James Hardie Industries plc Europa House 2nd Floor, Harcourt Centre Harcourt Street, Dublin 2, D02 WR20, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. Directors: Michael Hammes (Chairman, USA), Anne Lloyd (Deputy Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 23 September 2022 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 James Hardie 2022 Annual General Meeting Materials Dear Sir/Madam James Hardie Industries plc advises that the Notice of Meeting and supporting materials for the 2022 Annual General Meeting are now available to shareholders on our website at https://ir.jameshardie.com.au/events-presentations/annual-shareholder-meeting or www.investorvote.com.au. Regards Joseph C. Blasko General Counsel & Company Secretary This announcement has been authorised for release by the General Counsel and Company Secretary, Mr Joseph C. Blasko.

NOTICE OF ANNUAL GENERAL MEETING 2022 DUBLIN, IRELAND Thursday, 3 November 2022 at 5:00pm (New York Time) Thursday, 3 November 2022 at 9:00pm (Dublin time) Friday, 4 November 2022 at 8:00am (Sydney Time)

TABLE OF CONTENTS THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you should immediately consult your investment or other professional advisor. James Hardie Industries plc ARBN 097 829 895, with registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland and registered in Ireland under company number 485719. The liability of its members is limited. CONTENTS OF THIS BOOKLET Notice of Annual General Meeting 2022 1 Agenda and business of the Annual General Meeting 2 Voting and participation in the Annual General Meeting 4 Explanatory Notes 8

Notice of Annual General Meeting 2022 1 NOTICE OF ANNUAL GENERAL MEETING 2022 Notice is given that the Annual General Meeting (AGM) of James Hardie Industries plc (James Hardie or the Company) will be held on Thursday, 3 November 2022 at 9:00pm (Dublin time) / Friday, 4 November 2022 at 8:00am (Sydney time) in James Hardie’s Corporate Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, D02 WR20, Ireland. ATTENDANCE AT AGM Persons registered as shareholders as at 8:00am (Dublin time) / 7:00pm (Sydney time) on Wednesday, 2 November 2022 may attend the AGM in Dublin. Shareholders wishing to participate in the AGM can also participate remotely via teleconference, during which they will have the same opportunities to ask questions as people attending the AGM in person. However, shareholders will not be able to vote by way of teleconference. If shareholders wish for their vote to count, they must follow the instructions set out on page 4 of this booklet. Shareholders or proxies will all be able to ask questions of the Board of Directors of James Hardie (Board) and the Company’s external auditor, Ernst & Young LLP. To enable more questions to be answered, you can submit questions in advance of the AGM, whether or not you will be attending. Shareholders or proxies not present at the AGM wishing to ask questions can do so in the manner described on page 4 of this booklet. 2 NOV NOTICE AVAILABILITY Additional copies of this booklet can be downloaded from James Hardie’s Investor Relations website https://ir.jameshardie.com. au/financial-information/annual-reports-and-notice-of-meetings or they can be obtained by contacting the Company’s registrar, Computershare Investor Services Pty Limited (Computershare), by calling: 1300 855 080 from within Australia; or +61 3 9415 4000 from outside Australia.

2 AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING Explanations of the background, rationale and further information for each proposed resolution are set out in the Explanatory Notes on pages 8 to 24 of this Notice of Meeting. The following are items of ordinary business: 1 FINANCIAL STATEMENTS AND REPORTS FOR FISCAL YEAR 2022 To review James Hardie’s affairs and to consider and, if thought fit, pass the following resolution as an ordinary resolution: To receive and consider the financial statements and the reports of the Board and external auditor for the fiscal year ended 31 March 2022. The vote on this resolution is advisory only. 2 REMUNERATION REPORT FOR FISCAL YEAR 2022 As part of the review of James Hardie’s affairs, to consider and, if thought fit, pass the following resolution as a non-binding ordinary resolution: To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2022. The vote on this resolution is advisory only. 3 ELECTION / RE-ELECTION OF DIRECTORS To consider and, if thought fit, pass each of the following resolutions as separate ordinary resolutions: a) That Peter John Davis be elected as a director. b) That Aaron Erter be elected as a director. c) That Anne Lloyd, who retires by rotation in accordance with the Company’s Articles of Association, be re-elected as a director. d) That Rada Rodriguez, who retires by rotation in accordance with the Company’s Articles of Association, be re-elected as a director. 4 AUTHORITY TO FIX THE EXTERNAL AUDITOR’S REMUNERATION To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the Board be authorised to fix the remuneration of the external auditor for the fiscal year ended 31 March 2023. The following are items of special business: 5 GRANT OF RETURN ON CAPITAL EMPLOYED RESTRICTED STOCK UNITS To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s Chief Executive Officer and Director, Aaron Erter, of 152,000 return on capital employed (ROCE) restricted stock units (ROCE RSUs), and his acquisition of ROCE RSUs and ordinary shares of James Hardie (Shares) issuable thereunder is approved under and for the purposes of ASX Listing Rule 10.14, for all purposes in accordance with the terms of the restated 2006 Long Term Incentive Plan (2006 LTIP) and on the basis set out in the Explanatory Notes.

Notice of Annual General Meeting 2022 3 6 GRANT OF RELATIVE TOTAL SHAREHOLDER RETURN RESTRICTED STOCK UNITS To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s Chief Executive Officer and Director, Aaron Erter, of 280,000 relative total shareholder return (TSR) restricted stock units (Relative TSR RSUs), and his acquisition of Relative TSR RSUs and Shares issuable thereunder is approved under and for the purposes of ASX Listing Rule 10.14, for all purposes in accordance with the terms of the restated 2006 LTIP and on the basis set out in the Explanatory Notes. 8 APPROVAL OF ISSUE OF SHARES UNDER THE JAMES HARDIE 2020 NON-EXECUTIVE DIRECTOR EQUITY PLAN To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the issue of Shares to non-executive directors under the James Hardie 2020 Non-Executive Director Equity Plan (the NED Equity Plan) be approved under and for the purposes of ASX Listing Rule 10.14, and for all other purposes and on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, James Hardie will disregard any votes cast in favour of Resolution 8 if they are cast by or on behalf of any non-executive director of James Hardie or their respective associates. The non-executive directors and their associates will not have their votes disregarded if: (i) they are acting as a proxy or attorney for a person who is entitled to vote, in accordance with the directions on a Voting Instruction Form or form of proxy; (ii) they are chairing the meeting as proxy or attorney for a person who is entitled to vote, in accordance with a direction on a Voting Instruction Form or form of proxy to vote as the proxy or attorney decides; or (iii) they are acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: (A) the beneficiary provides written confirmation to them that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the resolution; and (B) they vote in accordance with the directions on a Voting Instruction Form or otherwise given by the beneficiary. Notes on voting and the Explanatory Notes, and a Voting Instruction Form are enclosed. By order of the Board. 7 GRANT OF OPTIONS To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s Chief Executive Officer and Director, Aaron Erter, of stock options over Shares (Stock Options) and his acquisition of Stock Options and Shares issuable thereunder is approved under and for the purposes of ASX Listing Rule 10.14, for all purposes in accordance with the terms of the restated 2001 Equity Incentive Plan (2001 EIP) and on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, James Hardie will disregard any votes cast in favour of Resolution 5, 6 and 7 if they are cast by or on behalf of Aaron Erter (who is the only Director eligible to participate in the employee incentive schemes the subject of Resolutions 5, 6 and 7) or his associates. However, a person will not have their votes disregarded if: (i) they are acting as a proxy or attorney for a person who is entitled to vote, in accordance with the directions on a Voting Instruction Form or form of proxy; (ii) they are chairing the meeting as proxy or attorney for a person who is entitled to vote, in accordance with a direction on a Voting Instruction Form or form of proxy to vote as the proxy or attorney decides; or (iii) they are acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: (A) the beneficiary provides written confirmation to them that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the resolution; and (B) they vote in accordance with the directions on a Voting Instruction Form or otherwise given by the beneficiary. Joseph C. Blasko General Counsel & Company Secretary 23 September 2022

4 VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING If you are a registered shareholder as at 8:00am (Dublin time) / 7:00pm (Sydney time) on Wednesday, 2 November 2022, you may attend, speak and vote, in person or appoint a proxy (who need not be a shareholder) to attend, speak and vote on your behalf, at the AGM in Dublin, Ireland or participate and ask questions while participating via the AGM teleconference. See VOTING ON THE RESOLUTIONS below for information on how you can vote. AGM DETAILS The AGM will be held at James Hardie’s Corporate Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, D02 WR20, Ireland, starting at 9:00pm (Dublin time) on Thursday, 3 November 2022 / 8:00am (Sydney time) on Friday, 4 November 2022. OPTIONS FOR SHAREHOLDERS UNABLE TO ATTEND AGM The AGM will also be accessible by teleconference at 9:00pm (Dublin time) on Thursday, 3 November 2022 / 8:00am (Sydney time) on Friday, 4 November 2022. Shareholders participating in the AGM by teleconference will be able to ask questions of the Board and the Company’s external auditor, Ernst & Young LLP. You will need to have your Security Holder Reference Number (SRN) or the Holder Identification Number (HIN) (included on your Voting Instruction Form or most recent holding statement) as well as the name of your holding if you intend to ask a question via the teleconference. The following details are also set out on the Shareholder Meetings page on James Hardie’s Investor Relations website (https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp). PARTICIPATION IN AGM TELECONFERENCE To participate in the AGM teleconference, please: dial into the AGM using one of the following numbers: Australia toll free 1800 809 971 / USA toll free 1855 881 1339 or international toll +617 3145 4010 Passcode: 10024977; and provide the operator with your name and SRN / HIN. If you have any questions during the teleconference, follow the prompts from the teleconference operator.

