James Hardie Industries plc Europa House 2nd Floor, Harcourt Centre Harcourt Street, Dublin 2, D02 WR20, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. Directors: Michael Hammes (Chairman, USA), Andrea Gisle Joosen (Sweden), David Harrison (USA), Persio Lisboa (USA), Anne Lloyd (USA), Moe Nozari (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Dean Seavers (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Jack Truong (USA) Company number: 485719 ARBN: 097 829 895 27 August 2021 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Chairman’s Address to 2021 Annual General Meeting and Presentation Dear Sir/Madam James Hardie Industries plc will be holding its 2021 Annual General Meeting (AGM) on Thursday, 26 August 2021 at 11:00pm (Dublin time) / Friday, 27 August 2021 at 8:00am (Sydney time). As required under ASX Listing Rule 3.13.3, a copy of the Chairman’s Address to the 2021 AGM and the AGM Presentation are attached to this release. Regards Joseph C. Blasko General Counsel & Company Secretary This announcement has been authorised for release by the General Counsel and Company Secretary, Mr Joseph C. Blasko. Exhibit 99.1

Chairman’s Address 2021 Annual General Meeting Chairman’s Address 1 Address to the 2021 Annual General Meeting Michael Hammes, Chairman, James Hardie Industries plc Hello and welcome to James Hardie Industries plc’s 2021 Annual General Meeting (AGM), our twelfth AGM to be held in Dublin. Due to COVID-19 related restrictions I am unable to travel to Ireland to attend and chair the AGM in person, so I am attending and chairing the AGM via the teleconference facility available to all shareholders. I am pleased to have you join us. At James Hardie, our mission is to be a high-performance global company that delivers organic growth above market with strong returns, consistently. Over the past two fiscal years, Jack and his leadership team have transformed our company to become “A New James Hardie” that consistently provides value to our customers, employees and our shareholders. Foundational to our organic global strategy to transform and enable consistent profitable growth globally has been the successful execution of the following key initiatives by Jack and his leadership team. World Class Manufacturing via LEAN The first transformation that Jack and his team undertook was to become a World Class Manufacturer through the execution of a LEAN manufacturing strategy. James Hardie’s network of plants is on a continuous improvement path, which began back in 2019, to reduce variation, increase efficiency and improve quality to serve our customers better every day. Exceptional progress to date has been made, as we have generated $130 million in cumulative global LEAN savings through 30 June 2021. Further, efforts in this regard have enabled us to consistently and efficiently deliver premium quality products and service to our customers, and subsequently the market. Partnership with Customers Over the past two years, James Hardie has made a concerted effort to be truly customer focused. We took direct steps to shift from an organization focused solely on demand creation with home builders and contractors, to partnering more closely with our customers to enable profitable growth for them, as well as for James Hardie. Instilling this true customer-focused mindset throughout our company was critical to driving growth above market while taking market share in all three geographies that we participate in globally. This increased connectivity to partner with our customers, and a shift to a Push/Pull strategy, has helped to deliver more than 7% growth above our addressable market for 2 straight years in North America, and global annual Net Sales growth of 12% for fiscal year 2021. Supply Chain Integration Another key component of James Hardie’s transformation has been the increased integration of our supply chain with our customers. This critical integration ensured that we were able to service our customers continuously and seamlessly, providing them with the products they want, when they need them. This more integrated approach to actively manage the supply chain with our customers led to more optimal working capital for both our customers and James Hardie.

Chairman’s Address 2021 Annual General Meeting Chairman’s Address 2 Globally Integrated Management System Underpinning James Hardie’s entire transformation was our globally integrated management system. This management system allows us to make better, more holistic and faster decisions across various levels within the company. Additionally, it has enabled cross functional business teams from across the globe to make appropriate adjustments quickly and at the right time to keep our transformation on track. Delivering Consistent Financial Results The successful execution of James Hardie’s organic global strategic plan and transformation is a testament to the hard work and dedication of all James Hardie employees from around the world. The considerable progress Jack and his team have made has allowed James Hardie to deliver record global Net Sales, record Adjusted EBIT, record Adjusted Net Income and record Operating Cash Flow in fiscal year 2021. In fact, for fiscal year 2021, all three of our operating regions delivered double-digit growth in Adjusted EBIT, a testament to the successful execution of our strategic priorities as a global company. The step change in financial results reinforced our confidence in raising our target Adjusted EBIT margin in both North America and APAC. Jack and his leadership team have the Board’s full support to continue to drive the excellent progress we have already made in our transformation. We are even more excited about the future as we progress towards becoming a high-performance, global company that delivers organic growth above market with strong returns, consistently. Now turning to our fiscal year 2021 operating results in more detail. Our North America business delivered outstanding results in fiscal year 2021. Partnering closely with our customers, we were able to drive significant market share gain while servicing our customers and the end users of our products seamlessly. Net Sales exceeded $2.0 billion, a new record, and we achieved top line growth of 12% in fiscal year 2021. Our network of plants continued to improve under the Hardie Manufacturing Operating System, delivering significant LEAN savings which was the foundation to the expansion of our Adjusted EBIT Margin to 28.8% in fiscal year 2021. During fiscal year 2021, we allocated capital to position our North America manufacturing network for future growth. Our Prattville, Alabama greenfield site commissioned its first sheet machine in March 2021, and the second sheet machine was commissioned in July 2021. Shifting to our Asia Pacific segment. Our Asia Pacific business continued to exhibit strong overall performance in fiscal year 2021. A keen focus on adopting the global strategy to build stronger partnerships with our customers allowed us to drive significant market share gain in our Australian and New Zealand businesses. By consolidating our Australia and New Zealand regional production into our two Australian plants, and our continued execution of our LEAN strategy, we were able to deliver a record Adjusted EBIT Margin of 28.0% in fiscal year 2021. Finally, our European Building Products segment. Our European business delivered a dramatically improved performance in fiscal year 2021, achieving top line growth of 5% in Euros and Adjusted EBIT Margin of 10.4% . The improvement was driven by our focus on gaining end user demand of our high value products and LEAN savings. We finished the year with significant momentum; in the fourth quarter we delivered record Net Sales, record Adjusted EBIT, and record Adjusted EBIT Margin of 15.0%. I would now like to address the issue of capital management. On 5 May 2020, due to the COVID-19 pandemic and to further strengthen James Hardie’s liquidity position and manage market volatility, we announced the immediate suspension of dividends until further notice.

