Page 1 JHX Investor Day 2022 New York, 12-13 September 2022 – Day 2

Page 2 James Hardie Investor Day 2022 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non- GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Management Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Consolidated Financial Statements. See the section titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS USE OF NON-GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions, beliefs and general good faith evaluation of information available information at the time the forward-looking statements were made concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements or rely upon them as a guarantee of future performance or results or as an accurate indications of the times at or by which any such performance or results will be achieved Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2022, which include, but are not necessarily limited to risks such as changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID-19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law.

Page 3 James Hardie Investor Day 2022 AGENDA – DAY 2 ZIEGFELD BALLROOM Day 2 – Tuesday, September 13th Breakfast 7:00-8:00 AM All APAC 8:00-9:15 AM John Arneil & Travis Johnson Q&A 9:15-9:30 AM All Experience Session #1 9:30-10:00 AM Breakout Groups Break 10:00-10:15 AM All Europe 10:15-11:15 AM Tobias Bennerscheidt & Henning Risse Q&A 11:15-11:30AM All Experience Session #2 11:30-12:00 PM Breakout Groups Lunch 12:00-1:15 PM All Global Innovation 1:15-2:15 PM Joe Liu & Alan Miller Q&A 2:15-2:30 PM All Experience Session #3 2:30-3:00 PM Breakout Groups Break 3:00-3:15 PM All Global Capacity 3:15-4:00 PM Ryan Kilcullen Q&A 4:00-4:15 PM All Closing with CEO 4:15-4:45 PM Aaron Erter Q&A 4:45-5:00 PM All Happy Hour 5:00-6:30 PM All Dinner 6:30-9:00 PM All

Page 4 INVESTOR DAY 2022 – APAC

Page 5 James Hardie Investor Day 2022 APAC – PRESENTERS Travis Johnson Director – Commercial Australia John Arneil General Manager APAC

Page 6 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – APAC Topic Presenter APAC Overview John Arneil Value Chain John Arneil Homeowner John Arneil Contractor/Builder Travis Johnson Customer Travis Johnson Summary John Arneil

Page 7 James Hardie Investor Day 2022 APAC – SUMMARYJUST BEGUN Strong base business built over 40+ years in fiber cement with significant fiber cement market share and category share Significant growth opportunities exist in all our APAC regions We have the insight led innovation, consumer marketing focus, proven market development model and deep customer integration in place for sustained profitable growth

Page 8 INVESTOR DAY 2022 – APAC: OVERVIEW John Arneil, General Manager - APAC

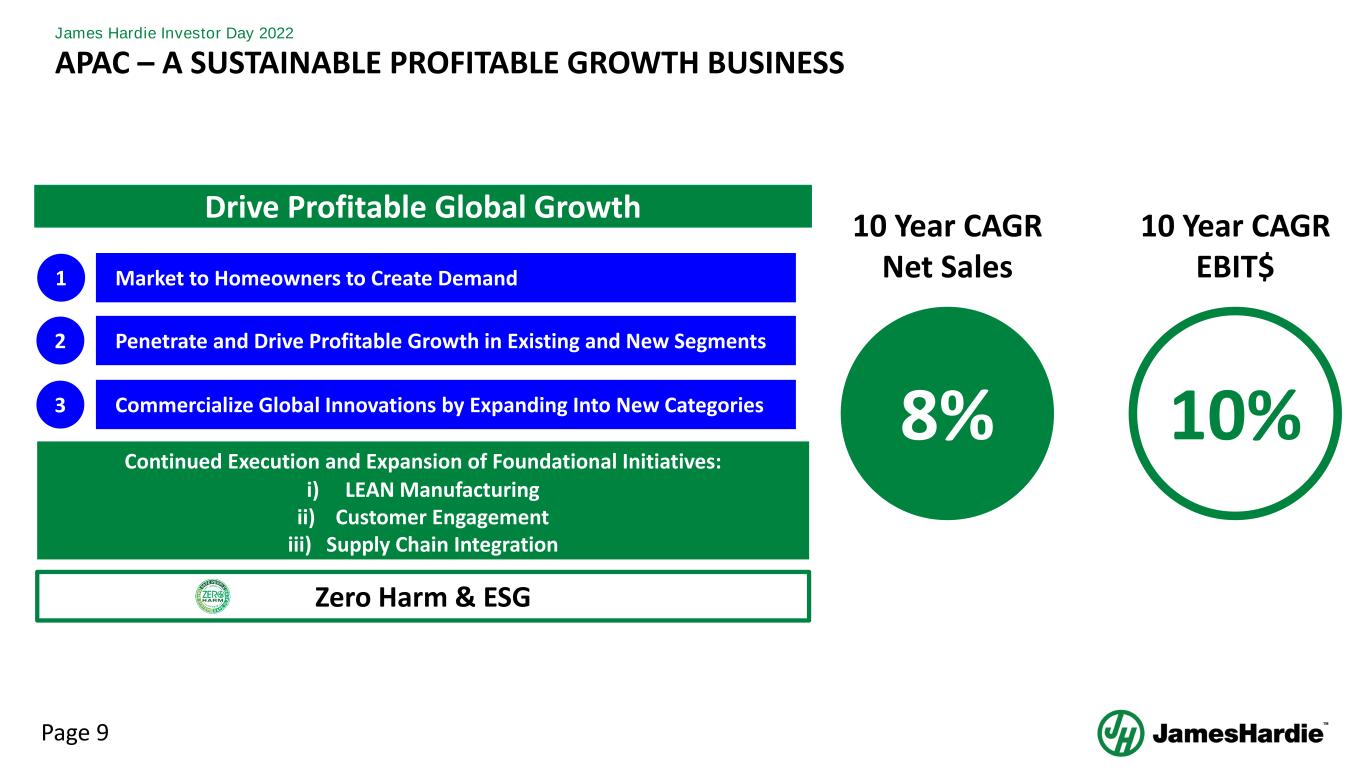

Page 9 James Hardie Investor Day 2022 APAC – A SUSTAINABLE PROFITABLE GROWTH BUSINESS Drive Profitable Global Growth Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG 8% 10% 10 Year CAGR Net Sales 10 Year CAGR EBIT$

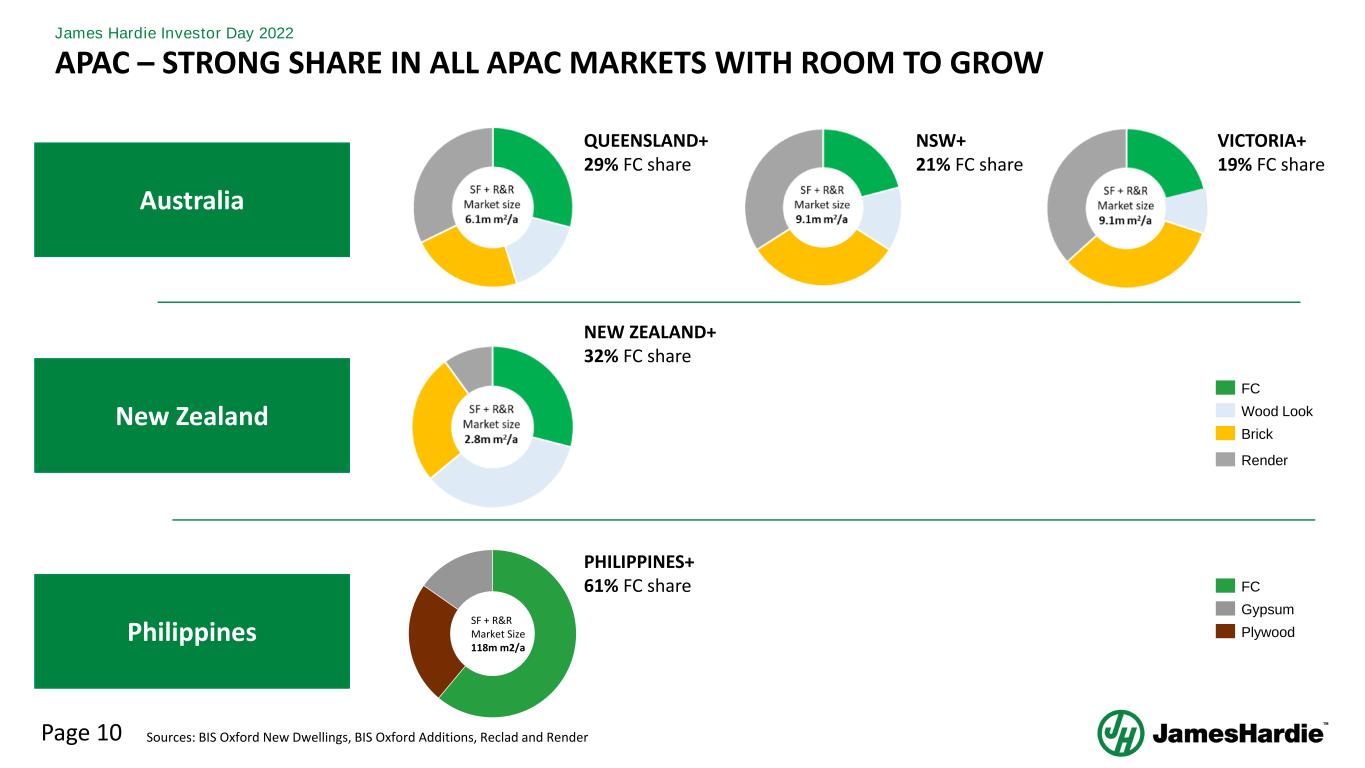

Page 10 James Hardie Investor Day 2022 APAC – STRONG SHARE IN ALL APAC MARKETS WITH ROOM TO GROW Sources: BIS Oxford New Dwellings, BIS Oxford Additions, Reclad and Render Australia New Zealand Philippines QUEENSLAND+ 29% FC share NSW+ 21% FC share VICTORIA+ 19% FC share PHILIPPINES+ 61% FC share FC Gypsum Plywood SF + R&R Market Size 118m m2/a NEW ZEALAND+ 32% FC share FC Wood Look Brick Render

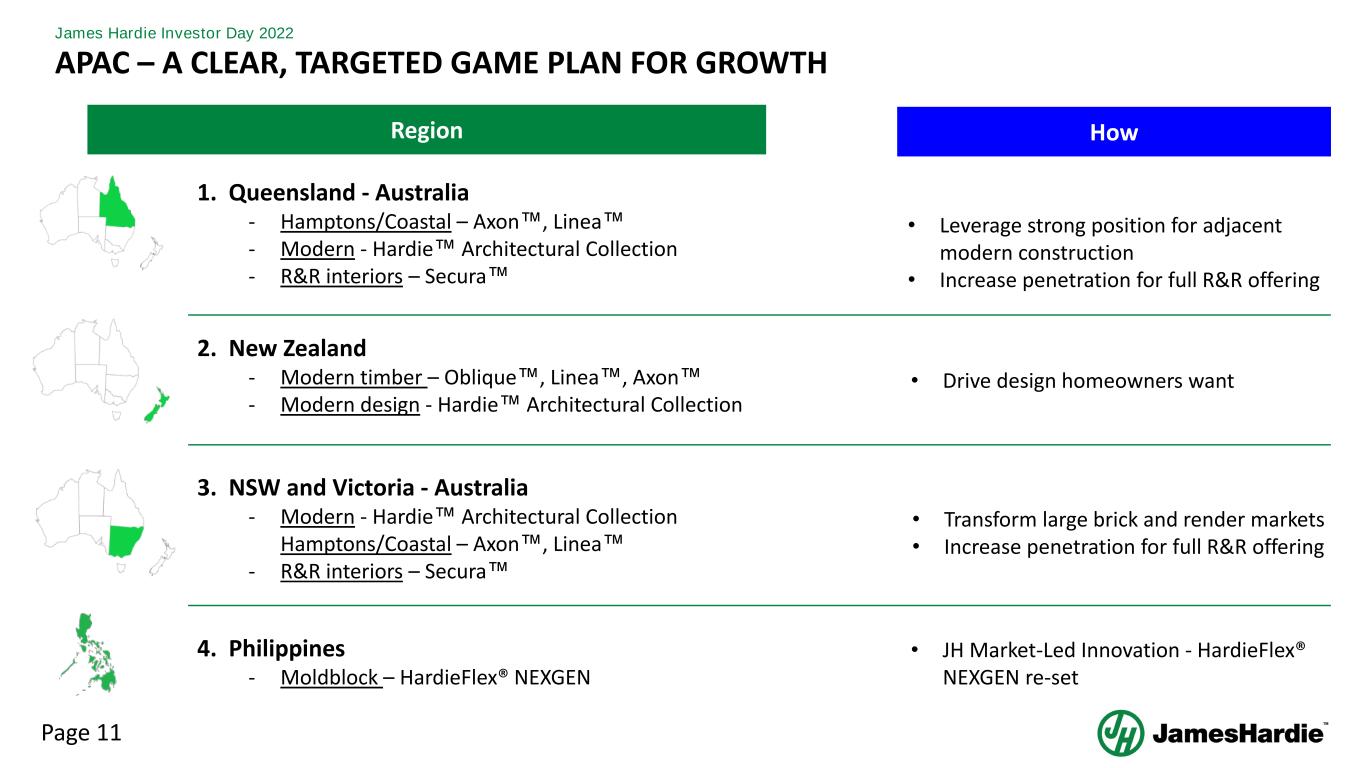

Page 11 James Hardie Investor Day 2022 Region How APAC – A CLEAR, TARGETED GAME PLAN FOR GROWTH 1. Queensland - Australia - Hamptons/Coastal – Axon™, Linea™ - Modern - Hardie™ Architectural Collection - R&R interiors – Secura™ 2. New Zealand - Modern timber – Oblique™, Linea™, Axon™ - Modern design - Hardie™ Architectural Collection 4. Philippines - Moldblock – HardieFlex® NEXGEN • Leverage strong position for adjacent modern construction • Increase penetration for full R&R offering • Drive design homeowners want • JH Market-Led Innovation - HardieFlex® NEXGEN re-set 3. NSW and Victoria - Australia - Modern - Hardie™ Architectural Collection Hamptons/Coastal – Axon™, Linea™ - R&R interiors – Secura™ • Transform large brick and render markets • Increase penetration for full R&R offering

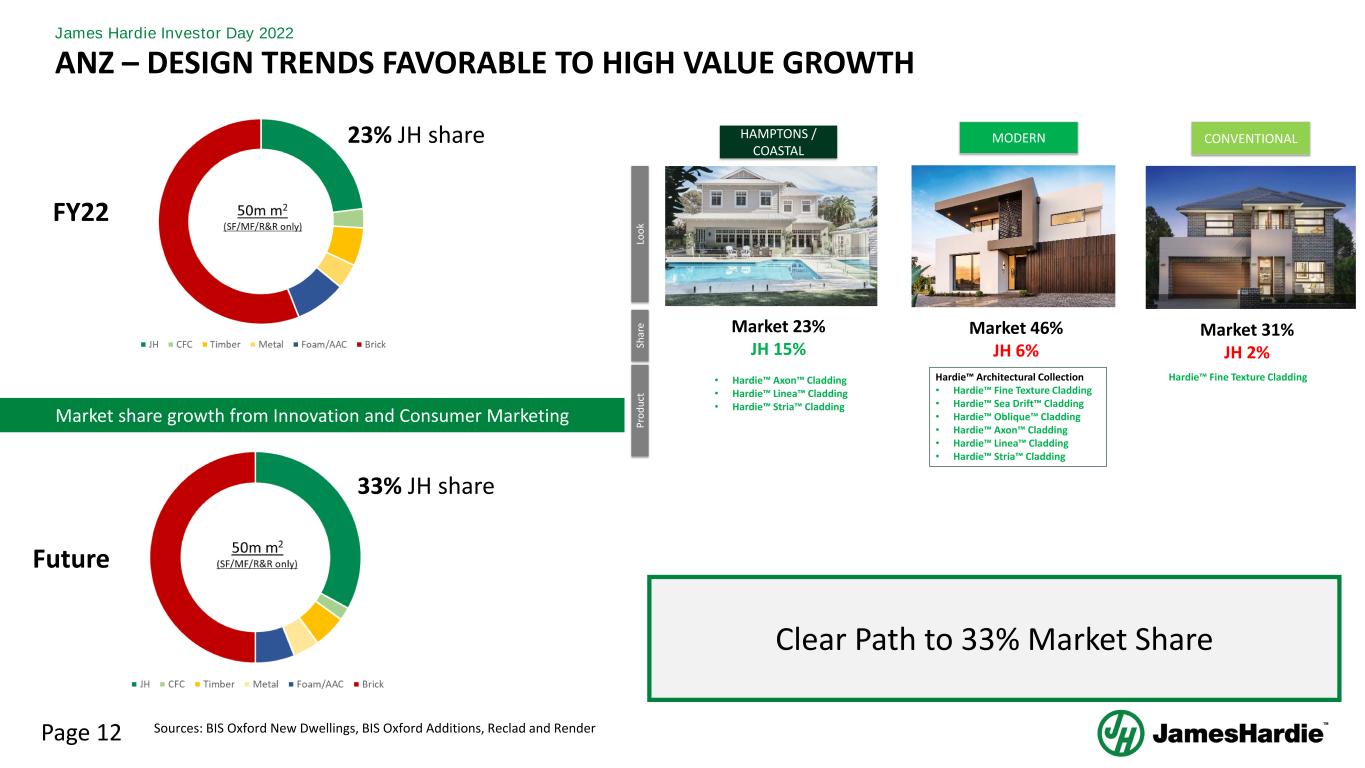

Page 12 James Hardie Investor Day 2022 ANZ – DESIGN TRENDS FAVORABLE TO HIGH VALUE GROWTH FY22 Future 23% JH share 33% JH share Market share growth from Innovation and Consumer Marketing Clear Path to 33% Market Share Sources: BIS Oxford New Dwellings, BIS Oxford Additions, Reclad and Render HAMPTONS / COASTAL MODERN CONVENTIONAL Lo o k P ro d u ct • Hardie Axon Cladding • Hardie Linea Cladding • Hardie Stria Cladding Hardie Architectural Collection • Hardie Fine Texture Cladding • Hardie Sea Drift Cladding • Hardie Oblique Cladding • Hardie Axon Cladding • Hardie Linea Cladding • Hardie Stria Cladding Market 23% JH 15% Market 46% JH 6% Market 31% JH 2% Hardie Fine Texture Cladding Sh ar e

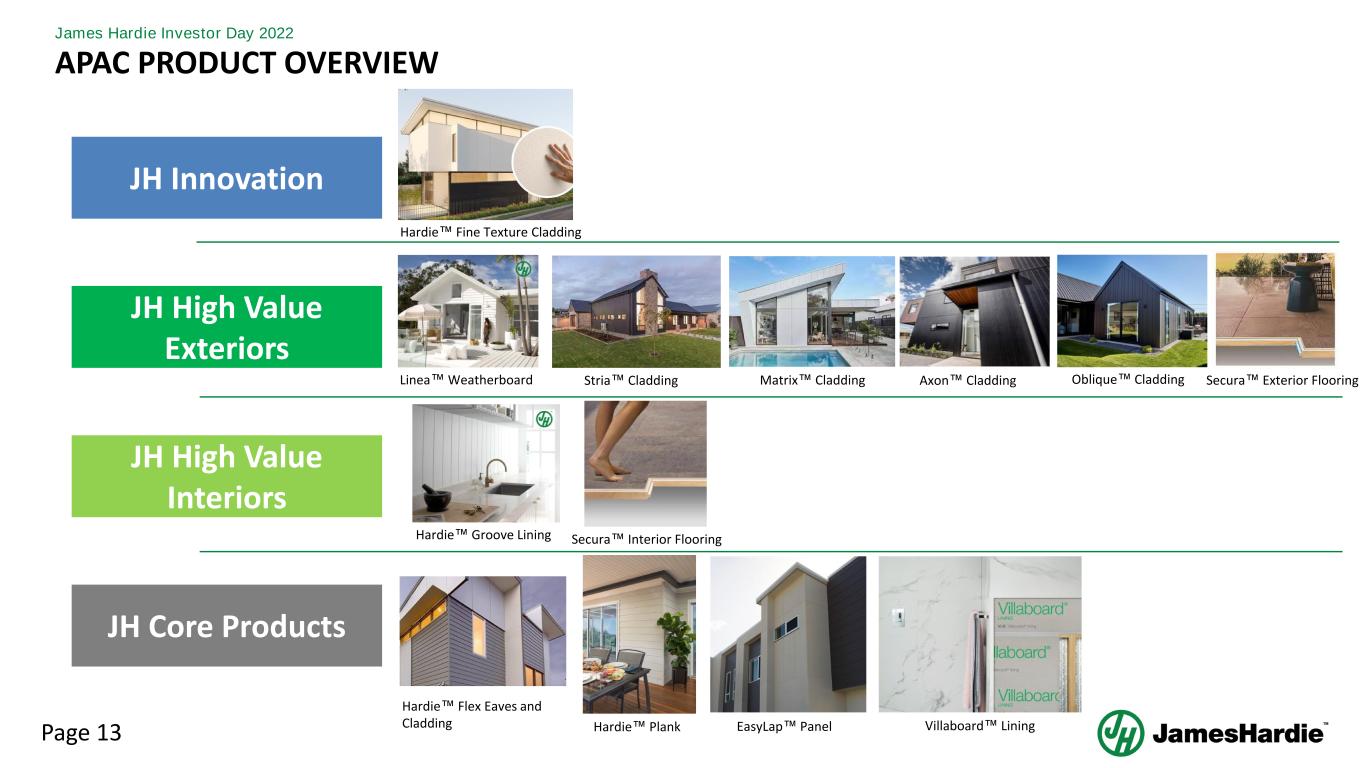

Page 13 James Hardie Investor Day 2022 APAC PRODUCT OVERVIEW JH Core Products JH High Value Interiors JH High Value Exteriors JH Innovation Hardie™ Fine Texture Cladding Linea™Weatherboard Stria™ Cladding Matrix™ Cladding Axon™ Cladding Oblique™ Cladding Hardie™ Flex Eaves and Cladding Hardie™ Plank EasyLap™ Panel Villaboard™ Lining Secura™ Interior Flooring Secura™ Exterior Flooring Hardie™ Groove Lining

Page 14 James Hardie Investor Day 2022 Hardie™ Architectural Collection – unlocking single storey and lowers of double storey Hardie™ Fine Texture Cladding – well positioned in modern uppers and against render ANZ – INNOVATION FOCUS ON FURTHER UNLOCKING MODERN LOOK

Page 15 James Hardie Investor Day 2022 Hardie™ Oblique™ - proven in NZ - validated in AU - refined and ready to scale ANZ - EXPANDING OBLIQUE™ TO AUSTRALIA

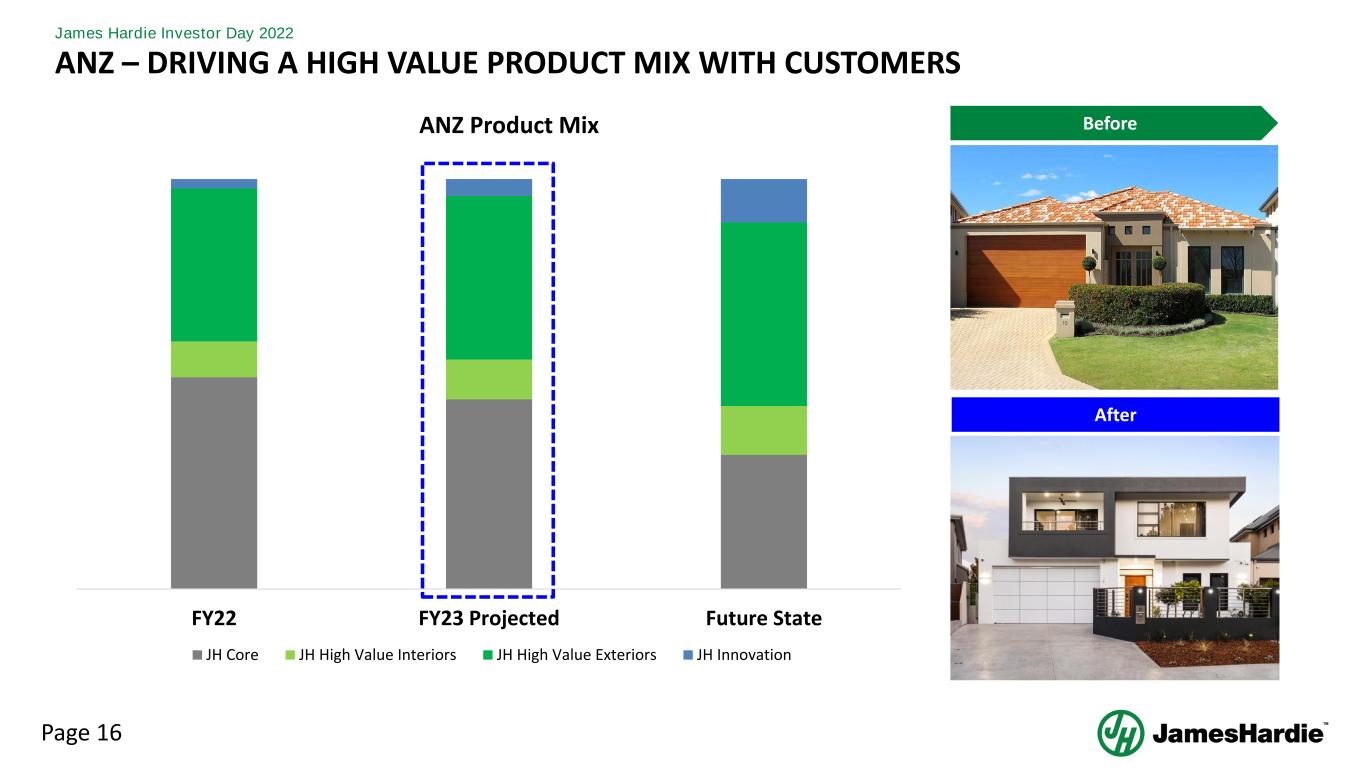

Page 16 James Hardie Investor Day 2022 ANZ – DRIVING A HIGH VALUE PRODUCT MIX WITH CUSTOMERS Before After ANZ Product Mix FY22 FY23 Projected Future State JH Core JH High Value Interiors JH High Value Exteriors JH Innovation

