Exhibit 99.2 TRANSFORMING TO DRIVE PROFITABLE GROWTH Annual Review Fiscal Year 2019

CONTENTS Operations overview 2 Results at a glance 4 Chairman’s message 6 CEO’s report 8 Sustainability review 12 Corporate directory BC

JAMES HARDIE IS A GROWTH COMPANY. We are aggressively driving organic growth above market across all our businesses and geographies, while being number one in every market we choose to participate in. We have a global presence, with great products and great people and have consistently delivered strong returns and created shareholder value over the long term. We must continue to transform to become an even stronger, global business with consistent profitable growth. JAMES HARDIE – TRANSFORMING TO DRIVE PROFITABLE GROWTH Annual Review 2019 1

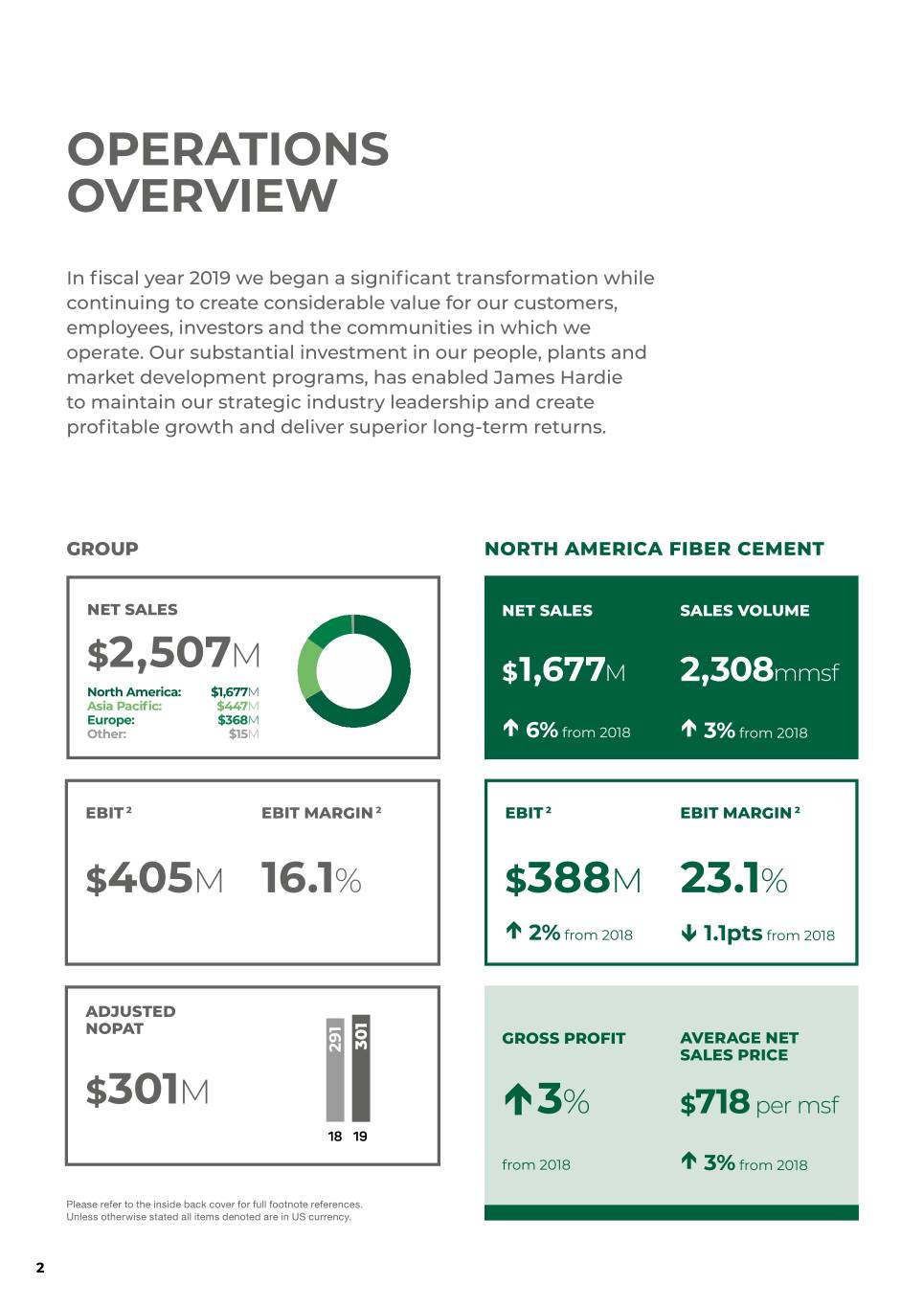

OPERATIONS OVERVIEW In fiscal year 2019 we began a significant transformation while continuing to create considerable value for our customers, employees, investors and the communities in which we operate. Our substantial investment in our people, plants and market development programs, has enabled James Hardie to maintain our strategic industry leadership and create profitable growth and deliver superior long-term returns. GROUP NORTH AMERICA FIBER CEMENT NET SALES NET SALES SALES VOLUME $ M 2,507 $1,677M 2,308mmsf North America: $1,677M Asia Pacific: $447M Europe: $368M Other: $15M 6% from 2018 3% from 2018 EBIT 2 EBIT MARGIN 2 EBIT 2 EBIT MARGIN 2 $405M 16.1% $388M 23.1% 2% from 2018 1.1pts from 2018 ADJUSTED NOPAT GROSS PROFIT AVERAGE NET 301 291 SALES PRICE $301M 3% $718 per msf 18 19 from 2018 3% from 2018 Please refer to the inside back cover for full footnote references. Unless otherwise stated all items denoted are in US currency. 2

