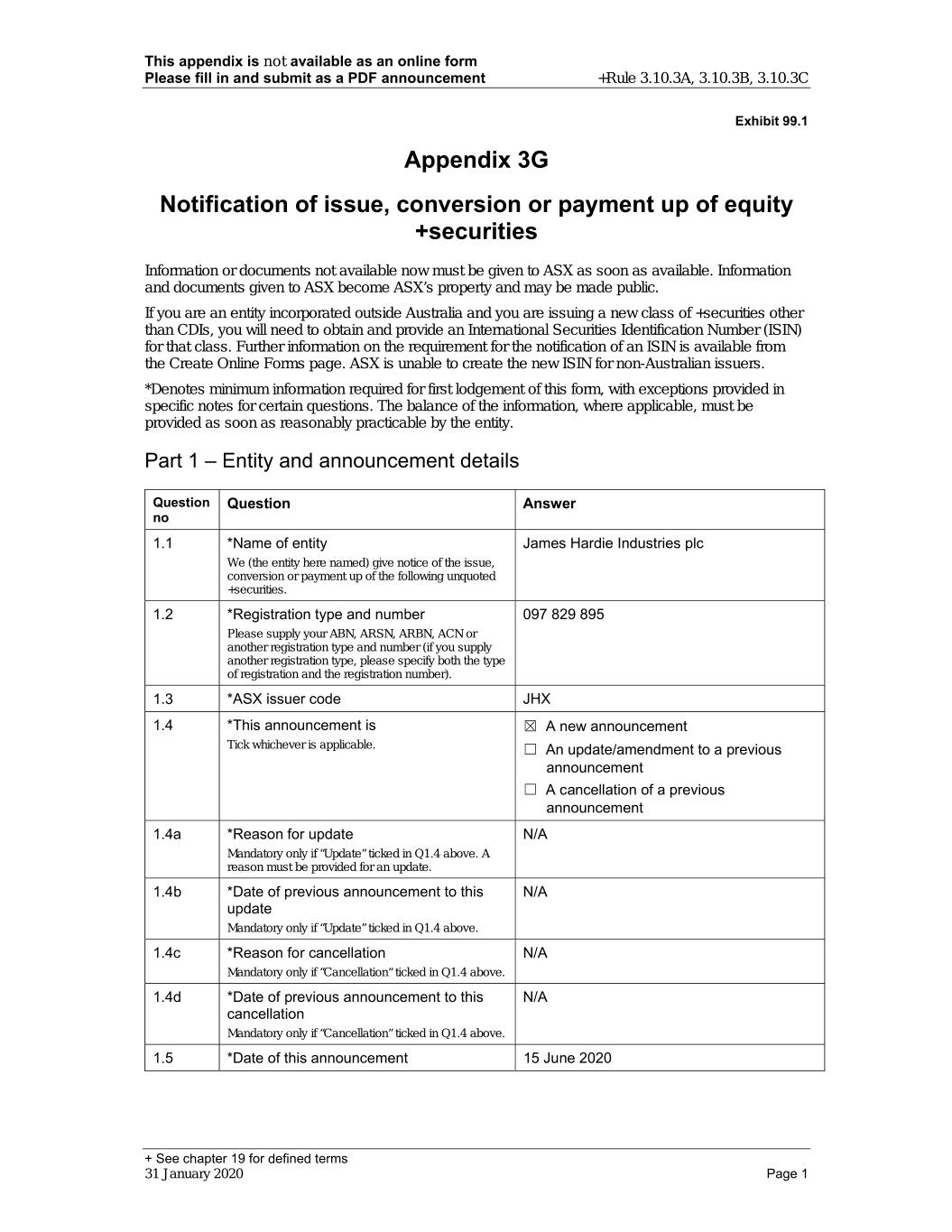

This appendix is not available as an online form Please fill in and submit as a PDF announcement +Rule 3.10.3A, 3.10.3B, 3.10.3C Exhibit 99.1 Appendix 3G Notification of issue, conversion or payment up of equity +securities Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. If you are an entity incorporated outside Australia and you are issuing a new class of +securities other than CDIs, you will need to obtain and provide an International Securities Identification Number (ISIN) for that class. Further information on the requirement for the notification of an ISIN is available from the Create Online Forms page. ASX is unable to create the new ISIN for non-Australian issuers. *Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity. Part 1 – Entity and announcement details Question Question Answer no 1.1 *Name of entity James Hardie Industries plc We (the entity here named) give notice of the issue, conversion or payment up of the following unquoted +securities. 1.2 *Registration type and number 097 829 895 Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). 1.3 *ASX issuer code JHX 1.4 *This announcement is ☒ A new announcement Tick whichever is applicable. ☐ An update/amendment to a previous announcement ☐ A cancellation of a previous announcement 1.4a *Reason for update N/A Mandatory only if “Update” ticked in Q1.4 above. A reason must be provided for an update. 1.4b *Date of previous announcement to this N/A update Mandatory only if “Update” ticked in Q1.4 above. 1.4c *Reason for cancellation N/A Mandatory only if “Cancellation” ticked in Q1.4 above. 1.4d *Date of previous announcement to this N/A cancellation Mandatory only if “Cancellation” ticked in Q1.4 above. 1.5 *Date of this announcement 15 June 2020 + See chapter 19 for defined terms 31 January 2020 Page 1

