Exhibit 99.9 • Xxx • Xxx Interiors Sean Gadd

JAMES HARDIE INTERIORS • Interiors overview • Competitive set • How we compete • Emerging trends • Growth path forward PAGE 2

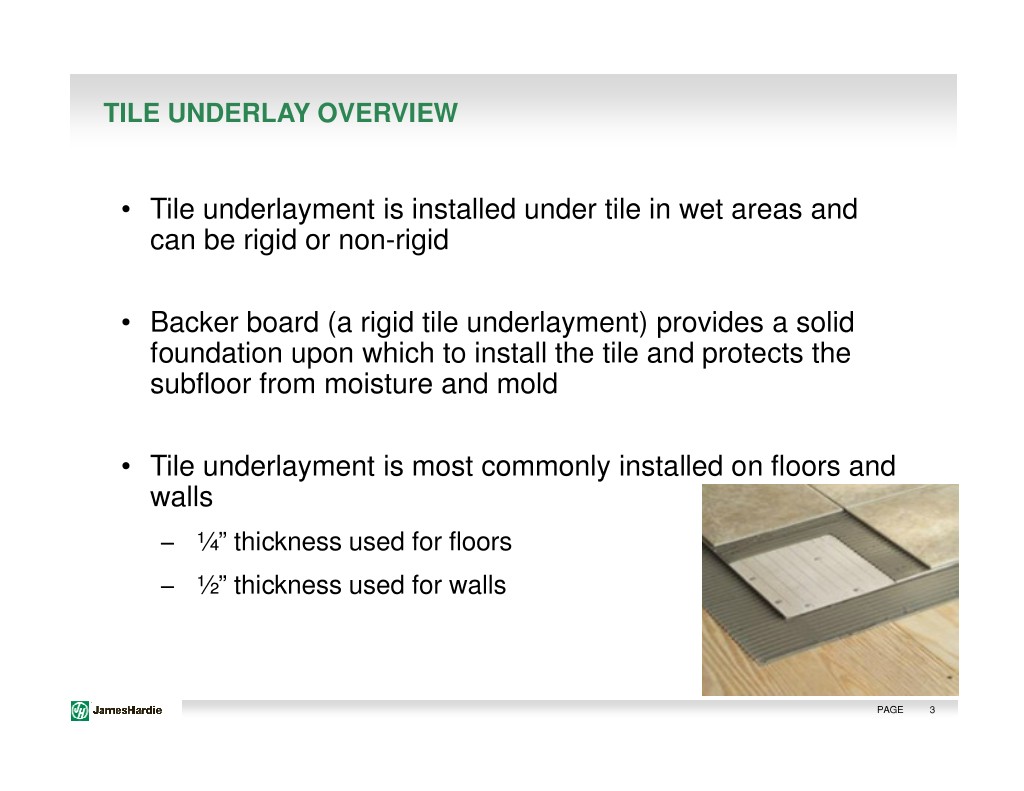

TILE UNDERLAY OVERVIEW • Tile underlayment is installed under tile in wet areas and can be rigid or non-rigid • Backer board (a rigid tile underlayment) provides a solid foundation upon which to install the tile and protects the subfloor from moisture and mold • Tile underlayment is most commonly installed on floors and walls ̶ ¼” thickness used for floors ̶ ½” thickness used for walls PAGE 3

