Q1 FY23 MANAGEMENT PRESENTATION 16 August 2022

Page 2 James Hardie Q1 FY23 Results CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward‐looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20‐F and 6‐K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward‐looking statements but are not the exclusive means of identifying such statements. These forward‐looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward‐ looking statements. Forward‐looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20‐F for the year ended 31 March 2022; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID‐19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on‐going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non‐GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non‐GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non‐GAAP financial measures for the same purposes. However, these non‐GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non‐GAAP financial measures presented in this Management Presentation, including a reconciliation of each non‐GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non‐GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross‐reference from the non‐GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Consolidated Financial Statements. See the section titled “Non‐GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS USE OF NON‐GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

Page 3 James Hardie Q1 FY23 Results AGENDA • Strategy Update • Q1 FY23 Financial Results • North America Update • Capital Allocation, Capacity Expansion & Guidance • Questions and Answers Harold Wiens Interim CEO Jason Miele CFO Sean Gadd North America President

Page 4 James Hardie Q1 FY23 Results JAMES HARDIE TO HOST GLOBAL INVESTOR DAY When:Monday and Tuesday, 12‐13 September Where: Ziegfeld Ballroom, New York City Registration link HERE Who: James Hardie leadership, key customers and partners Key topics • Strategy • Markets • Customer integration and engagement • Marketing to the Homeowner • Innovation • APAC • Europe • ESG

STRATEGY UPDATE

Page 6 James Hardie Q1 FY23 Results STRATEGY IS UNCHANGED AND CONTINUES TO DRIVE PROFITABLE GLOBAL GROWTH Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG

Page 7 James Hardie Q1 FY23 Results ADJUSTING IN AN UNCERTAIN MARKET United Kingdom NSW, Australia The current Macro‐economic environment: • Has significantly increased input costs and freight costs in FY23 • Is creating uncertainty for the housing sector in all three regions James Hardie: • Remains Financially strong • Has a management team with proven ‘uncertain market’ experience • Continues to invest in growth We are preparing for all scenarios, and: 1. Deliver strong results throughout, AND 2. Accelerate and expand our competitive advantages

Q1 FY23 FINANCIAL RESULTS

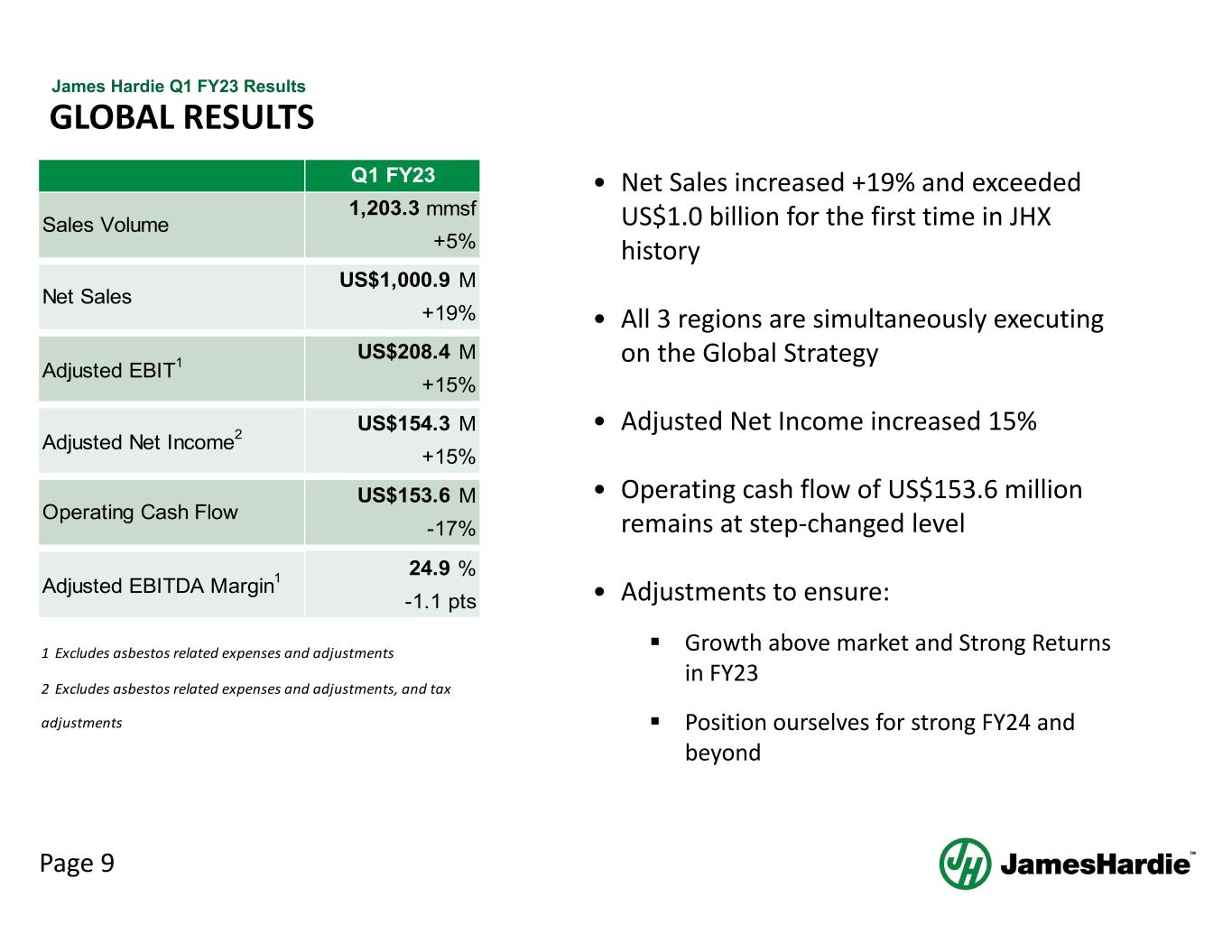

Page 9 James Hardie Q1 FY23 Results • Net Sales increased +19% and exceeded US$1.0 billion for the first time in JHX history • All 3 regions are simultaneously executing on the Global Strategy • Adjusted Net Income increased 15% • Operating cash flow of US$153.6 million remains at step‐changed level • Adjustments to ensure: Growth above market and Strong Returns in FY23 Position ourselves for strong FY24 and beyond GLOBAL RESULTS M M M M % US$153.6 -17% -1.1 pts 24.9 +15% US$154.3 +15% Operating Cash Flow Adjusted Net Income2 Adjusted EBIT1 Sales Volume Net Sales Q1 FY23 1,203.3 2 Excludes asbestos related expenses and adjustments, and tax adjustments 1 Excludes asbestos related expenses and adjustments mmsf +5% US$1,000.9 +19% Adjusted EBITDA Margin1 US$208.4

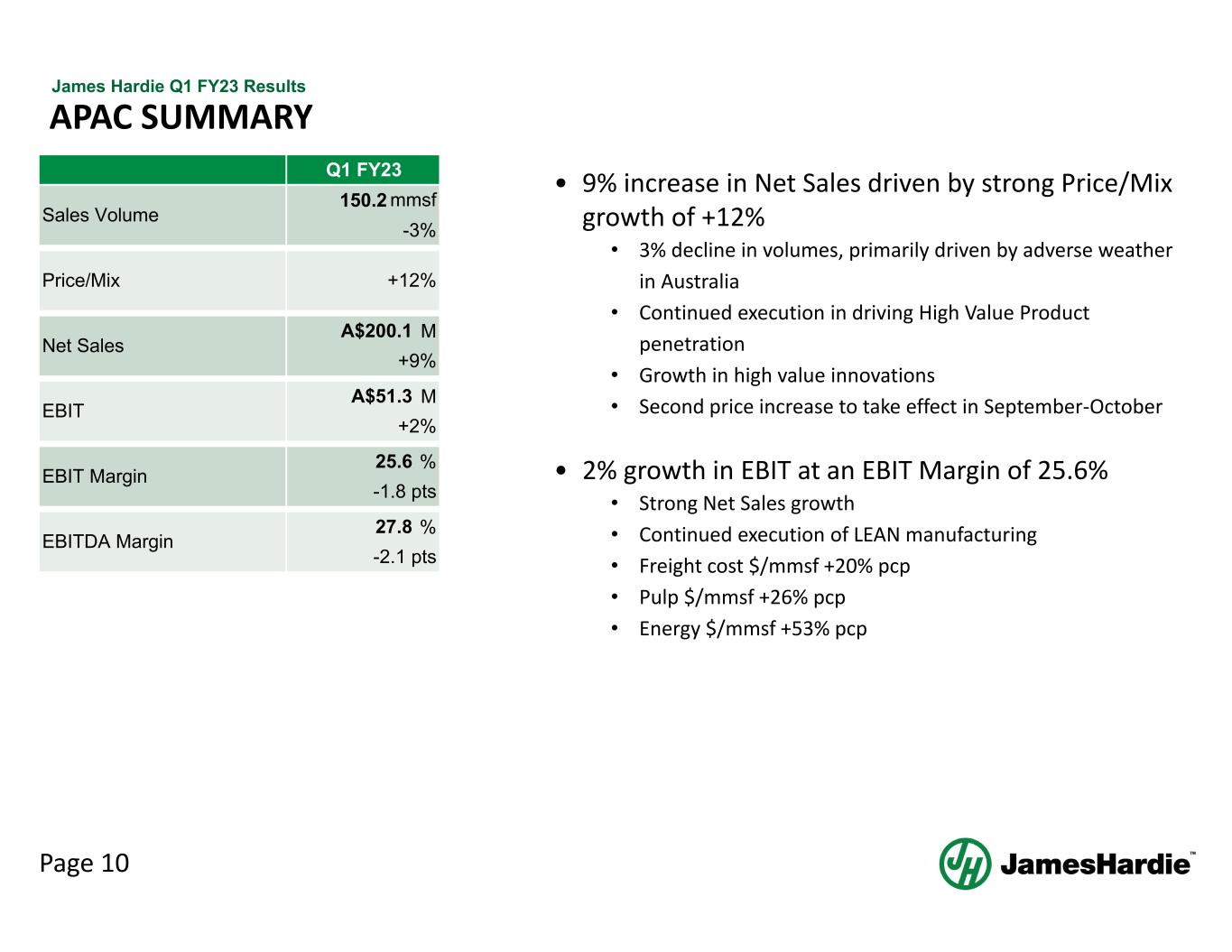

Page 10 James Hardie Q1 FY23 Results APAC SUMMARY • 9% increase in Net Sales driven by strong Price/Mix growth of +12% • 3% decline in volumes, primarily driven by adverse weather in Australia • Continued execution in driving High Value Product penetration • Growth in high value innovations • Second price increase to take effect in September‐October • 2% growth in EBIT at an EBIT Margin of 25.6% • Strong Net Sales growth • Continued execution of LEAN manufacturing • Freight cost $/mmsf +20% pcp • Pulp $/mmsf +26% pcp • Energy $/mmsf +53% pcp M M % % Q1 FY23 -3% EBIT Margin 25.6 Price/Mix -1.8 pts +12% EBIT A$51.3 +2% Net Sales A$200.1 +9% Sales Volume 150.2 mmsf 27.8 EBITDA Margin -2.1 pts

