Consultic, BCG • From exterior to interior Top 10 markets based on revenue 2016A: DE, FR, DK, NL, CH, AT, UK, CZ, IT, SE • Long-term growth above market Growth • Route to market Potential • Fiber gypsum / fiber cement: differentiated technical platforms PAGE 8

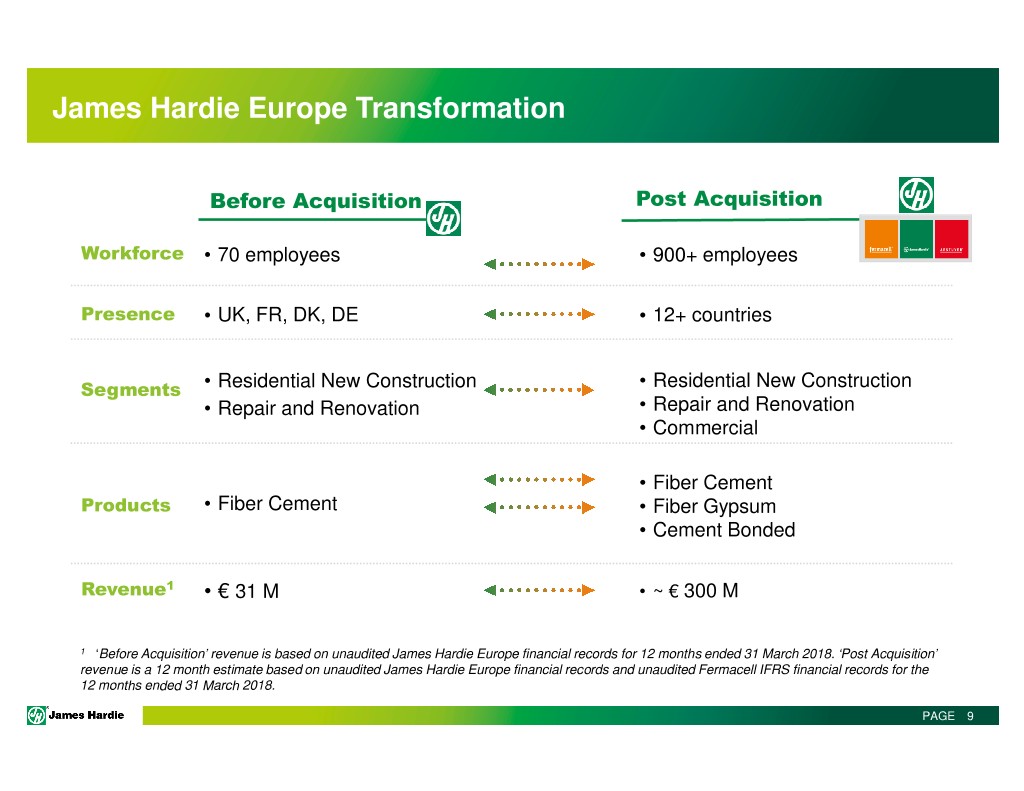

James Hardie Europe Transformation Before Acquisition Post Acquisition Workforce • 70 employees • 900+ employees Presence • UK, FR, DK, DE • 12+ countries Segments • Residential New Construction • Residential New Construction • Repair and Renovation • Repair and Renovation • Commercial • Fiber Cement Products • Fiber Cement • Fiber Gypsum • Cement Bonded Revenue 1 • € 31 M • ~ € 300 M 1 ‘Before Acquisition’ revenue is based on unaudited James Hardie Europe financial records for 12 months ended 31 March 2018. ‘Post Acquisition’ revenue is a 12 month estimate based on unaudited James Hardie Europe financial records and unaudited Fermacell IFRS financial records for the 12 months ended 31 March 2018. PAGE 9

