Exhibit 99.4 ASIA PACIFIC Conrad Groenewald, General Manager1

AGENDA • Driving Growth Above Market − APAC Strategy − Australia Execution − Philippines Execution • Driving Lean Manufacturing −APAC − New Zealand Manufacturing Recovery 2

AGENDA • Driving Growth Above Market − APAC Strategy − Australia Execution − Philippines Execution • Driving Lean Manufacturing −APAC − New Zealand Manufacturing Recovery 3

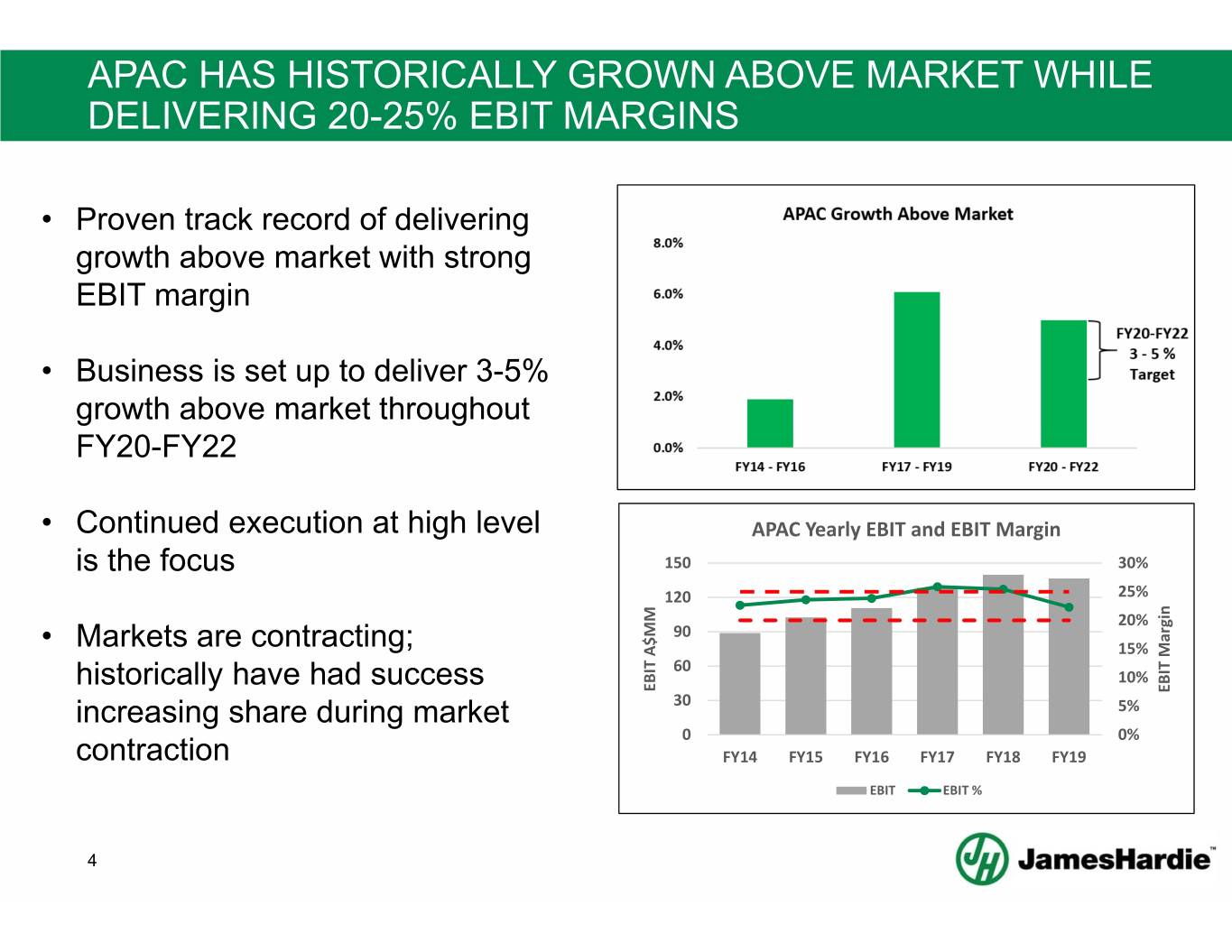

APAC HAS HISTORICALLY GROWN ABOVE MARKET WHILE DELIVERING 20-25% EBIT MARGINS • Proven track record of delivering growth above market with strong EBIT margin • Business is set up to deliver 3-5% growth above market throughout FY20-FY22 • Continued execution at high level APAC Yearly EBIT and EBIT Margin is the focus 150 30% 120 25% 20% 90 • Markets are contracting; 15% 60 historically have had success 10% EBIT A$MM EBIT Margin increasing share during market 30 5% 0 0% contraction FY14 FY15 FY16 FY17 FY18 FY19 EBIT EBIT % 4

