Page 1 James Hardie Investor Day 2021 JHX INVESTOR DAY MONDAY MAY 24TH, 2021 – CHICAGO, ILLINOIS FLORIDA: CAPE COD Exhibit 99.1

James Hardie Investor Day 2021 Page 2 CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward‐looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20‐F and 6‐K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward‐looking statements but are not the exclusive means of identifying such statements. These forward‐looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward‐looking statements. Forward‐looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20‐F for the year ended 31 March 2021; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID‐19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on‐going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non‐GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non‐GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non‐GAAP financial measures for the same purposes. However, these non‐GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non‐GAAP financial measures presented in this Management Presentation, including a reconciliation of each non‐GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non‐GAAP Financial Measures” included in James Hardie’s Q4 Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS USE OF NON‐GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

James Hardie Investor Day 2021 Page 3 AGENDA Time Topic Presenter 25 Mins Strategic Plan Jack 15 Mins Growth Through Marketing to Homeowners Marc / Cathleya 20 Mins Growth Through Global Innovation Fran / Sami 5 Mins Break 5 Mins Financial Summary Jason 5 Mins Closing Comments Jack 45 Mins Question and Answer Jack and Jason NEW YORK: COLONIAL TENNESSEE: MODERN FARMHOUSE NEW JERSEY: HARDIE® TEXTURED PANELS

James Hardie Investor Day 2021 Page 4 Dr. Jack Truong Chief Executive Officer Jason Miele Chief Financial Officer Marc Setty Head of Marketing North America Cathleya Buchanan Head of Marketing APAC Sami Rahman Head of Product Management North America Fran Flanagan Head of Consumer Marketing PRESENTERS

Page 5 James Hardie Investor Day 2021 JHX STRATEGIC PLAN NEW YORK: COLONIAL

James Hardie Investor Day 2021 Page 6 OUR VISION To be a PREMIER, CONSUMER BRANDED COMPANY that offers ENDLESS DESIGN POSSIBILITIES to EXTERIORS and INTERIORS of the home ALABAMA: CRAFTSMAN TUDOR

James Hardie Investor Day 2021 Page 7 OUR MISSION To be a HIGH PERFORMANCE GLOBAL COMPANY that delivers ORGANIC GROWTH ABOVE MARKET WITH STRONG RETURNS, consistently, QUARTER‐ON‐QUARTER, and YEAR‐ON‐YEAR CANADA: TRADITIONAL

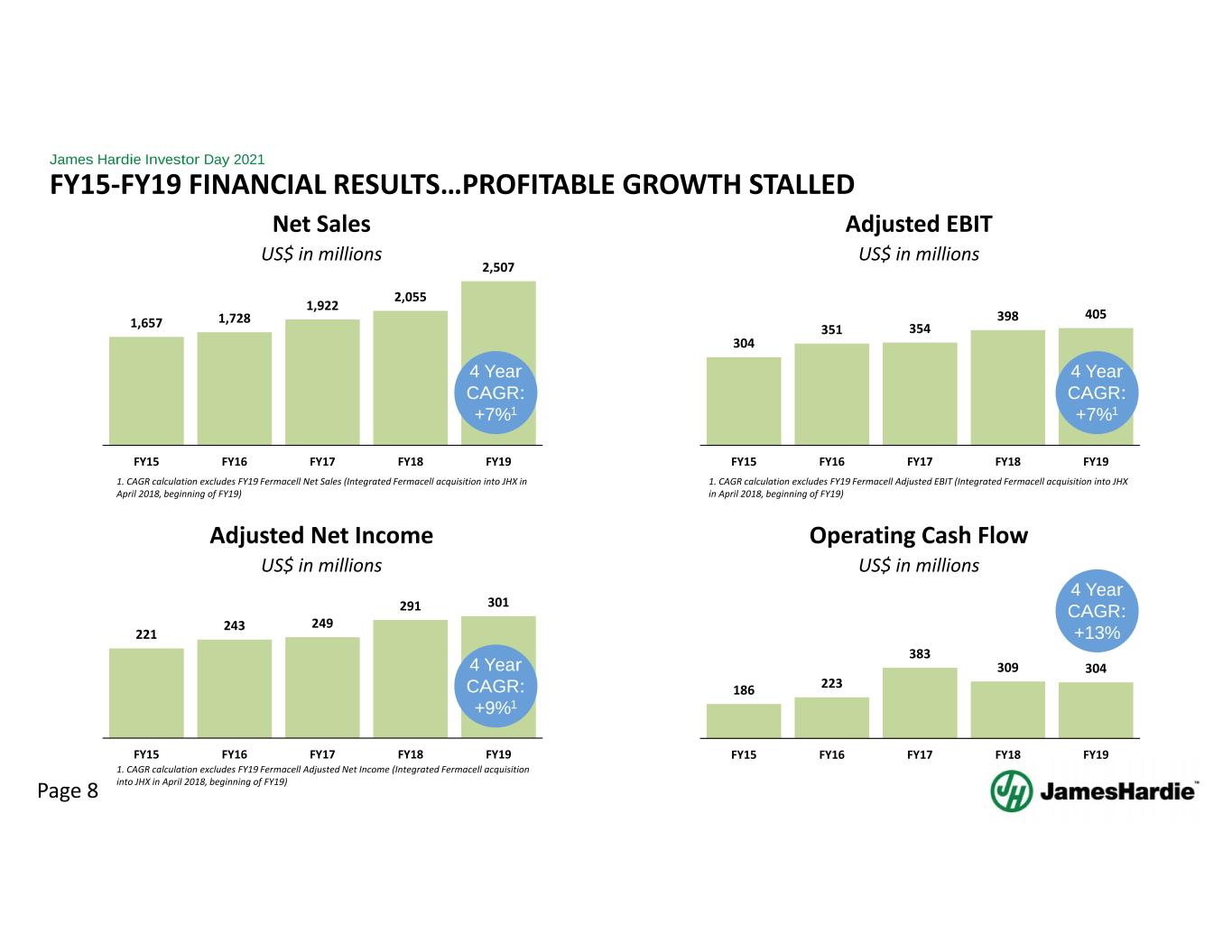

James Hardie Investor Day 2021 Page 8 FY15‐FY19 FINANCIAL RESULTS…PROFITABLE GROWTH STALLED 1,657 1,728 1,922 2,055 2,507 FY15 FY16 FY17 FY18 FY19 304 351 354 398 405 FY15 FY16 FY17 FY18 FY19 4 Year CAGR: +7%1 221 243 249 291 301 FY15 FY16 FY17 FY18 FY19 186 223 383 309 304 FY15 FY16 FY17 FY18 FY19 4 Year CAGR: +7%1 4 Year CAGR: +9%1 4 Year CAGR: +13% Net Sales US$ in millions Adjusted EBIT US$ in millions Adjusted Net Income US$ in millions Operating Cash Flow US$ in millions 1. CAGR calculation excludes FY19 Fermacell Adjusted Net Income (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19) 1. CAGR calculation excludes FY19 Fermacell Net Sales (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19) 1. CAGR calculation excludes FY19 Fermacell Adjusted EBIT (Integrated Fermacell acquisition into JHX in April 2018, beginning of FY19)

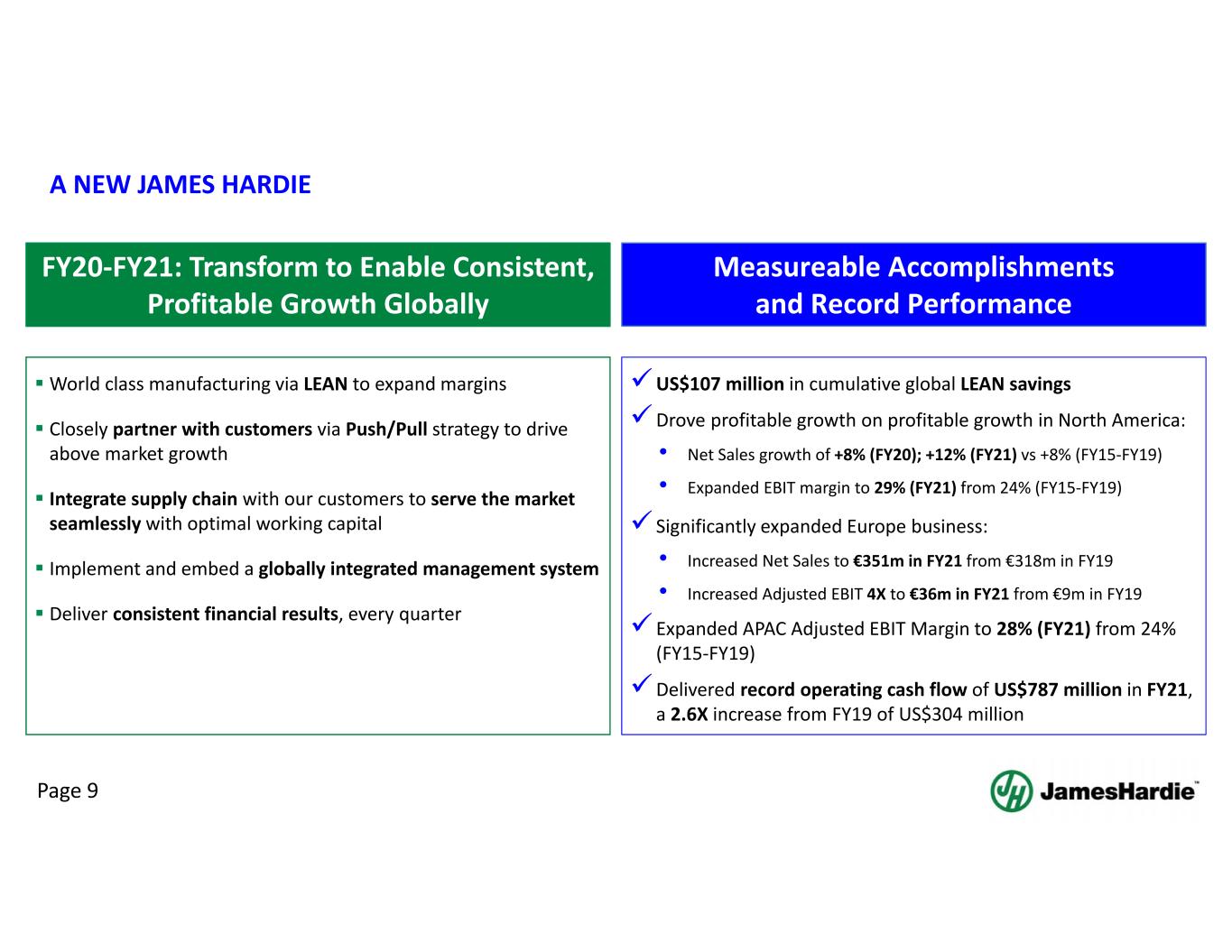

James Hardie Investor Day 2021 Page 9 A NEW JAMES HARDIE World class manufacturing via LEAN to expand margins Closely partner with customers via Push/Pull strategy to drive above market growth Integrate supply chain with our customers to serve the market seamlessly with optimal working capital Implement and embed a globally integrated management system Deliver consistent financial results, every quarter FY20‐FY21: Transform to Enable Consistent, Profitable Growth Globally US$107 million in cumulative global LEAN savings Drove profitable growth on profitable growth in North America: • Net Sales growth of +8% (FY20); +12% (FY21) vs +8% (FY15‐FY19) • Expanded EBIT margin to 29% (FY21) from 24% (FY15‐FY19) Significantly expanded Europe business: • Increased Net Sales to €351m in FY21 from €318m in FY19 • Increased Adjusted EBIT 4X to €36m in FY21 from €9m in FY19 Expanded APAC Adjusted EBIT Margin to 28% (FY21) from 24% (FY15‐FY19) Delivered record operating cash flow of US$787 million in FY21, a 2.6X increase from FY19 of US$304 million Measureable Accomplishments and Record Performance

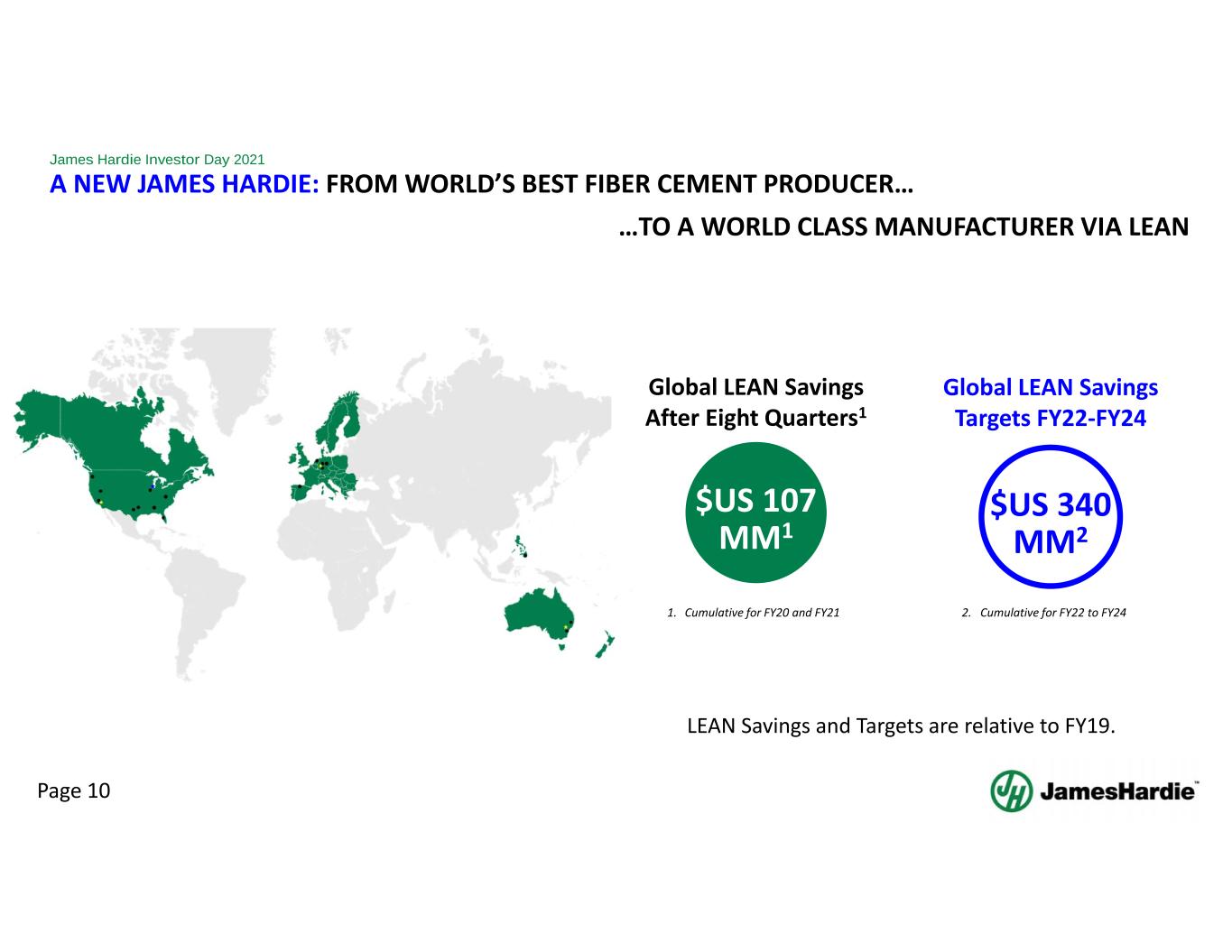

James Hardie Investor Day 2021 Page 10 A NEW JAMES HARDIE: FROM WORLD’S BEST FIBER CEMENT PRODUCER… Global LEAN Savings Targets FY22‐FY24 $US 340 MM2 …TO A WORLD CLASS MANUFACTURER VIA LEAN Global LEAN Savings After Eight Quarters1 $US 107 MM1 1. Cumulative for FY20 and FY21 LEAN Savings and Targets are relative to FY19. 2. Cumulative for FY22 to FY24