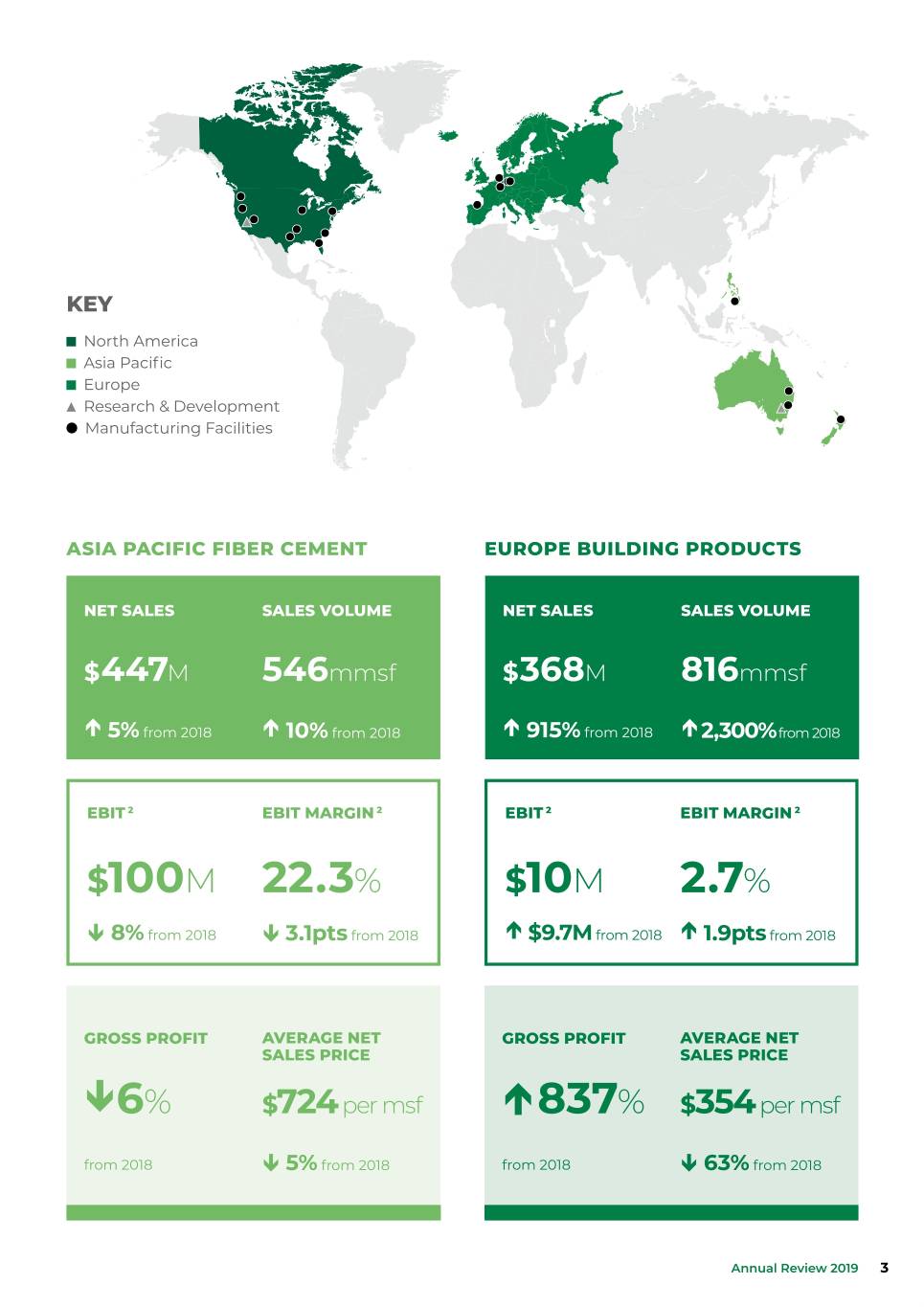

KEY North America Asia Pacific Europe Research & Development Manufacturing Facilities ASIA PACIFIC FIBER CEMENT EUROPE BUILDING PRODUCTS NET SALES SALES VOLUME NET SALES SALES VOLUME $447M 546mmsf $368M 816mmsf 5% from 2018 10% from 2018 915% from 2018 2,300% from 2018 EBIT 2 EBIT MARGIN 2 EBIT 2 EBIT MARGIN 2 $100M 22.3% $10M 2.7% 8% from 2018 3.1pts from 2018 $9.7M from 2018 1.9pts from 2018 GROSS PROFIT AVERAGE NET GROSS PROFIT AVERAGE NET SALES PRICE SALES PRICE 6% $724 per msf 837% $354 per msf from 2018 5% from 2018 from 2018 63% from 2018 Annual Review 2019 3

