Q3 FY20 MANAGEMENT PRESENTATION 12 February 2020

James Hardie Q3 FY20 Results CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS This Management Presentation contains forward‐looking statements. James Hardie Industries plc (the “Company”) may from time to time make forward‐looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20‐F and 6‐K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward‐looking statements and such forward‐looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward‐looking statements include: • statements about the Company’s future performance; • projections of the Company’s results of operations or financial condition; • statements regarding the Company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products; • expectations concerning the costs associated with the suspension or closure of operations at any of the Company’s plants and future plans with respect to any such plants; • expectations concerning the costs associated with the significant capital expenditure projects at any of the Company’s plants and future plans with respect to any such projects; • expectations regarding the extension or renewal of the Company’s credit facilities including changes to terms, covenants or ratios; • expectations concerning dividend payments and share buy‐backs; • statements concerning the Company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges; • uncertainty from the expected discontinuance of LIBOR and transition to any other interest rate benchmark; • statements regarding tax liabilities and related audits, reviews and proceedings; • statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings; • expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos‐related personal injury and death claims; • expectations concerning the adequacy of the Company’s warranty provisions and estimates for future warranty‐related costs; • statements regarding the Company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third‐party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the Asia Pacific region, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. Page 2

James Hardie Q3 FY20 Results CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS (continued) Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,”“objective,”“outlook”andsimilar expressions are intended to identify forward‐looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward‐looking statements and all such forward‐looking statements are qualified in their entirety by reference to the following cautionary statements. Forward‐looking statements are based on the Company’s current expectations, estimates and assumptions and because forward‐looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied bytheseforward‐lookingstatements.Thesefactors,someofwhicharediscussed under “Risk Factors” in Section 3 of the Form 20‐F filed with the Securities and Exchange Commission on 21 May 2019 and subsequently amended on 8 August 2019, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; the continuation or termination of the governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the Company, or at all; acquisition or sale of businesses and business segments; changes in the Company’s key management personnel; inherent limitations on internal controls; use of accounting estimates; the integration of Fermacell into our business; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward‐looking statements. Forward‐looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward‐looking statements or information except as required by law. Page 3

James Hardie Q3 FY20 Results USE OF NON‐GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (US GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on‐going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures include: • Adjusted EBIT; • North America Fiber Cement Segment Adjusted EBIT excluding product line discontinuation; • Europe Building Products Segment Adjusted EBIT excluding costs associated with the acquisition; • Adjusted EBIT margin; • North America Fiber Cement Segment Adjusted EBIT margin excluding product line discontinuation; • Europe Building Products Segment Adjusted EBIT margin excluding costs associated with the acquisition; • Adjusted net operating profit; • Adjusted diluted earnings per share; • Adjusted operating profit before income taxes; • Adjusted income tax expense; • Adjusted effective tax rate; • Adjusted EBITDA; • Adjusted EBITDA excluding Asbestos; and • Adjusted selling, general and administrative expenses (“Adjusted SG&A”). These financial measures are or may be non‐US GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with US GAAP. These non‐GAAP financial measures should not be considered to be more meaningful than the equivalent US GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non‐GAAP financial measures for the same purposes. However, these non‐GAAP financial measures are not prepared in accordance with US GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non‐GAAP financial measures presented in this Management Presentation, including a reconciliation of each non‐GAAP financial measure to the equivalent US GAAP measure, see the slide titled “Non‐US GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with US GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Condensed Consolidated Financial Statements in accordance with US GAAP, the Company provides investors with a table and definitions presenting cross‐references between each US GAAP financial measure used in the Company’s Condensed Consolidated Financial Statements to the equivalent non‐US GAAP financial measure used in this Management Presentation. See the section titled “Non‐US GAAP Financial Measures” included in the Appendix to this Management Presentation. Page 4

James Hardie Q3 FY20 Results AGENDA • Group Operating Review Dr. Jack Truong, CEO • Financial Review Jason Miele, VP of Investor Relations • Strategy Update Dr. Jack Truong, CEO • Questions and Answers Page 5

GROUP OPERATING REVIEW – DR. JACK TRUONG, CEO

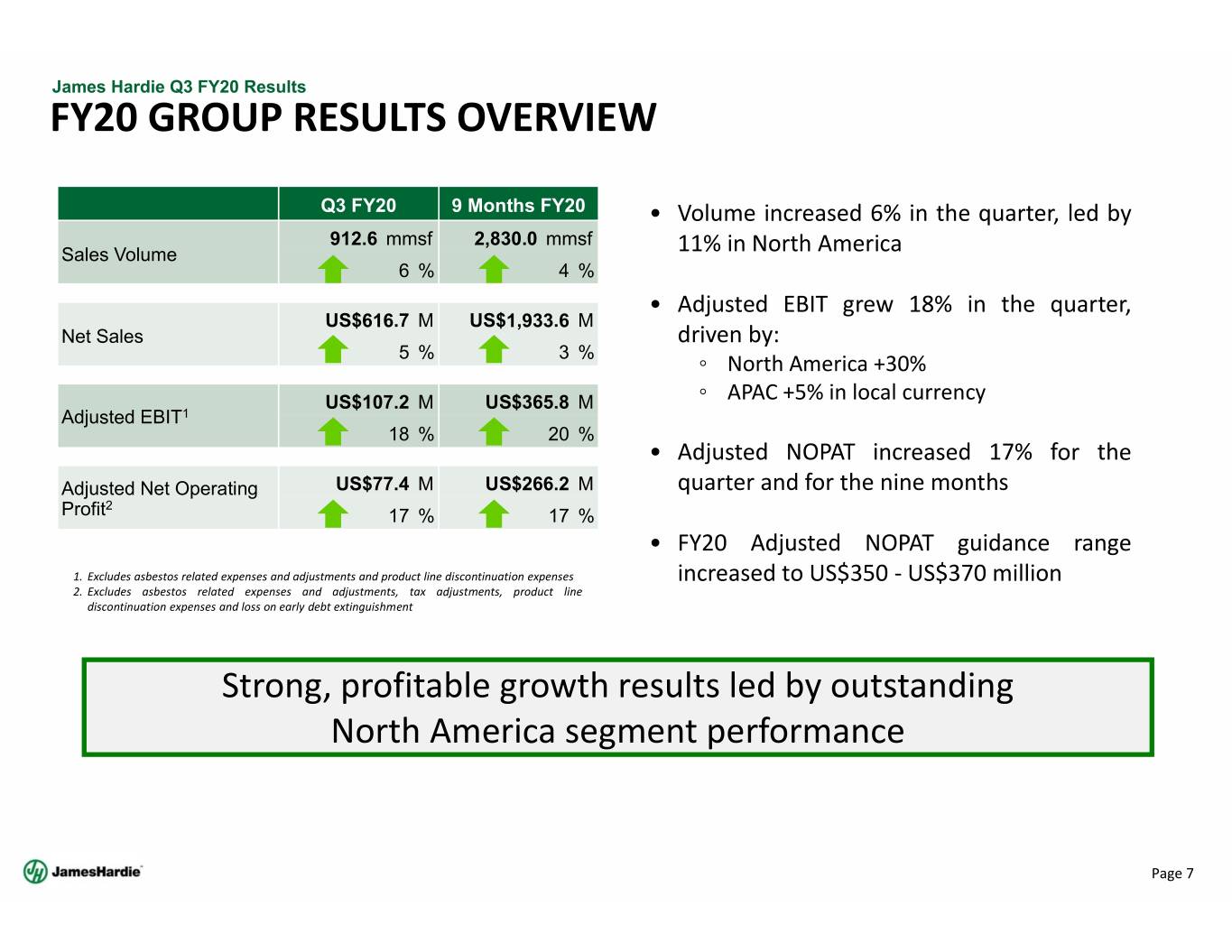

James Hardie Q3 FY20 Results FY20 GROUP RESULTS OVERVIEW Q3 FY20 9 Months FY20 • Volume increased 6% in the quarter, led by 912.6 mmsf 2,830.0 mmsf Sales Volume 11% in North America 6% 4% aa • Adjusted EBIT grew 18% in the quarter, US$616.7 M US$1,933.6 M Net Sales driven by: 5% 3% ◦ North America +30% aa US$107.2 M US$365.8 M ◦ APAC +5% in local currency Adjusted EBIT1 18 % 20 % aa • Adjusted NOPAT increased 17% for the Adjusted Net Operating US$77.4 M US$266.2 M quarterandfortheninemonths 2 Profit 17 % 17 % • FY20 Adjusted NOPAT guidance range 1. Excludes asbestos related expenses and adjustments and product line discontinuation expenses increased to US$350 ‐ US$370 million 2. Excludes asbestos related expenses and adjustments, tax adjustments, product line discontinuation expenses and loss on early debt extinguishment Strong, profitable growth results led by outstanding North America segment performance Page 7

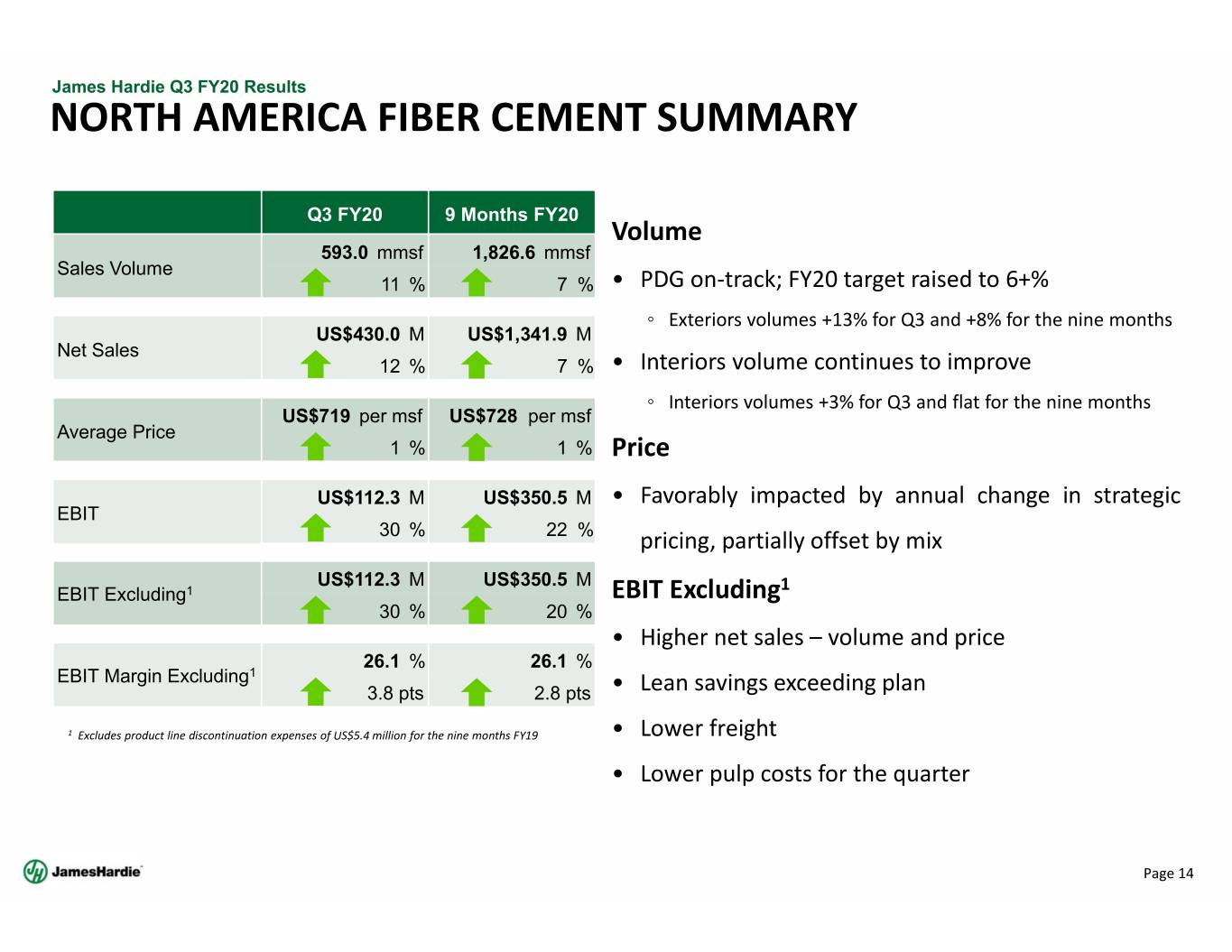

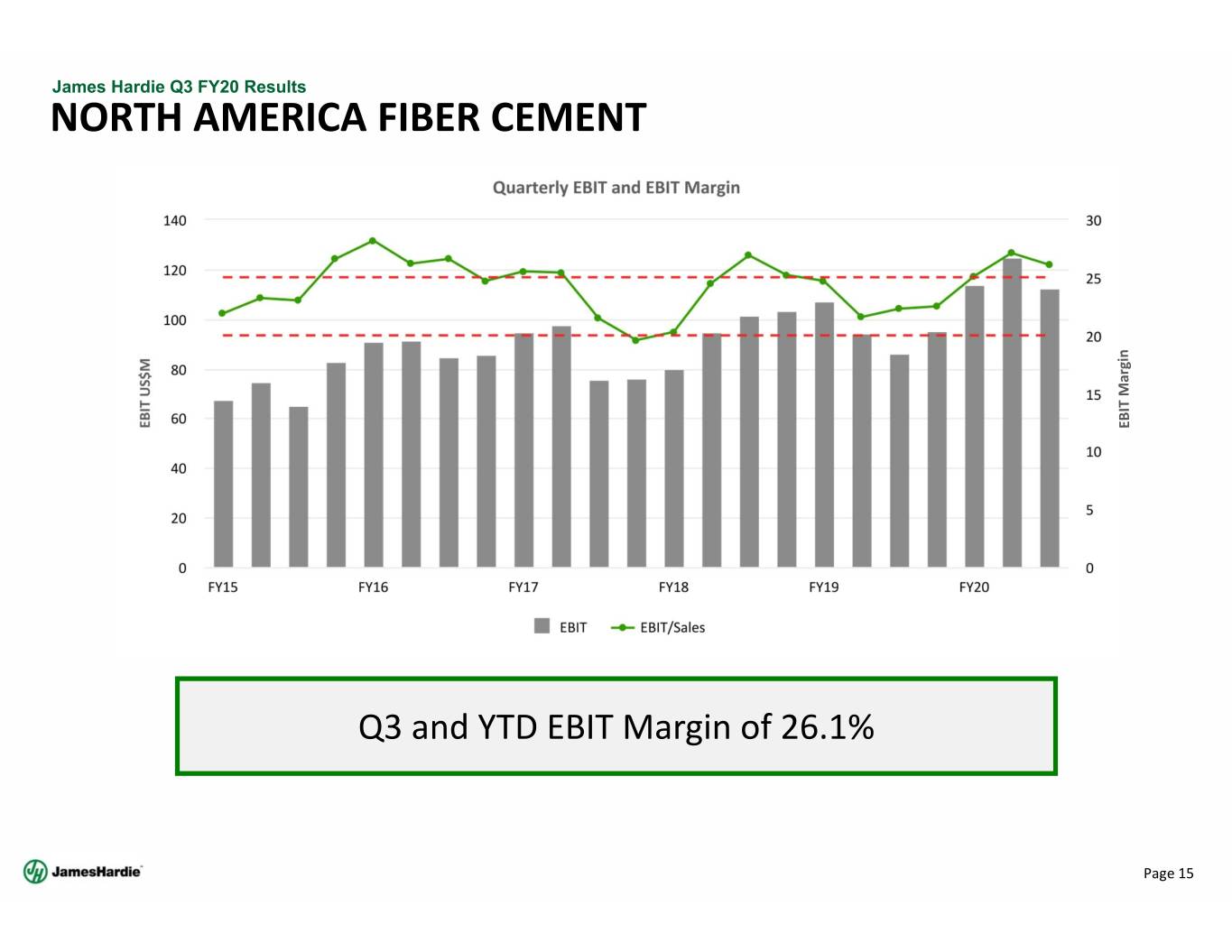

James Hardie Q3 FY20 Results FY20 NORTH AMERICA SUMMARY Q3 FY20 9 Months FY20 • Exteriors volume continued growth 593.0 mmsf 1,826.6 mmsf Sales Volume ◦ +13% for the quarter 11 % 7 % ◦ +8% for the nine months aa US$430.0 M US$1,341.9 M Net Sales • Interiors volume returned to growth 12 % 7 % ◦ aa +3% for the quarter US$112.3 M US$350.5 M ◦ Flat for the nine months EBIT Excluding1 30 % 20 % aa • EBIT Margin of 26.1% exceeded top end of long‐ 26.1 % 26.1 % EBIT Margin Excluding1 term target range 3.8 pts 2.8 pts 1 Excludes product line discontinuation expenses of US$5.4 million in the nine months FY19 Commercial transformation is gaining momentum Lean transformation continues to gain traction Page 8

