Q2 FY23 MANAGEMENT PRESENTATION 8 November 2022

Page 2 James Hardie Q2 FY23 Results CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward‐looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20‐F and 6‐K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward‐looking statements but are not the exclusive means of identifying such statements. These forward‐looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward‐ looking statements. Forward‐looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20‐F for the year ended 31 March 2022; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including the impact of COVID‐19; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on‐going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non‐GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non‐GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non‐GAAP financial measures for the same purposes. However, these non‐GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non‐GAAP financial measures presented in this Management Presentation, including a reconciliation of each non‐GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non‐GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross‐reference from the non‐GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Consolidated Financial Statements. See the section titled “Non‐GAAP Financial Measures” included in the Appendix to this Management Presentation. CAUTIONARY NOTE ON FORWARD‐LOOKING STATEMENTS USE OF NON‐GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

Page 3 James Hardie Q2 FY23 Results AGENDA • Strategy and Operations Update • Q2 FY23 Financial Results • Closing • Questions and Answers Aaron Erter CEO Jason Miele CFO

STRATEGY AND OPERATIONS UPDATE

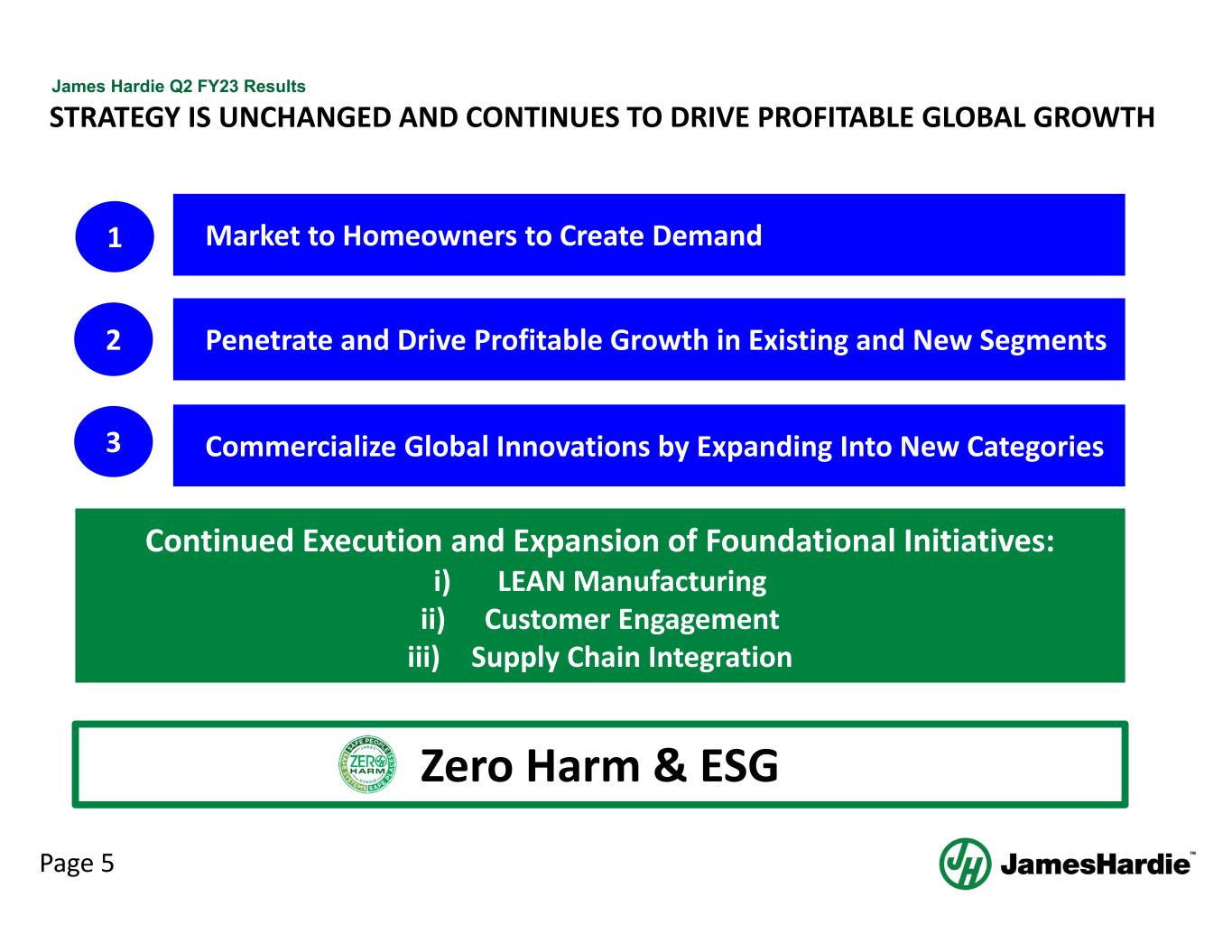

Page 5 James Hardie Q2 FY23 Results STRATEGY IS UNCHANGED AND CONTINUES TO DRIVE PROFITABLE GLOBAL GROWTH Market to Homeowners to Create Demand Penetrate and Drive Profitable Growth in Existing and New Segments Commercialize Global Innovations by Expanding Into New Categories Continued Execution and Expansion of Foundational Initiatives: i) LEAN Manufacturing ii) Customer Engagement iii) Supply Chain Integration 1 2 3 Zero Harm & ESG

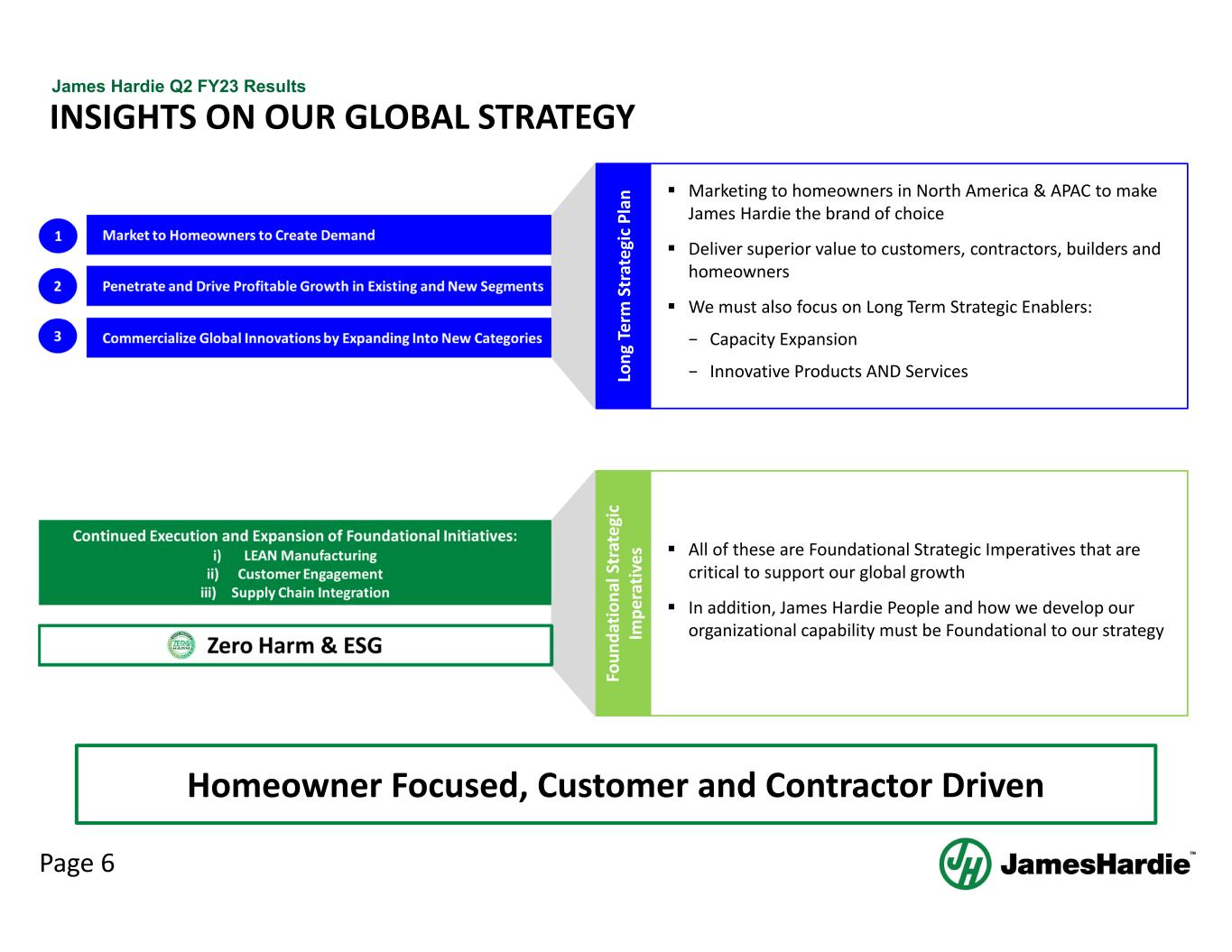

Page 6 James Hardie Q2 FY23 Results INSIGHTS ON OUR GLOBAL STRATEGY Marketing to homeowners in North America & APAC to make James Hardie the brand of choice Deliver superior value to customers, contractors, builders and homeowners We must also focus on Long Term Strategic Enablers: − Capacity Expansion − Innovative Products AND Services Homeowner Focused, Customer and Contractor Driven Lo ng T er m S tr at eg ic P la n Fo un da tio na l S tr at eg ic Im pe ra tiv es All of these are Foundational Strategic Imperatives that are critical to support our global growth In addition, James Hardie People and how we develop our organizational capability must be Foundational to our strategy

