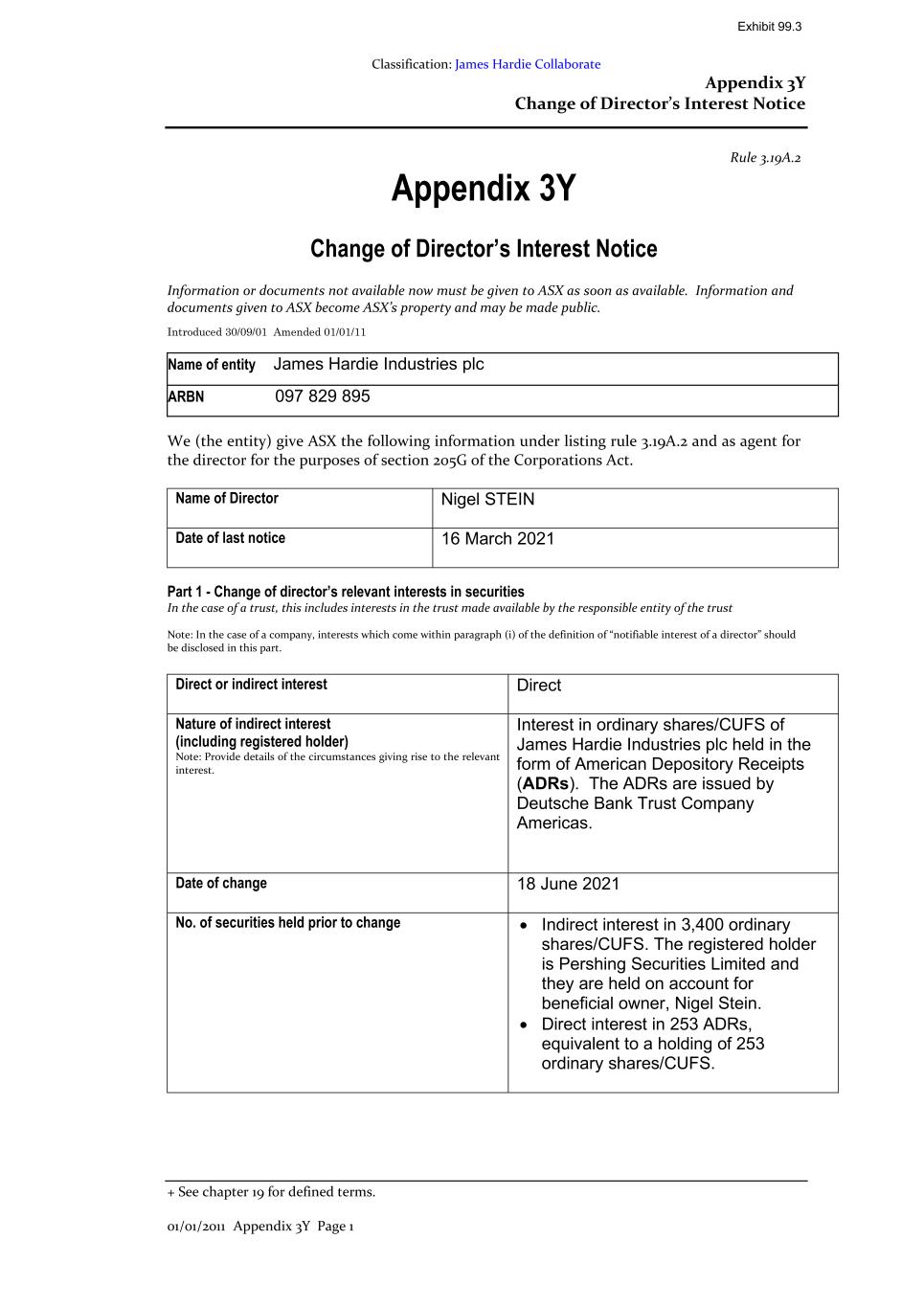

Classification: James Hardie Collaborate Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 Rule 3.19A.2 Appendix 3Y Change of Director’s Interest Notice Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. Introduced 30/09/01 Amended 01/01/11 Name of entity James Hardie Industries plc ARBN 097 829 895 We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. Name of Director Nigel STEIN Date of last notice 16 March 2021 Part 1 - Change of director’s relevant interests in securities In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part. Direct or indirect interest Direct Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. Date of change 18 June 2021 No. of securities held prior to change • Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Pershing Securities Limited and they are held on account for beneficial owner, Nigel Stein. • Direct interest in 253 ADRs, equivalent to a holding of 253 ordinary shares/CUFS. Exhibit 99.3