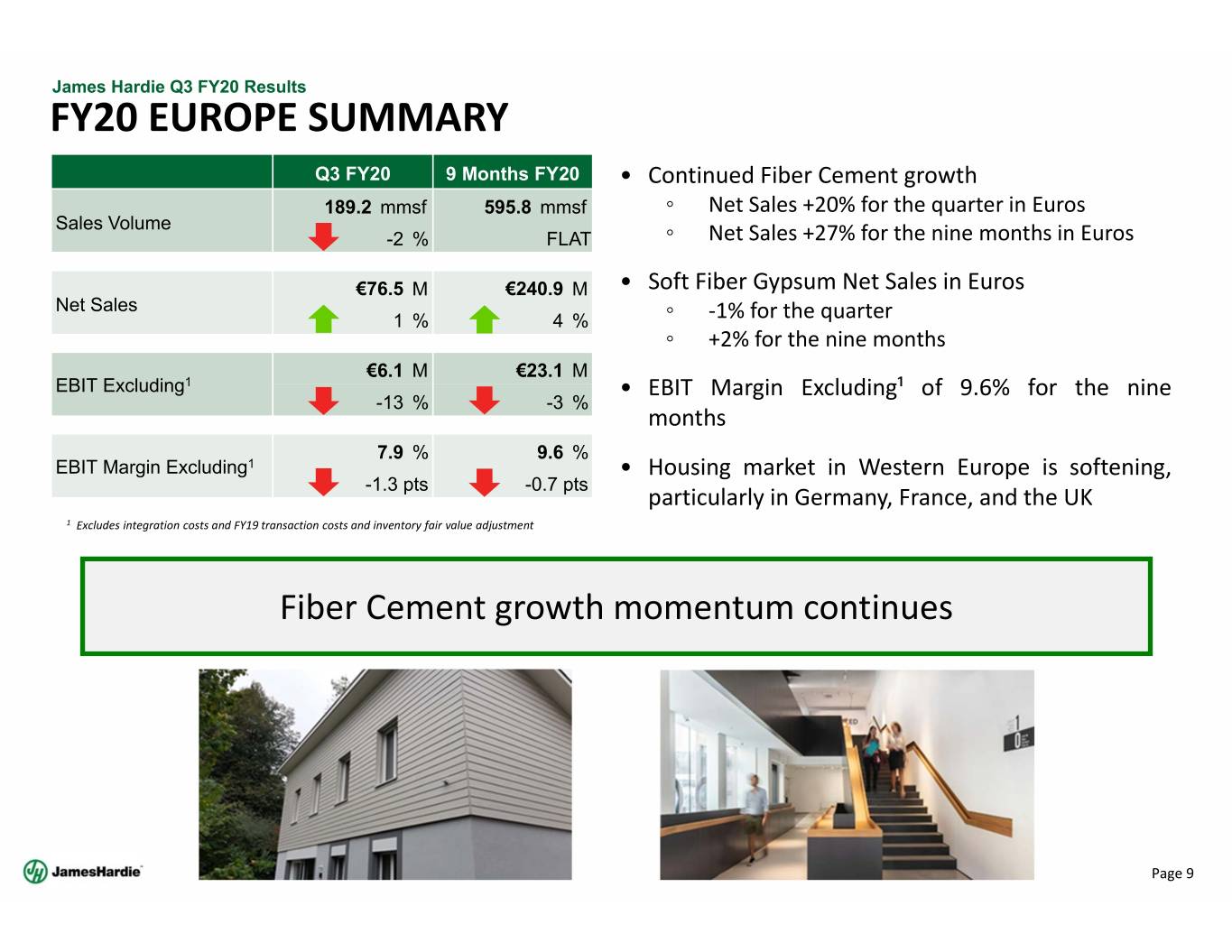

James Hardie Q3 FY20 Results FY20 EUROPE SUMMARY Q3 FY20 9 Months FY20 • Continued Fiber Cement growth 189.2 mmsf 595.8 mmsf ◦ Net Sales +20% for the quarter in Euros Sales Volume -2 % FLAT ◦ Net Sales +27% for the nine months in Euros €76.5 M €240.9 M • SoftFiberGypsumNetSalesinEuros Net Sales 1% 4% ◦ ‐1% for the quarter ◦ +2% for the nine months €6.1 M €23.1 M EBIT Excluding1 • EBIT Margin Excluding¹ of 9.6% for the nine -13 % -3 % months 7.9 % 9.6 % EBIT Margin Excluding1 • Housing market in Western Europe is softening, -1.3 pts -0.7 pts particularly in Germany, France, and the UK 1 Excludes integration costs and FY19 transaction costs and inventory fair value adjustment Fiber Cement growth momentum continues Page 9

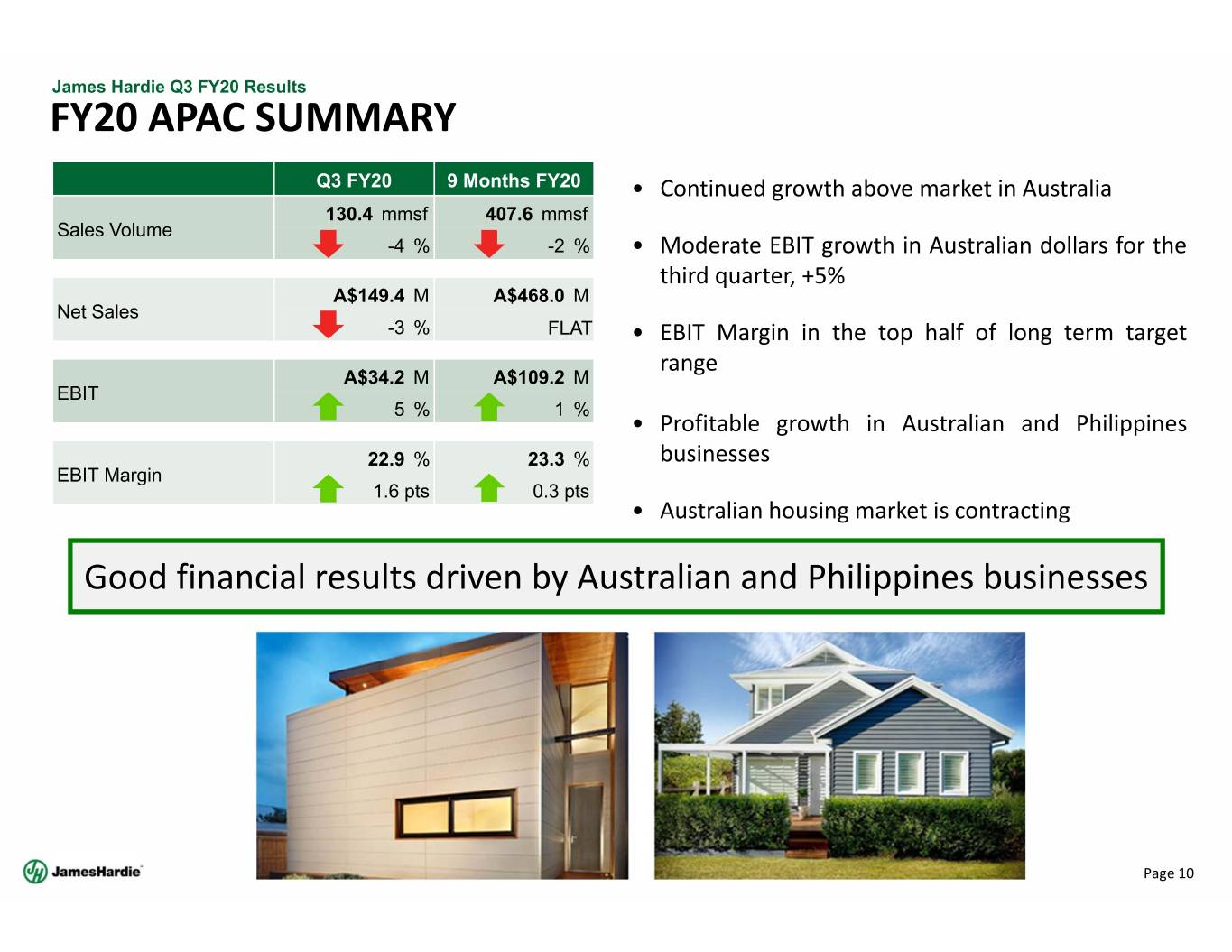

James Hardie Q3 FY20 Results FY20 APAC SUMMARY Q3 FY20 9 Months FY20 • Continued growth above market in Australia 130.4 mmsf 407.6 mmsf Sales Volume -4 % -2 % • ModerateEBITgrowthinAustraliandollarsforthe aa third quarter, +5% A$149.4 M A$468.0 M Net Sales -3 % FLAT • EBITMargininthetophalfoflongtermtarget aa range A$34.2 M A$109.2 M EBIT 5% 1% aa •ProfitablegrowthinAustralianandPhilippines 22.9 % 23.3 % businesses EBIT Margin 1.6 pts 0.3 pts • Australian housing market is contracting Good financial results driven by Australian and Philippines businesses Page 10

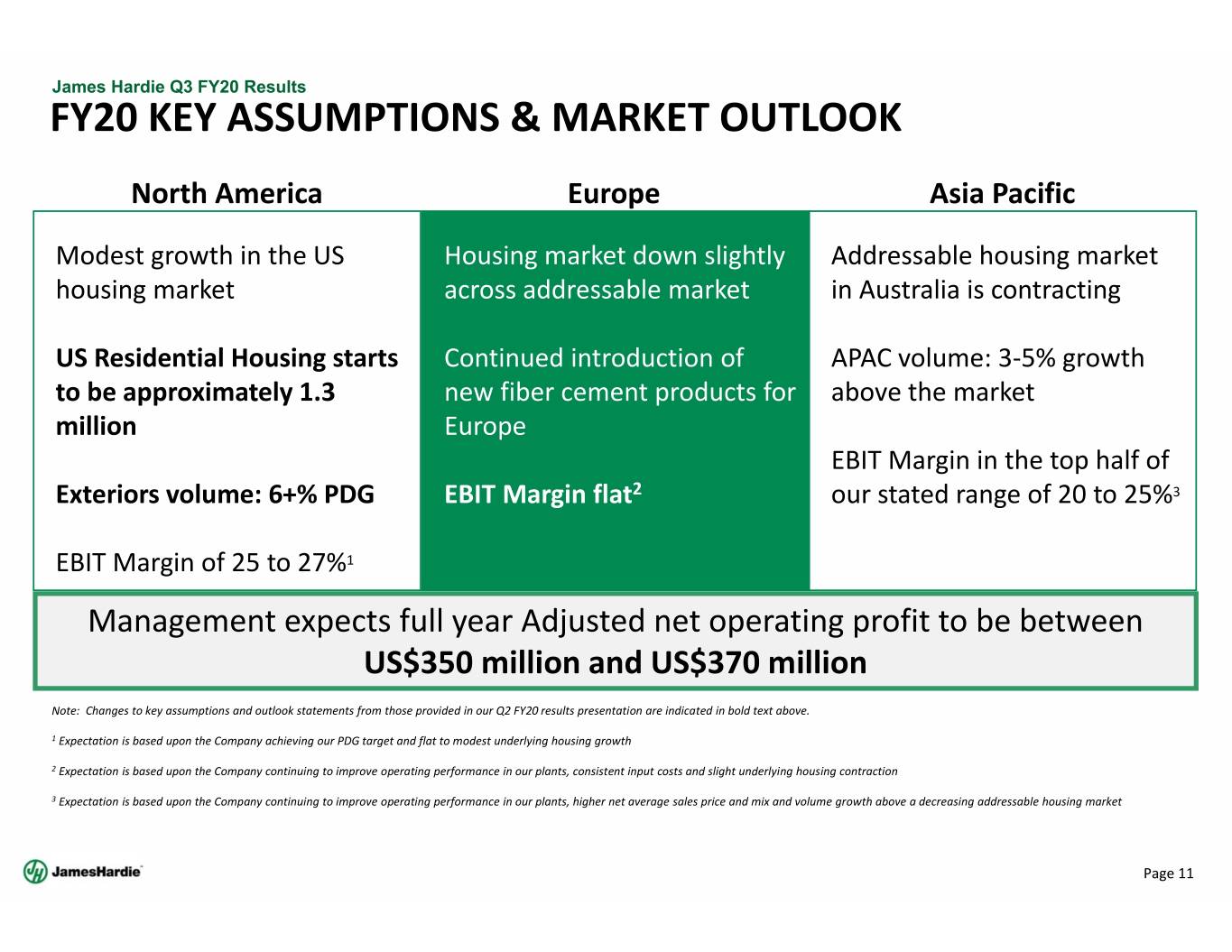

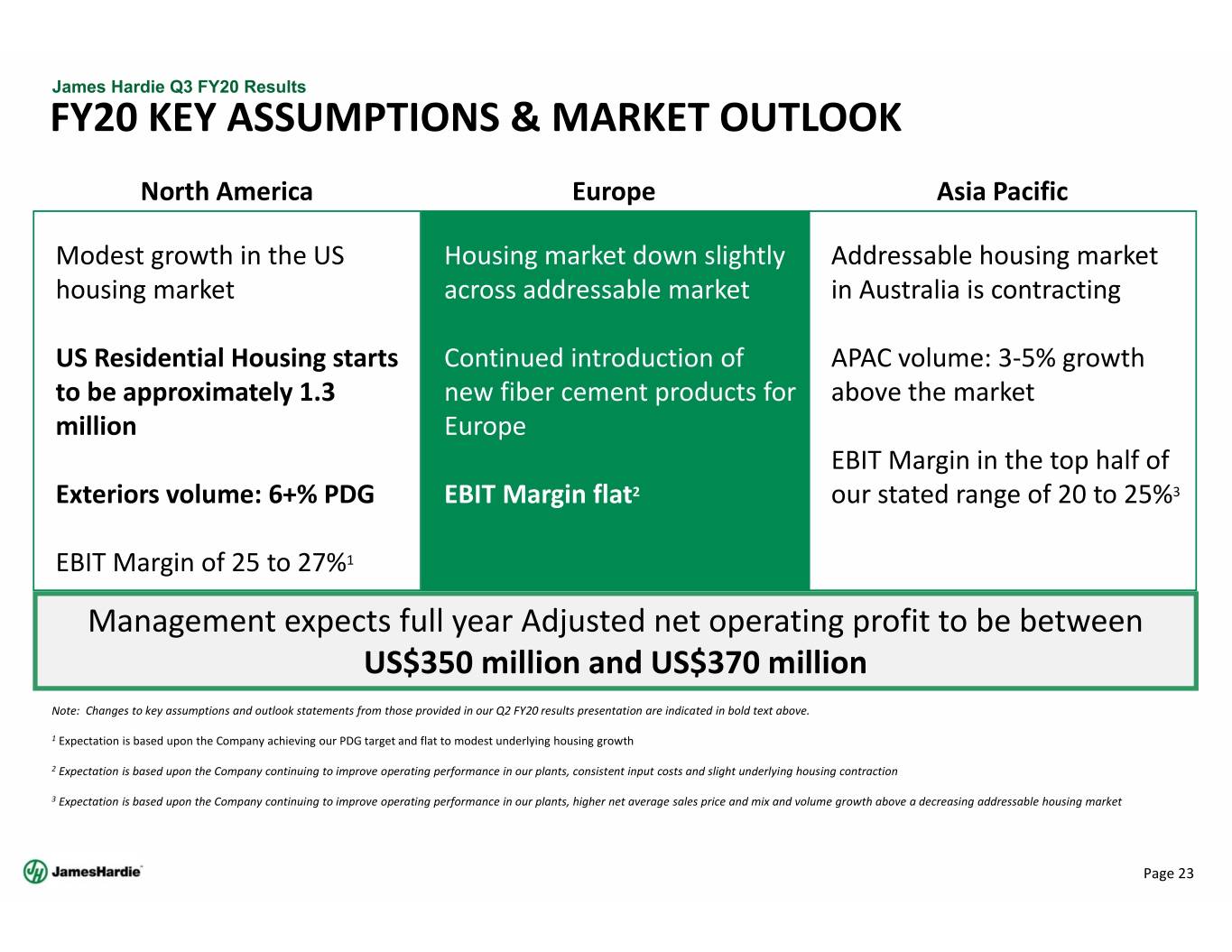

James Hardie Q3 FY20 Results FY20 KEY ASSUMPTIONS & MARKET OUTLOOK North AmericaEurope Asia Pacific Modest growth in the US Housing market down slightly Addressable housing market housing market across addressable market in Australia is contracting US Residential Housing starts Continued introduction of APAC volume: 3‐5% growth to be approximately 1.3 new fiber cement products for above the market million Europe EBIT Margin in the top half of Exteriors volume: 6+% PDG EBIT Margin flat2 our stated range of 20 to 25%3 EBIT Margin of 25 to 27%1 Management expects full year Adjusted net operating profit to be between US$350 million and US$370 million Note: Changes to key assumptions and outlook statements from those provided in our Q2 FY20 results presentation are indicated in bold text above. 1 Expectation is based upon the Company achieving our PDG target and flat to modest underlying housing growth 2 Expectation is based upon the Company continuing to improve operating performance in our plants, consistent input costs and slight underlying housing contraction 3 Expectation is based upon the Company continuing to improve operating performance in our plants, higher net average sales price and mix and volume growth above a decreasing addressable housing market Page 11

FINANCIAL REVIEW – JASON MIELE, VP OF INVESTOR RELATIONS

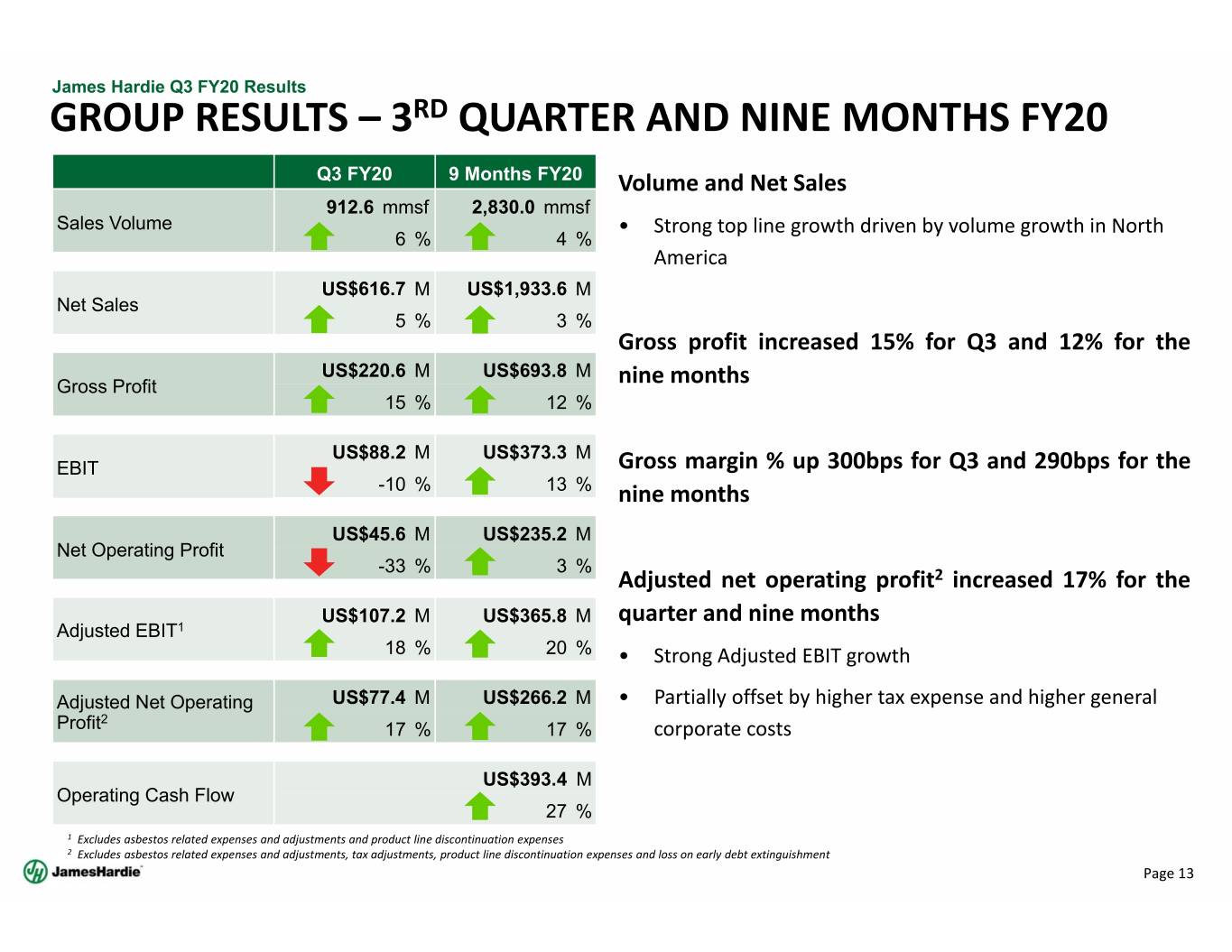

James Hardie Q3 FY20 Results GROUP RESULTS – 3RD QUARTER AND NINE MONTHS FY20 Q3 FY20 9 Months FY20 Volume and Net Sales 912.6 mmsf 2,830.0 mmsf Sales Volume • Strong top line growth driven by volume growth in North 6% 4% aa America US$616.7 M US$1,933.6 M Net Sales 5% 3% aa Gross profit increased 15% for Q3 and 12% for the US$220.6 M US$693.8 M Gross Profit nine months 15 % 12 % aa US$88.2 M US$373.3 M EBIT Gross margin % up 300bps for Q3 and 290bps for the -10 % 13 % nine months aa US$45.6 M US$235.2 M Net Operating Profit -33 % 3 % 2 aa Adjusted net operating profit increased 17% for the US$107.2 M US$365.8 M quarter and nine months Adjusted EBIT1 18 % 20 % • Strong Adjusted EBIT growth aa Adjusted Net Operating US$77.4 M US$266.2 M • Partially offset by higher tax expense and higher general 2 Profit 17 % 17 % corporate costs aa US$393.4 M Operating Cash Flow 27 % 1 Excludes asbestos related expenses and adjustments and product line discontinuation expenses 2 Excludes asbestos related expenses and adjustments, tax adjustments, product line discontinuation expenses and loss on early debt extinguishment Page 13