Page 17 APAC: VALUE CHAIN OVERVIEW John Arneil, General Manager - APAC

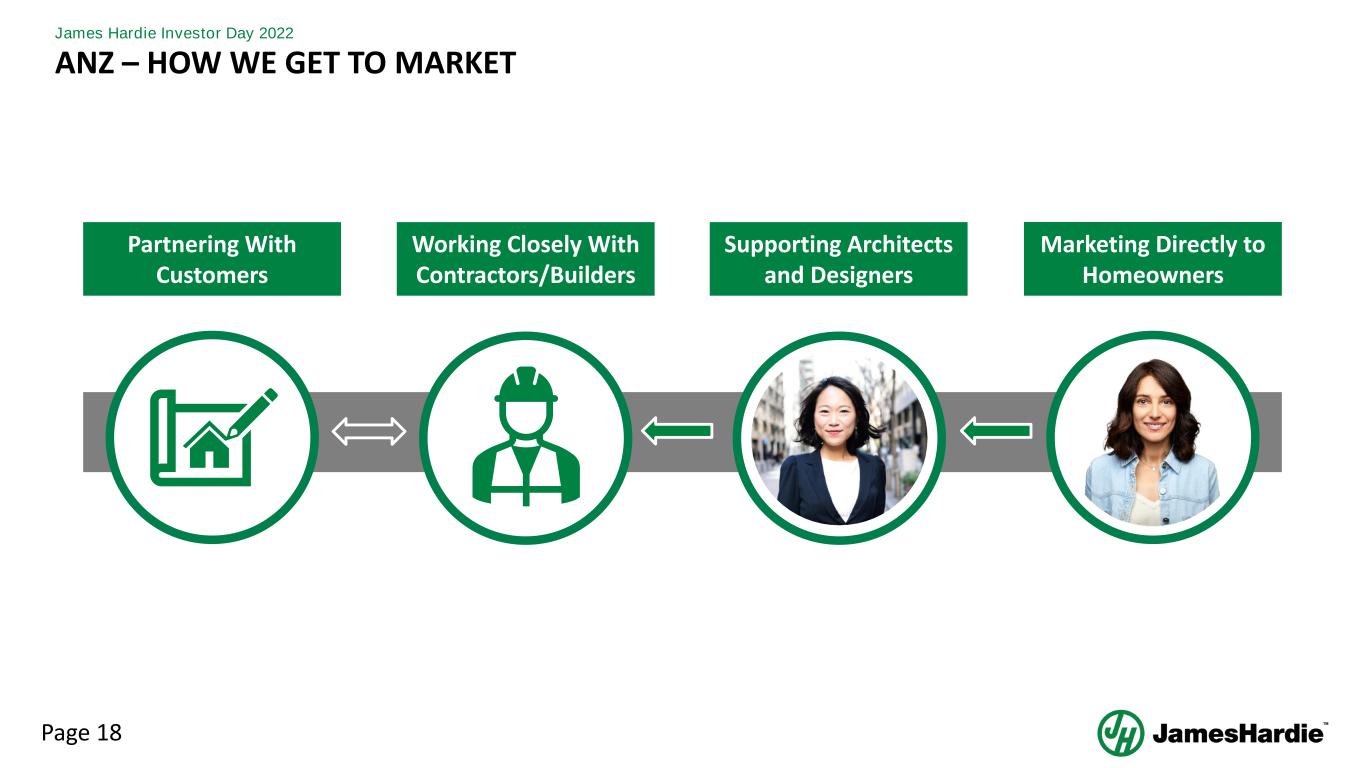

Page 18 James Hardie Investor Day 2022 ANZ – HOW WE GET TO MARKET Marketing Directly to Homeowners Partnering With Customers Working Closely With Contractors/Builders Supporting Architects and Designers

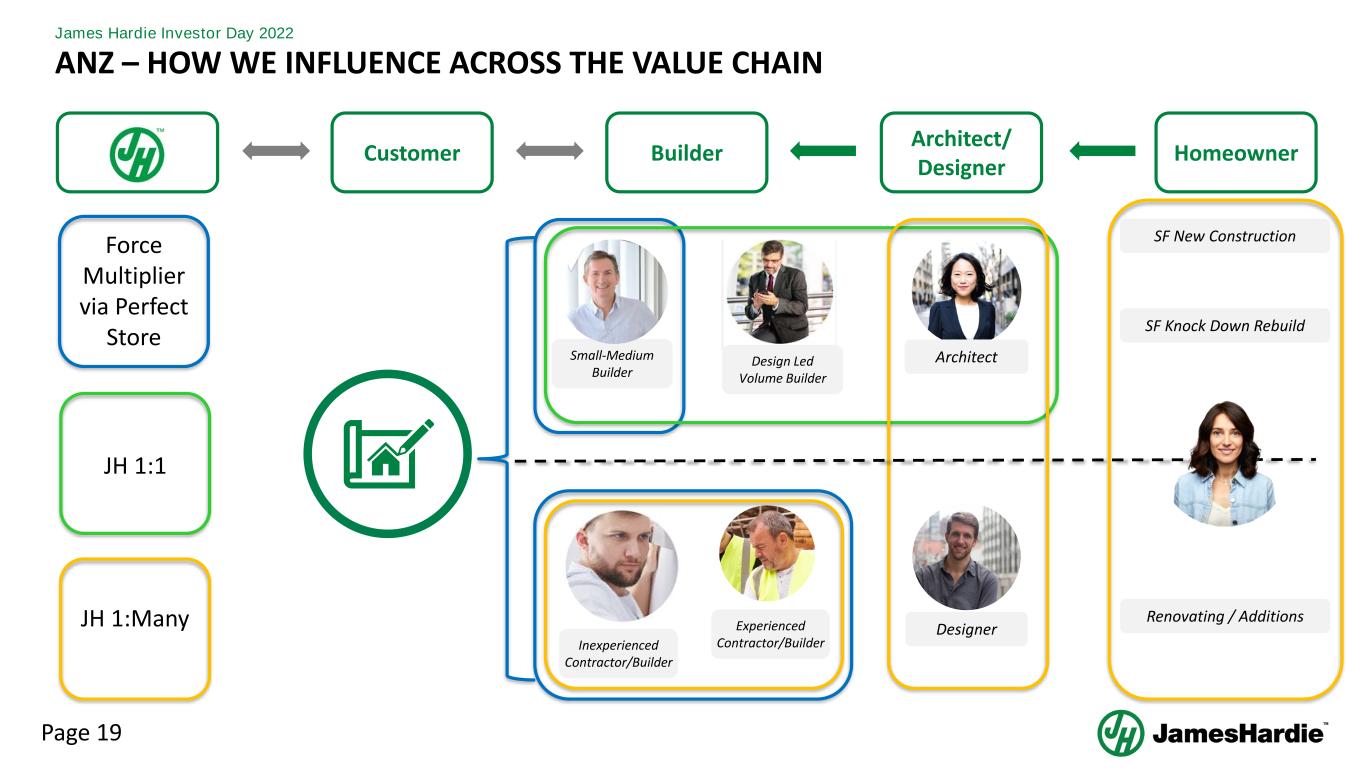

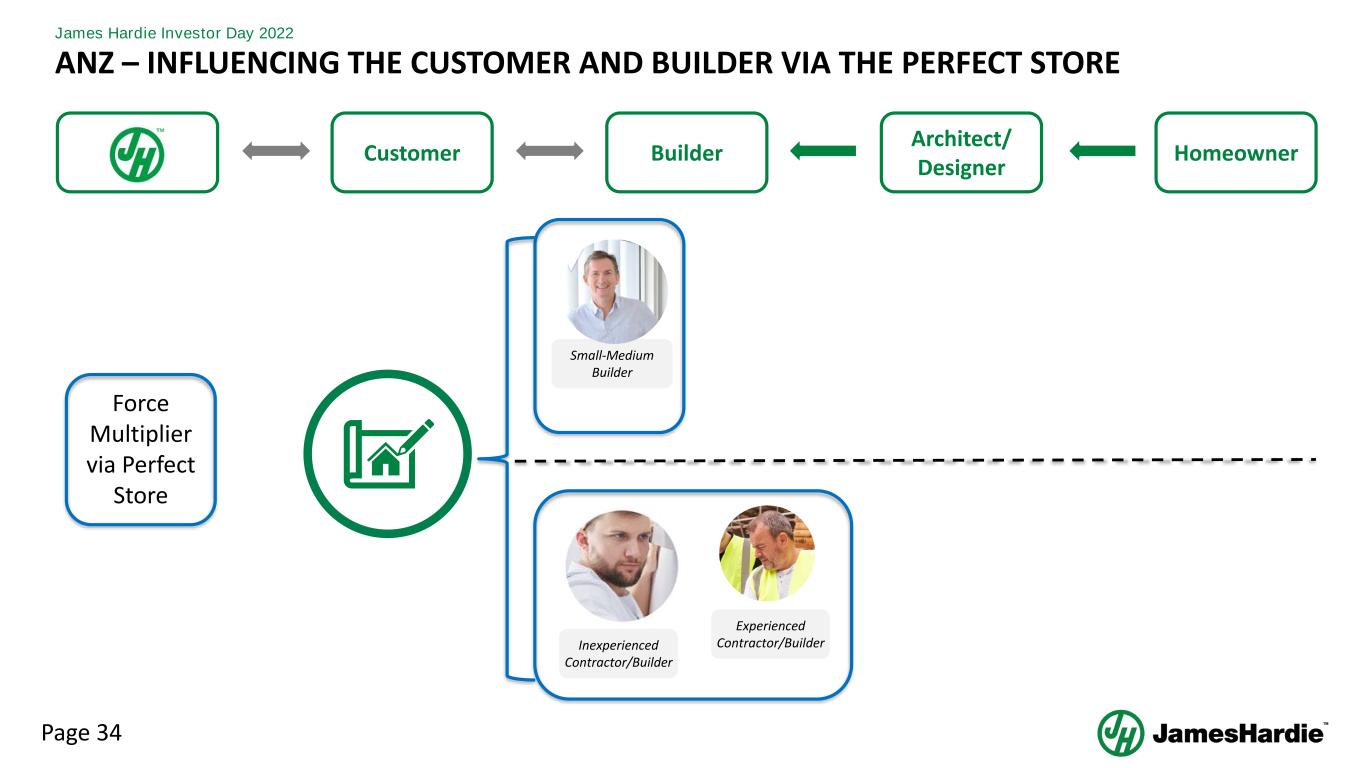

Page 19 James Hardie Investor Day 2022 ANZ – HOW WE INFLUENCE ACROSS THE VALUE CHAIN DesignerExperienced Contractor/Builder Renovating / Additions Small-Medium Builder SF New Construction Architect Force Multiplier via Perfect Store JH 1:1 JH 1:Many Design Led Volume Builder SF Knock Down Rebuild Customer Builder Architect/ Designer Homeowner Inexperienced Contractor/Builder

Page 20 INVESTOR DAY 2022 – APAC: INFLUENCING HOMEOWNER John Arneil, General Manager - APAC

Page 21

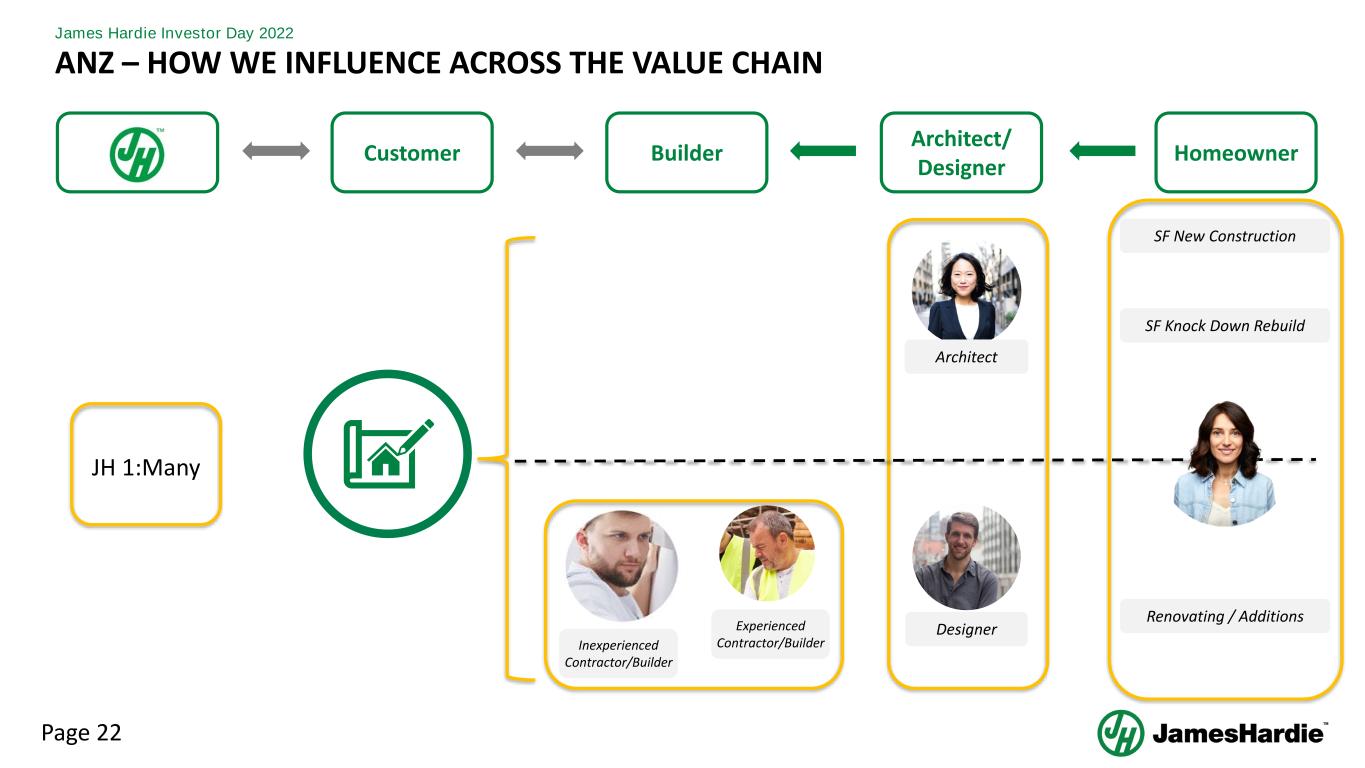

Page 22 James Hardie Investor Day 2022 ANZ – HOW WE INFLUENCE ACROSS THE VALUE CHAIN DesignerExperienced Contractor/Builder Renovating / Additions SF New Construction Architect JH 1:Many SF Knock Down Rebuild Customer Builder Architect/ Designer Homeowner Inexperienced Contractor/Builder

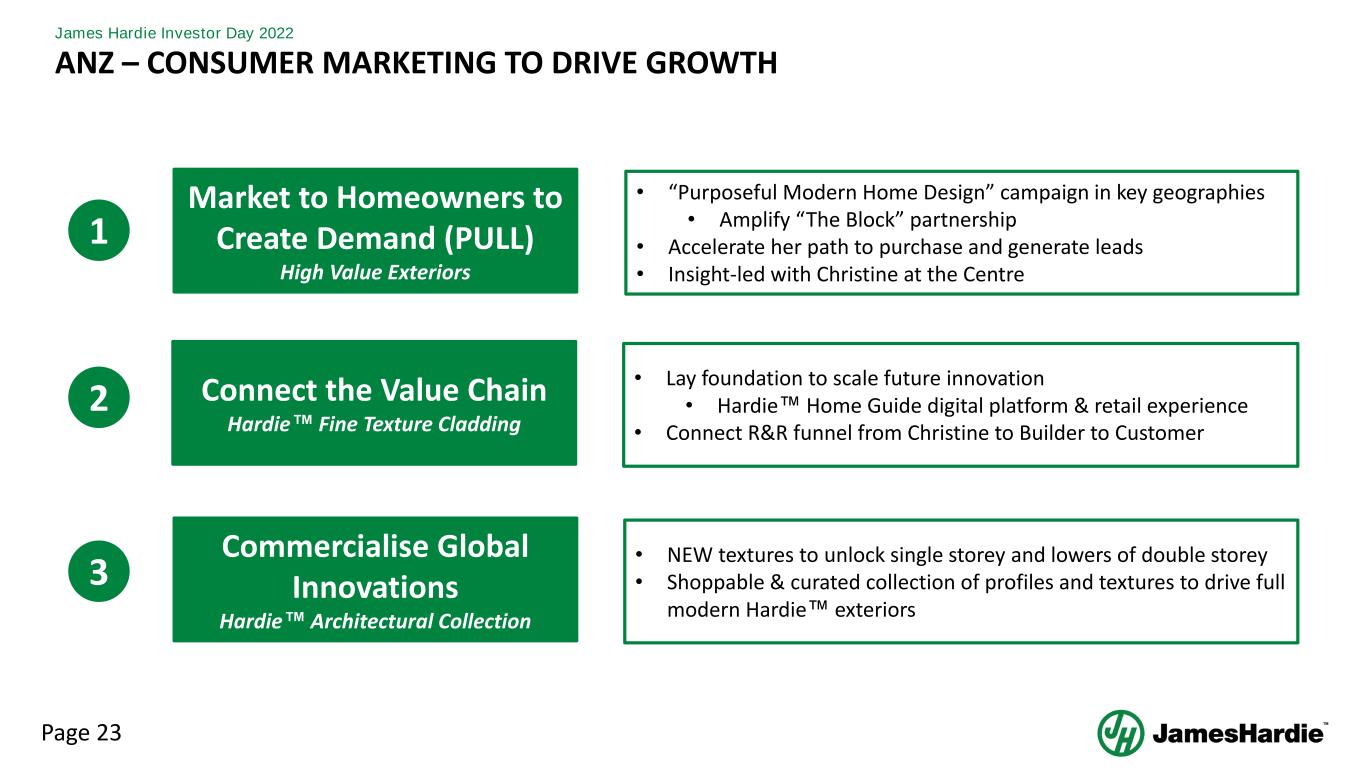

Page 23 James Hardie Investor Day 2022 ANZ – CONSUMER MARKETING TO DRIVE GROWTH Commercialise Global Innovations Hardie™ Architectural Collection 1 Connect the Value Chain Hardie™ Fine Texture Cladding 2 Market to Homeowners to Create Demand (PULL) High Value Exteriors 3 • NEW textures to unlock single storey and lowers of double storey • Shoppable & curated collection of profiles and textures to drive full modern Hardie™ exteriors • Lay foundation to scale future innovation • Hardie™ Home Guide digital platform & retail experience • Connect R&R funnel from Christine to Builder to Customer • “Purposeful Modern Home Design” campaign in key geographies • Amplify “The Block” partnership • Accelerate her path to purchase and generate leads • Insight-led with Christine at the Centre

Page 24 James Hardie Investor Day 2022 AU – PURPOSEFUL MODERN DESIGN CAMPAIGN IN-MARKET Paid Social PostsDigital BVOD Targeted Digital Media Digital Retargeting Assets Modern Look Book

Page 25 James Hardie Investor Day 2022 ANZ – BUILD OUT AND AMPLIFY A VIRTUAL SHOWROOM FOR MODERN HOMES

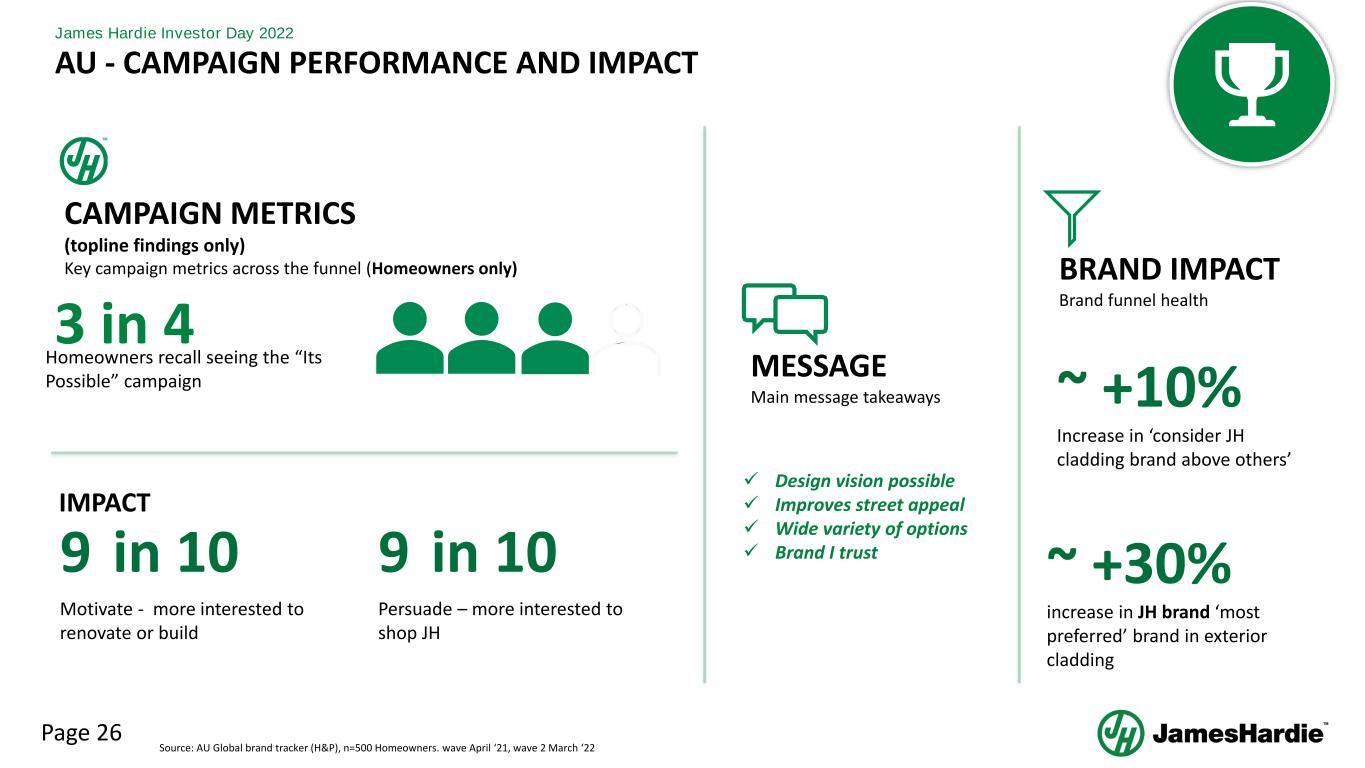

Page 26 James Hardie Investor Day 2022 CAMPAIGN METRICS (topline findings only) Key campaign metrics across the funnel (Homeowners only) MESSAGE Main message takeaways BRAND IMPACT Brand funnel health 9 in 10 Persuade – more interested to shop JH 9 in 10 Motivate - more interested to renovate or build 3 in 4 Homeowners recall seeing the “Its Possible” campaign ✓ Design vision possible ✓ Improves street appeal ✓ Wide variety of options ✓ Brand I trust IMPACT ~ +30% increase in JH brand ‘most preferred’ brand in exterior cladding ~ +10% Increase in ‘consider JH cladding brand above others’ Source: AU Global brand tracker (H&P), n=500 Homeowners. wave April ‘21, wave 2 March ‘22 AU - CAMPAIGN PERFORMANCE AND IMPACT

Page 27 James Hardie Investor Day 2022 AU – THE BLOCK 2022 Source: Nine Entertainment Co >2021 saw 11.4 million viewers (40%+ of AU population) High proportion of audience is Christine: 55% aged 25-54 60% women Eastern seaboard audience location: 82% NSW, QLD, VIC and 76% metro.