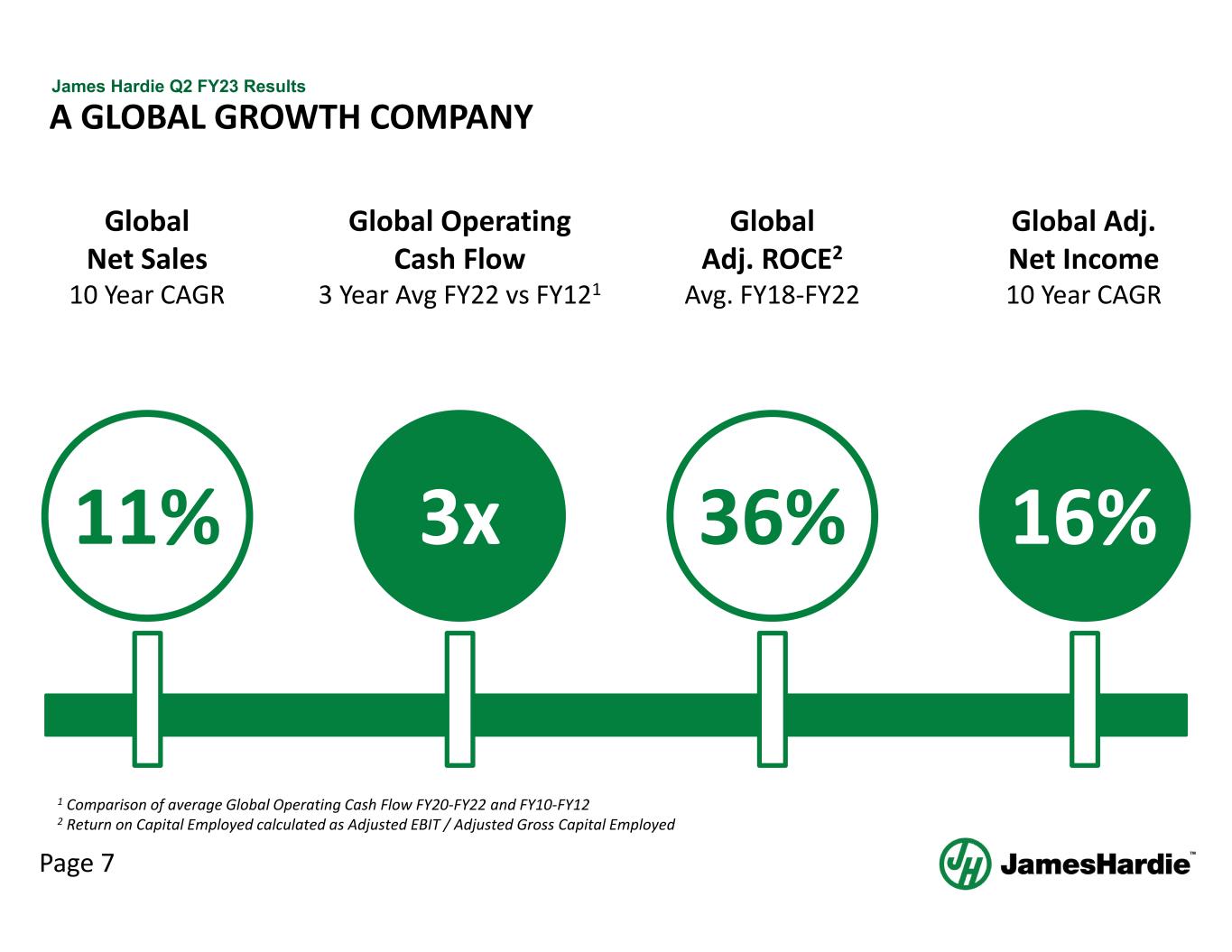

Page 7 James Hardie Q2 FY23 Results A GLOBAL GROWTH COMPANY Global Net Sales 10 Year CAGR Global Adj. Net Income 10 Year CAGR Global Operating Cash Flow 3 Year Avg FY22 vs FY121 11% 3x 16%36% Global Adj. ROCE2 Avg. FY18‐FY22 1 Comparison of average Global Operating Cash Flow FY20‐FY22 and FY10‐FY12 2 Return on Capital Employed calculated as Adjusted EBIT / Adjusted Gross Capital Employed

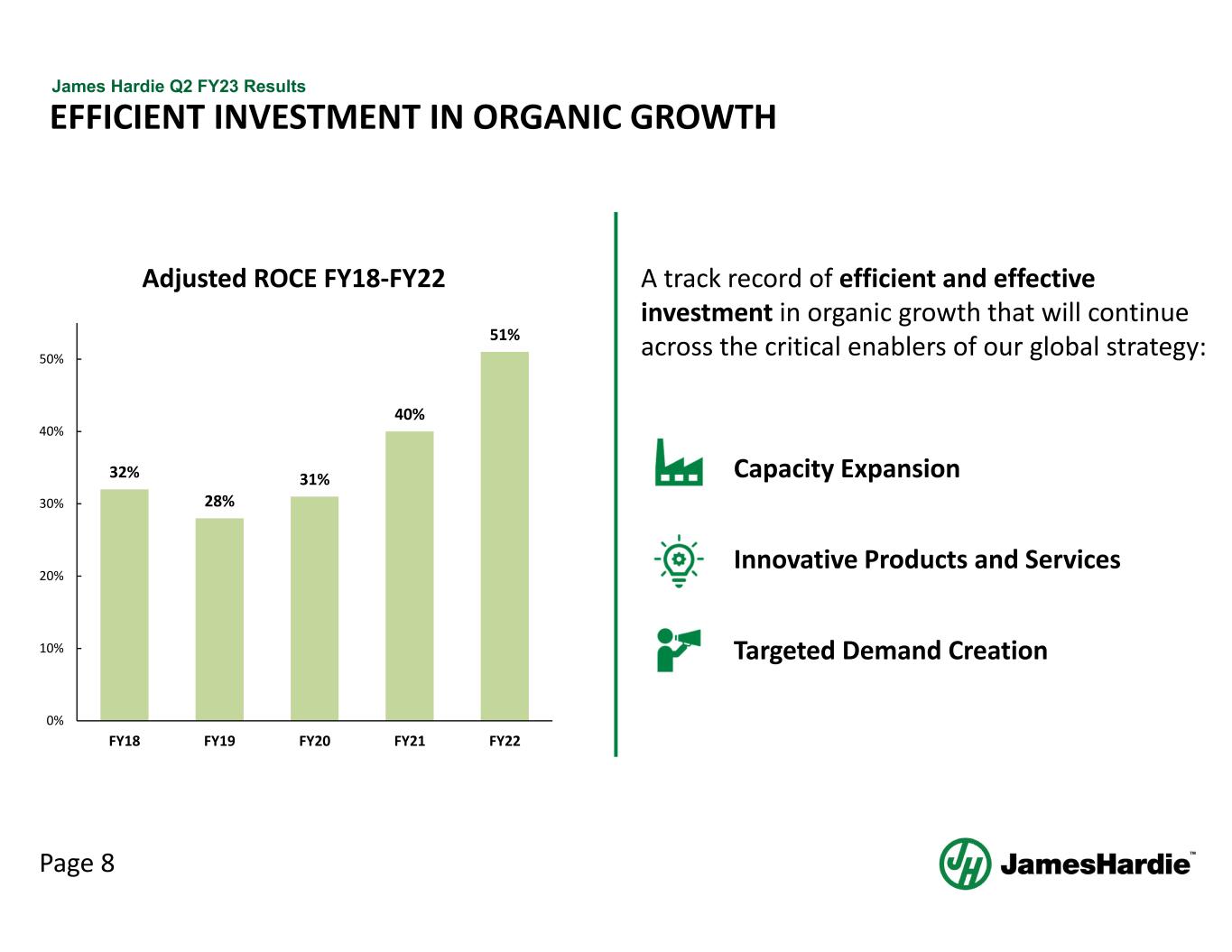

Page 8 James Hardie Q2 FY23 Results EFFICIENT INVESTMENT IN ORGANIC GROWTH 32% 28% 31% 40% 51% 0% 10% 20% 30% 40% 50% FY18 FY19 FY20 FY21 FY22 Adjusted ROCE FY18‐FY22 A track record of efficient and effective investment in organic growth that will continue across the critical enablers of our global strategy: Capacity Expansion Innovative Products and Services Targeted Demand Creation

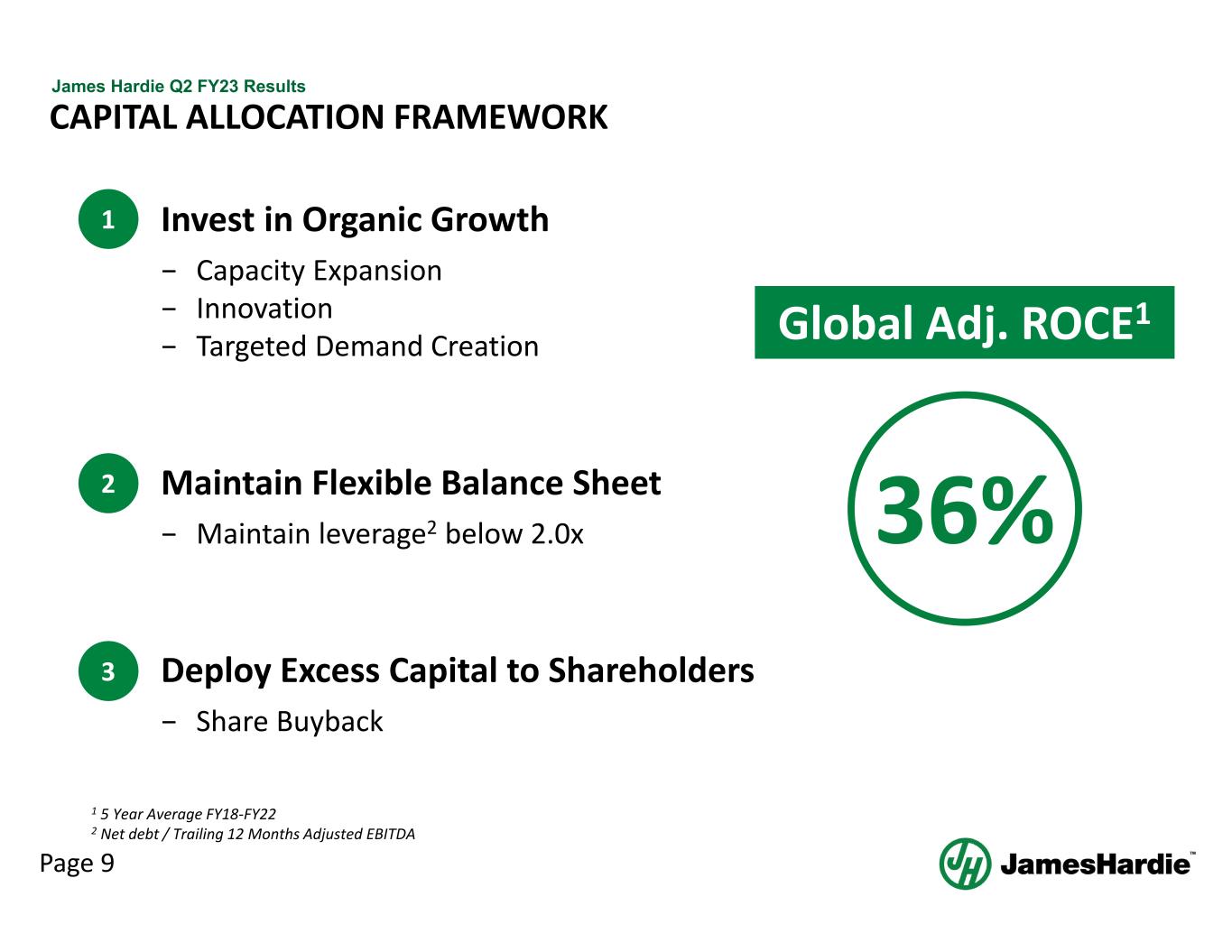

Page 9 James Hardie Q2 FY23 Results • Invest in Organic Growth − Capacity Expansion − Innovation − Targeted Demand Creation • Maintain Flexible Balance Sheet − Maintain leverage2 below 2.0x • Deploy Excess Capital to Shareholders − Share Buyback 1 3 36% Global Adj. ROCE1 1 5 Year Average FY18‐FY22 2 Net debt / Trailing 12 Months Adjusted EBITDA 2 CAPITAL ALLOCATION FRAMEWORK

Page 10 James Hardie Q2 FY23 Results US$200 million through 31 October 2023 • As part of our continued focus on deploying excess capital to shareholders, management announces the replacement of our unfranked ordinary dividend with an on‐market share buyback program to acquire up to: SHARE BUYBACK ANNOUNCED