Chairman’s Address 2021 Annual General Meeting Chairman’s Address 3 On 9 February 2021, based on our strong strategic execution through the pandemic and our confidence in continued strong cash generation, we believed it was appropriate to announce the resumption of dividends, with the Board declaring a special dividend of US$0.70 cents per share, paid on 30 April 2021. We intend to resume our ordinary dividend policy in fiscal year 2022 in order to return capital to shareholders, beginning with a first half fiscal year 2022 dividend to be declared in November 2021. Additionally, due to our strong financial performance in fiscal year 2021, James Hardie will contribute approximately A$328.2 million to the Asbestos Injuries Compensation Fund (AICF) during fiscal year 2022, which we are obliged to provide as part of our commitment under the Amended and Restated Final Funding Agreement. Including this contribution, we will have provided approximately A$1.9 billion towards asbestos disease related compensation since the AICF was established in February 2007. Now turning our attention to Board changes. We remain committed to ensuring we have a strong, diverse, and independent Board. During fiscal year 2021, we added two new directors who bring strong business experience and valuable perspective to James Hardie. I would like to take this opportunity to welcome Suzanne B. Rowland and Dean Seavers. We announced the appointments of Suzanne and Dean to our Board in February 2021 and they will be standing for election at this AGM. Suzanne has a diverse set of functional experiences and brings business leadership experience across a wide range of complex global specialty materials and industrial businesses. Dean is a seasoned senior leader of transformation and turnaround strategies and currently serves as Chairman of Pacific Gas & Electric Company. During his career, Mr Seavers advanced through learning and applying best in class operating systems and tools such as LEAN and Six Sigma. Finally, with effect from the conclusion of today’s AGM, Andrea Gisle Joosen will retire as a non-executive director. The Board expresses its thanks to Ms Joosen for her valued contribution to James Hardie and wishes her well in her retirement. I would like to spend a few minutes discussing ESG, or sometimes referred to as sustainability. In fiscal year 2021 we formalized our commitment to sustainability; from innovating future home building materials to creating a positive impact in the communities in which we live and operate. To ensure we stay the course we established a strategy built on the four pillars of Communities, Environment, Innovation and Zero Harm supported by measurable goals and metrics including greenhouse gas reduction, diversity, environmental product declarations and safety. Jack and his leadership team are focused on continuous improvement within the ESG space and have the Board’s full support in this initiative. Jack and his leadership team are focused on continuous improvement within the ESG space and have the Board’s full support in this initiative. Jack, his leadership team and the Board, recognize ESG reporting is important to our investors, and thus in May of 2019, we made a commitment to improve our ESG reporting, committing to a full sustainability report utilizing the Global Reporting Initiative (GRI) framework to be issued during the fiscal year 2021 reporting cycle. I am pleased that we fulfilled this commitment by publishing our inaugural sustainability report titled “Building Sustainable Communities” on 28 July 2021. The Board is pleased with the management teams’ commitment to continuous improvement with regards to ESG topics, and this milestone represents and captures the significant efforts we have made on our sustainability journey during the year. As our sustainability program progresses, the Board and management are committed to aligning with best-practice reporting standards and frameworks, including those set forth by GRI, the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

Chairman’s Address 2021 Annual General Meeting Chairman’s Address 4 I would like to close today by extending the Board’s gratitude and thanks to the nearly 5,000 employees of James Hardie around the world. Your ability to navigate the global pandemic while accelerating the strategy and improving the financial results is truly extraordinary and a testament to a strong team that is working globally and cross-functionally. END Forward-Looking Statements This Chairman’s Address contains forward-looking statements and information that are necessarily subject to risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this release, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2021; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Media Release except as required by law. James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland.

ANNUAL GENERAL MEETING 26 August 2021 (New York and Dublin) / 27 August 2021 (Sydney)

2 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2021; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID-19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law.

Contents are confidential and subject to disclosure and insider trading considerations 3 Michael Hammes, Chairman ANNUAL GENERAL MEETING – CHAIRMAN’S ADDRESS

• Xxx • Xxx *Shareholders should refer to the Notice of Annual General Meeting 2021 for the full text and background to each resolution set forth in the presentation ANNUAL GENERAL MEETING – ITEMS OF BUSINESS*

5 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2021 • To receive and consider the financial statements and the reports of the Board and external auditor for the fiscal year ended 31 March 2021

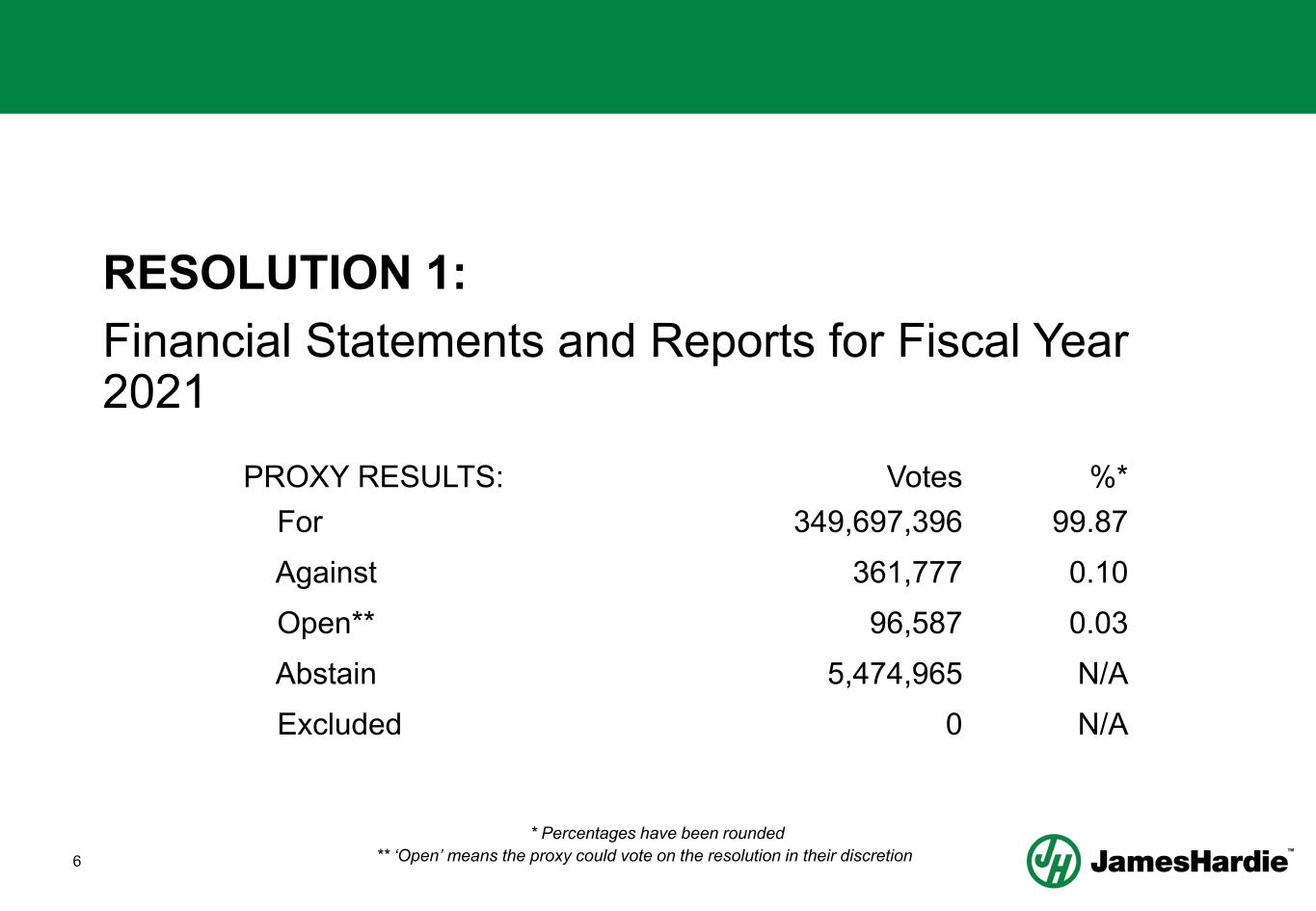

6 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2021 PROXY RESULTS: Votes %* For 349,697,396 99.87 Against 361,777 0.10 Open** 96,587 0.03 Abstain 5,474,965 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