Page 28

Page 29 APAC: DRIVING DEMAND IN SFNC WITH THE BUILDER Travis Johnson, Director - Commercial Australia

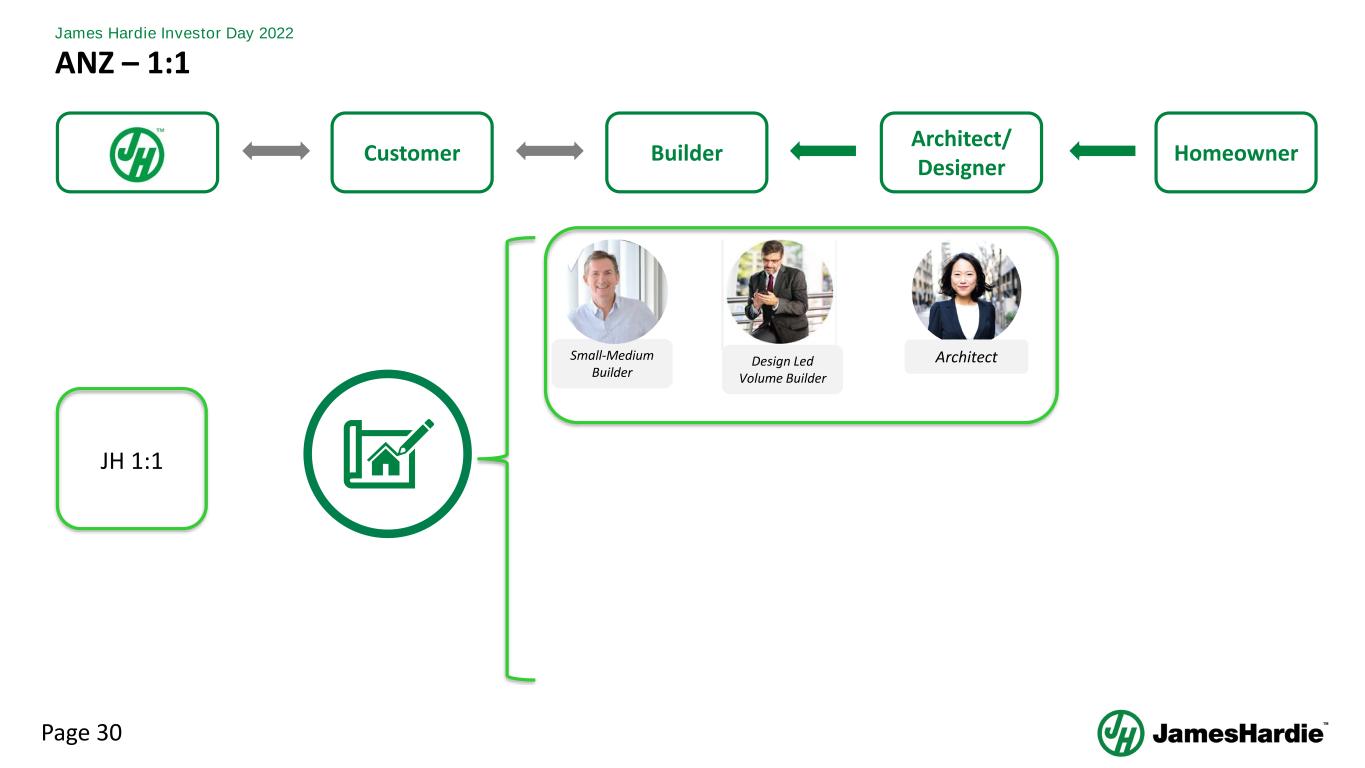

Page 30 James Hardie Investor Day 2022 ANZ – 1:1 Small-Medium Builder Architect JH 1:1 Design Led Volume Builder Customer Builder Architect/ Designer Homeowner

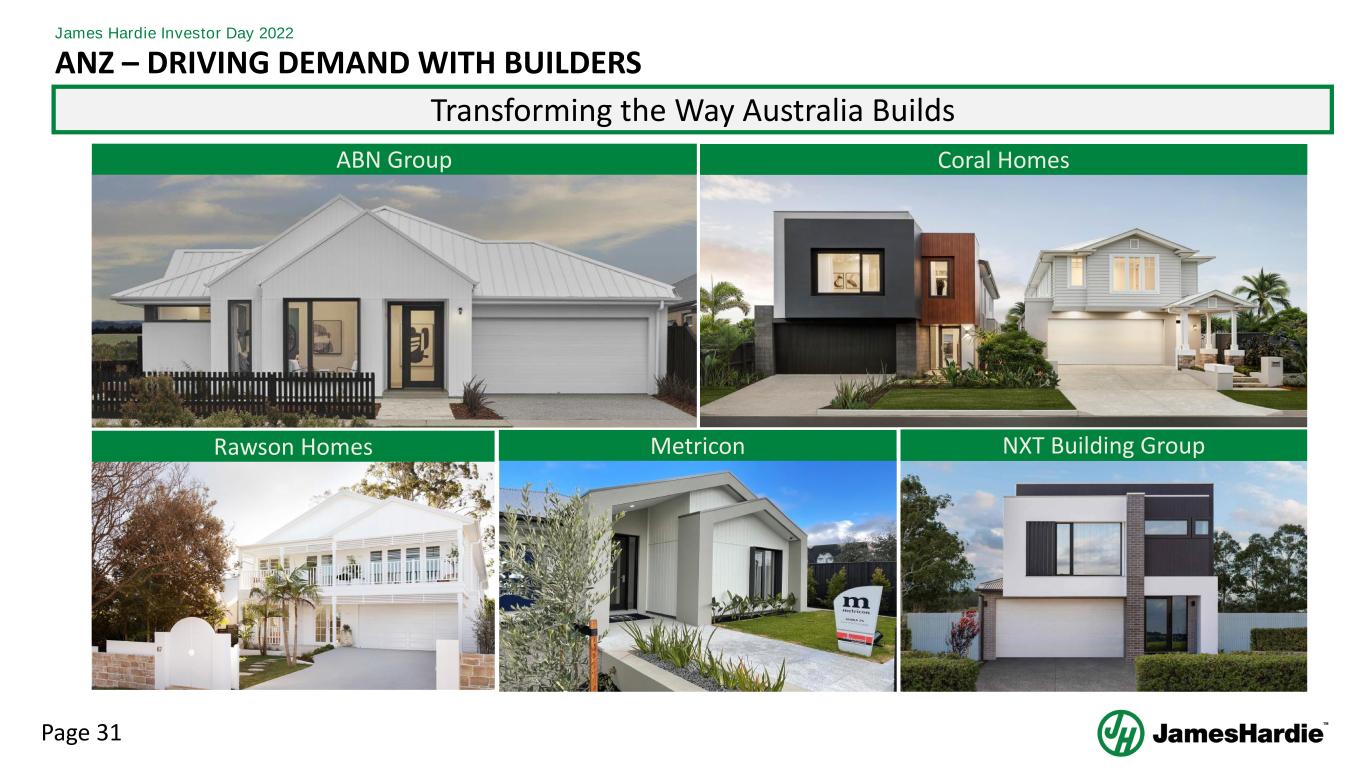

Page 31 James Hardie Investor Day 2022 Coral HomesABN Group Rawson Homes Metricon NXT Building Group ANZ – DRIVING DEMAND WITH BUILDERS Transforming the Way Australia Builds

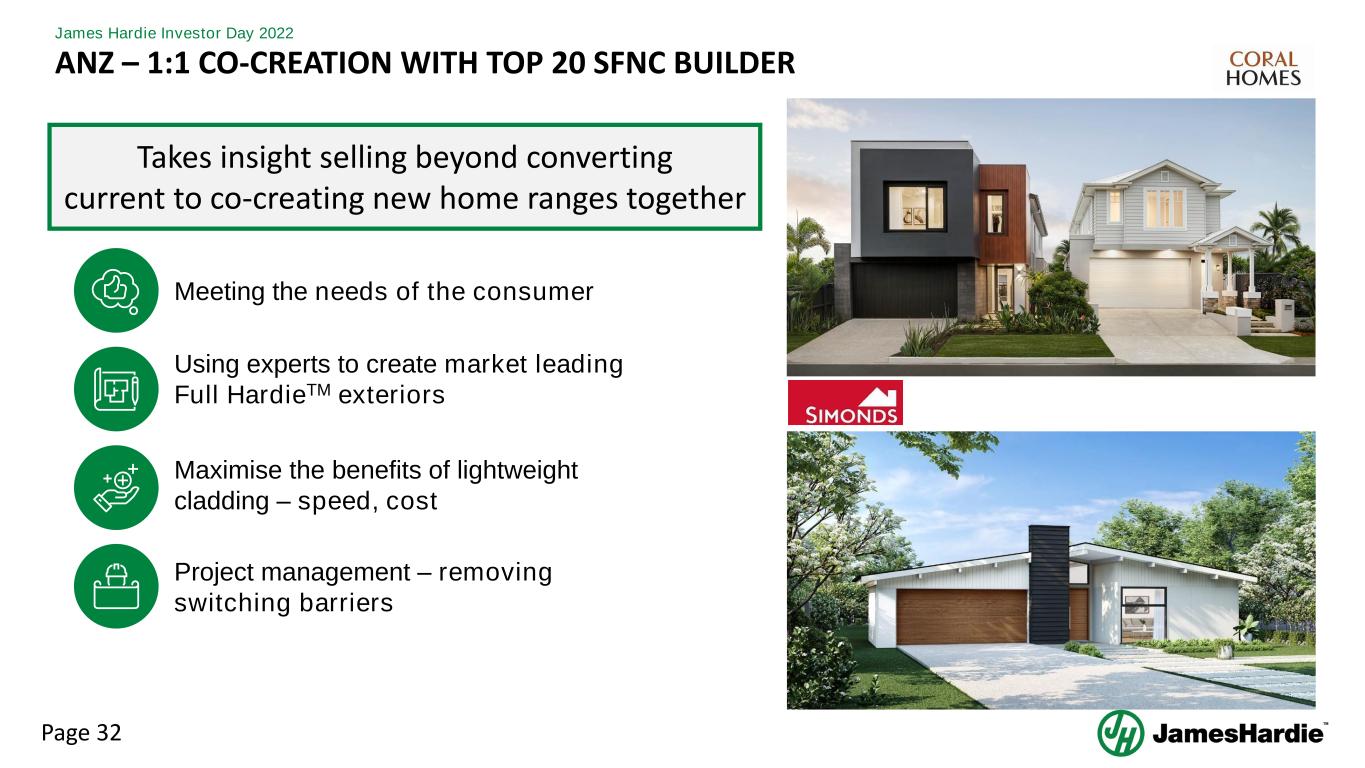

Page 32 James Hardie Investor Day 2022 Meeting the needs of the consumer Using experts to create market leading Full HardieTM exteriors Maximise the benefits of lightweight cladding – speed, cost Project management – removing switching barriers Takes insight selling beyond converting current to co-creating new home ranges together ANZ – 1:1 CO-CREATION WITH TOP 20 SFNC BUILDER

Page 33 APAC: ENABLING OUR CUSTOMERS TO DRIVE GROWTH WITH BUILDERS Travis Johnson, Director - Commercial Australia

Page 34 James Hardie Investor Day 2022 ANZ – INFLUENCING THE CUSTOMER AND BUILDER VIA THE PERFECT STORE Experienced Contractor/Builder Small-Medium Builder Force Multiplier via Perfect Store Customer Builder Architect/ Designer Homeowner Inexperienced Contractor/Builder

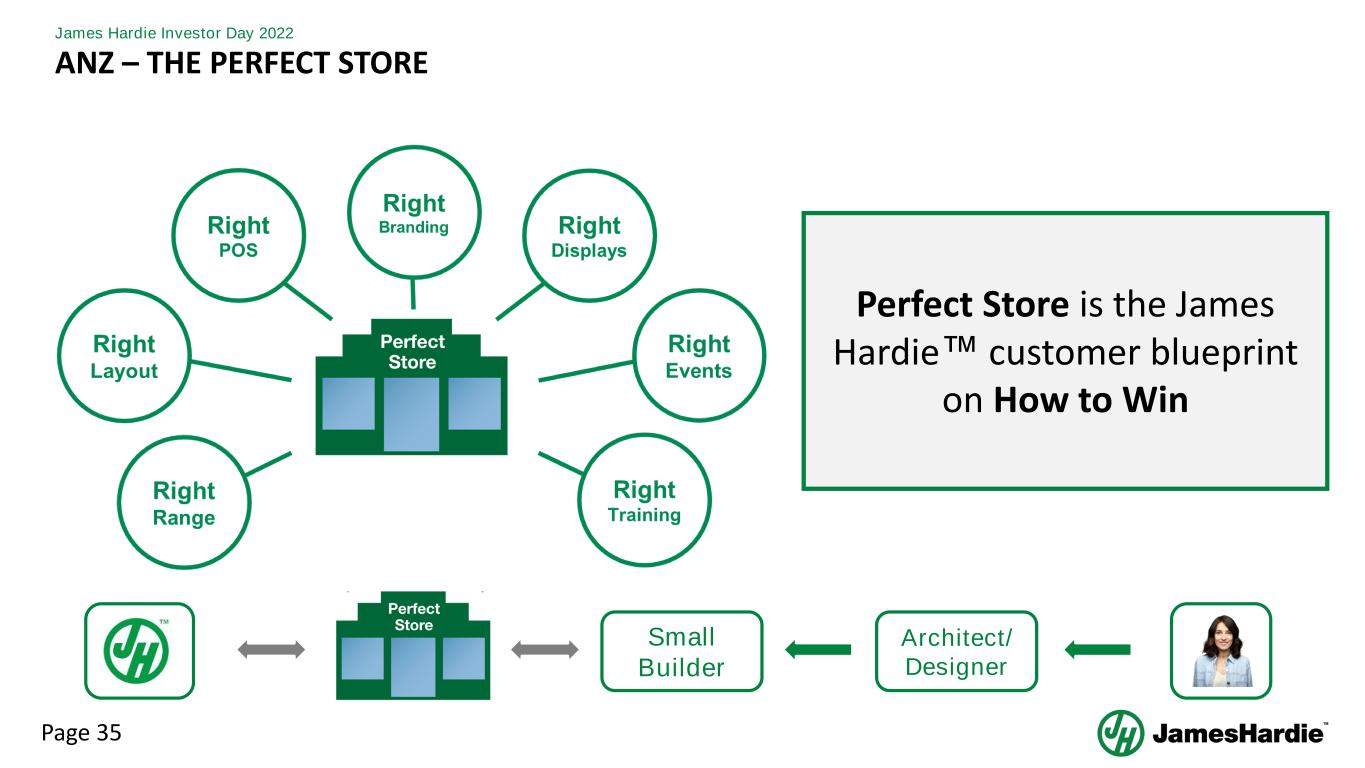

Page 35 James Hardie Investor Day 2022 ANZ – THE PERFECT STORE Small Builder Architect/ Designer Perfect Store is the James Hardie™ customer blueprint on How to Win

Page 36 James Hardie Investor Day 2022 ANZ – KEEPING CUSTOMERS STOCKED WITH THE RIGHT RANGE IS OUR #1 PRIORITY RIGHT RANGE Collaborate Planning and Forecasting Keeping customers stocked Set the Range Set Min & Max Stock Levels Forecast Sales Demand Place Forward Orders Check and Adjust Right Range to the Right Customer at the Right Time

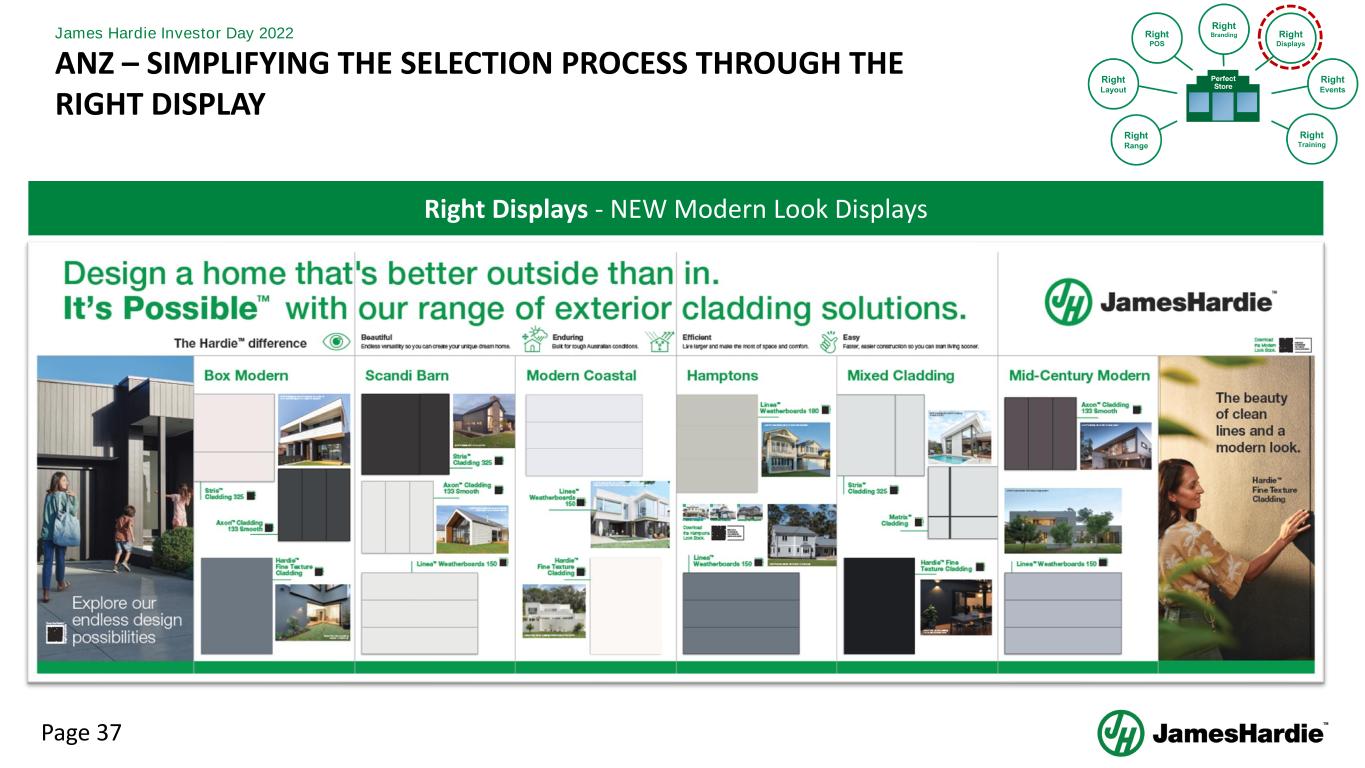

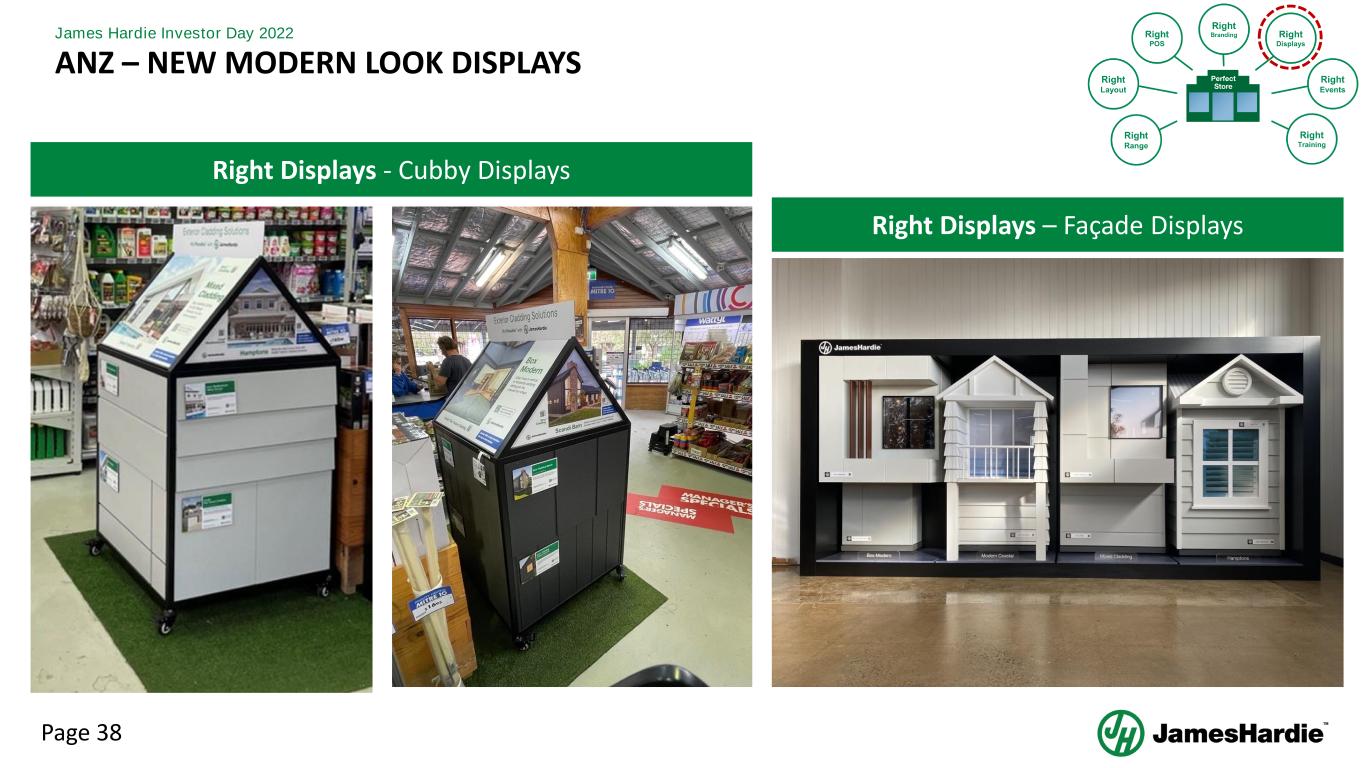

Page 37 James Hardie Investor Day 2022 Right Displays - NEW Modern Look Displays ANZ – SIMPLIFYING THE SELECTION PROCESS THROUGH THE RIGHT DISPLAY

Page 38 James Hardie Investor Day 2022 Right Displays - Cubby Displays Right Displays – Façade Displays ANZ – NEW MODERN LOOK DISPLAYS

Page 39 James Hardie Investor Day 2022 Right Events - Hardie™ containers 10,000 builders targeted across FY23 ANZ – SCALABLE EXECUTION OF PUSH WITH CUSTOMERS Right Events - Mobile Construction Clinics Trailers

Page 40 APAC: SUMMARY John Arneil, General Manager - APAC

Page 41 James Hardie Investor Day 2022 APAC – SUMMARYJUST BEGUN Strong base business built over 40+ years in fiber cement with significant fiber cement market share and category share Significant growth opportunities exist in all our APAC regions We have the insight led innovation, consumer marketing focus, proven market development model and deep customer integration in place for sustained profitable growth

Page 42 Q&A

Page 43 EXPERIENCE SESSION #1

Page 44 15 MINUTE BREAK

Page 45 INVESTOR DAY 2022 – EUROPE

Page 46 James Hardie Investor Day 2022 PRESENTERS Henning Risse Sales Director – Europe Tobias Bennerscheidt Director Marketing & Segments – Europe

Page 47 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – Europe Topic Presenter Europe Overview Tobias Bennerscheidt Fiber Gypsum Growth Henning Risse Fiber Cement Growth Tobias Bennerscheidt

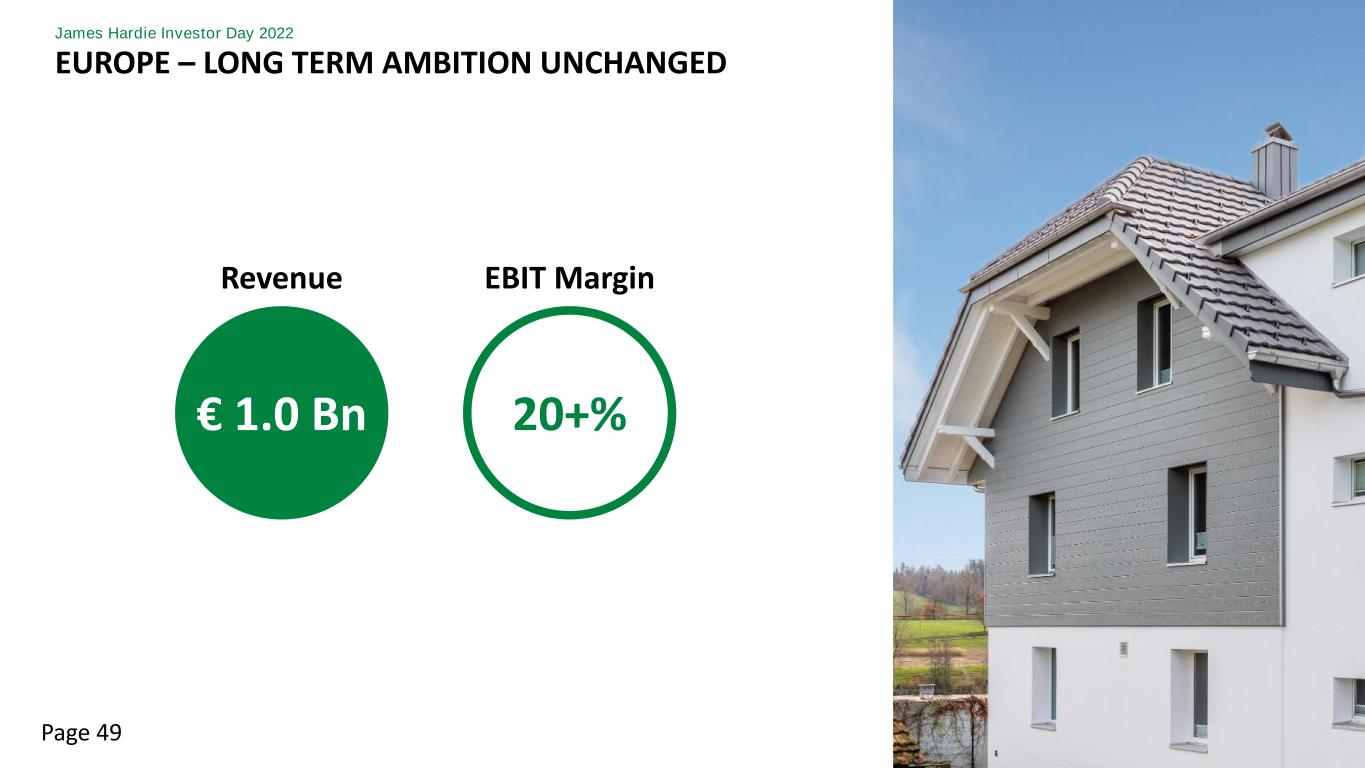

Page 48 James Hardie Investor Day 2022 EUROPE – SUMMARY Europe’s long term ambition remains unchanged at €1 billion in Net Sales and 20+% EBIT Margin Clear path to €500 million of Fiber Gypsum Net Sales with proven track record Two key Fiber Cement growth opportunities to take a significant step toward €500 million in Fiber Cement Net Sales