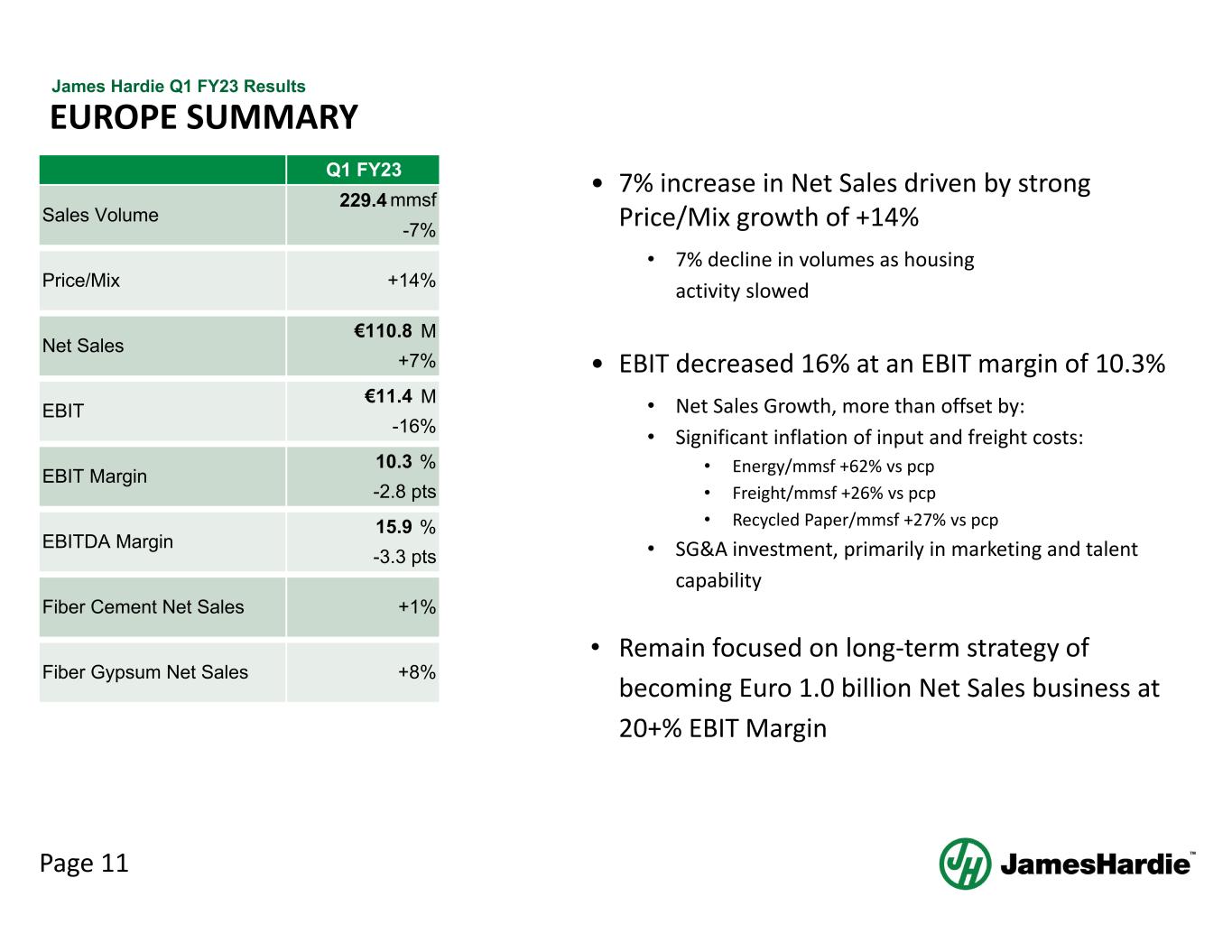

Page 11 James Hardie Q1 FY23 Results EUROPE SUMMARY • 7% increase in Net Sales driven by strong Price/Mix growth of +14% • 7% decline in volumes as housing activity slowed • EBIT decreased 16% at an EBIT margin of 10.3% • Net Sales Growth, more than offset by: • Significant inflation of input and freight costs: • Energy/mmsf +62% vs pcp • Freight/mmsf +26% vs pcp • Recycled Paper/mmsf +27% vs pcp • SG&A investment, primarily in marketing and talent capability • Remain focused on long‐term strategy of becoming Euro 1.0 billion Net Sales business at 20+% EBIT Margin M M % % Net Sales +7% €110.8 +14% EBITDA Margin 15.9 -3.3 pts EBIT EBIT Margin 10.3 Price/Mix Q1 FY23 Sales Volume 229.4 mmsf -7% Fiber Gypsum Net Sales Fiber Cement Net Sales +1% +8% -2.8 pts €11.4 -16%

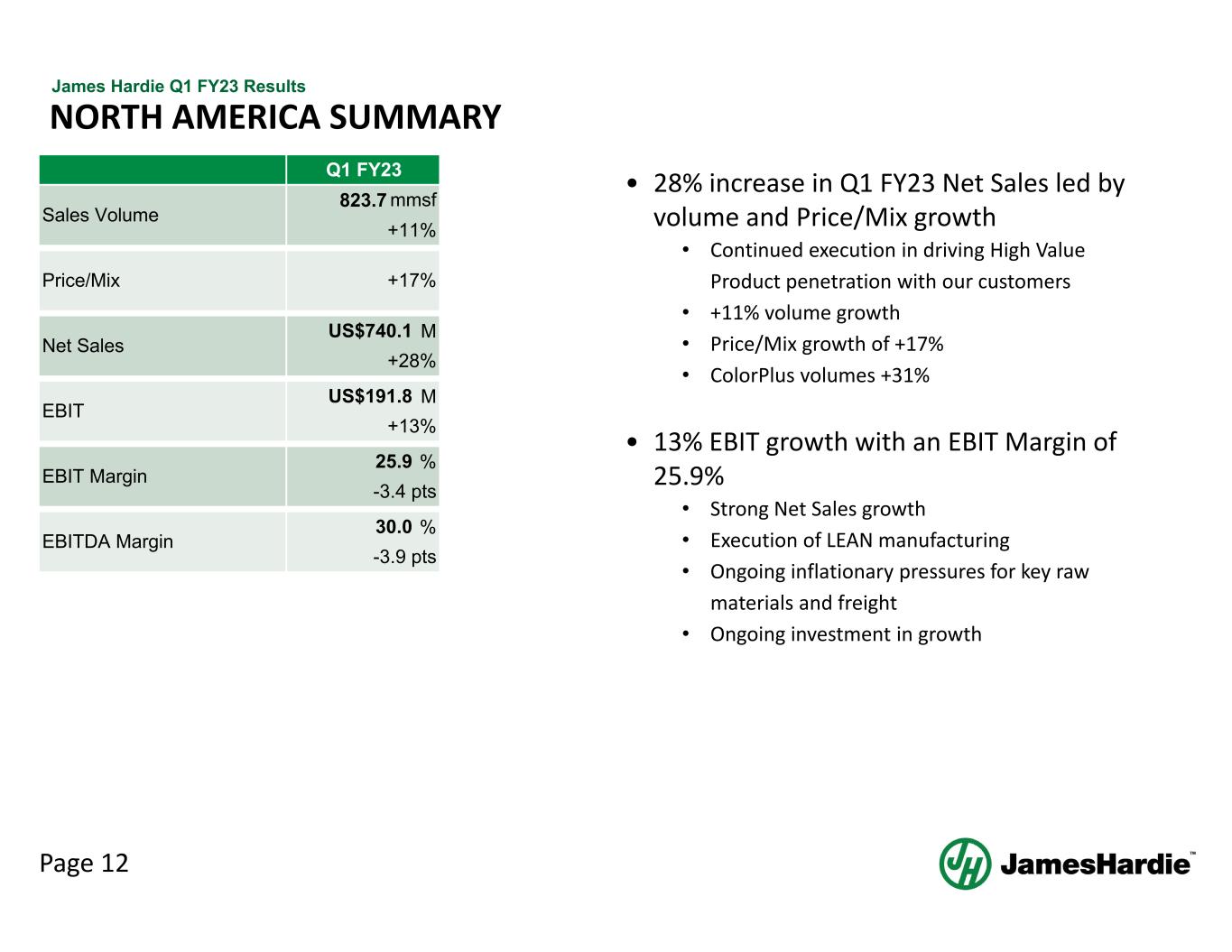

Page 12 James Hardie Q1 FY23 Results NORTH AMERICA SUMMARY • 28% increase in Q1 FY23 Net Sales led by volume and Price/Mix growth • Continued execution in driving High Value Product penetration with our customers • +11% volume growth • Price/Mix growth of +17% • ColorPlus volumes +31% • 13% EBIT growth with an EBIT Margin of 25.9% • Strong Net Sales growth • Execution of LEAN manufacturing • Ongoing inflationary pressures for key raw materials and freight • Ongoing investment in growth M M % % Q1 FY23 823.7 mmsf +11% EBITDA Margin 30.0 -3.9 pts +17%Price/Mix US$740.1 Net Sales EBIT Margin EBIT 25.9 -3.4 pts US$191.8 +13% +28% Sales Volume

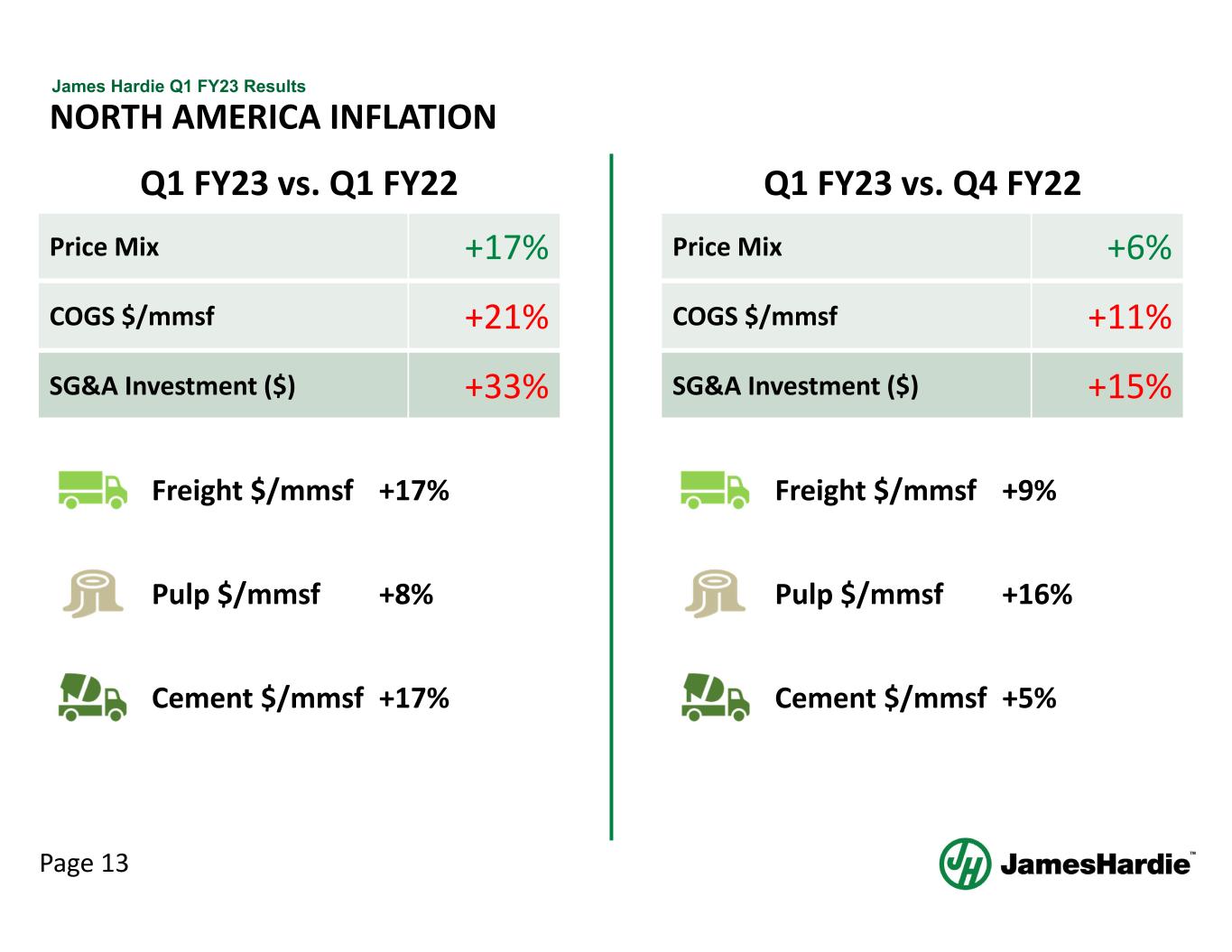

Page 13 James Hardie Q1 FY23 Results NORTH AMERICA INFLATION Price Mix +17% COGS $/mmsf +21% SG&A Investment ($) +33% Q1 FY23 vs. Q1 FY22 Q1 FY23 vs. Q4 FY22 Price Mix +6% COGS $/mmsf +11% SG&A Investment ($) +15% Pulp $/mmsf +8% Freight $/mmsf +17% Cement $/mmsf +17% Pulp $/mmsf +16% Freight $/mmsf +9% Cement $/mmsf +5%