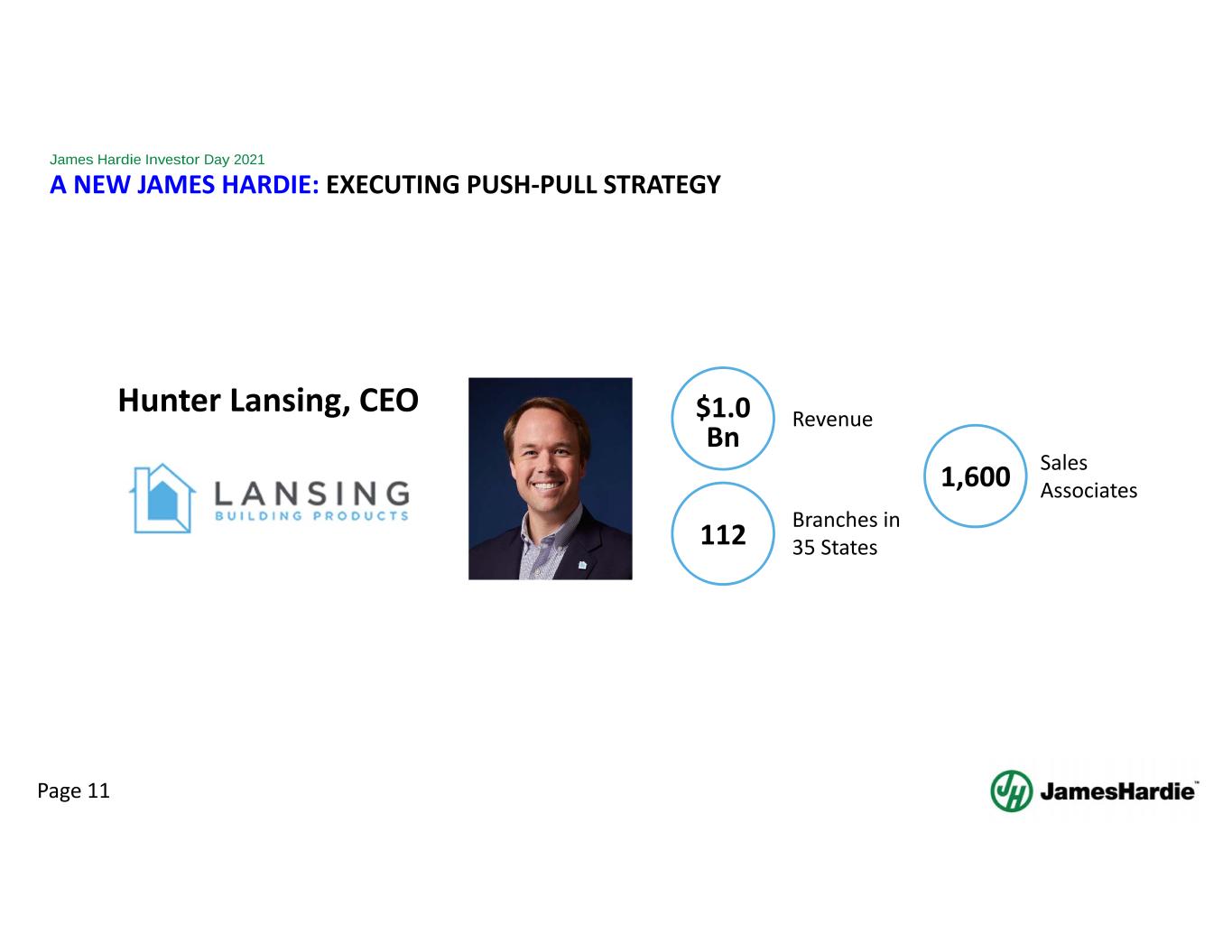

James Hardie Investor Day 2021 Page 11 A NEW JAMES HARDIE: EXECUTING PUSH‐PULL STRATEGY Hunter Lansing, CEO $1.0 Bn Revenue 112 Branches in 35 States 1,600 Sales Associates

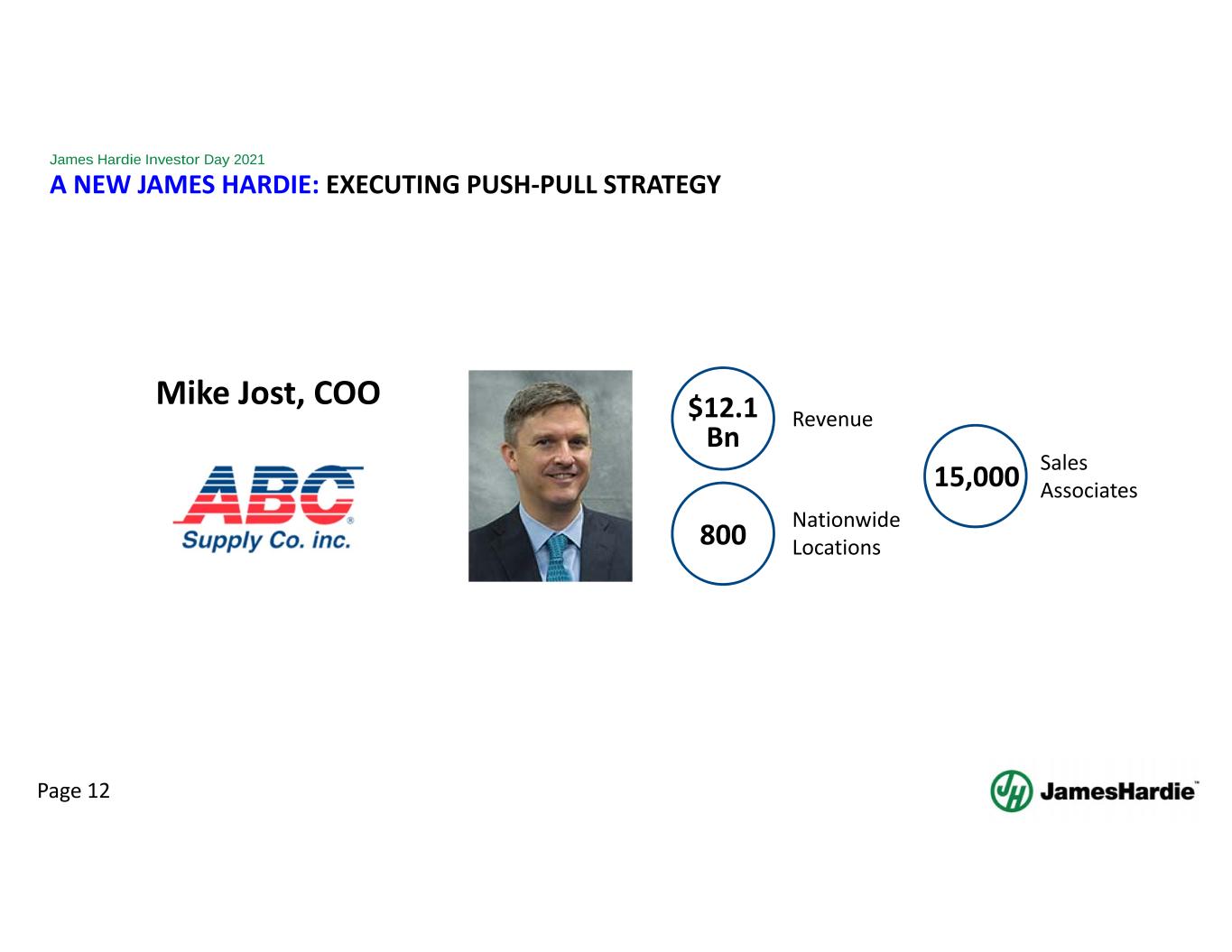

James Hardie Investor Day 2021 Page 12 A NEW JAMES HARDIE: EXECUTING PUSH‐PULL STRATEGY Mike Jost, COO $12.1 Bn Revenue 800 Nationwide Locations 15,000 Sales Associates

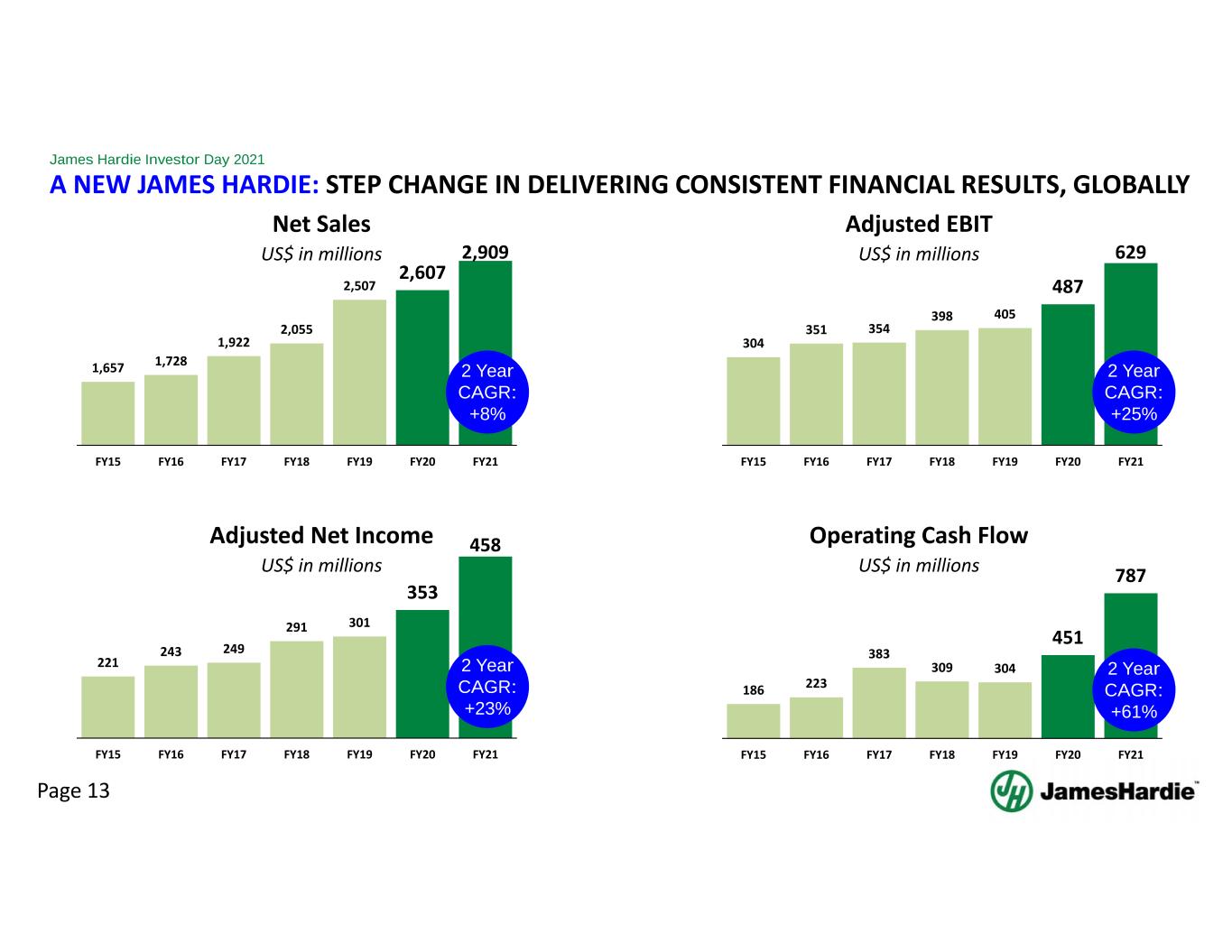

James Hardie Investor Day 2021 Page 13 A NEW JAMES HARDIE: STEP CHANGE IN DELIVERING CONSISTENT FINANCIAL RESULTS, GLOBALLY 1,657 1,728 1,922 2,055 2,507 2,607 2,909 FY15 FY16 FY17 FY18 FY19 FY20 FY21 304 351 354 398 405 487 629 FY15 FY16 FY17 FY18 FY19 FY20 FY21 2 Year CAGR: +8% 221 243 249 291 301 353 458 FY15 FY16 FY17 FY18 FY19 FY20 FY21 186 223 383 309 304 451 787 FY15 FY16 FY17 FY18 FY19 FY20 FY21 2 Year CAGR: +25% 2 Year CAGR: +23% 2 Year CAGR: +61% Net Sales US$ in millions Adjusted EBIT US$ in millions Adjusted Net Income US$ in millions Operating Cash Flow US$ in millions

