Page 1 JHX Investor Day 2022 New York, 12-13 September 2022 – Day 1

Page 2 James Hardie Investor Day 2022 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non- GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Management Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Consolidated Financial Statements. See the section titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS USE OF NON-GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions, beliefs and general good faith evaluation of information available at the time the forward-looking statements were made concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements or rely upon them as a guarantee of future performance or results or as an accurate indications of the times at or by which any such performance or results will be achieved Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2022, which include, but are not necessarily limited to risks such as changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID-19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law.

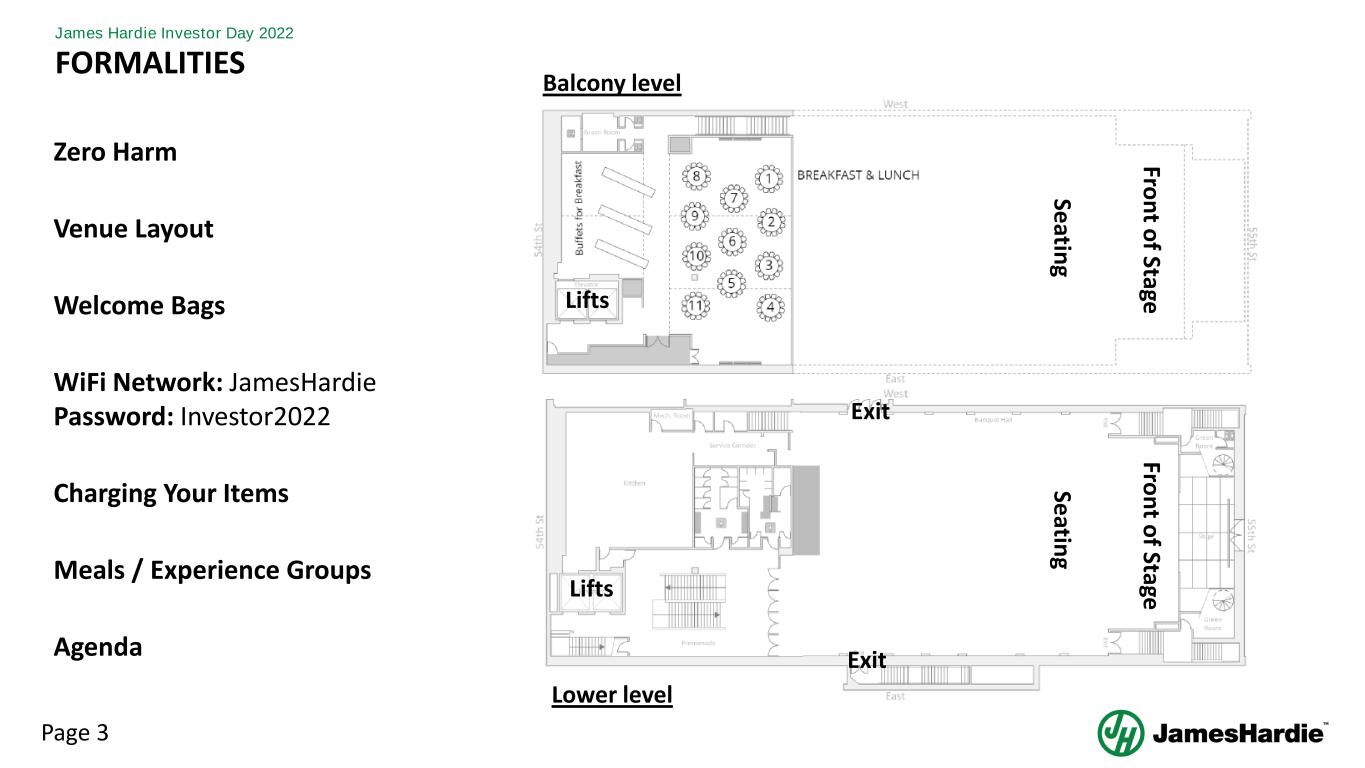

Page 3 James Hardie Investor Day 2022 FORMALITIES Zero Harm Venue Layout Welcome Bags WiFi Network: JamesHardie Password: Investor2022 Charging Your Items Meals / Experience Groups Agenda Balcony level Lower level Fro n t o f Stage Fro n t o f Stage Exit Exit Se atin g Se atin g Lifts Lifts

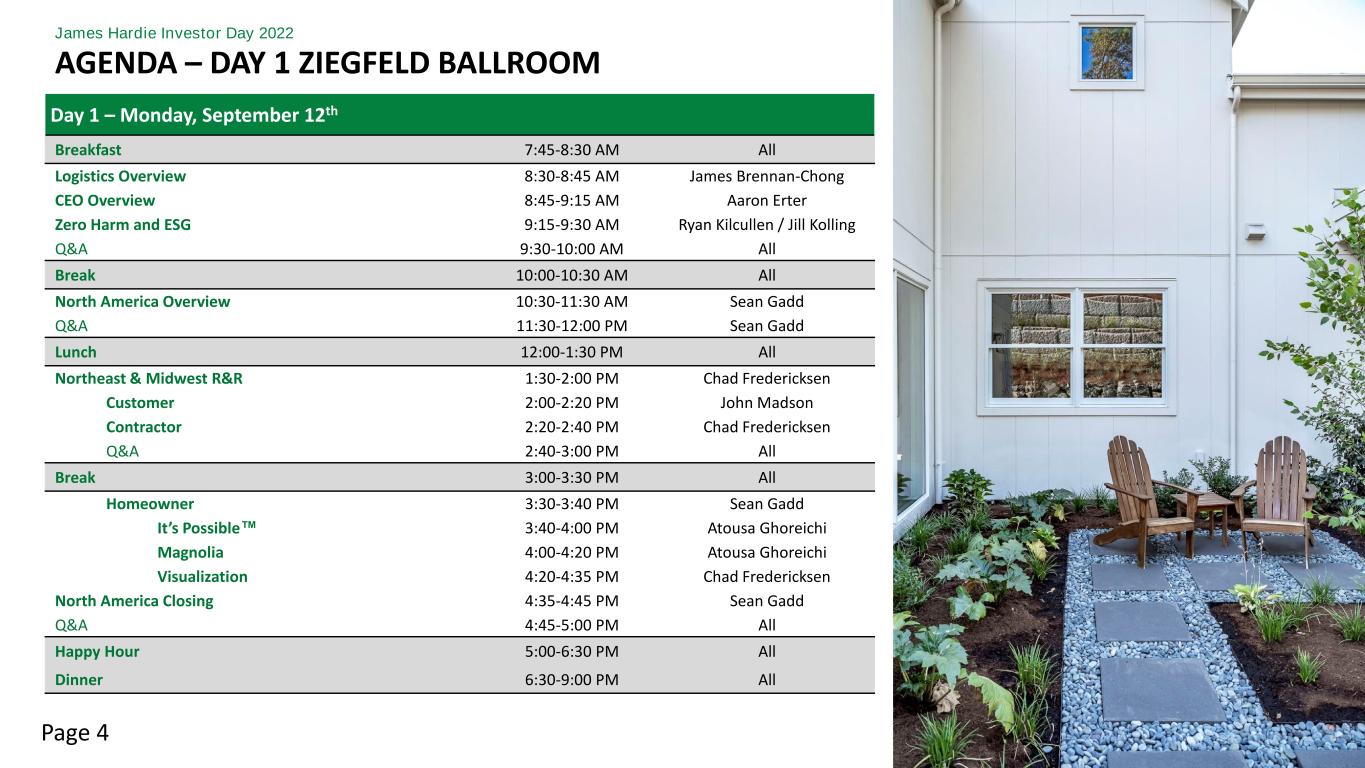

Page 4 James Hardie Investor Day 2022 AGENDA – DAY 1 ZIEGFELD BALLROOM Day 1 – Monday, September 12th Breakfast 7:45-8:30 AM All Logistics Overview 8:30-8:45 AM James Brennan-Chong CEO Overview 8:45-9:15 AM Aaron Erter Zero Harm and ESG 9:15-9:30 AM Ryan Kilcullen / Jill Kolling Q&A 9:30-10:00 AM All Break 10:00-10:30 AM All North America Overview 10:30-11:30 AM Sean Gadd Q&A 11:30-12:00 PM Sean Gadd Lunch 12:00-1:30 PM All Northeast & Midwest R&R 1:30-2:00 PM Chad Fredericksen Customer 2:00-2:20 PM John Madson Contractor 2:20-2:40 PM Chad Fredericksen Q&A 2:40-3:00 PM All Break 3:00-3:30 PM All Homeowner 3:30-3:40 PM Sean Gadd It’s Possible™ 3:40-4:00 PM Atousa Ghoreichi Magnolia 4:00-4:20 PM Atousa Ghoreichi Visualization 4:20-4:35 PM Chad Fredericksen North America Closing 4:35-4:45 PM Sean Gadd Q&A 4:45-5:00 PM All Happy Hour 5:00-6:30 PM All Dinner 6:30-9:00 PM All

Page 5 James Hardie Investor Day 2022 AGENDA – DAY 2 ZIEGFELD BALLROOM Day 2 – Tuesday, September 13th Breakfast 7:00-8:00 AM All APAC 8:00-9:15 AM John Arneil & Travis Johnson Q&A 9:15-9:30 AM All Experience Session #1 9:30-10:00 AM Breakout Groups Break 10:00-10:15 AM All Europe 10:15-11:15 AM Tobias Bennerscheidt & Henning Risse Q&A 11:15-11:30AM All Experience Session #2 11:30AM-12:00 PM Breakout Groups Lunch 12:00-1:15 PM All Global Innovation 1:15-2:15 PM Joe Liu & Alan Miller Q&A 2:15-2:30 PM All Experience Session #3 2:30-3:00 PM Breakout Groups Break 3:00-3:15 PM All Global Capacity 3:15-4:00 PM Ryan Kilcullen Q&A 4:00-4:15 PM All Closing with CEO & CFO 4:15-4:45 PM Aaron Erter & Jason Miele Q&A 4:45-5:00 PM All Happy Hour 5:00-6:30 PM All Dinner 6:30-9:00 PM All

Page 6 INVESTOR DAY 2022 – CEO AARON ERTER

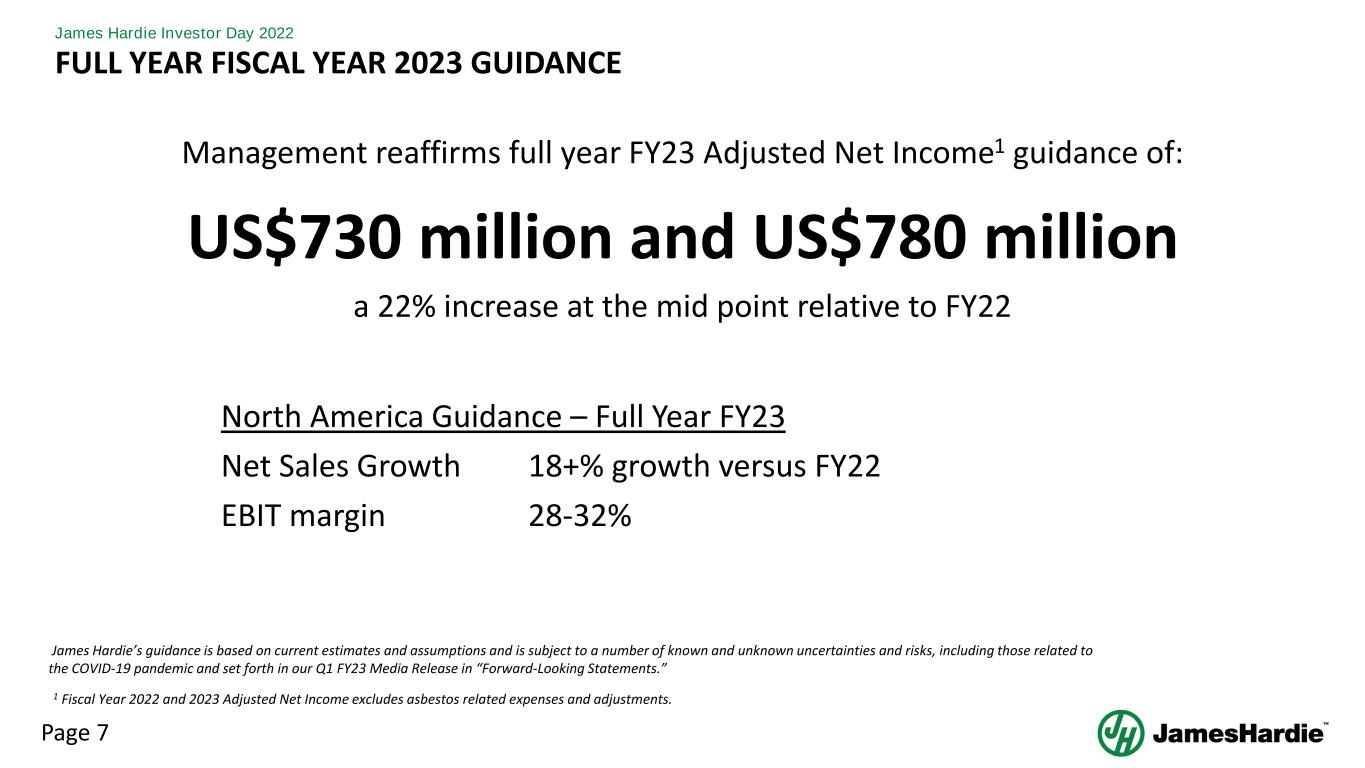

Page 7 James Hardie Investor Day 2022 FULL YEAR FISCAL YEAR 2023 GUIDANCE Management reaffirms full year FY23 Adjusted Net Income1 guidance of: US$730 million and US$780 million a 22% increase at the mid point relative to FY22 North America Guidance – Full Year FY23 Net Sales Growth 18+% growth versus FY22 EBIT margin 28-32% James Hardie’s guidance is based on current estimates and assumptions and is subject to a number of known and unknown uncertainties and risks, including those related to the COVID-19 pandemic and set forth in our Q1 FY23 Media Release in “Forward-Looking Statements.” 1 Fiscal Year 2022 and 2023 Adjusted Net Income excludes asbestos related expenses and adjustments.

Page 8 James Hardie Investor Day 2022 WHO AM I? 8

Page 9 James Hardie Investor Day 2022 WHO AM I? Driven sustained profitable growth Developed deep experience in new business development and commercialization Demonstrated passion and experience in building consumer-centric and brand led growth organizations Developed insight driven innovation organizations Integrated customer focused supply chain organizations Managed diverse global businesses

Page 10 James Hardie Investor Day 2022 WHY JAMES HARDIE? ✓ Great Reputation Within the Industry ✓ Experienced & Talented Team ✓ First Class and Committed Board ✓ Strong Cash Position ✓ Tremendous Growth Opportunities ✓ My Experience is Aligned to Accelerate Value

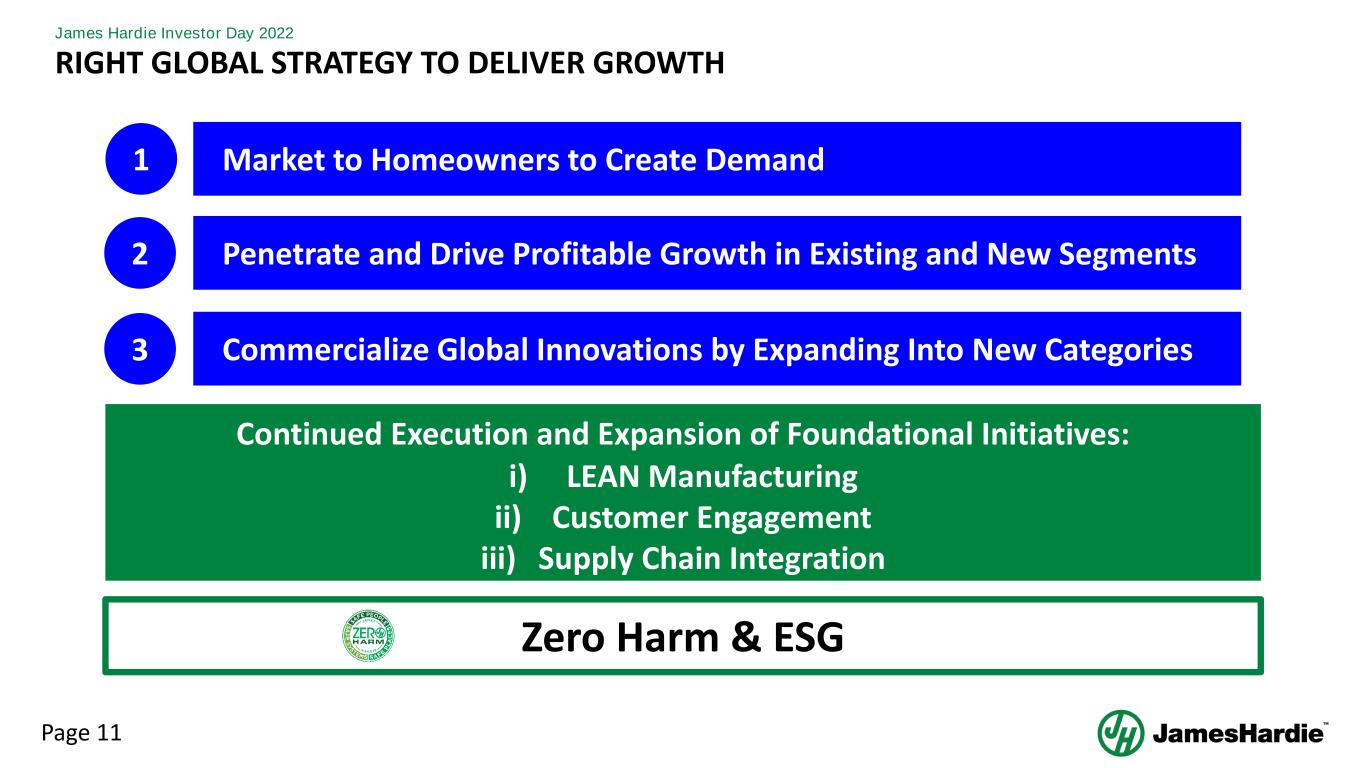

Page 11 James Hardie Investor Day 2022 RIGHT GLOBAL STRATEGY TO DELIVER GROWTH Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG

Page 12 James Hardie Investor Day 2022 MY FOCUS Being in the field with our customers and team members Successfully executing on our commitments Developing a diverse world-class team rooted in respect and teamwork Driving Profitable growth

Page 13 James Hardie Investor Day 2022 WHAT TO EXPECT? Consumer Focused Customer & Trade Driven

Page 14

ZERO HARM AND ESG

Page 16 James Hardie Investor Day 2022 ZERO HARM UPDATE AND ESG – PRESENTERS Jill Kolling VP ESG and Chief Sustainability Officer Ryan Kilcullen EVP Global Operations

Page 17 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – Zero Harm and ESG Topic Presenter Zero Harm Update Ryan Kilcullen ESG Update Jill Kolling

ZERO HARM UPDATE Ryan Kilcullen, EVP Operations

Page 19 Our conviction that every incident is preventable

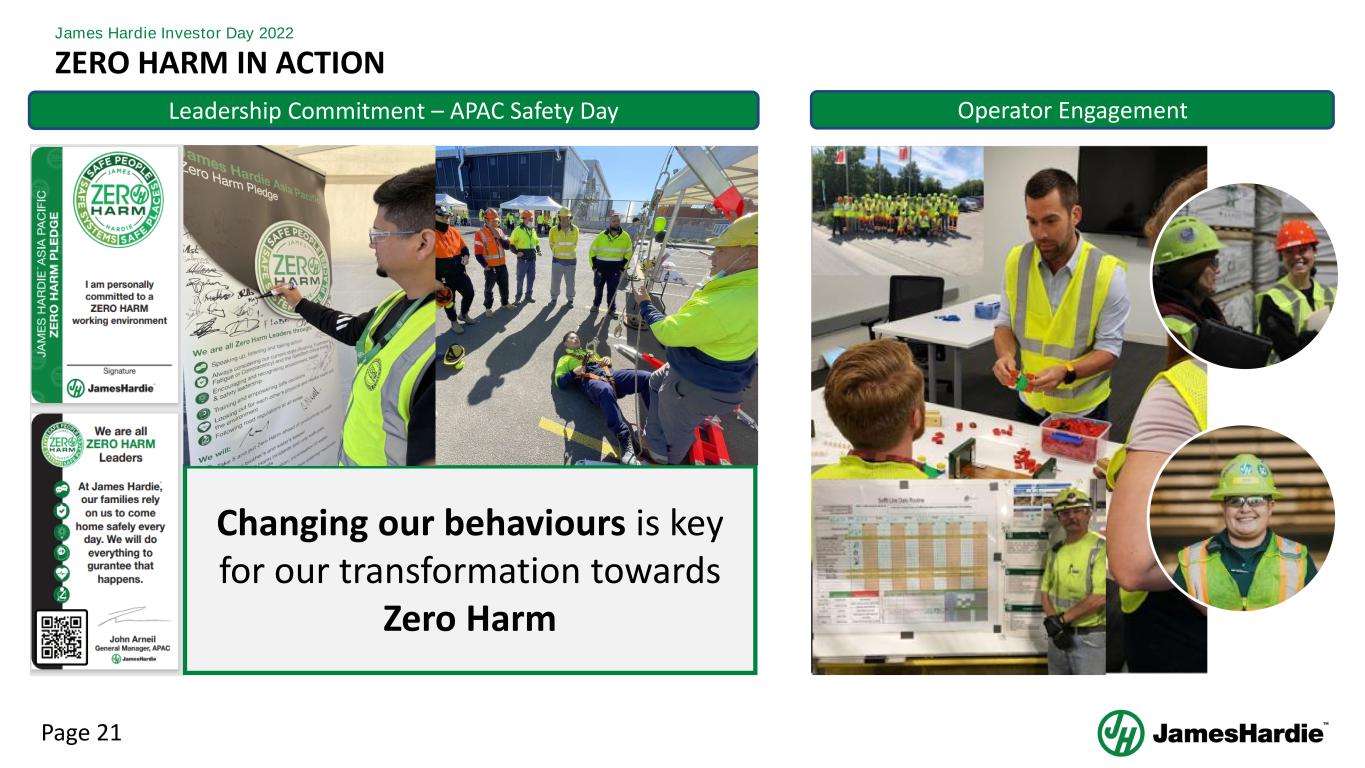

Page 20 James Hardie Investor Day 2022 JH ZERO HARM Building better safety systems is at the heart of James Hardie’s Zero Harm program. Safety is embedded in our corporate culture 24/7 across our global operations.

Page 21 James Hardie Investor Day 2022 Leadership Commitment – APAC Safety Day ZERO HARM IN ACTION Changing our behaviours is key for our transformation towards Zero Harm Operator Engagement

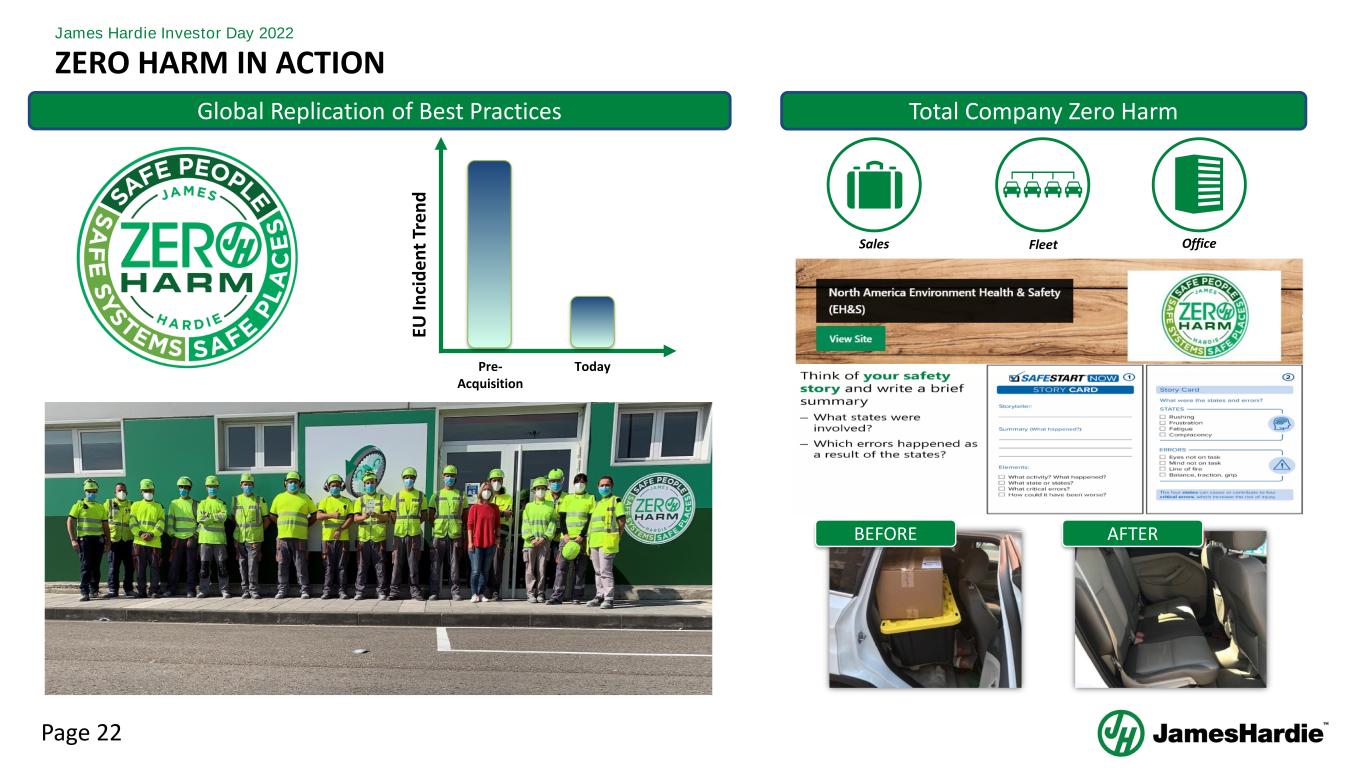

Page 22 James Hardie Investor Day 2022 ZERO HARM IN ACTION Sales Fleet Office BEFORE AFTER Pre- Acquisition Today EU In ci d e n t Tr e n d Total Company Zero HarmGlobal Replication of Best Practices