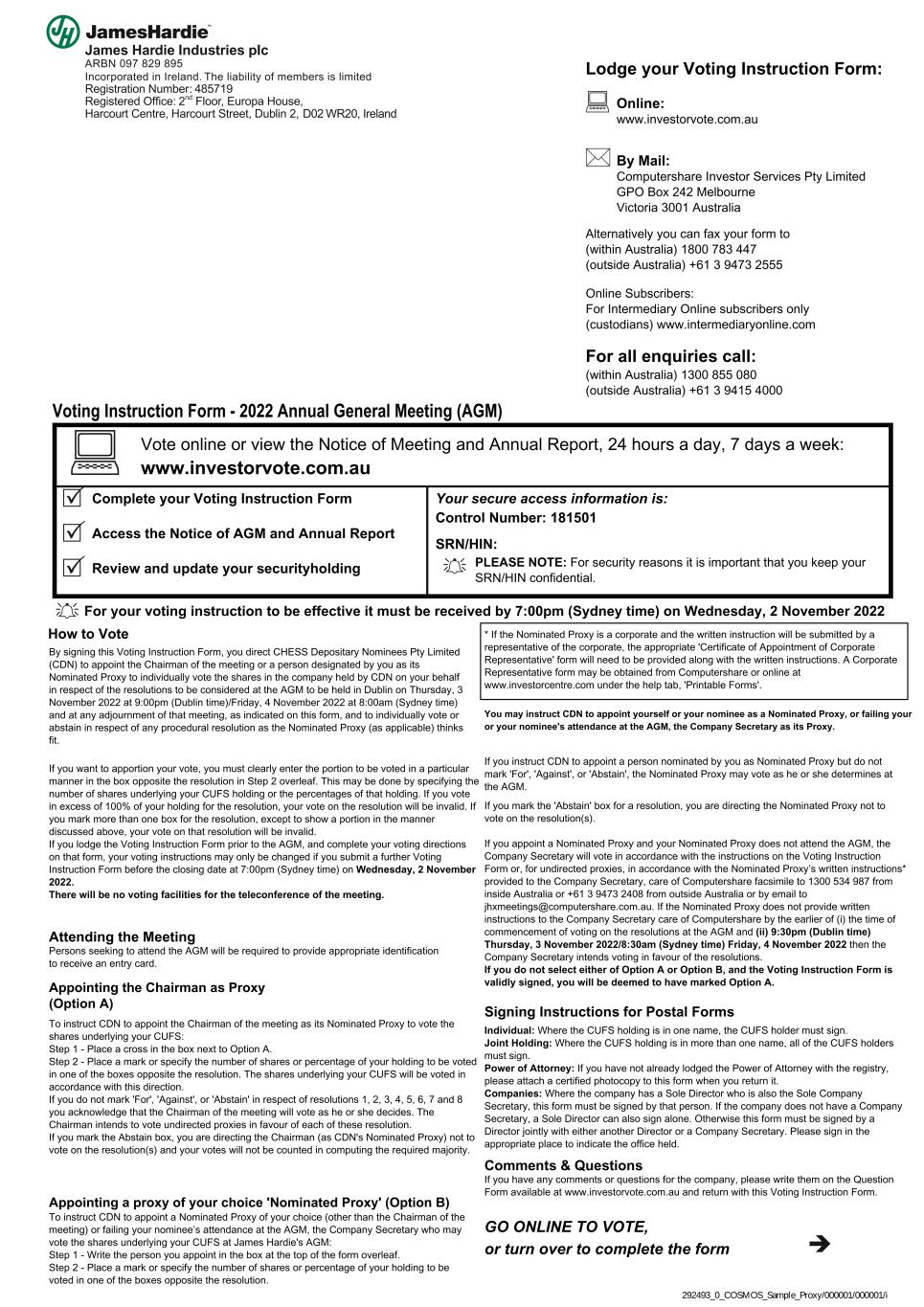

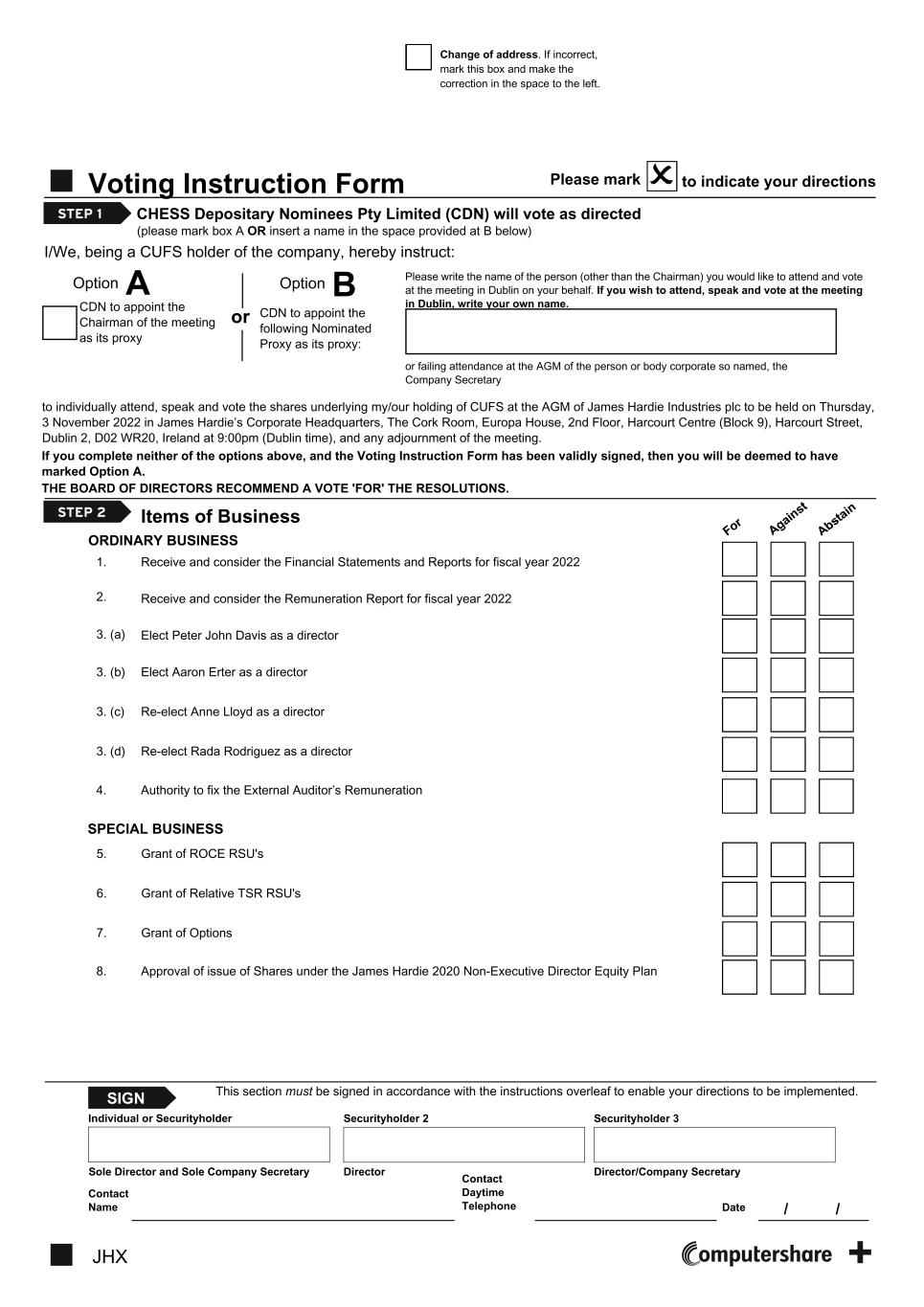

Notice of Annual General Meeting 2022 5 APPOINTING A PROXY To instruct the appointment of: a proxy to attend the AGM in person on your behalf (Nominated Proxy); and the Company Secretary in the event your Nominated Proxy does not attend the AGM, please complete the relevant section of the Voting Instruction Form, and return it to Computershare no later than 8:00am (Dublin time) / 7:00pm (Sydney time) on Wednesday, 2 November 2022 using the “Lodgement Instructions” set out on page 7. If you hold more than one Share carrying voting rights, you may instruct the appointment of more than one proxy to attend, speak and vote at the meeting on your behalf provided each proxy is appointed to exercise rights attached to different Shares held by you. VOTING ON THE RESOLUTIONS How you can vote will depend on whether you are: a shareholder; a holder of American Depositary Shares, which trade on the New York Stock Exchange (NYSE) in the form of American Depositary Receipts (ADRs); or a Nominated Proxy. Voting if you are a shareholder: If you are a shareholder and want to vote on the resolutions to be considered at the AGM, you have the following two options: Option A – If you are not attending the AGM or appointing a Nominated Proxy Follow this option if you do not intend to attend the AGM in person or appoint a Nominated Proxy. You may lodge a Voting Instruction Form directing CHESS Depository Nominees Pty Limited (CDN) (the legal holder of Shares for the purposes of the ASX Settlement Operating Rules) to nominate the Chairman of the AGM as its proxy to vote the Shares underlying your holding of CHESS Units of Foreign Securities (CUFS) that it holds on your behalf. You can submit your Voting Instruction Form as follows: 1. Complete the hard copy Voting Instruction Form and lodge it using the “Lodgement Instructions” set out on page 7. 2. Complete a Voting Instruction Form using the internet: Go to www.investorvote.com.au. You will need: your Control Number (located on your Voting Instruction Form); and your SRN or HIN for your holding; and your postcode as recorded in the Company’s register. If you lodge the Voting Instruction Form in accordance with these instructions, you will be taken to have signed it. For your vote to count, your completed Voting Instruction Form must be received by Computershare no later than 8:00am (Dublin time) / 7:00pm (Sydney time) on Wednesday, 2 November 2022. You will not be able to vote your Shares by way of teleconference.

6 Option B – If you are (or your Nominated Proxy is) attending the AGM If you would like to attend the AGM or appoint a Nominated Proxy to attend the AGM on your behalf, and vote in person, you may use a Voting Instruction Form to direct CDN to nominate: a) you or another person nominated by you (who does not need to be a shareholder) as a Nominated Proxy; and b) the Company Secretary in the event the Nominated Proxy does not attend the AGM, as proxy to vote the Shares underlying your holding of CUFS on behalf of CDN in person at the AGM in Dublin. If the Nominated Proxy does not attend the AGM, the Company Secretary will vote the relevant Shares in accordance with the instructions on the Voting Instruction Form or, for undirected proxies, in accordance with the Nominated Proxy’s written instructions. If the Nominated Proxy does not provide written instructions to the Company Secretary care of Computershare by facsimile to 1300 534 987 from inside Australia, or +61 3 9473 2408 from outside Australia, or by email to jhxmeetings@ computershare.com.au by the earlier of (i) the time of commencement of voting on the resolutions at the AGM and (ii) 9:30pm (Dublin time) on Thursday, 3 November 2022 / 8:30am (Sydney time) on Friday, 4 November 2022, then each Company Proxy intends voting in favour of all of the resolutions. For your proxy appointment to count, your completed Voting Instruction Form must be received by Computershare no later than 8:00am (Dublin time) / 7:00pm (Sydney time) on Wednesday, 2 November 2022. To obtain a free copy of CDN’s Financial Services Guide, or any Supplementary Financial Services Guide, go to http://www.asx. com.au/documents/settlement/CHESS_Depositary_Interests.pdf or phone 131279 from within Australia or +61 2 9338 0000 from outside Australia to ask to have one sent to you. If you submit a completed Voting Instruction Form to Computershare, but fail to select either of Option A or Option B, you are deemed to have selected Option A. COVID-19 Public Health Restrictions Please note that in-person attendance at the AGM will be subject to prevailing COVID-19 public health restrictions in place at the date of the AGM and social distancing capacity constraints at the venue meeting. We would therefore encourage you to select Option A above in order to ensure that your shares are voted at the AGM. Voting if you hold American Depositary Shares (ADSs): The depositary for ADSs held in James Hardie’s ADR program is Deutsche Bank Trust Company Americas (Deutsche Bank). Deutsche Bank will send the proxy materials to ADS holders on or about 6 October 2022 and advise ADS holders how to give their voting instructions. To be eligible to vote, ADS holders must be the registered or beneficial owner as at 5:00pm US Eastern Daylight Time (US EDT) on 26 September 2022 (the ADS record date). Deutsche Bank must receive any voting instructions, in the form required by Deutsche Bank, no later than 1:00pm (US EDT) on 27 October 2022. Deutsche Bank will endeavour, as far as is practicable, and permitted under applicable law, to instruct that the Shares ultimately underlying the ADSs are voted in accordance with the instructions received from ADS holders. If an ADS holder does not submit any voting instructions, the Shares ultimately underlying the ADSs held by that holder will not be voted. If you do not provide voting instructions, the Shares ultimately underlying your ADSs will not be voted on any resolution for which a broker does not have discretionary authority to vote. Under NYSE rules, brokers that are NYSE member organisations are prohibited from directing the voting of the Shares underlying ADSs held in customer accounts on non-routine matters (such as executive compensation and director elections) if they have not received voting instructions from the beneficial holders. Accordingly, if you are the beneficial owner of Shares underlying ADSs, and your broker holds your ADSs in its name, then you must instruct your broker as to how to vote your Shares. Otherwise, your broker may not vote your Shares. If you do not give your broker voting instructions and the broker does not vote your Shares, this is a “broker non-vote” which is treated as an abstention and does not count toward determining the votes for / against the resolution. VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING (CONTINUED)

Notice of Annual General Meeting 2022 7 Voting if you are a Nominated Proxy: If you are a Nominated Proxy and you do not attend and vote at the AGM, the Company Secretary will vote the Shares in accordance with the instructions on the Voting Instruction Form or form of proxy or, for undirected proxies, in accordance with your written instructions (where provided). If you wish to direct the Company Secretary how to vote any undirected proxies, you must submit your written instructions to the Company Secretary by no later than the earlier of (i) the time of commencement of voting on the resolutions at the AGM and (ii) 9:30pm (Dublin time) on Thursday, 3 November 2022/8:30am (Sydney time) on Friday, 4 November 2022, otherwise, if you have not provided written instructions to the Company Secretary by such time, then the Company Secretary intends voting in favour of all of the resolutions. NO VOTING AVAILABLE IN AGM TELECONFERENCE You will not be able to vote by way of teleconference. If you wish for your vote to count, you must follow the instructions set out above. LODGEMENT INSTRUCTIONS Completed Voting Instruction Forms may be lodged with Computershare using one of the following methods: a) by post to GPO Box 242, Melbourne, Victoria 3001, Australia; or b) by delivery to Computershare at Level 5, 115 Grenfell Street, Adelaide SA 5000, Australia; or c) online at www.investorvote.com.au; or d) for Intermediary Online subscribers only (custodians), online at www.intermediaryonline.com; or e) by facsimile to 1800 783 447 from inside Australia or +61 3 9473 2555 from outside Australia. Written instructions to the Company Secretary (if required) may be lodged by the Nominated Proxy with Computershare using one of the following methods: a) by facsimile to 1300 534 987 from inside Australia, or +61 3 9473 2408 from outside Australia; or b) by email to [email protected]. If the Nominated Proxy is a corporate and the written instructions will be submitted by a representative of the corporate, the appropriate ‘Certificate of Appointment of Corporate Representative’ form will need to be provided along with the written instructions. A form of certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab and then click on ‘Printable Forms’.

8 EXPLANATORY NOTES TERMINOLOGY References to shareholders in this Notice of Meeting, including these Explanatory Notes, include references to all the shareholders of James Hardie acting together, and include holders of CUFS, holders of ADSs, holders of Shares and members of the Company within the meaning of the Irish Companies Act 2014, except where describing how each group of shareholders may cast their votes. RESOLUTION 1 – FINANCIAL STATEMENTS AND REPORTS FOR FISCAL YEAR 2022 Resolution 1 asks shareholders to receive and consider the financial statements and the reports of the Board and the Company’s external auditor, Ernst & Young LLP, for the year ended 31 March 2022. This resolution will also involve the review by the members of James Hardie’s affairs. The financial statements which are the subject of Resolution 1 are those prepared in accordance with Irish law, US Generally Accepted Accounting Principles (US GAAP) (to the extent that the use of those principles in the preparation of the financial statements does not contravene any provision of Irish law) and Accounting Standards issued by the Accounting Standards Board and promulgated by the Institute of Chartered Accountants in Ireland (Generally Accepted Accounting Practice in Ireland), as distinct from the US GAAP consolidated financial statements of the James Hardie Group as set out in the Company’s 2022 Annual Report. A brief overview of the financial and operating performance of the James Hardie Group during the year ended 31 March 2022 will be provided during the AGM. Copies of the James Hardie Group’s consolidated Irish financial statements are available free of charge either: a) at the AGM in Dublin, Ireland; b) at the Company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland; c) at the Company’s registered Australian office at Level 20, 60 Castlereagh Street, Sydney NSW 2000; or d) on the Company’s Investor Relations website, https://ir.jameshardie.com.au/. Recommendation The Board believes it is in the interests of shareholders that the financial statements and the reports of the Board and external auditor for the year ended 31 March 2022 be received and considered and recommends that you vote in favour of Resolution 1. RESOLUTION 2 – REMUNERATION REPORT FOR FISCAL YEAR 2022 Resolution 2 asks shareholders to receive and consider the Remuneration Report for the year ended 31 March 2022. The Company is not required to produce a remuneration report or to submit it to shareholders under Irish, Australian or US law or regulations. However, taking into consideration James Hardie’s Australian and US shareholder base and ASX listing, the Company has voluntarily produced a remuneration report for non-binding shareholder approval for a number of years and currently intends to continue to do so. This report provides information on James Hardie’s remuneration practices in fiscal year 2022 and also voluntarily includes an outline of the Company’s proposed remuneration framework for fiscal year 2023. James Hardie’s Remuneration Report is set out on pages 26 to 65 of the 2022 Annual Report and can also be found on the Company’s Investor Relations website, https://ir.jameshardie.com.au/. Although this vote does not bind the Company, the Board intends to take the outcome of the vote into consideration when considering the Company’s future remuneration policy. Recommendation The Board believes it is in the interests of shareholders that the Company’s Remuneration Report for the year ended 31 March 2022 be received and considered and recommends that you vote in favour of Resolution 2.

