Q4 FY21 MANAGEMENT PRESENTATION 18 May 2021 Exhibit 99.5

Page 2 James Hardie Q4 FY21 Results CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward- looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2021; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID-19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Management Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with a table and definitions presenting cross-references between each GAAP financial measure used in the Company’s Consolidated Financial Statements to the equivalent non-GAAP financial measure used in this Management Presentation. See the section titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS USE OF NON-GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

Page 3 James Hardie Q4 FY21 Results AGENDA • Business Highlights • Q4 and Full Year FY21 Financial Results • Investor Day Preview • Questions and Answers Dr. Jack Truong Chief Executive Officer Jason Miele Chief Financial Officer

BUSINESS HIGHLIGHTS

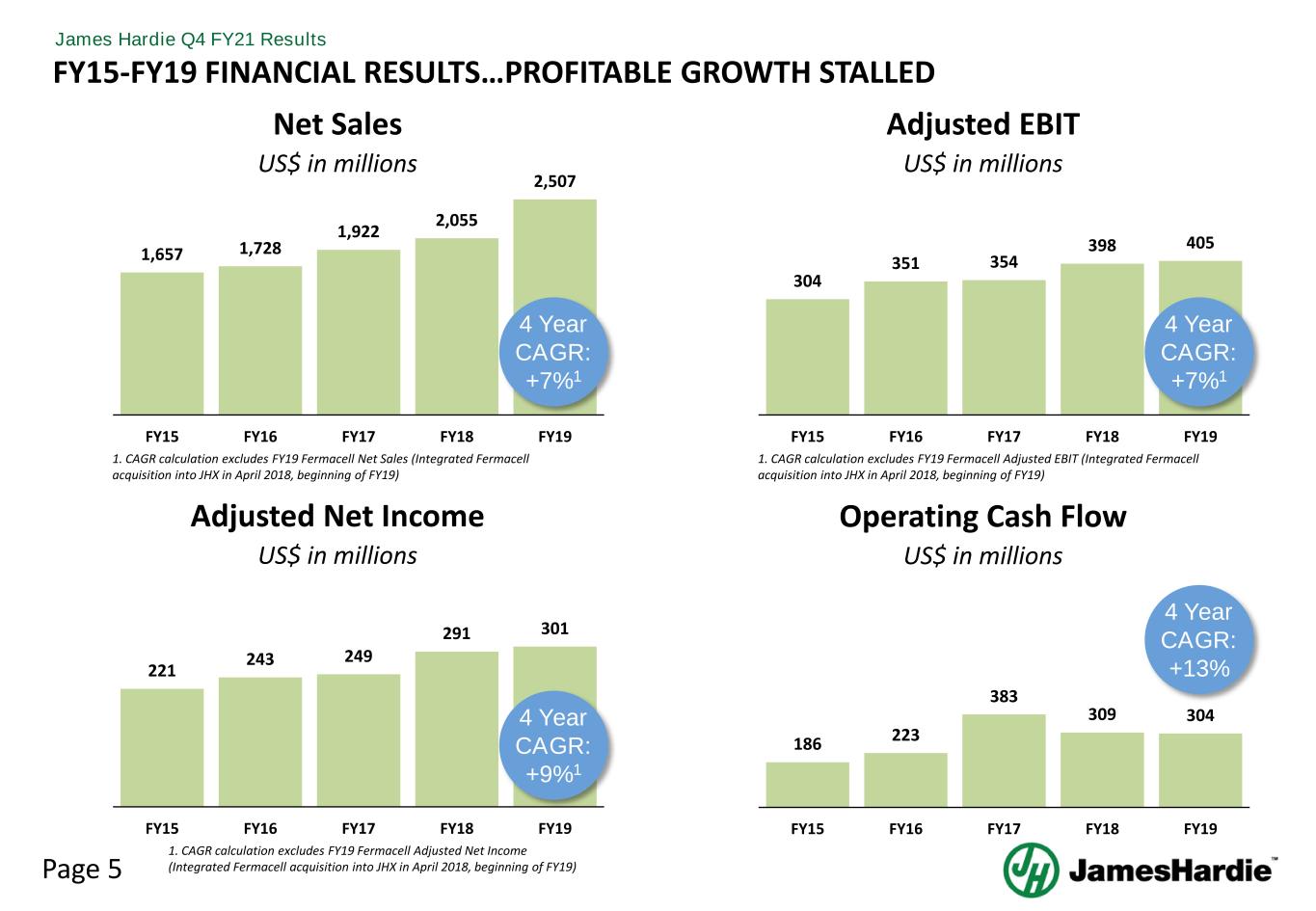

Page 5 James Hardie Q4 FY21 Results 1,657 1,728 1,922 2,055 2,507 FY15 FY16 FY17 FY18 FY19 FY15-FY19 FINANCIAL RESULTS…PROFITABLE GROWTH STALLED Net Sales 304 351 354 398 405 FY15 FY16 FY17 FY18 FY19 US$ in millions US$ in millions 4 Year CAGR: +7%1 Adjusted EBIT 221 243 249 291 301 FY15 FY16 FY17 FY18 FY19 Adjusted Net Income US$ in millions 186 223 383 309 304 FY15 FY16 FY17 FY18 FY19 US$ in millions Operating Cash Flow 4 Year CAGR: +7%1 4 Year CAGR: +9%1 4 Year CAGR: +13% 1. CAGR calculation excludes FY19 Fermacell Net Sales (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19) 1. CAGR calculation excludes FY19 Fermacell Adjusted EBIT (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19) 1. CAGR calculation excludes FY19 Fermacell Adjusted Net Income (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19)

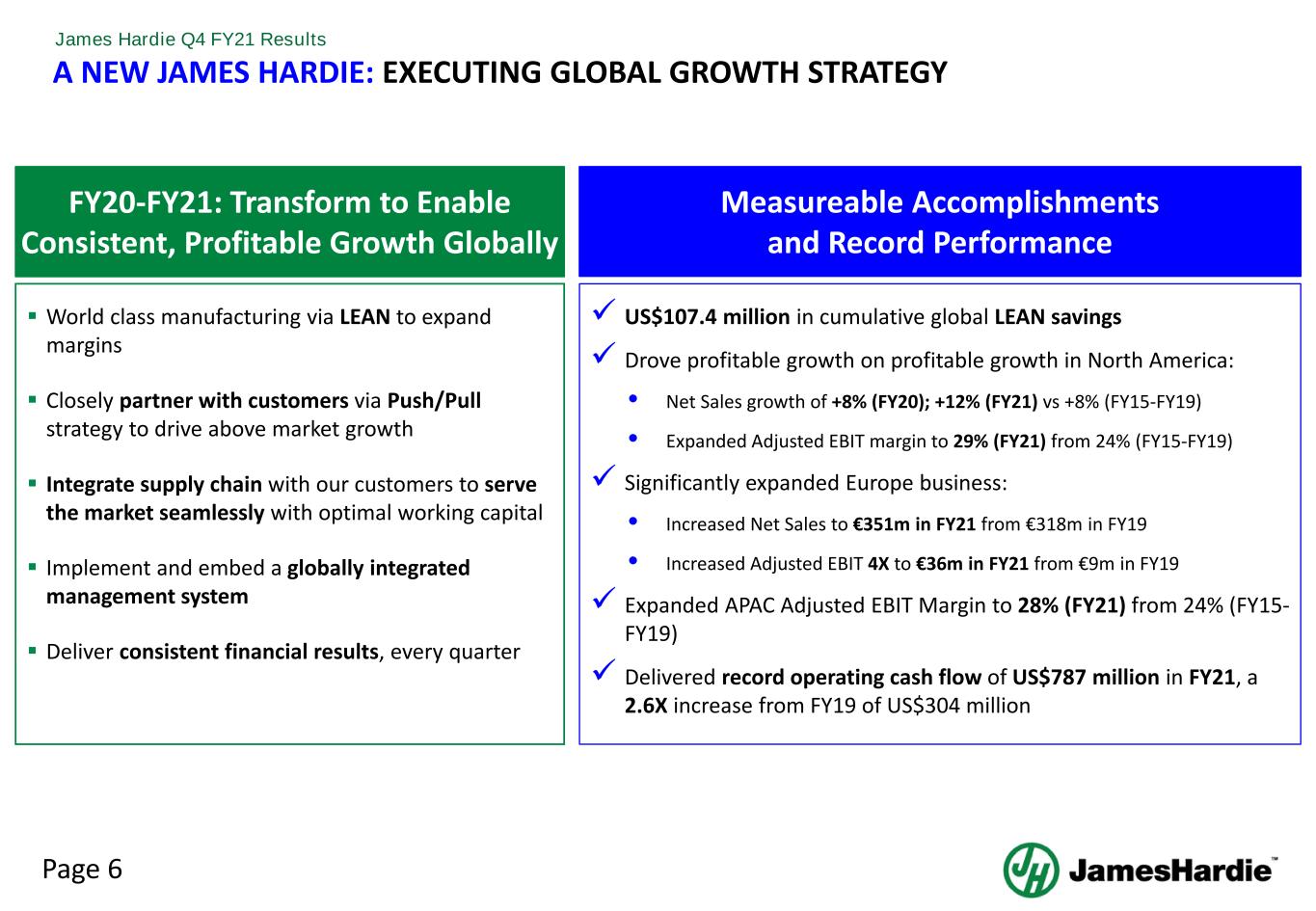

Page 6 James Hardie Q4 FY21 Results A NEW JAMES HARDIE: EXECUTING GLOBAL GROWTH STRATEGY US$107.4 million in cumulative global LEAN savings Drove profitable growth on profitable growth in North America: • Net Sales growth of +8% (FY20); +12% (FY21) vs +8% (FY15-FY19) • Expanded Adjusted EBIT margin to 29% (FY21) from 24% (FY15-FY19) Significantly expanded Europe business: • Increased Net Sales to €351m in FY21 from €318m in FY19 • Increased Adjusted EBIT 4X to €36m in FY21 from €9m in FY19 Expanded APAC Adjusted EBIT Margin to 28% (FY21) from 24% (FY15- FY19) Delivered record operating cash flow of US$787 million in FY21, a 2.6X increase from FY19 of US$304 million World class manufacturing via LEAN to expand margins Closely partner with customers via Push/Pull strategy to drive above market growth Integrate supply chain with our customers to serve the market seamlessly with optimal working capital Implement and embed a globally integrated management system Deliver consistent financial results, every quarter FY20-FY21: Transform to Enable Consistent, Profitable Growth Globally Measureable Accomplishments and Record Performance

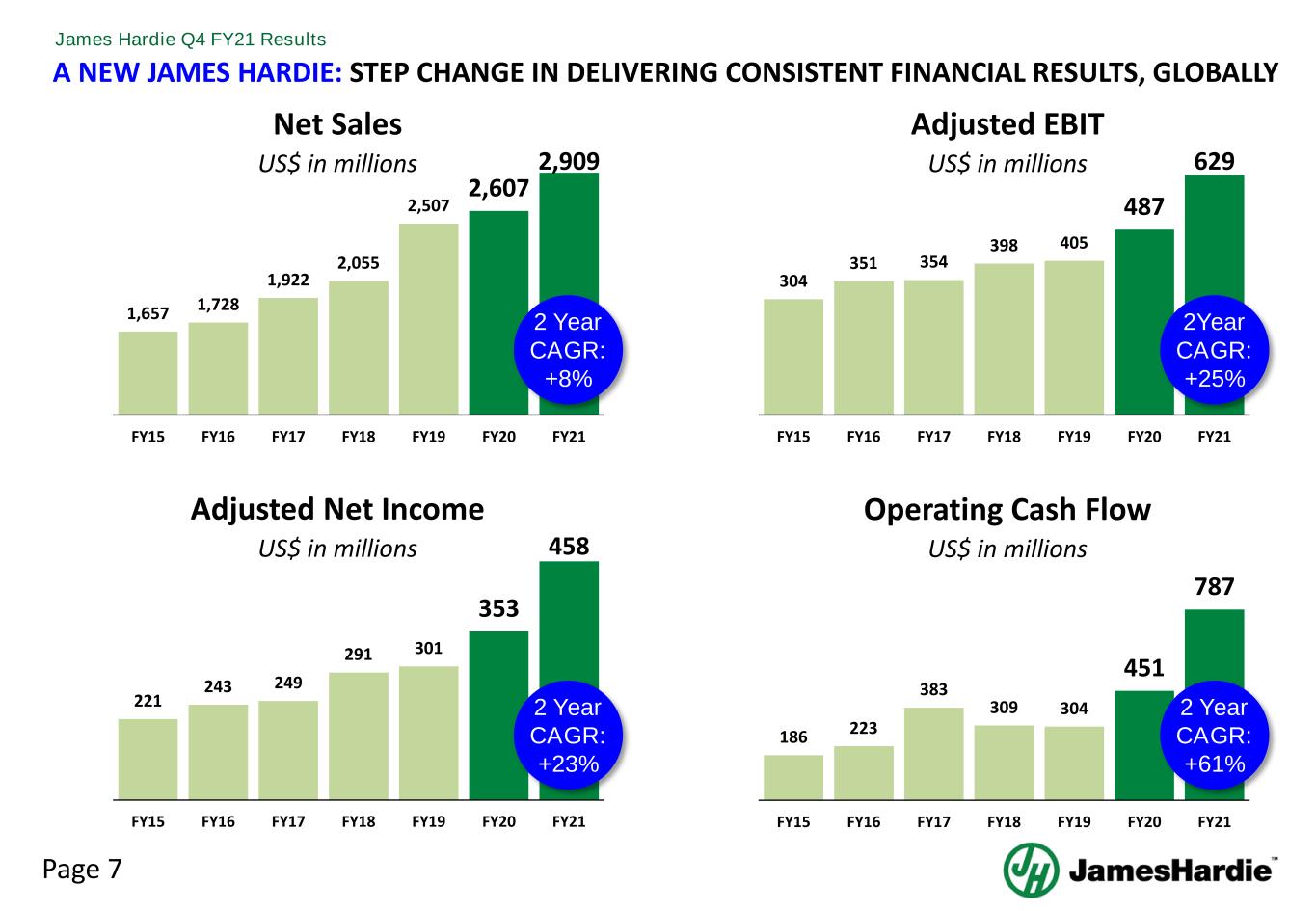

Page 7 James Hardie Q4 FY21 Results 1,657 1,728 1,922 2,055 2,507 2,607 2,909 FY15 FY16 FY17 FY18 FY19 FY20 FY21 A NEW JAMES HARDIE: STEP CHANGE IN DELIVERING CONSISTENT FINANCIAL RESULTS, GLOBALLY Net Sales 304 351 354 398 405 487 629 FY15 FY16 FY17 FY18 FY19 FY20 FY21 US$ in millions US$ in millions 2 Year CAGR: +8% Adjusted EBIT 221 243 249 291 301 353 458 FY15 FY16 FY17 FY18 FY19 FY20 FY21 Adjusted Net Income US$ in millions 186 223 383 309 304 451 787 FY15 FY16 FY17 FY18 FY19 FY20 FY21 US$ in millions Operating Cash Flow 2Year CAGR: +25% 2 Year CAGR: +23% 2 Year CAGR: +61%