ESG UPDATE Jill Kolling, VP ESG & Chief Sustainability Officer

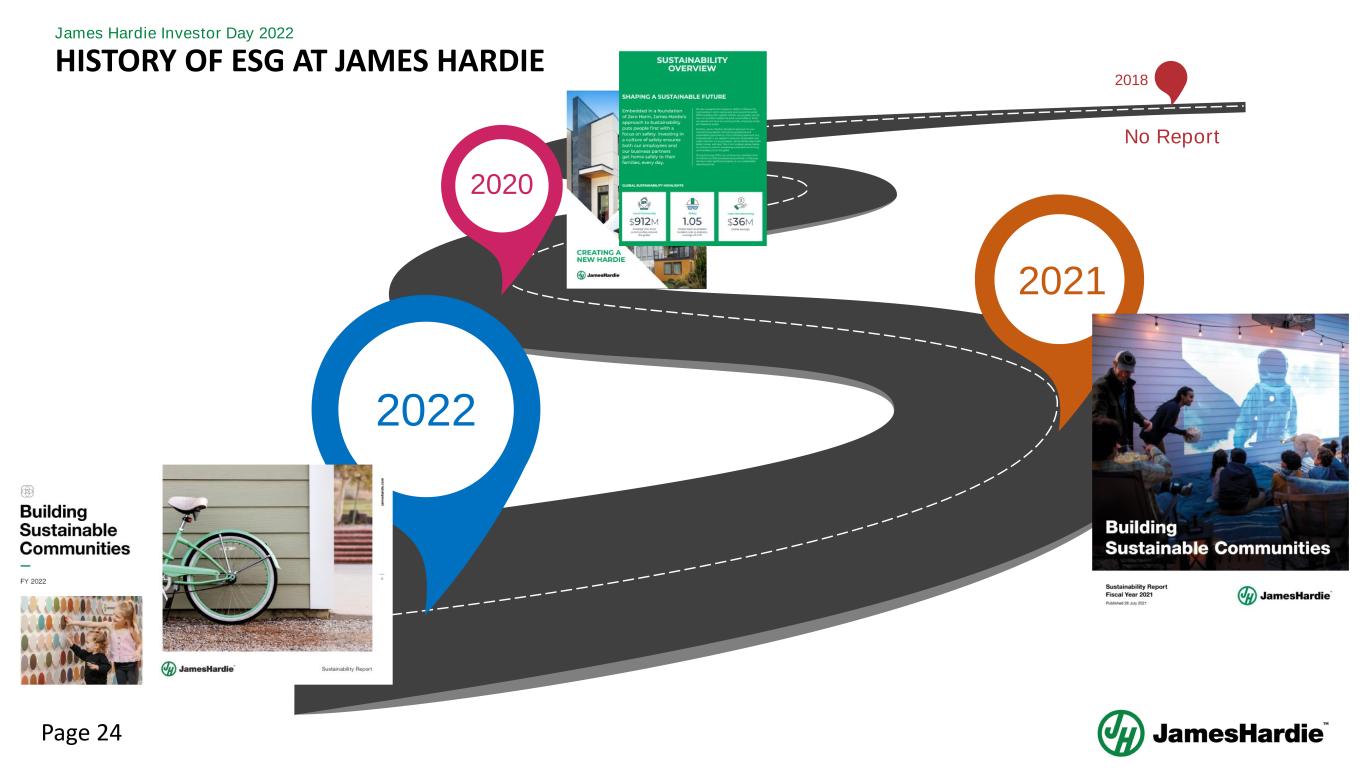

Page 24 James Hardie Investor Day 2022 HISTORY OF ESG AT JAMES HARDIE 2018 2020 2021 2022 No Report

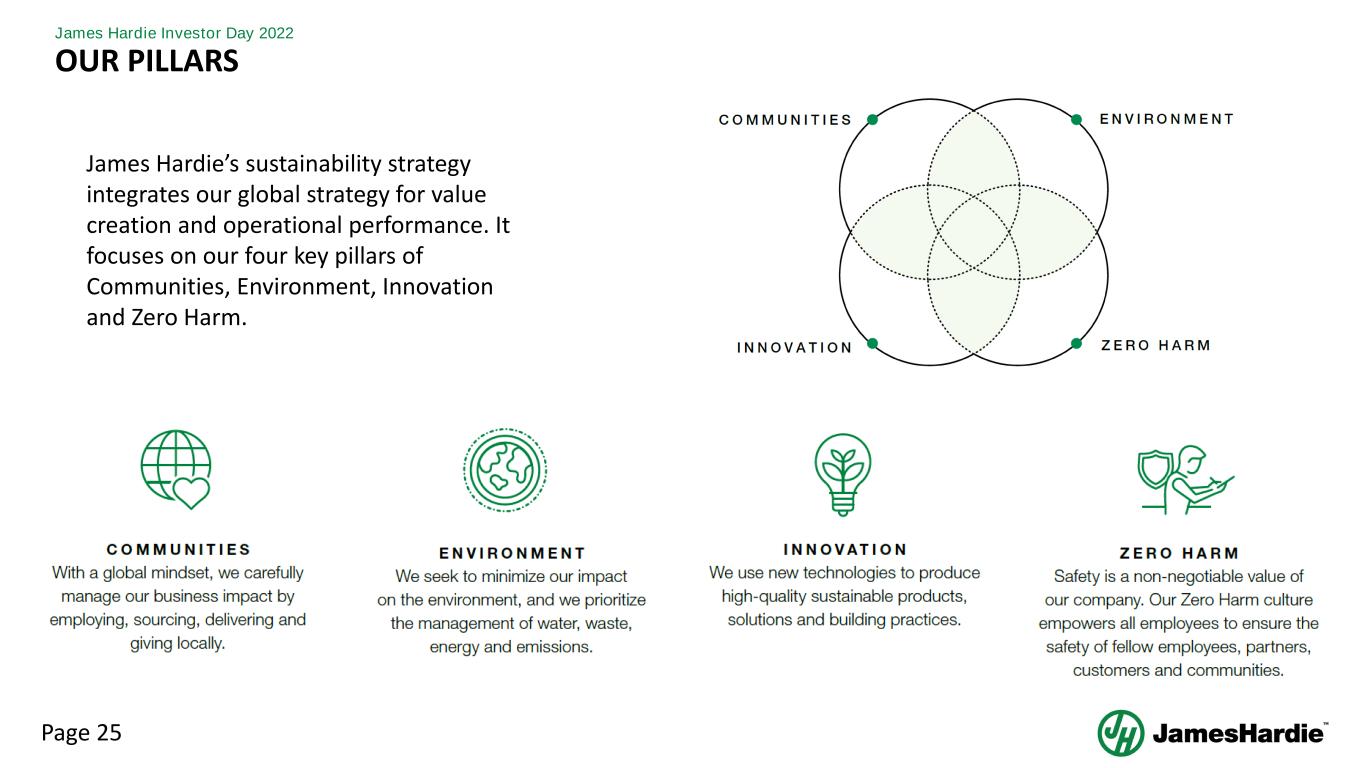

Page 25 James Hardie Investor Day 2022 OUR PILLARS James Hardie’s sustainability strategy integrates our global strategy for value creation and operational performance. It focuses on our four key pillars of Communities, Environment, Innovation and Zero Harm.

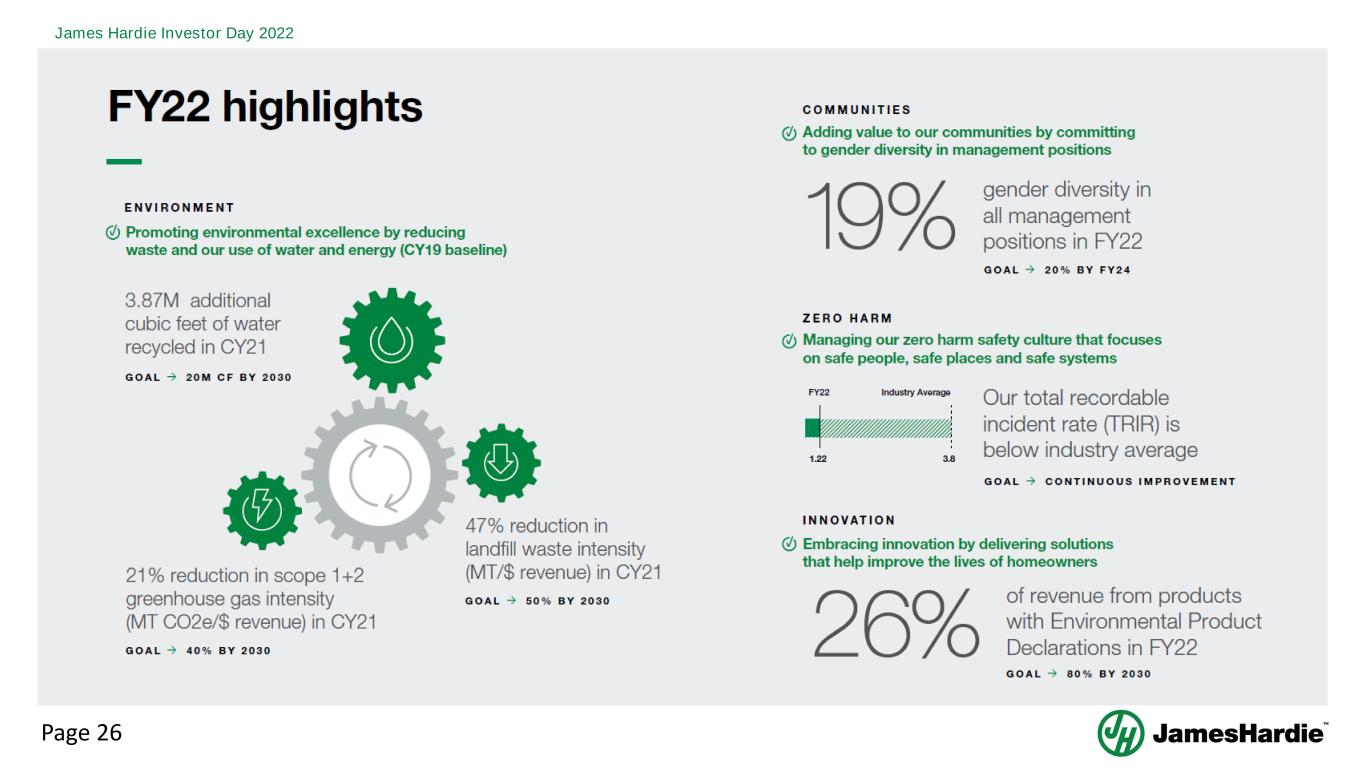

Page 26 James Hardie Investor Day 2022

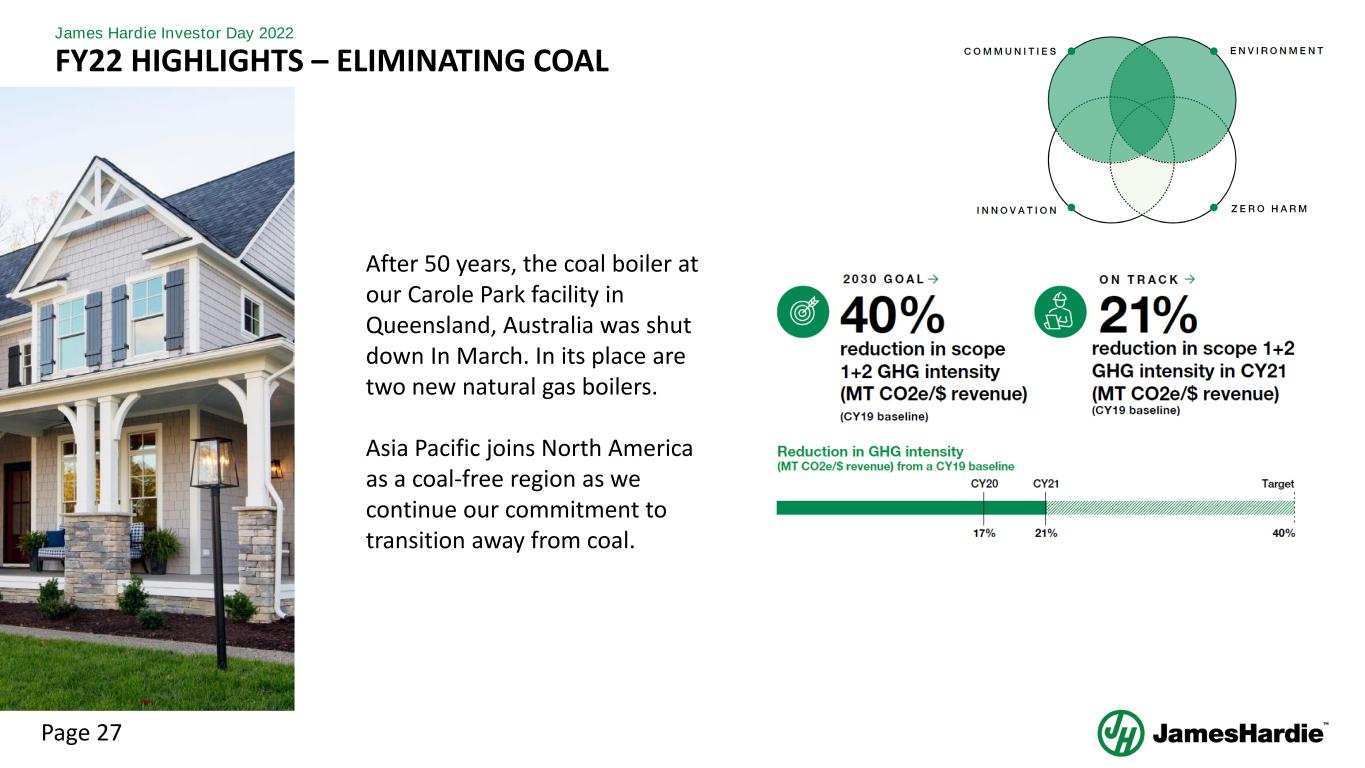

Page 27 James Hardie Investor Day 2022 FY22 HIGHLIGHTS – ELIMINATING COAL After 50 years, the coal boiler at our Carole Park facility in Queensland, Australia was shut down In March. In its place are two new natural gas boilers. Asia Pacific joins North America as a coal-free region as we continue our commitment to transition away from coal.

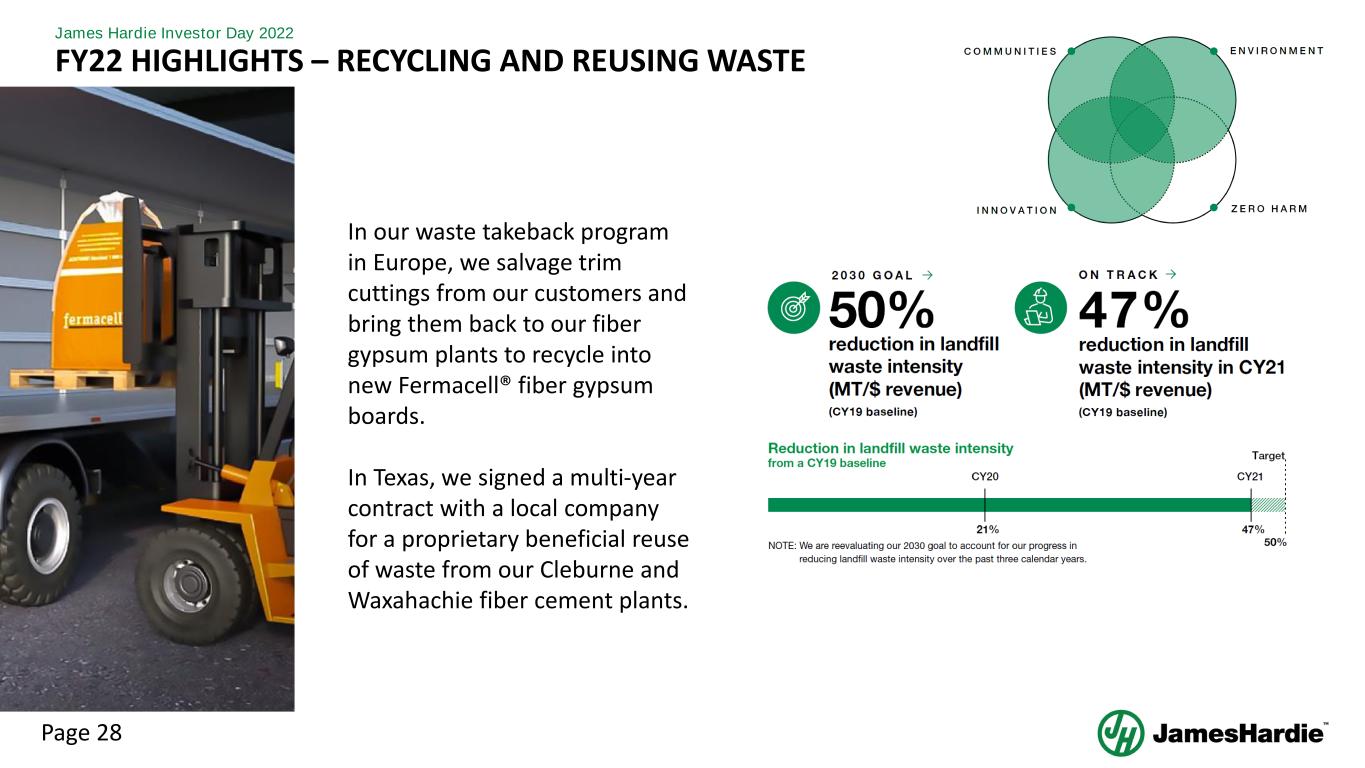

Page 28 James Hardie Investor Day 2022 FY22 HIGHLIGHTS – RECYCLING AND REUSING WASTE In our waste takeback program in Europe, we salvage trim cuttings from our customers and bring them back to our fiber gypsum plants to recycle into new Fermacell® fiber gypsum boards. In Texas, we signed a multi-year contract with a local company for a proprietary beneficial reuse of waste from our Cleburne and Waxahachie fiber cement plants.

Page 29 James Hardie Investor Day 2022 FY22 HIGHLIGHTS – INCLUSION AND DIVERSITY Our I&D program focuses on culture, employee engagement, employee capabilities, hiring practices, and growing and developing talent in the organization. We prioritize inclusion in the workplace so our employees feel they have a voice and are comfortable doing their best work.

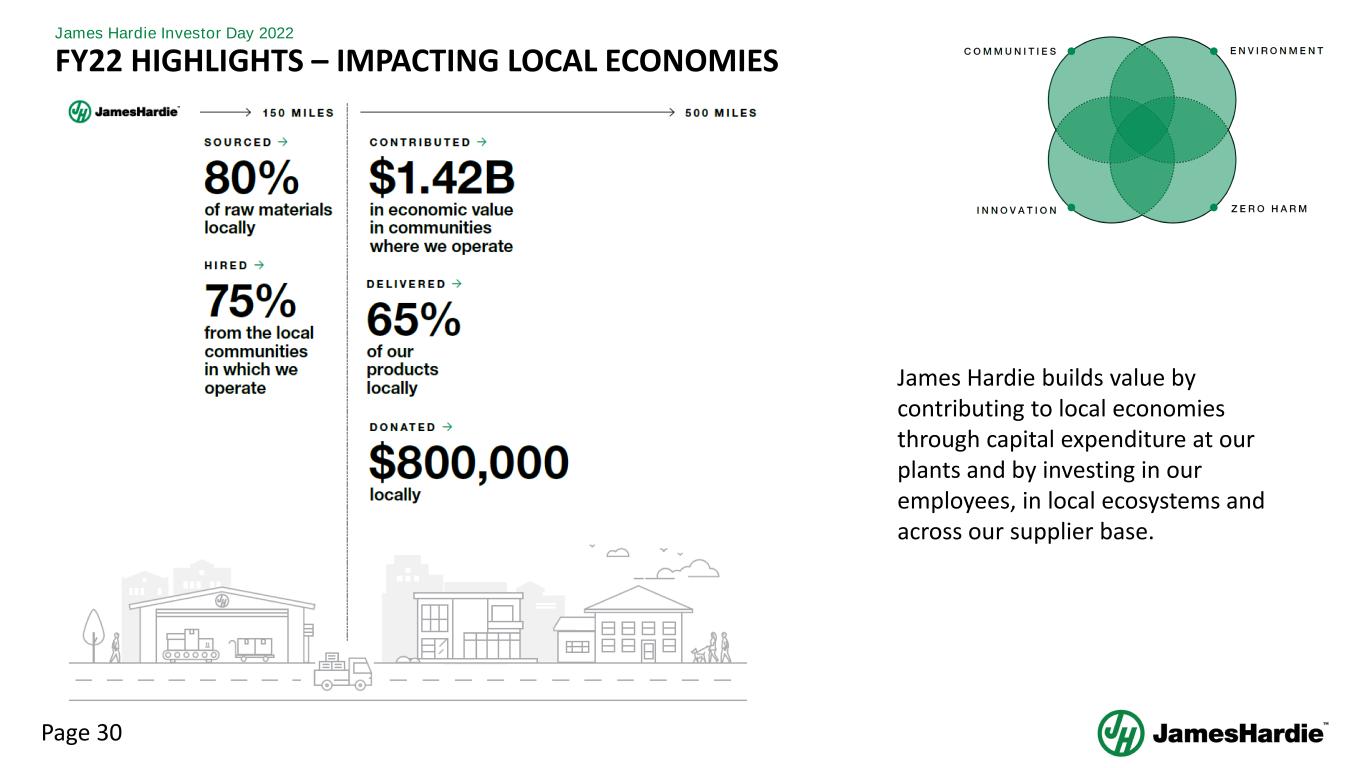

Page 30 James Hardie Investor Day 2022 FY22 HIGHLIGHTS – IMPACTING LOCAL ECONOMIES James Hardie builds value by contributing to local economies through capital expenditure at our plants and by investing in our employees, in local ecosystems and across our supplier base.

Page 31 James Hardie Investor Day 2022 CONTINUING OUR ESG JOURNEY • Building out a global ESG team • Continue to evolve our ESG reporting • Incorporate customer and consumer insights • Gain a better understanding of our upstream and downstream carbon footprint • Develop a more strategic approach to social sustainability • Revisit our goals

Q&A

30 MINUTE BREAK

Page 34 INVESTOR DAY 2022 – NORTH AMERICA

Page 35 James Hardie Investor Day 2022 PRESENTERS Sean Gadd President North America Chad Fredericksen VP North America Professional Channel John Madson VP North America Sales Atousa Ghoreichi SVP North America Marketing, PR, and Communications

Page 36 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – North America Topic Presenter North America Overview Sean Gadd Built for Growth Why We Win Regional Approach Q&A Lunch Northeast & Midwest Repair & Remodel Chad Fredericksen Customer John Madson Contractor Chad Fredericksen Q&A / Break Homeowner Sean Gadd It’s Possible™ Atousa Ghoreichi Magnolia Atousa Ghoreichi Visualization Chad Fredericksen North America Closing Sean Gadd Q&A

Page 37 NORTH AMERICA: OVERVIEW Sean Gadd, President North America

Page 38 James Hardie Investor Day 2022 NORTH AMERICA – SUMMARY Proven track record as a growth company James Hardie fiber cement proven to deliver high value We want to win in all regions and all segments Accelerate sustainable profitable growth in Northeast and Midwest Repair & Remodel market

Page 39 NORTH AMERICA: BUILT FOR GROWTH

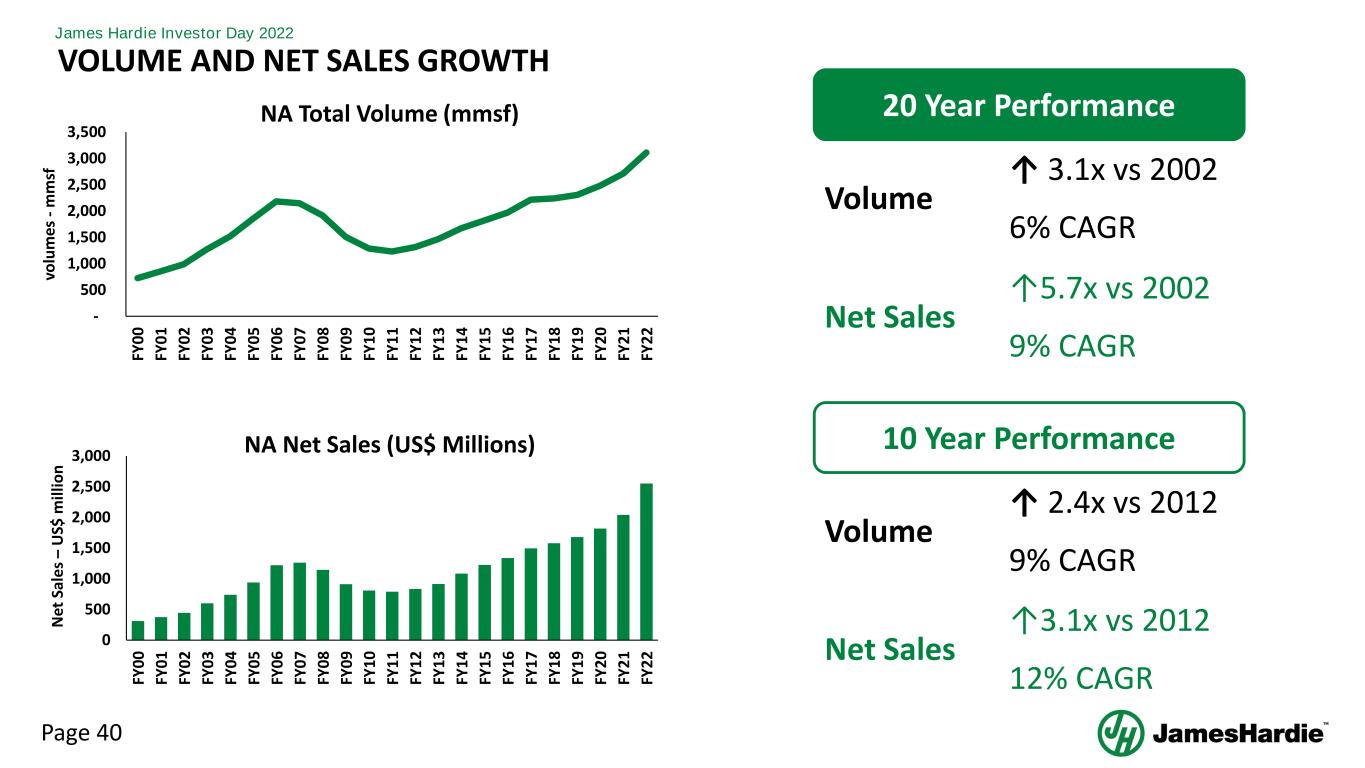

Page 40 James Hardie Investor Day 2022 VOLUME AND NET SALES GROWTH 0 500 1,000 1,500 2,000 2,500 3,000 FY 0 0 FY 0 1 FY 0 2 FY 0 3 FY 0 4 FY 0 5 FY 0 6 FY 0 7 FY 0 8 FY 0 9 FY 1 0 FY 1 1 FY 1 2 FY 1 3 FY 1 4 FY 1 5 FY 1 6 FY 1 7 FY 1 8 FY 1 9 FY 2 0 FY 2 1 FY 2 2 N et S al e s – U S$ m ill io n - 500 1,000 1,500 2,000 2,500 3,000 3,500 FY 0 0 FY 0 1 FY 0 2 FY 0 3 FY 0 4 FY 0 5 FY 0 6 FY 0 7 FY 0 8 FY 0 9 FY 1 0 FY 1 1 FY 1 2 FY 1 3 FY 1 4 FY 1 5 FY 1 6 FY 1 7 FY 1 8 FY 1 9 FY 2 0 FY 2 1 FY 2 2 vo lu m es - m m sf NA Total Volume (mmsf) NA Net Sales (US$ Millions) 20 Year Performance ↑ 3.1x vs 2002 6% CAGR Volume ↑5.7x vs 2002 9% CAGR Net Sales 10 Year Performance ↑ 2.4x vs 2012 9% CAGR Volume ↑3.1x vs 2012 12% CAGR Net Sales