Notice of Annual General Meeting 2022 9 RESOLUTION 3 – ELECTION / RE-ELECTION OF DIRECTORS As part of their review of the composition of the Board, the Board and the Nominating and Governance Committee considered the desired profile of the Board, including the right number, mix of skills, qualifications, experience, expertise, diversity and geographic location of its directors, to maximise the effectiveness of the Board. The Board and Nominating and Governance Committee work together to ensure James Hardie puts in place appropriate mechanisms for Board renewal. Resolution 3(a) asks shareholders to consider the election of Peter John Davis to the Board. Resolution 3(b) asks shareholders to consider the election of Aaron Erter to the Board. Resolution 3(c) asks shareholders to consider the re-election of Anne Lloyd to the Board. Resolution 3(d) asks shareholders to consider the re-election of Rada Rodriguez to the Board. James Hardie’s Articles of Association currently require that directors (other than the Chief Executive Officer) shall be divided into three classes. Each Class I director’s initial term shall expire at the conclusion of the 2022 AGM and thereafter each shall serve in accordance with the Articles of Association. The current Class I directors are Anne Lloyd and Rada Rodriguez. If elected Peter John Davis will be designated as a Class I director. Profiles of the candidates follow: PETER JOHN DAVIS AGE: 63 Peter John Davis (PJ) was appointed as an independent non-executive director of James Hardie in August 2022. He is a member of the Remuneration Committee. Experience: Mr Davis previously served as Chief Operating Officer (COO) of Bunnings Australia & New Zealand. During his 15-year tenure as COO, the division was one of the most profitable of the Wesfarmers Group. With over 40 years’ experience in various retail and trade formats and home improvement industries, PJ commenced his career on the sales floor and held senior roles in operations, marketing, advertising and merchandising before moving into general management and leading the development of the highly successful Bunnings Warehouse concept. PJ was responsible for the development, strategic direction, and operational management of the Bunnings businesses and its employees. His main objectives were to ensure growth in revenues and profitability and provide satisfactory returns for shareholders. PJ completed the Advanced Management Program at Harvard Business School in Boston, USA and is the Founding Director ANRA (Australian National Retailers Association) and Foundation Member of the Australian Institute of Company Directors. The Company conducted appropriate background checks into Mr Davis’ background and experience prior to his appointment in August 2022. Directorships of listed companies in the past five years: Former – Director of Bunnings Homebase BUKI (2016-2018). Last elected: Appointed to the Board in August 2022 and will therefore stand for election at the 2022 AGM.

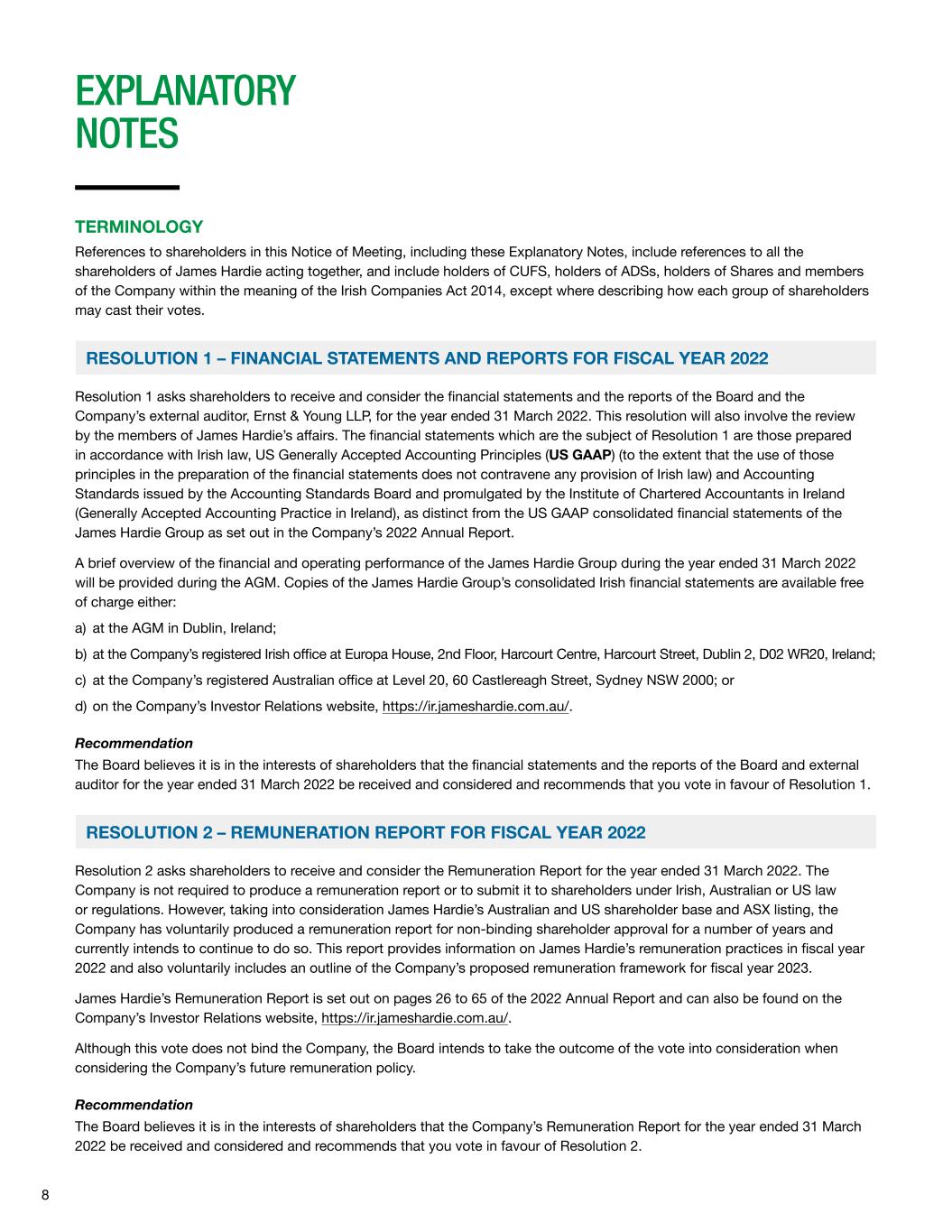

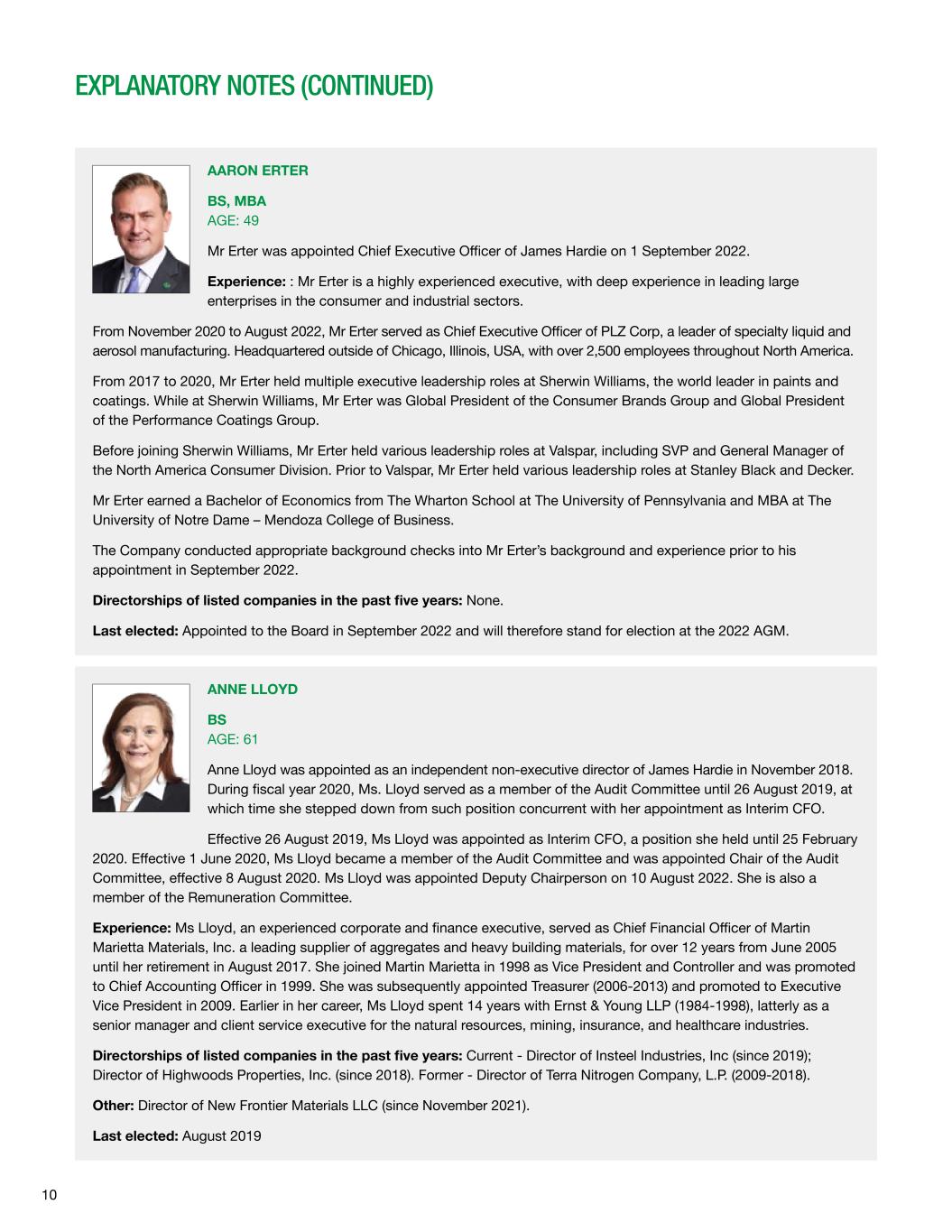

10 AARON ERTER BS, MBA AGE: 49 Mr Erter was appointed Chief Executive Officer of James Hardie on 1 September 2022. Experience: : Mr Erter is a highly experienced executive, with deep experience in leading large enterprises in the consumer and industrial sectors. From November 2020 to August 2022, Mr Erter served as Chief Executive Officer of PLZ Corp, a leader of specialty liquid and aerosol manufacturing. Headquartered outside of Chicago, Illinois, USA, with over 2,500 employees throughout North America. From 2017 to 2020, Mr Erter held multiple executive leadership roles at Sherwin Williams, the world leader in paints and coatings. While at Sherwin Williams, Mr Erter was Global President of the Consumer Brands Group and Global President of the Performance Coatings Group. Before joining Sherwin Williams, Mr Erter held various leadership roles at Valspar, including SVP and General Manager of the North America Consumer Division. Prior to Valspar, Mr Erter held various leadership roles at Stanley Black and Decker. Mr Erter earned a Bachelor of Economics from The Wharton School at The University of Pennsylvania and MBA at The University of Notre Dame – Mendoza College of Business. The Company conducted appropriate background checks into Mr Erter’s background and experience prior to his appointment in September 2022. Directorships of listed companies in the past five years: None. Last elected: Appointed to the Board in September 2022 and will therefore stand for election at the 2022 AGM. ANNE LLOYD BS AGE: 61 Anne Lloyd was appointed as an independent non-executive director of James Hardie in November 2018. During fiscal year 2020, Ms. Lloyd served as a member of the Audit Committee until 26 August 2019, at which time she stepped down from such position concurrent with her appointment as Interim CFO. Effective 26 August 2019, Ms Lloyd was appointed as Interim CFO, a position she held until 25 February 2020. Effective 1 June 2020, Ms Lloyd became a member of the Audit Committee and was appointed Chair of the Audit Committee, effective 8 August 2020. Ms Lloyd was appointed Deputy Chairperson on 10 August 2022. She is also a member of the Remuneration Committee. Experience: Ms Lloyd, an experienced corporate and finance executive, served as Chief Financial Officer of Martin Marietta Materials, Inc. a leading supplier of aggregates and heavy building materials, for over 12 years from June 2005 until her retirement in August 2017. She joined Martin Marietta in 1998 as Vice President and Controller and was promoted to Chief Accounting Officer in 1999. She was subsequently appointed Treasurer (2006-2013) and promoted to Executive Vice President in 2009. Earlier in her career, Ms Lloyd spent 14 years with Ernst & Young LLP (1984-1998), latterly as a senior manager and client service executive for the natural resources, mining, insurance, and healthcare industries. Directorships of listed companies in the past five years: Current - Director of Insteel Industries, Inc (since 2019); Director of Highwoods Properties, Inc. (since 2018). Former - Director of Terra Nitrogen Company, L.P. (2009-2018). Other: Director of New Frontier Materials LLC (since November 2021). Last elected: August 2019 EXPLANATORY NOTES (CONTINUED)

