It’s Possible™ Annual Report 2022 Exhibit 99.4

NORTH AMERICA Global Business Overview James Hardie operates 19 manufacturing facilities across three regions and sells high-performance fiber cement and fiber gypsum products in over 20 countries. With James Hardie, It’s PossibleTM Manufacturing Facilities Research and Development ^ 25% from FY21 Net Sales US$2,551.3 million ^ 26% from FY21 Adjusted EBIT US$741.2 million James Hardie is the world’s number one manufacturer and marketer of fibre cement and fibre gypsum, and we create value by providing homeowners with endless design possibilities. FY22 GROUP RESULTS ^ 24% from FY21 Net Sales US$3,614.7 million ^ 30% from FY21 Adjusted EBIT US$815.6 million ^ 36% from FY21 Adjusted Net Income US$620.7 million Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

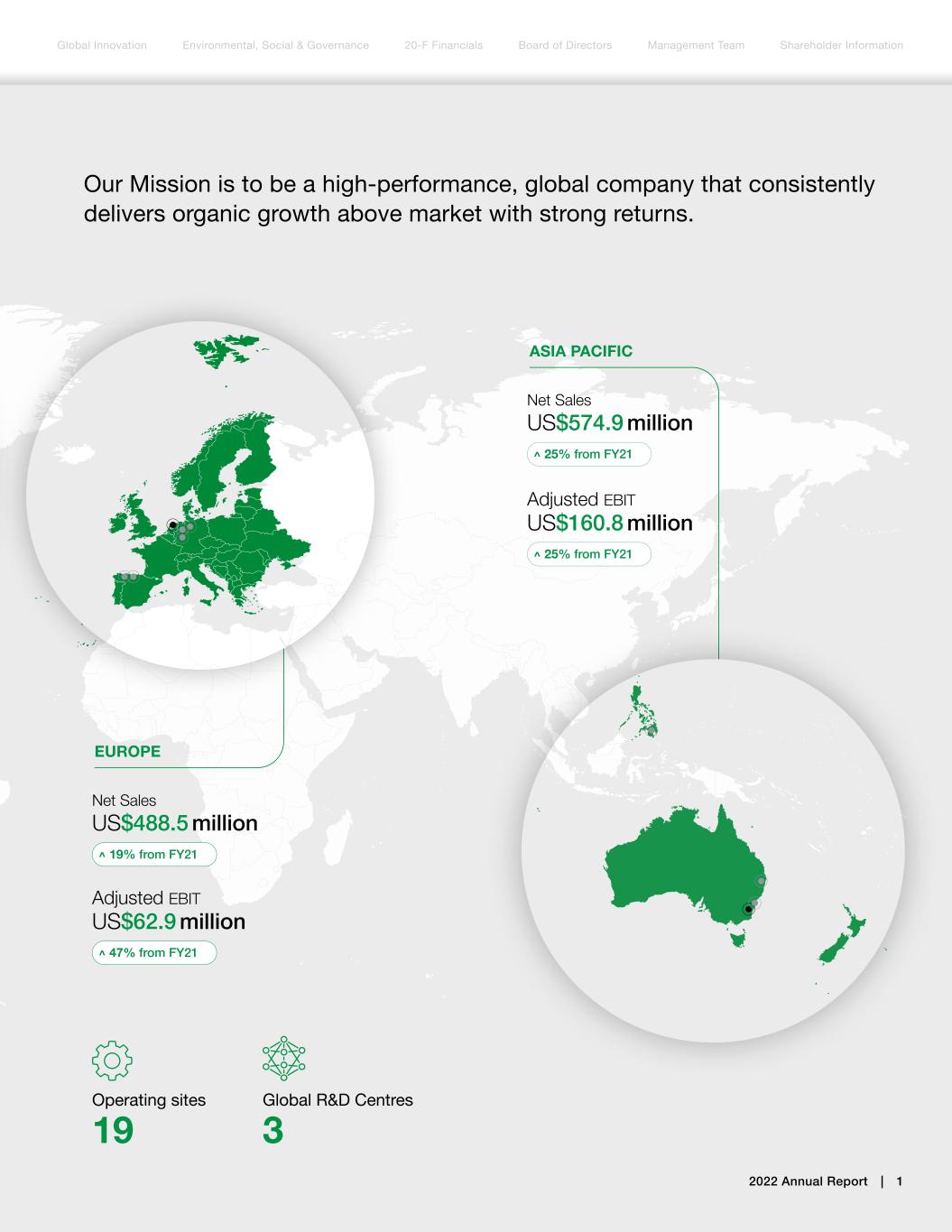

ASIA PACIFIC EUROPE ^ 19% from FY21 Net Sales US$488.5 million ^ 25% from FY21 Net Sales US$574.9 million ^ 47% from FY21 Adjusted EBIT US$62.9 million ^ 25% from FY21 Adjusted EBIT US$160.8 million Our Mission is to be a high-performance, global company that consistently delivers organic growth above market with strong returns. Operating sites 19 Global R&D Centres 3 2022 Annual Report | 1 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

In this Annual Report, pages 1-246, unless otherwise stated all items are denoted in U.S. dollars. Any financial metric referred to as “Adjusted” is a Non-GAAP Financial measure. The amounts denoted as “Adjusted” are done so consistently with the Company’s other financial reporting, please see Page 36, Financial Endnotes, for further explanation of Non-GAAP Financial Information. 2 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

Letter to Shareholders 4 Global Results Summary 10 North America Fiber Cement 14 Asia Pacific Fiber Cement 16 Europe Building Products 18 Global Capacity Expansion 20 Marketing Directly to Homeowners 24 Global Innovation 28 Environmental, Social & Governance 32 20-F Financials 38 Board of Directors 242 Management Team 243 Shareholder Information 244 James Hardie acknowledges the traditional custodians of the lands on which our business and assets operate, and recognise their ongoing connection to land, waters and community. We pay our respects to the Indigenous Custodians on these lands before us, the Indigenous Peoples today, and the generations to come. 2022 Annual Report | 3 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Fiscal Year 2022 was our third consecutive year of substantial growth globally. Adjusted Net Income of US$620.7 million is more than two times the Adjusted Net Income result in Fiscal Year 2019. This transformational growth was delivered across all three regions. Over the three years since we unveiled our global strategy, group sales have increased 44% to over US$3.6 billion and adjusted net income grew 107% to $620.7 million. This exceptional growth is the result of the successful execution of our strategy by our 5,000 employees across the globe. I have been passionate about James Hardie’s growth for a long time, and as I sit here today, I can tell you I have never been more excited about the future for this business given what the Board and the James Hardie team have put in motion. FISCAL YEAR 2022 OPERATING RESULTS Our North America segment is delivering a step change in growth underpinned by strong volumes and execution on our high value product mix strategy. Fiscal year 2022 net sales grew by 25% to over US$2.5 billion and were reinforced by a 10% improvement in Price/Mix. The growth in high value product mix is a testament to our improved partnering with customers, initial gains in marketing directly to the homeowner, and strong continued underlying demand for James Hardie’s fiber cement products. North American adjusted EBIT expanded by 26% to over US$740 million. Despite high inflation across the U.S. during a disruptive year for global supply chains, along with significant reinvestment in our business as we transform into a premier consumer branded company, the North American team was able to lift adjusted EBIT margins to 29.1% from 28.8% in fiscal year 2021. This is truly an impressive business. Our Asia Pacific segment continued to benefit from strong demand and a focus on a high value product mix strategy. Fiscal year 2022 net sales grew by 22% to over A$777 million. Execution on a high value product mix drove an improvement in Price/Mix of 5% and demand for our products resulted in volumes expanding 17%. Asia Pacific adjusted EBIT expanded 23% to over A$217 million with an impressive adjusted EBIT margin of 28.0%. Our European segment delivered strong results in fiscal year 2022, with net sales expanding 20% to over €420 million. Fiber cement sales grew 39% to over €65 million, a testament to the growing demand for our fiber cement products which ultimately supports our confidence in expanding our European presence. European adjusted EBIT expanded 51% to €54 million, an incredible result considering the massive inflationary pressures facing continental Europe. I would like to congratulate our team for a truly remarkable set of results in terms of sales and profit growth. MICHAEL HAMMES Executive Chairman CHAIRMAN’S Letter to Shareholders 4 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