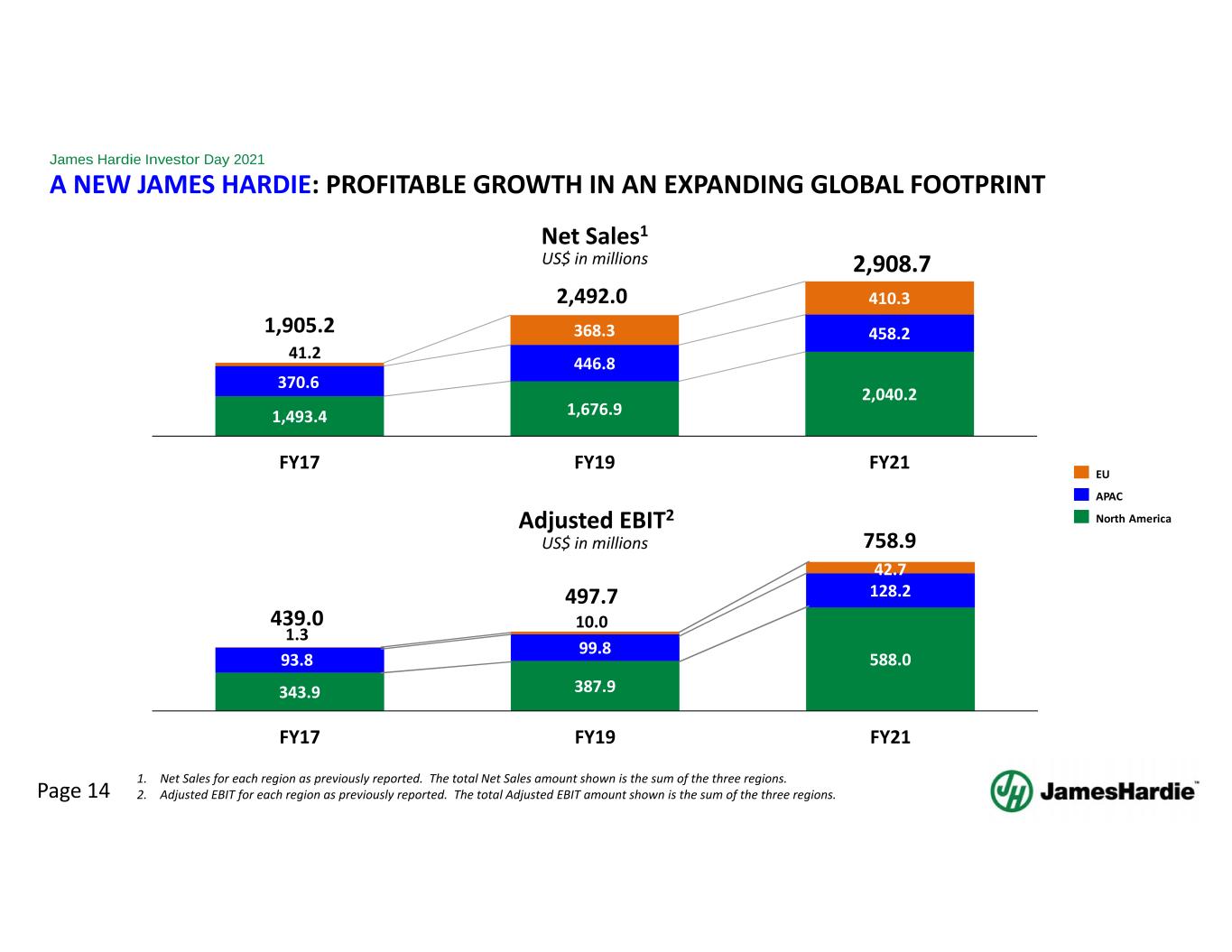

James Hardie Investor Day 2021 Page 14 343.9 387.9 588.093.8 99.8 128.2 1.3 10.0 42.7 439.0 497.7 758.9 FY17 FY19 FY21 A NEW JAMES HARDIE: PROFITABLE GROWTH IN AN EXPANDING GLOBAL FOOTPRINT 1,493.4 1,676.9 2,040.2 370.6 446.8 458.2 41.2 368.3 410.3 1,905.2 2,492.0 2,908.7 FY17 FY19 FY21 Net Sales1 US$ in millions North America APAC EU US$ in millions Adjusted EBIT2 1. Net Sales for each region as previously reported. The total Net Sales amount shown is the sum of the three regions. 2. Adjusted EBIT for each region as previously reported. The total Adjusted EBIT amount shown is the sum of the three regions.

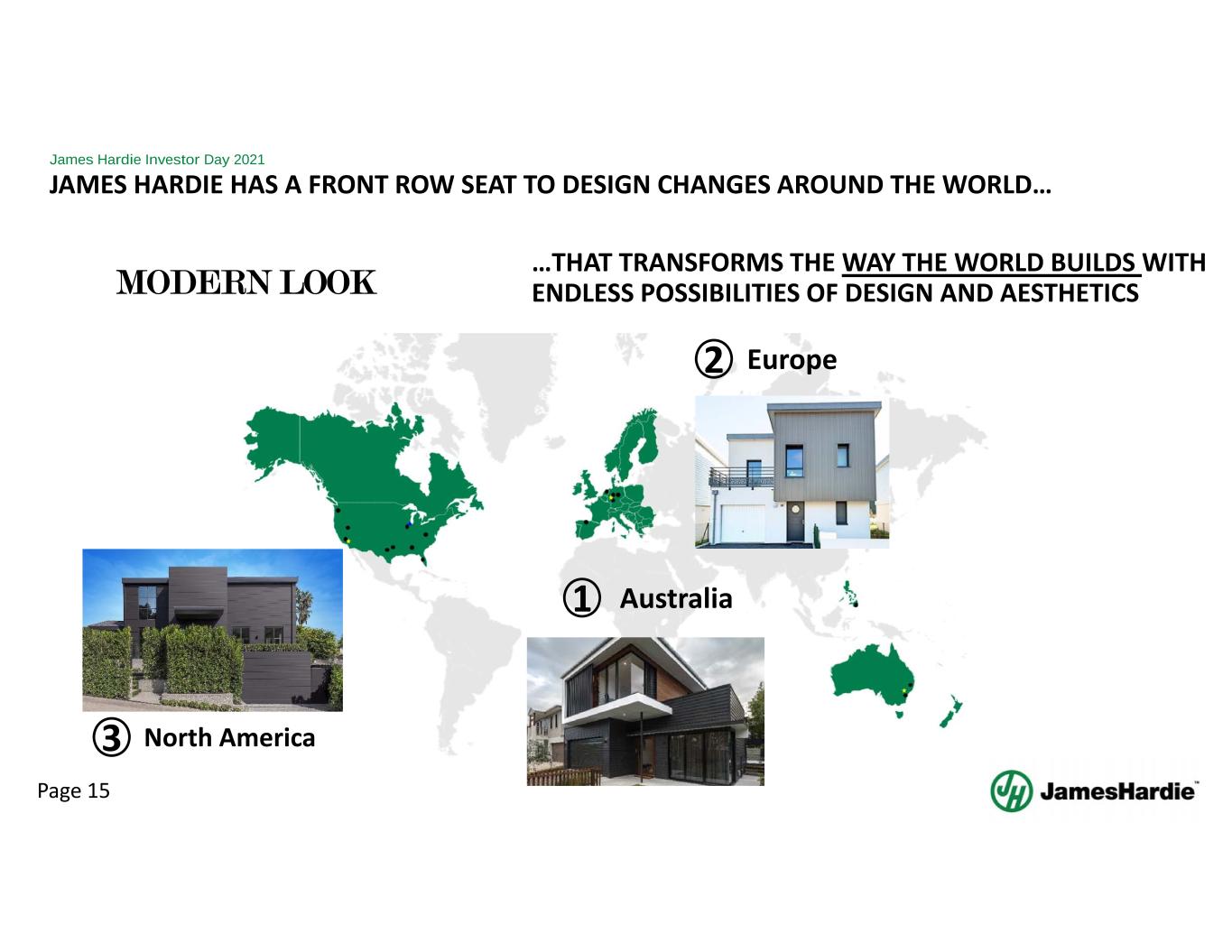

Page 15 James Hardie Investor Day 2021 JAMES HARDIE HAS A FRONT ROW SEAT TO DESIGN CHANGES AROUND THE WORLD… …THAT TRANSFORMS THE WAY THE WORLD BUILDS WITH ENDLESS POSSIBILITIES OF DESIGN AND AESTHETICSMODERN LOOK Europe2 Australia1 North America3

James Hardie Investor Day 2021 Page 16 FY22 AND BEYOND: DRIVE PROFITABLE GROWTH GLOBALLY Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing, ii) Customer Engagement, and iii) Supply Chain Integration 1 2 3

James Hardie Investor Day 2021 Page 17 PUSH – PULL: 360 INTEGRATED MARKETING TO CHRISTINE… Campaign Started on May 3rd, 2021

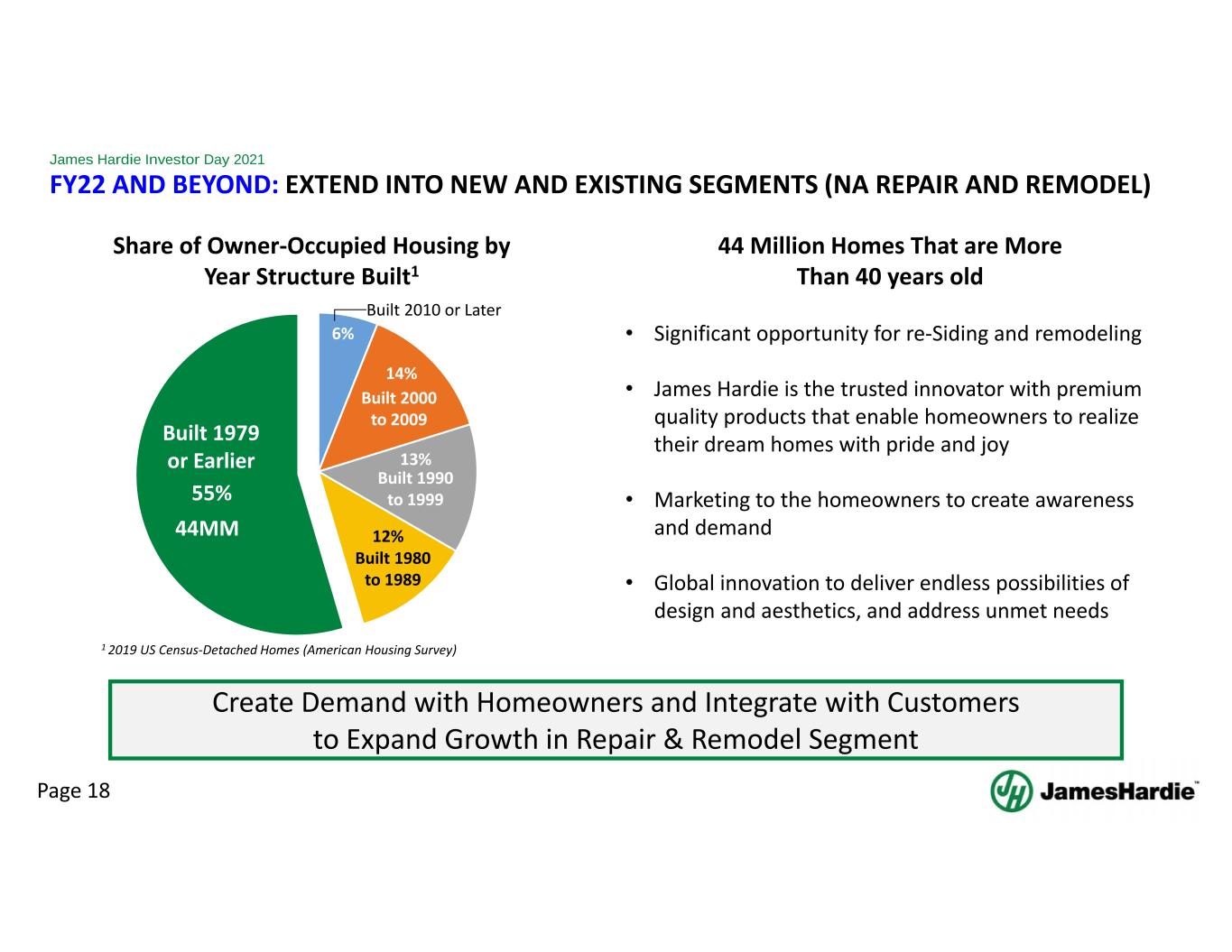

James Hardie Investor Day 2021 Page 18 FY22 AND BEYOND: EXTEND INTO NEW AND EXISTING SEGMENTS (NA REPAIR AND REMODEL) 6% 14% 13% 12% 55% Built 1979 or Earlier Built 2000 to 2009 Built 1990 to 1999 Built 1980 to 1989 1 2019 US Census‐Detached Homes (American Housing Survey) Built 2010 or Later Share of Owner‐Occupied Housing by Year Structure Built1 44MM 44 Million Homes That are More Than 40 years old • Significant opportunity for re‐Siding and remodeling • James Hardie is the trusted innovator with premium quality products that enable homeowners to realize their dream homes with pride and joy • Marketing to the homeowners to create awareness and demand • Global innovation to deliver endless possibilities of design and aesthetics, and address unmet needs Create Demand with Homeowners and Integrate with Customers to Expand Growth in Repair & Remodel Segment

