James Hardie Industries plc Europa House 2nd Floor, Harcourt Centre Harcourt Street, Dublin 2, D02 WR20, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland. Directors: Michael Hammes (Chairman, USA), Anne Lloyd (Deputy Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 4 November 2022 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Chairman’s Address to 2022 Annual General Meeting and Presentation Dear Sir/Madam James Hardie Industries plc will be holding its 2022 Annual General Meeting (AGM) on Thursday, 3 November 2022 at 9:00pm (Dublin time) / Friday, 4 November 2022 at 8:00am (Sydney time). As required under ASX Listing Rule 3.13.3, a copy of the Chairman’s Address to the 2022 AGM and the AGM Presentation are attached to this release. Regards Joseph C. Blasko General Counsel & Company Secretary This announcement has been authorised for release by the General Counsel and Company Secretary, Mr Joseph C. Blasko

Chairman’s Address 2022 Annual General Meeting Chairman’s Address 1 Address to the 2022 Annual General Meeting Michael Hammes, Chairman, James Hardie Industries plc Hello and welcome to James Hardie Industries plc’s 2022 Annual General Meeting (AGM), our thirteenth AGM to be held in Dublin. I am pleased to have you join us. A New Chairperson This will be my last James Hardie AGM as your Chairman. I have served you, the shareholders, the company, and the Board for over 15 years, and I am truly proud of what this company has achieved during my tenure. I believe the strategy we have put in place along with the talented and deep leadership team, will continue to drive further growth for James Hardie. It gives me great pleasure to be able to pass on this important role and responsibility to someone the caliber of Anne Lloyd. Anne has been on our Board for four years and has operated within the industry for several decades. Her knowledge of James Hardie operations, the executive leadership team and the building materials industry make her an excellent choice to be the next Chairperson of James Hardie. A new CEO Earlier this year, we commenced the search for a new CEO and I’m very pleased that we welcomed Aaron Erter to James Hardie in September. Our search was comprehensive and conducted by global executive recruitment firm Heidrick & Struggles, who identified a number of outstanding candidates. Following a thorough evaluation process, the Board concluded that Aaron’s combination of experience, capabilities and leadership attributes was the ideal fit to lead James Hardie. Aaron is an exceptional leader and we’re excited that he has joined James Hardie. Aaron has more than two decades of experience leading large and complex industrial and consumer businesses, including various global leadership roles at Sherwin Williams, as well as the last two years as the CEO of PLZ Corporation. Aaron brings a wealth of experience and passion to James Hardie and will be supported by our highly capable leadership team. James Hardie is a high-performance global company that has built its presence and reputation over many years through fast-paced and results oriented work. The Board is confident that Aaron has the right mix of attributes to continue the considerable growth ambitions of the business while strengthening our culture as the business evolves and expands Aaron is a leader of exceptional caliber and joins James Hardie at a pivotal time in our history; we are in a strong financial position, we have the right foundational strategy, and we have an excellent core leadership team. Aaron brings experience leading global teams and the ability to execute strategies that leverage a company’s value proposition to drive profitable growth. Aaron has proven capability and extensive experience in understanding the consumers’ needs, commercializing the right innovative products to meet those needs, and driving growth through the right targeted marketing. Zero Harm and ESG I am pleased with our team’s achievement delivering James Hardie’s second sustainability report in fiscal year 2023. In addition, I am proud to report that we appointed our first Chief Sustainability Officer, Jill Kolling earlier this year. We recognize that keeping environmental and social considerations at the core of everything we do is fundamental to our success, and the report plus Ms. Kolling’s appointment represents a significant milestone in our sustainability journey. The Group’s sustainability progress reflects the efforts of our global team. Their passion, expertise and capability drives the success of our business outcomes, and examples of our progress in fiscal year 2022 can be found here.

Chairman’s Address 2022 Annual General Meeting Chairman’s Address 2 Aaron and his leadership team are focused on continuous improvement within the ESG space and have the Board’s full support in this initiative. As our sustainability program progresses, the Board and management are committed to aligning with best-practice reporting standards and frameworks, including those set forth by the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate- related Financial Disclosures (TCFD). A Growth Company James Hardie is a Growth Company and we have a strong historical track record of creating global value; • 11% Global Net Sales, 10 year CAGR • 3x Global Operating cash flow, 3 year average FY22 vs FY12 • 38% Global Adjusted ROCE, avg FY19-FY22 • 16% Global Adjusted Net Income, 10 year CAGR We have the right strategy and people in place to deliver long term sustainable growth. Our proven sustainable growth has come from all 3 regions we operate. In North America, we have grown Net Sales over the last 10 years by 12% CAGR while growing Adjusted EBIT by 16% CAGR. In APAC, in Australian dollars, we have grown Net Sales over the last 10 years by 8% CAGR while growing Adjusted EBIT by 10% CAGR. Finally, during our 4 years in Europe since the acquisition of Fermacell in FY19, in Euros, we have grown Net Sales by 10% CAGR and Adjusted EBIT by 17% CAGR. We continue to see long term growth opportunities in all 3 regions we operate in. At our Investor Day in September, the North American team focused on the Repair & Remodel opportunities in the Northeast and Midwest. In APAC, our team highlighted the significant opportunity to continue to take market share against masonry. While in Europe, the team demonstrated the opportunities for Fiber Cement growth in the Panel and Plank markets, as well as outlining a plan for sustained growth in Fiber Gypsum. We have the opportunities for sustained growth in each region, but more importantly we have the right strategies and enablers in place to execute on these opportunities that will propel growth. These strategies include marketing to the entire value chain and supported by enablers including Market Driven Global Innovation, Marketing to Homeowners in North America and APAC as well as our Global Capacity Expansion. James Hardie’s track record, opportunities, strategies and enablers position the firm for sustained profitable growth. Global Capacity In fiscal year 2022, we announced our global capacity expansion program that will result in new plants being built in all three of our operating regions. Long-term demand for fiber cement is strong, supported by design trends as well as industry labor and skill shortages, which our products look to alleviate. In addition, as we begin to market directly to homeowners and start to expand our product offering beyond the wood-look category, we need to have the right capacity ahead of demand. Delivering Consistent Financial Results The successful execution of James Hardie’s organic global strategic plan and transformation is a testament to the hard work and dedication of all James Hardie employees from around the world. Fiscal year 2022 was our third consecutive year of substantial growth globally. Adjusted Net Income of US$620.7 million is more than two times the Adjusted Net Income result in fiscal year 2019. This transformational growth was delivered across all three regions. Over the three years since we unveiled

