false2021FY0001159152us-gaap:AccountingStandardsUpdate201602Memberjhx:AccountingStandardsUpdate201616Member00011591522020-04-012021-03-310001159152dei:BusinessContactMember2020-04-012021-03-31xbrli:shares00011591522021-03-31iso4217:USD00011591522020-03-310001159152jhx:EuropeBuildingProductsMember2021-03-31iso4217:EURxbrli:shares00011591522019-04-012020-03-3100011591522018-04-012019-03-31iso4217:USDxbrli:shares00011591522019-03-3100011591522018-03-310001159152us-gaap:CommonStockMember2018-03-310001159152us-gaap:AdditionalPaidInCapitalMember2018-03-310001159152us-gaap:RetainedEarningsMember2018-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-03-310001159152us-gaap:RetainedEarningsMember2018-04-012019-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-04-012019-03-310001159152us-gaap:CommonStockMember2018-04-012019-03-310001159152us-gaap:AdditionalPaidInCapitalMember2018-04-012019-03-310001159152us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-03-310001159152srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-03-310001159152us-gaap:CommonStockMember2019-03-310001159152us-gaap:AdditionalPaidInCapitalMember2019-03-310001159152us-gaap:RetainedEarningsMember2019-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001159152us-gaap:RetainedEarningsMember2019-04-012020-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012020-03-310001159152us-gaap:CommonStockMember2019-04-012020-03-310001159152us-gaap:AdditionalPaidInCapitalMember2019-04-012020-03-310001159152us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-03-310001159152srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-03-310001159152us-gaap:CommonStockMember2020-03-310001159152us-gaap:AdditionalPaidInCapitalMember2020-03-310001159152us-gaap:RetainedEarningsMember2020-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001159152us-gaap:RetainedEarningsMember2020-04-012021-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012021-03-310001159152us-gaap:CommonStockMember2020-04-012021-03-310001159152us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-310001159152us-gaap:CommonStockMember2021-03-310001159152us-gaap:AdditionalPaidInCapitalMember2021-03-310001159152us-gaap:RetainedEarningsMember2021-03-310001159152us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-3100011591522017-04-012018-03-31xbrli:purejhx:director0001159152jhx:AsbestosInjuriesCompensationFundMember2020-04-012021-03-310001159152jhx:NewSouthWalesAustraliaMemberjhx:AsbestosInjuriesCompensationFundMember2020-04-012021-03-310001159152jhx:AsbestosInjuriesCompensationFundMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:BuildingMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:BuildingMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:BuildingImprovementsMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:BuildingImprovementsMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2020-04-012021-03-310001159152srt:MinimumMember2020-04-012021-03-310001159152srt:MaximumMember2020-04-012021-03-310001159152jhx:ContingentSharesNotExpectedToVestMember2020-04-012021-03-310001159152jhx:ContingentSharesNotExpectedToVestMember2019-04-012020-03-310001159152jhx:ContingentSharesNotExpectedToVestMember2018-04-012019-03-310001159152jhx:FibercementMemberjhx:NorthAmericaFiberCementMember2020-04-012021-03-310001159152jhx:FibercementMemberjhx:AsiaPacificFiberCementMember2020-04-012021-03-310001159152jhx:FibercementMemberjhx:EuropeBuildingProductsMember2020-04-012021-03-310001159152jhx:FibercementMember2020-04-012021-03-310001159152jhx:FibergypsumMemberjhx:NorthAmericaFiberCementMember2020-04-012021-03-310001159152jhx:FibergypsumMemberjhx:AsiaPacificFiberCementMember2020-04-012021-03-310001159152jhx:FibergypsumMemberjhx:EuropeBuildingProductsMember2020-04-012021-03-310001159152jhx:FibergypsumMember2020-04-012021-03-310001159152jhx:NorthAmericaFiberCementMember2020-04-012021-03-310001159152jhx:AsiaPacificFiberCementMember2020-04-012021-03-310001159152jhx:EuropeBuildingProductsMember2020-04-012021-03-310001159152jhx:FibercementMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152jhx:FibercementMemberjhx:AsiaPacificFiberCementMember2019-04-012020-03-310001159152jhx:FibercementMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152jhx:FibercementMemberjhx:OtherBusinessesMember2019-04-012020-03-310001159152jhx:FibercementMember2019-04-012020-03-310001159152jhx:FibergypsumMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152jhx:FibergypsumMemberjhx:AsiaPacificFiberCementMember2019-04-012020-03-310001159152jhx:FibergypsumMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152jhx:FibergypsumMemberjhx:OtherBusinessesMember2019-04-012020-03-310001159152jhx:FibergypsumMember2019-04-012020-03-310001159152jhx:OtherrevenuesMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152jhx:AsiaPacificFiberCementMemberjhx:OtherrevenuesMember2019-04-012020-03-310001159152jhx:OtherrevenuesMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152jhx:OtherBusinessesMemberjhx:OtherrevenuesMember2019-04-012020-03-310001159152jhx:OtherrevenuesMember2019-04-012020-03-310001159152jhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152jhx:AsiaPacificFiberCementMember2019-04-012020-03-310001159152jhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152jhx:OtherBusinessesMember2019-04-012020-03-310001159152jhx:FibercementMemberjhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152jhx:FibercementMemberjhx:AsiaPacificFiberCementMember2018-04-012019-03-310001159152jhx:FibercementMemberjhx:EuropeBuildingProductsMember2018-04-012019-03-310001159152jhx:FibercementMemberjhx:OtherBusinessesMember2018-04-012019-03-310001159152jhx:FibercementMember2018-04-012019-03-310001159152jhx:FibergypsumMemberjhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152jhx:FibergypsumMemberjhx:AsiaPacificFiberCementMember2018-04-012019-03-310001159152jhx:FibergypsumMemberjhx:EuropeBuildingProductsMember2018-04-012019-03-310001159152jhx:FibergypsumMemberjhx:OtherBusinessesMember2018-04-012019-03-310001159152jhx:FibergypsumMember2018-04-012019-03-310001159152jhx:OtherrevenuesMemberjhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152jhx:AsiaPacificFiberCementMemberjhx:OtherrevenuesMember2018-04-012019-03-310001159152jhx:OtherrevenuesMemberjhx:EuropeBuildingProductsMember2018-04-012019-03-310001159152jhx:OtherBusinessesMemberjhx:OtherrevenuesMember2018-04-012019-03-310001159152jhx:OtherrevenuesMember2018-04-012019-03-310001159152jhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152jhx:AsiaPacificFiberCementMember2018-04-012019-03-310001159152jhx:EuropeBuildingProductsMember2018-04-012019-03-310001159152jhx:OtherBusinessesMember2018-04-012019-03-310001159152srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-03-3100011591522020-04-012020-12-310001159152jhx:EuropeBuildingProductsMember2019-03-310001159152jhx:AsiaPacificFiberCementMember2019-03-310001159152jhx:EuropeBuildingProductsMember2020-03-310001159152jhx:AsiaPacificFiberCementMember2020-03-310001159152jhx:AsiaPacificFiberCementMember2021-03-310001159152us-gaap:TradeNamesMember2021-03-310001159152us-gaap:TradeNamesMember2020-03-310001159152us-gaap:OtherIntangibleAssetsMember2021-03-310001159152us-gaap:OtherIntangibleAssetsMember2020-03-310001159152us-gaap:CustomerRelationshipsMember2021-03-310001159152us-gaap:OtherIntangibleAssetsMember2021-03-310001159152us-gaap:CustomerRelationshipsMember2020-03-310001159152us-gaap:OtherIntangibleAssetsMember2020-03-310001159152us-gaap:LandMember2021-03-310001159152us-gaap:LandMember2020-03-310001159152us-gaap:BuildingMember2021-03-310001159152us-gaap:BuildingMember2020-03-310001159152us-gaap:MachineryAndEquipmentMember2021-03-310001159152us