7 RESOLUTION 2: Remuneration Report for Fiscal Year 2021 • To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2021

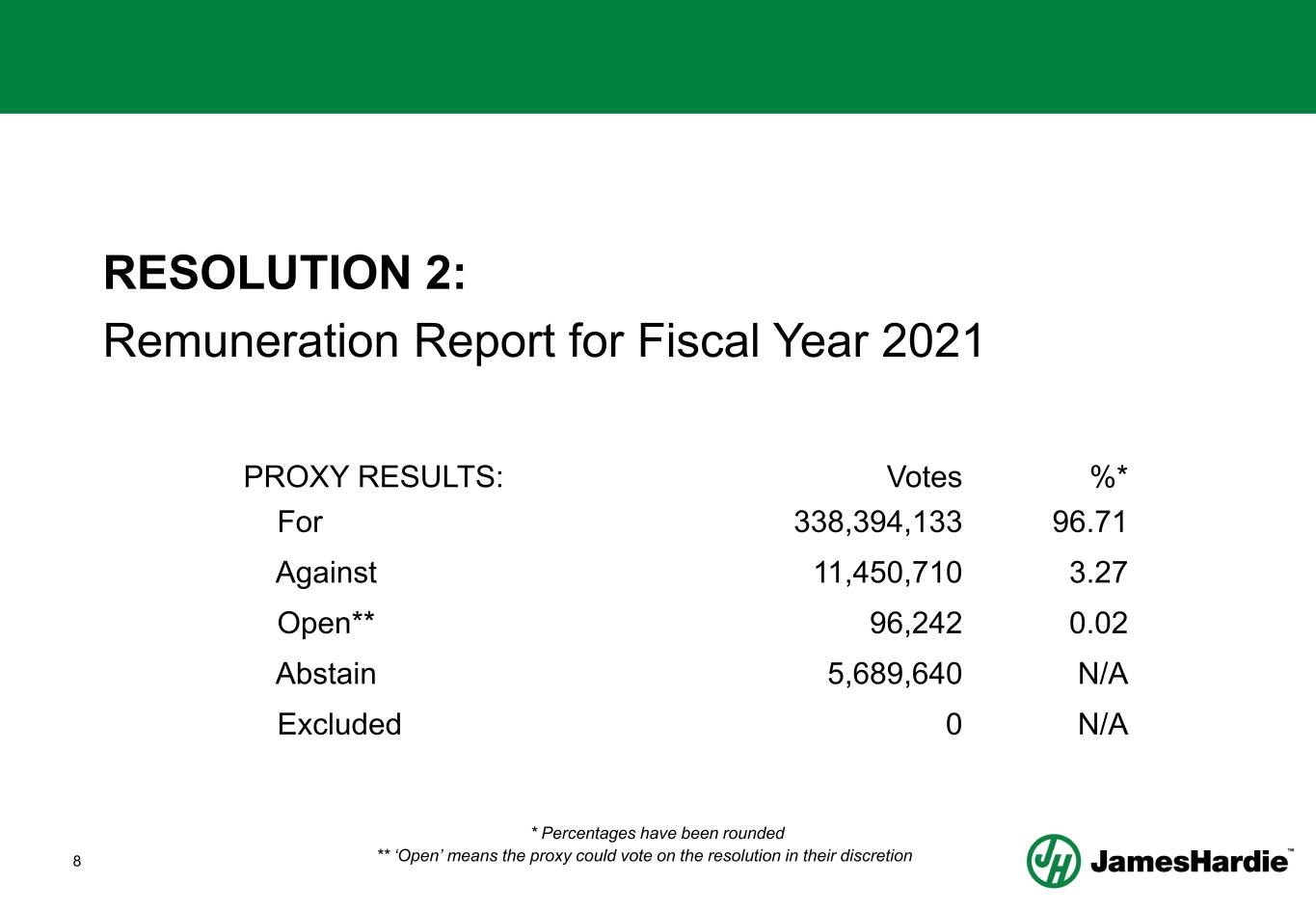

8 RESOLUTION 2: Remuneration Report for Fiscal Year 2021 PROXY RESULTS: Votes %* For 338,394,133 96.71 Against 11,450,710 3.27 Open** 96,242 0.02 Abstain 5,689,640 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

9 RESOLUTION 3: Election/Re-election of Directors a. That Suzanne B. Rowland be elected as a director b. That Dean Seavers be elected as a director c. That Michael Hammes be re-elected as a director d. That Persio V. Lisboa be re-elected as a director

