Exhibit 99.6 • Xxx • Xxx OPERATIONS Matt Marsh Ryan Kilcullen Dave Merkley

AGENDA • Introduction • Enabling Growth & Network Returns • Transforming Our Manufacturing Approach • Customer Value Creation & FC Process Innovation • Capacity Project Update PAGE 2

• Xxx • Xxx INTRODUCTION

HARDIE OPERATIONS – HISTORICAL PERSPECTIVE JH Operations: A significant enabler of our 35/90 organic growth strategy NETWORK CAPACITY FC MANUFACTURING PROCESS INNOVATION & WITH UNIQUE RETURNS SCALE ADVANTAGE CUSTOMER VALUE • Regional flexibility • Hatcheck scale up • Engineered for Climate ® • Efficient freight network • 24/7 fiber cement • Low density • Capex:Capacity efficiency • High throughput ColorPlus ® • Coatings advantage technology PAGE 4

HARDIE PLANT OVERVIEW Manufacturing Key Process Inventory Processes Objectives Model Raw Materials Continuous Long Continuous Make-to- Process Run Inventory Sheet Machine Raw Material Raw Material Postponed Pre-Autoclave Conversion Yield Differentiation Autoclaves Finishing Material Long Continuous Make-to- Handling Run Inventory & ColorPlus® Discrete Piece Coatings Make-to- Post-Autoclave Finished Goods Processing Yield Order Inventory PAGE 5

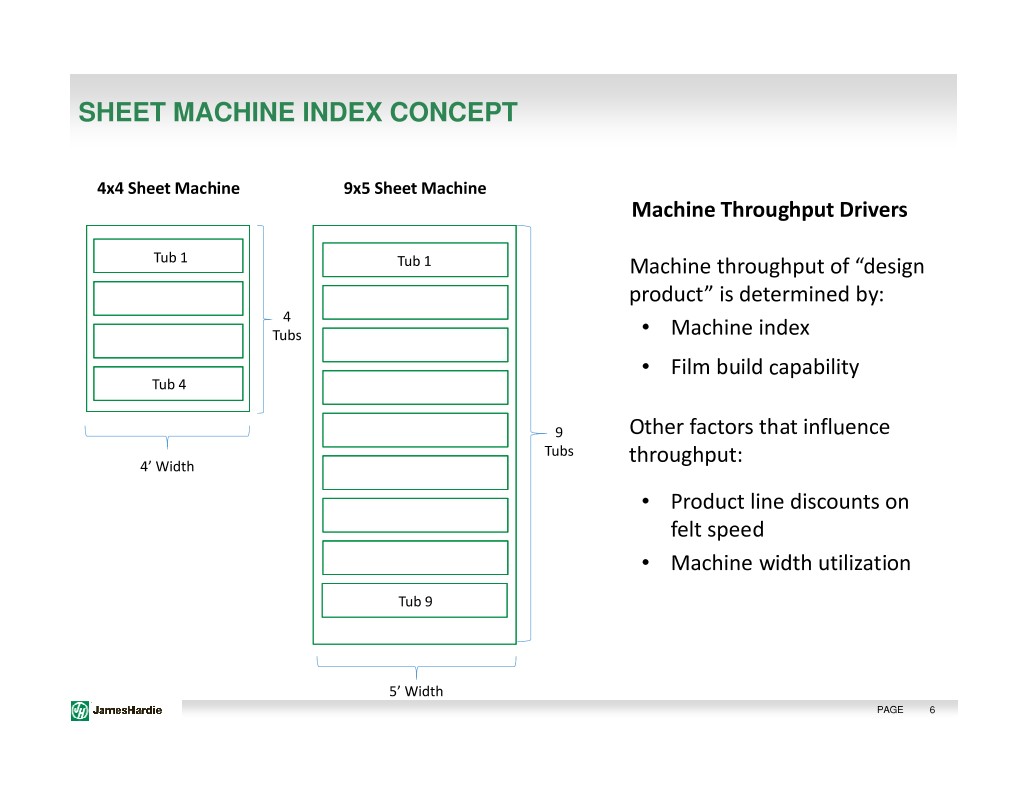

SHEET MACHINE INDEX CONCEPT 4x4 Sheet Machine 9x5 Sheet Machine Machine Throughput Drivers Tub 1 Tub 1 Machine throughput of “design product” is determined by: 4 Tubs • Machine index • Film build capability Tub 4 9 Other factors that influence Tubs throughput: 4’ Width • Product line discounts on felt speed • Machine width utilization Tub 9 5’ Width PAGE 6

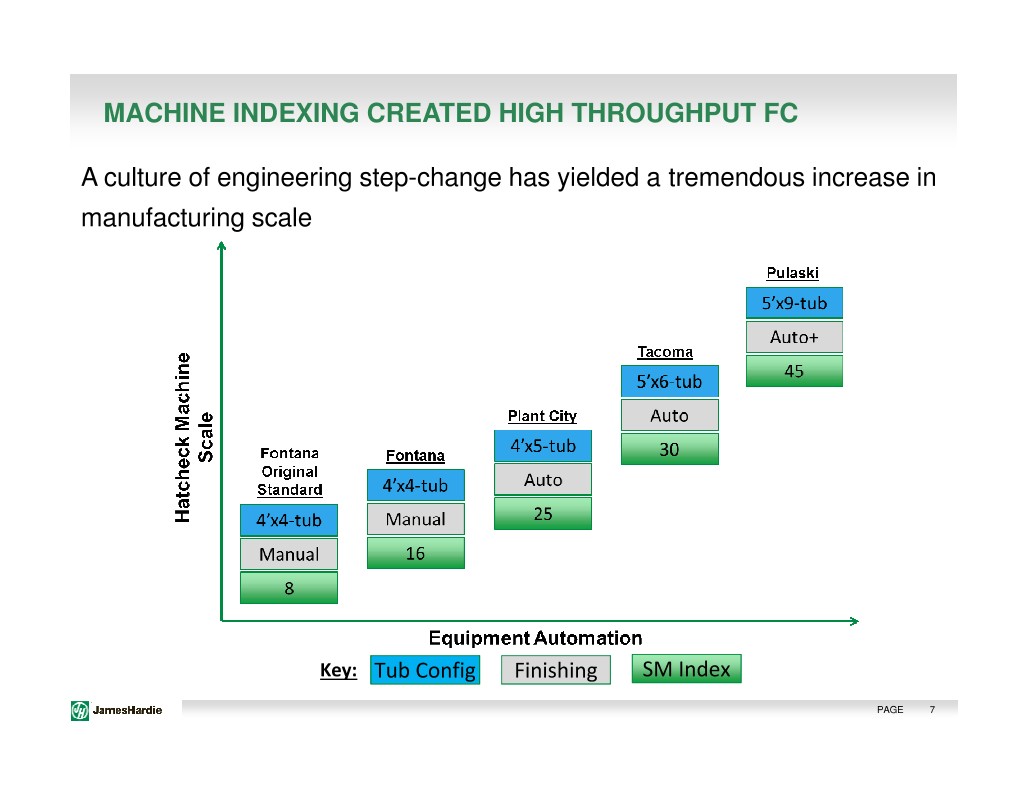

MACHINE INDEXING CREATED HIGH THROUGHPUT FC A culture of engineering step-change has yielded a tremendous increase in manufacturing scale Key: Tub Config Finishing SM Index PAGE 7

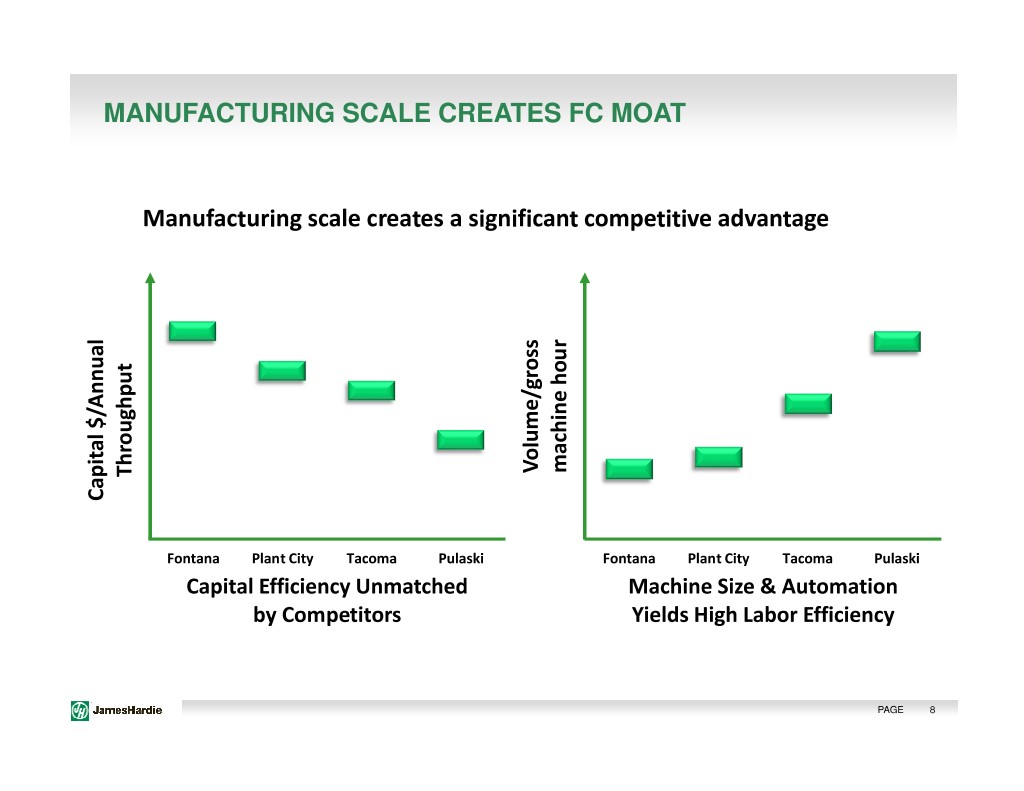

MANUFACTURING SCALE CREATES FC MOAT Manufacturing scale creates a significant competitive advantage machine hour machine Volume/gross Throughput Capital $/Annual Capital Fontana Plant City Tacoma Pulaski Fontana Plant City Tacoma Pulaski Capital Efficiency Unmatched Machine Size & Automation by Competitors Yields High Labor Efficiency PAGE 8