-gaap:MachineryAndEquipmentMember2020-03-310001159152us-gaap:ConstructionInProgressMember2021-03-310001159152us-gaap:ConstructionInProgressMember2020-03-310001159152jhx:OtherBusinessesMember2020-04-012021-03-310001159152jhx:ShutDownofSummervilleSouthCarolinaFacilityMember2019-04-012020-03-310001159152jhx:NonCoreAssetsMember2019-04-012020-03-31jhx:plant0001159152jhx:ExitofBusinessMemberjhx:AsiaPacificFiberCementMember2019-04-012020-03-310001159152jhx:PenrosePlantAssetsMemberjhx:AsiaPacificFiberCementMember2020-03-310001159152jhx:NonCoreAssetsMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152us-gaap:CostOfSalesMemberjhx:NorthAmericaFiberCementMember2020-04-012021-03-310001159152us-gaap:CostOfSalesMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152us-gaap:CostOfSalesMemberjhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152us-gaap:SeniorNotesMemberjhx:A475SeniorUnsecuredNotesDue2025Member2020-03-310001159152us-gaap:SeniorNotesMemberjhx:A475SeniorUnsecuredNotesDue2025Member2021-03-310001159152us-gaap:SeniorNotesMemberjhx:A3625SeniorUnsecuredNotesDue2026Member2021-03-31iso4217:EUR0001159152us-gaap:SeniorNotesMemberjhx:A3625SeniorUnsecuredNotesDue2026Member2020-03-310001159152us-gaap:SeniorNotesMemberjhx:A5000SeniorUnsecuredNotesDue2028Member2021-03-310001159152us-gaap:SeniorNotesMemberjhx:A5000SeniorUnsecuredNotesDue2028Member2020-03-310001159152us-gaap:SeniorNotesMember2021-03-310001159152us-gaap:SeniorNotesMember2020-03-310001159152us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-03-310001159152us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-03-310001159152us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Member2021-03-310001159152us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Member2020-03-310001159152us-gaap:SeniorNotesMemberjhx:A475SeniorUnsecuredNotesDue2025Member2021-01-152021-01-150001159152us-gaap:SeniorNotesMemberjhx:A475SeniorUnsecuredNotesDue2025Member2021-01-150001159152us-gaap:SeniorNotesMemberjhx:A3625SeniorUnsecuredNotesDue2026Member2018-10-012018-10-310001159152us-gaap:SeniorNotesMemberjhx:A3625SeniorUnsecuredNotesDue2026Member2018-10-310001159152jhx:A364DayTermLoanFacilityMember2018-10-012018-10-310001159152jhx:A364DayTermLoanFacilityMember2018-10-032018-10-030001159152us-gaap:SeniorNotesMemberjhx:A3625SeniorUnsecuredNotesDue2026Member2018-10-032018-10-030001159152jhx:A364DayTermLoanFacilityMember2018-04-012019-03-310001159152us-gaap:SeniorNotesMemberjhx:A5000SeniorUnsecuredNotesDue2028Member2017-12-012017-12-310001159152jhx:A5000SeniorUnsecuredNotesDue2028Member2017-12-310001159152us-gaap:RevolvingCreditFacilityMember2015-12-310001159152us-gaap:RevolvingCreditFacilityMember2015-12-012015-12-310001159152srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2020-04-012021-03-310001159152us-gaap:RevolvingCreditFacilityMember2021-03-310001159152us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-03-310001159152jhx:BankGuaranteeMemberus-gaap:LineOfCreditMember2021-03-310001159152us-gaap:SubsequentEventMemberus-gaap:RevolvingCreditFacilityMember2021-05-180001159152jhx:DiscountedAndInflatedMember2021-03-31iso4217:AUD0001159152jhx:UndiscountedButInflatedMember2021-03-310001159152jhx:UndiscountedAndUninflatedMember2021-03-310001159152jhx:DiscountedAndInflatedMember2020-04-012021-03-31jhx:claim00011591522017-03-3100011591522016-03-3100011591522016-04-012017-03-310001159152jhx:AsbestosLiabilityMember2020-03-310001159152jhx:InsuranceReceivablesMember2020-03-310001159152jhx:RestrictedCashAndShortTermInvestmentsMember2020-03-310001159152jhx:OtherAssetsAndLiabilitiesMember2020-03-310001159152jhx:NetUnfundedAFFALiabilityMember2020-03-310001159152jhx:DeferredTaxAssetsMember2020-03-310001159152jhx:IncomeTaxPayableMember2020-03-310001159152jhx:NetUnfundedAFFALiabilityNetofTaxMember2020-03-310001159152jhx:AsbestosLiabilityMember2020-04-012021-03-310001159152jhx:RestrictedCashAndShortTermInvestmentsMember2020-04-012021-03-310001159152jhx:NetUnfundedAFFALiabilityNetofTaxMember2020-04-012021-03-310001159152jhx:NetUnfundedAFFALiabilityMember2020-04-012021-03-310001159152jhx:InsuranceReceivablesMember2020-04-012021-03-310001159152jhx:DeferredTaxAssetsMember2020-04-012021-03-310001159152jhx:IncomeTaxPayableMember2020-04-012021-03-310001159152jhx:OtherAssetsAndLiabilitiesMember2020-04-012021-03-310001159152jhx:AsbestosLiabilityMember2021-03-310001159152jhx:InsuranceReceivablesMember2021-03-310001159152jhx:RestrictedCashAndShortTermInvestmentsMember2021-03-310001159152jhx:OtherAssetsAndLiabilitiesMember2021-03-310001159152jhx:NetUnfundedAFFALiabilityMember2021-03-310001159152jhx:DeferredTaxAssetsMember2021-03-310001159152jhx:IncomeTaxPayableMember2021-03-310001159152jhx:NetUnfundedAFFALiabilityNetofTaxMember2021-03-310001159152jhx:AsbestosInjuriesCompensationFundMembersrt:ScenarioForecastMember2021-04-012022-03-310001159152srt:ScenarioForecastMember2021-04-012022-03-310001159152jhx:RestrictedCashAndShortTermInvestmentsMember2019-04-012020-03-310001159152jhx:RestrictedCashAndShortTermInvestmentsMember2018-04-012019-03-310001159152jhx:TimeDeposits2July2021MaturityDateMember2021-03-310001159152jhx:TimeDeposits30April2020MaturityDateMember2021-03-310001159152jhx:TimeDeposits1June2020MaturityDateMember2021-03-310001159152us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2021-03-310001159152us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-03-310001159152us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2021-03-310001159152us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2020-03-310001159152us-gaap:ForeignExchangeContractMemberjhx:AsbestosAdjustmentsMember2020-04-012021-03-310001159152us-gaap:ForeignExchangeContractMemberjhx:AsbestosAdjustmentsMember2019-04-012020-03-310001159152us-gaap:ForeignExchangeContractMemberjhx:AsbestosAdjustmentsMember2018-04-012019-03-310001159152us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-04-012021-03-310001159152us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2019-04-012020-03-310001159152us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2018-04-012019-03-310001159152us-gaap:ForeignExchangeContractMember2020-04-012021-03-310001159152us-gaap:ForeignExchangeContractMember2019-04-012020-03-310001159152us-gaap:ForeignExchangeContractMember2018-04-012019-03-310001159152jhx:NewZealandWeathertightnessMembersrt:SubsidiariesMembercountry:NZ2015-04-012016-03-310001159152jhx:NewZealandWeathertightnessMembersrt:SubsidiariesMembercountry:NZ2016-03-3100011591522015-04-012020-03-310001159152us-gaap:ForeignCountryMember2021-03-310001159152jhx:LiabilityAwardsMember2020-04-012021-03-310001159152jhx:LiabilityAwardsMember2019-04-012020-03-310001159152jhx:LiabilityAwardsMember2018-04-012019-03-310001159152jhx:EquityAwardsMember2020-04-012021-03-310001159152jhx:EquityAwardsMember2019-04-012020-03-310001159152jhx:EquityAwardsMember2018-04-012019-03-310001159152jhx:RestrictedStockUnitsServiceVestingMember2019-03-310001159152jhx:RestrictedStockUnitsPerformanceVestingMember2019-03-310001159152jhx:RestrictedStockUnitsMarketConditionMember2019-03-310001159152us-gaap:RestrictedStockUnitsRSUMember2019-03-31iso4217:AUDxbrli:shares0001159152jhx:RestrictedStockUnitsServiceVestingMember2019-04-012020-03-310001159152jhx:RestrictedStockUnitsPerformanceVestingMember2019-04-012020-03-310001159152jhx:RestrictedStockUnitsMarketConditionMember2019-04-012020-03-310001159152us-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310001159152jhx:RestrictedStockUnitsServiceVestingMember2020-03-310001159152jhx:RestrictedStockUnitsPerformanceVestingMember2020-03-310001159152jhx:RestrictedStockUnitsMarketConditionMember2020-03-310001159152us-gaap:RestrictedStockUnitsRSUMember2020-03-310001