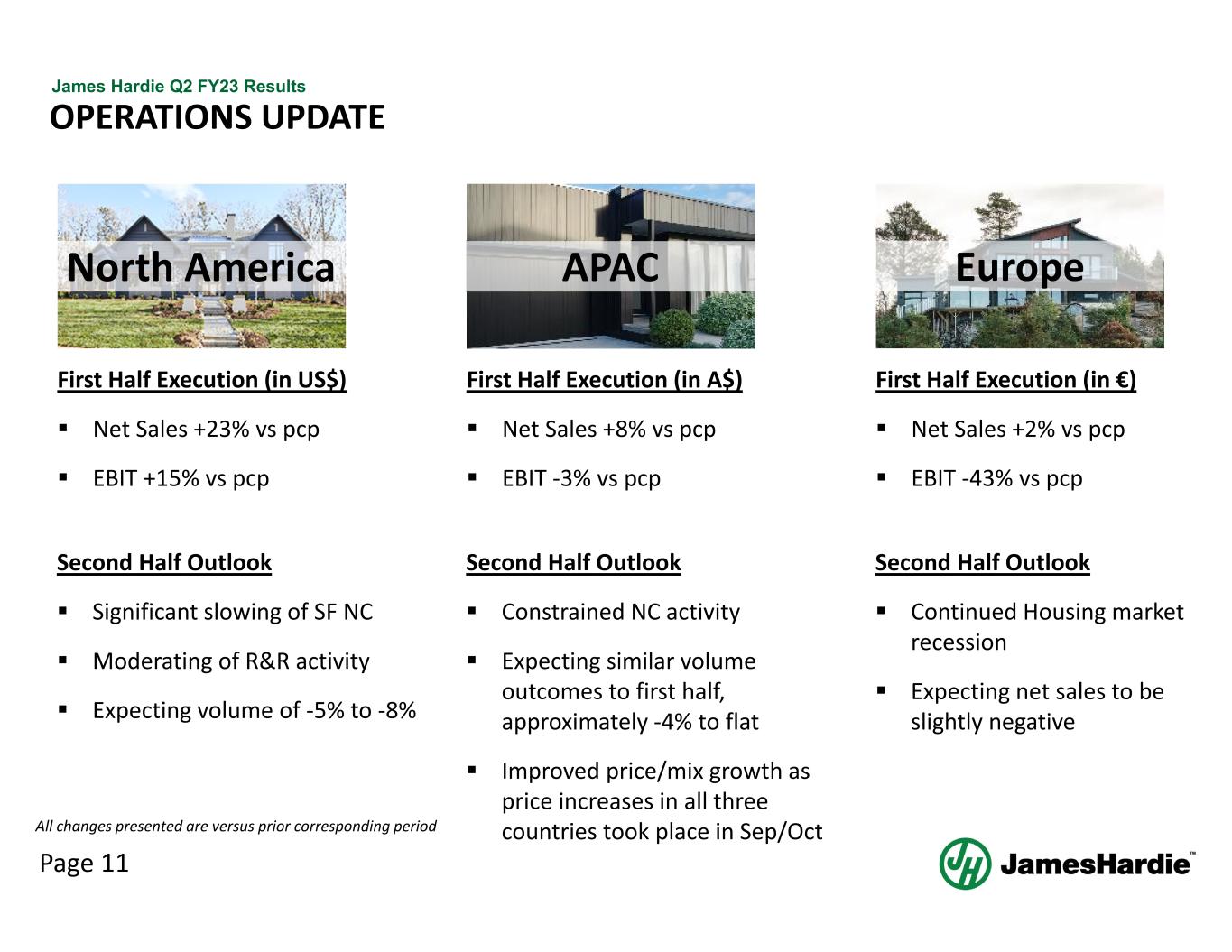

Page 11 James Hardie Q2 FY23 Results OPERATIONS UPDATE APACNorth America Europe First Half Execution (in US$) Net Sales +23% vs pcp EBIT +15% vs pcp Second Half Outlook Significant slowing of SF NC Moderating of R&R activity Expecting volume of ‐5% to ‐8% Second Half Outlook Constrained NC activity Expecting similar volume outcomes to first half, approximately ‐4% to flat Improved price/mix growth as price increases in all three countries took place in Sep/Oct Second Half Outlook Continued Housing market recession Expecting net sales to be slightly negative First Half Execution (in A$) Net Sales +8% vs pcp EBIT ‐3% vs pcp First Half Execution (in €) Net Sales +2% vs pcp EBIT ‐43% vs pcp All changes presented are versus prior corresponding period

Q2 FY23 FINANCIAL RESULTS

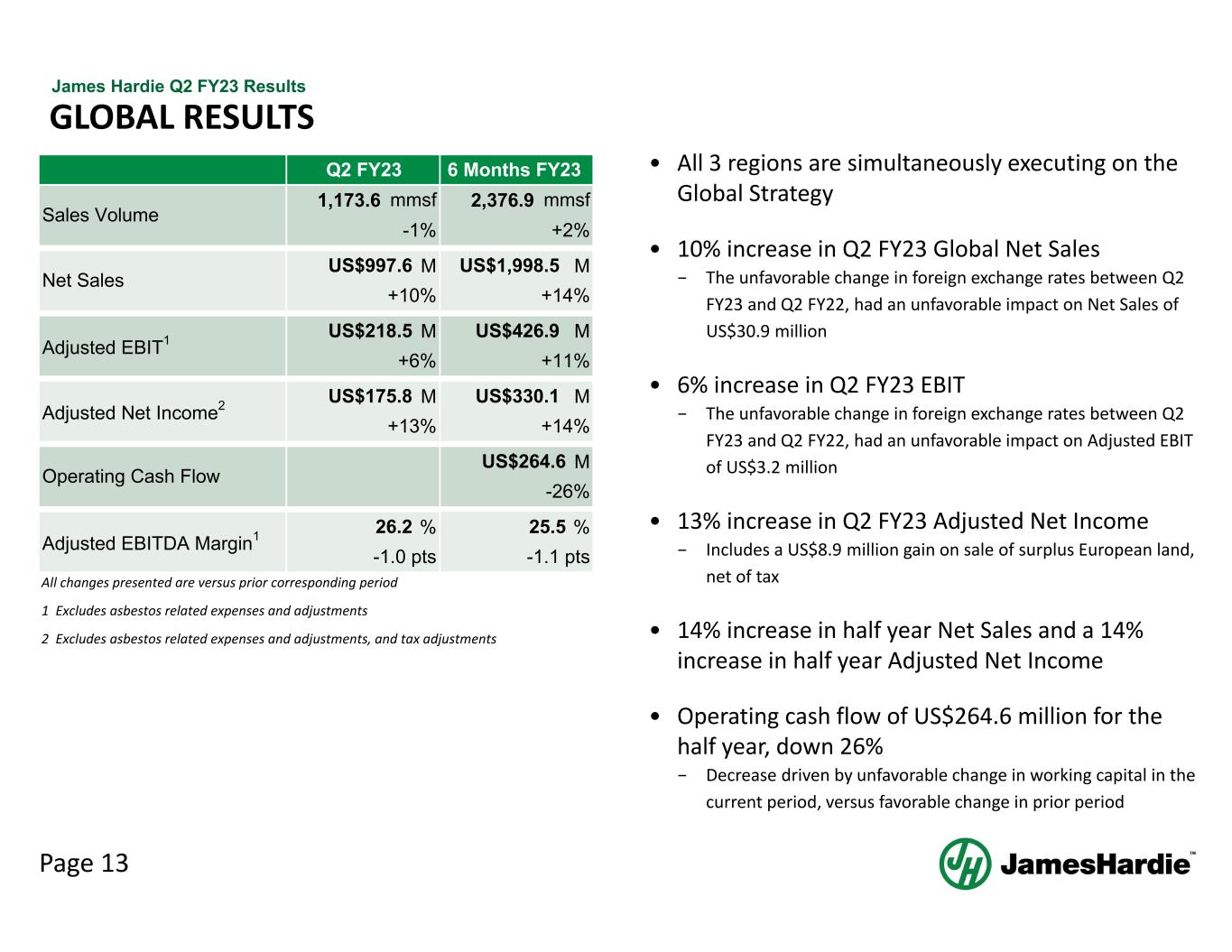

Page 13 James Hardie Q2 FY23 Results M M M M M M M % % 1 Excludes asbestos related expenses and adjustments 2 Excludes asbestos related expenses and adjustments, and tax adjustments mmsf +2% US$1,998.5 +14% Adjusted EBITDA Margin1 26.2 -1.0 pts US$426.9 US$997.6 +10% +6% -1% All changes presented are versus prior corresponding period Operating Cash Flow Adjusted Net Income2 Adjusted EBIT1 Sales Volume Net Sales Q2 FY23 1,173.6 +13% US$218.5 mmsf US$175.8 6 Months FY23 2,376.9 -1.1 pts 25.5 +11% US$330.1 +14% US$264.6 -26% • All 3 regions are simultaneously executing on the Global Strategy • 10% increase in Q2 FY23 Global Net Sales − The unfavorable change in foreign exchange rates between Q2 FY23 and Q2 FY22, had an unfavorable impact on Net Sales of US$30.9 million • 6% increase in Q2 FY23 EBIT − The unfavorable change in foreign exchange rates between Q2 FY23 and Q2 FY22, had an unfavorable impact on Adjusted EBIT of US$3.2 million • 13% increase in Q2 FY23 Adjusted Net Income − Includes a US$8.9 million gain on sale of surplus European land, net of tax • 14% increase in half year Net Sales and a 14% increase in half year Adjusted Net Income • Operating cash flow of US$264.6 million for the half year, down 26% − Decrease driven by unfavorable change in working capital in the current period, versus favorable change in prior period GLOBAL RESULTS