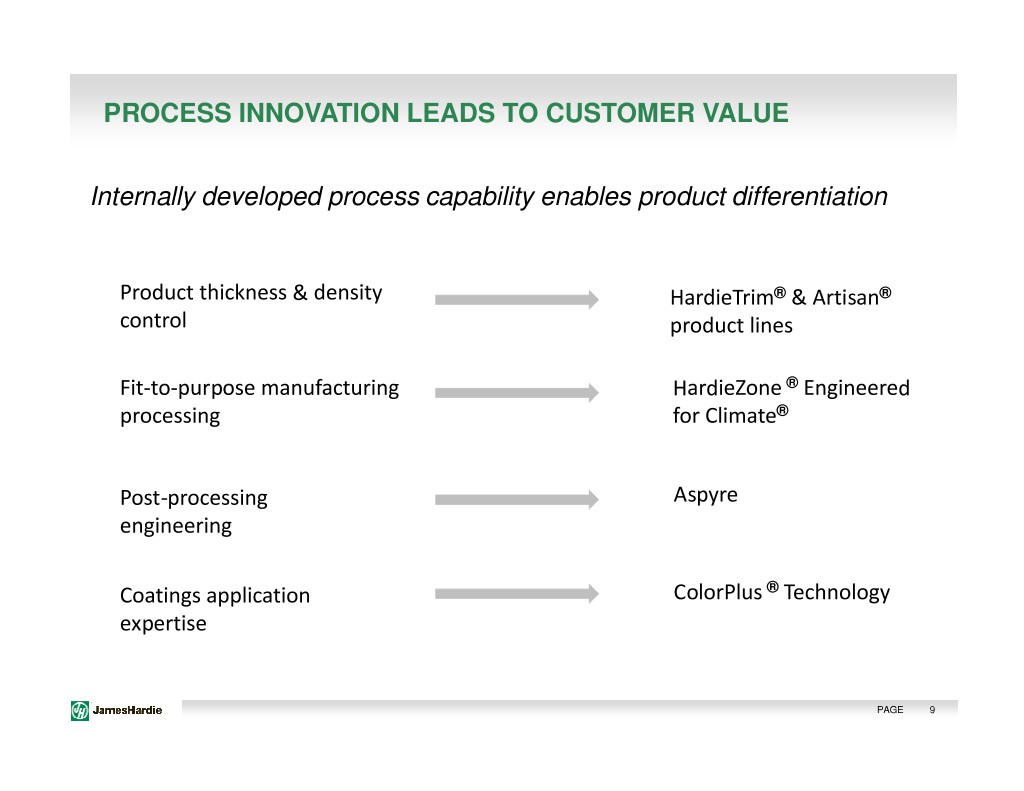

PROCESS INNOVATION LEADS TO CUSTOMER VALUE Internally developed process capability enables product differentiation Product thickness & density HardieTrim ® & Artisan ® control product lines Fit-to-purpose manufacturing HardieZone ® Engineered processing for Climate ® Post-processing Aspyre engineering Coatings application ColorPlus ® Technology expertise PAGE 9

HARDIE OPERATIONS – ENABLING FUTURE VALUE CREATION JH Operations: Organized to deliver on the next phase of value creation in our 35/90 organic growth strategy NETWORK CAPACITY FC MANUFACTURING PROCESS INNOVATION & WITH UNIQUE RETURNS SCALE ADVANTAGE CUSTOMER VALUE High scale mega-sites Transforming from the world FC process innovation & optimizing total network leading FC producer to a scale advantage delivering returns world class manufacturer customer value & returns PAGE 10

• Xxx • Xxx ENABLING GROWTH & NETWORK RETURNS

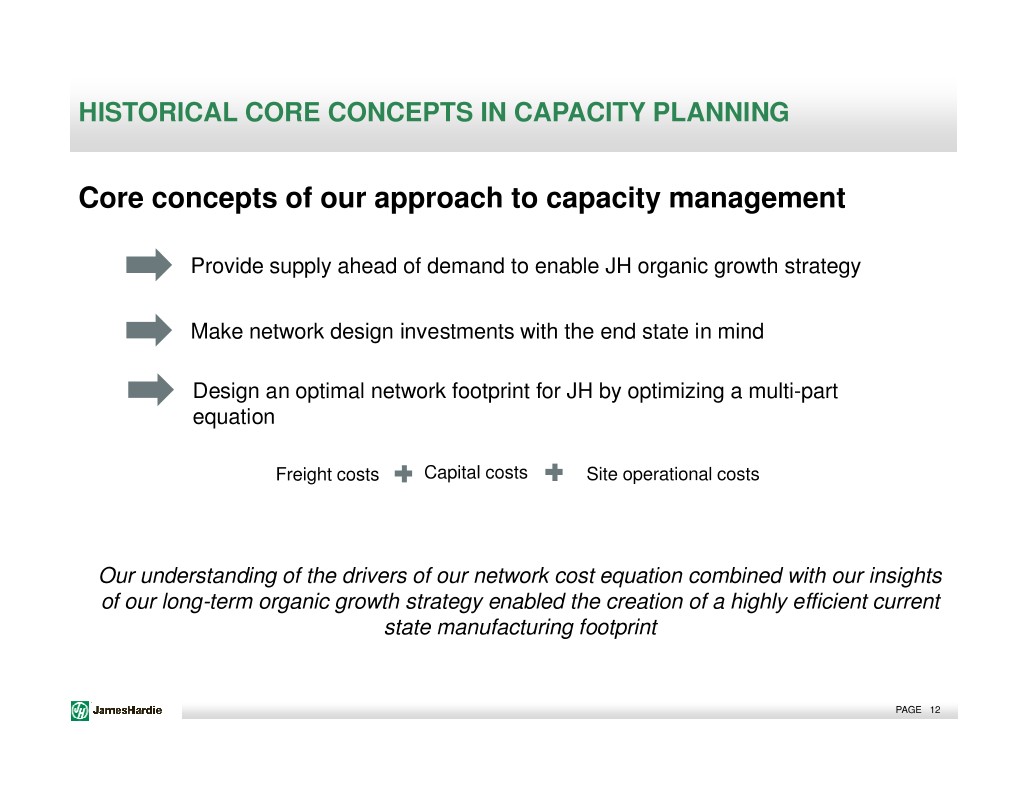

HISTORICAL CORE CONCEPTS IN CAPACITY PLANNING Core concepts of our approach to capacity management Provide supply ahead of demand to enable JH organic growth strategy Make network design investments with the end state in mind Design an optimal network footprint for JH by optimizing a multi-part equation Freight costs Capital costs Site operational costs Our understanding of the drivers of our network cost equation combined with our insights of our long-term organic growth strategy enabled the creation of a highly efficient current state manufacturing footprint PAGE 12

DESIGNING AN OPTIMIZED JH FOOTPRINT JH Total Network Cost Trade-Off Curve Total Network Cost Network Total # of Site Locations As the Number of Freight Total Manufacturing Sites Increases Capex Site Opex PAGE 13

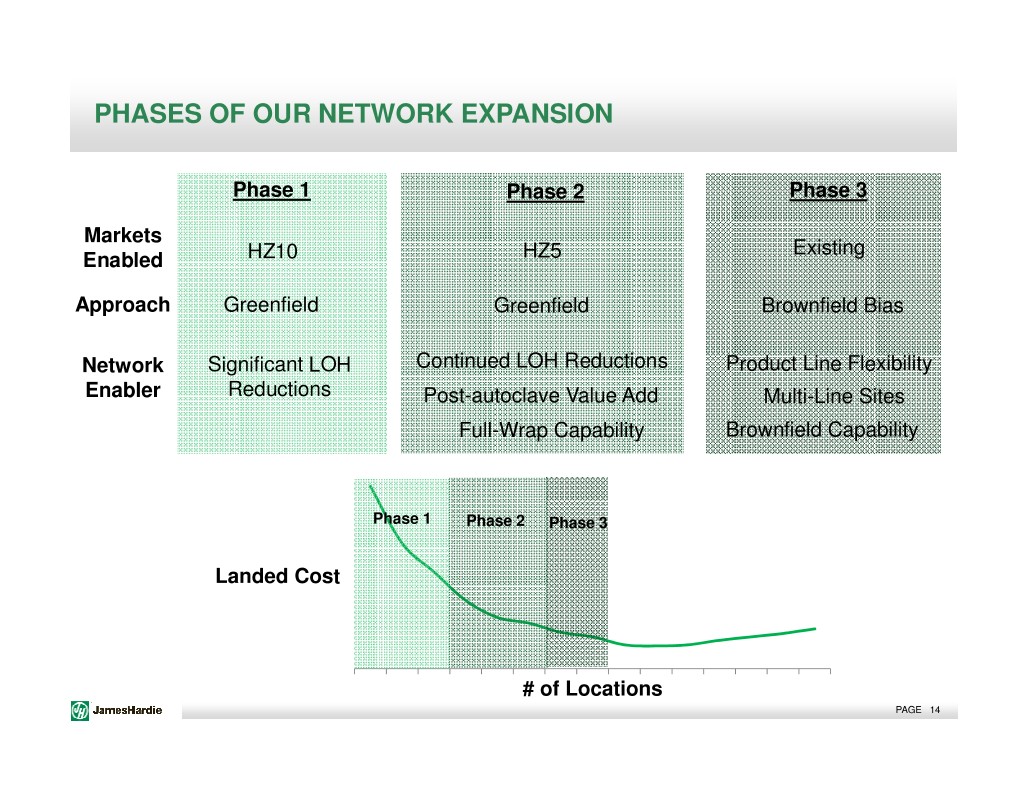

PHASES OF OUR NETWORK EXPANSION Phase 1 Phase 2 Phase 3 Markets Existing Enabled HZ10 HZ5 Approach Greenfield Greenfield Brownfield Bias Network Significant LOH Continued LOH Reductions Product Line Flexibility Enabler Reductions Post-autoclave Value Add Multi-Line Sites Full-Wrap Capability Brownfield Capability Phase 1 Phase 2 Phase 3 Landed Cost # of Locations PAGE 14