NORTH AMERICA UPDATE

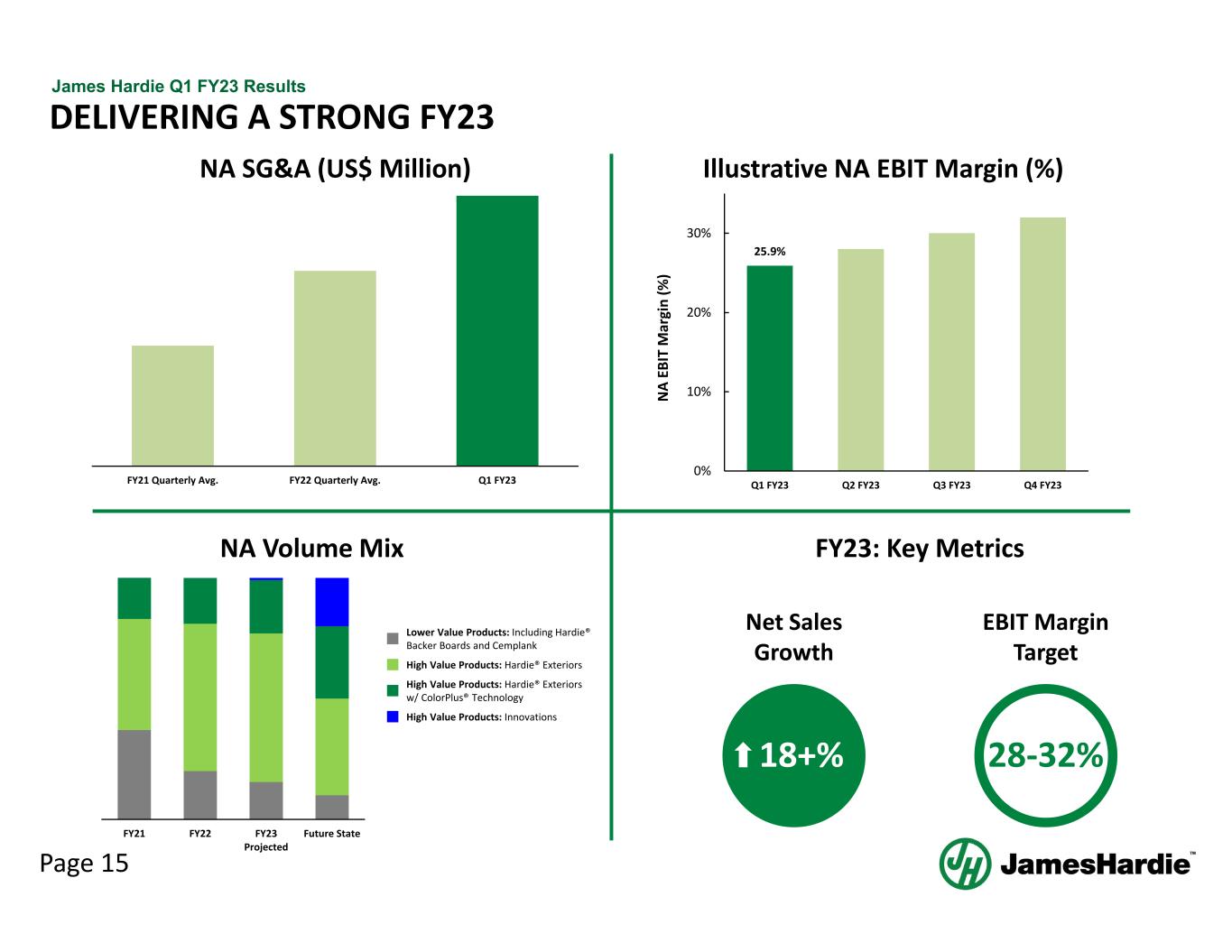

Page 15 James Hardie Q1 FY23 Results DELIVERING A STRONG FY23 FY23: Key Metrics Net Sales Growth EBIT Margin Target 18+% 28‐32% FY21 Quarterly Avg. FY22 Quarterly Avg. Q1 FY23 NA SG&A (US$ Million) 25.9% 0% 10% 20% 30% Q1 FY23 Q2 FY23 Q3 FY23 Q4 FY23 N A EB IT M ar gi n (% ) Illustrative NA EBIT Margin (%) FY21 FY22 FY23 Projected Future State NA Volume Mix Lower Value Products: Including Hardie® Backer Boards and Cemplank High Value Products: Hardie® Exteriors High Value Products: Hardie® Exteriors w/ ColorPlus® Technology High Value Products: Innovations

Page 16 James Hardie Q1 FY23 Results NORTH AMERICA – FLEXIBILITY FOR FY24 AND BEYOND 1 Continue to build and accelerate customer engagement and partnership 2 In FY23 maintain quarterly SG&A flat to Q1FY23 to retain flexibility heading into FY24 3 Continue to invest in marketing to the homeowner to drive long term strategic growth

Page 17 James Hardie Q1 FY23 Results CONNECTING THE ROPE Managing Relationships Across the Repair and Remodel Value Chain to Drive Profitable Growth Marketing Directly to Homeowners Partnering With Customers Working Closely With Contractors / Installers

Page 18 James Hardie Q1 FY23 Results MAGNOLIA Focused on ColorPlus® Technology finished products 16 colors curated by Joanna Gaines leveraging ColorPlus® Technology finishes Builds additional credibility with homeowners Joanna Gaines builds trust and credibility around aesthetic design Chip Gaines builds trust and credibility around durability and low maintenance @JoannaGaines @JamesHardie @MagnoliaHome @ChipGaines

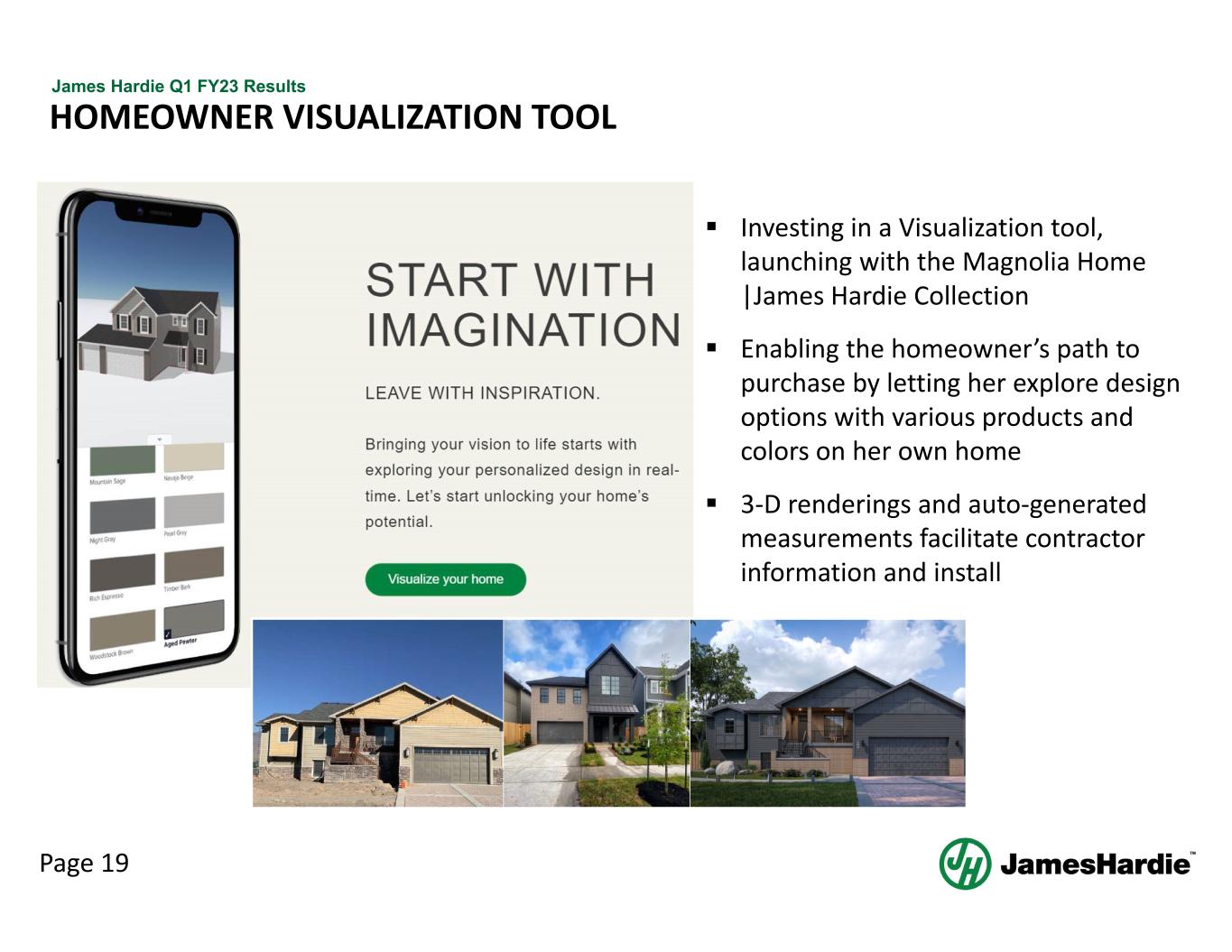

Page 19 James Hardie Q1 FY23 Results HOMEOWNER VISUALIZATION TOOL Investing in a Visualization tool, launching with the Magnolia Home |James Hardie Collection Enabling the homeowner’s path to purchase by letting her explore design options with various products and colors on her own home 3‐D renderings and auto‐generated measurements facilitate contractor information and install

CAPITAL ALLOCATION, CAPACITY EXPANSION & GUIDANCE

Page 21 James Hardie Q1 FY23 Results CAPITAL ALLOCATION • Preserve strong liquidity and flexibility • Invest in organic growth: capacity expansion, market driven innovation & marketing • Maintain net leverage ratio of less than 2x • 0.73x leverage ratio as of 30 June 2022 • Return capital to shareholders