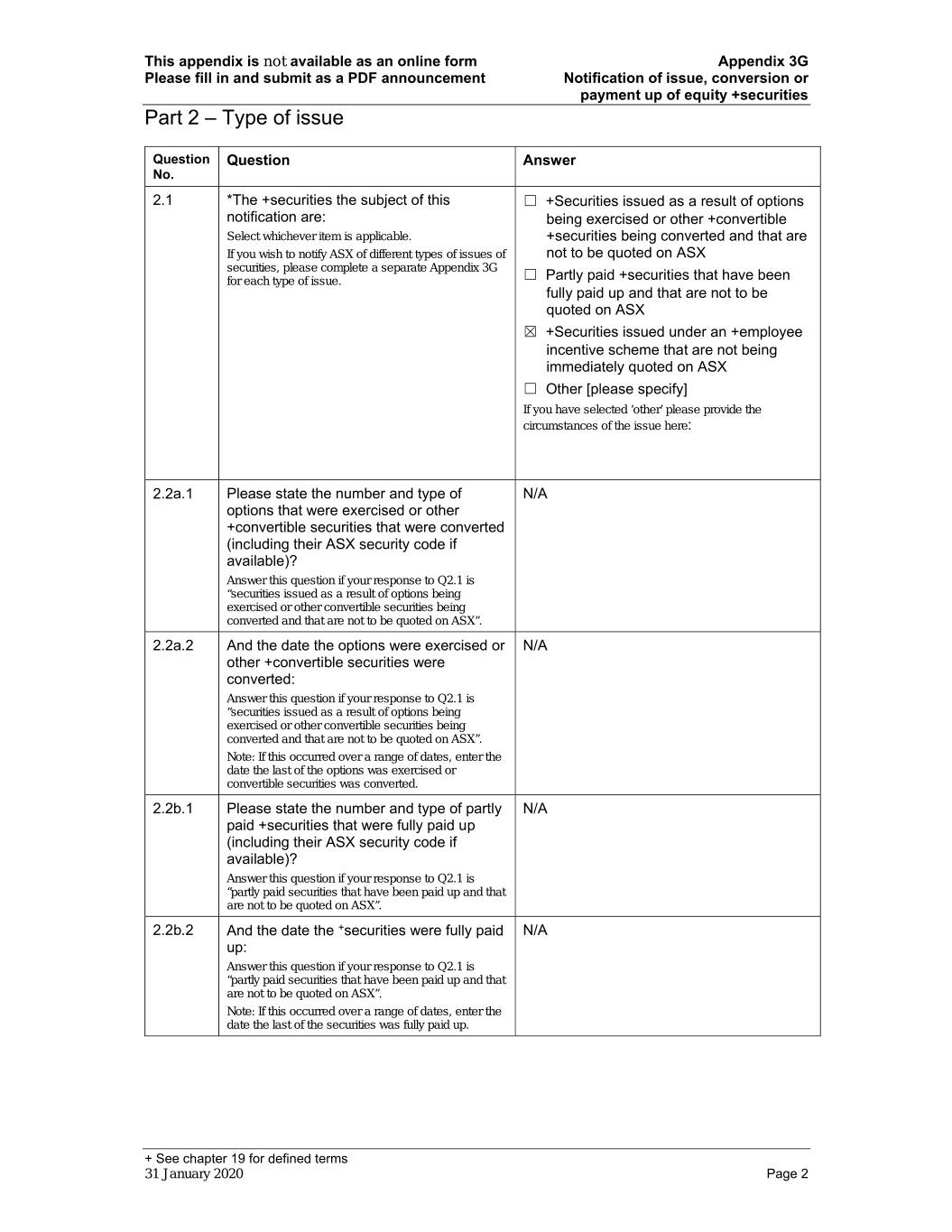

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 2 – Type of issue Question Question Answer No. 2.1 *The +securities the subject of this ☐ +Securities issued as a result of options notification are: being exercised or other +convertible Select whichever item is applicable. +securities being converted and that are If you wish to notify ASX of different types of issues of not to be quoted on ASX securities, please complete a separate Appendix 3G for each type of issue. ☐ Partly paid +securities that have been fully paid up and that are not to be quoted on ASX ☒ +Securities issued under an +employee incentive scheme that are not being immediately quoted on ASX ☐ Other [please specify] If you have selected ‘other’ please provide the circumstances of the issue here: 2.2a.1 Please state the number and type of N/A options that were exercised or other +convertible securities that were converted (including their ASX security code if available)? Answer this question if your response to Q2.1 is “securities issued as a result of options being exercised or other convertible securities being converted and that are not to be quoted on ASX”. 2.2a.2 And the date the options were exercised or N/A other +convertible securities were converted: Answer this question if your response to Q2.1 is “securities issued as a result of options being exercised or other convertible securities being converted and that are not to be quoted on ASX”. Note: If this occurred over a range of dates, enter the date the last of the options was exercised or convertible securities was converted. 2.2b.1 Please state the number and type of partly N/A paid +securities that were fully paid up (including their ASX security code if available)? Answer this question if your response to Q2.1 is “partly paid securities that have been paid up and that are not to be quoted on ASX”. 2.2b.2 And the date the +securities were fully paid N/A up: Answer this question if your response to Q2.1 is “partly paid securities that have been paid up and that are not to be quoted on ASX”. Note: If this occurred over a range of dates, enter the date the last of the securities was fully paid up. + See chapter 19 for defined terms 31 January 2020 Page 2

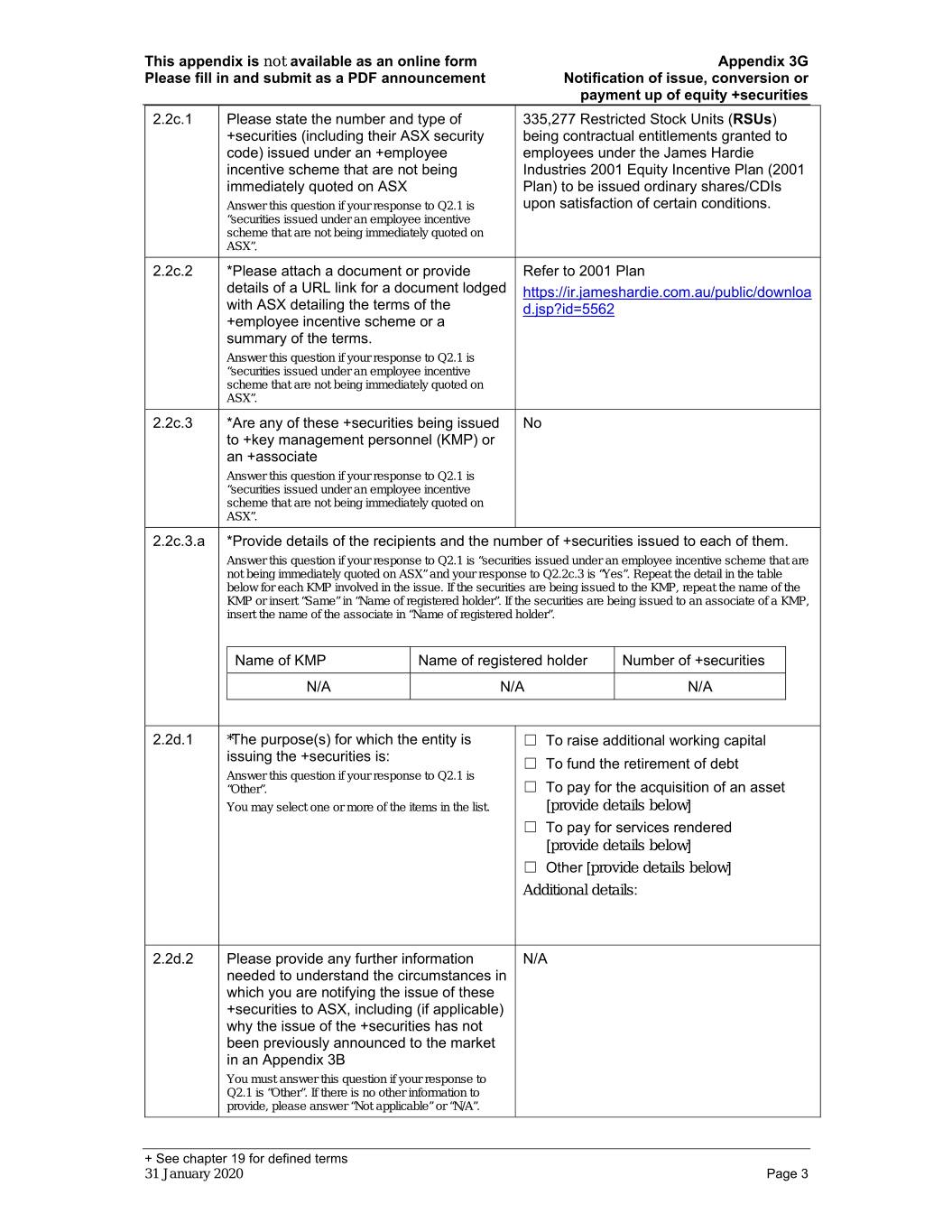

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 2.2c.1 Please state the number and type of 335,277 Restricted Stock Units (RSUs) +securities (including their ASX security being contractual entitlements granted to code) issued under an +employee employees under the James Hardie incentive scheme that are not being Industries 2001 Equity Incentive Plan (2001 immediately quoted on ASX Plan) to be issued ordinary shares/CDIs Answer this question if your response to Q2.1 is upon satisfaction of certain conditions. “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 2.2c.2 *Please attach a document or provide Refer to 2001 Plan details of a URL link for a document lodged https://ir.jameshardie.com.au/public/downloa with ASX detailing the terms of the d.jsp?id=5562 +employee incentive scheme or a summary of the terms. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 2.2c.3 *Are any of these +securities being issued No to +key management personnel (KMP) or an +associate Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 2.2c.3.a *Provide details of the recipients and the number of +securities issued to each of them. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX” and your response to Q2.2c.3 is “Yes”. Repeat the detail in the table below for each KMP involved in the issue. If the securities are being issued to the KMP, repeat the name of the KMP or insert “Same” in “Name of registered holder”. If the securities are being issued to an associate of a KMP, insert the name of the associate in “Name of registered holder”. Name of KMP Name of registered holder Number of +securities N/A N/A N/A 2.2d.1 *The purpose(s) for which the entity is ☐ To raise additional working capital issuing the +securities is: ☐ To fund the retirement of debt Answer this question if your response to Q2.1 is “Other”. ☐ To pay for the acquisition of an asset You may select one or more of the items in the list. [provide details below] ☐ To pay for services rendered [provide details below] ☐ Other [provide details below] Additional details: 2.2d.2 Please provide any further information N/A needed to understand the circumstances in which you are notifying the issue of these +securities to ASX, including (if applicable) why the issue of the +securities has not been previously announced to the market in an Appendix 3B You must answer this question if your response to Q2.1 is “Other”. If there is no other information to provide, please answer “Not applicable” or “N/A”. + See chapter 19 for defined terms 31 January 2020 Page 3