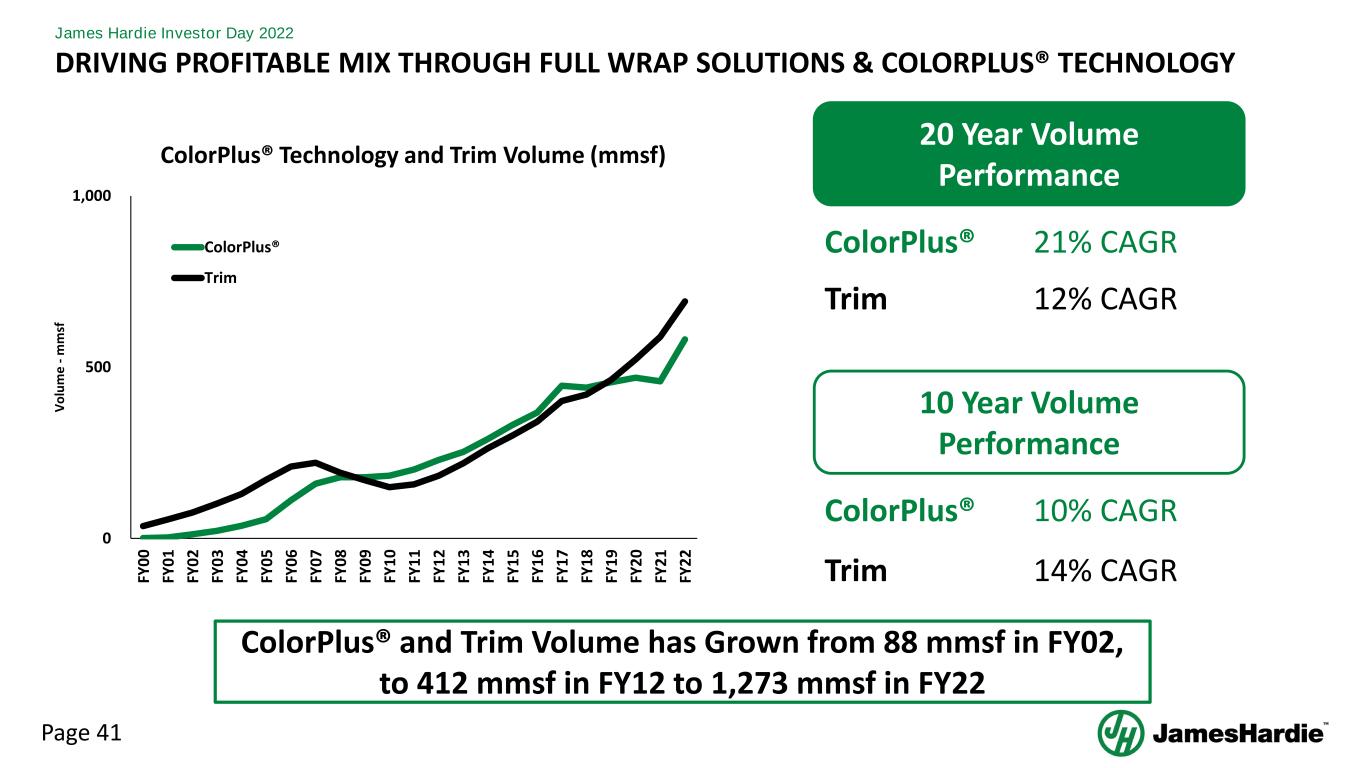

Page 41 James Hardie Investor Day 2022 DRIVING PROFITABLE MIX THROUGH FULL WRAP SOLUTIONS & COLORPLUS® TECHNOLOGY ColorPlus® and Trim Volume has Grown from 88 mmsf in FY02, to 412 mmsf in FY12 to 1,273 mmsf in FY22 0 500 1,000 FY 0 0 FY 0 1 FY 0 2 FY 0 3 FY 0 4 FY 0 5 FY 0 6 FY 0 7 FY 0 8 FY 0 9 FY 1 0 FY 1 1 FY 1 2 FY 1 3 FY 1 4 FY 1 5 FY 1 6 FY 1 7 FY 1 8 FY 1 9 FY 2 0 FY 2 1 FY 2 2 V o lu m e - m m sf ColorPlus® Trim 20 Year Volume Performance 21% CAGRColorPlus® 12% CAGRTrim 10 Year Volume Performance 10% CAGRColorPlus® 14% CAGRTrim ColorPlus® Technology and Trim Volume (mmsf)

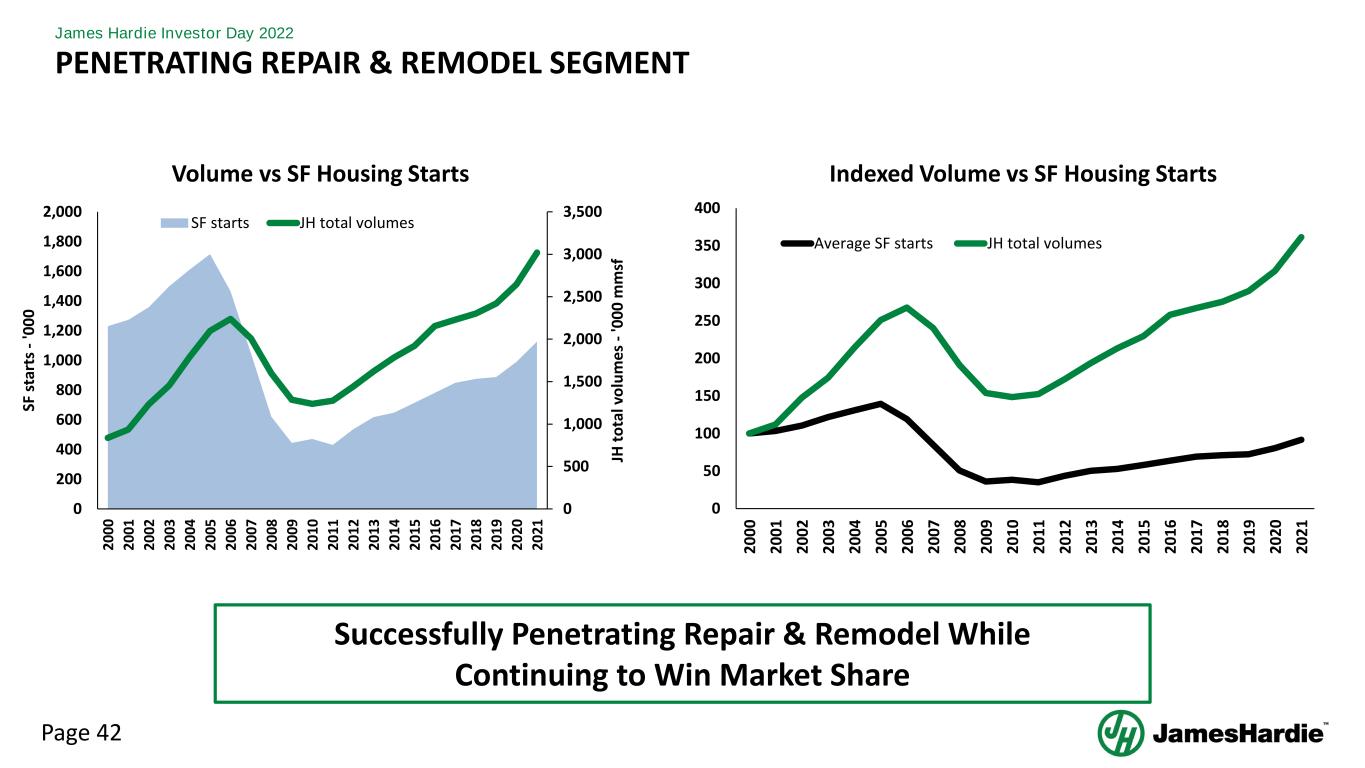

Page 42 James Hardie Investor Day 2022 PENETRATING REPAIR & REMODEL SEGMENT 0 500 1,000 1,500 2,000 2,500 3,000 3,500 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 20 0 0 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 1 9 20 20 20 21 JH t o ta l v o lu m es - '0 0 0 m m sf SF s ta rt s - '0 0 0 SF starts JH total volumes 0 50 100 150 200 250 300 350 400 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 Average SF starts JH total volumes Successfully Penetrating Repair & Remodel While Continuing to Win Market Share Volume vs SF Housing Starts Indexed Volume vs SF Housing Starts

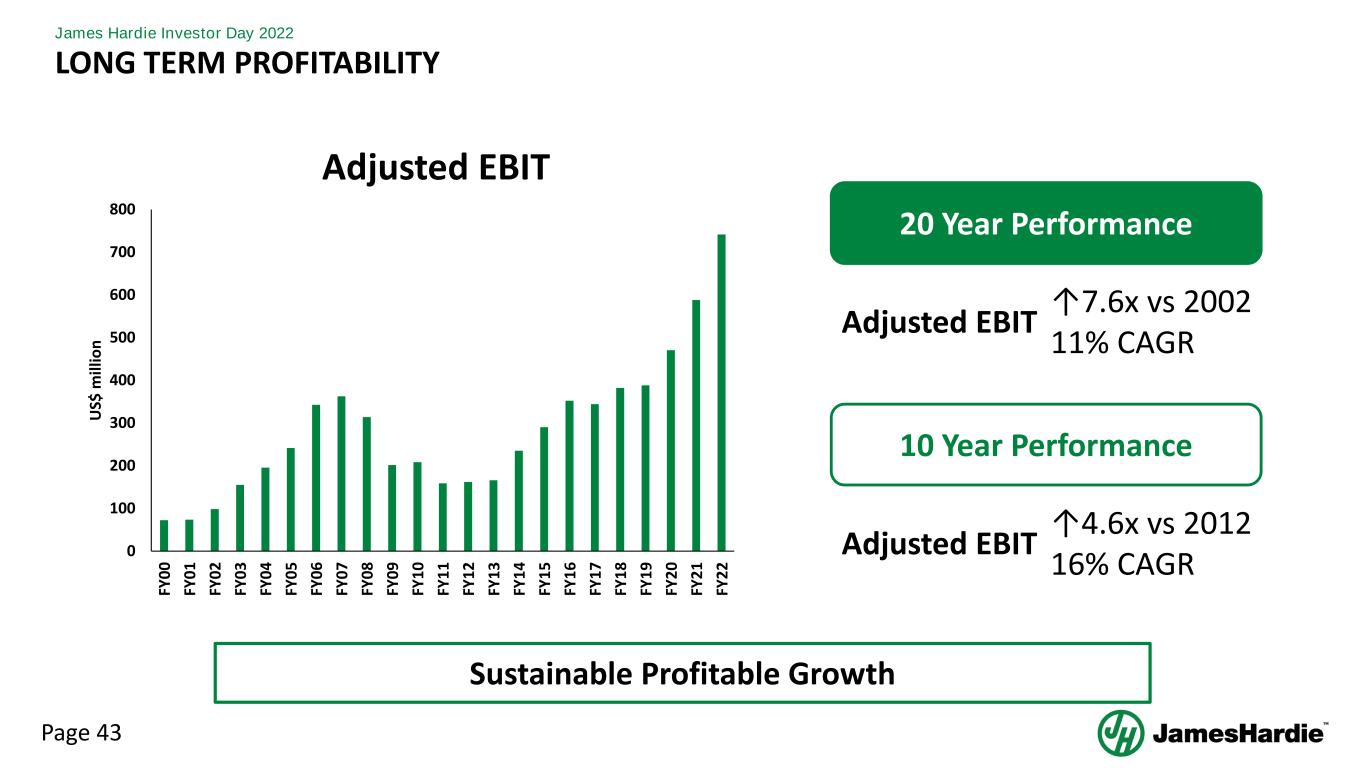

Page 43 James Hardie Investor Day 2022 LONG TERM PROFITABILITY 0 100 200 300 400 500 600 700 800 FY 0 0 FY 0 1 FY 0 2 FY 0 3 FY 0 4 FY 0 5 FY 0 6 FY 0 7 FY 0 8 FY 0 9 FY 1 0 FY 1 1 FY 1 2 FY 1 3 FY 1 4 FY 1 5 FY 1 6 FY 1 7 FY 1 8 FY 1 9 FY 2 0 FY 2 1 FY 2 2 U S$ m ill io n 20 Year Performance ↑7.6x vs 2002 11% CAGR Adjusted EBIT 10 Year Performance ↑4.6x vs 2012 16% CAGR Adjusted EBIT Sustainable Profitable Growth Adjusted EBIT

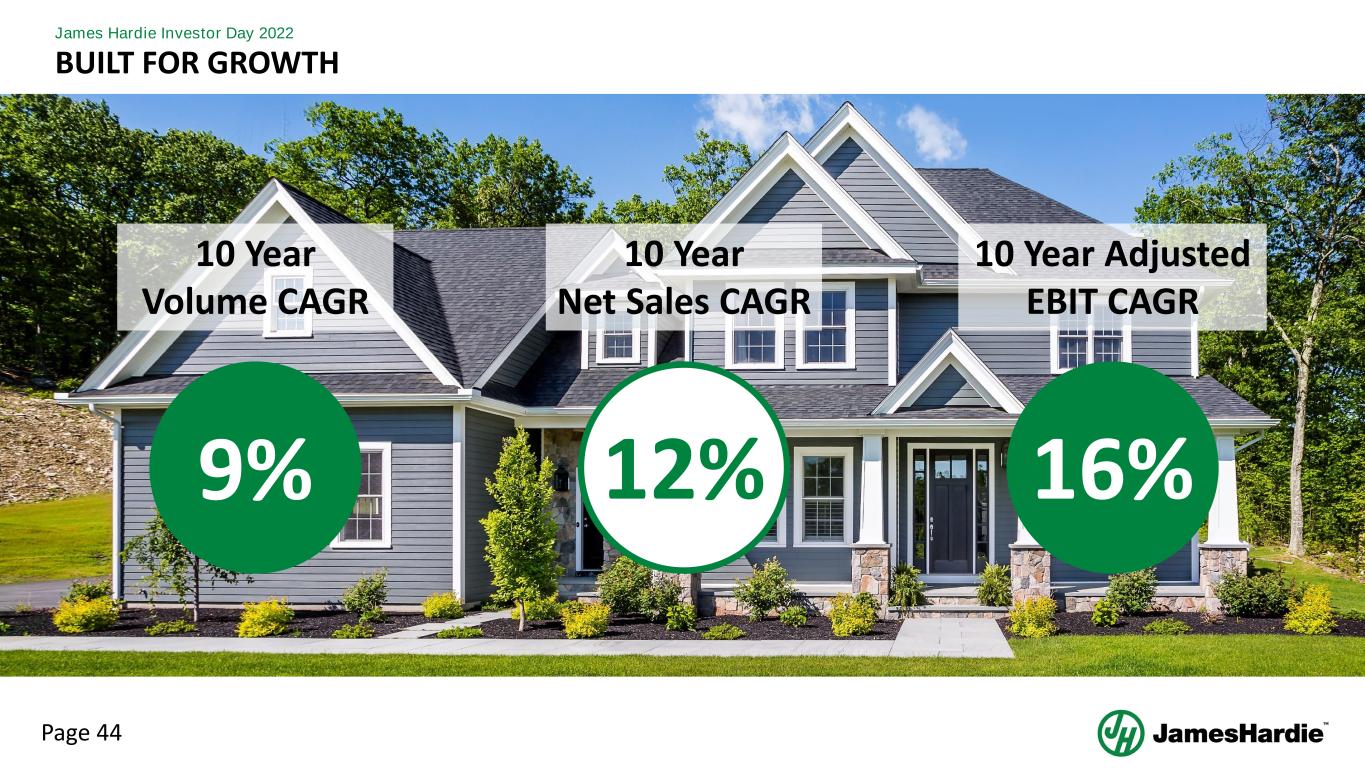

Page 44 James Hardie Investor Day 2022 BUILT FOR GROWTH 9% 10 Year Volume CAGR 10 Year Net Sales CAGR 10 Year Adjusted EBIT CAGR 16%12%

Page 45 NORTH AMERICA: WHY WE WIN

Page 46 James Hardie Investor Day 2022 Exterior Design ✓ Curb Appeal James Hardie Value Proposition Superior Durability ✓ Resistance to Fire & Weather Low Maintenance ✓ Full Wrap Solution Trusted Brand ✓ On Over 10 Million Homes Unrivaled Business Support

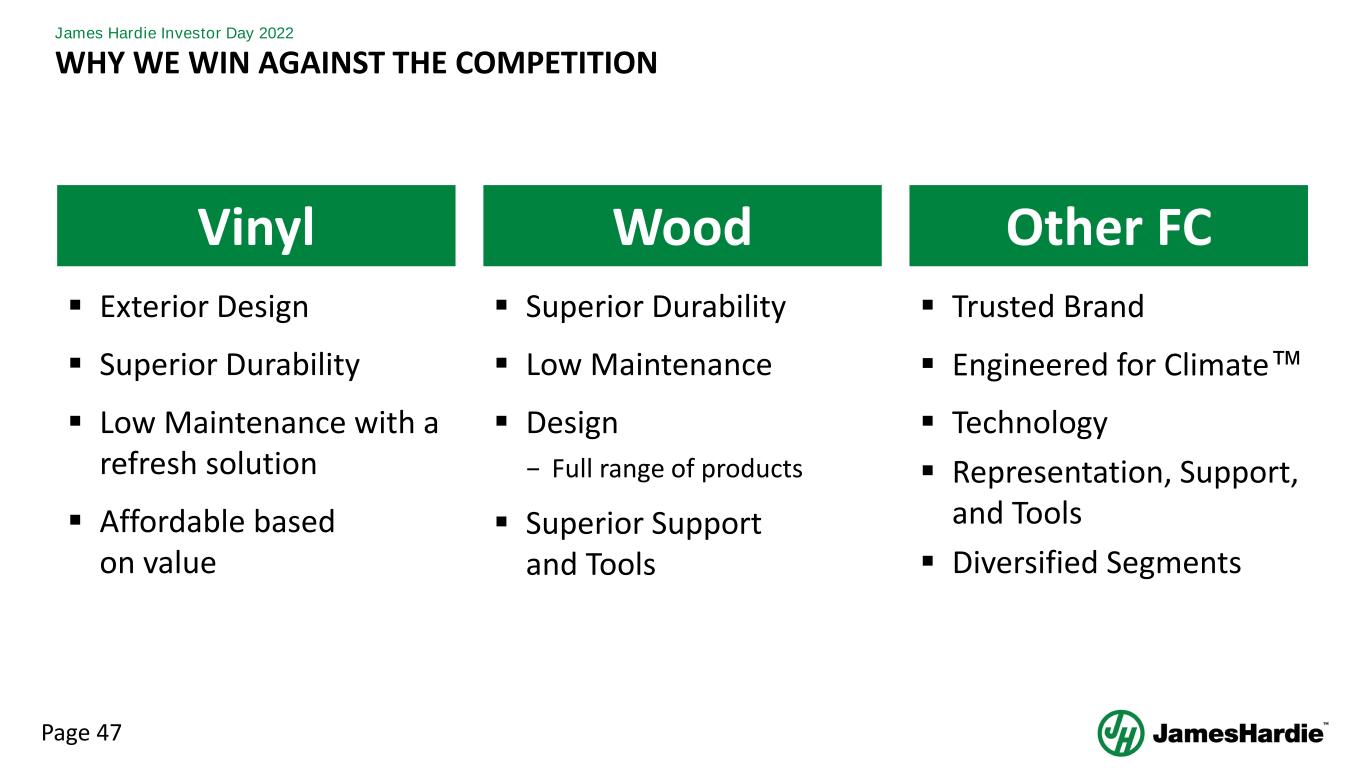

Page 47 James Hardie Investor Day 2022 WHY WE WIN AGAINST THE COMPETITION Vinyl Wood Other FC ▪ Exterior Design ▪ Superior Durability ▪ Low Maintenance with a refresh solution ▪ Affordable based on value ▪ Superior Durability ▪ Low Maintenance ▪ Design − Full range of products ▪ Superior Support and Tools ▪ Trusted Brand ▪ Engineered for Climate™ ▪ Technology ▪ Representation, Support, and Tools ▪ Diversified Segments

Page 48 James Hardie Investor Day 2022 FULL WRAP SOLUTION We Manufacture High Performance Fiber Cement Building Solutions

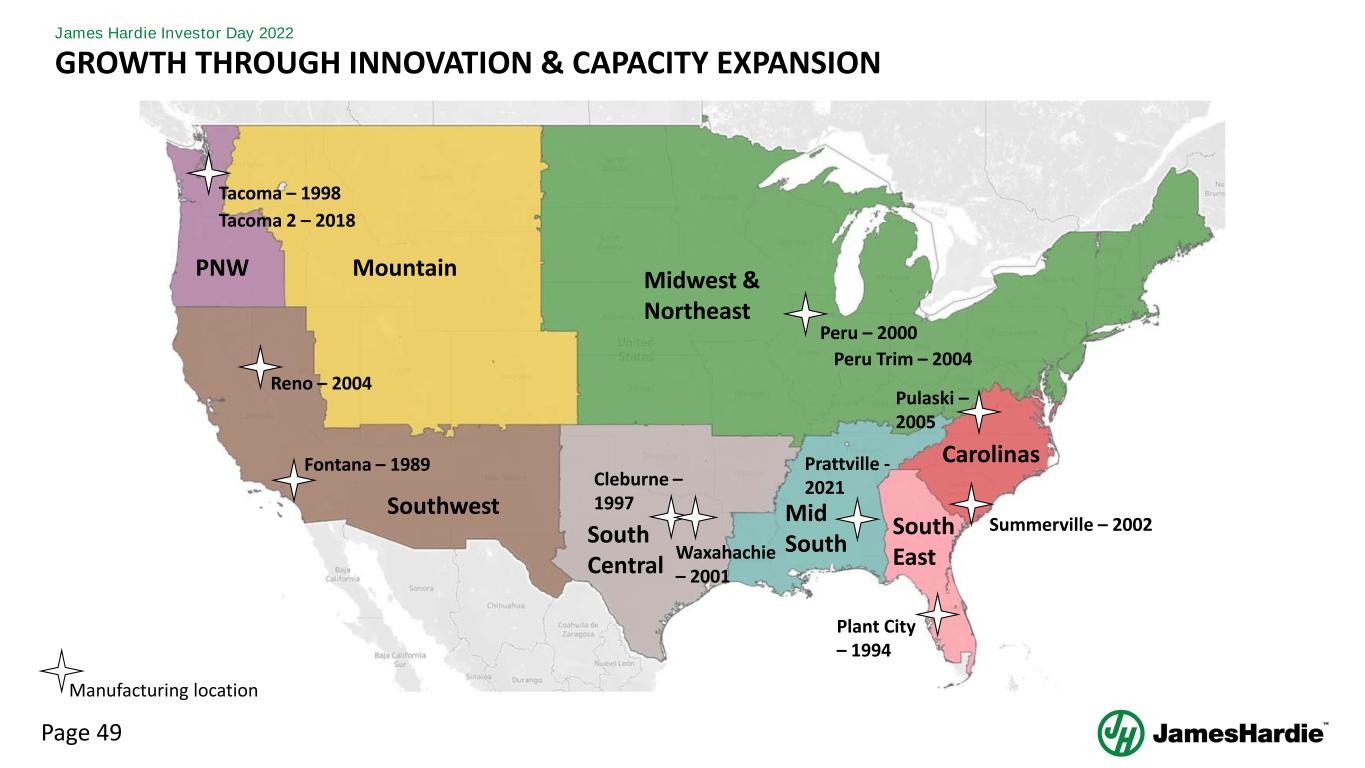

Page 49 James Hardie Investor Day 2022 GROWTH THROUGH INNOVATION & CAPACITY EXPANSION Midwest & Northeast MountainPNW Mid South Carolinas South East Tacoma – 1998 Reno – 2004 Peru – 2000 Prattville - 2021 Summerville – 2002 Cleburne – 1997 Fontana – 1989 Southwest Manufacturing location Pulaski – 2005 South Central Waxahachie – 2001 Plant City – 1994 Peru Trim – 2004 Tacoma 2 – 2018