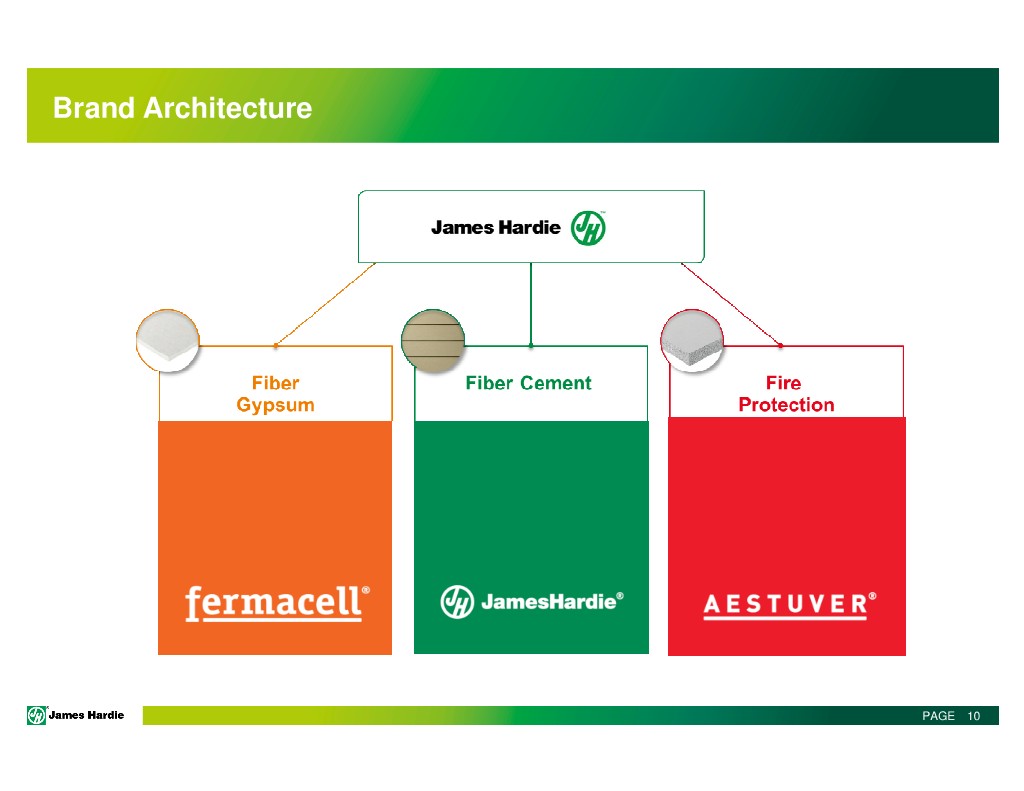

Brand Architecture PAGE 10

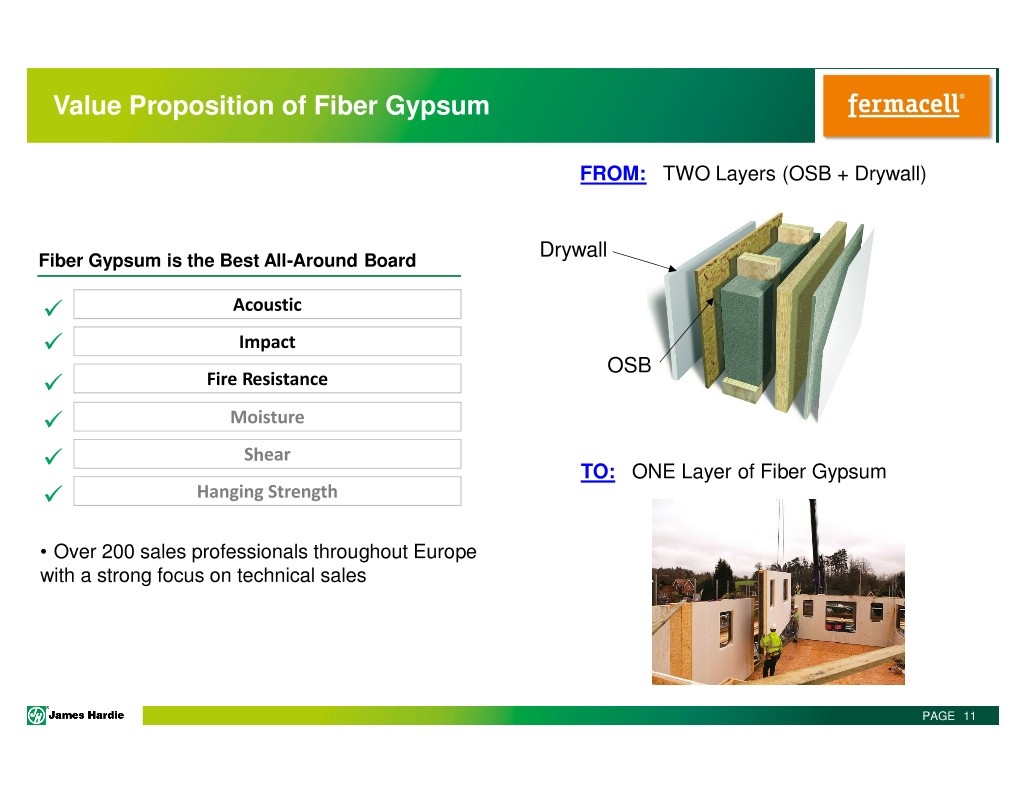

Value Proposition of Fiber Gypsum FROM: TWO Layers (OSB + Drywall) Drywall Fiber Gypsum is the Best All-Around Board Acoustic Impact OSB Fire Resistance Moisture Shear TO: ONE Layer of Fiber