Chairman’s Address 2022 Annual General Meeting Chairman’s Address 3 our global strategy, group sales have increased 44% to over US$3.6 billion and adjusted net income grew 107% to US$620.7 million. This exceptional growth is the result of the successful execution of our strategy by our over 5,000 employees across the globe. Asbestos Injury Compensation Fund (AICF) Since the inception of AICF, James Hardie has contributed approximately A$2.0 billion to the fund. We at James Hardie remain committed to AICF and the terms of the Amended and Restated Final Funding Agreement. Board Changes We remain committed to ensuring we have a strong, diverse, and independent Board, and I would like to thank my fellow Board members for their continued support and demonstrated leadership during the year. During 2022, we welcomed Peter John (PJ) Davis. We announced his appointment to our Board in August 2022 and he will be standing for election at this AGM. PJ previously served as Chief Operating Officer (COO) of Bunnings Australia & New Zealand. During his 15-year tenure as COO, the division was one of the most profitable of the Wesfarmers Group. With over 40 years’ experience in various retail and trade formats and home improvement industries, PJ commenced his career on the sales floor and held senior roles in operations, marketing, advertising and merchandising before moving into general management and leading the development of the highly successful Bunnings Warehouse concept. PJ completed the Advanced Management Program at Harvard Business School in Boston, USA and is the Founding Director of ANRA (Australian National Retailers Association) and Foundation Member of the Australian Institute of Company Directors. Closing I would like to close today by extending the Board’s gratitude and thanks to the over 5,000 employees of James Hardie around the world. Your ability to navigate the global market uncertainty while accelerating the strategy and improving the financial results is truly extraordinary and a testament to a strong team that is working globally and cross-functionally. Finally, I would like to congratulate Anne Lloyd on her appointment as Chairperson and I wish her the very best. END Forward-Looking Statements This Chairman’s Address contains forward-looking statements and information that are necessarily subject to risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this release, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2022; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Media Release except as required by law.

Chairman’s Address 2022 Annual General Meeting Chairman’s Address 4 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland.

ANNUAL GENERAL MEETING 3 November 2022 (New York and Dublin) / 4 November 2022 (Sydney)

2 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2022; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID-19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Management Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Consolidated Financial Statements. See the section titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS USE OF NON-GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

Contents are confidential and subject to disclosure and insider trading considerations 3 Michael Hammes, Chairman ANNUAL GENERAL MEETING – CHAIRMAN’S ADDRESS

• Xxx • Xxx *Shareholders should refer to the Notice of Annual General Meeting 2022 for the full text and background to each resolution set forth in the presentation ANNUAL GENERAL MEETING – ITEMS OF BUSINESS*

5 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2022 • To receive and consider the financial statements and the reports of the Board and external auditor for the fiscal year ended 31 March 2022

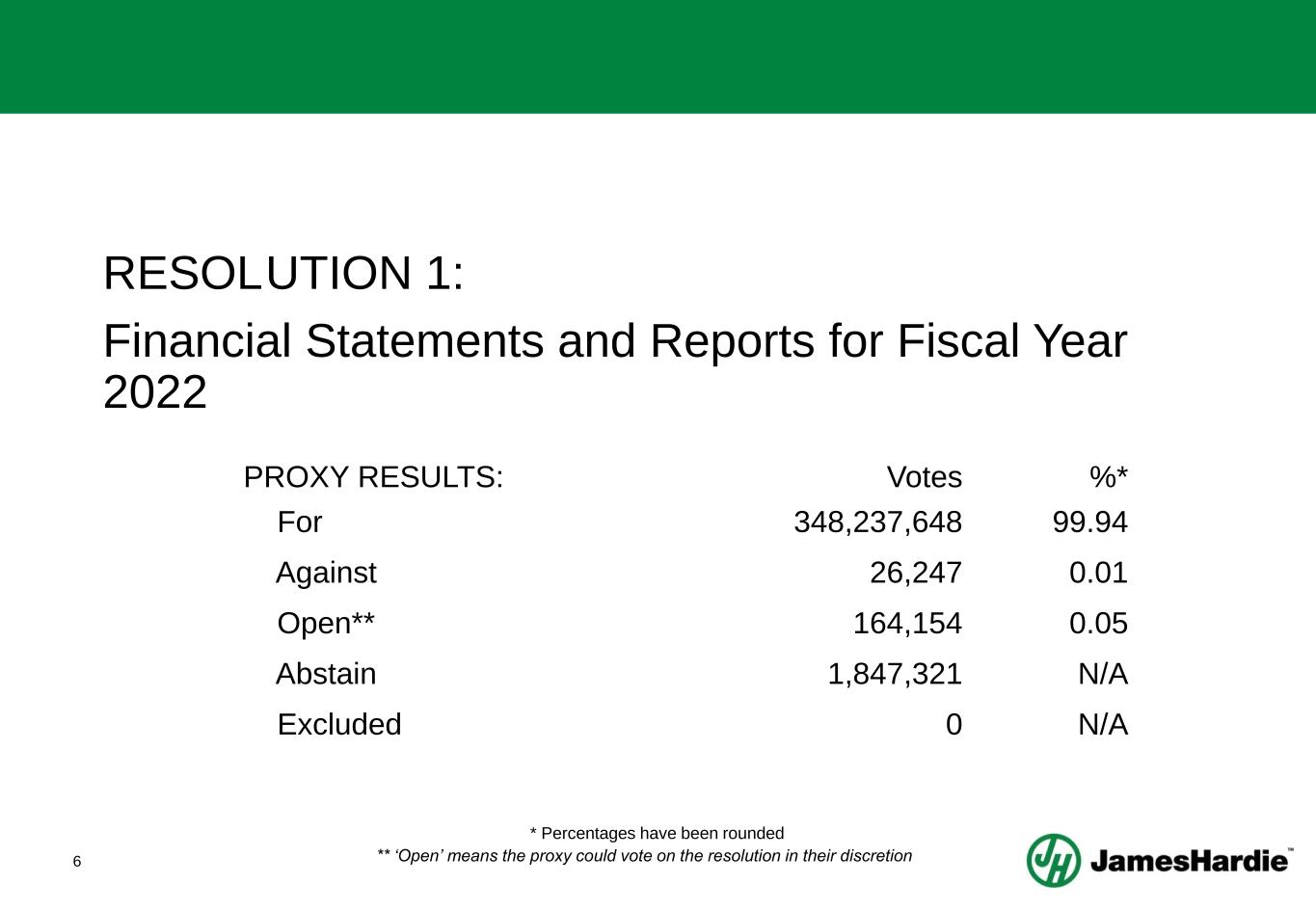

6 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2022 PROXY RESULTS: Votes %* For 348,237,648 99.94 Against 26,247 0.01 Open** 164,154 0.05 Abstain 1,847,321 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