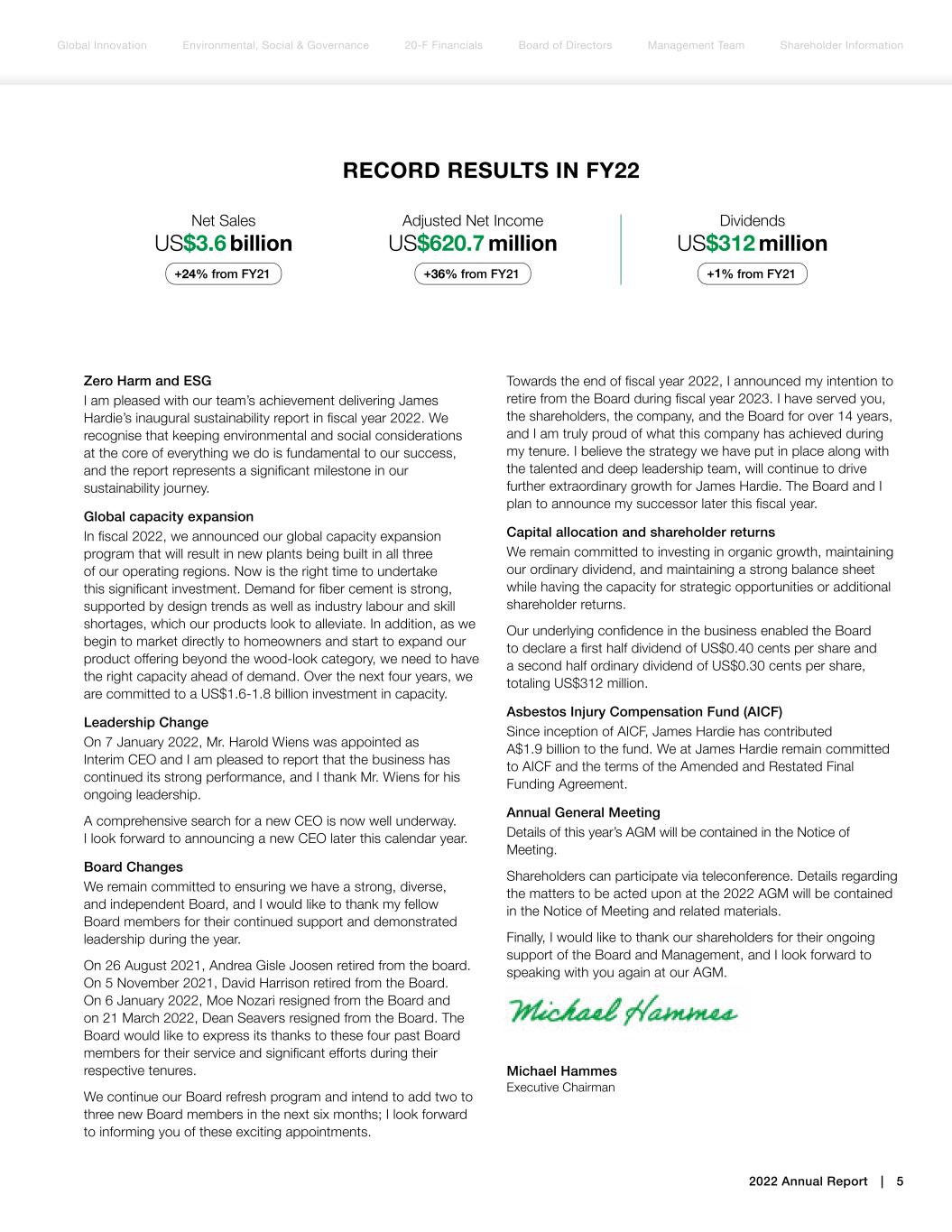

Zero Harm and ESG I am pleased with our team’s achievement delivering James Hardie’s inaugural sustainability report in fiscal year 2022. We recognise that keeping environmental and social considerations at the core of everything we do is fundamental to our success, and the report represents a significant milestone in our sustainability journey. Global capacity expansion In fiscal 2022, we announced our global capacity expansion program that will result in new plants being built in all three of our operating regions. Now is the right time to undertake this significant investment. Demand for fiber cement is strong, supported by design trends as well as industry labour and skill shortages, which our products look to alleviate. In addition, as we begin to market directly to homeowners and start to expand our product offering beyond the wood-look category, we need to have the right capacity ahead of demand. Over the next four years, we are committed to a US$1.6-1.8 billion investment in capacity. Leadership Change On 7 January 2022, Mr. Harold Wiens was appointed as Interim CEO and I am pleased to report that the business has continued its strong performance, and I thank Mr. Wiens for his ongoing leadership. A comprehensive search for a new CEO is now well underway. I look forward to announcing a new CEO later this calendar year. Board Changes We remain committed to ensuring we have a strong, diverse, and independent Board, and I would like to thank my fellow Board members for their continued support and demonstrated leadership during the year. On 26 August 2021, Andrea Gisle Joosen retired from the board. On 5 November 2021, David Harrison retired from the Board. On 6 January 2022, Moe Nozari resigned from the Board and on 21 March 2022, Dean Seavers resigned from the Board. The Board would like to express its thanks to these four past Board members for their service and significant efforts during their respective tenures. We continue our Board refresh program and intend to add two to three new Board members in the next six months; I look forward to informing you of these exciting appointments. Towards the end of fiscal year 2022, I announced my intention to retire from the Board during fiscal year 2023. I have served you, the shareholders, the company, and the Board for over 14 years, and I am truly proud of what this company has achieved during my tenure. I believe the strategy we have put in place along with the talented and deep leadership team, will continue to drive further extraordinary growth for James Hardie. The Board and I plan to announce my successor later this fiscal year. Capital allocation and shareholder returns We remain committed to investing in organic growth, maintaining our ordinary dividend, and maintaining a strong balance sheet while having the capacity for strategic opportunities or additional shareholder returns. Our underlying confidence in the business enabled the Board to declare a first half dividend of US$0.40 cents per share and a second half ordinary dividend of US$0.30 cents per share, totaling US$312 million. Asbestos Injury Compensation Fund (AICF) Since inception of AICF, James Hardie has contributed A$1.9 billion to the fund. We at James Hardie remain committed to AICF and the terms of the Amended and Restated Final Funding Agreement. Annual General Meeting Details of this year’s AGM will be contained in the Notice of Meeting. Shareholders can participate via teleconference. Details regarding the matters to be acted upon at the 2022 AGM will be contained in the Notice of Meeting and related materials. Finally, I would like to thank our shareholders for their ongoing support of the Board and Management, and I look forward to speaking with you again at our AGM. Michael Hammes Executive Chairman +24% from FY21 Net Sales US$3.6 billion +36% from FY21 Adjusted Net Income US$620.7 million +1% from FY21 Dividends US$312 million RECORD RESULTS IN FY22 2022 Annual Report | 5 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Dear shareholders, At James Hardie, our mission is to be a high-performance global company that consistently delivers organic growth above market with strong returns. In fiscal year 2022, the transformation of our company has accelerated as we become a premier, consumer branded company that consistently provides value to our customers, employees, and you — our shareholders. ZERO HARM AND ESG & THREE YEARS OF RESULTS Over the past three fiscal years, the James Hardie team has made significant progress on our global transformation. This would not have been possible without ongoing improvement in our processes, with a view that the decisions we make each day must also be environmentally and socially responsible to create sustainable value for our investors. The Group’s sustainability progress reflects the efforts of our global team. Their passion, expertise and capability drives the success of our business outcomes, and examples of our progress in fiscal year 2022 can be found in the Building Sustainable Communities section of this report. In addition to our relentless focus on Zero Harm and ESG, what is foundational to our organic global strategy to transform and enable consistent profitable growth globally is successful execution of the following initiatives: 1. World Class Manufacturing via LEAN The first transformation we undertook was to become a world class manufacturer through the execution of our LEAN manufacturing strategy. Our network of plants is on a continuous journey of improvement, which began in 2019 to reduce variation, increase efficiency and improve quality to serve our customers better every day. Exceptional progress has been made to date, as we have generated $215.1 million in cumulative global LEAN savings, including $150.4 million LEAN savings in North America. These ongoing efforts have enabled us to deliver premium quality products consistently and efficiently, improve service to our customers and mitigate inflationary pressures. 2. Partnership with Customers Over the past two years, we have made a concerted effort to be truly customer focused. We have taken direct steps to shift from an organization focused solely on demand creation with home builders and contractors, to partnering more closely with our customers enabling profitable growth for them as well as James Hardie. Instilling this true customer focused mindset throughout the company has been critical to driving growth above market while taking market share in all three geographies that we operate in. Over the last two fiscal years, this increased connectivity has helped our North America business to deliver more than 9% per annum volume growth. 3. Supply Chain Integration Another key component of our transformation has been the improved integration of our supply chain. This critical initiative ensures that we are able to continuously and seamlessly service our customers, providing them with the products they want, when they need them. This more integrated approach to actively manage the supply chain with our customers has led to more optimal working capital for both our customers and James Hardie. HAROLD WIENS Interim Chief Executive Officer, Executive Director LEAN SAVINGS cumulative global saving for 36 month period US$215.1 million cumulative NA savings for 36 month period US$150.4 million 6 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion INTERIM CEO Letter to Shareholders

