Exhibit 99.1 James Hardie Industries plc Europa House 2nd Floor, Harcourt Centre Harcourt Street, Dublin 2, D02 WR20, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 1 October 2020 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam James Hardie 2020 Annual General Meeting Materials James Hardie Industries plc advises that the Notice of Meeting and supporting materials for the 2020 Annual General Meeting have been mailed to shareholders. Yours faithfully Joseph C. Blasko General Counsel & Company Secretary This announcement has been authorised for release by the General Counsel and Company Secretary, Mr Joseph C. Blasko. James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. Directors: Michael Hammes (Chairman, USA), Brian Anderson (USA), Russell Chenu (Australia), Andrea Gisle Joosen (Sweden), David Harrison (USA), Persio Lisboa (USA), Anne Lloyd (USA), Moe Nozari (USA), Rada Rodriguez (Sweden), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Jack Truong (USA) Company number: 485719 ARBN: 097 829 895

DUBLIN, IRELAND 5 NOVEMBER 2020 AT 9:00PM (DUBLIN TIME) 6 NOVEMBER 2020 AT 8:00AM (SYDNEY TIME) NOTICE OF ANNUAL GENERAL MEETING 2020

TABLE OF CONTENTS Notice of Annual General Meeting 2020 3 Agenda and business of the Annual General Meeting 4 Voting and participation in the Annual General Meeting 6 Explanatory Notes 9 Annexure 20 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you should immediately consult your investment or other professional advisor. James Hardie Industries plc ARBN 097 829 895, with registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland and registered in Ireland under company number 485719. The liability of its members is limited. 2

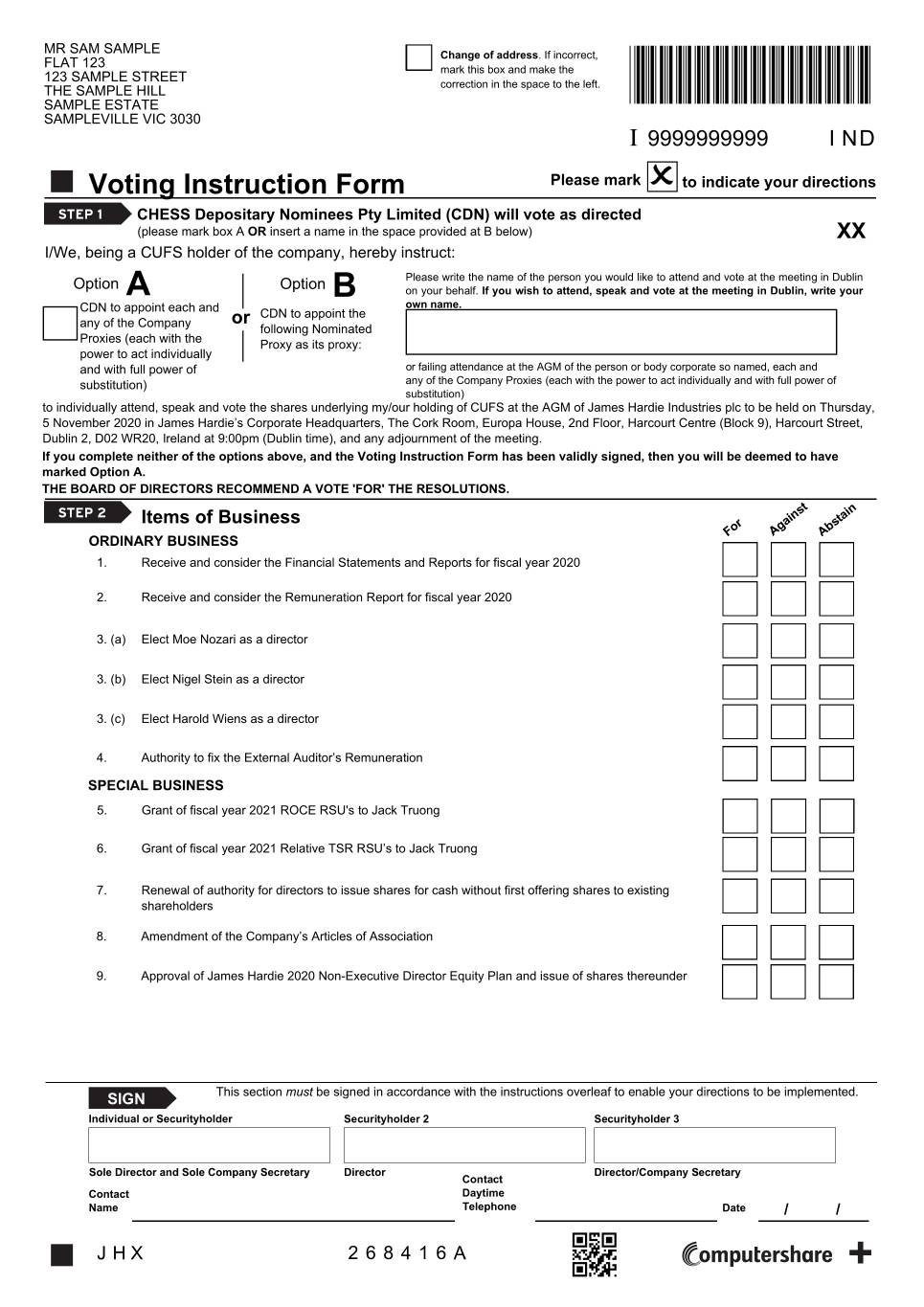

NOTICE OF ANNUAL GENERAL MEETING 2020 Notice is given that the Annual General Meeting (AGM) of James Hardie Industries plc (James Hardie or the Company) will be held on Thursday, 5 November 2020 at 9:00pm (Dublin time) / Friday, 6 November 2020 at 8:00am (Sydney time) in James Hardie’s Corporate Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, D02 WR20, Ireland. ATTENDANCE AT AGM NOTICE AVAILABILITY Persons registered as shareholders as at 7:00pm (Sydney Additional copies of this booklet can be downloaded time) / 8:00am (Dublin time) on Wednesday, 4 November from James Hardie’s Investor Relations website (http:// 2020 may attend the AGM in person in Dublin. www.ir.jameshardie.com.au/jh/shareholder_meetings.jsp) or they can be obtained by contacting the Company’s Shareholders wishing to participate in the AGM can also registrar, Computershare Investor Services Pty Limited participate remotely via teleconference, during which they (Computershare), by calling: will have the same opportunities to ask questions as people attending the AGM in person. § 1300 855 080 from within Australia; or § +61 3 9415 4000 from outside Australia. Shareholders or proxies will all be able to ask questions of the Board of Directors of James Hardie (Board) and the Company’s external auditor, Ernst & Young LLP. To enable more questions to be answered, enclosed is a form that you can use to submit questions in advance of the AGM, whether or not you will be attending. Shareholders or proxies not present at the AGM wishing to ask questions can do so in the manner described on page 6 of this booklet. In the event that the chairman of the Board (the Chairman) is unable to travel to Ireland to attend and chair the AGM in person due to COVID-19 related restrictions, he will attend and chair the AGM (which will still be held at our Corporate Headquarters in Dublin, Ireland) via the teleconference facility available to all shareholders. Additionally, in light of potential logistical difficulties related to COVID-19 restrictions and in order to ensure your votes are properly cast at the AGM, this year we are asking you to instruct the appointment of each of: (i) the Chairman; (ii) the company secretary of the Company (the Company Secretary); (iii) Mr Lorcan Murtagh; and (iv) Mr James Lenney (each a Company Proxy and together, the Company Proxies) as proxy for your shares, each with the power to act individually and with full power of substitution. Mr Murtagh and Mr Lenney are senior James Hardie group employees based in our corporate headquarters in Dublin, Ireland. This will mean that any Company Proxy who is present at the AGM will be able to vote your shares in the manner that you direct or, in the absence of direction, as they see fit. SeeVOTING ON THE RESOLUTIONS on page 6 for further information. Notice of Annual General Meeting 2020 3

AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING Explanations of the background, rationale and further The following are items of special business: information for each proposed resolution are set out 5. Grant of Fiscal Year 2021 Return on Capital in the Explanatory Notes on pages 9 to 19 of this Employed Restricted Stock Units Notice of Meeting. To consider and, if thought fit, pass the following The following are items of ordinary business: resolution as an ordinary resolution: 1. Financial statements and reports for fiscal That the award to the Company’s CEO and Director, year 2020 Jack Truong, of 82,131 return on capital employed To review James Hardie’s affairs and to consider and, (ROCE) restricted stock units (ROCE RSUs), and if thought fit, pass the following resolution as an his acquisition of ROCE RSUs and ordinary shares ordinary resolution: of James Hardie (Shares) issuable thereunder is To receive and consider the financial statements approved under and for the purposes of ASX Listing and the reports of the Board and external auditor Rule 10.14, for all purposes in accordance with the for the fiscal year ended 31 March 2020. terms of the James Hardie Industries Long Term Incentive Plan 2006 as amended (the 2006 LTIP) The vote on this resolution is advisory only. and on the basis set out in the Explanatory Notes. 2. Remuneration Report for fiscal year 2020 Voting Exclusion Statement As part of the review of James Hardie’s affairs, In accordance with the ASX Listing Rules, James Hardie will to consider and, if thought fit, pass the following disregard any votes cast in favour of Resolution 5 if they are resolution as a non‑binding ordinary resolution: cast by or on behalf of Jack Truong (who is the only director To receive and consider the Remuneration eligible to participate in the employee incentive scheme the Report of the Company for the fiscal year ended subject of Resolutions 5 and 6) or his associates. Dr Truong 31 March 2020. and his associates will not have their votes disregarded if: (i) they are acting as a proxy or attorney for a person The vote on this resolution is advisory only. who is entitled to vote, in accordance with the directions on a Voting Instruction Form or form of proxy; (ii) they are 3. Election / Re-election of Directors chairing the meeting as proxy or attorney for a person To consider and, if thought fit, pass each of the who is entitled to vote, in accordance with a direction following resolutions as separate ordinary resolutions: on a Voting Instruction Form or form of proxy to vote as (a) That Moe Nozari be elected as a director. the proxy or attorney decides; or (iii) they are acting solely in a nominee, trustee, custodial or other fiduciary capacity (b) That Nigel Stein be elected as a director. on behalf of a beneficiary provided the following conditions (c) That Harold Wiens be elected as a director. are met: (A) the beneficiary provides written confirmation 4. Authority to fix the External Auditor’s to them that the beneficiary is not excluded from voting, Remuneration and is not an associate of a person excluded from voting, on the resolution; and (B) they vote in accordance with the To consider and, if thought fit, pass the following directions on a Voting Instruction Form or otherwise given resolution as an ordinary resolution: by the beneficiary. That the Board be authorised to fix the remuneration 6. Grant of Fiscal Year 2021 Relative Total of the external auditor for the fiscal year ended Shareholder Return Restricted Stock Units 31 March 2021. To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s CEO and Director, Jack Truong, of 127,083 relative total shareholder return (TSR) restricted stock units (Relative TSR RSUs), and his acquisition of Relative TSR RSUs and Shares issuable thereunder is approved under and for the purposes of ASX Listing Rule 10.14, for all purposes in accordance with the terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. 4