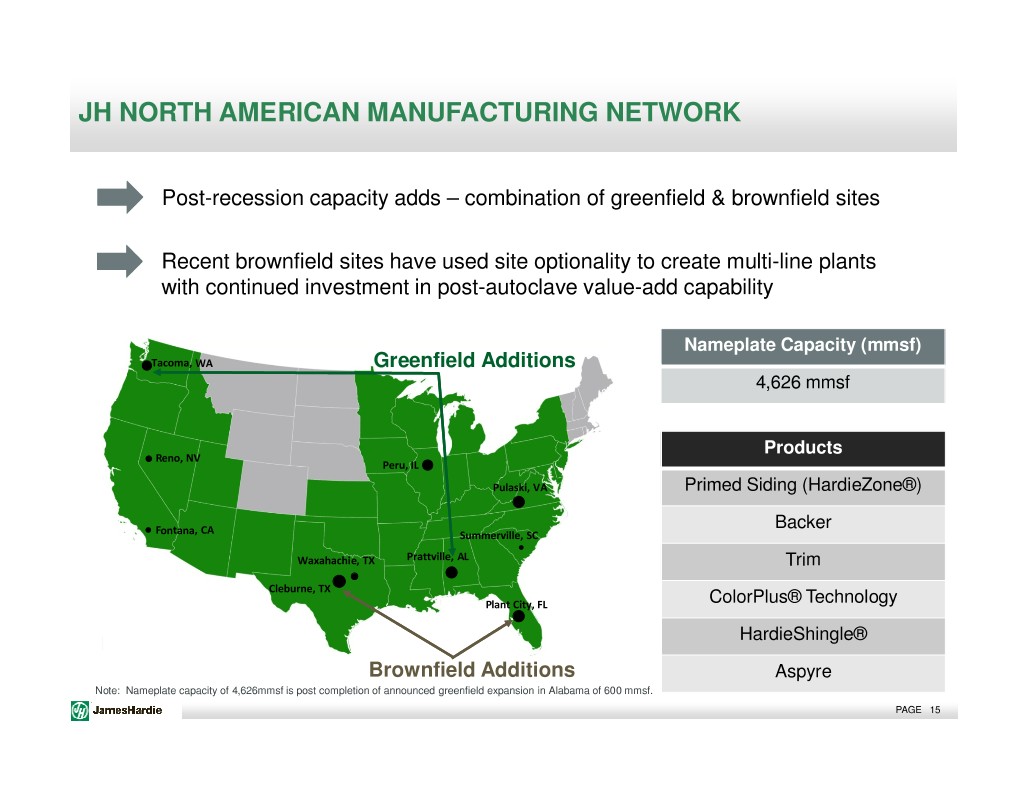

JH NORTH AMERICAN MANUFACTURING NETWORK Post-recessionSingle & double capacity line flat sheetadds –plants combination were constru of greenfctedield to enable& brownfield NA FC sites growth LocationsRecent brownfield driven by sites proximity have usedto raw site materials optionality & ma torket create to minimize multi-line freight plants with continued investment in post-autoclave value-add capability Nameplate Capacity (mmsf) Tacoma,Tacoma, WAWA Greenfield Additions 3,2264,6261,216550 mmsf mmsf ProductsProducts Reno, NV Peru, IL Pulaski, VA Primed PrimedSidingRaw Siding(HardieZone®) Siding Fontana,Fontana, CACA BackerBacker Fontana,Fontana, CACA Summerville, SC Waxahachie, TX Prattville, AL Trim Cleburne,Cleburne, TXTX PlantPlantPlant City, City,City, FL FLFL ColorPlus®ColorPlus® Technology HardieShingle®Heritage Brownfield Additions Aspyre Note: Nameplate capacity of 4,626mmsf is post completion of announced greenfield expansion in Alabama of 600 mmsf. PAGE 15

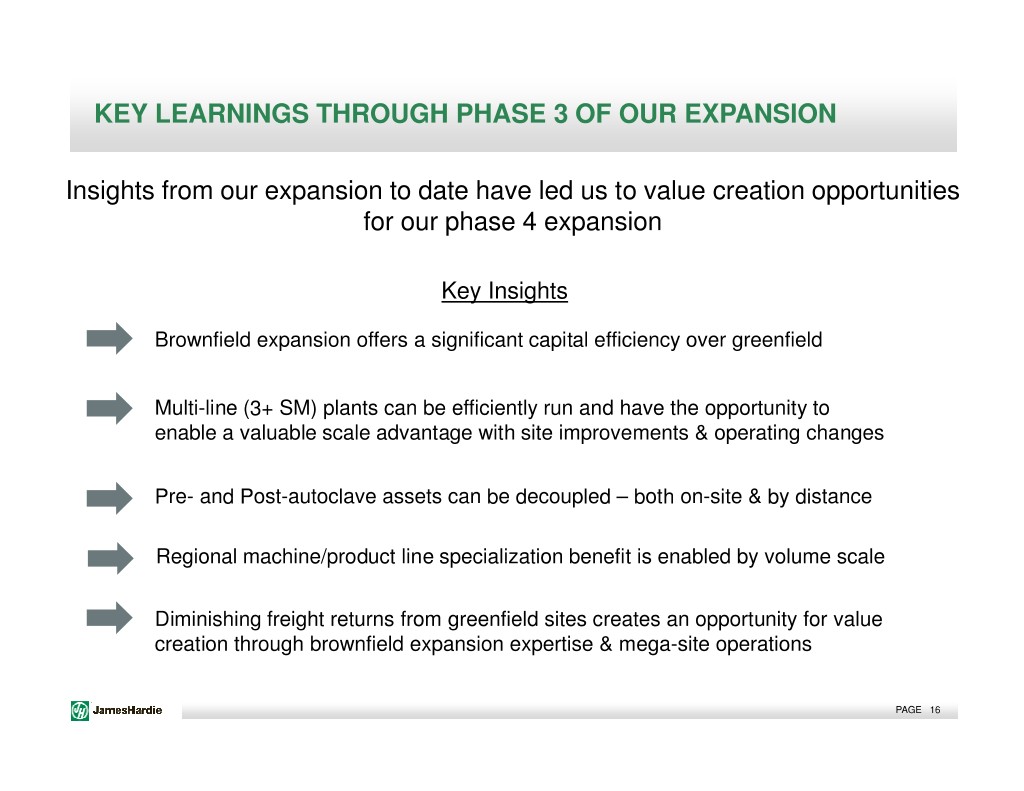

KEY LEARNINGS THROUGH PHASE 3 OF OUR EXPANSION Insights from our expansion to date have led us to value creation opportunities for our phase 4 expansion Key Insights Brownfield expansion offers a significant capital efficiency over greenfield Multi-line (3+ SM) plants can be efficiently run and have the opportunity to enable a valuable scale advantage with site improvements & operating changes Pre- and Post-autoclave assets can be decoupled – both on-site & by distance Regional machine/product line specialization benefit is enabled by volume scale Diminishing freight returns from greenfield sites creates an opportunity for value creation through brownfield expansion expertise & mega-site operations PAGE 16