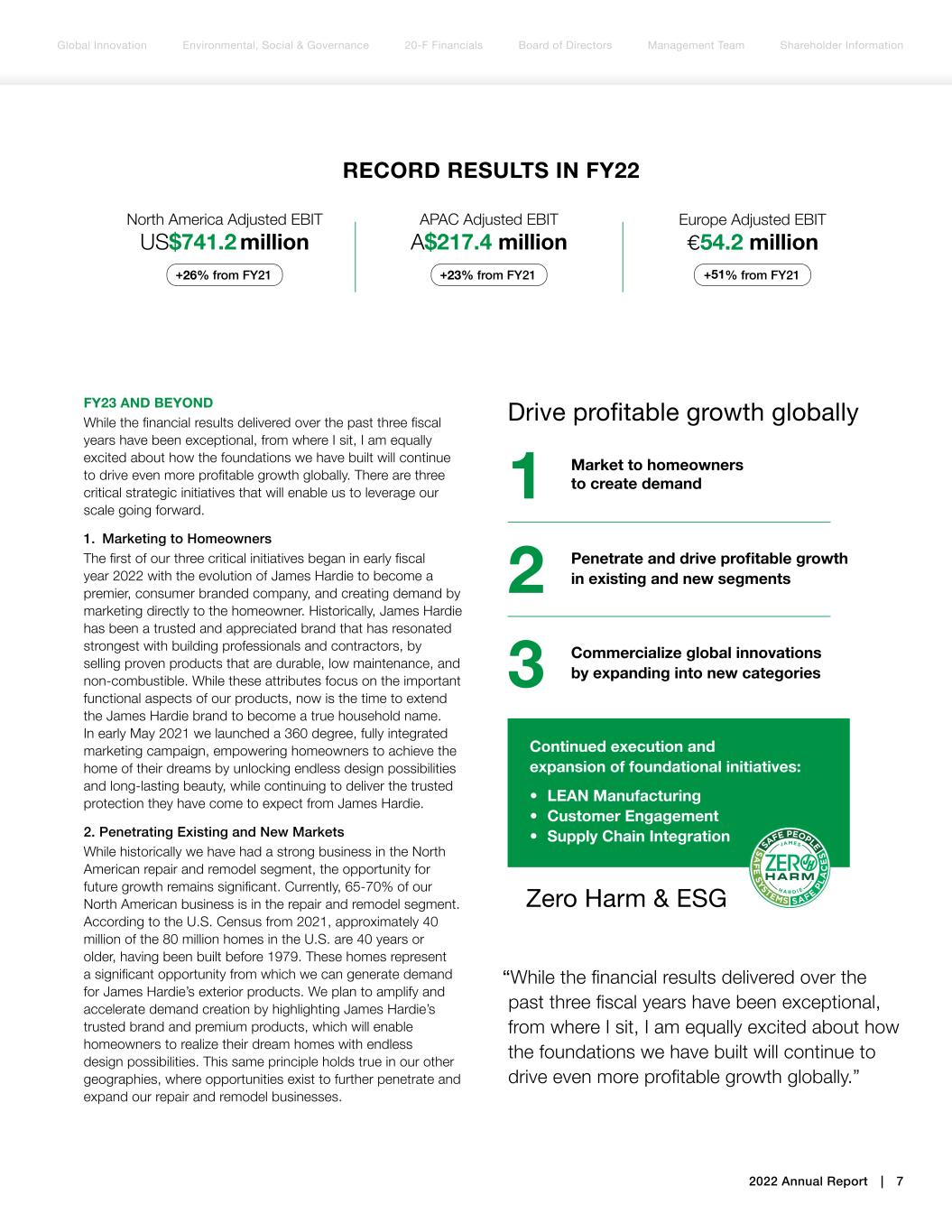

“While the financial results delivered over the past three fiscal years have been exceptional, from where I sit, I am equally excited about how the foundations we have built will continue to drive even more profitable growth globally.” FY23 AND BEYOND While the financial results delivered over the past three fiscal years have been exceptional, from where I sit, I am equally excited about how the foundations we have built will continue to drive even more profitable growth globally. There are three critical strategic initiatives that will enable us to leverage our scale going forward. 1. Marketing to Homeowners The first of our three critical initiatives began in early fiscal year 2022 with the evolution of James Hardie to become a premier, consumer branded company, and creating demand by marketing directly to the homeowner. Historically, James Hardie has been a trusted and appreciated brand that has resonated strongest with building professionals and contractors, by selling proven products that are durable, low maintenance, and non-combustible. While these attributes focus on the important functional aspects of our products, now is the time to extend the James Hardie brand to become a true household name. In early May 2021 we launched a 360 degree, fully integrated marketing campaign, empowering homeowners to achieve the home of their dreams by unlocking endless design possibilities and long-lasting beauty, while continuing to deliver the trusted protection they have come to expect from James Hardie. 2. Penetrating Existing and New Markets While historically we have had a strong business in the North American repair and remodel segment, the opportunity for future growth remains significant. Currently, 65-70% of our North American business is in the repair and remodel segment. According to the U.S. Census from 2021, approximately 40 million of the 80 million homes in the U.S. are 40 years or older, having been built before 1979. These homes represent a significant opportunity from which we can generate demand for James Hardie’s exterior products. We plan to amplify and accelerate demand creation by highlighting James Hardie’s trusted brand and premium products, which will enable homeowners to realize their dream homes with endless design possibilities. This same principle holds true in our other geographies, where opportunities exist to further penetrate and expand our repair and remodel businesses. +26% from FY21 North America Adjusted EBIT US$741.2 million +23% from FY21 APAC Adjusted EBIT A$217.4 million +51% from FY21 Europe Adjusted EBIT €54.2 million Drive profitable growth globally Zero Harm & ESG Market to homeowners to create demand Penetrate and drive profitable growth in existing and new segments Commercialize global innovations by expanding into new categories 1 2 3 Continued execution and expansion of foundational initiatives: • LEAN Manufacturing • Customer Engagement • Supply Chain Integration RECORD RESULTS IN FY22 2022 Annual Report | 7 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

3. Global Innovation In order to maintain the considerable momentum of the past three fiscal years, it is crucial that we continue introducing new innovative products to the market. Our approach to innovation is about developing market driven products that address unmet needs and contribute to profitable, organic growth. Our global innovation platform focuses on products that deliver endless design possibilities for the homeowner. This also extends to delivering the superior performance the market has come to expect from James Hardie’s unique fiber cement technology, including: • durability, • low maintenance, and • noncombustible. Fundamental to our long term global innovation strategy, is developing a product suite that allows us to participate in all exterior siding categories, not just the wood-look category. In February 2022, we launched the Hardie™ Architectural Collection at the International Builders’ Show in Florida. The Hardie™ Architectural Collection debuted with a brand-new suite of premium Hardie™ Architectural Panels in distinctive textures inspired by nature. We unveiled these new products in response to several megatrends in the industry, including labor shortages, consumers looking to personalize and modernize their homes, and demand for more sustainable exteriors that offer protection against damage from severe weather. These products extend James Hardie’s portfolio beyond the wood-look category and mark the company’s most significant product expansion to date. According to the U.S. census, 1 in 5 new homes is built using Fiber Cement as its primary cladding. This highlights the significant opportunity ahead of us now that we have the products to compete in the non-wood look category. The Hardie™ Architectural Collection is a significant proof point in our mission to transform the way the world builds and become a premier, consumer branded company. Our intent is to continue to evolve the HardieTM Architectural Collection, and launch even more design-forward exterior options, as we empower homeowners, architects, and homebuilders with endless design possibilities. CLOSING It has been an exciting few months as your Interim CEO, and I could not be more proud of all my colleagues around the world for continuing to deliver excellent financial results. The successful execution of our global strategic plan has allowed James Hardie to deliver strong growth, with global sales up 13% pa and adjusted net income up 27% pa since fiscal year 2019. This step change in financial results has been remarkable. Harold Wiens Interim Chief Exective Officer, Executive Director According to the US census ONE in FIVE New homes are built using Fiber Cement as its primary cladding 8 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 9 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Global Results Summary 10 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 11 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

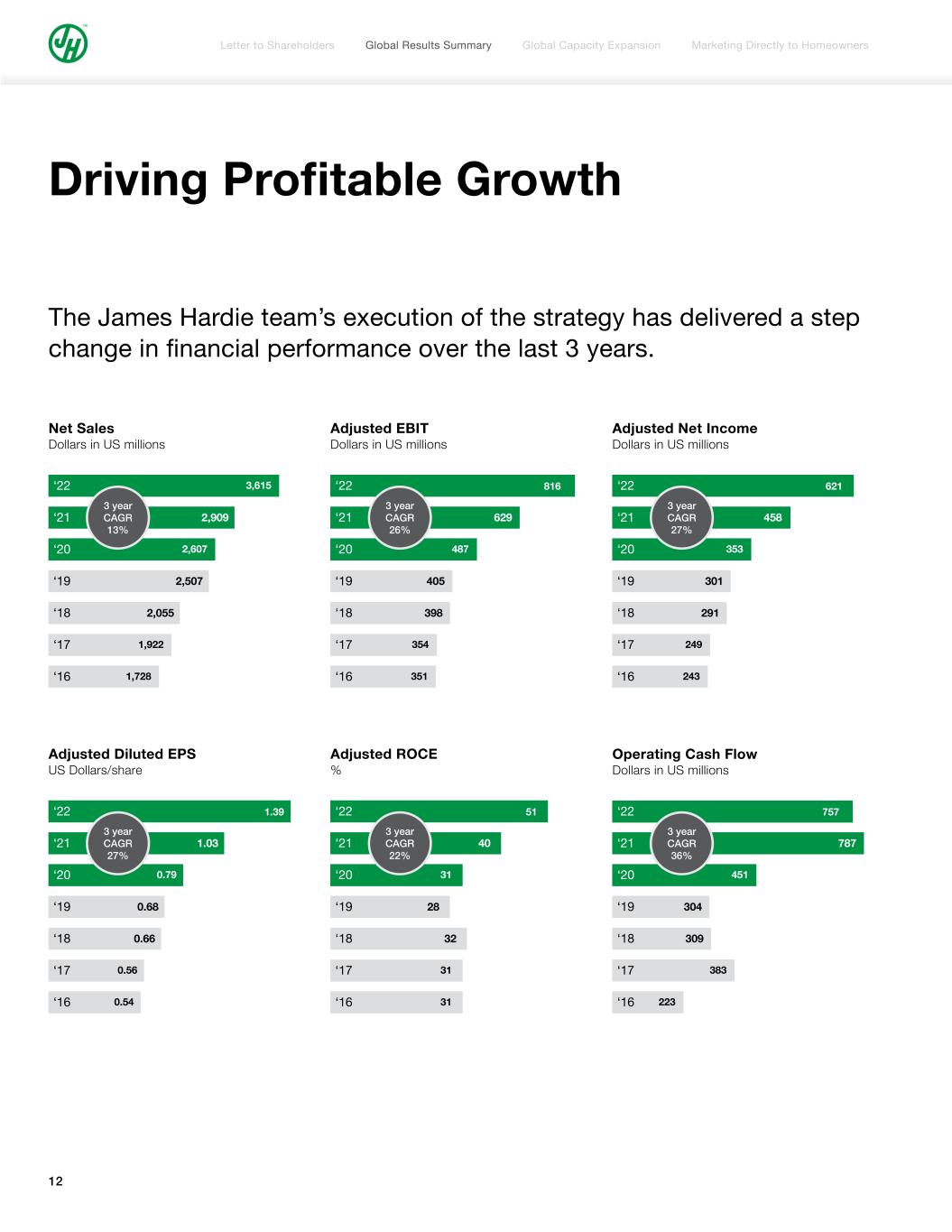

Driving Profitable Growth The James Hardie team’s execution of the strategy has delivered a step change in financial performance over the last 3 years. Adjusted Diluted EPS US Dollars/share ‘22 1.39 1.03 0.79 0.68 0.66 0.56 0.54 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 27% Net Sales Dollars in US millions ‘22 3,615 2,909 2,607 2,507 2,055 1,922 1,728 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 13% Adjusted ROCE % ‘22 51 40 31 28 32 31 31 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 22% Adjusted EBIT Dollars in US millions ‘22 816 629 487 405 398 354 351 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 26% Operating Cash Flow Dollars in US millions ‘22 757 787 451 304 309 383 223 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 36% Adjusted Net Income Dollars in US millions ‘22 621 458 353 301 291 249 243 ‘21 ‘20 ‘19 ‘18 ‘17 ‘16 3 year CAGR 27% 12 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

