James Hardie Industries plc Europa House 2nd Floor, Harcourt Centre Harcourt Street, Dublin 2, D02 WR20, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. Directors: Michael Hammes (Chairman, USA), Andrea Gisle Joosen (Sweden), David Harrison (USA), Persio Lisboa (USA), Anne Lloyd (USA), Moe Nozari (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Dean Seavers (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Jack Truong (USA) Company number: 485719 ARBN: 097 829 895 25 June 2021 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached a copy of the substantial holding notice received by James Hardie on 24 June 2021. Regards Joseph C. Blasko General Counsel & Company Secretary This announcement has been authorised for release by the General Counsel and Company Secretary, Mr Joseph C. Blasko. Exhibit 99.1

James Hardie Industries PLC Group Company Secretary Second Floor, Europa House, Harcourt Centre Harcourt Street Dublin 2, Ireland 24th June 2021 Dear Sir/Madam, Re: Disclosure of Holding below 5% Threshold Commonwealth Bank of Australia (“CBA”) on behalf of its subsidiaries: ASB Group Investments Limited, Avanteos Investments Limited, Colonial First State Investments Limited and Commonwealth Bank Officers Superannuation Corporation Pty Limited have a requirement to make a subsequent disclosure under Section 1048/1050 of the Companies Act 2014. These entities have an aggregated interest in James Hardie Industries PLC, Chess Depository Interests of 4.996% ordinary share capital, as at 22nd June 2021. This is based upon 22,198,835 shares held and a total of 444,366,491 voting rights on issue. A previous announcement of 5.992% interest in relevant share capital was disclosed on the 17th March 2020 for value date 16th March 2020.