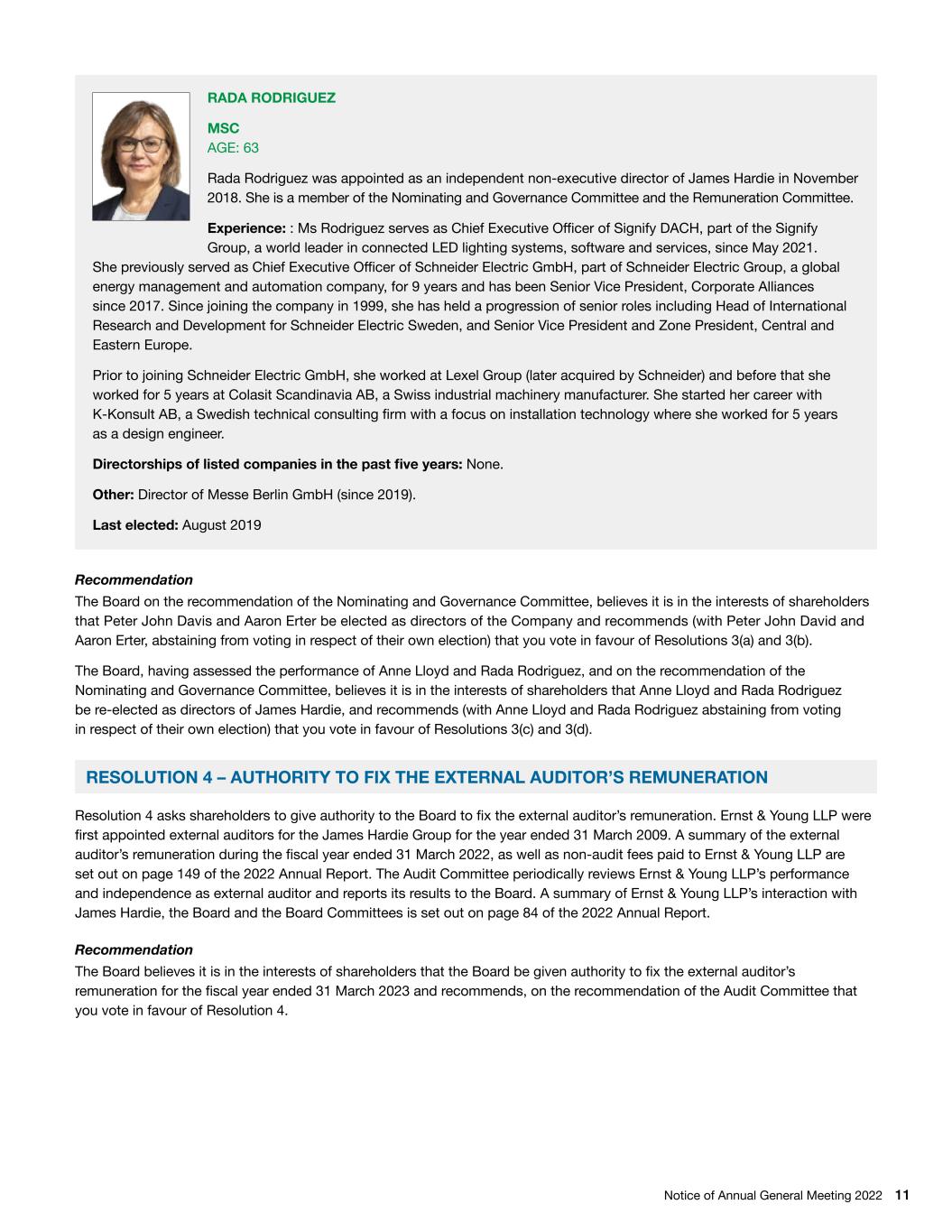

Notice of Annual General Meeting 2022 11 RADA RODRIGUEZ MSC AGE: 63 Rada Rodriguez was appointed as an independent non-executive director of James Hardie in November 2018. She is a member of the Nominating and Governance Committee and the Remuneration Committee. Experience: : Ms Rodriguez serves as Chief Executive Officer of Signify DACH, part of the Signify Group, a world leader in connected LED lighting systems, software and services, since May 2021. She previously served as Chief Executive Officer of Schneider Electric GmbH, part of Schneider Electric Group, a global energy management and automation company, for 9 years and has been Senior Vice President, Corporate Alliances since 2017. Since joining the company in 1999, she has held a progression of senior roles including Head of International Research and Development for Schneider Electric Sweden, and Senior Vice President and Zone President, Central and Eastern Europe. Prior to joining Schneider Electric GmbH, she worked at Lexel Group (later acquired by Schneider) and before that she worked for 5 years at Colasit Scandinavia AB, a Swiss industrial machinery manufacturer. She started her career with K-Konsult AB, a Swedish technical consulting firm with a focus on installation technology where she worked for 5 years as a design engineer. Directorships of listed companies in the past five years: None. Other: Director of Messe Berlin GmbH (since 2019). Last elected: August 2019 Recommendation The Board on the recommendation of the Nominating and Governance Committee, believes it is in the interests of shareholders that Peter John Davis and Aaron Erter be elected as directors of the Company and recommends (with Peter John David and Aaron Erter, abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(a) and 3(b). The Board, having assessed the performance of Anne Lloyd and Rada Rodriguez, and on the recommendation of the Nominating and Governance Committee, believes it is in the interests of shareholders that Anne Lloyd and Rada Rodriguez be re-elected as directors of James Hardie, and recommends (with Anne Lloyd and Rada Rodriguez abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(c) and 3(d). RESOLUTION 4 – AUTHORITY TO FIX THE EXTERNAL AUDITOR’S REMUNERATION Resolution 4 asks shareholders to give authority to the Board to fix the external auditor’s remuneration. Ernst & Young LLP were first appointed external auditors for the James Hardie Group for the year ended 31 March 2009. A summary of the external auditor’s remuneration during the fiscal year ended 31 March 2022, as well as non-audit fees paid to Ernst & Young LLP are set out on page 149 of the 2022 Annual Report. The Audit Committee periodically reviews Ernst & Young LLP’s performance and independence as external auditor and reports its results to the Board. A summary of Ernst & Young LLP’s interaction with James Hardie, the Board and the Board Committees is set out on page 84 of the 2022 Annual Report. Recommendation The Board believes it is in the interests of shareholders that the Board be given authority to fix the external auditor’s remuneration for the fiscal year ended 31 March 2023 and recommends, on the recommendation of the Audit Committee that you vote in favour of Resolution 4.

12 EXPLANATORY NOTES (CONTINUED) RESOLUTION 5 – GRANT OF ROCE RSUS Resolution 5 asks shareholders to approve the grant of ROCE RSUs under the restated 2006 LTIP under and for the purposes of ASX Listing Rule 10.14 to James Hardie’s Director and Chief Executive Officer, Aaron Erter. The Remuneration Committee has allocated the Long-Term Incentive (LTI) target of the Chief Executive Officer (and each senior executive) between the following three components to ensure that the reward is based on a diverse range of factors which validly reflect longer term performance, as well as provide an appropriate incentive to ensure senior executives focus on the key areas which will drive shareholder value creation over the medium and long-term: 25% to ROCE RSUs – an indicator of James Hardie’s capital efficiency over time; 25% to Relative TSR RSUs – an indicator of James Hardie’s performance relative to its US peers; and 50% to Scorecard LTI – an indicator of each senior executive’s contribution to James Hardie achieving its long-term strategic goals. Three tranches of ROCE RSUs will be granted: Tranche 1 ROCE RSUs – in relation to James Hardie’s performance in fiscal years 2021 to 2023. The Tranche 1 ROCE RSU target is $208,333; Tranche 2 ROCE RSUs – in relation to James Hardie’s for performance in fiscal years 2022 to 2024. The Tranche 2 ROCE RSU target is $208,333; Tranche 3 ROCE RSUs – in relation to James Hardie’s for performance in fiscal years 2023 to 2025. The Tranche 3 ROCE RSU target is $833,333, together, the ROCE RSUs. As the Board and Remuneration Committee believe the LTI program is achieving the stated objectives, and that management understands the current LTI program and continues to be motivated by it, the LTI components for fiscal year 2023 are materially consistent with the components for fiscal year 2022. Reasons for ROCE RSUs The Tranche 1 ROCE RSUs and the Tranche 2 ROCE RSUs are being granted to align Aaron Erter’s LTI performance hurdles with the James Hardie leadership team. ROCE RSUs shall vest if James Hardie’s ROCE performance meets or exceeds ROCE performance hurdles over the applicable period, subject to the exercise of negative discretion by the Remuneration Committee. James Hardie introduced ROCE RSUs in fiscal year 2013 once the US housing market had stabilised to an extent which permitted the setting of multi-year financial metrics. As James Hardie funds capacity expansions and market initiatives in the US, Asia Pacific and Europe it is important that management focuses on ensuring that the Company continues to achieve strong ROCE results while pursuing growth. Upon vesting, ROCE RSUs shall be settled in CUFS on a 1-to-1 basis. ROCE RSU changes for fiscal year 2023 The Tranche 1, Tranche 2 and Tranche 3 ROCE RSUs have the same design and hurdles (or payout scale) as the ROCE RSUs granted by James Hardie to management for fiscal years 2021, 2022 and 2023, respectively, with the design and hurdles (or payout scale) for fiscal year 2023 remaining unchanged from fiscal year 2022.

Notice of Annual General Meeting 2022 13 Key aspects of ROCE RSUs Goal Setting: ROCE performance hurdles for the ROCE RSUs are based on historical results and take into account the forecasts for the US and Asia Pacific housing markets. By way of reference, the three-year average ROCE result for fiscal years 2020, 2021 and 2022 was 41.0%. ROCE Definitions: The ROCE measure will be determined by dividing Adjusted Earnings Before Interest and Tax (Adjusted EBIT) by Adjusted Capital Employed each as further explained below. The Adjusted EBIT component of the ROCE measure will be determined as follows. Earnings before interest and taxation as reported in James Hardie’s financial results, adjusted by: excluding the earnings impact of legacy issues (such as asbestos adjustments); and adding back asset impairment charges in the relevant period, unless otherwise determined by the Remuneration Committee. Since management’s performance will be assessed on the pre-impairment value of James Hardie’s assets, the Remuneration Committee would not normally deduct the impact of any asset impairments from the Company’s EBIT for the purposes of measuring ROCE performance. The Adjusted Capital Employed component of the ROCE measure will be determined as follows. Total Assets minus Current Liabilities, as reported in James Hardie’s financial results, adjusted by: excluding balance sheet items related to legacy issues (such as asbestos adjustments), dividends payable and deferred taxes; adding back asset impairment charges in the relevant period, unless otherwise determined by the Remuneration Committee, in order to align the Adjusted Capital Employed with the determination of Adjusted EBIT; adding back leasehold assets for manufacturing facilities and other material leased assets, which the Remuneration Committee believes give a more complete measure of the Company’s capital base employed in income generation; and deducting all greenfield construction-in-progress, and any brownfield construction-in-progress projects involving capacity expansion that are individually greater than US$20 million, until such assets reach commercial production and are transferred to the fixed asset register, in order to encourage management to invest in capital expenditure projects that are aligned with the long-term interests of the Company. The ROCE performance hurdles will be indexed for changes to US and Asia Pacific addressable housing starts. The resulting Adjusted Capital Employed for each quarter of any fiscal year will be averaged to better reflect capital employed over the course of a year rather than at a certain point in time. The ROCE result to compare to the performance hurdles will be: Tranche 1 ROCE RSUs – the average of James Hardie’s ROCE in fiscal years 2021, 2022 and 2023; Tranche 2 ROCE RSUs – the average of James Hardie’s ROCE in fiscal years 2022, 2023 and 2024; and Tranche 3 ROCE RSUs – the average of James Hardie’s ROCE in fiscal years 2023, 2024 and 2025. These definitions have been framed to ensure management is rewarded and held accountable for the aspects over which they have direct influence and control, while not discouraging management from recommending that James Hardie undertake investments that will provide for future Company growth. Grant: The Chief Executive Officer will receive the following grants: Tranche 1 ROCE RSUs – a grant equal to the maximum number of Tranche 1 ROCE RSUs (2.0x target). The number of Tranche 1 ROCE RSUs which vest, and the number of Shares ultimately received in 2023 will depend on James Hardie’s Tranche 1 ROCE performance in fiscal years 2021 to 2023 together with the Remuneration Committee’s exercise of negative discretion; Tranche 2 ROCE RSUs – a grant equal to the maximum number of Tranche 2 ROCE RSUs (2.0x target). The number of Tranche 2 ROCE RSUs which vest, and the number of Shares ultimately received in 2024 will depend on James Hardie’s Tranche 2 ROCE performance in fiscal years 2022 to 2024 together with the Remuneration Committee’s exercise of negative discretion; and Tranche 3 ROCE RSUs – a grant equal to the maximum number of Tranche 3 ROCE RSUs (2.0x target). The number of Tranche 3 ROCE RSUs which vest, and the number of Shares ultimately received in 2025 will depend on James Hardie’s ROCE performance in fiscal years 2023 to 2025 together with the Remuneration Committee’s exercise of negative discretion.