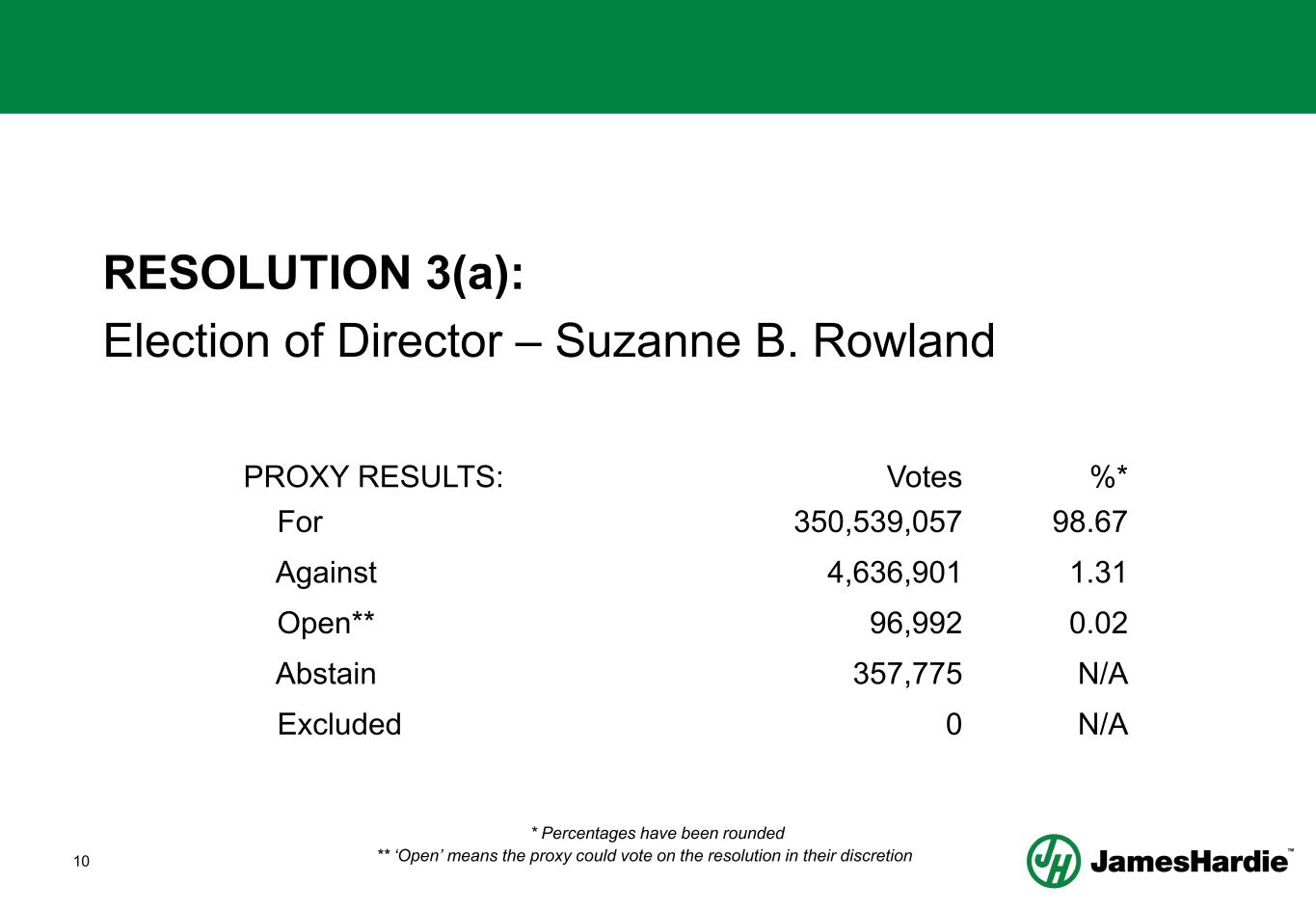

10 RESOLUTION 3(a): Election of Director – Suzanne B. Rowland PROXY RESULTS: Votes %* For 350,539,057 98.67 Against 4,636,901 1.31 Open** 96,992 0.02 Abstain 357,775 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

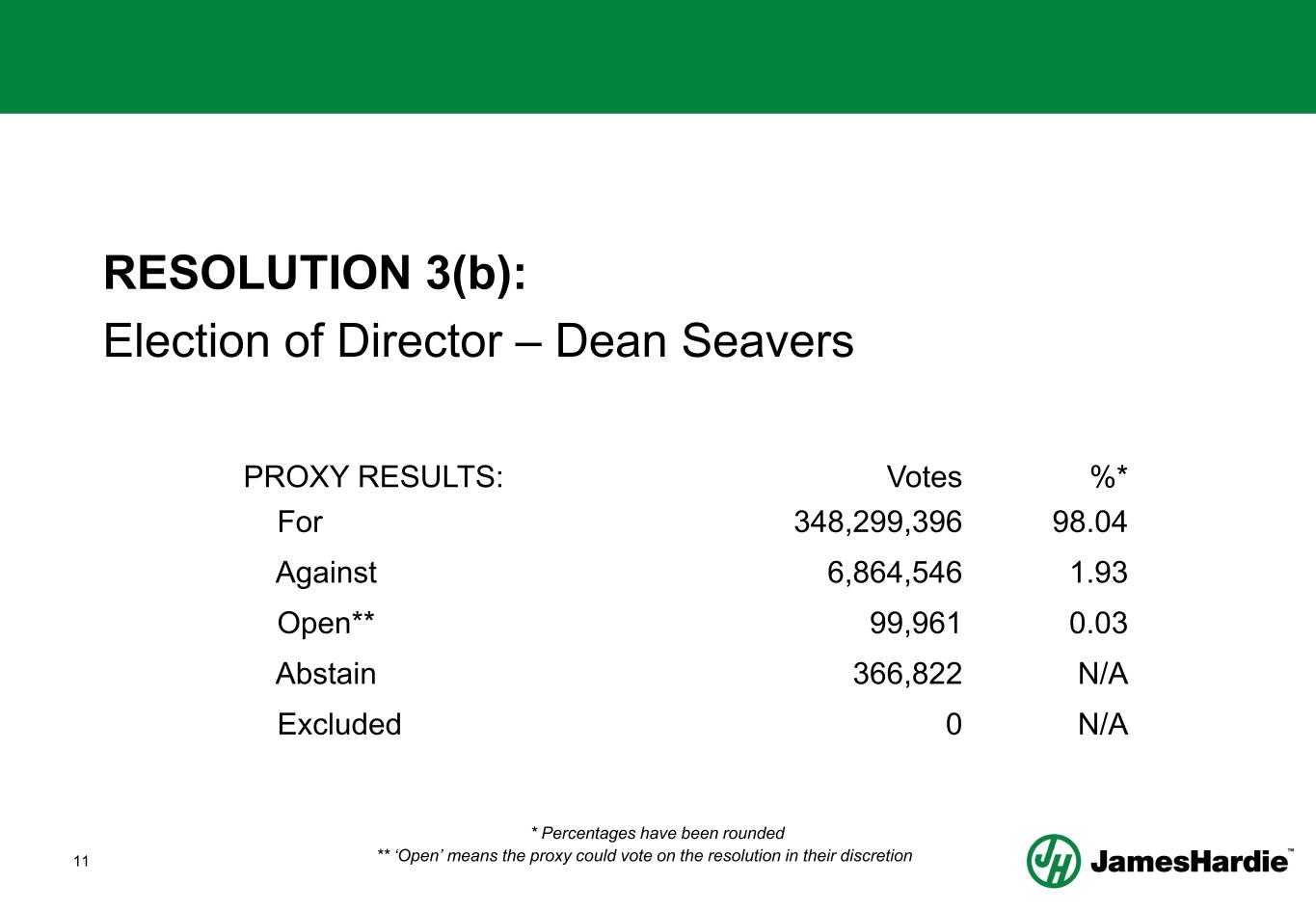

11 RESOLUTION 3(b): Election of Director – Dean Seavers PROXY RESULTS: Votes %* For 348,299,396 98.04 Against 6,864,546 1.93 Open** 99,961 0.03 Abstain 366,822 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