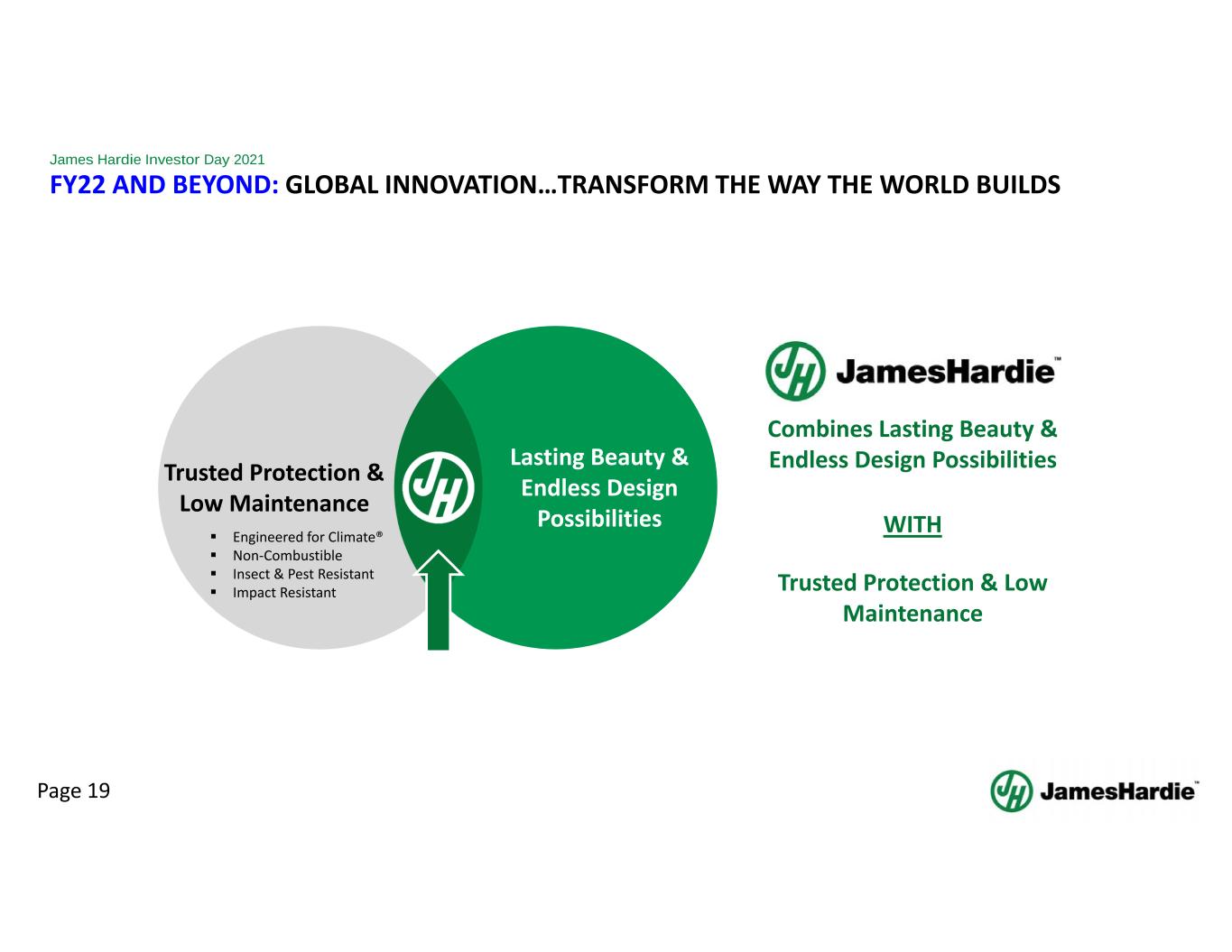

Page 19 James Hardie Investor Day 2021 FY22 AND BEYOND: GLOBAL INNOVATION…TRANSFORM THE WAY THE WORLD BUILDS Trusted Protection & Low Maintenance Engineered for Climate® Non‐Combustible Insect & Pest Resistant Impact Resistant Lasting Beauty & Endless Design Possibilities Combines Lasting Beauty & Endless Design Possibilities WITH Trusted Protection & Low Maintenance

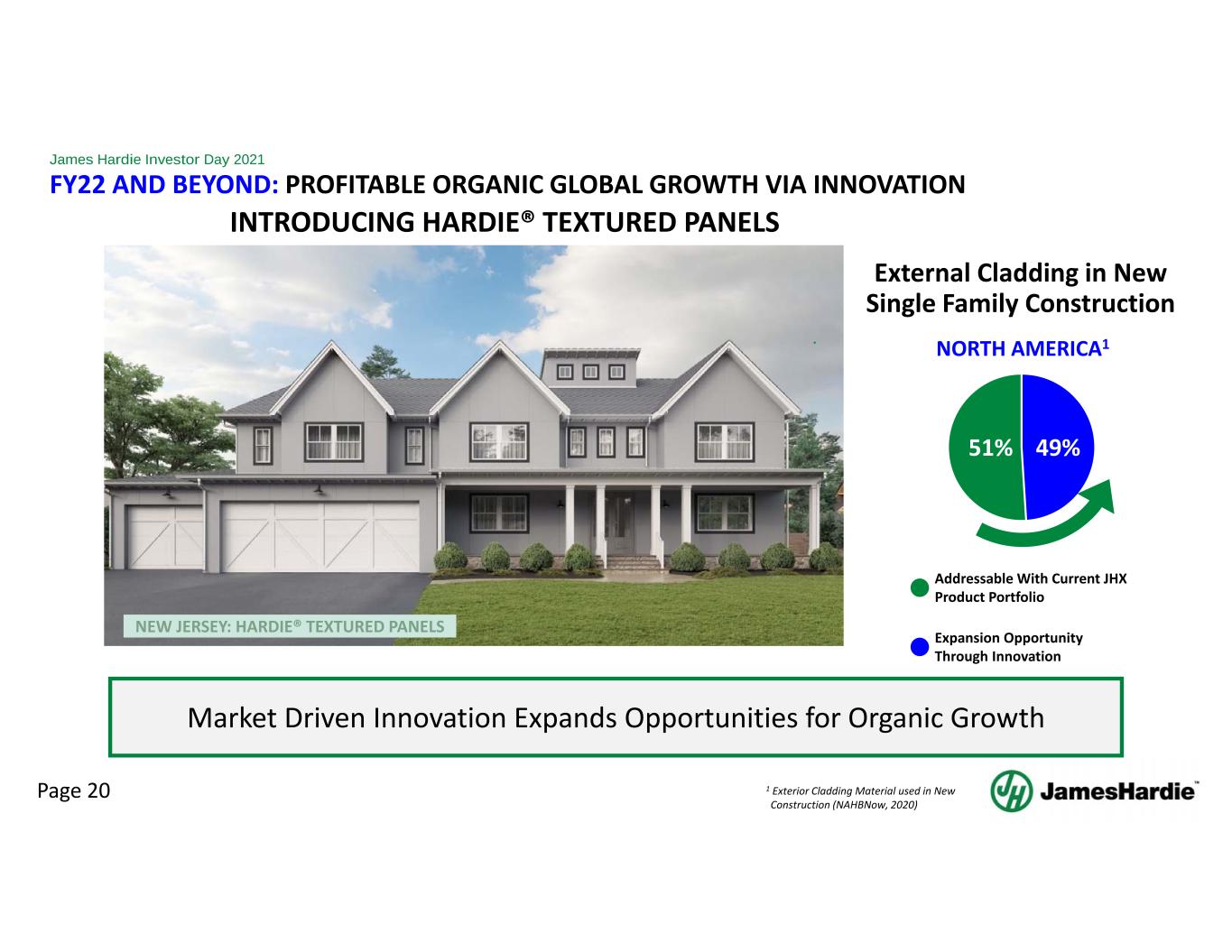

Page 20 James Hardie Investor Day 2021 1 Exterior Cladding Material used in New Construction (NAHBNow, 2020) INTRODUCING HARDIE® TEXTURED PANELS FY22 AND BEYOND: PROFITABLE ORGANIC GLOBAL GROWTH VIA INNOVATION Market Driven Innovation Expands Opportunities for Organic Growth 51% 49% External Cladding in New Single Family Construction NORTH AMERICA1 Addressable With Current JHX Product Portfolio Expansion Opportunity Through Innovation NEW JERSEY: HARDIE® TEXTURED PANELS

Page 21 James Hardie Investor Day 2021 APAC1 41% 59% Hardie® Multi-Groove Panel INTRODUCING HARDIE™ FINE TEXTURE CLADDING Market Driven Innovation Expands Opportunities for Organic Growth FY22 AND BEYOND: PROFITABLE ORGANIC GLOBAL GROWTH VIA INNOVATION External Cladding in New Single Family Construction Addressable With Current JHX Product Portfolio Expansion Opportunity Through Innovation 1 Source: BIS Oxford, Australian Bureau of Statistics, BRANZ and Management Estimates AUSTRALIA: HARDIE™ FINE TEXTURE CLADDING

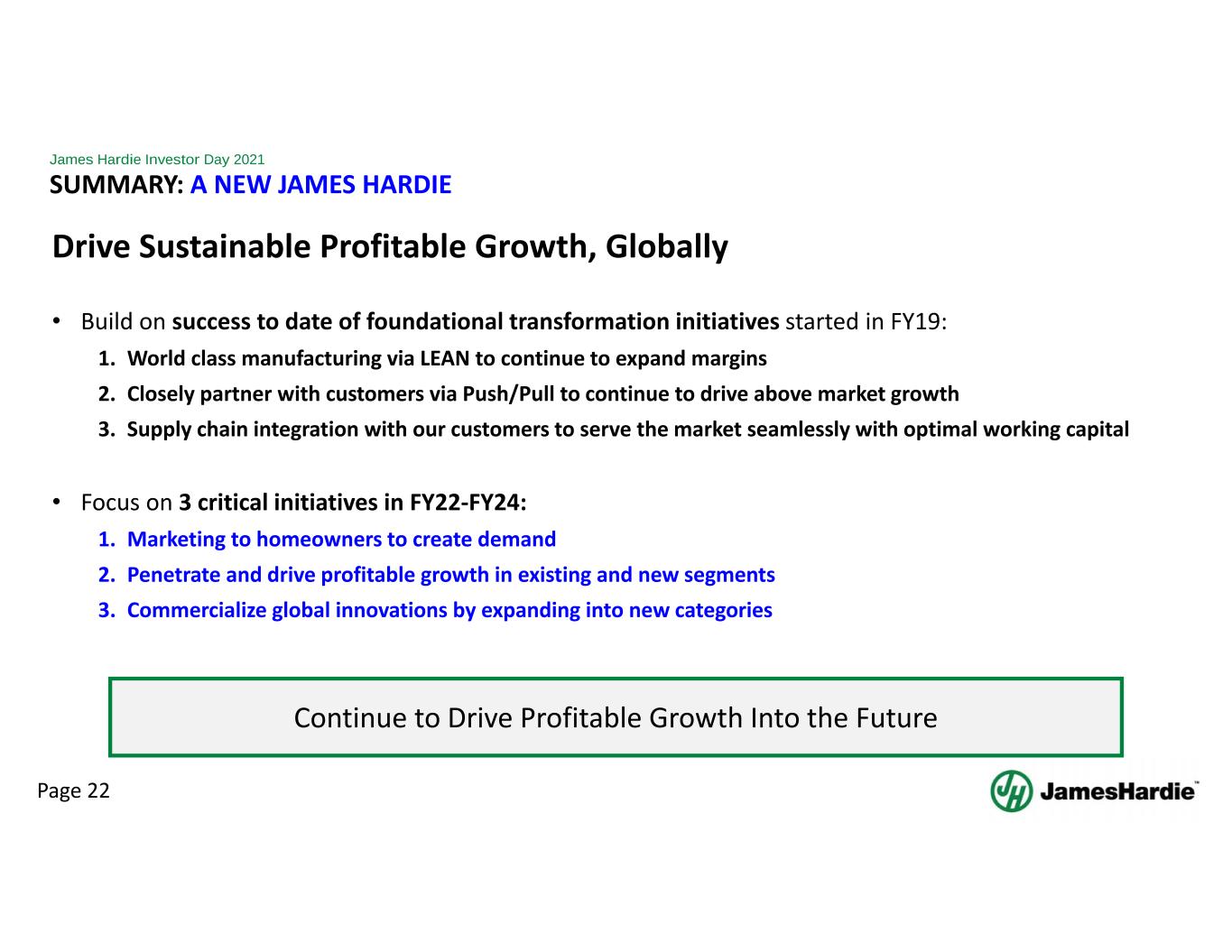

Page 22 James Hardie Investor Day 2021 SUMMARY: A NEW JAMES HARDIE Drive Sustainable Profitable Growth, Globally • Build on success to date of foundational transformation initiatives started in FY19: 1. World class manufacturing via LEAN to continue to expand margins 2. Closely partner with customers via Push/Pull to continue to drive above market growth 3. Supply chain integration with our customers to serve the market seamlessly with optimal working capital • Focus on 3 critical initiatives in FY22‐FY24: 1. Marketing to homeowners to create demand 2. Penetrate and drive profitable growth in existing and new segments 3. Commercialize global innovations by expanding into new categories Continue to Drive Profitable Growth Into the Future

Page 23 James Hardie Investor Day 2021 GROWTH THROUGH MARKETING TO HOMEOWNERS TENNESSEE: MODERN FARMHOUSE

James Hardie Investor Day 2021 Page 24 BRAND VISION Be the top of mind brand that delivers curb appeal to homeowners. Self‐Expression Authenticity Pride & Joy Purposeful Design Sanctuary

James Hardie Investor Day 2021 Page 25 TRANSFORMATION TO A GLOBAL CONSUMER BRAND • Establishing a direct line of communication with homeowners • Marketing high-value products and solutions • Building a Global consumer brand