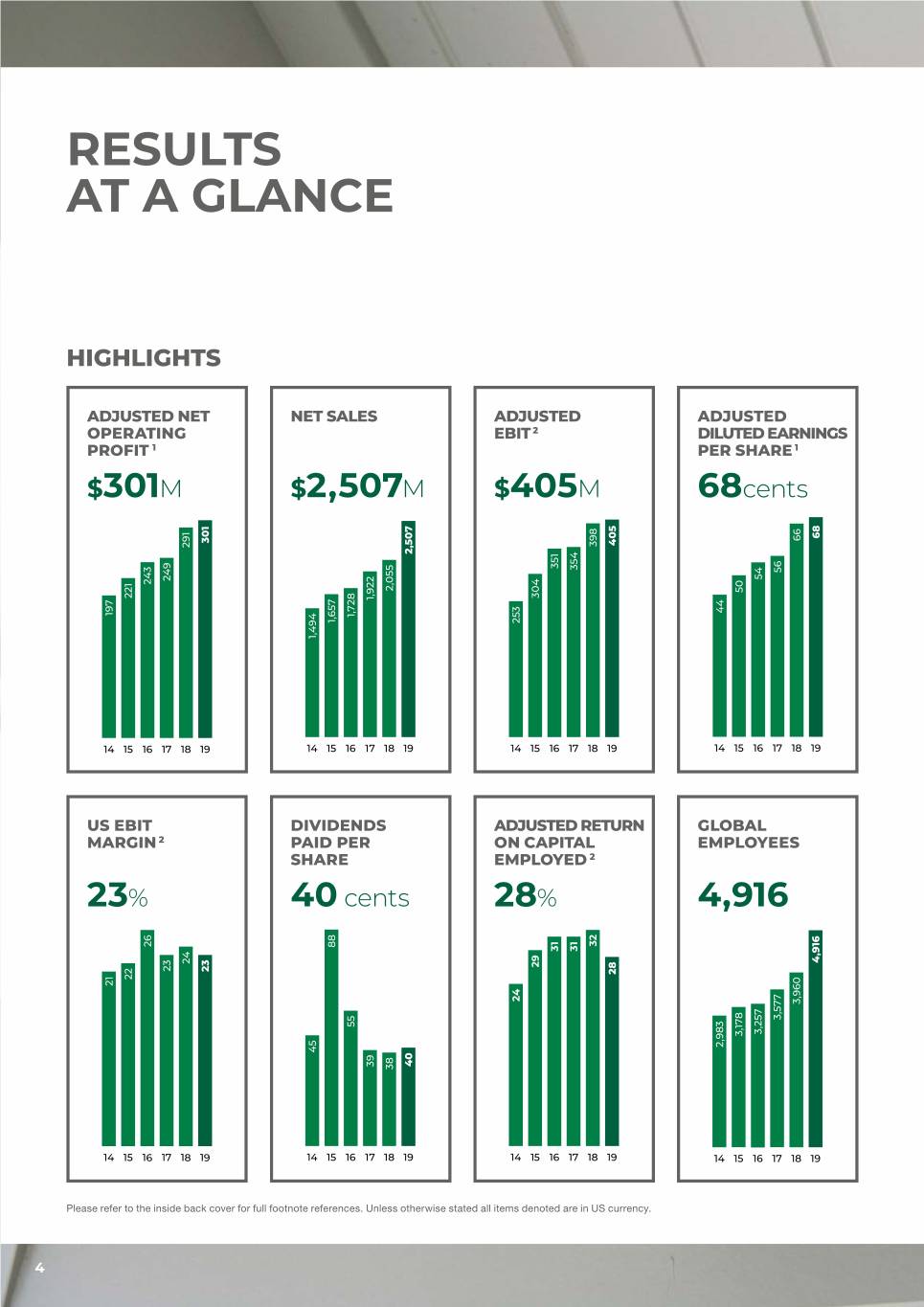

RESULTS AT A GLANCE HIGHLIGHTS ADJUSTED NET NET SALES ADJUSTED ADJUSTED OPERATING EBIT 2 DILUTED EARNINGS PROFIT 1 PER SHARE 1 $301M $2,507M $405M 68cents 68 66 301 405 398 291 2,507 351 354 56 54 249 243 2,055 50 304 221 1,922 44 197 1,728 1,657 253 1,494 14 15 16 17 18 19 14 15 16 17 18 19 14 15 16 17 18 19 14 15 16 17 18 19 US EBIT DIVIDENDS ADJUSTED RETURN GLOBAL MARGIN 2 PAID PER ON CAPITAL EMPLOYEES SHARE EMPLOYED 2 23% 40 cents 28% 4,916 32 26 88 31 31 4,916 24 29 23 23 28 22 21 24 3,960 3,577 55 3,257 3,178 2,983 45 40 39 38 14 15 16 17 18 19 14 15 16 17 18 19 14 15 16 17 18 19 14 15 16 17 18 19 Please refer to the inside back cover for full footnote references. Unless otherwise stated all items denoted are in US currency. 4

INDUSTRY ENDORSEMENTS US: US: BRAND GOOD LEADER HOUSEKEEPING ENDORSEMENT Chosen by HardiePlank® builders as a lap siding Brand Leader in is backed Builder magazine by the Good for over 20 years Housekeeping Seal US: US: MOST TOP BUILDING SUSTAINABLE MATERIALS PRODUCT AND PRODUCTS Green Builder Listed as top Magazine Readers’ building materials Choice, “Most and products Sustainable by Professional Product” 2019 Builder 2018 AUSTRALIA: GERMANY: NATIONAL OUTSTANDING SUPPLIER BRAND AWARD OF THE YEAR Won National Fermacell was Supplier of the Year recognised as from Australian one of the best Plaster & Building building material Accessories brands in Germany Annual Review 2019 5

CHAIRMAN’S MESSAGE In fiscal year 2019 we began a transformation that we are confident will lead to the next phase of sustained profitable growth for James Hardie. We start and end fiscal year 2019 with two key transactions During fiscal year 2019 we allocated capital to position our North that will be critical to this transformation. We began the year America manufacturing network for the future, including continuing by acquiring Fermacell, which we believe positions us to create the start-up of our greenfield expansion project in Tacoma a significant European building materials business, and toward (Washington), and the start of construction of a greenfield expansion the end of the year we appointed Dr Jack Truong as the new project in Prattville (Alabama). We also initiated the expansion project James Hardie CEO on 31 January 2019. within our ColorPlus product line including equipment, land and buildings, this includes projects at our Peru (Illinois) and Pulaski Jack has already set James Hardie on the path of this (Virginia) plants, and a greenfield project in Massachusetts. transformation. In Jack we have a strong and capable executive to lead James Hardie’s strategic direction, and the company’s Our Asia Pacific segment once again contributed strong operational and financial performance into the future. At the results during fiscal year 2019. Net sales increased 11% January 2019 Board meeting Jack presented his 3 year strategic in Australian dollars due to strong volume growth in our plan to transform James Hardie to become an even stronger, Australia and Philippines businesses and EBIT margin was global business and deliver our next phase of profitable growth. 22.3%, driven by a very strong performance in our Australian The Board endorses the strategic plan to drive organic growth business. During fiscal year 2019, we continued the start‑up above market, deliver strong returns and be number one in every of the additional capacity expansion in the Philippines, market we choose to participate in. and we continued the planning and design of a brownfield expansion project at our Carole Park (Australia) plant. Our North America segment achieved 3% top line growth and EBIT margin of 23.1%, which is within our target range of 20–25%. Our Europe Building Products segment delivered a strong pro forma Our primary focus for fiscal year 2020 will be to return primary net sales increase of 7% in Euros and an adjusted EBIT margin demand growth to our targeted range and we are confident that of 10.6% for fiscal year 2019. the strategic plan that Jack outlined will drive this outcome. 6