Page 50 NORTH AMERICA: REGIONAL APPROACH

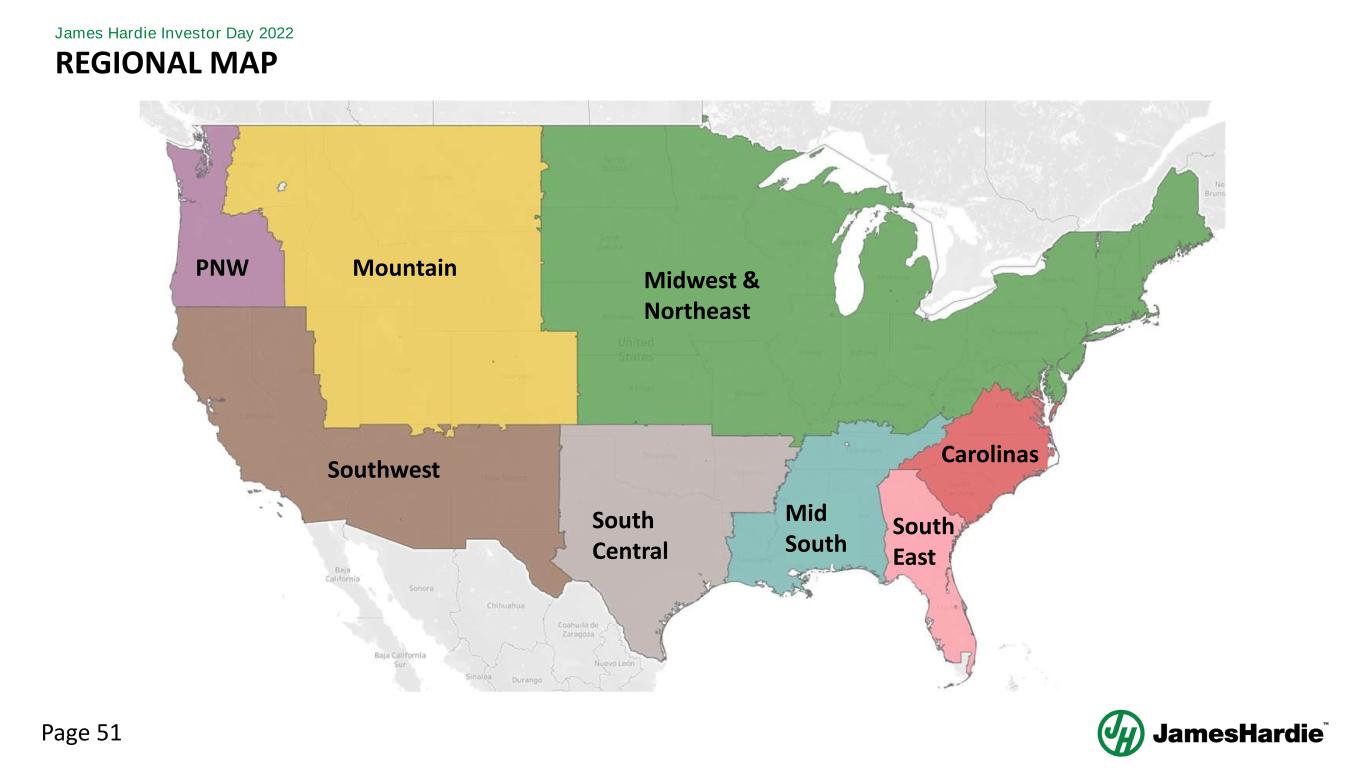

Page 51 James Hardie Investor Day 2022 REGIONAL MAP Midwest & Northeast Mountain Southwest South Central PNW Carolinas Mid South South East

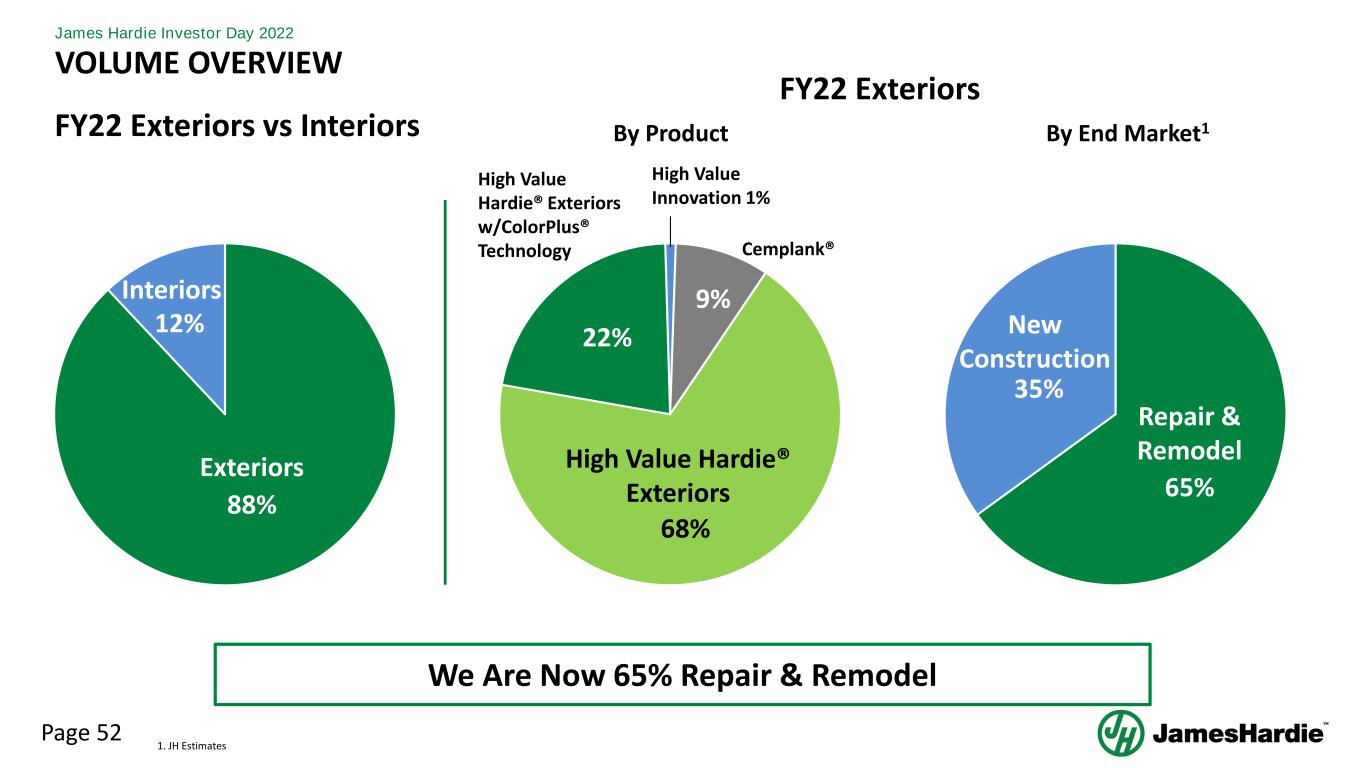

Page 52 James Hardie Investor Day 2022 VOLUME OVERVIEW FY22 Exteriors By Product Exteriors 88% Interiors 12% High Value Hardie® Exteriors 68% High Value Hardie® Exteriors w/ColorPlus® Technology 22% High Value Innovation 1% 1. JH Estimates Cemplank® 9% Repair & Remodel 65% New Construction 35% FY22 Exteriors vs Interiors By End Market1 We Are Now 65% Repair & Remodel

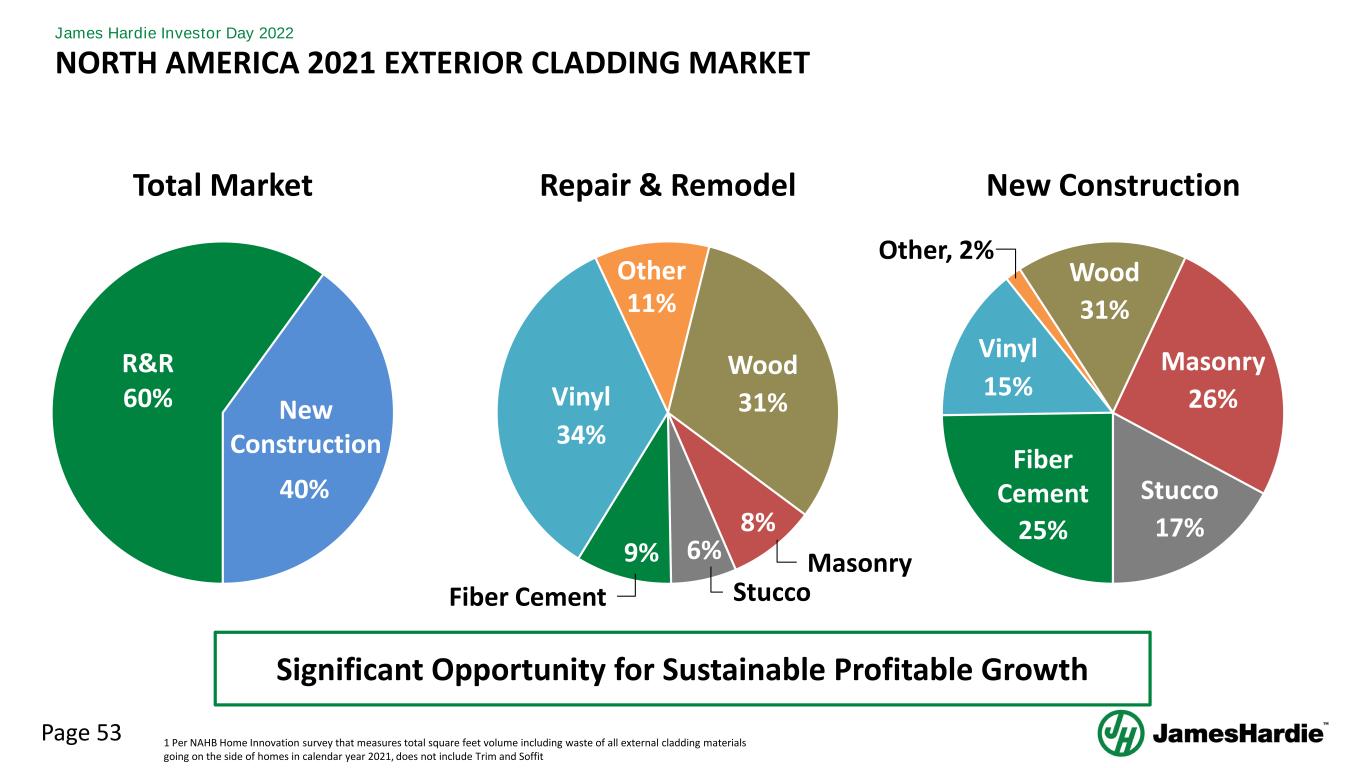

Page 53 James Hardie Investor Day 2022 NORTH AMERICA 2021 EXTERIOR CLADDING MARKET New ConstructionRepair & RemodelTotal Market R&R 60% New Construction 40% Wood 31% Other 11% Vinyl 34% Masonry 8% Stucco 6%9% Fiber Cement Wood 31% Stucco 17% Fiber Cement 25% Vinyl 15% Other, 2% Masonry 26% Significant Opportunity for Sustainable Profitable Growth 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit

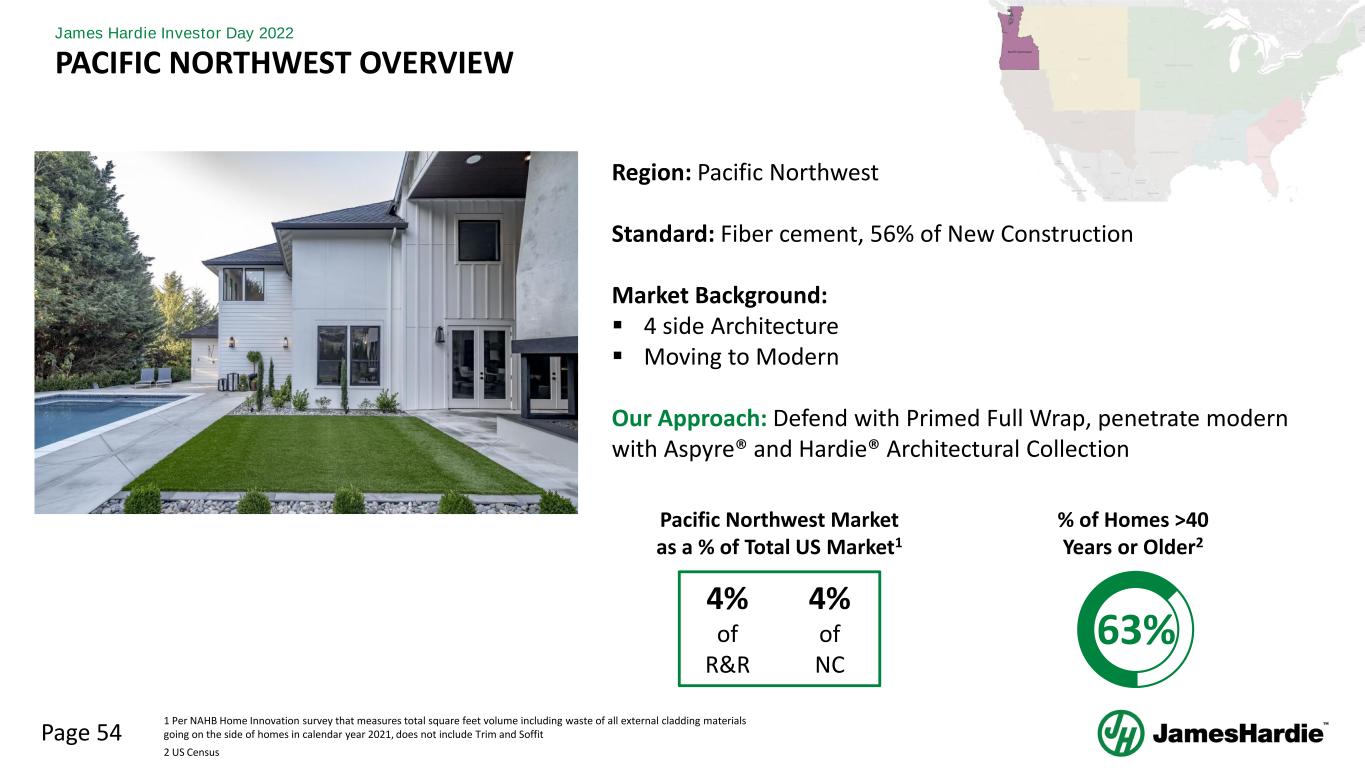

Page 54 James Hardie Investor Day 2022 PACIFIC NORTHWEST OVERVIEW Region: Pacific Northwest Standard: Fiber cement, 56% of New Construction Market Background: ▪ 4 side Architecture ▪ Moving to Modern Our Approach: Defend with Primed Full Wrap, penetrate modern with Aspyre® and Hardie® Architectural Collection 4% of R&R 4% of NC 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census Pacific Northwest Market as a % of Total US Market1 % of Homes >40 Years or Older2 63%

Page 55 James Hardie Investor Day 2022 SOUTHWEST OVERVIEW Region: Southwest Standard: Stucco, 57% of New Construction Market Background: ▪ Mediterranean look Our Approach: Win with Primed full wrap everywhere, with separate focus on Southern California Coast and Northern California with Aspyre. Opportunity to win Modern with Hardie® Architectural Collection 13% of R&R 11% of NC Southwest Market as a % of Total US Market1 % of Homes >40 Years or Older2 49% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census

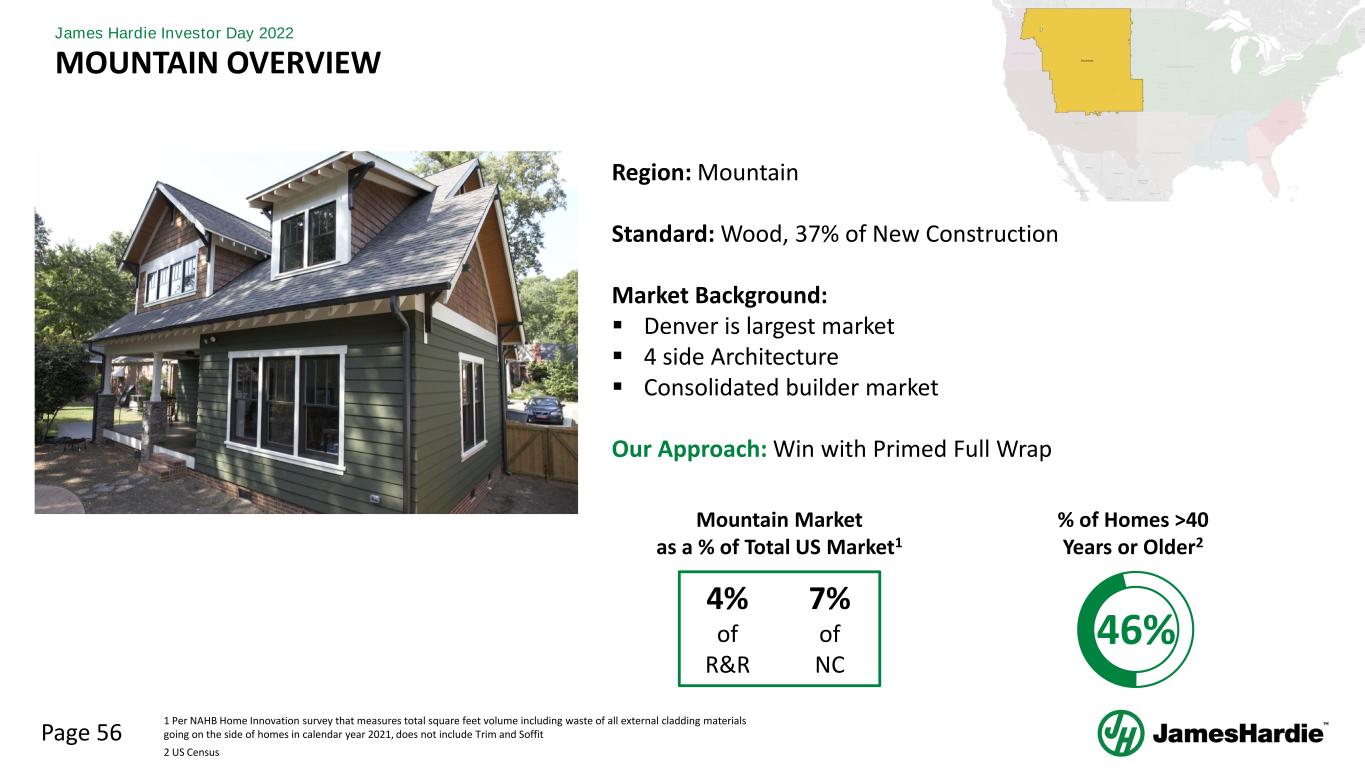

Page 56 James Hardie Investor Day 2022 MOUNTAIN OVERVIEW Region: Mountain Standard: Wood, 37% of New Construction Market Background: ▪ Denver is largest market ▪ 4 side Architecture ▪ Consolidated builder market Our Approach: Win with Primed Full Wrap 4% of R&R 7% of NC Mountain Market as a % of Total US Market1 % of Homes >40 Years or Older2 46% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census

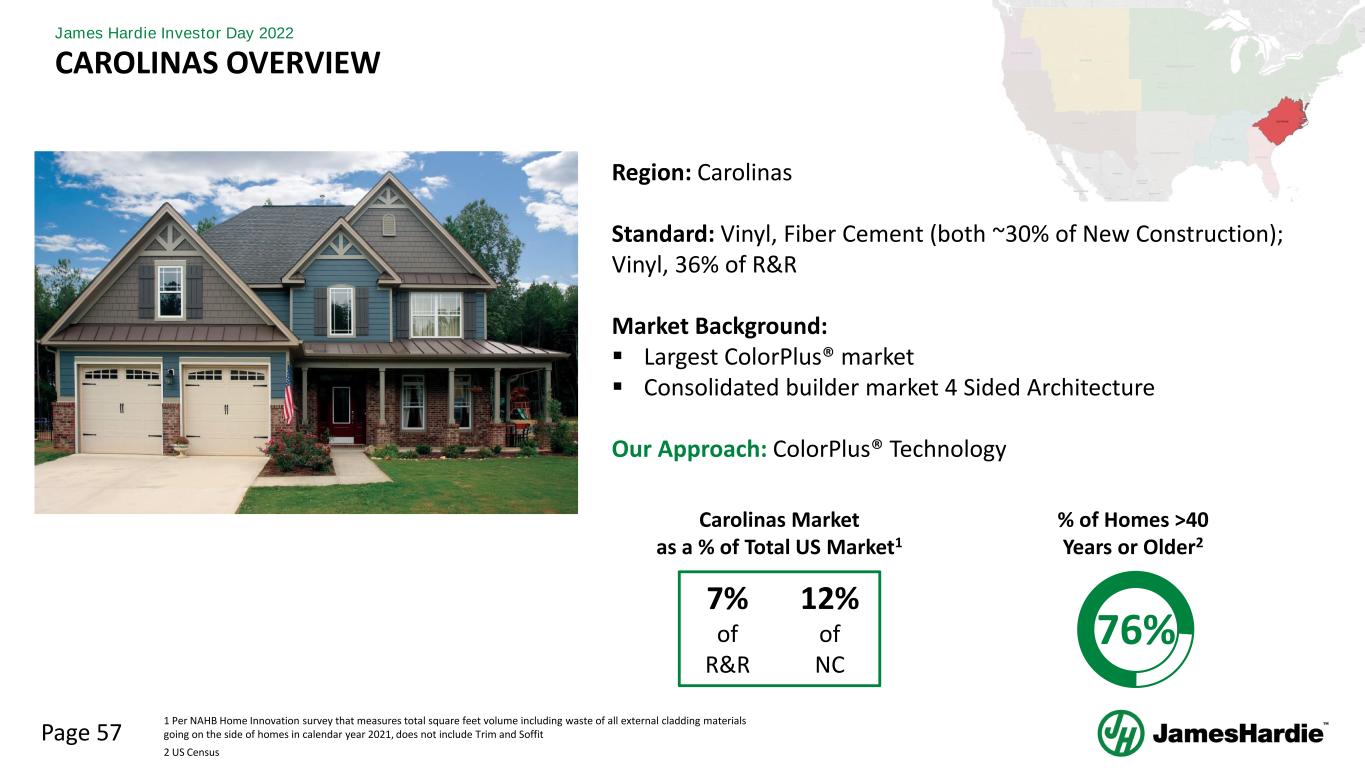

Page 57 James Hardie Investor Day 2022 CAROLINAS OVERVIEW Region: Carolinas Standard: Vinyl, Fiber Cement (both ~30% of New Construction); Vinyl, 36% of R&R Market Background: ▪ Largest ColorPlus® market ▪ Consolidated builder market 4 Sided Architecture Our Approach: ColorPlus® Technology 7% of R&R 12% of NC Carolinas Market as a % of Total US Market1 % of Homes >40 Years or Older2 76% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census

Page 58 James Hardie Investor Day 2022 SOUTHEAST OVERVIEW Region: Southeast Standard: Stucco, 36% of New Construction; Fiber Cement Market Background: ▪ Atlanta very consolidated 4 Side Architecture ▪ Florida: Stucco liability Our Approach: Defend with Primed in Atlanta, and grow in Florida with Full Wrap ColorPlus® Technology and Hardie® Architectural Collection 10% of R&R 19% of NC Southeast Market as a % of Total US Market1 % of Homes >40 Years or Older2 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census 51%

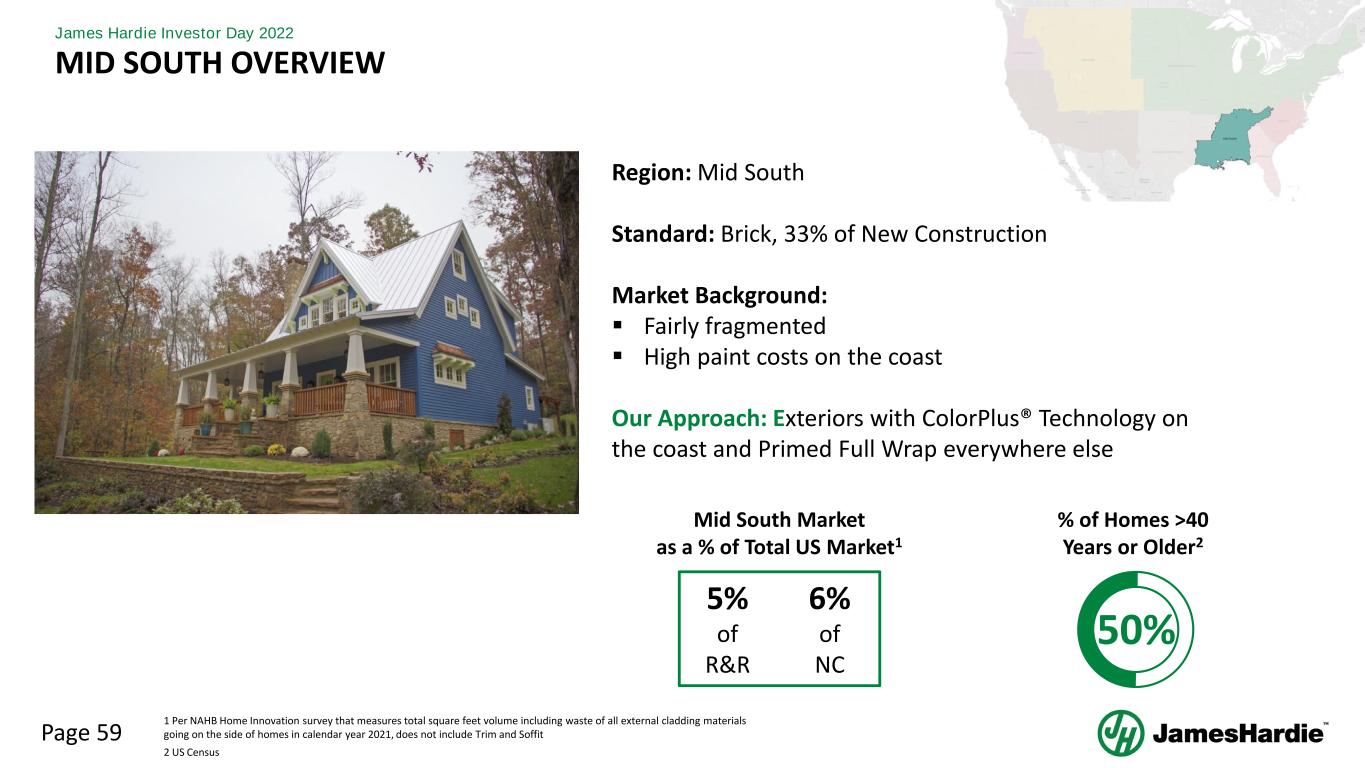

Page 59 James Hardie Investor Day 2022 MID SOUTH OVERVIEW Region: Mid South Standard: Brick, 33% of New Construction Market Background: ▪ Fairly fragmented ▪ High paint costs on the coast Our Approach: Exteriors with ColorPlus® Technology on the coast and Primed Full Wrap everywhere else 5% of R&R 6% of NC Mid South Market as a % of Total US Market1 % of Homes >40 Years or Older2 50% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census