Voting Exclusion Statement 9. Approval of James Hardie 2020 In accordance with the ASX Listing Rules, James Hardie will Non‑Executive Director Equity Plan and disregard any votes cast in favour of Resolution 6 if they are Issue of Shares Thereunder cast by or on behalf of Jack Truong (who is the only director To consider and, if thought fit, pass the following eligible to participate in the employee incentive scheme the resolution as an ordinary resolution: subject of Resolutions 5 and 6) or his associates. Dr Truong That the James Hardie 2020 Non-Executive Director and his associates will not have their votes disregarded Equity Plan (the NED Equity Plan) and the issue if: (i) they are acting as a proxy or attorney for a person of Shares to non-executive directors under the NED who is entitled to vote, in accordance with the directions Equity Plan be approved under and for the purposes on a Voting Instruction Form or form of proxy; (ii) they are of ASX Listing Rule 10.14, and for all other purposes chairing the meeting as proxy or attorney for a person and on the basis set out in the Explanatory Notes. who is entitled to vote, in accordance with a direction on a Voting Instruction Form or form of proxy to vote as Voting Exclusion Statement the proxy or attorney decides; or (iii) they are acting solely In accordance with the ASX Listing Rules, James Hardie in a nominee, trustee, custodial or other fiduciary capacity will disregard any votes cast in favour of Resolution 9 if on behalf of a beneficiary provided the following conditions they are cast by or on behalf of any non-executive director are met: (A) the beneficiary provides written confirmation of James Hardie or their respective associates. The to them that the beneficiary is not excluded from voting, non-executive directors and their associates will not have and is not an associate of a person excluded from voting, their votes disregarded if: (i) they are acting as a proxy or on the resolution; and (B) they vote in accordance with the attorney for a person who is entitled to vote, in accordance directions on a Voting Instruction Form or otherwise given with the directions on a Voting Instruction Form or form of by the beneficiary. proxy; (ii) they are chairing the meeting as proxy or attorney 7. Renewal of Authority for Directors to Issue for a person who is entitled to vote, in accordance with Shares for Cash Without First Offering Shares a direction on a Voting Instruction Form or form of proxy to Existing Shareholders to vote as the proxy or attorney decides; or (iii) they are acting solely in a nominee, trustee, custodial or other To consider and, if thought fit, pass the following fiduciary capacity on behalf of a beneficiary provided the resolution as a special resolution: following conditions are met: (A) the beneficiary provides That the directors be and are hereby empowered written confirmation to them that the beneficiary is not pursuant to section 1023 of the Irish Companies excluded from voting, and is not an associate of a person Act 2014 to allot equity securities (as defined in excluded from voting, on the resolution; and (B) they vote section 1023 of the Irish Companies Act 2014) for in accordance with the directions on a Voting Instruction cash, pursuant to the allotment authority conferred Form or otherwise given by the beneficiary. by Resolution 9 passed at the Company’s 2019 Notes on voting and Explanatory Notes follow, and a Voting AGM, as if subsection (1) of section 1022 of the Instruction Form and Question Form are enclosed. Irish Companies Act 2014 did not apply to any such allotment up to the amount of the Company’s By order of the Board. authorized but unissued share capital as at the date of this resolution, provided that this authority shall expire on the date of the renewed issuance authority on 7 August 2024, unless previously renewed, varied or revoked, provided that the Company may make an offer or agreement before the expiry of this authority, which would or might require any such securities to be allotted after this authority has expired, and in that case, the directors may allot Joseph C. Blasko equity securities in pursuance of any such offer General Counsel & Company Secretary or agreement as if the authority conferred hereby had not expired. 1 October 2020 8. Amendment of the Company’s Articles of Association To consider and, if thought fit, pass the following resolution as a special resolution: That the Company’s Articles of Association be and are hereby amended in the manner provided for in the Annexure to this Notice of Meeting. Notice of Annual General Meeting 2020 5

VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING If you are a registered shareholder as at 7:00pm (Sydney APPOINTING A PROXY time) / 8:00am (Dublin time) on Wednesday, 4 November To instruct the appointment of: 2020, you may attend, speak and vote, in person or appoint a proxy (who need not be a shareholder) to attend, § a proxy to attend the AGM in person on your behalf speak and vote on your behalf, at the AGM in Dublin, (Nominated Proxy); and Ireland or participate and ask questions while participating § each of the Company Proxies (each with the power to via the AGM teleconference. act individually and with full power of substitution) in the event your Nominated Proxy does not attend the AGM, See VOTING ON THE RESOLUTIONS below for information on how you can vote. please complete the relevant section of the Voting Instruction Form, and return it to Computershare no later AGM DETAILS than 7:00pm (Sydney time) / 8:00am (Dublin time) on Wednesday, 4 November 2020 using the “Lodgement The AGM will be held at James Hardie’s Corporate Instructions” set out on page 8. Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, If you hold more than one Share carrying voting rights, D02 WR20, Ireland, starting at 9:00pm (Dublin time) you may instruct the appointment of more than one on Thursday, 5 November 2020 / 8:00am (Sydney time) proxy to attend, speak and vote at the meeting on your on Friday, 6 November 2020. behalf provided each proxy is appointed to exercise rights attached to different Shares held by you. OPTIONS FOR SHAREHOLDERS UNABLE TO ATTEND AGM VOTING ON THE RESOLUTIONS The AGM will be accessible by teleconference at 8:00am How you can vote will depend on whether you are: (Sydney time) on Friday, 6 November 2020 / 9:00pm § a shareholder; (Dublin time) on Thursday, 5 November 2020. Shareholders § a holder of American Depositary Shares, which trade participating in the AGM teleconference will be able to ask on the New York Stock Exchange (NYSE) in the form questions of the Board and the Company’s external auditor, of American Depositary Receipts (ADRs); or Ernst & Young LLP. You will need to have your Security § a Nominated Proxy. Holder Reference Number (SRN) or the Holder Identification Number (HIN) (included on your Voting Instruction Form or Voting if you are a shareholder: most recent holding statement) as well as the name of your If you are a shareholder and want to vote on the resolutions holding if you intend to ask a question via the teleconference. to be considered at the AGM, you have the following In the event that the Chairman is unable to travel to Ireland two options: to attend and chair the AGM in person due to COVID-19 related restrictions, he will attend and chair the AGM Option A – If you are not attending the AGM (which will still be held at our Corporate Headquarters or appointing a Nominated Proxy in Dublin, Ireland) via the teleconference facility available Follow this option if you do not intend to attend the AGM to all shareholders. in person or appoint a Nominated Proxy. The following details are also set out on the Shareholder You may lodge a Voting Instruction Form directing CHESS Meetings page on James Hardie’s Investor Relations website Depository Nominees Pty Limited (CDN) (the legal (https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp). holder of Shares for the purposes of the ASX Settlement Operating Rules) to nominate each of the Company Proxies PARTICIPATION IN AGM TELECONFERENCE (each with the power to act individually and with full power of substitution) as its proxy to vote the Shares underlying To participate in the AGM teleconference, please: your holding of CHESS Units of Foreign Securities (CUFS) § dial into the AGM using one of the following numbers: that it holds on your behalf. Australia toll free 1800 148 258 / USA toll free 1866 586 2813 or the rest of the world 1866 586 2813 § Passcode: 9188544; and § provide the operator with your name and SRN / HIN. If you have any questions during the teleconference, follow the prompts from the teleconference operator. 6

You can submit your Voting Instruction Form as follows: For your proxy appointment to count, your 1. Complete the hard copy Voting Instruction Form completed Voting Instruction Form must be accompanying this Notice of Meeting and lodge it using received by Computershare no later than 7:00pm the “Lodgement Instructions” set out on page 8. (Sydney time) / 8:00am (Dublin time) on Wednesday, 4 November 2020. 2. Complete a Voting Instruction Form using the internet: Go to www.investorvote.com.au To obtain a free copy of CDN’s Financial Services Guide, or any Supplementary Financial Services Guide, You will need: go to http://www.asx.com.au/documents/settlement/ § your Control Number (located on your Voting CHESS_Depositary_Interests.pdf or phone 131279 from Instruction Form); and within Australia or +61 2 9338 0000 from outside Australia § your SRN or HIN for your holding; and to ask to have one sent to you. § your postcode as recorded in the Company’s register. If you submit a completed Voting Instruction Form If you lodge the Voting Instruction Form in accordance to Computershare, but fail to select either of Option with these instructions, you will be taken to have signed it. A or Option B, you are deemed to have selected Option A. For your vote to count, your completed Voting Instruction Form must be received by Voting if you hold American Depositary Shares (ADSs): Computershare no later than 7:00pm (Sydney time) The depositary for ADSs held in James Hardie’s ADR / 8:00am (Dublin time) on Wednesday, 4 November program is Deutsche Bank Trust Company Americas 2020. You will not be able to vote your Shares by way (Deutsche Bank). Deutsche Bank will send this Notice of teleconference. of Meeting to ADS holders on or about 1 October 2020 and advise ADS holders how to give their voting instructions. Option B – If you are (or your Nominated Proxy is) To be eligible to vote, ADS holders must be the registered attending the AGM or beneficial owner as at 5:00pm US Eastern Daylight Time If you would like to attend the AGM or appoint a Nominated (US EDT) on 28 September 2020 (the ADS record date). Proxy to attend the AGM on your behalf, and vote in Deutsche Bank must receive any voting instructions, in the person, you may use a Voting Instruction Form to direct form required by Deutsche Bank, no later than 5:00pm CDN to nominate: (US EDT) on 30 October 2020. (a) you or another person nominated by you (who does not Deutsche Bank will endeavour, as far as is practicable, and need to be a shareholder) as a Nominated Proxy; and permitted under applicable law, to instruct that the Shares (b) each of the Company Proxies (each with the power to ultimately underlying the ADSs are voted in accordance act individually and with full power of substitution) in the with the instructions received from ADS holders. If an ADS event the Nominated Proxy does not attend the AGM, holder does not submit any voting instructions, the Shares as proxy to vote the Shares underlying your holding of ultimately underlying the ADSs held by that holder will not CUFS on behalf of CDN in person at the AGM in Dublin. be voted. If the Nominated Proxy does not attend the AGM, one If you do not provide voting instructions, the Shares of the Company Proxies will vote the relevant Shares ultimately underlying your ADSs will not be voted on any in accordance with the instructions on the Voting resolution for which a broker does not have discretionary Instruction Form or, for undirected proxies, in accordance authority to vote. Under NYSE rules, brokers that are NYSE with the Nominated Proxy’s written instructions. If the member organisations are prohibited from directing the Nominated Proxy does not provide written instructions voting of the Shares underlying ADSs held in customer to the Company Secretary care of Computershare accounts on non-routine matters (such as executive by facsimile to 1300 534 987 from inside Australia, compensation and director elections) if they have not or +61 3 9473 2408 from outside Australia, or by email received voting instructions from the beneficial holders. to [email protected] by the earlier of Accordingly, if you are the beneficial owner of Shares (i) the time of commencement of voting on the resolutions underlying ADSs, and your broker holds your ADSs in its at the AGM and (ii) 9:30pm (Dublin time) on Thursday, name, then you must instruct your broker as to how to vote 5 November 2020 / 8:30am (Sydney time) on Friday, your Shares. Otherwise, your broker may not vote your 6 November 2020, then each Company Proxy intends Shares. If you do not give your broker voting instructions voting in favour of all of the resolutions. and the broker does not vote your Shares, this is a “broker non-vote” which is treated as an abstention and does not count toward determining the votes for / against the resolution. Notice of Annual General Meeting 2020 7

VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING (CONTINUED) COVID-19 Public Health Restrictions LODGEMENT INSTRUCTIONS Please note that in-person attendance at the AGM will Completed Voting Instruction Forms may be lodged with be subject to prevailing COVID-19 public health restrictions Computershare using one of the following methods: in place at the date of the AGM and social distancing (a) by post to GPO Box 242, Melbourne, Victoria 3001, capacity constraints at the venue meeting. We would Australia; or therefore encourage you to select Option A above (b) by delivery to Computershare at Level 5, in order to ensure that your shares are voted at the AGM. 115 Grenfell Street, Adelaide SA 5000, Australia; or Voting if you are a Nominated Proxy: (c) online at www.investorvote.com.au; or If you are a Nominated Proxy and you do not attend and (d) for Intermediary Online subscribers only (custodians), vote at the AGM, one of the Company Proxies will vote the online at www.intermediaryonline.com; or Shares in accordance with the instructions on the Voting (e) by facsimile to 1800 783 447 from inside Australia Instruction Form or form of proxy or, for undirected proxies, or +61 3 9473 2555 from outside Australia. in accordance with your written instructions. If you wish to direct the Company Proxies how to vote any undirected Written instructions to the Company Secretary proxies, you must submit your written instructions to the (if required) may be lodged by the Nominated Proxy Company Secretary by no later than the earlier of (i) the with Computershare using one of the following methods: time of commencement of voting on the resolutions (a) by facsimile to 1300 534 987 from inside Australia, at the AGM and (ii) 9:30pm (Dublin time) on Thursday, or +61 3 9473 2408 from outside Australia; or 5 November 2020 / 8:30am (Sydney time) on Friday, (b) by email to [email protected]. 6 November 2020, otherwise, if you have not provided written instructions to the Company Secretary by such time, If the Nominated Proxy is a corporate and the written then each Company Proxy intends voting in favour of all instructions will be submitted by a representative of the of the resolutions. corporate, the appropriate ‘Certificate of Appointment of Corporate Representative’ form will need to be provided along with the written instructions. A form of certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab and then click on ‘Printable Forms’. NO VOTING AVAILABLE IN AGM TELECONFERENCE You will not be able to vote by way of teleconference. If you wish for your vote to count, you must follow the instructions set out above. 8