159152jhx:RestrictedStockUnitsServiceVestingMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsPerformanceVestingMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMember2020-04-012021-03-310001159152us-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsServiceVestingMember2021-03-310001159152jhx:RestrictedStockUnitsPerformanceVestingMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMember2021-03-310001159152us-gaap:RestrictedStockUnitsRSUMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:September2020GrantMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:November2020GrantMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:February2020GrantMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:September2019GrantMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:August2019GrantMember2020-04-012021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:September2020GrantMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:November2020GrantMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:February2020GrantMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:September2019GrantMember2021-03-310001159152jhx:RestrictedStockUnitsMarketConditionMemberjhx:August2019GrantMember2021-03-310001159152jhx:CashSettledUnitsMember2020-04-012021-03-310001159152jhx:CashSettledUnitsMember2019-04-012020-03-310001159152jhx:CashSettledUnitsMember2018-04-012019-03-310001159152jhx:FiscalYearTwoThousandAndTwentyOneSpecialDividendMember2020-04-012021-03-310001159152jhx:FiscalYearTwoThousandAndTwentyFirstHalfDividendMember2020-04-012021-03-310001159152jhx:FiscalYearTwoThousandAndNineteenSecondHalfDividendMember2020-04-012021-03-310001159152jhx:FiscalYearTwoThousandAndNineteenFirstHalfDividendMember2020-04-012021-03-310001159152jhx:FiscalYearTwoThousandAndEighteenSecondHalfDividendMember2020-04-012021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:NorthAmericaFiberCementMember2020-04-012021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:NorthAmericaFiberCementMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMember2020-04-012021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMemberjhx:EuropeBuildingProductsMember2020-04-012021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:EuropeBuildingProductsMember2018-04-012019-03-310001159152jhx:OtherBusinessesMemberus-gaap:OperatingSegmentsMember2020-04-012021-03-310001159152jhx:OtherBusinessesMemberus-gaap:OperatingSegmentsMember2019-04-012020-03-310001159152jhx:OtherBusinessesMemberus-gaap:OperatingSegmentsMember2018-04-012019-03-310001159152jhx:ResearchAndDevelopmentMemberus-gaap:OperatingSegmentsMember2020-04-012021-03-310001159152jhx:ResearchAndDevelopmentMemberus-gaap:OperatingSegmentsMember2019-04-012020-03-310001159152jhx:ResearchAndDevelopmentMemberus-gaap:OperatingSegmentsMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMember2020-04-012021-03-310001159152us-gaap:OperatingSegmentsMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMember2018-04-012019-03-310001159152us-gaap:CorporateNonSegmentMember2020-04-012021-03-310001159152us-gaap:CorporateNonSegmentMember2019-04-012020-03-310001159152us-gaap:CorporateNonSegmentMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMemberjhx:NorthAmericaFiberCementMember2021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:NorthAmericaFiberCementMember2020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMember2021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMember2020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:EuropeBuildingProductsMember2021-03-310001159152us-gaap:OperatingSegmentsMemberjhx:EuropeBuildingProductsMember2020-03-310001159152jhx:ResearchAndDevelopmentMemberus-gaap:OperatingSegmentsMember2021-03-310001159152jhx:ResearchAndDevelopmentMemberus-gaap:OperatingSegmentsMember2020-03-310001159152us-gaap:OperatingSegmentsMember2021-03-310001159152us-gaap:OperatingSegmentsMember2020-03-310001159152us-gaap:CorporateNonSegmentMember2021-03-310001159152us-gaap:CorporateNonSegmentMember2020-03-310001159152srt:NorthAmericaMember2020-04-012021-03-310001159152srt:NorthAmericaMember2019-04-012020-03-310001159152srt:NorthAmericaMember2018-04-012019-03-310001159152country:AU2020-04-012021-03-310001159152country:AU2019-04-012020-03-310001159152country:AU2018-04-012019-03-310001159152country:DE2020-04-012021-03-310001159152country:DE2019-04-012020-03-310001159152country:DE2018-04-012019-03-310001159152country:NZ2020-04-012021-03-310001159152country:NZ2019-04-012020-03-310001159152country:NZ2018-04-012019-03-310001159152jhx:OtherCountriesMember2020-04-012021-03-310001159152jhx:OtherCountriesMember2019-04-012020-03-310001159152jhx:OtherCountriesMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2021-03-310001159152us-gaap:OperatingSegmentsMembersrt:NorthAmericaMember2020-03-310001159152country:AUus-gaap:OperatingSegmentsMember2021-03-310001159152country:AUus-gaap:OperatingSegmentsMember2020-03-310001159152country:DEus-gaap:OperatingSegmentsMember2021-03-310001159152country:DEus-gaap:OperatingSegmentsMember2020-03-310001159152us-gaap:OperatingSegmentsMembercountry:NZ2021-03-310001159152us-gaap:OperatingSegmentsMembercountry:NZ2020-03-310001159152jhx:OtherCountriesMemberus-gaap:OperatingSegmentsMember2021-03-310001159152jhx:OtherCountriesMemberus-gaap:OperatingSegmentsMember2020-03-310001159152jhx:ResearchAndDevelopmentMember2020-04-012021-03-310001159152jhx:ResearchAndDevelopmentMember2019-04-012020-03-310001159152jhx:ResearchAndDevelopmentMember2018-04-012019-03-310001159152us-gaap:OperatingSegmentsMemberus-gaap:PropertyPlantAndEquipmentMemberjhx:NorthAmericaFiberCementMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMemberjhx:AsiaPacificFiberCementMemberus-gaap:PropertyPlantAndEquipmentMember2019-04-012020-03-310001159152us-gaap:OperatingSegmentsMemberus-gaap:PropertyPlantAndEquipmentMemberjhx:EuropeBuildingProductsMember2019-04-012020-03-310001159152us-gaap:CorporateNonSegmentMemberus-gaap:PropertyPlantAndEquipmentMember2019-04-012020-03-310001159152us-gaap:PropertyPlantAndEquipmentMember2019-04-012020-03-310001159152us-gaap:OtherNoncurrentLiabilitiesMemberjhx:AsiaPacificFiberCementMember2020-03-310001159152us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberjhx:NorthAmericaFiberCementMemberjhx:CustomerMember2020-04-012021-03-310001159152us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberjhx:NorthAmericaFiberCementMemberjhx:CustomerMember2019-04-012020-03-310001159152us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberjhx:NorthAmericaFiberCementMemberjhx:CustomerMember2018-04-012019-03-310001159152us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMemberus-gaap:NonUsMember2020-04-012021-03-310001159152us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMemberus-gaap:NonUsMember2019-04-012020-03-310001159152us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMemberus-gaap:NonUsMember2018-04-012019-03-310001159152us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-03-310001159152us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-03-310001159152us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001159152us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-04-012021-03-310001159152us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-04-012021-03-310001159152us-gaap:AccumulatedTranslationAdjustmentMember2020-04-012021-03-310001159152us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310001159152us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-03-310001159152us-gaap:AccumulatedTranslationAdjustmentMember2021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended 31 March 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number 1-15240