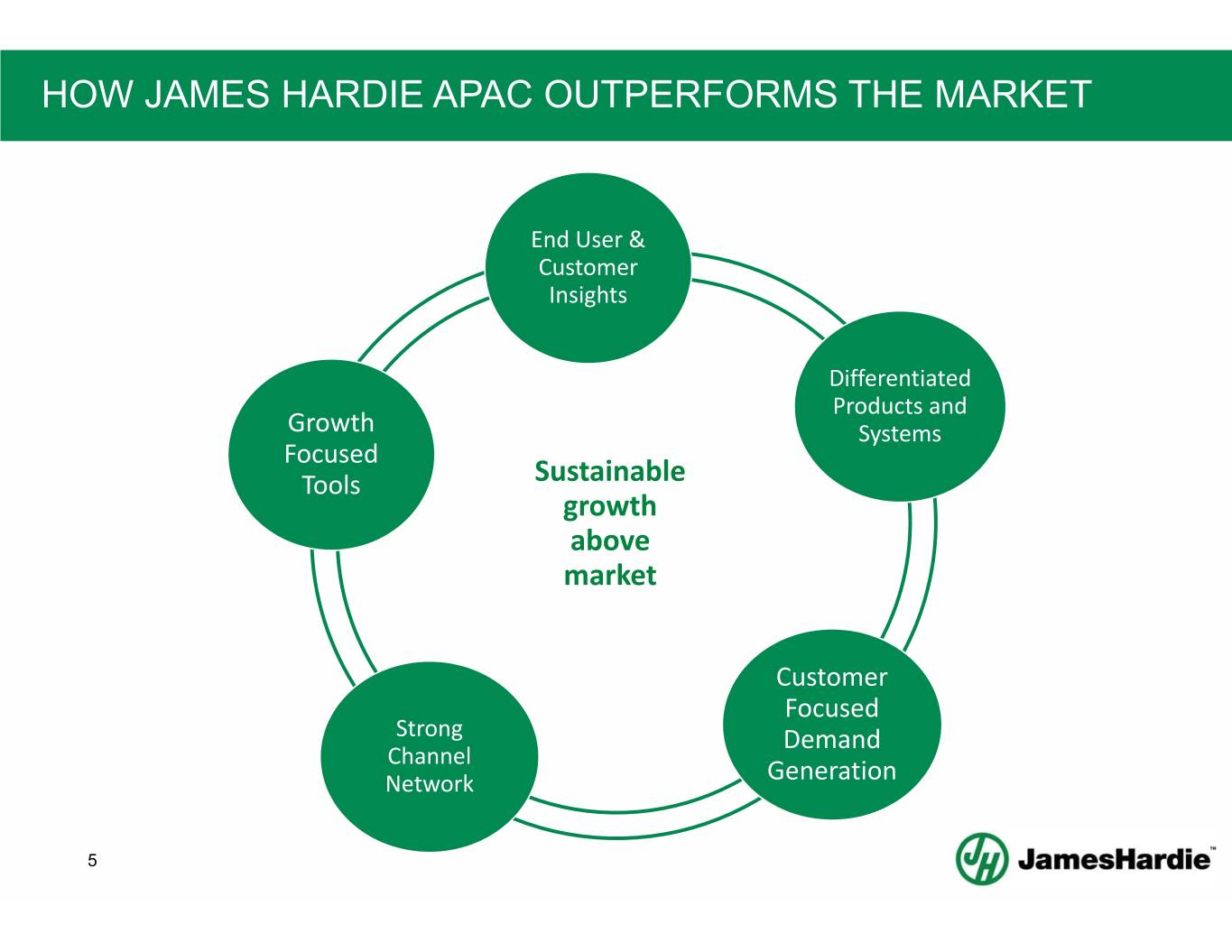

HOW JAMES HARDIE APAC OUTPERFORMS THE MARKET End User & Customer Insights Differentiated Products and Growth Systems Focused Tools Sustainable growth above market Customer Focused Strong Demand Channel Network Generation 5

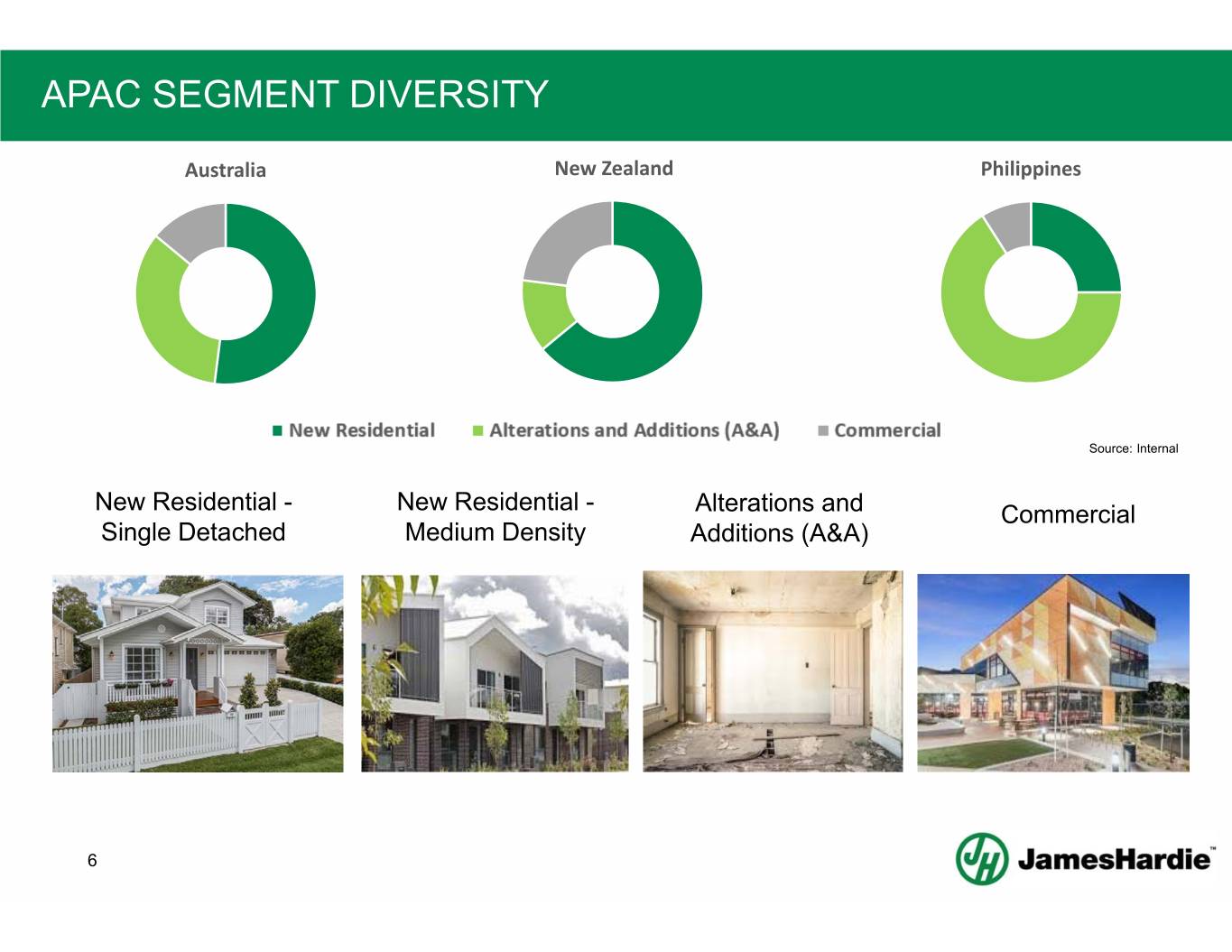

APAC SEGMENT DIVERSITY Australia New Zealand Philippines Source: Internal New Residential - New Residential - Alterations and Commercial Single Detached Medium Density Additions (A&A) 6