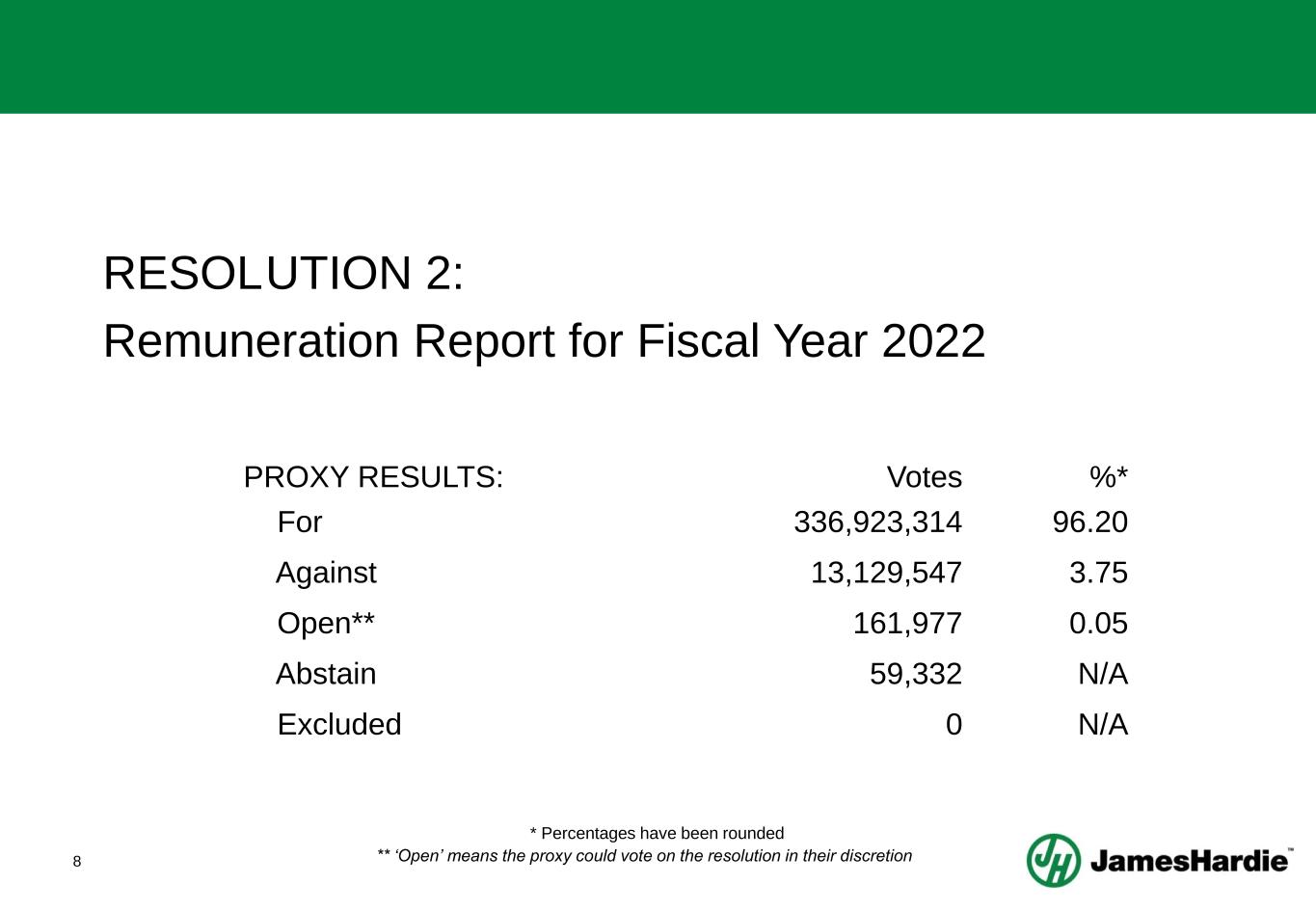

7 RESOLUTION 2: Remuneration Report for Fiscal Year 2022 • To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2022

8 RESOLUTION 2: Remuneration Report for Fiscal Year 2022 PROXY RESULTS: Votes %* For 336,923,314 96.20 Against 13,129,547 3.75 Open** 161,977 0.05 Abstain 59,332 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

9 RESOLUTION 3: Election/Re-election of Directors a. That Peter John Davis be elected as a director b. That Aaron Erter be elected as a director c. That Anne Lloyd be re-elected as a director d. That Rada Rodriguez be re-elected as a director

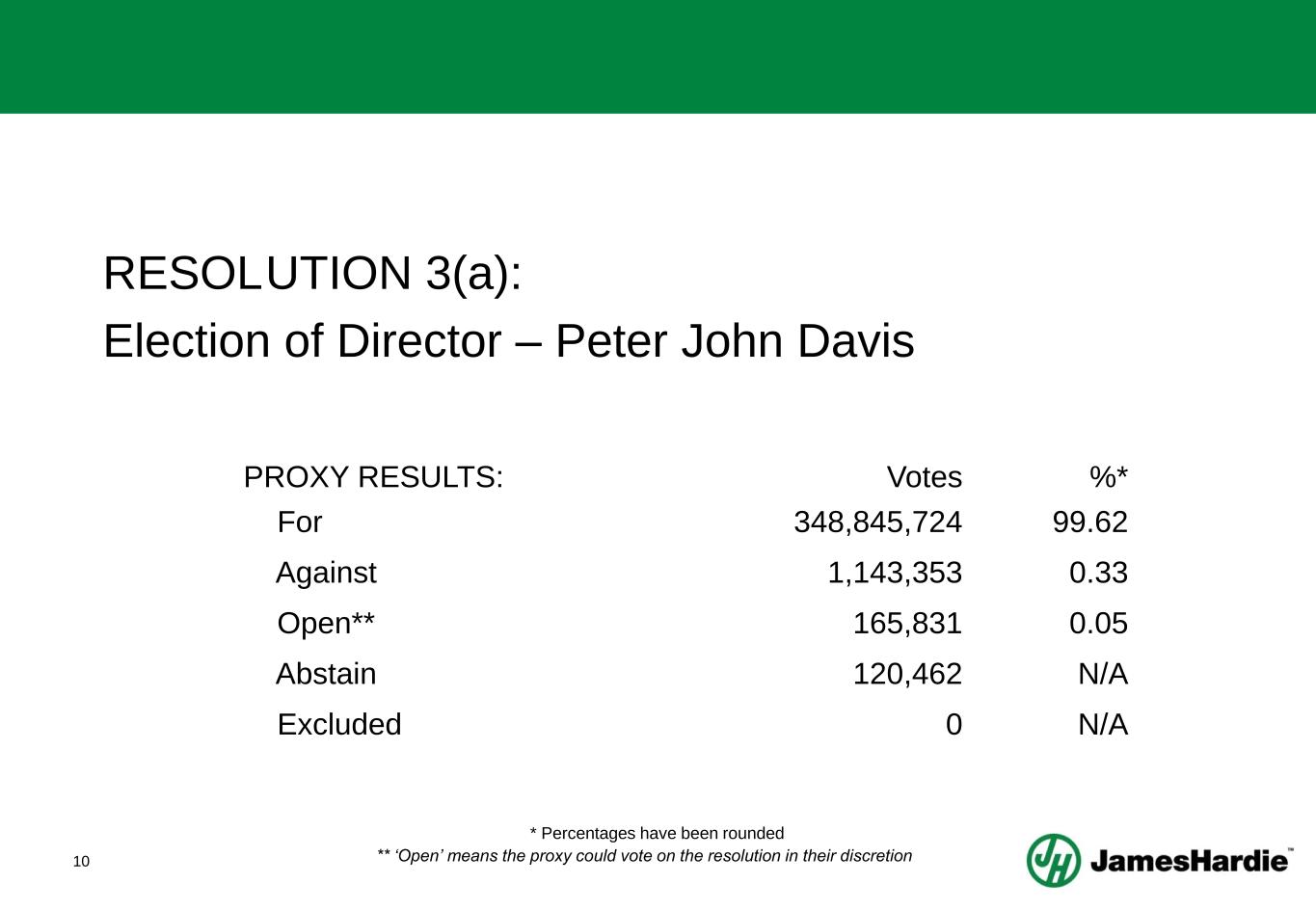

10 RESOLUTION 3(a): Election of Director – Peter John Davis PROXY RESULTS: Votes %* For 348,845,724 99.62 Against 1,143,353 0.33 Open** 165,831 0.05 Abstain 120,462 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