EXPLANATORY NOTES TERMINOLOGY RESOLUTION 2 – REMUNERATION REPORT References to shareholders in this Notice of Meeting, FOR FISCAL YEAR 2020 including these Explanatory Notes, include references Resolution 2 asks shareholders to receive and consider the to all the shareholders of James Hardie acting together, Remuneration Report for the year ended 31 March 2020. and include holders of CUFS, holders of ADSs, holders The Company is not required to produce a remuneration of Shares and members of the Company within the report or to submit it to shareholders under Irish, Australian meaning of the Irish Companies Act 2014, except where or US law or regulations. However, taking into consideration describing how each group of shareholders may cast James Hardie’s Australian and US shareholder base their votes. and ASX listing, the Company has voluntarily produced a remuneration report for non-binding shareholder approval RESOLUTION 1 – FINANCIAL STATEMENTS for some years and currently intends to continue to do AND REPORTS FOR FISCAL YEAR 2020 so. This report provides information on James Hardie’s remuneration practices in fiscal year 2020 and also Resolution 1 asks shareholders to receive and consider voluntarily includes an outline of the Company’s proposed the financial statements and the reports of the Board and remuneration framework for fiscal year 2021. the Company’s external auditor, Ernst & Young LLP, for the year ended 31 March 2020. This resolution will also Copies of the Company’s Remuneration Report are involve the review by the members of James Hardie’s available free of charge either: affairs. The financial statements which are the subject (a) at the AGM in Dublin, Ireland; of Resolution 1 are those prepared in accordance with Irish law, US Generally Accepted Accounting Principles (b) at the Company’s registered Irish office at Europa (US GAAP) (to the extent that the use of those principles House, 2nd Floor, Harcourt Centre, Harcourt Street, in the preparation of the financial statements does not Dublin 2, D02 WR20, Ireland; contravene any provision of Irish law) and Accounting (c) at the Company’s registered Australian office at Standards issued by the Accounting Standards Board Level 20, 60 Castlereagh Street, Sydney NSW 2000; or and promulgated by the Institute of Chartered Accountants (d) on the Company’s Investor Relations website, in Ireland (Generally Accepted Accounting Practice http://www.ir.jameshardie.com.au/. in Ireland), as distinct from the US GAAP consolidated financial statements of the James Hardie Group as set out Although this vote does not bind the Company, the Board in the Company’s 2020 Annual Report. intends to take the outcome of the vote into consideration when considering the Company’s future remuneration policy. A brief overview of the financial and operating performance of the James Hardie Group during the year ended Recommendation 31 March 2020 will be provided during the AGM. Copies The Board believes it is in the interests of shareholders of the James Hardie Group’s consolidated Irish financial that the Company’s Remuneration Report for the year statements are available free of charge either: ended 31 March 2020 be received and considered and (a) at the AGM in Dublin, Ireland; recommends that you vote in favour of Resolution 2. (b) at the Company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, RESOLUTION 3 – ELECTION / RE-ELECTION Dublin 2, D02 WR20, Ireland; OF DIRECTORS (c) at the Company’s registered Australian office at As part of their review of the composition of the Board, the Level 20, 60 Castlereagh Street, Sydney NSW 2000; or Board and the Nominating and Governance Committee considered the desired profile of the Board, including (d) on the Company’s Investor Relations website, the right number, mix of skills, qualifications, experience, http://www.ir.jameshardie.com.au/. expertise, diversity and geographic location of its directors, Recommendation to maximise the effectiveness of the Board. The Board and Nominating and Governance Committee work The Board believes it is in the interests of shareholders together to ensure James Hardie puts in place appropriate that the financial statements and the reports of the Board mechanisms for Board renewal. and external auditor for the year ended 31 March 2020 be received and considered and recommends that you Resolution 3(a) asks shareholders to consider the election vote in favour of Resolution 1. of Moe Nozari to the Board. Notice of Annual General Meeting 2020 9

EXPLANATORY NOTES (CONTINUED) Resolution 3(b) asks shareholders to consider the election Nigel Stein of Nigel Stein to the Board. CA, BSc Age: 64 Resolution 3(c) asks shareholders to consider the election of Harold Wiens to the Board. Nigel Stein was appointed as an independent non-executive director James Hardie’s Articles of Association currently require of James Hardie in May 2020. that directors (other than the Chief Executive Officer) shall He is a member of the Audit Committee. be divided into three classes. Each Class II director’s initial term shall expire at the conclusion of the 2020 AGM and Experience: Mr Stein has extensive thereafter each shall serve in accordance with the Articles experience in the global automotive and manufacturing of Association. The current Class II directors are Brian sectors. He currently serves as Chairman of Inchcape Anderson and Russell Chenu. Mr Anderson and Mr Chenu plc (Inchcape), an automotive distribution, retail and are not seeking re-election and therefore both will retire financing company, a position he has held since May 2018. from office when their term expires at the conclusion of the Mr Stein joined Inchcape as a non-executive director 2020 AGM. If elected Dr Nozari, Mr Stein and Mr Wiens in October 2015. will be designated as Class II directors. Prior to holding this position, Mr Stein served as Chief Profiles of the candidates follow: Executive Officer of GKN plc GKN( ) from January 2012 to December 2017. He joined the automotive and aerospace Moe Nozari components supplier in 1994 and during his time with GKN BA, MS, PhD and Postdoctoral held various senior positions in general management and Research Fellow finance including six years as Group Chief Financial Officer. Age: 78 Earlier in his career, Mr Stein held senior finance positions Dr Moe Nozari was appointed as an with Laird plc and Hestair plc. From 2003 until 2011, independent non-executive director he served as an independent non-executive director on of James Hardie in November the Board of Ferguson (formerly Wolseley) plc, the leading 2019. He is a member of the specialist distributor of plumbing and heating products Remuneration Committee and the Nominating and in North America and the UK. Mr Stein is a member of the Governance Committee. Institute of Chartered Accountants of Scotland and Industry Experience: Dr Nozari worked at 3M for thirty-eight Chairman of Automotive Council. years. Latterly, he served as an Executive Vice President The Company conducted appropriate background checks of Consumer and Office Business at 3M Company, from into Mr Stein’s background and experience prior to his 2002 until his retirement from 3M in July 2009. Prior to that appointment in May 2020. he served as an Executive Vice President of Consumer and Office Markets at 3M Company from 1999 to 2002 and Directorships of listed companies in the past five served as its Group Vice President of Consumer and Office years: Current – Director of Inchcape plc (since 2015). Markets Group from 1996 to 1999. Dr Nozari joined 3M, Former – Director of GKN plc (2001–2017). in the Central Research Laboratories in 1971 and advanced Last elected: Appointed to the Board in May 2020. to the position of Technical Director of the Photographic Will stand for election at the 2020 AGM. Products Division. Harold Wiens After a succession of managerial and business BS responsibilities in 1986 he was named a Division Vice Age: 74 President, then a Group Vice President in 1996. While at 3M his focus was on the development of new products, Harold Wiens was appointed as brands, identification, and development of people. an independent non-executive director of James Hardie in May The Company conducted appropriate background checks 2020. He is a member of the into Dr Nozari’s background and experience prior to his Remuneration Committee. appointment in May 2020. Experience: Mr Wiens worked at 3M Company (3M) for Directorships of listed companies in the past five thirty-eight years. He served as Executive Vice President, years: None. Industrial Business and Transportation Business from 1998 Last elected: Appointed to the Board in November 2019. until his retirement from 3M in 2006. It is 3M’s largest and Will stand for election at the 2020 AGM. most diverse business serving many different end markets ranging from electronic to automotive and aerospace manufacturing. During this time, Mr Wiens restructured the business, leading a global implementation of Six Sigma that drove significant international growth. 10

Prior to holding this position, Mr Wiens served as Executive A summary of the terms and conditions of the 2006 LTIP Vice President, Sumitomo 3M, 3M’s largest subsidiary, was included in the 2018 AGM Notice of Meeting. That headquartered in Tokyo, Japan, from 1995 to 1998 and document may be accessed from the Shareholder Meetings served as Data Storage Business Leader and Vice President page on James Hardie’s Investor Relations website (http:// from 1988 to 1995 and as Memory Technologies Group www.ir.jameshardie.com.au/jh/shareholder_meetings.jsp). Manufacturing Manager from 1983 to 1988. Mr Wiens began For fiscal year 2021, the Remuneration Committee has his career with 3M in 1968 and held many positions of allocated the Long-Term Incentive (LTI) target of the Chief increasing responsibility over his first fifteen years with 3M. Executive Officer (and each senior executive) between The Company conducted appropriate background checks the following three components to ensure that the reward into Mr Wien’s background and experience prior to his is based on a diverse range of factors which validly reflect appointment in May 2020. longer term performance, as well as provide an appropriate incentive to ensure senior executives focus on the key Directorships of listed companies in the past five areas which will drive shareholder value creation over the years: Current – Director of Bio-Techne Corporation medium and long-term: (since 2014). § 25% to ROCE RSUs – an indicator of James Hardie’s Last elected: Appointed to the Board in May 2020. capital efficiency over time; Will stand for election at the 2020 AGM. § 25% to Relative TSR RSUs – an indicator of James Recommendation Hardie’s performance relative to its US peers; and The Board, on the recommendation of the Nominating § 50% to Scorecard LTI – an indicator of each senior and Governance Committee, believes it is in the interests executive’s contribution to James Hardie achieving of shareholders that Moe Nozari, Nigel Stein and Harold its long-term strategic goals. Wiens be elected as directors of the Company and As the Board and Remuneration Committee believe the recommends (with Moe Nozari, Nigel Stein and Harold LTI program is achieving the stated objectives, and that Wiens abstaining from voting in respect of their own management understands the current LTI program and election) that you vote in favour of Resolutions 3(a), 3(b) continues to be motivated by it, the LTI components and 3(c). for fiscal year 2021 are materially consistent with the RESOLUTION 4 – AUTHORITY TO FIX THE components for fiscal year 2020. EXTERNAL AUDITOR’S REMUNERATION Reasons for ROCE RSUs Resolution 4 asks shareholders to give authority to the ROCE RSUs shall vest if James Hardie’s ROCE performance Board to fix the external auditor’s remuneration. Ernst meets or exceeds ROCE performance hurdles over & Young LLP were first appointed external auditors for the a three‑year period, subject to the exercise of negative James Hardie Group for the year ended 31 March 2009. discretion by the Remuneration Committee. A summary of the external auditor’s remuneration during the fiscal year ended 31 March 2020, as well as non‑audit James Hardie introduced ROCE RSUs in fiscal year 2013 fees paid to Ernst & Young LLP are set out on page 147 once the US housing market had stabilised to an extent of the 2020 Annual Report. The Audit Committee which permitted the setting of multi-year financial metrics. periodically reviews Ernst & Young LLP’s performance and As James Hardie funds capacity expansions and market independence as external auditor and reports its results initiatives in the US, Asia Pacific and Europe it is important to the Board. A summary of Ernst & Young LLP’s interaction that management focuses on ensuring that the Company with James Hardie, the Board and the Board Committees continues to achieve strong ROCE results while pursuing is set out on pages 63 and 64 of the 2020 Annual Report. growth. Upon vesting, ROCE RSUs shall be settled in CUFS on a 1-to-1 basis. Recommendation ROCE RSU changes for fiscal year 2021 The Board believes it is in the interests of shareholders that the Board be given authority to fix the external auditor’s The FY2021 ROCE RSU plan has the same design and remuneration for the fiscal year ended 31 March 2021 hurdles as the FY2020 plan. and recommends, on the recommendation of the Audit Key aspects of ROCE RSUs Committee that you vote in favour of Resolution 4. Goal Setting: ROCE performance hurdles for the ROCE RESOLUTION 5 – GRANT OF FISCAL YEAR RSUs are based on historical results and take into account 2021 ROCE RSUs the forecasts for the US and Asia Pacific housing markets. By way of reference, the three-year average ROCE result Resolution 5 asks shareholders to approve the grant for fiscal years 2018, 2019 and 2020 was 33.8%. of ROCE RSUs under the 2006 LTIP under and for the purposes of ASX Listing Rule 10.14 to James Hardie’s Director and Chief Executive Officer, Jack Truong for the fiscal year 2021. Notice of Annual General Meeting 2020 11