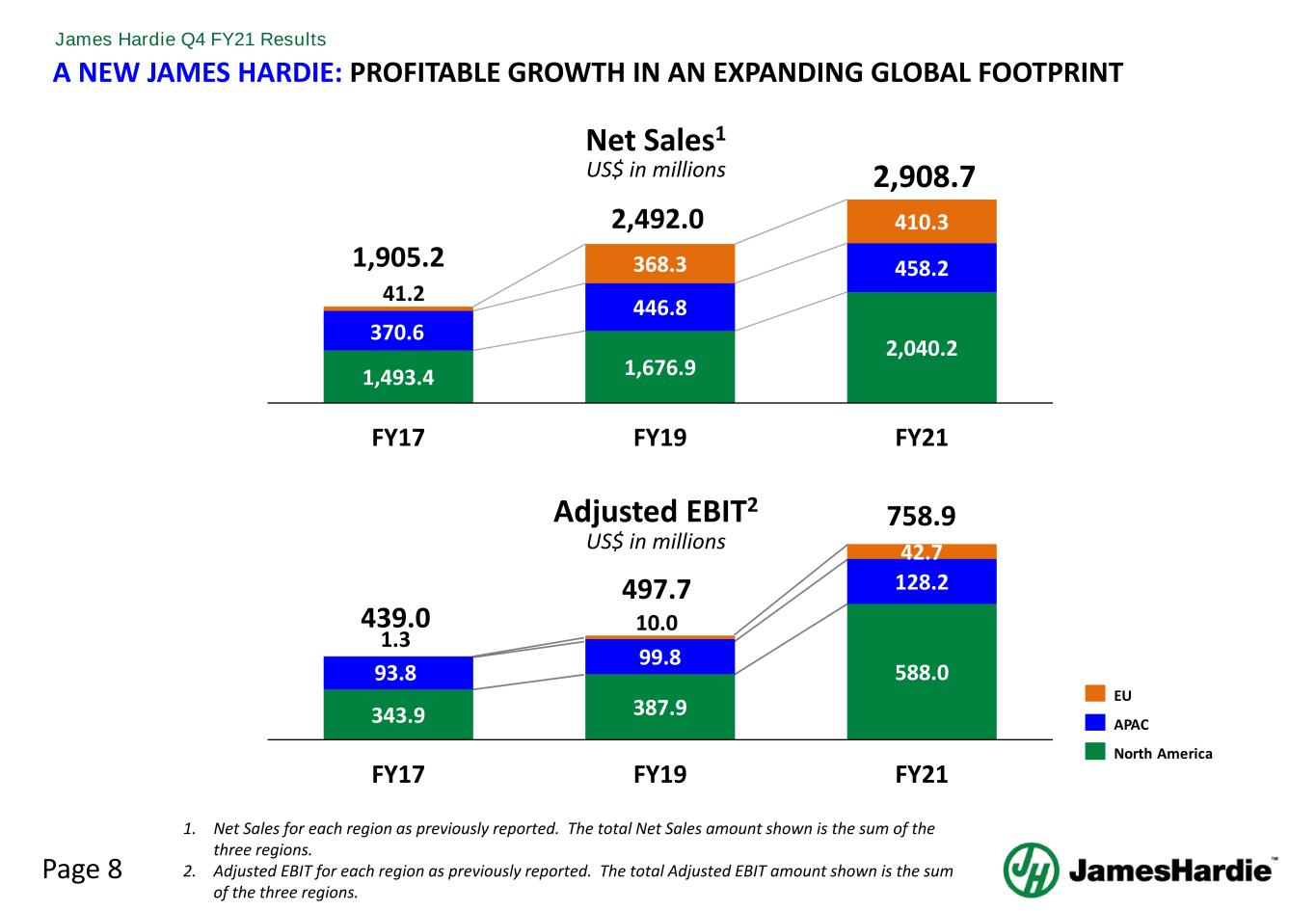

Page 8 James Hardie Q4 FY21 Results 1,493.4 1,676.9 2,040.2 370.6 446.8 458.2 41.2 368.3 410.3 1,905.2 2,492.0 2,908.7 FY17 FY19 FY21 Net Sales1 US$ in millions Adjusted EBIT2 US$ in millions A NEW JAMES HARDIE: PROFITABLE GROWTH IN AN EXPANDING GLOBAL FOOTPRINT North America APAC EU 1. Net Sales for each region as previously reported. The total Net Sales amount shown is the sum of the three regions. 2. Adjusted EBIT for each region as previously reported. The total Adjusted EBIT amount shown is the sum of the three regions. 343.9 387.9 588.093.8 99.8 128.2 1.3 10.0 42.7 439.0 497.7 758.9 FY17 FY19 FY21

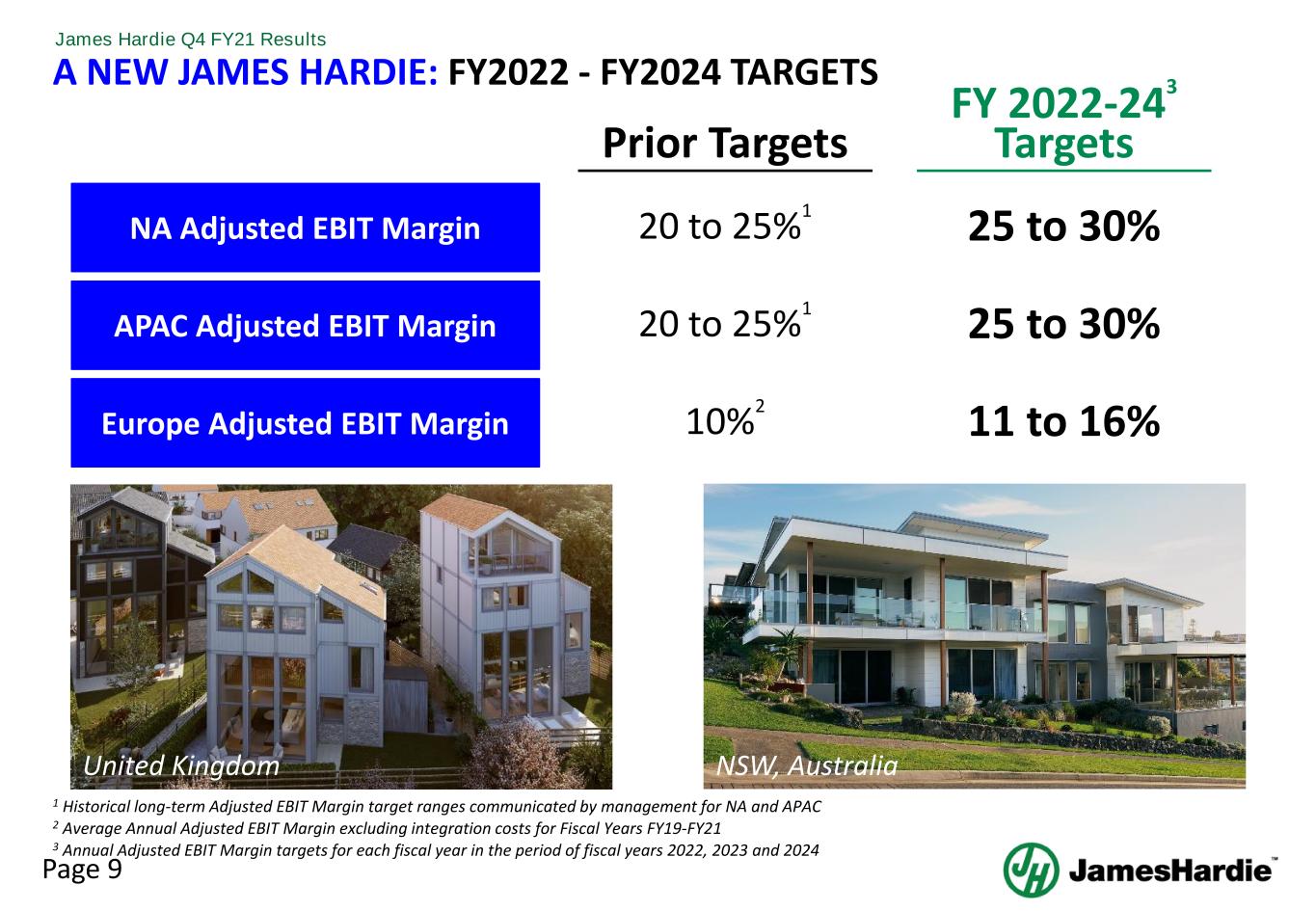

Page 9 James Hardie Q4 FY21 Results A NEW JAMES HARDIE: FY2022 - FY2024 TARGETS 1 Historical long-term Adjusted EBIT Margin target ranges communicated by management for NA and APAC NA Adjusted EBIT Margin 25 to 30% United Kingdom NSW, Australia APAC Adjusted EBIT Margin Europe Adjusted EBIT Margin 25 to 30% 11 to 16% FY 2022-243 Targets 20 to 25%1 20 to 25%1 10%2 Prior Targets 3 Annual Adjusted EBIT Margin targets for each fiscal year in the period of fiscal years 2022, 2023 and 2024 2 Average Annual Adjusted EBIT Margin excluding integration costs for Fiscal Years FY19-FY21

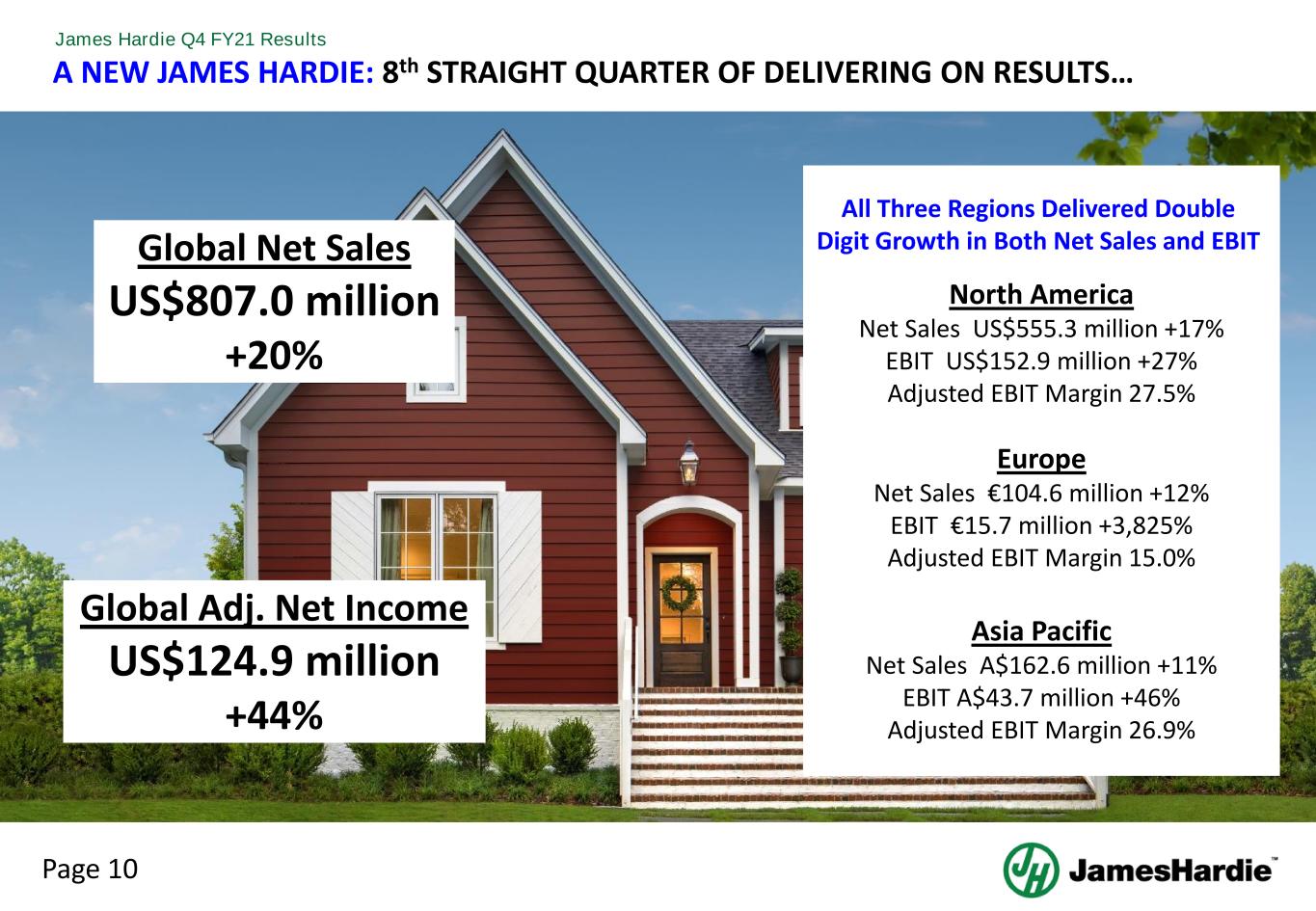

Page 10 James Hardie Q4 FY21 Results Global Net Sales US$807.0 million +20% Global Adj. Net Income US$124.9 million +44% AllEurope Net Sales €104.6 million +12% EBIT €15.7 million +3,825% Adjusted EBIT Margin 15.0% North America Net Sales US$555.3 million +17% EBIT US$152.9 million +27% Adjusted EBIT Margin 27.5% Asia Pacific Net Sales A$162.6 million +11% EBIT A$43.7 million +46% Adjusted EBIT Margin 26.9% All Three Regions Delivered Double Digit Growth in Both Net Sales and EBIT A NEW JAMES HARDIE: 8th STRAIGHT QUARTER OF DELIVERING ON RESULTS…

Q4 AND FULL YEAR FY21 FINANCIAL RESULTS

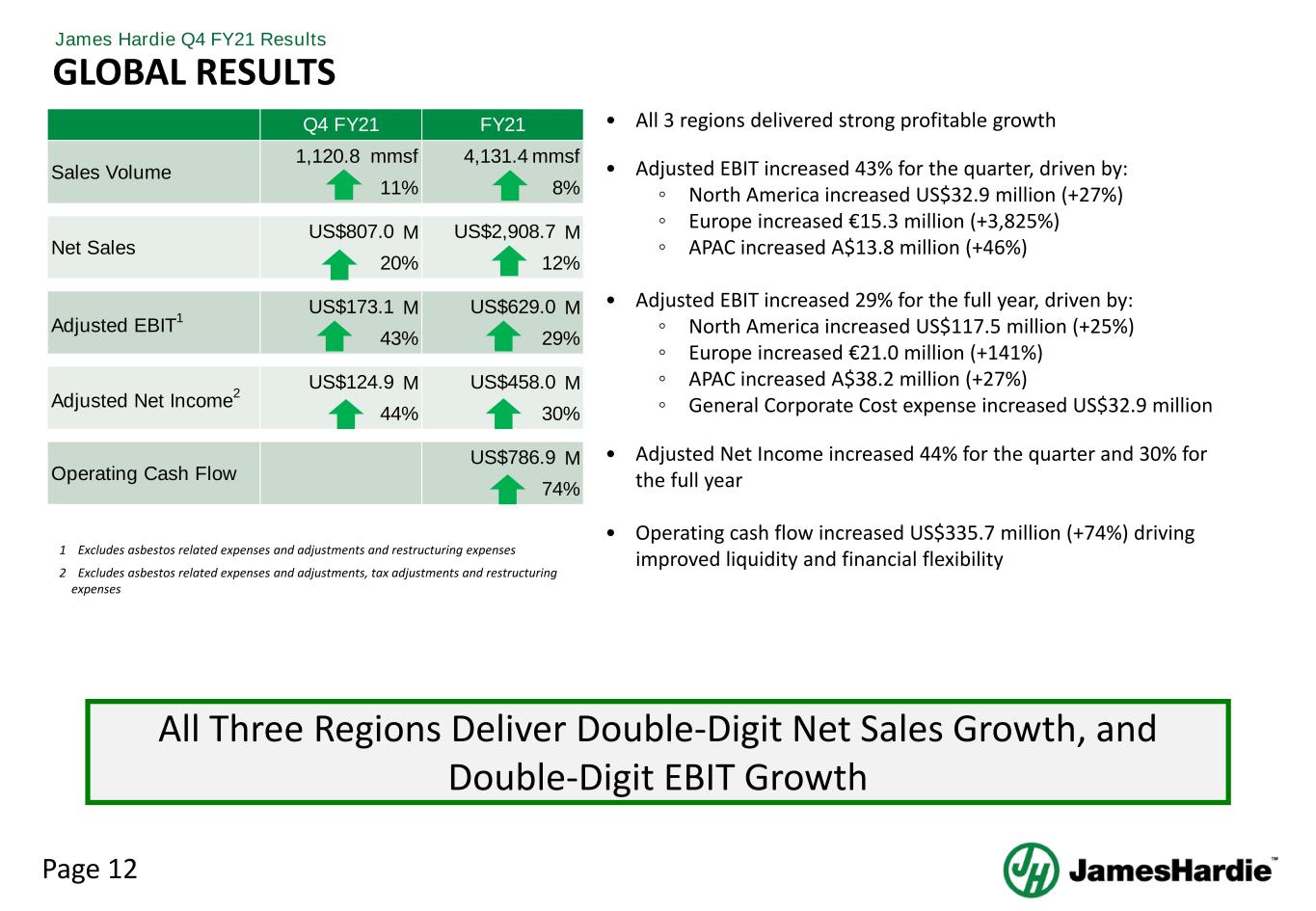

Page 12 James Hardie Q4 FY21 Results M M M M M M M Operating Cash Flow Adjusted Net Income2 Adjusted EBIT1 Sales Volume Net Sales 20% 43% US$124.9 44% Q4 FY21 1,120.8 mmsf 11% US$807.0 US$173.1 FY21 4,131.4 mmsf 8% US$2,908.7 12% US$629.0 29% US$458.0 30% US$786.9 74% • All 3 regions delivered strong profitable growth • Adjusted EBIT increased 43% for the quarter, driven by: ◦ North America increased US$32.9 million (+27%) ◦ Europe increased €15.3 million (+3,825%) ◦ APAC increased A$13.8 million (+46%) • Adjusted EBIT increased 29% for the full year, driven by: ◦ North America increased US$117.5 million (+25%) ◦ Europe increased €21.0 million (+141%) ◦ APAC increased A$38.2 million (+27%) ◦ General Corporate Cost expense increased US$32.9 million • Adjusted Net Income increased 44% for the quarter and 30% for the full year • Operating cash flow increased US$335.7 million (+74%) driving improved liquidity and financial flexibility GLOBAL RESULTS All Three Regions Deliver Double-Digit Net Sales Growth, and Double-Digit EBIT Growth 1 Excludes asbestos related expenses and adjustments and restructuring expenses 2 Excludes asbestos related expenses and adjustments, tax adjustments and restructuring expenses