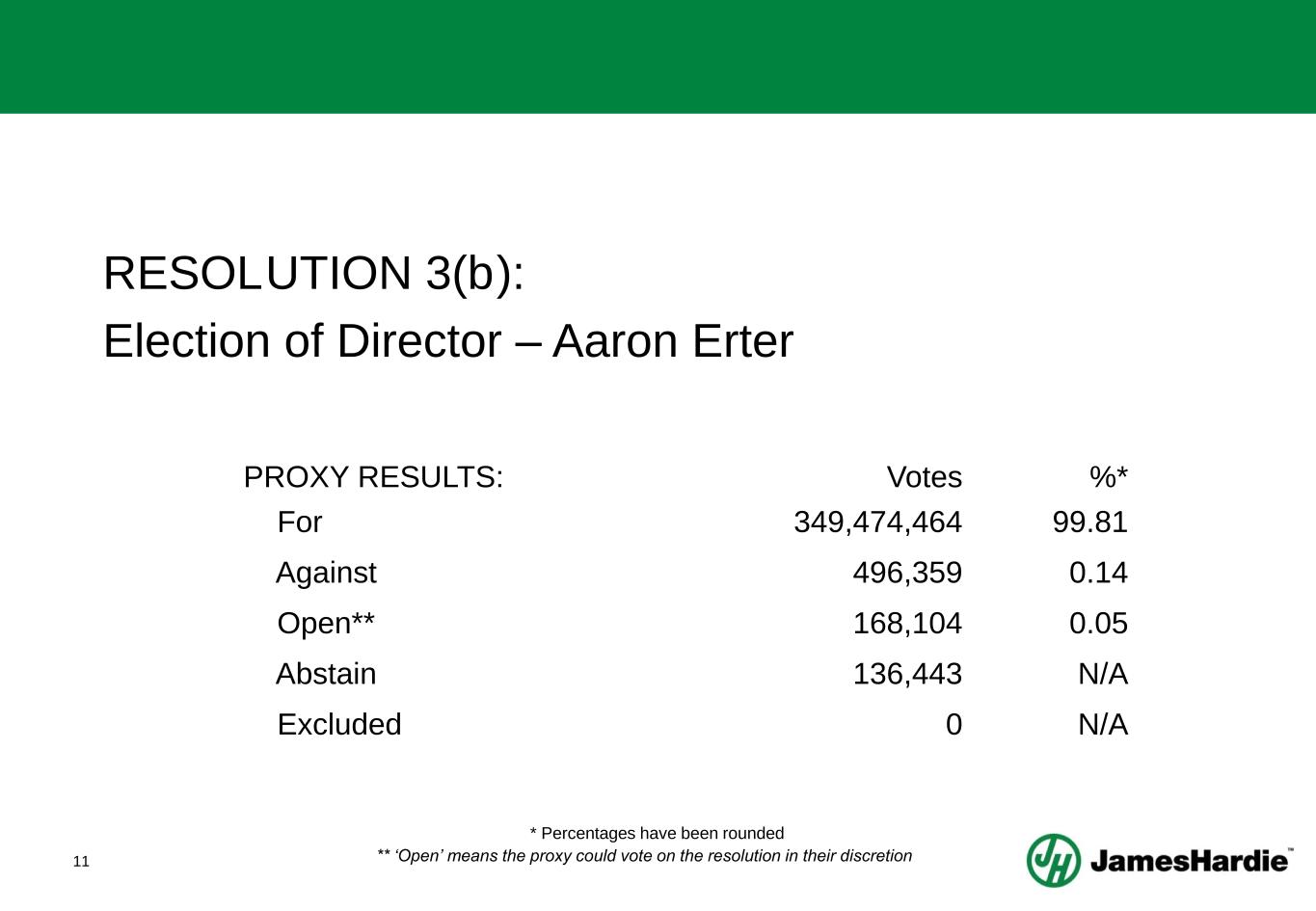

11 RESOLUTION 3(b): Election of Director – Aaron Erter PROXY RESULTS: Votes %* For 349,474,464 99.81 Against 496,359 0.14 Open** 168,104 0.05 Abstain 136,443 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