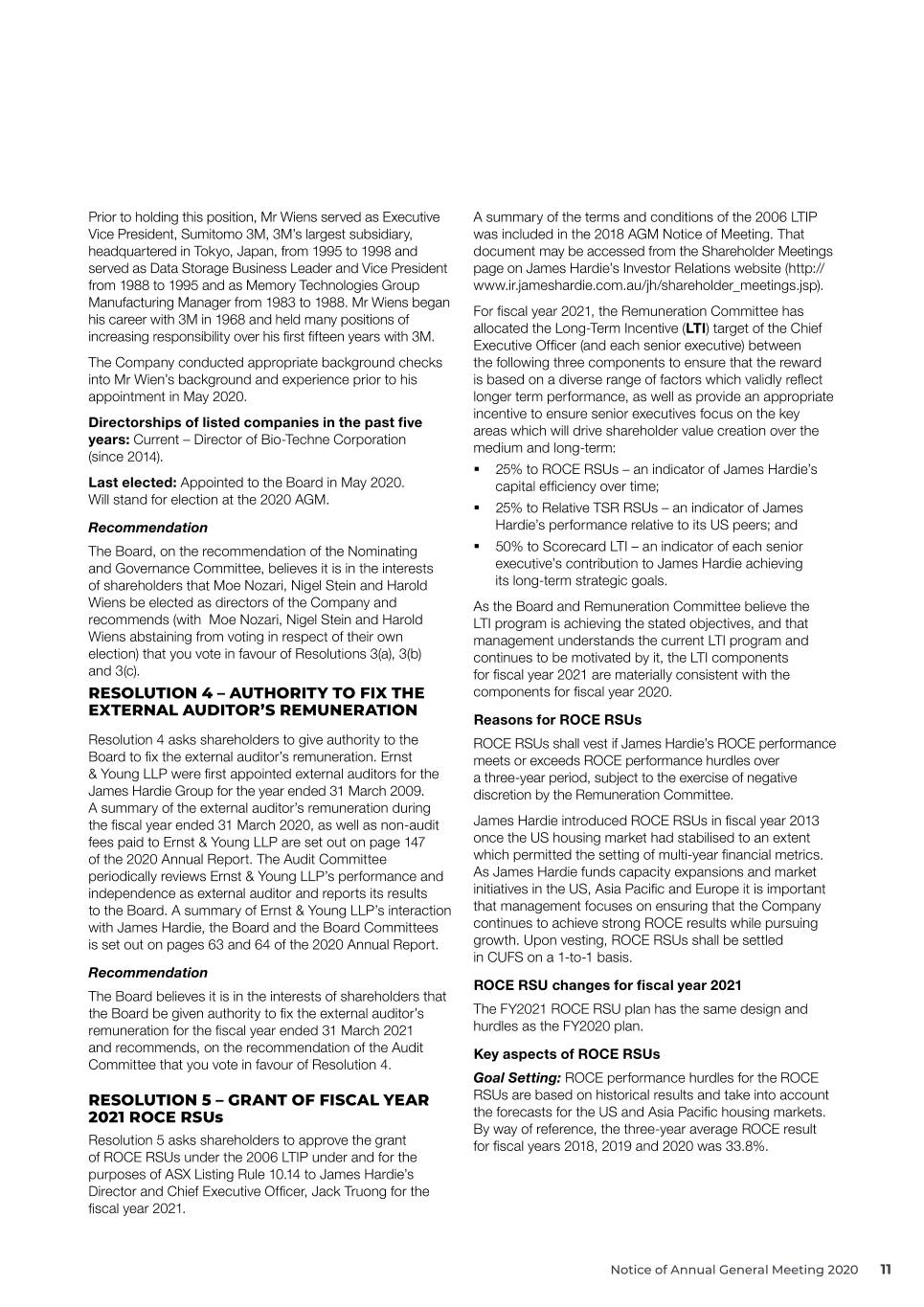

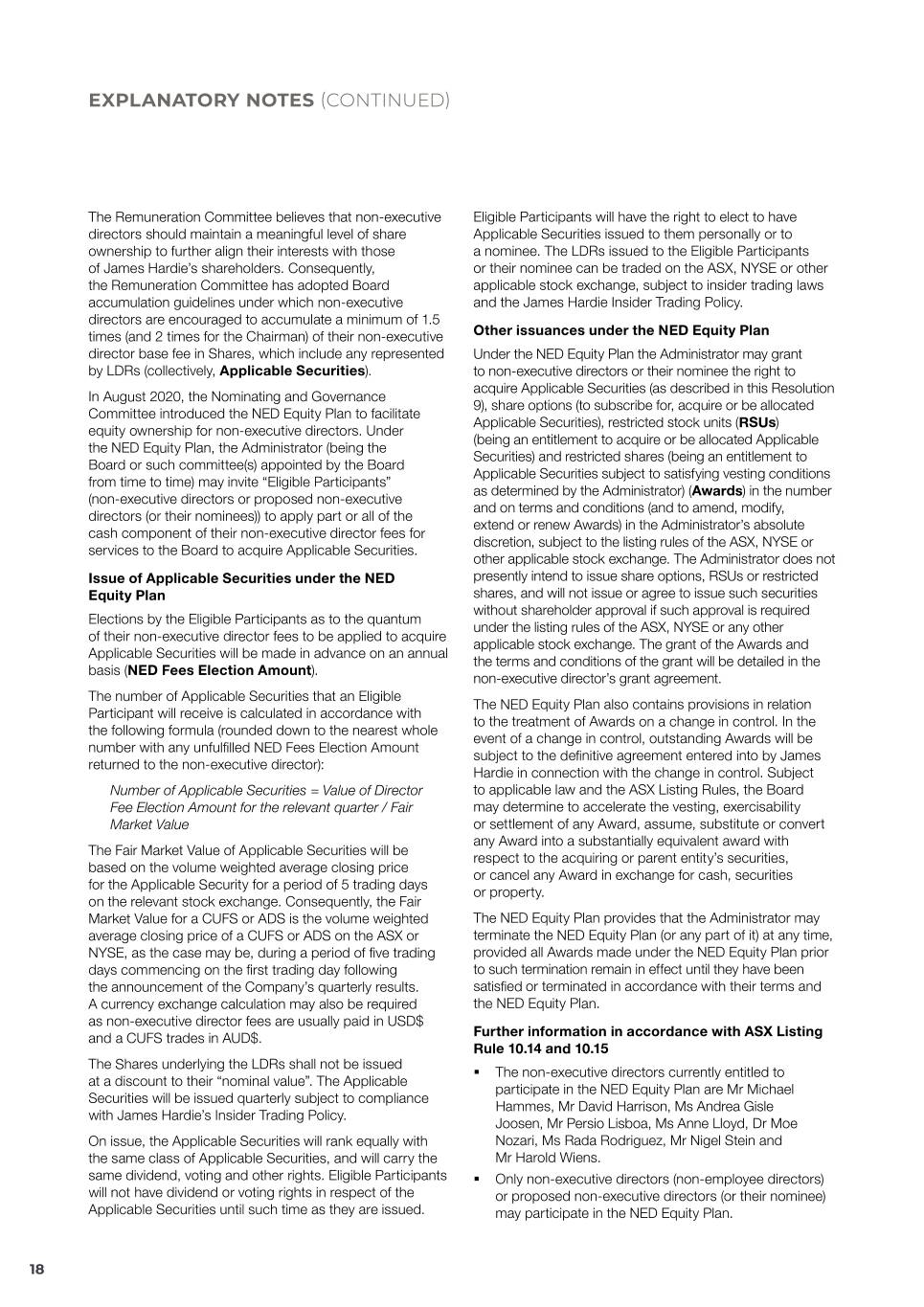

EXPLANATORY NOTES (CONTINUED) ROCE Definitions: The ROCE measure will be determined Grant: The Chief Executive Officer will receive a grant for by dividing Adjusted Earnings Before Interest and Tax fiscal year 2021 equal to the maximum number of ROCE (Adjusted EBIT) by Adjusted Capital Employed each RSUs (2.0x target). The number of ROCE RSUs which as further explained below. vest, and the number of Shares ultimately received in 2023 will depend on James Hardie’s ROCE performance in The Adjusted EBIT component of the ROCE measure will be fiscal years 2021 to 2023 together with the Remuneration determined as follows. Earnings before interest and taxation Committee’s exercise of negative discretion. as reported in James Hardie’s financial results, adjusted by: § excluding the earnings impact of legacy issues (such Performance Hurdle: The performance hurdles for ROCE as asbestos adjustments); and RSUs granted in fiscal year 2021 (for performance in fiscal years 2021 to 2023) are: § adding back asset impairment charges in the relevant period, unless otherwise determined by the AMOUNT OF TARGET Remuneration Committee. Since management’s ROCE ROCE RSUs TO VEST performance will be assessed on the pre-impairment < 24.0% 0.0x value of James Hardie’s assets, the Remuneration ≥ 24.0%, but < 26.0% 0.5x Committee would not normally deduct the impact of any asset impairments from the Company’s EBIT ≥ 26.0%, but < 27.5% 1.0x for the purposes of measuring ROCE performance. ≥ 27.5%, but < 28.5% 1.5x The Adjusted Capital Employed component of the ROCE ≥ 28.5% 2.0x measure will be determined as follows. Total Assets minus Current Liabilities, as reported in James Hardie’s financial The earnings component of ROCE performance targets results, adjusted by: is predicated on assumptions in market growth. Market § excluding balance sheet items related to legacy issues growth in James Hardie’s primary markets has two main (such as asbestos adjustments), dividends payable and components – independent third-party sourced data for deferred taxes; new housing starts and an independent third-party data sourced index for the repair and remodel market. These § adding back asset impairment charges in the relevant two main components are blended for an index of market period, unless otherwise determined by the Remuneration growth. The above performance hurdles can be indexed Committee, in order to align the Adjusted Capital up or down to the extent that actual US and Asia Pacific Employed with the determination of Adjusted EBIT; addressable housing starts over the performance period § adding back leasehold assets for manufacturing are higher or lower than those assumed in James Hardie’s facilities and other material leased assets, which fiscal years 2021–2023 business plan. the Remuneration Committee believes give a more complete measure of the Company’s capital base Performance period: The overall performance period employed in income generation; and is three years. The ROCE RSUs vest three years from August 2020, subject to the exercise of negative discretion § deducting all greenfield construction-in-progress, by the Remuneration Committee. and any brownfield construction-in-progress projects involving capacity expansion that are individually greater Conditions and negative discretion: In 2023, the than US$20 million, until such assets reach commercial Remuneration Committee will review James Hardie’s production and are transferred to the fixed asset performance over the performance period and may register, in order to encourage management to invest exercise negative discretion to reduce the number of in capital expenditure projects that are aligned with the ROCE RSUs that would otherwise vest under the ROCE long-term interests of the Company. vesting scale above based on the quality of the ROCE returns balanced against management’s delivery of market The ROCE performance hurdles will be indexed for share growth and performance against certain specified changes to US and Asia Pacific addressable housing starts. strategic goals and objectives (i.e., the Scorecard). The resulting Adjusted Capital Employed for each The Remuneration Committee can only exercise negative quarter of any fiscal year will be averaged to better reflect discretion. It cannot be applied to enhance the reward capital employed over the course of a year rather than at that can be received. The potential to exercise negative a certain point in time. The ROCE result to compare to the discretion allows the Remuneration Committee to ensure performance hurdles will be the average of James Hardie’s that ROCE returns are not obtained at the expense ROCE in fiscal years 2021, 2022 and 2023. of long‑term sustainability. These definitions have been framed to ensure management is rewarded and held accountable for the aspects over which they have direct influence and control, while not discouraging management from recommending that James Hardie undertake investments that will provide for future Company growth. 12