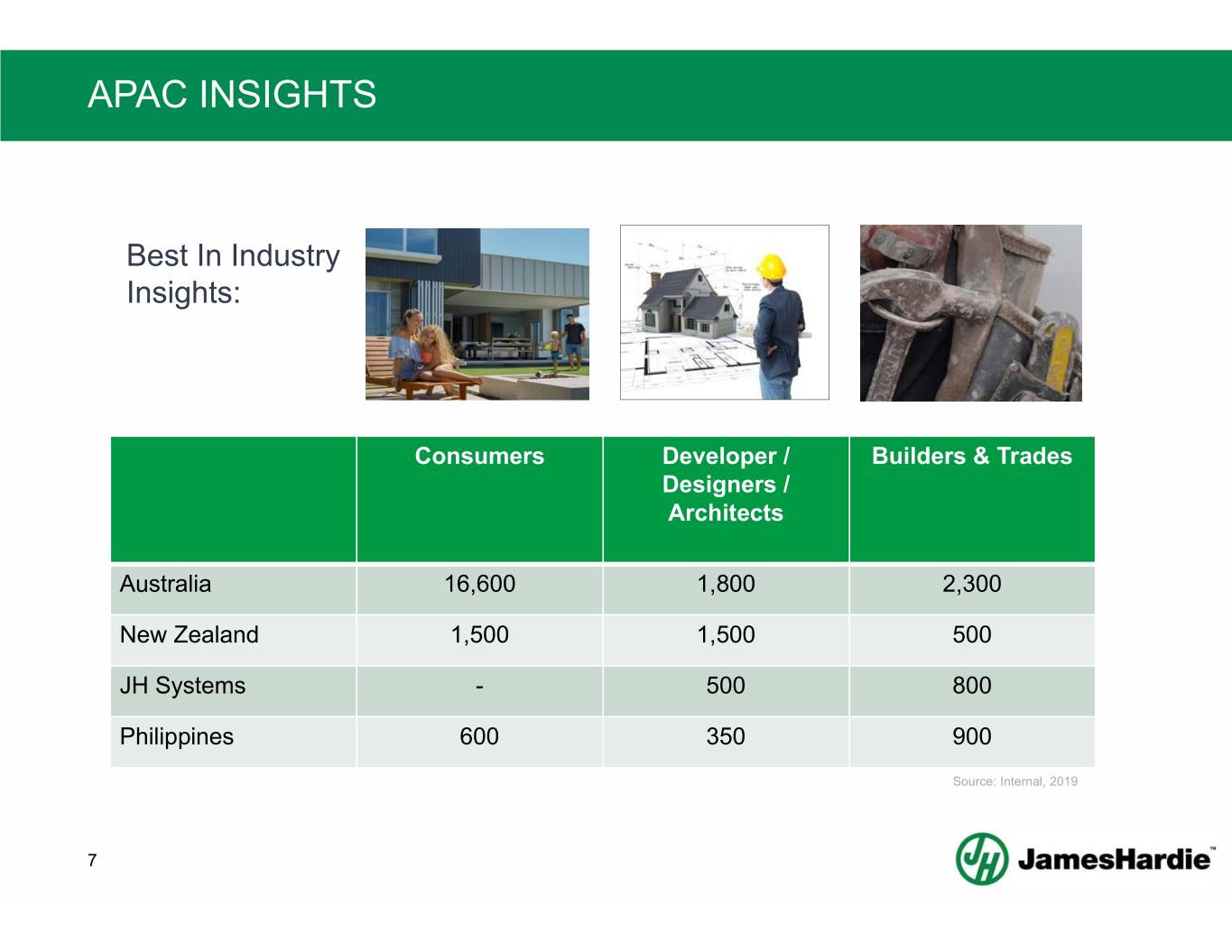

APAC INSIGHTS Best In Industry Insights: Consumers Developer / Builders & Trades Designers / Architects Australia 16,600 1,800 2,300 New Zealand 1,500 1,500 500 JH Systems - 500 800 Philippines 600 350 900 Source: Internal, 2019 7

APAC INSIGHTS INTO ACTION INSIGHTS & DATA • Life-stage consumer segmentation • Builder segmentation to • Home building path to purchase understand key business drivers • Leading design trends - Hamptons • Insights on the Millennial buyer • Insights on the Millennial buyer • Speed of install data From BRICK to HARDIE HOME We love the Hamptons “Look” I need a differentiated offer • Insight-led tailored customer • Hamptons-led inspiration in acquisition sales programs marketing media investment • Design guidance & construction • PR/Social Media engagement support • Social Influencer strategy • Co-marketing investment DRIVE ACTIONABLE CUSTOMER CENTRIC STRATEGY 8

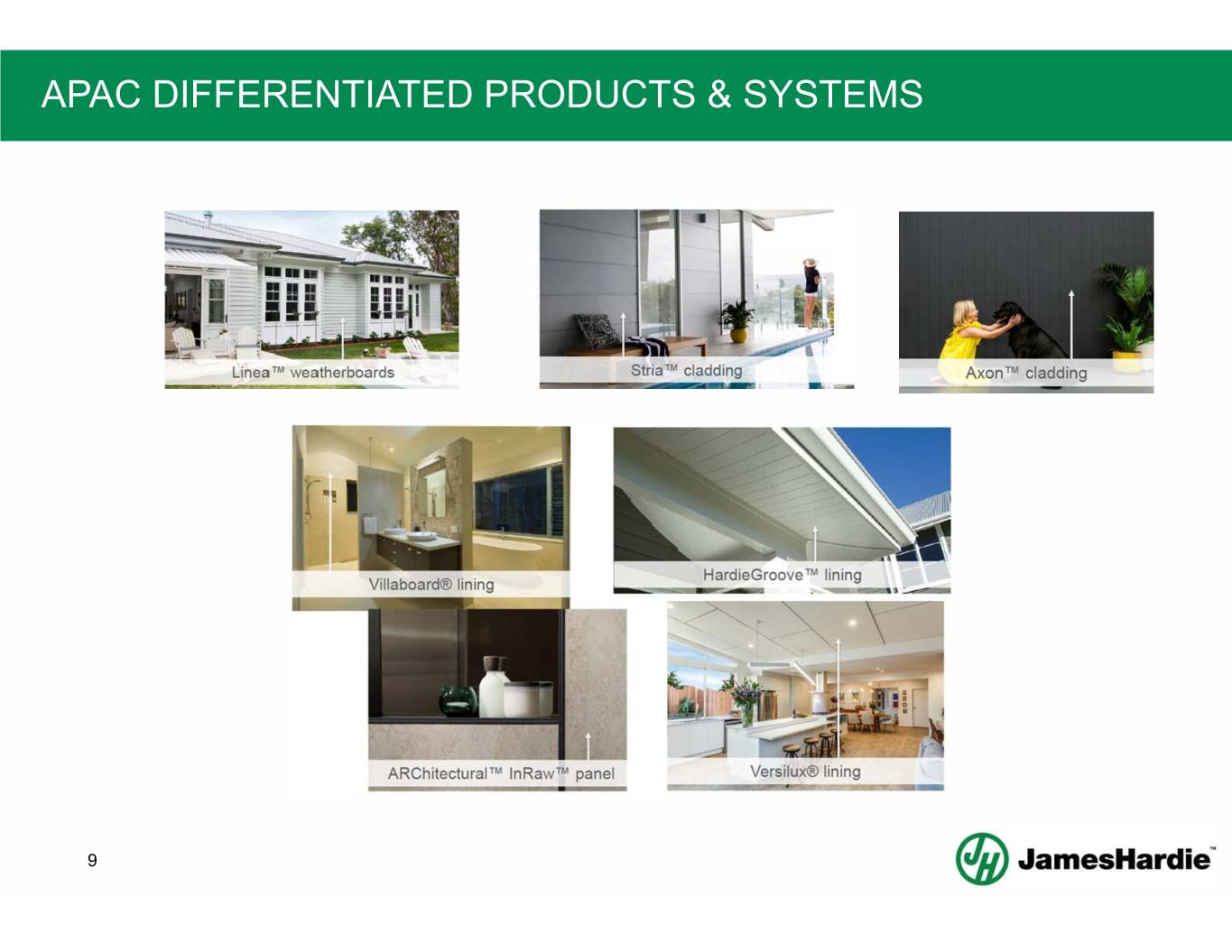

APAC DIFFERENTIATED PRODUCTS & SYSTEMS 9

APAC DIFFERENTIATED PRODUCTS & SYSTEMS 10

APAC STRONG CHANNEL NETWORK Australia New Zealand Philippines Kelly Hardware & EVY 11