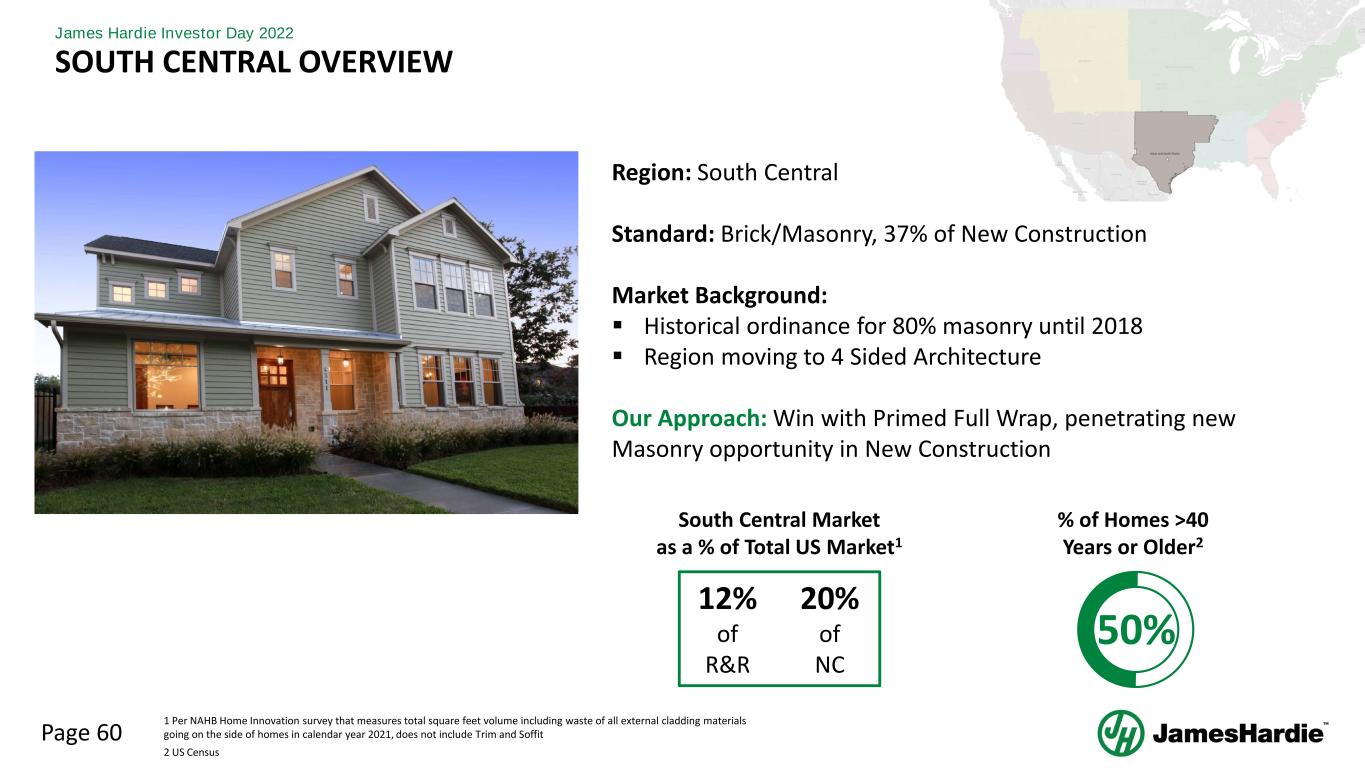

Page 60 James Hardie Investor Day 2022 SOUTH CENTRAL OVERVIEW Region: South Central Standard: Brick/Masonry, 37% of New Construction Market Background: ▪ Historical ordinance for 80% masonry until 2018 ▪ Region moving to 4 Sided Architecture Our Approach: Win with Primed Full Wrap, penetrating new Masonry opportunity in New Construction 12% of R&R 20% of NC South Central Market as a % of Total US Market1 % of Homes >40 Years or Older2 50% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census

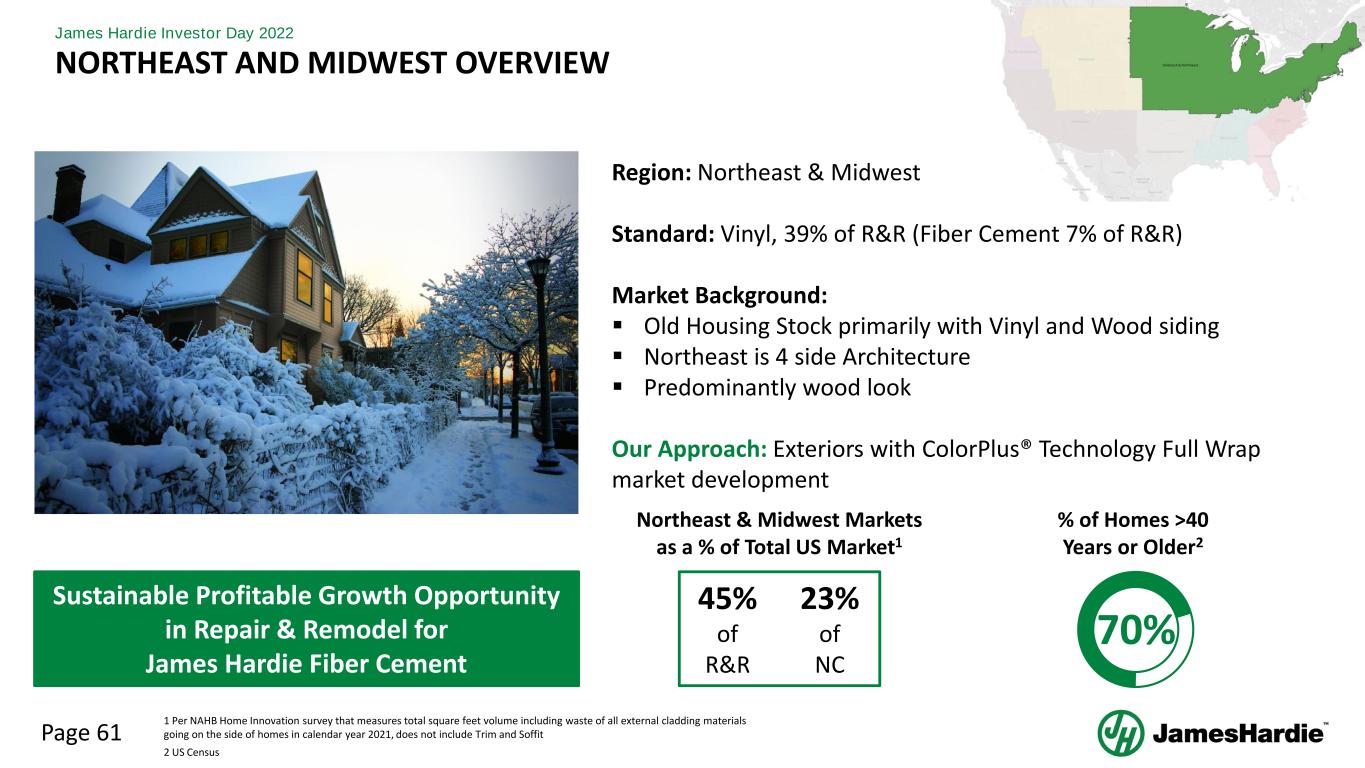

Page 61 James Hardie Investor Day 2022 NORTHEAST AND MIDWEST OVERVIEW Region: Northeast & Midwest Standard: Vinyl, 39% of R&R (Fiber Cement 7% of R&R) Market Background: ▪ Old Housing Stock primarily with Vinyl and Wood siding ▪ Northeast is 4 side Architecture ▪ Predominantly wood look Our Approach: Exteriors with ColorPlus® Technology Full Wrap market development 45% of R&R 23% of NC Northeast & Midwest Markets as a % of Total US Market1 % of Homes >40 Years or Older2 70% 1 Per NAHB Home Innovation survey that measures total square feet volume including waste of all external cladding materials going on the side of homes in calendar year 2021, does not include Trim and Soffit 2 US Census Sustainable Profitable Growth Opportunity in Repair & Remodel for James Hardie Fiber Cement

Page 62 Q&A

Page 63 90 MINUTE LUNCH

Page 64 NORTH AMERICA: NORTHEAST AND MIDWEST R&R Chad Fredericksen, VP North America Pro Channel

Page 65 James Hardie Investor Day 2022 NORTHEAST AND MIDWEST REPAIR & REMODEL – SUMMARY The Repair & Remodel market in the Northeast and Midwest is a Sustainable Profitable Growth Opportunity James Hardie has industry leading capabilities across the entire Repair & Remodel value chain Our integrated and aligned value chain enables our key customers and contractors to capture a disproportionate share of demand helping them and us make more money

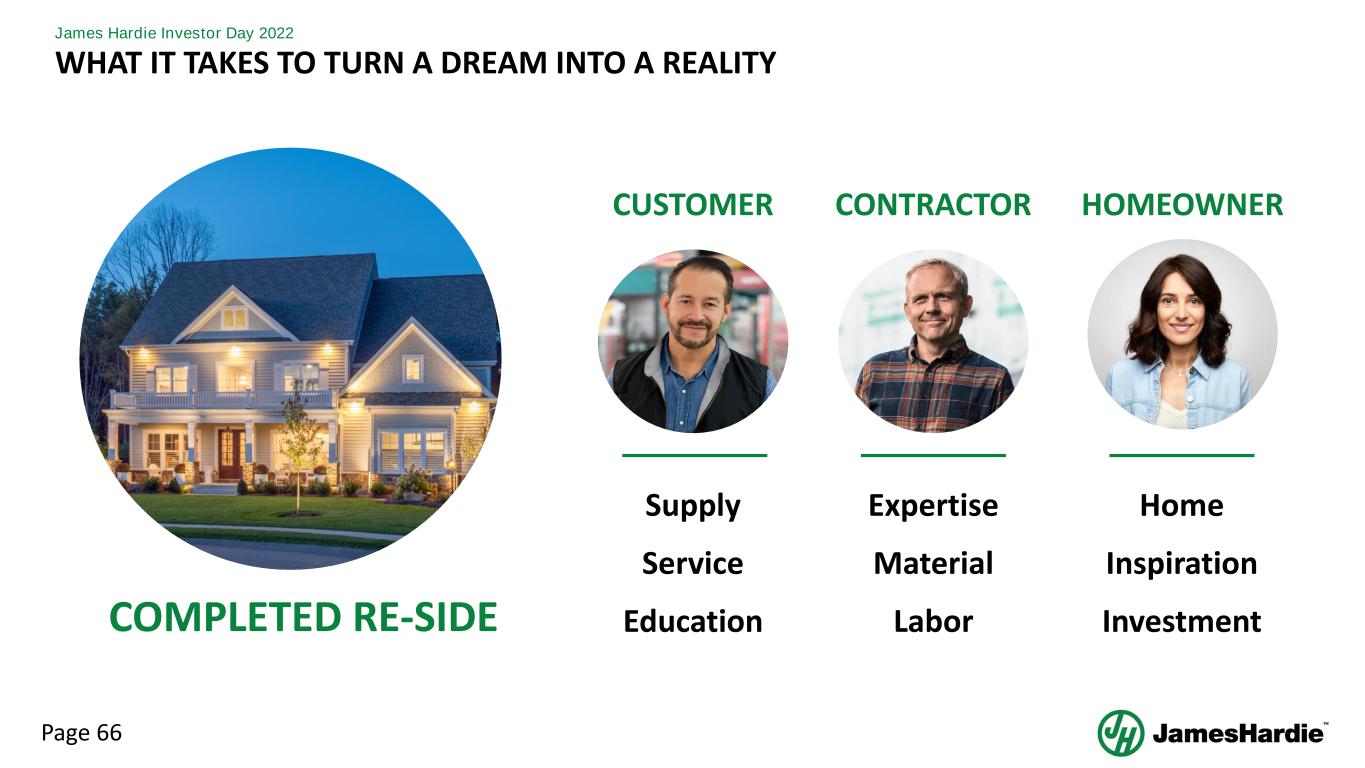

Page 66 James Hardie Investor Day 2022 WHAT IT TAKES TO TURN A DREAM INTO A REALITY Expertise Material Labor CONTRACTOR Supply Service Education CUSTOMER COMPLETED RE-SIDE Home Inspiration Investment HOMEOWNER

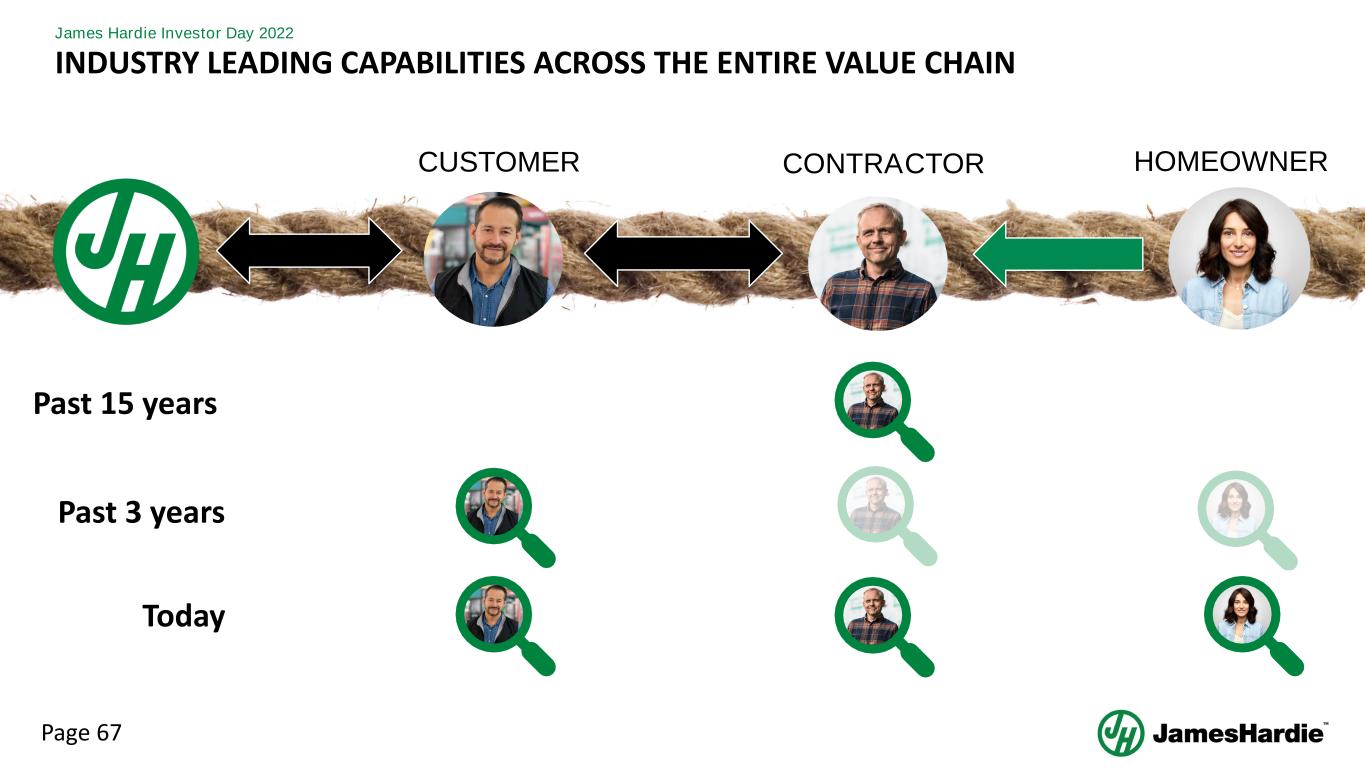

Page 67 James Hardie Investor Day 2022 INDUSTRY LEADING CAPABILITIES ACROSS THE ENTIRE VALUE CHAIN Past 15 years Past 3 years Today CUSTOMER CONTRACTOR HOMEOWNER

Page 68 James Hardie Investor Day 2022 CONNECTING THE VALUE CHAIN TO DRIVE GROWTH Ensuring our Customers capture a disproportionate amount of the demand created and become the force multiplier CUSTOMER CONTRACTOR HOMEOWNER

Page 69 NORTH AMERICA: CUSTOMER John Madson, VP North America Sales

Page 70 James Hardie Investor Day 2022 CUSTOMER – KEY TAKEAWAYS We are better aligned with our customers today than ever before Our customers are motivated to support us as they make more money per transaction selling James Hardie than competitive products The customer interacts with every contractor and can communicate the James Hardie value proposition to them at scale

Page 71 James Hardie Investor Day 2022 HOW JAMES HARDIE DELIVERS WHAT THE CUSTOMER VALUES CUSTOMER Organic growth Higher value products Efficient working capital utilization THE CUSTOMER CARES ABOUT Defined as any building materials supplier. Their customers include; R&R contractors, siding installers, and residential builders.

Page 72 James Hardie Investor Day 2022 HOW JAMES HARDIE DELIVERS WHAT THE CUSTOMER VALUES ORGANIC GROWTH HIGHER VALUE PRODUCTS EFFICIENT WORKING CAPITAL Superior demand creation Innovation LEAN inventory management Broad product portfolio C u st o m e r N e e d JH V al u e C re at io n

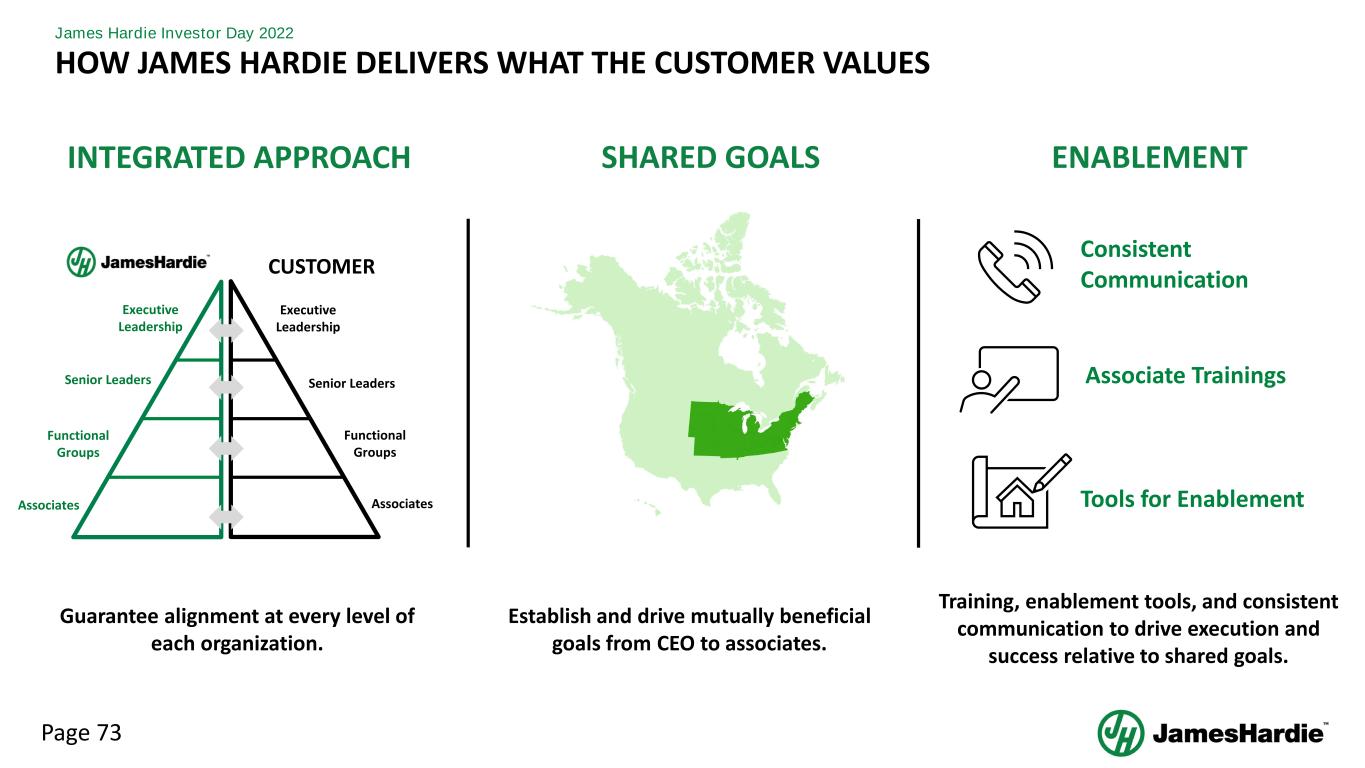

Page 73 James Hardie Investor Day 2022 HOW JAMES HARDIE DELIVERS WHAT THE CUSTOMER VALUES INTEGRATED APPROACH Executive Leadership Executive Leadership CUSTOMER Associates Associates Functional Groups Senior Leaders Senior Leaders Functional Groups SHARED GOALS ENABLEMENT Guarantee alignment at every level of each organization. Establish and drive mutually beneficial goals from CEO to associates. Training, enablement tools, and consistent communication to drive execution and success relative to shared goals. Associate Trainings Consistent Communication Tools for Enablement

Page 74 James Hardie Investor Day 2022 CUSTOMER – SUMMARY We are better aligned with our customers today than ever before Our customers are motivated to support us as they make more money per transaction selling James Hardie than competitive products The customer has a broad reach to contractors and can communicate the JH value prop to them at scale

Page 75 NORTH AMERICA: CONTRACTOR Chad Fredericksen, VP North America Pro Channel

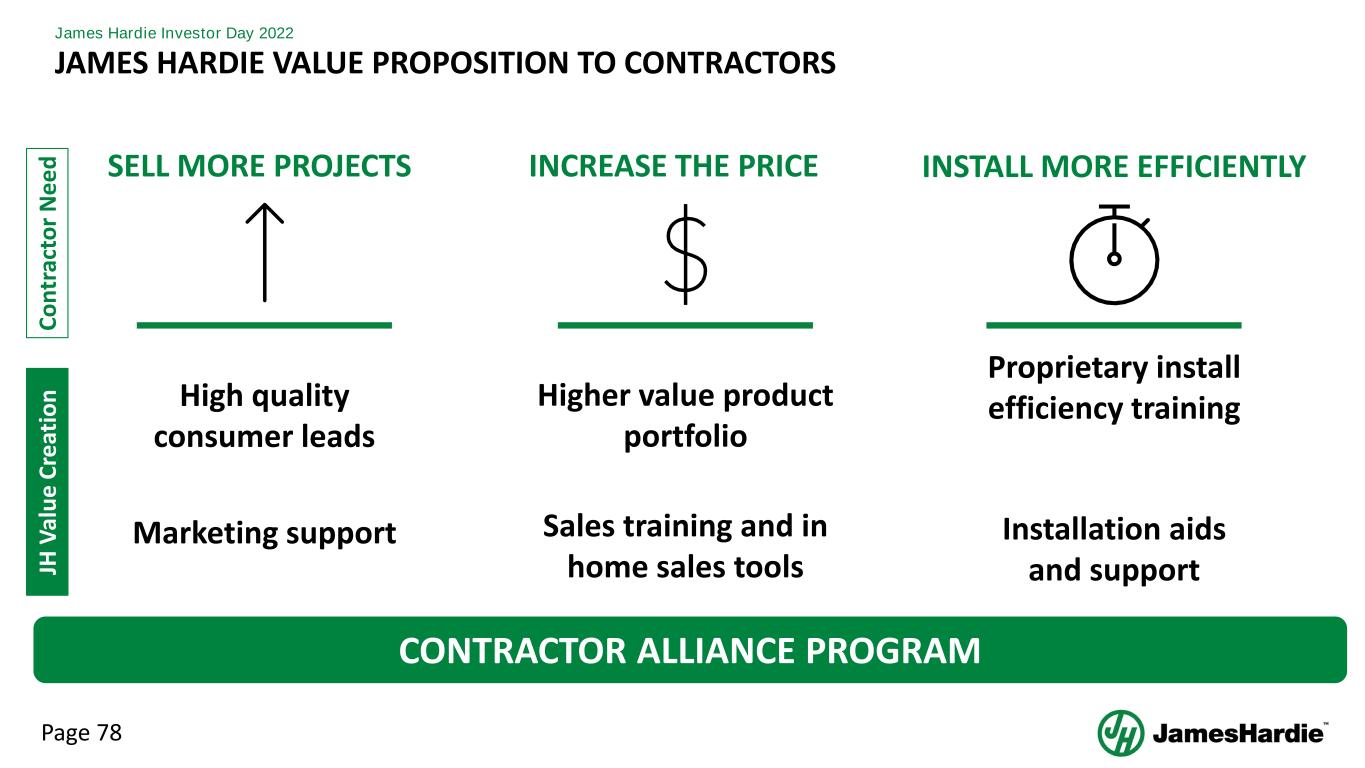

Page 76 James Hardie Investor Day 2022 THE R&R CONTRACTOR – SUMMARY Empower contractors to make more revenue and profit selling James Hardie over competitors Expand the number of contractors that sell James Hardie through our customer partnerships Retain the contractors by continually adding value to them through our Contractor Alliance Program

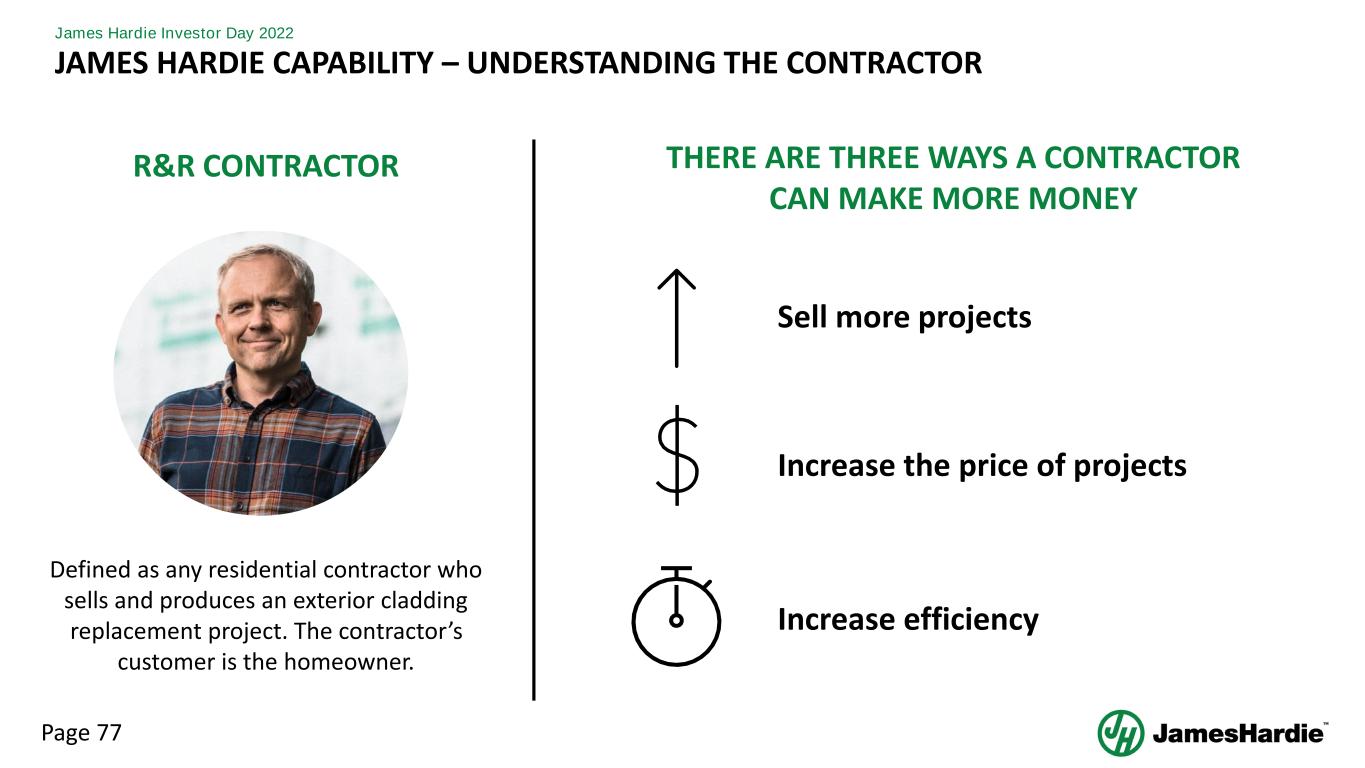

Page 77 James Hardie Investor Day 2022 JAMES HARDIE CAPABILITY – UNDERSTANDING THE CONTRACTOR Defined as any residential contractor who sells and produces an exterior cladding replacement project. The contractor’s customer is the homeowner. R&R CONTRACTOR Sell more projects Increase the price of projects Increase efficiency THERE ARE THREE WAYS A CONTRACTOR CAN MAKE MORE MONEY