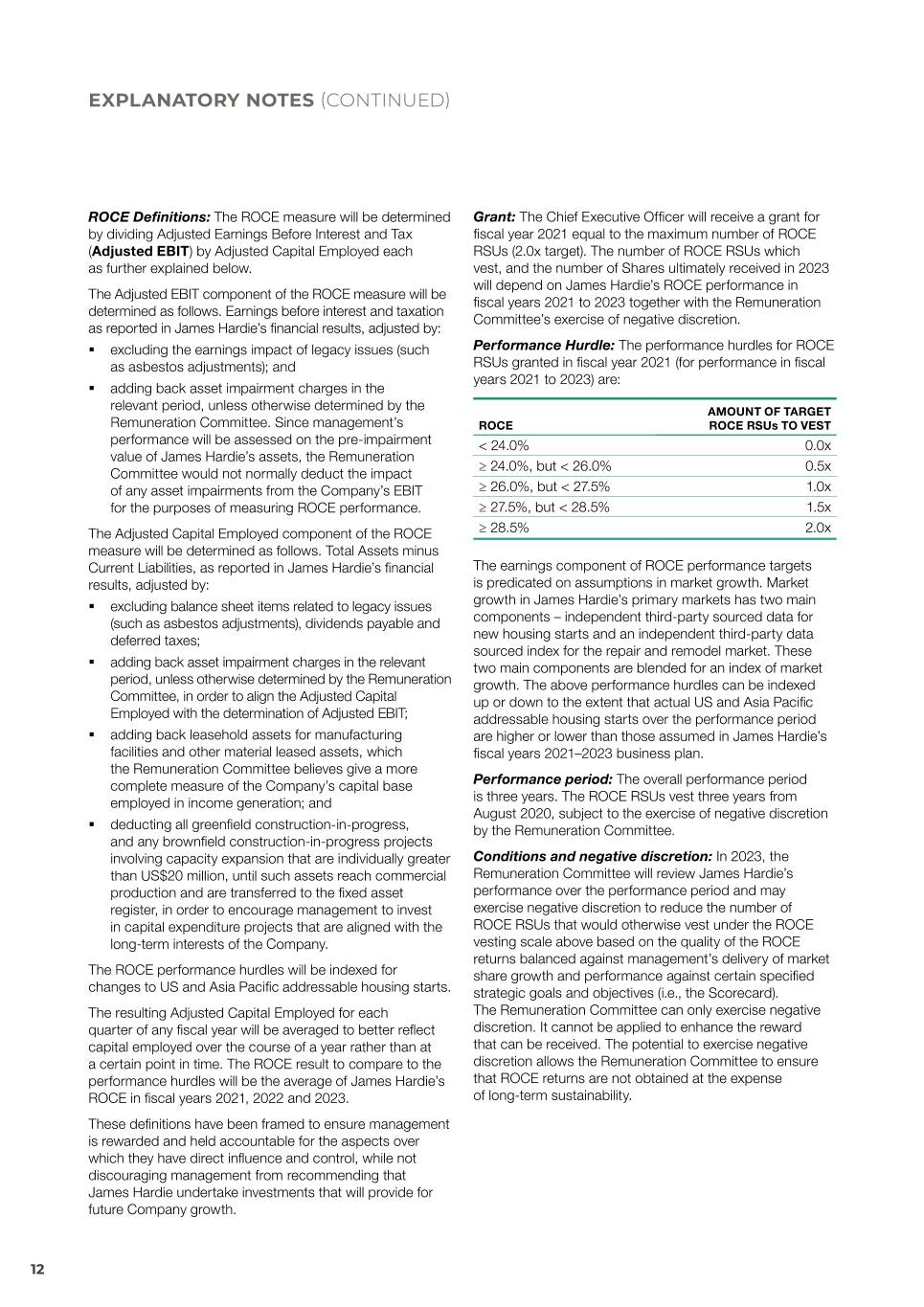

The Scorecard includes several longer-term measures Maximum and actual number of ROCE RSUs which the Remuneration Committee believes are important The maximum number of Shares and ROCE RSUs for contributors to long-term creation of shareholder value. which approval is sought under this Resolution 5 is 82,131 Each year the Remuneration Committee approves and is based on the grant that would be made if James several key objectives and the measures it expects to see Hardie’s performance warranted the maximum possible achieved for each of these objectives. The fiscal year 2021 award for fiscal year 2021 (i.e. 2.0x LTI target) and the Scorecard applicable for the grants of ROCE RSUs (and Remuneration Committee did not exercise any negative Scorecard LTI) is set out in the Remuneration Report for the discretion to reduce the number of ROCE RSUs which year ended 31 March 2020. The Remuneration Committee ultimately are to vest and be settled into Shares. considers the goals to be reflective of James Hardie’s overall long‑term goals. The actual number of ROCE RSUs granted is determined by dividing the maximum dollar amount granted under the The Chief Executive Officer’s rating ultimately depends ROCE RSUs portion of the LTI target (which is 2.0x LTI on the Remuneration Committee’s assessment (and the target) by James Hardie’s share price over the 20 trading Board’s review) of his contribution to James Hardie in days preceding the date of grant, subject to the maximum meeting the Scorecard objectives. Although most of the specified in the resolution. objectives in the Scorecard have quantitative targets, the Board has not allocated a specific weighting to any and In the unlikely event the grant calculation returns an actual the final Scorecard assessment and exercise of negative number of ROCE RSUs to be granted that is greater than discretion (if any) will involve an element of judgment by the the maximum number of Shares for which approval is Remuneration Committee. A different amount of negative sought under this Resolution 5, James Hardie may grant discretion is likely to be applied when assessing the Chief a cash settled award equal in value to the number of ROCE Executive Officer’s performance for the Scorecard LTI RSUs which exceed the maximum number of Shares. grants (which only include consideration of Scorecard Any such cash settled award made will vest on the same measures) and ROCE RSUs grants (which involve a broader criteria as set forth above and would only vest in the event assessment of the quality of James Hardie’s results). the ROCE RSU grant vests in full. Worked Example Previous grants The following example uses the Chief Executive Officer’s For fiscal year 2021, as Chief Executive Officer of James LTI fiscal year 2021 target quantum of US$3,475,000 and Hardie, Dr Truong is eligible to participate in the 2006 LTIP. assumes for illustrative purposes, a three-year average The number of ROCE RSUs granted to Dr Truong since ROCE performance of 28%. shareholder approval was last obtained at the 2019 AGM At grant date the LTI quantum granted to the Chief was (i) 9,519 granted on 9 August 2019 (made in connection Executive Officer in ROCE RSUs is: with his appointment as the Company’s Chief Executive $3,475,000 LTI target x 25% of LTI target issued Officer, and (ii) 75,545 granted on 17 August 2019 (compared in ROCE RSUs x 2.0 target leverage = US$1,737,500 to the maximum number approved, being 118,101). to be granted in ROCE RSUs. Dr Truong, as a senior executive of James Hardie since At a value of US$19.00 / share, this is equivalent April 2017, has previously received grants of ROCE RSUs to a grant of 91,447 ROCE RSUs. Based on a 28% under the 2006 LTIP in that capacity. As Dr Truong was not average ROCE result for the three-year period to fiscal a Director of James Hardie until January 31, 2019, the 2017 year 2023, 1.5x target would be eligible to vest: and 2018 grants were able to be made without the need for 91,447 RSUs x 75% = 68,585 ROCE RSUs specific shareholder approval under ASX Listing Rule 10.14. Note: 1.5x target equals 75% of total ROCE RSUs granted. The number of ROCE RSUs granted to Dr Truong in the last three years, excluding the grants that are the subject At the conclusion of the three-year performance period, of Resolutions 5 and 6, is set out in the table below: the Remuneration Committee will review James Hardie’s performance (and decide whether to reduce the number DATE OF GRANT NUMBER GRANTED VESTING DATE of ROCE RSUs which vest based on its negative discretion). 17 August 2019 75,545 17 August 2022 For indicative purposes, assuming that the 9 August 2019 9,519 17 August 2021 Remuneration Committee determines that 1.0x target 6 September 25,385 17 August 2021 (rather than the 1.5x target based on performance 2018 against the ROCE performance hurdles) of the Chief Executive Officer’s total ROCE RSUs should vest, 17 August 2018 30,553 17 August 2021 the Chief Executive Officer would receive: 21 August 2017 68,220 21 August 2020 91,447 RSUs x 50% = 45,724 ROCE RSUs Note: 1.0x target equals 50% of total ROCE RSUs granted. There was no consideration paid by, and James Hardie did not provide loans to, the Chief Executive Officer in relation to the grant of these ROCE RSUs. Notice of Annual General Meeting 2020 13