AGENDA • Driving Growth Above Market − APAC Strategy Detached NC - Win vs. Brick − Australia Execution A&A – Win via channel & digital − Philippines Execution • Driving Lean Manufacturing −APAC − Australia Execution − New Zealand Manufacturing Recovery 12

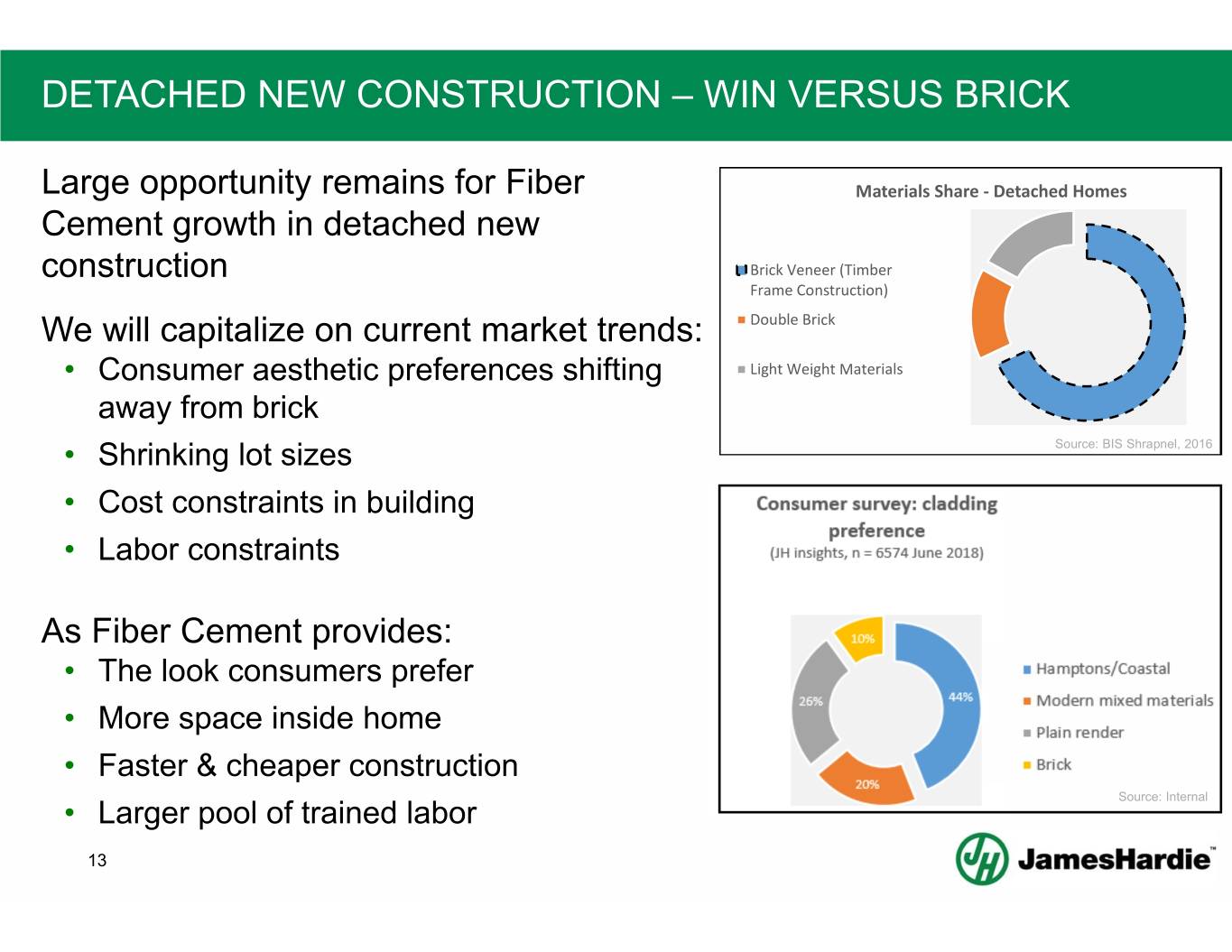

DETACHED NEW CONSTRUCTION – WIN VERSUS BRICK Large opportunity remains for Fiber Materials Share ‐ Detached Homes Cement growth in detached new construction Brick Veneer (Timber Frame Construction) We will capitalize on current market trends: Double Brick • Consumer aesthetic preferences shifting Light Weight Materials away from brick • Shrinking lot sizes Source: BIS Shrapnel, 2016 • Cost constraints in building • Labor constraints As Fiber Cement provides: • The look consumers prefer • More space inside home • Faster & cheaper construction Source: Internal • Larger pool of trained labor 13