James Hardie Q3 FY20 Results NORTH AMERICA FIBER CEMENT SUMMARY Q3 FY20 9 Months FY20 Volume 593.0 mmsf 1,826.6 mmsf Sales Volume 11 % 7 % • PDG on‐track; FY20 target raised to 6+% ddddddddd ◦ Exteriors volumes +13% for Q3 and +8% for the nine months US$430.0 M US$1,341.9 M Net Sales 12 % 7 % • Interiors volume continues to improve ddddddddd ◦ Interiors volumes +3% for Q3 and flat for the nine months US$719 per msf US$728 per msf Average Price 1% 1% Price ddddddddd US$112.3 M US$350.5 M • Favorably impacted by annual change in strategic EBIT 30 % 22 % pricing, partially offset by mix ddddddddd US$112.3 M US$350.5 M 1 EBIT Excluding1 EBIT Excluding 30 % 20 % ddddddddd• Higher net sales – volume and price 26.1 % 26.1 % EBIT Margin Excluding1 3.8 pts 2.8 pts • Lean savings exceeding plan 1 Excludes product line discontinuation expenses of US$5.4 million for the nine months FY19 • Lower freight • Lower pulp costs for the quarter Page 14

James Hardie Q3 FY20 Results NORTH AMERICA FIBER CEMENT Q3 and YTD EBIT Margin of 26.1% Page 15

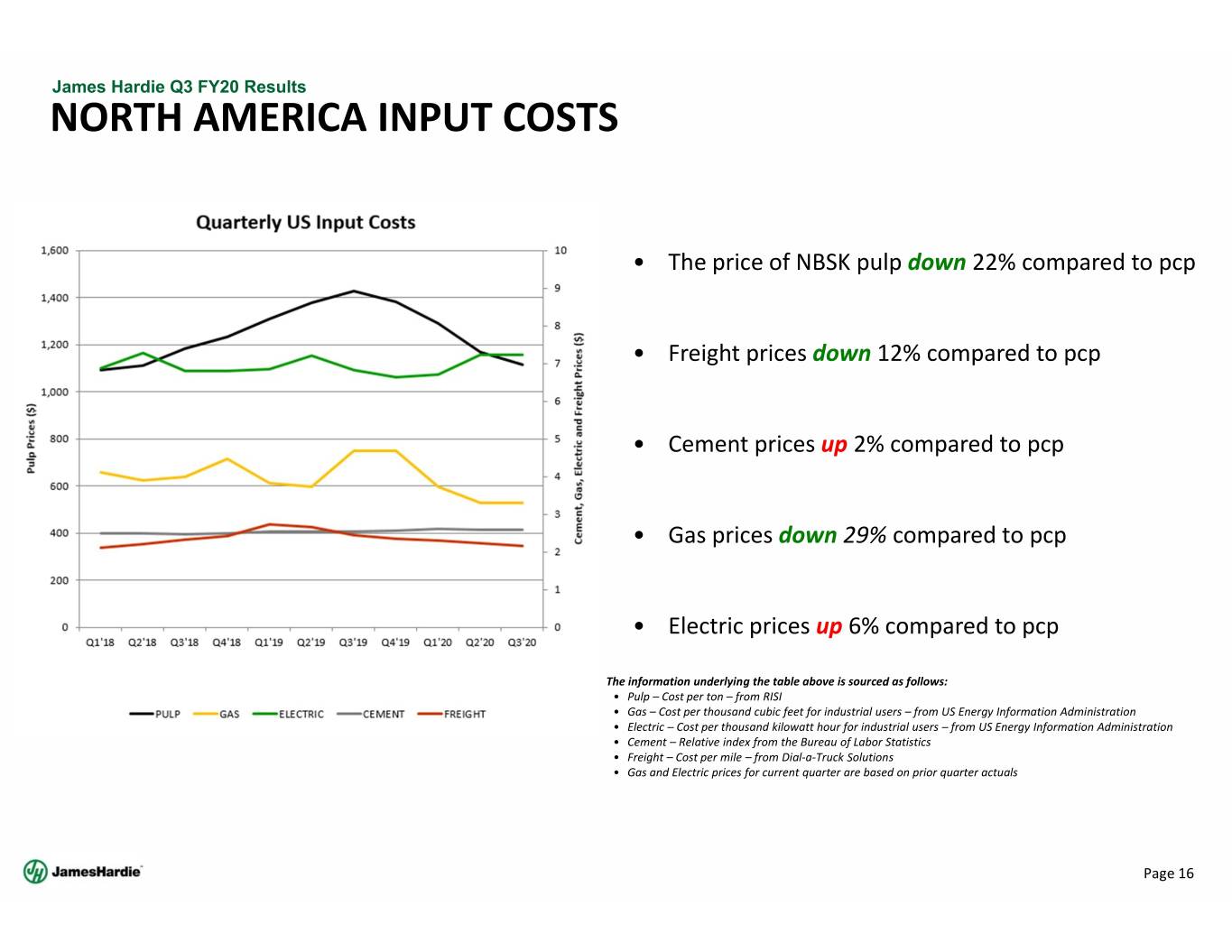

James Hardie Q3 FY20 Results NORTH AMERICA INPUT COSTS • The price of NBSK pulp down 22% compared to pcp •Freight pricesdown 12% compared to pcp • Cement prices up 2% compared to pcp •Gas prices down 29% compared to pcp • Electric prices up 6% compared to pcp The information underlying the table above is sourced as follows: • Pulp – Cost per ton – from RISI • Gas – Cost per thousand cubic feet for industrial users – from US Energy Information Administration • Electric – Cost per thousand kilowatt hour for industrial users – from US Energy Information Administration • Cement – Relative index from the Bureau of Labor Statistics • Freight – Cost per mile – from Dial‐a‐Truck Solutions • Gas and Electric prices for current quarter are based on prior quarter actuals Page 16

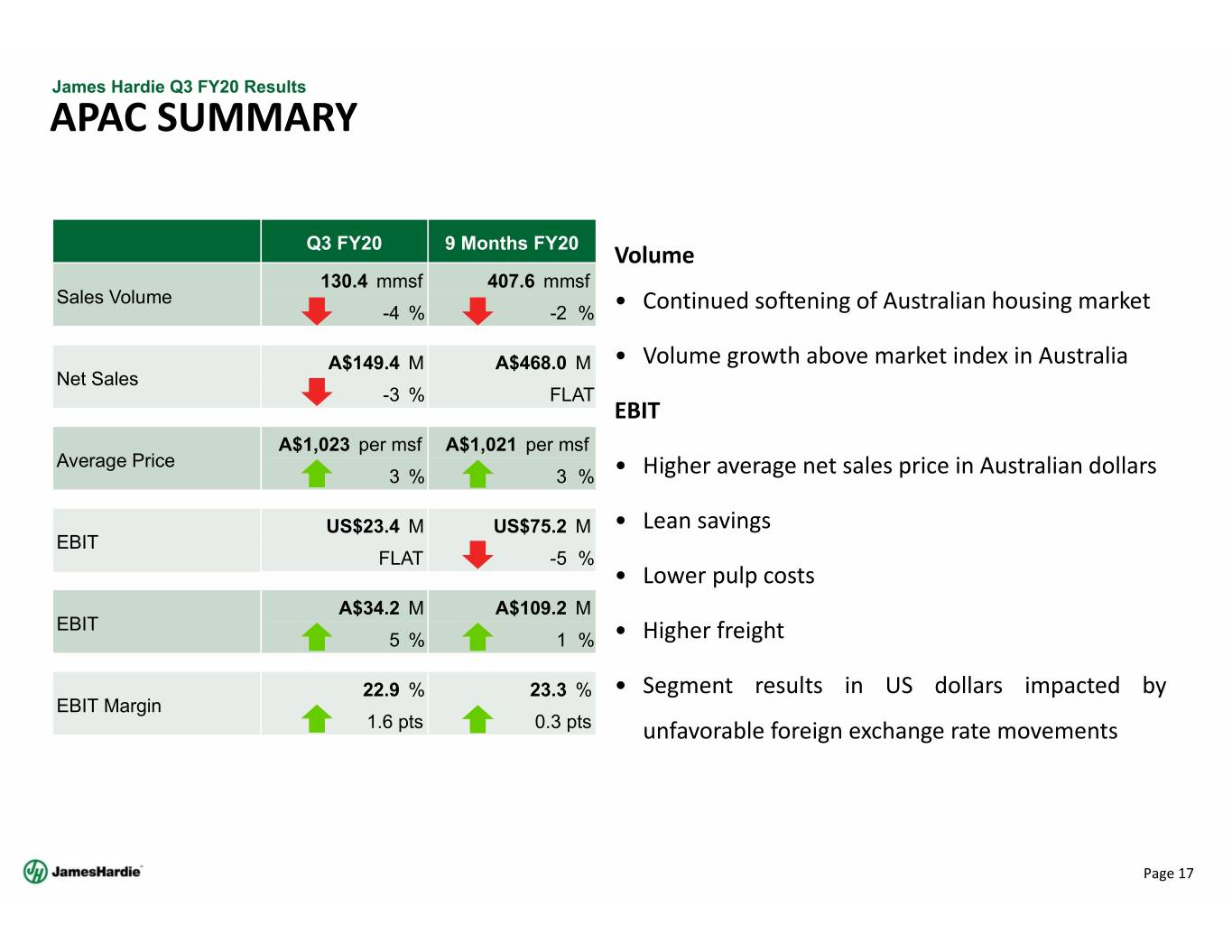

James Hardie Q3 FY20 Results APAC SUMMARY Q3 FY20 9 Months FY20 Volume 130.4 mmsf 407.6 mmsf Sales Volume -4 % -2 % • Continued softening of Australian housing market d d dd d d dd d A$149.4 M A$468.0 M • Volume growth above market index in Australia Net Sales -3 % FLAT d d dd d d dd d EBIT A$1,023 per msf A$1,021 per msf Average Price 3% 3 % • Higher average net sales price in Australian dollars d d dd d d dd d US$23.4 M US$75.2 M •Leansavings EBIT FLAT -5 % d d dd d d dd d • Lower pulp costs A$34.2 M A$109.2 M EBIT 5% 1 % • Higher freight d d dd d d dd d 22.9 % 23.3 % • Segment results in US dollars impacted by EBIT Margin 1.6 pts 0.3 pts unfavorable foreign exchange rate movements Page 17

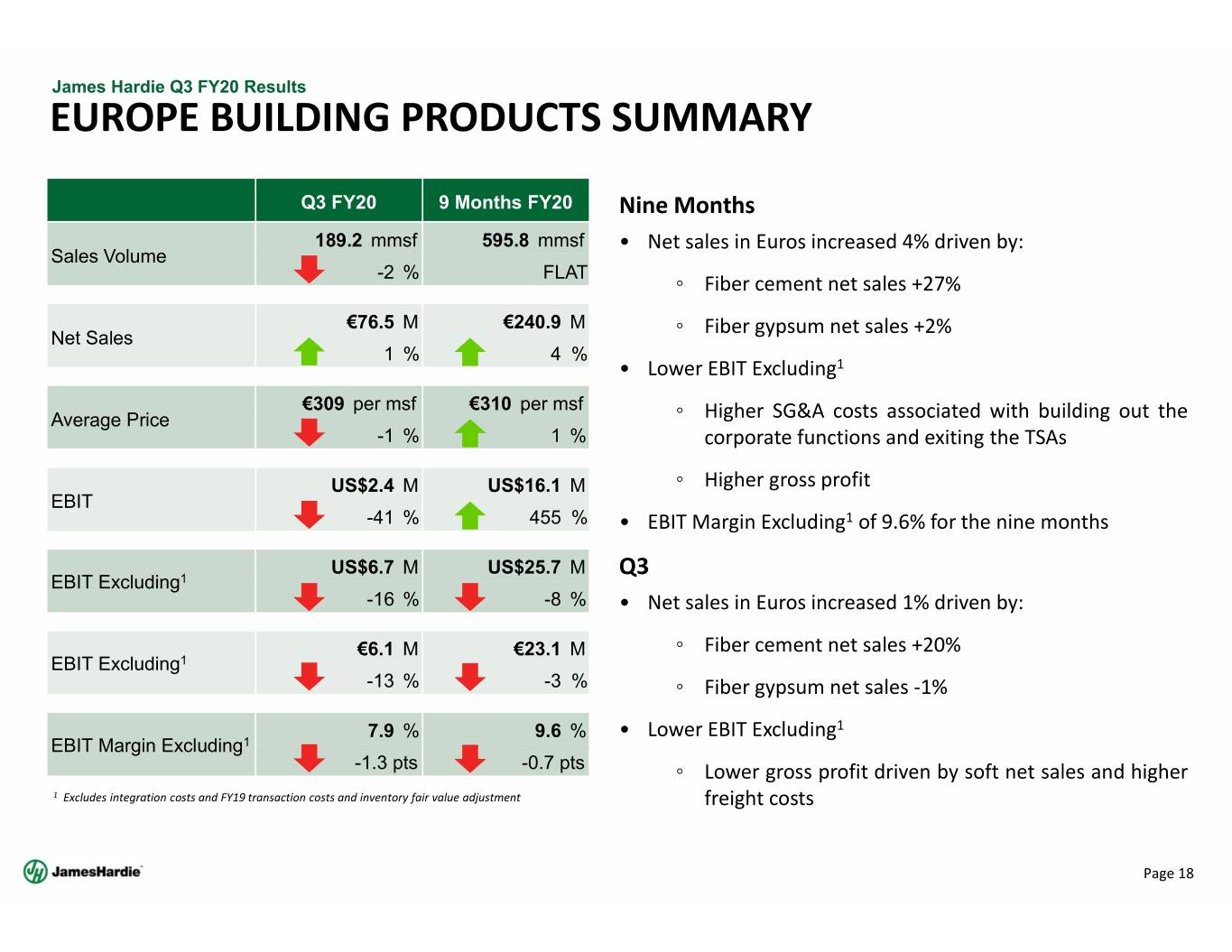

James Hardie Q3 FY20 Results EUROPE BUILDING PRODUCTS SUMMARY Q3 FY20 9 Months FY20 Nine Months 189.2 mmsf 595.8 mmsf • Net sales in Euros increased 4% driven by: Sales Volume -2 % FLAT ◦ Fiber cement net sales +27% ddddddddd €76.5 M €240.9 M ◦ Fiber gypsum net sales +2% Net Sales 1% 4% 1 ddddddddd• Lower EBIT Excluding €309 per msf €310 per msf Average Price ◦ Higher SG&A costs associated with building out the -1 % 1 % corporate functions and exiting the TSAs ddddddddd US$2.4 M US$16.1 M ◦ Higher gross profit EBIT -41 % 455 % • EBIT Margin Excluding1 of 9.6% for the nine months ddddddddd US$6.7 M US$25.7 M Q3 EBIT Excluding1 -16 % -8 % • Net sales in Euros increased 1% driven by: ddddddddd €6.1 M €23.1 M ◦ Fiber cement net sales +20% EBIT Excluding1 -13 % -3 % ◦ Fiber gypsum net sales ‐1% ddddddddd 7.9 % 9.6 % • Lower EBIT Excluding1 EBIT Margin Excluding1 -1.3 pts -0.7 pts ◦ Lower gross profit driven by soft net sales and higher 1 Excludes integration costs and FY19 transaction costs and inventory fair value adjustment freight costs Page 18

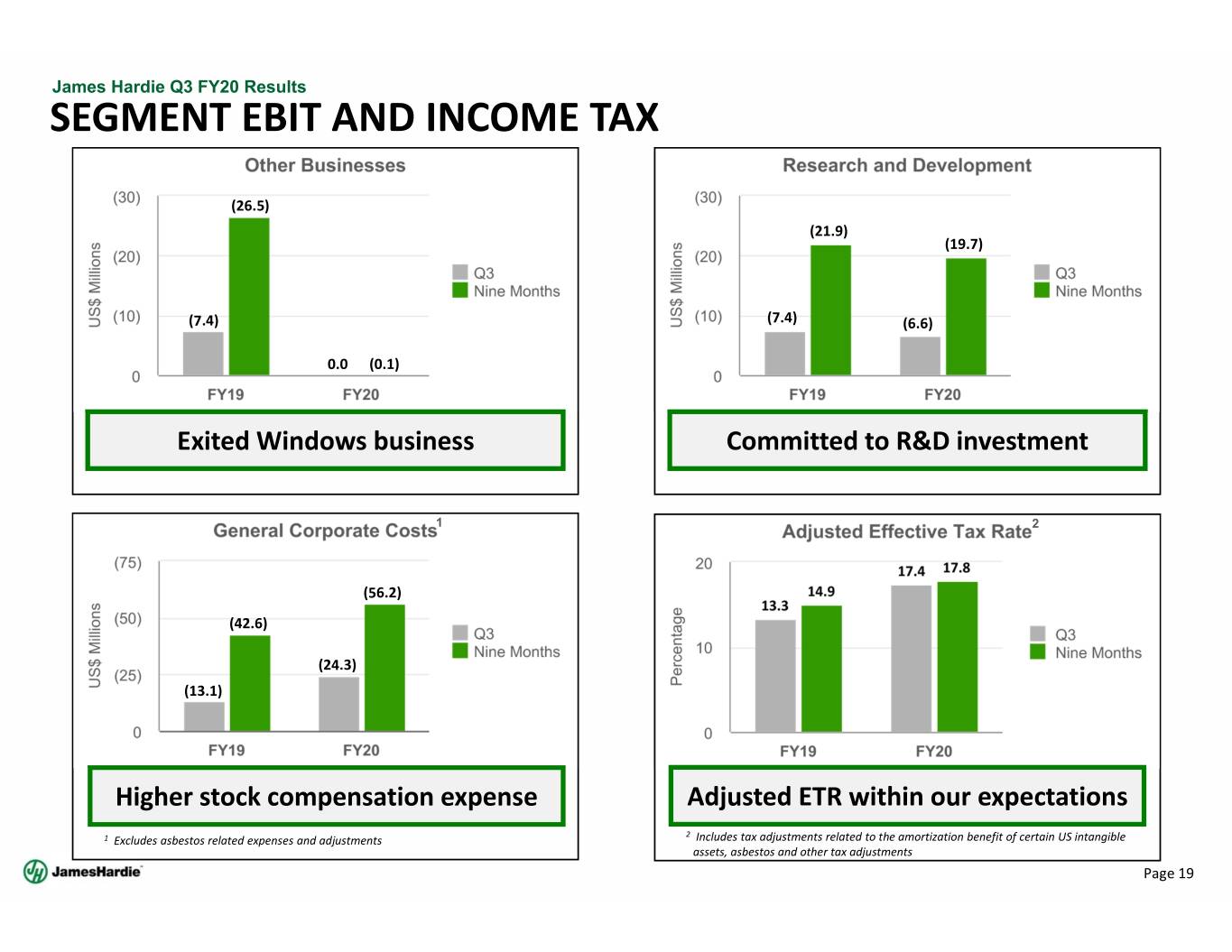

James Hardie Q3 FY20 Results SEGMENT EBIT AND INCOME TAX (26.5) (21.9) (19.7) (7.4) (7.4) (6.6) 0.0 (0.1) Exited Windows business Committed to R&D investment 1 2 (56.2) (42.6) (24.3) (13.1) Higher stock compensation expense Adjusted ETR within our expectations 2 1 Excludes asbestos related expenses and adjustments Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos and other tax adjustments Page 19