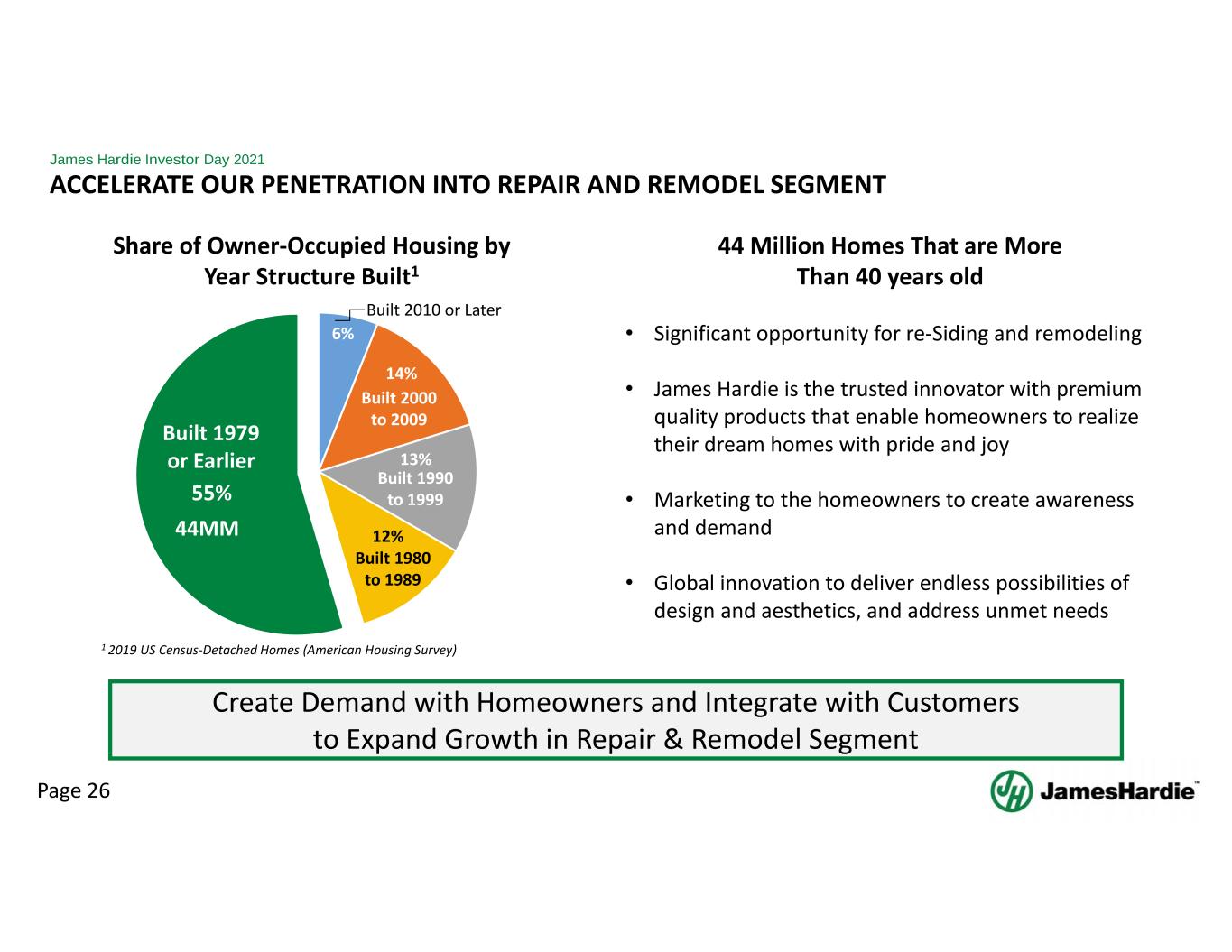

James Hardie Investor Day 2021 Page 26 6% 14% 13% 12% 55% Built 1979 or Earlier Built 2000 to 2009 Built 1990 to 1999 Built 1980 to 1989 1 2019 US Census‐Detached Homes (American Housing Survey) Built 2010 or Later Share of Owner‐Occupied Housing by Year Structure Built1 44MM 44 Million Homes That are More Than 40 years old • Significant opportunity for re‐Siding and remodeling • James Hardie is the trusted innovator with premium quality products that enable homeowners to realize their dream homes with pride and joy • Marketing to the homeowners to create awareness and demand • Global innovation to deliver endless possibilities of design and aesthetics, and address unmet needs Create Demand with Homeowners and Integrate with Customers to Expand Growth in Repair & Remodel Segment ACCELERATE OUR PENETRATION INTO REPAIR AND REMODEL SEGMENT

James Hardie Investor Day 2021 Page 27 Age: 35-54 HHI: $150K+ Home Value*: $350K - $1MILL *wide range to account for regional nuances MEET CHRISTINE Description: • Married, mother of two • In the process of renovating her home • Creative, imaginative and perfectionist • Cares about how other perceive her • Her home is her hobby – an extension of herself “The outside of my home is a reflection of me.” “The outside of my home should keep what’s inside safe.” “The exterior materials of a house are the first impression of the family that lives inside.”Actively planning to remodel the exterior of her home. THE HOMEOWNER IS AT THE CENTER OF OUR ATTENTION

James Hardie Investor Day 2021 Page 28 JAMES HARDIE’S VALUE TO THE HOMEOWNER • Endless design possibilities to achieve your dream look • Long-lasting beauty • Trusted protection

James Hardie Investor Day 2021 Page 29 360 INTEGRATED MARKETING TO CHRISTINE PURCHASE AMPLIFICATION CONSIDERATION It’s possible with Homeowner isat the center of our attention DRTV Targeted Digital Media AWARENESS Influencer Content Creation

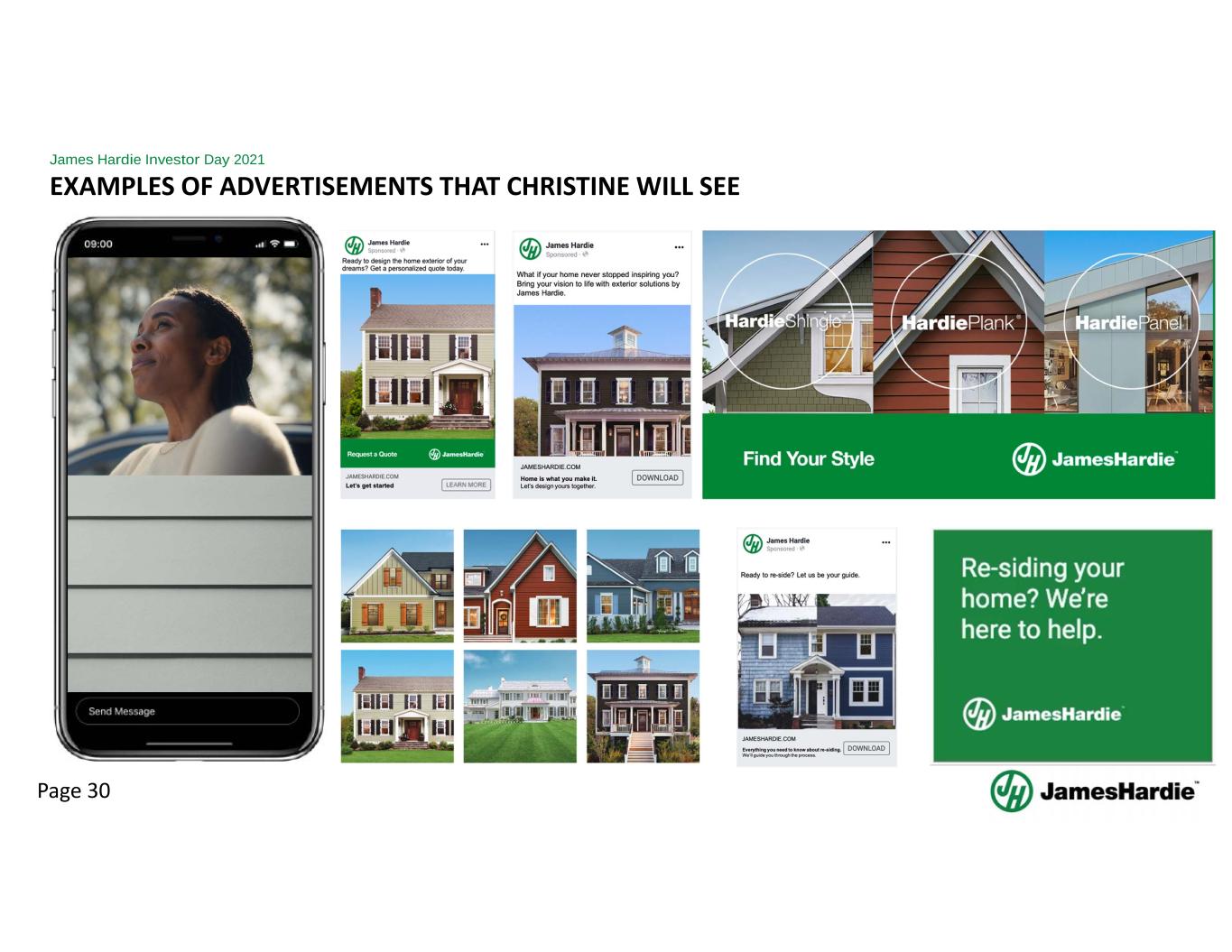

James Hardie Investor Day 2021 Page 30 EXAMPLES OF ADVERTISEMENTS THAT CHRISTINE WILL SEE

James Hardie Investor Day 2021 Page 31 360 INTEGRATED MARKETING TO CHRISTINE PURCHASE AMPLIFICATION CONSIDERATION It’s possible with Homeowner isat the center of our attention DRTV Targeted Digital Media AWARENESS

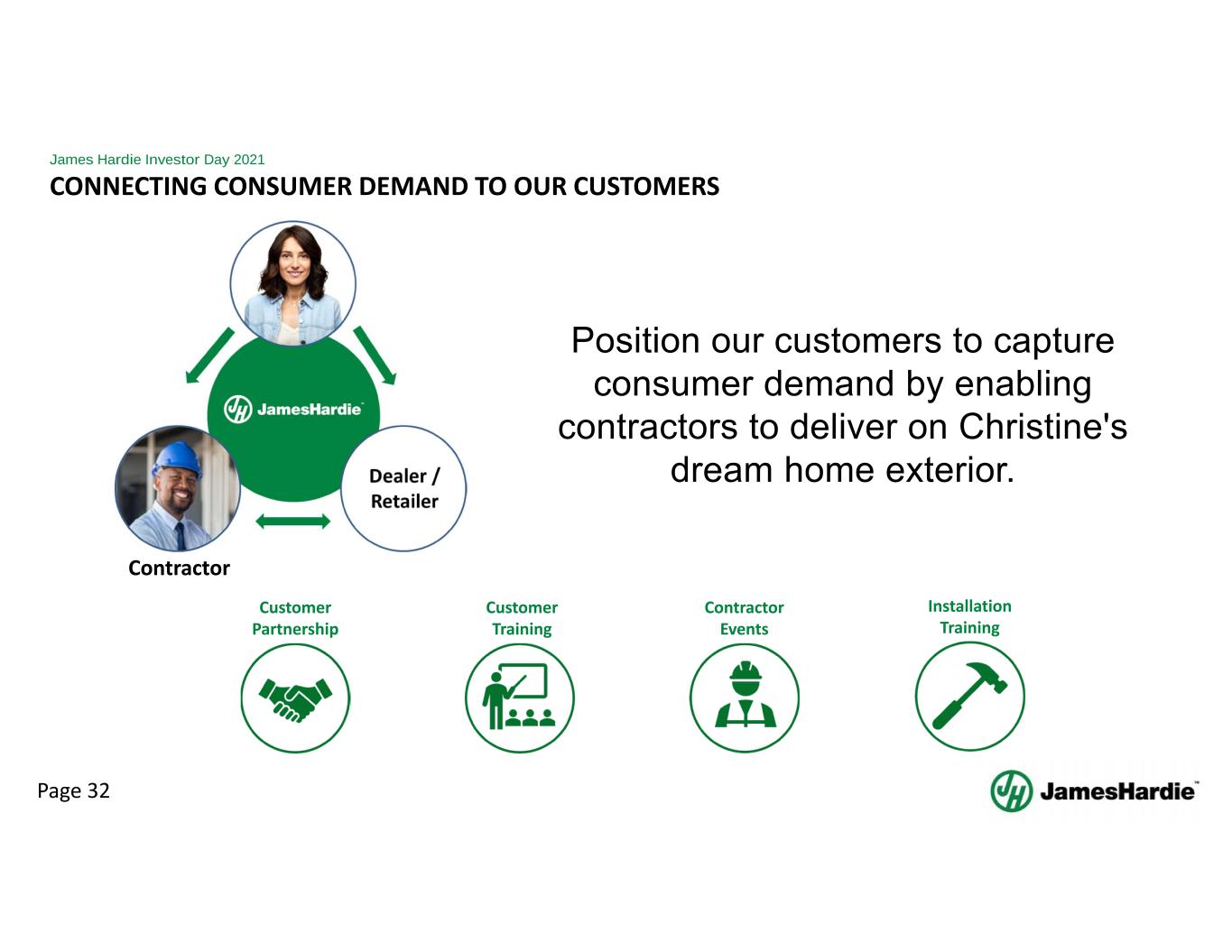

James Hardie Investor Day 2021 Page 32 Position our customers to capture consumer demand by enabling contractors to deliver on Christine's dream home exterior. Customer Partnership Customer Training Contractor Events Installation Training CONNECTING CONSUMER DEMAND TO OUR CUSTOMERS Contractor

James Hardie Investor Day 2021 Page 33 WITH JAMES HARDIE, IT’S POSSIBLE™ • We are just getting started with our multi-year campaign • We are marketing directly to the homeowner to create demand, particularly in the R&R market • Platform to improve on how we innovate and commercialize new products to the market

Page 34 James Hardie Investor Day 2021 NEW JERSEY: HARDIE® TEXTURED PANELS GROWTH THROUGH GLOBAL INNOVATION

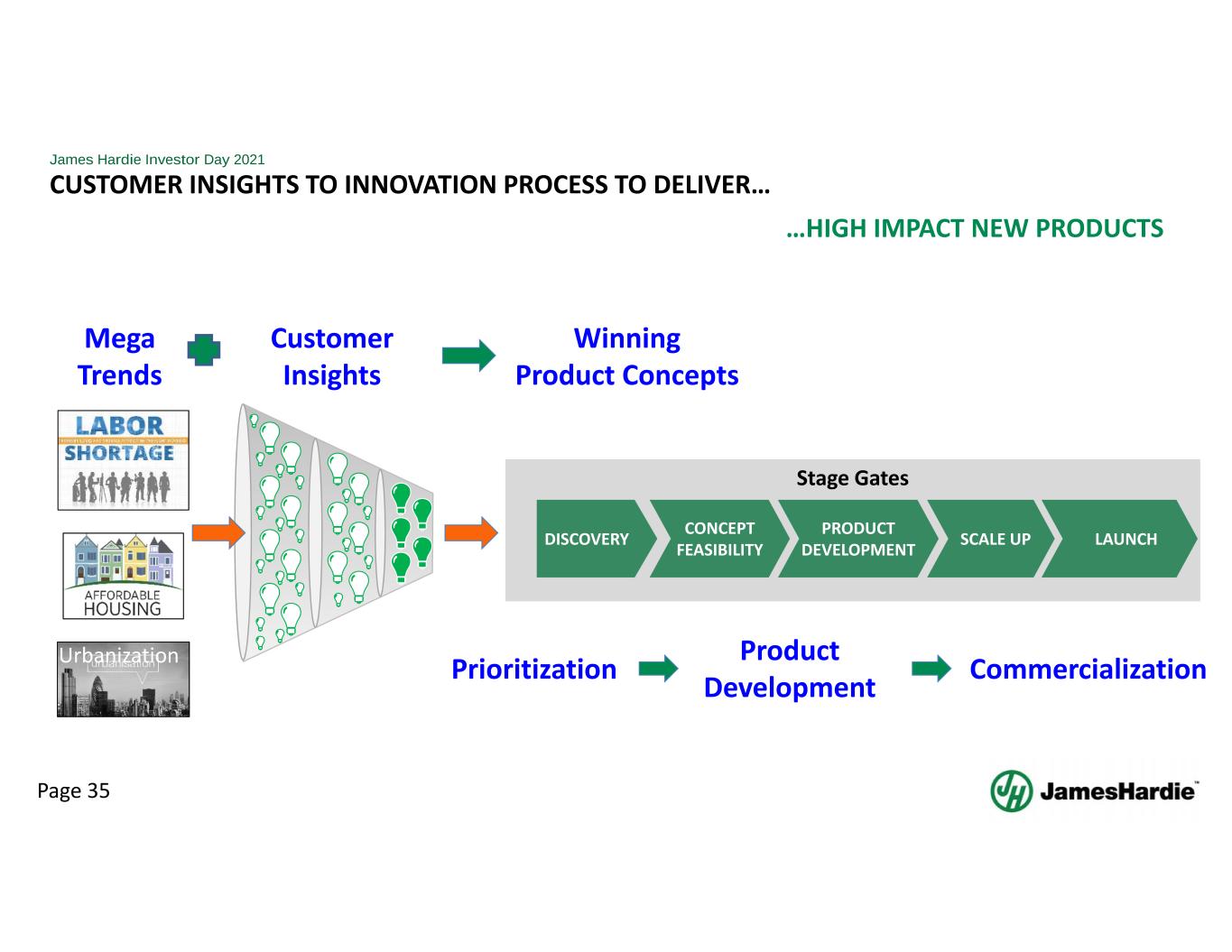

James Hardie Investor Day 2021 Page 35 …HIGH IMPACT NEW PRODUCTS Mega Trends Customer Insights Winning Product Concepts Prioritization Product Development Commercialization DISCOVERY CONCEPT FEASIBILITY PRODUCT DEVELOPMENT SCALE UP LAUNCH Stage Gates Urbanization CUSTOMER INSIGHTS TO INNOVATION PROCESS TO DELIVER…