JAMES HARDIE INDUSTRIES plc

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Ireland

(Jurisdiction of incorporation or organization)

Europa House, 2nd Floor

Harcourt Centre

Harcourt Street, Dublin 2, D02, WR20, Ireland

(Address of principal executive offices)

Joseph C. Blasko

General Counsel & Company Secretary

(Contact name)

353 1411 6924 (Telephone) 353 1479 1128 (Facsimile)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading Symbol: | Name of each exchange on which registered: |

| Common stock, represented by CHESS Units of Foreign Securities | JHX | New York Stock Exchange* |

| CHESS Units of Foreign Securities | JHX | New York Stock Exchange* |

| American Depositary Shares, each representing one unit of CHESS Units of Foreign Securities | JHX | New York Stock Exchange |

* Listed, not for trading, but only in connection with the registered American Depositary Shares, pursuant to the requirements of the U.S. Securities and Exchange Commission |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: 444,288,874 shares of common stock at 31 March 2021

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note — Checking the box will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large accelerated filer | | ☒ |

| Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ |

| Emerging growth company | | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after 5 April 2012.

| | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report | ☒ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | |

International Financial Reporting Standards as issued by the International Accounting

Standards Board | | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ☐ Item 17 ☐ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

2021

ANNUAL REPORT

ON FORM 20-F

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | i |

| |

TABLE OF CONTENTS

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | ii |

| |

FORM 20-F CROSS REFERENCE

| | | | | |

| Page(s) |

| PART 1 | |

| Item 1. Identity of Directors, Senior Management and Advisers | Not applicable |

| Item 2. Offer Statistics and Expected Timetable | Not applicable |

| Item 3. Key Information | |

| A. [Reserved] | Not applicable |

| B. Capitalization and Indebtedness | Not applicable |

| C. Reasons for the Offer and Use of Proceeds | Not applicable |

| D. Risk Factors | 153-165 |

| Item 4. Information on the Company | |

| A. History and Development of the Company | 2-3; 13; 181 |

| B. Business Overview | 4-9 |

| C. Organizational Structure | 3; 10 |

| D. Property, Plants and Equipment | 11-13; 105 |

| Item 4A. Unresolved Staff Comments | None |

| Item 5. Operating and Financial Review and Prospects | |

| A. Operating Results | 96-103 |

| B. Liquidity and Capital Resources | 103-106 |

| C. Research and Development, Patents and Licenses, etc. | 8-9 |

| D. Trend Information | 106-107 |

| E. Critical Accounting Estimates | 92-95 |

| Item 6. Directors, Senior Management and Employees | |

| A. Directors and Senior Management | 14-26 |

| B. Compensation | 27-65 |

| C. Board Practices | 19-26; 66-89 |

| D. Employees | 170 |

| E. Share Ownership | 53-56; 61-65 |

| Item 7. Major Shareholders and Related Party Transactions | |

| A. Major Shareholders | 185-186 |

| B. Related Party Transactions | 80 |

| C. Interests of Experts and Counsel | Not Applicable |

| Item 8. Financial Information | |

| A. Consolidated Statements and Other Financial Information | 108-151; 173 |

| B. Significant Changes | None |

| Item 9. The Offer and Listing | |

| A. Offer and Listing Details | 170-172 |

| B. Plan of Distribution | Not Applicable |

| C. Markets | 170-171 |

| D. Selling Shareholders | Not Applicable |

| E. Dilution | Not Applicable |

| F. Expenses of the Issue | Not Applicable |

| |

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | iii |

| |

| | | | | |

| PART 1 (continued) | |

| Item 10. Additional Information | |

| A. Share Capital | Not Applicable |

| B. Memorandum and Articles of Association | 173 |

| C. Material Contracts | 173 |

| D. Exchange Controls | 173 |

| E. Taxation | 173-181 |

| F. Dividends and Paying Agents | Not Applicable |

| G. Statement by Experts | Not Applicable |

| H. Documents on Display | 181 |

| I. Subsidiary Information | Not Applicable |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 182-184 |

| Item 12. Description of Securities Other Than Equity Securities | |

| A. Debt Securities | Not Applicable |

| B. Warrants and Rights | Not Applicable |

| C. Other Securities | Not Applicable |

| D. American Depositary Shares | 171-172 |

| PART II | |

| Item 13. Defaults, Dividend Arrearages and Delinquencies | None |

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | None |

| Item 15. Controls and Procedures | 168-169 |

| Item 16A. Audit Committee Financial Expert | 84 |

| Item 16B. Code of Ethics | 81-82 |

| Item 16C. Principal Accountant Fees and Services | 152 |

Item 16D. Exemptions from the Listing Standards for Audit Committees | None |

| Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | None |

| Item 16F. Change in Registrant’s Certifying Accountant | None |

| Item 16G. Corporate Governance | 66-89 |

| Item 16H. Mine Safety Disclosure | 12 |

| PART III | |

| Item 17. Financial Statements | Not Applicable |

| Item 18. Financial Statements | 108-151 |

| Item 19. Exhibits | 193-199 |

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 1 |

| |

SECTION 1

INTRODUCTION

James Hardie Industries plc is a world leader in the manufacturing of fiber cement building solutions, and a market leader in Europe for fiber gypsum products. Our current primary geographic markets include the United States of America (“US,” “USA” or the “United States”), Australia, Europe, New Zealand, the Philippines and Canada.

James Hardie Industries plc is a “public limited company,” incorporated and existing under the laws of Ireland. Except as the context otherwise may require, references in this Annual Report on Form 20-F (this “Annual Report”) to “James Hardie,” the “James Hardie Group,” the “Company,” “JHI plc,” “we,” “our” or “us” refer to James Hardie Industries plc, together with its direct and indirect wholly owned subsidiaries as of the time relevant to the applicable reference.

For certain information about the basis of preparing the financial information in this Annual Report as well as an explanation of forward-looking statements and the risks, uncertainties and assumptions to which they are subject, see “Section 2 – Reading this Report.” Further, a “Glossary of Abbreviations and Definitions” has also been included under Section 4 of this Annual Report.

The term “fiscal year” refers to our fiscal year ended 31 March of such year; the term “dollars,” “US$” or “$” refers to US dollars; the term “A$” refers to Australian dollars; and the term "EUR" or “€” refers to Euros.

Information contained in or accessible through the websites mentioned in this Annual Report does not form a part of this Annual Report unless we specifically state that it is incorporated by reference herein. All references in this Annual Report to websites are inactive textual references and are for information only.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 2 |

| |

INFORMATION ON THE COMPANY

History and Development of the Company

About James Hardie

James Hardie Industries plc is incorporated and existing under the laws of Ireland. As an Irish plc, we are governed by the Irish Companies Act 2014 and we operate under the regulatory requirements of numerous jurisdictions and organizations, including the Australian Securities Exchange ("ASX"), Australian Securities and Investments Commission ("ASIC"), the New York Stock Exchange (“NYSE”), the United States Securities and Exchange Commission (“SEC”), the Irish Takeover Panel and various other rulemaking bodies.

The address of our registered office in Ireland is Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. The telephone number is +353 1411 6924. Our agent in the United States is CT Corporation. Its office is located at 28 Liberty Street - 42nd Floor, New York, New York 10005. The address of our registered office in Australia is Level 20, 60 Castlereagh Street, Sydney NSW 2000 and the telephone number is +61 2 9638 9205. Our share registry is maintained by Computershare Investor Services Pty Ltd. All inquiries and correspondence regarding holdings should be directed to: Computershare Investor Services Pty Ltd, Level 5, 115 Grenfell Street, Adelaide, SA 5000; telephone: +61 3 9415 4000 or toll free within Australia: 1300 855 080. Our American Depositary Receipt ("ADR") register is maintained by Deutsche Bank. All inquiries and correspondence regarding American Depositary Shares ("ADSs") should be directed to Deutsche Bank, 60 Wall Street, New York, New York 10005, United States; telephone 1-212-250-9100.