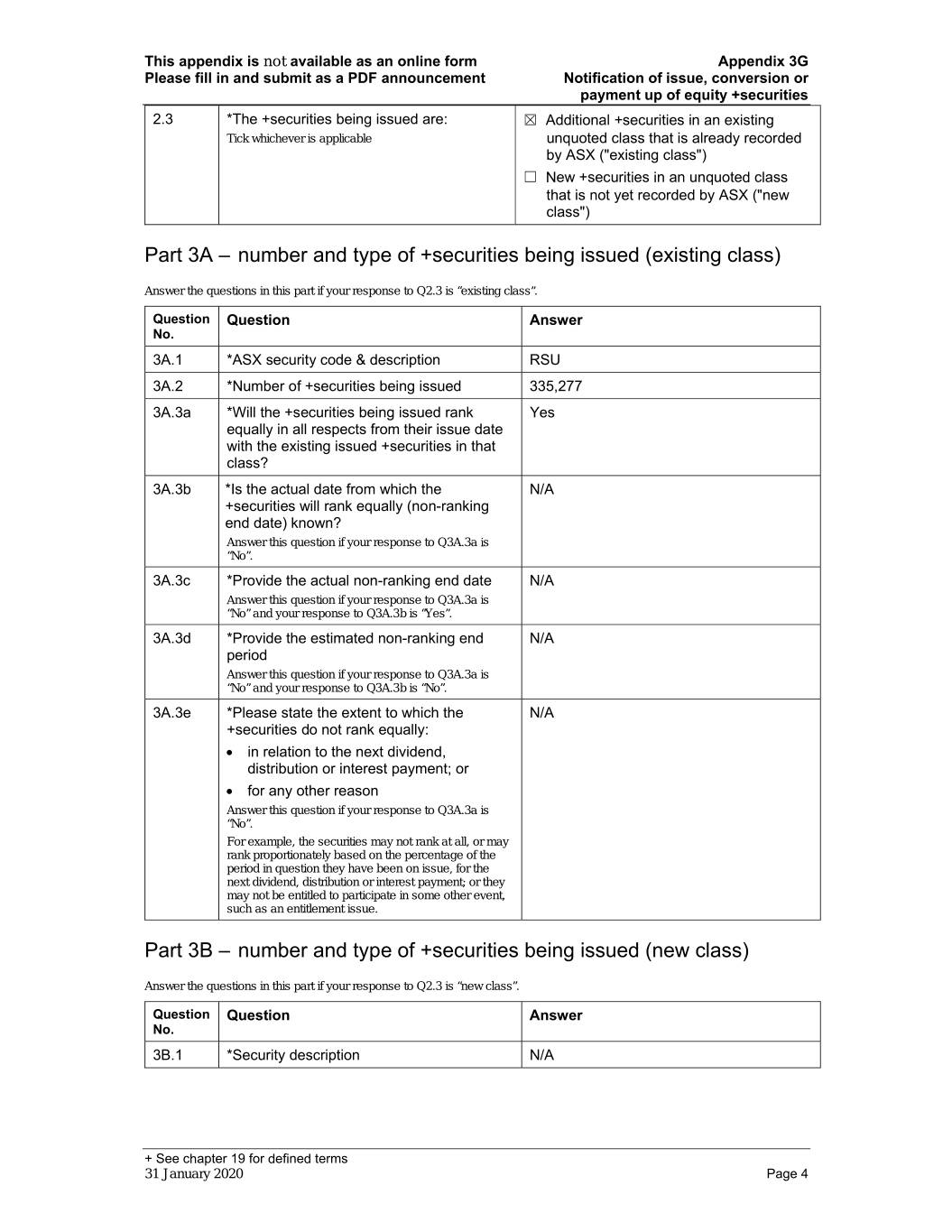

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 2.3 *The +securities being issued are: ☒ Additional +securities in an existing Tick whichever is applicable unquoted class that is already recorded by ASX ("existing class") ☐ New +securities in an unquoted class that is not yet recorded by ASX ("new class") Part 3A – number and type of +securities being issued (existing class) Answer the questions in this part if your response to Q2.3 is “existing class”. Question Question Answer No. 3A.1 *ASX security code & description RSU 3A.2 *Number of +securities being issued 335,277 3A.3a *Will the +securities being issued rank Yes equally in all respects from their issue date with the existing issued +securities in that class? 3A.3b *Is the actual date from which the N/A +securities will rank equally (non-ranking end date) known? Answer this question if your response to Q3A.3a is “No”. 3A.3c *Provide the actual non-ranking end date N/A Answer this question if your response to Q3A.3a is “No” and your response to Q3A.3b is “Yes”. 3A.3d *Provide the estimated non-ranking end N/A period Answer this question if your response to Q3A.3a is “No” and your response to Q3A.3b is “No”. 3A.3e *Please state the extent to which the N/A +securities do not rank equally: in relation to the next dividend, distribution or interest payment; or for any other reason Answer this question if your response to Q3A.3a is “No”. For example, the securities may not rank at all, or may rank proportionately based on the percentage of the period in question they have been on issue, for the next dividend, distribution or interest payment; or they may not be entitled to participate in some other event, such as an entitlement issue. Part 3B – number and type of +securities being issued (new class) Answer the questions in this part if your response to Q2.3 is “new class”. Question Question Answer No. 3B.1 *Security description N/A + See chapter 19 for defined terms 31 January 2020 Page 4