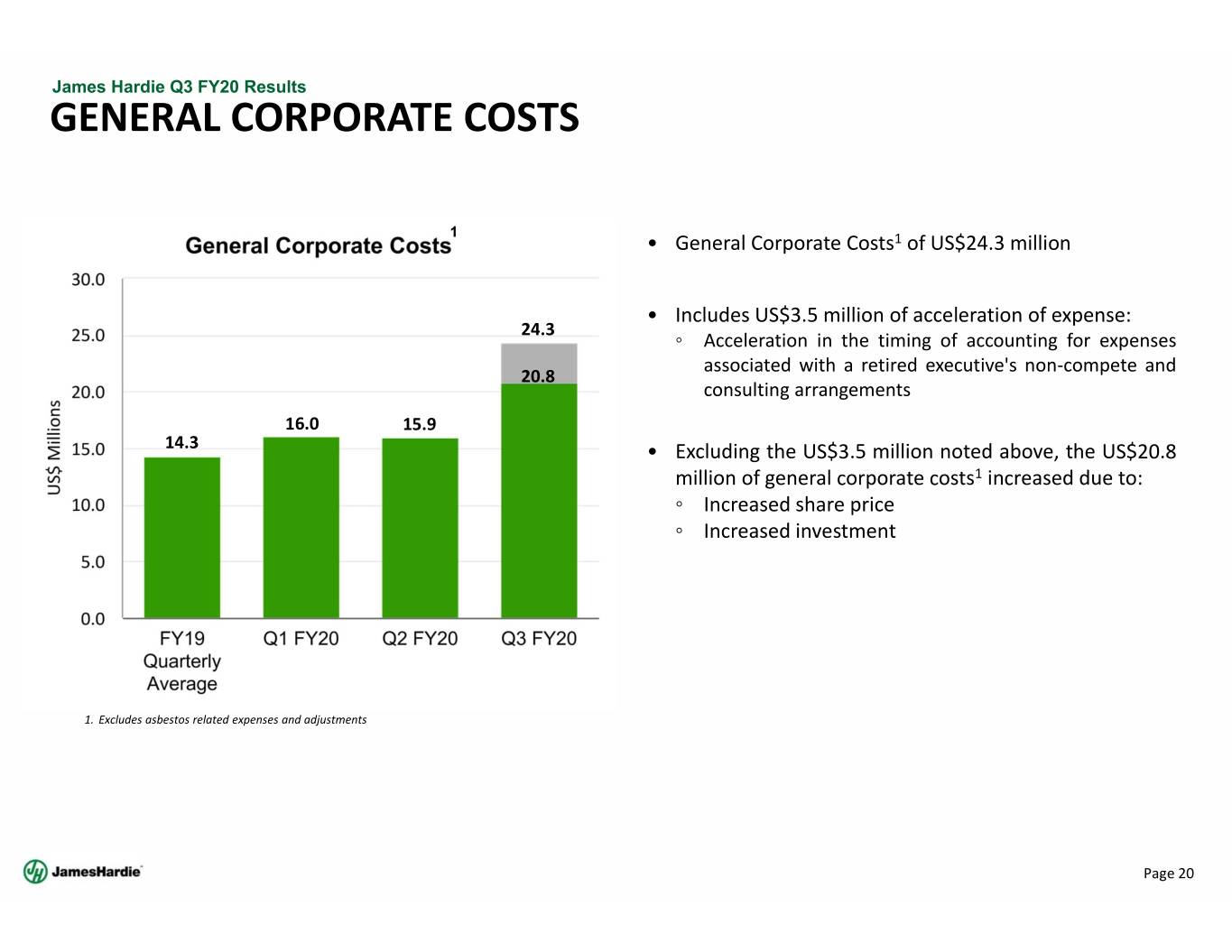

James Hardie Q3 FY20 Results GENERAL CORPORATE COSTS 1 • General Corporate Costs1 of US$24.3 million • Includes US$3.5 million of acceleration of expense: 24.3 ◦ Acceleration in the timing of accounting for expenses associated with a retired executive's non‐compete and 20.8 consulting arrangements 16.0 15.9 14.3 • Excluding the US$3.5 million noted above, the US$20.8 million of general corporate costs1 increased due to: ◦ Increased share price ◦ Increased investment 1. Excludes asbestos related expenses and adjustments Page 20

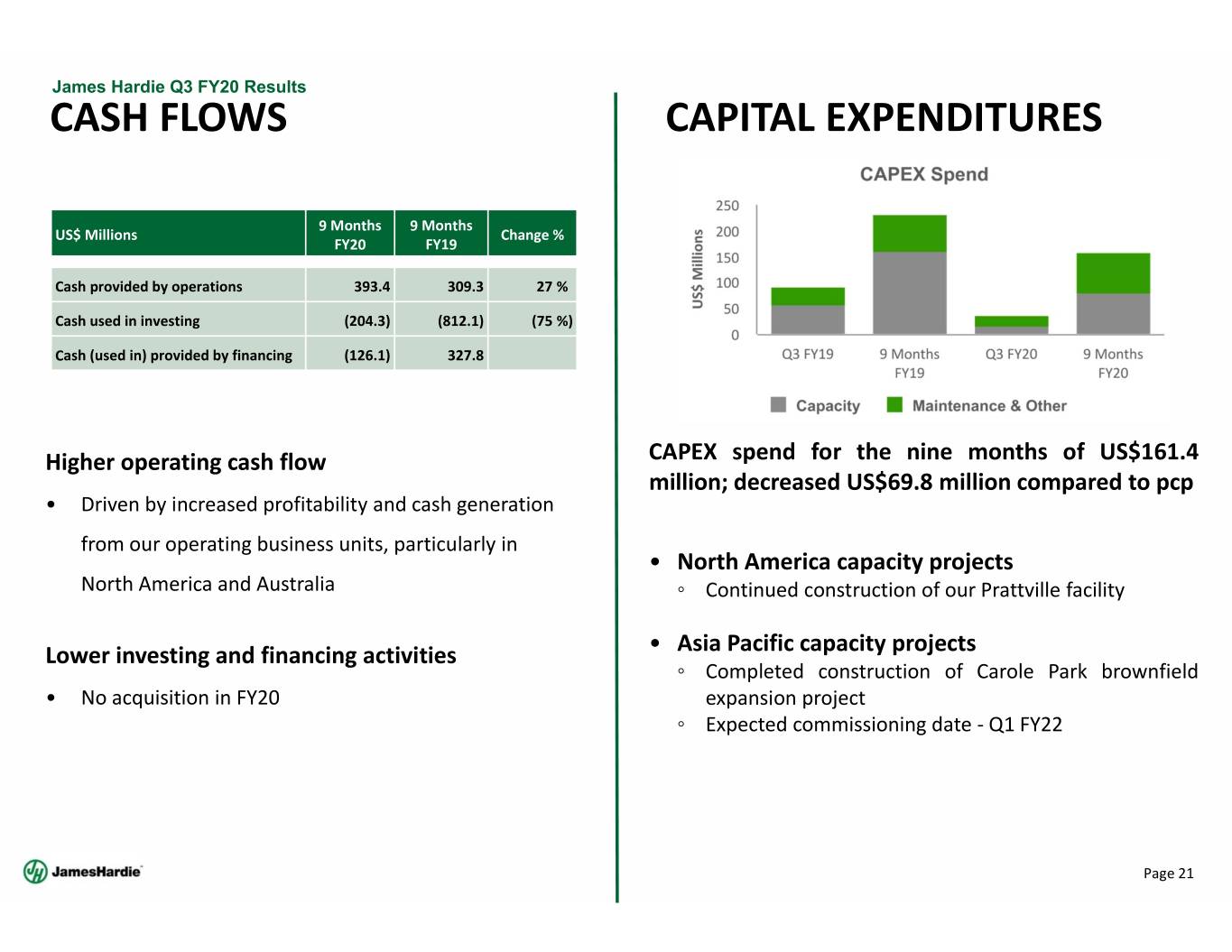

James Hardie Q3 FY20 Results CASH FLOWS CAPITAL EXPENDITURES 9 Months 9 Months US$ Millions Change % FY20 FY19 a a a a Cash provided by operations 393.4 309.3 27 % 1 Cash used in investing (204.3) (812.1) (75 %) Cash (used in) provided by financing (126.1) 327.8 Higher operating cash flow CAPEX spend for the nine months of US$161.4 million; decreased US$69.8 million compared to pcp • Driven by increased profitability and cash generation from our operating business units, particularly in • North America capacity projects North America and Australia ◦ Continued construction of our Prattville facility Lower investing and financing activities • Asia Pacific capacity projects ◦ Completed construction of Carole Park brownfield • No acquisition in FY20 expansion project ◦ Expected commissioning date ‐ Q1 FY22 Page 21

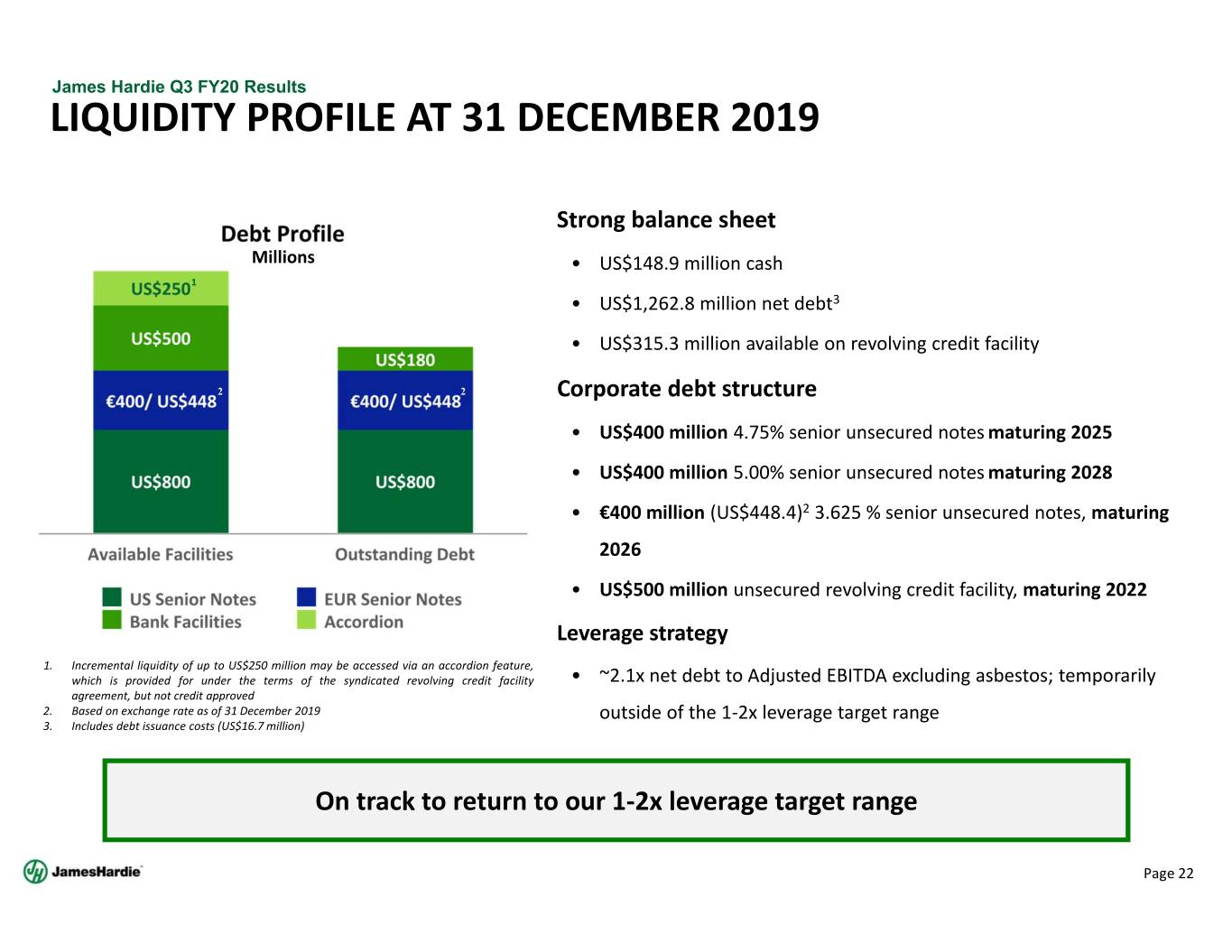

James Hardie Q3 FY20 Results LIQUIDITY PROFILE AT 31 DECEMBER 2019 Strong balance sheet Millions • US$148.9 million cash 1 • US$1,262.8 million net debt3 • US$315.3 million available on revolving credit facility 22Corporate debt structure • US$400 million 4.75% senior unsecured notes maturing 2025 • US$400 million 5.00% senior unsecured notes maturing 2028 • €400 million (US$448.4)2 3.625 % senior unsecured notes, maturing 2026 • US$500 million unsecured revolving credit facility, maturing 2022 Leverage strategy 1. Incremental liquidity of up to US$250 million may be accessed via an accordion feature, which is provided for under the terms of the syndicated revolving credit facility • ~2.1x net debt to Adjusted EBITDA excluding asbestos; temporarily agreement, but not credit approved 2. Based on exchange rate as of 31 December 2019 outside of the 1‐2x leverage target range 3. Includes debt issuance costs (US$16.7 million) On track to return to our 1‐2x leverage target range Page 22

James Hardie Q3 FY20 Results FY20 KEY ASSUMPTIONS & MARKET OUTLOOK North AmericaEurope Asia Pacific Modest growth in the US Housing market down slightly Addressable housing market housing market across addressable market in Australia is contracting US Residential Housing starts Continued introduction of APAC volume: 3‐5% growth to be approximately 1.3 new fiber cement products for above the market million Europe EBIT Margin in the top half of Exteriors volume: 6+% PDG EBIT Margin flat2 our stated range of 20 to 25%3 EBIT Margin of 25 to 27%1 Management expects full year Adjusted net operating profit to be between US$350 million and US$370 million Note: Changes to key assumptions and outlook statements from those provided in our Q2 FY20 results presentation are indicated in bold text above. 1 Expectation is based upon the Company achieving our PDG target and flat to modest underlying housing growth 2 Expectation is based upon the Company continuing to improve operating performance in our plants, consistent input costs and slight underlying housing contraction 3 Expectation is based upon the Company continuing to improve operating performance in our plants, higher net average sales price and mix and volume growth above a decreasing addressable housing market Page 23

STRATEGY UPDATE – DR. JACK TRUONG, CEO

James Hardie Q3 FY20 Results TRANSFORMING FROM A BIG, SMALL TO A SMALL, BIG COMPANY FROM: TO: Pull Push‐Pull Independent plants HMOS (based on LEAN) Technology push innovation Market driven innovation Top down Empowerment & accountability Functional silos Cross‐functional Regionally focused Globally connected Hero mentality Best practice sharing and replication Reactive Future forward planning "Home Run" mentality Continuous improvement (PDCA) mindset On a New "Track" to Deliver Sustainable, Profitable Growth Page 25