Gypsum Hanging Strength • Over 200 sales professionals throughout Europe with a strong focus on technical sales PAGE 11

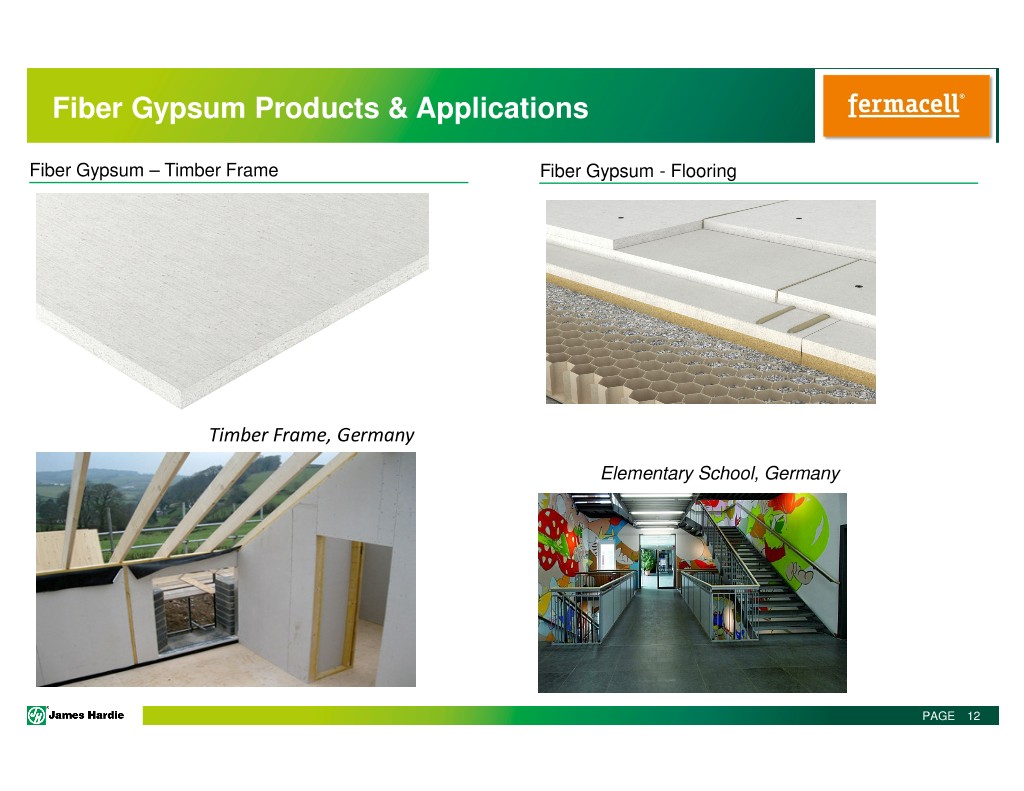

Fiber Gypsum Products & Applications Fiber Gypsum – Timber Frame Fiber Gypsum - Flooring Timber Frame, Germany Elementary School, Germany PAGE 12