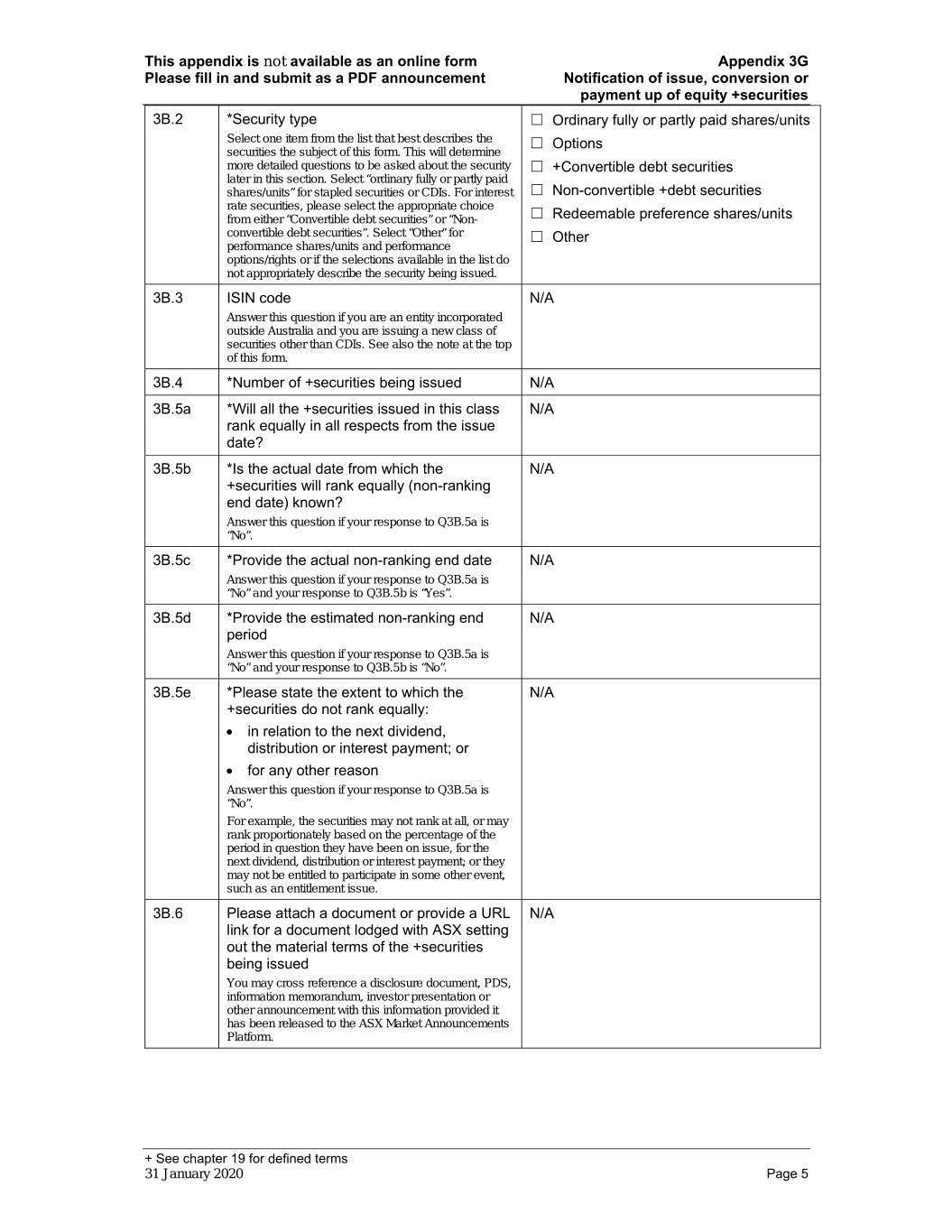

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 3B.2 *Security type ☐ Ordinary fully or partly paid shares/units Select one item from the list that best describes the ☐ Options securities the subject of this form. This will determine more detailed questions to be asked about the security ☐ +Convertible debt securities later in this section. Select “ordinary fully or partly paid shares/units” for stapled securities or CDIs. For interest ☐ Non-convertible +debt securities rate securities, please select the appropriate choice from either “Convertible debt securities” or “Non- ☐ Redeemable preference shares/units convertible debt securities”. Select “Other” for ☐ Other performance shares/units and performance options/rights or if the selections available in the list do not appropriately describe the security being issued. 3B.3 ISIN code N/A Answer this question if you are an entity incorporated outside Australia and you are issuing a new class of securities other than CDIs. See also the note at the top of this form. 3B.4 *Number of +securities being issued N/A 3B.5a *Will all the +securities issued in this class N/A rank equally in all respects from the issue date? 3B.5b *Is the actual date from which the N/A +securities will rank equally (non-ranking end date) known? Answer this question if your response to Q3B.5a is “No”. 3B.5c *Provide the actual non-ranking end date N/A Answer this question if your response to Q3B.5a is “No” and your response to Q3B.5b is “Yes”. 3B.5d *Provide the estimated non-ranking end N/A period Answer this question if your response to Q3B.5a is “No” and your response to Q3B.5b is “No”. 3B.5e *Please state the extent to which the N/A +securities do not rank equally: in relation to the next dividend, distribution or interest payment; or for any other reason Answer this question if your response to Q3B.5a is “No”. For example, the securities may not rank at all, or may rank proportionately based on the percentage of the period in question they have been on issue, for the next dividend, distribution or interest payment; or they may not be entitled to participate in some other event, such as an entitlement issue. 3B.6 Please attach a document or provide a URL N/A link for a document lodged with ASX setting out the material terms of the +securities being issued You may cross reference a disclosure document, PDS, information memorandum, investor presentation or other announcement with this information provided it has been released to the ASX Market Announcements Platform. + See chapter 19 for defined terms 31 January 2020 Page 5

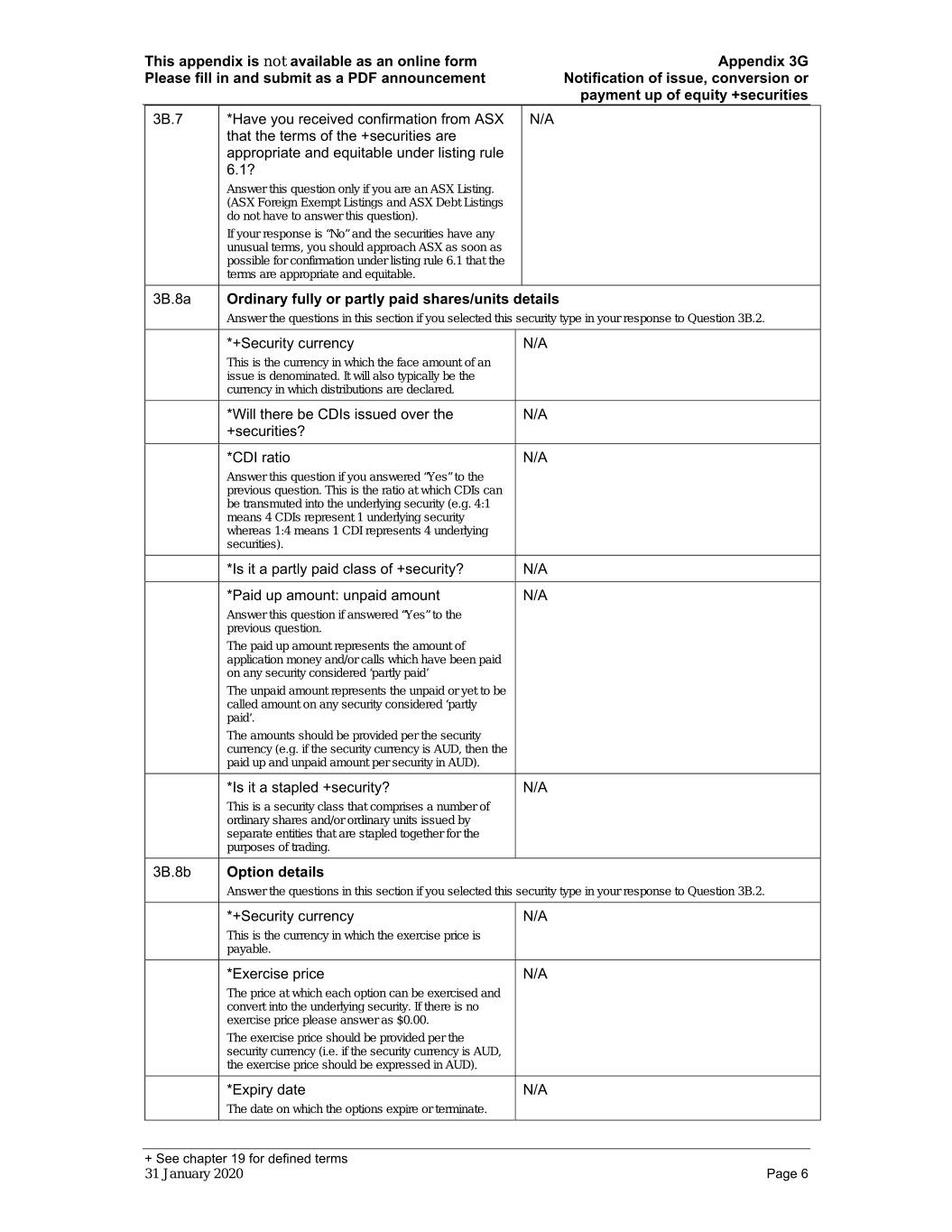

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 3B.7 *Have you received confirmation from ASX N/A that the terms of the +securities are appropriate and equitable under listing rule 6.1? Answer this question only if you are an ASX Listing. (ASX Foreign Exempt Listings and ASX Debt Listings do not have to answer this question). If your response is “No” and the securities have any unusual terms, you should approach ASX as soon as possible for confirmation under listing rule 6.1 that the terms are appropriate and equitable. 3B.8a Ordinary fully or partly paid shares/units details Answer the questions in this section if you selected this security type in your response to Question 3B.2. *+Security currency N/A This is the currency in which the face amount of an issue is denominated. It will also typically be the currency in which distributions are declared. *Will there be CDIs issued over the N/A +securities? *CDI ratio N/A Answer this question if you answered “Yes” to the previous question. This is the ratio at which CDIs can be transmuted into the underlying security (e.g. 4:1 means 4 CDIs represent 1 underlying security whereas 1:4 means 1 CDI represents 4 underlying securities). *Is it a partly paid class of +security? N/A *Paid up amount: unpaid amount N/A Answer this question if answered “Yes” to the previous question. The paid up amount represents the amount of application money and/or calls which have been paid on any security considered ‘partly paid’ The unpaid amount represents the unpaid or yet to be called amount on any security considered ‘partly paid’. The amounts should be provided per the security currency (e.g. if the security currency is AUD, then the paid up and unpaid amount per security in AUD). *Is it a stapled +security? N/A This is a security class that comprises a number of ordinary shares and/or ordinary units issued by separate entities that are stapled together for the purposes of trading. 3B.8b Option details Answer the questions in this section if you selected this security type in your response to Question 3B.2. *+Security currency N/A This is the currency in which the exercise price is payable. *Exercise price N/A The price at which each option can be exercised and convert into the underlying security. If there is no exercise price please answer as $0.00. The exercise price should be provided per the security currency (i.e. if the security currency is AUD, the exercise price should be expressed in AUD). *Expiry date N/A The date on which the options expire or terminate. + See chapter 19 for defined terms 31 January 2020 Page 6