James Hardie Q3 FY20 Results BEING CUSTOMER FOCUSED: PUSH‐PULL Page 26

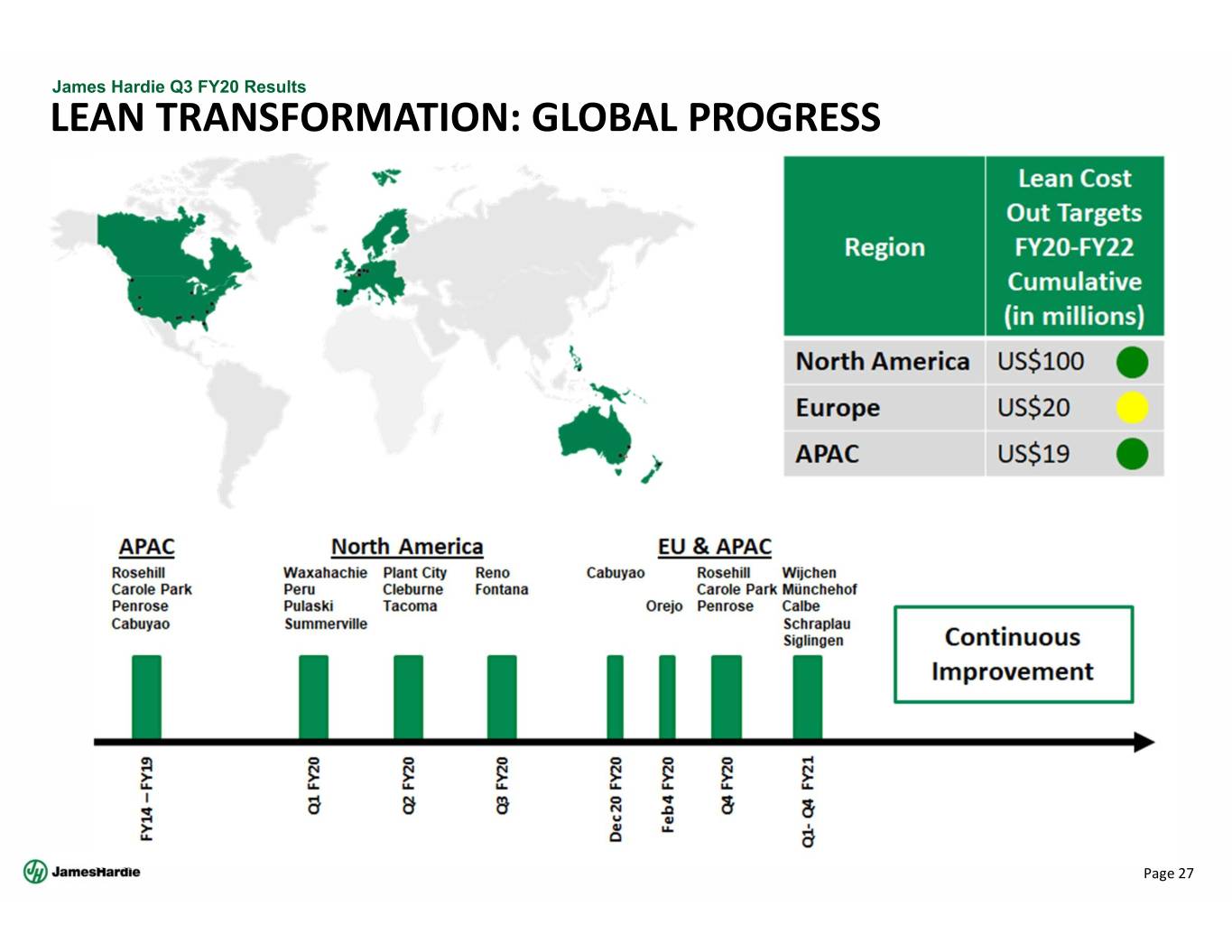

James Hardie Q3 FY20 Results LEAN TRANSFORMATION: GLOBAL PROGRESS Page 27

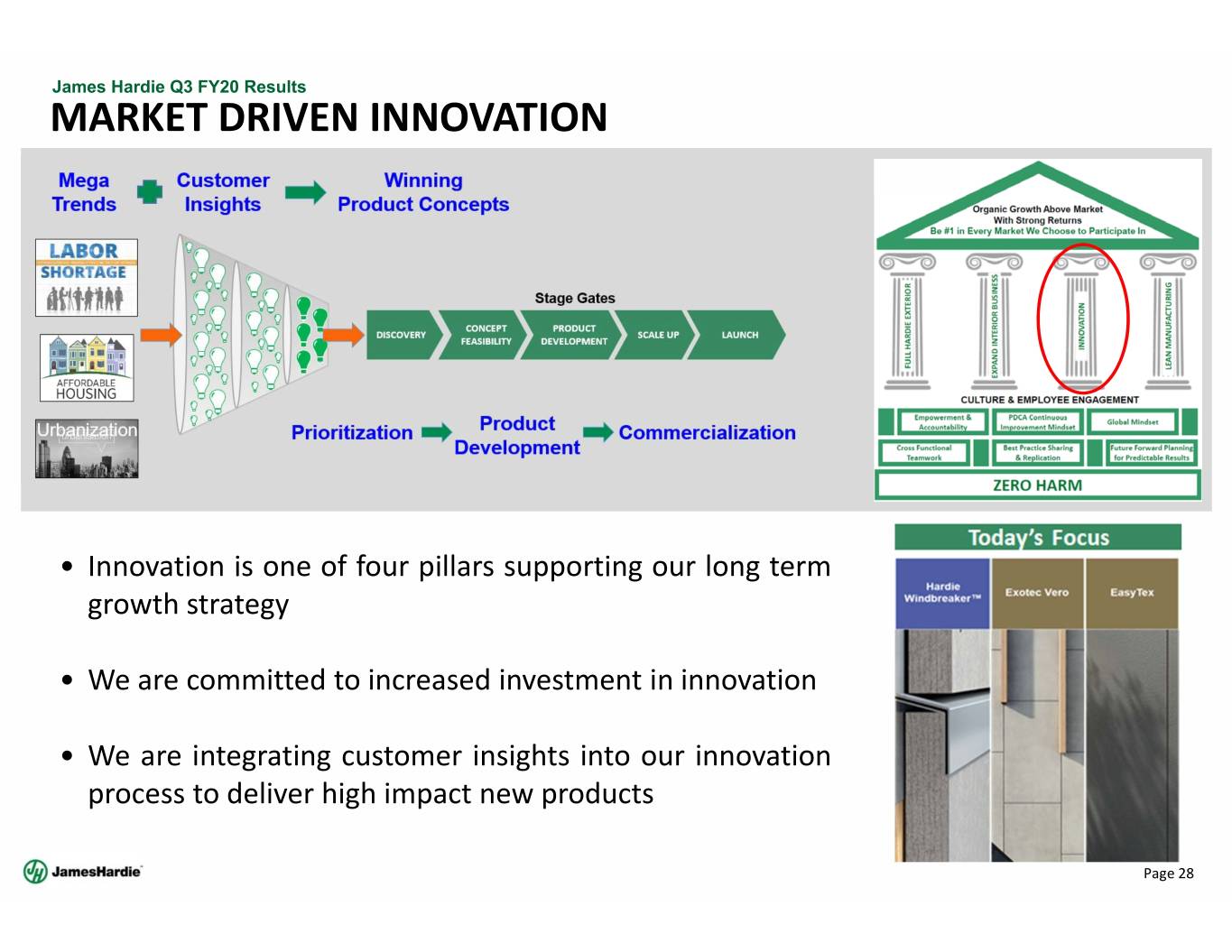

James Hardie Q3 FY20 Results MARKET DRIVEN INNOVATION • Innovation is one of four pillars supporting our long term growth strategy • We are committed to increased investment in innovation • We are integrating customer insights into our innovation process to deliver high impact new products Page 28

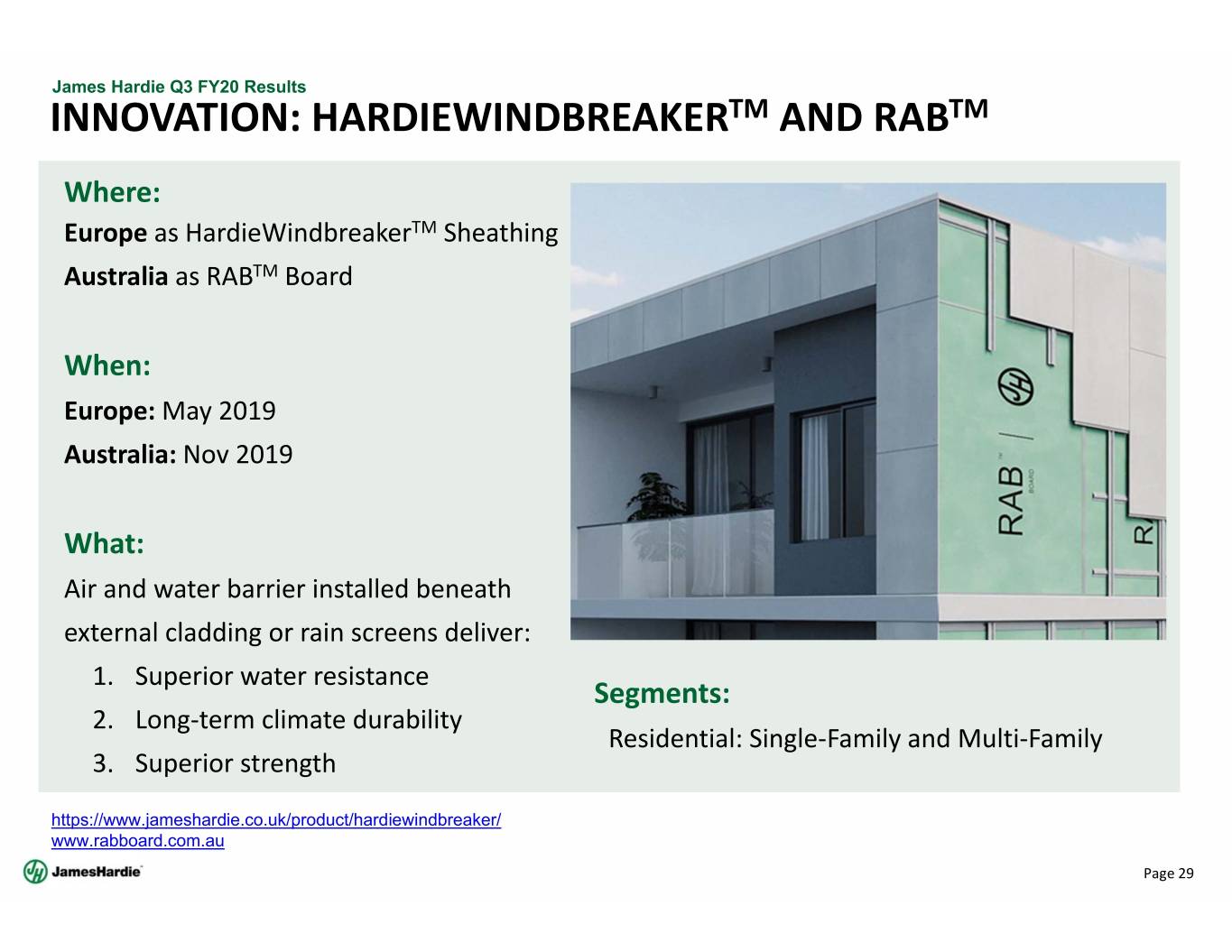

James Hardie Q3 FY20 Results INNOVATION: HARDIEWINDBREAKERTM AND RABTM Where: Europe as HardieWindbreakerTM Sheathing Australia as RABTM Board When: Europe: May 2019 Australia: Nov 2019 What: Air and water barrier installed beneath external cladding or rain screens deliver: 1. Superior water resistance Segments: 2. Long‐term climate durability Residential: Single‐Family and Multi‐Family 3. Superior strength https://www.jameshardie.co.uk/product/hardiewindbreaker/ www.rabboard.com.au Page 29

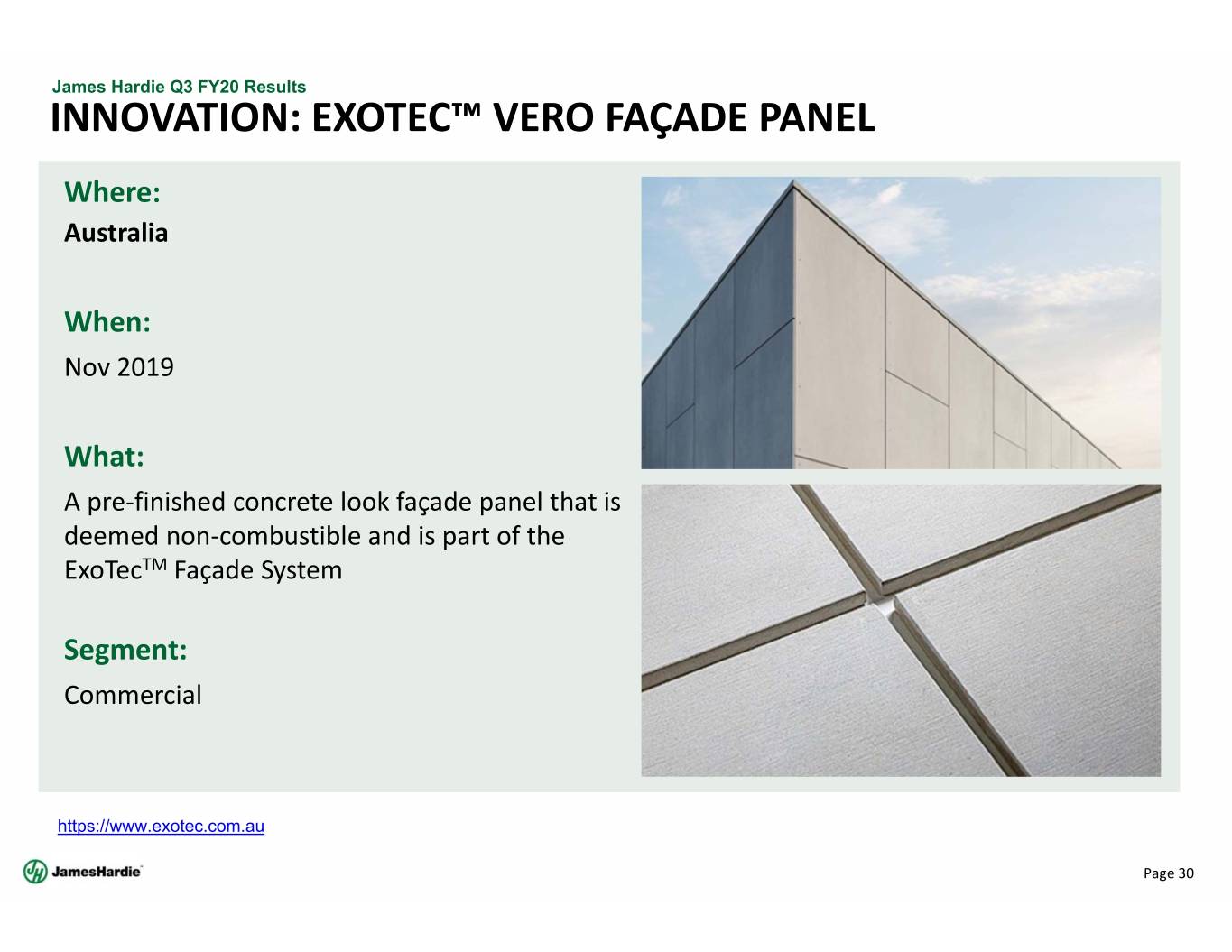

James Hardie Q3 FY20 Results INNOVATION: EXOTEC™ VERO FAÇADE PANEL Where: Australia When: Nov 2019 What: A pre‐finished concrete look façade panel that is deemed non‐combustible and is part of the ExoTecTM Façade System Segment: Commercial https://www.exotec.com.au Page 30

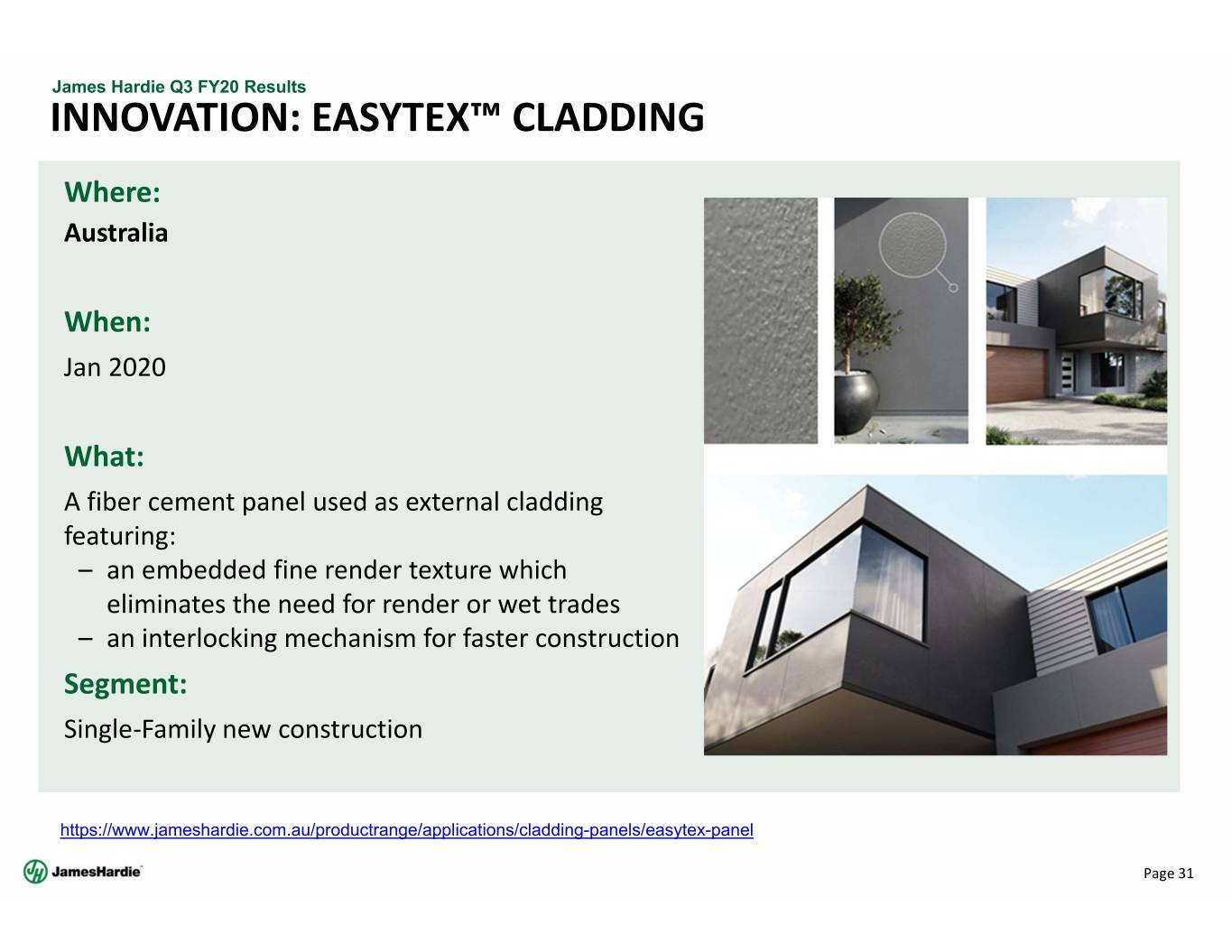

James Hardie Q3 FY20 Results INNOVATION: EASYTEX™ CLADDING Where: Australia When: Jan 2020 What: A fiber cement panel used as external cladding featuring: – an embedded fine render texture which eliminates the need for render or wet trades – an interlocking mechanism for faster construction Segment: Single‐Family new construction https://www.jameshardie.com.au/productrange/applications/cladding-panels/easytex-panel Page 31

QUESTIONS

APPENDIX

James Hardie Q3 FY20 Results FY20 GUIDANCE • Management notes the range of analysts’ forecasts for net operating profit excluding asbestos for the year ending 31 March 2020 is between US$356 million and US$380 million, with a mean of US$367 million • Management expects full year Adjusted net operating profit to be between US$350 million and US$370 million assuming, among other things, housing conditions in the United States remain consistent and in line with our assumed forecast of new construction starts and repair and remodel activity, input costs remain consistent, and an average USD/AUD exchange rate that is at or near current levels for the remainder of the year • Management is unable to forecast the comparable US GAAP financial measuredueto uncertainty regarding the impact of actuarial estimates on asbestos‐related assets and liabilities in future periods Page 34