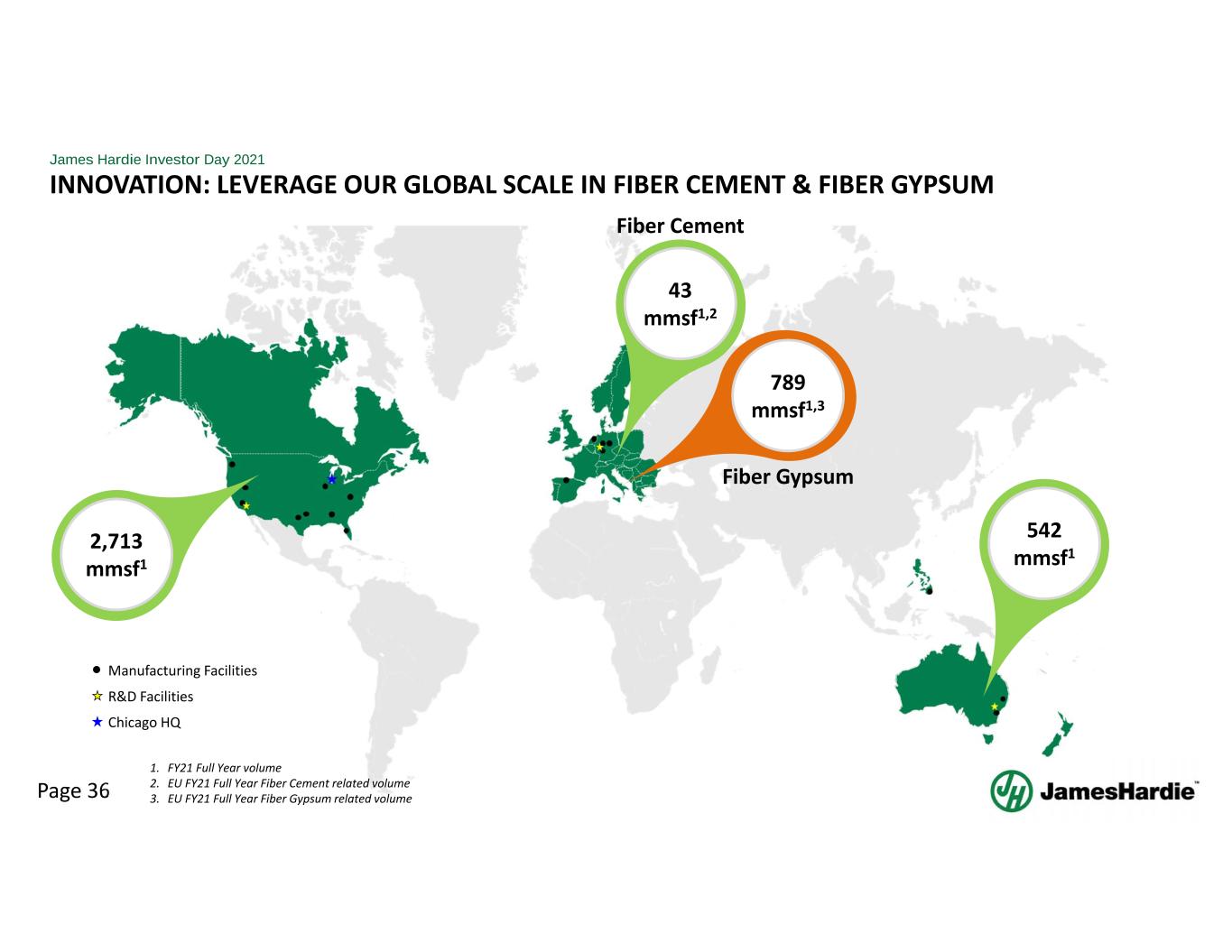

James Hardie Investor Day 2021 Page 36 INNOVATION: LEVERAGE OUR GLOBAL SCALE IN FIBER CEMENT & FIBER GYPSUM Manufacturing Facilities R&D Facilities Chicago HQ 1. FY21 Full Year volume 2. EU FY21 Full Year Fiber Cement related volume 3. EU FY21 Full Year Fiber Gypsum related volume 789 mmsf1,3 43 mmsf1,2 Fiber Cement Fiber Gypsum 2,713 mmsf1 542 mmsf1

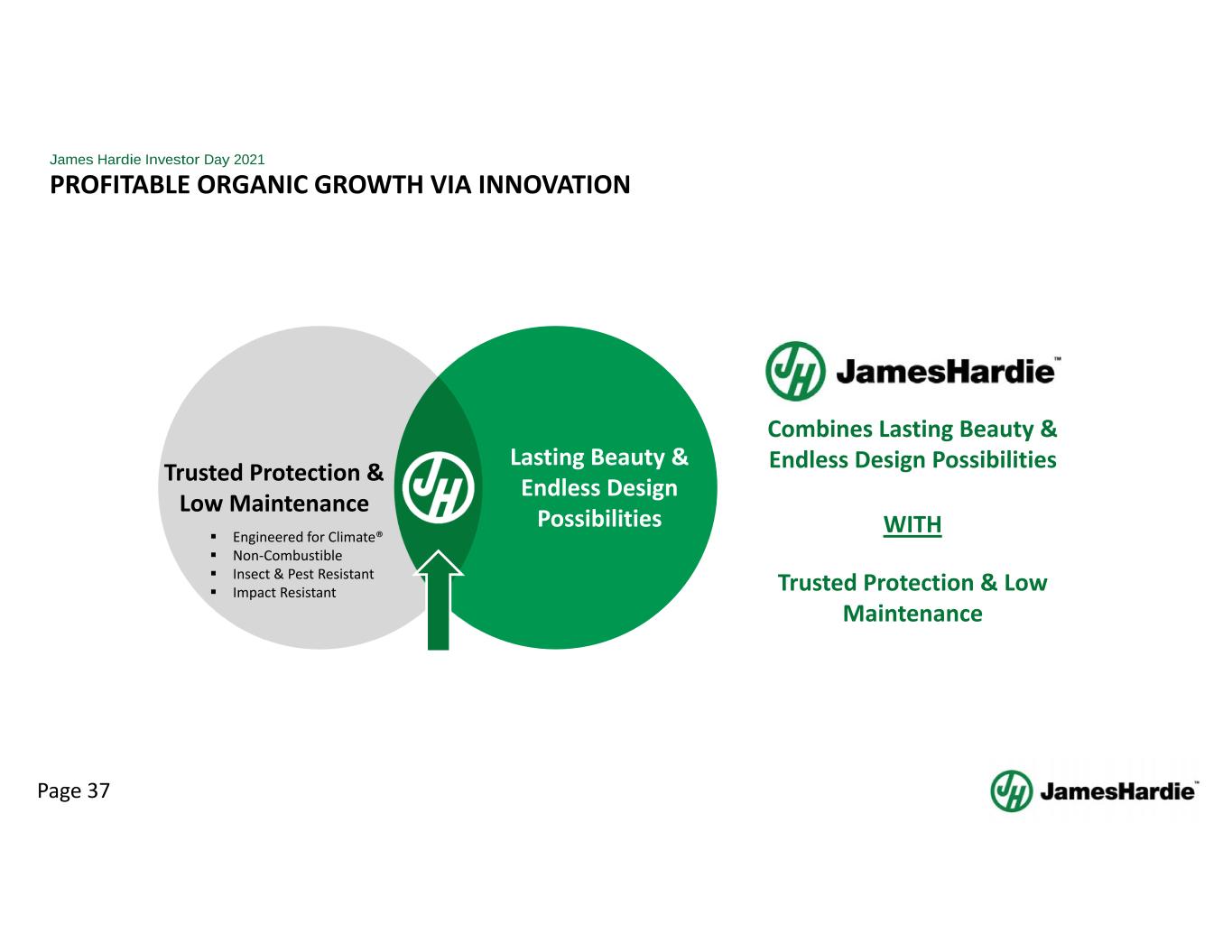

James Hardie Investor Day 2021 Page 37 PROFITABLE ORGANIC GROWTH VIA INNOVATION Trusted Protection & Low Maintenance Engineered for Climate® Non‐Combustible Insect & Pest Resistant Impact Resistant Lasting Beauty & Endless Design Possibilities Combines Lasting Beauty & Endless Design Possibilities WITH Trusted Protection & Low Maintenance

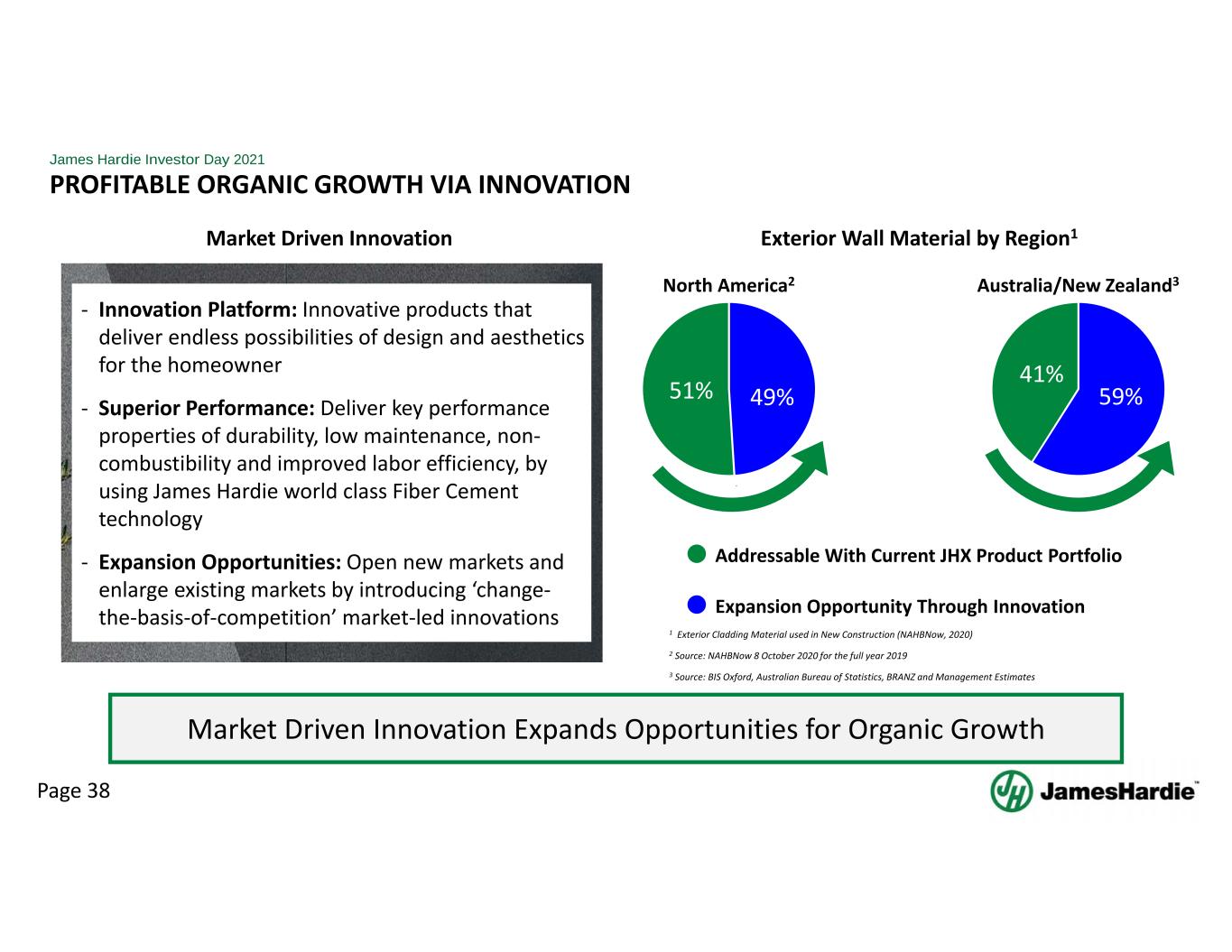

James Hardie Investor Day 2021 Page 38 PROFITABLE ORGANIC GROWTH VIA INNOVATION Market Driven Innovation ‐ Innovation Platform: Innovative products that deliver endless possibilities of design and aesthetics for the homeowner ‐ Superior Performance: Deliver key performance properties of durability, low maintenance, non‐ combustibility and improved labor efficiency, by using James Hardie world class Fiber Cement technology ‐ Expansion Opportunities: Open new markets and enlarge existing markets by introducing ‘change‐ the‐basis‐of‐competition’ market‐led innovations 1 Exterior Cladding Material used in New Construction (NAHBNow, 2020) Exterior Wall Material by Region1 Addressable With Current JHX Product Portfolio Expansion Opportunity Through Innovation 2 Source: NAHBNow 8 October 2020 for the full year 2019 North America2 51% 49% Australia/New Zealand3 41% 59% 3 Source: BIS Oxford, Australian Bureau of Statistics, BRANZ and Management Estimates Market Driven Innovation Expands Opportunities for Organic Growth