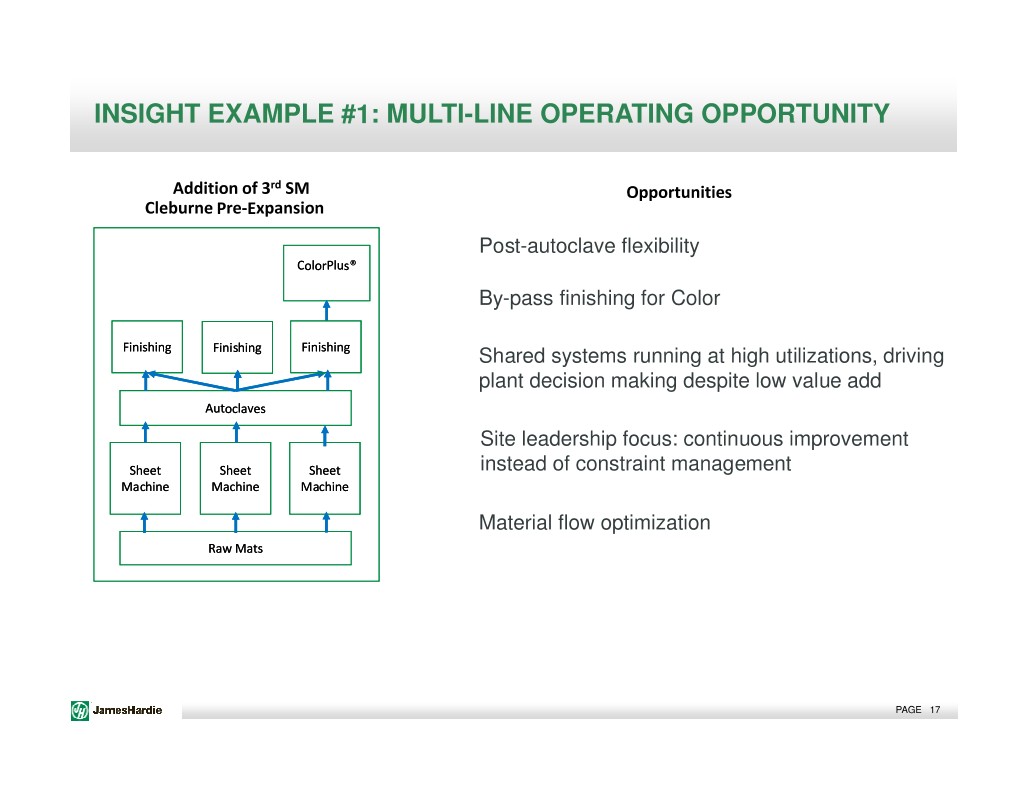

INSIGHT EXAMPLE #1: MULTI-LINE OPERATING OPPORTUNITY Addition of 3 rd SM Opportunities Cleburne Pre-Expansion Post-autoclave flexibility ColorPlus® By-pass finishing for Color Finishing Finishing Finishing Shared systems running at high utilizations, driving plant decision making despite low value add Autoclaves Site leadership focus: continuous improvement Sheet Sheet Sheet instead of constraint management Machine Machine Machine Material flow optimization Raw Mats PAGE 17

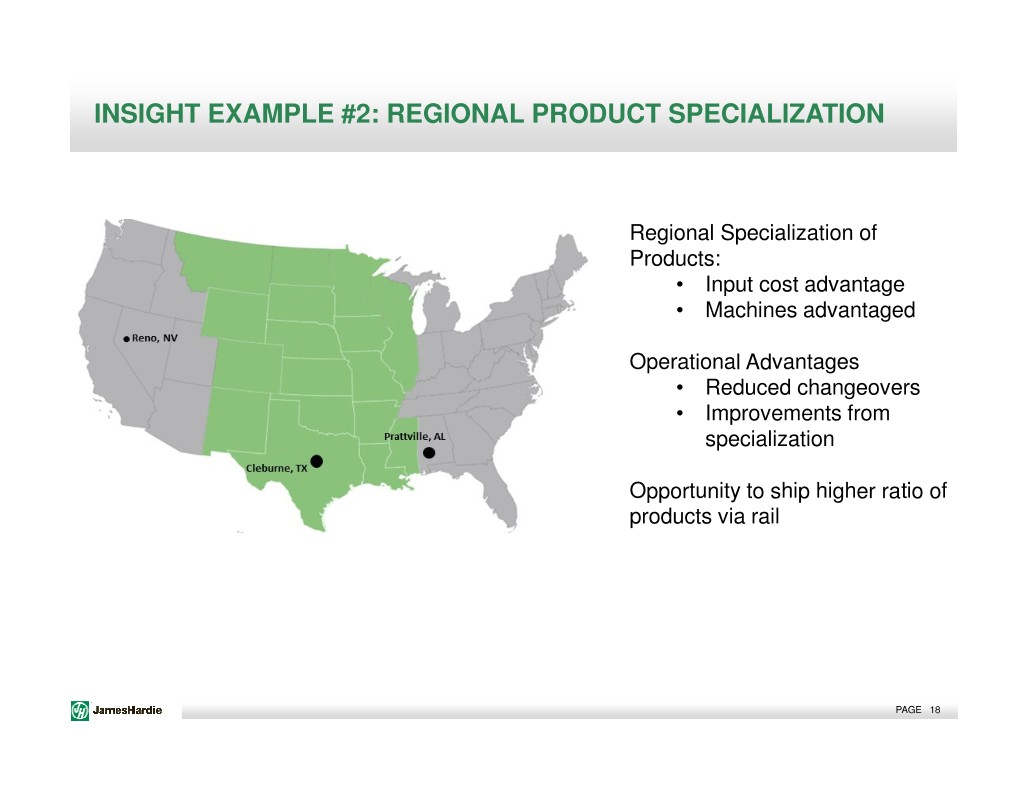

INSIGHT EXAMPLE #2: REGIONAL PRODUCT SPECIALIZATION Regional Specialization of Products: • Input cost advantage • Machines advantaged Operational Advantages • Reduced changeovers • Improvements from specialization Opportunity to ship higher ratio of products via rail PAGE 18

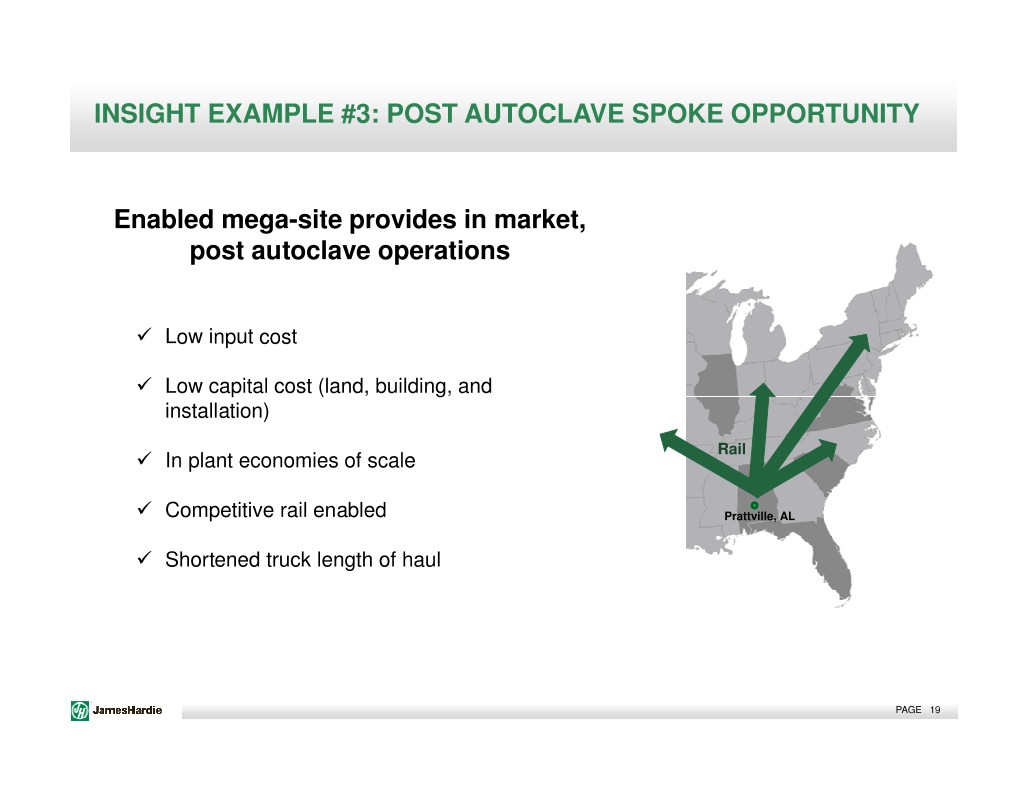

INSIGHT EXAMPLE #3: POST AUTOCLAVE SPOKE OPPORTUNITY Enabled mega-site provides in market, post autoclave operations Low input cost Low capital cost (land, building, and installation) Rail In plant economies of scale Competitive rail enabled Prattville, AL Shortened truck length of haul PAGE 19

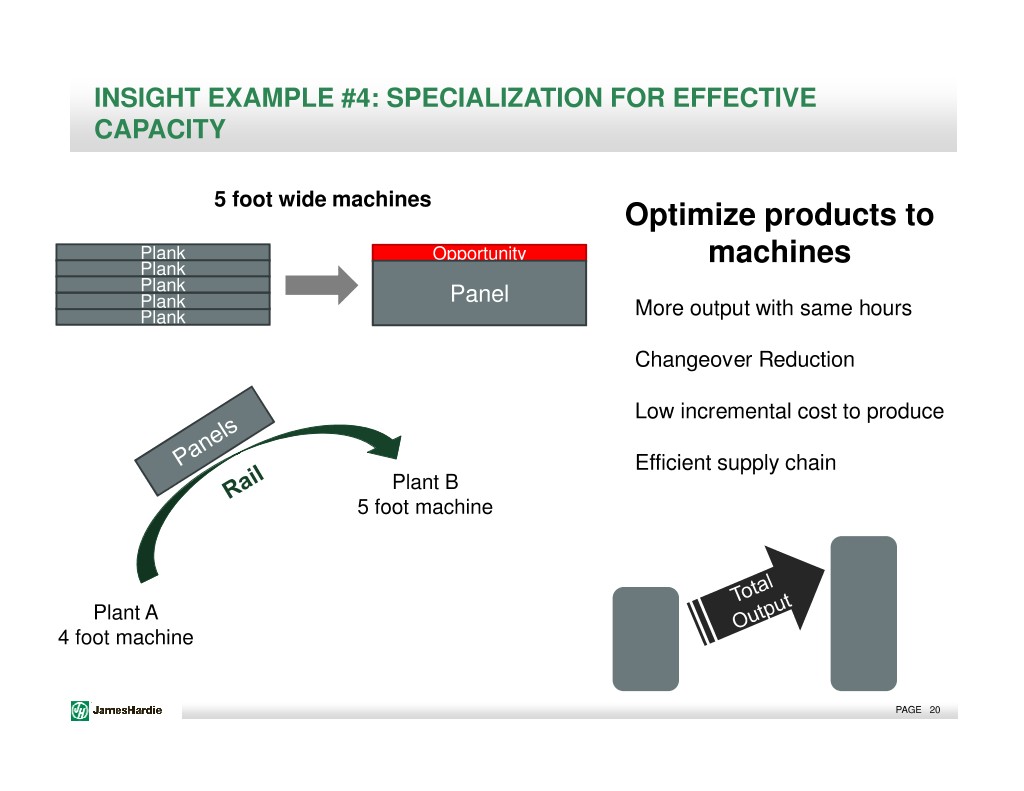

INSIGHT EXAMPLE #4: SPECIALIZATION FOR EFFECTIVE CAPACITY 5 foot wide machines Optimize products to Plank Opportunity machines Plank Plank Plank Panel Plank More output with same hours Changeover Reduction Low incremental cost to produce Efficient supply chain Plant B 5 foot machine Plant A 4 foot machine PAGE 20