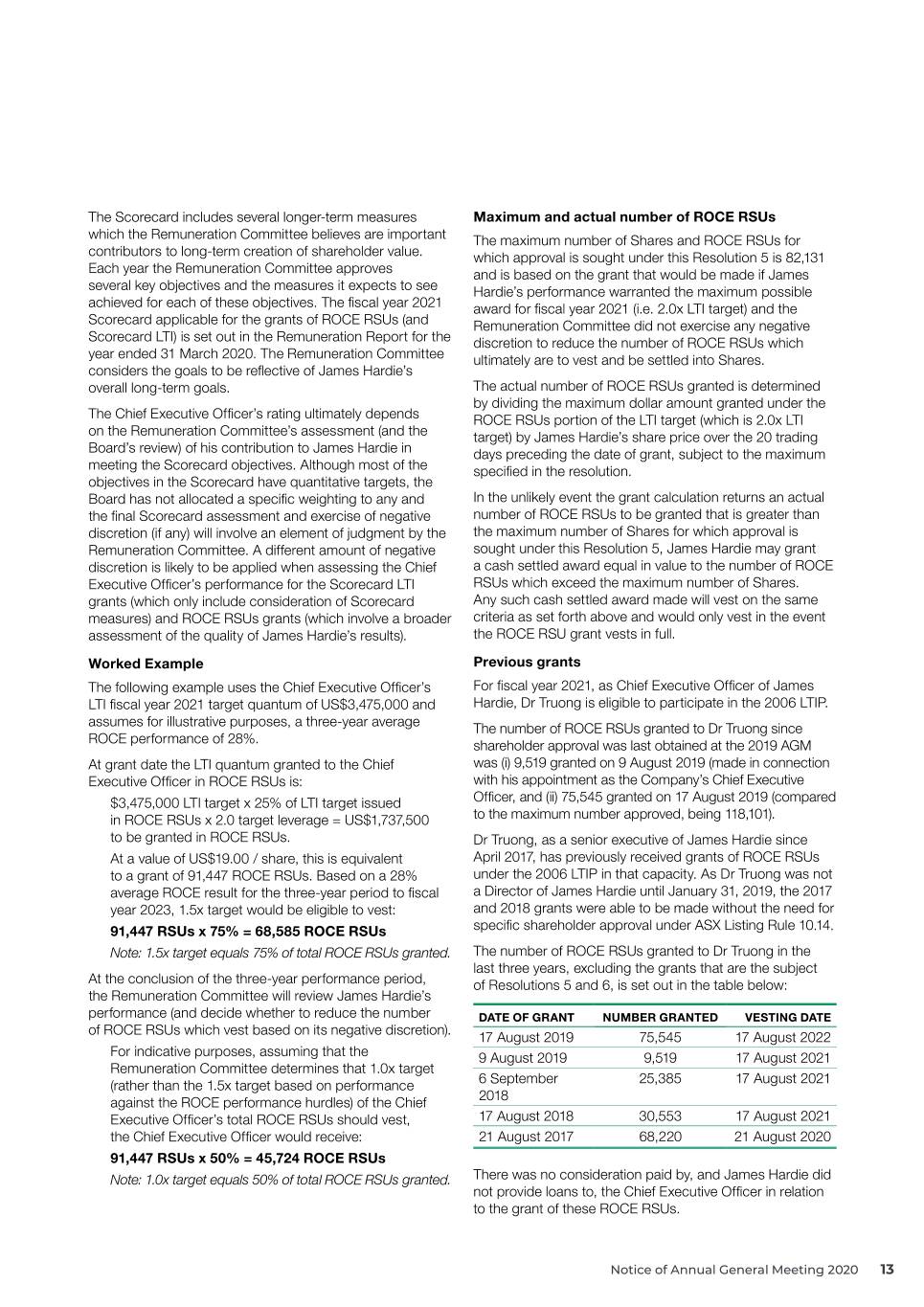

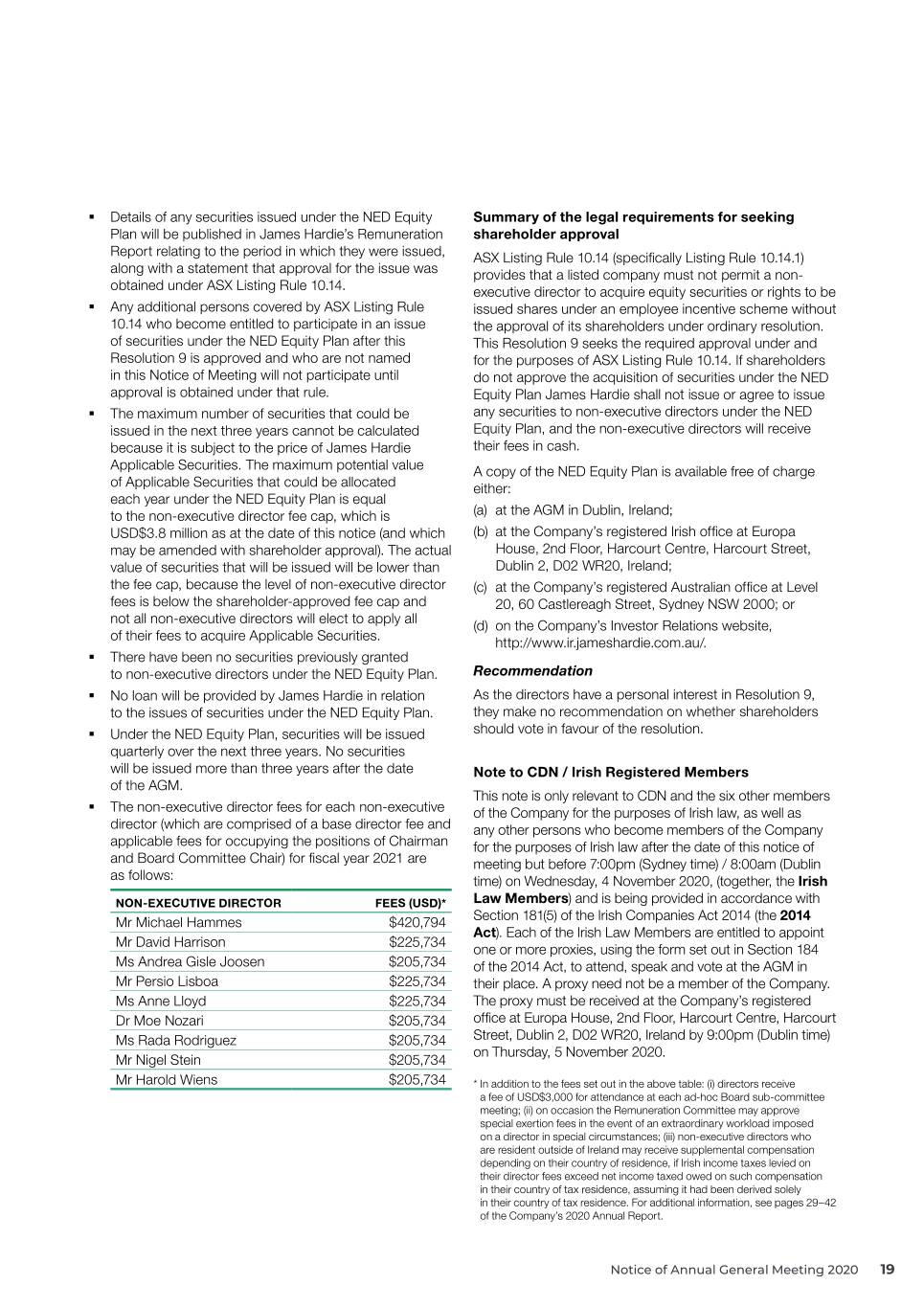

EXPLANATORY NOTES (CONTINUED) General Relative TSR RSU changes for fiscal year 2021 ROCE RSUs will be granted in accordance with the The key aspects of the Relative TSR RSUs are unchanged. terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. Key aspects of Relative TSR RSUs Grant: The Chief Executive Officer will receive a grant No director other than Dr Truong has received any grant equal to the maximum number of Relative TSR RSUs under the 2006 LTIP since the last AGM. (2.0x target). The number of Relative TSR RSUs which vest, Currently Dr Truong is the only Director of James Hardie and the number of Shares ultimately received depends entitled to participate in the 2006 LTIP. on James Hardie’s Relative TSR performance compared to the performance hurdles. ROCE RSUs will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Performance Hurdle: The performance hurdle vesting Officer in relation to the grant of ROCE RSUs. Subject to scale for fiscal year 2021 grants is unchanged from fiscal the performance hurdles being met and the Remuneration year 2020 and is as follows: Committee’s exercise of negative discretion (if any), the Chief Executive Officer will be entitled to receive Shares PERFORMANCE AGAINST AMOUNT OF TARGET upon vesting of the ROCE RSUs for no consideration. PEER GROUP RELATIVE TSR RSUs TO VEST ROCE RSUs will be granted to the Chief Executive Officer < 40th Percentile 0.0 no later than 12 months after the passing of Resolution 5. 40th Percentile 0.5x th th Summary of the legal requirements for seeking >40 – <60 Percentile Sliding Scale shareholder approval 60th Percentile 1.0x th th ASX Listing Rule 10.14 (specifically ASX Listing Rule >60 – <80 Percentile Sliding Scale 10.14.1) provides that a listed company must not permit ≥80th Percentile 2.0x a director to acquire shares or rights to be issued shares under an employee incentive scheme without the approval Peer Group: The Peer Group for the fiscal year 2021 of shareholders by ordinary resolution. Relative TSR RSU grant is comprised of other companies exposed to the US building materials market, which is James Resolution 5 seeks the required shareholder approval Hardie’s major market. The Remuneration Committee and to approve the grant of ROCE RSUs under the 2006 LTIP the Board reviewed the composition of the Peer Group under and for the purposes of ASX Listing Rule 10.14 to with the Company’s independent advisors, Aon Hewitt, James Hardie’s Director and Chief Executive Officer, Jack and determined that no changes would be made with Truong, for the fiscal year 2021 on the basis set out above. the exception of the removal of USG which was acquired If Resolution 5 is passed, the Company will be able by Germany-based Knauf KG and is therefore no longer to proceed with the grant of ROCE RSUs under the 2006 a public company. The Peer Group for fiscal year 2021 is: LTIP to James Hardie’s Director and Chief Executive Officer, Jack Truong, for the fiscal year 2021 on the basis set out Acuity Brands, Lennox Quanex Building above. If Resolution 5 is not passed, the Company will not Inc International, Inc Products Corp be able to proceed with the grant. American Louisiana-Pacific Simpson Woodmark Corp Corp Manufacturing Co., Recommendation Inc The Board believes it is in the interests of shareholders Apogee Martin Marietta Trex Co., Inc that the fiscal year 2021 grant of ROCE RSUs to the Chief Enterprises, Inc Materials Inc Executive Officer up to the number specified in Resolution Armstrong World Masco Valmont Industries, 5 under the 2006 LTIP, subject to the above terms and Indus, Inc Corporation Inc conditions, is approved under and for the purposes of ASX Cornerstone Mohawk Vulcan Materials Co Listing Rule 10.14 and recommends that you vote in favour Building Brands, Industries, Inc of Resolution 5. Inc. RESOLUTION 6 – GRANT OF FISCAL YEAR Eagle Materials, Mueller Water Watsco, Inc 2021 RELATIVE TSR RSUs Inc Products, Inc Fortune Brands, Owens Corning Resolution 6 asks shareholders to approve under and for Home & Security the purposes of ASX Listing Rule 10.14 the grant of Relative Inc. TSR RSUs to Jack Truong, James Hardie’s Director and Chief Executive Officer, for the fiscal year 2021. Relative TSR RSUs shall vest if James Hardie’s TSR performance meets or exceeds the Relative TSR performance hurdles. Upon vesting, Relative TSR RSUs shall be settled in CUFS on a 1-to-1 basis. 14