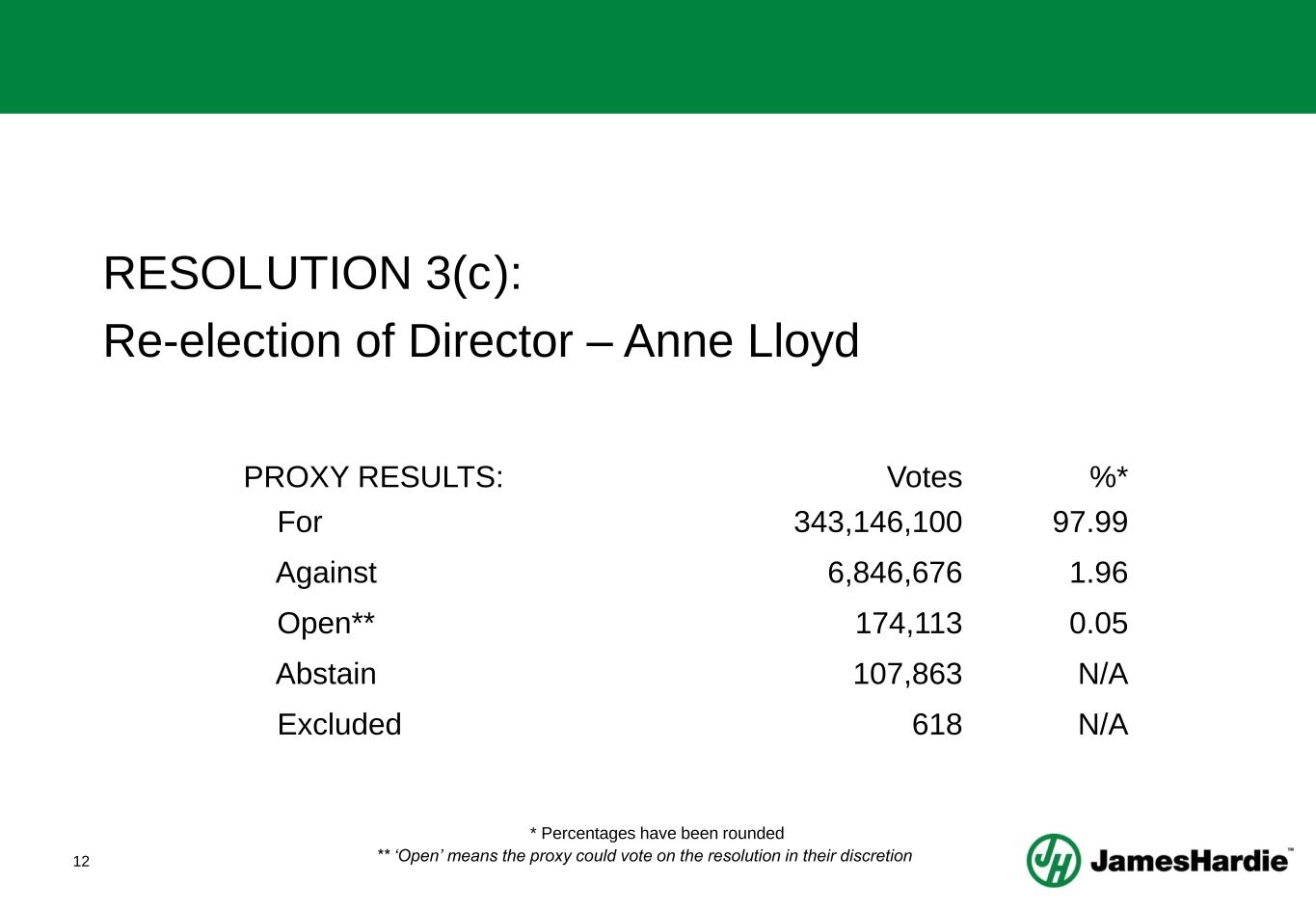

12 RESOLUTION 3(c): Re-election of Director – Anne Lloyd PROXY RESULTS: Votes %* For 343,146,100 97.99 Against 6,846,676 1.96 Open** 174,113 0.05 Abstain 107,863 N/A Excluded 618 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

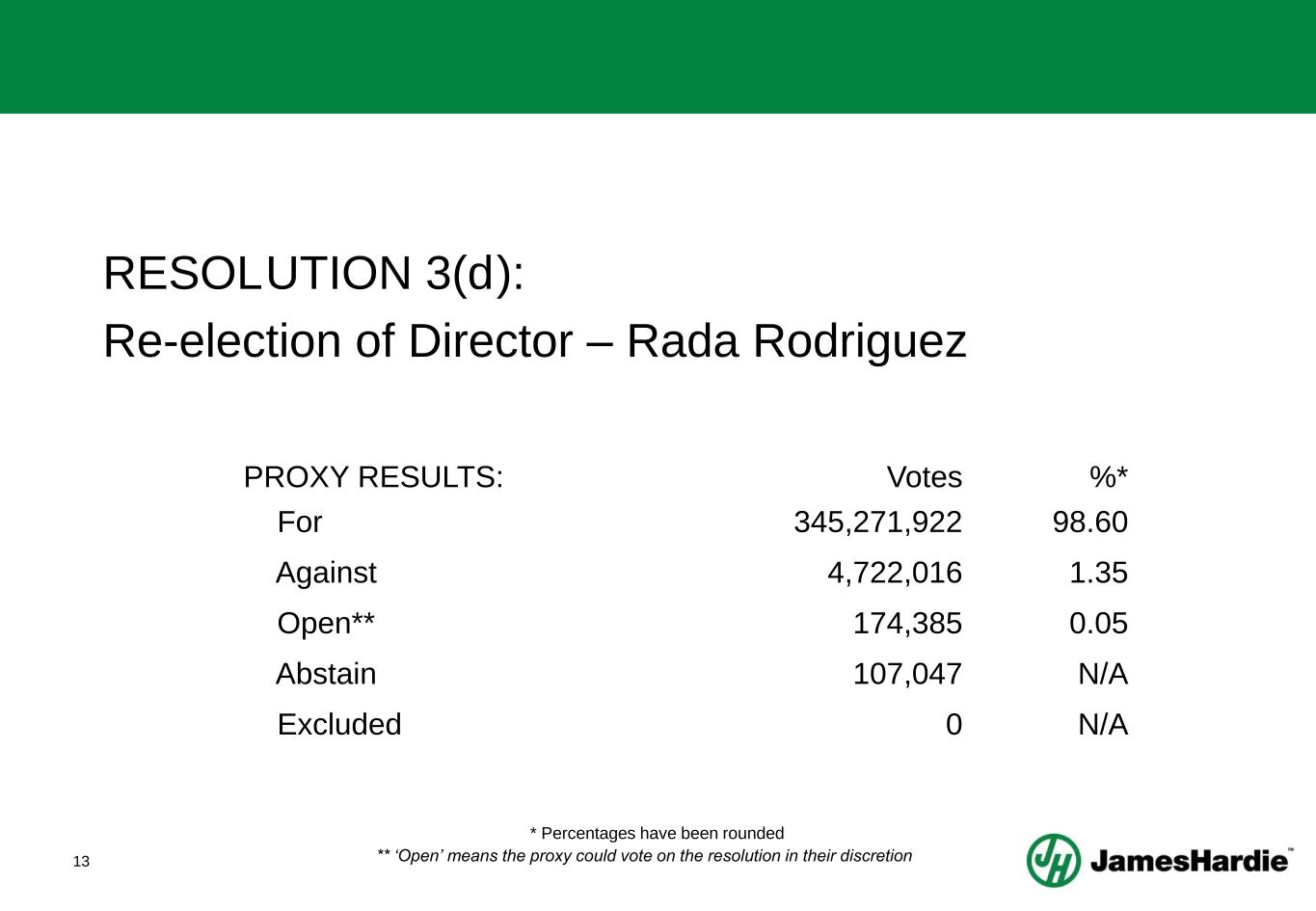

13 RESOLUTION 3(d): Re-election of Director – Rada Rodriguez PROXY RESULTS: Votes %* For 345,271,922 98.60 Against 4,722,016 1.35 Open** 174,385 0.05 Abstain 107,047 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

14 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration • That the Board be authorised to fix the remuneration of the external auditor for the fiscal year ended 31 March 2023