Page 49 James Hardie Investor Day 2022 EUROPE – LONG TERM AMBITION UNCHANGED € 1.0 Bn 20+% Revenue EBIT Margin

Page 50 EUROPE: OVERVIEW Tobias Bennerscheidt, Director Marketing & Segments

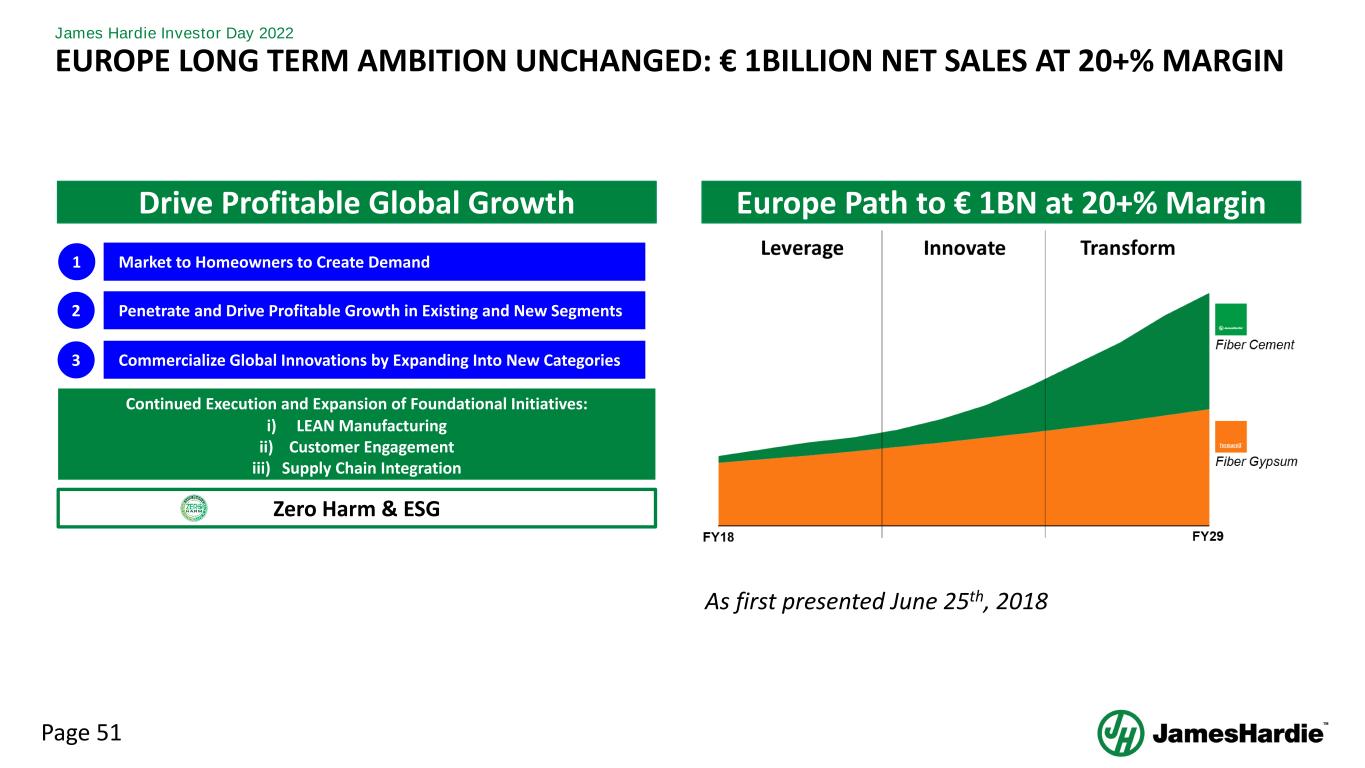

Page 51 James Hardie Investor Day 2022 EUROPE LONG TERM AMBITION UNCHANGED: € 1BILLION NET SALES AT 20+% MARGIN As first presented June 25th, 2018 Drive Profitable Global Growth Europe Path to € 1BN at 20+% Margin Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG

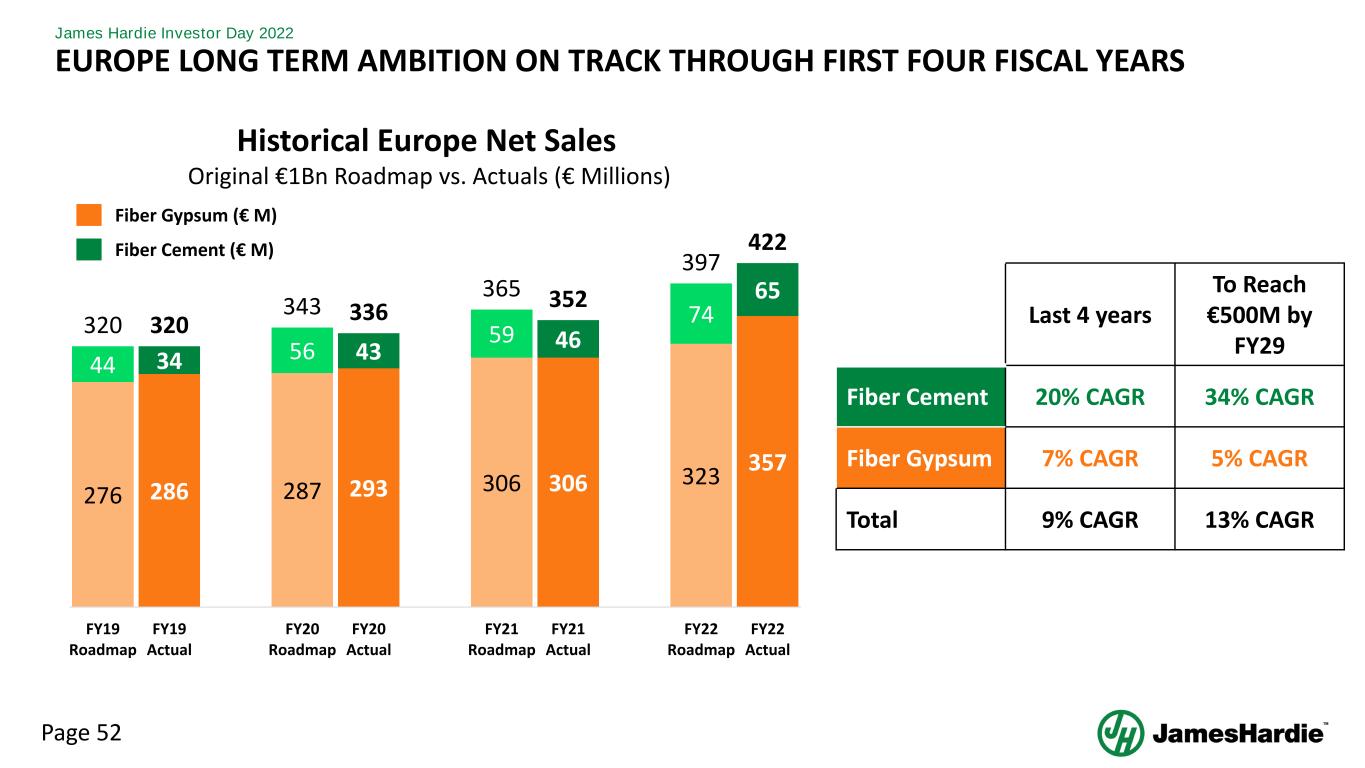

Page 52 James Hardie Investor Day 2022 EUROPE LONG TERM AMBITION ON TRACK THROUGH FIRST FOUR FISCAL YEARS 276 286 287 293 306 306 323 357 44 34 56 43 59 46 74 65 320 320 343 336 365 352 397 422 FY19 Roadmap FY19 Actual FY20 Roadmap FY20 Actual FY21 Roadmap FY21 Actual FY22 Roadmap FY22 Actual Historical Europe Net Sales Original €1Bn Roadmap vs. Actuals (€ Millions) Fiber Gypsum (€ M) Fiber Cement (€ M) Last 4 years To Reach €500M by FY29 Fiber Cement 20% CAGR 34% CAGR Fiber Gypsum 7% CAGR 5% CAGR Total 9% CAGR 13% CAGR

Page 53 EUROPE: FIBER GYPSUM GROWTH Henning Risse, Sales Director – Europe

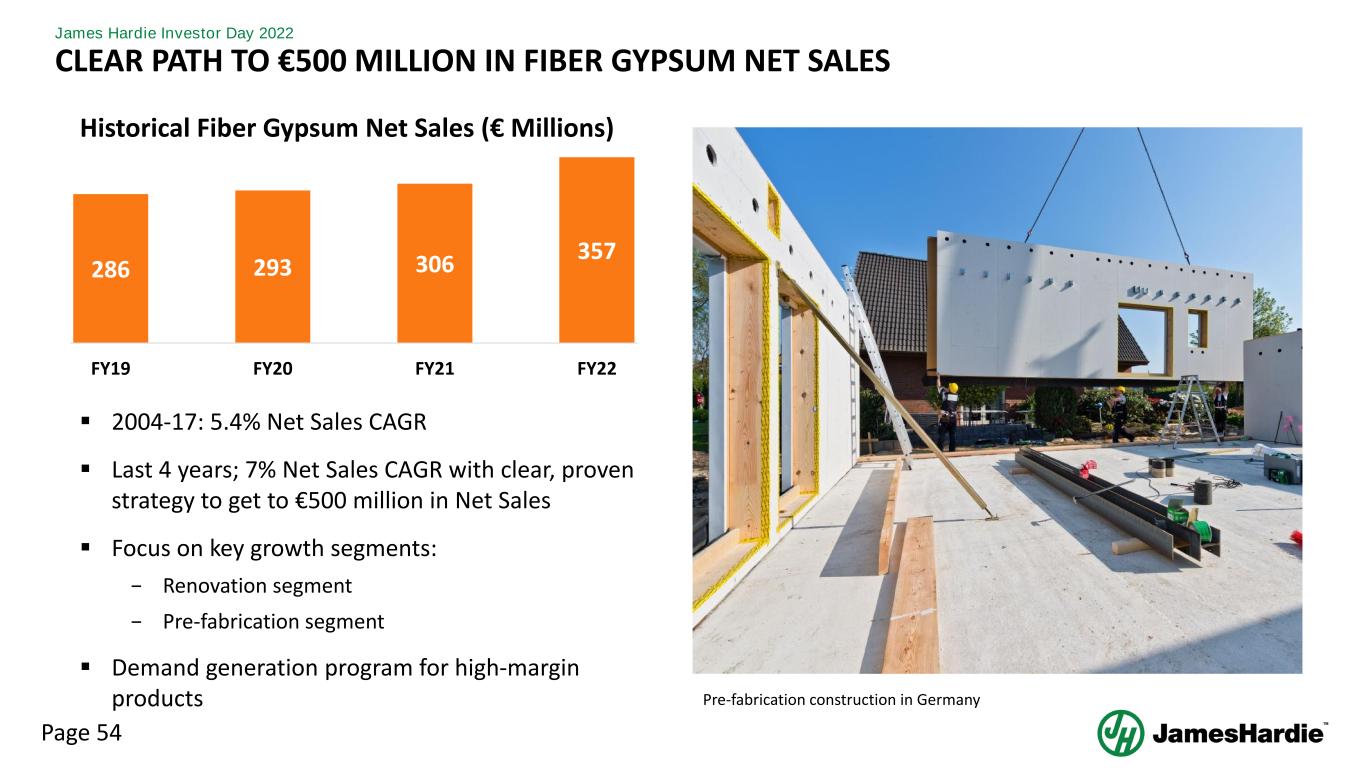

Page 54 James Hardie Investor Day 2022 CLEAR PATH TO €500 MILLION IN FIBER GYPSUM NET SALES ▪ 2004-17: 5.4% Net Sales CAGR ▪ Last 4 years; 7% Net Sales CAGR with clear, proven strategy to get to €500 million in Net Sales ▪ Focus on key growth segments: − Renovation segment − Pre-fabrication segment ▪ Demand generation program for high-margin products 286 293 306 357 FY19 FY20 FY21 FY22 Historical Fiber Gypsum Net Sales (€ Millions) Pre-fabrication construction in Germany

Page 55 James Hardie Investor Day 2022 FIBER GYPSUM PRODUCT SUMMARY Product Wall Board for Pre-Fabrication Wall Board for Dry Lining fermacell® Large Format Wall Boards Pre-Fabrication Application fermacell® Tapered Edge Wall Boards Dry-Lining Application Application Flooring Elements for Renovation fermacell® Flooring Element Renovation Application

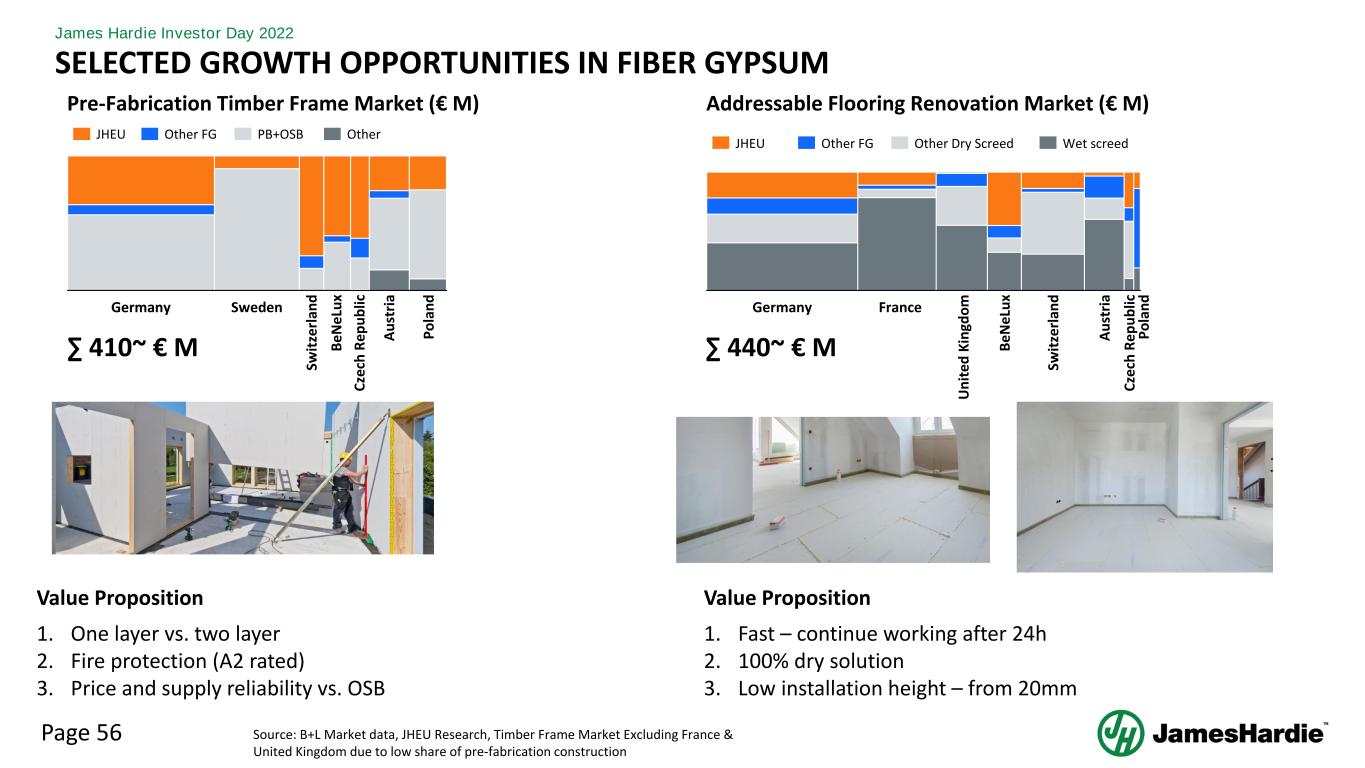

Page 56 James Hardie Investor Day 2022 SELECTED GROWTH OPPORTUNITIES IN FIBER GYPSUM Pre-Fabrication Timber Frame Market (€ M) Value Proposition 1. One layer vs. two layer 2. Fire protection (A2 rated) 3. Price and supply reliability vs. OSB JHEU PB+OSB OtherOther FG ∑ 410~ € M JHEU Other Dry Screed Wet screedOther FG Value Proposition 1. Fast – continue working after 24h 2. 100% dry solution 3. Low installation height – from 20mm Germany Sweden Source: B+L Market data, JHEU Research, Timber Frame Market Excluding France & United Kingdom due to low share of pre-fabrication construction Addressable Flooring Renovation Market (€ M) Sw it ze rl an d ∑ 440~ € MB e N e Lu x C ze ch R e p u b lic A u st ri a P o la n d Germany France U n it e d K in gd o m B e N e Lu x Sw it ze rl an d A u st ri a C ze ch R e p u b lic P o la n d

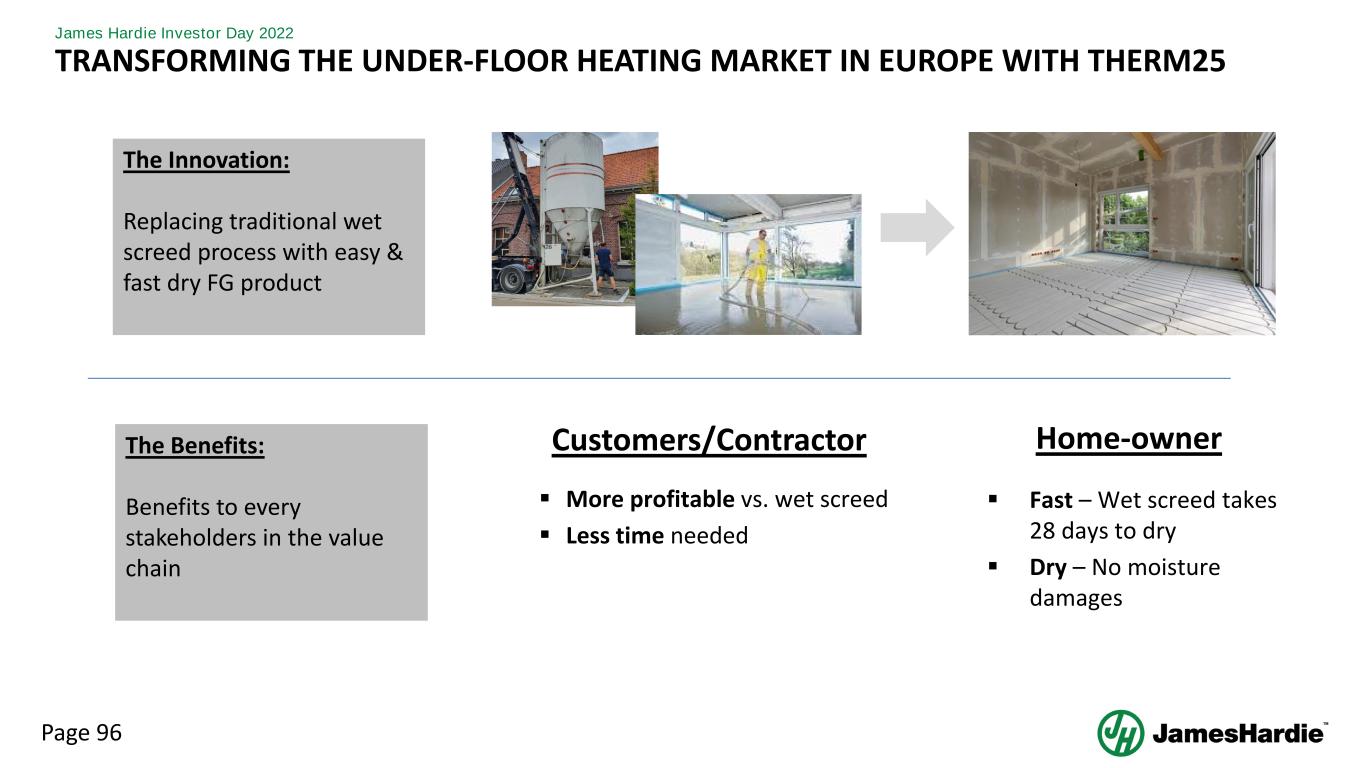

Page 57 James Hardie Investor Day 2022 LAUNCH OF FLOORING INNOVATION TO ENABLE GROWTH IN NEW APPLICATIONS * Source: JH Research ▪ Main Fiber Gypsum product for renovation is fermacell® flooring ▪ In the past JHEU did not offer a competitive solution for underfloor heating ▪ Roughly 50% of renovations in Germanic region include an underfloor heating solution* New fermacell® Therm 25 is a thin, fast and dry solution for underfloor heating launched in Germanic region, and additional countries to follow in FY23 First Therm 25 reference project (Germany) Opening new markets for fermacell thanks to innovations

Page 58 James Hardie Investor Day 2022 EUROPE – FIBER GYPSUM SUMMARY Clear path to €500 million of Fiber Gypsum Net Sales with proven track record of >5% CAGR Two substantial growth opportunities in Pre-Fabrication and Flooring New innovation (Therm25) for significant under floor heating market

Page 59 EUROPE: FIBER CEMENT GROWTH Tobias Bennerscheidt, Director Marketing & Segments

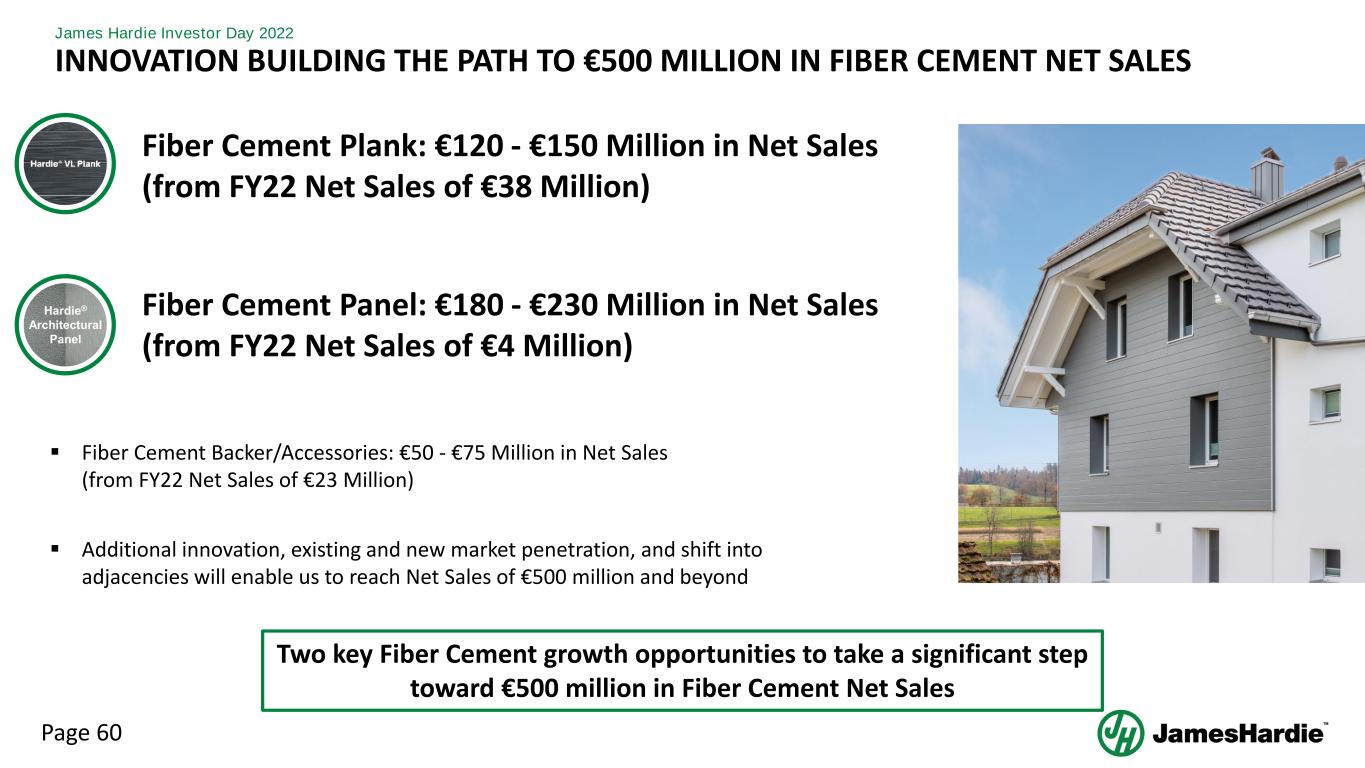

Page 60 James Hardie Investor Day 2022 INNOVATION BUILDING THE PATH TO €500 MILLION IN FIBER CEMENT NET SALES Fiber Cement Plank: €120 - €150 Million in Net Sales (from FY22 Net Sales of €38 Million) Fiber Cement Panel: €180 - €230 Million in Net Sales (from FY22 Net Sales of €4 Million) ▪ Fiber Cement Backer/Accessories: €50 - €75 Million in Net Sales (from FY22 Net Sales of €23 Million) ▪ Additional innovation, existing and new market penetration, and shift into adjacencies will enable us to reach Net Sales of €500 million and beyond Two key Fiber Cement growth opportunities to take a significant step toward €500 million in Fiber Cement Net Sales