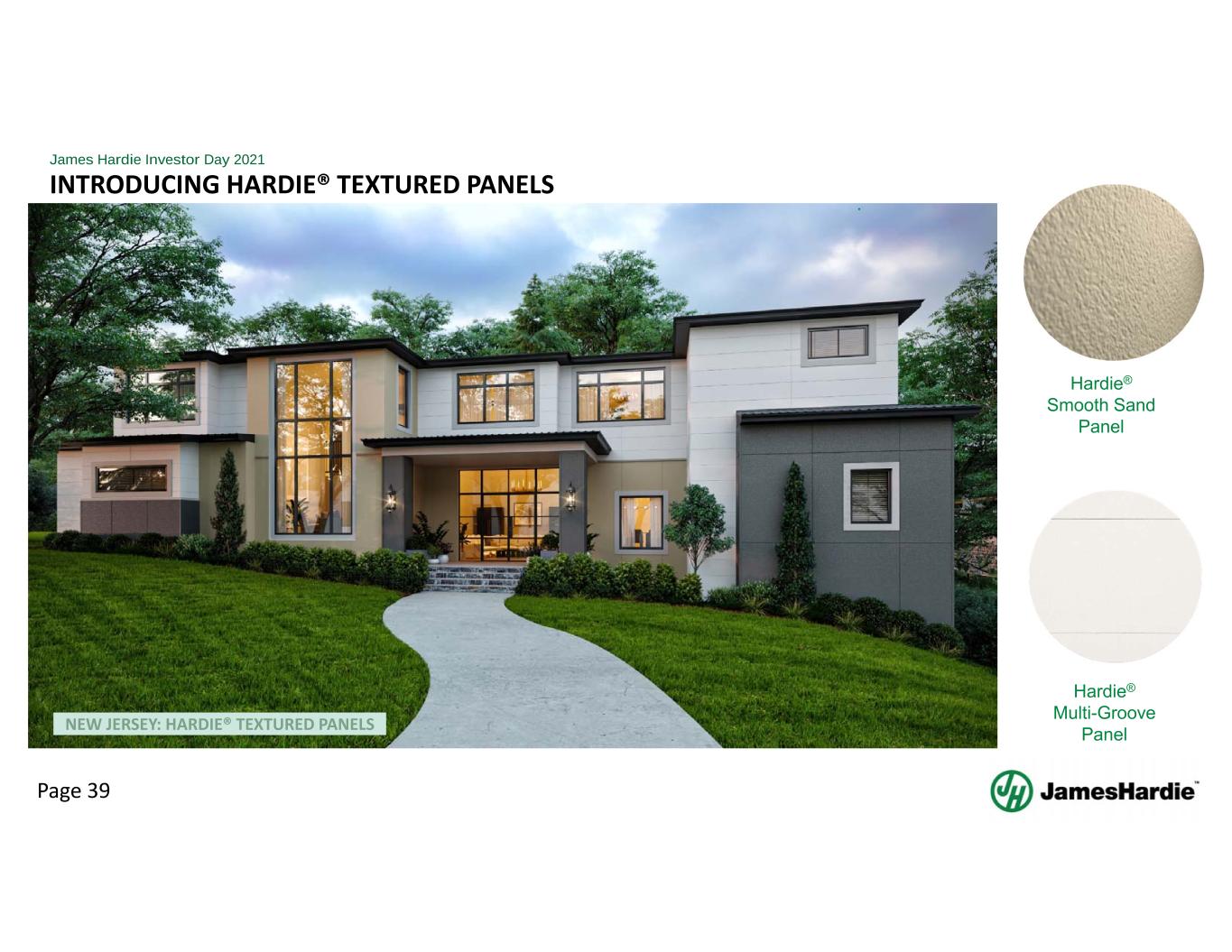

James Hardie Investor Day 2021 Page 39 Hardie® Smooth Sand Panel Hardie® Multi-Groove Panel INTRODUCING HARDIE® TEXTURED PANELS NEW JERSEY: HARDIE® TEXTURED PANELS

James Hardie Investor Day 2021 Page 40 Hardie® Smooth Sand Panel Hardie® Multi-Groove Panel Hardie™ Fine Texture Cladding INTRODUCING HARDIE™ FINE TEXTURE CLADDING AUSTRALIA: HARDIE™ FINE TEXTURE CLADDING

James Hardie Investor Day 2021 Page 41 HARDIE® TEXTURED PANELS FLORIDA: HARDIE® TEXTURED PANELS

James Hardie Investor Day 2021 Page 42 HARDIE® TEXTURED PANELS FLORIDA: HARDIE® TEXTURED PANELS

James Hardie Investor Day 2021 Page 43 HARDIE® TEXTURED PANELS OREGON: HARDIE® TEXTURED PANELS

James Hardie Investor Day 2021 Page 44 HARDIE™ FINE TEXTURE CLADDING AUSTRALIA: HARDIE™ FINE TEXTURE CLADDING

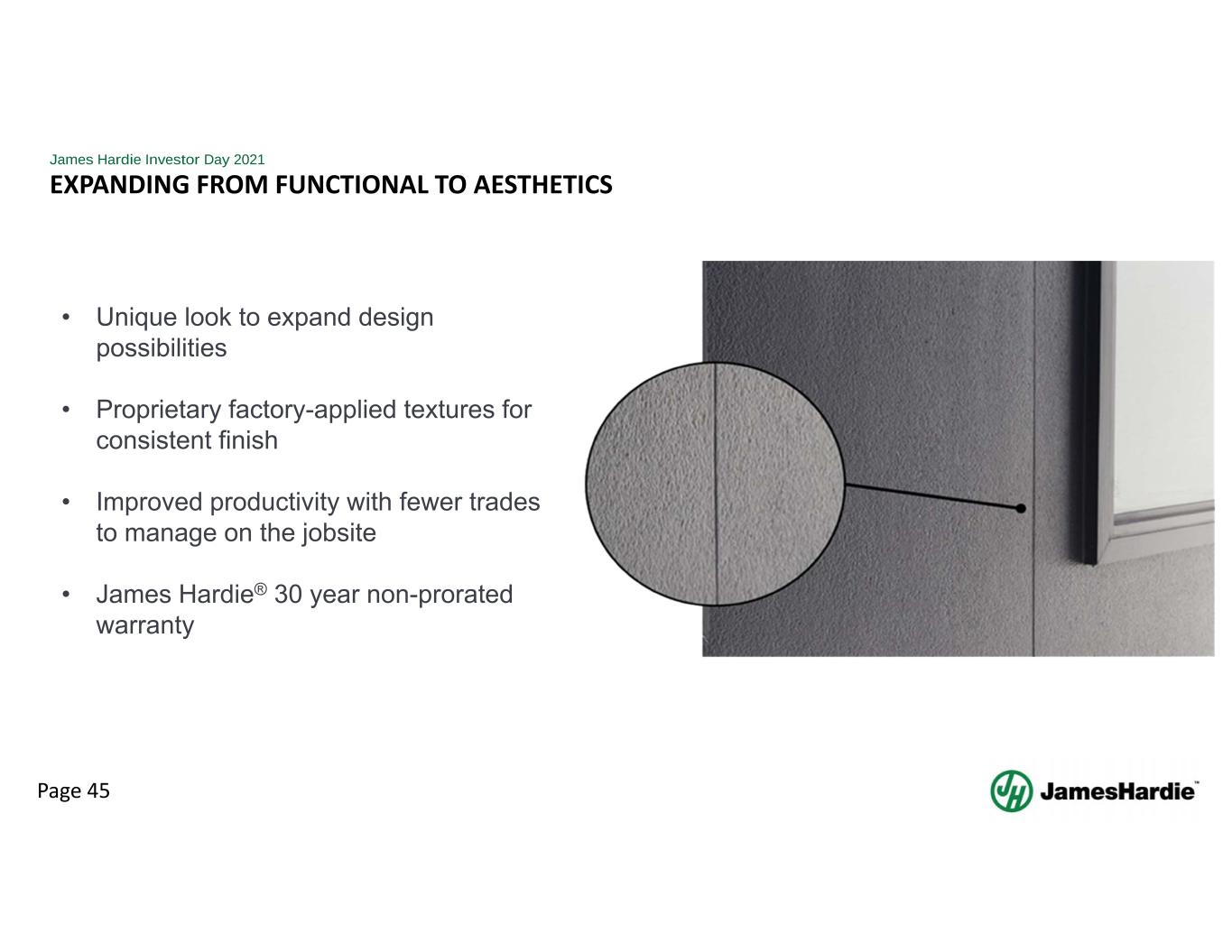

James Hardie Investor Day 2021 Page 45 EXPANDING FROM FUNCTIONAL TO AESTHETICS • Unique look to expand design possibilities • Proprietary factory-applied textures for consistent finish • Improved productivity with fewer trades to manage on the jobsite • James Hardie® 30 year non-prorated warranty

James Hardie Investor Day 2021 Page 46 MAKING THE HOMEOWNER THE CENTER OF OUR ATTENTION REPAIR & REMODEL (NA) Jennifer & Brent Huntington Beach, California, USA Home Value: US$ 850k NEW CONSTRUCTION (NA) San Dee & Cary Portland, Oregon, USA Home Value: US$ 630k REPAIR & REMODEL (APAC) Jane & Matt Illawarra, NSW, Australia Home Value: AU$ 1,000k

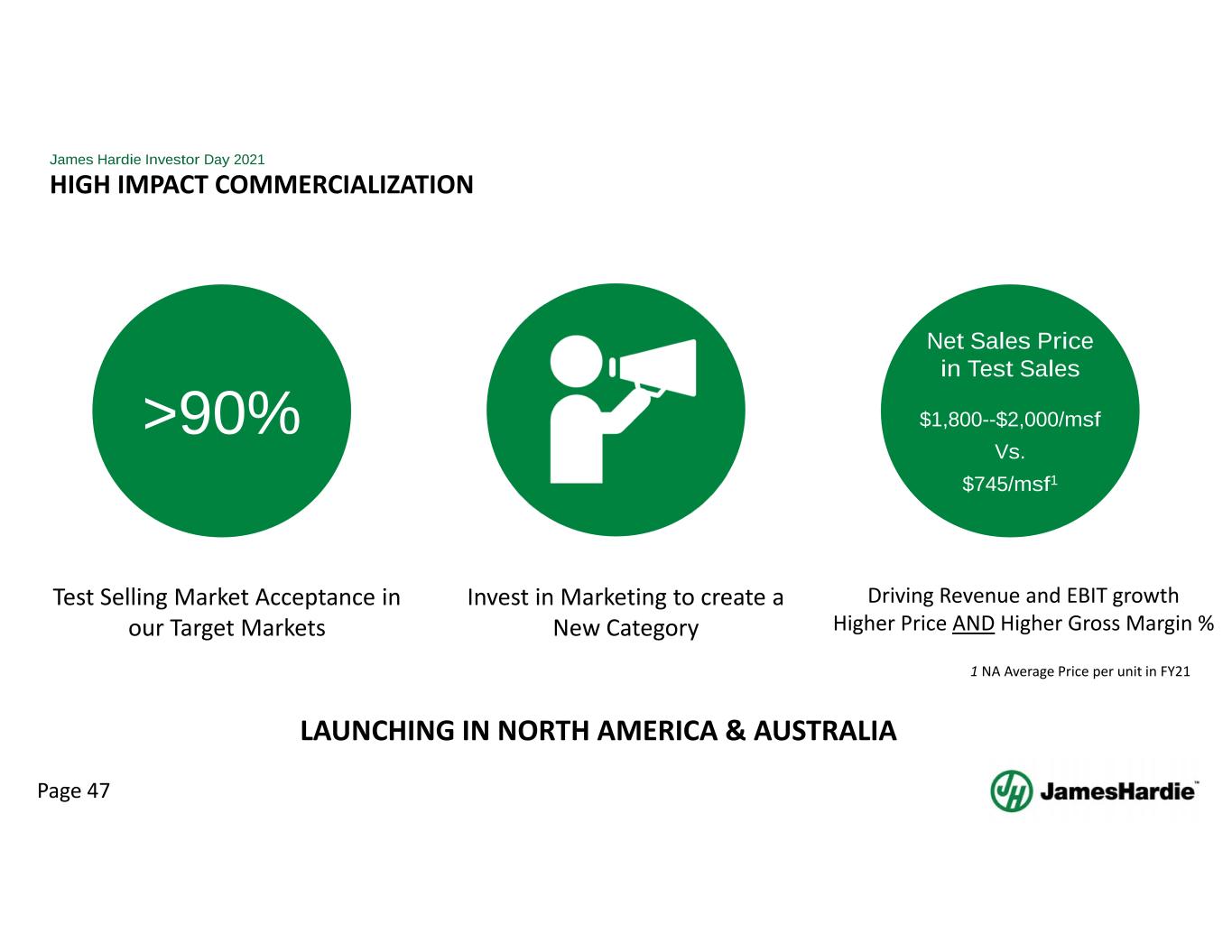

James Hardie Investor Day 2021 Page 47 HIGH IMPACT COMMERCIALIZATION >90% Test Selling Market Acceptance in our Target Markets Invest in Marketing to create a New Category Driving Revenue and EBIT growth Higher Price AND Higher Gross Margin % LAUNCHING IN NORTH AMERICA & AUSTRALIA Net Sales Price in Test Sales $1,800--$2,000/msf Vs. $745/msf1 1 NA Average Price per unit in FY21

James Hardie Investor Day 2021 Page 48 PROFITABLE ORGANIC GROWTH VIA INNOVATION Trusted Protection & Low Maintenance Engineered for Climate® Non‐Combustible Insect & Pest Resistant Impact Resistant Lasting Beauty & Endless Design Possibilities Combines Lasting Beauty & Endless Design Possibilities WITH Trusted Protection & Low Maintenance