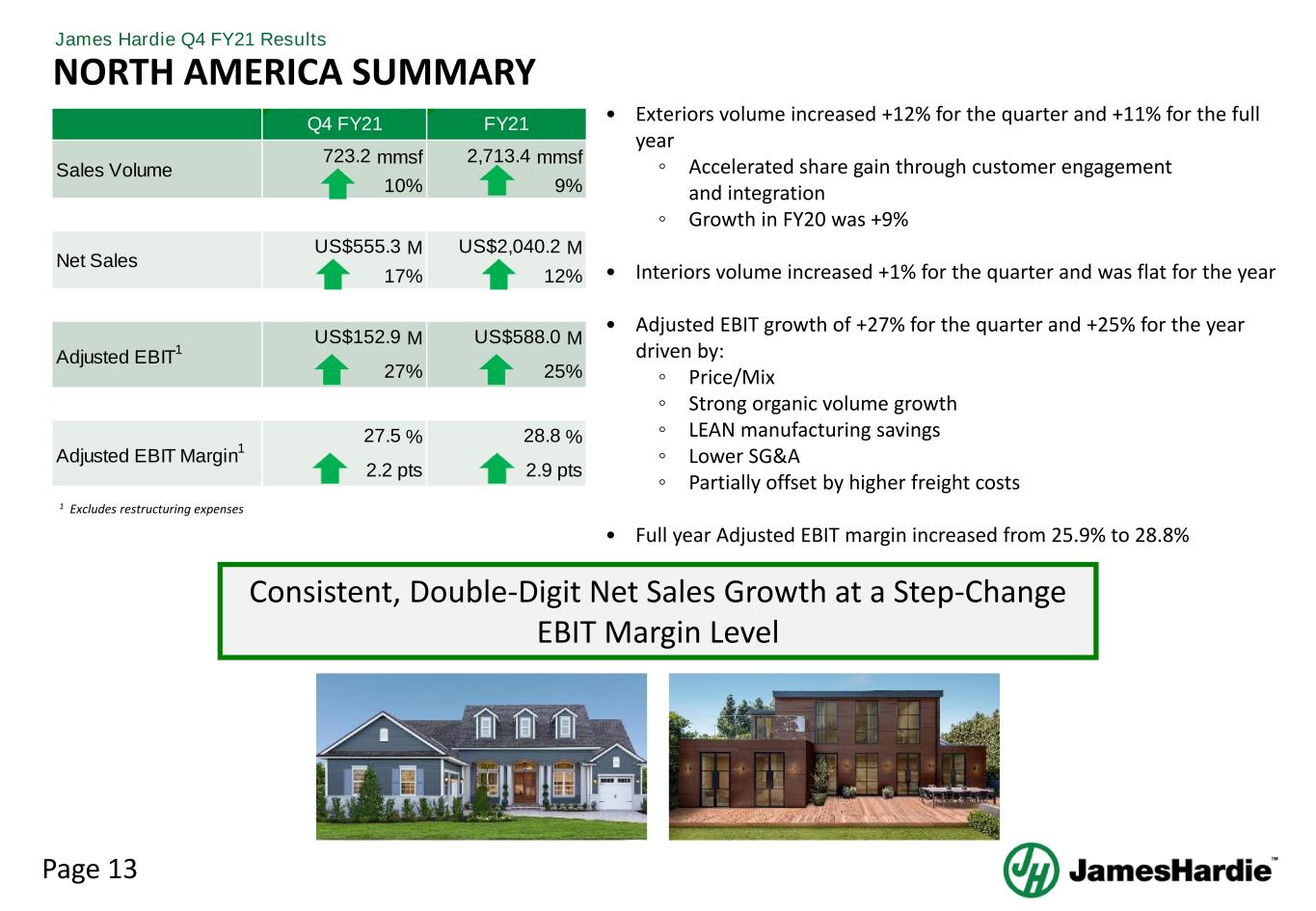

Page 13 James Hardie Q4 FY21 Results M M M M % % Sales Volume Net Sales Adjusted EBIT Margin1 Adjusted EBIT1 US$555.3 17% Q4 FY21 723.2 mmsf 10% 27.5 2.2 pts US$152.9 27% FY21 2,713.4 mmsf 9% US$2,040.2 12% 28.8 2.9 pts US$588.0 25% NORTH AMERICA SUMMARY Consistent, Double-Digit Net Sales Growth at a Step-Change EBIT Margin Level 1 Excludes restructuring expenses • Exteriors volume increased +12% for the quarter and +11% for the full year ◦ Accelerated share gain through customer engagement and integration ◦ Growth in FY20 was +9% • Interiors volume increased +1% for the quarter and was flat for the year • Adjusted EBIT growth of +27% for the quarter and +25% for the year driven by: ◦ Price/Mix ◦ Strong organic volume growth ◦ LEAN manufacturing savings ◦ Lower SG&A ◦ Partially offset by higher freight costs • Full year Adjusted EBIT margin increased from 25.9% to 28.8%

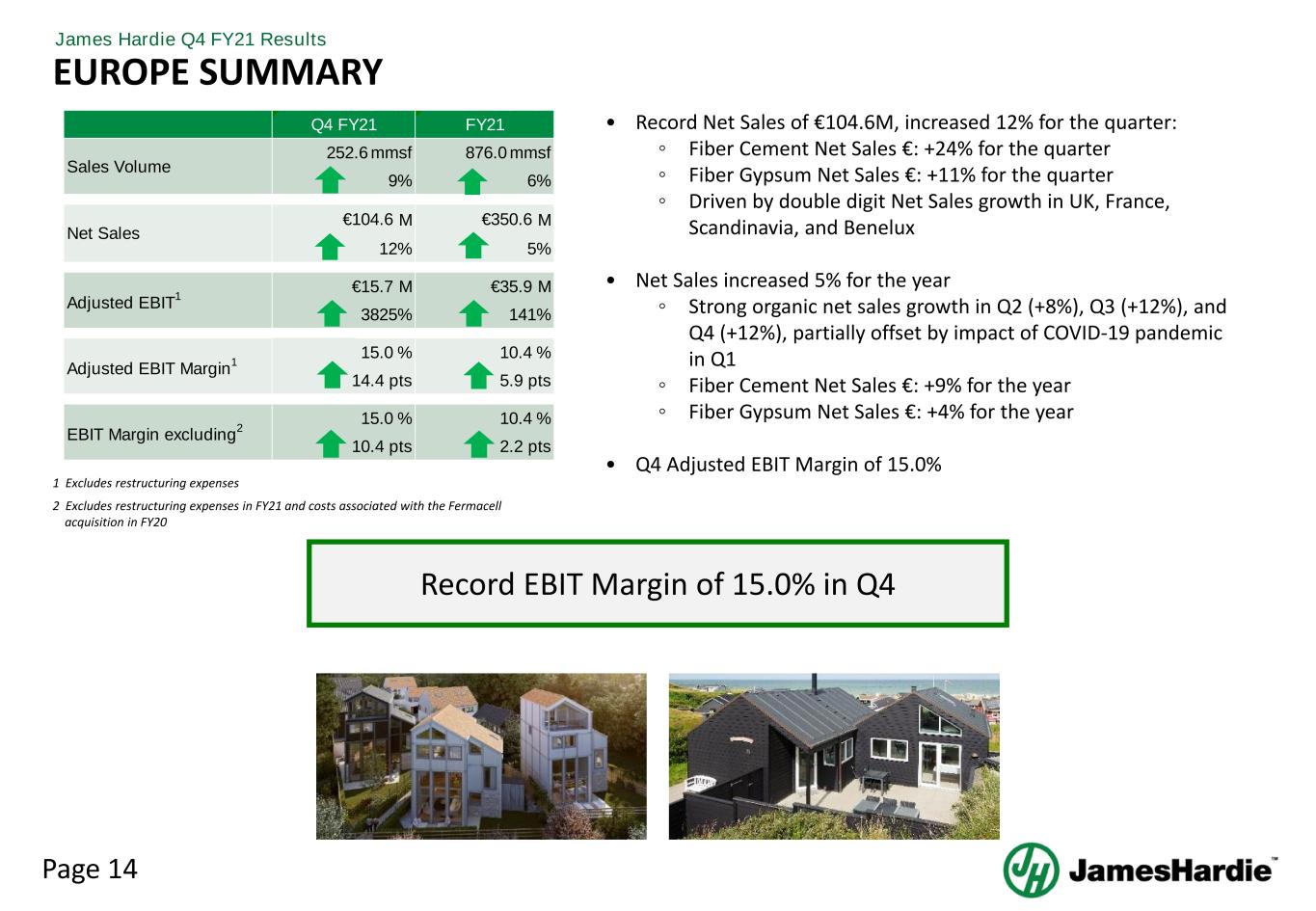

Page 14 James Hardie Q4 FY21 Results EUROPE SUMMARY • Record Net Sales of €104.6M, increased 12% for the quarter: ◦ Fiber Cement Net Sales €: +24% for the quarter ◦ Fiber Gypsum Net Sales €: +11% for the quarter ◦ Driven by double digit Net Sales growth in UK, France, Scandinavia, and Benelux • Net Sales increased 5% for the year ◦ Strong organic net sales growth in Q2 (+8%), Q3 (+12%), and Q4 (+12%), partially offset by impact of COVID-19 pandemic in Q1 ◦ Fiber Cement Net Sales €: +9% for the year ◦ Fiber Gypsum Net Sales €: +4% for the year • Q4 Adjusted EBIT Margin of 15.0% Record EBIT Margin of 15.0% in Q4 1 Excludes restructuring expenses 2 Excludes restructuring expenses in FY21 and costs associated with the Fermacell acquisition in FY20 M M M M % % % % EBIT Margin excluding2 10.4 2.2 pts 15.0 10.4 pts Adjusted EBIT1 9% 6% Net Sales €104.6 €350.6 12% 5% €35.9 141% 10.4 5.9 pts Q4 FY21 FY21 Sales Volume 252.6 mmsf 876.0 mmsf Adjusted EBIT Margin1 15.0 14.4 pts €15.7 3825%

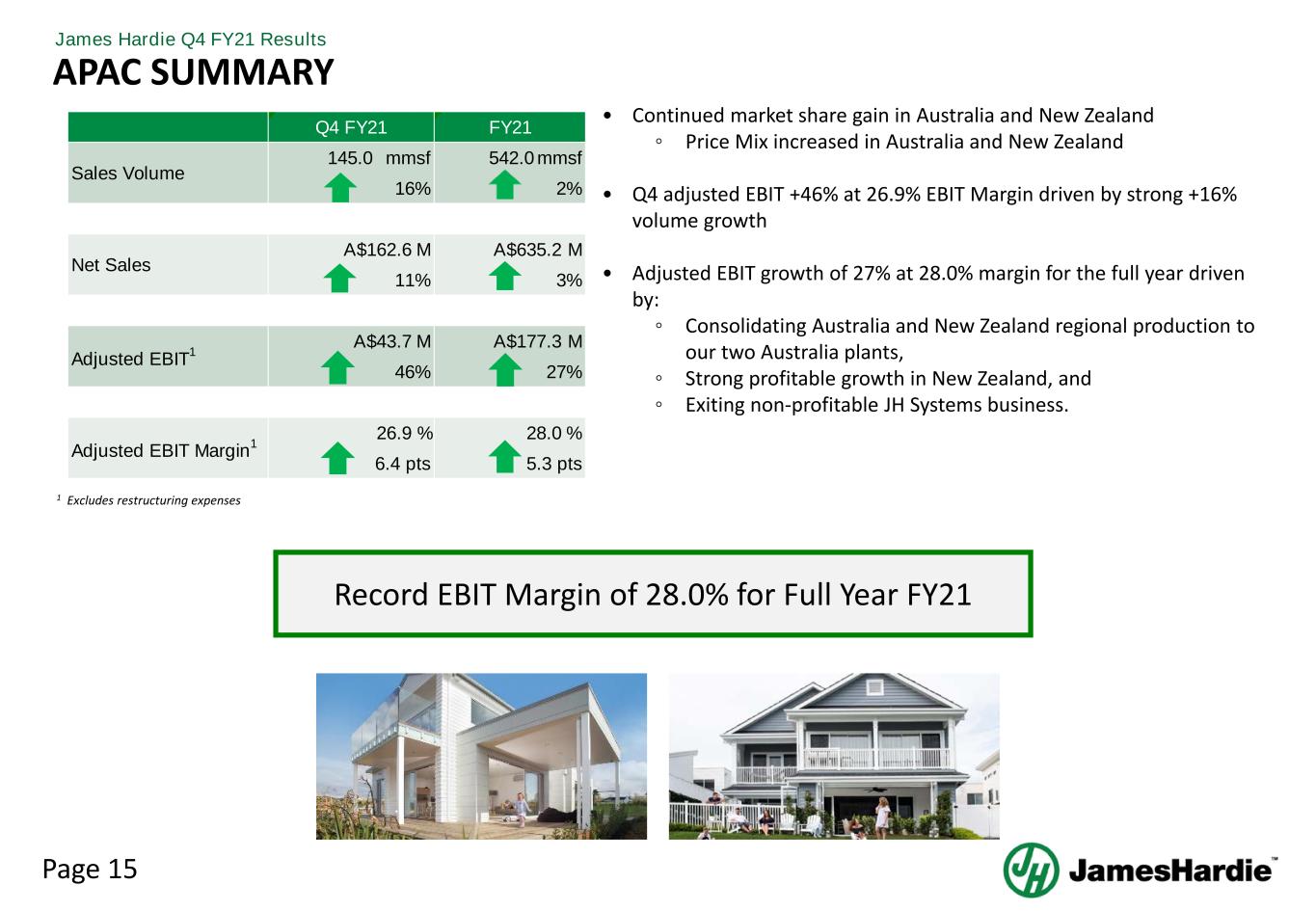

Page 15 James Hardie Q4 FY21 Results APAC SUMMARY • Continued market share gain in Australia and New Zealand ◦ Price Mix increased in Australia and New Zealand • Q4 adjusted EBIT +46% at 26.9% EBIT Margin driven by strong +16% volume growth • Adjusted EBIT growth of 27% at 28.0% margin for the full year driven by: ◦ Consolidating Australia and New Zealand regional production to our two Australia plants, ◦ Strong profitable growth in New Zealand, and ◦ Exiting non-profitable JH Systems business. Record EBIT Margin of 28.0% for Full Year FY21 1 Excludes restructuring expenses M M M M % % Adjusted EBIT Margin1 26.9 28.0 6.4 pts 5.3 pts Net Sales A$162.6 A$635.2 11% 3% Adjusted EBIT1 A$43.7 A$177.3 46% 27% Sales Volume 145.0 mmsf 542.0 Q4 FY21 FY21 mmsf 16% 2%