Page 78 James Hardie Investor Day 2022 JAMES HARDIE VALUE PROPOSITION TO CONTRACTORS SELL MORE PROJECTS INCREASE THE PRICE INSTALL MORE EFFICIENTLY High quality consumer leads Marketing support Higher value product portfolio Sales training and in home sales tools Proprietary install efficiency training Installation aids and support CONTRACTOR ALLIANCE PROGRAM C o n tr ac to r N e e d JH V al u e C re at io n

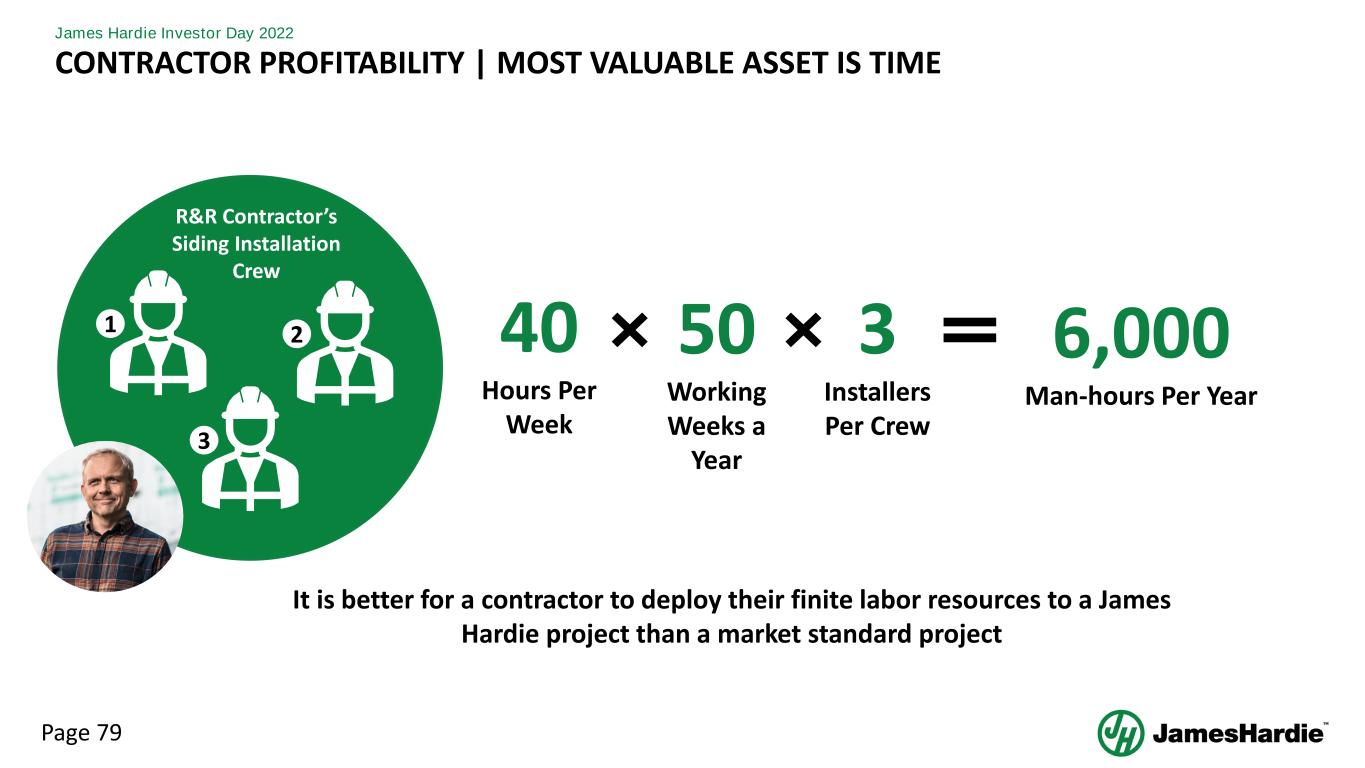

Page 79 James Hardie Investor Day 2022 CONTRACTOR PROFITABILITY | MOST VALUABLE ASSET IS TIME 1 2 3 40 Hours Per Week 50 Working Weeks a Year 3 Installers Per Crew 6,000 Man-hours Per Year It is better for a contractor to deploy their finite labor resources to a James Hardie project than a market standard project R&R Contractor’s Siding Installation Crew

Page 80

Page 81 James Hardie Investor Day 2022 ALIGNING CUSTOMERS AND CONTRACTORS | FROM – TO FROM: CUSTOMER CONTRACTOR

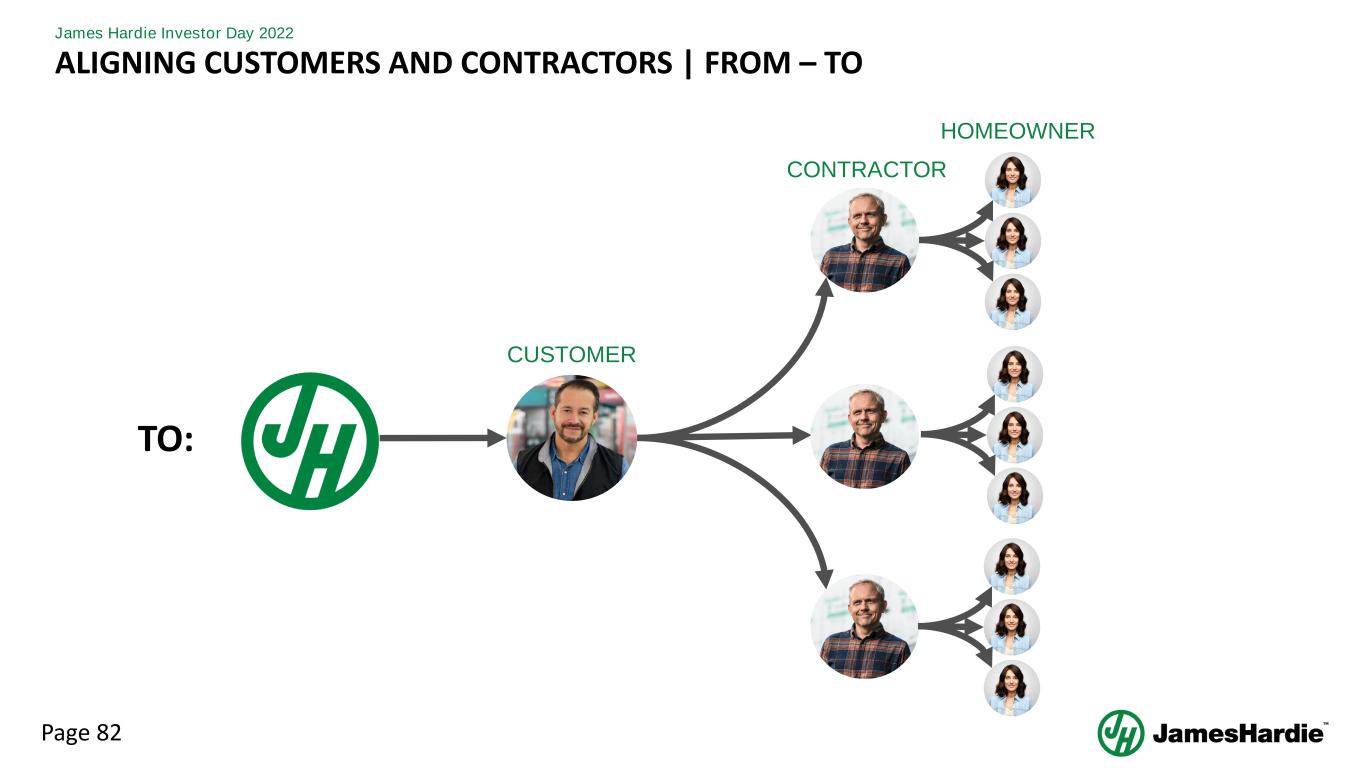

Page 82 James Hardie Investor Day 2022 ALIGNING CUSTOMERS AND CONTRACTORS | FROM – TO TO: CUSTOMER CONTRACTOR HOMEOWNER

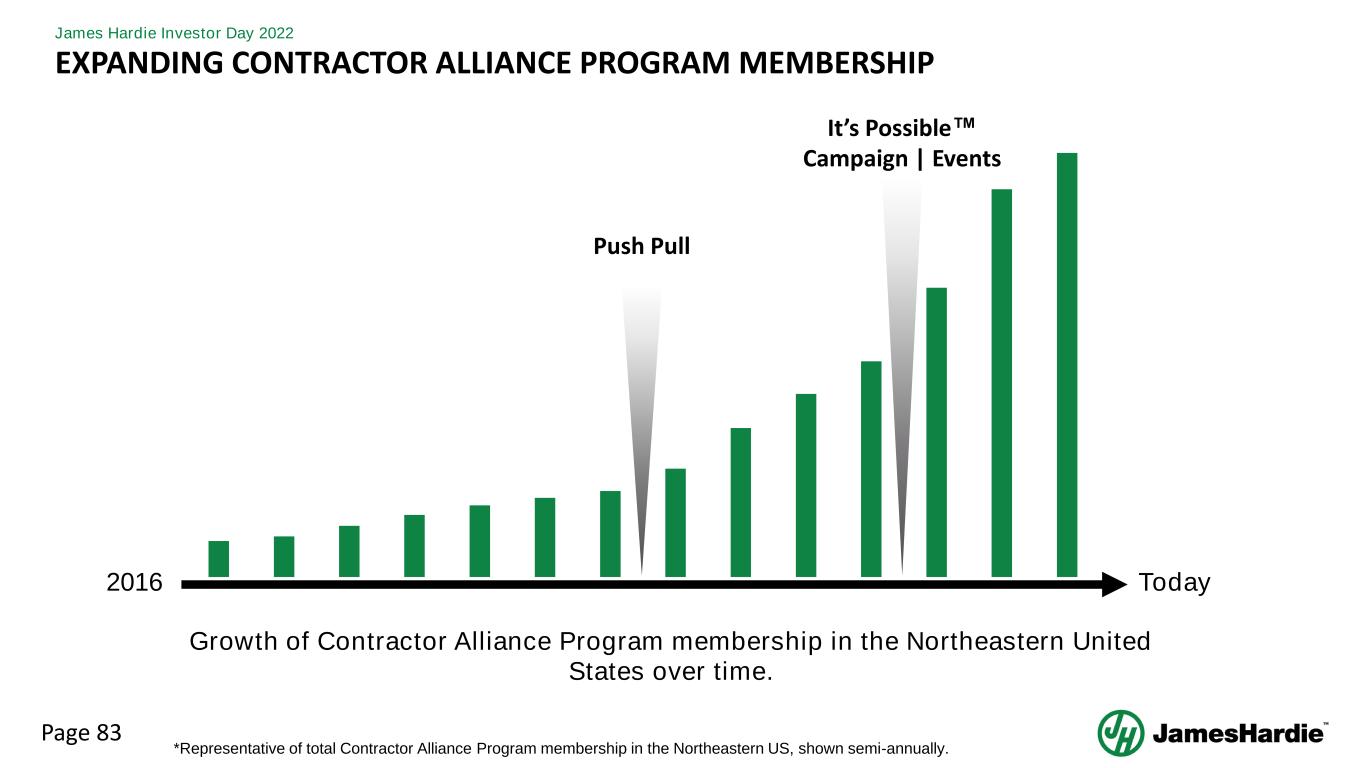

Page 83 James Hardie Investor Day 2022 EXPANDING CONTRACTOR ALLIANCE PROGRAM MEMBERSHIP Growth of Contractor Alliance Program membership in the Northeastern United States over time. *Representative of total Contractor Alliance Program membership in the Northeastern US, shown semi-annually. Push Pull It’s Possible™ Campaign | Events 2016 Today

Page 84 James Hardie Investor Day 2022 THE R&R CONTRACTOR – SUMMARY Empower contractors to make more revenue and profit selling James Hardie over competitors Expand the number of contractors that sell James Hardie through our customer partnerships Retain the contractors by continually adding value to them through our Contractor Alliance Program

Page 85 Q&A

Page 86 30 MINUTE BREAK

Page 87 NORTH AMERICA: HOMEOWNER Sean Gadd, President North America

Page 88 James Hardie Investor Day 2022 HOW JAMES HARDIE DELIVERS WHAT THE HOMEOWNER VALUES HOMEOWNER Exterior appeal and design Superior durability Low maintenance THE HOMEOWNER CARES ABOUT

Page 89 James Hardie Investor Day 2022 THE HOMEOWNER – SUMMARY We have researched and drawn insights into the pain points of the Homeowner’s path to purchase Our 360 degree Marketing Strategy to the Homeowner is working We have specific programs and tools to alleviate the homeowner pain points and improve their path to purchase

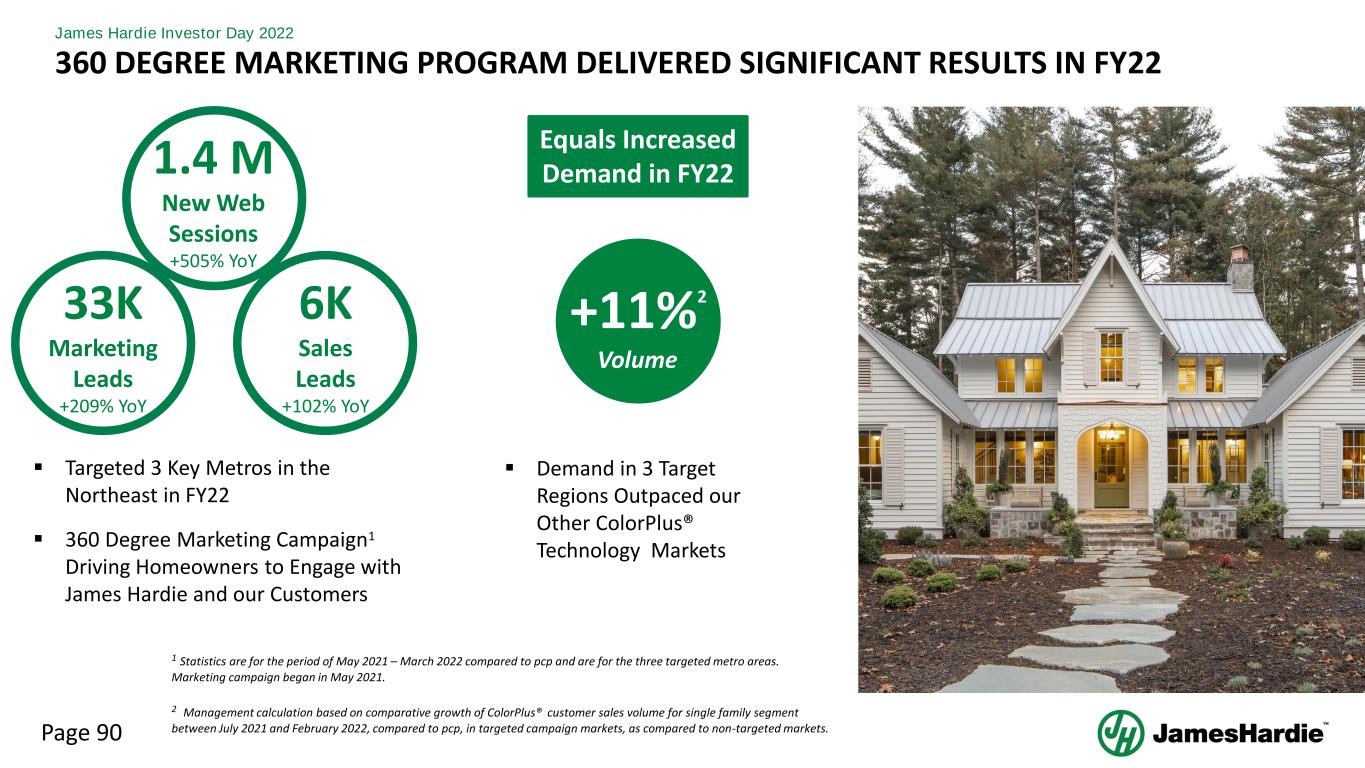

Page 90 James Hardie Investor Day 2022 360 DEGREE MARKETING PROGRAM DELIVERED SIGNIFICANT RESULTS IN FY22 1.4 M New Web Sessions +505% YoY 33K Marketing Leads +209% YoY 6K Sales Leads +102% YoY ▪ Targeted 3 Key Metros in the Northeast in FY22 ▪ 360 Degree Marketing Campaign1 Driving Homeowners to Engage with James Hardie and our Customers 1 Statistics are for the period of May 2021 – March 2022 compared to pcp and are for the three targeted metro areas. Marketing campaign began in May 2021. 2 Management calculation based on comparative growth of ColorPlus® customer sales volume for single family segment between July 2021 and February 2022, compared to pcp, in targeted campaign markets, as compared to non-targeted markets. Equals Increased Demand in FY22 ▪ Demand in 3 Target Regions Outpaced our Other ColorPlus® Technology Markets +11%2 Volume

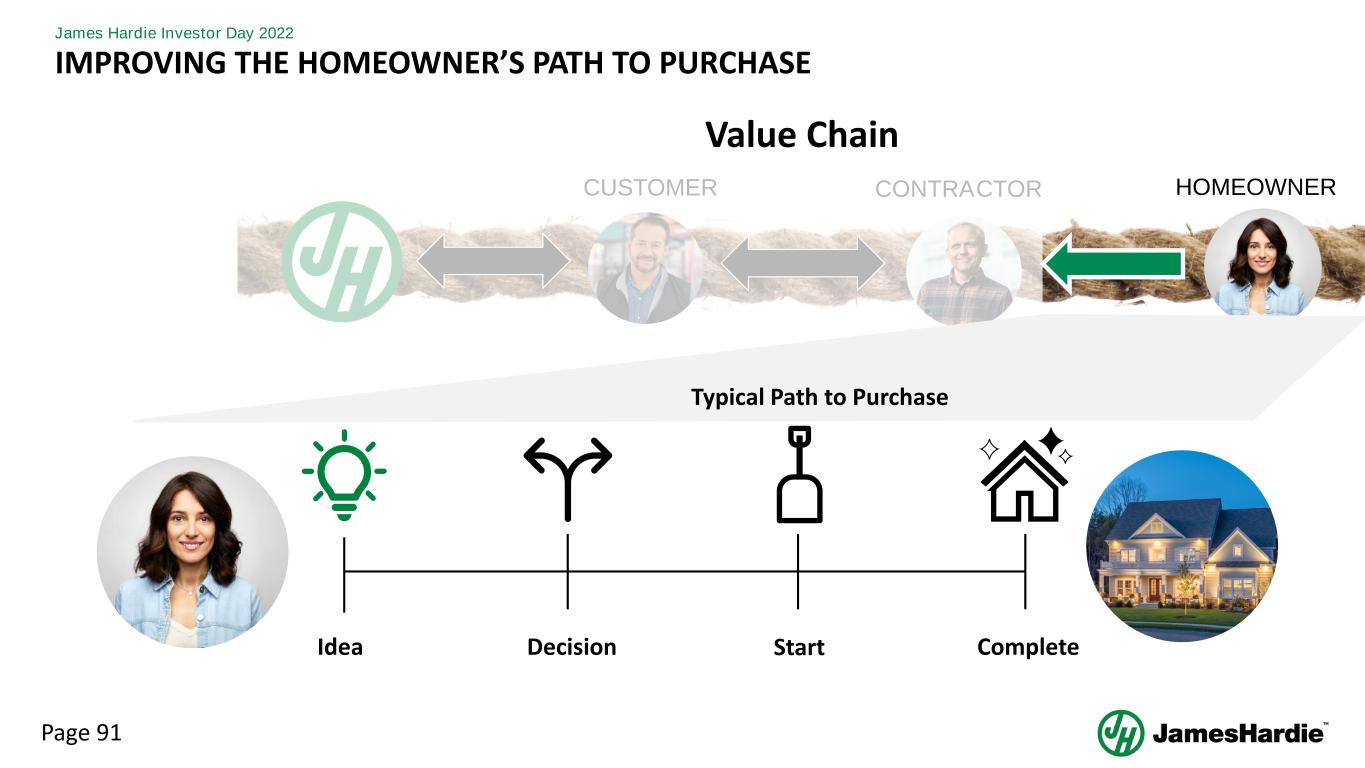

Page 91 James Hardie Investor Day 2022 IMPROVING THE HOMEOWNER’S PATH TO PURCHASE Idea Decision Start Complete CUSTOMER CONTRACTOR HOMEOWNER Value Chain Typical Path to Purchase

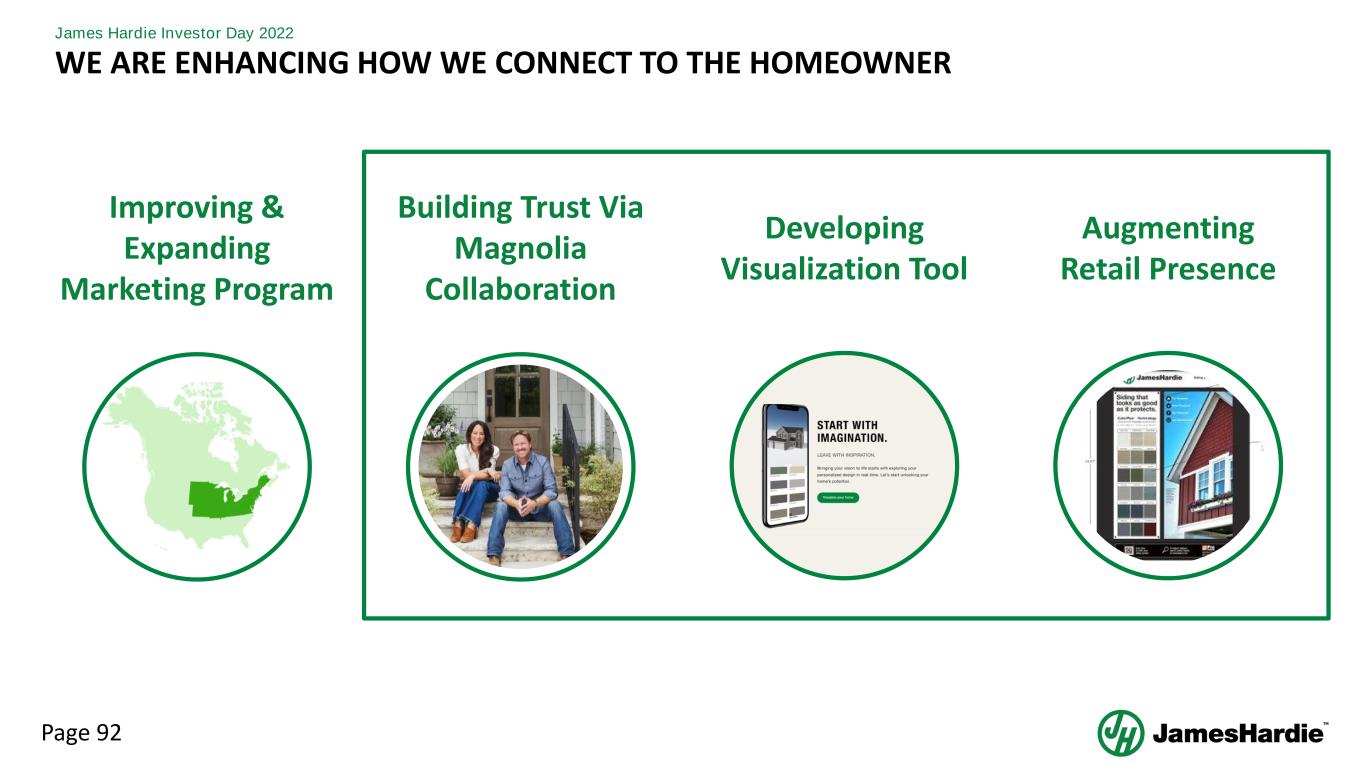

Page 92 James Hardie Investor Day 2022 WE ARE ENHANCING HOW WE CONNECT TO THE HOMEOWNER Improving & Expanding Marketing Program Building Trust Via Magnolia Collaboration Developing Visualization Tool Augmenting Retail Presence

Page 93 NORTH AMERICA: HOMEOWNER – IT’S POSSIBLE™ Atousa Ghoreichi, SVP North America Marketing

Page 94 James Hardie Investor Day 2022 THE HOMEOWNER: IT’S POSSIBLE™ – SUMMARY We have taken learnings from this first year to inform and enhance the program moving forward Building a consumer brand is a journey and results of the year one launch are promising Given the positive results to date, we are expanding our focus to 3 new key target metros in the Northeast and Midwest