James Hardie Q3 FY20 Results FINANCIAL MANAGEMENT FRAMEWORK Strong Financial Management Disciplined Capital Allocation Liquidity and Funding • Strong margins and operating cash flows • Invest in R&D and capacity expansion to • Conservative leveraging of balance sheet support organic growth at a target within 1‐2 times Adjusted • Strong governance and transparency EBITDA excluding asbestos. • Maintain ordinary dividends within the • Investment‐grade financial management defined payout ratio ◦ US$500 million unsecured revolving credit facility; • Flexibility for: ◦ US$800m senior unsecured notes at Q3 ◦ Cyclical market volatility FY20; ◦ Accretive and strategic inorganic ◦ €400m (US$448.4m) senior unsecured opportunities or further shareholder notes at Q3 FY20; returns, when appropriate ◦ At 31 December 2019, total debt had a Moody’s S&P Fitch weighted average maturity of 5.6 years and weighted average rate of 4.3% Ba1 BB BBB‐ affirmed Sept’18 affirmed Mar’19 affirmed Mar’19 outlook stable outlook stable outlook stable Financial management consistent with investment grade credit Ability to withstand market cycles and other unanticipated events Page 35

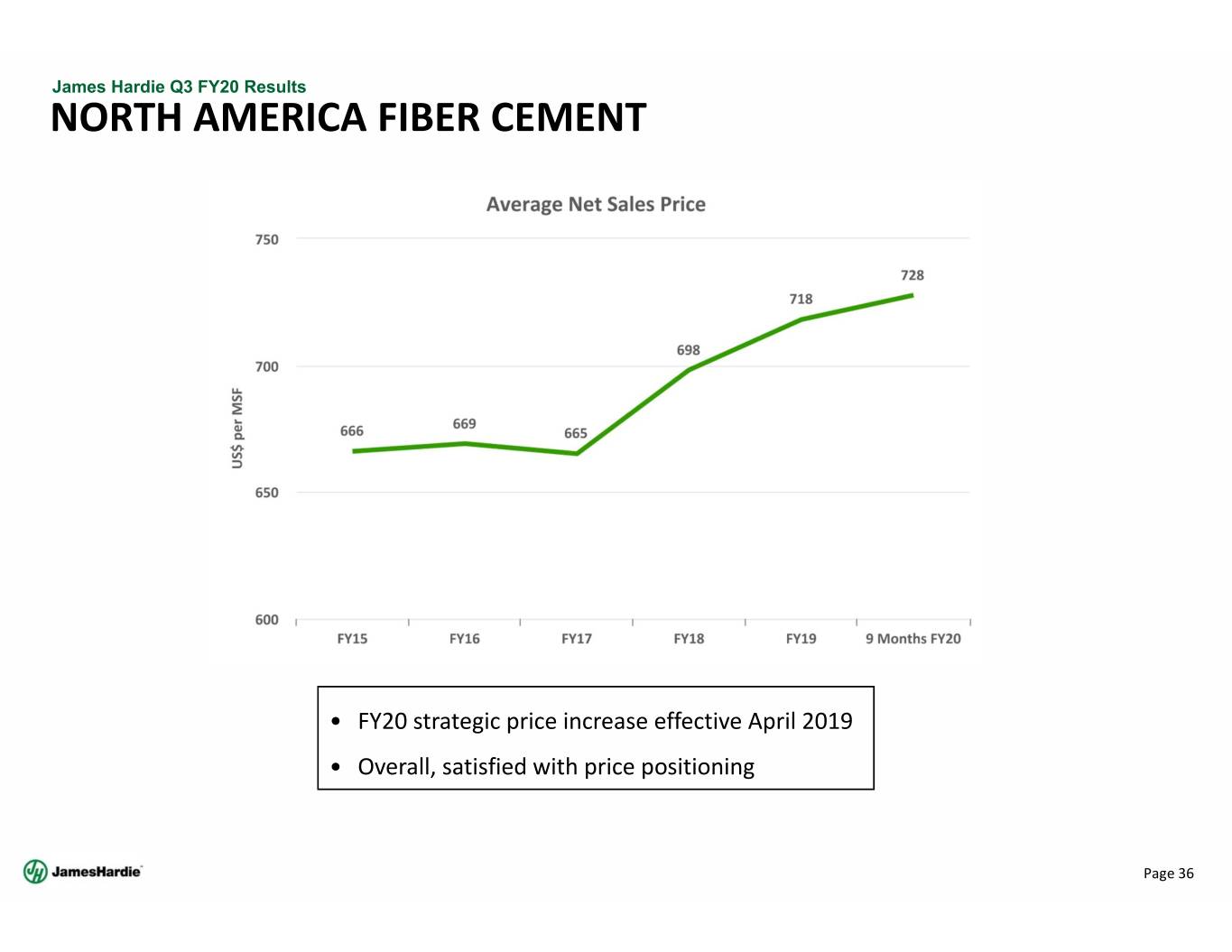

James Hardie Q3 FY20 Results NORTH AMERICA FIBER CEMENT • FY20 strategic price increase effective April 2019 • Overall, satisfied with price positioning Page 36

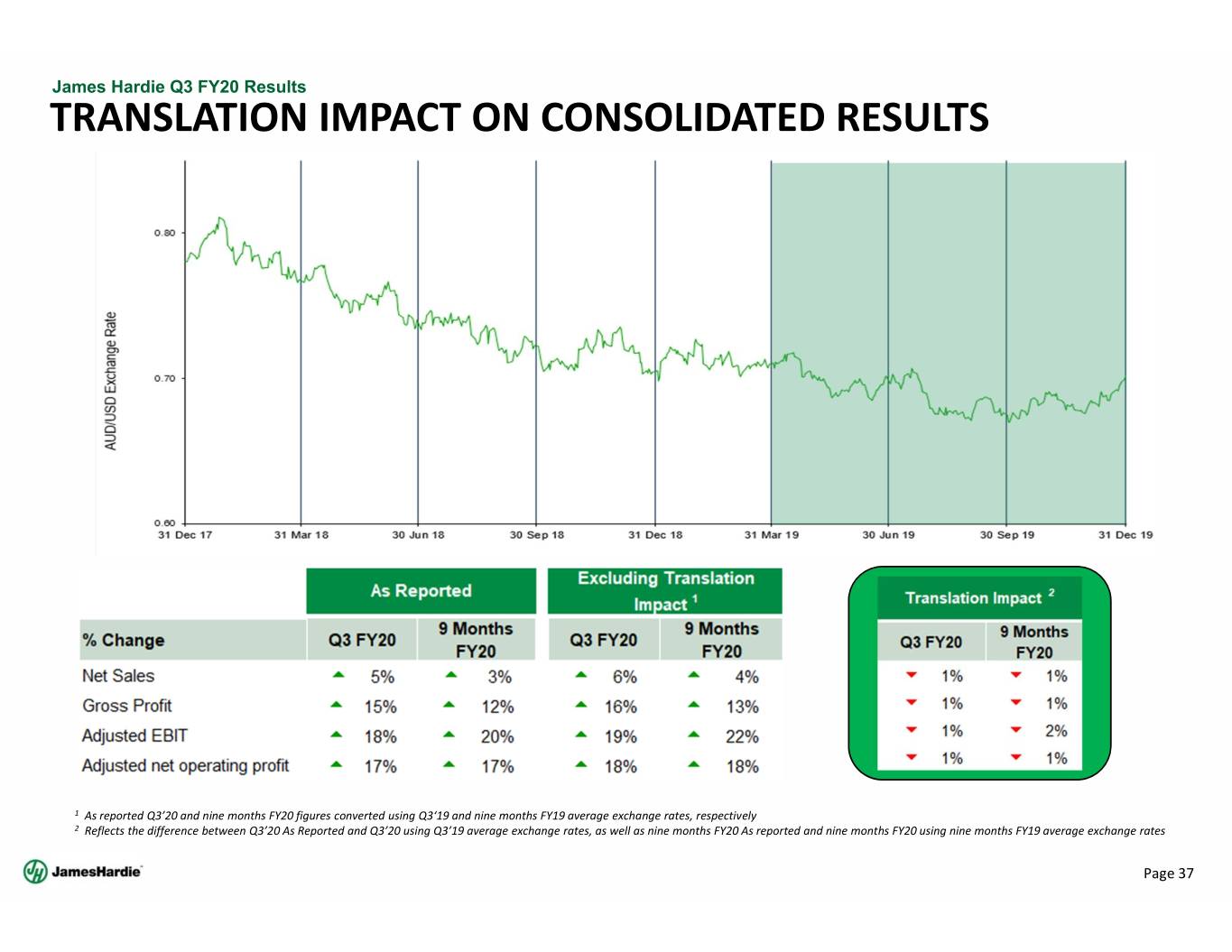

James Hardie Q3 FY20 Results TRANSLATION IMPACT ON CONSOLIDATED RESULTS 1 As reported Q3’20 and nine months FY20 figures converted using Q3‘19 and nine months FY19 average exchange rates, respectively 2 Reflects the difference between Q3’20 As Reported and Q3’20 using Q3’19 average exchange rates, as well as nine months FY20 As reported and nine months FY20 using nine months FY19 average exchange rates Page 37

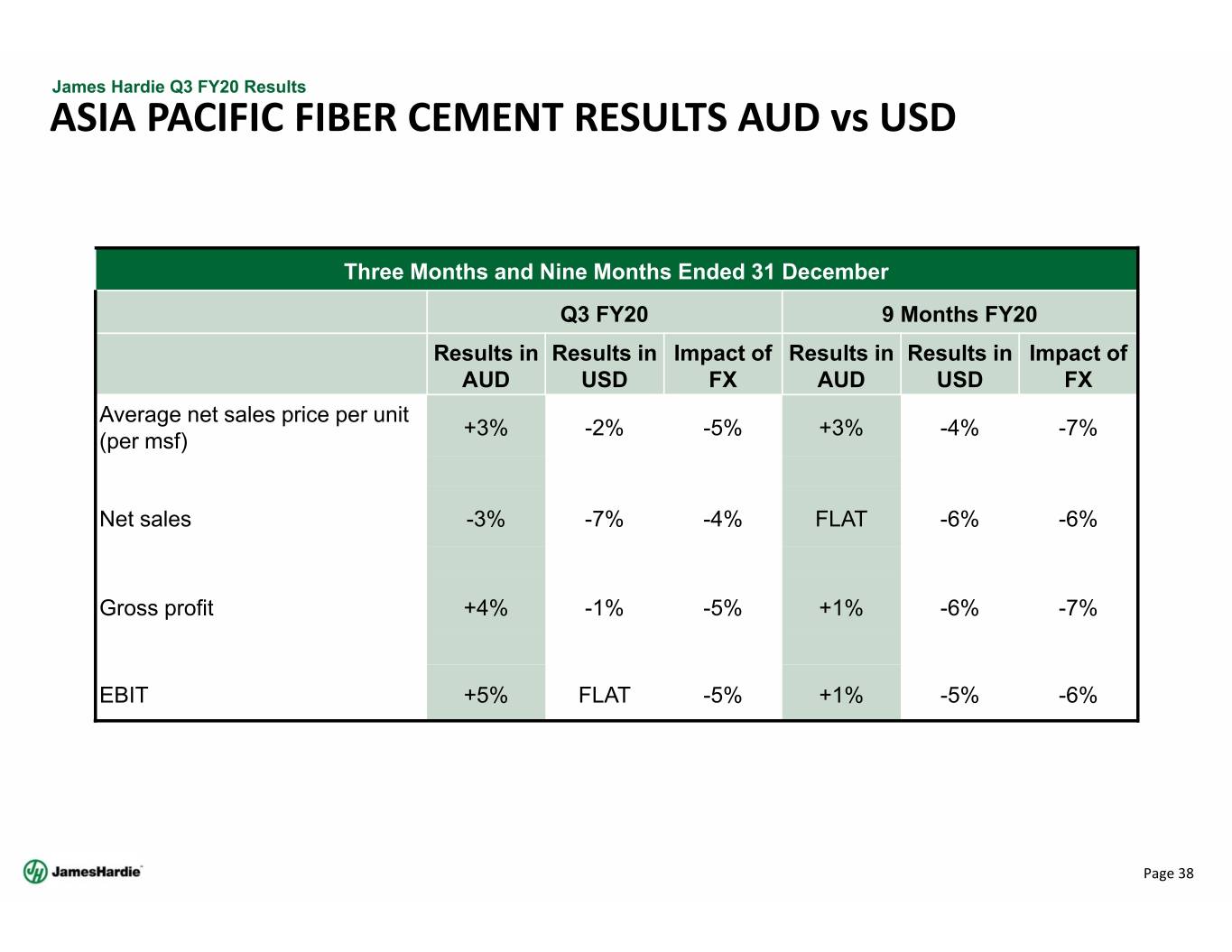

James Hardie Q3 FY20 Results ASIA PACIFIC FIBER CEMENT RESULTS AUD vs USD Three Months and Nine Months Ended 31 December Q3 FY20 9 Months FY20 Results in Results in Impact of Results in Results in Impact of AUD USD FX AUD USD FX Average net sales price per unit +3% -2% -5% +3% -4% -7% (per msf) Net sales -3% -7% -4% FLAT -6% -6% Gross profit +4% -1% -5% +1% -6% -7% EBIT +5% FLAT -5% +1% -5% -6% Page 38

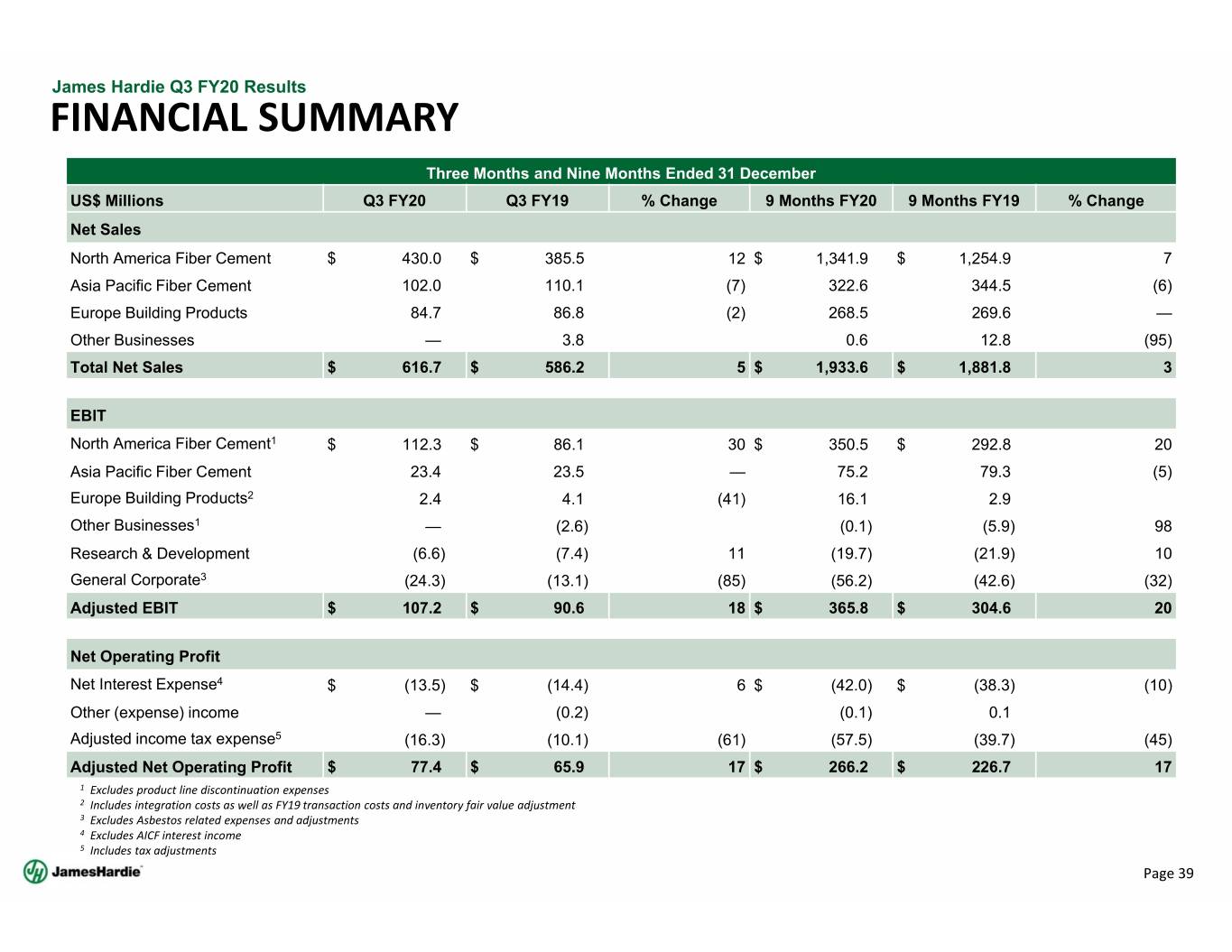

James Hardie Q3 FY20 Results FINANCIAL SUMMARY Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 % Change 9 Months FY20 9 Months FY19 % Change Net Sales North America Fiber Cement $ 430.0 $ 385.5 12 $ 1,341.9 $ 1,254.9 7 Asia Pacific Fiber Cement 102.0 110.1 (7) 322.6 344.5 (6) Europe Building Products 84.7 86.8 (2) 268.5 269.6 — Other Businesses — 3.8 0.6 12.8 (95) Total Net Sales $ 616.7 $ 586.2 5 $ 1,933.6 $ 1,881.8 3 EBIT North America Fiber Cement1 $ 112.3 $ 86.1 30 $ 350.5 $ 292.8 20 Asia Pacific Fiber Cement 23.4 23.5 — 75.2 79.3 (5) Europe Building Products2 2.4 4.1 (41) 16.1 2.9 Other Businesses1 — (2.6) (0.1) (5.9) 98 Research & Development (6.6) (7.4) 11 (19.7) (21.9) 10 General Corporate3 (24.3) (13.1) (85) (56.2) (42.6) (32) Adjusted EBIT $ 107.2 $ 90.6 18 $ 365.8 $ 304.6 20 Net Operating Profit Net Interest Expense4 $ (13.5) $ (14.4) 6 $ (42.0) $ (38.3) (10) Other (expense) income — (0.2) (0.1) 0.1 Adjusted income tax expense5 (16.3) (10.1) (61) (57.5) (39.7) (45) Adjusted Net Operating Profit $ 77.4 $ 65.9 17 $ 266.2 $ 226.7 17 1 Excludes product line discontinuation expenses 2 Includes integration costs as well as FY19 transaction costs and inventory fair value adjustment 3 Excludes Asbestos related expenses and adjustments 4 Excludes AICF interest income 5 Includes tax adjustments Page 39