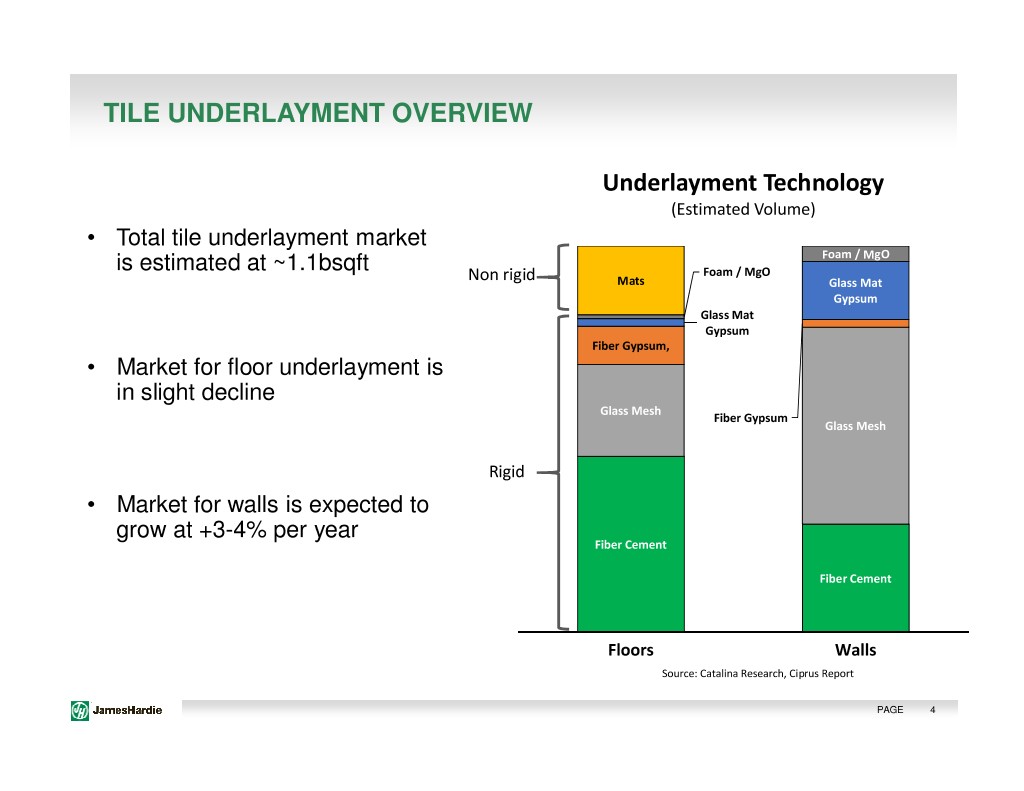

TILE UNDERLAYMENT OVERVIEW Underlayment Technology (Estimated Volume) • Total tile underlayment market Foam / MgO is estimated at ~1.1bsqft Foam / MgO Non rigid Mats Glass Mat Gypsum Glass Mat Gypsum Fiber Gypsum, • Market for floor underlayment is in slight decline Glass Mesh Fiber Gypsum Glass Mesh Rigid • Market for walls is expected to grow at +3-4% per year Fiber Cement Fiber Cement Floors Walls Source: Catalina Research, Ciprus Report PAGE 4