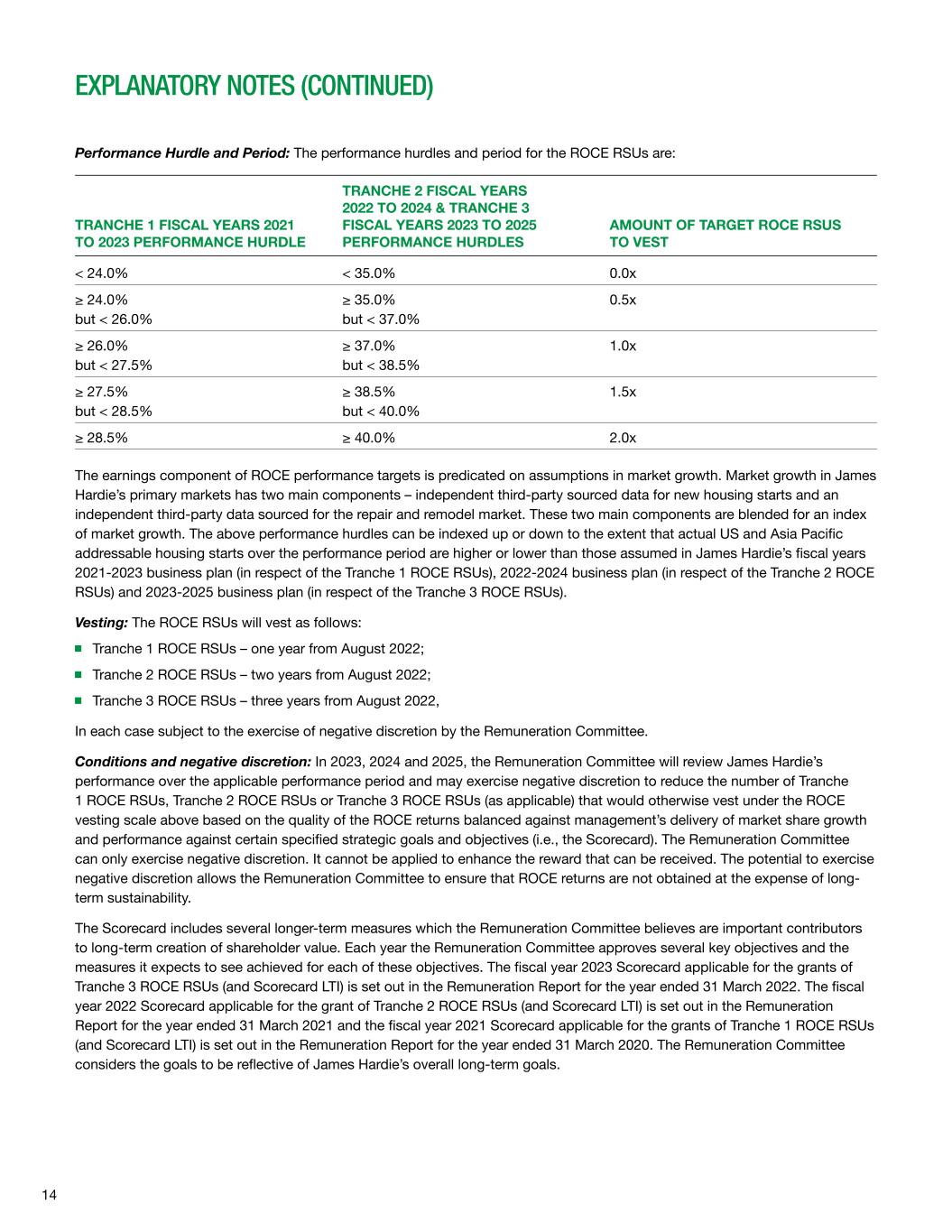

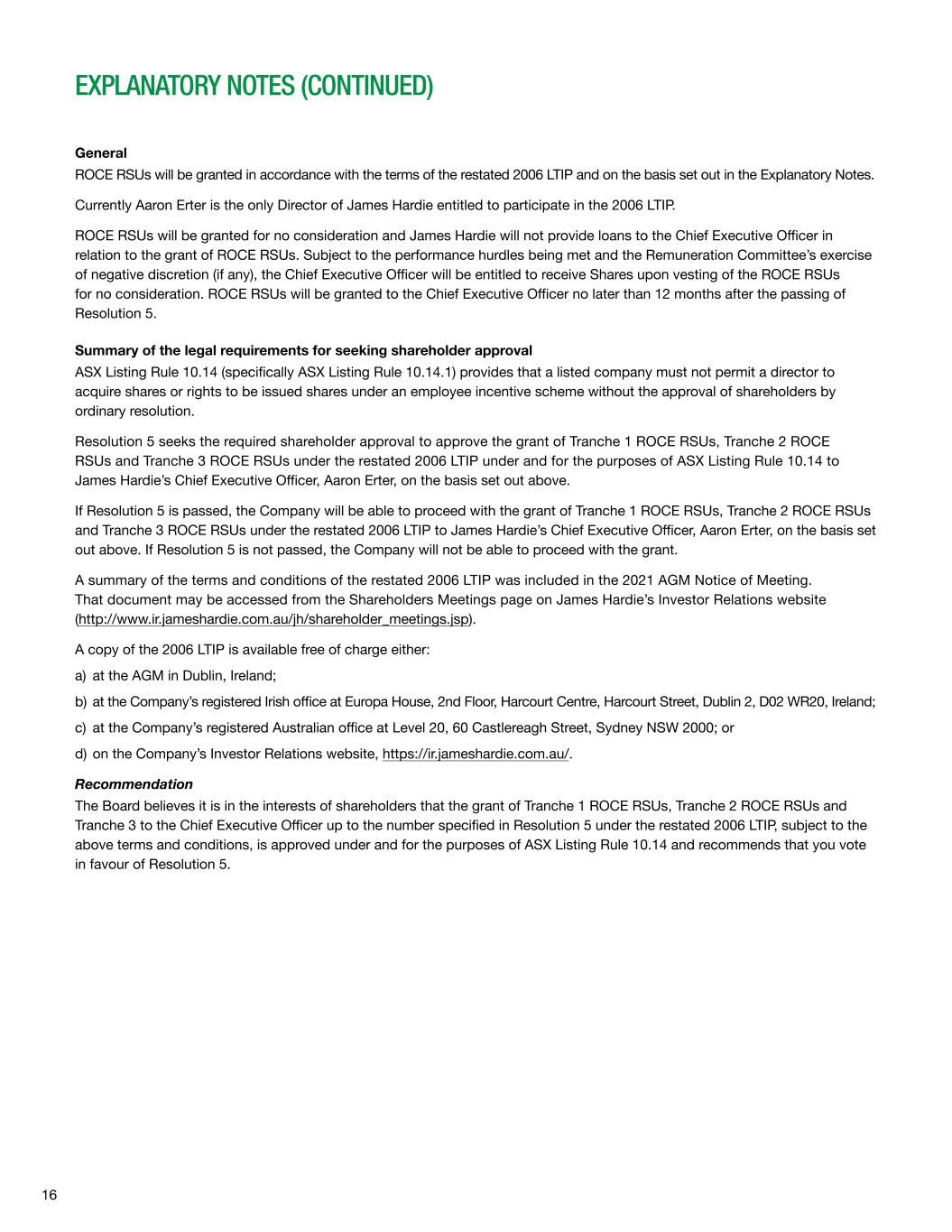

14 EXPLANATORY NOTES (CONTINUED) Performance Hurdle and Period: The performance hurdles and period for the ROCE RSUs are: TRANCHE 1 FISCAL YEARS 2021 TO 2023 PERFORMANCE HURDLE TRANCHE 2 FISCAL YEARS 2022 TO 2024 & TRANCHE 3 FISCAL YEARS 2023 TO 2025 PERFORMANCE HURDLES AMOUNT OF TARGET ROCE RSUS TO VEST < 24.0% < 35.0% 0.0x ≥ 24.0% but < 26.0% ≥ 35.0% but < 37.0% 0.5x ≥ 26.0% but < 27.5% ≥ 37.0% but < 38.5% 1.0x ≥ 27.5% but < 28.5% ≥ 38.5% but < 40.0% 1.5x ≥ 28.5% ≥ 40.0% 2.0x The earnings component of ROCE performance targets is predicated on assumptions in market growth. Market growth in James Hardie’s primary markets has two main components – independent third-party sourced data for new housing starts and an independent third-party data sourced for the repair and remodel market. These two main components are blended for an index of market growth. The above performance hurdles can be indexed up or down to the extent that actual US and Asia Pacific addressable housing starts over the performance period are higher or lower than those assumed in James Hardie’s fiscal years 2021-2023 business plan (in respect of the Tranche 1 ROCE RSUs), 2022-2024 business plan (in respect of the Tranche 2 ROCE RSUs) and 2023-2025 business plan (in respect of the Tranche 3 ROCE RSUs). Vesting: The ROCE RSUs will vest as follows: Tranche 1 ROCE RSUs – one year from August 2022; Tranche 2 ROCE RSUs – two years from August 2022; Tranche 3 ROCE RSUs – three years from August 2022, In each case subject to the exercise of negative discretion by the Remuneration Committee. Conditions and negative discretion: In 2023, 2024 and 2025, the Remuneration Committee will review James Hardie’s performance over the applicable performance period and may exercise negative discretion to reduce the number of Tranche 1 ROCE RSUs, Tranche 2 ROCE RSUs or Tranche 3 ROCE RSUs (as applicable) that would otherwise vest under the ROCE vesting scale above based on the quality of the ROCE returns balanced against management’s delivery of market share growth and performance against certain specified strategic goals and objectives (i.e., the Scorecard). The Remuneration Committee can only exercise negative discretion. It cannot be applied to enhance the reward that can be received. The potential to exercise negative discretion allows the Remuneration Committee to ensure that ROCE returns are not obtained at the expense of long- term sustainability. The Scorecard includes several longer-term measures which the Remuneration Committee believes are important contributors to long-term creation of shareholder value. Each year the Remuneration Committee approves several key objectives and the measures it expects to see achieved for each of these objectives. The fiscal year 2023 Scorecard applicable for the grants of Tranche 3 ROCE RSUs (and Scorecard LTI) is set out in the Remuneration Report for the year ended 31 March 2022. The fiscal year 2022 Scorecard applicable for the grant of Tranche 2 ROCE RSUs (and Scorecard LTI) is set out in the Remuneration Report for the year ended 31 March 2021 and the fiscal year 2021 Scorecard applicable for the grants of Tranche 1 ROCE RSUs (and Scorecard LTI) is set out in the Remuneration Report for the year ended 31 March 2020. The Remuneration Committee considers the goals to be reflective of James Hardie’s overall long-term goals.

Notice of Annual General Meeting 2022 15 The Chief Executive Officer’s rating ultimately depends on the Remuneration Committee’s assessment (and the Board’s review) of his contribution to James Hardie in meeting the Scorecard objectives. Although most of the objectives in the Scorecard have quantitative targets, the Board has not allocated a specific weighting to any and the final Scorecard assessment and exercise of negative discretion (if any) will involve an element of judgment by the Remuneration Committee. A different amount of negative discretion is likely to be applied when assessing the Chief Executive Officer’s performance for the Scorecard LTI grants (which only include consideration of Scorecard measures) and ROCE RSUs grants (which involve a broader assessment of the quality of James Hardie’s results). Worked Example The Company has fixed the Chief Executive Officer’s ROCE RSU LTI target quantum as follows: Tranche 1 ROCE RSUs - $208,333; Tranche 2 ROCE RSUs – $208,333; Tranche 3 ROCE RSUs – $833,333. At grant date the LTI quantum granted to the Chief Executive Officer for each Tranche of ROCE RSUs will be: Amount of ROCE RSU LTI target quantum x 2.0 target leverage At a value of AUD 31.99 per Share, this is equivalent to a maximun grant of 19,070 Tranche 1 ROCE RSUs, 19,070 Tranche 2 ROCE RSUs and 76,281 Tranche 3 ROCE RSUs. Based on an average 39% ROCE result for the three-year period to fiscal year 2025, 1.5x target would be eligible to vest: 76,281 RSUs x 75% = 57,210 Tranche 3 ROCE RSUs vested. At the conclusion of the relevant performance period, the Remuneration Committee will review James Hardie’s performance (and decide whether to reduce the number of ROCE RSUs which vest based on its negative discretion). For illustrative purposes, assuming that the Remuneration Committee determines that 1.0x target (rather than the 1.5x target based on performance against the ROCE performance hurdles) of the Chief Executive Officer’s total ROCE RSUs should vest, the Chief Executive Officer would receive: 76,281 RSUs x 50% = 38,140 Tranche 3 ROCE RSUs granted. Maximum and actual number of ROCE RSUs The maximum number of Shares and ROCE RSUs for which approval is sought under this Resolution 5 is 152,000 for all three tranches and is based on the grant that would be made if James Hardie’s performance warranted the maximum possible award for each tranche (i.e. 2.0x each LTI target) and the Remuneration Committee did not exercise any negative discretion to reduce the number of ROCE RSUs which ultimately are to vest and be settled into Shares. The actual number of ROCE RSUs granted is determined by dividing the maximum dollar amount granted under the ROCE RSUs portion of the LTI target (which is 2.0x each LTI target) by the Grant Date VWAP, subject to the maximum specified in the resolution. In the unlikely event the grant calculation returns an actual number of ROCE RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 5, James Hardie may grant a cash settled award equal in value to the number of ROCE RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the ROCE RSU grant vests in full. Previous grants For fiscal year 2023, as Chief Executive Officer of James Hardie, Aaron Erter is eligible to participate in the 2006 LTIP. Aaron Erter has not previously been issued any securities under the 2006 LTIP.

16 EXPLANATORY NOTES (CONTINUED) General ROCE RSUs will be granted in accordance with the terms of the restated 2006 LTIP and on the basis set out in the Explanatory Notes. Currently Aaron Erter is the only Director of James Hardie entitled to participate in the 2006 LTIP. ROCE RSUs will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Officer in relation to the grant of ROCE RSUs. Subject to the performance hurdles being met and the Remuneration Committee’s exercise of negative discretion (if any), the Chief Executive Officer will be entitled to receive Shares upon vesting of the ROCE RSUs for no consideration. ROCE RSUs will be granted to the Chief Executive Officer no later than 12 months after the passing of Resolution 5. Summary of the legal requirements for seeking shareholder approval ASX Listing Rule 10.14 (specifically ASX Listing Rule 10.14.1) provides that a listed company must not permit a director to acquire shares or rights to be issued shares under an employee incentive scheme without the approval of shareholders by ordinary resolution. Resolution 5 seeks the required shareholder approval to approve the grant of Tranche 1 ROCE RSUs, Tranche 2 ROCE RSUs and Tranche 3 ROCE RSUs under the restated 2006 LTIP under and for the purposes of ASX Listing Rule 10.14 to James Hardie’s Chief Executive Officer, Aaron Erter, on the basis set out above. If Resolution 5 is passed, the Company will be able to proceed with the grant of Tranche 1 ROCE RSUs, Tranche 2 ROCE RSUs and Tranche 3 ROCE RSUs under the restated 2006 LTIP to James Hardie’s Chief Executive Officer, Aaron Erter, on the basis set out above. If Resolution 5 is not passed, the Company will not be able to proceed with the grant. A summary of the terms and conditions of the restated 2006 LTIP was included in the 2021 AGM Notice of Meeting. That document may be accessed from the Shareholders Meetings page on James Hardie’s Investor Relations website (http://www.ir.jameshardie.com.au/jh/shareholder_meetings.jsp). A copy of the 2006 LTIP is available free of charge either: a) at the AGM in Dublin, Ireland; b) at the Company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland; c) at the Company’s registered Australian office at Level 20, 60 Castlereagh Street, Sydney NSW 2000; or d) on the Company’s Investor Relations website, https://ir.jameshardie.com.au/. Recommendation The Board believes it is in the interests of shareholders that the grant of Tranche 1 ROCE RSUs, Tranche 2 ROCE RSUs and Tranche 3 to the Chief Executive Officer up to the number specified in Resolution 5 under the restated 2006 LTIP, subject to the above terms and conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and recommends that you vote in favour of Resolution 5.