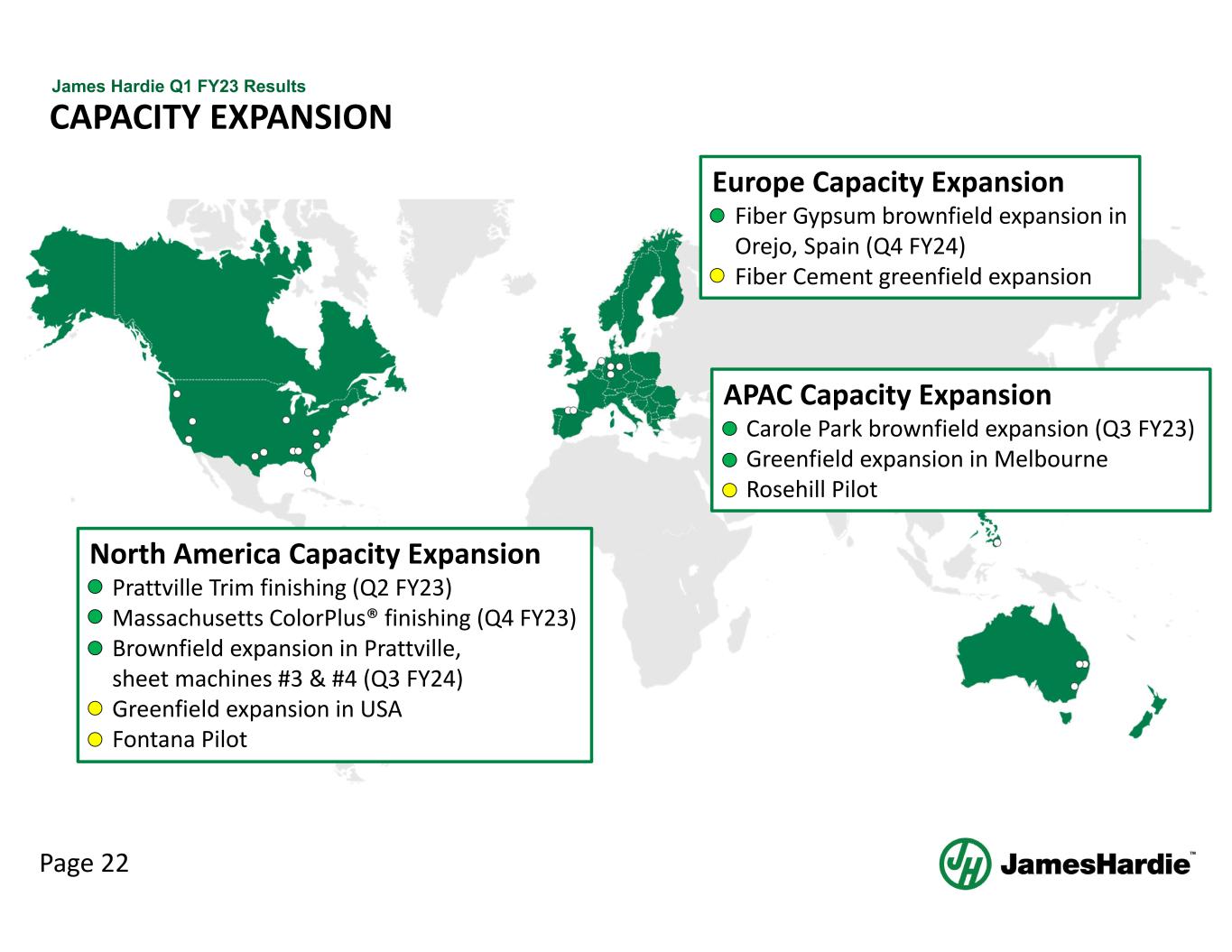

Page 22 James Hardie Q1 FY23 Results CAPACITY EXPANSION Europe Capacity Expansion − Fiber Gypsum brownfield expansion in Orejo, Spain (Q4 FY24) − Fiber Cement greenfield expansion APAC Capacity Expansion − Carole Park brownfield expansion (Q3 FY23) − Greenfield expansion in Melbourne − Rosehill Pilot North America Capacity Expansion − Prattville Trim finishing (Q2 FY23) − Massachusetts ColorPlus® finishing (Q4 FY23) − Brownfield expansion in Prattville, sheet machines #3 & #4 (Q3 FY24) − Greenfield expansion in USA − Fontana Pilot

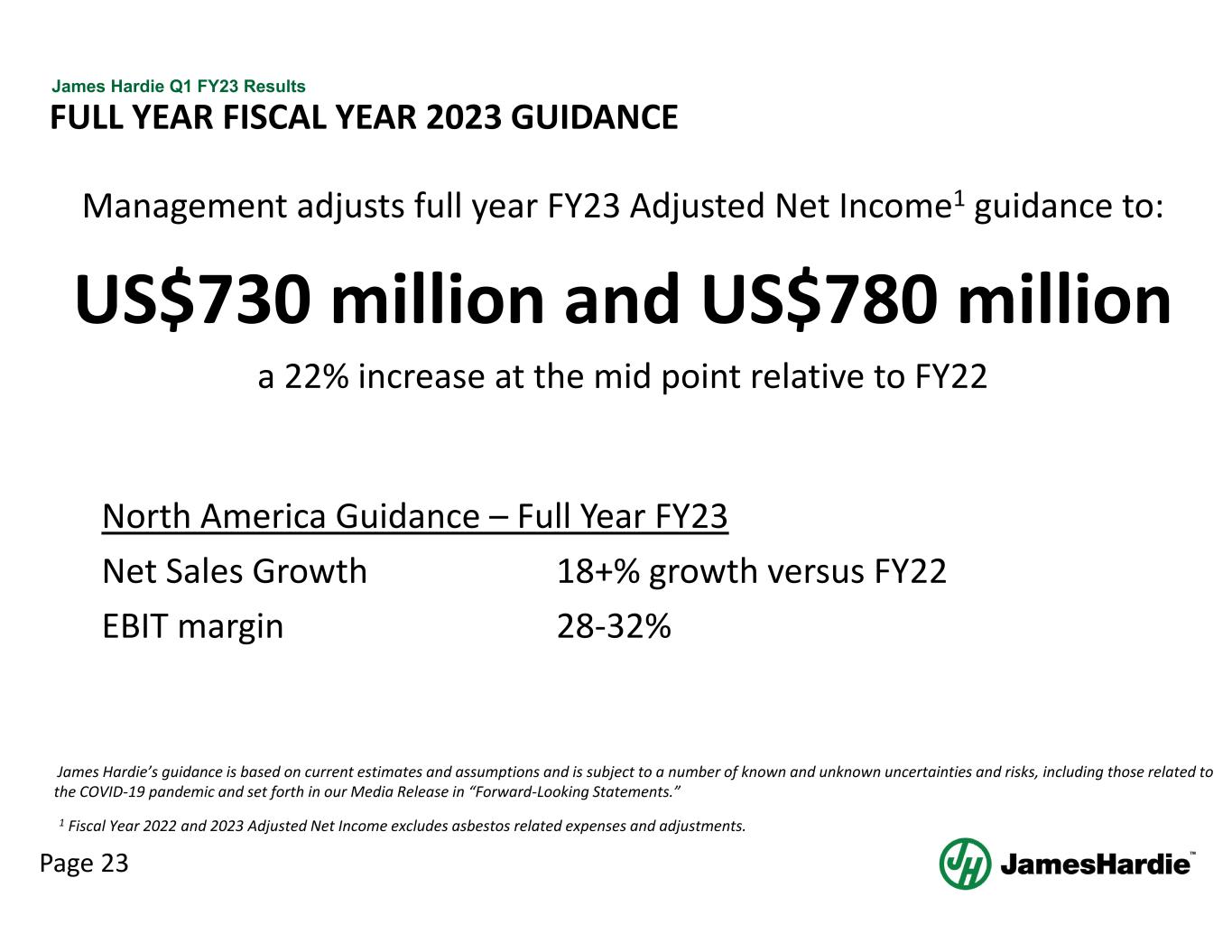

Page 23 James Hardie Q1 FY23 Results FULL YEAR FISCAL YEAR 2023 GUIDANCE Management adjusts full year FY23 Adjusted Net Income1 guidance to: US$730 million and US$780 million a 22% increase at the mid point relative to FY22 North America Guidance – Full Year FY23 Net Sales Growth 18+% growth versus FY22 EBIT margin 28‐32% James Hardie’s guidance is based on current estimates and assumptions and is subject to a number of known and unknown uncertainties and risks, including those related to the COVID‐19 pandemic and set forth in our Media Release in “Forward‐Looking Statements.” 1 Fiscal Year 2022 and 2023 Adjusted Net Income excludes asbestos related expenses and adjustments.

Page 24 James Hardie Q1 FY23 Results CLOSING United Kingdom NSW, Australia Financially Strong We are preparing for all scenarios, and: 1. deliver strong results throughout, AND 2. accelerate and expand our competitive advantages Right Strategy Experienced Management Team

QUESTIONS

APPENDIX

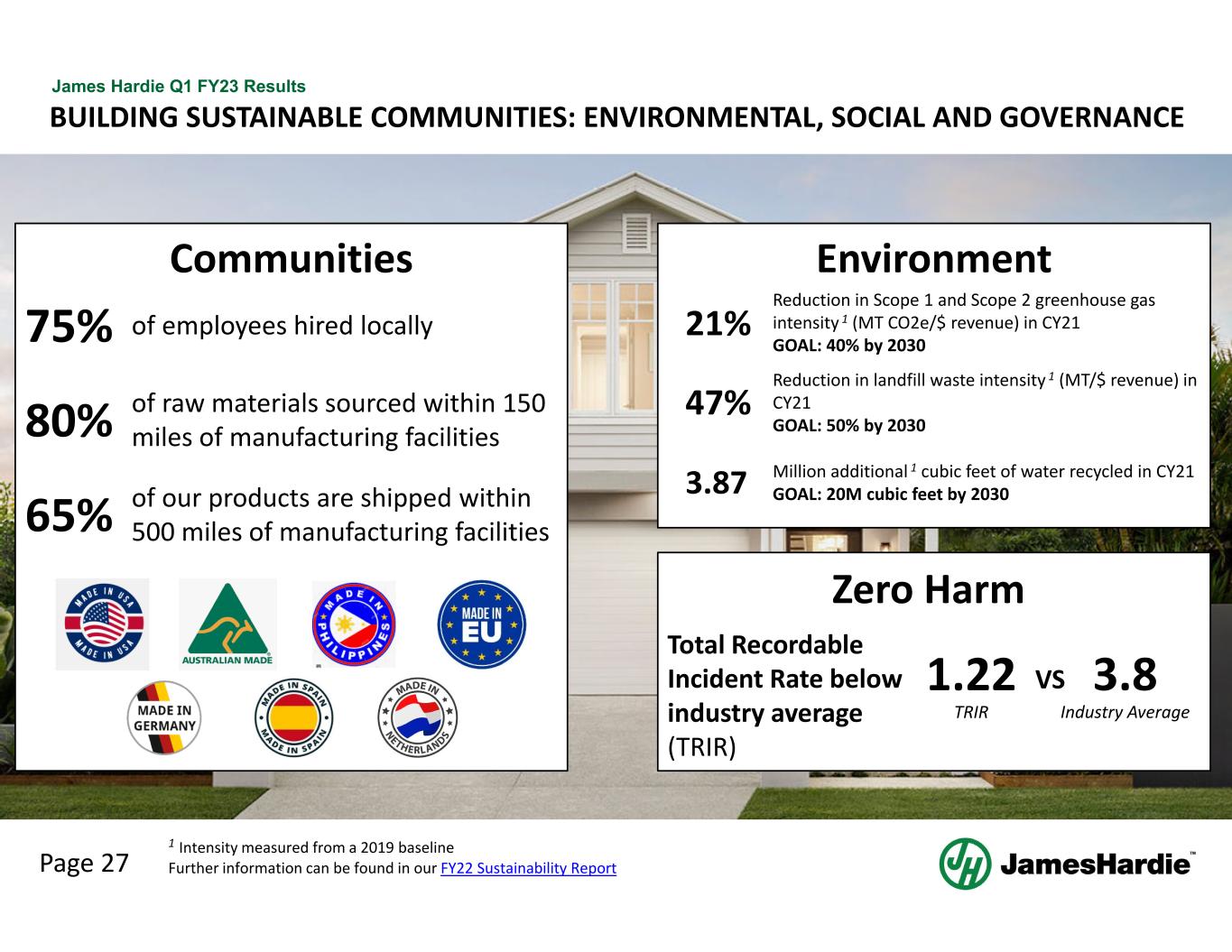

Page 27 James Hardie Q1 FY23 Results BUILDING SUSTAINABLE COMMUNITIES: ENVIRONMENTAL, SOCIAL AND GOVERNANCE 80% of raw materials sourced within 150 miles of manufacturing facilities 75% of employees hired locally 65% of our products are shipped within 500 miles of manufacturing facilities Total Recordable Incident Rate below industry average (TRIR) 1.22 TRIR Environment Zero Harm Communities 1 Intensity measured from a 2019 baseline Further information can be found in our FY22 Sustainability Report 3.8 Industry Average VS Reduction in Scope 1 and Scope 2 greenhouse gas intensity 1 (MT CO2e/$ revenue) in CY21 GOAL: 40% by 2030 21% Reduction in landfill waste intensity 1 (MT/$ revenue) in CY21 GOAL: 50% by 2030 47% Million additional 1 cubic feet of water recycled in CY21 GOAL: 20M cubic feet by 20303.87