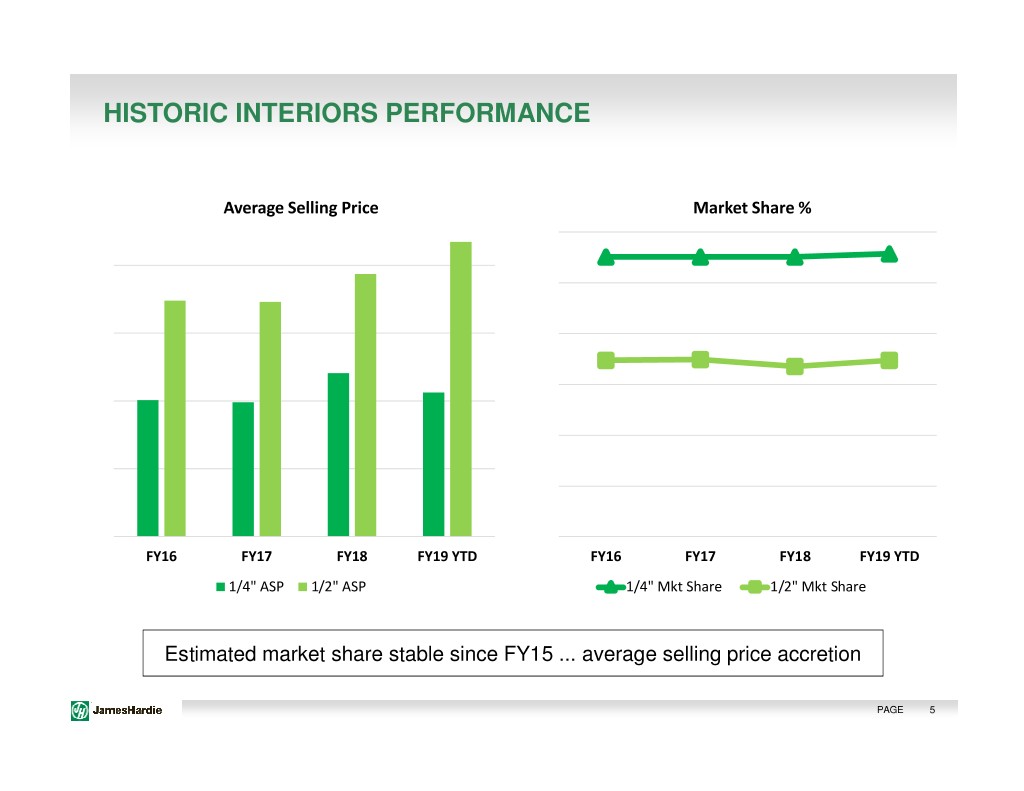

HISTORIC INTERIORS PERFORMANCE Average Selling Price Market Share % 60% 600 50% 550 40% 30% 500 20% 450 10% 400 0% FY16 FY17 FY18 FY19 YTD FY16 FY17 FY18 FY19 YTD 1/4" ASP 1/2" ASP 1/4" Mkt Share 1/2" Mkt Share Estimated market share stable since FY15 ... average selling price accretion PAGE 5

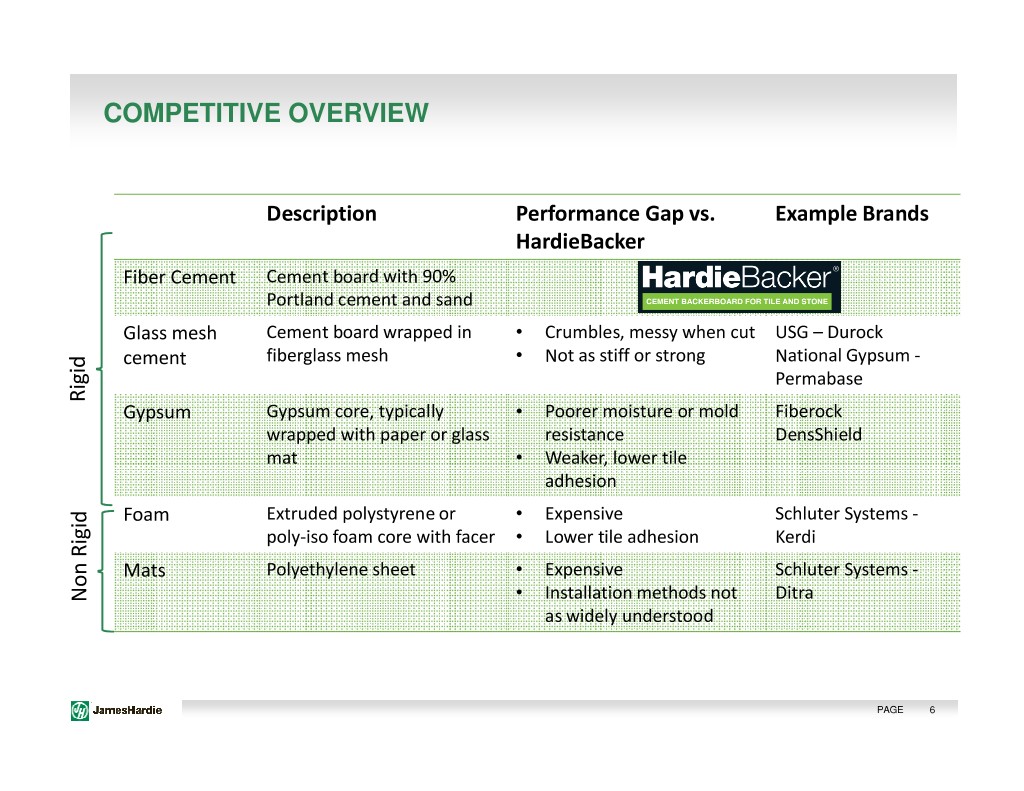

COMPETITIVE OVERVIEW Description Performance Gap vs. Example Brands HardieBacker Fiber Cement Cement board with 90% Portland cement and sand Glass mesh Cement board wrapped in • Crumbles, messy when cut USG – Durock cement fiberglass mesh • Not as stiff or strong National Gypsum - Permabase Rigid Gypsum Gypsum core, typically • Poorer moisture or mold Fiberock wrapped with paper or glass resistance DensShield mat • Weaker, lower tile adhesion Foam Extruded polystyrene or • Expensive Schluter Systems - poly-iso foam core with facer • Lower tile adhesion Kerdi Mats Polyethylene sheet • Expensive Schluter Systems - Non Rigid • Installation methods not Ditra as widely understood PAGE 6