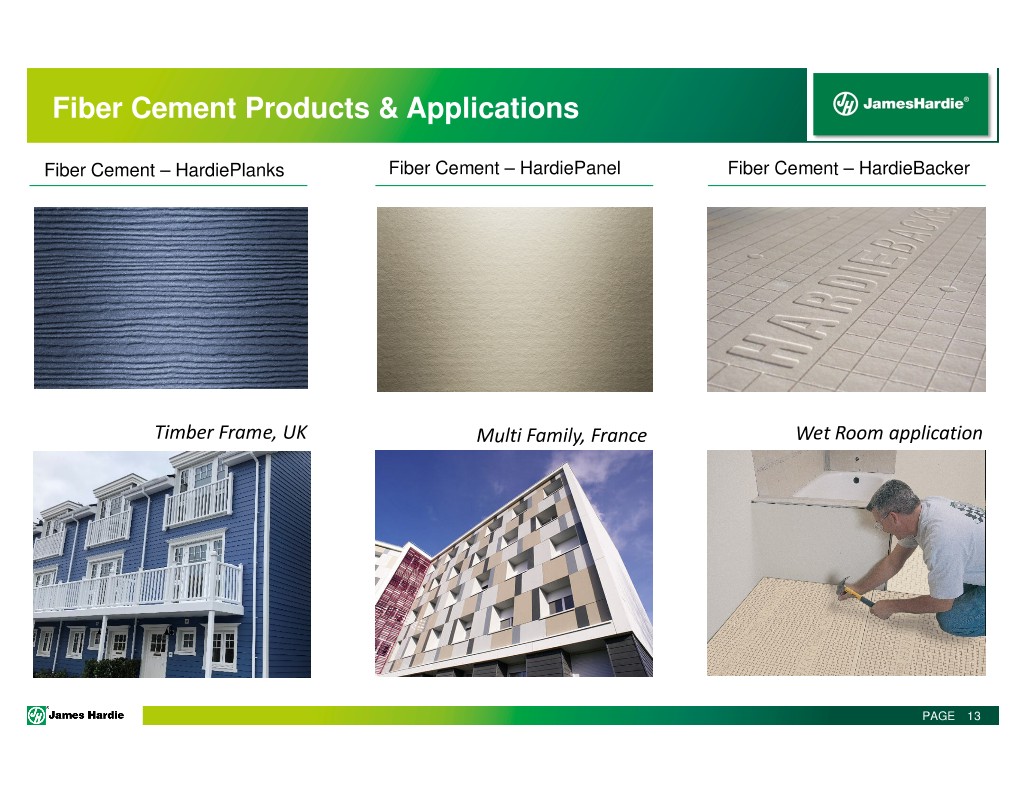

Fiber Cement Products & Applications Fiber Cement – HardiePlanks Fiber Cement – HardiePanel Fiber Cement – HardieBacker Timber Frame, UK Multi Family, France Wet Room application PAGE 13