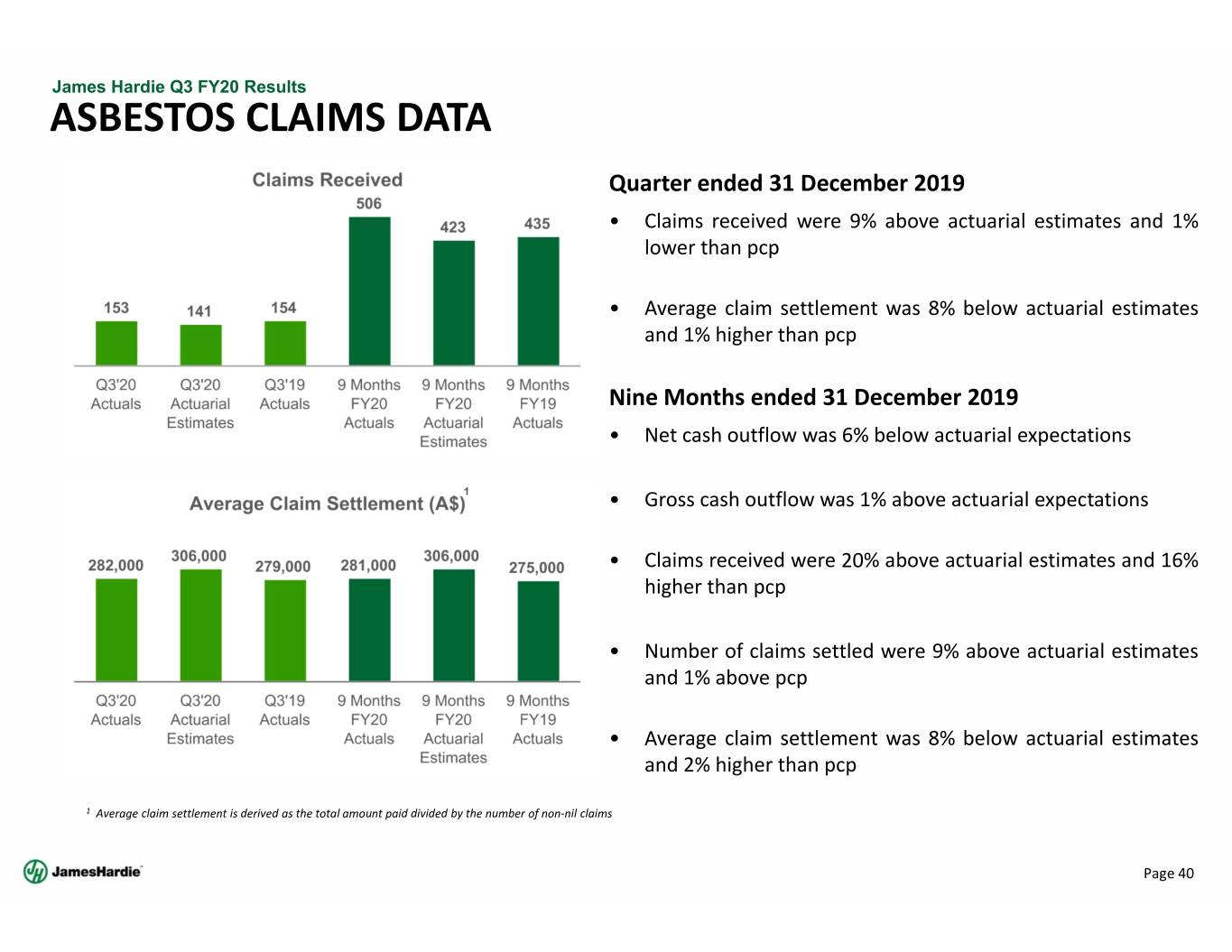

James Hardie Q3 FY20 Results ASBESTOS CLAIMS DATA Quarter ended 31 December 2019 • Claims received were 9% above actuarial estimates and 1% lower than pcp • Average claim settlement was 8% below actuarial estimates and 1% higher than pcp Nine Months ended 31 December 2019 • Net cash outflow was 6% below actuarial expectations 1 • Gross cash outflow was 1% above actuarial expectations • Claims received were 20% above actuarial estimates and 16% higher than pcp • Number of claims settled were 9% above actuarial estimates and 1% above pcp • Average claim settlement was 8% below actuarial estimates and 2% higher than pcp 1 Average claim settlement is derived as the total amount paid divided by the number of non‐nil claims Page 40

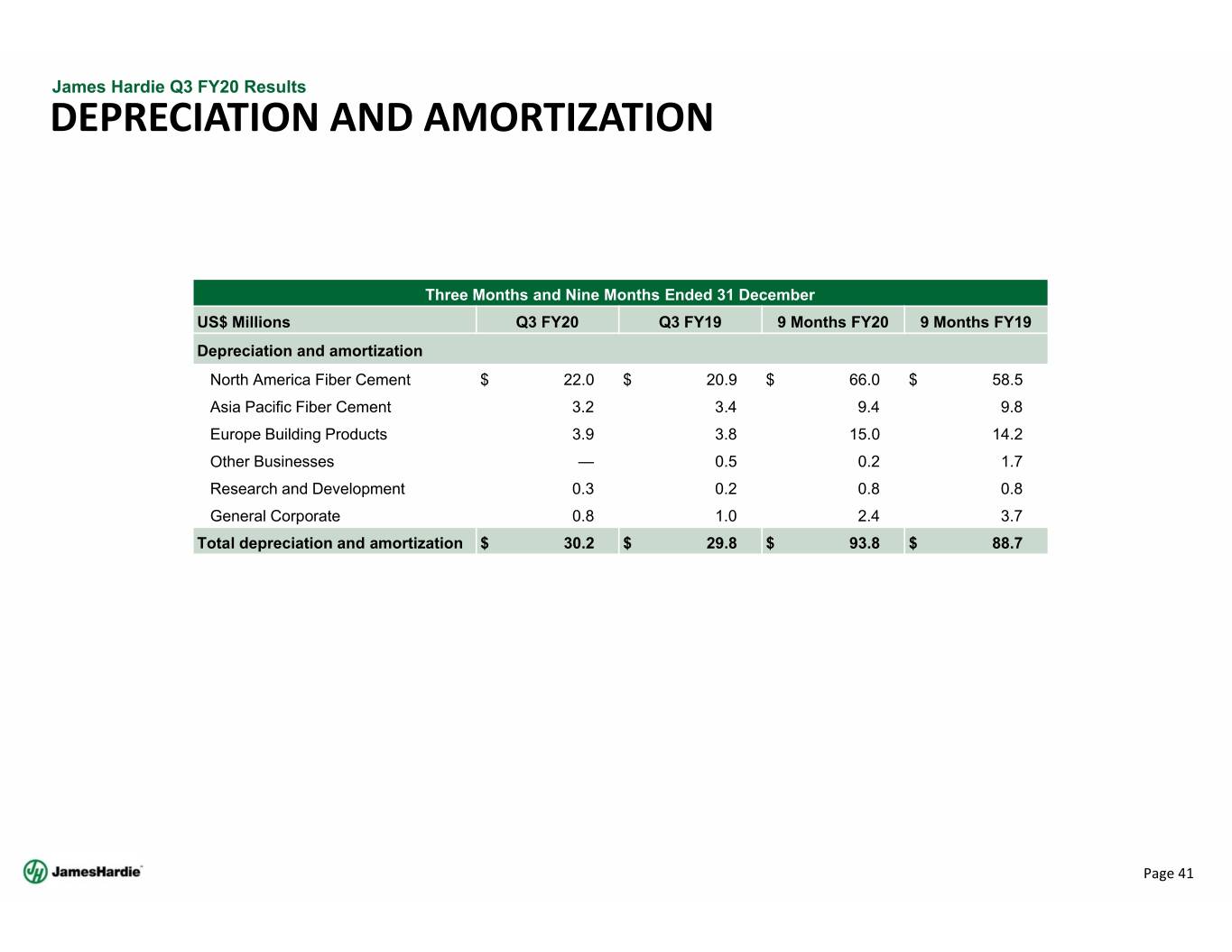

James Hardie Q3 FY20 Results DEPRECIATION AND AMORTIZATION Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 Depreciation and amortization North America Fiber Cement $ 22.0 $ 20.9 $ 66.0 $ 58.5 Asia Pacific Fiber Cement 3.2 3.4 9.4 9.8 Europe Building Products 3.9 3.8 15.0 14.2 Other Businesses — 0.5 0.2 1.7 Research and Development 0.3 0.2 0.8 0.8 General Corporate 0.8 1.0 2.4 3.7 Total depreciation and amortization $ 30.2 $ 29.8 $ 93.8 $ 88.7 Page 41

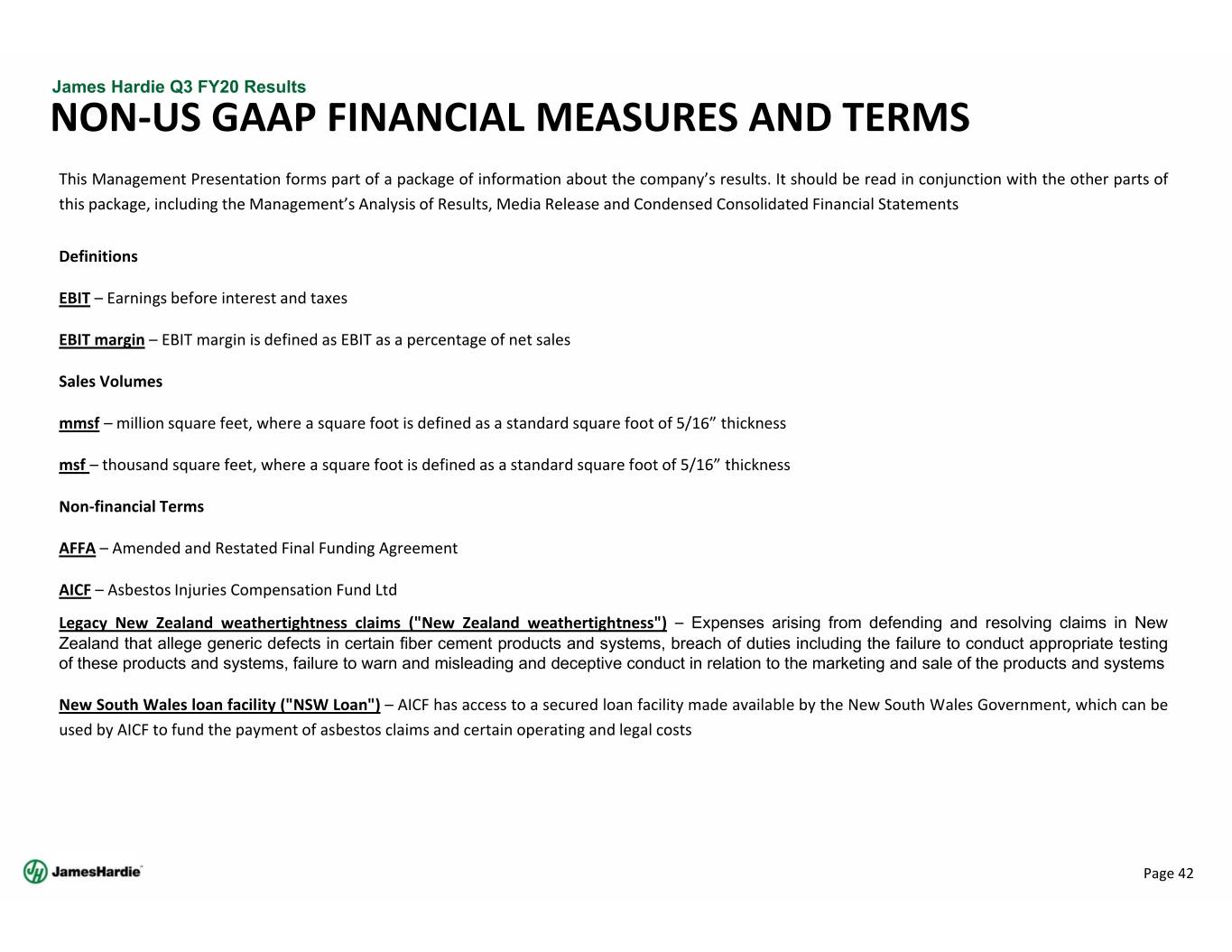

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES AND TERMS This Management Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other partsof this package, including the Management’s Analysis of Results, Media Release and Condensed Consolidated Financial Statements Definitions EBIT – Earnings before interest and taxes EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Sales Volumes mmsf – million square feet, where a square foot is defined as a standard square foot of 5/16” thickness msf – thousand square feet, where a square foot is defined as a standard square foot of 5/16” thickness Non‐financial Terms AFFA – Amended and Restated Final Funding Agreement AICF – Asbestos Injuries Compensation Fund Ltd Legacy New Zealand weathertightness claims ("New Zealand weathertightness") – Expenses arising from defending and resolving claims in New Zealand that allege generic defects in certain fiber cement products and systems, breach of duties including the failure to conduct appropriate testing of these products and systems, failure to warn and misleading and deceptive conduct in relation to the marketing and sale of the products and systems New South Wales loan facility ("NSW Loan") – AICF has access to a secured loan facility made available by the New South Wales Government, which can be used by AICF to fund the payment of asbestos claims and certain operating and legal costs Page 42

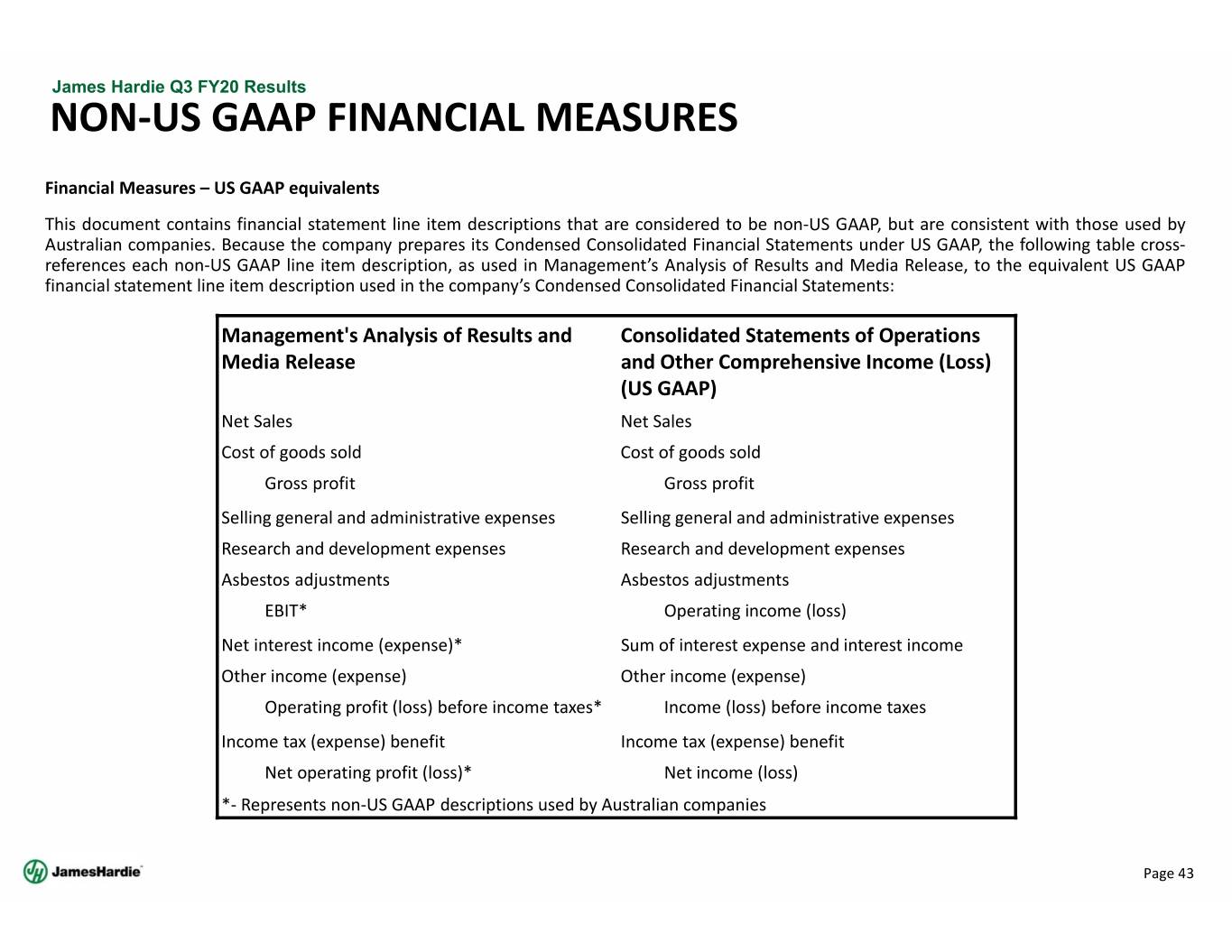

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES Financial Measures – US GAAP equivalents This document contains financial statement line item descriptions that are considered to be non‐US GAAP, but are consistent with those used by Australian companies. Because the company prepares its Condensed Consolidated Financial Statements under US GAAP, the following table cross‐ references each non‐US GAAP line item description, as used in Management’s Analysis of Results and Media Release, to the equivalent US GAAP financial statement line item description used in the company’s Condensed Consolidated Financial Statements: Management's Analysis of Results and Consolidated Statements of Operations Media Release and Other Comprehensive Income (Loss) (US GAAP) Net Sales Net Sales Cost of goods sold Cost of goods sold Gross profit Gross profit Selling general and administrative expenses Selling general and administrative expenses Research and development expenses Research and development expenses Asbestos adjustments Asbestos adjustments EBIT* Operating income (loss) Net interest income (expense)* Sum of interest expense and interest income Other income (expense) Other income (expense) Operating profit (loss) before income taxes* Income (loss) before income taxes Income tax (expense) benefit Income tax (expense) benefit Net operating profit (loss)* Net income (loss) *‐ Represents non‐US GAAP descriptions used by Australian companies Page 43