Page 61 James Hardie Investor Day 2022 LAP SIDING AND INTERLOCK SIDING

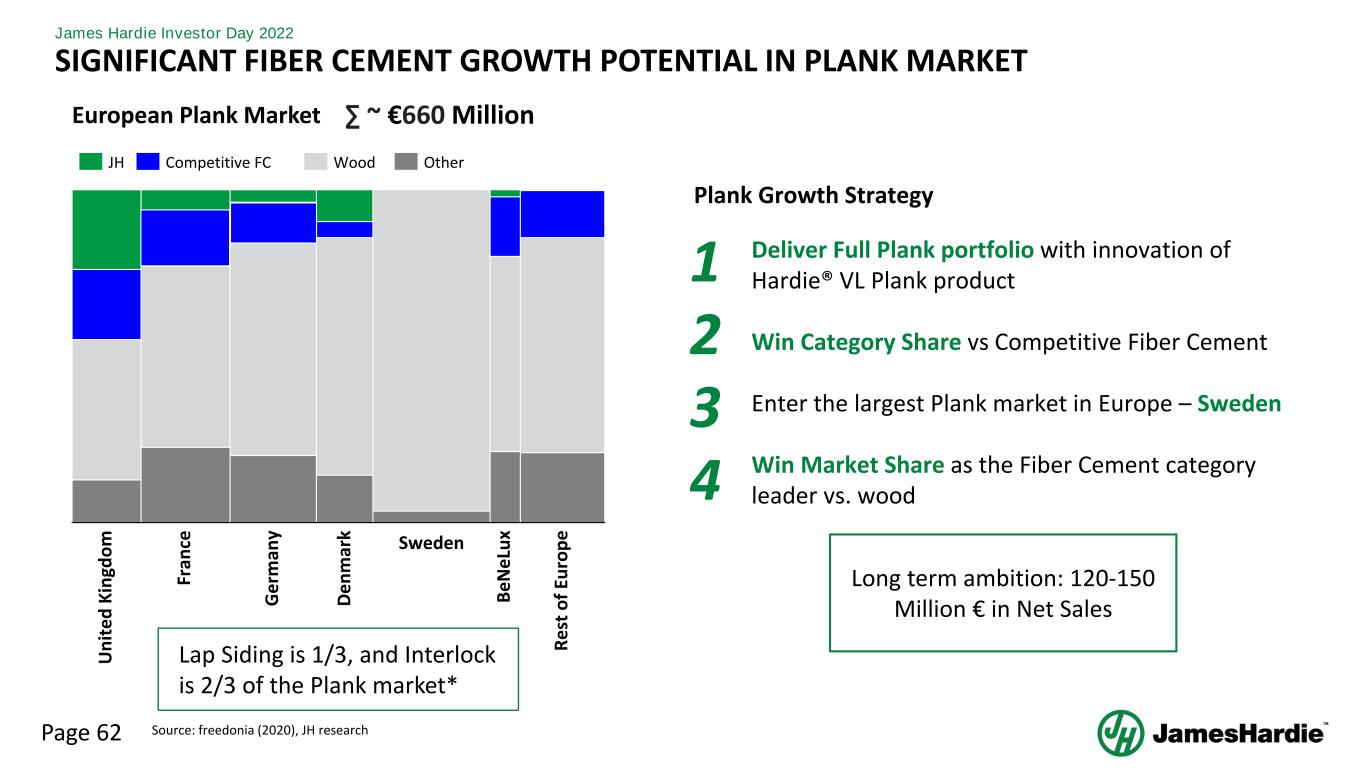

Page 62 James Hardie Investor Day 2022 SIGNIFICANT FIBER CEMENT GROWTH POTENTIAL IN PLANK MARKET Plank Growth Strategy Deliver Full Plank portfolio with innovation of Hardie® VL Plank product Win Category Share vs Competitive Fiber Cement Enter the largest Plank market in Europe – Sweden Win Market Share as the Fiber Cement category leader vs. wood 1 Source: freedonia (2020), JH research Long term ambition: 120-150 Million € in Net Sales Lap Siding is 1/3, and Interlock is 2/3 of the Plank market* U n it e d K in gd o m Sweden WoodJH Competitive FC Other European Plank Market ∑ ~ €660 Million Fr an ce G e rm an y D e n m ar k B e N e Lu x R e st o f Eu ro p e 2 3 4

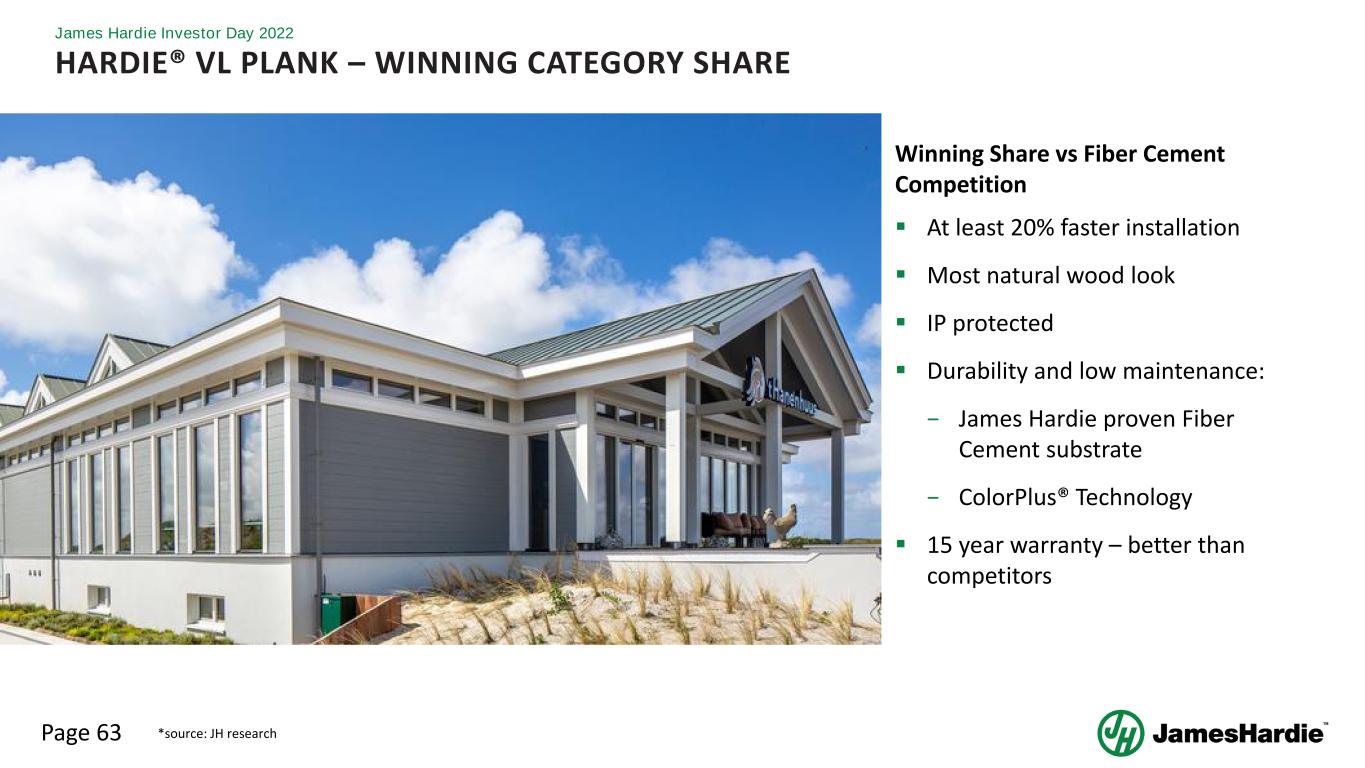

Page 63 James Hardie Investor Day 2022 HARDIE® VL PLANK – WINNING CATEGORY SHARE ▪ At least 20% faster installation ▪ Most natural wood look ▪ IP protected ▪ Durability and low maintenance: − James Hardie proven Fiber Cement substrate − ColorPlus® Technology ▪ 15 year warranty – better than competitors *source: JH research Winning Share vs Fiber Cement Competition

Page 64

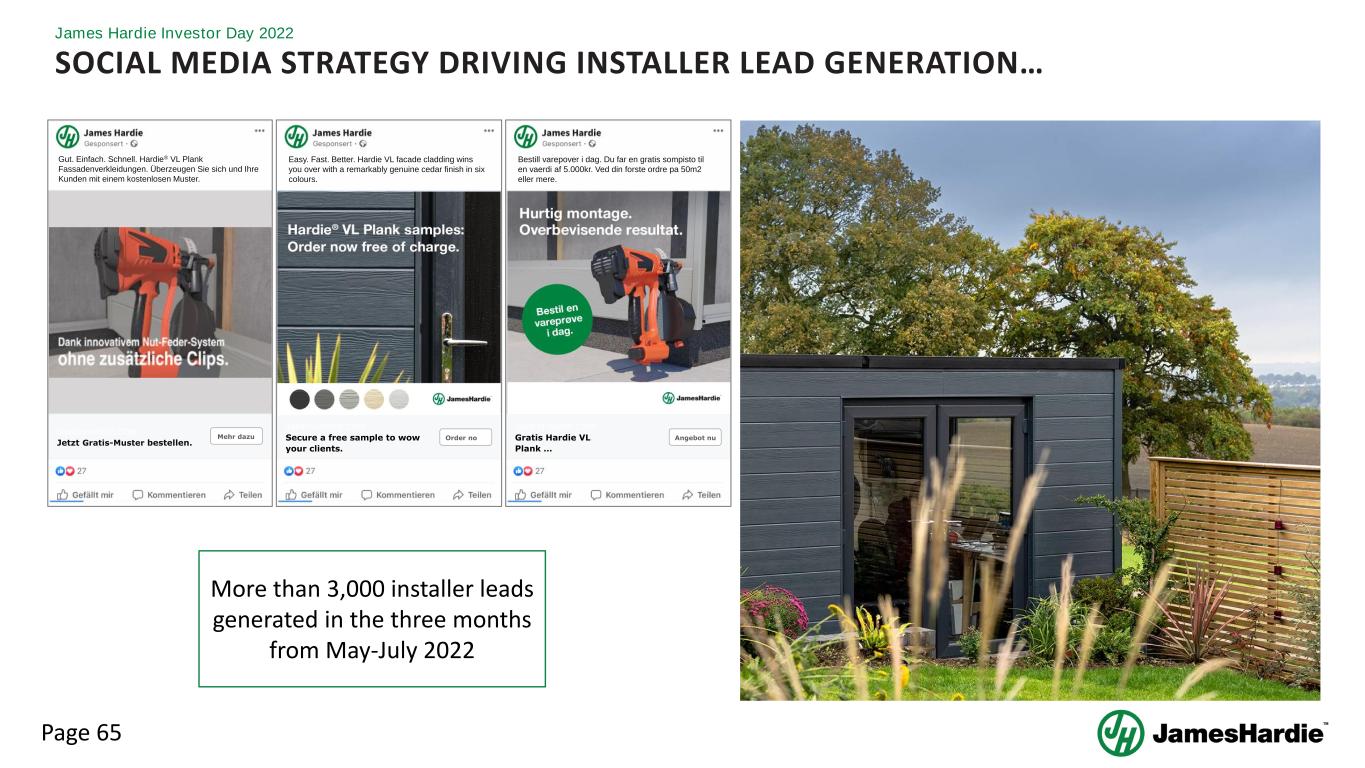

Page 65 James Hardie Investor Day 2022 SOCIAL MEDIA STRATEGY DRIVING INSTALLER LEAD GENERATION… More than 3,000 installer leads generated in the three months from May-July 2022 Gut. Einfach. Schnell. Hardie® VL Plank Fassadenverkleidungen. Überzeugen Sie sich und Ihre Kunden mit einem kostenlosen Muster. JAMESHARDIE.COM Jetzt Gratis-Muster bestellen. Mehr dazu Easy. Fast. Better. Hardie VL facade cladding wins you over with a remarkably genuine cedar finish in six colours. JAMESHARDIE.COM Secure a free sample to wow your clients. Order no Bestill varepover i dag. Du far en gratis sompisto til en vaerdi af 5.000kr. Ved din forste ordre pa 50m2 eller mere. JAMESHARDIE.COM Gratis Hardie VL Plank … Angebot nu

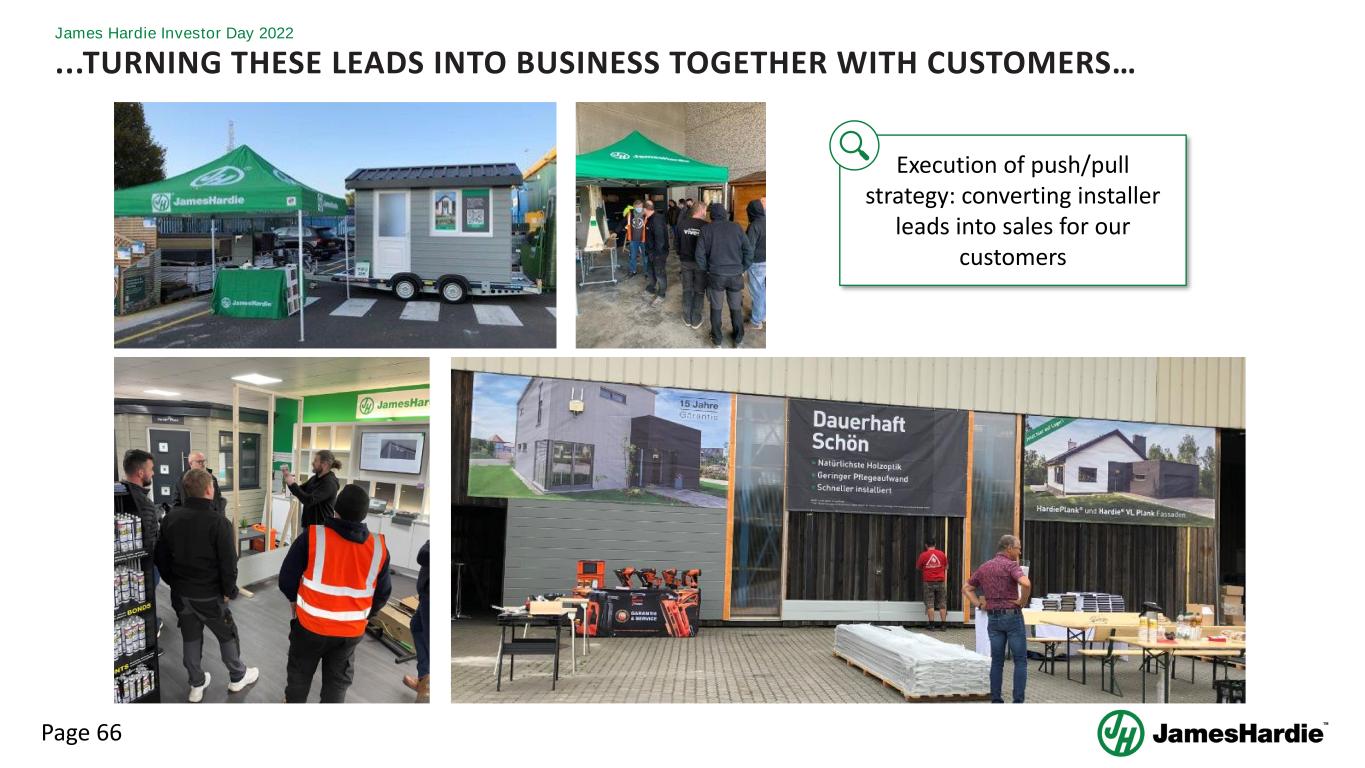

Page 66 James Hardie Investor Day 2022 Execution of push/pull strategy: converting installer leads into sales for our customers ...TURNING THESE LEADS INTO BUSINESS TOGETHER WITH CUSTOMERS…

Page 67 James Hardie Investor Day 2022 …LEADING TO NEW PROJECTS WITH HARDIE® VL PLANK IN EUROPE Switzerland United Kingdom Netherlands Germany Hardie® VL Plank helped drive Fiber Cement growth of 41% in FY22 over FY21

Page 68 Hardie® Panel

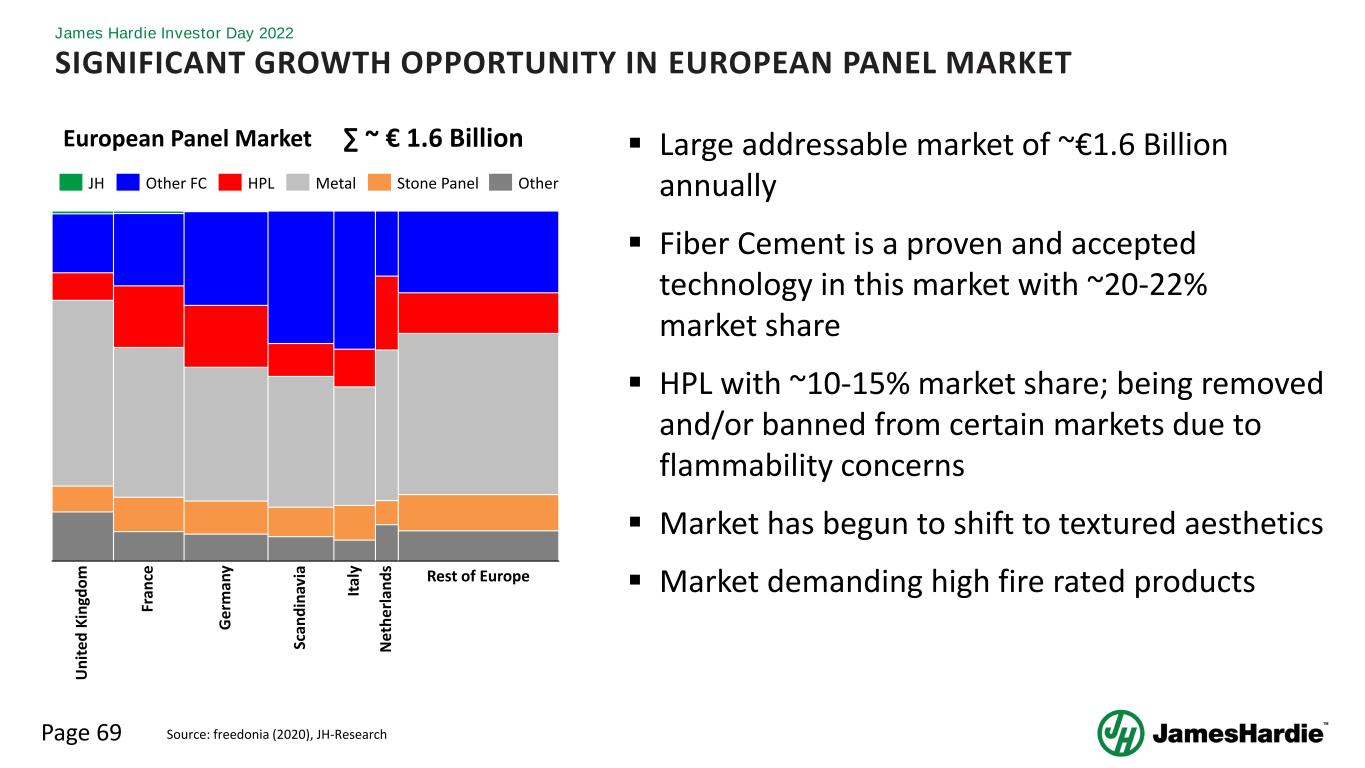

Page 69 James Hardie Investor Day 2022 Source: freedonia (2020), JH-Research SIGNIFICANT GROWTH OPPORTUNITY IN EUROPEAN PANEL MARKET ▪ Large addressable market of ~€1.6 Billion annually ▪ Fiber Cement is a proven and accepted technology in this market with ~20-22% market share ▪ HPL with ~10-15% market share; being removed and/or banned from certain markets due to flammability concerns ▪ Market has begun to shift to textured aesthetics ▪ Market demanding high fire rated products U n it e d K in gd o m JH Other FC MetalHPL Stone Panel Other European Panel Market ∑ ~ € 1.6 Billion Fr an ce G e rm an y Sc an d in av ia It al y N e th e rl an d s Rest of Europe

Page 70 James Hardie Investor Day 2022 JAMES HARDIE RIGHT TO WIN IN EUROPEAN PANEL MARKET ▪ World leader in Fiber Cement – entering a market with high Fiber Cement acceptance ▪ James Hardie Fiber Cement with A2 Fire rating ▪ James Hardie offers the low cost solution, delivering cost savings to the project ▪ James Hardie can deliver superior textured aesthetics ▪ James Hardie medium density fiber cement manufacturing capability enabling low cost leadership cannot be matched in Europe JHEU Long term ambition: 180- 230 Million € in Net Sales

Page 71 James Hardie Investor Day 2022 LAUNCHING HARDIE® ARCHITECTURAL PANEL IN EUROPE IN SEPTEMBER 2022 Hardie® Architectural Panel project (Worcester, UK) Design Flexibility A choice of ‘Smooth Sand’ or ‘Brushed Concrete’1 textures will enable you to build modern, contemporary designs. A2 Fire Rating James Hardie™ is the global leader of fiber cement products. We offer A2, s1-d0 rated cladding, backed by an industry leading 15-year warranty. Affordable Performance A smart, cost effective solution for every project, giving you style, quality and A2 fire rating at a great price. 1. Brushed Concrete is the European name for Hardie® Architectural Collection Sea Grass

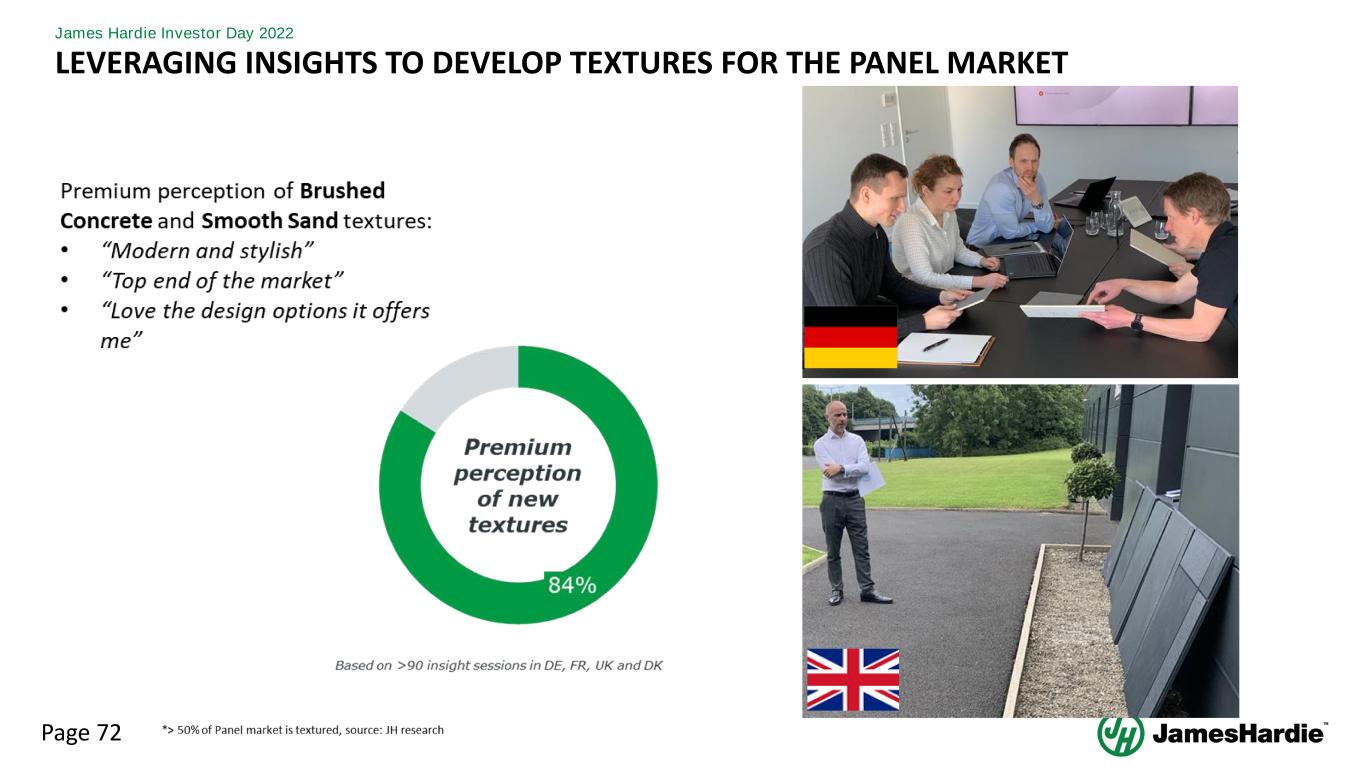

Page 72 James Hardie Investor Day 2022 LEVERAGING INSIGHTS TO DEVELOP TEXTURES FOR THE PANEL MARKET