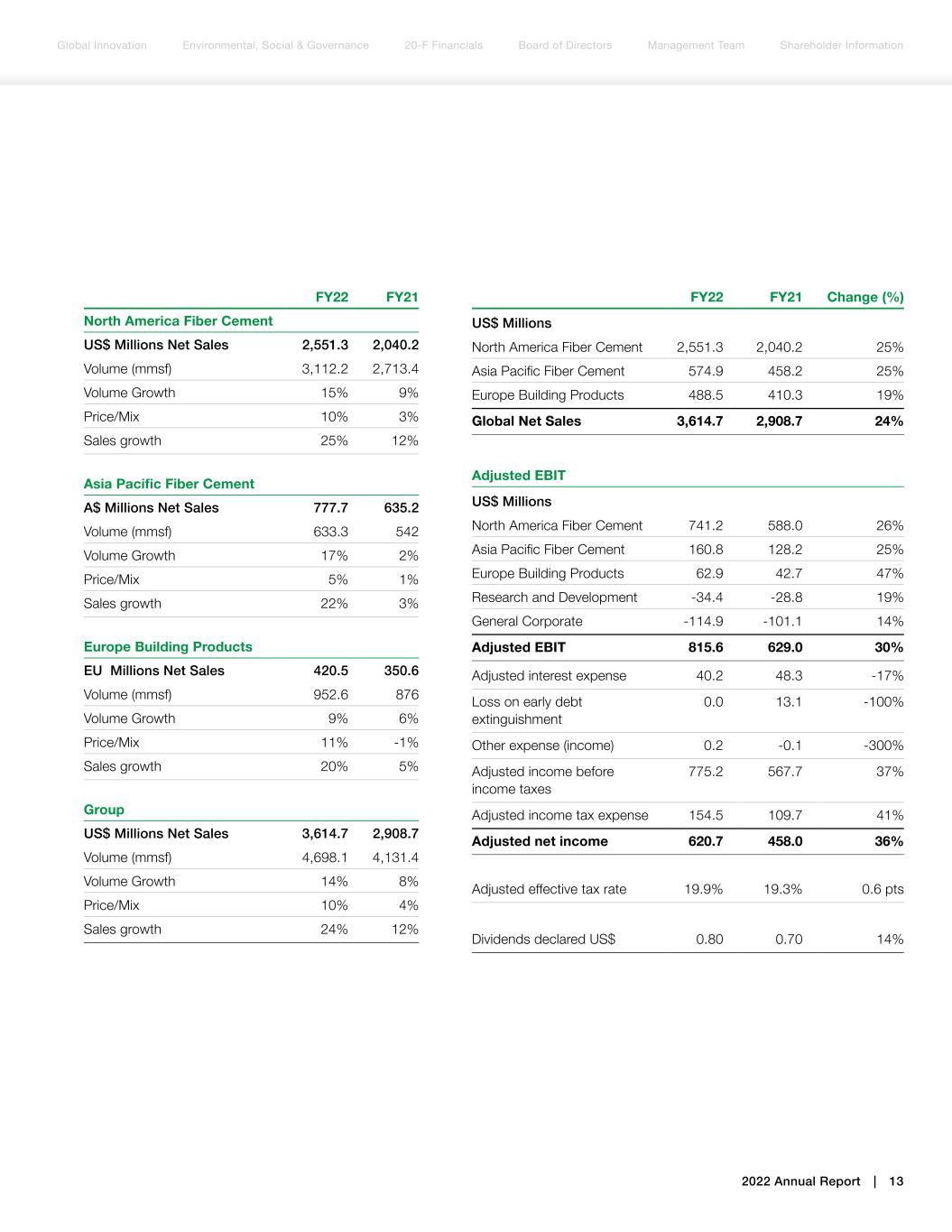

FY22 FY21 North America Fiber Cement US$ Millions Net Sales 2,551.3 2,040.2 Volume (mmsf) 3,112.2 2,713.4 Volume Growth 15% 9% Price/Mix 10% 3% Sales growth 25% 12% Asia Pacific Fiber Cement A$ Millions Net Sales 777.7 635.2 Volume (mmsf) 633.3 542 Volume Growth 17% 2% Price/Mix 5% 1% Sales growth 22% 3% Europe Building Products EU€ Millions Net Sales 420.5 350.6 Volume (mmsf) 952.6 876 Volume Growth 9% 6% Price/Mix 11% -1% Sales growth 20% 5% Group US$ Millions Net Sales 3,614.7 2,908.7 Volume (mmsf) 4,698.1 4,131.4 Volume Growth 14% 8% Price/Mix 10% 4% Sales growth 24% 12% FY22 FY21 Change (%) US$ Millions North America Fiber Cement 2,551.3 2,040.2 25% Asia Pacific Fiber Cement 574.9 458.2 25% Europe Building Products 488.5 410.3 19% Global Net Sales 3,614.7 2,908.7 24% Adjusted EBIT US$ Millions North America Fiber Cement 741.2 588.0 26% Asia Pacific Fiber Cement 160.8 128.2 25% Europe Building Products 62.9 42.7 47% Research and Development -34.4 -28.8 19% General Corporate -114.9 -101.1 14% Adjusted EBIT 815.6 629.0 30% Adjusted interest expense 40.2 48.3 -17% Loss on early debt extinguishment 0.0 13.1 -100% Other expense (income) 0.2 -0.1 -300% Adjusted income before income taxes 775.2 567.7 37% Adjusted income tax expense 154.5 109.7 41% Adjusted net income 620.7 458.0 36% Adjusted effective tax rate 19.9% 19.3% 0.6 pts Dividends declared US$ 0.80 0.70 14% 2022 Annual Report | 13 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

In fiscal year 2022, our North America business has once again delivered exceptional results. By further integrating with our customers and simultaneously marketing directly to homeowners, the James Hardie North America team was able to drive significant market share gains and a higher average selling price, while servicing our customers and the end users seamlessly. In fiscal year 2022, North America sales increased 25%, with volumes up 15% and Price/Mix of 10%. During the fiscal year, our North America volumes increased by 15%, outpacing single family completions, which were up 3%. Our growth above market reflects both market share gains in single family new construction as well as increasing penetration in the repair and remodeling segment. In 2021, the U.S. census estimated that 22% of new homes used fiber cement as its primary cladding. This is up from 9% in 2005. There is long term momentum in the markets’ adoption of fiber cement, underpinned by the desirable characteristics of our substrate, including it being non-combustible, low maintenance, and its curb appeal. Looking forward, we are positively amplifying demand for fiber cement in the market by: 1) marketing directly to the consumer, 2) partnering with customers, and 3) delivering new innovations that take fiber cement beyond our historical focus on the wood-look category. In North America, we sell an increasingly high-value product mix into the repair and remodel and new construction markets. During the year, we improved this product mix by focusing on product with ColorPlus® TechnologyTM sales into the NorthEast and refining our go-to market strategy for backer boards and CemplankTM, to ensure only the right customers were accessing these products. Improving our high-value product mix drove price/mix growth of 10% for fiscal year 2022. Looking forward, we have identified our future state product mix (as shown on the right-hand side page), with the goal of increasing our exposure to high-value products, namely Innovation and product with ColorPlus® Technology.TM Our products enable the homeowner to create the home of their dreams with endless design possibilities. Amongst others, our high-value products include, (i) Hardie® brand planks, panels, trims and soffits, (ii) Hardie® brand planks, panels, trims and soffits with ColorPlus® Technology, and (iii) the recently introduced Hardie® Architectural Collection. This year also saw our network of plants across the U.S. continue to improve under the Hardie Manufacturing Operating System (HMOS), delivering LEAN performance improvements as well as savings. These benefits as well as our execution on product mix were crucial during the high inflationary environment experienced during the year, and allowed us to expand our EBIT margin to 29.1% for fiscal year 2022. Looking forward, all else equal, profitability is expected to improve further as we deliver on our targeted product mix. “Fiscal year 2022 has been another very successful year for the James Hardie North America fiber cement business. This was achieved through our ongoing focus on partnering with our customers, marketing directly to the homeowner and improving our LEAN execution.” Sean Gadd President, North America 14 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion North America Fiber Cement

GROWTH ABOVE MARKET • Net Sales exceeded $2.55 billion in FY22 • Net Sales increased +25% in FY22 • Volumes increased 15% • Price/Mix growth of 10% in FY22 STRONG RETURNS • Adjusted EBIT growth of 26% in FY22; following +25% growth in FY21 • Adjusted EBIT Margin expanded to 29.1% in FY22, up 30 basis points vs FY21 • Adjusted EBITDA Margin expanded to 33.5% in FY22, up 30 basis points vs FY21 Our North America team is focused on delivering Growth Above Market AND Strong Returns. Segment Net Sales % of total JH 70 Net Sales FY19 FY20 1.821.68 FY21 FY22 Dollars in US billions 2.55 2.04 FY21 A FY22 A FY23 PROJECTED FUTURE STATE North America Volume Mix Low End Hardie Brand ColorPlus Innovation Adjusted EBIT FY19 FY20 471388 23.1 FY21 FY22 29.128.8 25.9 741 588 Adjusted EBIT (US$M) Adjusted EBIT margin (%) Core JH Market (%) R&R Other 65-70 Segment Adjusted EBIT1 % of total JH 76 1. ^* of operating EBIT Photo © 2021 Discovery or its subsidiaries and affiliates. All rights reserved. 2022 Annual Report | 15 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