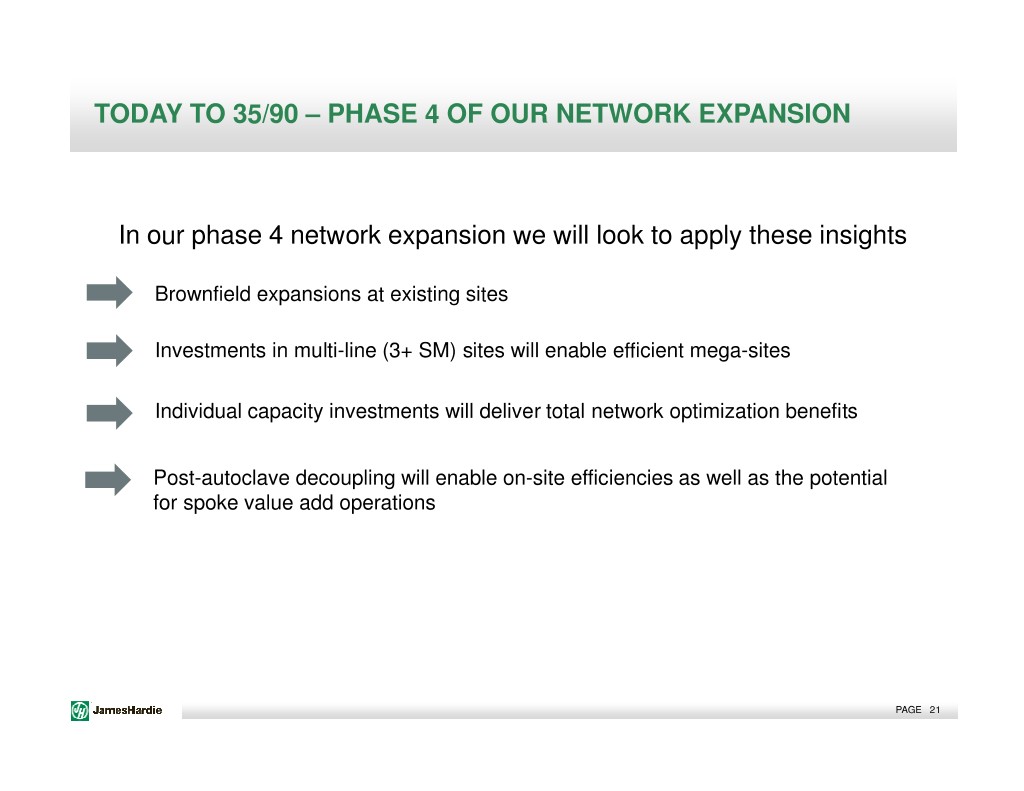

TODAY TO 35/90 – PHASE 4 OF OUR NETWORK EXPANSION In our phase 4 network expansion we will look to apply these insights Brownfield expansions at existing sites Investments in multi-line (3+ SM) sites will enable efficient mega-sites Individual capacity investments will deliver total network optimization benefits Post-autoclave decoupling will enable on-site efficiencies as well as the potential for spoke value add operations PAGE 21

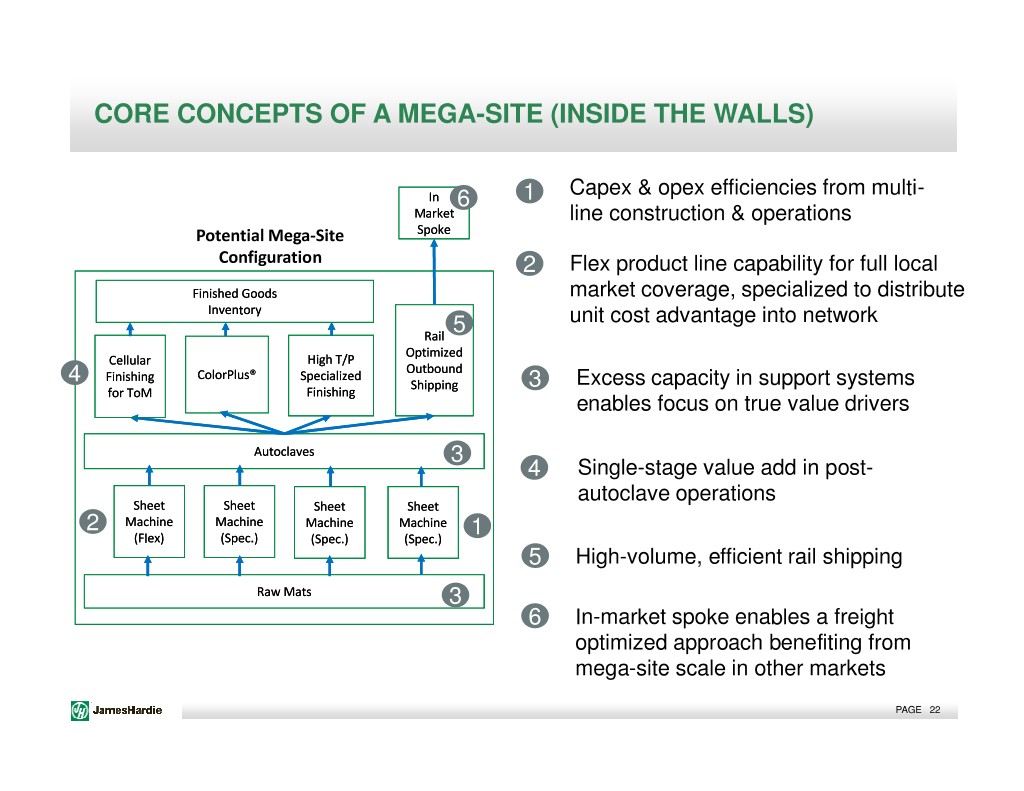

CORE CONCEPTS OF A MEGA-SITE (INSIDE THE WALLS) Capex & opex efficiencies from multi- In 6 1 Market line construction & operations Potential Mega-Site Spoke Configuration 2 Flex product line capability for full local Finished Goods market coverage, specialized to distribute Inventory unit cost advantage into network Rail 5 Optimized Cellular High T/P Outbound Finishing ColorPlus® Specialized 4 Shipping 3 Excess capacity in support systems for ToM Finishing enables focus on true value drivers Autoclaves 3 4 Single-stage value add in post- autoclave operations Sheet Sheet Sheet Sheet 2 Machine Machine Machine Machine (Flex) (Spec.) (Spec.) (Spec.) 1 5 High-volume, efficient rail shipping Raw Mats 3 6 In-market spoke enables a freight optimized approach benefiting from mega-site scale in other markets PAGE 22

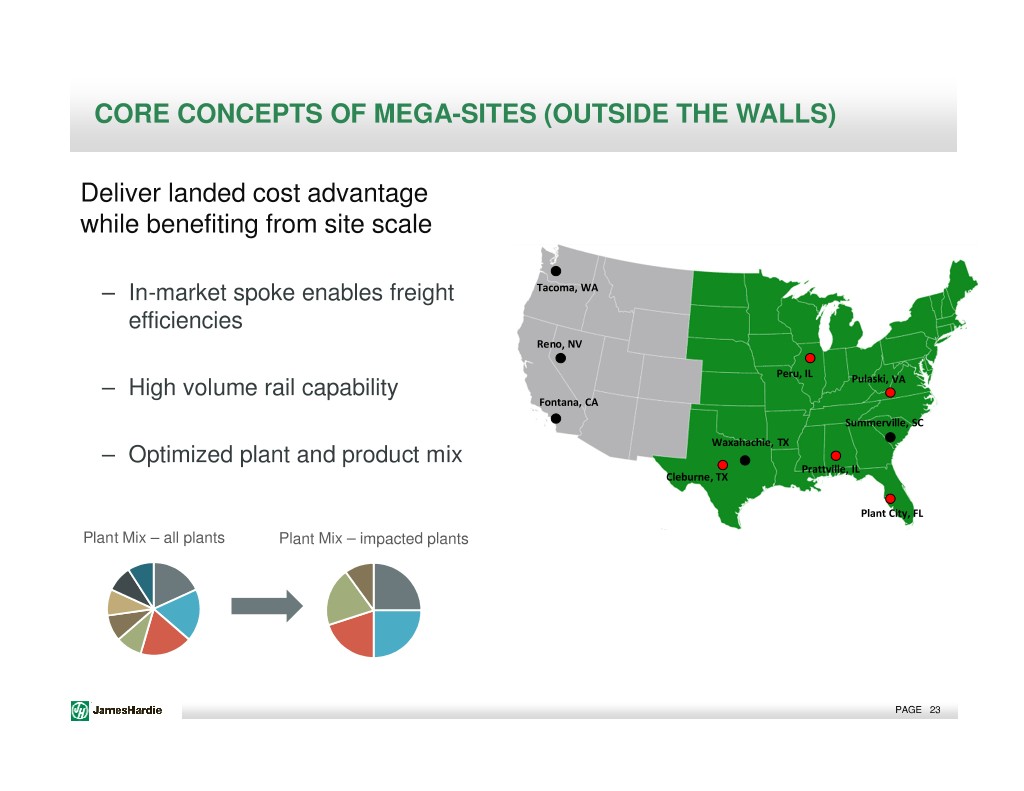

CORE CONCEPTS OF MEGA-SITES (OUTSIDE THE WALLS) Deliver landed cost advantage while benefiting from site scale – In-market spoke enables freight Tacoma, WA efficiencies Reno, NV Peru, IL – High volume rail capability Pulaski, VA Fontana, CA Summerville, SC Waxahachie, TX – Optimized plant and product mix Prattville, IL Cleburne, TX Plant City, FL Plant Mix – all plants Plant Mix – impacted plants PAGE 23