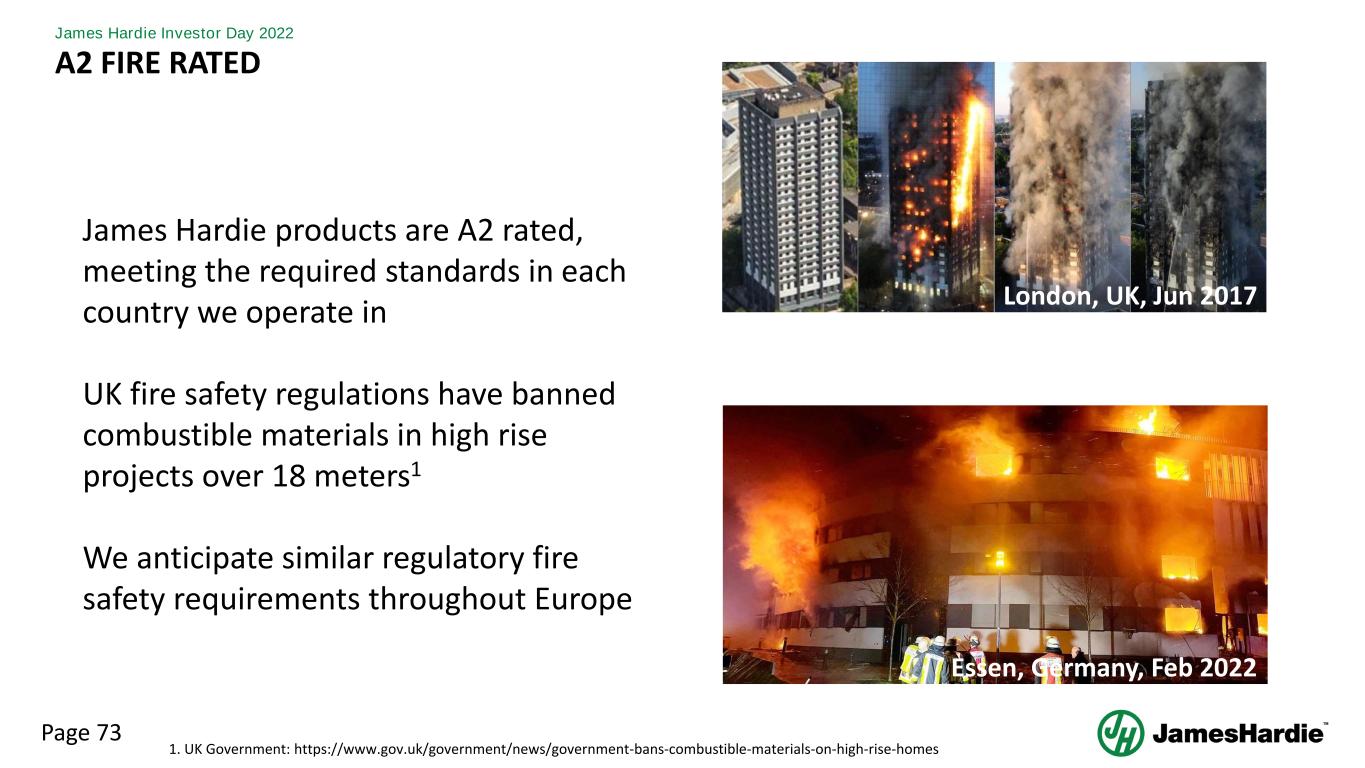

Page 73 James Hardie Investor Day 2022 A2 FIRE RATED James Hardie products are A2 rated, meeting the required standards in each country we operate in UK fire safety regulations have banned combustible materials in high rise projects over 18 meters1 We anticipate similar regulatory fire safety requirements throughout Europe Essen, Germany, Feb 2022 London, UK, Jun 2017 1. UK Government: https://www.gov.uk/government/news/government-bans-combustible-materials-on-high-rise-homes

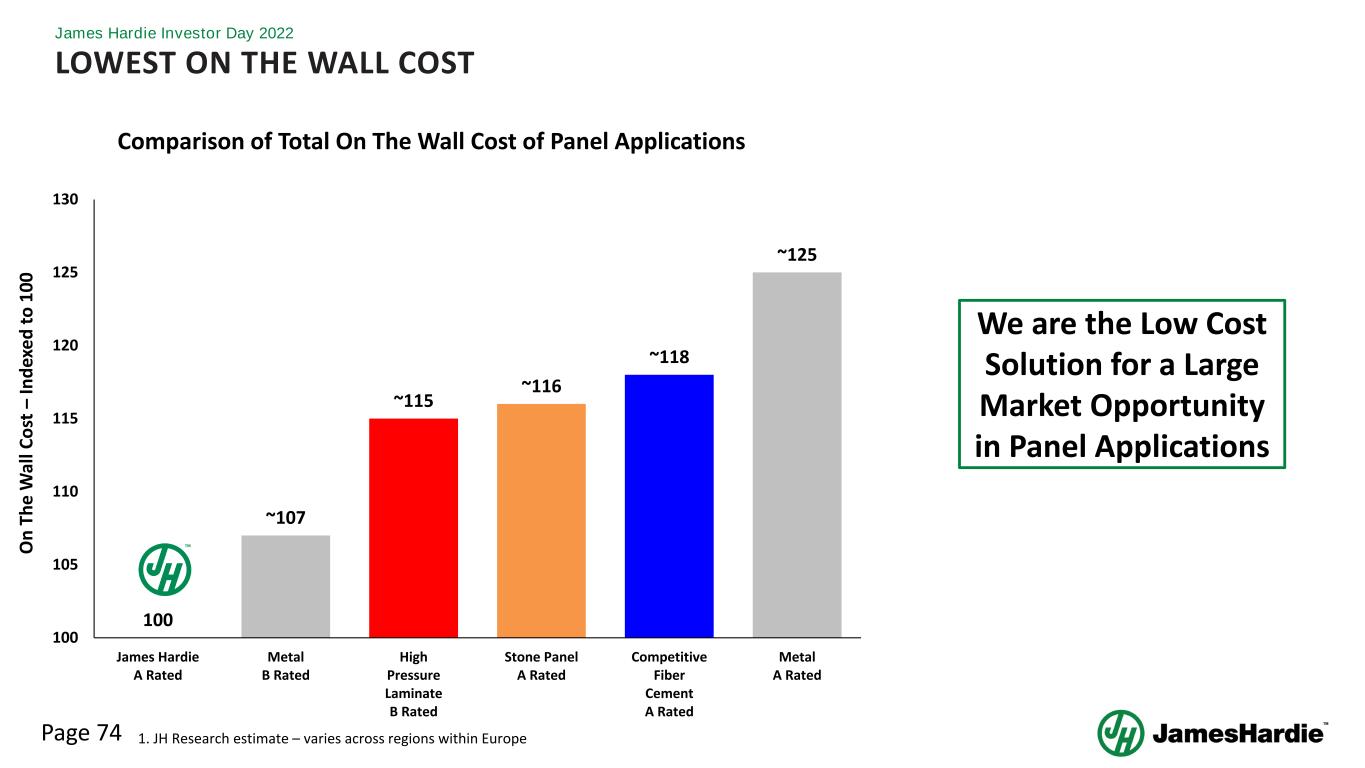

Page 74 James Hardie Investor Day 2022 LOWEST ON THE WALL COST 100 ~107 ~115 ~116 ~118 ~125 100 105 110 115 120 125 130 James Hardie A Rated Metal B Rated High Pressure Laminate B Rated Stone Panel A Rated Competitive Fiber Cement A Rated Metal A Rated O n T h e W al l C o st – In d ex e d t o 1 0 0 Comparison of Total On The Wall Cost of Panel Applications 1. JH Research estimate – varies across regions within Europe We are the Low Cost Solution for a Large Market Opportunity in Panel Applications

Page 75 James Hardie Investor Day 2022 EUROPE – FIBER CEMENT SUMMARY Proven capability to launch innovation successfully (Hardie® VL Plank) Two key Fiber Cement growth opportunities to take significant step toward €500 million in Fiber Cement Net Sales New innovation Hardie® Architectural Panel to unlock largest Fiber Cement opportunity in Europe (Panel)

Page 76 James Hardie Investor Day 2022 EUROPE – SUMMARY Europe’s long term ambition remains unchanged at €1 billion in Net Sales and 20+% EBIT Margin Clear path to €500 million of Fiber Gypsum Net Sales with proven track record Two key Fiber Cement growth opportunities to take a significant step toward €500 million in Fiber Cement Net Sales

Page 77 Q&A

Page 78 EXPERIENCE SESSION #2

Page 79 75 MINUTE LUNCH

Page 80 INVESTOR DAY 2022 – GLOBAL INNOVATION

Page 81 James Hardie Investor Day 2022 GLOBAL INNOVATION – PRESENTERS Dr. Joe Liu Chief Technology Officer Dr. Alan Miller Director, Global Innovation - Europe

Page 82 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – Global Innovation Topic Presenter Innovation Approach Joe Liu Global Technologies and Capabilities Joe Liu Innovation Driving Future Growth Alan Miller

Page 83 James Hardie Investor Day 2022 GLOBAL INNOVATION – SUMMARY Targeted innovation approach driven by mega trends and customer insights that inform our innovation process James Hardie has the capability to deliver innovations through our Global technologies and unique capabilities that help enable innovation with market valued features Innovation is critical to driving profitable growth in all current markets as well as potential new markets

Page 84 GLOBAL INNOVATION: INNOVATION APPROACH Joe Liu, Chief Technology Officer

Page 85 James Hardie Investor Day 2022 INNOVATION - A CRITICAL ELEMENT TO OUR STRATEGY Innovation is important to help continue to drive Profitable Global Growth Drive Profitable Global Growth

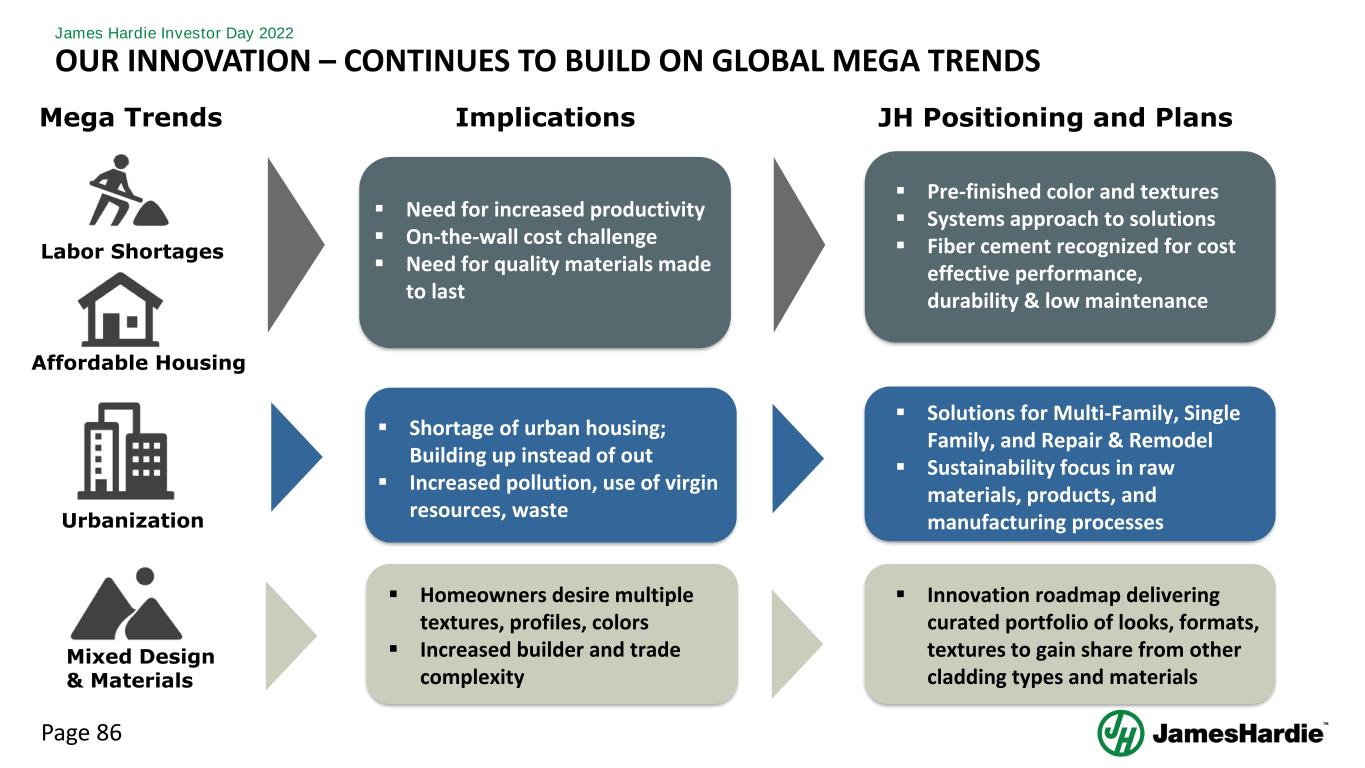

Page 86 James Hardie Investor Day 2022 OUR INNOVATION – CONTINUES TO BUILD ON GLOBAL MEGA TRENDS Mixed Design Implications JH Positioning and Plans ▪ Need for increased productivity ▪ On-the-wall cost challenge ▪ Need for quality materials made to last Mega Trends ▪ Pre-finished color and textures ▪ Systems approach to solutions ▪ Fiber cement recognized for cost effective performance, durability & low maintenance ▪ Shortage of urban housing; Building up instead of out ▪ Increased pollution, use of virgin resources, waste ▪ Solutions for Multi-Family, Single Family, and Repair & Remodel ▪ Sustainability focus in raw materials, products, and manufacturing processes ▪ Homeowners desire multiple textures, profiles, colors ▪ Increased builder and trade complexity ▪ Innovation roadmap delivering curated portfolio of looks, formats, textures to gain share from other cladding types and materials Labor Shortages Affordable Housing Urbanization Mixed Design & Materials

Page 87 James Hardie Investor Day 2022 OUR INNOVATION – CONSUMER-FOCUSED & CUSTOMER-DRIVEN WITH THE INSIGHTS Early Discovery Idea/Concept Feasibility Development Implementation Launch • Trends/Foresights • Needs, pain points, gaps in Mkt & End- User journeys • Short and longer-term concepts/refinements • Value propositions based on both technologies & Stakeholder needs • Prioritize most appealing concepts based on operating windows • Feasible product & system definition • Product, Price, Positioning • Further improvements / refinements before launch • Optimize go-to-market for pull through from end-users and consumers Insights from all key stakeholders throughout the entire Innovation process James Hardie Insights to Innovation process

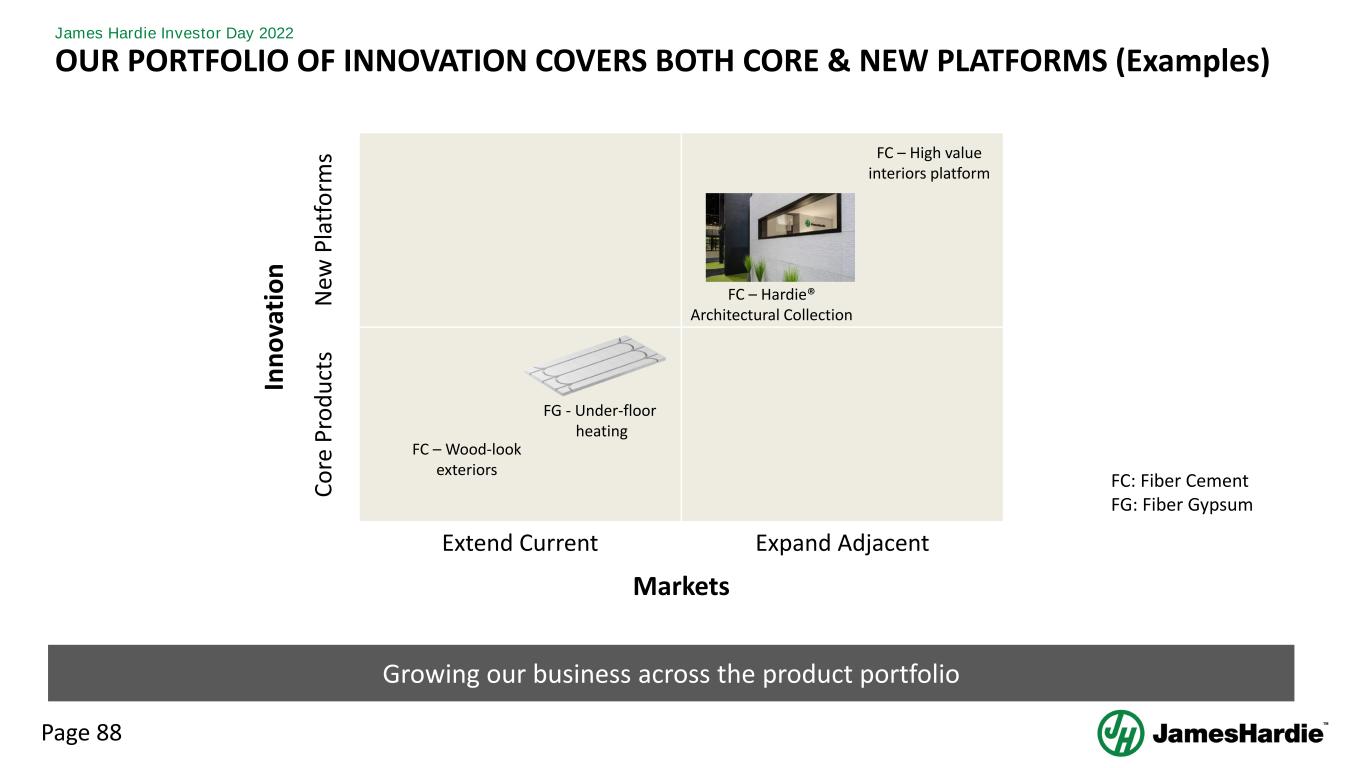

Page 88 James Hardie Investor Day 2022 In n o va ti o n N ew P la tf o rm s C o re P ro d u ct s Extend Current Expand Adjacent Markets Growing our business across the product portfolio OUR PORTFOLIO OF INNOVATION COVERS BOTH CORE & NEW PLATFORMS (Examples) FC: Fiber Cement FG: Fiber Gypsum FG - Under-floor heating FC – Wood-look exteriors FC – High value interiors platform FC – Hardie® Architectural Collection

Page 89 GLOBAL INNOVATION: TECHNOLOGIES AND CAPABITILITIES Joe Liu, Chief Technology Officer

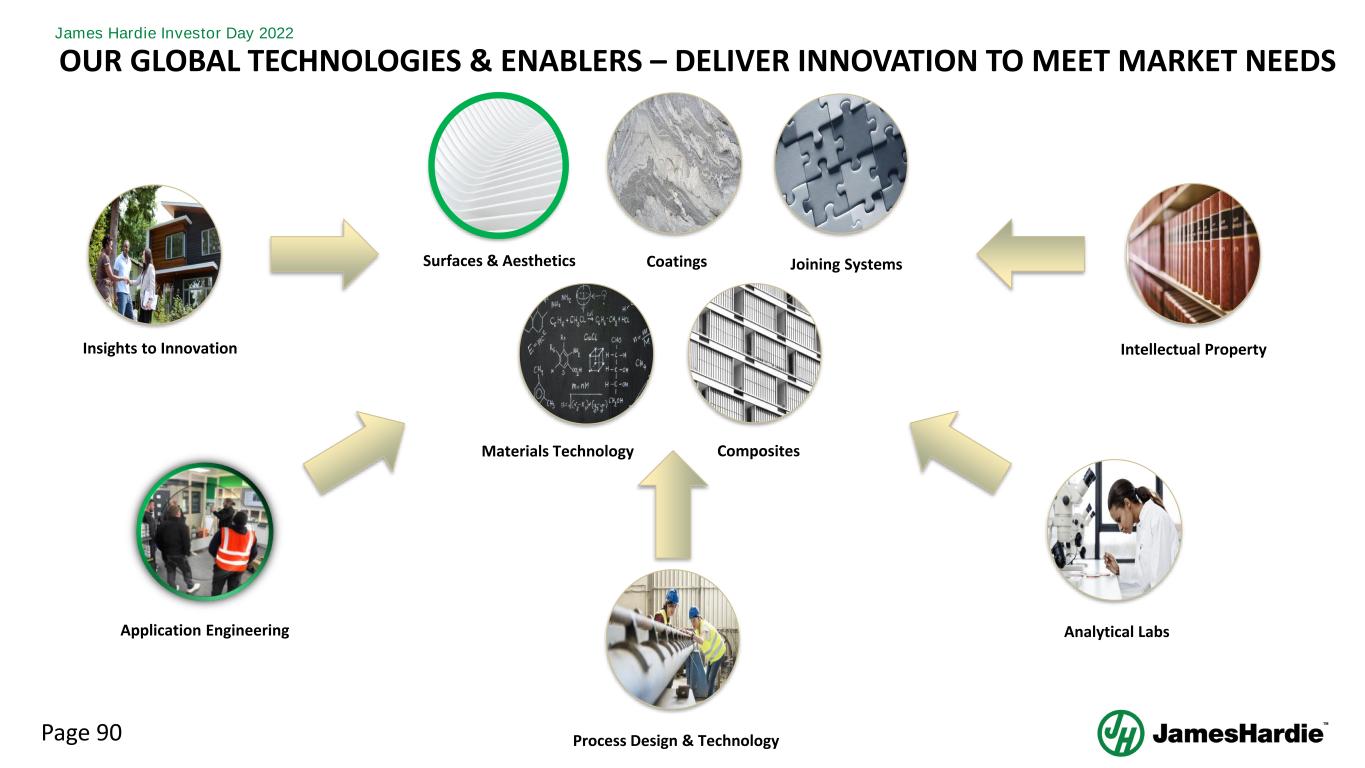

Page 90 James Hardie Investor Day 2022 OUR GLOBAL TECHNOLOGIES & ENABLERS – DELIVER INNOVATION TO MEET MARKET NEEDS Surfaces & Aesthetics Joining Systems Materials Technology Process Design & Technology Coatings Analytical Labs Composites Insights to Innovation Intellectual Property Application Engineering

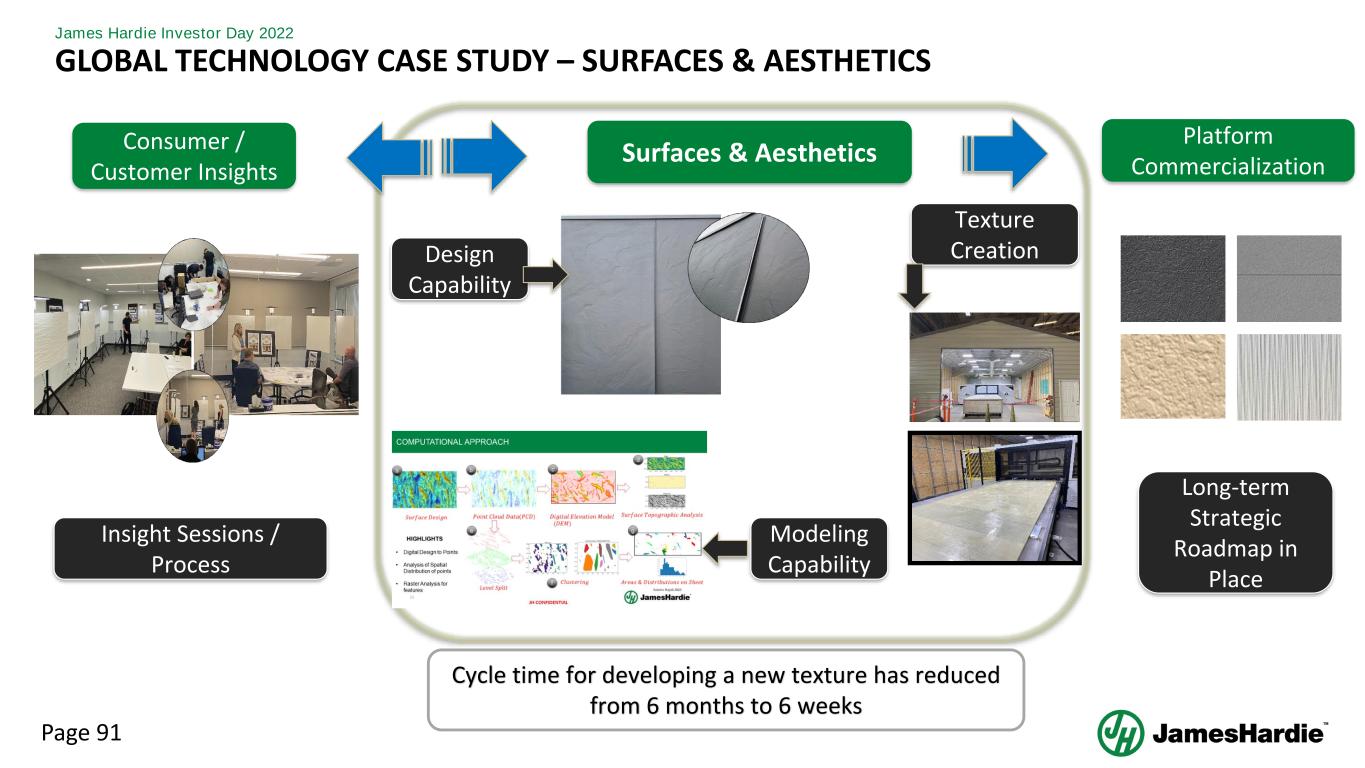

Page 91 James Hardie Investor Day 2022 GLOBAL TECHNOLOGY CASE STUDY – SURFACES & AESTHETICS Consumer / Customer Insights Surfaces & Aesthetics Platform Commercialization Design Capability Modeling Capability Texture Creation Insight Sessions / Process Cycle time for developing a new texture has reduced from 6 months to 6 weeks Long-term Strategic Roadmap in Place