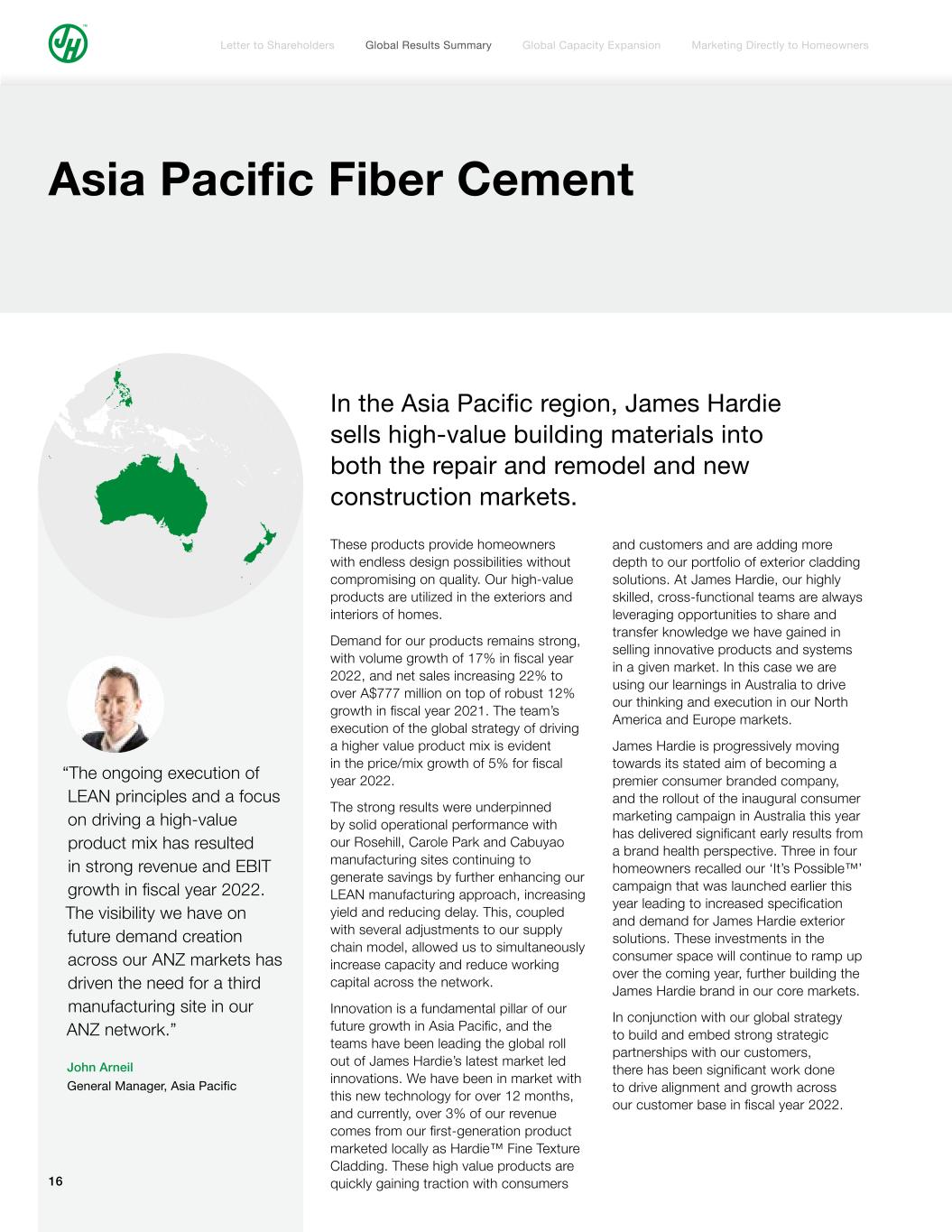

In the Asia Pacific region, James Hardie sells high-value building materials into both the repair and remodel and new construction markets. These products provide homeowners with endless design possibilities without compromising on quality. Our high-value products are utilized in the exteriors and interiors of homes. Demand for our products remains strong, with volume growth of 17% in fiscal year 2022, and net sales increasing 22% to over A$777 million on top of robust 12% growth in fiscal year 2021. The team’s execution of the global strategy of driving a higher value product mix is evident in the price/mix growth of 5% for fiscal year 2022. The strong results were underpinned by solid operational performance with our Rosehill, Carole Park and Cabuyao manufacturing sites continuing to generate savings by further enhancing our LEAN manufacturing approach, increasing yield and reducing delay. This, coupled with several adjustments to our supply chain model, allowed us to simultaneously increase capacity and reduce working capital across the network. Innovation is a fundamental pillar of our future growth in Asia Pacific, and the teams have been leading the global roll out of James Hardie’s latest market led innovations. We have been in market with this new technology for over 12 months, and currently, over 3% of our revenue comes from our first-generation product marketed locally as Hardie™ Fine Texture Cladding. These high value products are quickly gaining traction with consumers and customers and are adding more depth to our portfolio of exterior cladding solutions. At James Hardie, our highly skilled, cross-functional teams are always leveraging opportunities to share and transfer knowledge we have gained in selling innovative products and systems in a given market. In this case we are using our learnings in Australia to drive our thinking and execution in our North America and Europe markets. James Hardie is progressively moving towards its stated aim of becoming a premier consumer branded company, and the rollout of the inaugural consumer marketing campaign in Australia this year has delivered significant early results from a brand health perspective. Three in four homeowners recalled our ‘It’s Possible™’ campaign that was launched earlier this year leading to increased specification and demand for James Hardie exterior solutions. These investments in the consumer space will continue to ramp up over the coming year, further building the James Hardie brand in our core markets. In conjunction with our global strategy to build and embed strong strategic partnerships with our customers, there has been significant work done to drive alignment and growth across our customer base in fiscal year 2022. “The ongoing execution of LEAN principles and a focus on driving a high-value product mix has resulted in strong revenue and EBIT growth in fiscal year 2022. The visibility we have on future demand creation across our ANZ markets has driven the need for a third manufacturing site in our ANZ network.” John Arneil General Manager, Asia Pacific 16 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Asia Pacific Fiber Cement

Segment Adjusted EBIT1 % of total JH 17 Segment Net Sales % of total JH 16 Net Sales FY19 FY20 614612 FY21 FY22 Dollars in AUS millions 778 635 Adjusted EBIT FY19 FY20 139137 22.3 FY21 FY22 28.028.0 22.7 217 177 Adjusted EBIT (AUS$M) Adjusted EBIT margin (%) 1. ^* of operating EBIT In Australia, we have recently retrofitted shipping containers to provide an on-site customer experience which provides further education on James Hardie products to our customers, builders and consumers. We work with our channel partners to identify the right target market, segment and product within their local geographies. From here we then embark on extensive training to ensure our partners are both equipped and capable of capturing the increasing demand for James Hardie products. We are also investing in further integration of our respective supply chains to enable a more efficient market facing approach, getting the right product to the right locations at the right time. Our channel partners also play a key role in launching and driving sales of any new innovative products. We directly invest in demand creation for these new products through our integrated marketing campaigns, while working with our partners to get the new products in store, merchandised correctly and staff trained. The above initiatives have driven a strong result for the James Hardie APAC team in fiscal year 2022 with significant market share gains delivered at an adjusted EBIT margin of 28.0%. Our Asia Pacific team is focused on delivering Growth Above Market AND Strong Returns. STRONG RETURNS • Adjusted EBIT growth of 23% in FY22; following +27% growth in FY21 • Adjusted EBIT margin of 28% in FY22 • Adjusted EBITDA of 30.3% in FY22 GROWTH ABOVE MARKET • Net Sales of A$777.7 million in FY22 • Net Sales increased +22% in FY22 • Volumes increased 17% in FY22 • Price/Mix growth of 5% in FY22 2022 Annual Report | 17 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Europe’s execution on the strategy drove another year of margin expansion. “The Europe business has again delivered a strong finish to the year. Despite unprecedented challenges in the macro environment, our team has diligently and successfully embedded the principles of HMOS into the business, while simultaneously driving greater end-user demand for our high-value products, which has culminated in our strong results.” Jörg Brinkmann General Manager, Europe Our European team’s execution on the high-value product mix strategy drove a 20% increase in Net Sales to over €420 million. This was underpinned by an 11% growth in Price/Mix. This growth in Price/Mix was led by an exceptional 39% increase in fiber cement sales and a 17% increase in fiber gypsum sales. Key to fiber cement sales in fiscal year 2022 was demand for our Hardie VL PlankTM in the UK, France, Germany, Switzerland and Denmark. Hardie® VL Plank comes with a fantastic design for homeowners and architects as well as significant time savings for installers. Strong demand for our products is reflected in volumes lifting by 9% in fiscal year 2022. Momentum in our high-value product mix strategy translated clearly into margin performance. In fiscal year 2022, the team delivered an adjusted EBIT margin of 12.9%, up 250 basis points vs fiscal year 2021 and this was despite the business experiencing elevated levels of inflation in energy prices. The teams adjustments to these market dynamics saw the division achieve a 14.0% EBIT margin in Q4 fiscal year 2022. James Hardie® continues to leverage the Fermacell brand as we increase our market share in the European siding market through fiber cement sales growth. In Europe, we market and sell high-value exterior and interior building materials into the Repair and Remodel, New Construction, and Commercial markets. Our high-value products include Hardie® brand planks, trims and panels with ColorPlus® Technology, Fermacell® brand products utilized in interior wall and flooring applications, and our Aestuver® brand of products focused on fire protection. 18 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Europe Building Products

Segment Adjusted EBIT1 % of total JH 7 Segment Net Sales % of total JH 14 Net Sales FY19 FY20 334318 FY21 FY22 Dollars in € million 421 351 Adjusted EBIT FY19 FY20 14.99.1 2.7 FY21 FY22 12.9 10.4 4.5 54.2 35.9 Adjusted EBIT (€M) Adjusted EBIT margin (%) 1. ^* of operating EBIT Our European team is focused on delivering Growth Above Market AND Strong Returns. GROWTH ABOVE MARKET • Net Sales exceeded €420 million in FY22 • Net Sales increased +20% in FY22 • Volumes increased 9% in FY22, Price/Mix growth of 11% in FY22 • Fiber Cement Net Sales increased +39% in FY22 • Fiber Gypsum Net Sales increased +17% in FY22 STRONG RETURNS • Adjusted EBIT growth of 51% in FY22 • Adjusted EBIT Margin of 12.9% in FY22, up 250 basis points vs FY21 • Adjusted EBITDA Margin of 19.0% in FY22, up 190 basis points vs FY21 2022 Annual Report | 19 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Global Capacity Expansion Prattville, Alabama 20 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 21 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