CAPACITY SUMMARY • Our current network footprint was designed to enable future organic volume growth at a high efficiency • Insights from our network build out are well understood, and learnings are being applied to future investments • Mega-site facilities will enable a scale advantage locally & create total network optimization benefits PAGE 24

• Xxx • Xxx TRANSFORMING OUR MANUFACTURING APPROACH

HISTORICAL MANUFACTURING APPROACH JH Manufacturing Approach: A decentralized, entrepreneurial approach utilizing step change engineering to scale a process with unlocked potential An approach that enabled unique …that contributed significantly to manufacturing capabilities… the value creation equation of JH $100M in annual revenue Industry leading economic returns from Tacoma 1: manufacturing capacity $30M invested capital Step change engineering delivering 9x5 Hatschek productivity over Generation unmatched FC cost position One 4x4 FC line FC process technology leadership creates Low Density HLD Trim customer value HZ5 Durability Northern FC PAGE 26

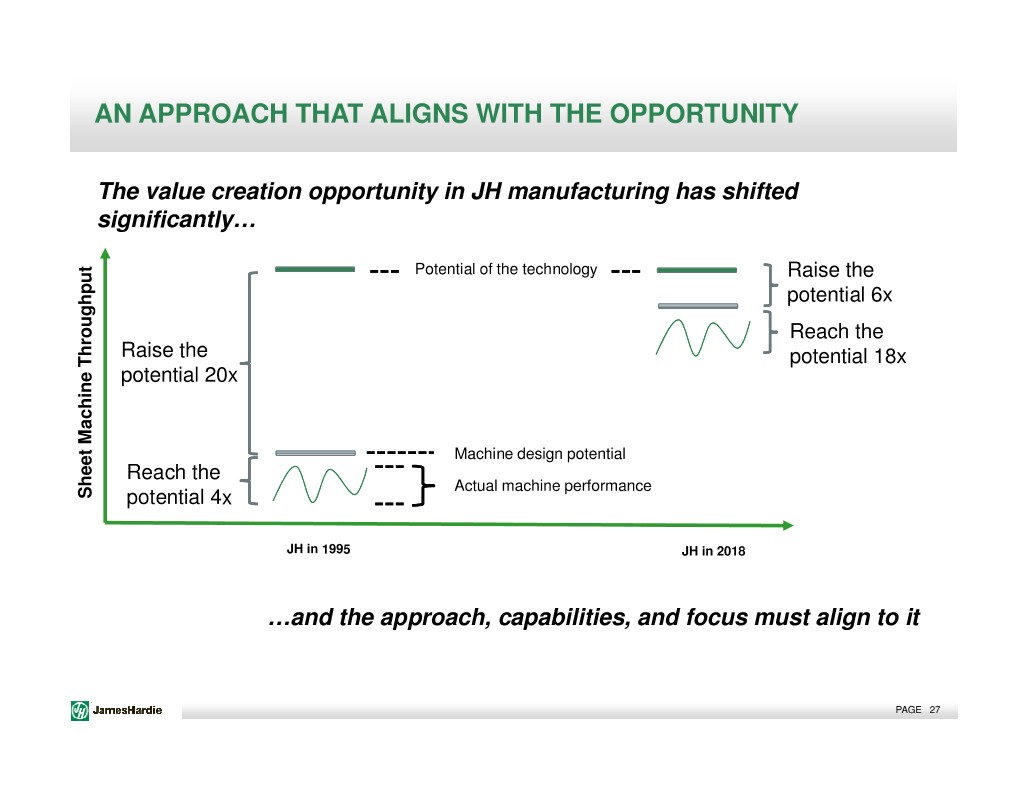

AN APPROACH THAT ALIGNS WITH THE OPPORTUNITY The value creation opportunity in JH manufacturing has shifted significantly… Potential of the technology Raise the potential 6x Reach the Raise the potential 18x potential 20x Machine design potential Reach the Actual machine performance Sheet Machine Throughput Machine Sheet potential 4x JH in 1995 JH in 2018 …and the approach, capabilities, and focus must align to it PAGE 27

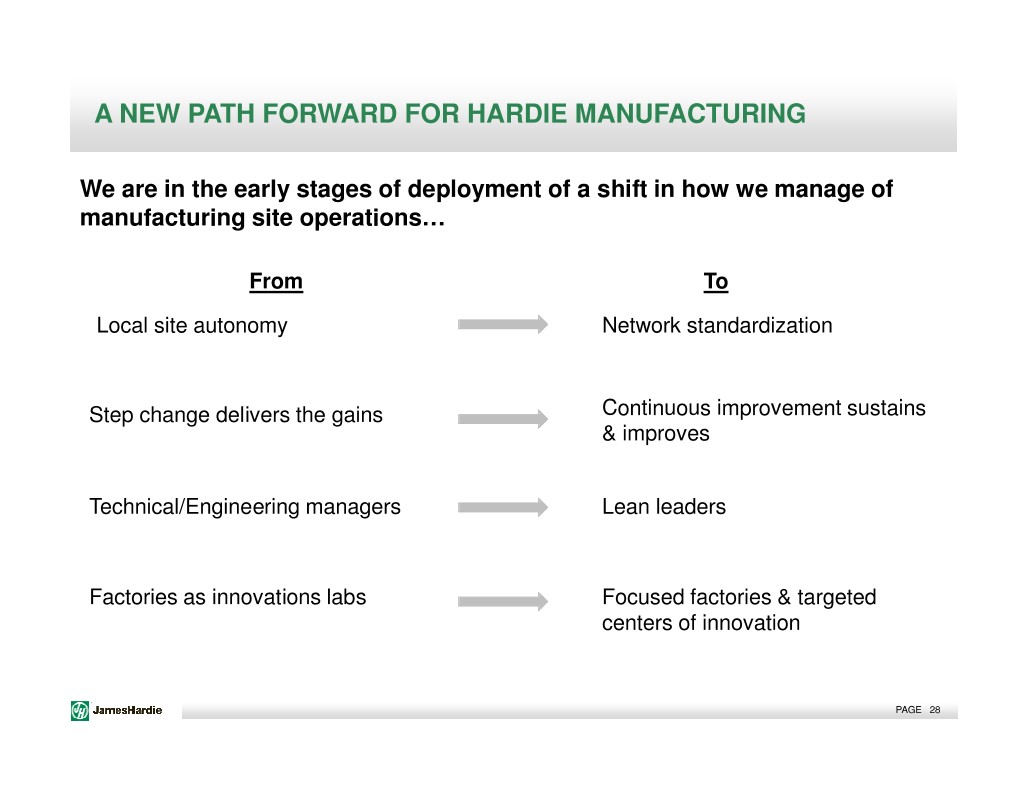

A NEW PATH FORWARD FOR HARDIE MANUFACTURING We are in the early stages of deployment of a shift in how we manage of manufacturing site operations… From To Local site autonomy Network standardization Step change delivers the gains Continuous improvement sustains & improves Technical/Engineering managers Lean leaders Factories as innovations labs Focused factories & targeted centers of innovation PAGE 28

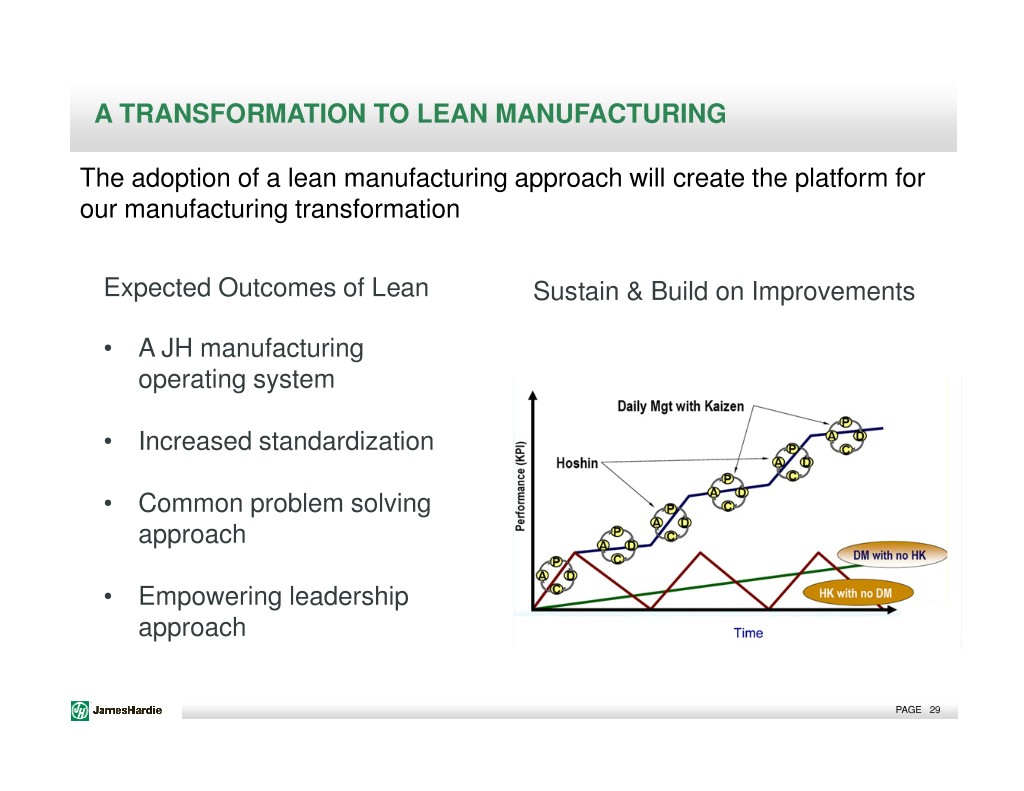

A TRANSFORMATION TO LEAN MANUFACTURING The adoption of a lean manufacturing approach will create the platform for our manufacturing transformation Expected Outcomes of Lean Sustain & Build on Improvements • A JH manufacturing operating system • Increased standardization • Common problem solving approach • Empowering leadership approach PAGE 29