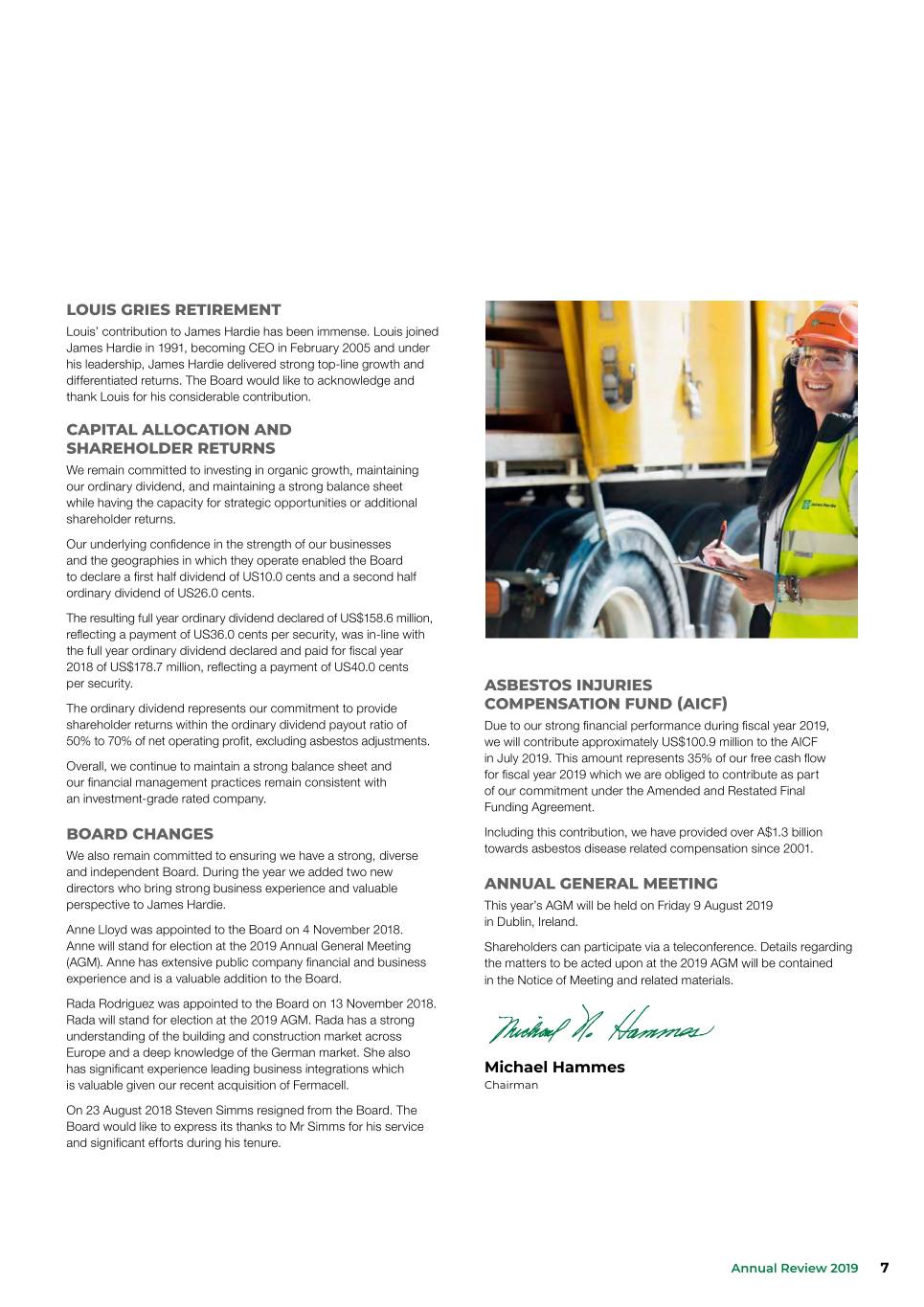

LOUIS GRIES RETIREMENT Louis’ contribution to James Hardie has been immense. Louis joined James Hardie in 1991, becoming CEO in February 2005 and under his leadership, James Hardie delivered strong top‑line growth and differentiated returns. The Board would like to acknowledge and thank Louis for his considerable contribution. CAPITAL ALLOCATION AND SHAREHOLDER RETURNS We remain committed to investing in organic growth, maintaining our ordinary dividend, and maintaining a strong balance sheet while having the capacity for strategic opportunities or additional shareholder returns. Our underlying confidence in the strength of our businesses and the geographies in which they operate enabled the Board to declare a first half dividend of US10.0 cents and a second half ordinary dividend of US26.0 cents. The resulting full year ordinary dividend declared of US$158.6 million, reflecting a payment of US36.0 cents per security, was in-line with the full year ordinary dividend declared and paid for fiscal year 2018 of US$178.7 million, reflecting a payment of US40.0 cents per security. ASBESTOS INJURIES The ordinary dividend represents our commitment to provide COMPENSATION FUND (AICF) shareholder returns within the ordinary dividend payout ratio of Due to our strong financial performance during fiscal year 2019, 50% to 70% of net operating profit, excluding asbestos adjustments. we will contribute approximately US$100.9 million to the AICF in July 2019. This amount represents 35% of our free cash flow Overall, we continue to maintain a strong balance sheet and for fiscal year 2019 which we are obliged to contribute as part our financial management practices remain consistent with of our commitment under the Amended and Restated Final an investment-grade rated company. Funding Agreement. BOARD CHANGES Including this contribution, we have provided over A$1.3 billion towards asbestos disease related compensation since 2001. We also remain committed to ensuring we have a strong, diverse and independent Board. During the year we added two new directors who bring strong business experience and valuable ANNUAL GENERAL MEETING perspective to James Hardie. This year’s AGM will be held on Friday 9 August 2019 in Dublin, Ireland. Anne Lloyd was appointed to the Board on 4 November 2018. Anne will stand for election at the 2019 Annual General Meeting Shareholders can participate via a teleconference. Details regarding (AGM). Anne has extensive public company financial and business the matters to be acted upon at the 2019 AGM will be contained experience and is a valuable addition to the Board. in the Notice of Meeting and related materials. Rada Rodriguez was appointed to the Board on 13 November 2018. Rada will stand for election at the 2019 AGM. Rada has a strong understanding of the building and construction market across Europe and a deep knowledge of the German market. She also has significant experience leading business integrations which Michael Hammes is valuable given our recent acquisition of Fermacell. Chairman On 23 August 2018 Steven Simms resigned from the Board. The Board would like to express its thanks to Mr Simms for his service and significant efforts during his tenure. Annual Review 2019 7