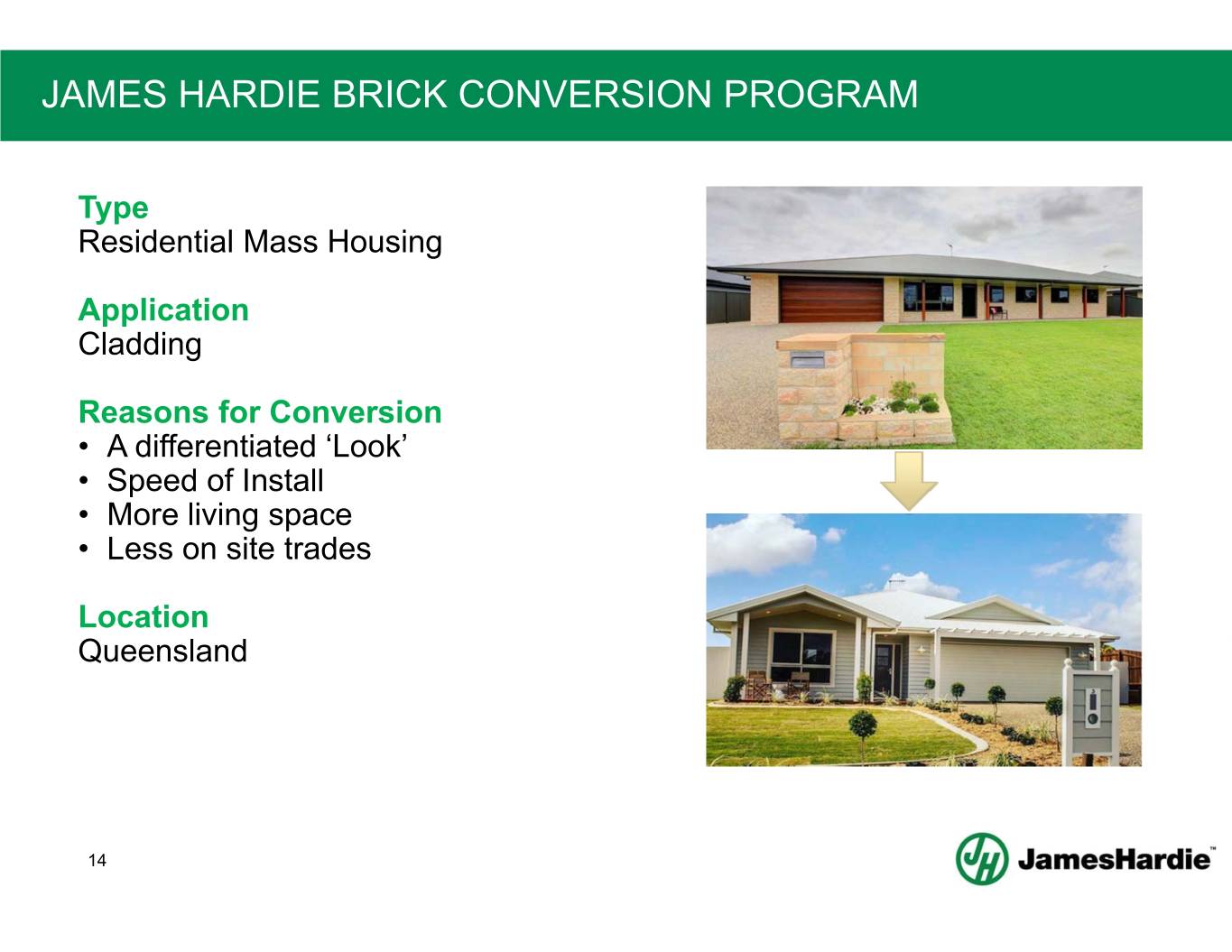

JAMES HARDIE BRICK CONVERSION PROGRAM Type Residential Mass Housing Application Cladding Reasons for Conversion • A differentiated ‘Look’ • Speed of Install • More living space • Less on site trades Location Queensland 14

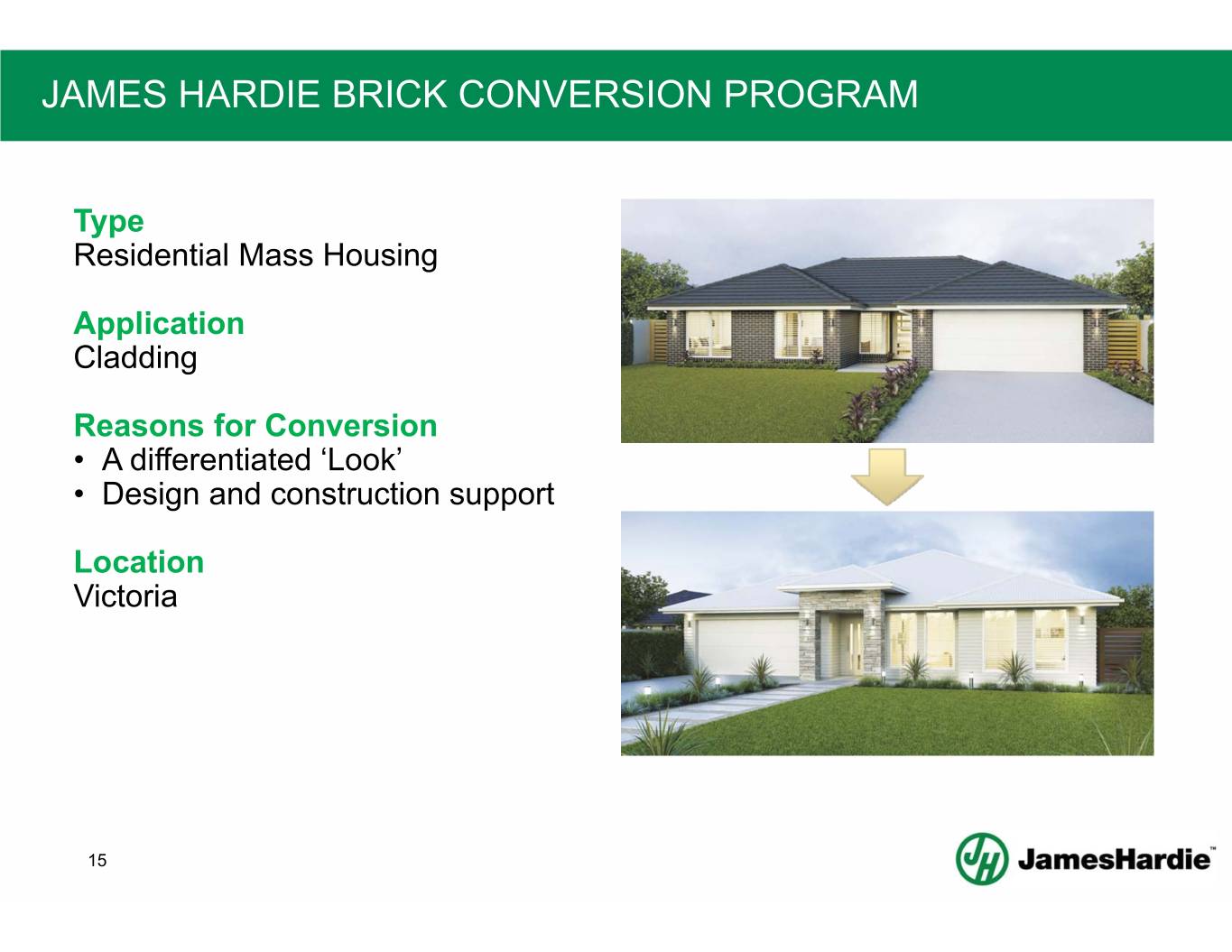

JAMES HARDIE BRICK CONVERSION PROGRAM Type Residential Mass Housing Application Cladding Reasons for Conversion • A differentiated ‘Look’ • Design and construction support Location Victoria 15

JAMES HARDIE BRICK CONVERSION PROGRAM Type Residential Mass Housing Application Cladding Reasons for Conversion • Leading design trends - Hamptons • Insights on the Millennial buyer • Speed of install Location New South Wales 16