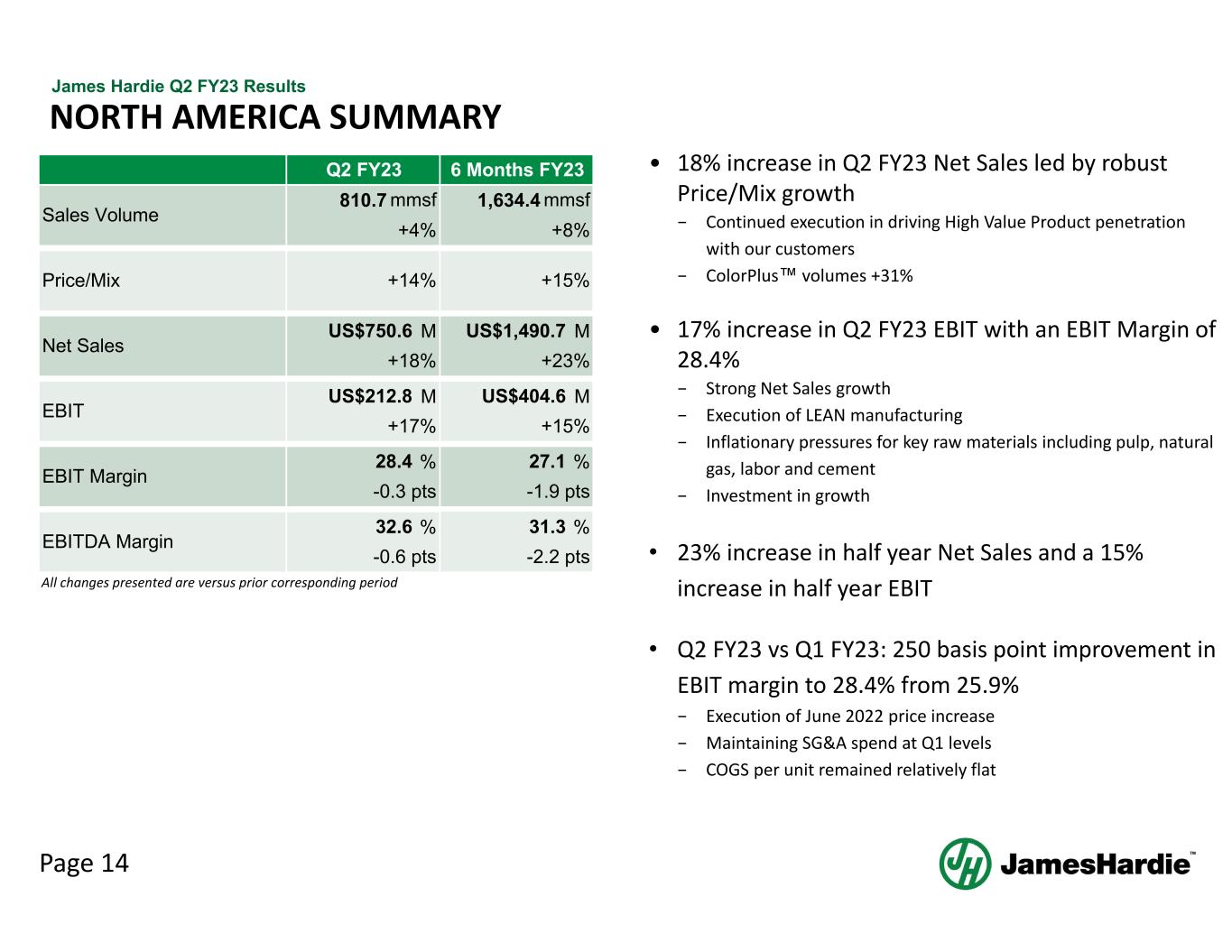

Page 14 James Hardie Q2 FY23 Results NORTH AMERICA SUMMARY • 18% increase in Q2 FY23 Net Sales led by robust Price/Mix growth − Continued execution in driving High Value Product penetration with our customers − ColorPlus™ volumes +31% • 17% increase in Q2 FY23 EBIT with an EBIT Margin of 28.4% − Strong Net Sales growth − Execution of LEAN manufacturing − Inflationary pressures for key raw materials including pulp, natural gas, labor and cement − Investment in growth • 23% increase in half year Net Sales and a 15% increase in half year EBIT • Q2 FY23 vs Q1 FY23: 250 basis point improvement in EBIT margin to 28.4% from 25.9% − Execution of June 2022 price increase − Maintaining SG&A spend at Q1 levels − COGS per unit remained relatively flat M M M M % % % % All changes presented are versus prior corresponding period 31.3 -2.2 pts US$1,490.7 +23% US$404.6 +15% 6 Months FY23 1,634.4 Sales Volume Net Sales EBIT Margin EBIT 28.4 -0.3 pts US$212.8 +17% +18% EBITDA Margin 32.6 -0.6 pts +14%Price/Mix US$750.6 +15% Q2 FY23 810.7 mmsf +4% mmsf +8% 27.1 -1.9 pts

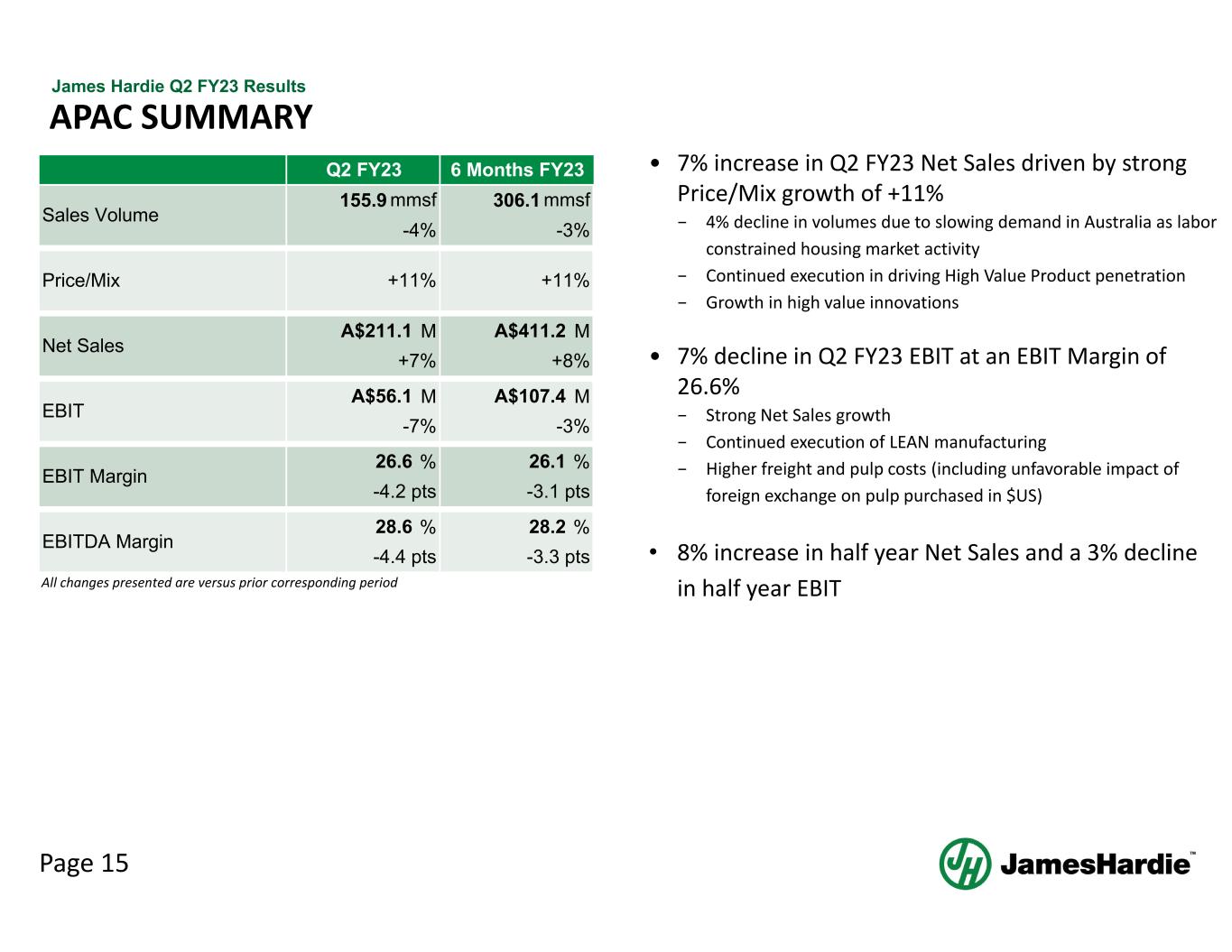

Page 15 James Hardie Q2 FY23 Results APAC SUMMARY • 7% increase in Q2 FY23 Net Sales driven by strong Price/Mix growth of +11% − 4% decline in volumes due to slowing demand in Australia as labor constrained housing market activity − Continued execution in driving High Value Product penetration − Growth in high value innovations • 7% decline in Q2 FY23 EBIT at an EBIT Margin of 26.6% − Strong Net Sales growth − Continued execution of LEAN manufacturing − Higher freight and pulp costs (including unfavorable impact of foreign exchange on pulp purchased in $US) • 8% increase in half year Net Sales and a 3% decline in half year EBIT M M M M % % % % +11% -3.3 pts A$107.4 -3% EBITDA Margin -4.4 pts All changes presented are versus prior corresponding period 26.1 -3.1 pts 28.2 6 Months FY23 306.1 mmsf -3% 28.6 A$411.2 +8% EBIT A$56.1 -7% Net Sales A$211.1 +7% Sales Volume 155.9 mmsf -4% EBIT Margin 26.6 Price/Mix -4.2 pts +11% Q2 FY23

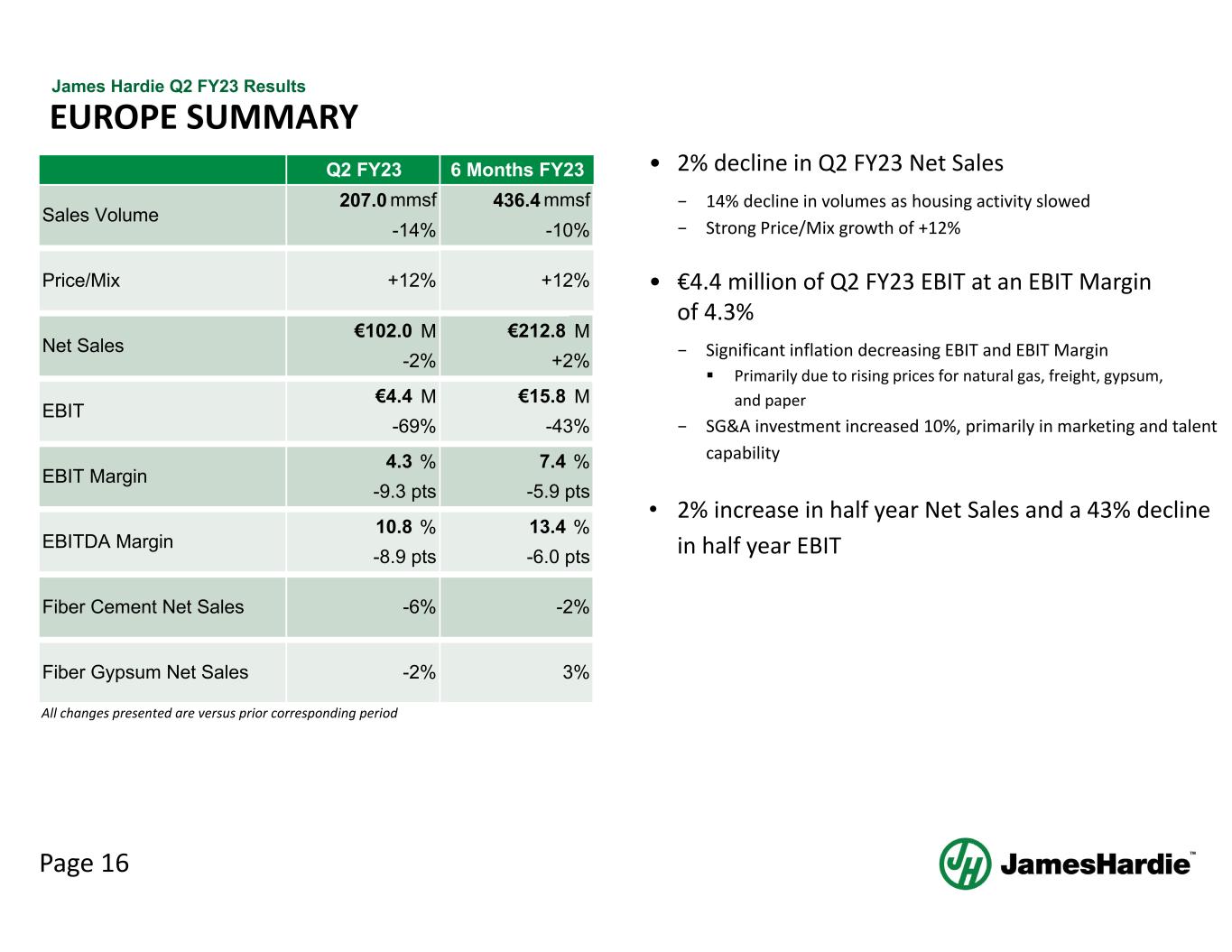

Page 16 James Hardie Q2 FY23 Results EUROPE SUMMARY • 2% decline in Q2 FY23 Net Sales − 14% decline in volumes as housing activity slowed − Strong Price/Mix growth of +12% • €4.4 million of Q2 FY23 EBIT at an EBIT Margin of 4.3% − Significant inflation decreasing EBIT and EBIT Margin Primarily due to rising prices for natural gas, freight, gypsum, and paper − SG&A investment increased 10%, primarily in marketing and talent capability • 2% increase in half year Net Sales and a 43% decline in half year EBIT M M M M % % % % +12% -6% -2% -2% 3% 7.4 -5.9 pts-9.3 pts €4.4 -69% Fiber Gypsum Net Sales Fiber Cement Net Sales All changes presented are versus prior corresponding period 13.4 -6.0 pts 6 Months FY23 436.4 mmsf -10% €212.8 +2% €15.8 -43% Price/Mix Q2 FY23 Sales Volume 207.0 mmsf -14% Net Sales -2% €102.0 +12% EBITDA Margin 10.8 -8.9 pts EBIT EBIT Margin 4.3