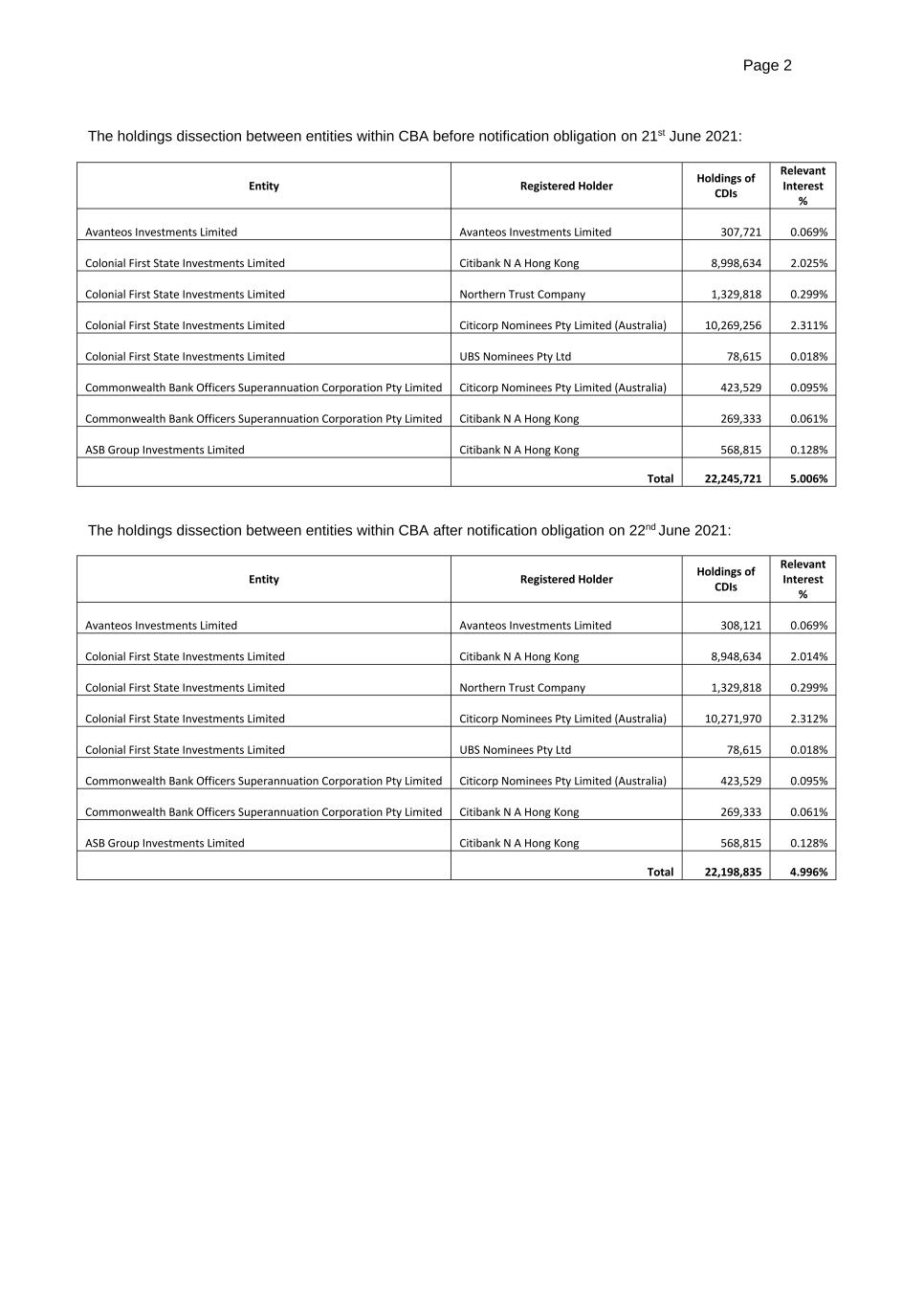

Page 2 The holdings dissection between entities within CBA before notification obligation on 21st June 2021: Entity Registered Holder Holdings of CDIs Relevant Interest % Avanteos Investments Limited Avanteos Investments Limited 307,721 0.069% Colonial First State Investments Limited Citibank N A Hong Kong 8,998,634 2.025% Colonial First State Investments Limited Northern Trust Company 1,329,818 0.299% Colonial First State Investments Limited Citicorp Nominees Pty Limited (Australia) 10,269,256 2.311% Colonial First State Investments Limited UBS Nominees Pty Ltd 78,615 0.018% Commonwealth Bank Officers Superannuation Corporation Pty Limited Citicorp Nominees Pty Limited (Australia) 423,529 0.095% Commonwealth Bank Officers Superannuation Corporation Pty Limited Citibank N A Hong Kong 269,333 0.061% ASB Group Investments Limited Citibank N A Hong Kong 568,815 0.128% Total 22,245,721 5.006% The holdings dissection between entities within CBA after notification obligation on 22nd June 2021: Entity Registered Holder Holdings of CDIs Relevant Interest % Avanteos Investments Limited Avanteos Investments Limited 308,121 0.069% Colonial First State Investments Limited Citibank N A Hong Kong 8,948,634 2.014% Colonial First State Investments Limited Northern Trust Company 1,329,818 0.299% Colonial First State Investments Limited Citicorp Nominees Pty Limited (Australia) 10,271,970 2.312% Colonial First State Investments Limited UBS Nominees Pty Ltd 78,615 0.018% Commonwealth Bank Officers Superannuation Corporation Pty Limited Citicorp Nominees Pty Limited (Australia) 423,529 0.095% Commonwealth Bank Officers Superannuation Corporation Pty Limited Citibank N A Hong Kong 269,333 0.061% ASB Group Investments Limited Citibank N A Hong Kong 568,815 0.128% Total 22,198,835 4.996%