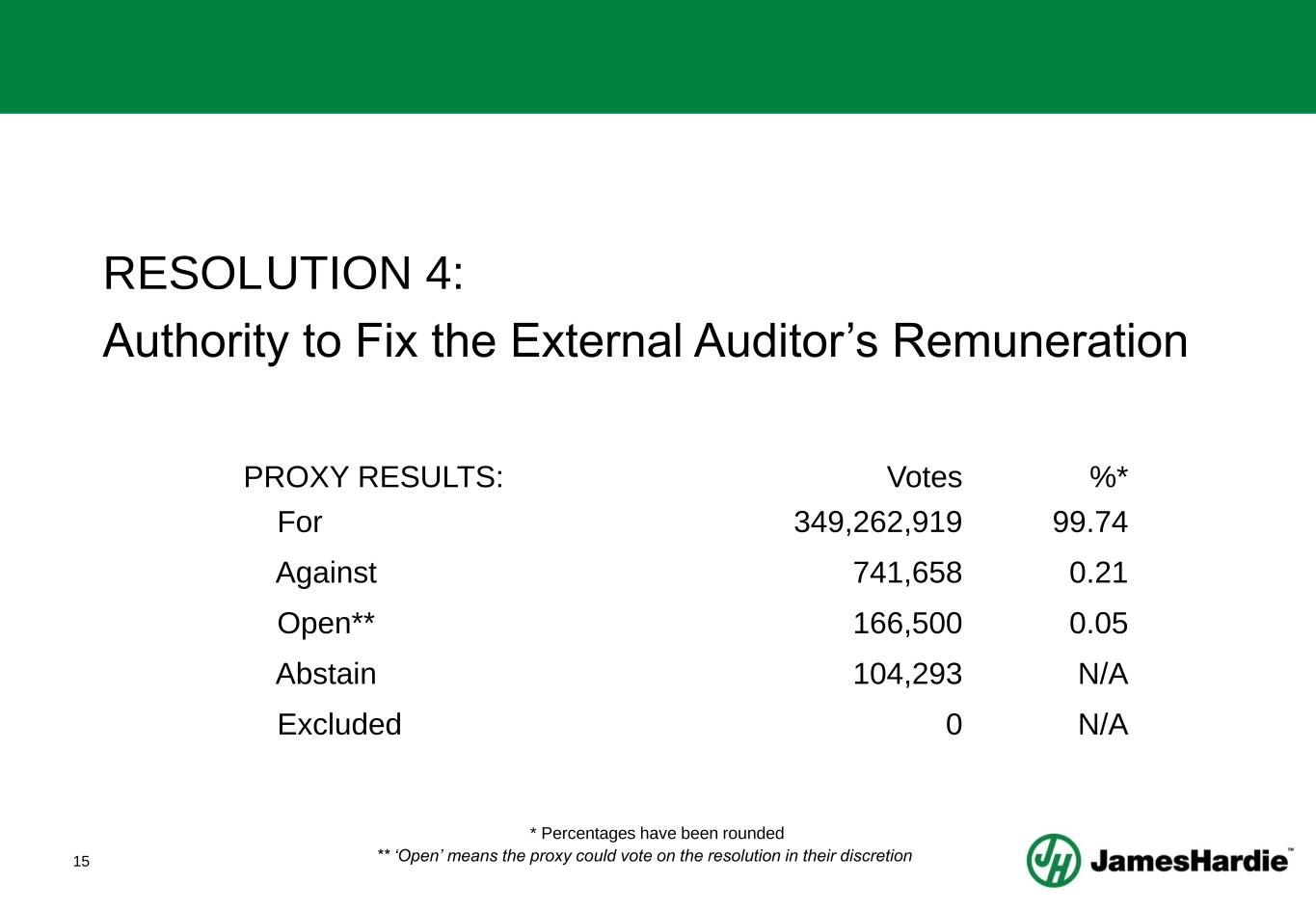

15 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration PROXY RESULTS: Votes %* For 349,262,919 99.74 Against 741,658 0.21 Open** 166,500 0.05 Abstain 104,293 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

16 RESOLUTION 5: Grant of Return on Capital Employed Restricted Stock Units • Approve the grant of Return on Capital Employed (ROCE) Restricted Stock Units (RSUs) under the terms of the restated 2006 LTIP to James Hardie’s Director and Chief Executive Officer, Aaron Erter

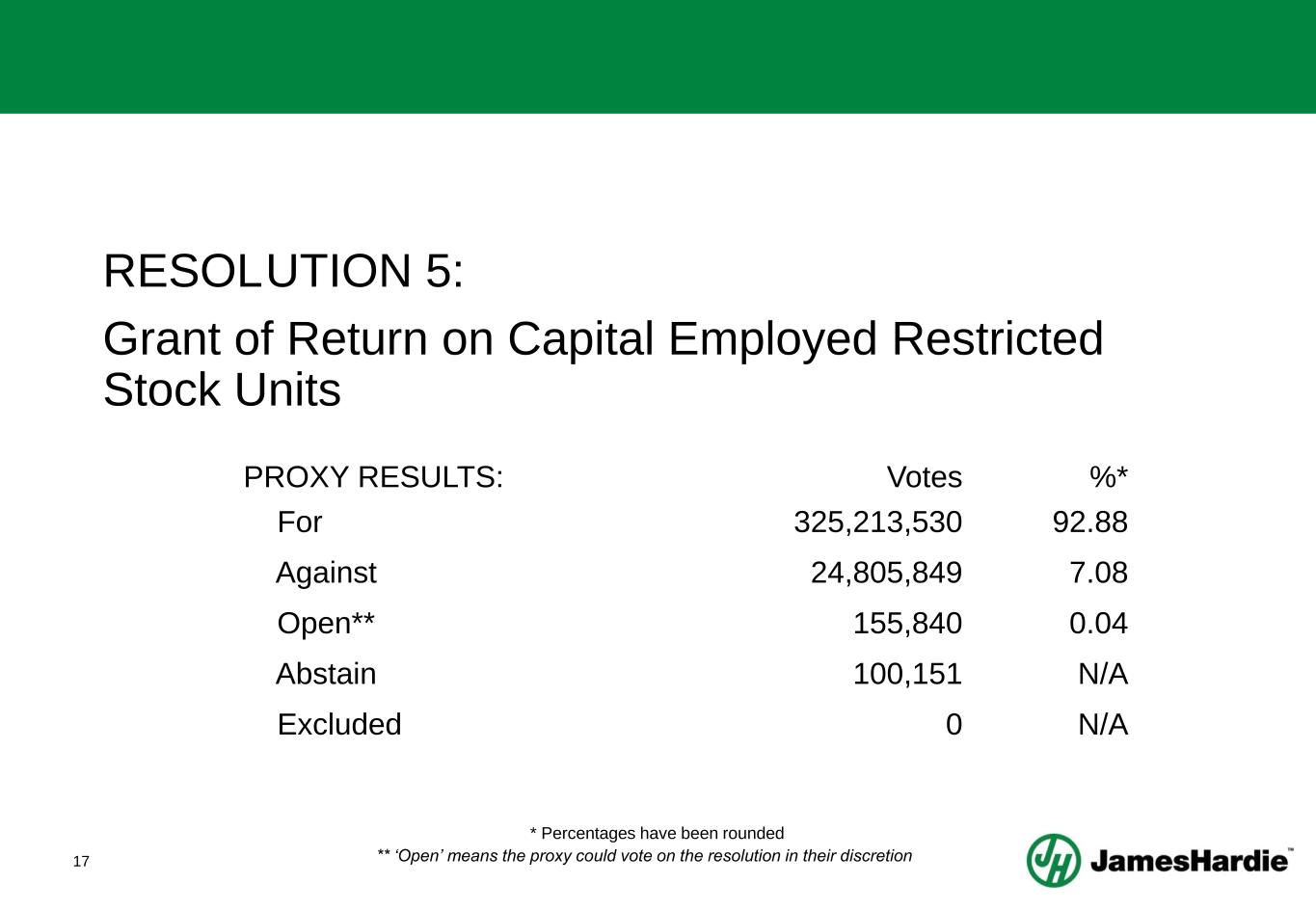

17 RESOLUTION 5: Grant of Return on Capital Employed Restricted Stock Units PROXY RESULTS: Votes %* For 325,213,530 92.88 Against 24,805,849 7.08 Open** 155,840 0.04 Abstain 100,151 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