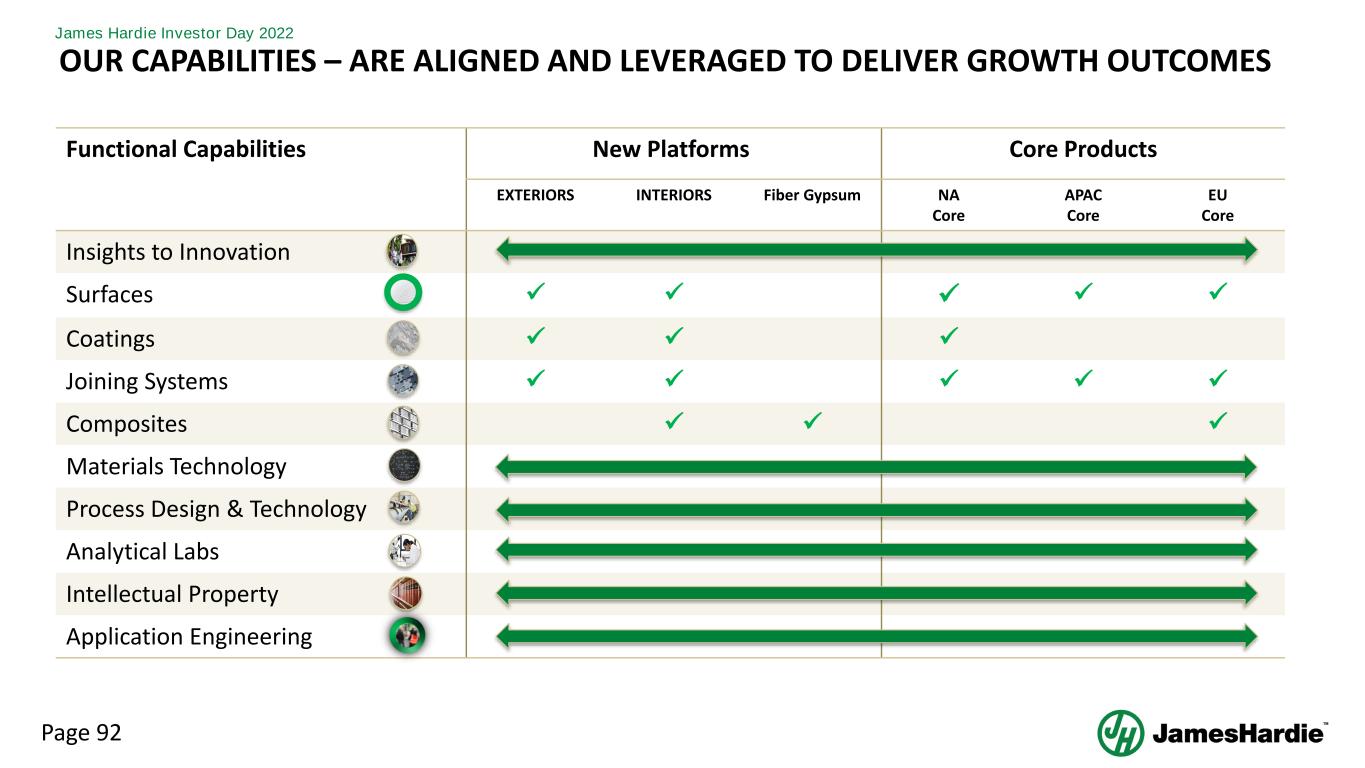

Page 92 James Hardie Investor Day 2022 OUR CAPABILITIES – ARE ALIGNED AND LEVERAGED TO DELIVER GROWTH OUTCOMES Functional Capabilities New Platforms Core Products EXTERIORS INTERIORS Fiber Gypsum NA Core APAC Core EU Core Insights to Innovation Surfaces ✓ ✓ ✓ ✓ ✓ Coatings ✓ ✓ ✓ Joining Systems ✓ ✓ ✓ ✓ ✓ Composites ✓ ✓ ✓ Materials Technology Process Design & Technology Analytical Labs Intellectual Property Application Engineering

Page 93 GLOBAL INNOVATION: INNOVATION DRIVING FUTURE GROWTH Alan Miller, Director, Global Innovation - Europe

Page 94 James Hardie Investor Day 2022 ALIGNING MEGA TRENDS AND OUR CAPABILITIES TO DELIVER INNOVATION Mega Trends Our Technologies & Capabilities Hardie™ Architectural Collection Therm25 Under-floor Heating

Page 95 James Hardie Investor Day 2022 UNLOCKING THE MODERN LOOK WITH HARDIE ACHITECTURAL COLLECTION APAC NA EU

Page 96 James Hardie Investor Day 2022 TRANSFORMING THE UNDER-FLOOR HEATING MARKET IN EUROPE WITH THERM25 Customers/Contractor Home-owner ▪ More profitable vs. wet screed ▪ Less time needed ▪ Fast – Wet screed takes 28 days to dry ▪ Dry – No moisture damages The Innovation: Replacing traditional wet screed process with easy & fast dry FG product The Benefits: Benefits to every stakeholders in the value chain

Page 97 James Hardie Investor Day 2022 GLOBAL INNOVATION – SUMMARY Targeted innovation approach driven by mega trends and customer insights that inform our innovation process James Hardie has the capability to deliver innovations through our Global technologies and unique capabilities that help enable innovation with market valued features Innovation is critical to driving profitable growth in all current markets as well as potential new markets

Page 98 Q&A

Page 99 EXPERIENCE SESSION #3

Page 100 15 MINUTE BREAK

Page 101 INVESTOR DAY 2022 – GLOBAL CAPACITY

Page 102 James Hardie Investor Day 2022 PRESENTER Ryan Kilcullen EVP Operations

Page 103 James Hardie Investor Day 2022 AGENDA Investor Day 2022 – Global Capacity Topic Presenter JH Operational Advantage Ryan Kilcullen Global Capacity Expansion Strategy Ryan Kilcullen

Page 104 James Hardie Investor Day 2022 GLOBAL CAPACITY – SUMMARYUN Operational scale advantage centered around a network of strategically located plants near our customers & inputs A culture of continuous improvement with clear strategies to enhance our capabilities We have a global capacity expansion strategy to enable the profitable growth plans in all three regions

Page 105 GLOBAL CAPACITY: JH OPERATIONAL ADVANTAGE Ryan Kilcullen, EVP Operations

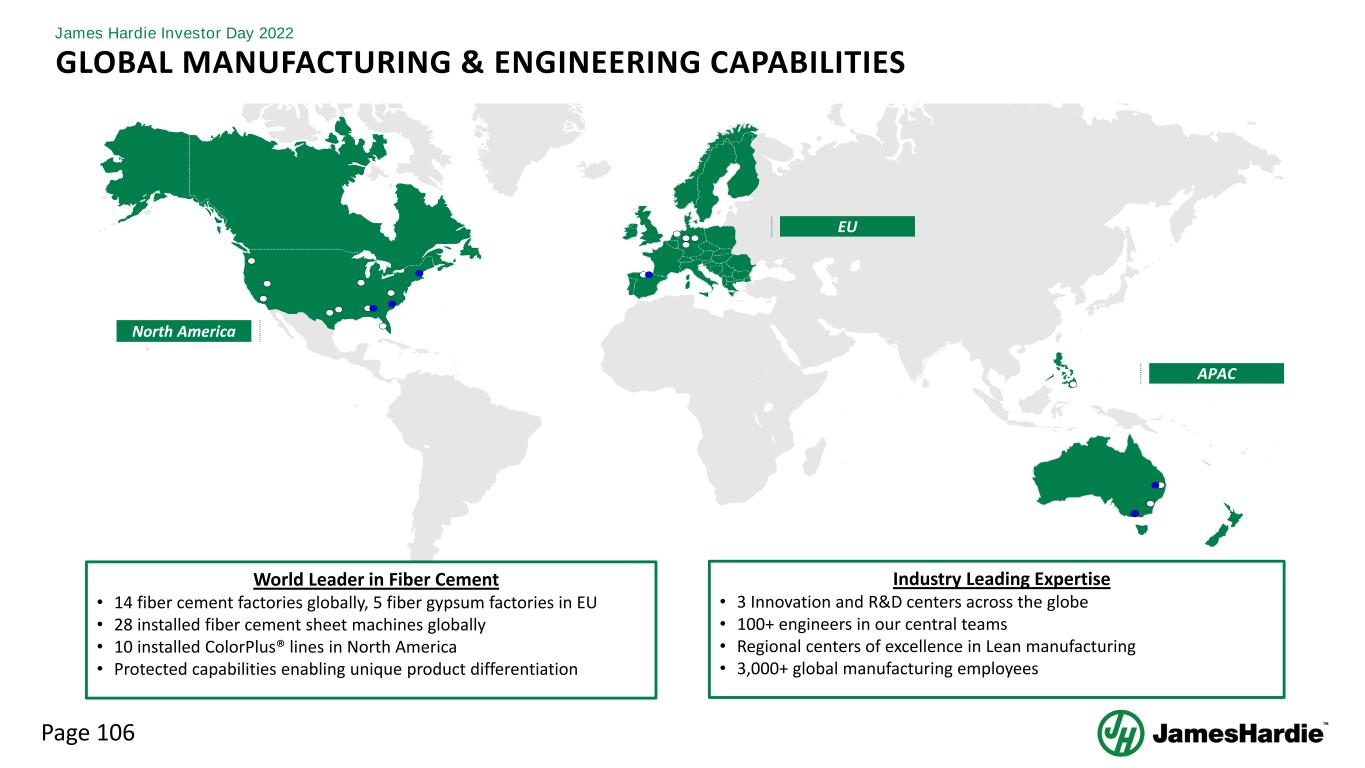

Page 106 James Hardie Investor Day 2022 GLOBAL MANUFACTURING & ENGINEERING CAPABILITIES World Leader in Fiber Cement • 14 fiber cement factories globally, 5 fiber gypsum factories in EU • 28 installed fiber cement sheet machines globally • 10 installed ColorPlus® lines in North America • Protected capabilities enabling unique product differentiation EU APAC North America Industry Leading Expertise • 3 Innovation and R&D centers across the globe • 100+ engineers in our central teams • Regional centers of excellence in Lean manufacturing • 3,000+ global manufacturing employees

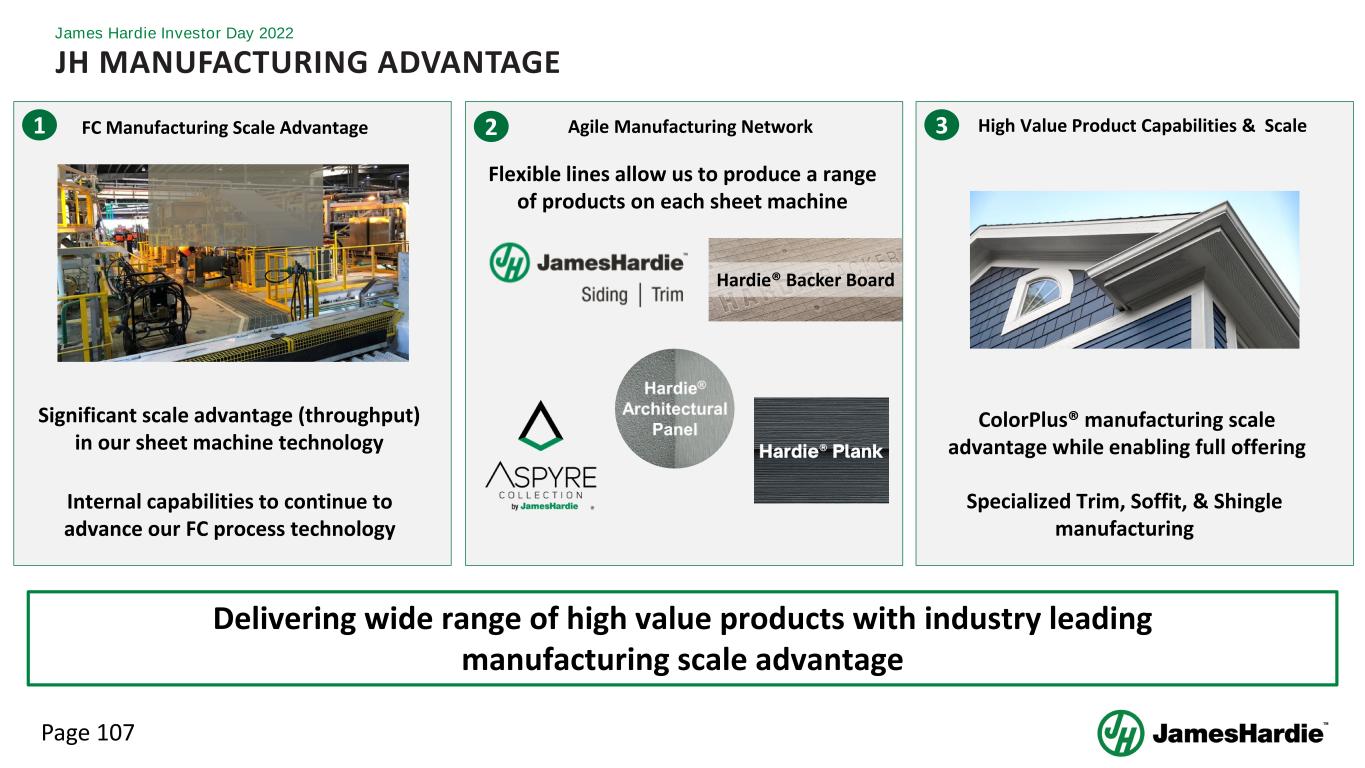

Page 107 James Hardie Investor Day 2022 JH MANUFACTURING ADVANTAGE Agile Manufacturing Network High Value Product Capabilities & Scale2 3FC Manufacturing Scale Advantage Significant scale advantage (throughput) in our sheet machine technology 1 Internal capabilities to continue to advance our FC process technology Flexible lines allow us to produce a range of products on each sheet machine ColorPlus® manufacturing scale advantage while enabling full offering Specialized Trim, Soffit, & Shingle manufacturing Hardie® Backer Board Delivering wide range of high value products with industry leading manufacturing scale advantage

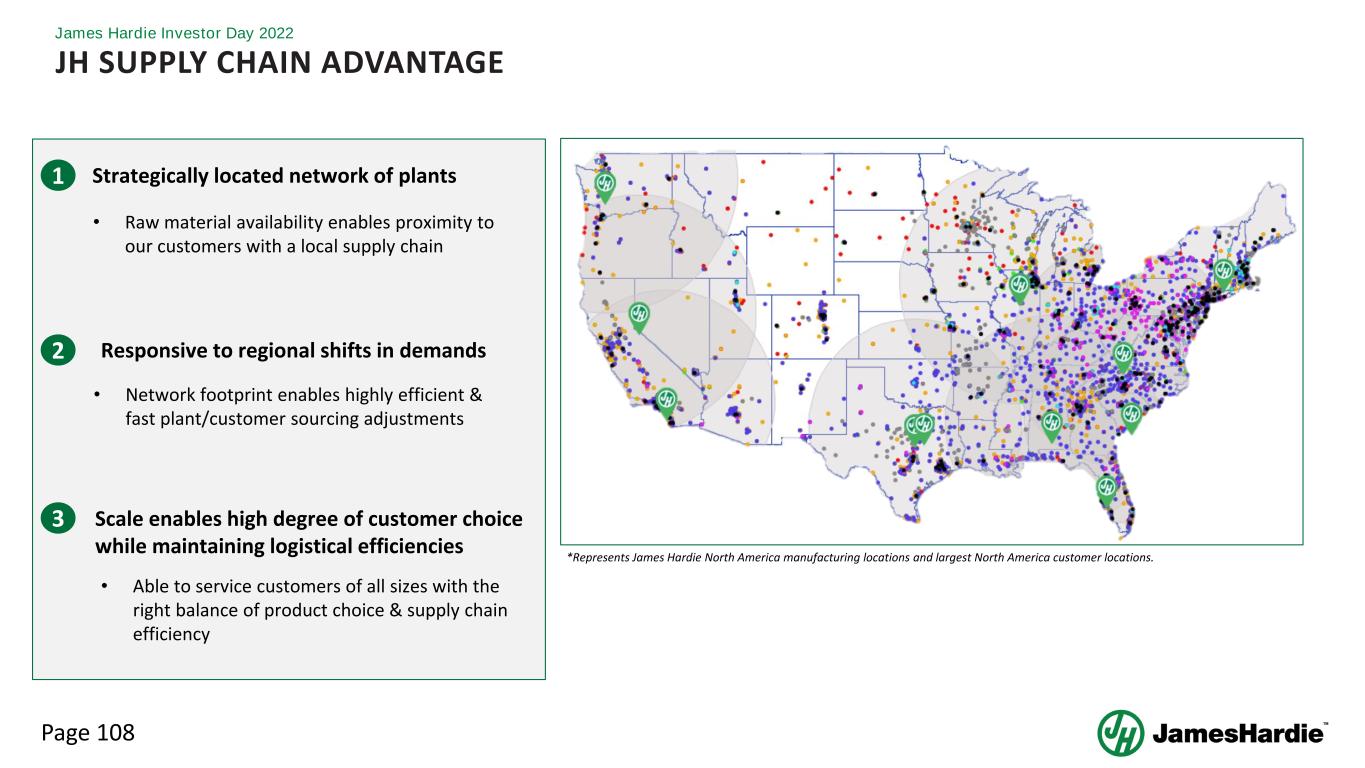

Page 108 James Hardie Investor Day 2022 JH SUPPLY CHAIN ADVANTAGE Strategically located network of plants1 2 3 • Raw material availability enables proximity to our customers with a local supply chain Responsive to regional shifts in demands • Network footprint enables highly efficient & fast plant/customer sourcing adjustments Scale enables high degree of customer choice while maintaining logistical efficiencies • Able to service customers of all sizes with the right balance of product choice & supply chain efficiency *Represents James Hardie North America manufacturing locations and largest North America customer locations.

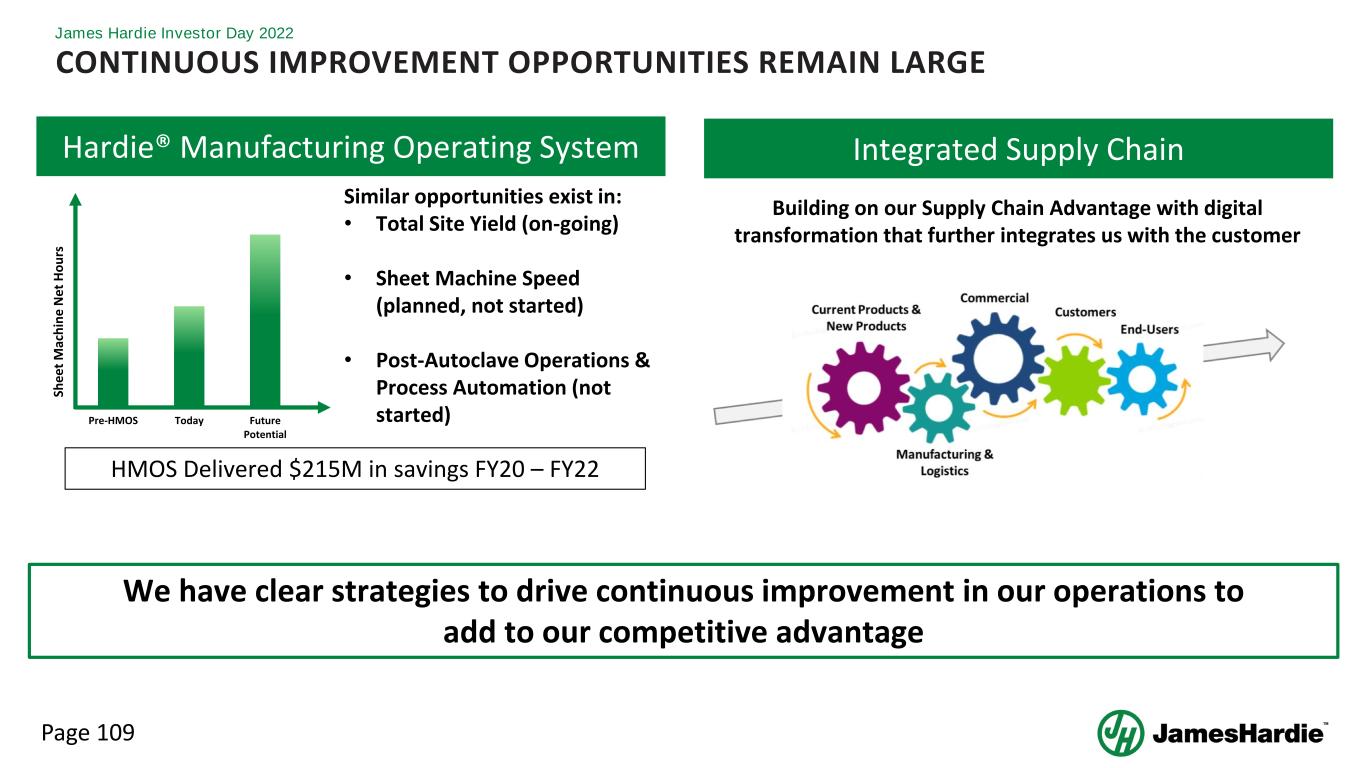

Page 109 James Hardie Investor Day 2022 CONTINUOUS IMPROVEMENT OPPORTUNITIES REMAIN LARGE Hardie® Manufacturing Operating System Similar opportunities exist in: • Total Site Yield (on-going) • Sheet Machine Speed (planned, not started) • Post-Autoclave Operations & Process Automation (not started) Integrated Supply Chain We have clear strategies to drive continuous improvement in our operations to add to our competitive advantage HMOS Delivered $215M in savings FY20 – FY22 Building on our Supply Chain Advantage with digital transformation that further integrates us with the customer Pre-HMOS Today Future Potential Sh e e t M ac h in e N e t H o u rs

Page 110 James Hardie Investor Day 2022 OPERATIONAL ADVANTAGES SUMMARY James Hardie is the world leader in fiber cement & embraces continuous improvement. Flexible supply chain that can quickly & efficiently respond to shifts in demand Network of plants that is strategically located near our Customers & inputs Culture of continuous improvement with clear strategies to enhance our capabilities Significant scale advantage in our Fiber Cement operations

Page 111 GLOBAL CAPACITY: GLOBAL CAPACITY EXPANSION STRATEGY Ryan Kilcullen, EVP Operations

Page 112 James Hardie Investor Day 2022 AN INTEGRATED STRATEGY TO ENABLE PROFITABLE GROWTH Zero Harm foundation 1 Key pillars of Global Capacity Expansion strategic plan: Global organization created to leverage JH & partner capabilities 2 Data driven best practice focus in people, process, & systems 3 High category share regions: bias to always invest ahead of demand 4 Management systems in place to continuously check & adjust5 Build assets with financial returns inline with historical JH results6 Data Driven Best Practices Consistent Asset Performance Global Scale & Partners Build Ahead of Demand PDCA Mindset Zero Harm Our Global Capacity Expansion plan will enable profitable growth in all regions & build on impressive JH ROCE outcomes

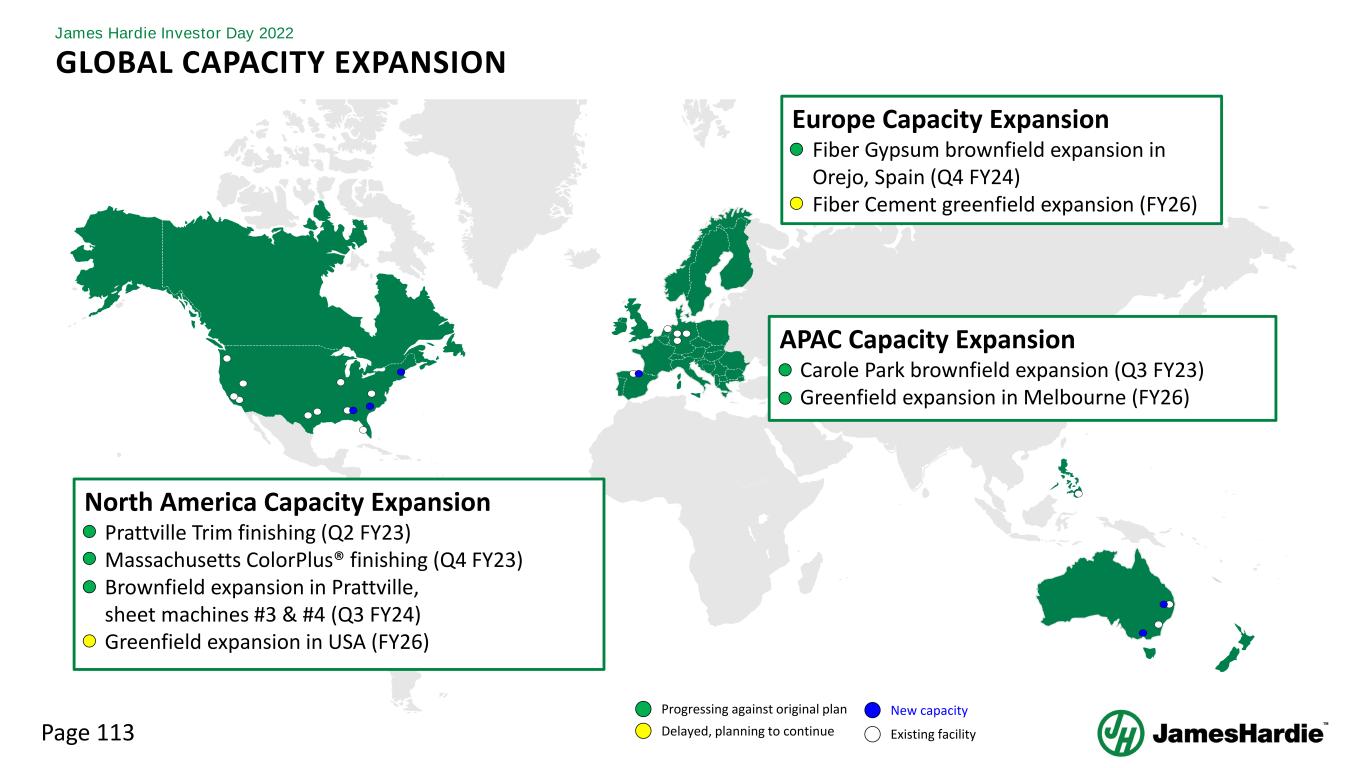

Page 113 James Hardie Investor Day 2022 GLOBAL CAPACITY EXPANSION North America Capacity Expansion − Prattville Trim finishing (Q2 FY23) − Massachusetts ColorPlus® finishing (Q4 FY23) − Brownfield expansion in Prattville, sheet machines #3 & #4 (Q3 FY24) − Greenfield expansion in USA (FY26) APAC Capacity Expansion − Carole Park brownfield expansion (Q3 FY23) − Greenfield expansion in Melbourne (FY26) Europe Capacity Expansion − Fiber Gypsum brownfield expansion in Orejo, Spain (Q4 FY24) − Fiber Cement greenfield expansion (FY26) Delayed, planning to continue Progressing against original plan New capacity Existing facility