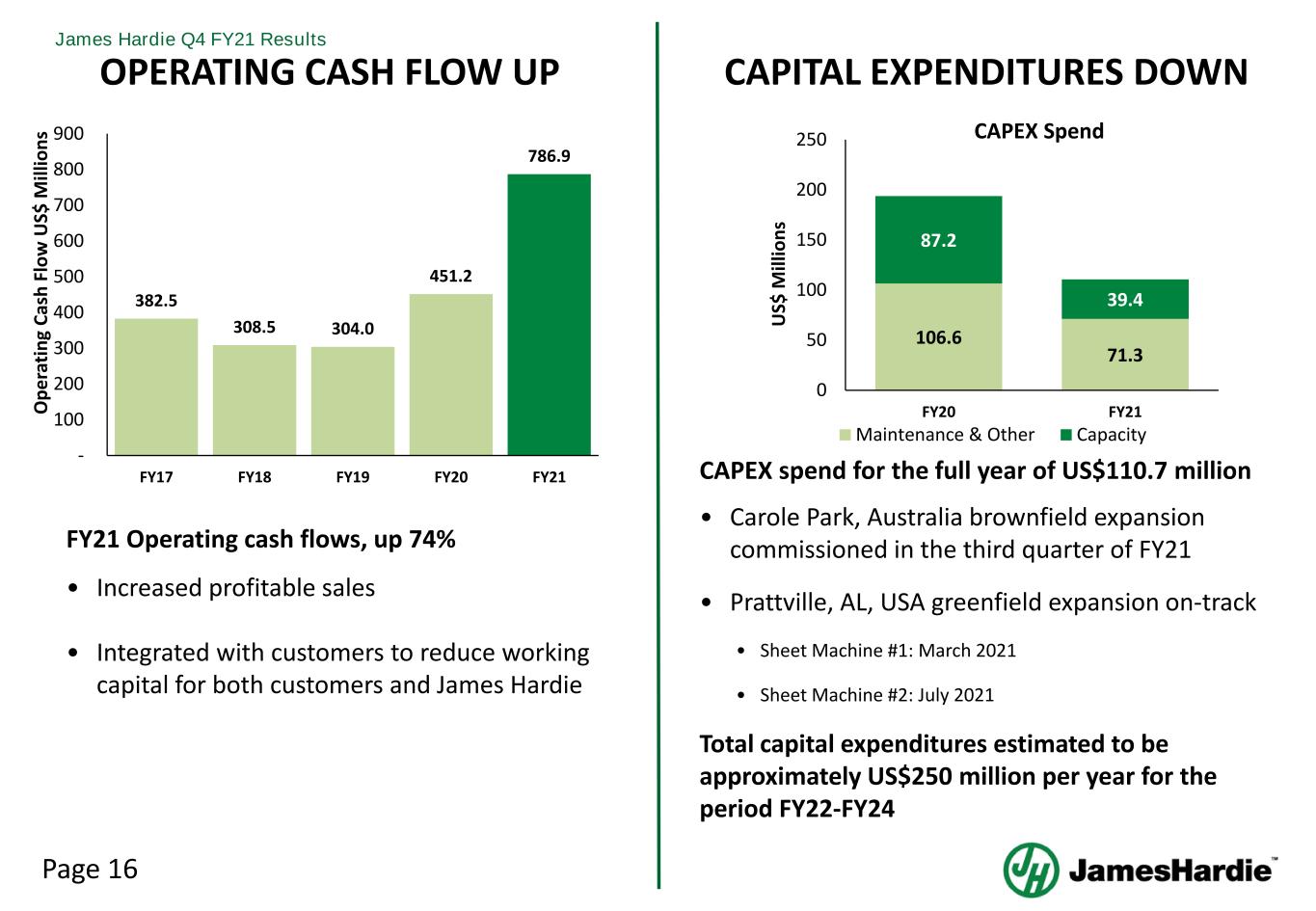

Page 16 James Hardie Q4 FY21 Results 1 OPERATING CASH FLOW UP CAPITAL EXPENDITURES DOWN CAPEX spend for the full year of US$110.7 million • Carole Park, Australia brownfield expansion commissioned in the third quarter of FY21 • Prattville, AL, USA greenfield expansion on-track • Sheet Machine #1: March 2021 • Sheet Machine #2: July 2021 Total capital expenditures estimated to be approximately US$250 million per year for the period FY22-FY24 FY21 Operating cash flows, up 74% • Increased profitable sales • Integrated with customers to reduce working capital for both customers and James Hardie 382.5 308.5 304.0 451.2 786.9 - 100 200 300 400 500 600 700 800 900 FY17 FY18 FY19 FY20 FY21 O pe ra ti ng C as h Fl ow U S$ M ill io ns 106.6 71.3 87.2 39.4 0 50 100 150 200 250 FY20 FY21 Maintenance & Other Capacity U S$ M ill io ns CAPEX Spend

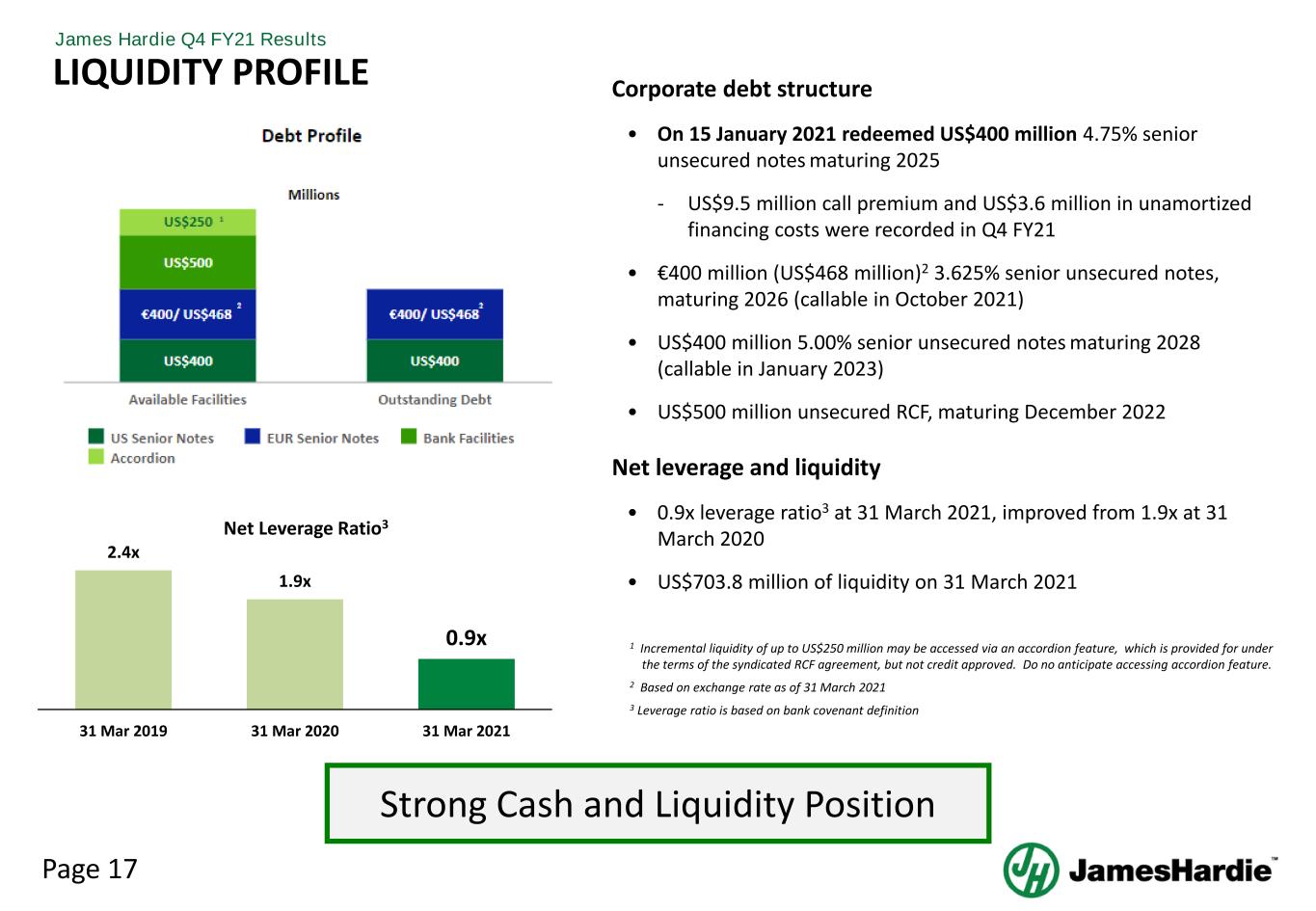

Page 17 James Hardie Q4 FY21 Results LIQUIDITY PROFILE Strong Cash and Liquidity Position 2 1 Incremental liquidity of up to US$250 million may be accessed via an accordion feature, which is provided for under the terms of the syndicated RCF agreement, but not credit approved. Do no anticipate accessing accordion feature. 2 Based on exchange rate as of 31 March 2021 3 Leverage ratio is based on bank covenant definition 2.4x 1.9x 0.9x 31 Mar 2019 31 Mar 2020 31 Mar 2021 Net Leverage Ratio3 Corporate debt structure • On 15 January 2021 redeemed US$400 million 4.75% senior unsecured notes maturing 2025 - US$9.5 million call premium and US$3.6 million in unamortized financing costs were recorded in Q4 FY21 • €400 million (US$468 million)2 3.625% senior unsecured notes, maturing 2026 (callable in October 2021) • US$400 million 5.00% senior unsecured notes maturing 2028 (callable in January 2023) • US$500 million unsecured RCF, maturing December 2022 Net leverage and liquidity • 0.9x leverage ratio3 at 31 March 2021, improved from 1.9x at 31 March 2020 • US$703.8 million of liquidity on 31 March 2021

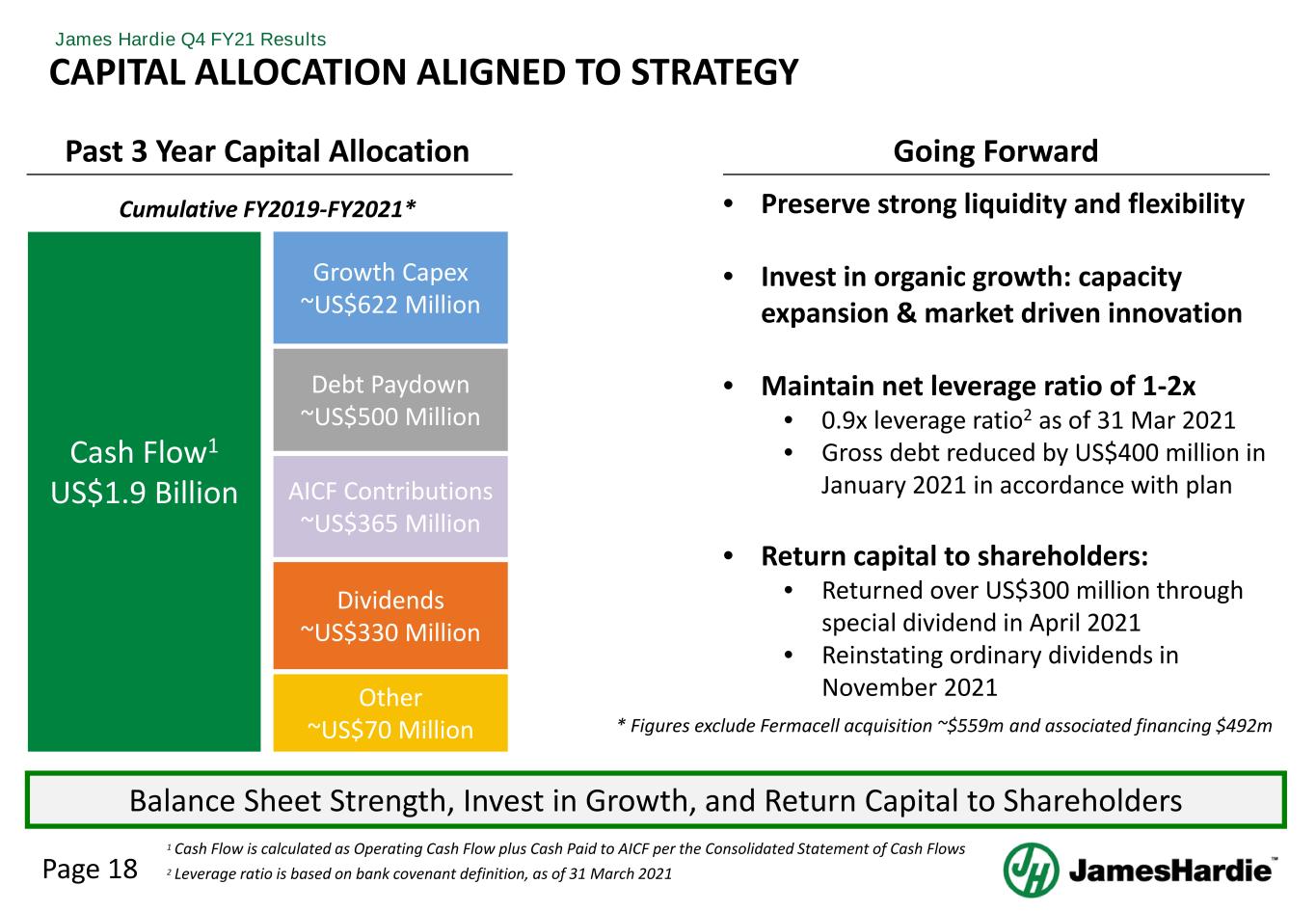

Page 18 James Hardie Q4 FY21 Results CAPITAL ALLOCATION ALIGNED TO STRATEGY Cash Flow1 US$1.9 Billion Other ~US$70 Million Debt Paydown ~US$500 Million Dividends ~US$330 Million Cumulative FY2019-FY2021* Growth Capex ~US$622 Million Past 3 Year Capital Allocation Balance Sheet Strength, Invest in Growth, and Return Capital to Shareholders Going Forward • Preserve strong liquidity and flexibility • Invest in organic growth: capacity expansion & market driven innovation • Maintain net leverage ratio of 1-2x • 0.9x leverage ratio2 as of 31 Mar 2021 • Gross debt reduced by US$400 million in January 2021 in accordance with plan • Return capital to shareholders: • Returned over US$300 million through special dividend in April 2021 • Reinstating ordinary dividends in November 2021 2 Leverage ratio is based on bank covenant definition, as of 31 March 2021 AICF Contributions ~US$365 Million * Figures exclude Fermacell acquisition ~$559m and associated financing $492m 1 Cash Flow is calculated as Operating Cash Flow plus Cash Paid to AICF per the Consolidated Statement of Cash Flows

Page 19 James Hardie Q4 FY21 Results FULL YEAR FISCAL YEAR 2022 GUIDANCE 1 Fiscal Year 2021 Adjusted Net Income excludes asbestos related expenses and adjustments, and restructuring expenses 2 Adjusted Net Income formerly referred to as Adjusted NOPAT Adjusted Net Income1,2 $458 million $520 to $570 million Ohio, USA PNW, USA FY 2021 FY 2022 +14% to +24% vs pcp

ANNUAL INVESTOR DAY PREVIEW

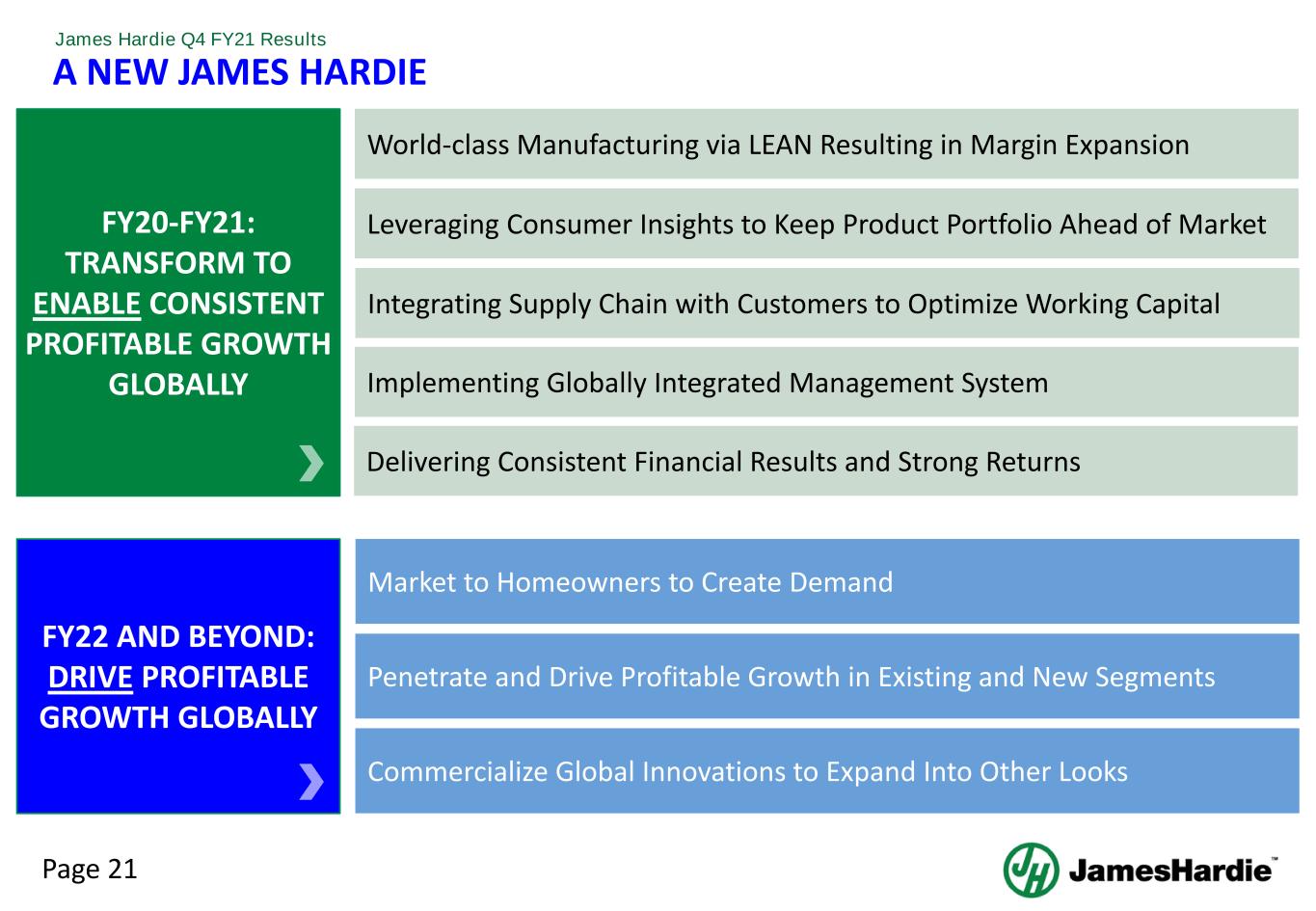

Page 21 James Hardie Q4 FY21 Results FY20-FY21: TRANSFORM TO ENABLE CONSISTENT PROFITABLE GROWTH GLOBALLY FY22 AND BEYOND: DRIVE PROFITABLE GROWTH GLOBALLY World-class Manufacturing via LEAN Resulting in Margin Expansion Leveraging Consumer Insights to Keep Product Portfolio Ahead of Market Implementing Globally Integrated Management System Integrating Supply Chain with Customers to Optimize Working Capital Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations to Expand Into Other Looks Delivering Consistent Financial Results and Strong Returns A NEW JAMES HARDIE