Our History

James Hardie was established in 1888 as an import business, listing on the ASX in 1951 to become a publicly owned company in Australia. After becoming a listed company, we built a diverse portfolio of building and industrial products. In the late-1970s, we pioneered the development of asbestos-free fiber cement technology and in the early-1980’s began designing and manufacturing a wide range of fiber cement building products that made use of the benefits that came from the products’ durability, versatility and strength. Using the technical and manufacturing expertise developed in Australia, we expanded into the United States, opening our first fiber cement plant in Fontana, California in February 1990. Since then, we have expanded our product portfolio and global footprint, with fiber cement manufacturing plants across the United States, Australia and the Philippines. In April 2018, we completed the acquisition of Fermacell, a market leader in fiber gypsum and cement-bonded boards in Europe.

Our Agreement with Asbestos Injuries Compensation Fund

Prior to 1987, ABN 60 Pty Limited (formerly James Hardie Industries Limited, then the ultimate parent company of the James Hardie Group) (“ABN 60”) and two of its former subsidiaries, Amaca Pty Limited (“Amaca”) and Amaba Pty Limited (“Amaba”) (collectively, the “Former James Hardie Companies”), manufactured products in Australia that contained asbestos. The manufacture and sale of these products has resulted in liabilities for the Former James Hardie Companies in Australia.

In February 2007, our shareholders approved the Amended and Restated Final Funding Agreement (“AFFA”) entered into on 21 November 2006 to provide long-term funding to Asbestos Injuries Compensation Fund ("AICF") for the compensation of proven Australian-related personal injuries for which the Former James Hardie Companies are found liable. AICF, an independent trust, subsequently assumed ownership of the Former James Hardie Companies. We do not own AICF, however, we are

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 3 |

| |

entitled to appoint three directors, including the Chairman, and the New South Wales (“NSW”) Government is entitled to appoint two directors.

Under the terms of the AFFA, James Hardie 117 Pty Ltd (the “Performing Subsidiary”) will make annual payments to AICF. The amount of these annual payments is dependent on several factors, including our free cash flow (as defined in the AFFA), actuarial estimations, actual claims paid, operating expenses of AICF, changes in the AUD/USD exchange rate and the annual cash flow cap. JHI plc owns 100% of the Performing Subsidiary and guarantees the Performing Subsidiary’s obligation. As a result, for US GAAP purposes, we consider JHI plc to be the primary beneficiary of AICF.

Although we have no legal ownership in AICF, for financial reporting purposes, our interest in AICF is considered variable and we consolidate AICF due to our pecuniary and contractual interests in AICF as a result of the funding arrangements outlined in the AFFA. For additional information on our consolidation of AICF and asbestos-related assets and liabilities, see Note 1 to our consolidated financial statements in Section 2.

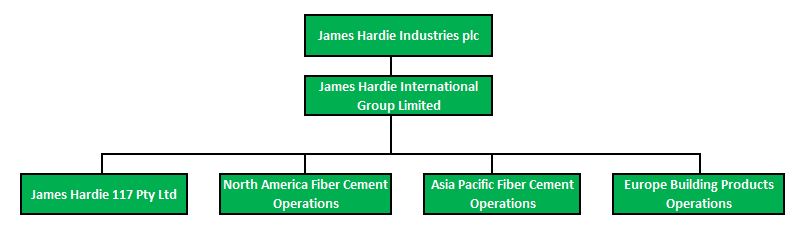

Corporate Structure

The following diagram summarizes our corporate structure at 31 March 2021:

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 4 |

| |

Business Overview

General Overview of Our Business

We are a world leader in the manufacture of fiber cement building materials. Based on net sales, we believe we are the largest manufacturer of fiber cement products and systems for external and internal building construction applications in the United States, Australia and the Philippines. We market our fiber cement products and systems under various brand names, such as HardiePlank®, HardiePanel®, HardieTrim® and HardieBacker®, and other brand names such as Aspyre Collection by James Hardie™, Artisan®, Reveal®, Cemplank®, Scyon® and Linea®. We are also a market leader in the European premium timber frame and dry lining business, especially in Germany, Switzerland and Denmark. We market our fiber gypsum and cement-bonded boards under the Fermacell® brand and our fire-protection boards under the AESTUVER® brand.

The Company currently has three operating segments: North America Fiber Cement, Asia Pacific Fiber Cement and Europe Building Products. See Notes 2 and 18 to our consolidated financial statements in Section 2 for a description of our operating segments and a breakdown of our net sales by operating segment and geographic market for each of our last three fiscal years.

Products

We manufacture fiber cement, fiber gypsum and cement bonded boards. Our fiber cement building materials includes a wide-range of products for both external and internal use across a broad range of applications, including external applications: siding, cladding, trim, soffit; and internal applications: walls, floors, ceilings. While there are some market specific products, our core fiber cement products, planks and flat panels are sold across all of the markets in which we operate. Our fiber gypsum and cement-bonded boards are used mainly for interior applications such as dry lining walls, walls in timber frame buildings and flooring solutions. In addition, our cement-bonded boards are used in exterior and industrial applications as well as for fire protection.

Products Used in External Applications

We developed a proprietary technology platform that enables us to produce thicker yet lighter-weight fiber cement products that are generally easier to handle than most traditional building products. Further, we believe that our fiber cement products provide certain durability and performance advantages leading to improved maintenance, while offering comparable aesthetics to competing products, such as wood, and superior aesthetics when compared to vinyl siding.

Performance and design advantages:

•Our fiber cement products exhibit resistance to the damaging effects of moisture, fire, impact and termites compared to natural and engineered wood and wood-based products;

•Competing products do not duplicate fiber cement aesthetics;

•Our fiber cement products provide the ability to imprint designs that closely resemble the patterns and profiles of traditional building materials such as wood and stucco;

•The surface properties of our products provide an effective paint-holding finish, especially when compared to natural and engineered wood products, allowing for greater periods of time between necessary maintenance and repainting; and

•Compared to masonry construction, fiber cement is lightweight, physically flexible and can be cut using readily available tools, making our products more appealing across a broad range of architectural styles, be it of timber or steel-framed construction.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 5 |

| |

We believe the benefits associated with our fiber cement products have enabled us to gain a competitive advantage over competing products.

Products Used in Internal Applications

Compared to natural and oriented strand board ("OSB") and wood-based products, we believe our product range for internal applications provide the same general advantages provided by our products for external applications. In addition, our fiber cement products for internal applications exhibit less movement in response to exposure to moisture and impact damage than many competing products, providing a more consistent and durable substrate on which to install tiles. Further, we believe our ceramic tile underlayment products exhibit better handling and installation characteristics compared to fiberglass mesh cement boards. We believe our fiber gypsum products offer superior stability, fire safety and sound insulation properties compared to OSB and gypsum plaster boards. Furthermore, we believe our fiber gypsum flooring solutions offer superior handling properties, especially in the modernization of existing buildings, compared to wet screed solutions.

Significant New Products

In North America, new products released over the last three years include Hydrodefense® HardieBacker® boards, expanded ColorPlus® Technology offering through the Dream CollectionTM and Statement CollectionTM, and higher ventilation VentedPlus® HardieSoffit® boards.

In Asia Pacific, we have extended our product portfolio in both wood look and non-wood look exteriors. Over the last three years, the range of Linea®, Linea® Oblique and Stria® cladding products has been broadened to increase design versatility in line with modern design trends.

In Europe, new fiber cement products released over the past three years include HardieFoamTM, a solution for install of HardieBacker®. In our Fermacell business, new products released over the last three years include AESTUVER® Tx board, a key milestone for our fire protection boards.

Principal Markets for Our Products

Fiber Cement

In the US and Canada, the largest application for fiber cement building products is in external siding for the residential building industry.

Competition in this market comes primarily from substitute products, such as natural wood or OSB, vinyl, stucco and brick. We believe we can continue to increase our market share from these competing products through targeted marketing programs designed to educate customers and homeowners on our brand and the performance, design and cost advantages of our products.