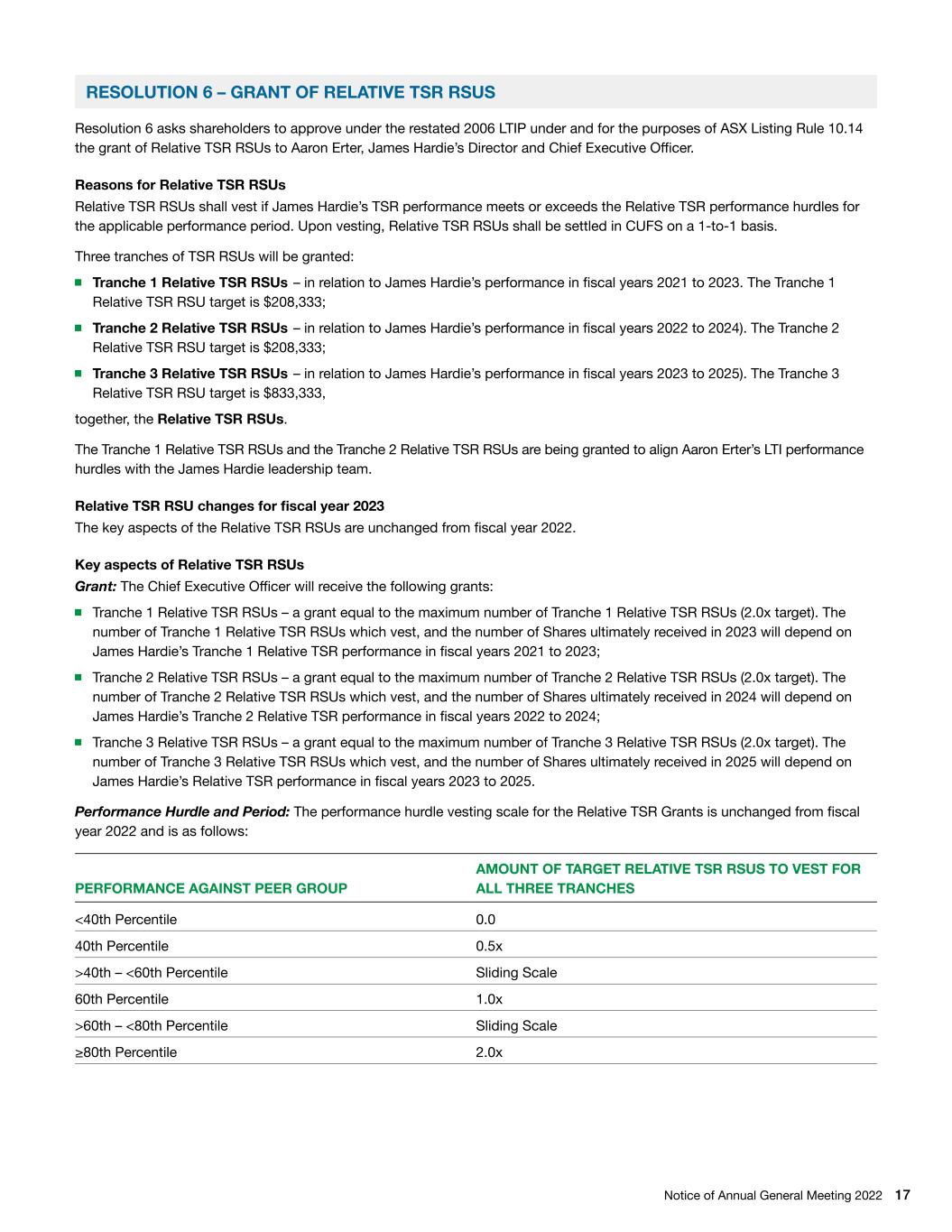

Notice of Annual General Meeting 2022 17 RESOLUTION 6 – GRANT OF RELATIVE TSR RSUS Resolution 6 asks shareholders to approve under the restated 2006 LTIP under and for the purposes of ASX Listing Rule 10.14 the grant of Relative TSR RSUs to Aaron Erter, James Hardie’s Director and Chief Executive Officer. Reasons for Relative TSR RSUs Relative TSR RSUs shall vest if James Hardie’s TSR performance meets or exceeds the Relative TSR performance hurdles for the applicable performance period. Upon vesting, Relative TSR RSUs shall be settled in CUFS on a 1-to-1 basis. Three tranches of TSR RSUs will be granted: Tranche 1 Relative TSR RSUs – in relation to James Hardie’s performance in fiscal years 2021 to 2023. The Tranche 1 Relative TSR RSU target is $208,333; Tranche 2 Relative TSR RSUs – in relation to James Hardie’s performance in fiscal years 2022 to 2024). The Tranche 2 Relative TSR RSU target is $208,333; Tranche 3 Relative TSR RSUs – in relation to James Hardie’s performance in fiscal years 2023 to 2025). The Tranche 3 Relative TSR RSU target is $833,333, together, the Relative TSR RSUs. The Tranche 1 Relative TSR RSUs and the Tranche 2 Relative TSR RSUs are being granted to align Aaron Erter’s LTI performance hurdles with the James Hardie leadership team. Relative TSR RSU changes for fiscal year 2023 The key aspects of the Relative TSR RSUs are unchanged from fiscal year 2022. Key aspects of Relative TSR RSUs Grant: The Chief Executive Officer will receive the following grants: Tranche 1 Relative TSR RSUs – a grant equal to the maximum number of Tranche 1 Relative TSR RSUs (2.0x target). The number of Tranche 1 Relative TSR RSUs which vest, and the number of Shares ultimately received in 2023 will depend on James Hardie’s Tranche 1 Relative TSR performance in fiscal years 2021 to 2023; Tranche 2 Relative TSR RSUs – a grant equal to the maximum number of Tranche 2 Relative TSR RSUs (2.0x target). The number of Tranche 2 Relative TSR RSUs which vest, and the number of Shares ultimately received in 2024 will depend on James Hardie’s Tranche 2 Relative TSR performance in fiscal years 2022 to 2024; Tranche 3 Relative TSR RSUs – a grant equal to the maximum number of Tranche 3 Relative TSR RSUs (2.0x target). The number of Tranche 3 Relative TSR RSUs which vest, and the number of Shares ultimately received in 2025 will depend on James Hardie’s Relative TSR performance in fiscal years 2023 to 2025. Performance Hurdle and Period: The performance hurdle vesting scale for the Relative TSR Grants is unchanged from fiscal year 2022 and is as follows: PERFORMANCE AGAINST PEER GROUP AMOUNT OF TARGET RELATIVE TSR RSUS TO VEST FOR ALL THREE TRANCHES <40th Percentile 0.0 40th Percentile 0.5x >40th – <60th Percentile Sliding Scale 60th Percentile 1.0x >60th – <80th Percentile Sliding Scale ≥80th Percentile 2.0x

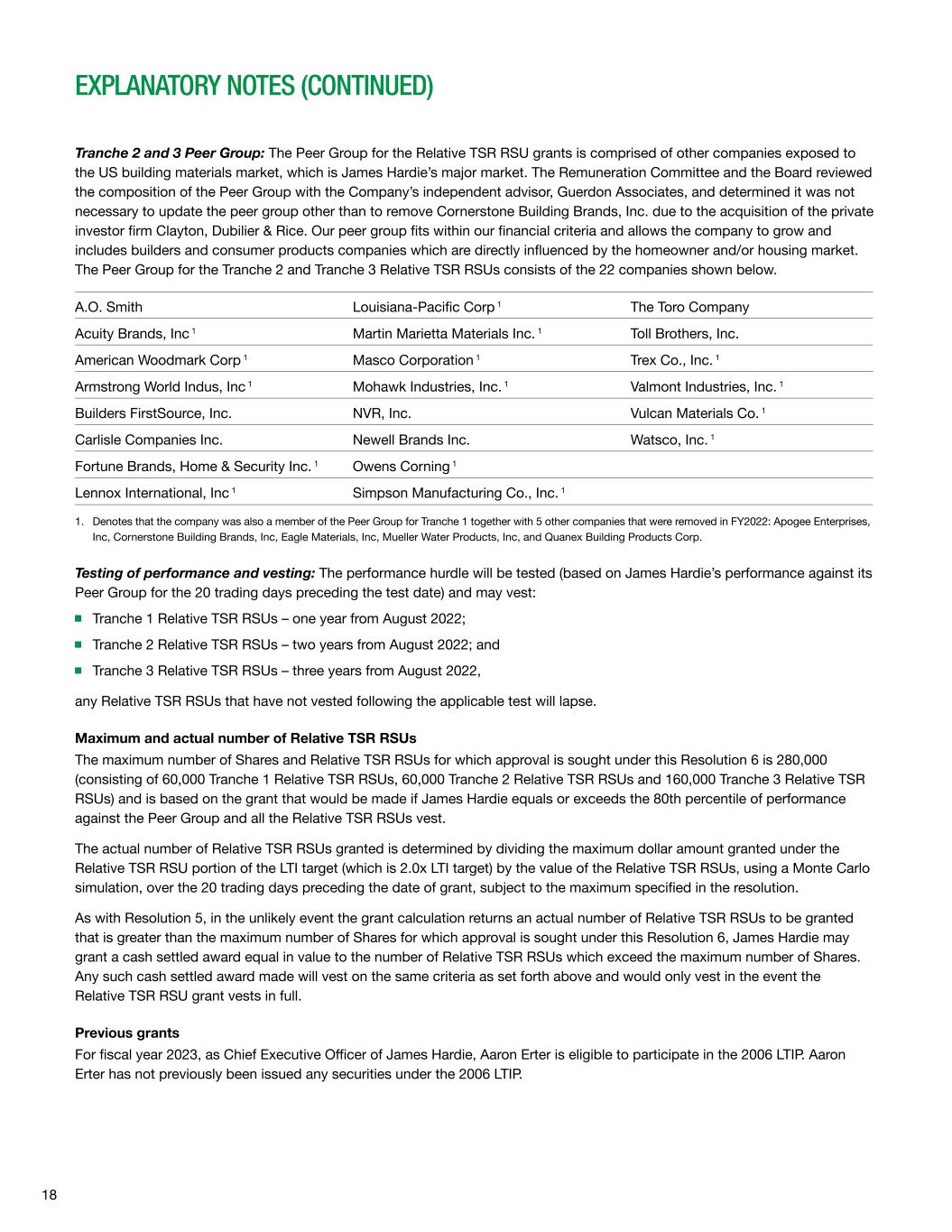

18 EXPLANATORY NOTES (CONTINUED) Tranche 2 and 3 Peer Group: The Peer Group for the Relative TSR RSU grants is comprised of other companies exposed to the US building materials market, which is James Hardie’s major market. The Remuneration Committee and the Board reviewed the composition of the Peer Group with the Company’s independent advisor, Guerdon Associates, and determined it was not necessary to update the peer group other than to remove Cornerstone Building Brands, Inc. due to the acquisition of the private investor firm Clayton, Dubilier & Rice. Our peer group fits within our financial criteria and allows the company to grow and includes builders and consumer products companies which are directly influenced by the homeowner and/or housing market. The Peer Group for the Tranche 2 and Tranche 3 Relative TSR RSUs consists of the 22 companies shown below. A.O. Smith Louisiana-Pacific Corp 1 The Toro Company Acuity Brands, Inc 1 Martin Marietta Materials Inc. 1 Toll Brothers, Inc. American Woodmark Corp 1 Masco Corporation 1 Trex Co., Inc. 1 Armstrong World Indus, Inc 1 Mohawk Industries, Inc. 1 Valmont Industries, Inc. 1 Builders FirstSource, Inc. NVR, Inc. Vulcan Materials Co. 1 Carlisle Companies Inc. Newell Brands Inc. Watsco, Inc. 1 Fortune Brands, Home & Security Inc. 1 Owens Corning 1 Lennox International, Inc 1 Simpson Manufacturing Co., Inc. 1 1. Denotes that the company was also a member of the Peer Group for Tranche 1 together with 5 other companies that were removed in FY2022: Apogee Enterprises, Inc, Cornerstone Building Brands, Inc, Eagle Materials, Inc, Mueller Water Products, Inc, and Quanex Building Products Corp. Testing of performance and vesting: The performance hurdle will be tested (based on James Hardie’s performance against its Peer Group for the 20 trading days preceding the test date) and may vest: Tranche 1 Relative TSR RSUs – one year from August 2022; Tranche 2 Relative TSR RSUs – two years from August 2022; and Tranche 3 Relative TSR RSUs – three years from August 2022, any Relative TSR RSUs that have not vested following the applicable test will lapse. Maximum and actual number of Relative TSR RSUs The maximum number of Shares and Relative TSR RSUs for which approval is sought under this Resolution 6 is 280,000 (consisting of 60,000 Tranche 1 Relative TSR RSUs, 60,000 Tranche 2 Relative TSR RSUs and 160,000 Tranche 3 Relative TSR RSUs) and is based on the grant that would be made if James Hardie equals or exceeds the 80th percentile of performance against the Peer Group and all the Relative TSR RSUs vest. The actual number of Relative TSR RSUs granted is determined by dividing the maximum dollar amount granted under the Relative TSR RSU portion of the LTI target (which is 2.0x LTI target) by the value of the Relative TSR RSUs, using a Monte Carlo simulation, over the 20 trading days preceding the date of grant, subject to the maximum specified in the resolution. As with Resolution 5, in the unlikely event the grant calculation returns an actual number of Relative TSR RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 6, James Hardie may grant a cash settled award equal in value to the number of Relative TSR RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the Relative TSR RSU grant vests in full. Previous grants For fiscal year 2023, as Chief Executive Officer of James Hardie, Aaron Erter is eligible to participate in the 2006 LTIP. Aaron Erter has not previously been issued any securities under the 2006 LTIP.