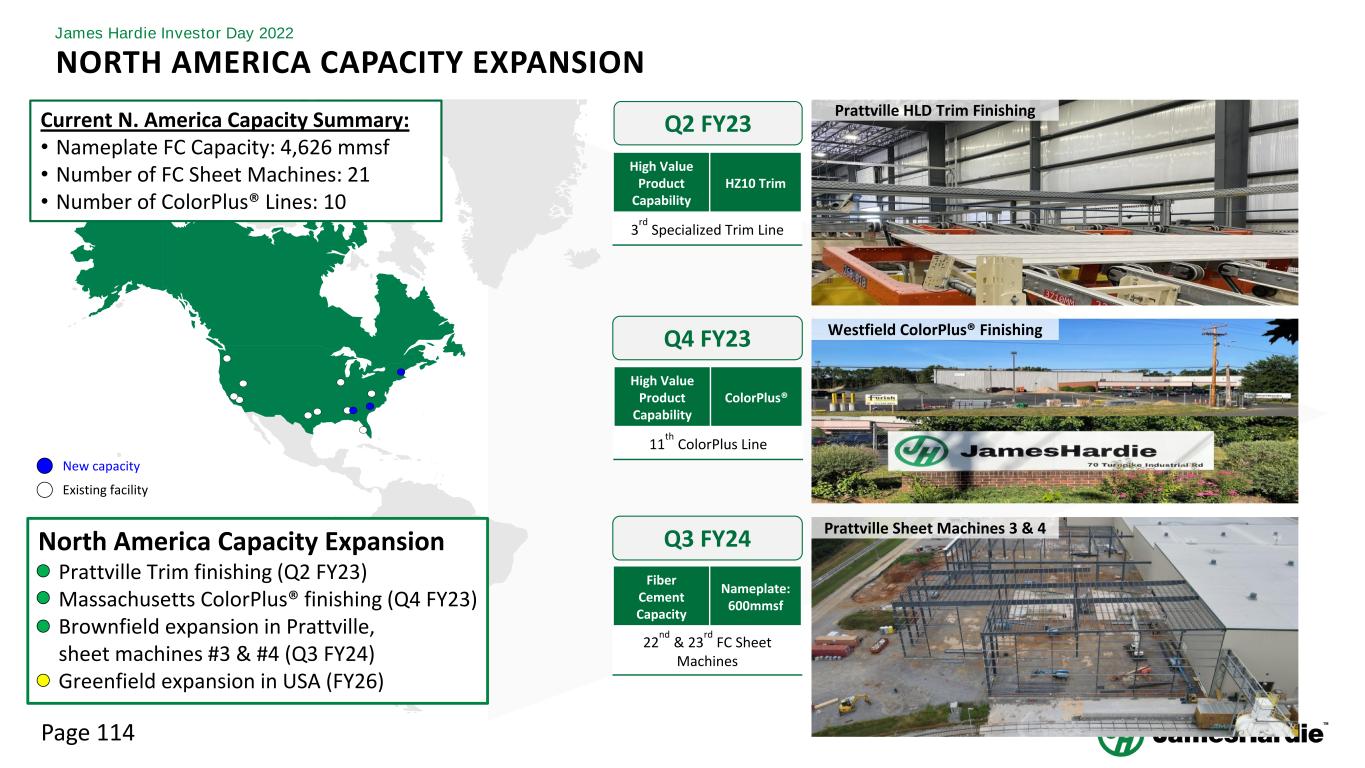

Page 114 James Hardie Investor Day 2022 NORTH AMERICA CAPACITY EXPANSION New capacity Existing facility North America Capacity Expansion − Prattville Trim finishing (Q2 FY23) − Massachusetts ColorPlus® finishing (Q4 FY23) − Brownfield expansion in Prattville, sheet machines #3 & #4 (Q3 FY24) − Greenfield expansion in USA (FY26) Q2 FY23 Prattville HLD Trim Finishing Westfield ColorPlus® Finishing Prattville Sheet Machines 3 & 4 Q4 FY23 Q3 FY24 High Value Product Capability HZ10 Trim 3 rd Specialized Trim Line Current N. America Capacity Summary: • Nameplate FC Capacity: 4,626 mmsf • Number of FC Sheet Machines: 21 • Number of ColorPlus® Lines: 10 High Value Product Capability ColorPlus® 11 th ColorPlus Line Fiber Cement Capacity Nameplate: 600mmsf 22 nd & 23 rd FC Sheet Machines

Page 115 James Hardie Investor Day 2022 APAC CAPACITY EXPANSION APAC Capacity Expansion − Carole Park brownfield expansion (Q3 FY23) − Greenfield expansion in Melbourne (Q1 FY26) New capacity Existing facility Q3 FY23 Q1 FY26 Carole Park Fiber Cement Brownfield APAC Fiber Cement Greenfield Current APAC Capacity Summary: • Nameplate FC Capacity: 612 mmsf • Number of FC Sheet Machines: 7 Fiber Cement Capacity Nameplate: 59mmsf Expansion of Existing FC Plant Fiber Cement Capacity Nameplate: 240mmsf 8 th Sheet Machine APAC Greenfield Investment Approach: • Acquired land and building infrastructure for 2+ FC sheet machines • Phase 1 (referenced above) will deliver 1 FC sheet machine & product capabilities to continue high value product mix shift

Page 116 James Hardie Investor Day 2022 EUROPE CAPACITY EXPANSION New capacity Existing facility Europe Capacity Expansion − Fiber Gypsum brownfield expansion in Orejo, Spain (Q4 FY24) − Fiber Cement greenfield expansion (FY26+) Q4 FY24 FY26+ EU Fiber Cement Greenfield Orejo Fiber Gypsum Brownfield Current EU Capacity Summary: • Nameplate FG Capacity: 1,143 mmsf • Number of FG Production Lines: 5 • Nameplate FC Capacity: 0 mmsf EU Greenfield Investment Approach: • Project is in final stages of land acquisition • Site planned to have multi-phase expansion capabilities, with Phase 1 (shown above) delivering 1 FC sheet machine (similar to APAC) • Current FC demand in EU is sourced from N. America plants Fiber Gypsum Capacity Nameplate: 252mmsf 6 th Fiber Gypsum Line Fiber Cement Capacity Nameplate: 300mmsf 1 st FC Sheet Machine

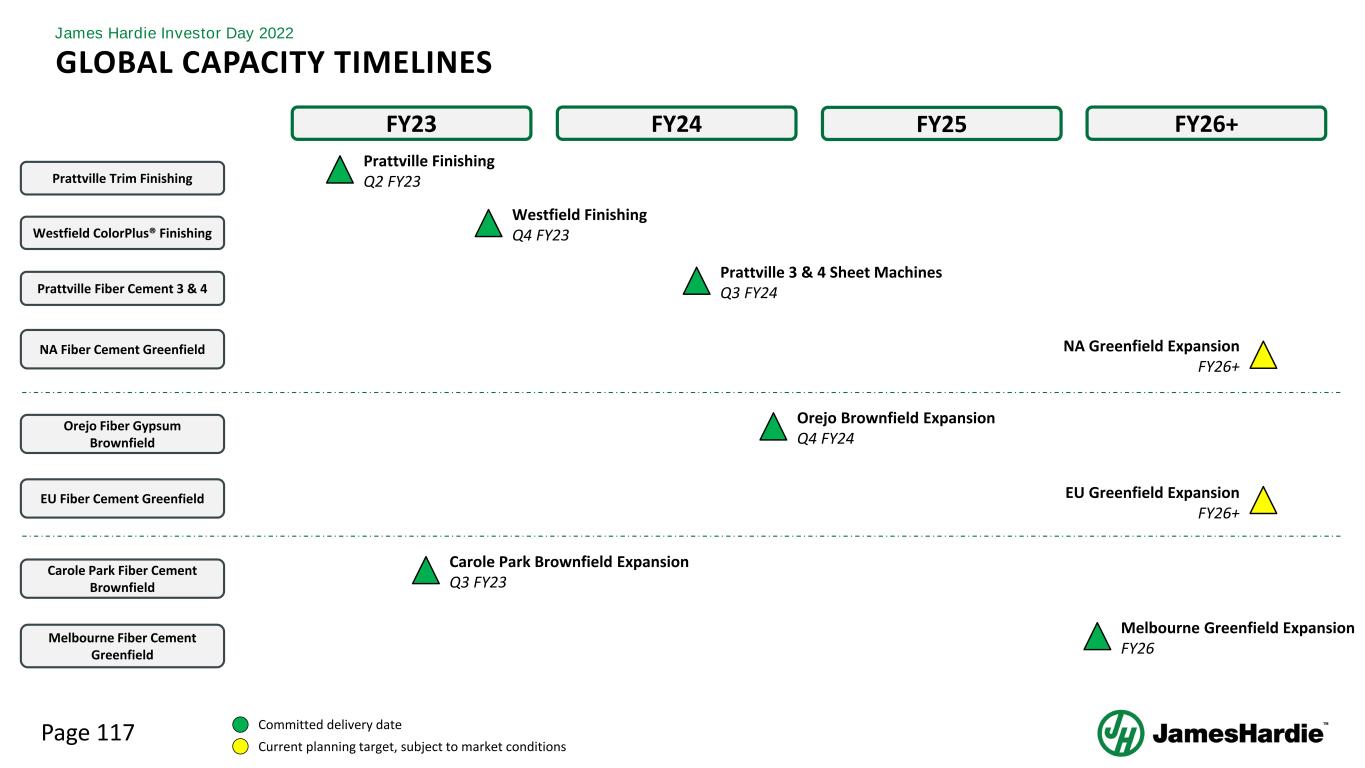

Page 117 James Hardie Investor Day 2022 GLOBAL CAPACITY TIMELINES Prattville Fiber Cement 3 & 4 Prattville Trim Finishing Westfield ColorPlus® Finishing NA Fiber Cement Greenfield EU Fiber Cement Greenfield Melbourne Fiber Cement Greenfield Carole Park Fiber Cement Brownfield Orejo Fiber Gypsum Brownfield FY23 FY25FY24 FY26+ Prattville Finishing Q2 FY23 Westfield Finishing Q4 FY23 Prattville 3 & 4 Sheet Machines Q3 FY24 NA Greenfield Expansion FY26+ Orejo Brownfield Expansion Q4 FY24 EU Greenfield Expansion FY26+ Carole Park Brownfield Expansion Q3 FY23 Melbourne Greenfield Expansion FY26 Current planning target, subject to market conditions Committed delivery date

Page 118 James Hardie Investor Day 2022 GLOBAL CAPACITY EXPANSION SUMMARY We have a fully integrated plan to deliver capacity ahead of demand while leveraging our vast, global capacities. We have a management system in place to continuously monitor the timing requirements of our capacity adds. We will continue to adjust when needed We have built a global organization to leverage the vast experience of our teams & partners to ensure efficient replication of best practices We have a global capacity expansion strategy to enable the profitable growth plans in all three regions

Page 119 James Hardie Investor Day 2022 GLOBAL CAPACITY – SUMMARYUN Operational scale advantage centered around a network of strategically located plants near our customers & inputs A culture of continuous improvement with clear strategies to enhance our capabilities We have a global capacity expansion strategy to enable the profitable growth plans in all three regions

Page 120 Q&A

Page 121 CLOSING: WHY JAMES HARDIE? Aaron Erter, CEO

Page 122 James Hardie Investor Day 2022 CONTROL WHAT WE CAN CONTROL We are navigating market uncertainty We will control what we can control We plan to win regardless of market conditions We will accelerate and expand our competitive advantages

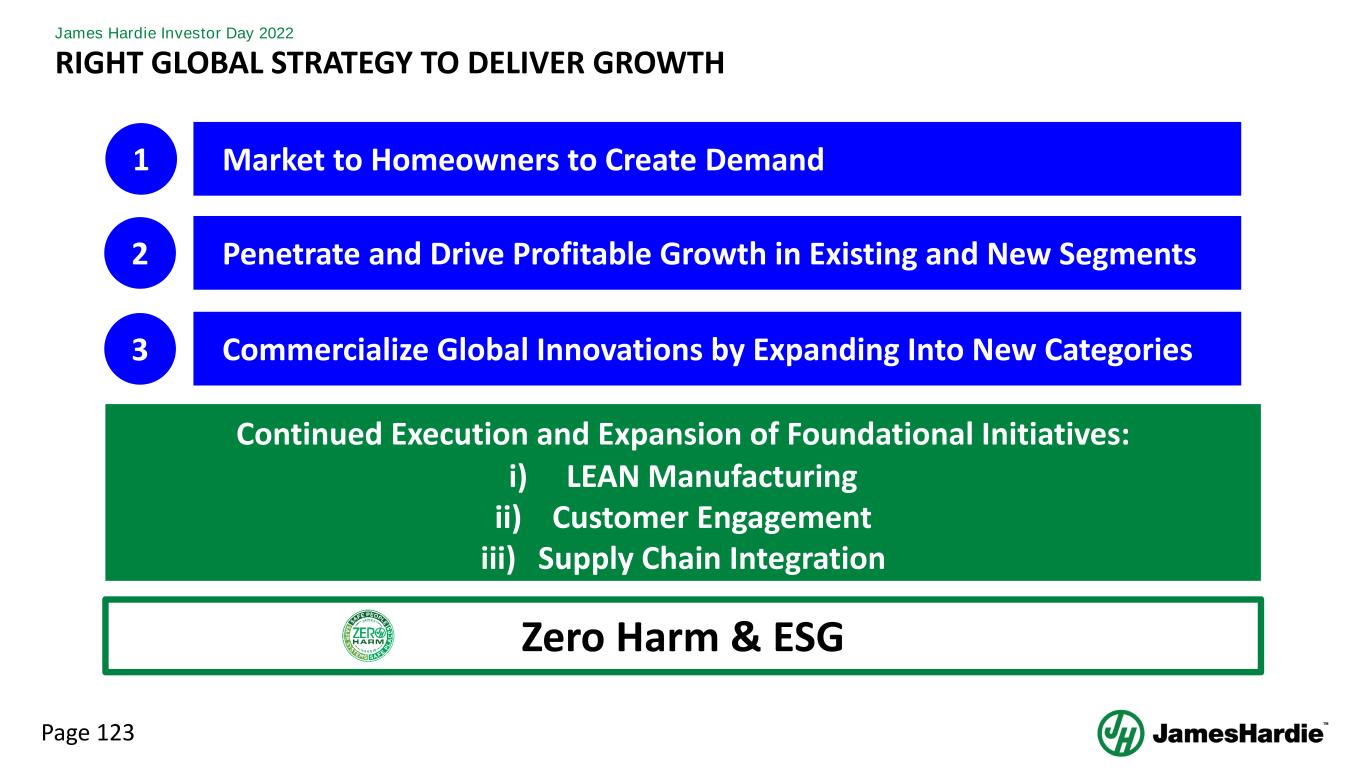

Page 123 James Hardie Investor Day 2022 RIGHT GLOBAL STRATEGY TO DELIVER GROWTH Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG

Page 124 James Hardie Investor Day 2022 Page 5 Our conviction that every incident is preventable ZERO HARM & ESG UNDERPIN THE GLOBAL STRATEGY Page 11 James Hardie Investor Day 2022 OUR PILLARS James Hardie’s sustainability strategy integrates our global strategy for value creation and operational performance. It focuses on our four key pillars of Communities, Environment, Innovation and Zero Harm. Zero Harm is a Foundational, Non Negotiable element of our Global Culture Our sustainability strategy integrates our global strategy for value creation and operational performance

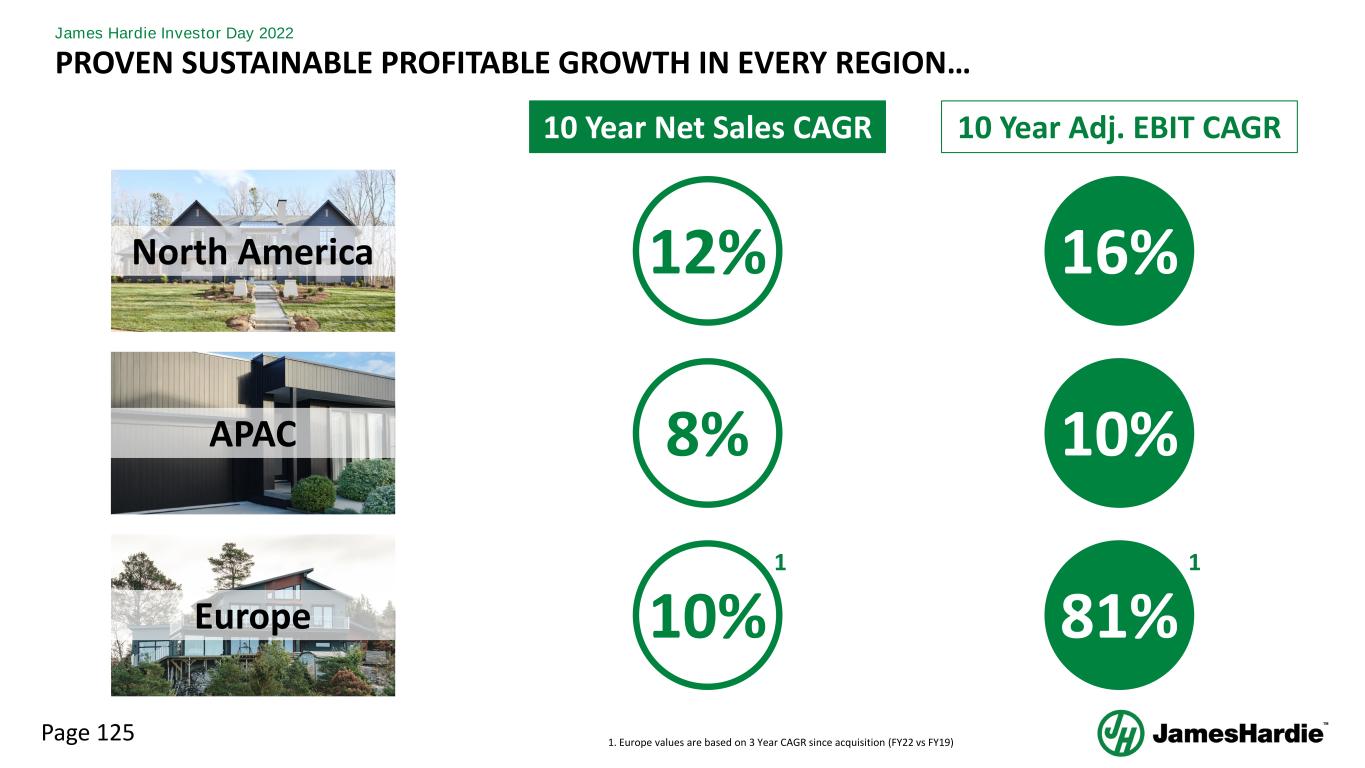

Page 125 James Hardie Investor Day 2022 APAC PROVEN SUSTAINABLE PROFITABLE GROWTH IN EVERY REGION… 12% 16%North America 10 Year Net Sales CAGR 10 Year Adj. EBIT CAGR 8% 10% 10% 81%Europe 1 1 1. Europe values are based on 3 Year CAGR since acquisition (FY22 vs FY19)

Page 126 James Hardie Investor Day 2022 …WITH SIGNIFICANT GROWTH OPPORTUNITIES IN ALL 3 REGIONS… We Want to Win in All Regions Northeast & Midwest R&R Represents Largest Opportunity APAC North America Europe Significant Market Share Growth Opportunity in ANZ €660 M Plank Market €1.6 Bn Panel Market U n it e d K in gd o m Sweden WoodJH Competitive FC Other European Plank Market ∑ ~ €660 Million Fr an ce G e rm an y D e n m ar k B e N e Lu x R e st o f Eu ro p e Plank U n it ed K in gd o m JH Other FC MetalHPL Stone Panel Other European Panel Market ∑ ~ € 1.6 Billion Fr an ce G er m an y Sc an d in av ia It al y N et h er la n d s Rest of Europe Panel FY22 Future Repair & Remodel 65% New Construction 35%

Page 127 James Hardie Investor Day 2022 …A STRATEGY TO DELIVER GROWTH IN EACH REGION… APAC North America Europe CUSTOMER CONTRACTOR HOMEOWNER Small Builder Architect/ Designer North America Value Chain Perfect Store in ANZ Fiber Cement and Fiber Gypsum in Europe

Page 128 James Hardie Investor Day 2022 …& THE RIGHT ENABLERS TO PROPEL GROWTH Market Driven Global Innovation Global Capacity Expansion 51% Adj. ROCE1 Full Wrap Solutions and ColorPlus® Hardie™ Architectural Collection in Multi Family North America Hardie™ Architectural Collection APAC Europe Proven Execution of Innovation: Marketing to Homeowners in North America and APAC 1. FY22 Adjusted ROCE Mega Trends Our Technologies & Capabilities Hardie™ Architectural Collection Therm25 Under-floor Heating

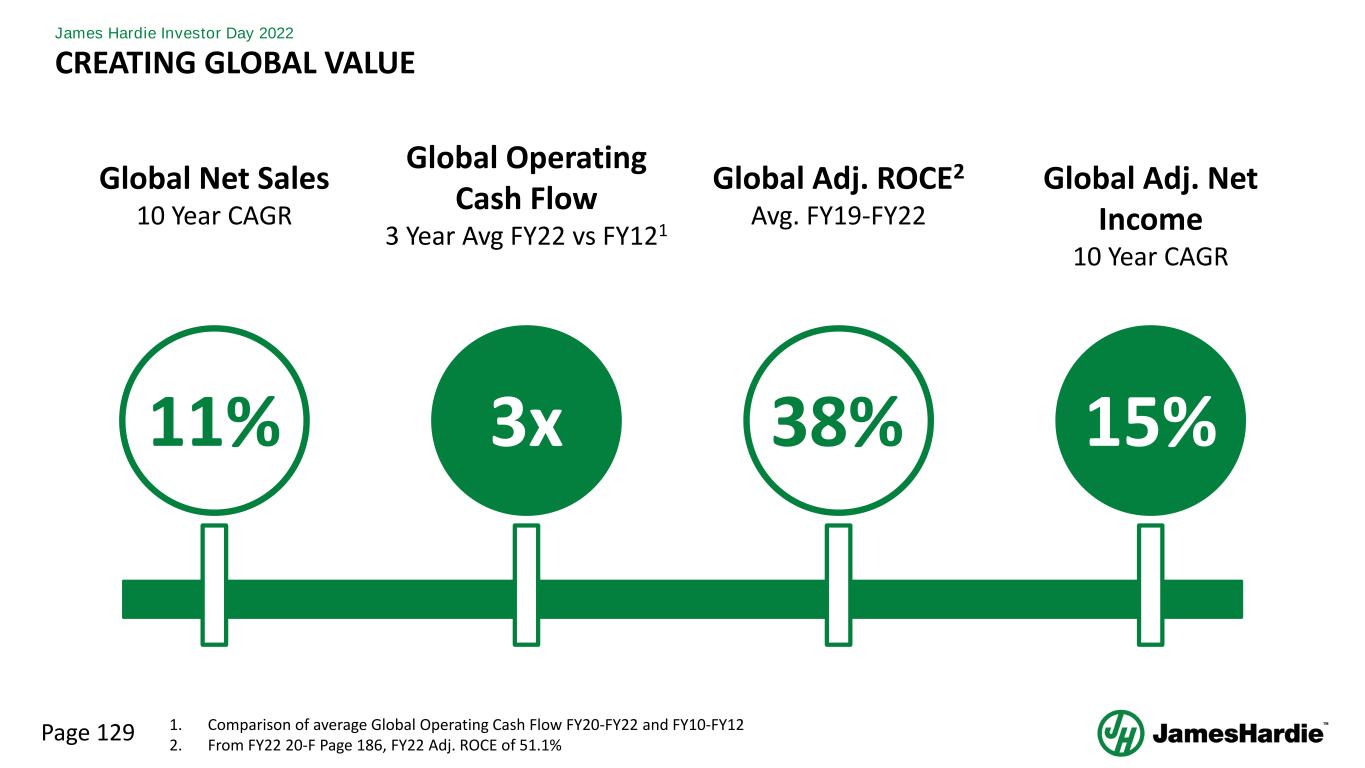

Page 129 James Hardie Investor Day 2022 CREATING GLOBAL VALUE Global Net Sales 10 Year CAGR Global Adj. ROCE2 Avg. FY19-FY22 Global Adj. Net Income 10 Year CAGR 11% Global Operating Cash Flow 3 Year Avg FY22 vs FY121 3x 15%38% 1. Comparison of average Global Operating Cash Flow FY20-FY22 and FY10-FY12 2. From FY22 20-F Page 186, FY22 Adj. ROCE of 51.1%

Page 130 James Hardie Investor Day 2022 WHY JHX? Strong Growth Opportunities Emerging Homeowner-Focused Brand Innovative Product Pipeline Integrated Localized Supply Chain Multi-Segment Focus Experienced Management Team Strong Balance Sheet & Cash Generation Attractive Returns Premium Product Portfolio Responsible Corporate Citizen Homeowner Focused, Customer & Contractor Driven

Page 131

Page 132 North America APAC Europe THANK YOU North America

Page 133 Q&A

Page 134 END OF DAY 2

Page 135 JHX Investor Day 2022 New York, 12-13 September 2022 – Day 2