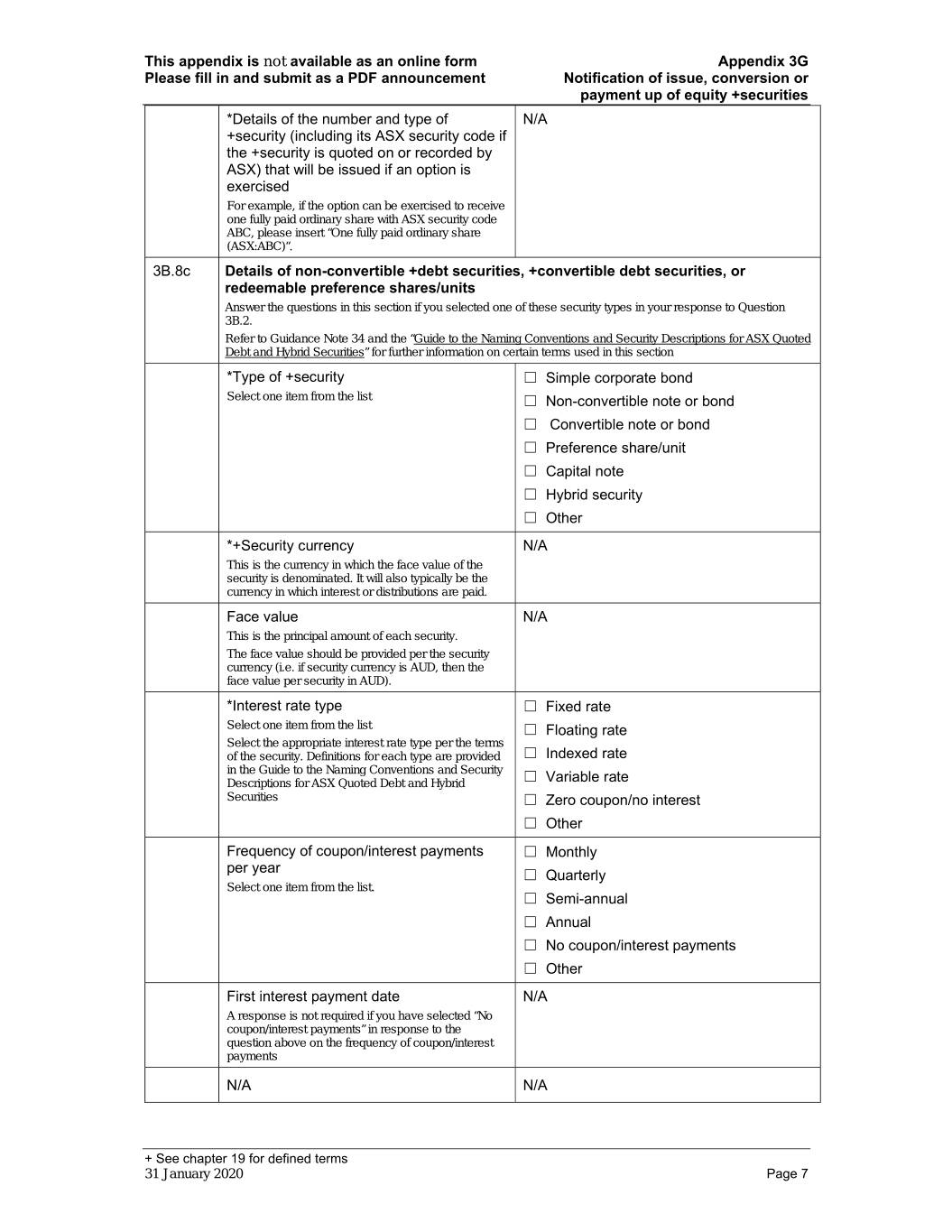

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities *Details of the number and type of N/A +security (including its ASX security code if the +security is quoted on or recorded by ASX) that will be issued if an option is exercised For example, if the option can be exercised to receive one fully paid ordinary share with ASX security code ABC, please insert “One fully paid ordinary share (ASX:ABC)“. 3B.8c Details of non-convertible +debt securities, +convertible debt securities, or redeemable preference shares/units Answer the questions in this section if you selected one of these security types in your response to Question 3B.2. Refer to Guidance Note 34 and the “Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities” for further information on certain terms used in this section *Type of +security ☐ Simple corporate bond Select one item from the list ☐ Non-convertible note or bond ☐ Convertible note or bond ☐ Preference share/unit ☐ Capital note ☐ Hybrid security ☐ Other *+Security currency N/A This is the currency in which the face value of the security is denominated. It will also typically be the currency in which interest or distributions are paid. Face value N/A This is the principal amount of each security. The face value should be provided per the security currency (i.e. if security currency is AUD, then the face value per security in AUD). *Interest rate type ☐ Fixed rate Select one item from the list ☐ Floating rate Select the appropriate interest rate type per the terms of the security. Definitions for each type are provided ☐ Indexed rate in the Guide to the Naming Conventions and Security ☐ Descriptions for ASX Quoted Debt and Hybrid Variable rate Securities ☐ Zero coupon/no interest ☐ Other Frequency of coupon/interest payments ☐ Monthly per year ☐ Quarterly Select one item from the list. ☐ Semi-annual ☐ Annual ☐ No coupon/interest payments ☐ Other First interest payment date N/A A response is not required if you have selected “No coupon/interest payments” in response to the question above on the frequency of coupon/interest payments N/A N/A + See chapter 19 for defined terms 31 January 2020 Page 7