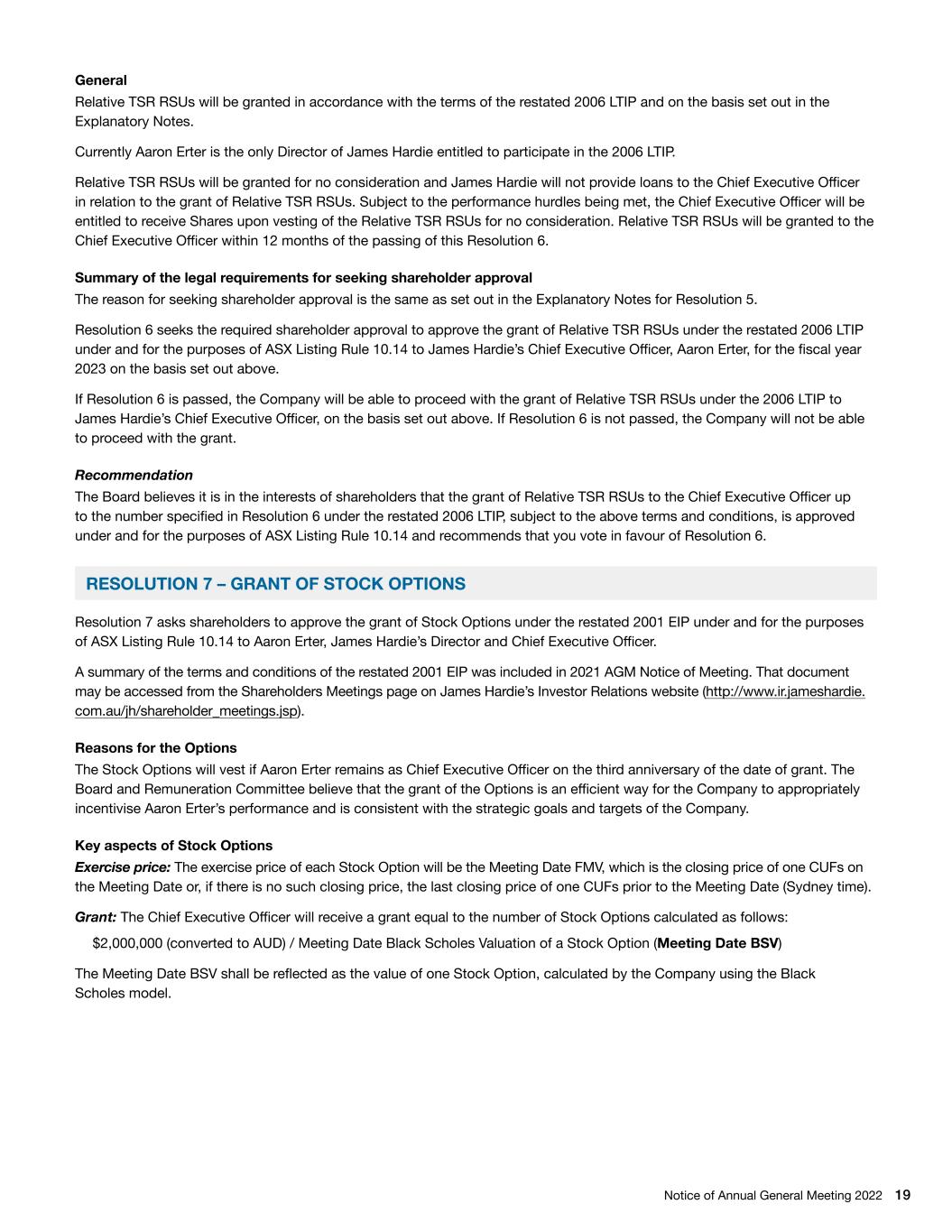

Notice of Annual General Meeting 2022 19 General Relative TSR RSUs will be granted in accordance with the terms of the restated 2006 LTIP and on the basis set out in the Explanatory Notes. Currently Aaron Erter is the only Director of James Hardie entitled to participate in the 2006 LTIP. Relative TSR RSUs will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Officer in relation to the grant of Relative TSR RSUs. Subject to the performance hurdles being met, the Chief Executive Officer will be entitled to receive Shares upon vesting of the Relative TSR RSUs for no consideration. Relative TSR RSUs will be granted to the Chief Executive Officer within 12 months of the passing of this Resolution 6. Summary of the legal requirements for seeking shareholder approval The reason for seeking shareholder approval is the same as set out in the Explanatory Notes for Resolution 5. Resolution 6 seeks the required shareholder approval to approve the grant of Relative TSR RSUs under the restated 2006 LTIP under and for the purposes of ASX Listing Rule 10.14 to James Hardie’s Chief Executive Officer, Aaron Erter, for the fiscal year 2023 on the basis set out above. If Resolution 6 is passed, the Company will be able to proceed with the grant of Relative TSR RSUs under the 2006 LTIP to James Hardie’s Chief Executive Officer, on the basis set out above. If Resolution 6 is not passed, the Company will not be able to proceed with the grant. Recommendation The Board believes it is in the interests of shareholders that the grant of Relative TSR RSUs to the Chief Executive Officer up to the number specified in Resolution 6 under the restated 2006 LTIP, subject to the above terms and conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and recommends that you vote in favour of Resolution 6. RESOLUTION 7 – GRANT OF STOCK OPTIONS Resolution 7 asks shareholders to approve the grant of Stock Options under the restated 2001 EIP under and for the purposes of ASX Listing Rule 10.14 to Aaron Erter, James Hardie’s Director and Chief Executive Officer. A summary of the terms and conditions of the restated 2001 EIP was included in 2021 AGM Notice of Meeting. That document may be accessed from the Shareholders Meetings page on James Hardie’s Investor Relations website (http://www.ir.jameshardie. com.au/jh/shareholder_meetings.jsp). Reasons for the Options The Stock Options will vest if Aaron Erter remains as Chief Executive Officer on the third anniversary of the date of grant. The Board and Remuneration Committee believe that the grant of the Options is an efficient way for the Company to appropriately incentivise Aaron Erter’s performance and is consistent with the strategic goals and targets of the Company. Key aspects of Stock Options Exercise price: The exercise price of each Stock Option will be the Meeting Date FMV, which is the closing price of one CUFs on the Meeting Date or, if there is no such closing price, the last closing price of one CUFs prior to the Meeting Date (Sydney time). Grant: The Chief Executive Officer will receive a grant equal to the number of Stock Options calculated as follows: $2,000,000 (converted to AUD) / Meeting Date Black Scholes Valuation of a Stock Option (Meeting Date BSV) The Meeting Date BSV shall be reflected as the value of one Stock Option, calculated by the Company using the Black Scholes model.

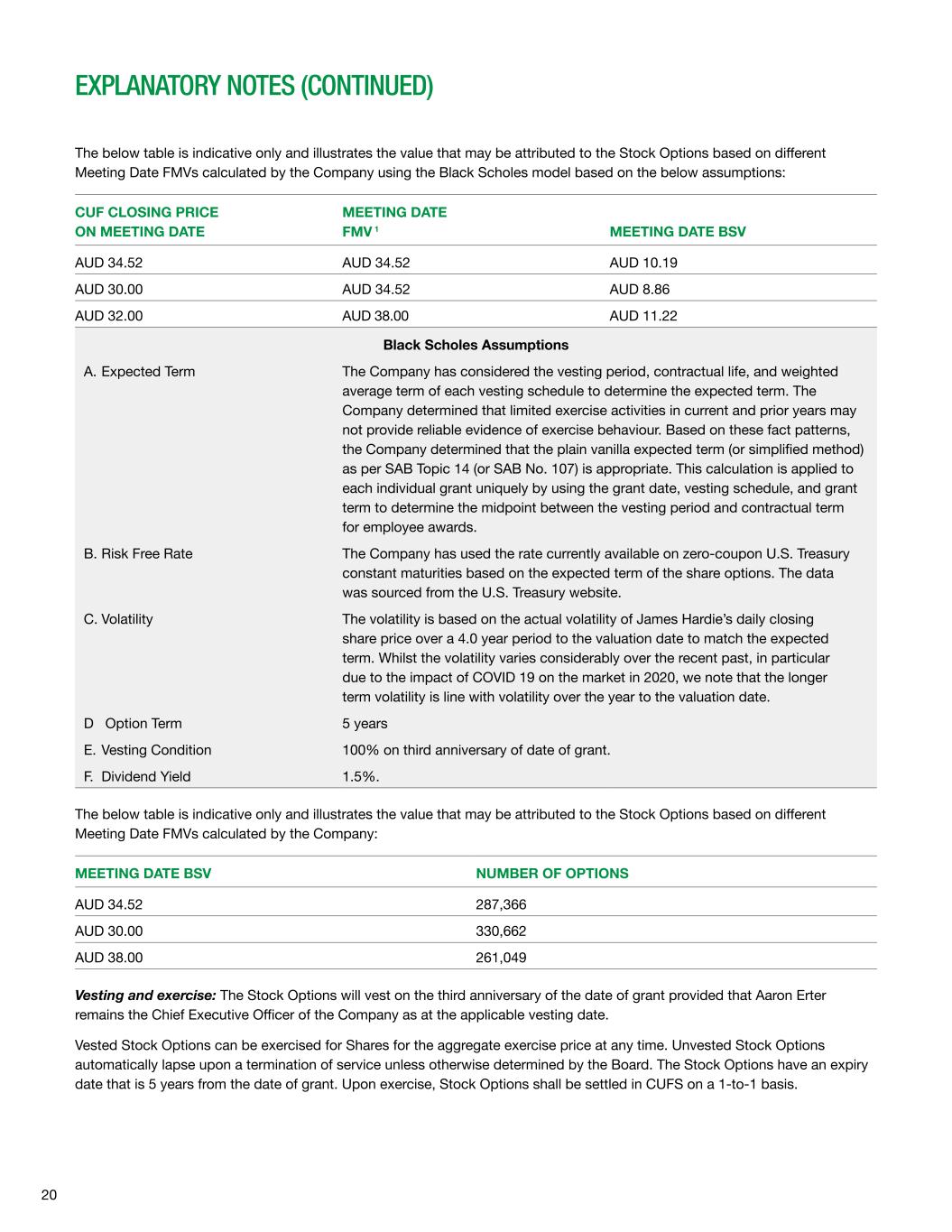

20 EXPLANATORY NOTES (CONTINUED) The below table is indicative only and illustrates the value that may be attributed to the Stock Options based on different Meeting Date FMVs calculated by the Company using the Black Scholes model based on the below assumptions: CUF CLOSING PRICE ON MEETING DATE MEETING DATE FMV 1 MEETING DATE BSV AUD 34.52 AUD 34.52 AUD 10.19 AUD 30.00 AUD 34.52 AUD 8.86 AUD 32.00 AUD 38.00 AUD 11.22 Black Scholes Assumptions A. Expected Term The Company has considered the vesting period, contractual life, and weighted average term of each vesting schedule to determine the expected term. The Company determined that limited exercise activities in current and prior years may not provide reliable evidence of exercise behaviour. Based on these fact patterns, the Company determined that the plain vanilla expected term (or simplified method) as per SAB Topic 14 (or SAB No. 107) is appropriate. This calculation is applied to each individual grant uniquely by using the grant date, vesting schedule, and grant term to determine the midpoint between the vesting period and contractual term for employee awards. B. Risk Free Rate The Company has used the rate currently available on zero-coupon U.S. Treasury constant maturities based on the expected term of the share options. The data was sourced from the U.S. Treasury website. C. Volatility The volatility is based on the actual volatility of James Hardie’s daily closing share price over a 4.0 year period to the valuation date to match the expected term. Whilst the volatility varies considerably over the recent past, in particular due to the impact of COVID 19 on the market in 2020, we note that the longer term volatility is line with volatility over the year to the valuation date. D Option Term 5 years E. Vesting Condition 100% on third anniversary of date of grant. F. Dividend Yield 1.5%. The below table is indicative only and illustrates the value that may be attributed to the Stock Options based on different Meeting Date FMVs calculated by the Company: MEETING DATE BSV NUMBER OF OPTIONS AUD 34.52 287,366 AUD 30.00 330,662 AUD 38.00 261,049 Vesting and exercise: The Stock Options will vest on the third anniversary of the date of grant provided that Aaron Erter remains the Chief Executive Officer of the Company as at the applicable vesting date. Vested Stock Options can be exercised for Shares for the aggregate exercise price at any time. Unvested Stock Options automatically lapse upon a termination of service unless otherwise determined by the Board. The Stock Options have an expiry date that is 5 years from the date of grant. Upon exercise, Stock Options shall be settled in CUFS on a 1-to-1 basis.

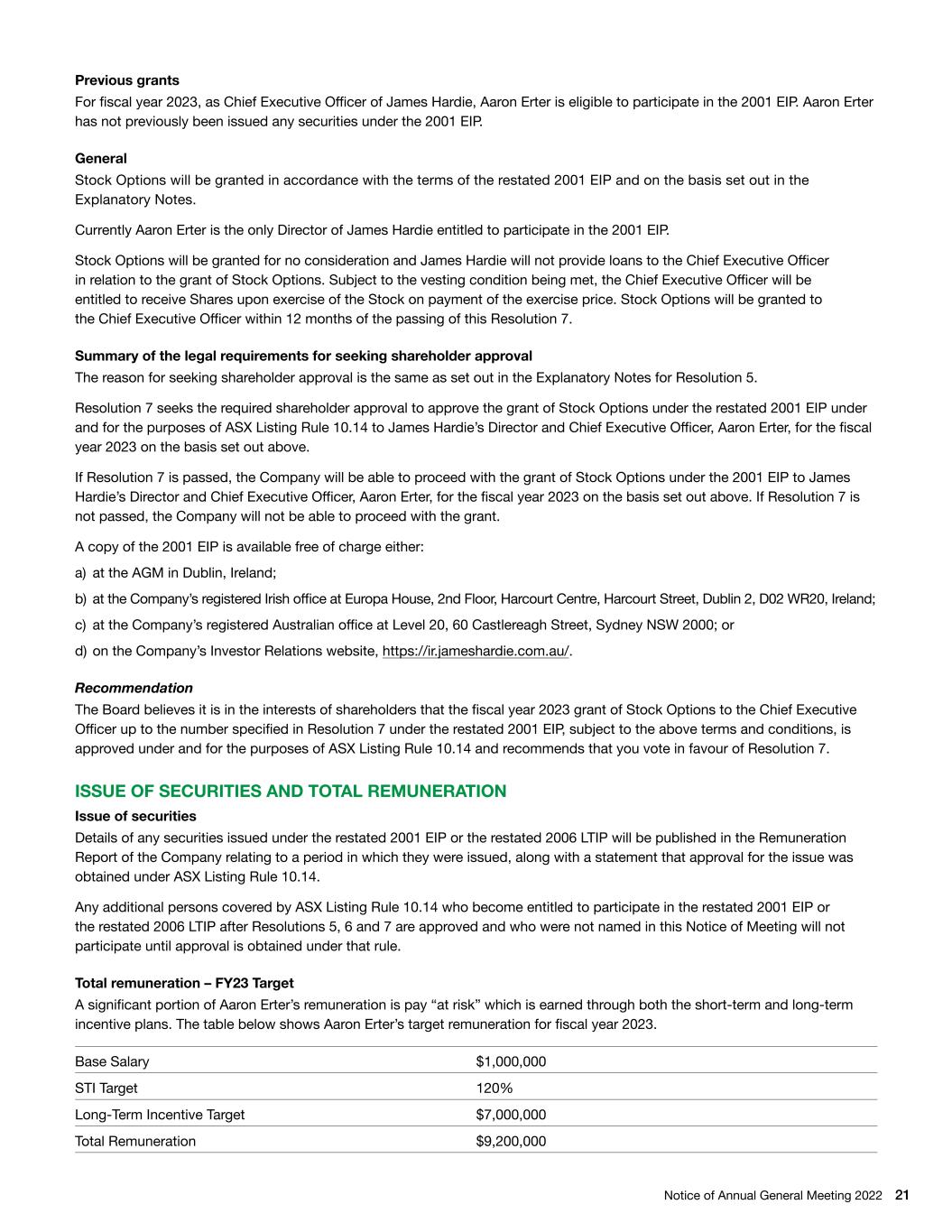

Notice of Annual General Meeting 2022 21 Previous grants For fiscal year 2023, as Chief Executive Officer of James Hardie, Aaron Erter is eligible to participate in the 2001 EIP. Aaron Erter has not previously been issued any securities under the 2001 EIP. General Stock Options will be granted in accordance with the terms of the restated 2001 EIP and on the basis set out in the Explanatory Notes. Currently Aaron Erter is the only Director of James Hardie entitled to participate in the 2001 EIP. Stock Options will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Officer in relation to the grant of Stock Options. Subject to the vesting condition being met, the Chief Executive Officer will be entitled to receive Shares upon exercise of the Stock on payment of the exercise price. Stock Options will be granted to the Chief Executive Officer within 12 months of the passing of this Resolution 7. Summary of the legal requirements for seeking shareholder approval The reason for seeking shareholder approval is the same as set out in the Explanatory Notes for Resolution 5. Resolution 7 seeks the required shareholder approval to approve the grant of Stock Options under the restated 2001 EIP under and for the purposes of ASX Listing Rule 10.14 to James Hardie’s Director and Chief Executive Officer, Aaron Erter, for the fiscal year 2023 on the basis set out above. If Resolution 7 is passed, the Company will be able to proceed with the grant of Stock Options under the 2001 EIP to James Hardie’s Director and Chief Executive Officer, Aaron Erter, for the fiscal year 2023 on the basis set out above. If Resolution 7 is not passed, the Company will not be able to proceed with the grant. A copy of the 2001 EIP is available free of charge either: a) at the AGM in Dublin, Ireland; b) at the Company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland; c) at the Company’s registered Australian office at Level 20, 60 Castlereagh Street, Sydney NSW 2000; or d) on the Company’s Investor Relations website, https://ir.jameshardie.com.au/. Recommendation The Board believes it is in the interests of shareholders that the fiscal year 2023 grant of Stock Options to the Chief Executive Officer up to the number specified in Resolution 7 under the restated 2001 EIP, subject to the above terms and conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and recommends that you vote in favour of Resolution 7. ISSUE OF SECURITIES AND TOTAL REMUNERATION Issue of securities Details of any securities issued under the restated 2001 EIP or the restated 2006 LTIP will be published in the Remuneration Report of the Company relating to a period in which they were issued, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in the restated 2001 EIP or the restated 2006 LTIP after Resolutions 5, 6 and 7 are approved and who were not named in this Notice of Meeting will not participate until approval is obtained under that rule. Total remuneration – FY23 Target A significant portion of Aaron Erter’s remuneration is pay “at risk” which is earned through both the short-term and long-term incentive plans. The table below shows Aaron Erter’s target remuneration for fiscal year 2023. Base Salary $1,000,000 STI Target 120% Long-Term Incentive Target $7,000,000 Total Remuneration $9,200,000