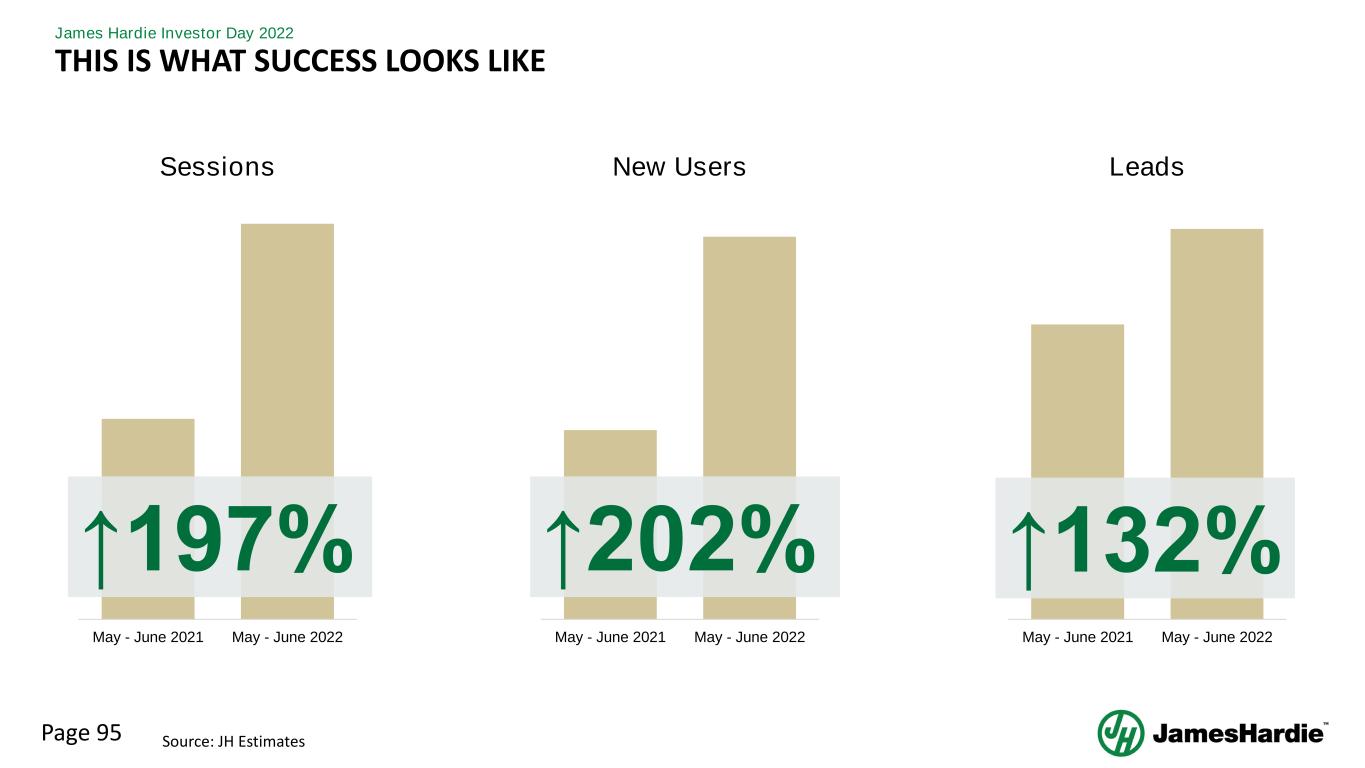

Page 95 James Hardie Investor Day 2022 THIS IS WHAT SUCCESS LOOKS LIKE May - June 2021 May - June 2022 Sessions ↑197% May - June 2021 May - June 2022 New Users ↑202% May - June 2021 May - June 2022 Leads ↑132% Source: JH Estimates

Page 96

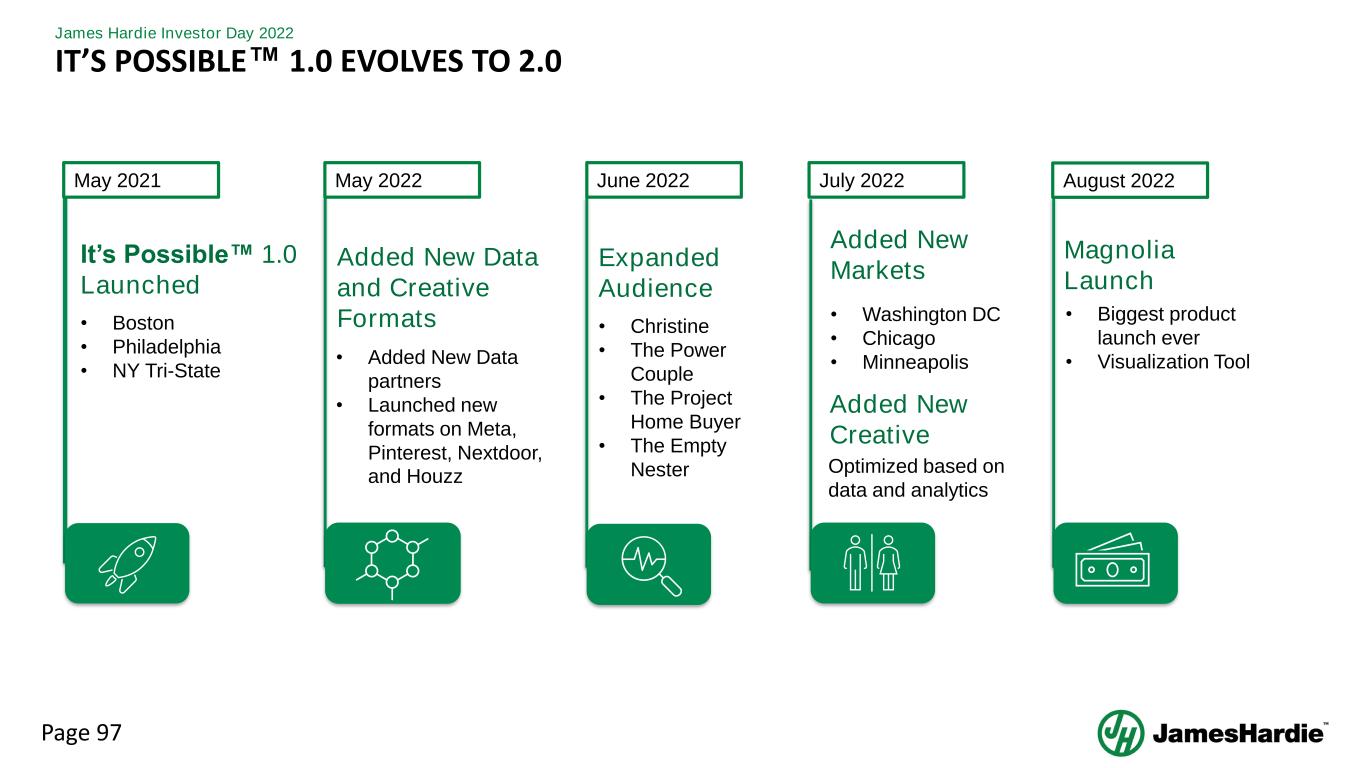

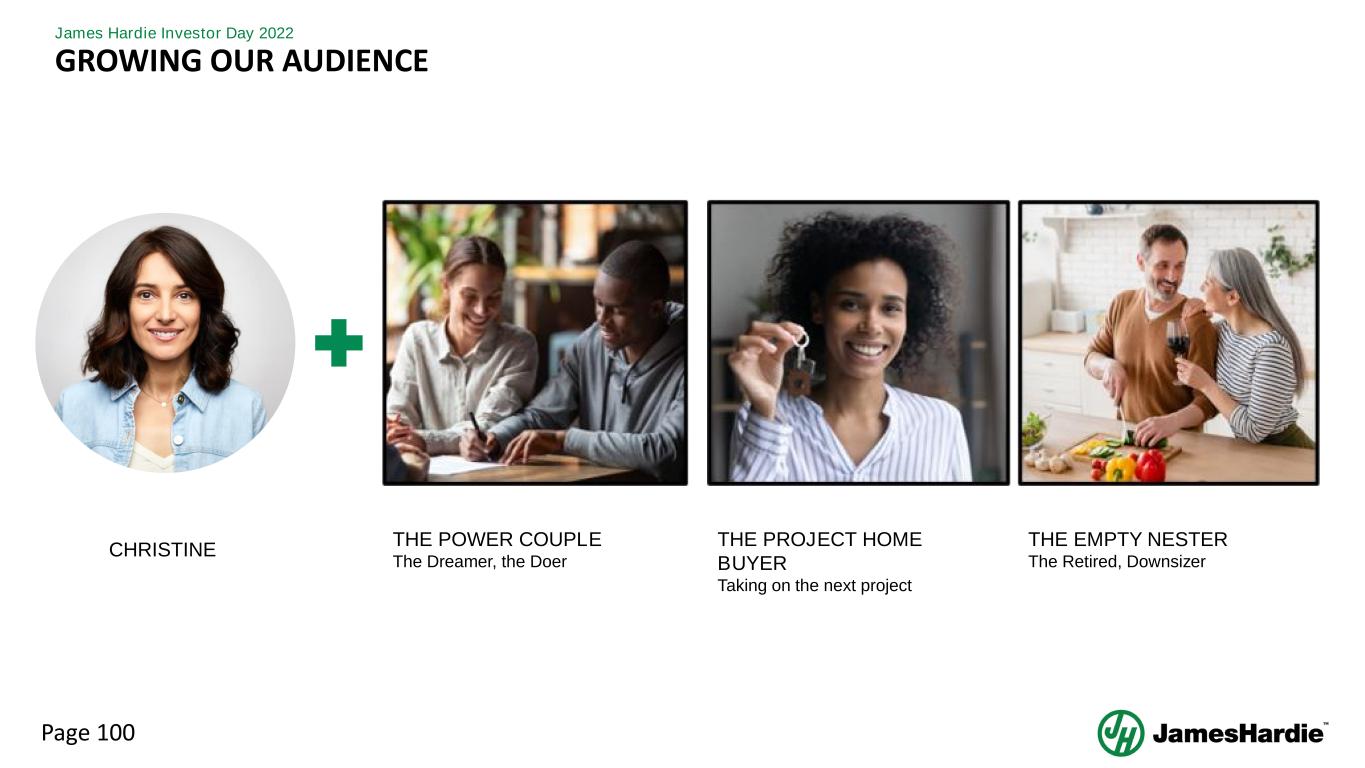

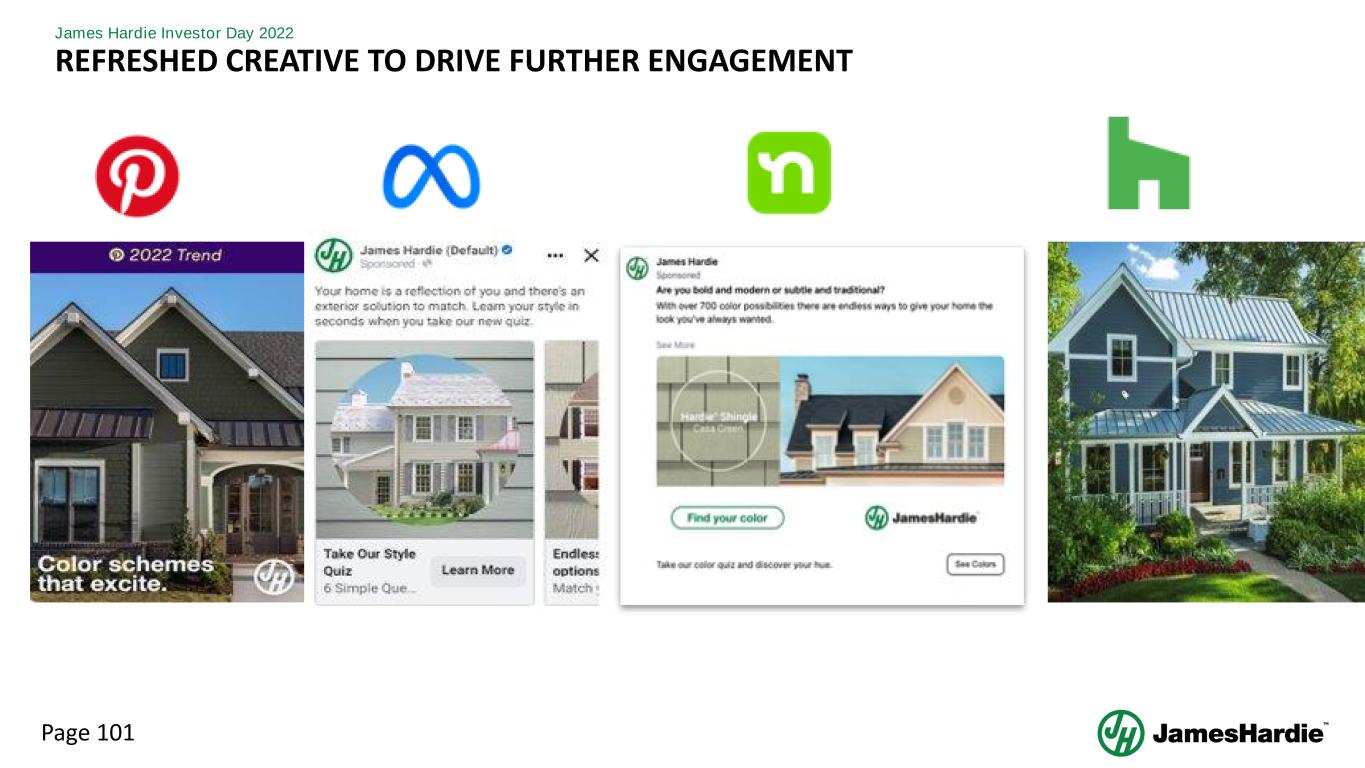

Page 97 James Hardie Investor Day 2022 IT’S POSSIBLE™ 1.0 EVOLVES TO 2.0 It’s Possible™ 1.0 Launched • Boston • Philadelphia • NY Tri-State Added New Data and Creative Formats • Added New Data partners • Launched new formats on Meta, Pinterest, Nextdoor, and Houzz Expanded Audience • Christine • The Power Couple • The Project Home Buyer • The Empty Nester Added New Markets • Washington DC • Chicago • Minneapolis Magnolia Launch • Biggest product launch ever • Visualization Tool May 2021 May 2022 June 2022 July 2022 August 2022 Added New Creative Optimized based on data and analytics

Page 98 James Hardie Investor Day 2022 STRATEGIC MEDIA PILLARS IN FY23 LEVERAGE MEDIA & DATA INNOVATION BUILD UPON EARLIER SUCCESS AUDIENCE SEGMENTATION & PERSONALIZATION CHRISTINE(S) ARE READY TO BUY

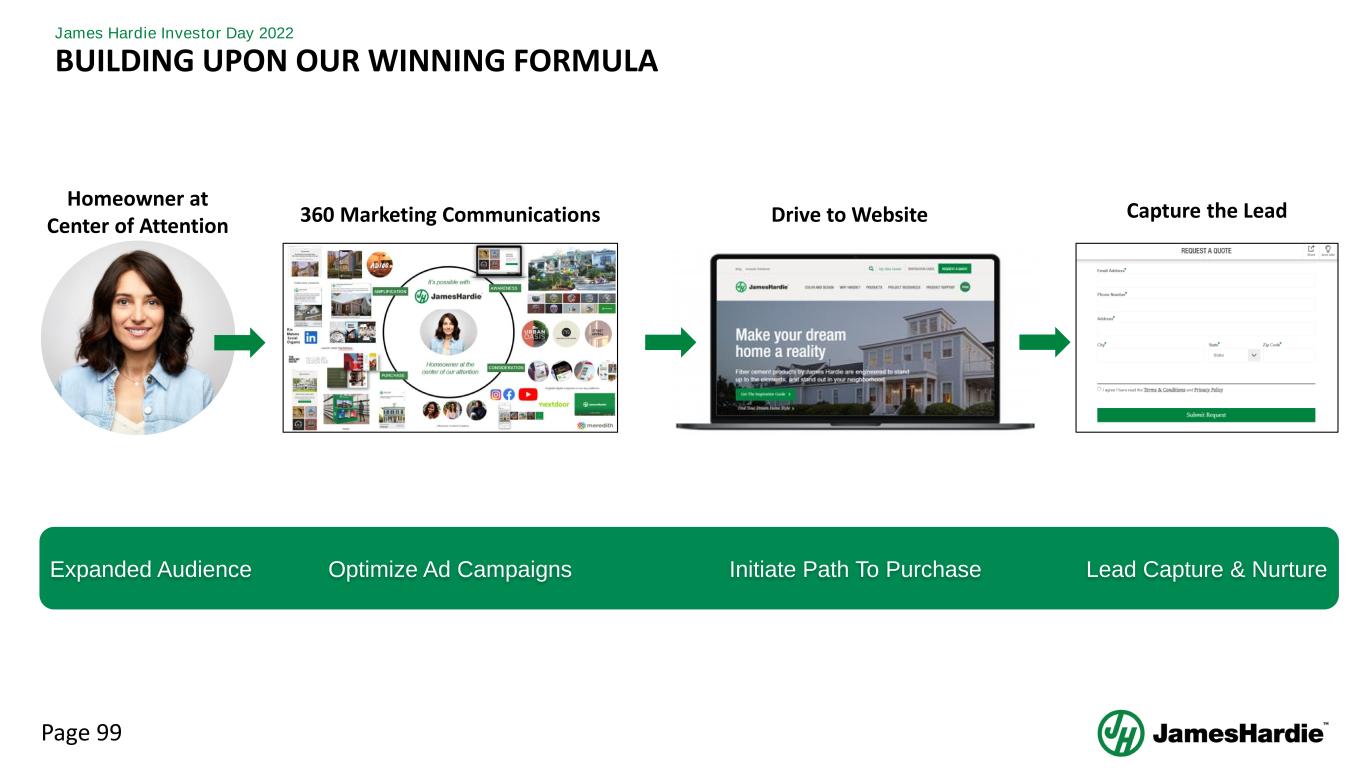

Page 99 James Hardie Investor Day 2022 BUILDING UPON OUR WINNING FORMULA 360 Marketing Communications Homeowner at Center of Attention Drive to Website Capture the Lead Expanded Audience Optimize Ad Campaigns Initiate Path To Purchase Lead Capture & Nurture

Page 100 James Hardie Investor Day 2022 GROWING OUR AUDIENCE THE POWER COUPLE The Dreamer, the Doer CHRISTINE THE PROJECT HOME BUYER Taking on the next project THE EMPTY NESTER The Retired, Downsizer

Page 101 James Hardie Investor Day 2022 REFRESHED CREATIVE TO DRIVE FURTHER ENGAGEMENT

Page 102 James Hardie Investor Day 2022 INSPIRING WITH DESIGN, REASSURING WITH DURABILITY

Page 103 James Hardie Investor Day 2022 INSPIRING WITH DESIGN, REASSURING WITH DURABILITY

Page 104 James Hardie Investor Day 2022 MAXIMIZING VIDEO ACROSS TV, INFLUENCERS & ORGANIC CHANNELS Lead Gen TV Spot Influencer Stories Exterior Design Week

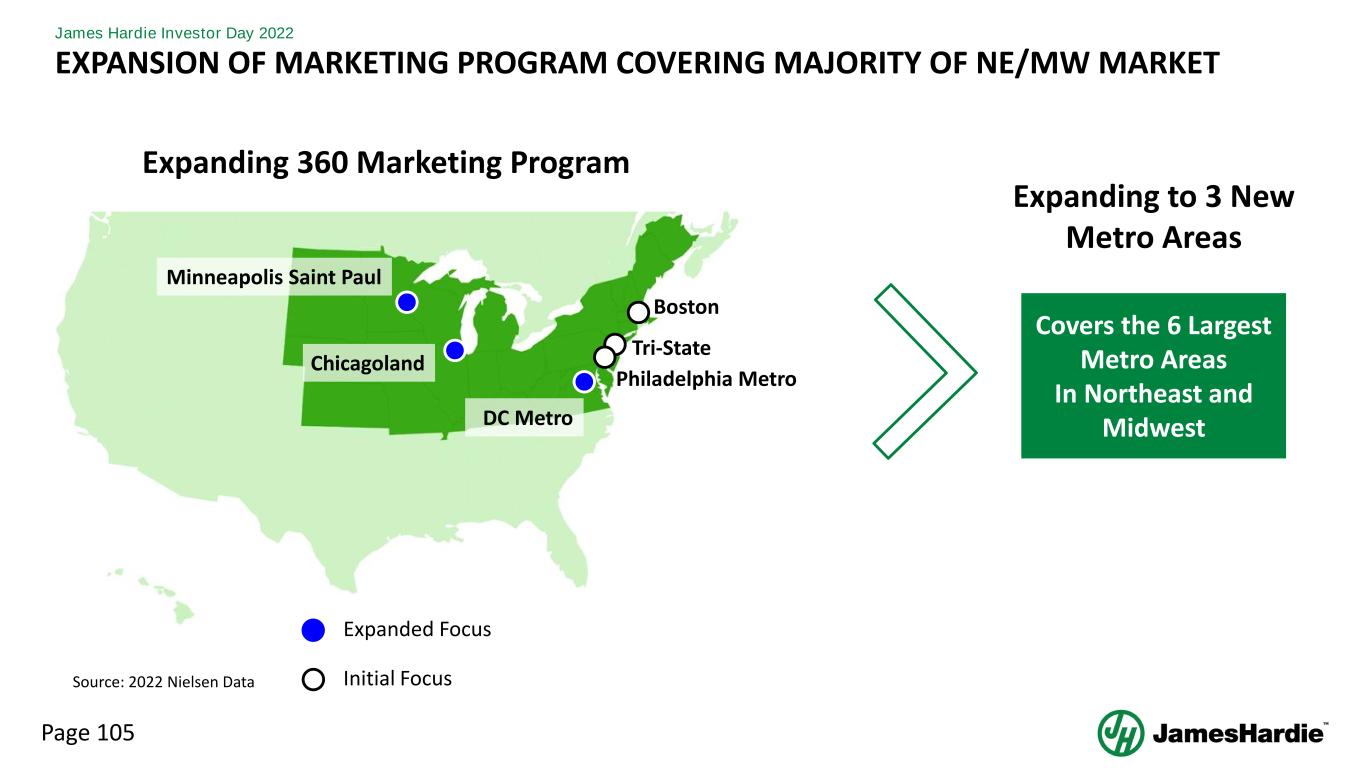

Page 105 James Hardie Investor Day 2022 EXPANSION OF MARKETING PROGRAM COVERING MAJORITY OF NE/MW MARKET Boston Tri-State Philadelphia Metro DC Metro Source: 2022 Nielsen Data Chicagoland Minneapolis Saint Paul Expanding 360 Marketing Program Expanded Focus Initial Focus Expanding to 3 New Metro Areas Covers the 6 Largest Metro Areas In Northeast and Midwest

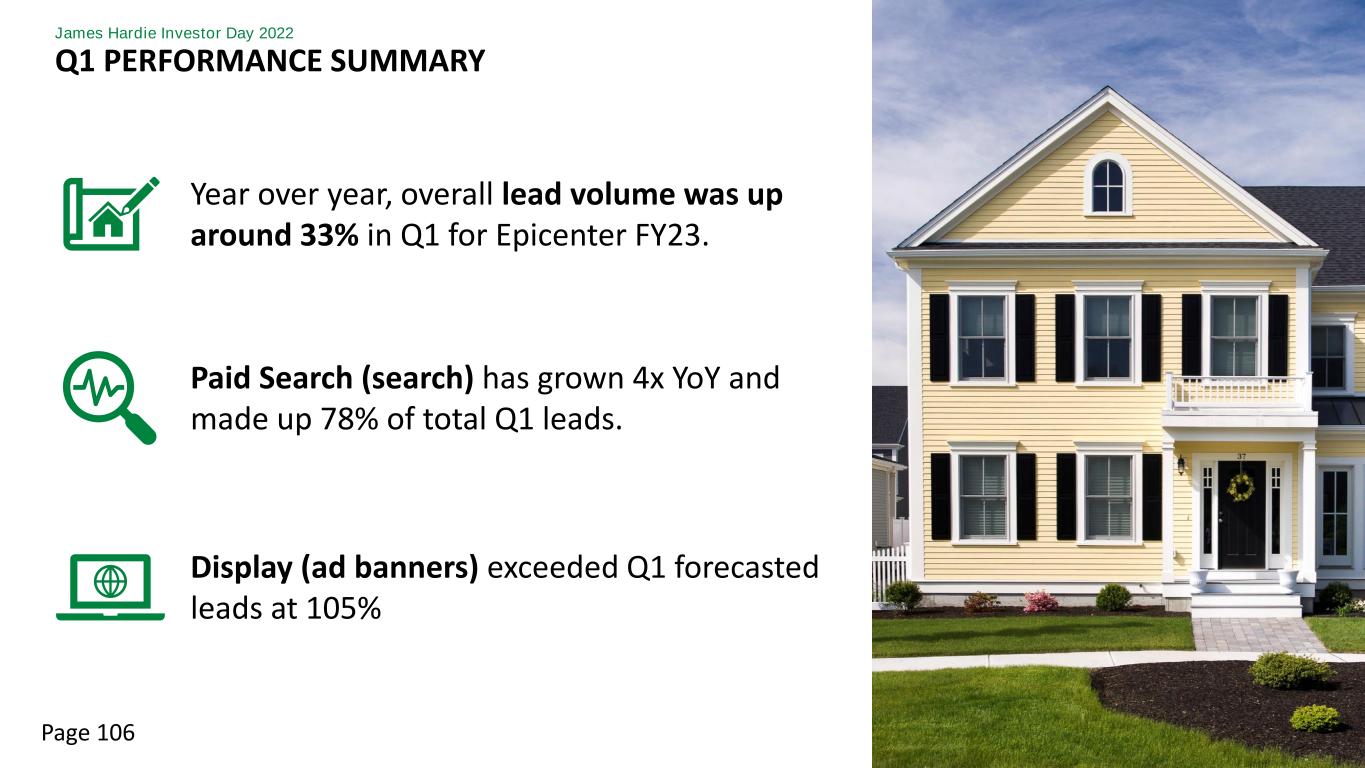

Page 106 James Hardie Investor Day 2022 Q1 PERFORMANCE SUMMARY Year over year, overall lead volume was up around 33% in Q1 for Epicenter FY23. Paid Search (search) has grown 4x YoY and made up 78% of total Q1 leads. Display (ad banners) exceeded Q1 forecasted leads at 105%

Page 107 NORTH AMERICA: HOMEOWNER – MAGNOLIA Atousa Ghoreichi, SVP North America Marketing