18 RESOLUTION 6: Grant of Relative Total Shareholder Return RSUs • Approve the grant of Relative Total Shareholder Return (TSR) RSUs to James Hardie’s Director and Chief Executive Officer, Aaron Erter

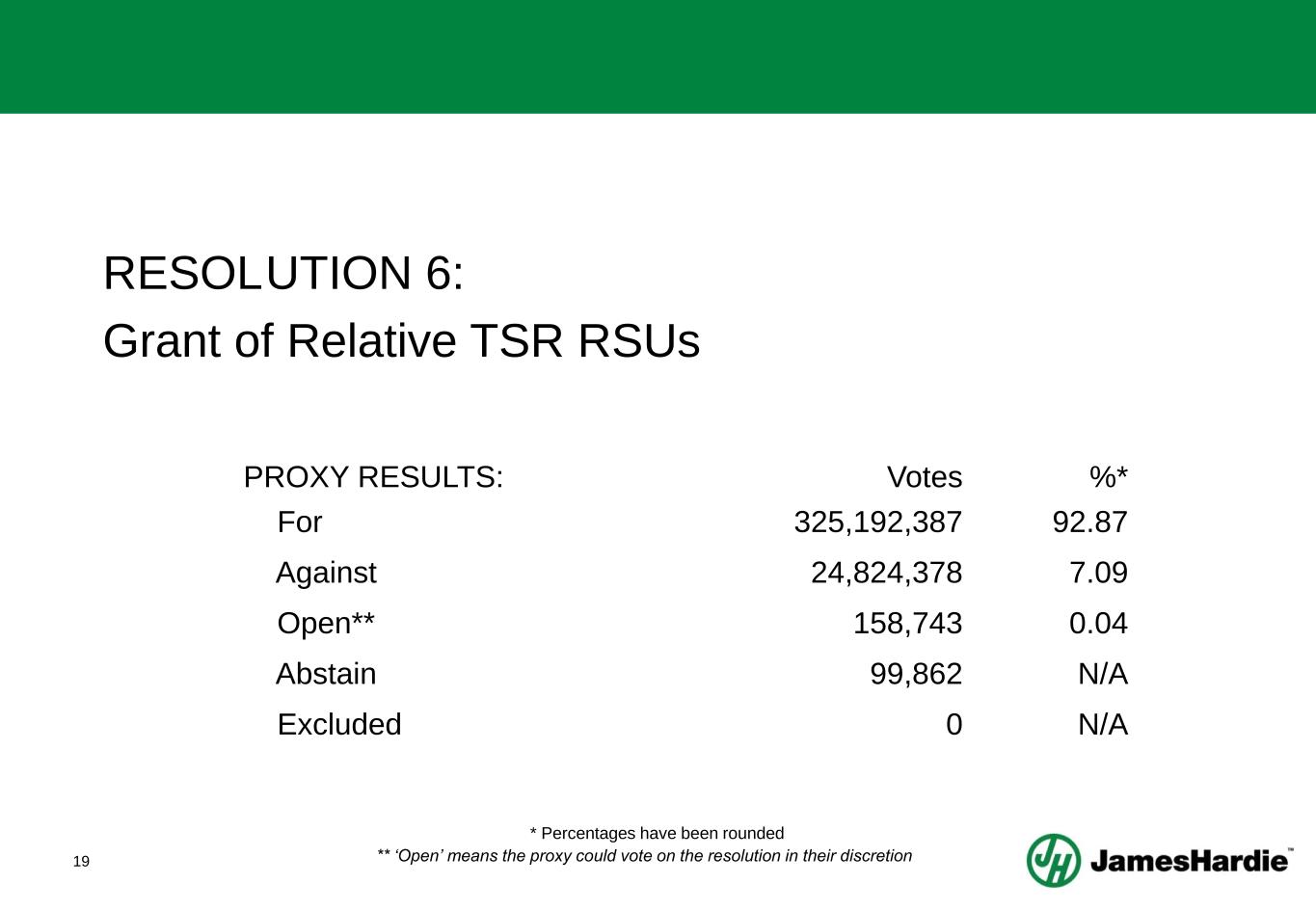

19 RESOLUTION 6: Grant of Relative TSR RSUs PROXY RESULTS: Votes %* For 325,192,387 92.87 Against 24,824,378 7.09 Open** 158,743 0.04 Abstain 99,862 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

20 RESOLUTION 7: Grant of Options • Approve the grant of stock options over shares (Stock Options) under the restated 2001 Equity Incentive Plan to James Hardie’s Director and Chief Executive Officer, Aaron Erter