22 EXPLANATORY NOTES (CONTINUED) RESOLUTION 8 – APPROVAL OF ISSUE OF SHARES UNDER THE JAMES HARDIE 2020 NON-EXECUTIVE DIRECTOR PLAN Resolution 8 asks shareholders to approve the issue of Shares (including those underlying any CUFS, ADSs or other equivalent listed depositary receipt which represents a beneficial interest in a Share (collectively, LDRs)) for cash to Persio Lisboa, Anne Lloyd, Rada Rodriguez, Nigel Stein, Harold Wiens, Suzanne Rowland and Peter John Davis (subject to his election as a director of the Company at this AGM) until renewal of the NED Equity Plan. At the November 2020 Annual General Meeting, shareholders approved the NED Equity Plan and the issue of Shares for cash to participants to facilitate equity ownership for non-executive directors. Under the NED Equity Plan approved in 2020, the Administrator (being the Board or such committee(s) appointed by the Board from time to time) may invite “Eligible Participants” (non-executive directors or proposed non-executive directors or their nominees) to apply part or all of the cash component of their non-executive director fees for services to the Board to acquire Shares, which include any Applicable Securities. Having taken advice from the company’s independent advisers, Guerdon and Associates and FW Cook, the Remuneration Committee and the Board have determined that it is appropriate for a fixed portion of non-executive director fees to be paid in Shares, rather than each non-executive director making an election, until such time as each non-executive Director has accumulated 1.5 times (and 2 times for the Chairperson) of their non-executive director fee base in Shares, which includes any represented by LDRs (Ownership Target). The portion will be the same for each non-executive director and will be fixed prior to 31 March 2023. When a non-executive director has met the Ownership Target they may elect to continue to receive a fixed portion of their non-executive director fees in Shares, or alternatively receive all of their non-executive director fees in cash. Issue of Shares under the NED Equity Plan The number of Applicable Securities that an Eligible Participant will receive is calculated in accordance with the following formula (rounded down to the nearest whole number): Number of Applicable Securities = Director Fee Amount for the relevant quarter / Fair Market Value The Director Fee Amount will be the proportion of the non-executive director fees that the Remuneration Committee and the Board determine will be paid in Applicable Securities. The Director Fee Amount will not exceed 50% of each non-executive director’s fee, and the proportion will be the same for each director. The Fair Market Value will be based on the volume weighted average closing price for a CUFS or ADS on the ASX or NYSE, as the case may be, during a period of 5 trading days commencing on the first trading day following the announcement of the Company’s quarterly results. A currency exchange calculation may also be required as non-executive director fees are usually paid in USD$ and a CUFS trades in AUD$. The Shares underlying the LDRs shall not be issued at a discount to their “nominal value”. The Applicable Securities will be issued quarterly subject to compliance with James Hardie’s Insider Trading Policy. On issue, the Applicable Securities will rank equally with the same class of Applicable Securities, and will carry the same dividend, voting and other rights. Eligible Participants will not have dividend or voting rights in respect of the Applicable Securities until such time as they are issued. Eligible Participants will have the right to elect to have Applicable Securities issued to them personally or to a nominee. The Applicable Securities issued to the Eligible Participants or their nominee can be traded on the ASX, NYSE or other applicable stock exchange, subject to insider trading laws and the James Hardie Insider Trading Policy.

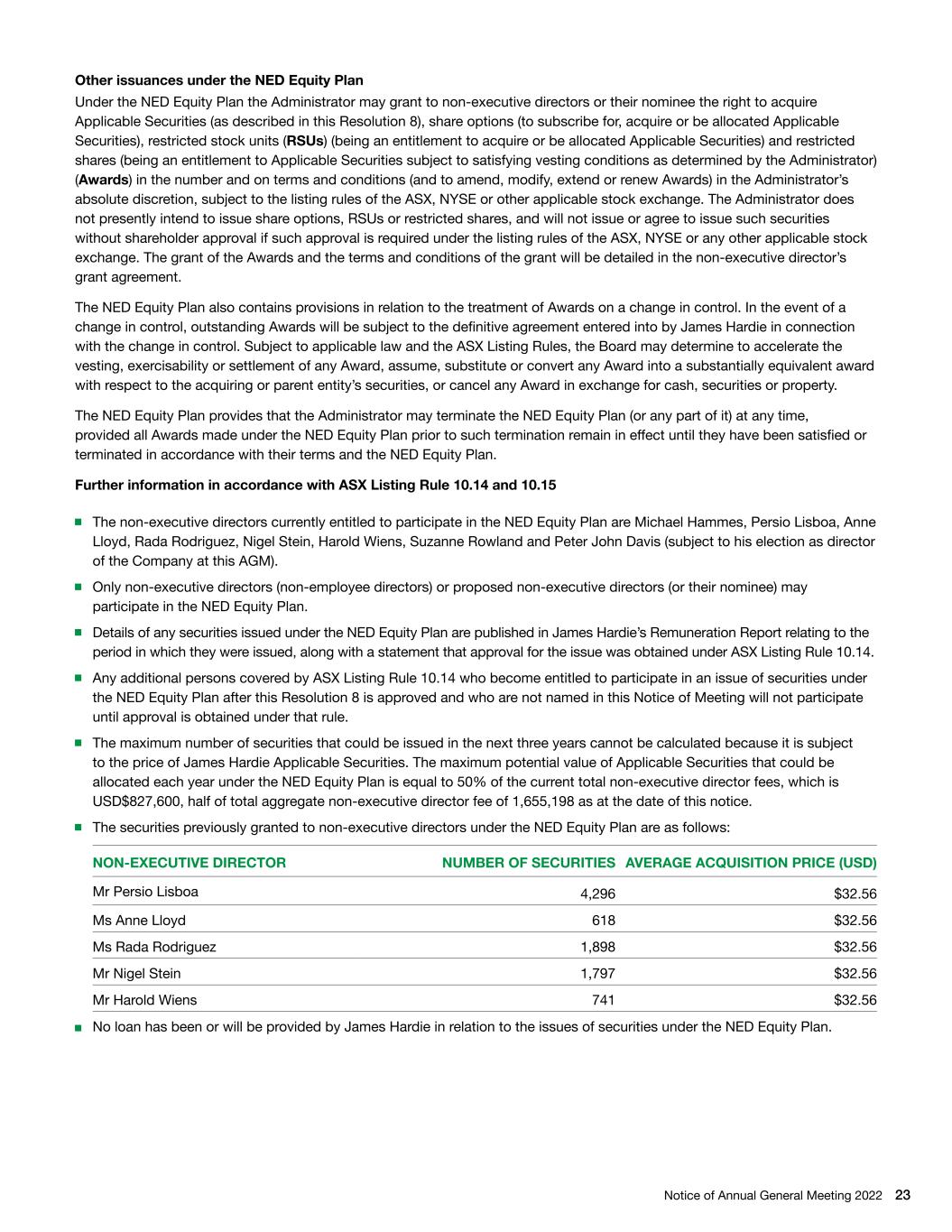

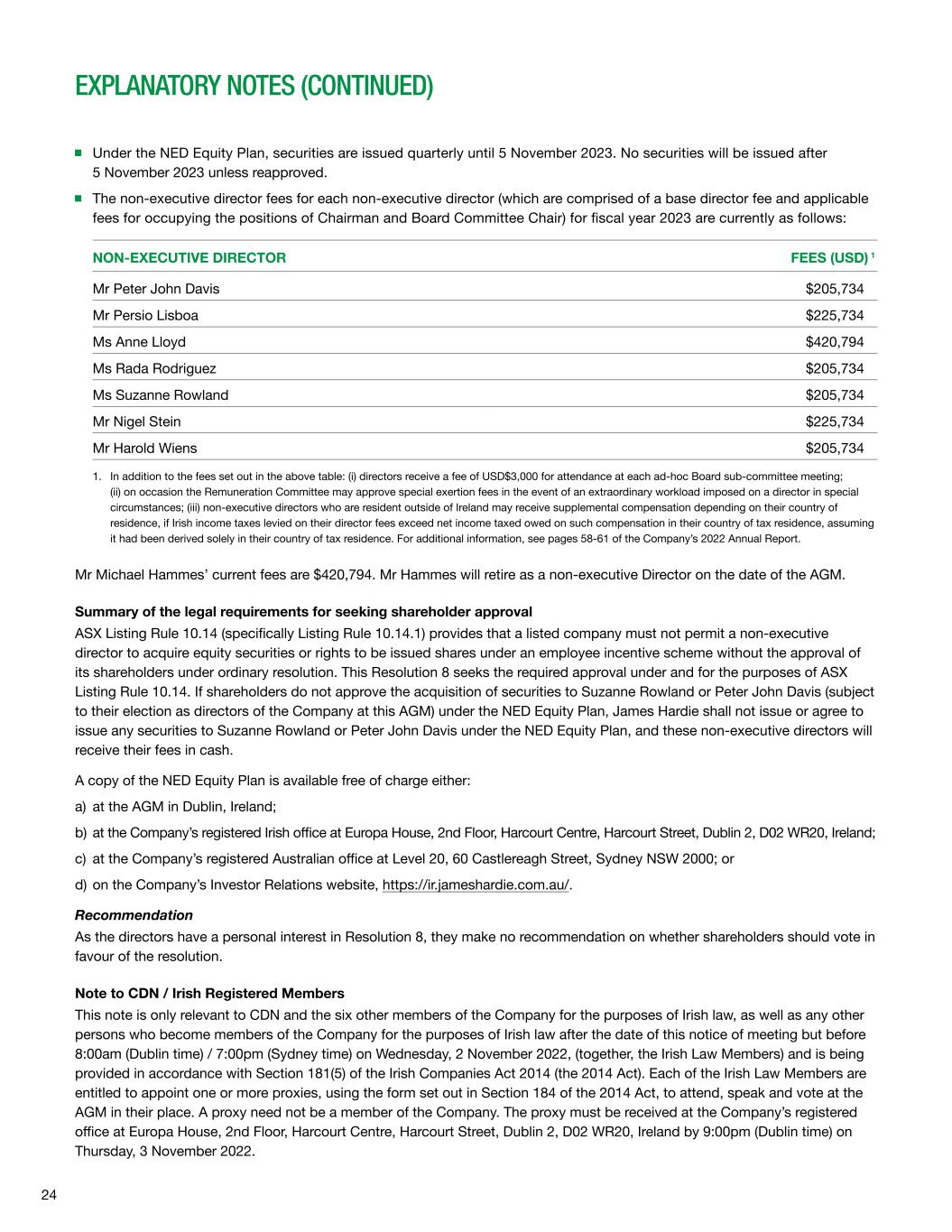

Notice of Annual General Meeting 2022 23 Other issuances under the NED Equity Plan Under the NED Equity Plan the Administrator may grant to non-executive directors or their nominee the right to acquire Applicable Securities (as described in this Resolution 8), share options (to subscribe for, acquire or be allocated Applicable Securities), restricted stock units (RSUs) (being an entitlement to acquire or be allocated Applicable Securities) and restricted shares (being an entitlement to Applicable Securities subject to satisfying vesting conditions as determined by the Administrator) (Awards) in the number and on terms and conditions (and to amend, modify, extend or renew Awards) in the Administrator’s absolute discretion, subject to the listing rules of the ASX, NYSE or other applicable stock exchange. The Administrator does not presently intend to issue share options, RSUs or restricted shares, and will not issue or agree to issue such securities without shareholder approval if such approval is required under the listing rules of the ASX, NYSE or any other applicable stock exchange. The grant of the Awards and the terms and conditions of the grant will be detailed in the non-executive director’s grant agreement. The NED Equity Plan also contains provisions in relation to the treatment of Awards on a change in control. In the event of a change in control, outstanding Awards will be subject to the definitive agreement entered into by James Hardie in connection with the change in control. Subject to applicable law and the ASX Listing Rules, the Board may determine to accelerate the vesting, exercisability or settlement of any Award, assume, substitute or convert any Award into a substantially equivalent award with respect to the acquiring or parent entity’s securities, or cancel any Award in exchange for cash, securities or property. The NED Equity Plan provides that the Administrator may terminate the NED Equity Plan (or any part of it) at any time, provided all Awards made under the NED Equity Plan prior to such termination remain in effect until they have been satisfied or terminated in accordance with their terms and the NED Equity Plan. Further information in accordance with ASX Listing Rule 10.14 and 10.15 The non-executive directors currently entitled to participate in the NED Equity Plan are Michael Hammes, Persio Lisboa, Anne Lloyd, Rada Rodriguez, Nigel Stein, Harold Wiens, Suzanne Rowland and Peter John Davis (subject to his election as director of the Company at this AGM). Only non-executive directors (non-employee directors) or proposed non-executive directors (or their nominee) may participate in the NED Equity Plan. Details of any securities issued under the NED Equity Plan are published in James Hardie’s Remuneration Report relating to the period in which they were issued, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of securities under the NED Equity Plan after this Resolution 8 is approved and who are not named in this Notice of Meeting will not participate until approval is obtained under that rule. The maximum number of securities that could be issued in the next three years cannot be calculated because it is subject to the price of James Hardie Applicable Securities. The maximum potential value of Applicable Securities that could be allocated each year under the NED Equity Plan is equal to 50% of the current total non-executive director fees, which is USD$827,600, half of total aggregate non-executive director fee of 1,655,198 as at the date of this notice. The securities previously granted to non-executive directors under the NED Equity Plan are as follows: NON-EXECUTIVE DIRECTOR NUMBER OF SECURITIES AVERAGE ACQUISITION PRICE (USD) Mr Persio Lisboa 4,296 $32.56 Ms Anne Lloyd 618 $32.56 Ms Rada Rodriguez 1,898 $32.56 Mr Nigel Stein 1,797 $32.56 Mr Harold Wiens 741 $32.56 No loan has been or will be provided by James Hardie in relation to the issues of securities under the NED Equity Plan.