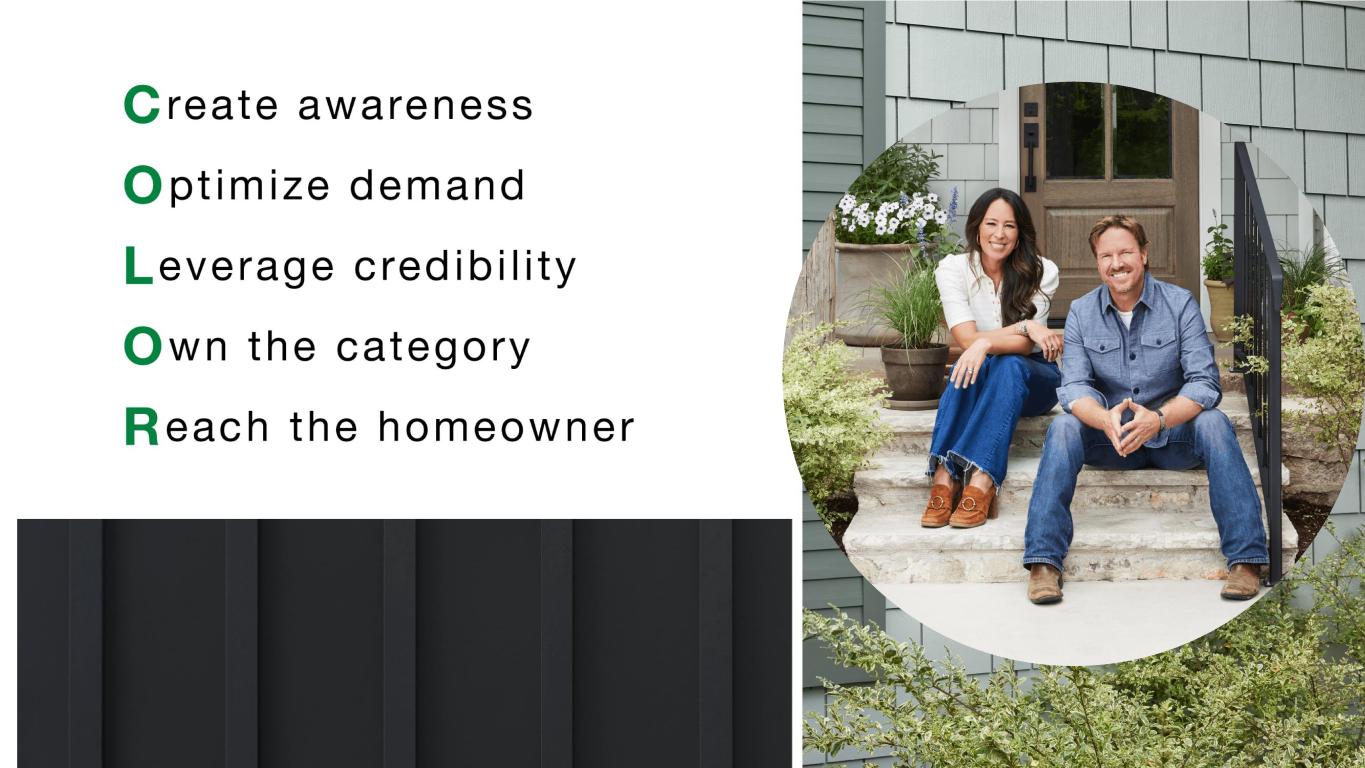

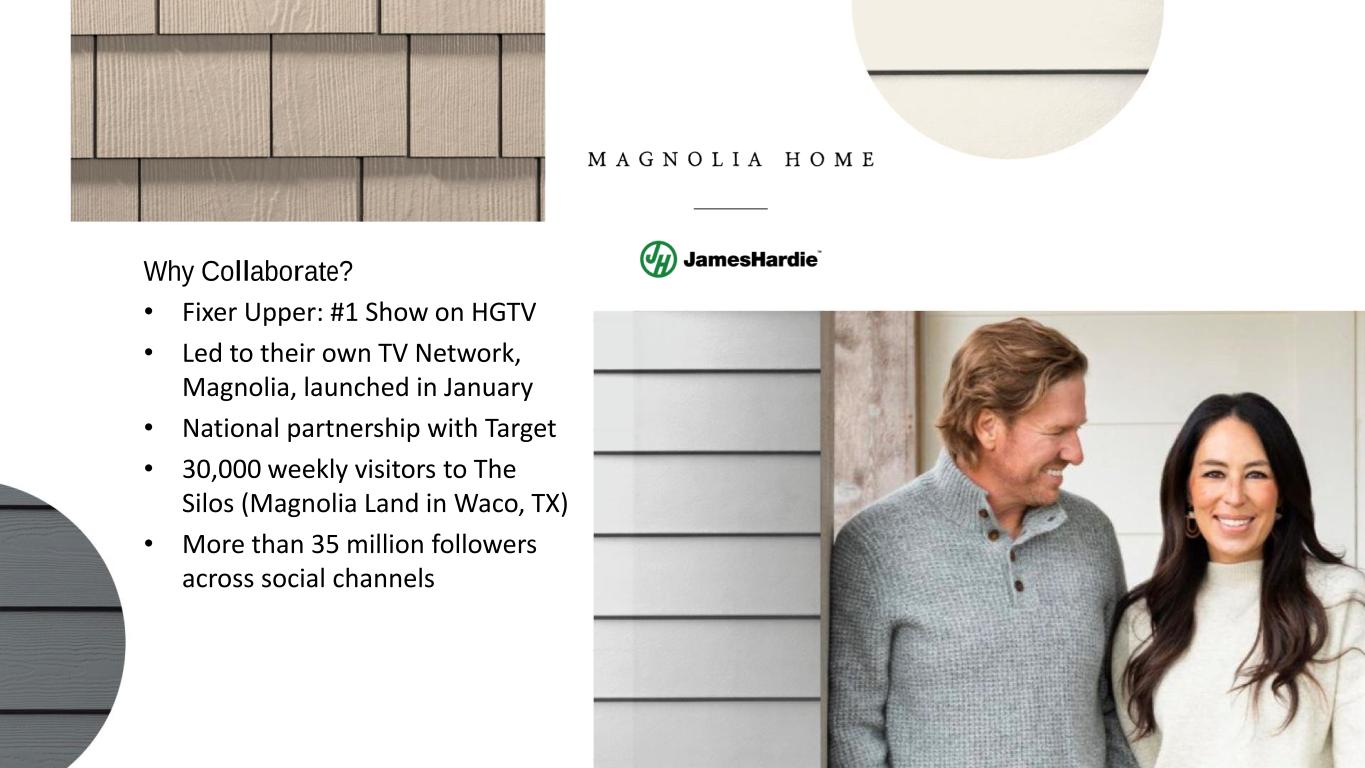

Page 108 James Hardie Investor Day 2022 THE HOMEOWNER: MAGNOLIA – SUMMARY Joanna Gaines helps build credibility with homeowners around design, while Chip builds credibility around contractor choice Chip and Joanna Gaines, and the significant reach of Magnolia will help drive awareness of James Hardie and allow us to sell more full-wrap ColorPlus® Technology finished products Together they provide trust and credibility about James Hardie fiber cement

Page 109 James Hardie Investor Day 2022

Page 110 James Hardie Investor Day 2022 110 Contents are confidential and subject to disclosure and insider trading considerations

Page 111

Page 112 James Hardie Investor Day 2022

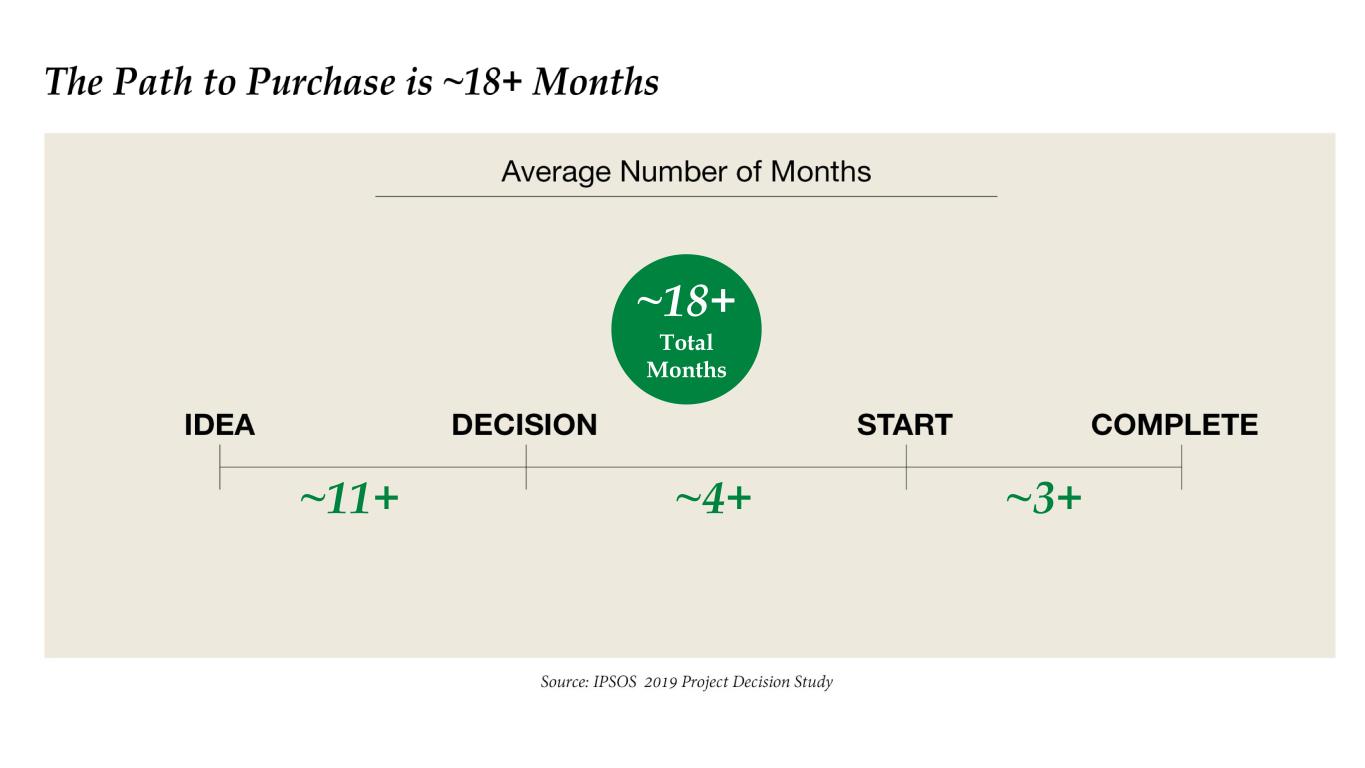

Page 113 James Hardie Investor Day 2022 ~18+ Total Months ~11+ ~4+ ~3+

Page 114 James Hardie Investor Day 2022 114 JH CONFIDENTIAL Why Collaborate? • Fixer Upper: #1 Show on HGTV • Led to their own TV Network, Magnolia, launched in January • National partnership with Target • 30,000 weekly visitors to The Silos (Magnolia Land in Waco, TX) • More than 35 million followers across social channels

Page 115

Page 116 James Hardie Investor Day 2022

Page 117 James Hardie Investor Day 2022 MAGNOLIA 360 MEDIA CHANNEL OVERVIEW Social Display/Video Search Partners Print

Page 118 James Hardie Investor Day 2022 LANDING PAGE: JAMESHARDIE.COM/MAGNOLIA Desktop Mobile

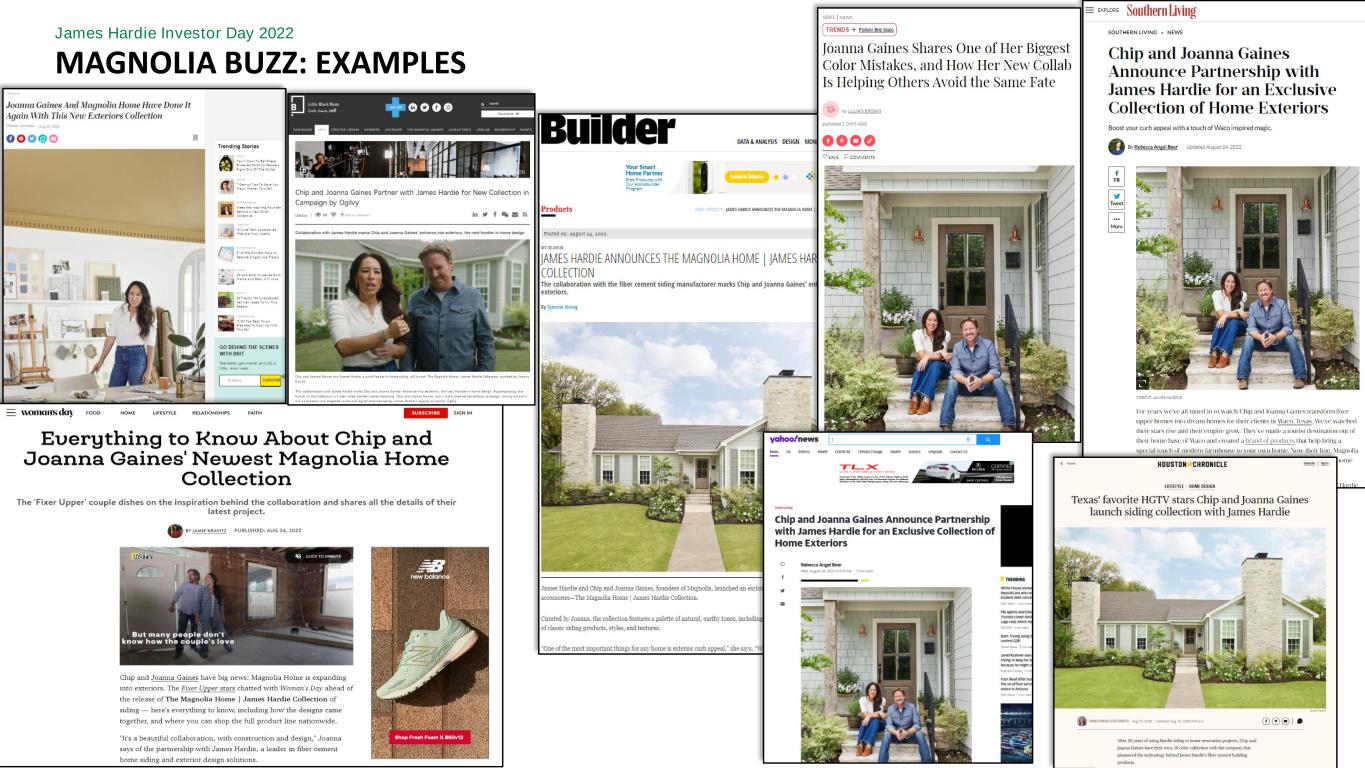

Page 119 James Hardie Investor Day 2022 MAGNOLIA BUZZ: EXAMPLES

Page 120 James Hardie Investor Day 2022 MAGNOLIA BUZZ: PEOPLE MAGAZINE “In an interview with PEOPLE, Joanna explains the reason why she loves partnering with James Hardie. ‘We drive by the homes we did 20 years ago down by Baylor University, and those were all Hardie-sided homes. This is truly a product that we've believed in for 20 years,’ she says. She adds that working with James Hardie was ‘a match made in heaven,’ and that she and Chip felt ‘honored’ to be collaborating with the company.” – People

Page 121 James Hardie Investor Day 2022 MAGNOLIA BUZZ 42 Media Placements 1.5 B+ Potential Audience

Page 122 NORTH AMERICA: HOMEOWNER – VISUALIZATION Chad Fredericksen, VP North America Pro Channel

Page 123 James Hardie Investor Day 2022 THE HOMEOWNER: VISUALIZATION – SUMMARY The visualization tool is a simple 3 step process that allows homeowners to experiment with different designs and connect them directly with a contractor Visualization is an invaluable tool to help inspire homeowners to reach their vision and better communicate that vision to contractors We are currently collaborating with an industry leading visualization provider to bring homeowner visions to life

Page 124 James Hardie Investor Day 2022 THE IMPORTANCE OF VISUALIZATION Most consumers will re-side their home once to twice in a lifetime. Visualization is an invaluable tool that can help inspire them to reach their vision and better communicate that vision to a contractor who will bring it to life.

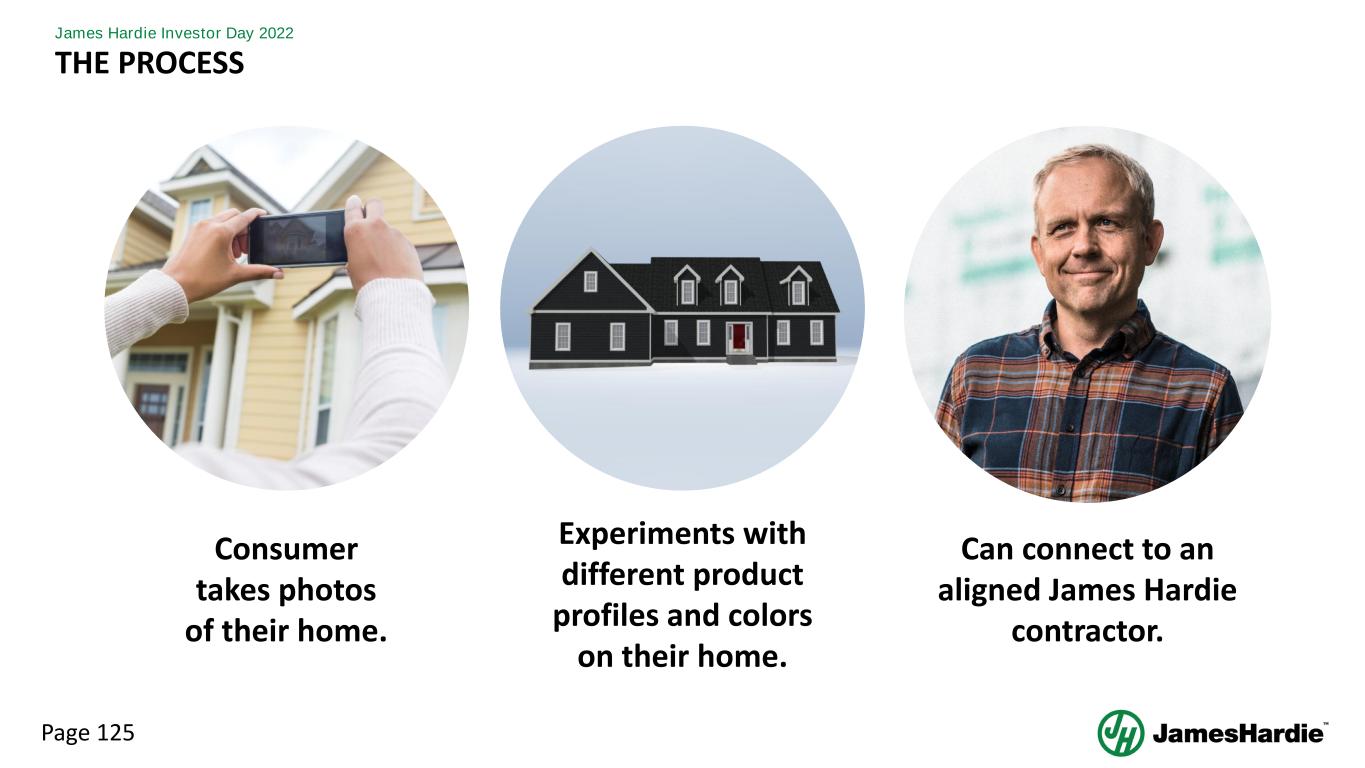

Page 125 James Hardie Investor Day 2022 THE PROCESS Consumer takes photos of their home. Experiments with different product profiles and colors on their home. Can connect to an aligned James Hardie contractor.

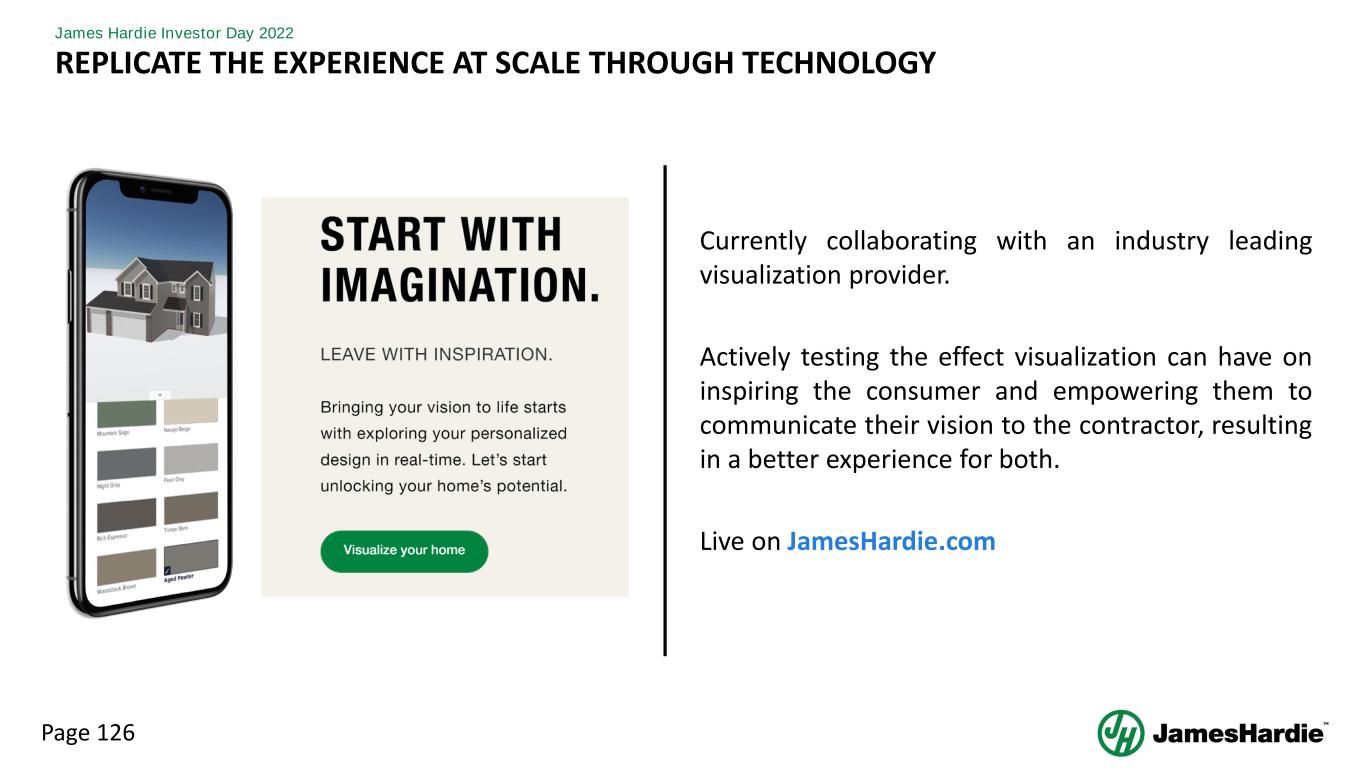

Page 126 James Hardie Investor Day 2022 REPLICATE THE EXPERIENCE AT SCALE THROUGH TECHNOLOGY Currently collaborating with an industry leading visualization provider. Actively testing the effect visualization can have on inspiring the consumer and empowering them to communicate their vision to the contractor, resulting in a better experience for both. Live on JamesHardie.com

Page 127 James Hardie Investor Day 2022 THE HOMEOWNER: VISUALIZATION – SUMMARY The visualization tool is a simple 3 step process that allows homeowners to experiment with different designs and connect them directly with a contractor Visualization is an invaluable tool to help inspire homeowners to reach their vision and better communicate that vision to contractors We are currently collaborating with an industry leading visualization provider to bring homeowner visions to life

Page 128 James Hardie Investor Day 2022 James Hardie – Maximizing value & profit across the entire Repair & Remodel value chain CONNECTING THE VALUE CHAIN TO DRIVE PROFITABLE GROWTH CUSTOMER CONTRACTOR HOMEOWNER

Page 129 NORTH AMERICA: CLOSING Sean Gadd, President North America

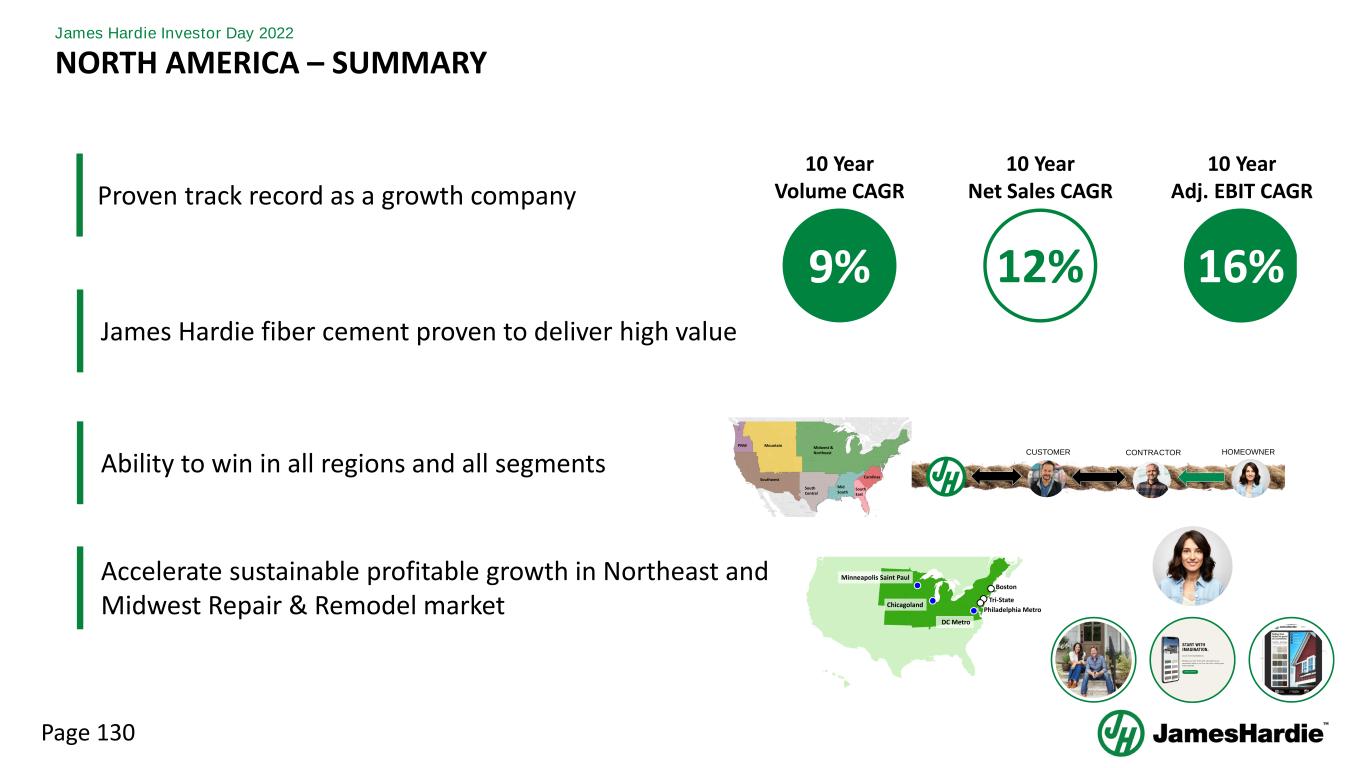

Page 130 James Hardie Investor Day 2022 CUSTOMER CONTRACTOR HOMEOWNER NORTH AMERICA – SUMMARY Proven track record as a growth company James Hardie fiber cement proven to deliver high value Ability to win in all regions and all segments Accelerate sustainable profitable growth in Northeast and Midwest Repair & Remodel market 12%9% 16% 10 Year Volume CAGR 10 Year Net Sales CAGR 10 Year Adj. EBIT CAGR Midwest & Northeast Mountain Southwest South Central PNW Carolinas Mid South South East Boston Tri-State Philadelphia Metro DC Metro Chicagoland Minneapolis Saint Paul

Page 131 Q&A

Page 132 END OF DAY 1

Page 133 JHX Investor Day 2022 New York, 12-13 September 2022 – Day 1