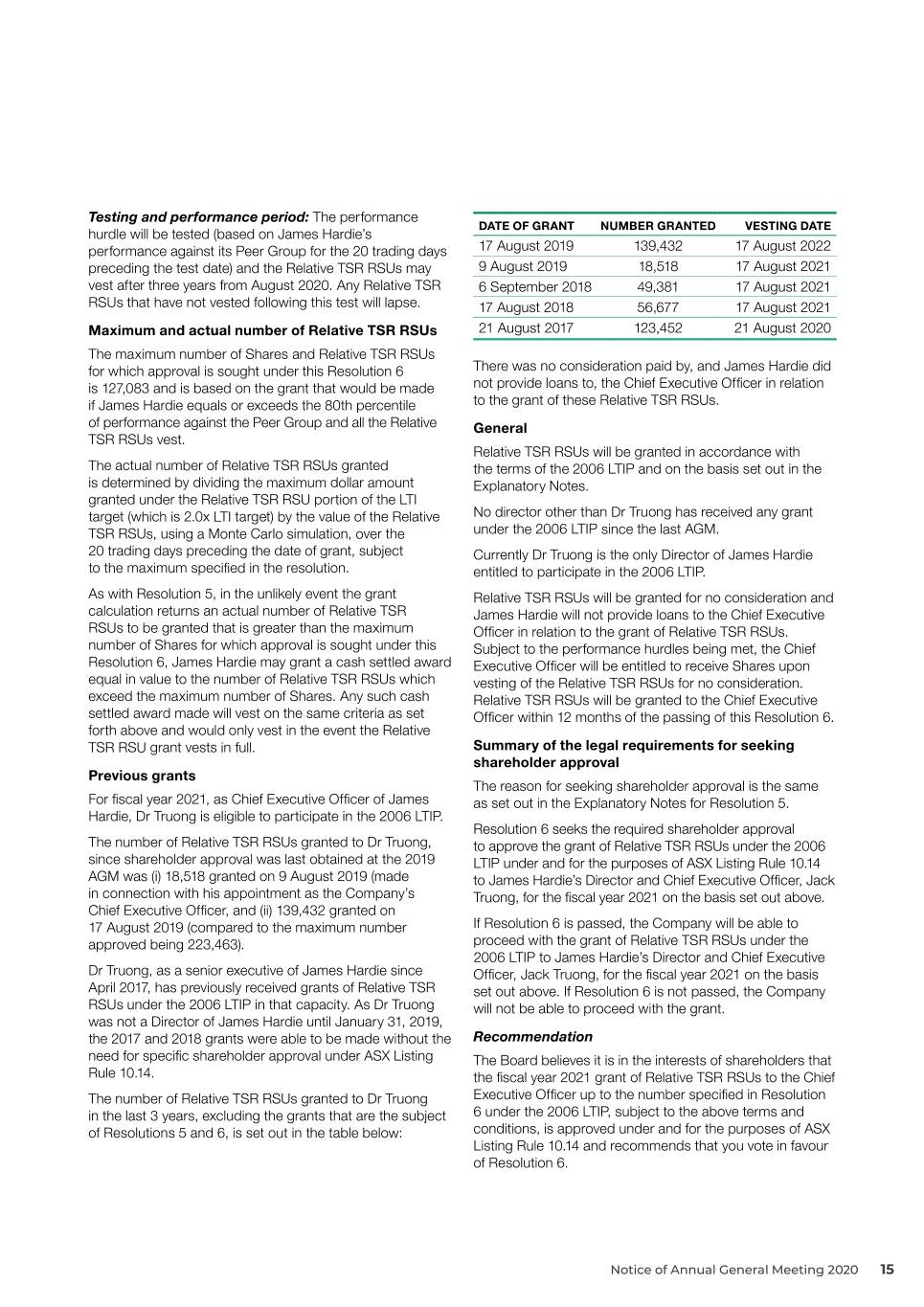

Testing and performance period: The performance DATE OF GRANT NUMBER GRANTED VESTING DATE hurdle will be tested (based on James Hardie’s performance against its Peer Group for the 20 trading days 17 August 2019 139,432 17 August 2022 preceding the test date) and the Relative TSR RSUs may 9 August 2019 18,518 17 August 2021 vest after three years from August 2020. Any Relative TSR 6 September 2018 49,381 17 August 2021 RSUs that have not vested following this test will lapse. 17 August 2018 56,677 17 August 2021 Maximum and actual number of Relative TSR RSUs 21 August 2017 123,452 21 August 2020 The maximum number of Shares and Relative TSR RSUs for which approval is sought under this Resolution 6 There was no consideration paid by, and James Hardie did is 127,083 and is based on the grant that would be made not provide loans to, the Chief Executive Officer in relation if James Hardie equals or exceeds the 80th percentile to the grant of these Relative TSR RSUs. of performance against the Peer Group and all the Relative General TSR RSUs vest. Relative TSR RSUs will be granted in accordance with The actual number of Relative TSR RSUs granted the terms of the 2006 LTIP and on the basis set out in the is determined by dividing the maximum dollar amount Explanatory Notes. granted under the Relative TSR RSU portion of the LTI target (which is 2.0x LTI target) by the value of the Relative No director other than Dr Truong has received any grant TSR RSUs, using a Monte Carlo simulation, over the under the 2006 LTIP since the last AGM. 20 trading days preceding the date of grant, subject Currently Dr Truong is the only Director of James Hardie to the maximum specified in the resolution. entitled to participate in the 2006 LTIP. As with Resolution 5, in the unlikely event the grant Relative TSR RSUs will be granted for no consideration and calculation returns an actual number of Relative TSR James Hardie will not provide loans to the Chief Executive RSUs to be granted that is greater than the maximum Officer in relation to the grant of Relative TSR RSUs. number of Shares for which approval is sought under this Subject to the performance hurdles being met, the Chief Resolution 6, James Hardie may grant a cash settled award Executive Officer will be entitled to receive Shares upon equal in value to the number of Relative TSR RSUs which vesting of the Relative TSR RSUs for no consideration. exceed the maximum number of Shares. Any such cash Relative TSR RSUs will be granted to the Chief Executive settled award made will vest on the same criteria as set Officer within 12 months of the passing of this Resolution 6. forth above and would only vest in the event the Relative TSR RSU grant vests in full. Summary of the legal requirements for seeking shareholder approval Previous grants The reason for seeking shareholder approval is the same For fiscal year 2021, as Chief Executive Officer of James as set out in the Explanatory Notes for Resolution 5. Hardie, Dr Truong is eligible to participate in the 2006 LTIP. Resolution 6 seeks the required shareholder approval The number of Relative TSR RSUs granted to Dr Truong, to approve the grant of Relative TSR RSUs under the 2006 since shareholder approval was last obtained at the 2019 LTIP under and for the purposes of ASX Listing Rule 10.14 AGM was (i) 18,518 granted on 9 August 2019 (made to James Hardie’s Director and Chief Executive Officer, Jack in connection with his appointment as the Company’s Truong, for the fiscal year 2021 on the basis set out above. Chief Executive Officer, and (ii) 139,432 granted on 17 August 2019 (compared to the maximum number If Resolution 6 is passed, the Company will be able to approved being 223,463). proceed with the grant of Relative TSR RSUs under the 2006 LTIP to James Hardie’s Director and Chief Executive Dr Truong, as a senior executive of James Hardie since Officer, Jack Truong, for the fiscal year 2021 on the basis April 2017, has previously received grants of Relative TSR set out above. If Resolution 6 is not passed, the Company RSUs under the 2006 LTIP in that capacity. As Dr Truong will not be able to proceed with the grant. was not a Director of James Hardie until January 31, 2019, the 2017 and 2018 grants were able to be made without the Recommendation need for specific shareholder approval under ASX Listing The Board believes it is in the interests of shareholders that Rule 10.14. the fiscal year 2021 grant of Relative TSR RSUs to the Chief The number of Relative TSR RSUs granted to Dr Truong Executive Officer up to the number specified in Resolution in the last 3 years, excluding the grants that are the subject 6 under the 2006 LTIP, subject to the above terms and of Resolutions 5 and 6, is set out in the table below: conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and recommends that you vote in favour of Resolution 6. Notice of Annual General Meeting 2020 15

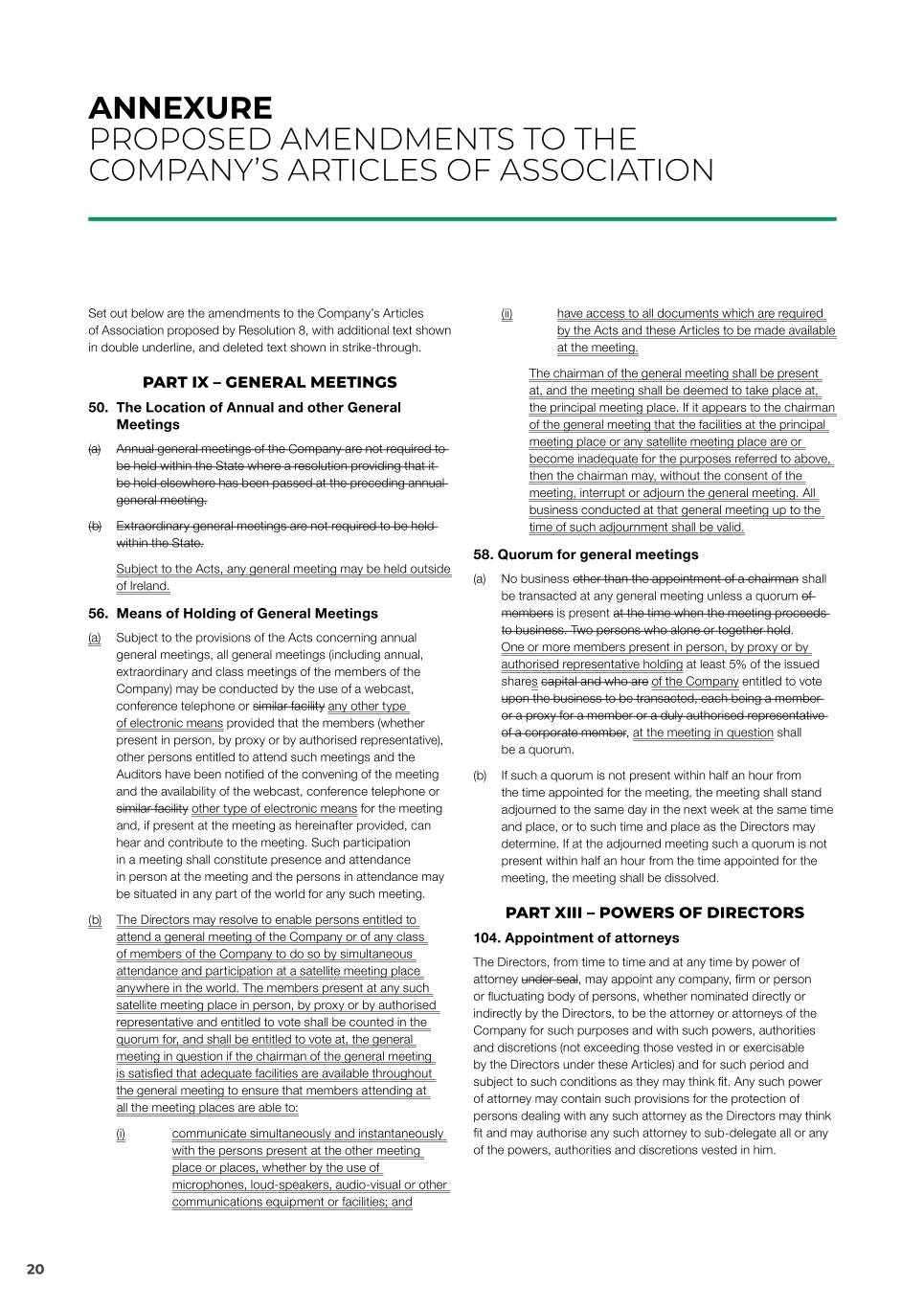

EXPLANATORY NOTES (CONTINUED) ISSUE OF SECURITIES AND TOTAL At our 2019 AGM, shareholders renewed the directors’ REMUNERATION authority to issue Shares up to a maximum of our authorised but unissued ordinary share capital (the renewed Issue of securities issuance authority) on the basis that the renewed issuance Details of any securities issued under the 2006 LTIP will authority only became effective upon the expiry of the be published in the Remuneration Report of the Company previously existing authority on 14 August 2020 and would relating to a period in which they were issued, along with expire on 7 August 2024. a statement that approval for the issue was obtained under We are now asking for your approval to renew the directors’ ASX Listing Rule 10.14. authority to disapply the statutory pre-emption right with Any additional persons covered by ASX Listing Rule 10.14 respect to the issuance of new Shares for cash consideration who become entitled to participate in the 2006 LTIP after pursuant to the renewed issuance authority on the terms set Resolutions 5 and 6 are approved and who were not out in the resolution and described further below. named in this Notice of Meeting will not participate until approval is obtained under that rule. Summary of the legal requirements for seeking shareholder approval Total remuneration – FY21 Target Similar to the renewed issuance authority sought and A significant portion of Dr Truong’s remuneration is pay obtained by resolution 9 at our AGM in 2019, the Company “at risk” which is earned through both the short-term is seeking to renew its previous disapplication authority and long-term incentive plans. The table below shows for an additional four‑year period, expiring on the same Dr Truong’s target remuneration for fiscal year 2021. date as the renewed issuance authority. This authority is fundamental to our business and will facilitate our ability Base Salary $900,000 to fund acquisitions and otherwise raise capital. We are STI Target $1,125,000 not asking you to approve an increase in our authorised Long-Term Incentive Target $3,475,000 share capital; rather, approval of this resolution will only Total Remuneration $5,500,000 grant the directors the authority to issue Shares for cash consideration in the manner permitted under our Articles of Association upon the terms set out in the resolution and RESOLUTION 7 – RENEWAL OF AUTHORITY consistent with the directors’ authority since 2010. FOR DIRECTORS TO ISSUE SHARES FOR Approval of this resolution would not exempt James Hardie CASH WITHOUT FIRST OFFERING SHARES from applicable ASX or NYSE requirements to obtain TO EXISTING SHAREHOLDERS shareholder approval prior to certain share issuances Introduction or to comply with applicable ASIC and / or SEC disclosure and other regulations, and the Board will continue to focus In general, before an Irish public limited company can issue on and satisfy its fiduciary duties to our shareholders with shares for cash consideration to any new shareholders respect to share issuances. (including rights to subscribe for or otherwise acquire any shares), it must first offer those shares or rights If Resolution 7 is not approved, our Board will generally not to existing shareholders of the company pro-rata to be able to issue any Shares or any rights to subscribe for their existing shareholding (commonly referred to as the Shares for cash consideration (other than to employees statutory pre-emption right). However, a public limited pursuant to our employee equity plans or pursuant to company’s shareholders can authorise a board to opt-out a pre-existing contractual obligation) without first offering of (or disapply) the statutory pre-emption right. those Shares or rights to existing shareholders of the company pro-rata to their existing shareholdings on the From the date of our re-domiciliation to Ireland in 2010 until same or more favourable terms. 14 August 2020, our Articles of Association authorised the directors to issue new Shares without shareholder Recommendation approval up to a maximum of our authorised but unissued The Board believes it is in the interests of shareholders that ordinary share capital, and further authorised the directors the Board’s authority to issue Shares for cash consideration to disapply the statutory pre-emption right where such without first offering them to existing shareholders be issuances were for cash consideration. As the maximum renewed in the manner described above and recommends time period for such authorities permitted under the Irish that you vote in favour of Resolution 7. Companies Act 2014 is five years, those authorities expired on 14 August 2020, five years after their last renewal at the Company’s 2015 AGM. If our 2020 AGM had not been delayed by the ongoing coronavirus pandemic, subject to shareholder approval, this authority would have been presented for renewal prior to its expiration. 16