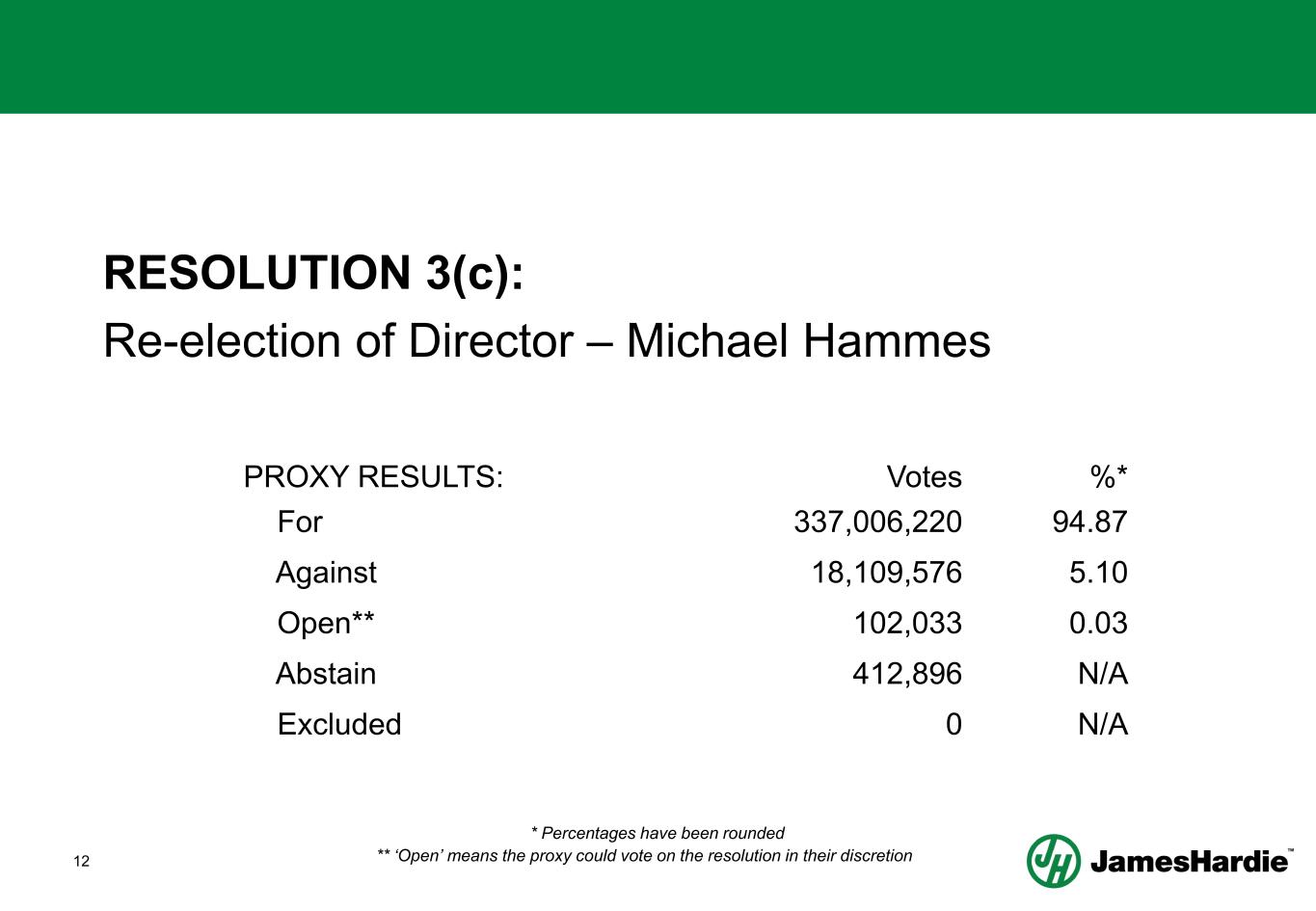

12 RESOLUTION 3(c): Re-election of Director – Michael Hammes PROXY RESULTS: Votes %* For 337,006,220 94.87 Against 18,109,576 5.10 Open** 102,033 0.03 Abstain 412,896 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

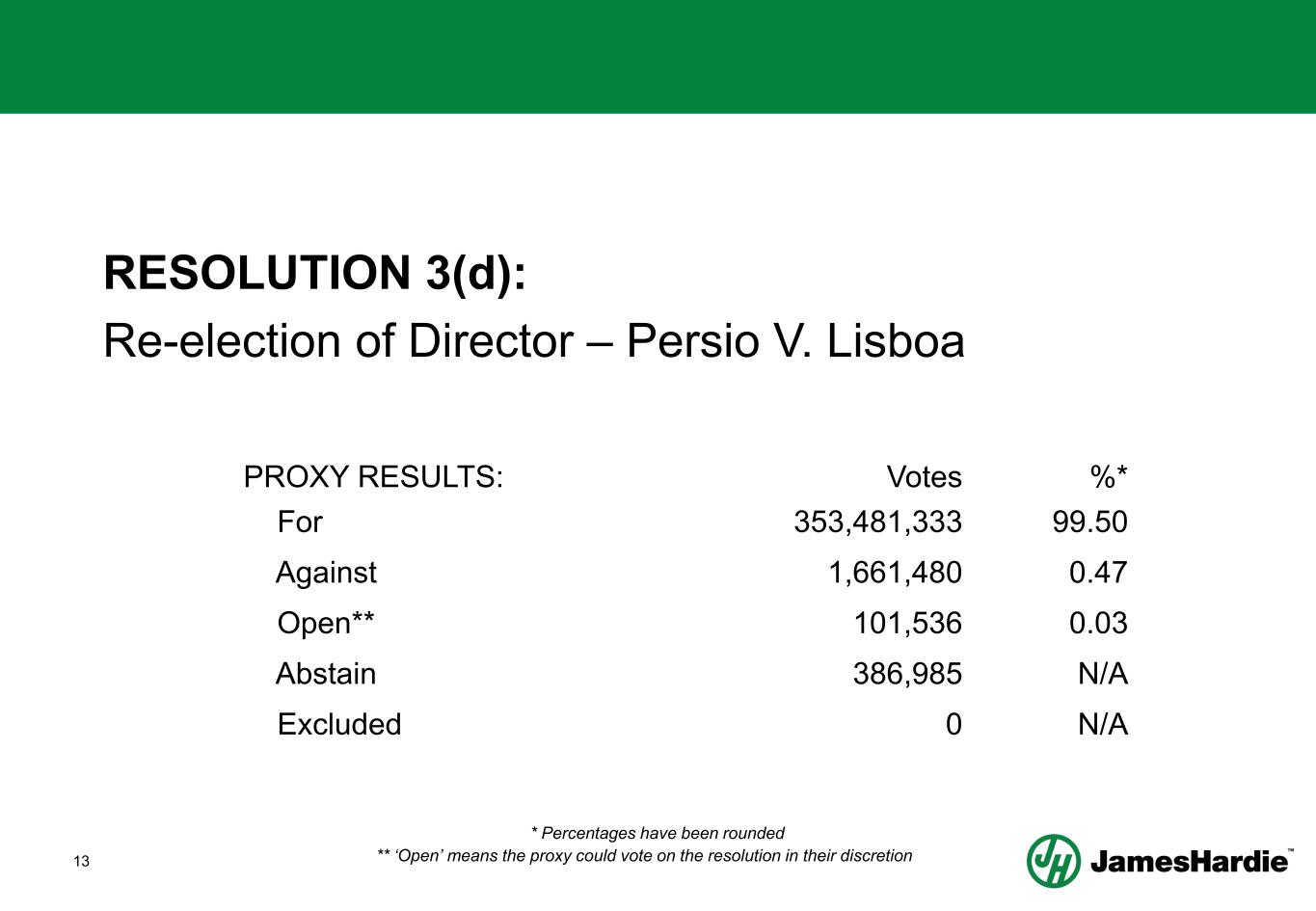

13 RESOLUTION 3(d): Re-election of Director – Persio V. Lisboa PROXY RESULTS: Votes %* For 353,481,333 99.50 Against 1,661,480 0.47 Open** 101,536 0.03 Abstain 386,985 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