Page 22 James Hardie Q4 FY21 Results PROFITABLE ORGANIC GROWTH THROUGH MARKETING TO HOMEOWNERS Create Demand with Homeowners AWARENESS PURCHASE AMPLIFICATION CONSIDERATION It’s possible with Homeownerisat the center of our attention DRTV Influencer Content Creation Targeted Digital Media Campaign Started on May 3rd, 2021

Page 23 James Hardie Q4 FY21 Results PROFITABLE ORGANIC GROWTH THROUGH GLOBAL INNOVATION Market Driven Innovation Expands Opportunities for Future Organic Growth New Jersey, USA California, USA United Kingdom Australia © This Land™ LTD 2021

Page 24 James Hardie Q4 FY21 Results JAMES HARDIE TO HOST VIRTUAL INVESTOR DAY Single session: Tuesday May 25th, 7:00AM-9:15AM (Sydney, Australia Time) Monday May 24th, 5:00PM-7:15PM (New York City, USA Time) The session will be recorded and available on our Investor Relations website Registration Link: https://JHXInvestorDay.joinceo.com Agenda Strategy Growth Through Marketing to Homeowners Growth Through Global Innovation

QUESTIONS

APPENDIX

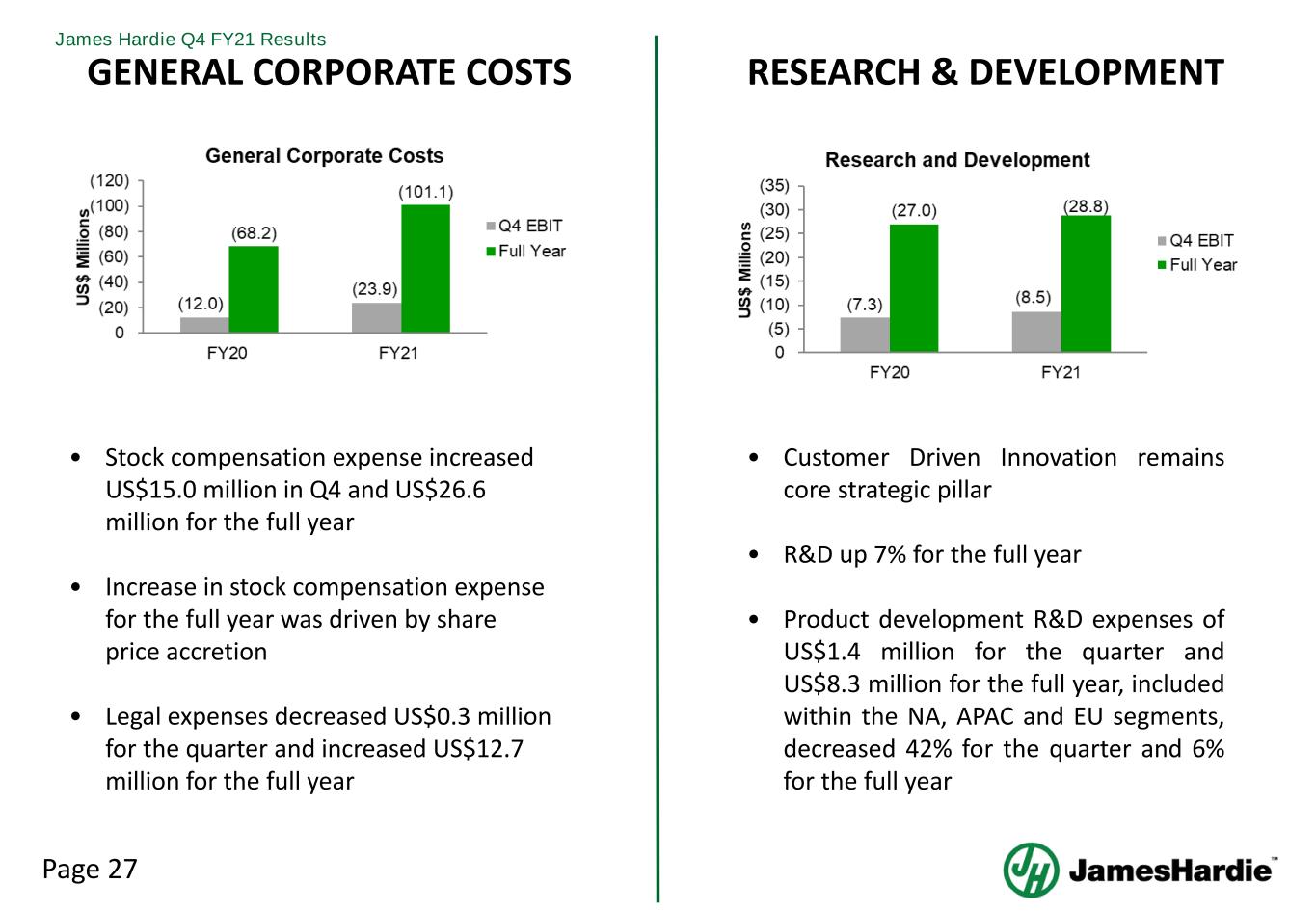

Page 27 James Hardie Q4 FY21 Results GENERAL CORPORATE COSTS • Stock compensation expense increased US$15.0 million in Q4 and US$26.6 million for the full year • Increase in stock compensation expense for the full year was driven by share price accretion • Legal expenses decreased US$0.3 million for the quarter and increased US$12.7 million for the full year • Customer Driven Innovation remains core strategic pillar • R&D up 7% for the full year • Product development R&D expenses of US$1.4 million for the quarter and US$8.3 million for the full year, included within the NA, APAC and EU segments, decreased 42% for the quarter and 6% for the full year RESEARCH & DEVELOPMENT

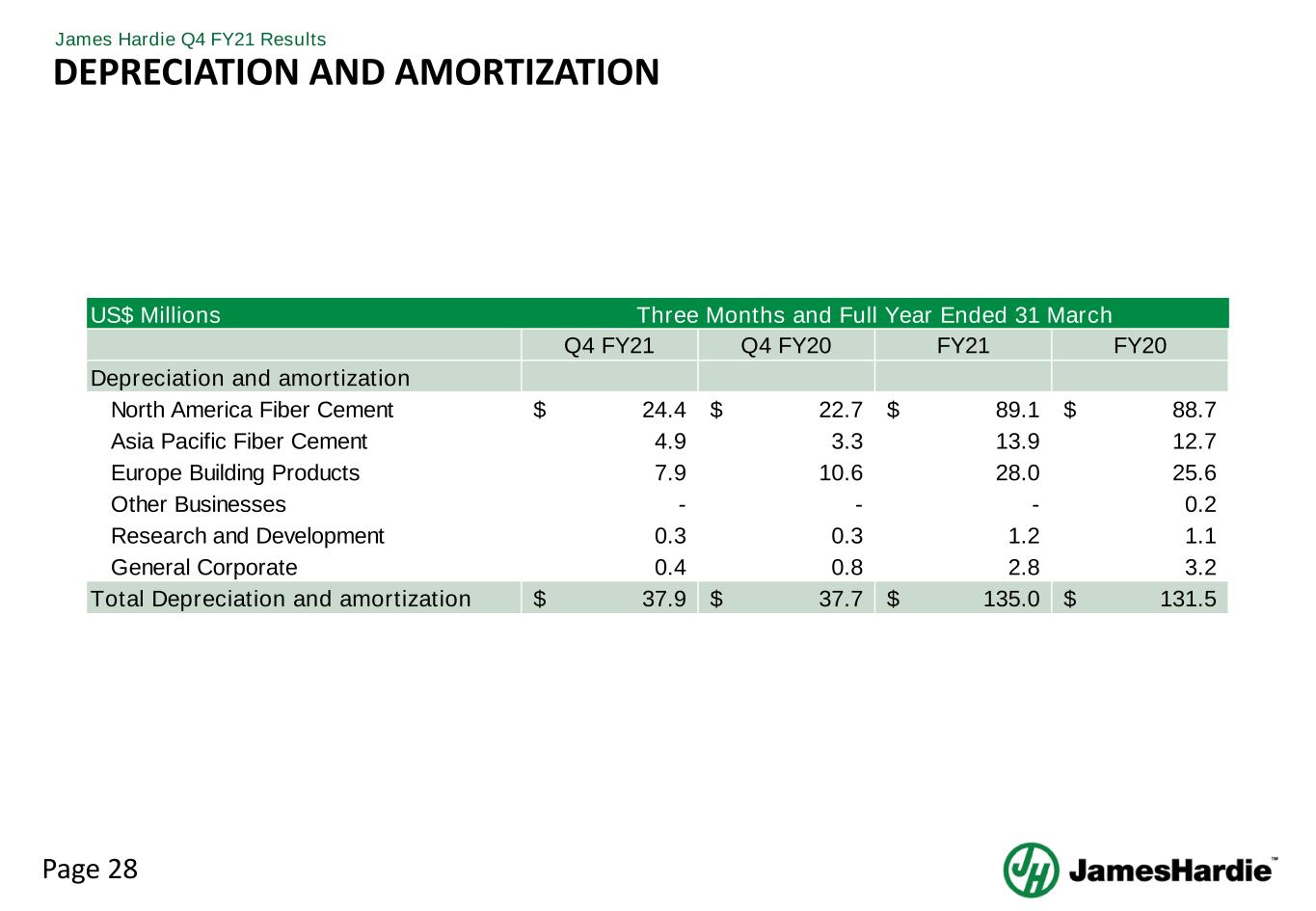

Page 28 James Hardie Q4 FY21 Results DEPRECIATION AND AMORTIZATION US$ Millions Q4 FY21 Q4 FY20 FY21 FY20 Depreciation and amortization North America Fiber Cement 24.4$ 22.7$ 89.1$ 88.7$ Asia Pacific Fiber Cement 4.9 3.3 13.9 12.7 Europe Building Products 7.9 10.6 28.0 25.6 Other Businesses - - - 0.2 Research and Development 0.3 0.3 1.2 1.1 General Corporate 0.4 0.8 2.8 3.2 Total Depreciation and amortization 37.9$ 37.7$ 135.0$ 131.5$ Three Months and Full Year Ended 31 March