CLOSING

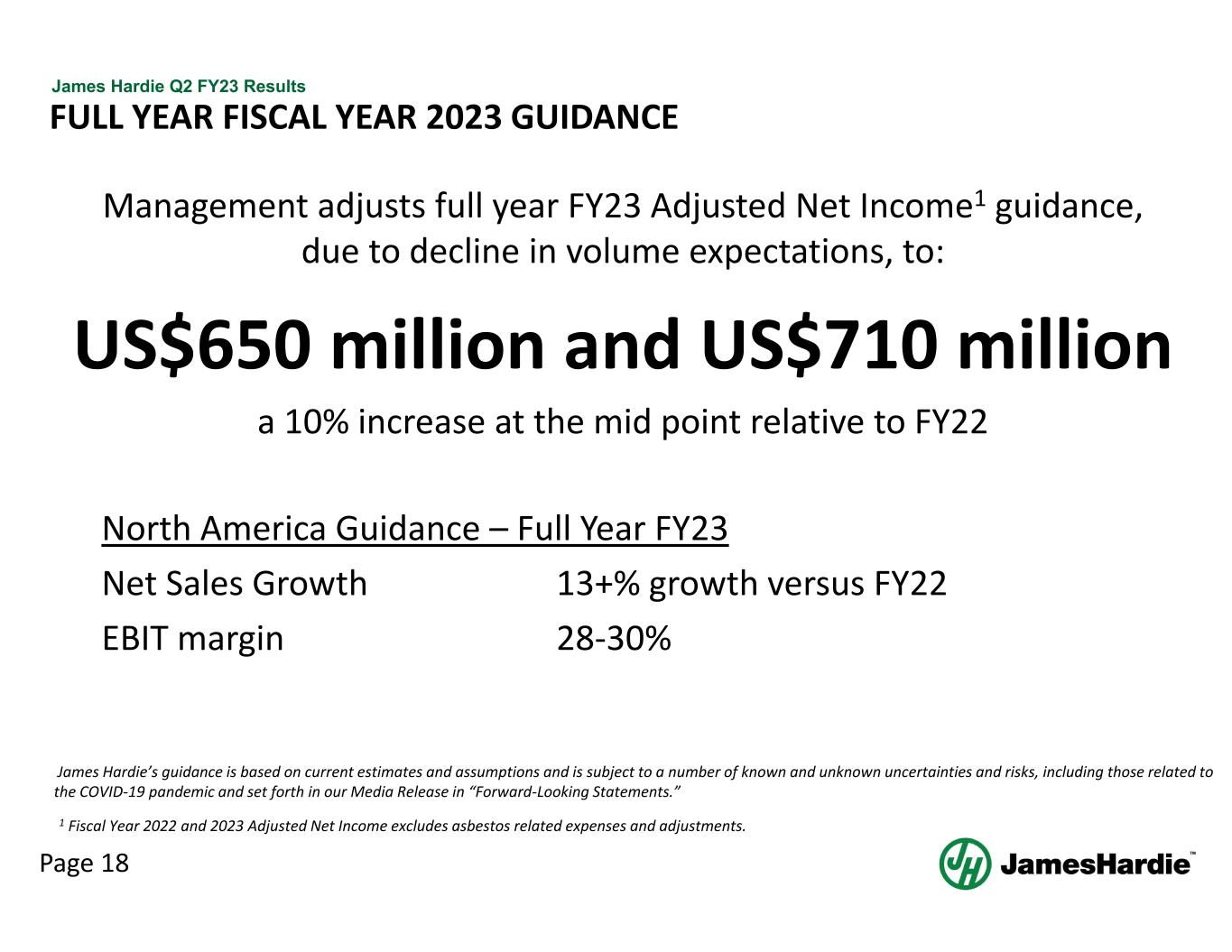

Page 18 James Hardie Q2 FY23 Results FULL YEAR FISCAL YEAR 2023 GUIDANCE Management adjusts full year FY23 Adjusted Net Income1 guidance, due to decline in volume expectations, to: US$650 million and US$710 million a 10% increase at the mid point relative to FY22 North America Guidance – Full Year FY23 Net Sales Growth 13+% growth versus FY22 EBIT margin 28‐30% James Hardie’s guidance is based on current estimates and assumptions and is subject to a number of known and unknown uncertainties and risks, including those related to the COVID‐19 pandemic and set forth in our Media Release in “Forward‐Looking Statements.” 1 Fiscal Year 2022 and 2023 Adjusted Net Income excludes asbestos related expenses and adjustments.

Page 19 James Hardie Q2 FY23 Results JAMES HARDIE – A GLOBAL GROWTH COMPANY Homeowner Focused, Customer and Contractor Driven 1 Comparison of average Global Operating Cash Flow FY20‐FY22 and FY10‐FY12 2 Return on Capital Employed calculated as Adjusted EBIT / Adjusted Gross Capital Employed Strong Growth Opportunities Brand of Choice Innovation Pipeline Integrated Localized Supply Chain Multi‐Segment Focus Experienced Management Team Strong Balance Sheet & Cash Generation Attractive Returns Premium Products and Services Responsible Corporate Citizen Global Net Sales 10 Year CAGR 11% 16% Global Adj. Net Income 10 Year CAGR 3x Global Operating Cash Flow 3 Year Avg FY22 vs FY121 Global Adj. ROCE2 Avg. FY18‐FY22 36%

QUESTIONS

APPENDIX

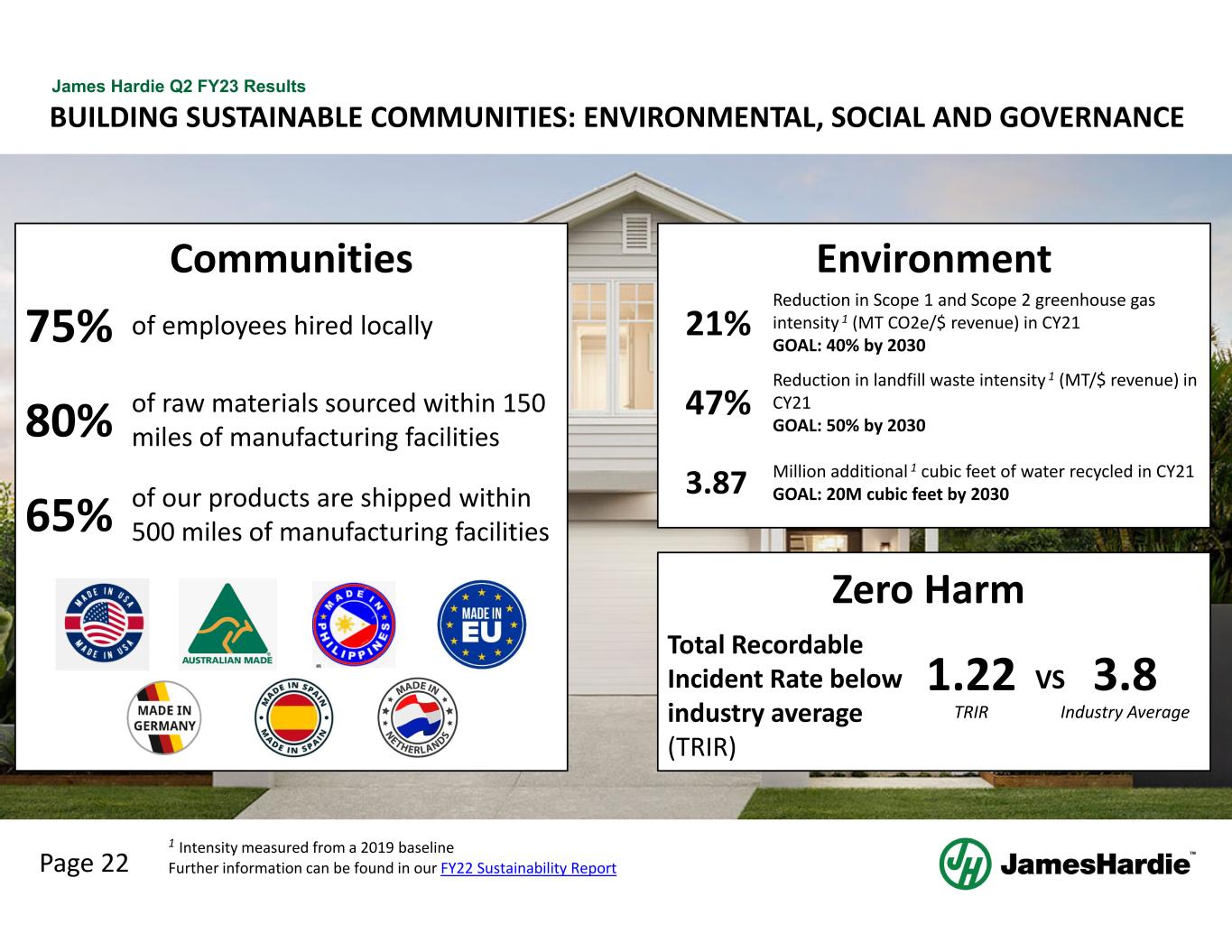

Page 22 James Hardie Q2 FY23 Results BUILDING SUSTAINABLE COMMUNITIES: ENVIRONMENTAL, SOCIAL AND GOVERNANCE 80% of raw materials sourced within 150 miles of manufacturing facilities 75% of employees hired locally 65% of our products are shipped within 500 miles of manufacturing facilities Total Recordable Incident Rate below industry average (TRIR) 1.22 TRIR Environment Zero Harm Communities 1 Intensity measured from a 2019 baseline Further information can be found in our FY22 Sustainability Report 3.8 Industry Average VS Reduction in Scope 1 and Scope 2 greenhouse gas intensity 1 (MT CO2e/$ revenue) in CY21 GOAL: 40% by 2030 21% Reduction in landfill waste intensity 1 (MT/$ revenue) in CY21 GOAL: 50% by 2030 47% Million additional 1 cubic feet of water recycled in CY21 GOAL: 20M cubic feet by 20303.87