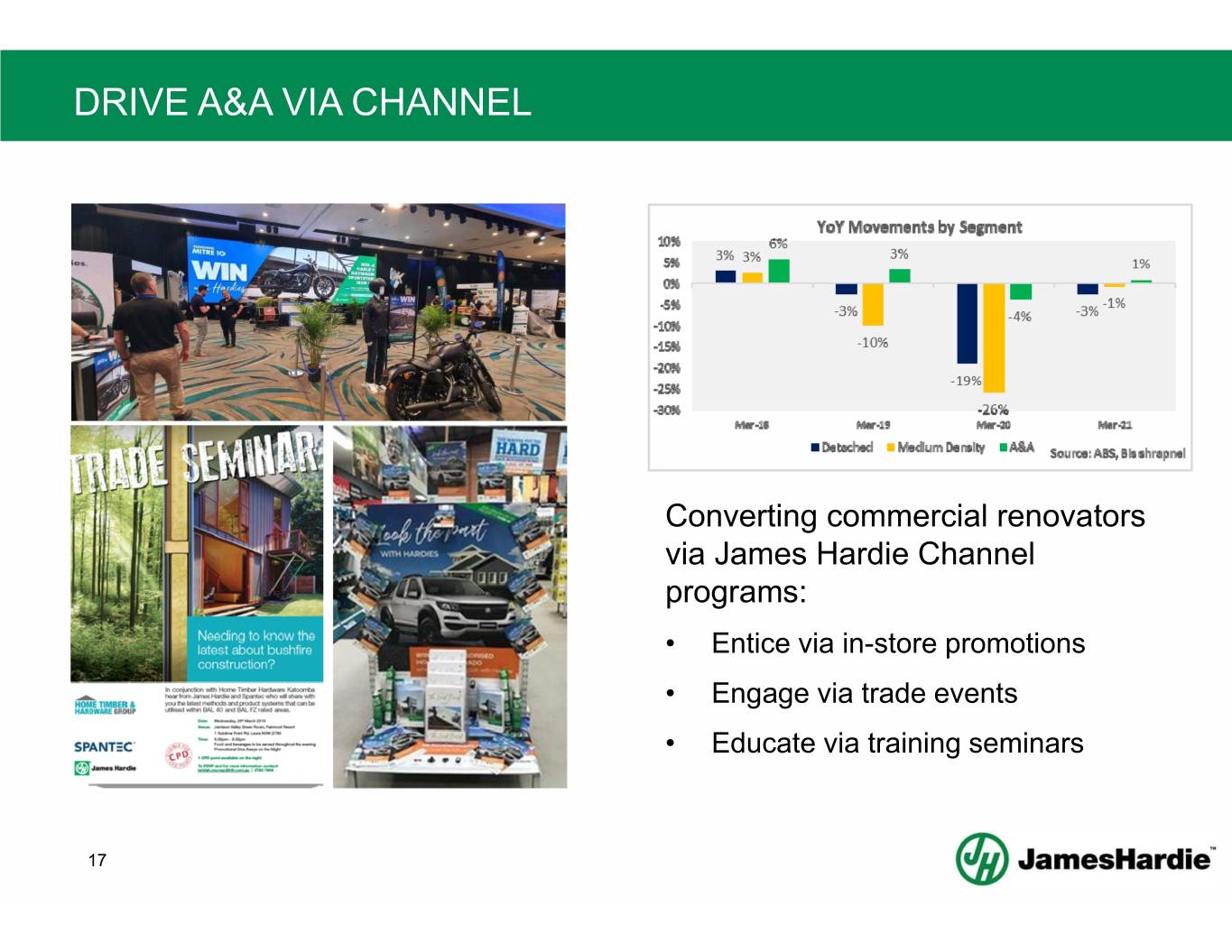

DRIVE A&A VIA CHANNEL Converting commercial renovators via James Hardie Channel programs: • Entice via in-store promotions • Engage via trade events • Educate via training seminars 17

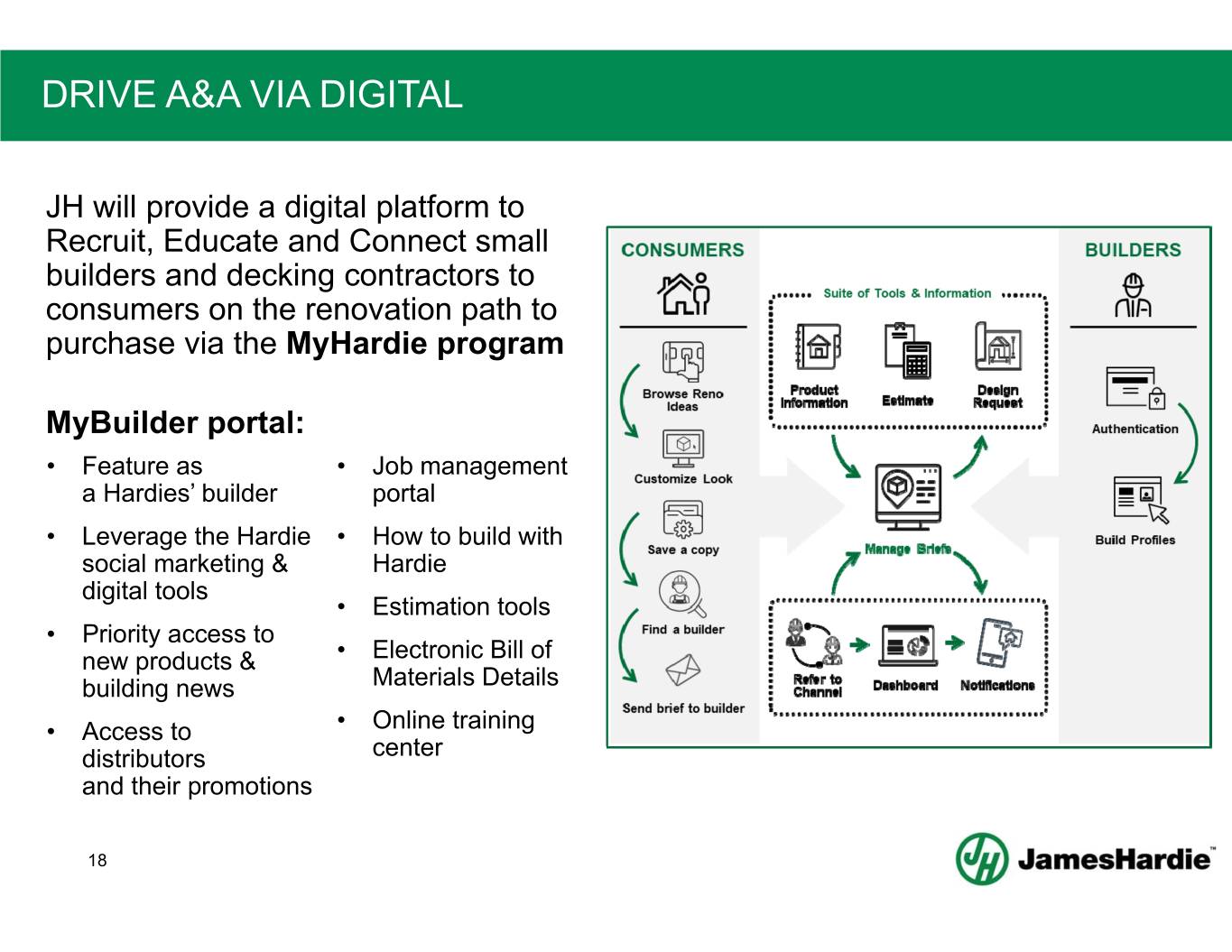

DRIVE A&A VIA DIGITAL JH will provide a digital platform to Recruit, Educate and Connect small builders and decking contractors to consumers on the renovation path to purchase via the MyHardie program MyBuilder portal: • Feature as • Job management a Hardies’ builder portal • Leverage the Hardie • How to build with social marketing & Hardie digital tools • Estimation tools • Priority access to new products & • Electronic Bill of building news Materials Details • Access to • Online training distributors center and their promotions 18

AGENDA • Driving Growth Above Market − APAC Strategy − Australia Execution Strong value proposition − Philippines Execution Increased retailer density • Driving Lean Manufacturing −APAC − Australia Execution − New Zealand Execution 19