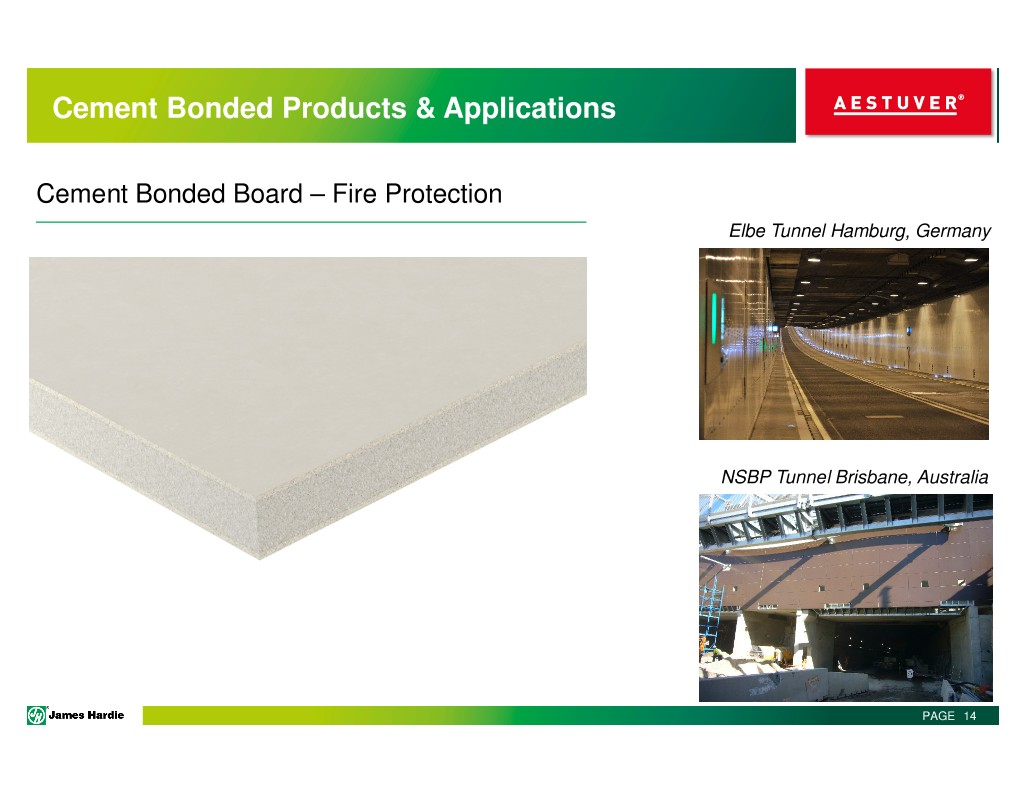

Cement Bonded Products & Applications Cement Bonded Board – Fire Protection Elbe Tunnel Hamburg, Germany NSBP Tunnel Brisbane, Australia 14 PAGE 14

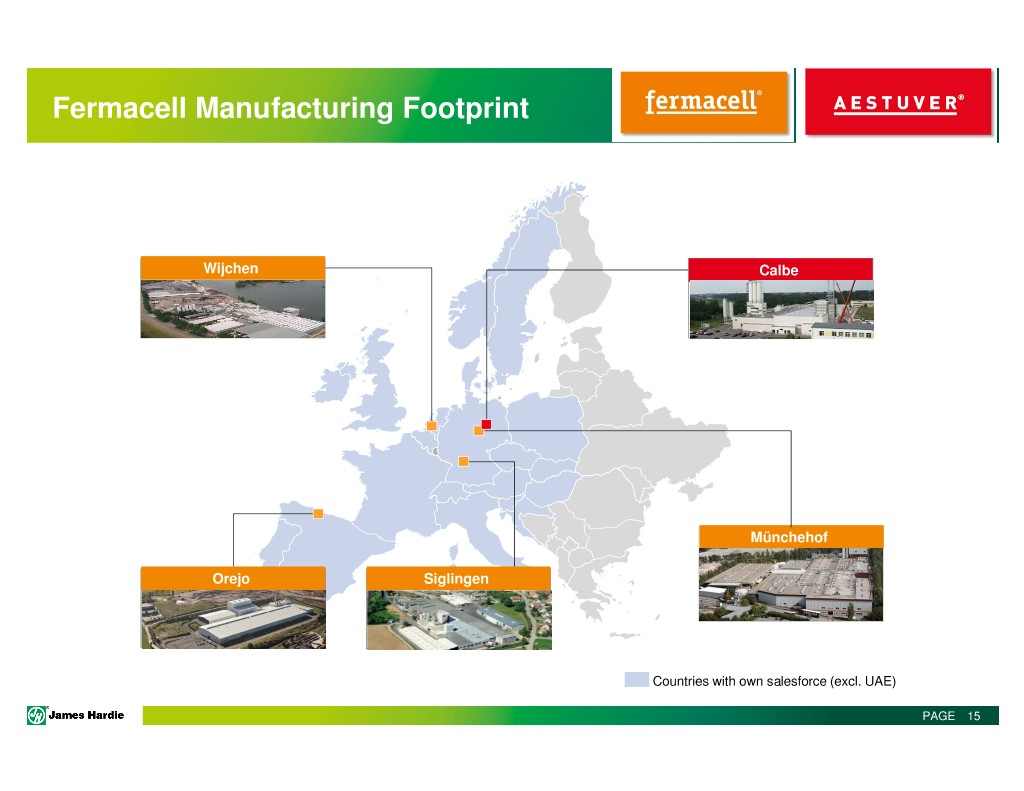

Fermacell Manufacturing Footprint Wijchen Calbe Münchehof Orejo Siglingen Countries with own salesforce (excl. UAE) PAGE 15