RESOLUTION 8 – AMENDMENTS TO THE § Article 134 is being amended to provide the directors COMPANY’S ARTICLES OF ASSOCIATION with the power to approve and give effect to distributions in specie, which are distributions paid Resolution 8 asks shareholders to approve the following or satisfied by the distribution of specific assets of amendments to the Company’s Articles of Association the Company (rather than cash), without shareholder (as set out in full in the Annexure to this Notice of Meeting) approval. This power would remain subject to any in order to provide a more modern and flexible means binding legal, stock exchange or other regulatory of communicating with shareholders and conducting the requirement to seek shareholder approval should the Company’s business in the future. In particular: specific situation demand it; and § Article 50 is being amended to remove the requirement § Articles 140(f) and 145 are being amended to permit for advance shareholder approval if the Company the Company to publish certain notices and documents wishes to hold its AGM outside of Ireland in the future, on its website and issue a short notice to shareholders taking advantage of a more flexible regime in this informing them of how to access those materials. area introduced by the Irish Companies Act 2014 (the If passed, the amendments will allow the Company 2014 Act). Removing the requirement for advance to avoid having to run large print quantities of such shareholder approval will allow the Company to quickly materials, thereby avoiding the associated cost, printing and appropriately respond to unforeseen circumstances and typesetting delays and ultimately the paper waste where it is desirable to hold an AGM outside of Ireland; generated in this process consistent with James § Article 56 is being amended to provide the Company Hardie’s commitment to environmental excellence. with flexibility and further options for how shareholders As an example, if the proposed amendments are can access and participate in future shareholder approved, following the 2020 AGM you may, in the meetings, including broadening how electronic access future, receive notifications of the electronic availability may be granted to meetings and allowing for the of notices of meeting such as this one rather than the possibility of multiple venues to be used throughout the document itself. world at which shareholders can attend and participate in a given meeting; A copy of the Articles of Association in the form amended by Resolution 8 is available free of charge either: § Article 58 simplifies the manner in which a quorum may be formed for shareholder meetings, without affecting (a) at the AGM in Dublin, Ireland; the existing 5% shareholding attendance threshold. (b) at the Company’s registered Irish office at Europa At the moment, the Company has seven registered House, 2nd Floor, Harcourt Centre, Harcourt Street, legal shareholders, consisting of CDN (which holds Dublin 2, D02 WR20, Ireland; legal title to almost the entirety of the Company’s (c) at the Company’s registered Australian office at Level issued share capital), and six other entities, each 20, 60 Castlereagh Street, Sydney NSW 2000; or holding one share for historic (now obsolete) Irish law reasons. The proposed amendment will ensure that (d) on the Company’s Investor Relations website, a shareholder meeting will be quorate where CDN is http://www.ir.jameshardie.com.au/. present (through a corporate representative or a proxy) Recommendation and has the power to vote at least 5% of the Company’s issued share capital. The amendment will also allow The Board believes that the proposed amendments to the Company to streamline its Irish law register of the Articles of Association provide a more modern and members in the future in order to remove the six legal flexible means of communicating with shareholders and shareholders who are no longer required as a matter conducting the Company’s business, will relieve the of Irish law; Company of unnecessary administrative burden and will have a positive effect on the Company’s environmental § Article 104 is being slightly amended as the 2014 impact. For these reasons, the Board believes it is in the Act now provides that powers of attorney may be best interests of shareholders to adopt the proposed executed without the use of a company’s common seal, changes to the Articles of Association and recommends notwithstanding anything to the contrary in a company’s that you vote in favour of Resolution 8. constitution. Article 104 is therefore out of date and is being amended to reflect the statutory position; RESOLUTION 9 – APPROVAL OF JAMES § Articles 128 and 129 are being amended to enhance HARDIE 2020 NON-EXECUTIVE DIRECTOR the Company’s flexibility for the signing and sealing EQUITY PLAN AND ISSUE OF SHARES of documents which require the Company’s common THEREUNDER seal to be affixed, and to reduce the logistical burden Resolution 9 asks shareholders to approve the NED Equity associated with that process (in particular by the Plan and the issue of Shares (including those underlying reduction of the number of required signatories from any CUFS, ADSs or other equivalent listed depositary two to one); receipt which represents a beneficial interest in a Share (collectively, LDRs)) for cash to participants for the next three years. Notice of Annual General Meeting 2020 17

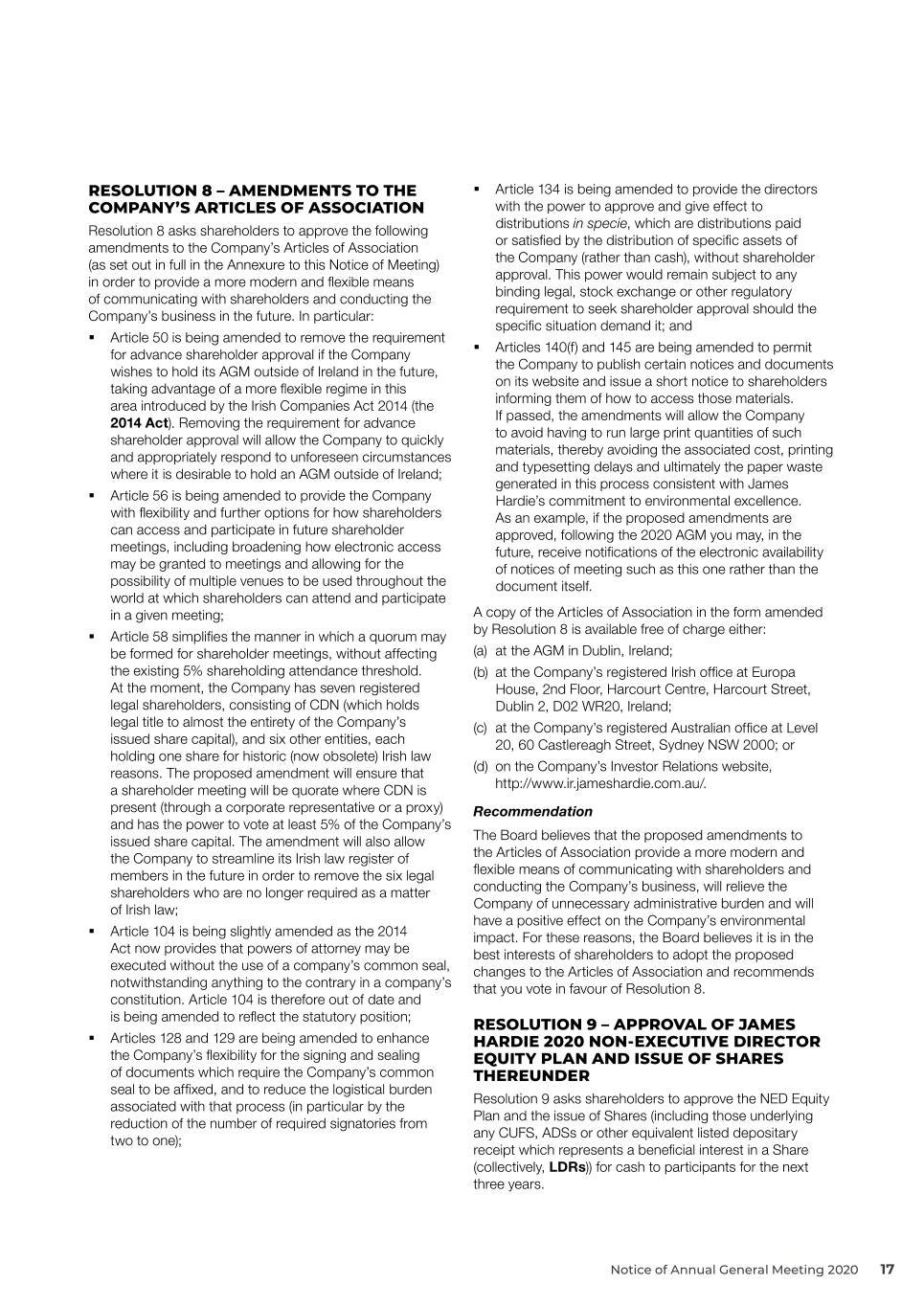

EXPLANATORY NOTES (CONTINUED) The Remuneration Committee believes that non‑executive Eligible Participants will have the right to elect to have directors should maintain a meaningful level of share Applicable Securities issued to them personally or to ownership to further align their interests with those a nominee. The LDRs issued to the Eligible Participants of James Hardie’s shareholders. Consequently, or their nominee can be traded on the ASX, NYSE or other the Remuneration Committee has adopted Board applicable stock exchange, subject to insider trading laws accumulation guidelines under which non‑executive and the James Hardie Insider Trading Policy. directors are encouraged to accumulate a minimum of 1.5 times (and 2 times for the Chairman) of their non-executive Other issuances under the NED Equity Plan director base fee in Shares, which include any represented Under the NED Equity Plan the Administrator may grant by LDRs (collectively, Applicable Securities). to non‑executive directors or their nominee the right to acquire Applicable Securities (as described in this Resolution In August 2020, the Nominating and Governance 9), share options (to subscribe for, acquire or be allocated Committee introduced the NED Equity Plan to facilitate Applicable Securities), restricted stock units (RSUs) equity ownership for non-executive directors. Under (being an entitlement to acquire or be allocated Applicable the NED Equity Plan, the Administrator (being the Securities) and restricted shares (being an entitlement to Board or such committee(s) appointed by the Board Applicable Securities subject to satisfying vesting conditions from time to time) may invite “Eligible Participants” as determined by the Administrator) (Awards) in the number (non‑executive directors or proposed non-executive and on terms and conditions (and to amend, modify, directors (or their nominees)) to apply part or all of the extend or renew Awards) in the Administrator’s absolute cash component of their non-executive director fees for discretion, subject to the listing rules of the ASX, NYSE or services to the Board to acquire Applicable Securities. other applicable stock exchange. The Administrator does not Issue of Applicable Securities under the NED presently intend to issue share options, RSUs or restricted Equity Plan shares, and will not issue or agree to issue such securities without shareholder approval if such approval is required Elections by the Eligible Participants as to the quantum under the listing rules of the ASX, NYSE or any other of their non-executive director fees to be applied to acquire applicable stock exchange. The grant of the Awards and Applicable Securities will be made in advance on an annual the terms and conditions of the grant will be detailed in the basis (NED Fees Election Amount). non‑executive director’s grant agreement. The number of Applicable Securities that an Eligible The NED Equity Plan also contains provisions in relation Participant will receive is calculated in accordance with to the treatment of Awards on a change in control. In the the following formula (rounded down to the nearest whole event of a change in control, outstanding Awards will be number with any unfulfilled NED Fees Election Amount subject to the definitive agreement entered into by James returned to the non-executive director): Hardie in connection with the change in control. Subject Number of Applicable Securities = Value of Director to applicable law and the ASX Listing Rules, the Board Fee Election Amount for the relevant quarter / Fair may determine to accelerate the vesting, exercisability Market Value or settlement of any Award, assume, substitute or convert any Award into a substantially equivalent award with The Fair Market Value of Applicable Securities will be respect to the acquiring or parent entity’s securities, based on the volume weighted average closing price or cancel any Award in exchange for cash, securities for the Applicable Security for a period of 5 trading days or property. on the relevant stock exchange. Consequently, the Fair Market Value for a CUFS or ADS is the volume weighted The NED Equity Plan provides that the Administrator may average closing price of a CUFS or ADS on the ASX or terminate the NED Equity Plan (or any part of it) at any time, NYSE, as the case may be, during a period of five trading provided all Awards made under the NED Equity Plan prior days commencing on the first trading day following to such termination remain in effect until they have been the announcement of the Company’s quarterly results. satisfied or terminated in accordance with their terms and A currency exchange calculation may also be required the NED Equity Plan. as non-executive director fees are usually paid in USD$ and a CUFS trades in AUD$. Further information in accordance with ASX Listing Rule 10.14 and 10.15 The Shares underlying the LDRs shall not be issued § The non-executive directors currently entitled to at a discount to their “nominal value”. The Applicable participate in the NED Equity Plan are Mr Michael Securities will be issued quarterly subject to compliance Hammes, Mr David Harrison, Ms Andrea Gisle with James Hardie’s Insider Trading Policy. Joosen, Mr Persio Lisboa, Ms Anne Lloyd, Dr Moe On issue, the Applicable Securities will rank equally with Nozari, Ms Rada Rodriguez, Mr Nigel Stein and the same class of Applicable Securities, and will carry the Mr Harold Wiens. same dividend, voting and other rights. Eligible Participants § Only non-executive directors (non-employee directors) will not have dividend or voting rights in respect of the or proposed non-executive directors (or their nominee) Applicable Securities until such time as they are issued. may participate in the NED Equity Plan. 18