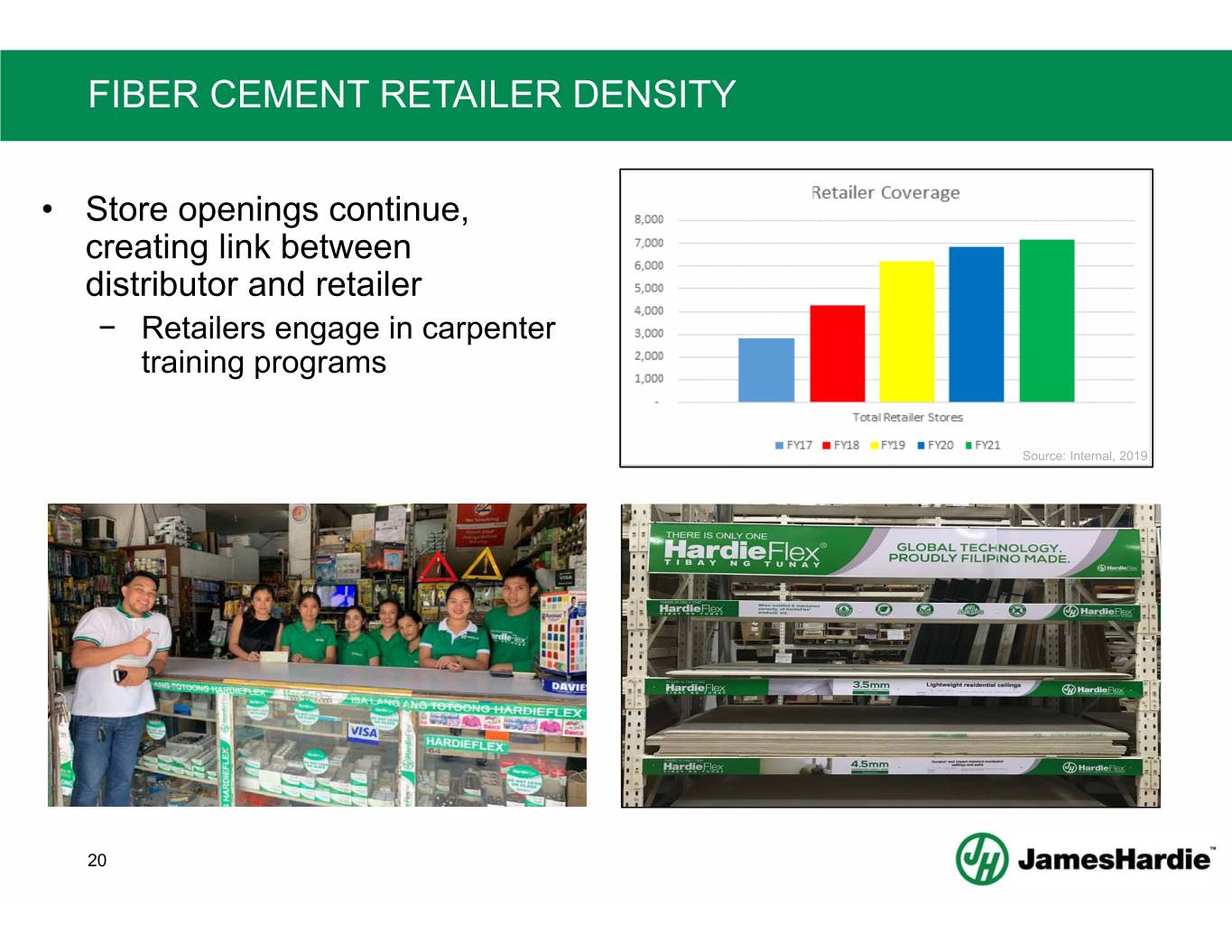

FIBER CEMENT RETAILER DENSITY • Store openings continue, creating link between distributor and retailer − Retailers engage in carpenter training programs Source: Internal, 2019 Images of retailers with product on shelves 20

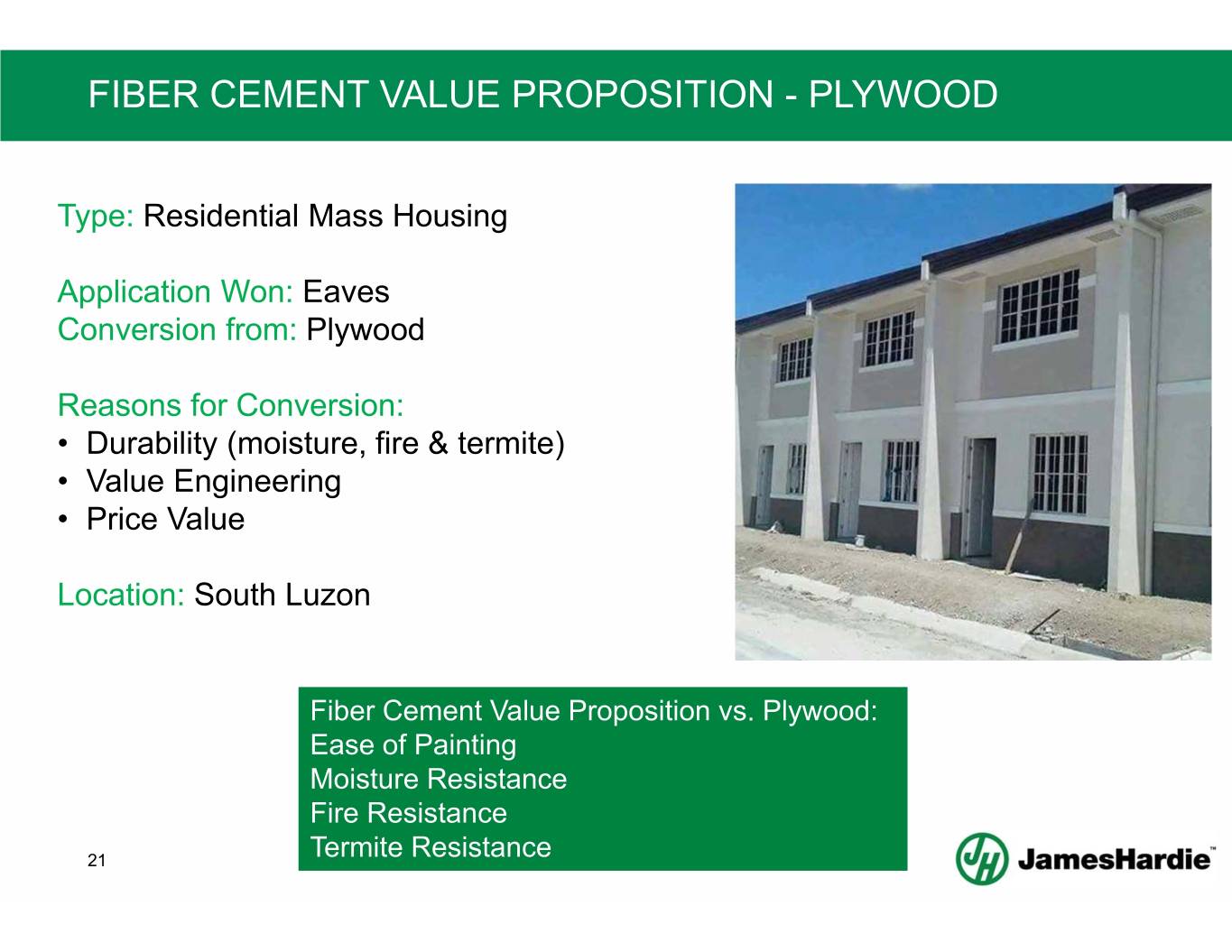

FIBER CEMENT VALUE PROPOSITION - PLYWOOD Type: Residential Mass Housing Application Won: Eaves Conversion from: Plywood Reasons for Conversion: • Durability (moisture, fire & termite) • Value Engineering • Price Value Location: South Luzon Fiber Cement Value Proposition vs. Plywood: Ease of Painting Moisture Resistance Fire Resistance 21 Termite Resistance