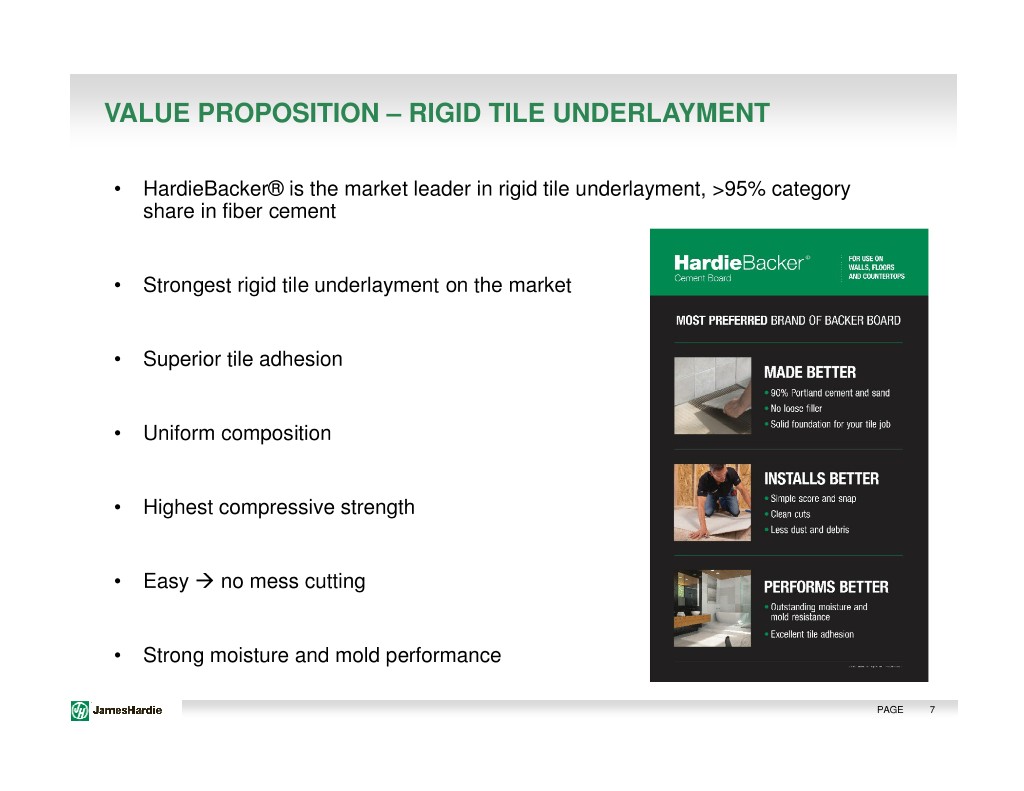

VALUE PROPOSITION – RIGID TILE UNDERLAYMENT • HardieBacker® is the market leader in rigid tile underlayment, >95% category share in fiber cement • Strongest rigid tile underlayment on the market • Superior tile adhesion • Uniform composition • Highest compressive strength • Easy no mess cutting • Strong moisture and mold performance PAGE 7