As a high performance, global company, we expect to deliver growth above market and strong returns in all three of the regions we operate in. INVESTMENT IN CAPACITY EXPANSION FY23-26 US$1.6-1.8 billion “As we drive profitable growth in new and existing segments, it is imperative that we regularly add capacity to ensure supply is keeping ahead of demand. Our global capacity expansion program is an integrated plan that will ensure we take a standardised approach to new developments, which seeks to shorten the duration of developments and ramp ups.” Ryan Kilcullen Executive Vice President, Global Operations NORTH AMERICA CAPACITY EXPANSION In fiscal year 2022, two new sources of capacity commenced. Firstly, in Prattville, Alabama, Sheet Machines 1 and 2 will add 600 million standard feet of nameplate production to our North American network once fully ramped up later in fiscal year 2023. Secondly, the restart of our Summerville facility in South Carolina began in late fiscal year 2022, which will add 190 million standard feet of nameplate at the end add “once fully ramped up later in fiscal year 2023. We are also adding additional ColorPlus® Technology finishing capacity in Massachusetts, which will be key to our long term product mix goals as we penetrate the repair and remodel segment. This finishing capacity is expected to start ramping up in the fourth quarter of fiscal year 2023. And, as we continue to ramp up sheet machines 1 and 2 in Prattville, we are implementing plans to double its capacity to 1.2 billion standard feet with the addition of Sheet Machines 3 and 4. Start-up is expected in the third quarter of fiscal year 2024. Beyond this, we are planning for a greenfield expansion in the U.S. to continue bolstering supply ahead of anticipated growing demand for our high-performance products. A location for this site is expected to be announced in fiscal year 2023 and its commissioning is planned for fiscal year 2026. 22 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Global Capacity Expansion

APAC CAPACITY EXPANSION In late fiscal year 2022, we announced that James Hardie had entered into an agreement to purchase land in Melbourne, Australia, which will be the location for our third Australian operating site. As we continue our strategic focus on marketing directly to the homeowner and commercializing market-led innovations, this site will help us to not only meet growing demand in Australia and New Zealand, but enable the manufacturing of new innovations and existing high-value products. Additionally, in Australia, we will build brownfield capacity at our Carole Park facility in Brisbane, Australia, with start up expected in the fourth quarter of fiscal year 2023. EUROPE CAPACITY EXPANSION In Europe, we have additional brownfield fiber gypsum capacity planned at our site in Orejo, Spain, which is scheduled to be commissioned in fiscal year 2026. Similar to North America and Asia Pacific, we are planning to add our first fiber cement manufacturing capacity on continental Europe. We look forward to announcing a location in fiscal year 2023 ahead of commission in fiscal year 2026. North America FY26 planned capacity 5,826 mmsf ^ 26% from FY22 ^ 49% from FY22 APAC FY26 planned capacity 911 mmsf Europe FY26 planned capacity 1,736 mmsf ^ 47% from FY22 2022 Annual Report | 23 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

24 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Marketing Directly to Homeowners

2022 Annual Report | 25 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

“The evolution of James Hardie as a consumer brand, marketing directly to homeowners, continues to gain traction. The It’s Possible™ marketing campaign is resonating with homeowners, inspiring them to achieve their aspirational home with James Hardie products. This demand creation allows us to have richer engagement with homeowners, providing deeper insights into their attitudes, habits, and behaviors, enabling James Hardie to fulfill our promise of providing endless possibilities so homeowners can achieve their dream home exterior.” Atousa Ghoreichi Senior Vice President, North America Marketing, PR, and Communications THE HOMEOWNER: MEET CHRISTINE Hardie® products have been in the market for many years, and our knowledge with channel partners, installers, specifiers and architects has led to a strong brand within the industry. As we move towards extending our brand beyond our existing trade audience to become a premier consumer branded company, we are shifting our center of attention towards the homeowner. More specifically, the female homeowner, whom we have personified as ‘Christine’. Our insights reveal Christine is the key decision maker when it comes to the design and aesthetics of both the interior and the exterior of the home. Our goal is to have female design-oriented homeowners seek out James Hardie early in the re-side or remodel process, or aspire to incorporate Hardie® products in their future home plans, maintaining a focus on the exterior throughout the process. Building the Brand, Driving Demand. OUR FOUR PILLARS INSPIRE Application: James Hardie’s portfolio of products brings your dream home to life with endless design possibilities. How this comes to life: Inspirational and achievable examples that showcase James Hardie’s ability to create homes that are uniquely beautiful. ENABLE AND EMPOWER Application: Hardie® products are the only choice for trusted protection and long-lasting beauty. How this comes to life: By humanizing our value propositions with innovative, real-world performance examples. COMMUNITIES Application: James Hardie makes life better locally and globally, benefitting our communities and the environment. How this comes to life: From innovation that builds stronger communities to sustainability, James Hardie is invested in the common good. OUR PEOPLE Application: Stories from the people behind the brand and products at James Hardie. How this comes to life: Company news and performance, thought leadership, and our inclusive and diverse global culture. 26 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Marketing Directly to Homeowners

360 INTEGRATED MARKETING CAMPAIGN Ho m eo wner is at the center of our attention W ith James Hardie, It’s Possib le .T M A M PL IF IC ATION P U R C HASE CONSID ERATI O N AWARENESS We aim to fulfil Christine’s unmet needs and ultimately accelerate the purchase cycle. Now that we have identified our global prime target, we are communicating to Christine with a 360 degree, 24/7 integrated marketing campaign, showcasing the value that James Hardie can offer so she can confidently choose and demand our products for her home. As the global leader of fiber cement exterior solutions, James Hardie has a unique, ownable position that combines the best functional benefits with endless design possibilities. Our wide range of premium exterior solutions provides the flexibility for her to reflect her design preferences, from traditional to modern home styles. We will continue to direct Christine to high value products like ColorPlus® Technology in North America, as well as our future innovations, to show her how we can make her personal vision for her home a reality. Awareness: At the awareness phase, we will introduce her to the James Hardie brand with a deliberate focus to elevate the role the exterior plays in delivering curb appeal. We do this by leveraging broad-reaching media channels. Consideration: We are using targeted digital platforms, including our own websites and an ecosystem of influencers and social channels to prove that only James Hardie can fully empower her to bring her vision to life. Purchase: We are aiding Christine with planning her project by equipping her with the tools and information she needs to make final design and contractor selection. Amplification: We want to encourage her to share the unique vision she has built and achieved with her family, friends, and peer group set. 3 KEY MARKETING METRICS FROM 3 TARGET AREAS IN THE NORTHEAST IN FISCAL YEAR 2022 This past year has seen the various components of the It’s Possible campaign develop traction across several key initiatives, including: +505% Year on year New User web sessions 1.4 million +209% Year on year Marketing leads 33 thousand +102% Year on year Sales leads 6 thousand 2022 Annual Report | 27 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Global Innovation 28 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 29 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

“As James Hardie transitions to become a consumer brand, we are gaining richer insights to better understand the homeowners and the markets where we can successfully commercialize new products that provide more design opportunities. The Hardie™ Architectural Collection is a significant example of this and our mission to transform the way the world builds.” Dr. Joe Liu Chief Technology Officer James Hardie is driven by innovation. We focus on market driven insights to deliver high-impact new products that address homeowners’ unmet needs and drive profitable organic growth. We focus on megatrends in the market and conduct in depth discovery and testing with homeowners to generate insights. We take these insights and prioritize product concepts that truly deliver on unfulfilled market needs and create value for all of our stakeholders including homeowners, customers, community, employees and shareholders. We leverage our global scale, know-how and collaborations with our world class research and development talents in our three innovation centers in north America, Asia Pacific and Europe. Our focus on innovation will allow us to transform the way the world builds. We create innovative products that provide superior performance, durability, low maintenance and non-combustibility, while also improving labor productivity for the installers and the builders. By combining these qualities the market has come to expect from James Hardie fiber cement products with lasting beauty and endless design possibilities, we believe that James Hardie can deliver both the ‘peace of mind’ protection homeowners need with the cutting edge design they want. In January 2022, James Hardie appointed Dr. Joe Liu as Chief Technology Officer. Dr. Liu joined James Hardie after an impressive 26-year career with 3M Company, where he held a variety of research & development, commercial and international management roles of increasing responsibility over the course of his career. His experience commercializing innovations based on insights regarding the end consumer is the perfect fit for our innovation strategy at James Hardie. Pictured: James Hardie booth at the International Builders’ Show in Florida in February 2022. 30 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Transforming the way the World Builds