FIBER CEMENT VALUE PROPSITION - PLASTERBOARD Type: Commercial – Hotel & Casino Application Won: Wet Area Walls & Common Area Conversion from: Plasterboard 9mm Reasons for Conversion: • Durability (moisture for wet area & impact for common areas) • Cost Efficiency Developer initially wanted to use (2) combined 9mm plasterboards to achieve 18mm single wall thickness. The system would require using total of (4) 9mm plasterboards to accomplish a 2 hour fire-rated double wall Location: Metro Manila Fiber Cement Value Proposition vs. Plasterboard: Impact Resistance Moisture Resistance* *Not relative to Plasterboard MR 22

AGENDA • Driving Growth Above Market − APAC Strategy − Australia Execution − Philippines Execution • Driving Lean Manufacturing −APAC − New Zealand Manufacturing Recovery 23

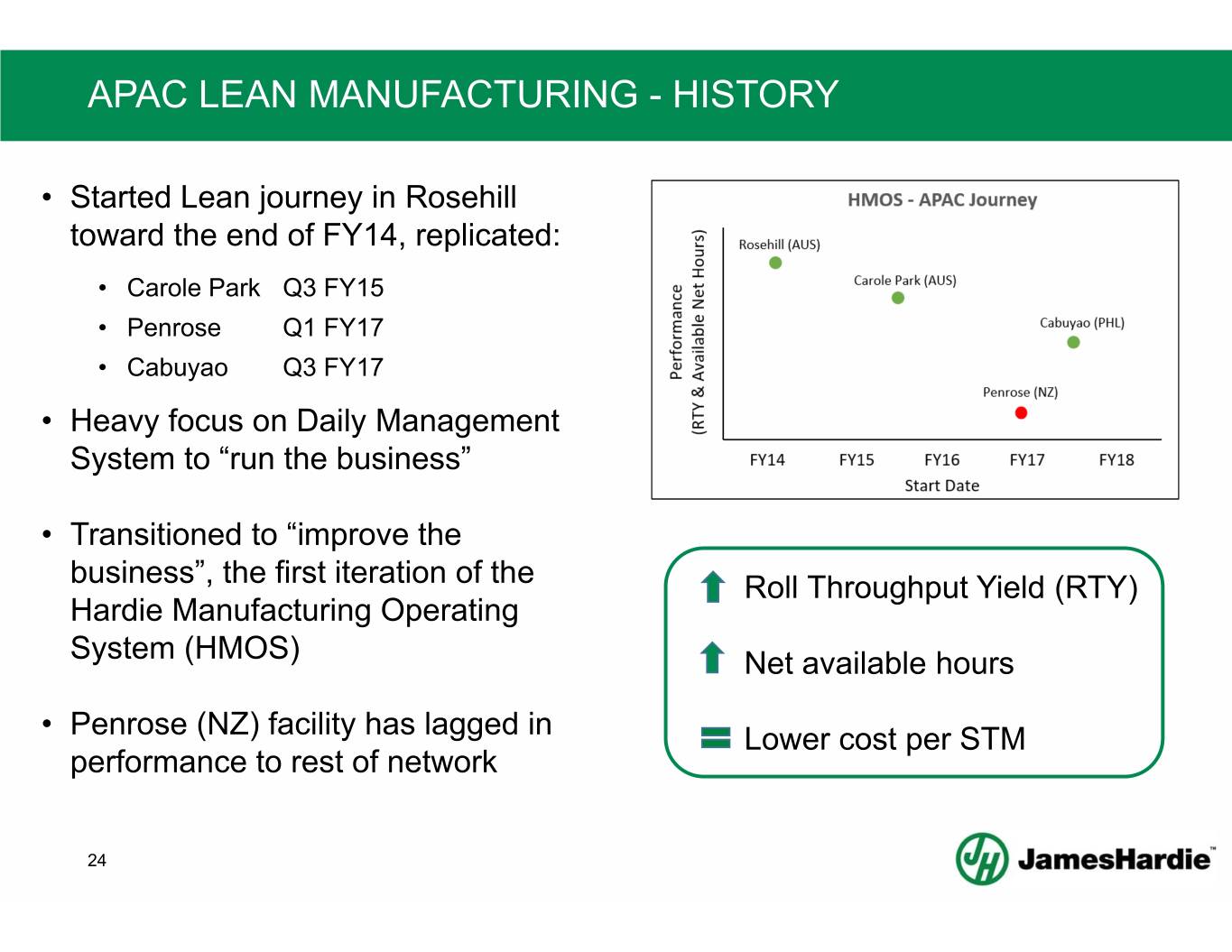

APAC LEAN MANUFACTURING - HISTORY • Started Lean journey in Rosehill toward the end of FY14, replicated: • Carole Park Q3 FY15 • Penrose Q1 FY17 • Cabuyao Q3 FY17 • Heavy focus on Daily Management System to “run the business” • Transitioned to “improve the business”, the first iteration of the Roll Throughput Yield (RTY) Hardie Manufacturing Operating System (HMOS) Net available hours • Penrose (NZ) facility has lagged in Lower cost per STM performance to rest of network 24

APAC LEAN MANUFACTURING – PATH FORWARD • A$27 million in targeted savings from lean initiatives FY20-FY22 • Intense focus on RTY in addition to net operating hours • Replicate key learnings from North America lean progress • Maximize Operator Engagement • FY20 is on-track 25

AGENDA • Driving Growth Above Market − APAC Strategy − Australia Execution − Philippines Execution • Driving Lean Manufacturing −APAC − New Zealand Manufacturing Recovery 26

NEW ZEALAND MANUFACTURING Leverage HMOS platforms to improve manufacturing: • Focus on Zero Harm • Leadership and Employee Engagement is the key to success •Drive: − Operator Standard Work − Leader Standard Work − Daily Management System as foundations to performance • Reduce variability, then drive improvement • New Plant Manager from Waxahachie, TX plant • Goal is to return to baseline performance in 2H FY20 27

KEY MESSAGES • Relentless focus on execution to drive Growth Above Market across network • Execute lean manufacturing initiatives to enable continued and sustainable cost improvements • Reaffirm growth above market of 3-5% and EBIT Margin of 20-25% 28