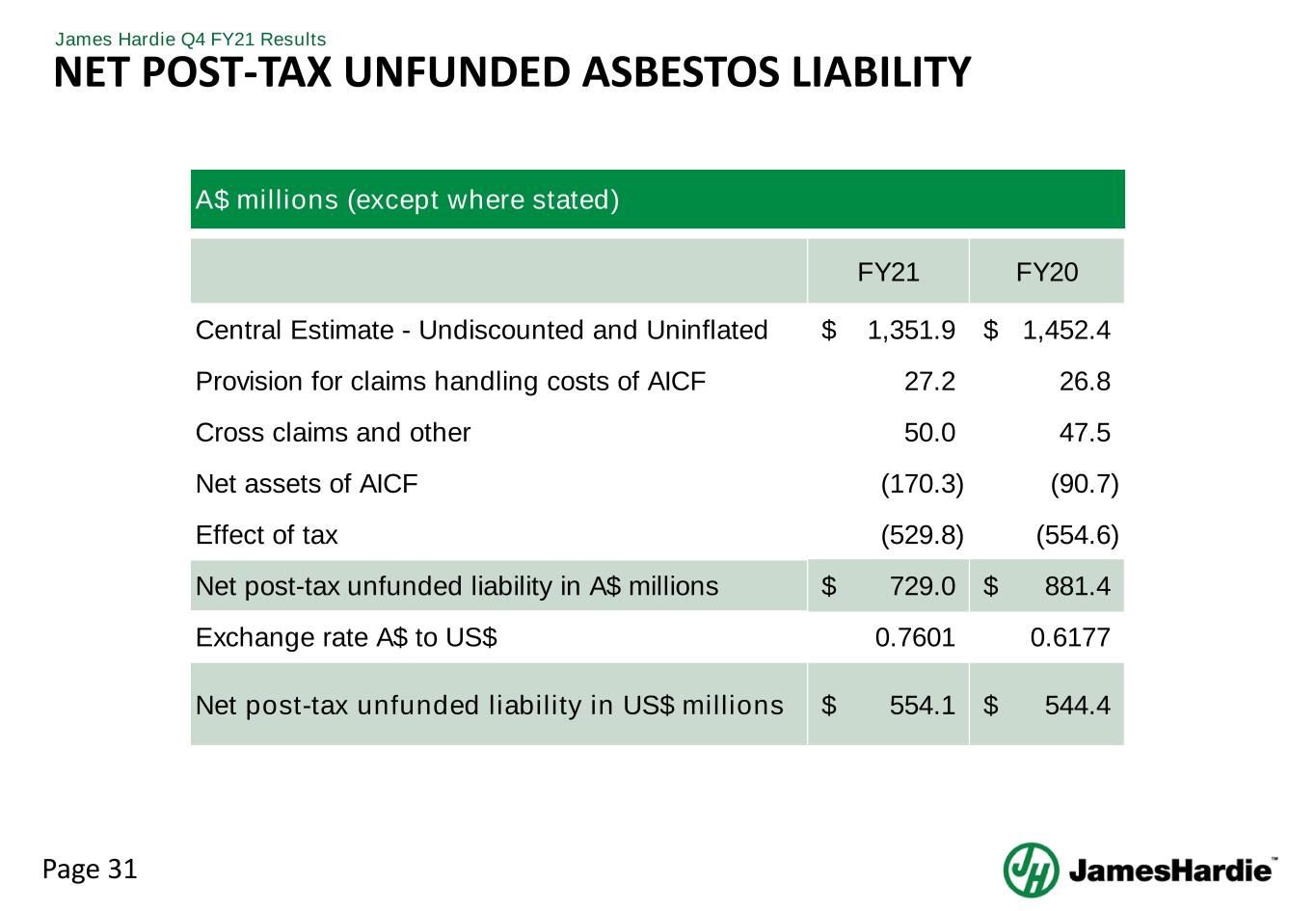

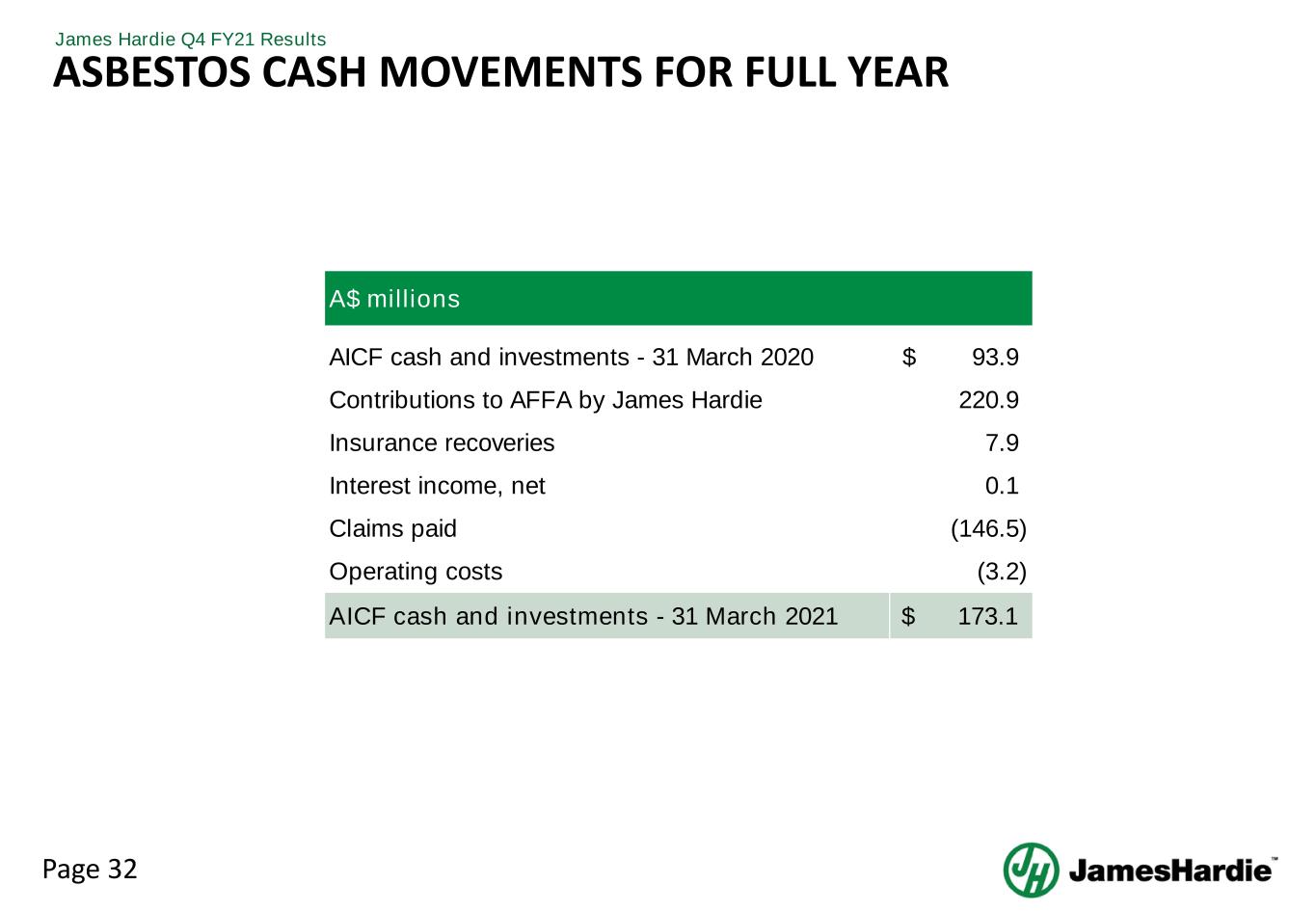

Page 29 James Hardie Q4 FY21 Results KEY POINTS • Updated actuarial report completed as at 31 March 2021 ◦ Undiscounted and uninflated estimate decreased to A$1,352 million from A$1,452 million • For fiscal year 2021, we noted the following related to asbestos-related claims experience: ◦ Net cash outflow was 13% below actuarial expectations ◦ Claims received were 13% below actuarial expectations ◦ Average claim settlement was 16% below actuarial expectations • Total contributions of US$153.3 million were made by James Hardie to AICF during FY2021 • AICF has A$173.1 million in cash and investments as at 31 March 2021 • We anticipate that we will make further contributions totaling approximately US$252.6 million to AICF during FY2022 ◦ Quarterly payments will be made in July 2021, October 2021, January 2022 and March 2022 ASBESTOS COMPENSATION

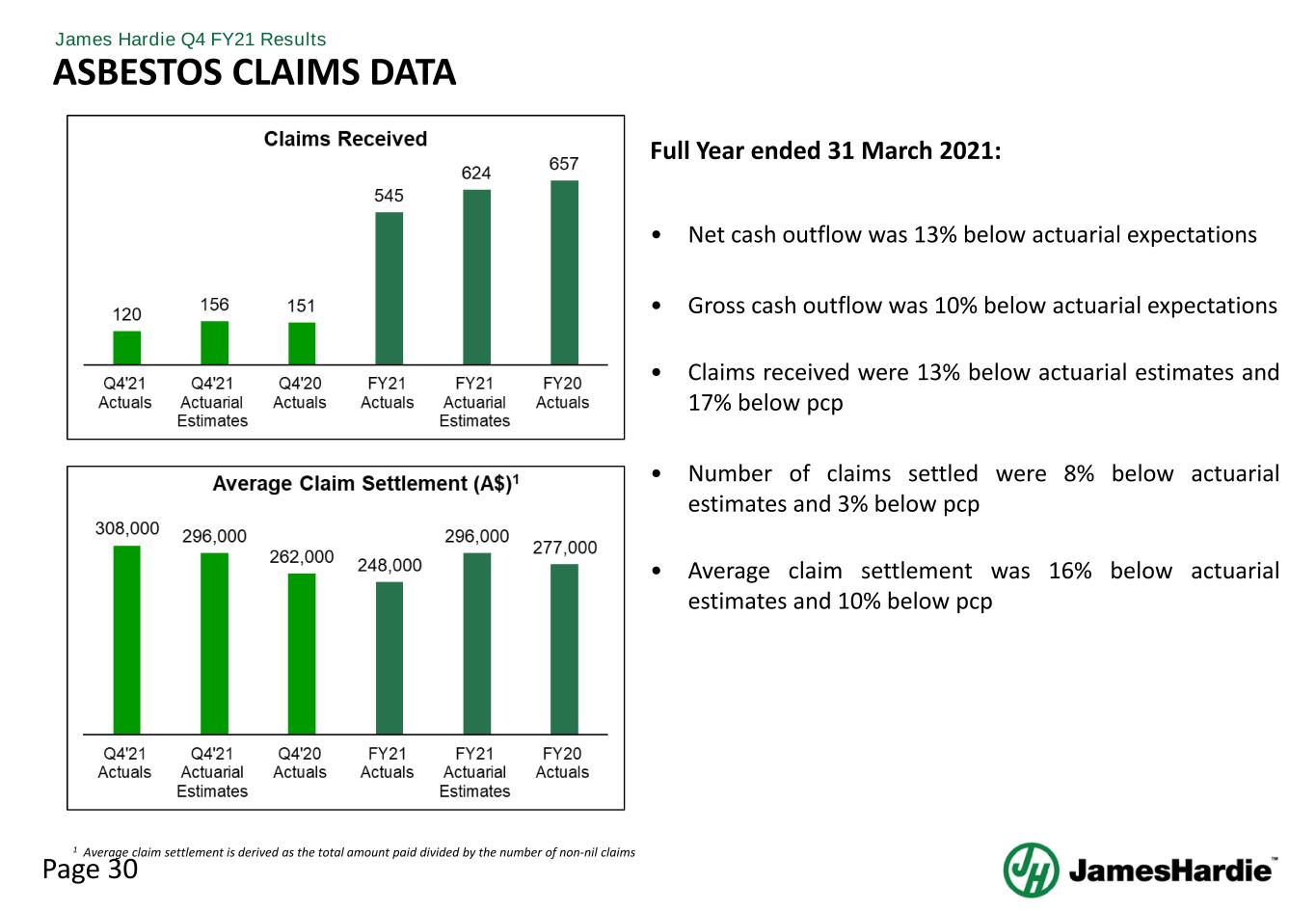

Page 30 James Hardie Q4 FY21 Results Full Year ended 31 March 2021: • Net cash outflow was 13% below actuarial expectations • Gross cash outflow was 10% below actuarial expectations • Claims received were 13% below actuarial estimates and 17% below pcp • Number of claims settled were 8% below actuarial estimates and 3% below pcp • Average claim settlement was 16% below actuarial estimates and 10% below pcp ASBESTOS CLAIMS DATA 1 Average claim settlement is derived as the total amount paid divided by the number of non-nil claims

Page 31 James Hardie Q4 FY21 Results NET POST-TAX UNFUNDED ASBESTOS LIABILITY A$ millions (except where stated) FY21 FY20 Central Estimate - Undiscounted and Uninflated 1,351.9$ 1,452.4$ Provision for claims handling costs of AICF 27.2 26.8 Cross claims and other 50.0 47.5 Net assets of AICF (170.3) (90.7) Effect of tax (529.8) (554.6) Net post-tax unfunded liability in A$ millions 729.0$ 881.4$ Exchange rate A$ to US$ 0.7601 0.6177 Net post-tax unfunded liability in US$ millions 554.1$ 544.4$

Page 32 James Hardie Q4 FY21 Results ASBESTOS CASH MOVEMENTS FOR FULL YEAR A$ millions AICF cash and investments - 31 March 2020 93.9$ Contributions to AFFA by James Hardie 220.9 Insurance recoveries 7.9 Interest income, net 0.1 Claims paid (146.5) Operating costs (3.2) AICF cash and investments - 31 March 2021 $ 173.1

Page 33 James Hardie Q4 FY21 Results NON-GAAP FINANCIAL MEASURES AND TERMS This Management Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Media Release and Condensed Consolidated Financial Statements Definitions EBIT – Earnings before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales EBITDA – Earnings before interest, tax, depreciation and amortization EBITDA margin – EBITDA margin is defined as EBITDA as a percentage of net sales Sales Volume mmsf – million square feet, where a square foot is defined as a standard square foot of 5/16” thickness msf – thousand square feet, where a square foot is defined as a standard square foot of 5/16” thickness Non-financial Terms AFFA – Amended and Restated Final Funding Agreement AICF – Asbestos Injuries Compensation Fund Ltd Legacy New Zealand weathertightness claims ("New Zealand weathertightness") – Expenses arising from defending and resolving claims in New Zealand that allege generic defects in certain fiber cement products and systems, breach of duties including the failure to conduct appropriate testing of these products and systems, failure to warn and misleading and deceptive conduct in relation to the marketing and sale of the products and systems New South Wales loan facility ("NSW Loan") – AICF has access to a secured loan facility made available by the New South Wales Government, which can be used by AICF to fund the payment of asbestos claims and certain operating and legal costs

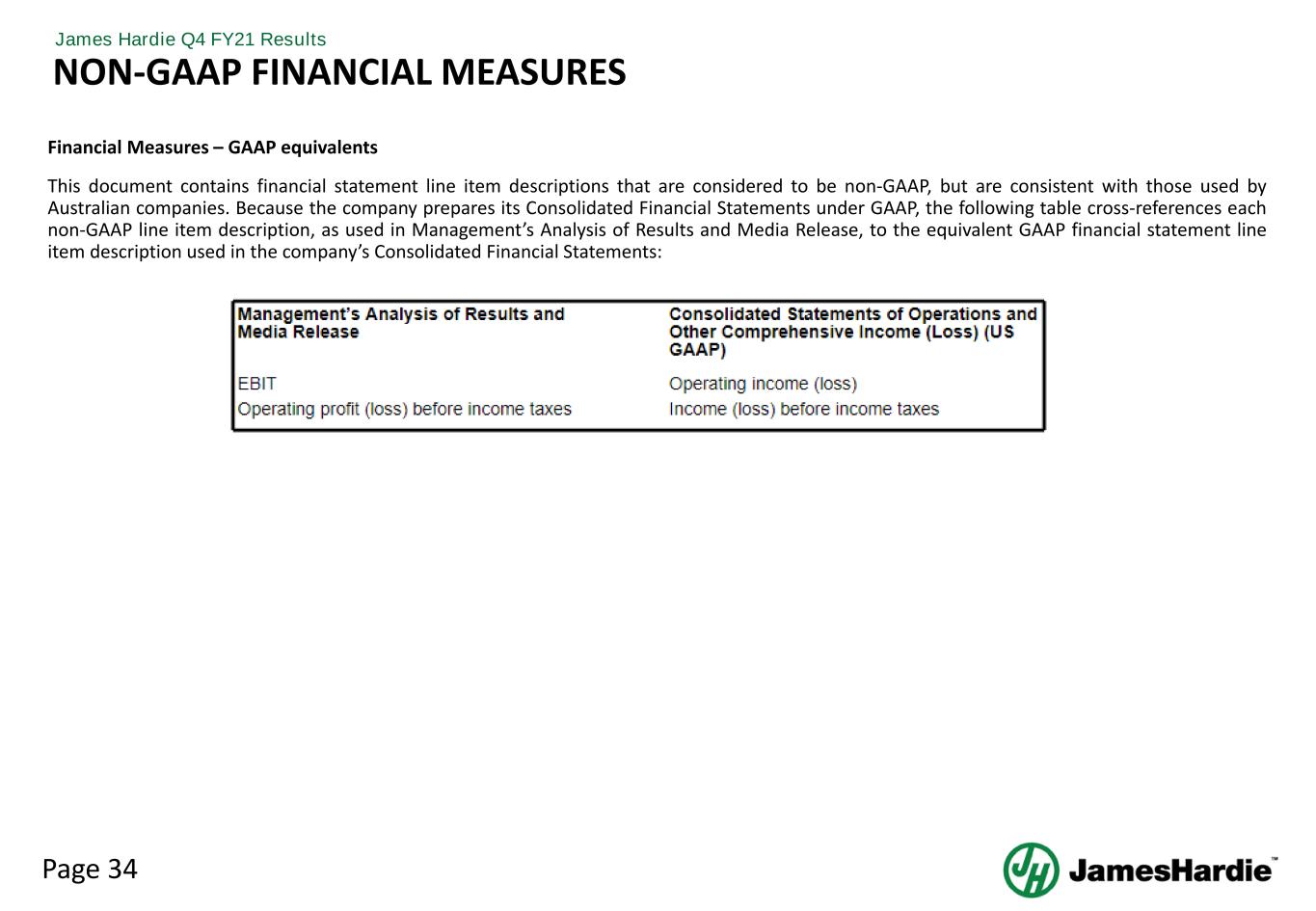

Page 34 James Hardie Q4 FY21 Results Financial Measures – GAAP equivalents This document contains financial statement line item descriptions that are considered to be non-GAAP, but are consistent with those used by Australian companies. Because the company prepares its Consolidated Financial Statements under GAAP, the following table cross-references each non-GAAP line item description, as used in Management’s Analysis of Results and Media Release, to the equivalent GAAP financial statement line item description used in the company’s Consolidated Financial Statements: NON-GAAP FINANCIAL MEASURES