CEO’S REPORT Fiscal year 2019 marks the beginning of a critical transformation that will launch the next phase of growth at James Hardie. I would like to start by sharing how honoured I am to serve as the LONG TERM VALUE CREATION CEO of James Hardie, and to lead its more than 5,000 employees worldwide into the future. I want to thank the Board for their trust in me to lead this incredible company. I would also like to take the opportunity to thank Louis Gries for his vision and leadership during NORTH AMERICA the past 14 years as James Hardie CEO. I am grateful for the very strong foundation that he built. EBIT James Hardie is a company with a global presence, with great 35/90 with 20–25% MARGIN products and great people. It is a company that has consistently delivered strong operational and financial results over the long term. However, in 2019 we began a transformation to ensure we become an even stronger, global business with consistent profitable growth. ASIA PACIFIC The Commercial Transformation in our North American business will help ensure we return to our growth above market targets and DELIVER ultimately achieve our long term ambition of 35% market share and EBIT GROWTH with 20–25% MARGIN 90% category share (“35/90”). ABOVE MARKET Shifting to being a company underpinned with a Lean mentality will not only deliver considerable cost out within our manufacturing plants, but ensure we are a global organisation focused on continuous improvement in everything we do. EUROPE Our long term value creation targets remain unchanged, and we have a clear and tangible three year plan to drive the necessary momentum and traction needed to take the next step toward BILLION € EBIT achieving these long term targets. 1REVENUE with 20+% MARGIN 8

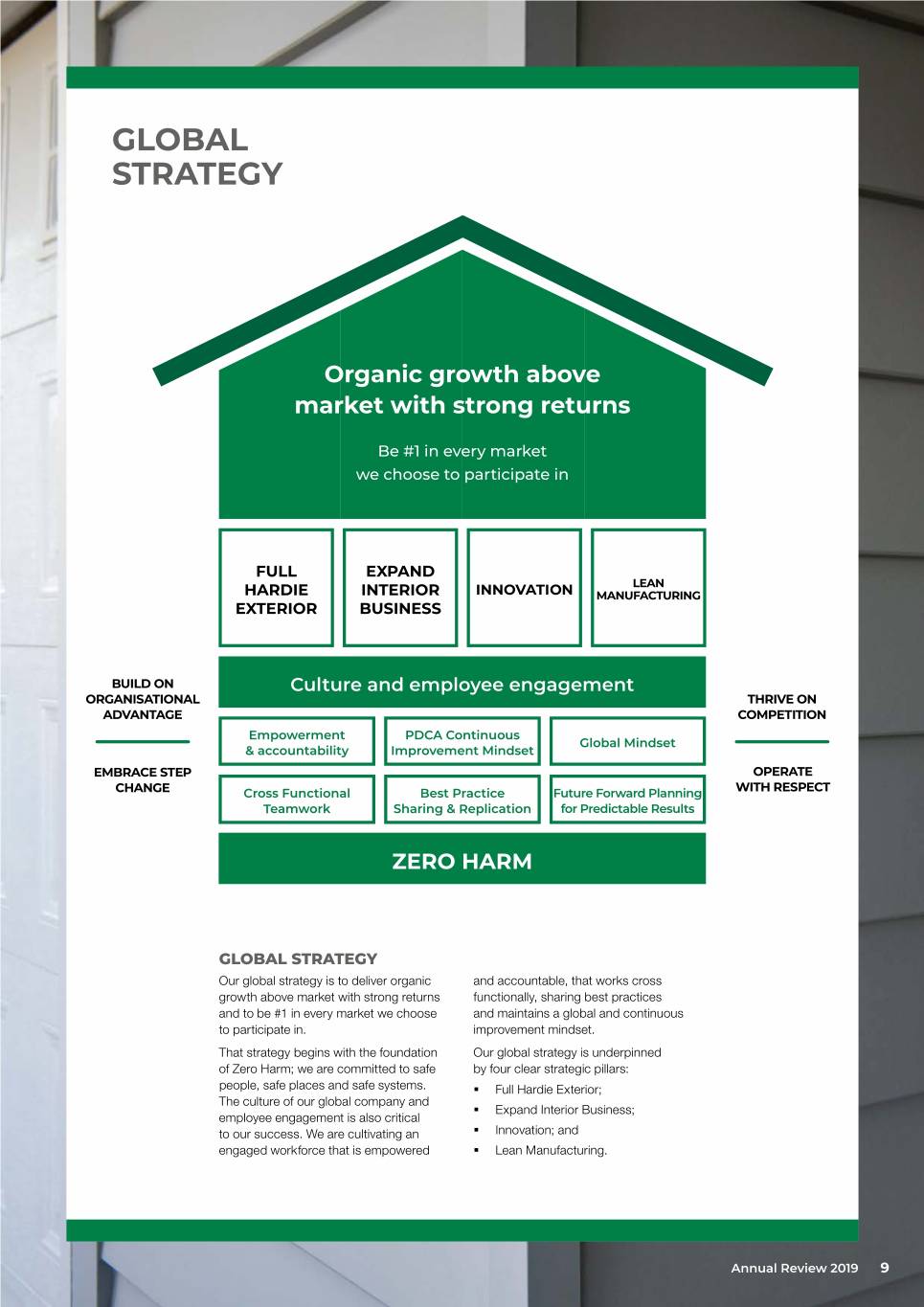

GLOBAL STRATEGY Organic growth above market with strong returns Be #1 in every market we choose to participate in FULL EXPAND LEAN HARDIE INTERIOR INNOVATION MANUFACTURING EXTERIOR BUSINESS BUILD ON Culture and employee engagement ORGANISATIONAL THRIVE ON ADVANTAGE COMPETITION Empowerment PDCA Continuous Global Mindset & accountability Improvement Mindset EMBRACE STEP OPERATE WITH RESPECT CHANGE Cross Functional Best Practice Future Forward Planning Teamwork Sharing & Replication for Predictable Results ZERO HARM GLOBAL STRATEGY Our global strategy is to deliver organic and accountable, that works cross growth above market with strong returns functionally, sharing best practices and to be #1 in every market we choose and maintains a global and continuous to participate in. improvement mindset. That strategy begins with the foundation Our global strategy is underpinned of Zero Harm; we are committed to safe by four clear strategic pillars: people, safe places and safe systems. §§ Full Hardie Exterior; The culture of our global company and §§ Expand Interior Business; employee engagement is also critical to our success. We are cultivating an §§ Innovation; and engaged workforce that is empowered §§ Lean Manufacturing. Annual Review 2019 9