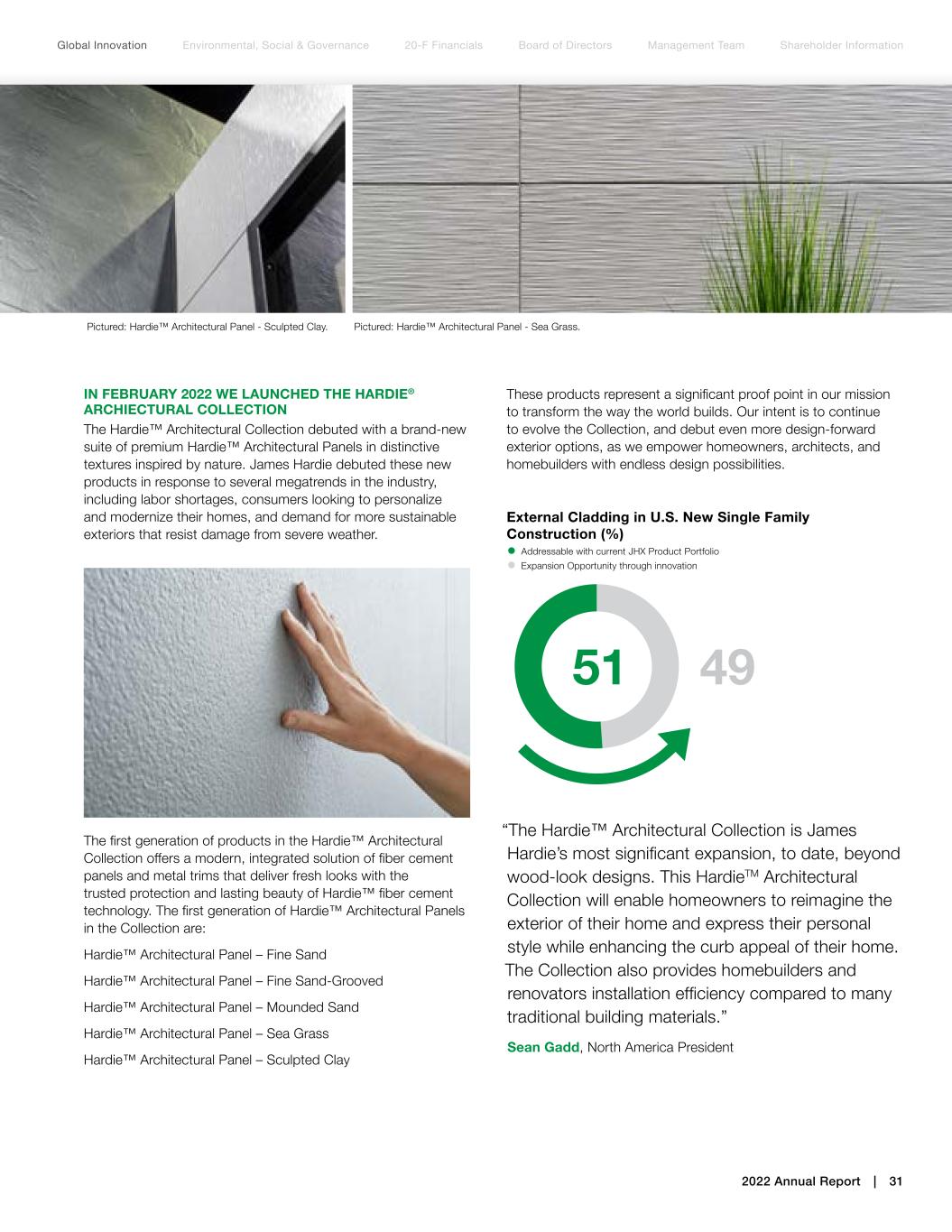

IN FEBRUARY 2022 WE LAUNCHED THE HARDIE® ARCHIECTURAL COLLECTION The Hardie™ Architectural Collection debuted with a brand-new suite of premium Hardie™ Architectural Panels in distinctive textures inspired by nature. James Hardie debuted these new products in response to several megatrends in the industry, including labor shortages, consumers looking to personalize and modernize their homes, and demand for more sustainable exteriors that resist damage from severe weather. The first generation of products in the Hardie™ Architectural Collection offers a modern, integrated solution of fiber cement panels and metal trims that deliver fresh looks with the trusted protection and lasting beauty of Hardie™ fiber cement technology. The first generation of Hardie™ Architectural Panels in the Collection are: Hardie™ Architectural Panel – Fine Sand Hardie™ Architectural Panel – Fine Sand-Grooved Hardie™ Architectural Panel – Mounded Sand Hardie™ Architectural Panel – Sea Grass Hardie™ Architectural Panel – Sculpted Clay These products represent a significant proof point in our mission to transform the way the world builds. Our intent is to continue to evolve the Collection, and debut even more design-forward exterior options, as we empower homeowners, architects, and homebuilders with endless design possibilities. “The Hardie™ Architectural Collection is James Hardie’s most significant expansion, to date, beyond wood-look designs. This HardieTM Architectural Collection will enable homeowners to reimagine the exterior of their home and express their personal style while enhancing the curb appeal of their home. The Collection also provides homebuilders and renovators installation efficiency compared to many traditional building materials.” Sean Gadd, North America President External Cladding in U.S. New Single Family Construction (%) Addressable with current JHX Product Portfolio Expansion Opportunity through innovation 51 49 Pictured: Hardie™ Architectural Panel - Sea Grass.Pictured: Hardie™ Architectural Panel - Sculpted Clay. 2022 Annual Report | 31 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Environmental, Social & Governance 32 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

Environmental, Social & Governance 2022 Annual Report | 33 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

“James Hardie is changing the way the world builds by providing homeowners with beautiful building products that are resource efficient and provide the foundation for resilient and sustainable communities. I am very excited for our future and the opportunity to further convert our strategic vision into tangible benefits for all of our stakeholders. Our 5,000 employees around the world are all committed to Building Sustainable Communities.” Jill Kolling - Vice President ESG and Chief Sustainability Officer In fiscal year 2022, James Hardie strengthened its investment in ESG by building internal capability and expertize, and by taking action to deliver progress against our goals. The Fiscal Year 2021 Sustainability Report can be found here, https://ir.jameshardie.com. au/esg/sustainability. It covers our sustainability performance progress for fiscal year 2021 across our global operations and also highlights our future priorities. As our sustainability program progresses, we are committed to aligning with best-practice reporting standards and frameworks, including those set forth by Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Building on our credentials in ESG, in March of 2022, James Hardie appointed its first Chief Sustainability Officer, Jill Kolling, Vice President ESG and Chief Sustainability Officer. James Hardie looks forward to providing a detailed update on its ESG goals and performance metrics in the Sustainability Report for fiscal year 2022 due to be published in our second quarter of fiscal year 2023. Building Sustainable Communities OUR PILLARS COMMUNITIES With a global mindset, we carefully manage our business impact by employing, sourcing, delivering, and giving locally. INNOVATION We are committed to transforming new technologies into high-quality and sustainable products, solutions, and building practices. ENVIRONMENT We seek to minimize our impact on the environment, and we prioritize the management of water, waste, energy, and emissions. ZERO HARM With our Zero Harm culture, we seek to ensure the safety of our products, employees, partners, customers, and communities. 34 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