In the Asia Pacific region, we principally sell into the Australian, New Zealand and Philippines markets, with the residential building industry representing the principal market for fiber cement products. The largest applications of fiber cement across our three primary markets are in external applications: siding, cladding, trim, soffit; and internal applications: walls, floors, ceilings.

In Australia, competition from imports and two locally based fiber cement manufacturers continues to be strong. Additionally, we have competition from natural and engineered wood, wallboard, masonry and brick products. In New Zealand and the Philippines, competitor fiber cement imports continue as manufacturers look to supplement their primary operating environments with additional markets.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 6 |

| |

In Europe, our fiber cement building products are used in both residential and commercial building applications in external siding, soffits and internal tile underlayment for walls and floors.

Fiber Gypsum and Cement-Bonded Boards

James Hardie Europe's Fermacell brand products are sold into the residential repair and remodel, commercial and residential new construction markets. Fermacell brand of products comprise fiber gypsum and cement-bonded boards, two complementary products in the high performance board space, mainly used in timber frame construction, commercial dry lining projects and repair and remodel. Cement bonded boards are also used for several fire protection projects including tunnels.

Our key markets for Fermacell brand products in Europe include Germany, Switzerland, UK, Denmark, France, Belgium, Netherlands and Luxembourg, where we sell our products to residential and commercial new-build as well as to repair and remodel. In addition, our fire protection AESTUVER® boards are sold to projects worldwide.

Seasonality

We do not have significant seasonality, however our businesses typically follow activity levels in the building and construction industry.

Raw Materials

The principal raw materials used in the manufacture of our fiber cement products are cellulose fiber (wood-based pulp), silica (sand), Portland cement and water. The key raw materials used in the manufacture of our fiber gypsum products are gypsum, recycled paper and water. We have established supplier relationships for all of our raw materials across the various markets in which we operate, and we do not anticipate having difficulty in obtaining our required raw materials from these suppliers. The purchase price of these raw materials and other materials can fluctuate depending on the supply-demand situation at any given point in time.

We work hard to reduce the effect of both price fluctuations and supply interruptions by entering into contracts with qualified suppliers and through continuous internal improvements in both our products and manufacturing processes.

Cellulose Fiber

Reliable access to specialized and consistent quality pulp is critical to the production of fiber cement building materials. As a result of our many years of experience and expertise in the industry, we share our internal expertise with pulp producers in New Zealand, the United States, Canada and Chile to ensure they are able to provide us with a highly specialized and proprietary formula crucial to the reinforcing cement matrix of our fiber cement products. We have confidentiality agreements with our pulp producers, and we have obtained patents in the United States and in certain other countries covering certain unique aspects of our pulping formulas and processes that we believe cannot adequately be protected through confidentiality agreements. However, we cannot be assured that our intellectual property and other proprietary information will be protected in all cases. See “Section 3 – Risk Factors.”

Silica

High purity silica is sourced locally by the various production plants. In the majority of locations, we use silica sand as a silica source. In certain other locations, however, we process quartz rock and beneficiate silica sand to ensure the quality and consistency of this key raw material.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 7 |

| |

Cement

Cement is acquired in bulk from local suppliers. We continue to evaluate options on agreements with suppliers for the purchase of cement that can lock in our cement prices over longer periods of time.

Water

We primarily use local water supplies and process all wastewater to comply with environmental requirements.

Gypsum

The primary types of gypsum used in the production of our fiber gypsum products are natural and synthetic gypsum. Natural gypsum is extracted and processed in Germany and Spain. Synthetic gypsum is obtained from power plants in Germany, Poland and the Netherlands. While synthetic gypsum will be phased out due to the coal power plant phase-out in the European Union, we are well positioned for the future with natural gypsum sources. In Germany, we have secured long-term contracts for the supply of natural gypsum and we have invested in a natural gypsum mine in Spain.

Recycled Paper

Recycled paper is generally acquired from local suppliers and we currently maintain long-term contracts with our key suppliers.

Sales, Marketing and Distribution

Our brand names, customer education in comparative product advantages, differentiated product range and customer service, including technical advice and assistance, provide the basis for our marketing strategy. In fiscal year 2022, the Company will be launching It's Possible™, a global integrated marketing campaign that seeks to empower homeowners to realize their dream home. The campaign is inclusive of television commercials, programmatic digital, social media, public relations, influencer and dynamic media partnerships, and more.

We offer our customers support through a specialized sales force and customer service infrastructure in North America, Australia, New Zealand, the Philippines and Europe.

Our customer service infrastructure includes inbound customer service support coordinated nationally in each country, and is complemented by outbound telemarketing capability. Within each regional market, we provide sales and marketing support to building products dealers and lumber yards and also provide support directly to the customers of these distribution channels, principally homebuilders and building contractors.

We maintain dedicated regional sales management teams in our major sales territories who maintain relationships with national and other major accounts. Our various sales forces, which in some instances manage specific product categories, include skilled trades people who provide on-site technical advice and assistance.

In North America, we sell our exterior fiber cement products for repair and remodel and new residential construction through a combination of distributors, dealers and lumber yards. Where sales are to distributors, they then sell these products to dealers or lumber yards. Our interior fiber cement products in North America are typically sold through the large home center retailers and specialist distributors or dealers. Our products are distributed across North America primarily by road and, to a lesser extent, by rail.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 8 |

| |

In Australia and New Zealand, both new construction and repair and remodel products are sold through a combination of distributors, dealers and lumber yards. In the Philippines, a network of thousands of small to medium size retail outlets sell our fiber cement products to consumers, builders and real estate developers and DIY type stores. The physical distribution of our product in each country is primarily by road, rail or sea transport.

In Europe, both new construction and repair and remodel products are primarily sold to builder’s merchants and DIY type stores. These customers then sell the products to applicators such as dry liners, timber frame companies, smaller applicators and end consumers. Our products are distributed across Europe primarily by road and rail and, to a lesser extent, by sea transport.

Despite the fact that distributors and dealers are generally our direct customers, we also aim to increase primary demand for our products by marketing our products directly to homeowners, architects and builders. We encourage them to specify and install our products because of the quality and craftsmanship of our products.

Geographic expansion of our fiber cement business has occurred in markets where framed construction is prevalent for residential applications or where there are opportunities to change building practices from masonry to framed construction. Expansion is also possible where there are direct substitution opportunities irrespective of the methods of construction. With the exception of our current major markets, as well as Japan and certain rural areas in Asia, and Eastern Europe, most markets in the world principally utilize masonry construction for external walls in residential construction. Accordingly, further geographic expansion depends substantially on our ability to provide alternative construction solutions and for those solutions to be accepted in those markets.

Dependence on Trade Secrets and Research and Development (“R&D”)

We pioneered the successful development of cellulose reinforced fiber cement and, since the early-1980s, have progressively introduced products developed as a result of our proprietary product formulation and process technology. The introduction of differentiated products is one of the core components of our global business strategy. This product differentiation strategy is supported by our significant investment in R&D activities.

We view spending on R&D as the key to sustaining our existing product leadership position, by providing a continuous pipeline of innovative new products and technologies with sustainable performance and unique design advantages over our competitors. Further, through our investments in new process technology or by modifying existing process technology, we aim to keep reducing our capital and operating costs and to find new ways to make existing and new products. As such, we expect to continue allocating significant funding to these endeavors.

Our current patent portfolio is based mainly on fiber cement compositions, associated manufacturing processes and the resulting products. Our non-patented technical intellectual property consists primarily of our operating and manufacturing know-how and raw material and operating equipment specifications, all of which are maintained as trade secret information. We have enhanced our abilities to effectively create, manage and utilize our intellectual property and have implemented a strategy that increasingly uses patenting and trade secret protection to protect and increase our competitive advantage.

In addition, we have a variety of industrial, commercial and financial contracts relating to our proprietary manufacturing processes. While we are dependent on the competitive advantage that these items provide as a whole, we are not dependent on any one of them individually and do not consider any one of them individually to be material. We do not materially rely on intellectual property licensed from any outside third parties. However, we cannot assure that our intellectual property and other proprietary

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 9 |

| |

information will be protected in all cases. In addition, if our R&D efforts fail to generate new, innovative products or processes, our overall profit margins may decrease and demand for our products may fall. See “Section 3 – Risk Factors.”