CEO’S REPORT (CONTINUED) FY19 OPERATING RESULTS Our operating results for fiscal year 2019 reflected good NET OPERATING and disciplined financial performance in a significant inflationary PROFIT AFTER TAX 1 cost environment. Highlights include revenue increasing by 22%, adjusted net operating profit increasing by 3% and adjusted return on capital employed remaining strong at 28%. $301M The North American business delivered good volume growth of 3% 3% from 2018 for fiscal year 2019. Our exteriors business continued to grow above our addressable market throughout the year. It is a good improvement over our fiscal year 2018 performance, albeit below our expectations. North America segment generated respectable EBIT margins at 23.1%, in a challenging input cost environment. Our management EBIT team is transforming our commercial strategy and implementing Lean NORTH AMERICA 2 manufacturing as our operating approach in North America. We are confident these transformations will lead to improvement in our ability to execute and deliver on expected results. $388M Our Asia Pacific business delivered excellent revenue growth of 11% in Australian dollars along with 22.3% EBIT margin. The strong 2% from 2018 revenue growth of the Asia Pacific segment was led by market share and category share gains in Australia, and supported by additional strong volume growth in the Philippines. The Europe business delivered strong pro forma net sales growth EBIT of 7% in Euros for fiscal year 2019 and an adjusted EBIT margin ASIA PACIFIC of 10.6%, which was in line with expectations. Since the acquisition of Fermacell on 3 April 2018 the integration has progressed well and we continue to be encouraged by the early indicators from $100M our European business. 8% from 2018 EBIT EUROPE $10M 9.7M from 2018 10

OUTLOOK ZERO HARM We expect to see modest growth in the US housing market in fiscal year 2020. The single family new Zero Harm is a non-negotiable value construction market and repair and remodel market for our company, as employees of growth rates in fiscal year 2020 are expected to grow, James Hardie we are all responsible albeit at a growth rate lower than that in fiscal year for Zero Harm and we need to 2019. The company expects new construction starts between approximately 1.2 million and 1.3 million. demonstrate that commitment every day. In FY19 we made progress in We expect our North America Fiber Cement segment EBIT margin to be in the top half of our range of 20% our Zero Harm journey, improving our to 25% for fiscal year 2020. This expectation is based Incident Rate from 1.10 to 0.84 and our upon the company continuing to improve operating DART Rate from 0.50 to 0.39. However, performance in our plants, higher net average sales we still have significant work to ensure price and mix, continued inflation for input costs and modest underlying housing growth. we continue to improve and achieve our Zero Harm goal. In Australia, it is anticipated that our addressable underlying market will decrease in fiscal year 2020 compared to fiscal year 2019. Net sales from our Australian business are expected to continue to trend above the average growth of the domestic repair and remodel and single family detached housing markets SUMMARY in the eastern states of Australia. This is an exciting time for James Hardie as We expect our Europe Building Products segment we transform our business to drive even more to achieve year on year net sales and EBIT consistent profitable growth globally. I am confident margin growth. that we are on the right path with the right talent, drive and capability to reach our goals of being a world class company. Dr Jack Truong CEO Annual Review 2019 11

SUSTAINABILITY REVIEW SUSTAINABILITY HIGHLIGHTS Engaged in Lean Manufacturing Drove our Zero Harm initiative which led to transformation through the implementation the implementation of James Hardie’s global of the Hardie Management Operating EHS Management System System (HMOS) Invested in plant infrastructure to Continued to support corporate and upgrade Water Recycling Capability employee engagement in local communities and Reduce Water Use where we live and work Upgraded our ISO14001 System Selected the 2019 Readers’ Choice at three North American plants “Greenest Siding Product” and at our European plants by Green Builder magazine 12

SUSTAINABLE MANUFACTURING James Hardie manufactures products that reflect our commitment to environmental stewardship. By producing environmentally friendly products we contribute to a variety of LEED New Construction James Hardie’s commitment points including: to environmental James Hardie ® Exterior Products: excellence and the value MR5 (MR4 for Homes) Recycled Content the company places on MR5 (MR4 for Homes) Regional Materials long‑term sustainability is James Hardie ® Interior Products: reflected in its maintenance Low-Emitting Materials (our HardieBacker ® product line of a comprehensive is certified GREENGUARD Gold) environmental management Sustainably Manufactured Product Highlights: system together with our §§ High quality standards for the raw materials used to drive best commitment to efficient in class performance of our products; §§ At least 75% of our raw materials are locally sourced, reducing manufacturing processes. the environmental impact caused by transportation of materials; §§ Our 19 manufacturing plants on four continents support the respective regional economies in which they are located, again In fiscal year 2019 we introduced the Hardie Manufacturing reducing the environmental impact caused by transportation Operating System (HMOS). HMOS drives improvement in of our product; our manufacturing and environmental performance through: (1) Employee Engagement and Empowerment, (2) Elimination §§ Raw materials such as cement, cellulose pulp, sand, and water of Daily Variability, and (3) Continuous Improvement in the are low in toxicity; and Manufacturing Processes. HMOS is a key aspect of James Hardie’s §§ Durable fiber cement and fiber gypsum materials not only require sustainability initiative, continually driving collective improvements fewer resources for replacement, but help reduce maintenance, in manufacturing efficiency, resource utilisation, and housekeeping. repair and replacement costs. ZERO TO LANDFILL IN EUROPE James Hardie Europe has four fiber gypsum manufacturing facilities across three European countries: Germany, the Netherlands and Spain. We are proud that all of these facilities are zero waste facilities with no landfill generated. We utilise four sources of gypsum, three of which are recycled materials. The fiber we utilise in our fiber gypsum products is produced from waste paper which is 100% recycled. We are proud to maintain a manufacturing process that leverages a majority of materials that are recycled and produces zero waste. Annual Review 2019 13