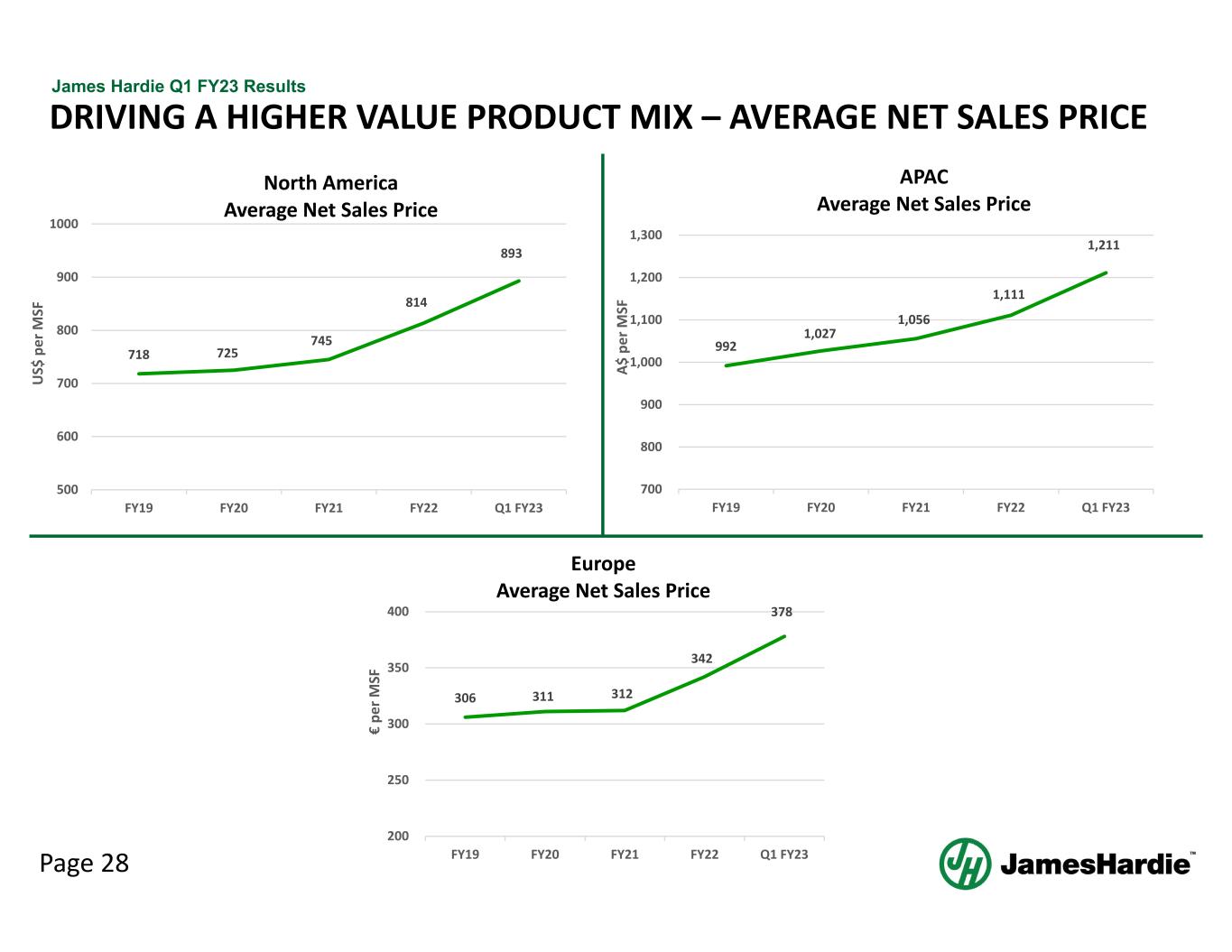

Page 28 James Hardie Q1 FY23 Results DRIVING A HIGHER VALUE PRODUCT MIX – AVERAGE NET SALES PRICE 718 725 745 814 893 500 600 700 800 900 1000 FY19 FY20 FY21 FY22 Q1 FY23 U S$ p er M SF North America Average Net Sales Price 306 311 312 342 378 200 250 300 350 400 FY19 FY20 FY21 FY22 Q1 FY23 € pe r M SF Europe Average Net Sales Price 992 1,027 1,056 1,111 1,211 700 800 900 1,000 1,100 1,200 1,300 FY19 FY20 FY21 FY22 Q1 FY23 A$ p er M SF APAC Average Net Sales Price

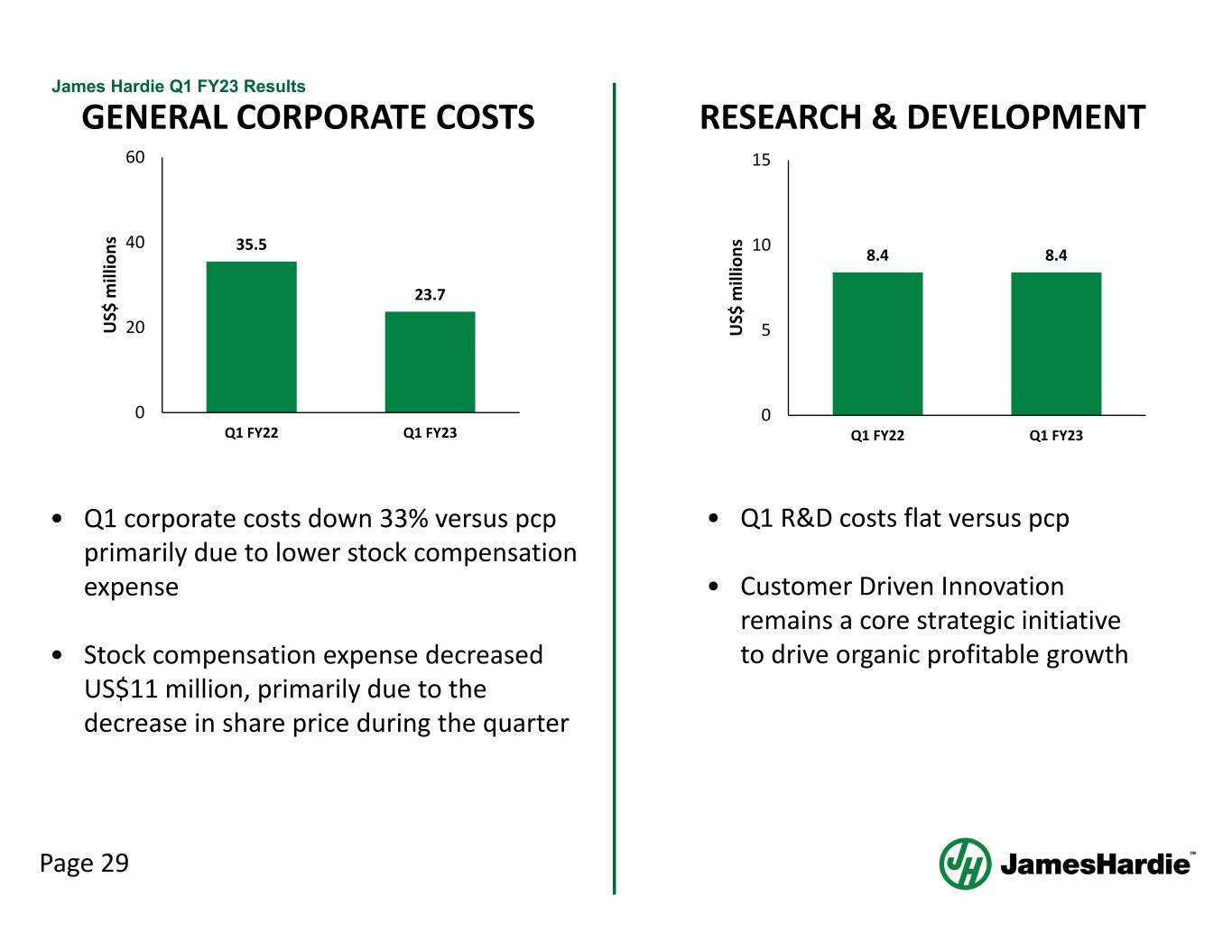

Page 29 James Hardie Q1 FY23 Results GENERAL CORPORATE COSTS • Q1 corporate costs down 33% versus pcp primarily due to lower stock compensation expense • Stock compensation expense decreased US$11 million, primarily due to the decrease in share price during the quarter • Q1 R&D costs flat versus pcp • Customer Driven Innovation remains a core strategic initiative to drive organic profitable growth RESEARCH & DEVELOPMENT 35.5 23.7 0 20 40 60 Q1 FY22 Q1 FY23 U S$ m ill io ns 8.4 8.4 0 5 10 15 Q1 FY22 Q1 FY23 U S$ m ill io ns