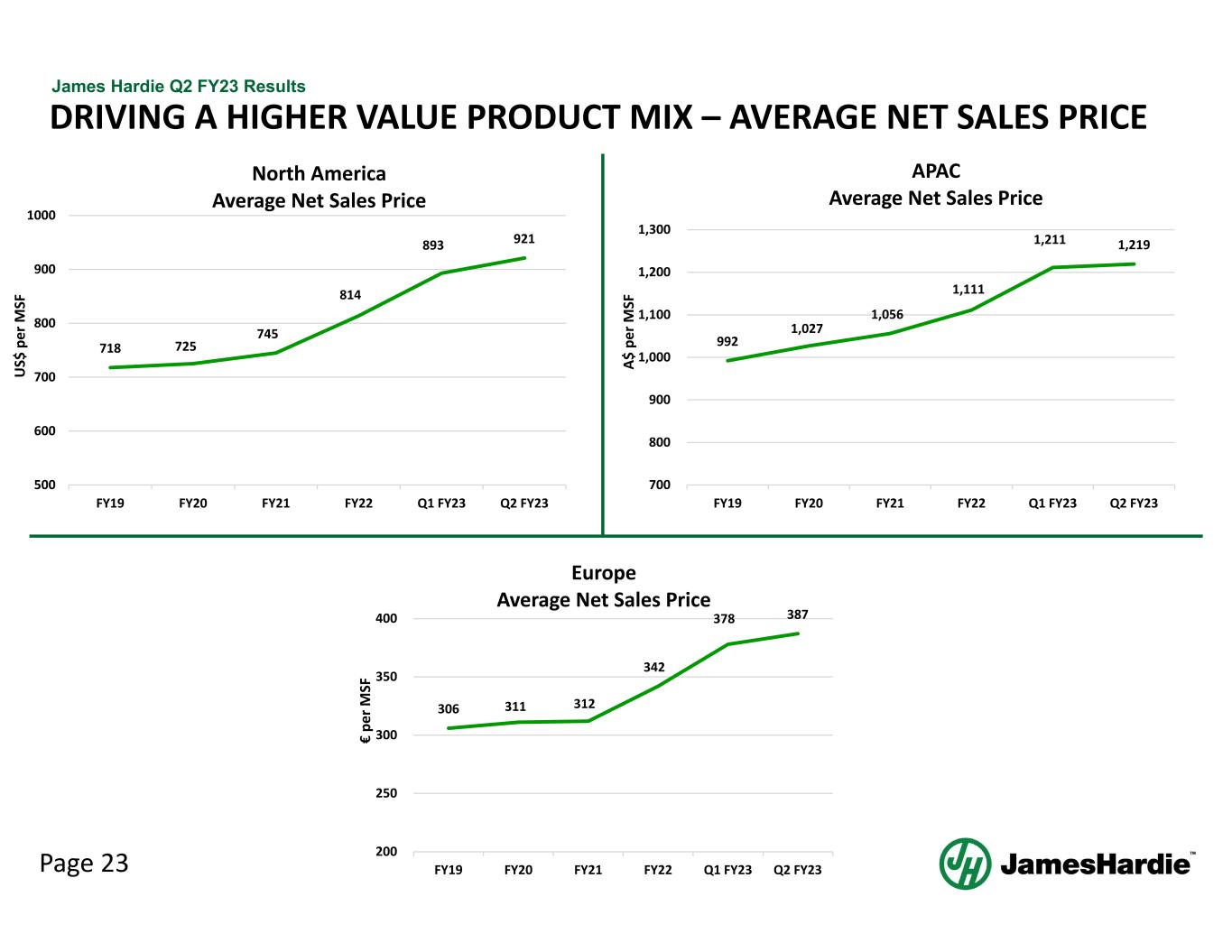

Page 23 James Hardie Q2 FY23 Results DRIVING A HIGHER VALUE PRODUCT MIX – AVERAGE NET SALES PRICE 718 725 745 814 893 921 500 600 700 800 900 1000 FY19 FY20 FY21 FY22 Q1 FY23 Q2 FY23 U S$ p er M SF North America Average Net Sales Price 306 311 312 342 378 387 200 250 300 350 400 FY19 FY20 FY21 FY22 Q1 FY23 Q2 FY23 € pe r M SF Europe Average Net Sales Price 992 1,027 1,056 1,111 1,211 1,219 700 800 900 1,000 1,100 1,200 1,300 FY19 FY20 FY21 FY22 Q1 FY23 Q2 FY23 A$ p er M SF APAC Average Net Sales Price

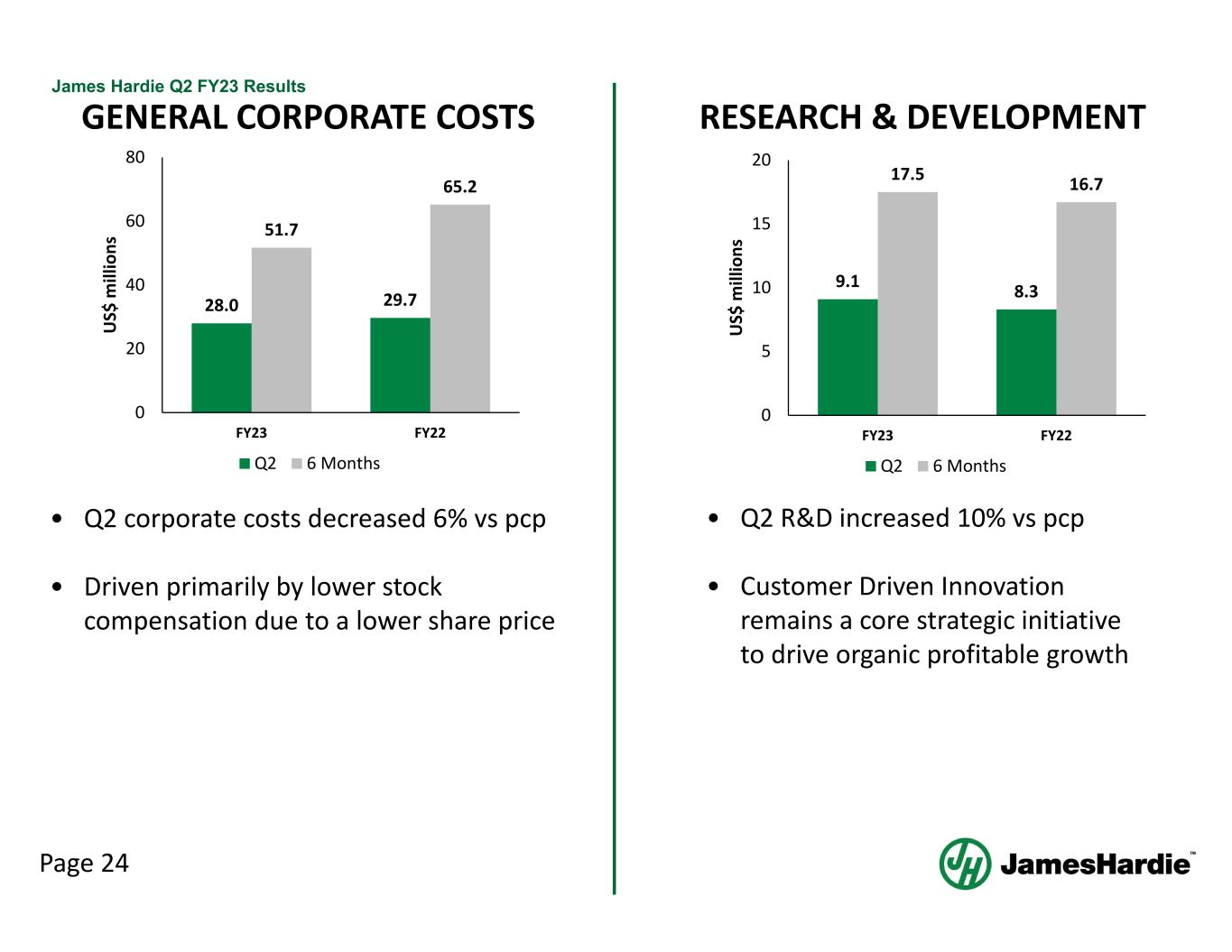

Page 24 James Hardie Q2 FY23 Results GENERAL CORPORATE COSTS • Q2 corporate costs decreased 6% vs pcp • Driven primarily by lower stock compensation due to a lower share price • Q2 R&D increased 10% vs pcp • Customer Driven Innovation remains a core strategic initiative to drive organic profitable growth RESEARCH & DEVELOPMENT 28.0 29.7 51.7 65.2 0 20 40 60 80 FY23 FY22 U S$ m ill io ns Q2 6 Months 9.1 8.3 17.5 16.7 0 5 10 15 20 FY23 FY22 U S$ m ill io ns Q2 6 Months

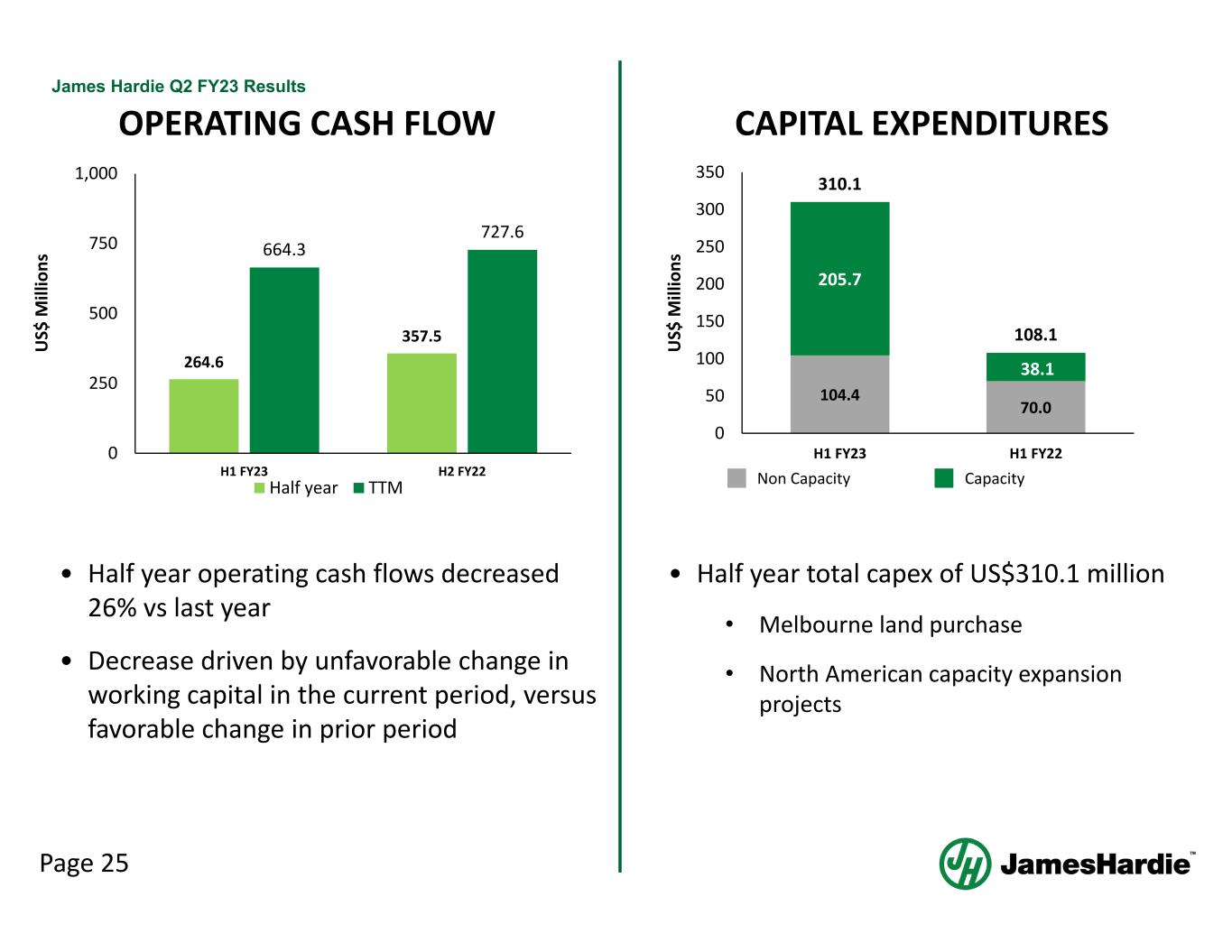

Page 25 James Hardie Q2 FY23 Results 1 OPERATING CASH FLOW CAPITAL EXPENDITURES • Half year total capex of US$310.1 million • Melbourne land purchase • North American capacity expansion projects • Half year operating cash flows decreased 26% vs last year • Decrease driven by unfavorable change in working capital in the current period, versus favorable change in prior period U S$ M ill io ns 264.6 357.5 664.3 727.6 0 250 500 750 1,000 H1 FY23 H2 FY22 Half year TTM 104.4 70.0 205.7 38.1 310.1 108.1 0 50 100 150 200 250 300 350 H1 FY23 H1 FY22 U S$ M ill io ns Non Capacity Capacity