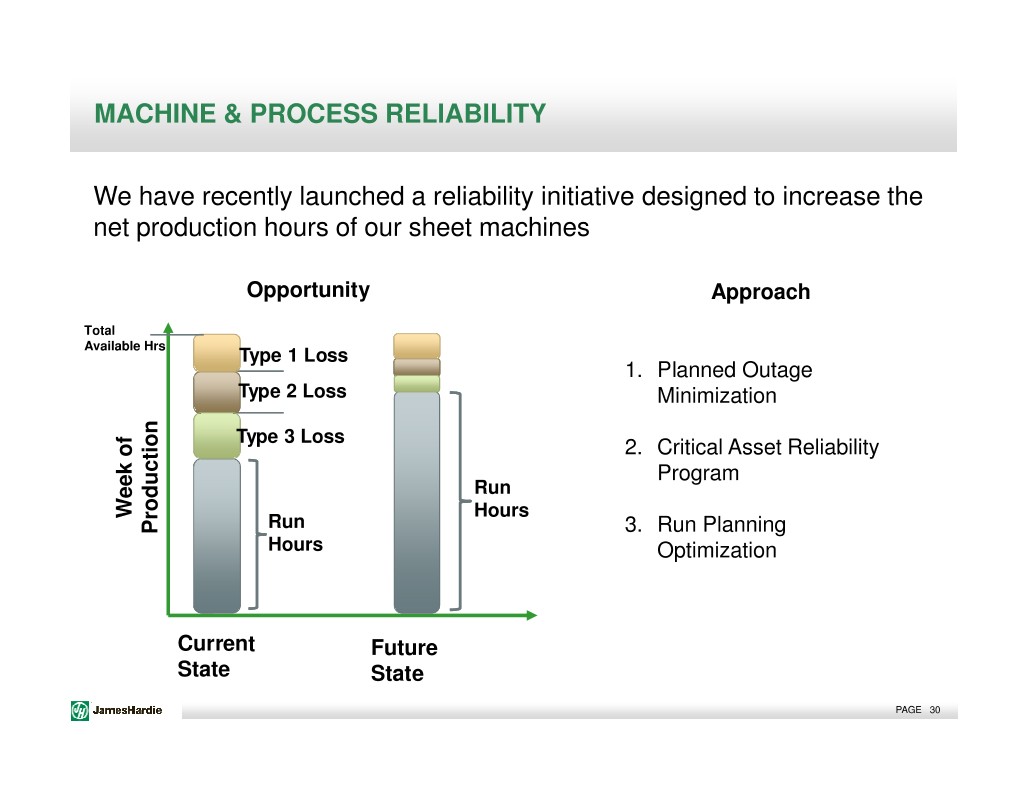

MACHINE & PROCESS RELIABILITY We have recently launched a reliability initiative designed to increase the net production hours of our sheet machines Opportunity Approach Total Available Hrs Type 1 Loss 1. Planned Outage Type 2 Loss Minimization Type 3 Loss 2. Critical Asset Reliability Program Run Week of of Week Hours Run Production 3. Run Planning Hours Optimization Current Future State State PAGE 30

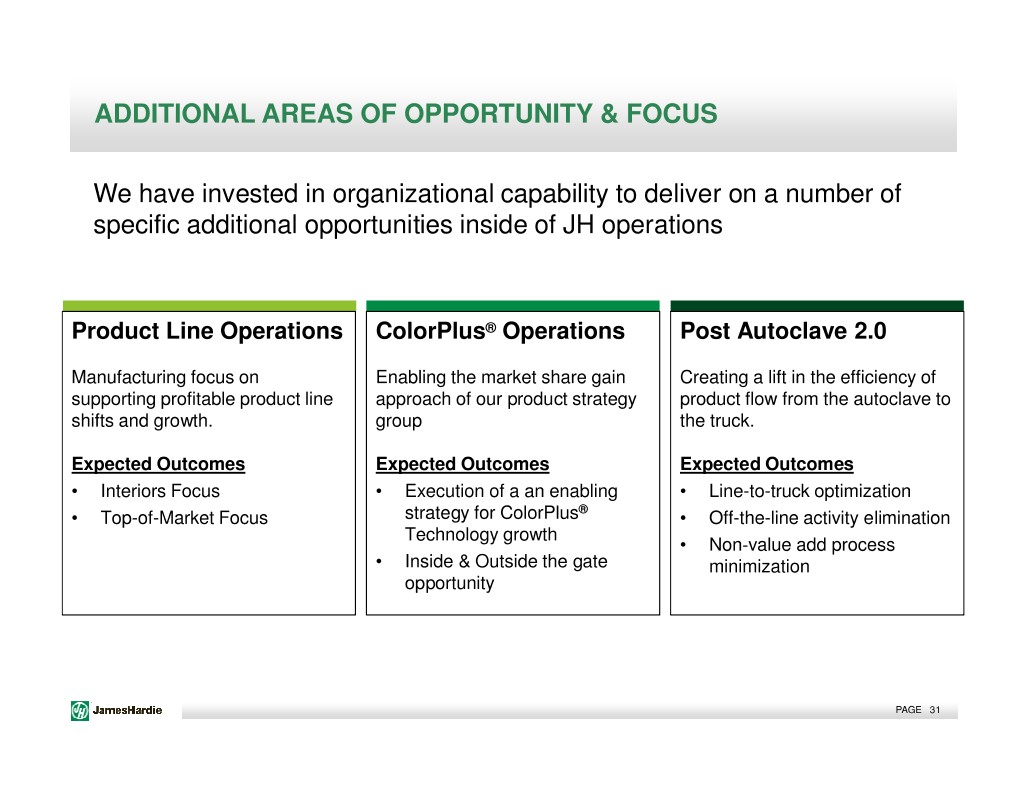

ADDITIONAL AREAS OF OPPORTUNITY & FOCUS We have invested in organizational capability to deliver on a number of specific additional opportunities inside of JH operations Product Line Operations ColorPlus ® Operations Post Autoclave 2.0 Manufacturing focus on Enabling the market share gain Creating a lift in the efficiency of supporting profitable product line approach of our product strategy product flow from the autoclave to shifts and growth. group the truck. Expected Outcomes Expected Outcomes Expected Outcomes • Interiors Focus • Execution of a an enabling • Line-to-truck optimization • Top-of-Market Focus strategy for ColorPlus ® • Off-the-line activity elimination Technology growth • Non-value add process • Inside & Outside the gate minimization opportunity PAGE 31

JH MANUFACTURING STRATEGY SUMMARY • A culture of innovation & step change has delivered significant value creation from our historical manufacturing approach • Greater efficiencies in our base network will be generated from a shift to continuous improvement, world class manufacturing • We are designing a more rigorous operating approach to manage the scale of our current & future sites PAGE 32