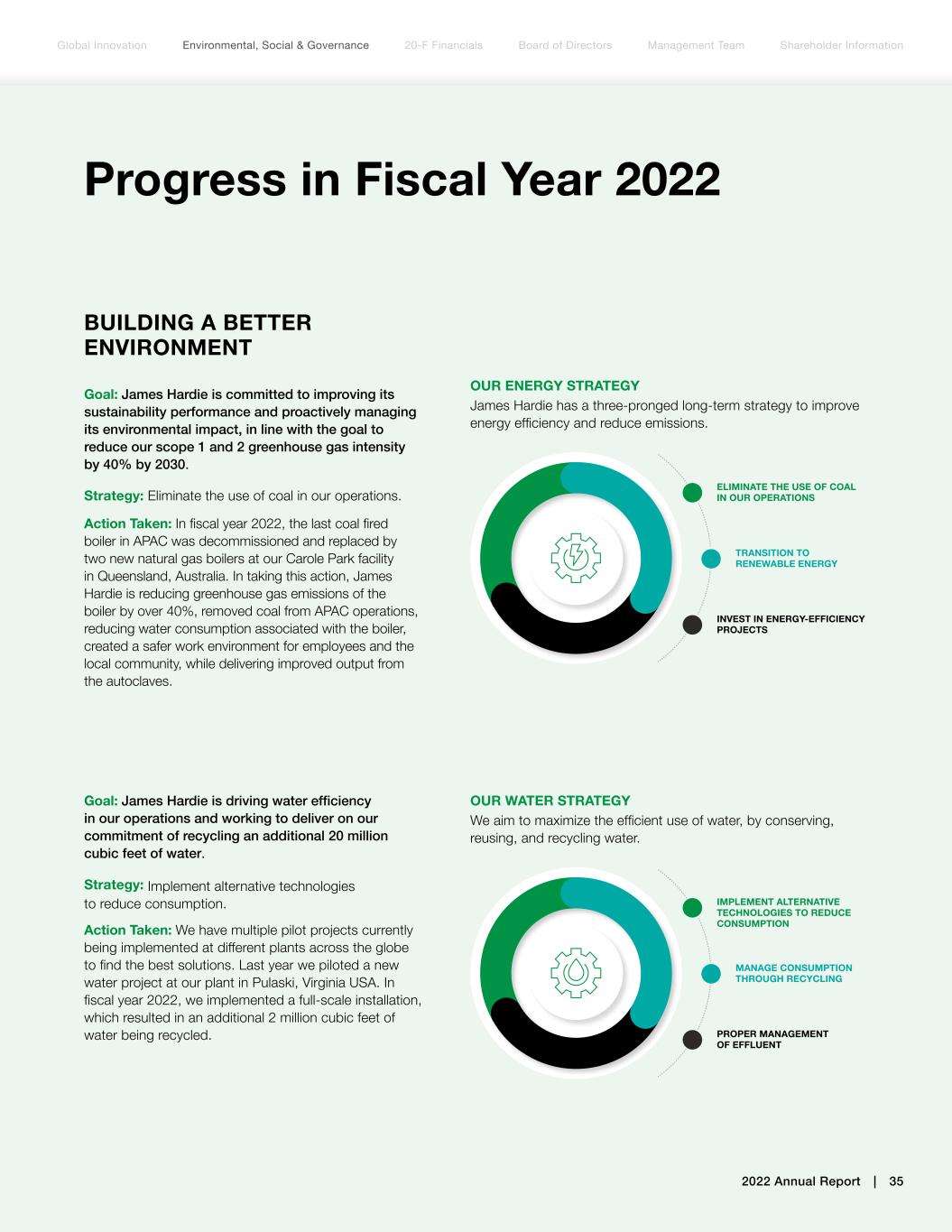

Progress in Fiscal Year 2022 Goal: James Hardie is committed to improving its sustainability performance and proactively managing its environmental impact, in line with the goal to reduce our scope 1 and 2 greenhouse gas intensity by 40% by 2030. Strategy: Eliminate the use of coal in our operations. Action Taken: In fiscal year 2022, the last coal fired boiler in APAC was decommissioned and replaced by two new natural gas boilers at our Carole Park facility in Queensland, Australia. In taking this action, James Hardie is reducing greenhouse gas emissions of the boiler by over 40%, removed coal from APAC operations, reducing water consumption associated with the boiler, created a safer work environment for employees and the local community, while delivering improved output from the autoclaves. Goal: James Hardie is driving water efficiency in our operations and working to deliver on our commitment of recycling an additional 20 million cubic feet of water. Strategy: Implement alternative technologies to reduce consumption. Action Taken: We have multiple pilot projects currently being implemented at different plants across the globe to find the best solutions. Last year we piloted a new water project at our plant in Pulaski, Virginia USA. In fiscal year 2022, we implemented a full-scale installation, which resulted in an additional 2 million cubic feet of water being recycled. OUR WATER STRATEGY We aim to maximize the efficient use of water, by conserving, reusing, and recycling water. IMPLEMENT ALTERNATIVE TECHNOLOGIES TO REDUCE CONSUMPTION MANAGE CONSUMPTION THROUGH RECYCLING PROPER MANAGEMENT OF EFFLUENT OUR ENERGY STRATEGY James Hardie has a three-pronged long-term strategy to improve energy efficiency and reduce emissions. ELIMINATE THE USE OF COAL IN OUR OPERATIONS TRANSITION TO RENEWABLE ENERGY INVEST IN ENERGY-EFFICIENCY PROJECTS BUILDING A BETTER ENVIRONMENT 2022 Annual Report | 35 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

Financial Endnotes Unless otherwise stated all items are in U.S. currency and financial information relates to fiscal year ended 31 March 2022. NON-GAAP FINANCIAL INFORMATION Pages 1-35 of this Annual Report contain financial measures that are not considered a measure of financial performance under US GAAP and should not be considered to be more meaningful than the equivalent US GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with US GAAP, may not be reported by all of James Hardie’s competitors and may not be directly comparable to similarly titled measures of James Hardie’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non- GAAP financial measures presented in this Annual Report, including a reconciliation of each non-GAAP financial measure to the equivalent US GAAP measure, see the section titled “Glossary of Abbreviations and Definitions” in James Hardie’s Annual Report Form 20-F for the year ended 31 March 2022. FORWARD-LOOKING STATEMENTS Certain statements in this Annual Report may constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. James Hardie uses such words as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. Forward-looking statements are based on James Hardie’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this Annual Report, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2022; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business, including the effect and consequences of the novel coronavirus public health crisis; changes in interest rates, changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. These forward- looking statements are made as of the date of this Annual Report and James Hardie does not assume any obligation to update them, except as required by law. Investors are encouraged to review James Hardie’s Annual Report on Form 20-F, and specifically the risk factors discussed therein, as it contains important disclosures regarding the risks attendant to investing in our securities. 36 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 37 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

20-F Financials Page references within the following 20-F Financials refer only to this financial doccument. 38 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

2022 Annual Report | 39 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

ANNUAL REPORT ON FORM 20-F FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION ON MAY 17, 2022 INCORPORATED BY REFERENCE HEREIN

Securities registered or to be registered pursuant to Section 12(g) of the Act. None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: 445,348,933 shares of common stock at 31 March 2022 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No Note — Checking the box will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐ If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐ † The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after 5 April 2012. Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☒ Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. GAAP ☒ International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ Other ☐ If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ☐ Item 17 ☐ Item 18 If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Michael Hammes was elected as an independent non-executive director in February 2007. He was appointed Chairman of the Board in January 2008 and Executive Chairman in January 2022. MICHAEL HAMMES (BS, MBA) Executive Chairman Rada Rodriguez was appointed as an independent non-executive director in November 2018. She is a member of the Nominating and Governance Committee, and the Remuneration Committee. RADA RODRIGUEZ (MSC) Non-executive Director Nigel Stein was appointed as an independent non-executive director in May 2020. He is Chairman of the Nomination and Governance Committee and a member of the Audit Committee. NIGEL STEIN (CA, BSC) Non-executive Director Anne Lloyd was appointed as an independent non-executive director in November 2018, and became the Lead Independent Director in January 2022. She is a member of the Remuneration Committee and Chair of the Audit Committee. ANNE LLOYD (BS) Lead Independent Director Suzanne Rowland was appointed as an independent non-executive director in February 2021. She is a member of the Audit Committee and the Remuneration Committee. SUZANNE ROWLAND (MS, BS) Non-executive Director Persio Lisboa was appointed as an independent non-executive director in February 2018. He is Chairman of the Remuneration Committee and a member of the Nominating and Governance Committee. PERSIO LISBOA (BS) Non-executive Director Board of Directors James Hardie’s directors have widespread experience, spanning general management, innovation, finance, manufacturing, marketing, and accounting. 242 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

Harold Wiens was appointed Interim CEO of James Hardie in January 2022. He remains a member of the Board of Directors. HAROLD WIENS (BS) Interim CEO Management Team Our management team covers the key areas of general management, commercial marketing, innovation, manufacturing and operations, finance, human resources, and legal. Ryan Kilcullen joined James Hardie in 2007 and was appointed Senior Vice President, Supply Chain Operations in November 2020 with responsibility for the company’s production planning, procurement and logistics operations. He was appointed Executive Vice President, Global Operations in January 2022 and is overseeing the global capacity expansion program. RYAN KILCULLEN (BSC, MS) Executive Vice President, Global Operations John Arneil joined James Hardie in 2002 and was appointed Country Manager, Australia in 2018. He is responsible for running the company’s Australian activities, which are headquartered in Sydney, Australia. JOHN ARNEIL General Manager, Asia Pacific Bob Stefansic joined James Hardie in July 2020 as Executive Vice President, North America, End to End Supply Chain with responsibility for driving operational efficiencies and improvements across the supply chain, with emphasis on delivering business value via the Hardie Manufacturing Operating System. In early 2022, he took the position of Interim Chief Human Resources Officer. BOB STEFANSIC Interim CHRO Sean Gadd joined James Hardie in 2004 and was appointed Executive Vice President, North America Commercial in December 2018 with responsibility for sales, products, segments and marketing. He was appointed North America President in January 2022. SEAN GADD (BENG, MBA) President, North America Joe Blasko joined James Hardie as General Counsel and Chief Compliance Officer in June 2011 and was appointed Company Secretary in June 2020. Mr. Blasko has responsibility for the company’s legal and regulatory compliance, corporate governance, enterprise risk management, corporate security, and government relations. JOE BLASKO (BSFS, JD) General Counsel, Chief Compliance Officer and Company Secretary Dr. Jörg Brinkmann joined James Hardie in April 2018 as part of the Fermacell acquisition. He is responsible for running the company’s European activities, which are headquartered in Düsseldorf, Germany. JÖRG BRINKMANN (MS, PHD) General Manager, Europe Dr. Joe Liu joined James Hardie as Senior Vice President and General Manager, Asia Pacific , in December 2021 and was appointed Chief Technology Officer in January 2022. Before joining James Hardie, Dr. Liu concluded an impressive 26-year career with 3M Company, where he held a variety of R&D, Commercial and International Management roles. DR. JOE LIU (BS, PHD) Chief Technology Officer James Johnson II joined James Hardie as Chief Information Officer (CIO) in December 2021. He is responsible for all aspects of information technology and cyber security globally, and will drive a focused IT vision and strategy. JAMES JOHNSON II (BA, MBA) Chief Information Officer Jason Miele joined James Hardie in 2007 and was appointed as CFO in February 2020. As CFO he oversees the company’s overall financial activities, including accounting, tax, treasury, performance and competitor analysis, internal audit, financial operations, information systems, and investor and media relations. JASON MIELE (BA) Chief Financial Officer 2022 Annual Report | 243 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

244 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion Shareholder Information

2022 Annual Report | 245 20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

2022 Key dates and calendar 1 17 May FY22 Fourth Quarter and Full Year results and management presentation 12-13 September Global Investor Day 16 August FY23 First Quarter results and management presentation 8 November FY23 Second Quarter and Half-Year results and management presentation 1. AUS time and future dates are indicative only and are subject to change. Annual General Meeting (AGM) Details of the 2022 AGM of James Hardie Industries plc will be set out in the Notice of Annual General Meeting 2022. Corporate Headquarters Europa House, 2nd Floor Harcourt Centre (Block 9) Harcourt Street, Dublin 2, D02 WR20, Ireland Telephone +353 1 411 6924 Facsimile +353 1 479 1128 Shareholder Information Share/Cufs Registry James Hardie Industries plc’s registry is managed by Computershare. All enquiries and correspondence regarding holdings should be directed to: Computershare Investor Services Pty Ltd Level 5, 115 Grenfell Street Adelaide SA 5000 Or GPO Box 2975 Melbourne VIC 3001 Telephone within Australia: 1300 850 505 Telephone outside Australia: +61 (0) 3 9415 4000 Website: www.computershare.com James Hardie Industries plc (ARBN 097 829 895) Incorporated in Ireland with its registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland and registered number 485719. The liability of its members is limited. ™ or ® denotes a trademark or Registered mark owned by James Hardie Technology Ltd. 246 Marketing Directly to HomeownersLetter to Shareholders Global Results Summary Global Capacity Expansion

20-F Financials Board of Directors Management TeamGlobal Innovation Environmental, Social & Governance Shareholder Information

2022 Annual Report jameshardie.com © 2022 James Hardie Building Products Inc. All Rights Reserved. TM, SM, and ® denote trademarks or registered trademarks of James Hardie Technology Limited. HS2218 05/22