SUSTAINABILITY REVIEW (CONTINUED) ENVIRONMENTAL MANAGEMENT & STEWARDSHIP James Hardie embraces an Environmental Policy that is based on four guiding principles: CEO MESSAGE ON SUSTAINABILITY REPORTING RENEWABLE AND RECYCLABLE RESOURCES WATER, RESOURCE AND ENERGY CONSERVATION PROTECTION OF THE The Executive Leadership Team and I are ENVIRONMENT committed to delivering a full sustainability report by the end of fiscal year 2021. We have decided to adopt the Global Reporting Initiatives (GRI) framework. The GRI will provide a framework for us to report on FULL LIFECYCLE AND material topics, their related impacts and how PRODUCT SUSTAINABILITY they are managed, and is the most widely adopted framework for Environmental, Social and Governance reporting. Management’s plan has the full support of the James Hardie remains committed to implementing innovative Board. As we engage in this transition toward solutions that optimise the use of raw materials, water and energy fiscal year 2021, we will continue to improve resources. Environmental stewardship highlights include: upon the sustainability reporting we include in our Annual Review and Annual Report §§ Beneficial use of waste water for companies on Form 20-F. in the mining industry near our facilities; §§ Enhanced recycling of waste material into our manufacturing process; §§ Improved raw material use from improved manufacturing yields; §§ Installation of energy efficient LED lighting across our global operations; §§ Enhanced boiler efficiency modifications in our Asia Pacific operations; Dr Jack Truong §§ Beneficial use of 100% recycled paper CEO in European fiber gypsum operations; and §§ Upgrades to ISO 14001-2015 standard in our North American and European plants. 14

ZERO HARM SAFETY CULTURE Our Zero Harm Safety Culture mission is to become a World‑Class Safety Organisation focused on Safe People, Safe Plants, and Safe Systems. SAFE PEOPLE Committed and Passionate Safety Leaders Team Members who are empowered and engaged Visible Commitment 24/7/365 SAFE SYSTEMS SAFE PLACES Provide the structure World Class Facilities for Zero Harm A focus on continuous Sets clear Standards improvement through safety and Expectations in design Real time data to support Housekeeping as the risk reduction and barometer of safety continuous improvement ZERO HARM IN ACTION PRODUCT SAFETY IN OUR COMMUNITY – RESOURCES ON THE GROUND Zero Harm extends beyond the workplace. A James More than 50 technical specialists around the country Hardie employee at our Pulaski (Virginia) facility share their expertise in training and applying installation was recognised by leadership for providing a high best practices, building science fundamentals, visibility vest to a citizen directing traffic at the construction and installation efficiencies, and small scene of an auto accident and for taking the time business development assistance. In many parts to provide instruction on how to position himself of North America, this includes on-site “First Board, on the road to reduce risk. One of many examples First Nail” training at the beginning of key projects of James Hardie’s Zero Harm initiative in action. to ensure they get off to the best start possible. In February 2019 our Wijchen, Netherlands plant celebrated 1000 days without a safety incident. Annual Review 2019 15

SUSTAINABILITY REVIEW (CONTINUED) SOCIAL RESPONSIBILITY ASBESTOS FUNDING James Hardie and its employees contribute to and support During July 2019, James Hardie will contribute approximately community improvement activities in the areas in which we operate US$100.9 million to Asbestos Injuries Compensation Fund (AICF). through participation in and monetary donations to charitable This amount represents 35% of James Hardie’s free cash flow groups and activities, including: for fiscal year 2019, which James Hardie is obliged to contribute §§ School supply drives at various locations across the company; as part of its commitment under the Amended and Restated Final §§ Food donations and food drives for homeless shelters; Funding Agreement (AFFA). §§ United Way Labor of Love initiative – Repairs and winterisation Including its July 2019 contribution, James Hardie will have provided of over two dozen homes near our Peru (Illinois) plant; over A$1.3 billion towards asbestos compensation. §§ Toys for Tots; Annual Actuarial Assessment §§ Habitat for Humanity; KPMG Actuarial conducts an annual actuarial assessment of AICF’s §§ Relay for Life; liabilities as a regular update of projections in line with actual claims §§ Wreaths Across America; experience and the claims outlook. §§ Over US$1 million in employee and company matching James Hardie received an updated actuarial report from KPMG donations to charitable organisations; and Actuarial at 31 March 2019, which showed the undiscounted and §§ Donated over US$100,000 of building products to the uninflated central estimate net of insurance recoveries decreased from Christopher House, a family of schools that helps low-income, A$1.443 billion at 31 March 2018 to A$1.400 billion at 31 March 2019. at-risk families succeed in school, the workplace, and in life. James Hardie discloses summary information on claims numbers as part of its quarterly results releases. For additional information, please see the full 2019 actuarial report of KPMG Actuarial, which is available on our Investor Relations website (www.ir.jameshardie.com.au). 16