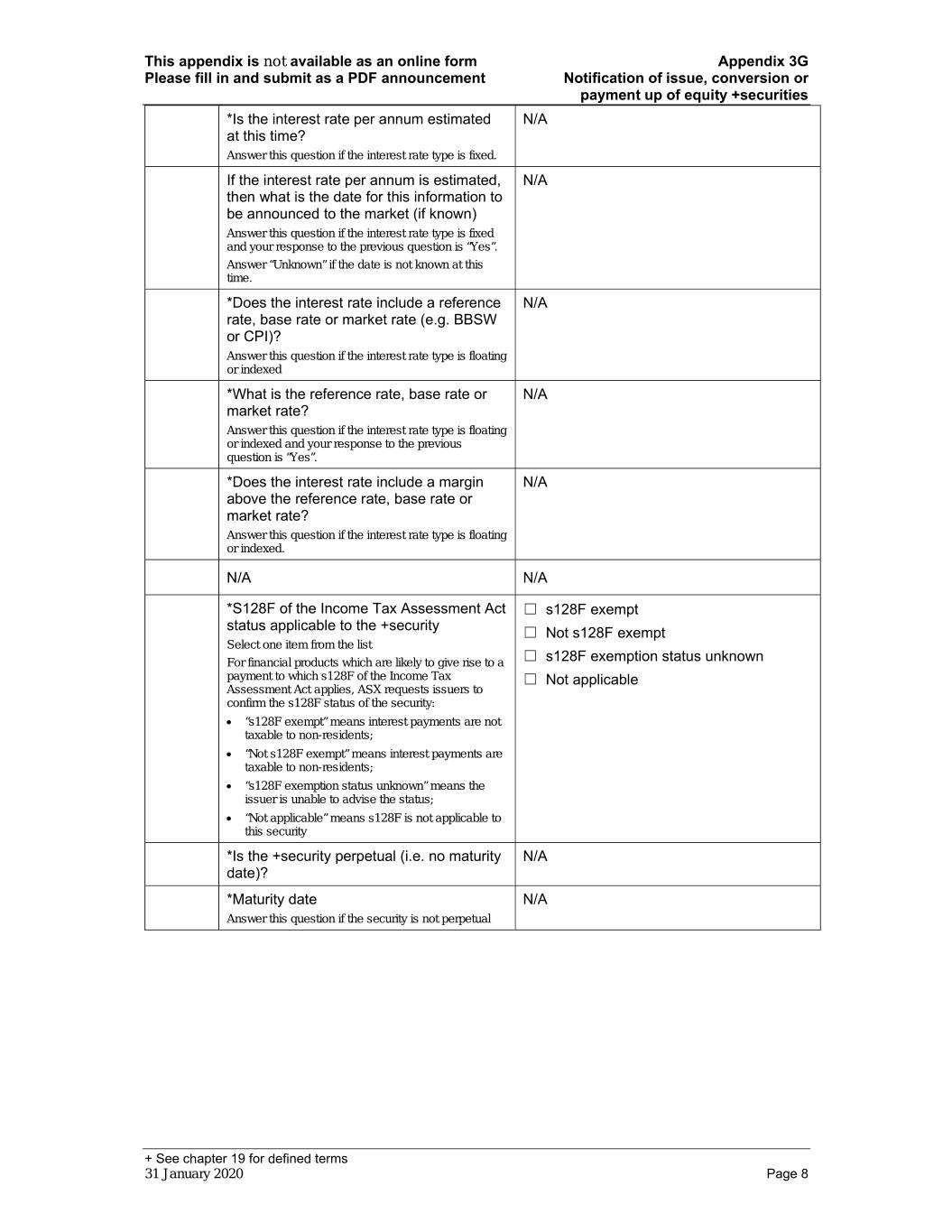

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities *Is the interest rate per annum estimated N/A at this time? Answer this question if the interest rate type is fixed. If the interest rate per annum is estimated, N/A then what is the date for this information to be announced to the market (if known) Answer this question if the interest rate type is fixed and your response to the previous question is “Yes”. Answer “Unknown” if the date is not known at this time. *Does the interest rate include a reference N/A rate, base rate or market rate (e.g. BBSW or CPI)? Answer this question if the interest rate type is floating or indexed *What is the reference rate, base rate or N/A market rate? Answer this question if the interest rate type is floating or indexed and your response to the previous question is “Yes”. *Does the interest rate include a margin N/A above the reference rate, base rate or market rate? Answer this question if the interest rate type is floating or indexed. N/A N/A *S128F of the Income Tax Assessment Act ☐ s128F exempt status applicable to the +security ☐ Not s128F exempt Select one item from the list For financial products which are likely to give rise to a ☐ s128F exemption status unknown payment to which s128F of the Income Tax ☐ Not applicable Assessment Act applies, ASX requests issuers to confirm the s128F status of the security: “s128F exempt” means interest payments are not taxable to non-residents; “Not s128F exempt” means interest payments are taxable to non-residents; “s128F exemption status unknown” means the issuer is unable to advise the status; “Not applicable” means s128F is not applicable to this security *Is the +security perpetual (i.e. no maturity N/A date)? *Maturity date N/A Answer this question if the security is not perpetual + See chapter 19 for defined terms 31 January 2020 Page 8

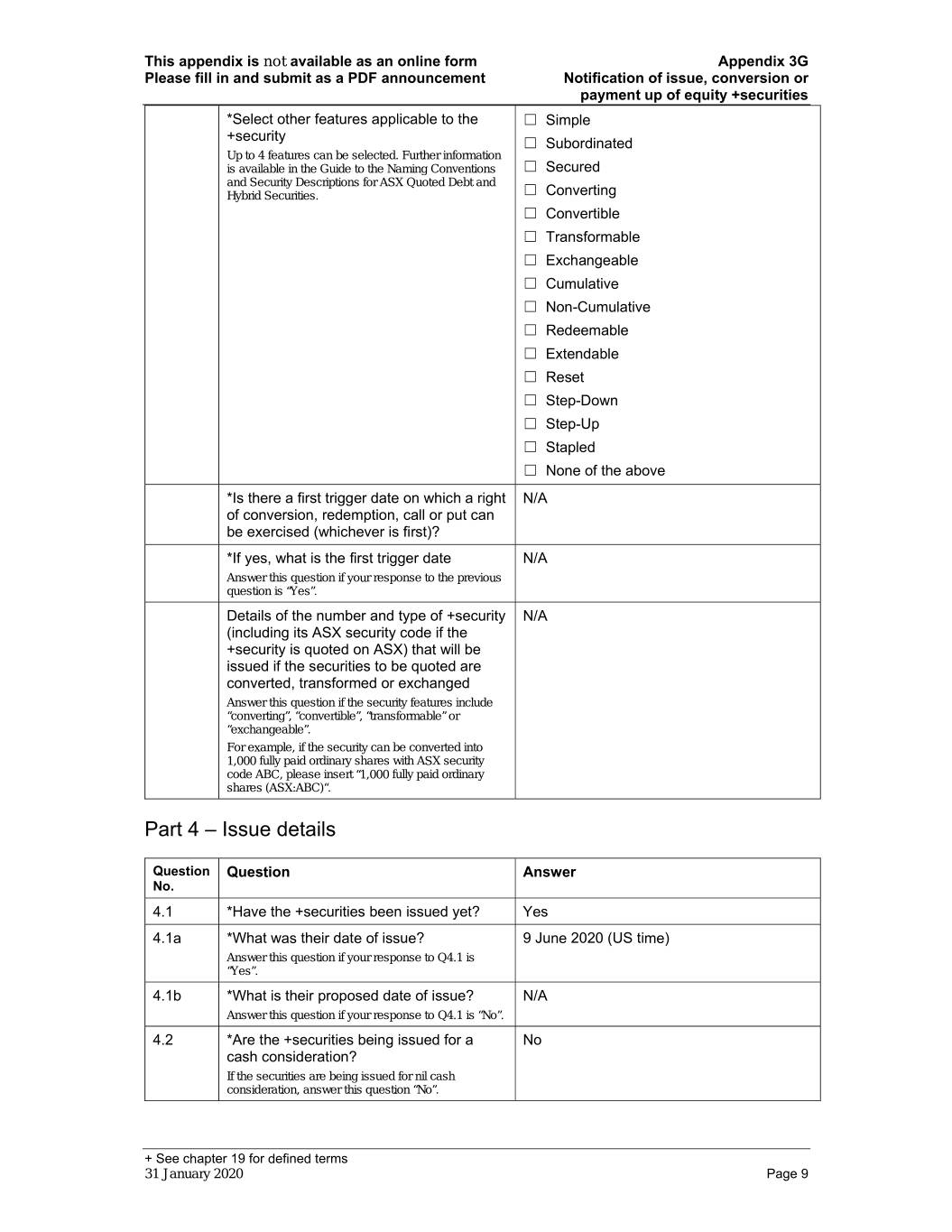

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities *Select other features applicable to the ☐ Simple +security ☐ Subordinated Up to 4 features can be selected. Further information is available in the Guide to the Naming Conventions ☐ Secured and Security Descriptions for ASX Quoted Debt and Hybrid Securities. ☐ Converting ☐ Convertible ☐ Transformable ☐ Exchangeable ☐ Cumulative ☐ Non-Cumulative ☐ Redeemable ☐ Extendable ☐ Reset ☐ Step-Down ☐ Step-Up ☐ Stapled ☐ None of the above *Is there a first trigger date on which a right N/A of conversion, redemption, call or put can be exercised (whichever is first)? *If yes, what is the first trigger date N/A Answer this question if your response to the previous question is “Yes”. Details of the number and type of +security N/A (including its ASX security code if the +security is quoted on ASX) that will be issued if the securities to be quoted are converted, transformed or exchanged Answer this question if the security features include “converting”, “convertible”, “transformable” or “exchangeable”. For example, if the security can be converted into 1,000 fully paid ordinary shares with ASX security code ABC, please insert “1,000 fully paid ordinary shares (ASX:ABC)“. Part 4 – Issue details Question Question Answer No. 4.1 *Have the +securities been issued yet? Yes 4.1a *What was their date of issue? 9 June 2020 (US time) Answer this question if your response to Q4.1 is “Yes”. 4.1b *What is their proposed date of issue? N/A Answer this question if your response to Q4.1 is “No”. 4.2 *Are the +securities being issued for a No cash consideration? If the securities are being issued for nil cash consideration, answer this question “No”. + See chapter 19 for defined terms 31 January 2020 Page 9