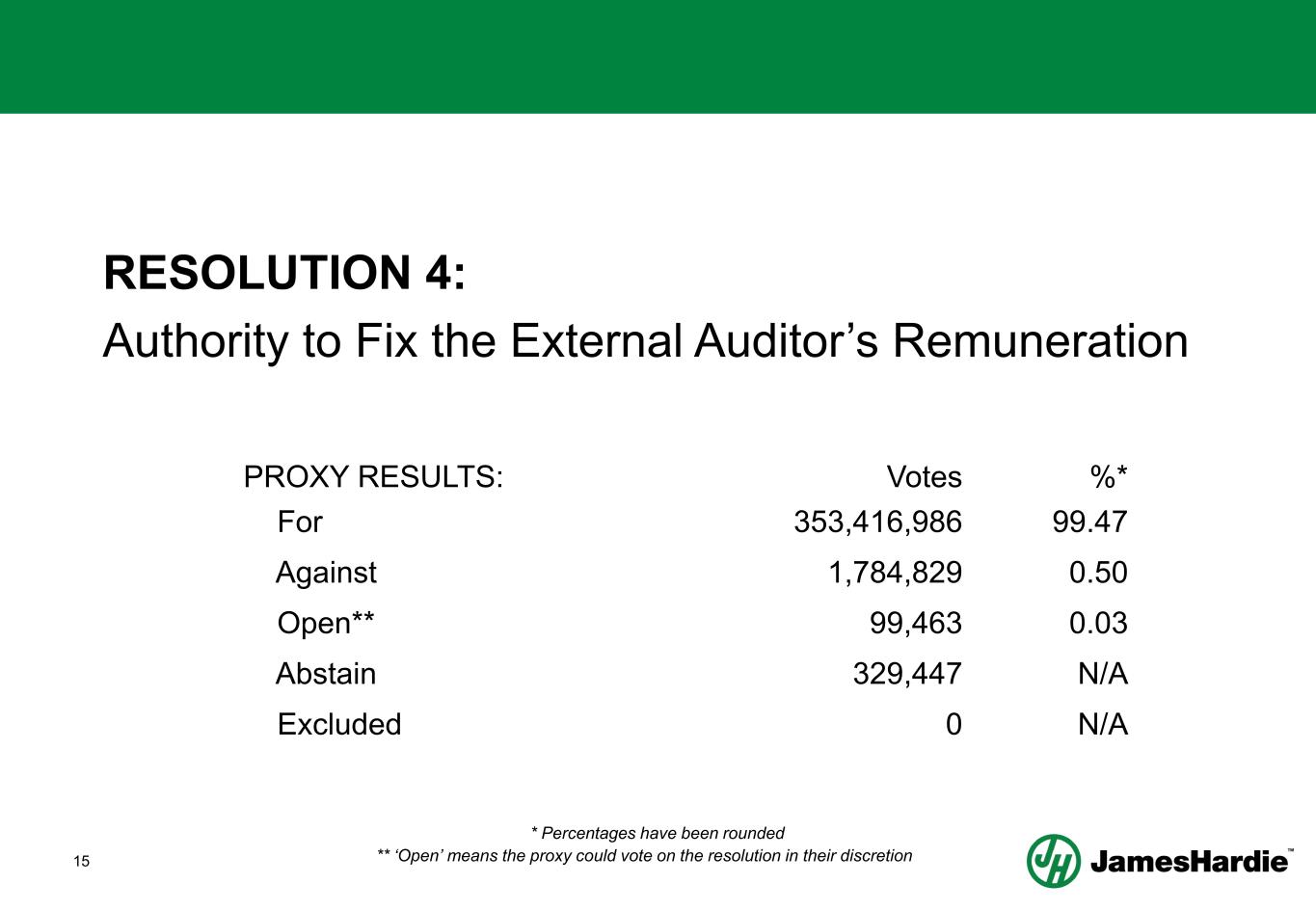

14 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration • That the Board be authorised to fix the remuneration of the external auditor for the fiscal year ended 31 March 2022

15 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration PROXY RESULTS: Votes %* For 353,416,986 99.47 Against 1,784,829 0.50 Open** 99,463 0.03 Abstain 329,447 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

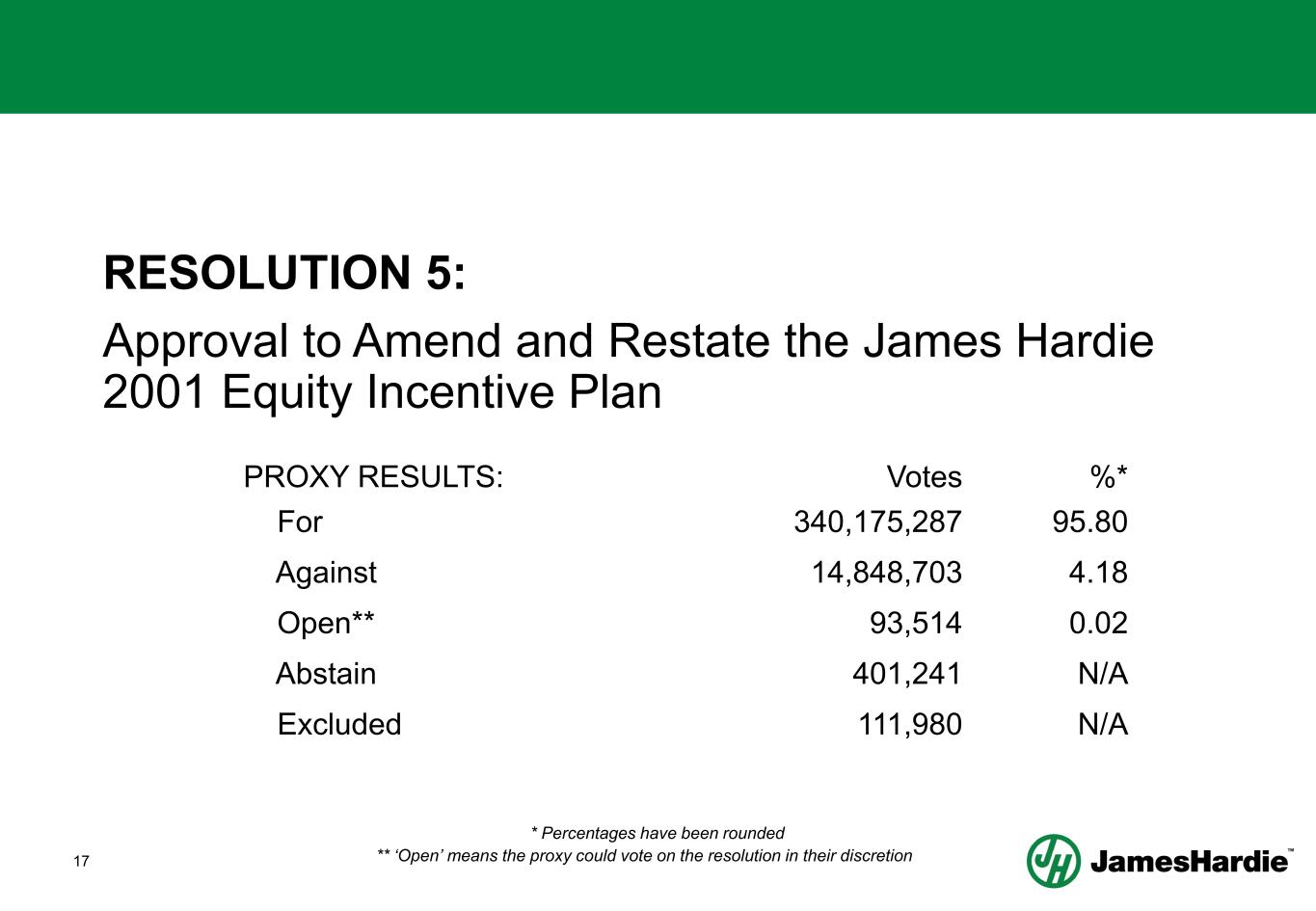

16 RESOLUTION 5: Approval to Amend and Restate the James Hardie 2001 Equity Incentive Plan • Approve the restated form of the James Hardie Industries 2001 Equity Incentive Plan and to issue equity securities under it