• Xxx • Xxx CUSTOMER VALUE CREATION & FC PROCESS INNOVATION

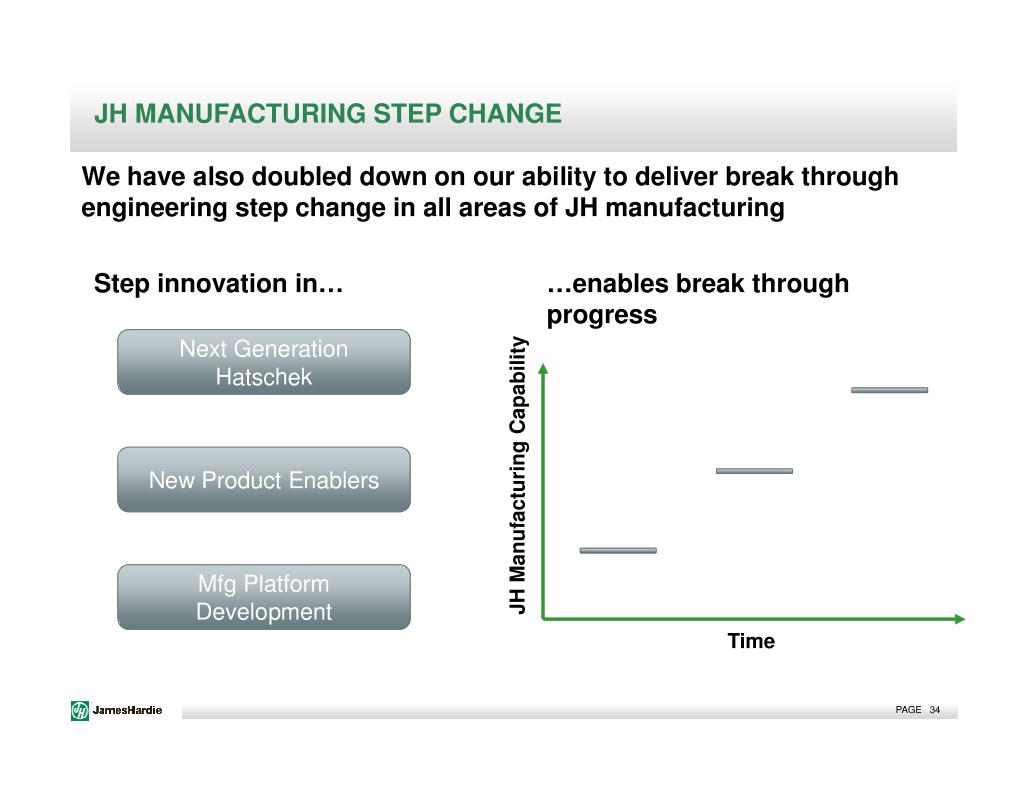

JH MANUFACTURING STEP CHANGE We have also doubled down on our ability to deliver break through engineering step change in all areas of JH manufacturing Step innovation in… …enables break through progress Next Generation Hatschek New Product Enablers Mfg Platform Development JH Manufacturing Capability Time PAGE 34

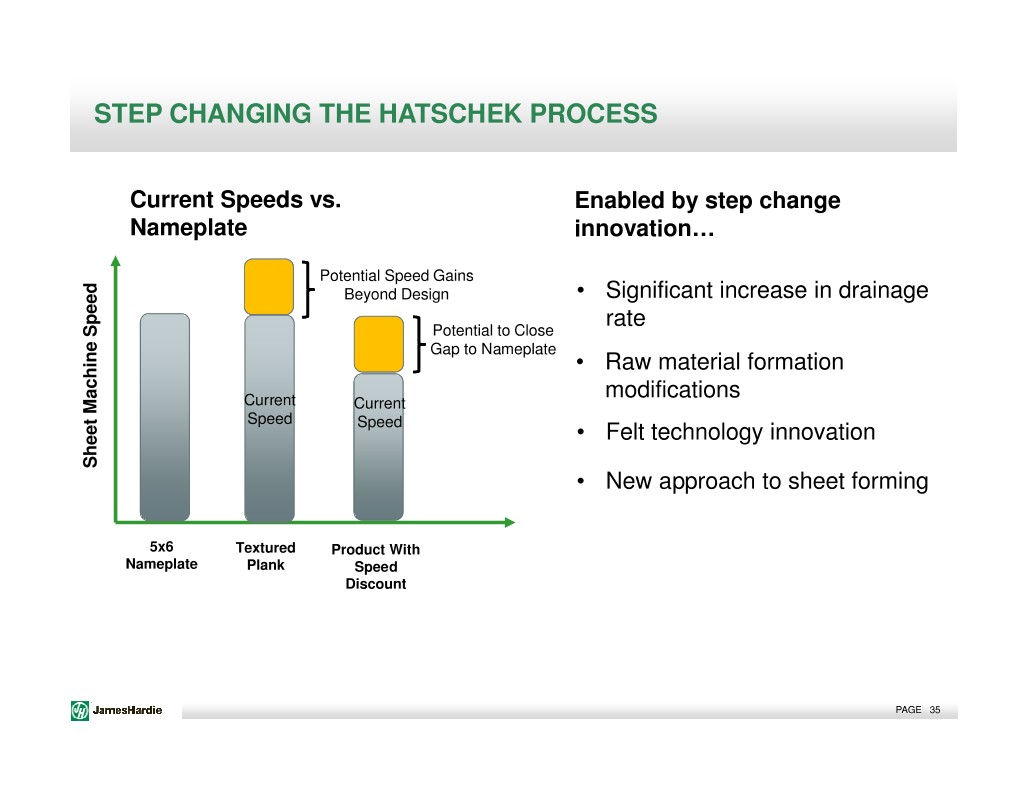

STEP CHANGING THE HATSCHEK PROCESS Current Speeds vs. Enabled by step change Nameplate innovation… Potential Speed Gains Beyond Design • Significant increase in drainage rate Potential to Close Gap to Nameplate • Raw material formation modifications Current Current Speed Speed • Felt technology innovation Sheet Machine Speed Machine Sheet • New approach to sheet forming 5x6 Textured Product With Nameplate Plank Speed Discount PAGE 35

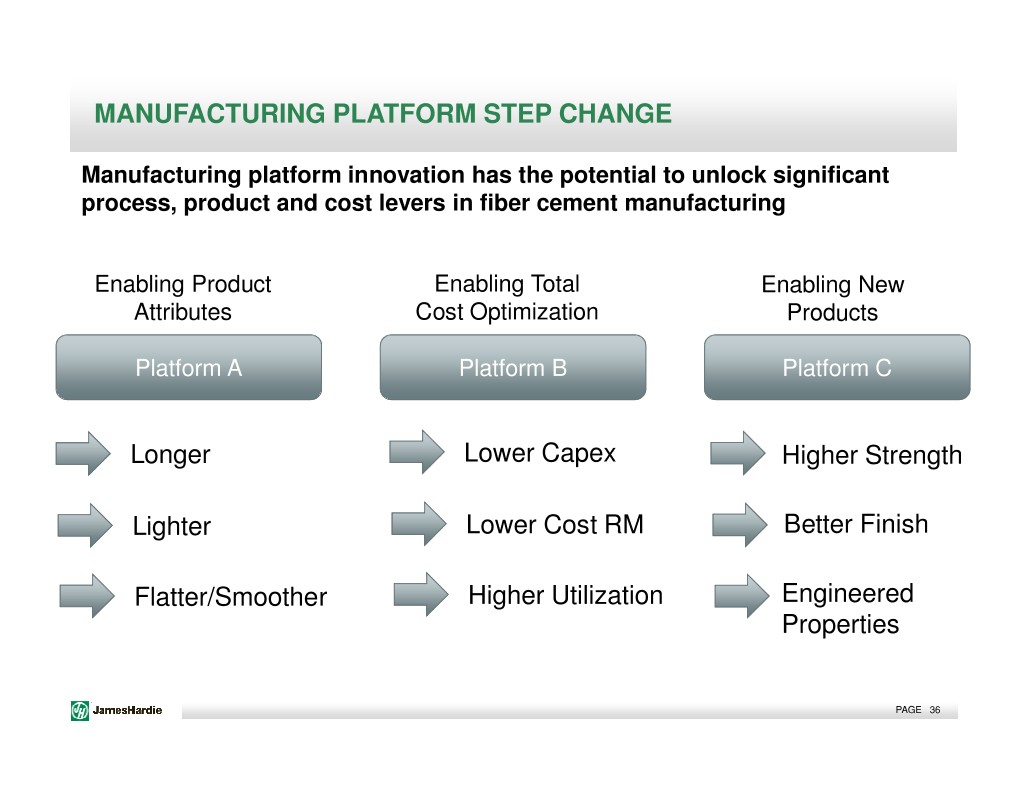

MANUFACTURING PLATFORM STEP CHANGE Manufacturing platform innovation has the potential to unlock significant process, product and cost levers in fiber cement manufacturing Enabling Product Enabling Total Enabling New Attributes Cost Optimization Products Platform A Platform B Platform C Longer Lower Capex Higher Strength Lighter Lower Cost RM Better Finish Flatter/Smoother Higher Utilization Engineered Properties PAGE 36

MANUFACTURING AND SUPPLY CHAIN SCALE Supply Chain enables efficient, full truck load shipments to distribution Scale and aggregation allows for efficient manufacturing Optionality offered Full Truck Aggregated Paint Long Sheet Machine to Customer Shipments Runs Product Runs PAGE 37

MANUFACTURING CAPABILITY SUMMARY • We have an established history in step change manufacturing innovation • We are adding to and enhancing the talent and capability of our engineering teams with the talent & capability to accelerate the pace of step change in JH • The value associated with continuous improvement has increased with our scale and we are organizing to deliver • Step change & continuous improvement efforts are both critical to delivering on our 35/90 manufacturing effort PAGE 38

• Xxx • Xxx CAPACITY PROJECT UPDATE

TACOMA 2 UPDATE • In start-up phase – C+ line expected 1H FY20 • Nameplate Capacity - 300 mmstdft/year • Capabilities – Plank, Backer, HardieShingle ®, ColorPlus ® Technology • 130 Employees at full production First Stacks Produced • Site benefits – Low input cost – Proximity to growing markets PAGE 40

ALABAMA UPDATE • Construction in process • Expected commissioning 1H FY20 • Initial Nameplate Capacity – 600 mmstdft/year • Anticipated Capabilities – HZ10 & HZ5 Plank, Backer, Aspyre Plank • 175 – 200 Employees at full production • Site benefits • Low input cost • Skilled manufacturing workforce • Rail accessibility PAGE 41

SUMMARY • Tacoma II and Alabama projects are on-track • Both investments bring incremental flat sheet and product line capacity to support future demand creation • Learnings from our previous experience in building & operating sites are being applied PAGE 42

OVERALL SUMMARY • We have a clear path forward in operations to continue to enable our 35/90 organic growth strategy • Our network design capabilities continue to improve and mega- sites are expected to be important to future capacity • Our journey to world class manufacturing has started • Process innovation and customer value creation will continue to be focus areas of our manufacturing strategy PAGE 43

• Xxx • Xxx Q&A