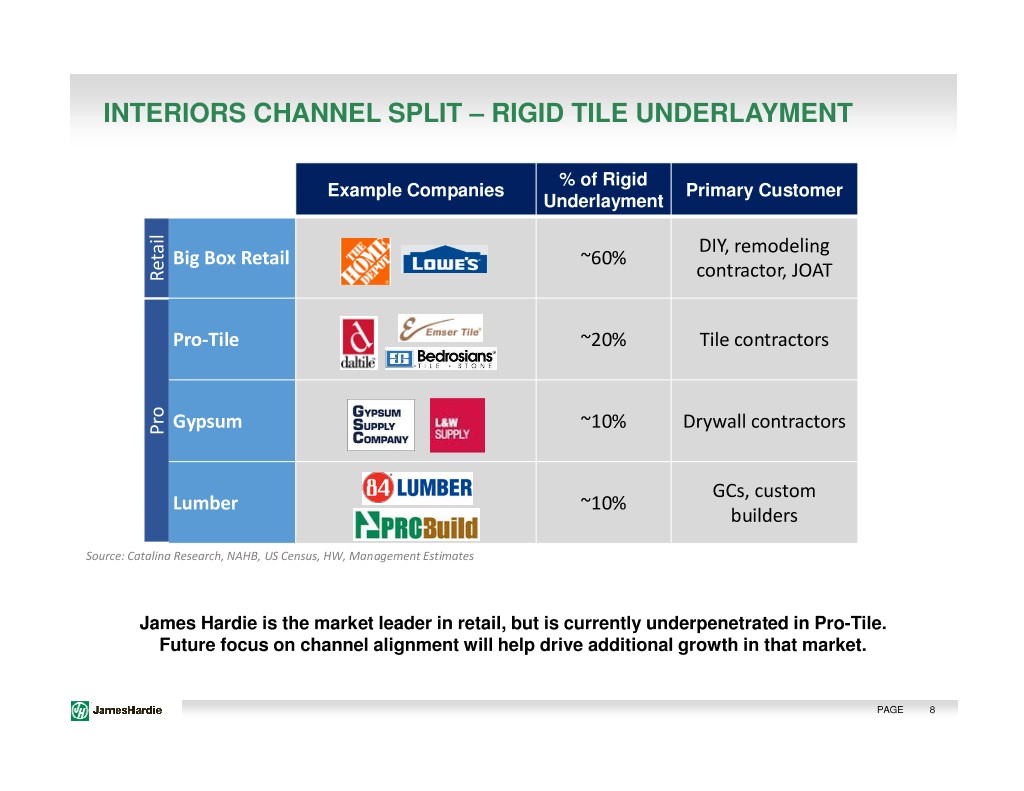

INTERIORS CHANNEL SPLIT – RIGID TILE UNDERLAYMENT % of Rigid Example Companies Primary Customer Underlayment DIY, remodeling Big Box Retail ~60% contractor, JOAT Retail Pro-Tile ~20% Tile contractors Gypsum ~10% Drywall contractors Pro GCs, custom Lumber ~10% builders Source: Catalina Research, NAHB, US Census, HW, Management Estimates James Hardie is the market leader in retail, but is currently underpenetrated in Pro-Tile. Future focus on channel alignment will help drive additional growth in that market. PAGE 8

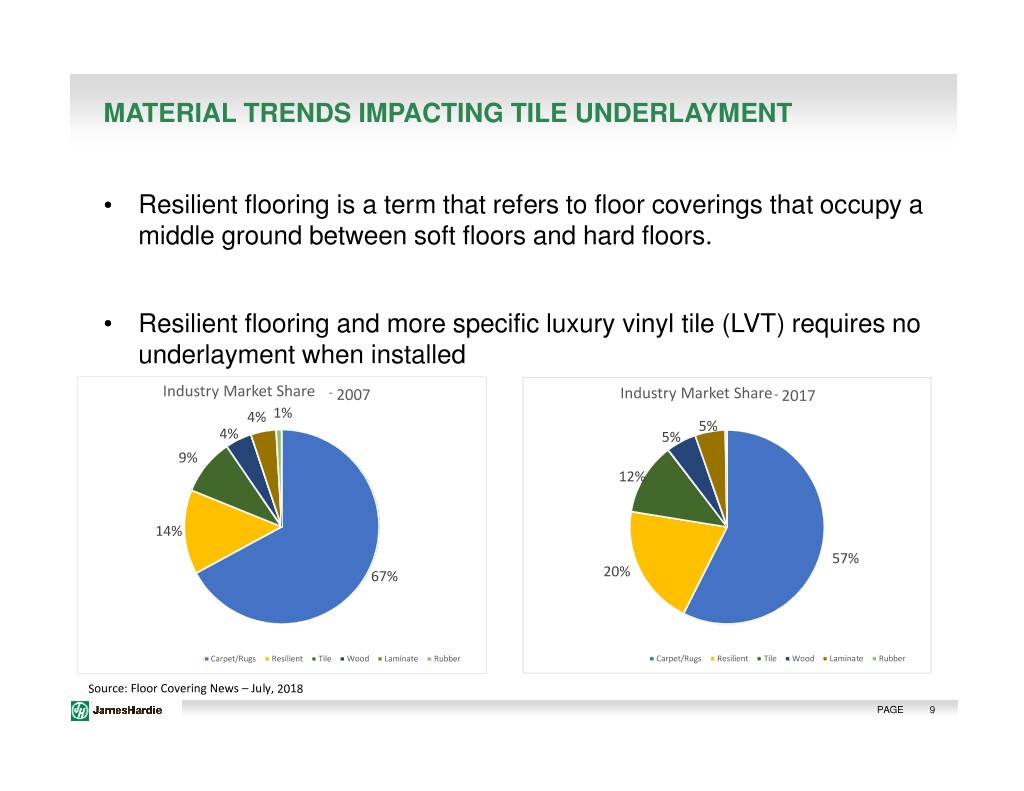

MATERIAL TRENDS IMPACTING TILE UNDERLAYMENT • Resilient flooring is a term that refers to floor coverings that occupy a middle ground between soft floors and hard floors. • Resilient flooring and more specific luxury vinyl tile (LVT) requires no underlayment when installed Industry Market Share - 2007 Industry Market Share - 2017 4% 1% 5% 4% 5% 9% 12% 14% 57% 67% 20% Carpet/Rugs Resilient Tile Wood Laminate Rubber Carpet/Rugs Resilient Tile Wood Laminate Rubber Source: Floor Covering News – July, 2018 PAGE 9