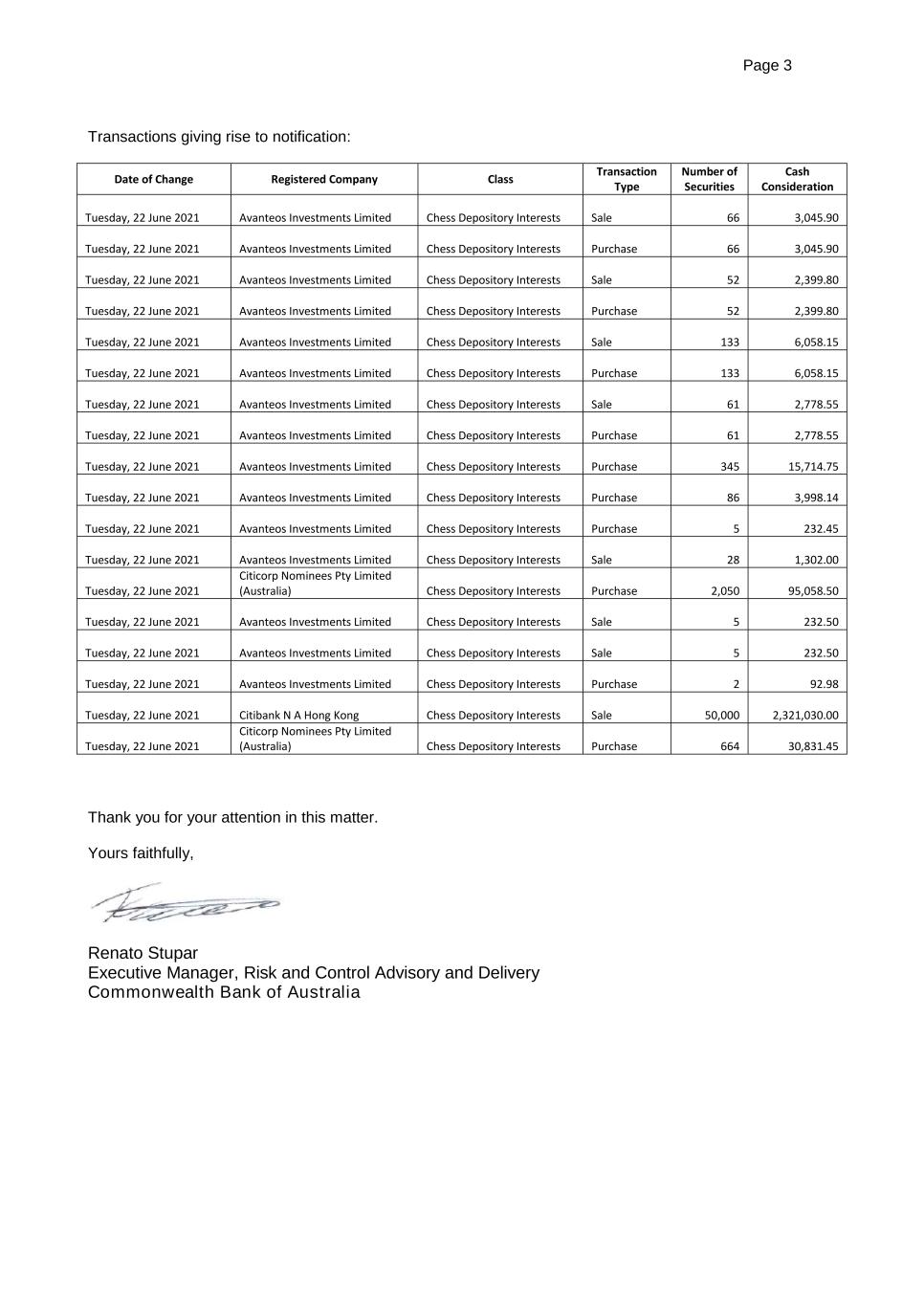

Page 3 Transactions giving rise to notification: Date of Change Registered Company Class Transaction Type Number of Securities Cash Consideration Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 66 3,045.90 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 66 3,045.90 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 52 2,399.80 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 52 2,399.80 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 133 6,058.15 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 133 6,058.15 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 61 2,778.55 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 61 2,778.55 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 345 15,714.75 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 86 3,998.14 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 5 232.45 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 28 1,302.00 Tuesday, 22 June 2021 Citicorp Nominees Pty Limited (Australia) Chess Depository Interests Purchase 2,050 95,058.50 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 5 232.50 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Sale 5 232.50 Tuesday, 22 June 2021 Avanteos Investments Limited Chess Depository Interests Purchase 2 92.98 Tuesday, 22 June 2021 Citibank N A Hong Kong Chess Depository Interests Sale 50,000 2,321,030.00 Tuesday, 22 June 2021 Citicorp Nominees Pty Limited (Australia) Chess Depository Interests Purchase 664 30,831.45 Thank you for your attention in this matter. Yours faithfully, Renato Stupar Executive Manager, Risk and Control Advisory and Delivery Commonwealth Bank of Australia