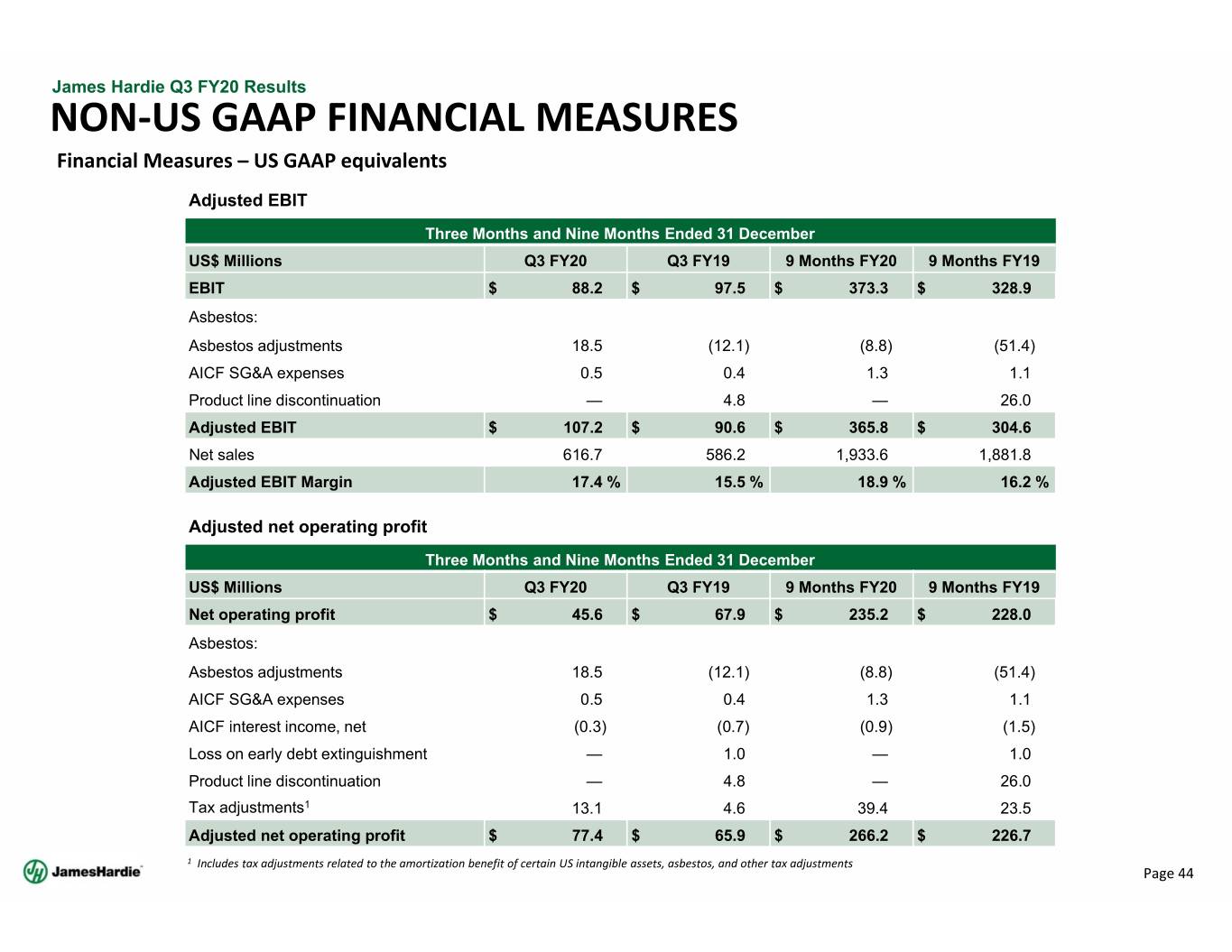

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES Financial Measures – US GAAP equivalents Adjusted EBIT Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 EBIT $ 88.2 $ 97.5 $ 373.3 $ 328.9 Asbestos: Asbestos adjustments 18.5 (12.1) (8.8) (51.4) AICF SG&A expenses 0.5 0.4 1.3 1.1 Product line discontinuation — 4.8 — 26.0 Adjusted EBIT $ 107.2 $ 90.6 $ 365.8 $ 304.6 Net sales 616.7 586.2 1,933.6 1,881.8 Adjusted EBIT Margin 17.4 % 15.5 % 18.9 % 16.2 % Adjusted net operating profit Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 Net operating profit $ 45.6 $ 67.9 $ 235.2 $ 228.0 Asbestos: Asbestos adjustments 18.5 (12.1) (8.8) (51.4) AICF SG&A expenses 0.5 0.4 1.3 1.1 AICF interest income, net (0.3) (0.7) (0.9) (1.5) Loss on early debt extinguishment — 1.0 — 1.0 Product line discontinuation — 4.8 — 26.0 Tax adjustments1 13.1 4.6 39.4 23.5 Adjusted net operating profit $ 77.4 $ 65.9 $ 266.2 $ 226.7 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Page 44

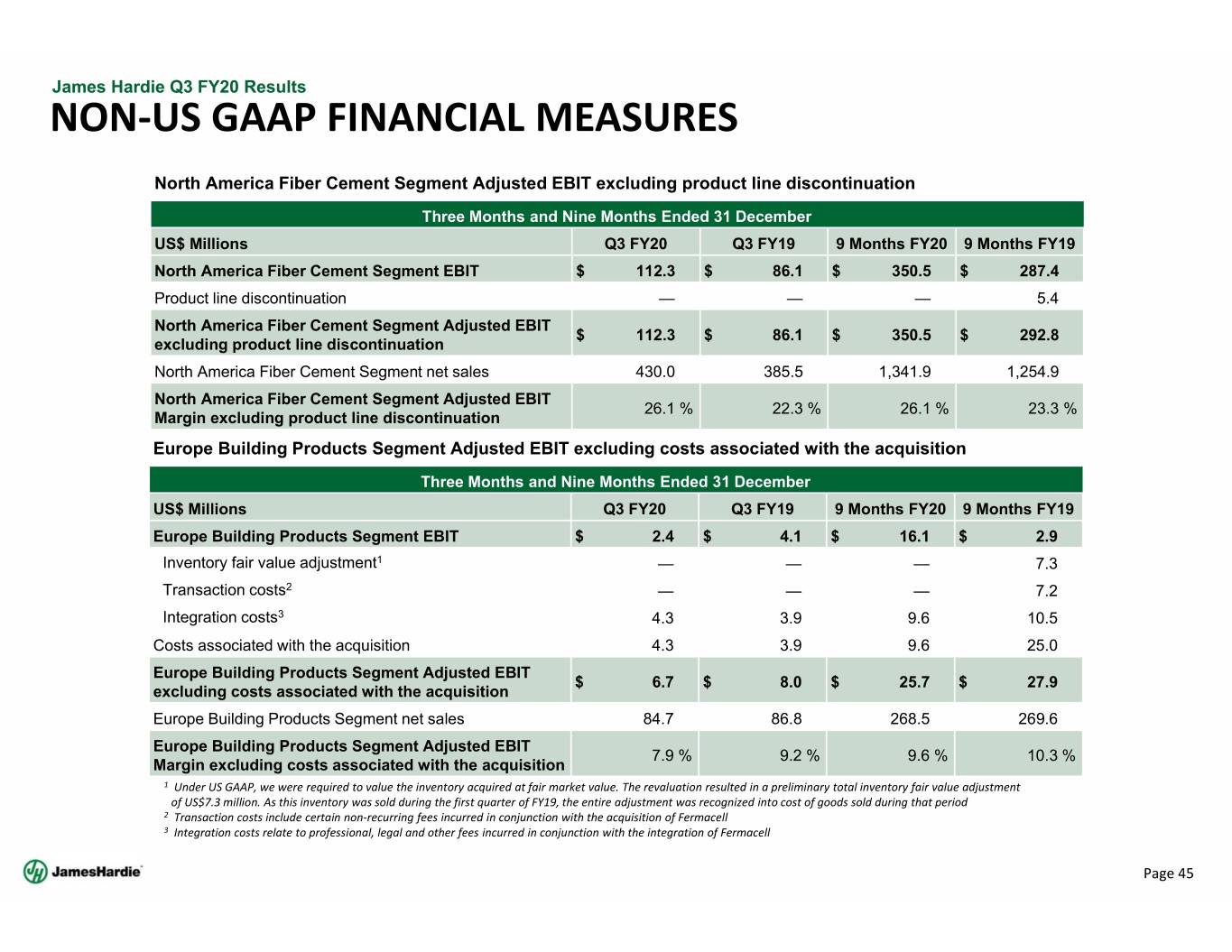

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES North America Fiber Cement Segment Adjusted EBIT excluding product line discontinuation Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 North America Fiber Cement Segment EBIT $ 112.3 $ 86.1 $ 350.5 $ 287.4 Product line discontinuation — — — 5.4 North America Fiber Cement Segment Adjusted EBIT $ 112.3 $ 86.1 $ 350.5 $ 292.8 excluding product line discontinuation North America Fiber Cement Segment net sales 430.0 385.5 1,341.9 1,254.9 North America Fiber Cement Segment Adjusted EBIT 26.1 % 22.3 % 26.1 % 23.3 % Margin excluding product line discontinuation Europe Building Products Segment Adjusted EBIT excluding costs associated with the acquisition Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 Europe Building Products Segment EBIT $ 2.4 $ 4.1 $ 16.1 $ 2.9 Inventory fair value adjustment1 ———7.3 Transaction costs2 ———7.2 Integration costs3 4.3 3.9 9.6 10.5 Costs associated with the acquisition 4.3 3.9 9.6 25.0 Europe Building Products Segment Adjusted EBIT $ 6.7 $ 8.0 $ 25.7 $ 27.9 excluding costs associated with the acquisition Europe Building Products Segment net sales 84.7 86.8 268.5 269.6 Europe Building Products Segment Adjusted EBIT 7.9 % 9.2 % 9.6 % 10.3 % Margin excluding costs associated with the acquisition 1 Under US GAAP, we were required to value the inventory acquired at fair market value. The revaluation resulted in a preliminary total inventory fair value adjustment of US$7.3 million. As this inventory was sold during the first quarter of FY19, the entire adjustment was recognized into cost of goods sold during that period 2 Transaction costs include certain non‐recurring fees incurred in conjunction with the acquisition of Fermacell 3 Integration costs relate to professional, legal and other fees incurred in conjunction with the integration of Fermacell Page 45

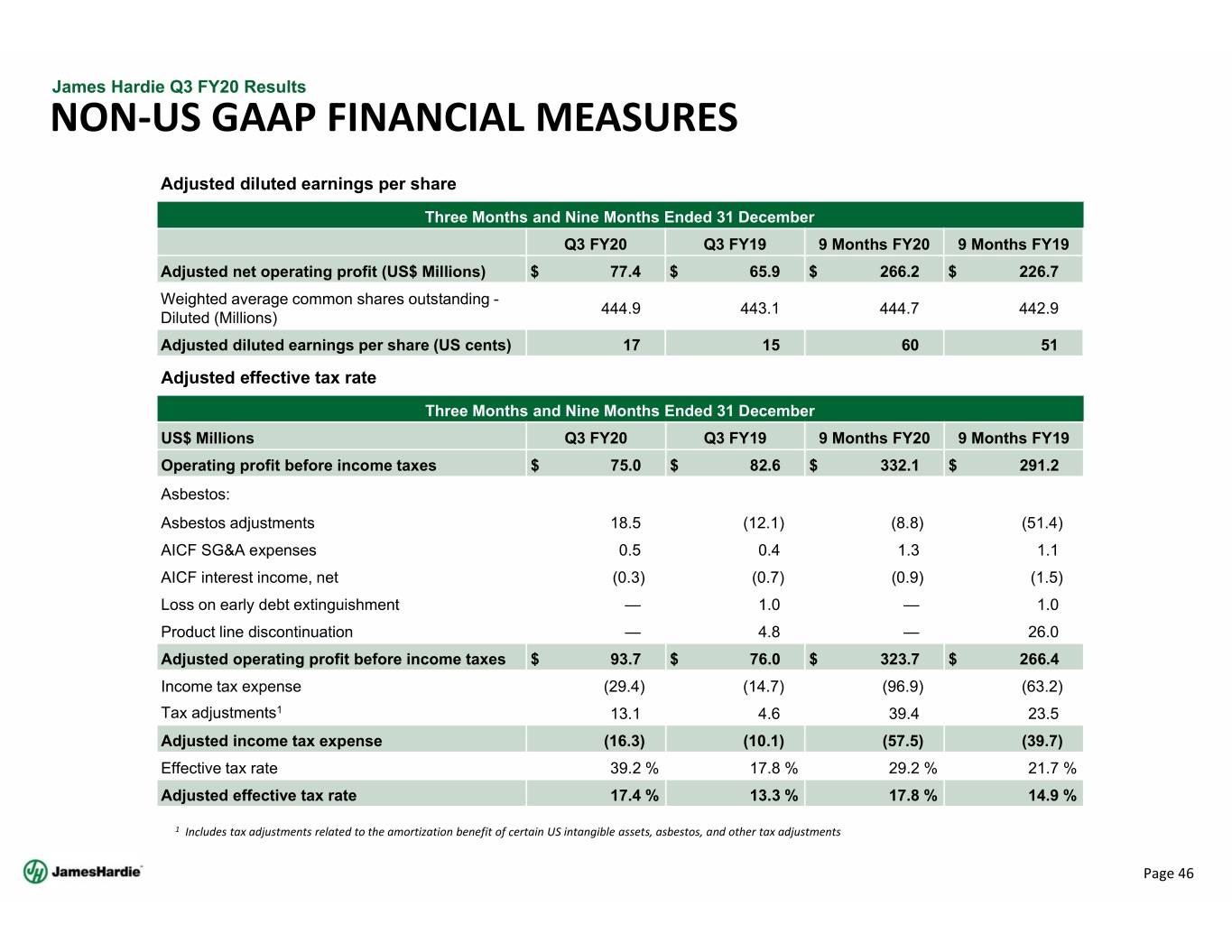

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES Adjusted diluted earnings per share Three Months and Nine Months Ended 31 December Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 Adjusted net operating profit (US$ Millions) $ 77.4 $ 65.9 $ 266.2 $ 226.7 Weighted average common shares outstanding - 444.9 443.1 444.7 442.9 Diluted (Millions) Adjusted diluted earnings per share (US cents) 17 15 60 51 Adjusted effective tax rate Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 Operating profit before income taxes $ 75.0 $ 82.6 $ 332.1 $ 291.2 Asbestos: Asbestos adjustments 18.5 (12.1) (8.8) (51.4) AICF SG&A expenses 0.5 0.4 1.3 1.1 AICF interest income, net (0.3) (0.7) (0.9) (1.5) Loss on early debt extinguishment — 1.0 — 1.0 Product line discontinuation — 4.8 — 26.0 Adjusted operating profit before income taxes $ 93.7 $ 76.0 $ 323.7 $ 266.4 Income tax expense (29.4) (14.7) (96.9) (63.2) Tax adjustments1 13.1 4.6 39.4 23.5 Adjusted income tax expense (16.3) (10.1) (57.5) (39.7) Effective tax rate 39.2 % 17.8 % 29.2 % 21.7 % Adjusted effective tax rate 17.4 % 13.3 % 17.8 % 14.9 % 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Page 46

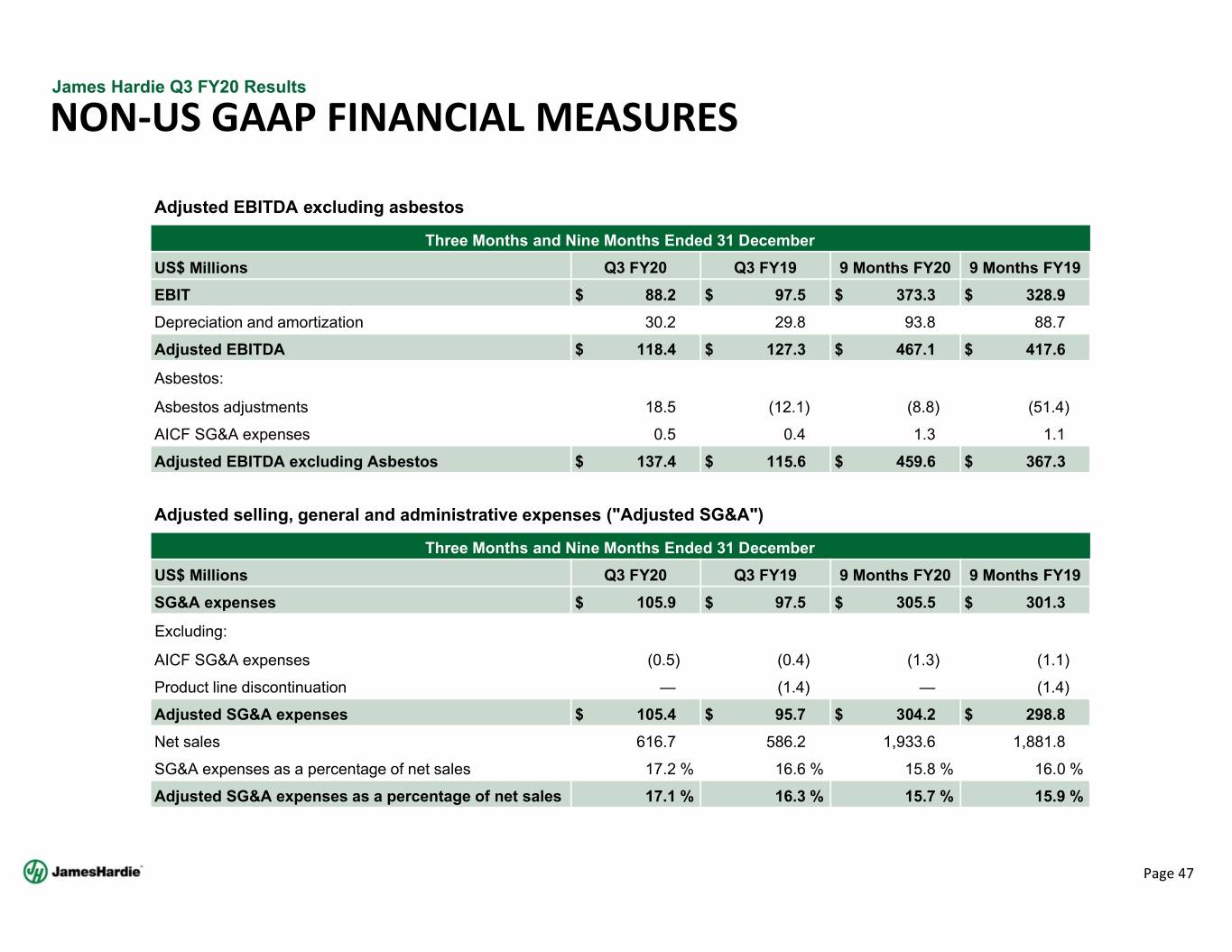

James Hardie Q3 FY20 Results NON‐US GAAP FINANCIAL MEASURES Adjusted EBITDA excluding asbestos Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 EBIT $ 88.2 $ 97.5 $ 373.3 $ 328.9 Depreciation and amortization 30.2 29.8 93.8 88.7 Adjusted EBITDA $ 118.4 $ 127.3 $ 467.1 $ 417.6 Asbestos: Asbestos adjustments 18.5 (12.1) (8.8) (51.4) AICF SG&A expenses 0.5 0.4 1.3 1.1 Adjusted EBITDA excluding Asbestos $ 137.4 $ 115.6 $ 459.6 $ 367.3 Adjusted selling, general and administrative expenses ("Adjusted SG&A") Three Months and Nine Months Ended 31 December US$ Millions Q3 FY20 Q3 FY19 9 Months FY20 9 Months FY19 SG&A expenses $ 105.9 $ 97.5 $ 305.5 $ 301.3 Excluding: AICF SG&A expenses (0.5) (0.4) (1.3) (1.1) Product line discontinuation — (1.4) — (1.4) Adjusted SG&A expenses $ 105.4 $ 95.7 $ 304.2 $ 298.8 Net sales 616.7 586.2 1,933.6 1,881.8 SG&A expenses as a percentage of net sales 17.2 % 16.6 % 15.8 % 16.0 % Adjusted SG&A expenses as a percentage of net sales 17.1 % 16.3 % 15.7 % 15.9 % Page 47

Q3 FY20 MANAGEMENT PRESENTATION 12 February 2020