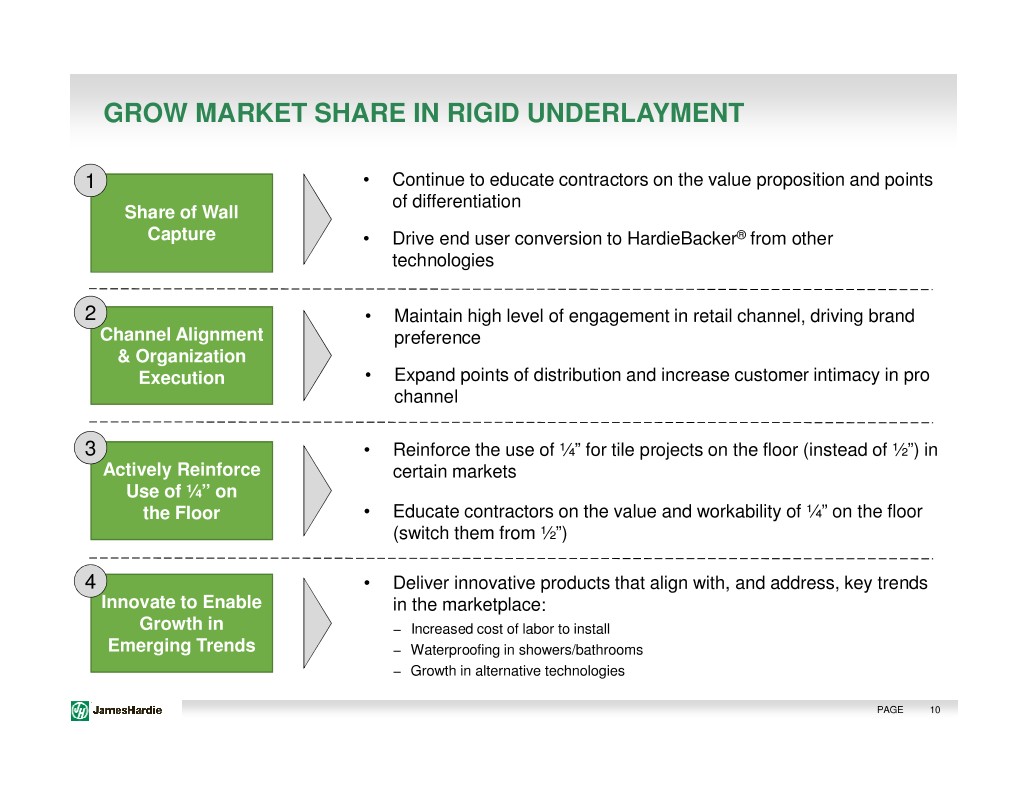

GROW MARKET SHARE IN RIGID UNDERLAYMENT 1 • Continue to educate contractors on the value proposition and points of differentiation Share of Wall Capture • Drive end user conversion to HardieBacker ® from other technologies 2 • Maintain high level of engagement in retail channel, driving brand Channel Alignment preference & Organization Execution • Expand points of distribution and increase customer intimacy in pro channel 3 • Reinforce the use of ¼” for tile projects on the floor (instead of ½”) in Actively Reinforce certain markets Use of ¼” on the Floor • Educate contractors on the value and workability of ¼” on the floor (switch them from ½”) 4 • Deliver innovative products that align with, and address, key trends Innovate to Enable in the marketplace: Growth in − Increased cost of labor to install Emerging Trends − Waterproofing in showers/bathrooms − Growth in alternative technologies PAGE 10

SUMMARY • Resilient flooring, which does not require a tile underlayment, is growing and is starting to reduce the addressable market for flooring tile underlayment • James Hardie has strong market share in ¼” backer – used on the floor • Opportunity to move contractors still using ½” gypsum on the floor to our ¼” product • Continue to grow share in ½” backer on the wall • Opportunity exists to develop products, taking advantage of the current trends • We are funding product development to address developing market preferences PAGE 11

• Xxx • Xxx Q&A