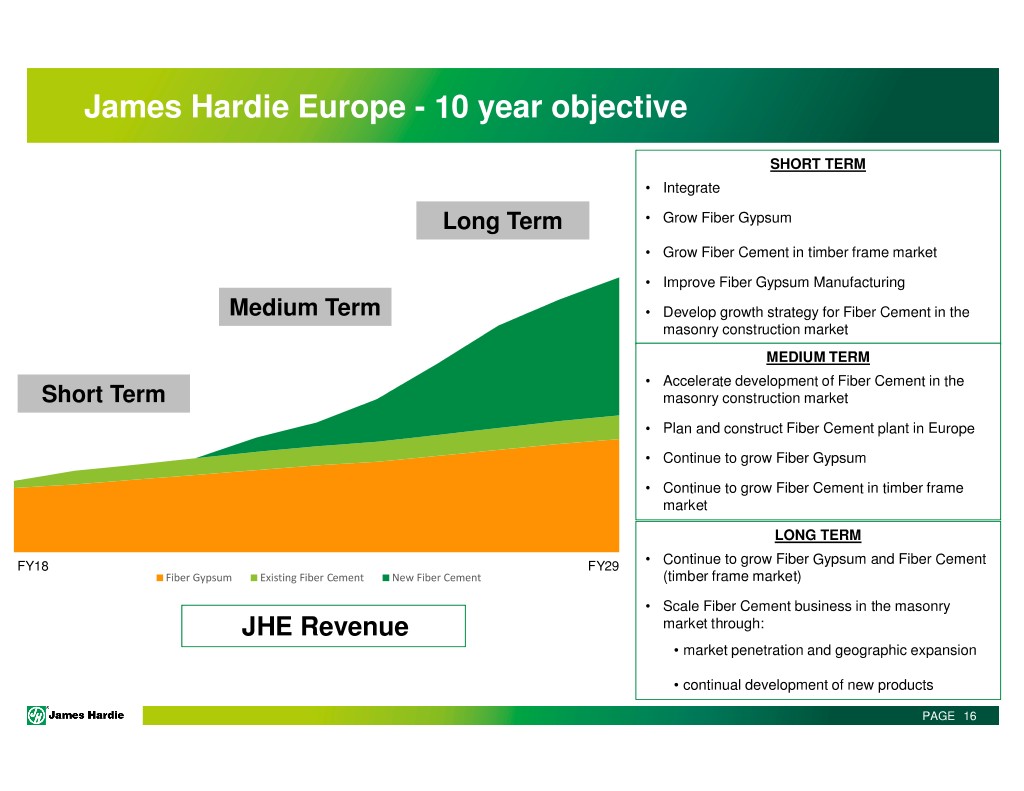

James Hardie Europe - 10 year objective SHORT TERM • Integrate Long Term • Grow Fiber Gypsum • Grow Fiber Cement in timber frame market • Improve Fiber Gypsum Manufacturing Medium Term • Develop growth strategy for Fiber Cement in the masonry construction market MEDIUM TERM • Accelerate development of Fiber Cement in the Short Term masonry construction market • Plan and construct Fiber Cement plant in Europe • Continue to grow Fiber Gypsum • Continue to grow Fiber Cement in timber frame market LONG TERM FY18 FY29 • Continue to grow Fiber Gypsum and Fiber Cement Fiber Gypsum Existing Fiber Cement New Fiber Cement (timber frame market) • Scale Fiber Cement business in the masonry JHE Revenue market through: • market penetration and geographic expansion • continual development of new products PAGE 16 16

AGENDA • International Strategy • James Hardie Europe • James Hardie Asia Pacific PAGE 17

James Hardie Asia Pacific ZERO HARM AT THE CORE OF OUR STRATEGY Australia • Continue to grow above market with strong focus on demand generation, new product launches, and operational excellence New Zealand • Continue to gain share with focus on demand generation and operational excellence Philippines • Accelerated growth through repair & renovation and residential new construction segments • Successful start up of new production line in Cabuyao JH Systems • Focused growth on medium density and high density multi- family new construction PAGE 18

International Consistently Delivers Strong Returns Quarterly EBIT and EBIT Margin 35 30 25 20 15 10 5 0 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 FY2012 FY2013 FY2013 FY2014 FY2014 FY2015 FY2015 FY2016 FY2016 FY2017 FY2017 FY2018 FY2018 in millions USD EBIT EBIT Margin PAGE 19

INTERNATIONAL PRIORITIES EU : Integrate Fermacell and Transform EU into 1B Euro Business in 10 years APAC : Continue to Make Current Business a Great Business North America International R&D Centers Manufacturing Facilities PAGE 20

QUESTIONS