17 RESOLUTION 5: Approval to Amend and Restate the James Hardie 2001 Equity Incentive Plan PROXY RESULTS: Votes %* For 340,175,287 95.80 Against 14,848,703 4.18 Open** 93,514 0.02 Abstain 401,241 N/A Excluded 111,980 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

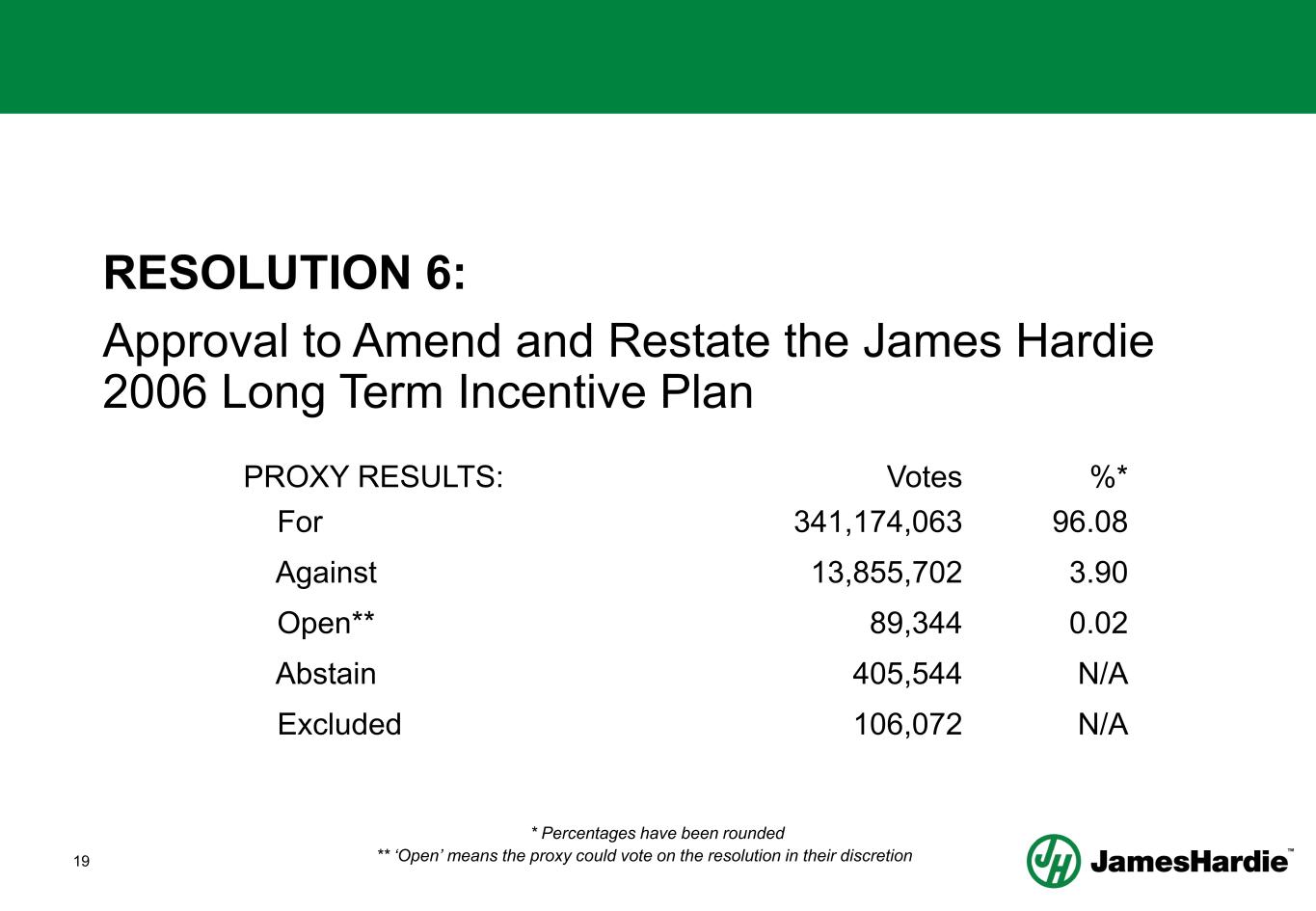

18 RESOLUTION 6: Approval to Amend and Restate the James Hardie 2006 Long Term Incentive Plan • Approve the restated form of the James Hardie Industries 2006 Long Term Incentive Plan and to issue equity securities under it

19 RESOLUTION 6: Approval to Amend and Restate the James Hardie 2006 Long Term Incentive Plan PROXY RESULTS: Votes %* For 341,174,063 96.08 Against 13,855,702 3.90 Open** 89,344 0.02 Abstain 405,544 N/A Excluded 106,072 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