Governmental Regulation

As an Irish plc, we are governed by the Irish Companies Act 2014 and are also subject to all applicable European Union level legislation. We also operate under the regulatory requirements of numerous jurisdictions and organizations, including the ASX, ASIC, the NYSE, the SEC, the Irish Takeover Panel and various other federal, state, local and foreign rulemaking bodies. See “Section 3 – Constitution” for additional information regarding the Irish Companies Act 2014 and regulations to which we are subject.

Environmental, Health and Safety Regulation

Our operations and properties are subject to extensive federal, state, local and foreign environmental protection, health and safety laws, regulations and ordinances governing activities and operations that may have adverse environmental effects. As it relates to our operations, regulated material, including wastewater and air emissions, may be produced at some of our manufacturing plants. The wastewater produced from our manufacturing plants is internally recycled and reused before eventually being discharged to publicly owned treatment works, a process which is monitored by us, as well as by regulators. In addition, we actively monitor air emissions and other regulated materials produced by our plants so as to ensure compliance with the various environmental regulations under which we operate.

Some environmental laws provide that a current or previous owner or operator of real property may be liable for the costs of investigation, removal or remediation of certain regulated materials on, under, or in that property or other impacted properties. In addition, persons who arrange, or are deemed to have arranged, for the disposal or treatment of certain regulated materials may also be liable for the costs of investigation, removal or remediation of the regulated materials at the disposal or treatment site, regardless of whether the affected site is owned or operated by such person. Environmental laws often impose liability whether or not the owner, operator, transporter or arranger knew of, or was responsible for, the presence of such regulated materials. Also, third parties may make claims against owners or operators of properties for personal injuries, property damage and/or for clean-up associated with releases of certain regulated materials pursuant to applicable environmental laws and common law tort theories, including strict liability.

In the past, from time to time, we have received notices of alleged discharges in excess of our water and air permit limits. In each case, and in compliance with our Environmental Policy, we have addressed the concerns raised in those notices, in part, through enhanced administrative controls and/or capital expenditures intended to prevent future discharges in excess of permitted levels and, on occasion, the payment of minor associated fines.

Environmental compliance costs in the future will depend, in part, on continued oversight of operations, expansion of operations and manufacturing activities, regulatory developments and future requirements that cannot presently be predicted.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 10 |

| |

Organizational Structure

JHI plc is incorporated and domiciled in Ireland and the table below sets forth our significant subsidiaries, all of which are wholly-owned by JHI plc, either directly or indirectly, as of 30 April 2021.

| | | | | | | | | | | | | | |

| Name of Company | | Jurisdiction of

Establishment | | Jurisdiction of

Tax Residence |

| Fermacell B.V. | | Netherlands | | Netherlands |

| Fermacell Schraplau GmbH | | Germany | | Germany |

| James Hardie 117 Pty Ltd | | Australia | | Australia |

| James Hardie Australia Pty Ltd | | Australia | | Australia |

| James Hardie Building Products Inc. | | United States | | United States |

| James Hardie Europe B.V. | | Netherlands | | Netherlands |

| James Hardie Europe GmbH | | Germany | | Germany |

| James Hardie Europe Holdings GmbH | | Germany | | Germany |

| James Hardie Holdings Limited | | Ireland | | Ireland |

| James Hardie International Finance Designated Activity Company | | Ireland | | Ireland |

| James Hardie International Group Limited | | Ireland | | Ireland |

| James Hardie International Holdings Limited | | Ireland | | Ireland |

| James Hardie NL1 B.V. | | Netherlands | | Netherlands |

| James Hardie NL2 B.V. | | Netherlands | | Netherlands |

| James Hardie NZ Holdings Limited | | New Zealand | | New Zealand |

| James Hardie North America, Inc | | United States | | United States |

| James Hardie Philippines Inc | | Philippines | | Philippines |

| James Hardie Research Pty Ltd | | Australia | | Australia |

| JH Research USA, LLC | | United States | | United States |

| James Hardie Spain S.L.U. | | Spain | | Spain |

| James Hardie Technology Holdings 1 Limited | | Ireland | | Ireland |

| James Hardie Technology Holdings 2 Limited | | Ireland | | Ireland |

| James Hardie Technology Limited | | Bermuda | | Ireland |

| James Hardie U.S. Investments Sierra Inc. | | United States | | United States |

| RCI Holdings Pty Ltd | | Australia | | Australia |

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 11 |

| |

Property, Plants and Equipment

We believe we have some of the largest and lowest cost fiber cement manufacturing plants across the United States, Australia and the Philippines, with our plants servicing both domestic and export markets. We also have six manufacturing plants in Europe. Our plants are ideally located to take advantage of established transportation networks, allowing us to distribute our products into key markets, while also providing easy access to key raw materials.

Manufacturing Capacity

At 31 March 2021, we had manufacturing facilities at the following locations:

| | | | | | | | | | | | | | |

| Plant Location | | Owned /

Leased | | Nameplate Capacity (mmsf)1 |

| United States fiber cement | | | | |

| Cleburne, Texas | | Owned | | 666 | |

| Peru, Illinois | | Owned | | 560 | |

| Plant City, Florida | | Owned | | 600 | |

| Pulaski, Virginia | | Owned | | 600 | |

| Reno, Nevada | | Owned | | 300 | |

| Tacoma, Washington | | Owned | | 500 | |

| Waxahachie, Texas | | Owned | | 360 | |

| Fontana, California | | Owned | | 250 | |

Prattville, Alabama 2 | | Owned | | 300 | |

| Asia Pacific fiber cement | | | | |

| Rosehill, New South Wales, Australia | | Owned | | 180 | |

| Carole Park, Queensland, Australia | | Owned | | 260 | |

Cabuyao City, Philippines | | Owned | | 172 | |

| Europe fiber gypsum | | | | |

| Münchehof, Germany | | Owned | | 441 | |

| Orejo, Spain | | Owned | | 275 | |

| Wijchen, the Netherlands | | Owned | | 273 | |

| Siglingen, Germany | | Owned | | 154 | |

| Other | | | | |

Calbe, Germany 3 | | Owned | | 41 | |

Schraplau, Germany 3 | | Owned | | N/A |

____________

1The calculated annual nameplate capacity in the United States, Europe and Asia Pacific is based on management’s historical experience with our production process and is calculated assuming continuous operation, 24 hours per day, seven days per week, producing 5/16” medium density product at a targeted operating speed. No accepted industry standard exists for the calculation of our fiber cement, fiber gypsum and cement bonded board manufacturing facility nameplate, design and utilization capacities.

2The first sheet machine in Prattville, Alabama was commissioned in Q4 of fiscal year 2021, with nameplate capacity of 300 mmsf. The second sheet machine is expected to be commissioned in July 2021, for a total nameplate capacity in Prattville, Alabama of 600 mmsf at the end of fiscal year 2022.

3 Our Calbe, Germany plant produces cement bonded boards. Our Schraplau, Germany facility is a raw materials processing facility for our fiber gypsum plants. As a result, no annual nameplate capacity is available.

We continually evaluate the capacity required to service the housing markets in which we operate to ensure we meet demand and achieve our market penetration objectives. For a discussion of significant active and recently completed capacity expansion projects, see “Capital Expenditures” below.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 12 |

| |

Management has determined that for measuring the annual design capacity of the fiber cement and fiber gypsum network, the calculation should incorporate our expected production based upon our historical experience with certain factors such as demand, product mix of varying thickness and density, batch size, plant availability, differing production speeds and downtime expectations.