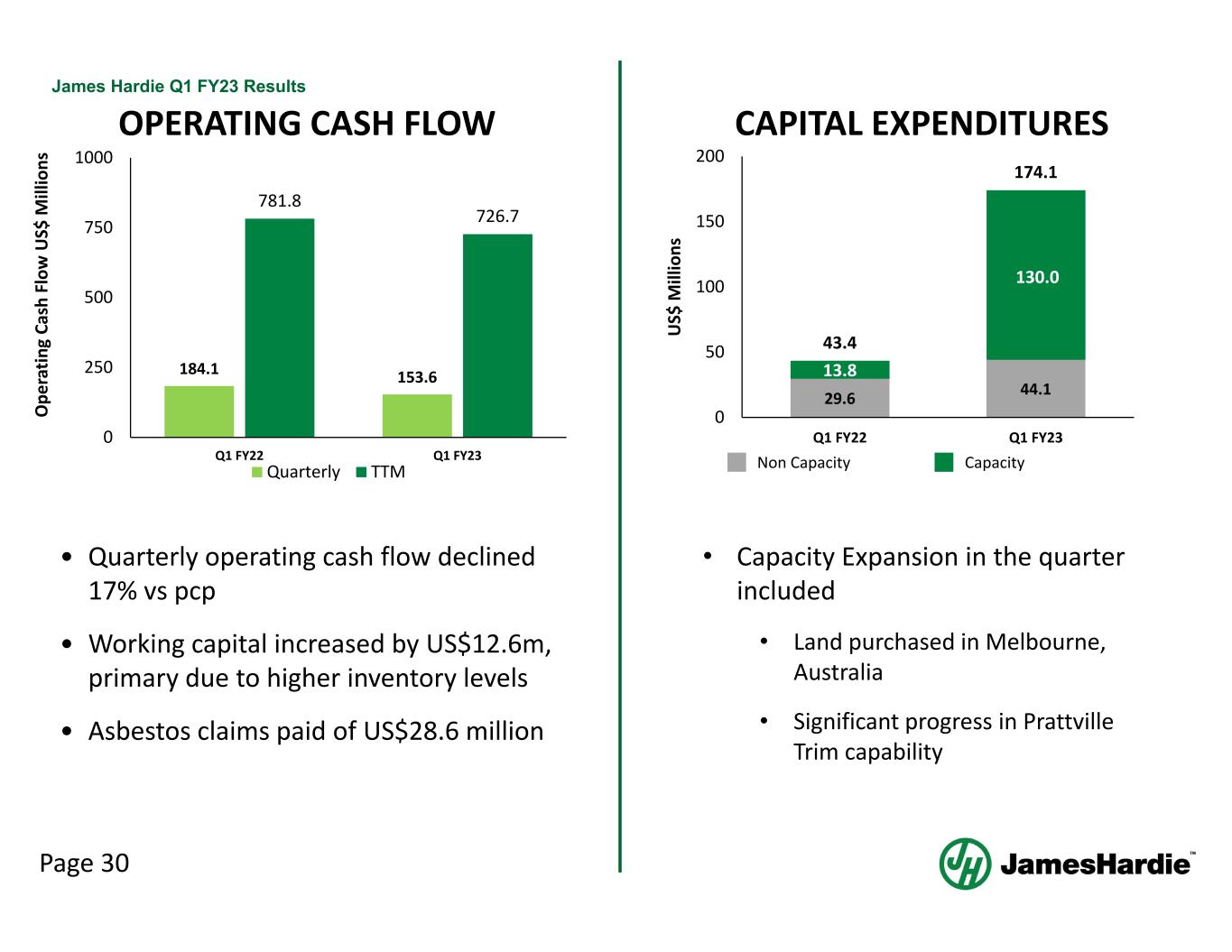

Page 30 James Hardie Q1 FY23 Results 1 OPERATING CASH FLOW CAPITAL EXPENDITURES • Capacity Expansion in the quarter included • Land purchased in Melbourne, Australia • Significant progress in Prattville Trim capability • Quarterly operating cash flow declined 17% vs pcp • Working capital increased by US$12.6m, primary due to higher inventory levels • Asbestos claims paid of US$28.6 million O pe ra tin g Ca sh F lo w U S$ M ill io ns 184.1 153.6 781.8 726.7 0 250 500 750 1000 Q1 FY22 Q1 FY23 Quarterly TTM 29.6 44.1 13.8 130.0 43.4 174.1 0 50 100 150 200 Q1 FY22 Q1 FY23 U S$ M ill io ns Non Capacity Capacity

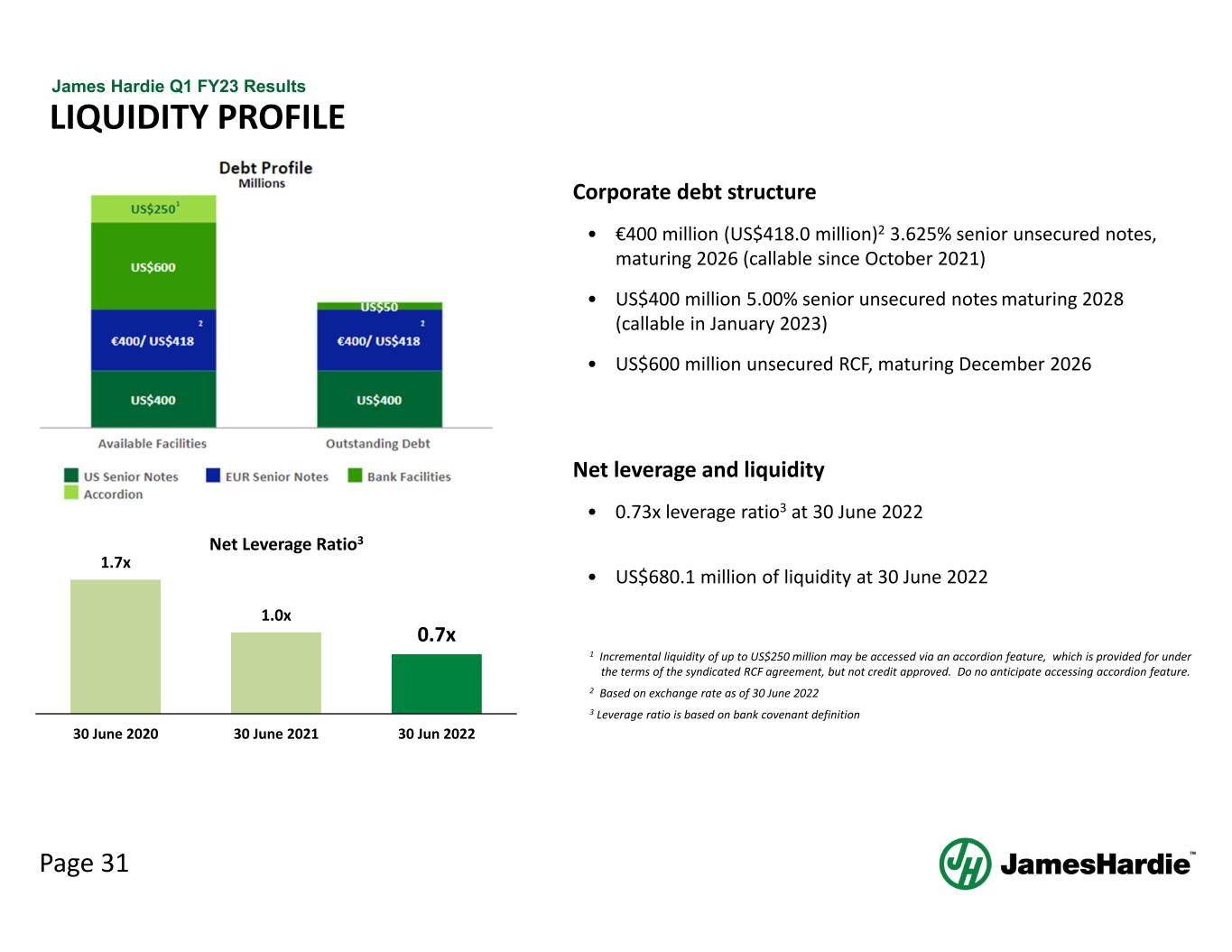

Page 31 James Hardie Q1 FY23 Results LIQUIDITY PROFILE 2 1 Incremental liquidity of up to US$250 million may be accessed via an accordion feature, which is provided for under the terms of the syndicated RCF agreement, but not credit approved. Do no anticipate accessing accordion feature. 2 Based on exchange rate as of 30 June 2022 3 Leverage ratio is based on bank covenant definition 1.7x 1.0x 0.7x 30 June 2020 30 June 2021 30 Jun 2022 Net Leverage Ratio3 Corporate debt structure • €400 million (US$418.0 million)2 3.625% senior unsecured notes, maturing 2026 (callable since October 2021) • US$400 million 5.00% senior unsecured notesmaturing 2028 (callable in January 2023) • US$600 million unsecured RCF, maturing December 2026 Net leverage and liquidity • 0.73x leverage ratio3 at 30 June 2022 • US$680.1 million of liquidity at 30 June 2022