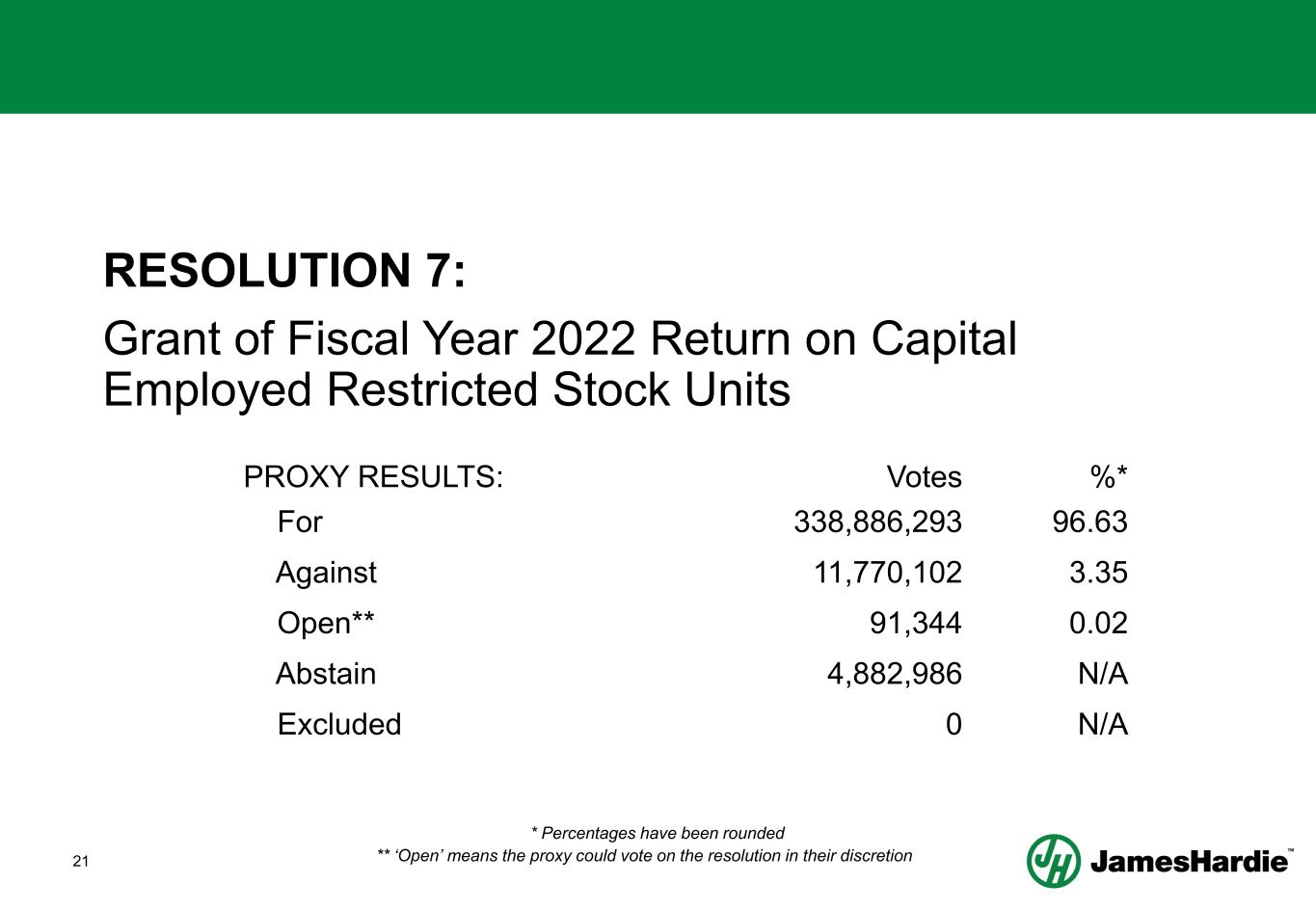

20 RESOLUTION 7: Grant of Fiscal Year 2022 Return on Capital Employed Restricted Stock Units • Approve the grant of Return on Capital Employed (ROCE) Restricted Stock Units (RSUs) under the 2006 LTIP (as amended) to James Hardie’s Director and Chief Executive Officer, Dr. Jack Truong for the fiscal year 2022

21 RESOLUTION 7: Grant of Fiscal Year 2022 Return on Capital Employed Restricted Stock Units PROXY RESULTS: Votes %* For 338,886,293 96.63 Against 11,770,102 3.35 Open** 91,344 0.02 Abstain 4,882,986 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

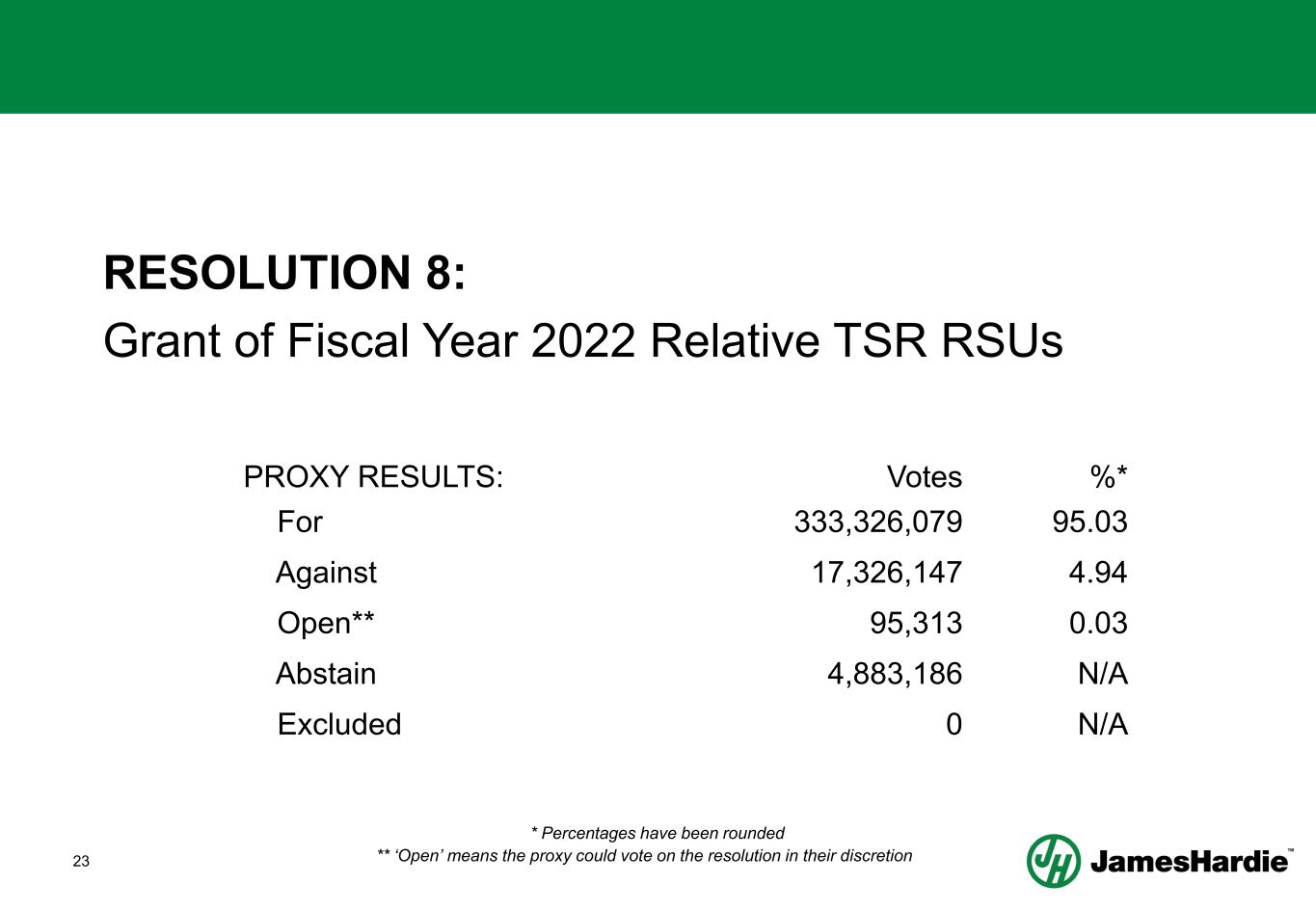

22 RESOLUTION 8: Grant of Fiscal Year 2022 Relative Total Shareholder Return RSUs • Approve the grant of Relative Total Shareholder Return (TSR) RSUs to James Hardie’s Director and Chief Executive Officer, Dr. Jack Truong for the fiscal year 2022

23 RESOLUTION 8: Grant of Fiscal Year 2022 Relative TSR RSUs PROXY RESULTS: Votes %* For 333,326,079 95.03 Against 17,326,147 4.94 Open** 95,313 0.03 Abstain 4,883,186 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

24 Page 24 ANNUAL GENERAL MEETING – OTHER ITEMS OF BUSINESS

ANNUAL GENERAL MEETING