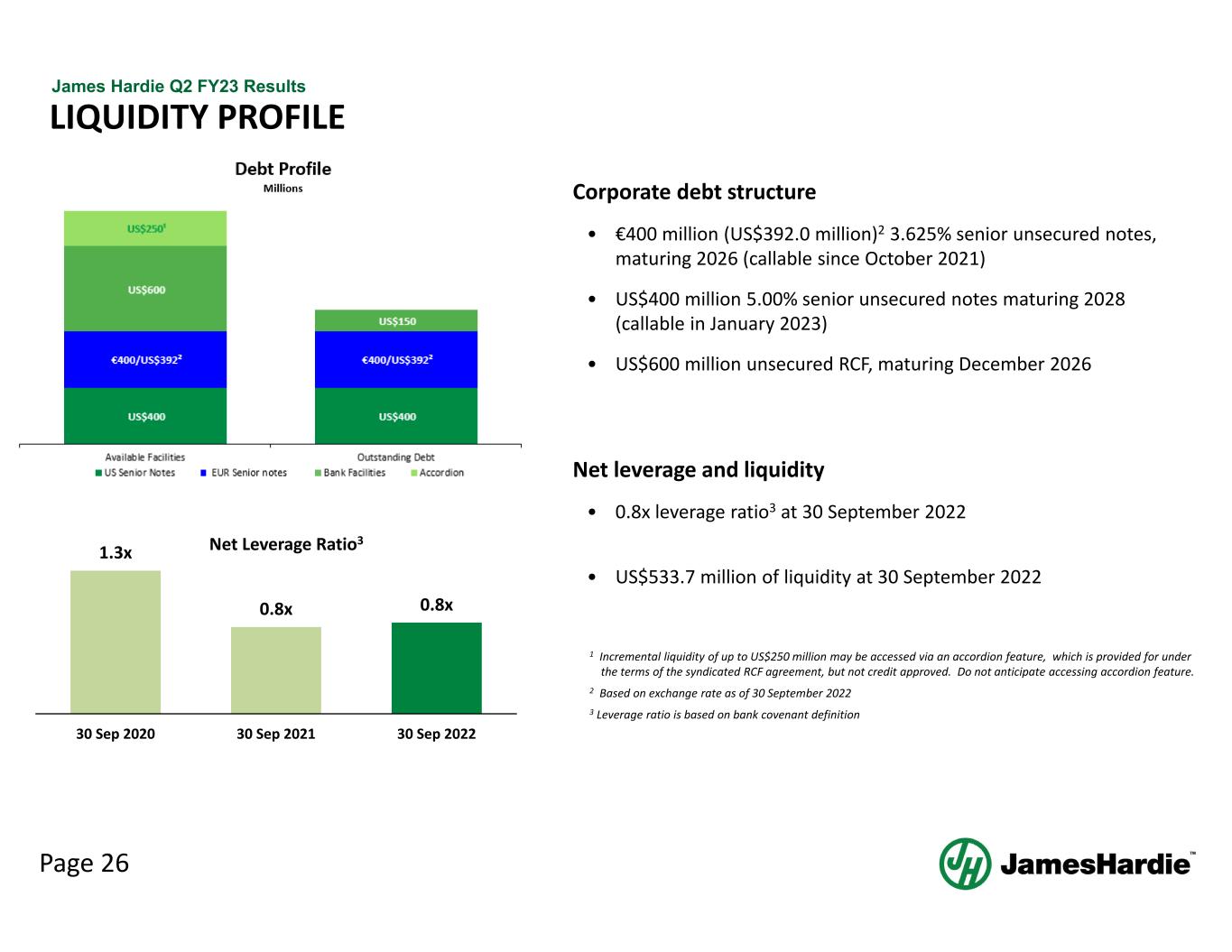

Page 26 James Hardie Q2 FY23 Results LIQUIDITY PROFILE 2 1 Incremental liquidity of up to US$250 million may be accessed via an accordion feature, which is provided for under the terms of the syndicated RCF agreement, but not credit approved. Do not anticipate accessing accordion feature. 2 Based on exchange rate as of 30 September 2022 3 Leverage ratio is based on bank covenant definition 1.3x 0.8x 0.8x 30 Sep 2020 30 Sep 2021 30 Sep 2022 Net Leverage Ratio3 Corporate debt structure • €400 million (US$392.0 million)2 3.625% senior unsecured notes, maturing 2026 (callable since October 2021) • US$400 million 5.00% senior unsecured notes maturing 2028 (callable in January 2023) • US$600 million unsecured RCF, maturing December 2026 Net leverage and liquidity • 0.8x leverage ratio3 at 30 September 2022 • US$533.7 million of liquidity at 30 September 2022