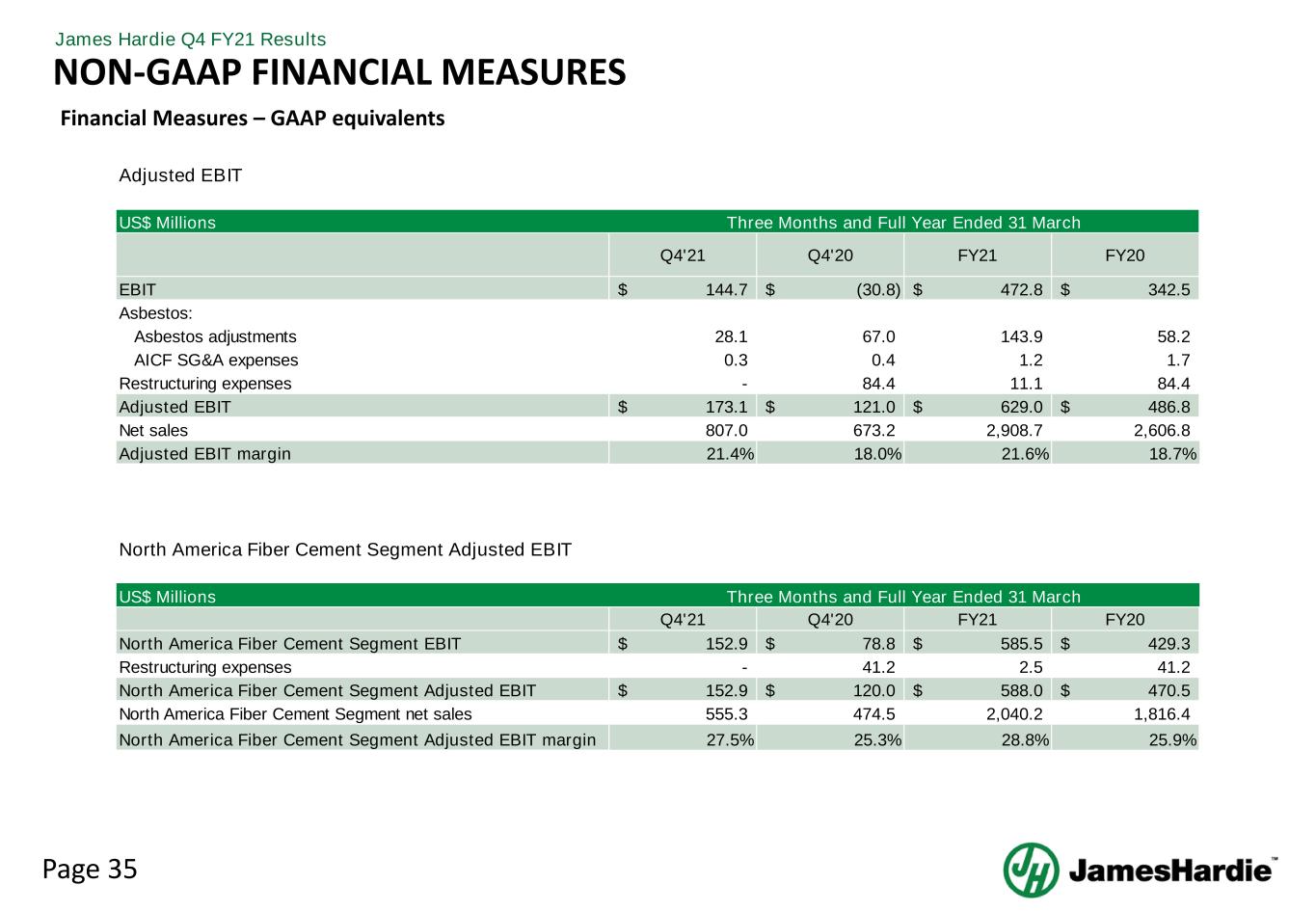

Page 35 James Hardie Q4 FY21 Results Adjusted EBIT US$ Millions Q4'21 Q4'20 FY21 FY20 EBIT 144.7$ (30.8)$ 472.8$ 342.5$ Asbestos: Asbestos adjustments 28.1 67.0 143.9 58.2 AICF SG&A expenses 0.3 0.4 1.2 1.7 Restructuring expenses - 84.4 11.1 84.4 Adjusted EBIT 173.1$ 121.0$ 629.0$ 486.8$ Net sales 807.0 673.2 2,908.7 2,606.8 Adjusted EBIT margin 21.4% 18.0% 21.6% 18.7% Three Months and Full Year Ended 31 March Financial Measures – GAAP equivalents NON-GAAP FINANCIAL MEASURES US$ Millions Q4'21 Q4'20 FY21 FY20 North America Fiber Cement Segment EBIT 152.9$ 78.8$ 585.5$ 429.3$ Restructuring expenses - 41.2 2.5 41.2 North America Fiber Cement Segment Adjusted EBIT 152.9$ 120.0$ 588.0$ 470.5$ North America Fiber Cement Segment net sales 555.3 474.5 2,040.2 1,816.4 North America Fiber Cement Segment Adjusted EBIT margin 27.5% 25.3% 28.8% 25.9% North America Fiber Cement Segment Adjusted EBIT Three Months and Full Year Ended 31 March

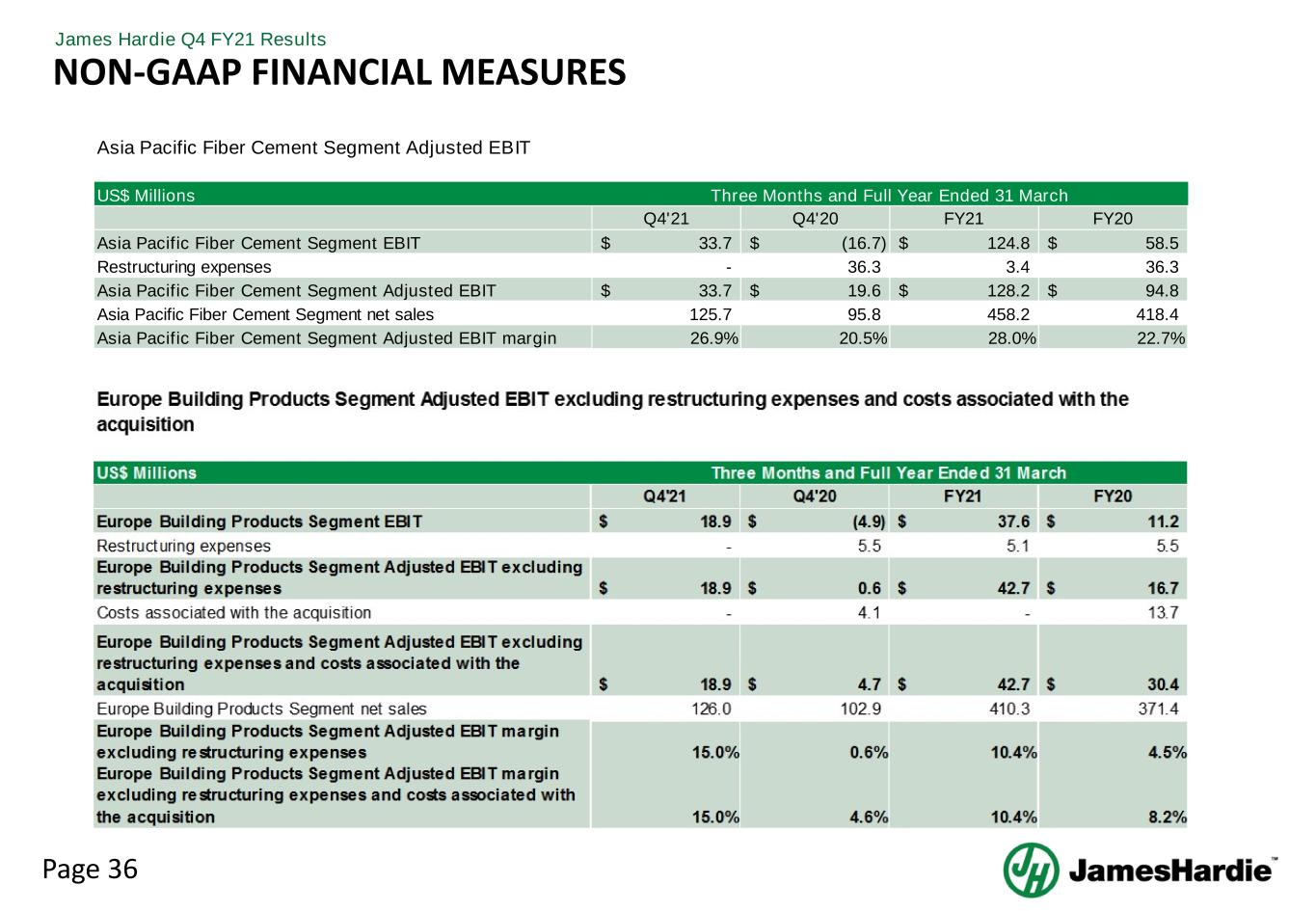

Page 36 James Hardie Q4 FY21 Results NON-GAAP FINANCIAL MEASURES US$ Millions Q4'21 Q4'20 FY21 FY20 Asia Pacific Fiber Cement Segment EBIT 33.7$ (16.7)$ 124.8$ 58.5$ Restructuring expenses - 36.3 3.4 36.3 Asia Pacific Fiber Cement Segment Adjusted EBIT 33.7$ 19.6$ 128.2$ 94.8$ Asia Pacific Fiber Cement Segment net sales 125.7 95.8 458.2 418.4 Asia Pacific Fiber Cement Segment Adjusted EBIT margin 26.9% 20.5% 28.0% 22.7% Asia Pacific Fiber Cement Segment Adjusted EBIT Three Months and Full Year Ended 31 March

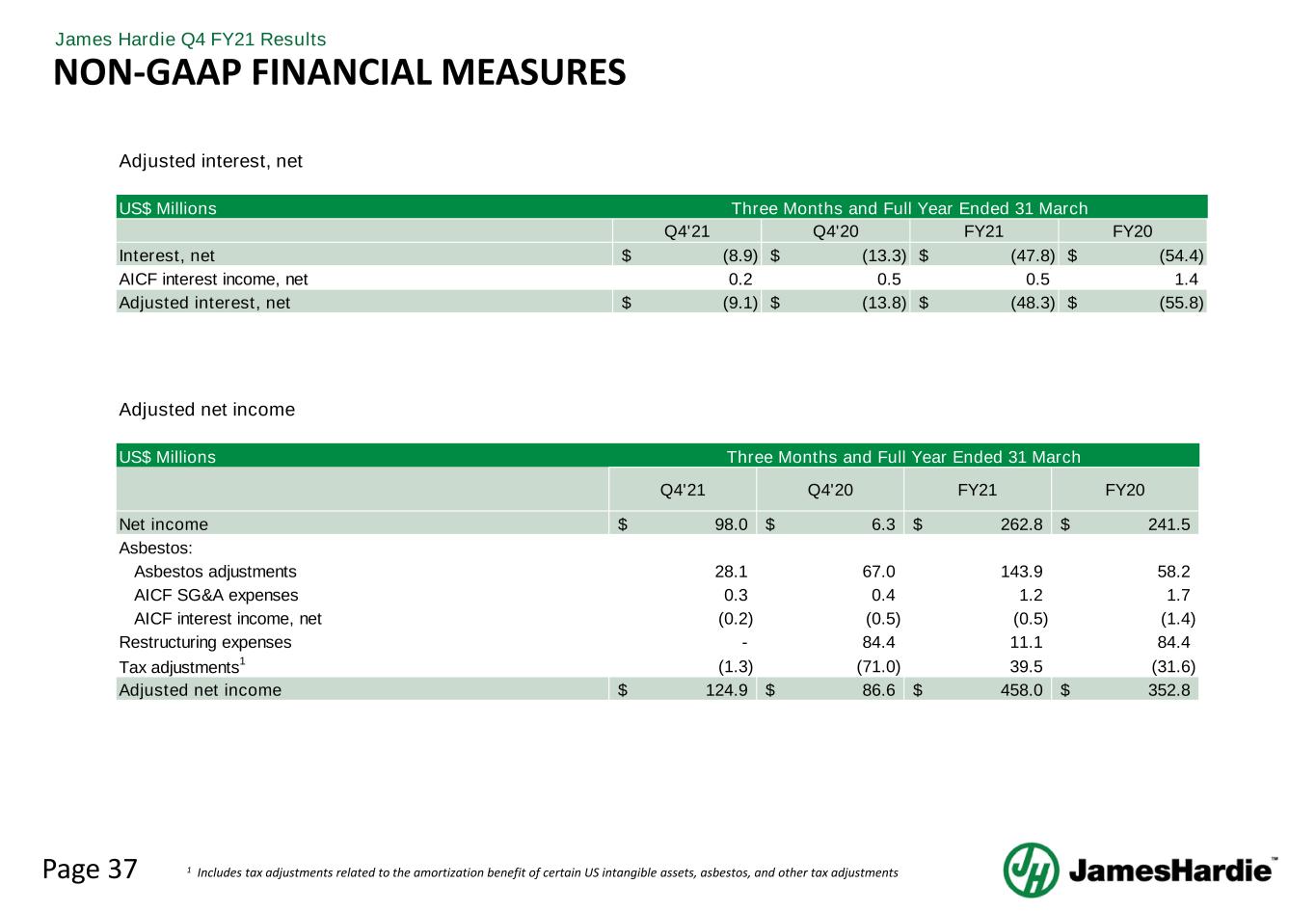

Page 37 James Hardie Q4 FY21 Results US$ Millions Q4'21 Q4'20 FY21 FY20 Interest, net (8.9)$ (13.3)$ (47.8)$ (54.4)$ AICF interest income, net 0.2 0.5 0.5 1.4 Adjusted interest, net (9.1)$ (13.8)$ (48.3)$ (55.8)$ Adjusted interest, net Three Months and Full Year Ended 31 March NON-GAAP FINANCIAL MEASURES 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Adjusted net income US$ Millions Q4'21 Q4'20 FY21 FY20 Net income 98.0$ 6.3$ 262.8$ 241.5$ Asbestos: Asbestos adjustments 28.1 67.0 143.9 58.2 AICF SG&A expenses 0.3 0.4 1.2 1.7 AICF interest income, net (0.2) (0.5) (0.5) (1.4) Restructuring expenses - 84.4 11.1 84.4 Tax adjustments1 (1.3) (71.0) 39.5 (31.6) Adjusted net income 124.9$ 86.6$ 458.0$ 352.8$ Three Months and Full Year Ended 31 March

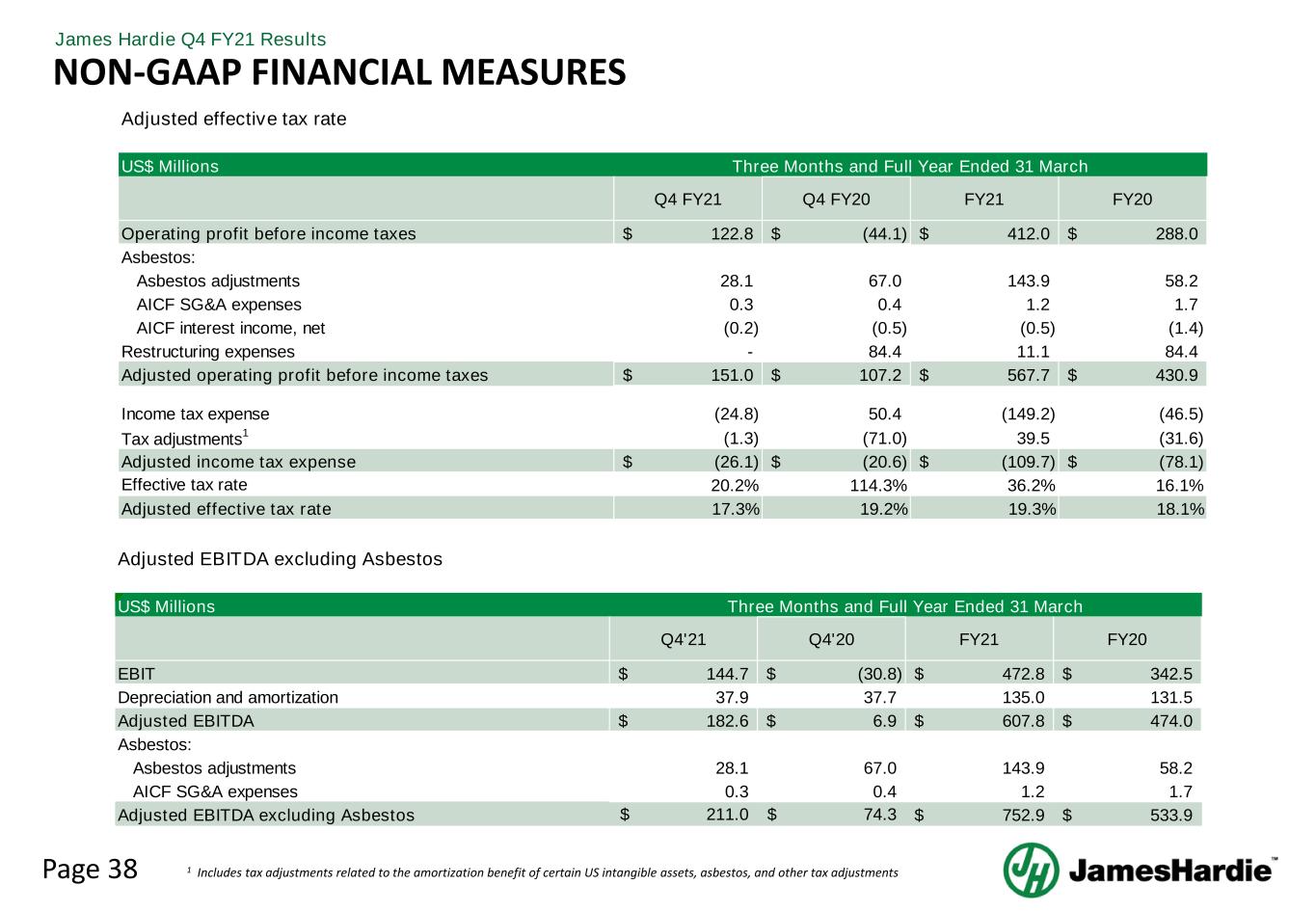

Page 38 James Hardie Q4 FY21 Results Adjusted effective tax rate US$ Millions Q4 FY21 Q4 FY20 FY21 FY20 Operating profit before income taxes 122.8$ (44.1)$ 412.0$ 288.0$ Asbestos: Asbestos adjustments 28.1 67.0 143.9 58.2 AICF SG&A expenses 0.3 0.4 1.2 1.7 AICF interest income, net (0.2) (0.5) (0.5) (1.4) Restructuring expenses - 84.4 11.1 84.4 Adjusted operating profit before income taxes 151.0$ 107.2$ 567.7$ 430.9$ Income tax expense (24.8) 50.4 (149.2) (46.5) Tax adjustments1 (1.3) (71.0) 39.5 (31.6) Adjusted income tax expense (26.1)$ (20.6)$ (109.7)$ (78.1)$ Effective tax rate 20.2% 114.3% 36.2% 16.1% Adjusted effective tax rate 17.3% 19.2% 19.3% 18.1% Three Months and Full Year Ended 31 March Adjusted EBITDA excluding Asbestos US$ Millions Q4'21 Q4'20 FY21 FY20 EBIT 144.7$ (30.8)$ 472.8$ 342.5$ Depreciation and amortization 37.9 37.7 135.0 131.5 Adjusted EBITDA 182.6$ 6.9$ 607.8$ 474.0$ Asbestos: Asbestos adjustments 28.1 67.0 143.9 58.2 AICF SG&A expenses 0.3 0.4 1.2 1.7 Adjusted EBITDA excluding Asbestos 211.0$ 74.3$ 752.9$ 533.9$ Three Months and Full Year Ended 31 March NON-GAAP FINANCIAL MEASURES 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments

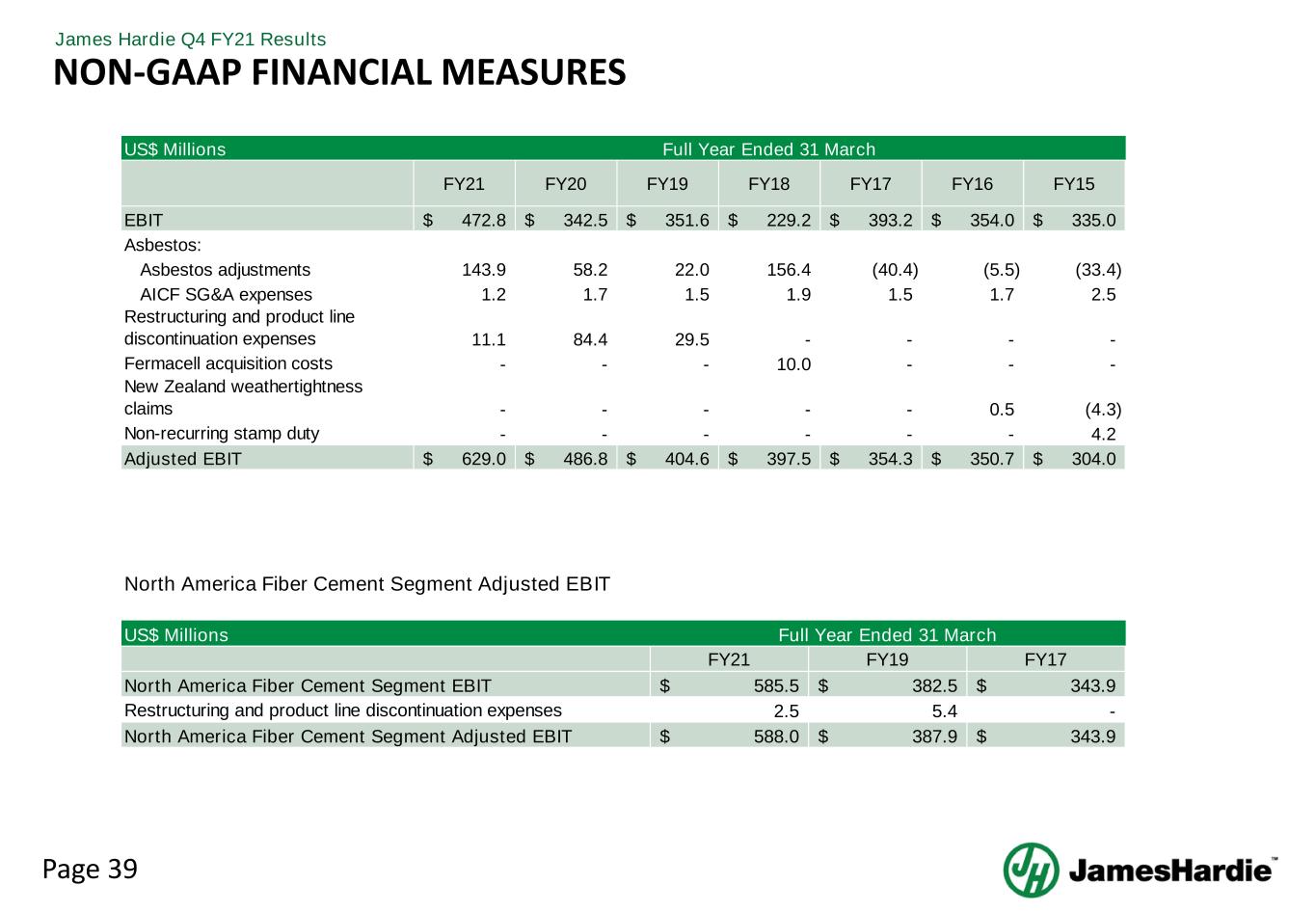

Page 39 James Hardie Q4 FY21 Results NON-GAAP FINANCIAL MEASURES US$ Millions FY21 FY19 FY17 North America Fiber Cement Segment EBIT 585.5$ 382.5$ 343.9$ Restructuring and product line discontinuation expenses 2.5 5.4 - North America Fiber Cement Segment Adjusted EBIT 588.0$ 387.9$ 343.9$ North America Fiber Cement Segment Adjusted EBIT Full Year Ended 31 March US$ Millions FY21 FY20 FY19 FY18 FY17 FY16 FY15 EBIT 472.8$ 342.5$ 351.6$ 229.2$ 393.2$ 354.0$ 335.0$ Asbestos: Asbestos adjustments 143.9 58.2 22.0 156.4 (40.4) (5.5) (33.4) AICF SG&A expenses 1.2 1.7 1.5 1.9 1.5 1.7 2.5 Restructuring and product line discontinuation expenses 11.1 84.4 29.5 - - - - Fermacell acquisition costs - - - 10.0 - - - New Zealand weathertightness claims - - - - - 0.5 (4.3) Non-recurring stamp duty - - - - - - 4.2 Adjusted EBIT 629.0$ 486.8$ 404.6$ 397.5$ 354.3$ 350.7$ 304.0$ Full Year Ended 31 March

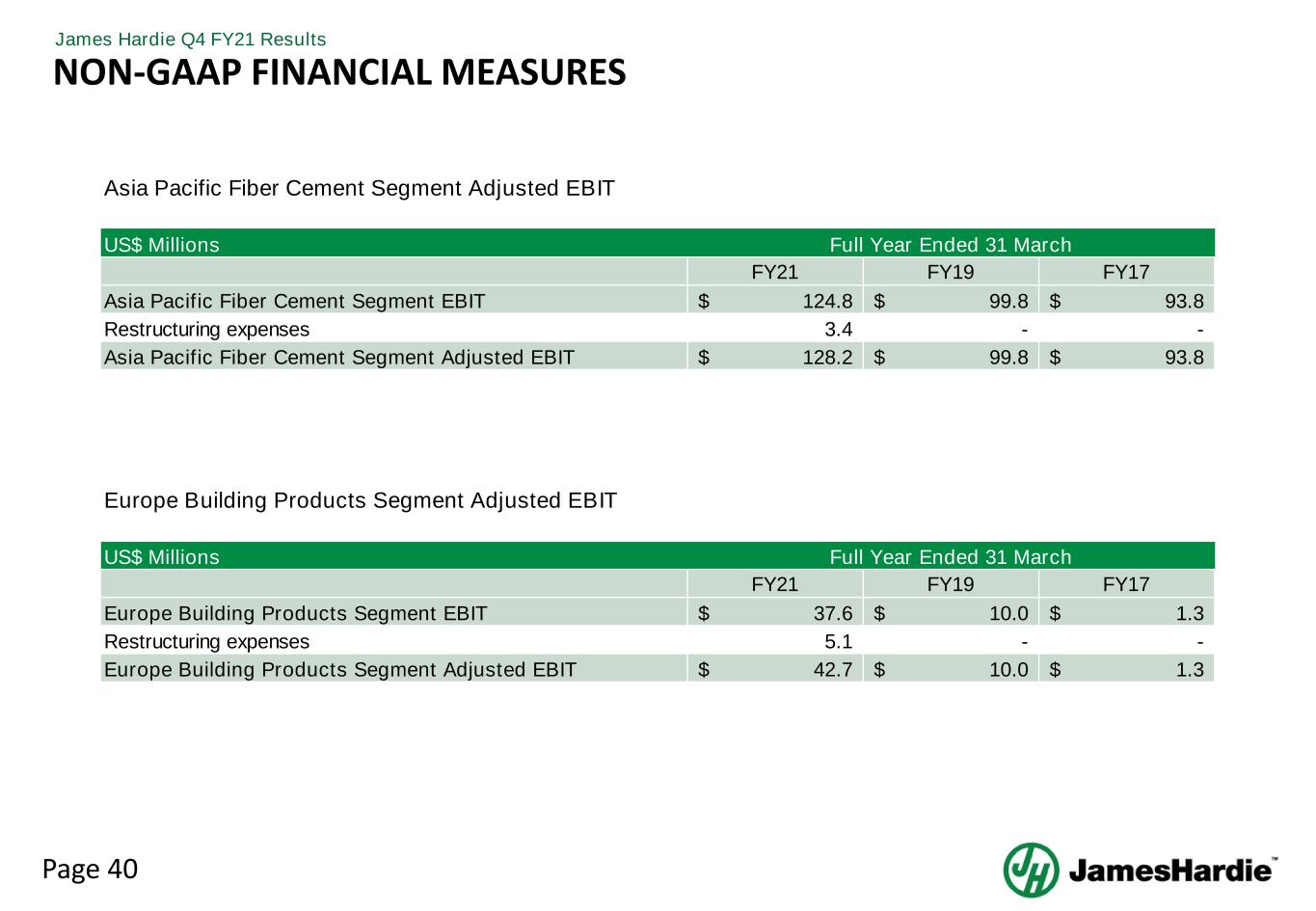

Page 40 James Hardie Q4 FY21 Results NON-GAAP FINANCIAL MEASURES US$ Millions FY21 FY19 FY17 Asia Pacific Fiber Cement Segment EBIT 124.8$ 99.8$ 93.8$ Restructuring expenses 3.4 - - Asia Pacific Fiber Cement Segment Adjusted EBIT 128.2$ 99.8$ 93.8$ Asia Pacific Fiber Cement Segment Adjusted EBIT Full Year Ended 31 March US$ Millions FY21 FY19 FY17 Europe Building Products Segment EBIT 37.6$ 10.0$ 1.3$ Restructuring expenses 5.1 - - Europe Building Products Segment Adjusted EBIT 42.7$ 10.0$ 1.3$ Full Year Ended 31 March Europe Building Products Segment Adjusted EBIT

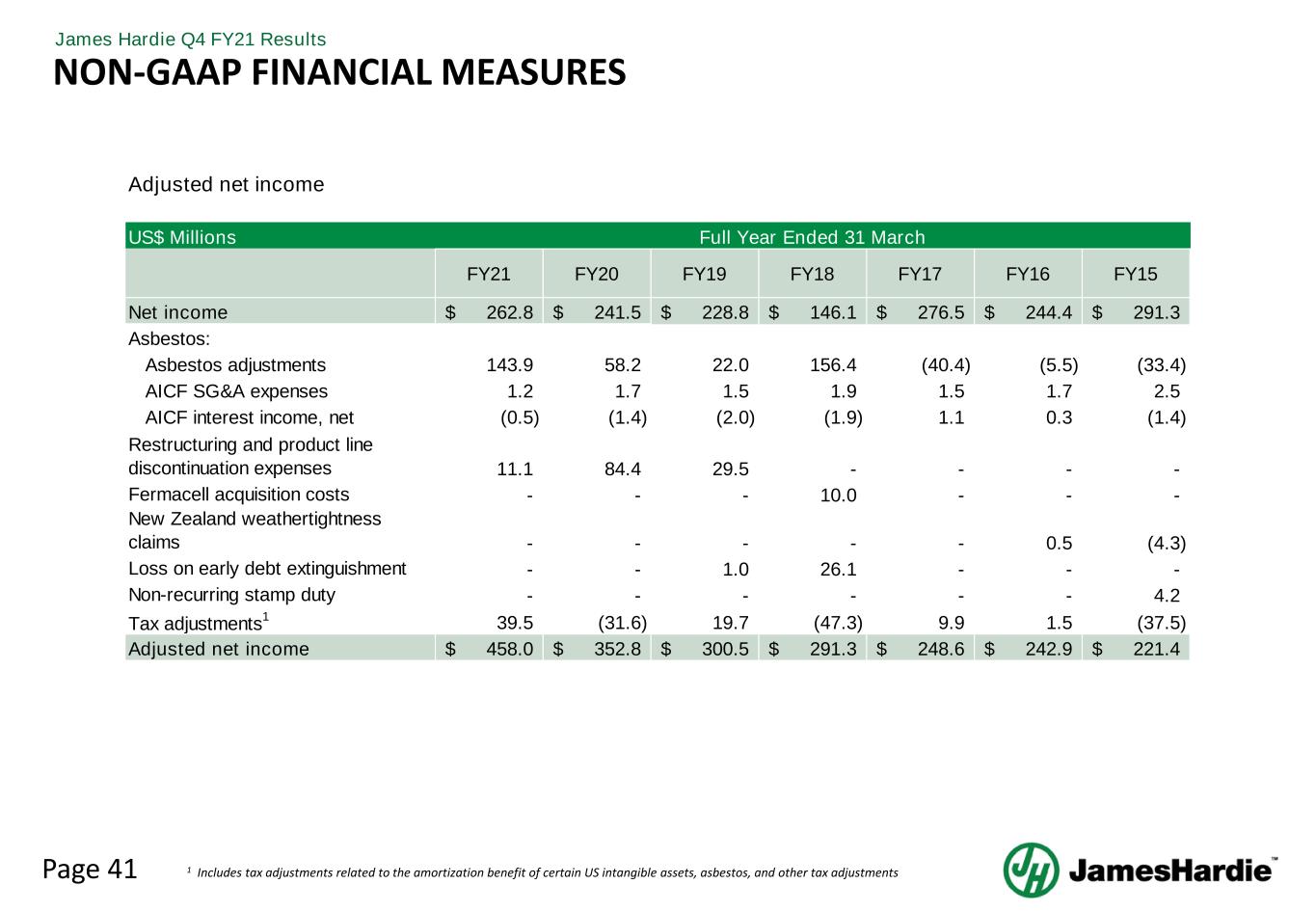

Page 41 James Hardie Q4 FY21 Results NON-GAAP FINANCIAL MEASURES 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Adjusted net income US$ Millions FY21 FY20 FY19 FY18 FY17 FY16 FY15 Net income 262.8$ 241.5$ 228.8$ 146.1$ 276.5$ 244.4$ 291.3$ Asbestos: Asbestos adjustments 143.9 58.2 22.0 156.4 (40.4) (5.5) (33.4) AICF SG&A expenses 1.2 1.7 1.5 1.9 1.5 1.7 2.5 AICF interest income, net (0.5) (1.4) (2.0) (1.9) 1.1 0.3 (1.4) Restructuring and product line discontinuation expenses 11.1 84.4 29.5 - - - - Fermacell acquisition costs - - - 10.0 - - - New Zealand weathertightness claims - - - - - 0.5 (4.3) Loss on early debt extinguishment - - 1.0 26.1 - - - Non-recurring stamp duty - - - - - - 4.2 Tax adjustments1 39.5 (31.6) 19.7 (47.3) 9.9 1.5 (37.5) Adjusted net income 458.0$ 352.8$ 300.5$ 291.3$ 248.6$ 242.9$ 221.4$ Full Year Ended 31 March

Q4 FY21 MANAGEMENT PRESENTATION 18 May 2021