WORKPLACE SAFETY We are fully committed to providing a safe and healthy working environment for every individual that works at or visits any James Hardie site. In fiscal year 2019, our global Incident Rate and Days Away, Restricted or Transferred (DART) rates were 0.84 and 0.39, respectively. These rates are significantly better than the average in our specific industry, cement and concrete product manufacturing, which had rates at 5.0 and 3.2, respectively. We strongly believe that any injury at any one §§ Installation, evaluation, and improvement of our sites is one too many. During fiscal year 2019 of our dust capture and control mechanisms we continued to intensify our progress on our Zero to eliminate harmful employee exposures Harm Culture initiative, with an enhanced focus and to ensure compliance with the OSHA on our commitment to provide a workplace that Silica Standard; does not result in physical harm to any individual §§ Inclusion of intensive EHS analysis at any of our sites. We ensure our employees are in all plant process modifications and included at the core of this commitment through expansion projects; their active participation in our Safety Culture §§ Global standardisation and optimisation Steering Committee. The Steering Committee of safety procedures and processes to ensure consists of a broad cross-section of employees from minimum standards are implemented across each plant as well as representatives from various our world‑wide operations; corporate manufacturing and support functions. §§ Implementation of our Zero Harm The Safety Culture Steering Committee developed Management System that provides and is now implementing their multi-year plan reporting, root cause analysis, corrective to attain our Zero Harm Culture goal, with specific action tracking, and other data analytics emphasis placed on a number of safety activities to support and focus resources on such as: opportunities for improvement; and §§ SafeStart ® and Milliken Safety Way ® §§ Provide tools and training to the installation training for manufacturing employees and specialists James Hardie partners with management team members; to ensure our product is installed safely and correctly. §§ Sustainable housekeeping in manufacturing plants as part of our 5S initiative. Our 5S housekeeping standards are Sort, Set in order, Shine, Standardise, Sustain; Annual Review 2019 17

2019 KEY DATES AND CALENDAR FORWARD-LOOKING STATEMENTS Certain statements in this Annual Review may constitute End of James Hardie Industries plc Fiscal “forward‑looking statements” as defined in the Private Securities 31 MARCH Year 2019 Litigation Reform Act of 1995. James Hardie uses such words FY19 Quarter 4 and Full Year results and as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,”, 21 MAY management presentation “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook,” and similar 22 MAY Annual Review released expressions are intended to identify forward-looking statements but Voting Instruction Forms close 10.00am (Irish are not the exclusive means of identifying such statements. Readers 7 AUGUST Standard Time) / 7.00pm (Australian Eastern are cautioned not to place undue reliance on these forward-looking Standard Time) for Annual General Meeting statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. 9 AUGUST Annual General Meeting, Dublin, Ireland Forward-looking statements are based on James Hardie’s FY20 Quarter 1 results and management 9 AUGUST current expectations, estimates and assumptions and because presentation forward‑looking statements address future results, events and 12–13 SEPTEMBER Europe Investor Tour – Dusseldorf conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the 16 SEPTEMBER North America Investor Tour – New York City company’s control. Many factors could cause the actual results, FY20 Quarter 2 and Half Year results and performance or achievements of James Hardie to be materially 7 NOVEMBER management presentation different from those expressed or implied in this Annual Review, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on CORPORATE HEADQUARTERS Form 20-F for the year ended 31 March 2019; changes in general Europa House, Second Floor economic, political, governmental and business conditions globally Harcourt Centre and in the countries in which James Hardie does business; Harcourt Street, Dublin 2, D02 WR20, Ireland changes in interest rates, changes in inflation rates; changes Telephone +353 1 411 6924 in exchange rates; the level of construction generally; changes in Facsimile +353 1 479 1128 cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. ANNUAL GENERAL MEETING (AGM) Should one or more of these risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may The 2019 AGM of James Hardie Industries plc will be held in Dublin, vary materially from those described herein. These forward-looking Ireland, at 7.00am (Irish Standard Time), on Friday, 9 August 2019. statements are made as of the date of this Annual Review and The AGM will be broadcast via a teleconference at 4.00pm James Hardie does not assume any obligation to update them, (Australian Eastern Standard Time). Further details will be set except as required by law. Investors are encouraged to review out in the Notice of Annual General Meeting 2019. James Hardie’s Annual Report on Form 20-F, and specifically the risk factors discussed therein, as it contains important disclosures SHARE/CUFS REGISTRY regarding the risks attendant to investing in our securities. James Hardie Industries plc’s registry is managed by Computershare. All enquiries and correspondence regarding NON-GAAP FINANCIAL INFORMATION holdings should be directed to: This Annual Review contains financial measures that are not Computershare Investor Services Pty Ltd considered a measure of financial performance under US GAAP Level 5, 115 Grenfell Street and should not be considered to be more meaningful than the Adelaide SA 5000 equivalent US GAAP measure. Management has included such Or measures to provide investors with an alternative method for GPO Box 2975 assessing its operating results in a manner that is focused on the Melbourne VIC 3001 performance of its ongoing operations. Additionally, management Telephone within Australia: 1300 850 505 uses such non‑GAAP financial measures for the same Telephone outside Australia: +61 (0) 3 9415 4000 purposes. However, these non-GAAP financial measures are not prepared in accordance with US GAAP, may not be reported Website: www.computershare.com by all of James Hardie’s competitors and may not be directly James Hardie Industries plc comparable to similarly titled measures of James Hardie’s (ARBN 097 829 895) competitors due to potential differences in the exact method Incorporated in Ireland with its registered office at Europa House, Second of calculation. For additional information regarding the non-GAAP Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland and financial measures presented in this Annual Review, including registered number 485719. The liability of its members is limited. a reconciliation of each non-GAAP financial measure to the equivalent US GAAP measure, see the sections titled “Definition ™ or ® denotes a trademark or Registered mark owned by James and Other Terms” and “Non-US GAAP Financial Measures” Hardie Technology Ltd. included in James Hardie’s Management’s Analysis of Results ©2019. James Hardie Industries plc. for the fourth quarter and twelve months ended 31 March 2019. FINANCIAL FOOTNOTES 1 Unless otherwise stated for fiscal years 2019, 2018, 2017, 2016, 2015 and 2014 adjusted net operating profit graphs and editorial comments throughout this report refer to EBIT that may exclude asbestos, asset impairments, New Zealand weathertightness claims, acquisition costs incurred prior to the close of Fermacell and product line discontinuation expenses. 2 Unless otherwise stated for fiscal years 2019, 2018, 2017, 2016, 2015 and 2014 adjusted EBIT graphs and editorial comments throughout this report refer to EBIT that may exclude asbestos, asset impairments, New Zealand weathertightness claims, acquisition costs incurred prior to the close of Fermacell and product line discontinuation expenses.