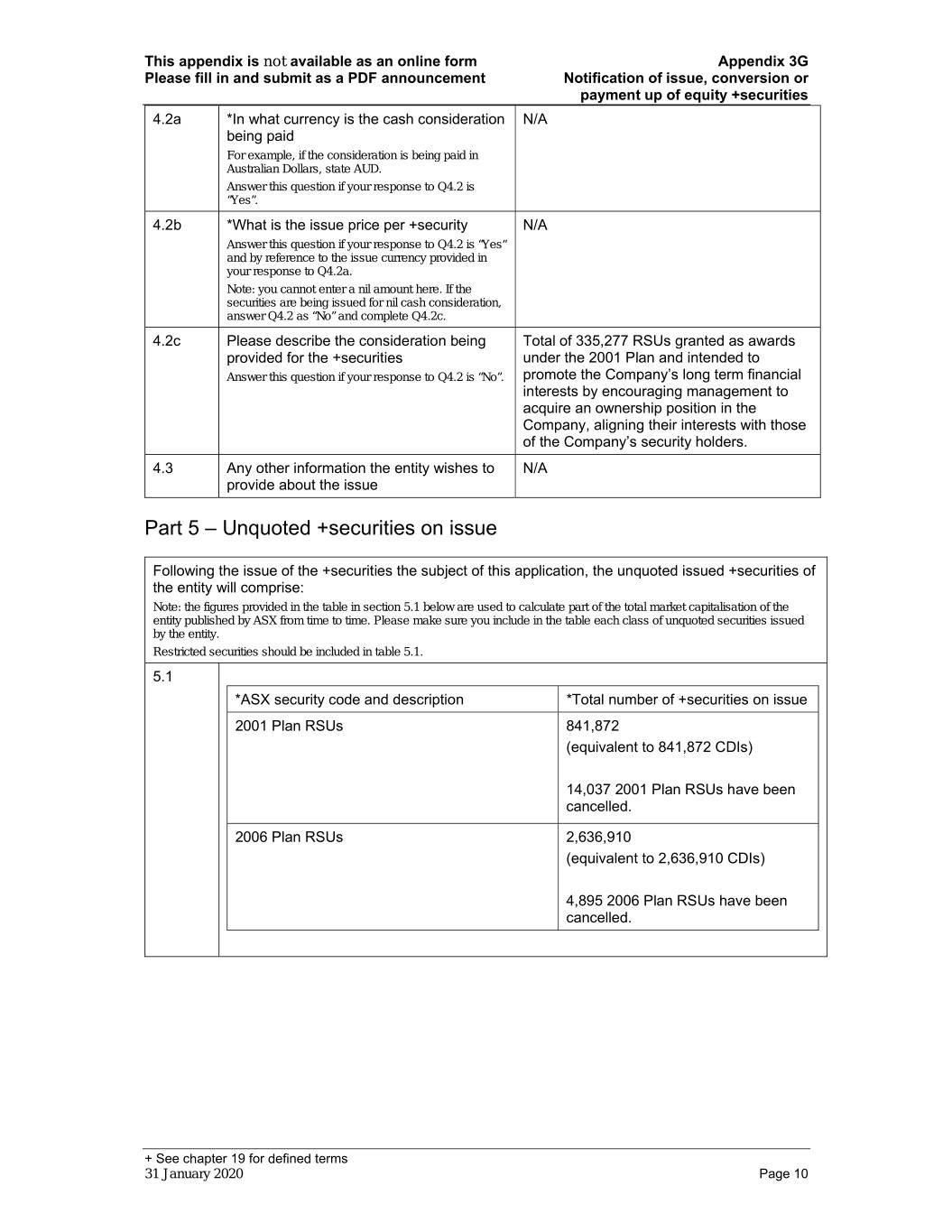

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 4.2a *In what currency is the cash consideration N/A being paid For example, if the consideration is being paid in Australian Dollars, state AUD. Answer this question if your response to Q4.2 is “Yes”. 4.2b *What is the issue price per +security N/A Answer this question if your response to Q4.2 is “Yes” and by reference to the issue currency provided in your response to Q4.2a. Note: you cannot enter a nil amount here. If the securities are being issued for nil cash consideration, answer Q4.2 as “No” and complete Q4.2c. 4.2c Please describe the consideration being Total of 335,277 RSUs granted as awards provided for the +securities under the 2001 Plan and intended to Answer this question if your response to Q4.2 is “No”. promote the Company’s long term financial interests by encouraging management to acquire an ownership position in the Company, aligning their interests with those of the Company’s security holders. 4.3 Any other information the entity wishes to N/A provide about the issue Part 5 – Unquoted +securities on issue Following the issue of the +securities the subject of this application, the unquoted issued +securities of the entity will comprise: Note: the figures provided in the table in section 5.1 below are used to calculate part of the total market capitalisation of the entity published by ASX from time to time. Please make sure you include in the table each class of unquoted securities issued by the entity. Restricted securities should be included in table 5.1. 5.1 *ASX security code and description *Total number of +securities on issue 2001 Plan RSUs 841,872 (equivalent to 841,872 CDIs) 14,037 2001 Plan RSUs have been cancelled. 2006 Plan RSUs 2,636,910 (equivalent to 2,636,910 CDIs) 4,895 2006 Plan RSUs have been cancelled. + See chapter 19 for defined terms 31 January 2020 Page 10