Page 49 James Hardie Investor Day 2021 FINANCIAL SUMMARY COASTAL: CONTEMPORARY

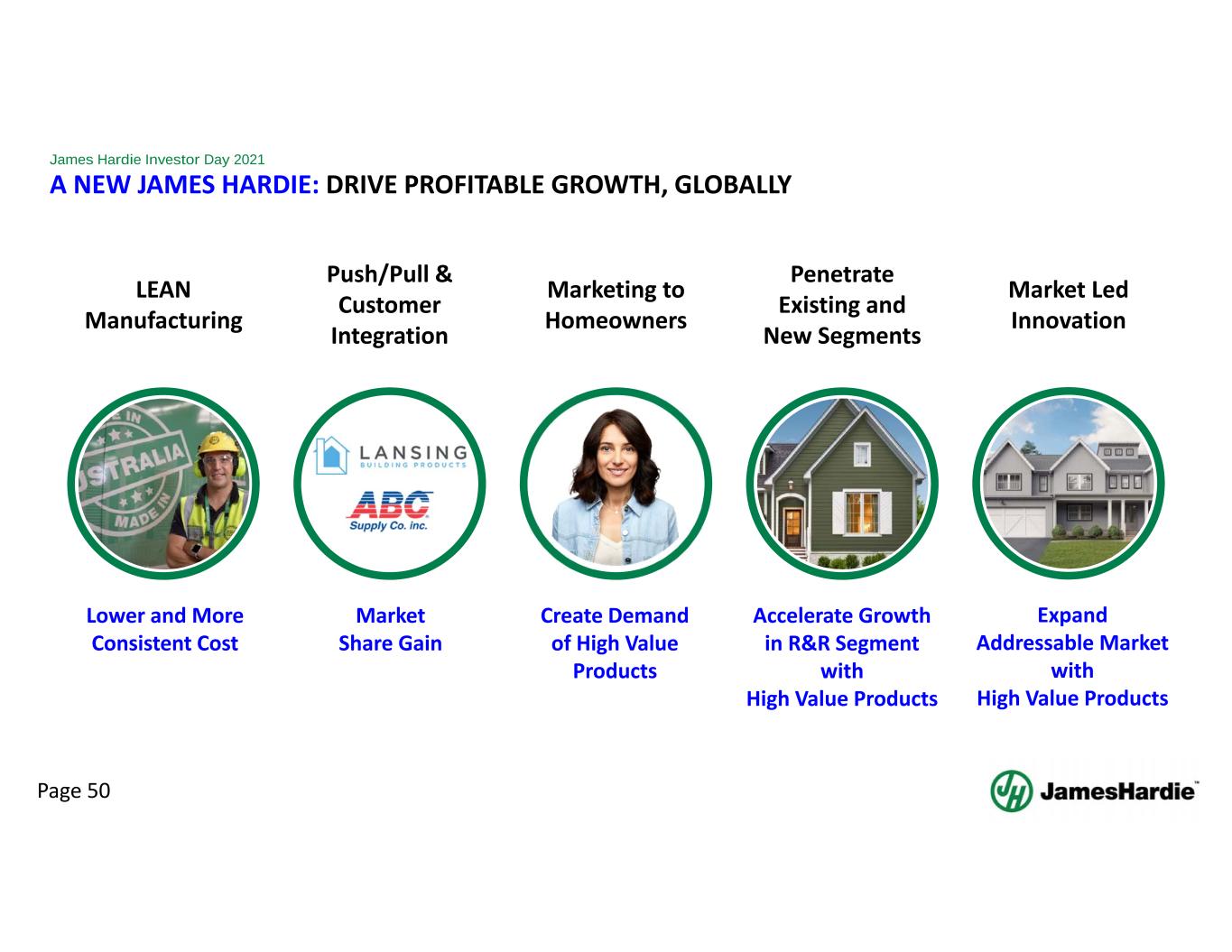

James Hardie Investor Day 2021 Page 50 A NEW JAMES HARDIE: DRIVE PROFITABLE GROWTH, GLOBALLY LEAN Manufacturing Push/Pull & Customer Integration Expand Addressable Market with High Value Products Marketing to Homeowners Market Led Innovation Penetrate Existing and New Segments Lower and More Consistent Cost Market Share Gain Create Demand of High Value Products Accelerate Growth in R&R Segment with High Value Products

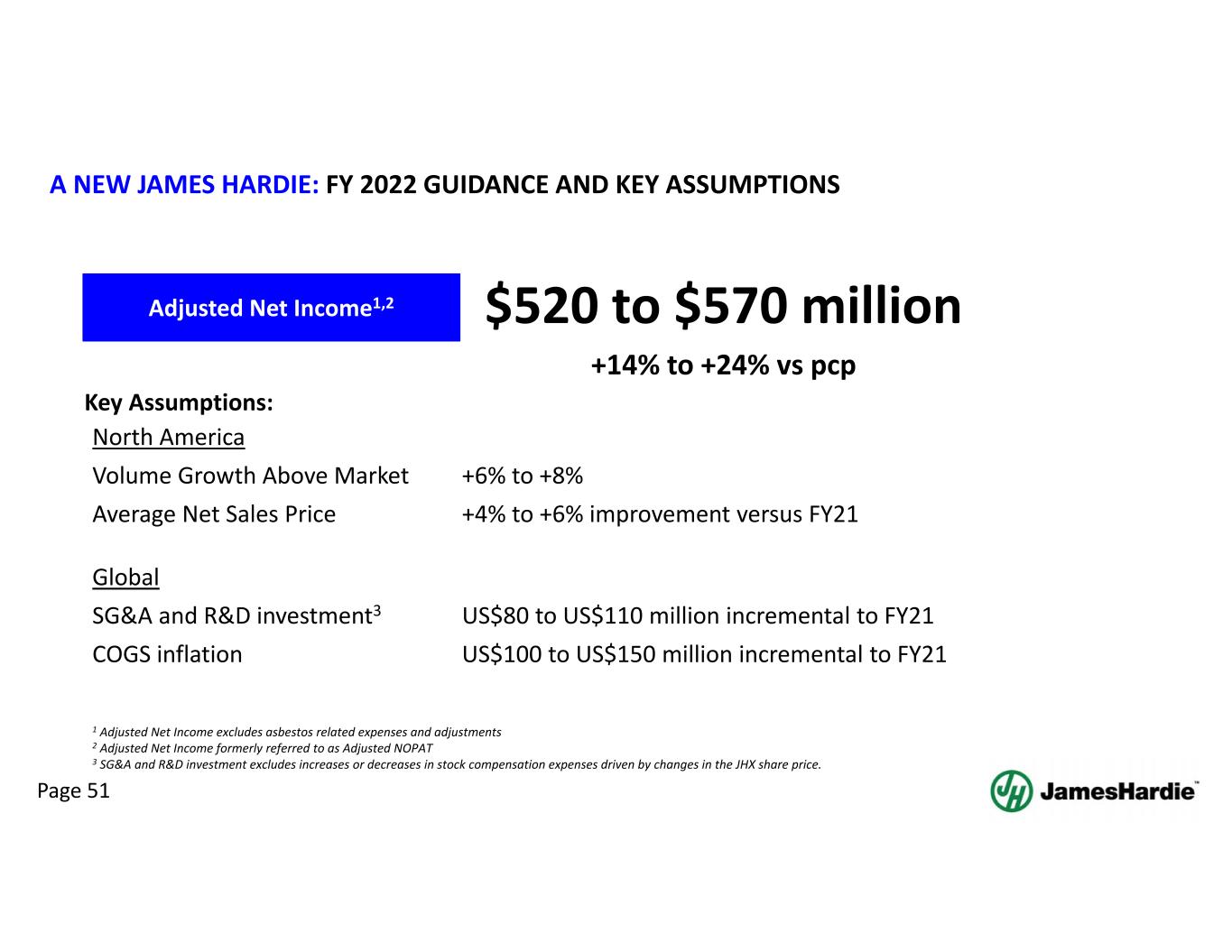

Page 51 James Hardie Investor Day 2021 A NEW JAMES HARDIE: FY 2022 GUIDANCE AND KEY ASSUMPTIONS 1 Adjusted Net Income excludes asbestos related expenses and adjustments 2 Adjusted Net Income formerly referred to as Adjusted NOPAT 3 SG&A and R&D investment excludes increases or decreases in stock compensation expenses driven by changes in the JHX share price. Adjusted Net Income1,2 $520 to $570 million Ohio, USA North America Volume Growth Above Market +6% to +8% Average Net Sales Price +4% to +6% improvement versus FY21 Global SG&A and R&D investment3 US$80 to US$110 million incremental to FY21 COGS inflation US$100 to US$150 million incremental to FY21 Key Assumptions: +14% to +24% vs pcp

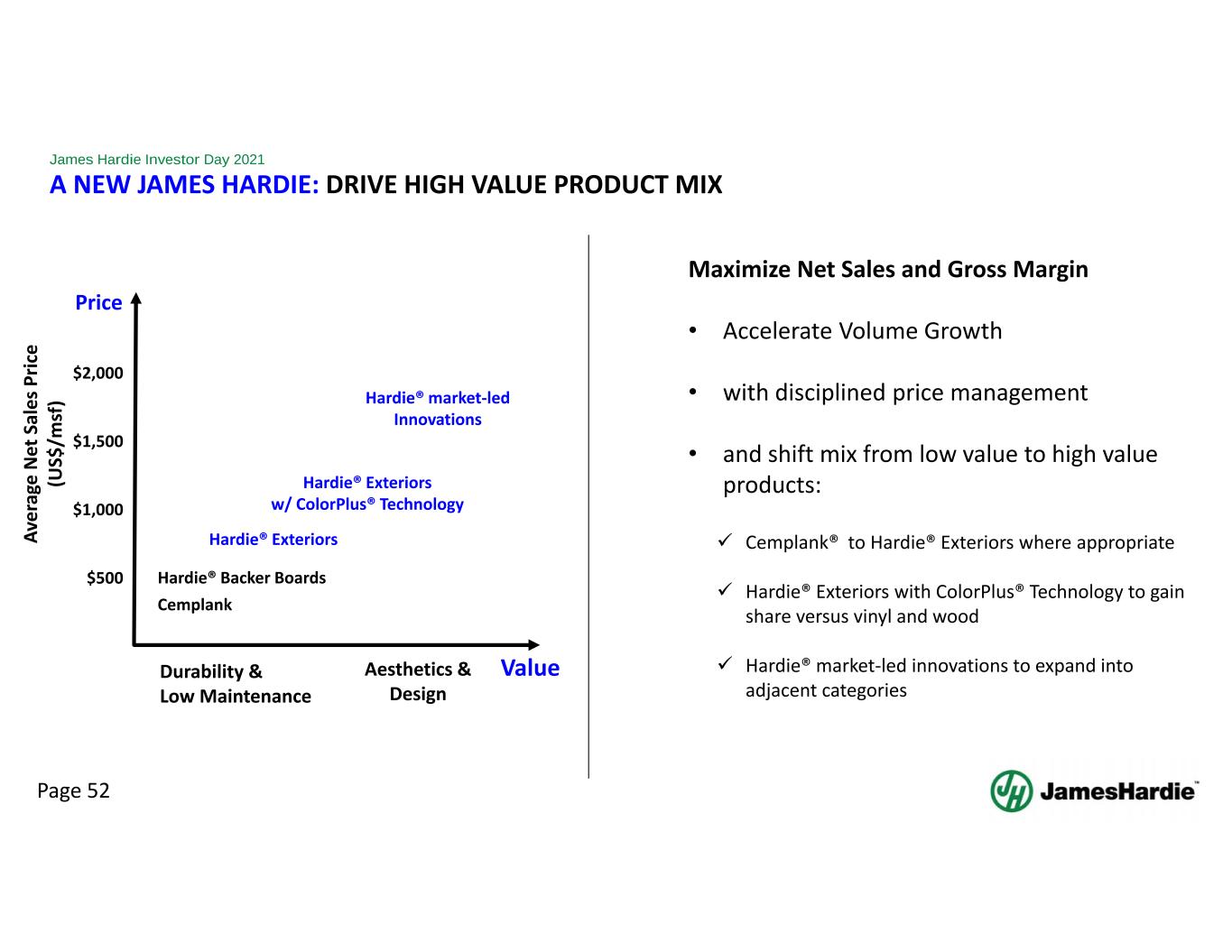

Page 52 James Hardie Investor Day 2021 Maximize Net Sales and Gross Margin • Accelerate Volume Growth • with disciplined price management • and shift mix from low value to high value products: Cemplank® to Hardie® Exteriors where appropriate Hardie® Exteriors with ColorPlus® Technology to gain share versus vinyl and wood Hardie® market‐led innovations to expand into adjacent categories Hardie® Backer Boards Cemplank Hardie® Exteriors Hardie® Exteriors w/ ColorPlus® Technology Hardie® market‐led Innovations Durability & Low Maintenance ValueAesthetics & Design A ve ra ge N et S al es P ri ce (U S$ /m sf ) $2,000 Price $500 $1,000 $1,500 A NEW JAMES HARDIE: DRIVE HIGH VALUE PRODUCT MIX

Page 53 James Hardie Investor Day 2021 A NEW JAMES HARDIE: FINANCIAL SUMMARY 1. Step Change In Global Financial Results 2. Drive High Value Product Mix While Accelerating Volume Growth 3. Raised Ebit Margin Targets In All Three Regions 4. Step Change In Operating Cash Flow & Strong Balance Sheet 5. Capital Allocation Priorities Aligned With Value Creation Organic Growth Above Market With Strong Returns

Page 54 James Hardie Investor Day 2021 CLOSING COMMENTS NEW YORK: COLONIAL

Page 55 James Hardie Investor Day 2021 A NEW JAMES HARDIE Drive Sustainable Profitable Growth, Globally • Build on success to date of foundational transformation initiatives started in FY19: 1. World class manufacturing via LEAN to continue to expand margins 2. Closely partner with customers via Push/Pull to continue to drive above market growth 3. Supply chain integration with our customers to serve the market seamlessly with optimal working capital • Focus on 3 critical initiatives in FY22‐FY24: 1. Marketing to homeowners to create demand 2. Penetrate and drive profitable growth in existing and new segments 3. Commercialize global innovations by expanding into new categories Continue to Drive Profitable Growth, Globally Into the Future

Page 56 James Hardie Investor Day 2021 FLORIDA: CAPE COD QUESTION AND ANSWER