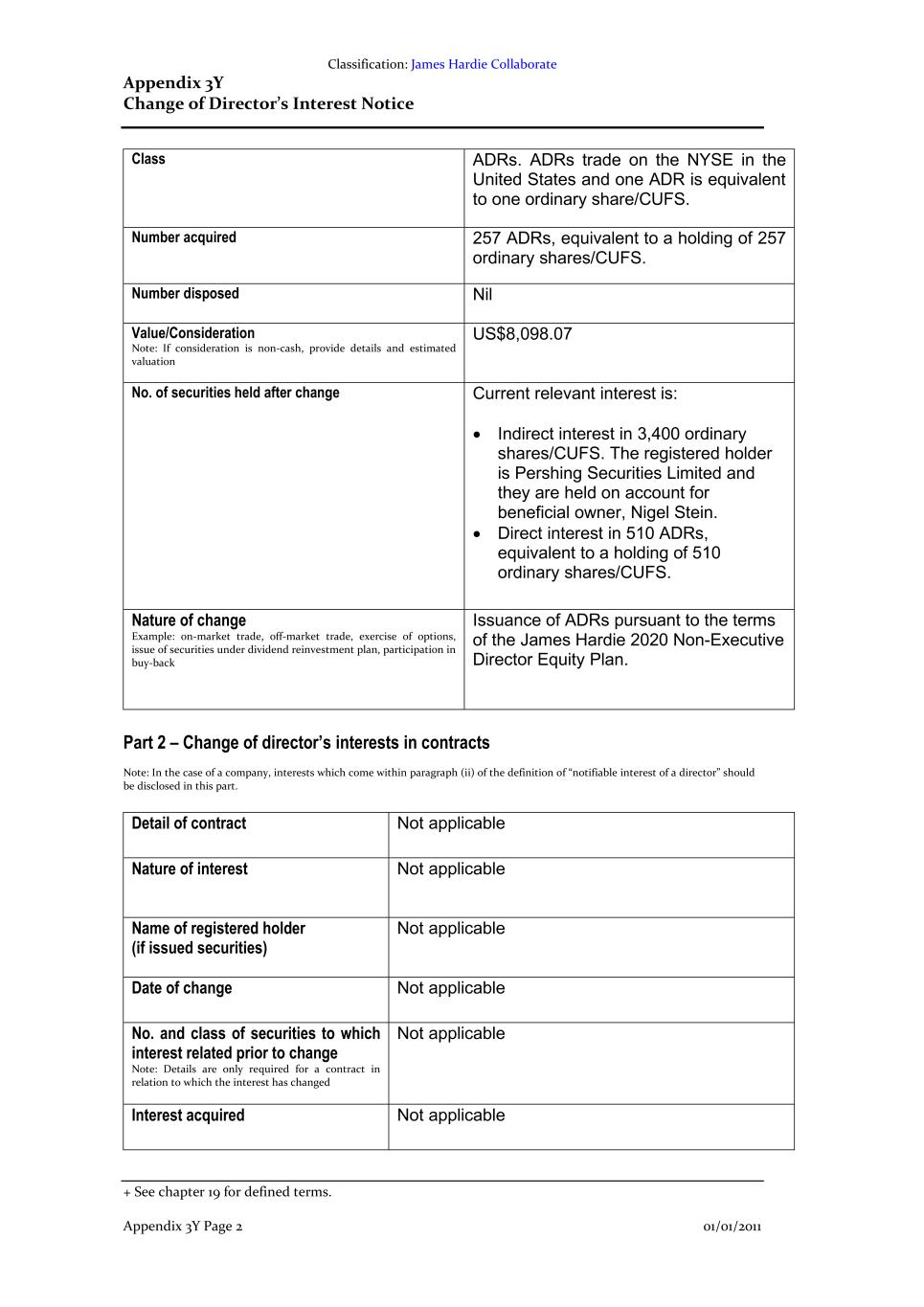

Classification: James Hardie Collaborate Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. Appendix 3Y Page 2 01/01/2011 Class ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. Number acquired 257 ADRs, equivalent to a holding of 257 ordinary shares/CUFS. Number disposed Nil Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation US$8,098.07 No. of securities held after change Current relevant interest is: • Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Pershing Securities Limited and they are held on account for beneficial owner, Nigel Stein. • Direct interest in 510 ADRs, equivalent to a holding of 510 ordinary shares/CUFS. Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. Part 2 – Change of director’s interests in contracts Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part. Detail of contract Not applicable Nature of interest Not applicable Name of registered holder (if issued securities) Not applicable Date of change Not applicable No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed Not applicable Interest acquired Not applicable

Classification: James Hardie Collaborate Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 3 Interest disposed Not applicable Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation Not applicable Interest after change Not applicable Part 3 – +Closed period Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? No If so, was prior written clearance provided to allow the trade to proceed during this period? Not applicable If prior written clearance was provided, on what date was this provided? Not applicable