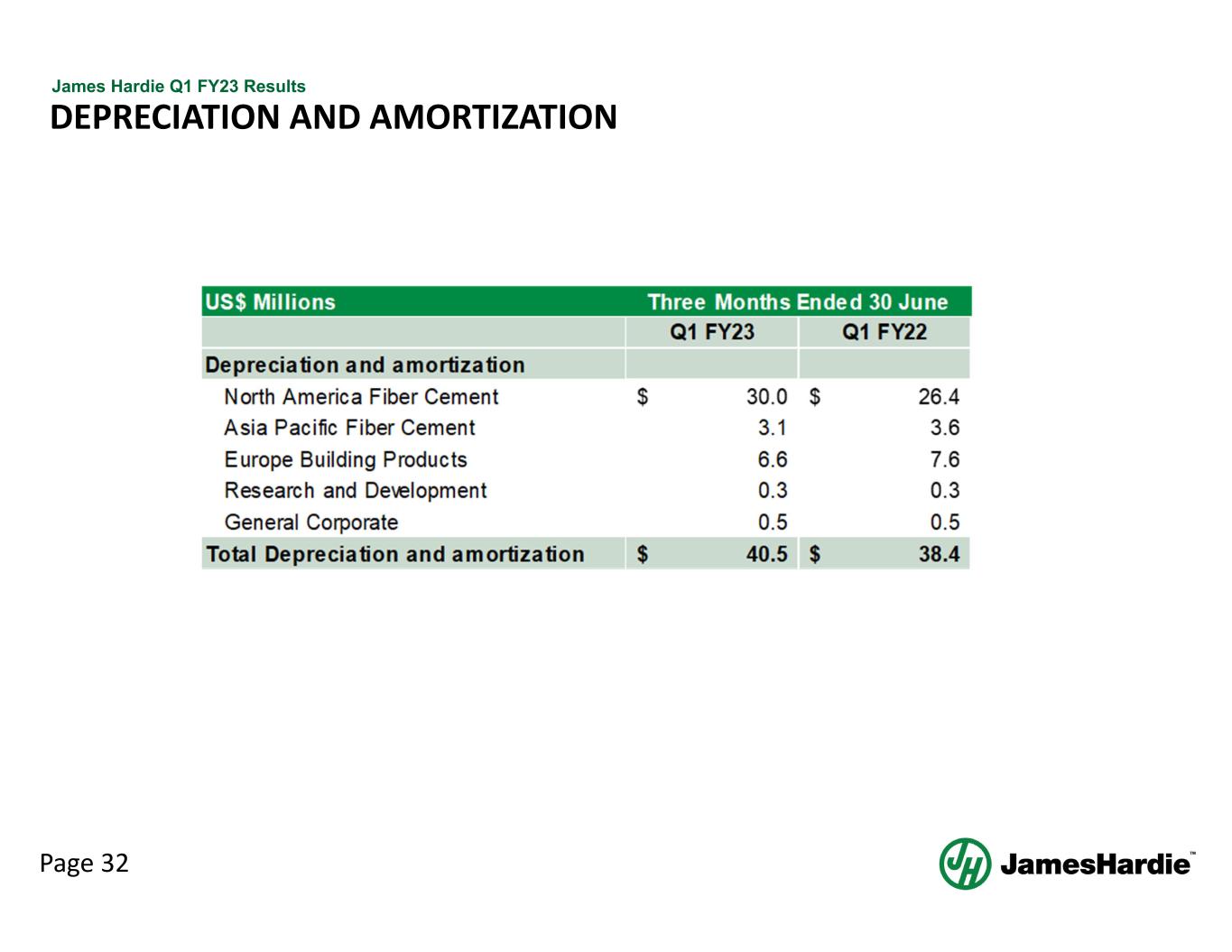

Page 32 James Hardie Q1 FY23 Results DEPRECIATION AND AMORTIZATION

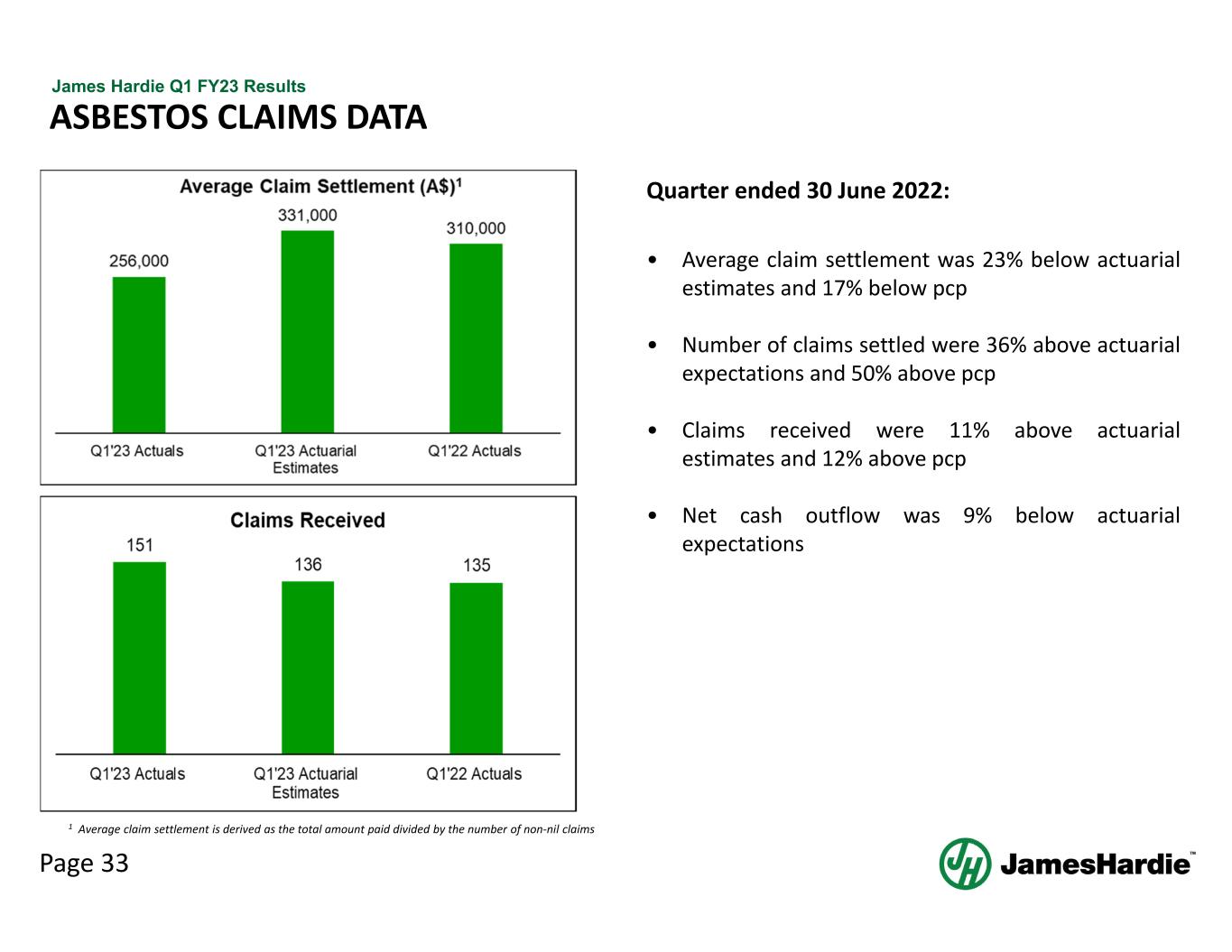

Page 33 James Hardie Q1 FY23 Results Quarter ended 30 June 2022: • Average claim settlement was 23% below actuarial estimates and 17% below pcp • Number of claims settled were 36% above actuarial expectations and 50% above pcp • Claims received were 11% above actuarial estimates and 12% above pcp • Net cash outflow was 9% below actuarial expectations ASBESTOS CLAIMS DATA 1 Average claim settlement is derived as the total amount paid divided by the number of non‐nil claims

Page 34 James Hardie Q1 FY23 Results This Management Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Media Release and Consolidated Financial Statements Financial Measures – GAAP Equivalents This document contains the financial statement line item EBIT, which is considered to be non‐GAAP, but is consistent with the term used by Australian companies. Because we prepare our consolidated financial statements under GAAP, the equivalent GAAP financial Statement line item description used in our consolidated financial statements is Operating income (loss). Definitions EBIT – Earnings before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Price/Mix – Price/Mix is defined as the percentage growth in revenue attributable to price increases and shift in mix of products sold. Price/Mix is calculated as the Net Sales growth percentage less the volume growth percentage. Sales Volume mmsf –million square feet, where a square foot is defined as a standard square foot of 5/16” thickness msf – thousand square feet, where a square foot is defined as a standard square foot of 5/16” thickness Non‐financial Terms AFFA – Amended and Restated Final Funding Agreement AICF – Asbestos Injuries Compensation Fund Ltd NON‐GAAP FINANCIAL MEASURES

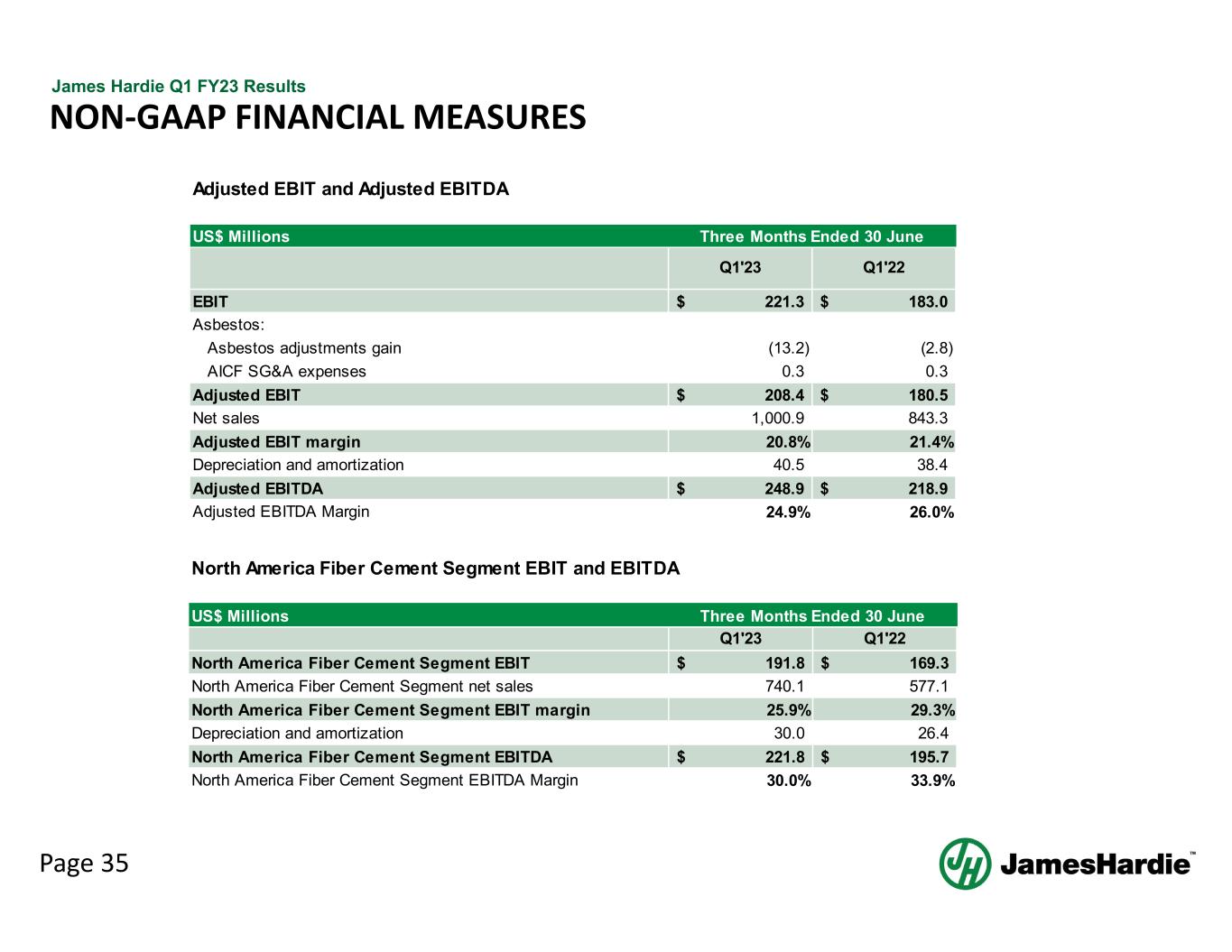

Page 35 James Hardie Q1 FY23 Results NON‐GAAP FINANCIAL MEASURES Adjusted EBIT and Adjusted EBITDA US$ Millions Q1'23 Q1'22 EBIT 221.3$ 183.0$ Asbestos: Asbestos adjustments gain (13.2) (2.8) AICF SG&A expenses 0.3 0.3 Adjusted EBIT 208.4$ 180.5$ Net sales 1,000.9 843.3 Adjusted EBIT margin 20.8% 21.4% Depreciation and amortization 40.5 38.4 Adjusted EBITDA 248.9$ 218.9$ Adjusted EBITDA Margin 24.9% 26.0% Three Months Ended 30 June US$ Millions Q1'23 Q1'22 North America Fiber Cement Segment EBIT 191.8$ 169.3$ North America Fiber Cement Segment net sales 740.1 577.1 North America Fiber Cement Segment EBIT margin 25.9% 29.3% Depreciation and amortization 30.0 26.4 North America Fiber Cement Segment EBITDA 221.8$ 195.7$ North America Fiber Cement Segment EBITDA Margin 30.0% 33.9% North America Fiber Cement Segment EBIT and EBITDA Three Months Ended 30 June