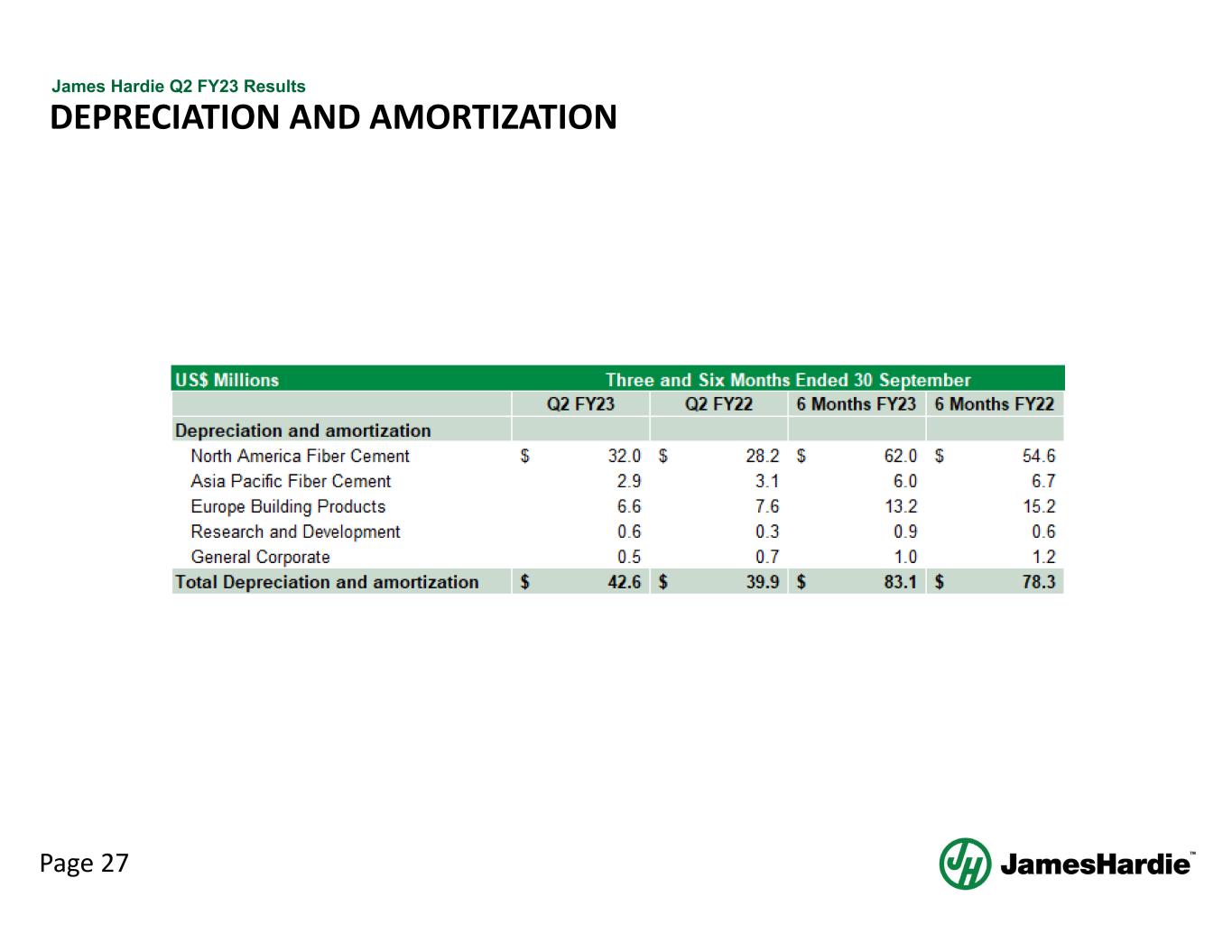

Page 27 James Hardie Q2 FY23 Results DEPRECIATION AND AMORTIZATION

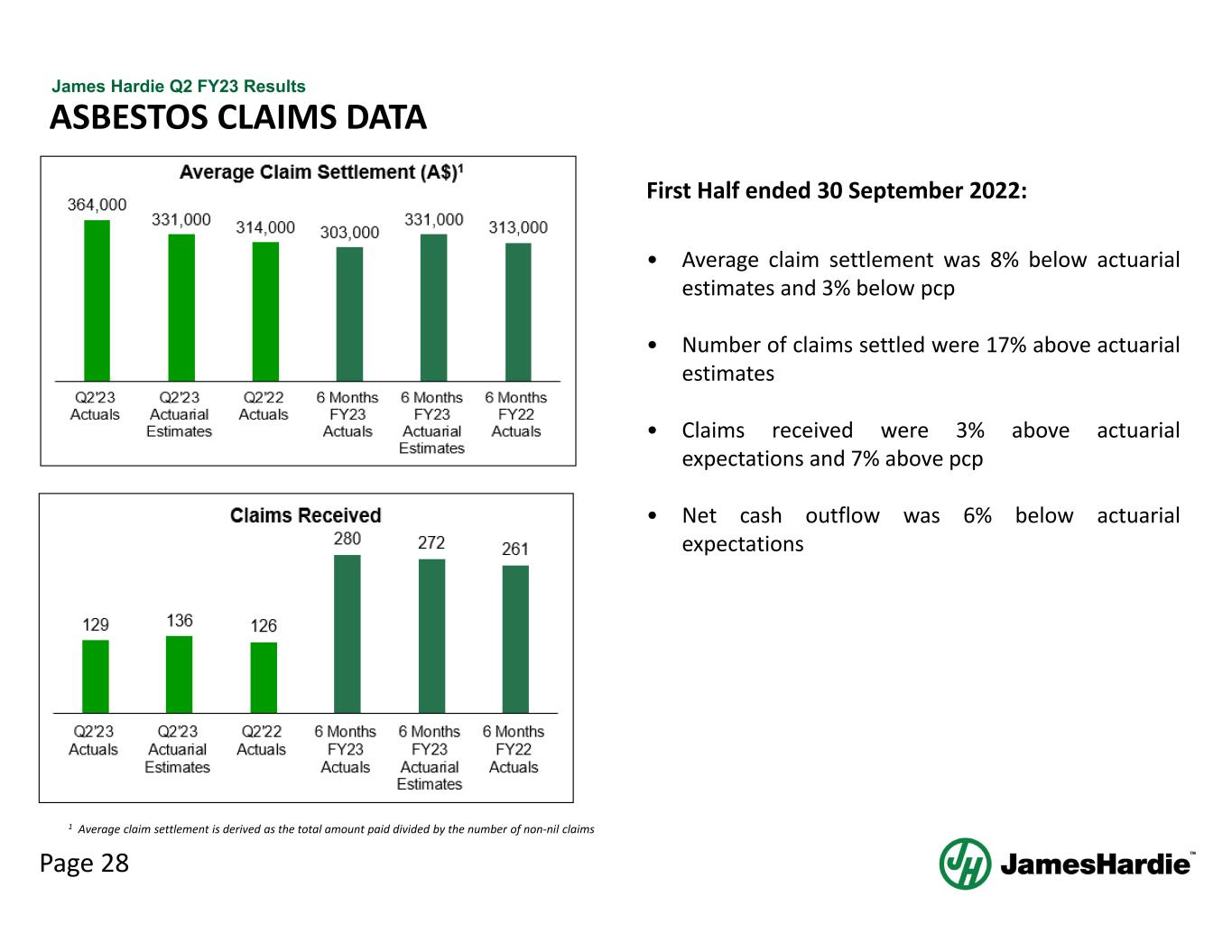

Page 28 James Hardie Q2 FY23 Results First Half ended 30 September 2022: • Average claim settlement was 8% below actuarial estimates and 3% below pcp • Number of claims settled were 17% above actuarial estimates • Claims received were 3% above actuarial expectations and 7% above pcp • Net cash outflow was 6% below actuarial expectations ASBESTOS CLAIMS DATA 1 Average claim settlement is derived as the total amount paid divided by the number of non‐nil claims

Page 29 James Hardie Q2 FY23 Results This Management Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Media Release and Condensed Consolidated Financial Statements Financial Measures – GAAP Equivalents This document contains the financial statement line item EBIT, which is considered to be non‐GAAP, but is consistent with the term used by Australian companies. Because we prepare our consolidated financial statements under GAAP, the equivalent GAAP financial Statement line item description used in our condensed consolidated financial statements is Operating income (loss). Definitions EBIT – Earnings before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Price/Mix – The percentage growth in revenue attributable to price increases and shift in mix of products sold. Price/Mix is calculated as the Net Sales growth percentage less the volume growth percentage. Working Capital – The working capital calculation used in our cash provided by operating analysis includes the change in: (1) Accounts and other receivables, net; (2) Inventories; and (3) Accounts payable and accrued liabilities. Sales Volume mmsf –million square feet, where a square foot is defined as a standard square foot of 5/16” thickness msf – thousand square feet, where a square foot is defined as a standard square foot of 5/16” thickness Non‐financial Terms AFFA – Amended and Restated Final Funding Agreement AICF – Asbestos Injuries Compensation Fund Ltd NON‐GAAP FINANCIAL MEASURES

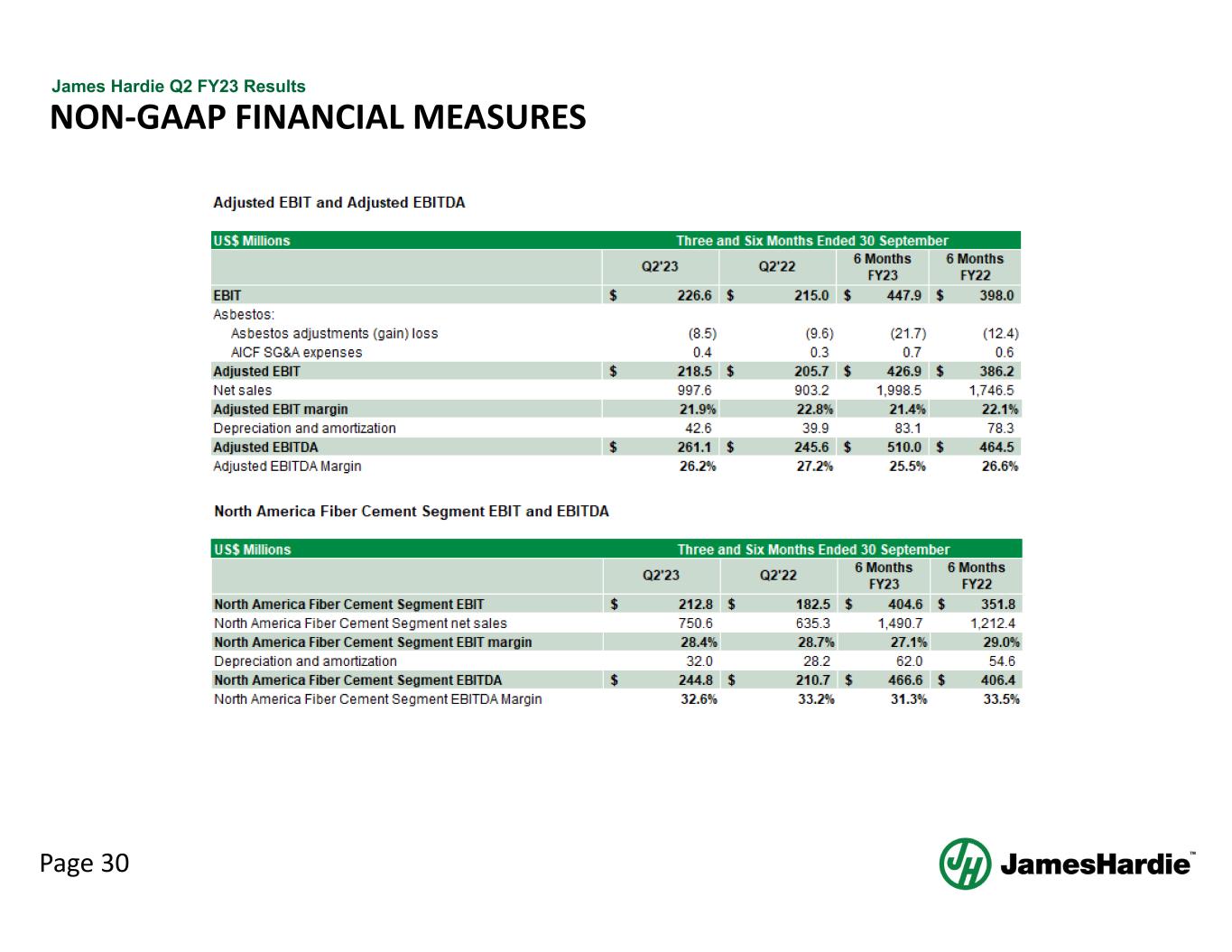

Page 30 James Hardie Q2 FY23 Results NON‐GAAP FINANCIAL MEASURES

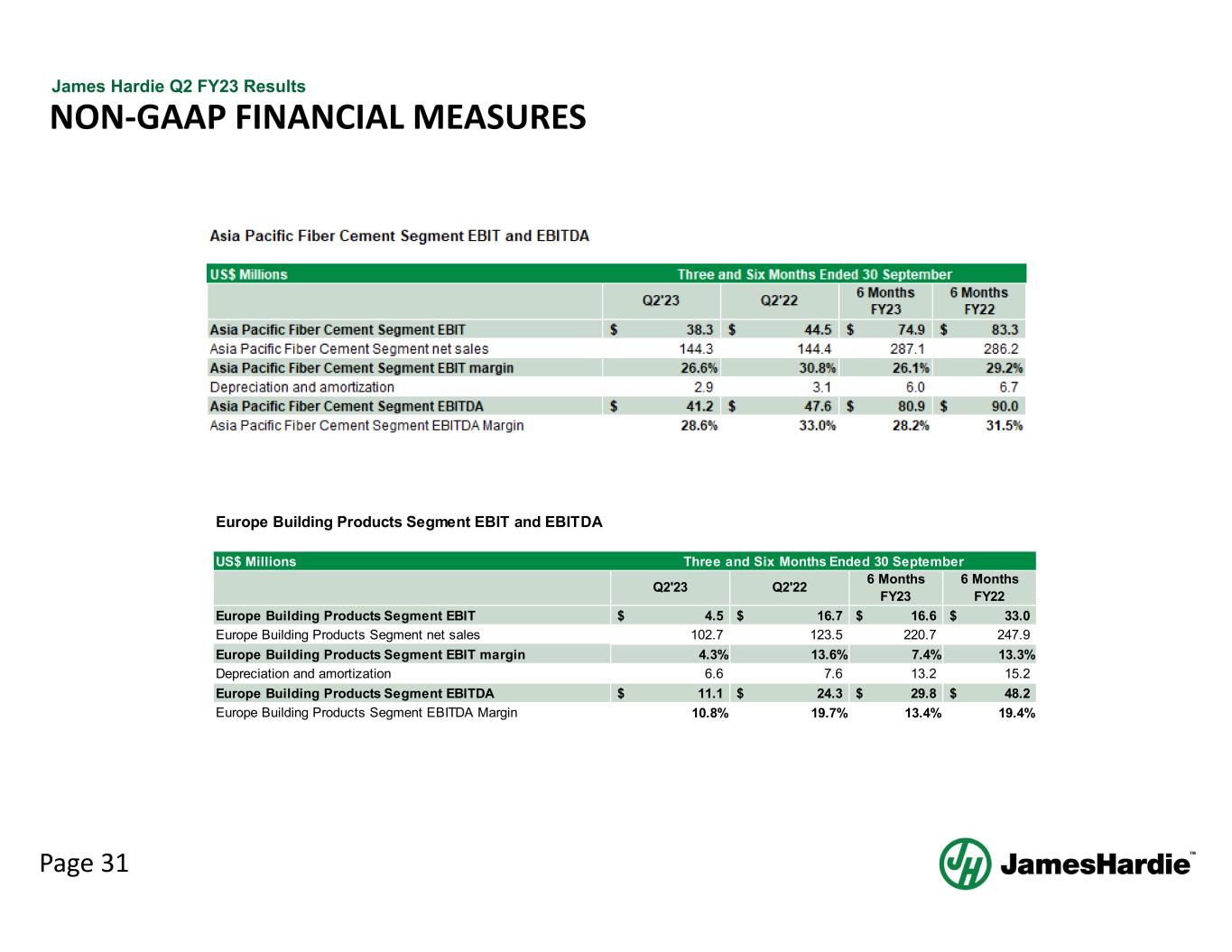

Page 31 James Hardie Q2 FY23 Results NON‐GAAP FINANCIAL MEASURES US$ Millions Q2'23 Q2'22 6 Months FY23 6 Months FY22 Europe Building Products Segment EBIT 4.5$ 16.7$ 16.6$ 33.0$ Europe Building Products Segment net sales 102.7 123.5 220.7 247.9 Europe Building Products Segment EBIT margin 4.3% 13.6% 7.4% 13.3% Depreciation and amortization 6.6 7.6 13.2 15.2 Europe Building Products Segment EBITDA 11.1$ 24.3$ 29.8$ 48.2$ Europe Building Products Segment EBITDA Margin 10.8% 19.7% 13.4% 19.4% Three and Six Months Ended 30 September Europe Building Products Segment EBIT and EBITDA

Page 32 James Hardie Q2 FY23 Results NON‐GAAP FINANCIAL MEASURES

Page 33 James Hardie Q2 FY23 Results NON‐GAAP FINANCIAL MEASURES

Q2 FY23 MANAGEMENT PRESENTATION 8 November 2022