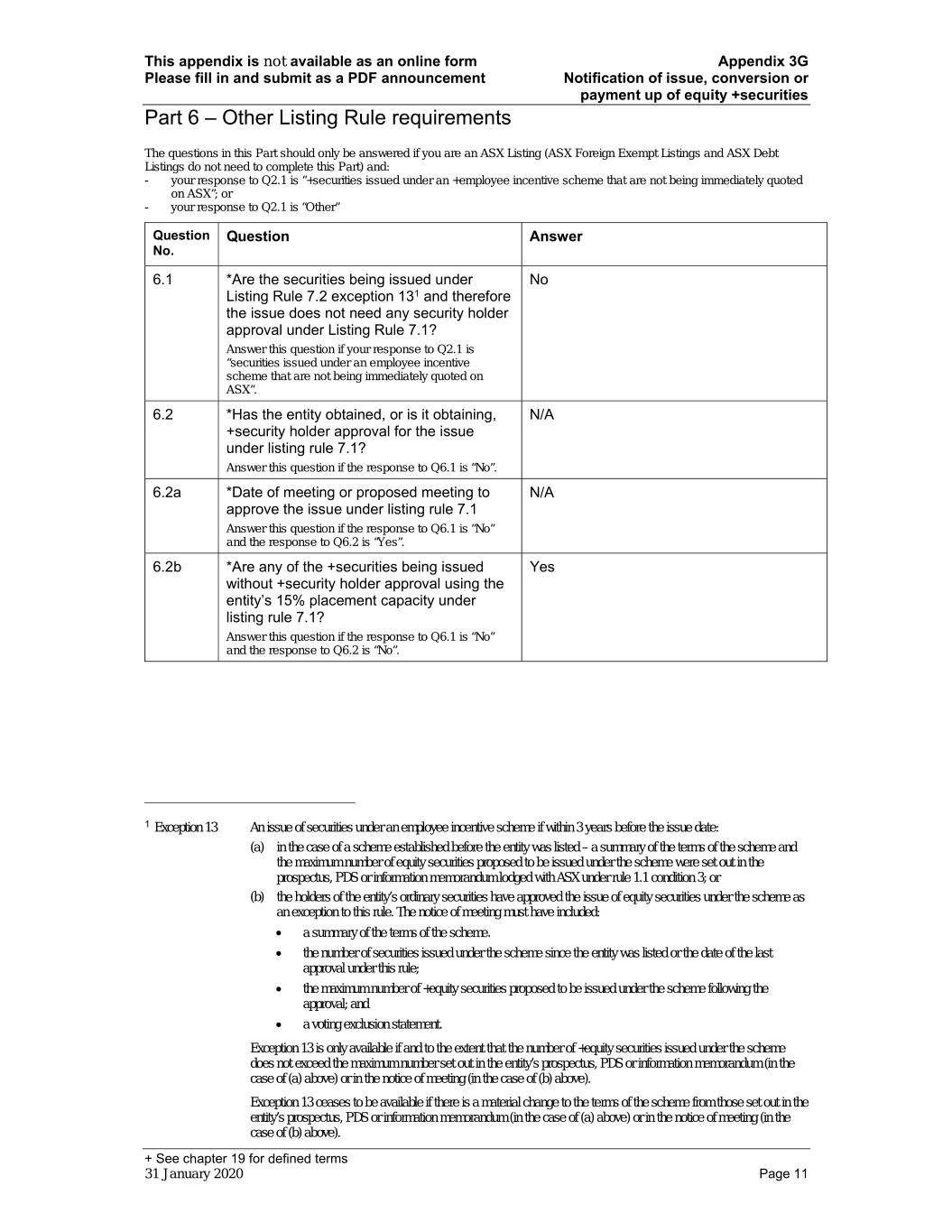

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 6 – Other Listing Rule requirements The questions in this Part should only be answered if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not need to complete this Part) and: - your response to Q2.1 is “+securities issued under an +employee incentive scheme that are not being immediately quoted on ASX”; or - your response to Q2.1 is “Other” Question Question Answer No. 6.1 *Are the securities being issued under No Listing Rule 7.2 exception 131 and therefore the issue does not need any security holder approval under Listing Rule 7.1? Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 6.2 *Has the entity obtained, or is it obtaining, N/A +security holder approval for the issue under listing rule 7.1? Answer this question if the response to Q6.1 is “No”. 6.2a *Date of meeting or proposed meeting to N/A approve the issue under listing rule 7.1 Answer this question if the response to Q6.1 is “No” and the response to Q6.2 is “Yes”. 6.2b *Are any of the +securities being issued Yes without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q6.1 is “No” and the response to Q6.2 is “No”. 1 Exception 13 An issue of securities under an employee incentive scheme if within 3 years before the issue date: (a) in the case of a scheme established before the entity was listed – a summary of the terms of the scheme and the maximum number of equity securities proposed to be issued under the scheme were set out in the prospectus, PDS or information memorandum lodged with ASX under rule 1.1 condition 3; or (b) the holders of the entity’s ordinary securities have approved the issue of equity securities under the scheme as an exception to this rule. The notice of meeting must have included: a summary of the terms of the scheme. the number of securities issued under the scheme since the entity was listed or the date of the last approval under this rule; the maximum number of +equity securities proposed to be issued under the scheme following the approval; and a voting exclusion statement. Exception 13 is only available if and to the extent that the number of +equity securities issued under the scheme does not exceed the maximum number set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above). Exception 13 ceases to be available if there is a material change to the terms of the scheme from those set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above). + See chapter 19 for defined terms 31 January 2020 Page 11

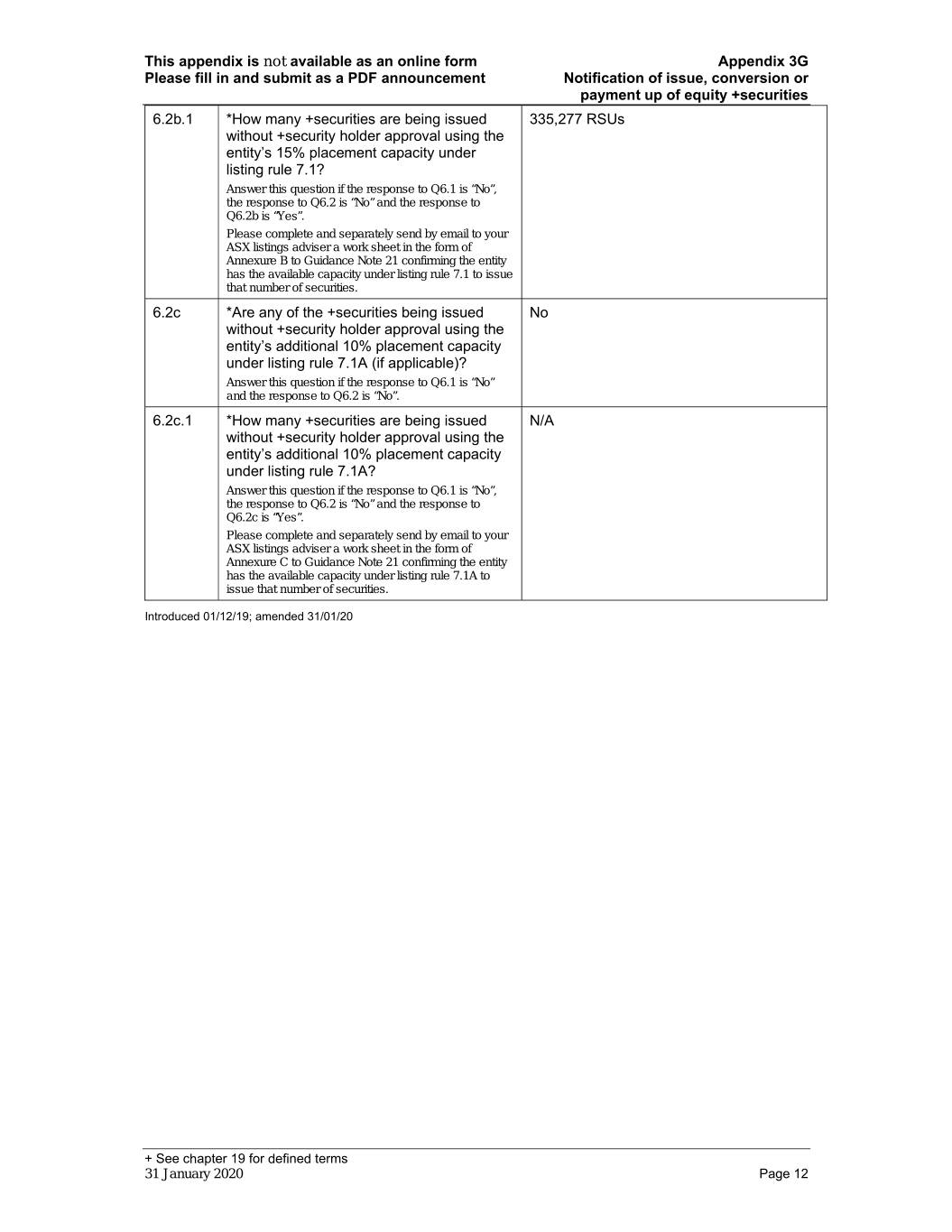

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 6.2b.1 *How many +securities are being issued 335,277 RSUs without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q6.1 is “No”, the response to Q6.2 is “No” and the response to Q6.2b is “Yes”. Please complete and separately send by email to your ASX listings adviser a work sheet in the form of Annexure B to Guidance Note 21 confirming the entity has the available capacity under listing rule 7.1 to issue that number of securities. 6.2c *Are any of the +securities being issued No without +security holder approval using the entity’s additional 10% placement capacity under listing rule 7.1A (if applicable)? Answer this question if the response to Q6.1 is “No” and the response to Q6.2 is “No”. 6.2c.1 *How many +securities are being issued N/A without +security holder approval using the entity’s additional 10% placement capacity under listing rule 7.1A? Answer this question if the response to Q6.1 is “No”, the response to Q6.2 is “No” and the response to Q6.2c is “Yes”. Please complete and separately send by email to your ASX listings adviser a work sheet in the form of Annexure C to Guidance Note 21 confirming the entity has the available capacity under listing rule 7.1A to issue that number of securities. Introduced 01/12/19; amended 31/01/20 + See chapter 19 for defined terms 31 January 2020 Page 12