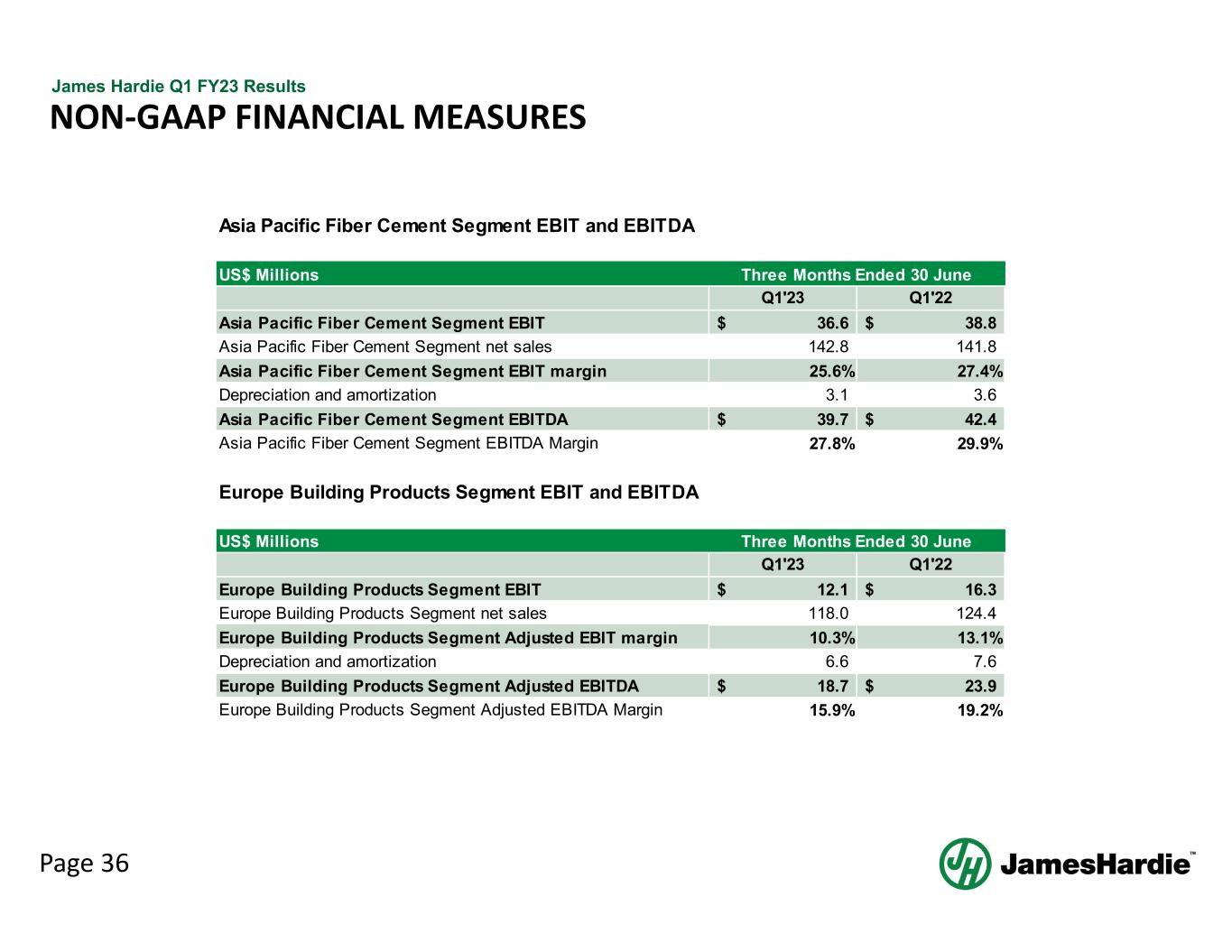

Page 36 James Hardie Q1 FY23 Results NON‐GAAP FINANCIAL MEASURES US$ Millions Q1'23 Q1'22 Europe Building Products Segment EBIT 12.1$ 16.3$ Europe Building Products Segment net sales 118.0 124.4 Europe Building Products Segment Adjusted EBIT margin 10.3% 13.1% Depreciation and amortization 6.6 7.6 Europe Building Products Segment Adjusted EBITDA 18.7$ 23.9$ Europe Building Products Segment Adjusted EBITDA Margin 15.9% 19.2% Three Months Ended 30 June Europe Building Products Segment EBIT and EBITDA US$ Millions Q1'23 Q1'22 Asia Pacific Fiber Cement Segment EBIT 36.6$ 38.8$ Asia Pacific Fiber Cement Segment net sales 142.8 141.8 Asia Pacific Fiber Cement Segment EBIT margin 25.6% 27.4% Depreciation and amortization 3.1 3.6 Asia Pacific Fiber Cement Segment EBITDA 39.7$ 42.4$ Asia Pacific Fiber Cement Segment EBITDA Margin 27.8% 29.9% Asia Pacific Fiber Cement Segment EBIT and EBITDA Three Months Ended 30 June

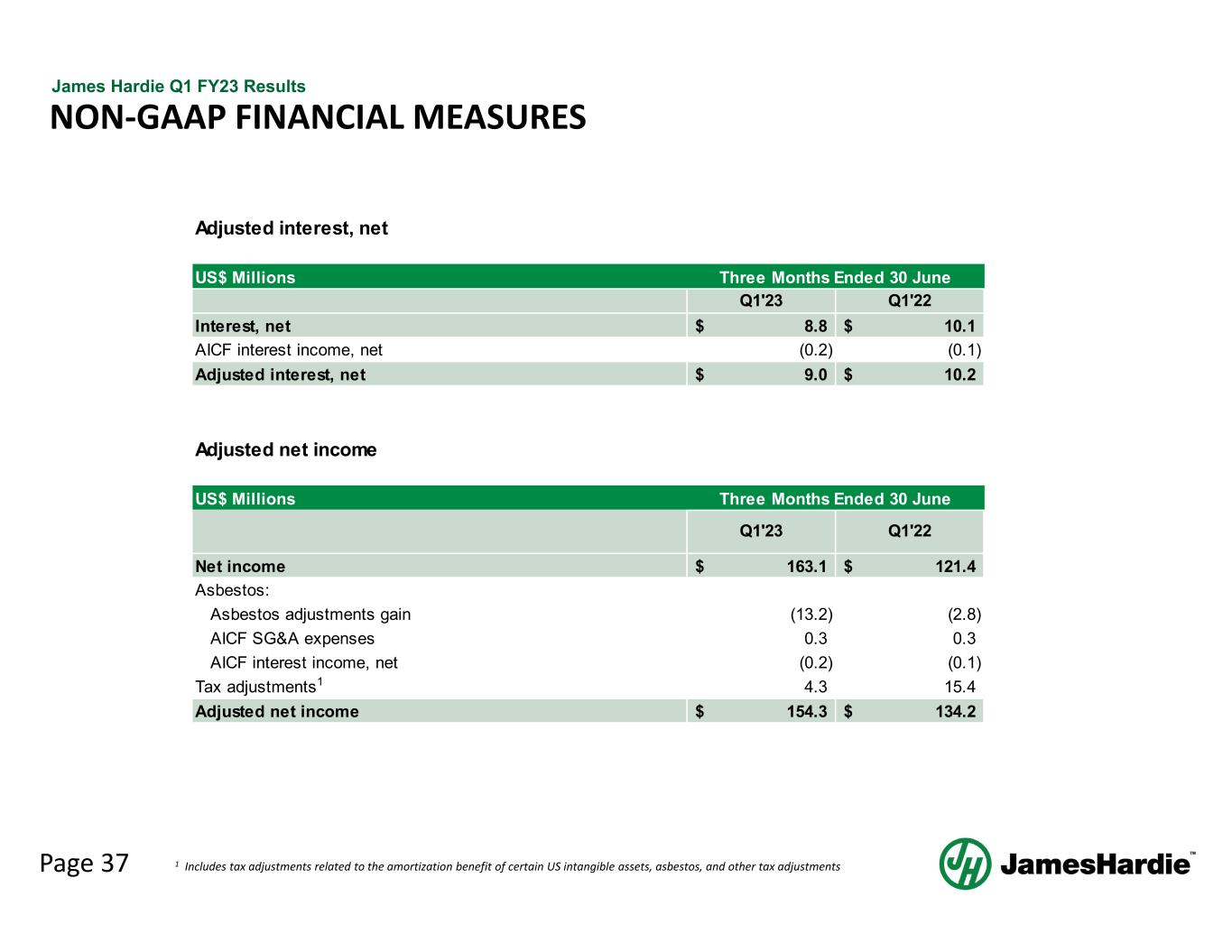

Page 37 James Hardie Q1 FY23 Results NON‐GAAP FINANCIAL MEASURES 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments US$ Millions Q1'23 Q1'22 Interest, net 8.8$ 10.1$ AICF interest income, net (0.2) (0.1) Adjusted interest, net 9.0$ 10.2$ Adjusted interest, net Three Months Ended 30 June Adjusted net income US$ Millions Q1'23 Q1'22 Net income 163.1$ 121.4$ Asbestos: Asbestos adjustments gain (13.2) (2.8) AICF SG&A expenses 0.3 0.3 AICF interest income, net (0.2) (0.1) Tax adjustments1 4.3 15.4 Adjusted net income 154.3$ 134.2$ Three Months Ended 30 June

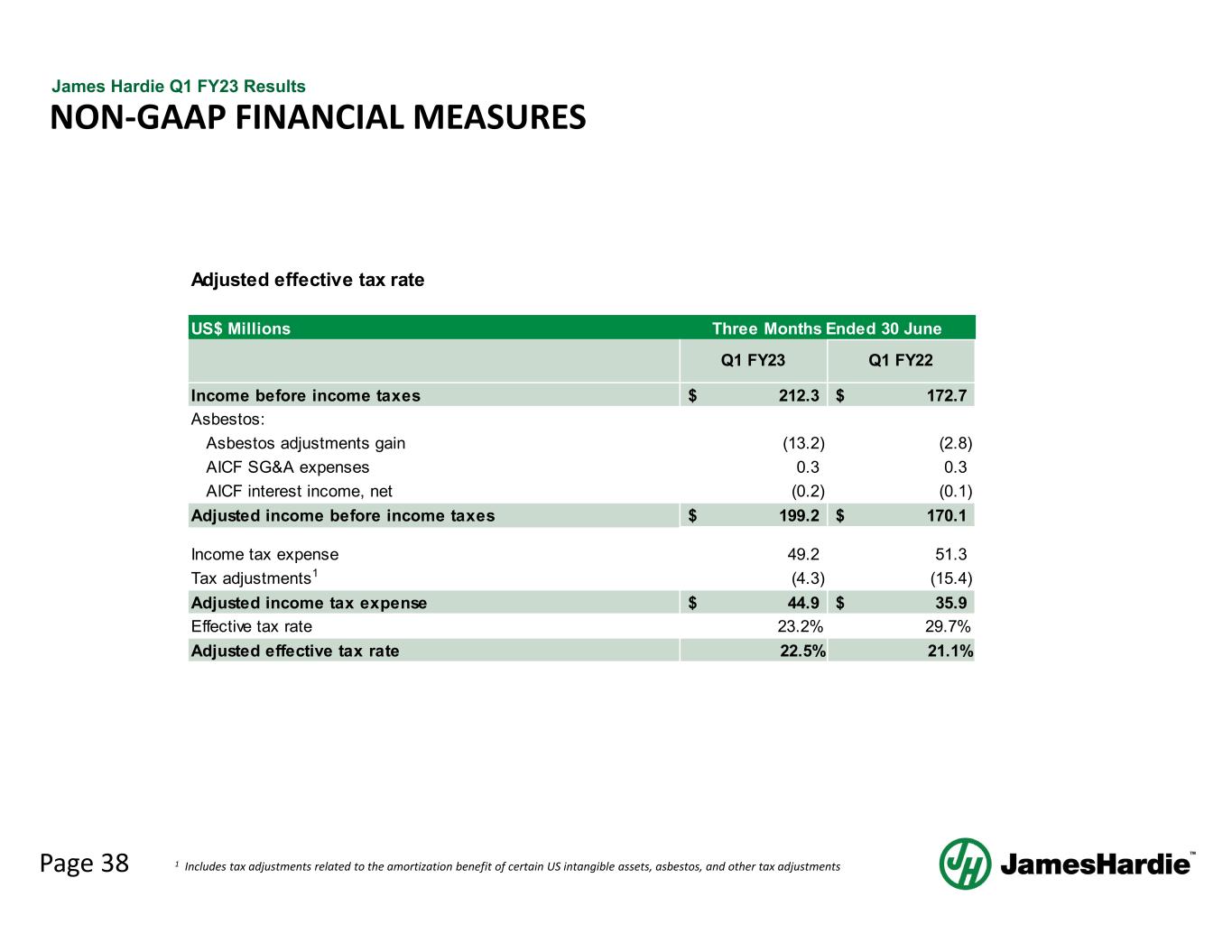

Page 38 James Hardie Q1 FY23 Results NON‐GAAP FINANCIAL MEASURES 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Adjusted effective tax rate US$ Millions Q1 FY23 Q1 FY22 Income before income taxes 212.3$ 172.7$ Asbestos: Asbestos adjustments gain (13.2) (2.8) AICF SG&A expenses 0.3 0.3 AICF interest income, net (0.2) (0.1) Adjusted income before income taxes 199.2$ 170.1$ Income tax expense 49.2 51.3 Tax adjustments1 (4.3) (15.4) Adjusted income tax expense 44.9$ 35.9$ Effective tax rate 23.2% 29.7% Adjusted effective tax rate 22.5% 21.1% Three Months Ended 30 June

Q1 FY23 MANAGEMENT PRESENTATION 16 August 2022