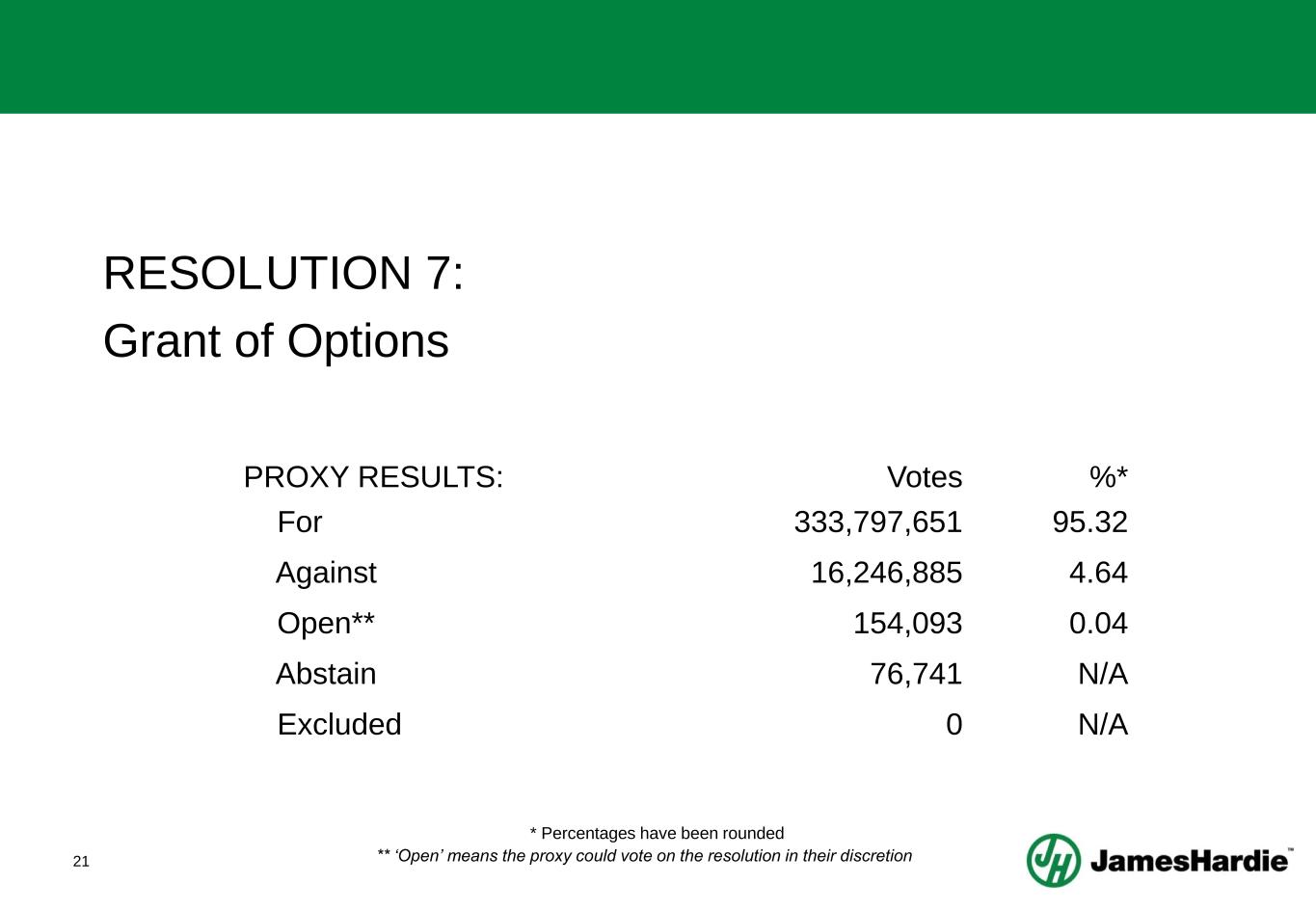

21 RESOLUTION 7: Grant of Options PROXY RESULTS: Votes %* For 333,797,651 95.32 Against 16,246,885 4.64 Open** 154,093 0.04 Abstain 76,741 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

22 RESOLUTION 8: Issue of shares under the James Hardie 2020 Non- Executive Director Equity Plan • Approval of the issue of shares to non-executive directors under the James Hardie 2020 Non-Executive Director Equity Plan

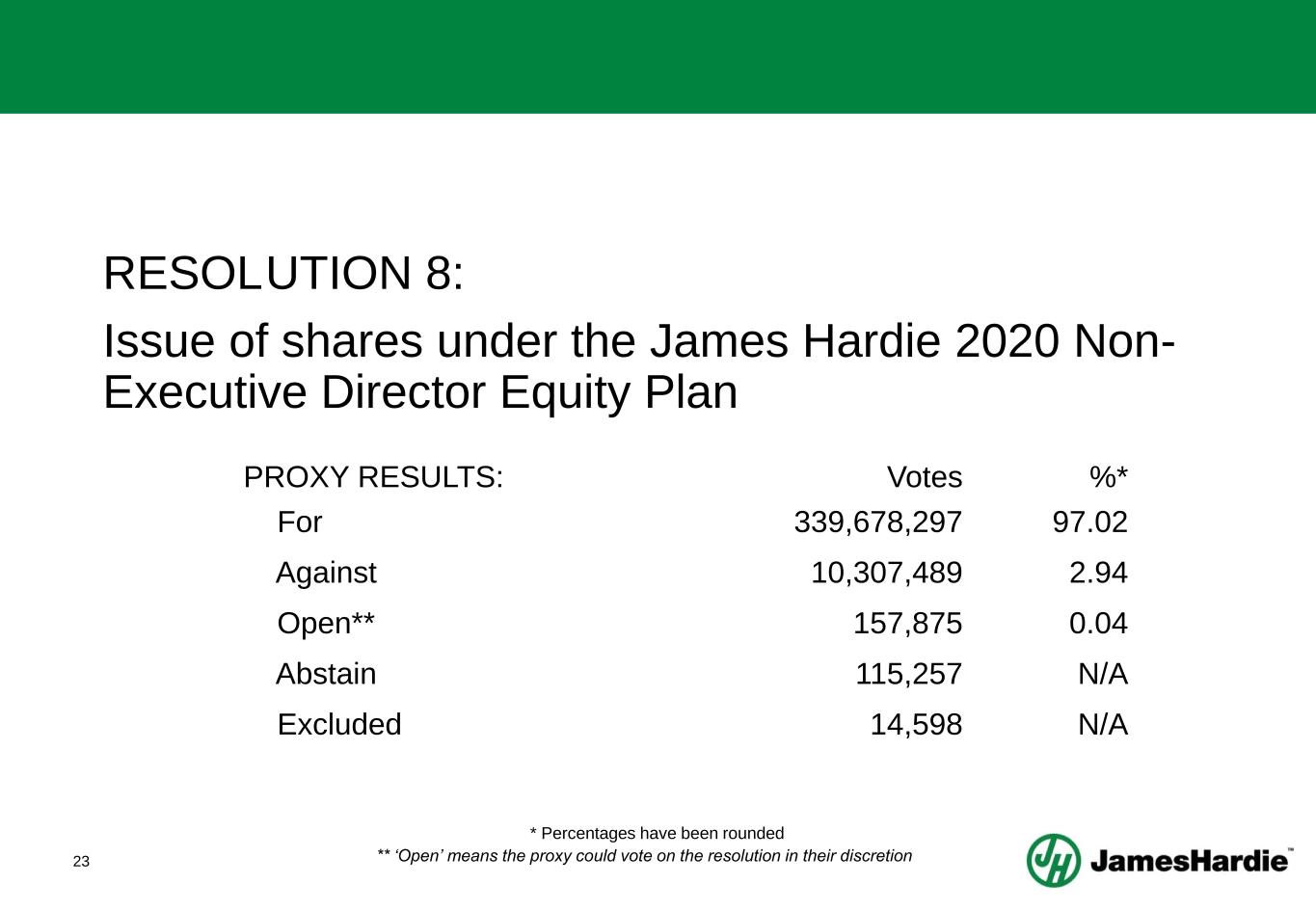

23 RESOLUTION 8: Issue of shares under the James Hardie 2020 Non- Executive Director Equity Plan PROXY RESULTS: Votes %* For 339,678,297 97.02 Against 10,307,489 2.94 Open** 157,875 0.04 Abstain 115,257 N/A Excluded 14,598 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

24 Page 24 ANNUAL GENERAL MEETING – OTHER ITEMS OF BUSINESS

ANNUAL GENERAL MEETING