Based on the methodology noted above, for the year ended 31 March 2021 and 2020, we had an annual fiber cement flat sheet design capacity of 4,180 mmsf and 4,330 mmsf in the United States, respectively, and 720 mmsf and 730 mmsf in Asia Pacific, respectively. For the years ended 31 March 2021 and 2020, we had an annual design capacity of 720 mmsf and 790 mmsf, respectively, for our European fiber gypsum plants. It is important to note that annual design capacity does not necessarily reflect the actual capacity utilization rates of our manufacturing facilities. Actual utilization is calculated using actual production, which is affected by factors such as demand, product mix, batch size, plant availability and production speeds. For fiscal year 2021, actual capacity utilization across our fiber cement and fiber gypsum plants was an average of 83%, 79% and 84% in the United States, Europe and Asia Pacific, respectively. For fiscal year 2020, actual capacity utilization across our fiber cement and fiber gypsum plants was an average of 79%, 77% and 90% in the United States, Europe and Asia Pacific, respectively.

Mines

In North America, we lease silica quartz mine sites in Tacoma, Washington and Reno, Nevada. The lease for our quartz mine in Tacoma, Washington expires in February 2022 (with additional options to renew). The lease for our silica quartz mine site in Reno, Nevada expires in January 2024. We also own property in Victorville, California which could be mined for silica. As of 30 April 2021, we have not begun to mine this site and have no immediate plans to do so.

As a mine operator in the US, we are required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), and rules promulgated by the SEC implementing that section of the Dodd-Frank Act, to provide certain information concerning mine safety violations and other regulatory matters concerning the operation of our mines. During fiscal year 2021, we did not receive any notices, citations, orders, legal action or other communication from the US Department of Labor’s Mine Safety and Health Administration that would necessitate additional disclosure under Section 1503(a) of the Dodd-Frank Act. Similarly, we have not experienced any mining-related fatalities in our mining operations. There are currently no pending legal actions before the Federal Mine Safety and Health Review Commission related to our mining operations.

Our Fermacell business has an operating license for a mining facility in Schraplau, Germany, however no active mining is being undertaken, or allowed with respect to the former owner FELS-WERKE GmbH, and the mine is only being used for storage of material. We also have an investment in a natural gypsum mine in Spain.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 13 |

| |

Capital Expenditures

We utilize a mix of operating cash flow and debt facilities to fund our capital expenditure projects and investments. We continuously invest in safety, equipment maintenance and upgrades, and capacity to ensure continued environmental compliance and operating effectiveness of our plants. The following table sets forth our capital expenditures for the three most recent fiscal years:

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of US dollars) |

| | | 2021 | | 2020 | | 2019 |

| North America Fiber Cement | | $ | 76.8 | | | $ | 137.1 | | | $ | 246.8 | |

| Asia Pacific Fiber Cement | | 18.3 | | | 32.2 | | | 41.1 | |

| Europe Building Products | | 13.5 | | | 23.5 | | | 26.0 | |

| Other Businesses | | — | | | — | | | 1.5 | |

| R&D and Corporate | | 2.1 | | | 1.0 | | | 2.1 | |

| Total Capital Expenditures | | $ | 110.7 | | | $ | 193.8 | | | $ | 317.5 | |

Significant active capital expenditures

At 31 March 2021, the following significant capital expenditures related to capacity projects remain in progress:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Project Description | | Approximate

Investment

(US millions) | | Investment

to date

(US millions) | | Project

Start Date | | Expected

Commission

Date | | Expected Nameplate Capacity Increase (mmsf) 1 |

| Prattville Greenfield expansion | | $ | 240.0 | | | $ | 233.8 | | | Q4FY18 | | FY22 | | 600 |

1 The first sheet machine in Prattville, Alabama was commissioned in Q4 of fiscal year 2021, with nameplate capacity of 300 mmsf. The second sheet machine is expected to be commissioned in July 2021, for a total nameplate capacity in Prattville, Alabama of 600 mmsf at the end of fiscal year 2022. |

Significant completed capital expenditure projects

The following is a list of significant capital expenditure projects we have invested in over the three most recent fiscal years:

| | | | | | | | | | | | | | |

| Project Description | | Total

Investment

(US Millions) | | Fiscal Year of

Expenditure |

| Philippines capacity expansion | | 18.0 | | | FY16 - FY19 |

| Tacoma Greenfield expansion | | 147.0 | | | FY17 - FY20 |

Carole Park Brownfield expansion

| | $ | 22.0 | | | FY19 - FY21 |

Capital Divestitures

During the three most recent fiscal years, we did not make any material capital divestitures. We do not consider the exit from our Penrose, New Zealand plant a material divestiture but a strategic decision to shift to an import sales model.

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 14 |

| |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

James Hardie Executive Team

Our management is overseen by our executive team, whose members cover the key areas of finance, human resources, investor relations, legal, manufacturing, marketing, operations, production, R&D and sales.

Members of our management executive team at 30 April 2021 are:

| | | | | |

Jack Truong BS, PhD Chief Executive Officer Age 58 |

| Dr Jack G. Truong joined James Hardie as President of International Operations in April 2017. Dr Truong was announced Chief Executive Officer ("CEO") successor and appointed President and Chief Operating Officer with the responsibility of running the Company's global business in September 2018. He was officially appointed CEO in January 2019.

Dr Truong’s ability to anticipate global market trends and deliver profitable revenue growth is evidenced by his extensive multinational and multisector business experience. Prior to James Hardie, Dr Truong was the President and Chief Executive Officer of leading home appliance manufacturer, Electrolux North America Inc, a $5+ billion revenue and 14,000+ employee business at the time of his leadership.

|

Before joining Electrolux, Dr Truong enjoyed a successful 22-year career at 3M Company, where he held senior leadership roles throughout the United States, Europe and Asia-Pacific, including Vice President and General Manager of the Global Construction and Home Improvements Division and Global Office Supplies Division.

As an engineer and inventor himself – earning his PhD in chemical engineering from the Rensselaer Polytechnic Institute in New York – Dr Truong is the recipient of 11 U.S. patents and several international patents. Dr Truong also enjoys giving time to philanthropic causes and professional industry associations, receiving multiple accolades for his humanitarian work and business accomplishments. |

| | | | | |

| |

James Hardie 2021 Annual Report on Form 20-F | 15 |

| |

| | | | | |

Jason Miele BA Chief Financial Officer Age 44 |

| Jason Miele was appointed as Chief Financial Officer (“CFO”) in February 2020. As CFO he oversees the Company’s overall financial activities, including accounting, tax, treasury, performance and competitor analysis, internal audit, financial operations, information systems, and investor and media relations.

Mr Miele has over 14 years of experience with James Hardie and has served in a number of important roles during his tenure, including most recently, as Vice President – Investor and Media Relations, a position he held from February 2017. In that role, Mr Miele had responsibility for overseeing James Hardie’s investor relations strategy and communicating James Hardie’s business strategy and its financial performance to various stakeholders including shareholders, investment analysts, and the financial media. |

Prior to that, Mr Miele served in a variety of roles of increasing responsibility, in finance functions such as Treasury, Controllership and Operational Finance, including reporting to the CFO as the Global Treasurer and later the Global Controller. Mr Miele has supported the James Hardie business during his tenure, working in multiple geographies including Dublin, Ireland, Amsterdam, Netherlands, Mission Viejo, California and Chicago, Illinois in the United States and most recently, Sydney, Australia. Mr Miele has a Bachelor’s Degree from the University of California at Santa Barbara, where he graduated with a degree in Business Economics with an emphasis in Accounting. |

| | | | | |

Julie Katigan BA, MA Chief Human Resources Officer Age 54 |

| Julie Katigan joined James Hardie as Chief Human Resources Officer (“CHRO”) in May 2019. As CHRO she has responsibility for the Company’s global human resource activities, including employee engagement, leadership and talent development and human resources strategy.

Most recently, Ms Katigan was the Senior Vice President, Human Resources for XPO Logistics’ Americas and Asia Pacific Supply Chain business unit, responsible for approximately 25,000 employees in 400 locations across the globe.

Prior to XPO Logistics, Ms Katigan held senior human resources leadership roles in both business partnering and specialty areas such as Talent Management and |

Organizational Development, with well-established companies that included Colfax Corporation, Electrolux, Mead Johnson Nutrition and Ford Motor Company.