13 FEBRUARY 2024 Q3 FY24 Management Presentation Exhibit 99.5

Page 2 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This Management Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Management Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2023; changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Management Presentation except as required by law. This Management Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Management Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see the slide titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. In addition, this Management Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Condensed Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Management Presentation to the equivalent GAAP financial measure used in the Company’s Condensed Consolidated Financial Statements. See the section titled “Non-GAAP Financial Measures” included in the Appendix to this Management Presentation. All amounts are in US Dollars, unless otherwise noted CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS USE OF NON-GAAP FINANCIAL INFORMATION; AUSTRALIAN EQUIVALENT TERMINOLOGY

Page 3 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S AGENDA • Strategy and Operations • Financial Results • Outlook and Guidance • Q&A Aaron Erter CEO Rachel Wilson CFO

Strategy and Operations 13 FEBRUARY 2024

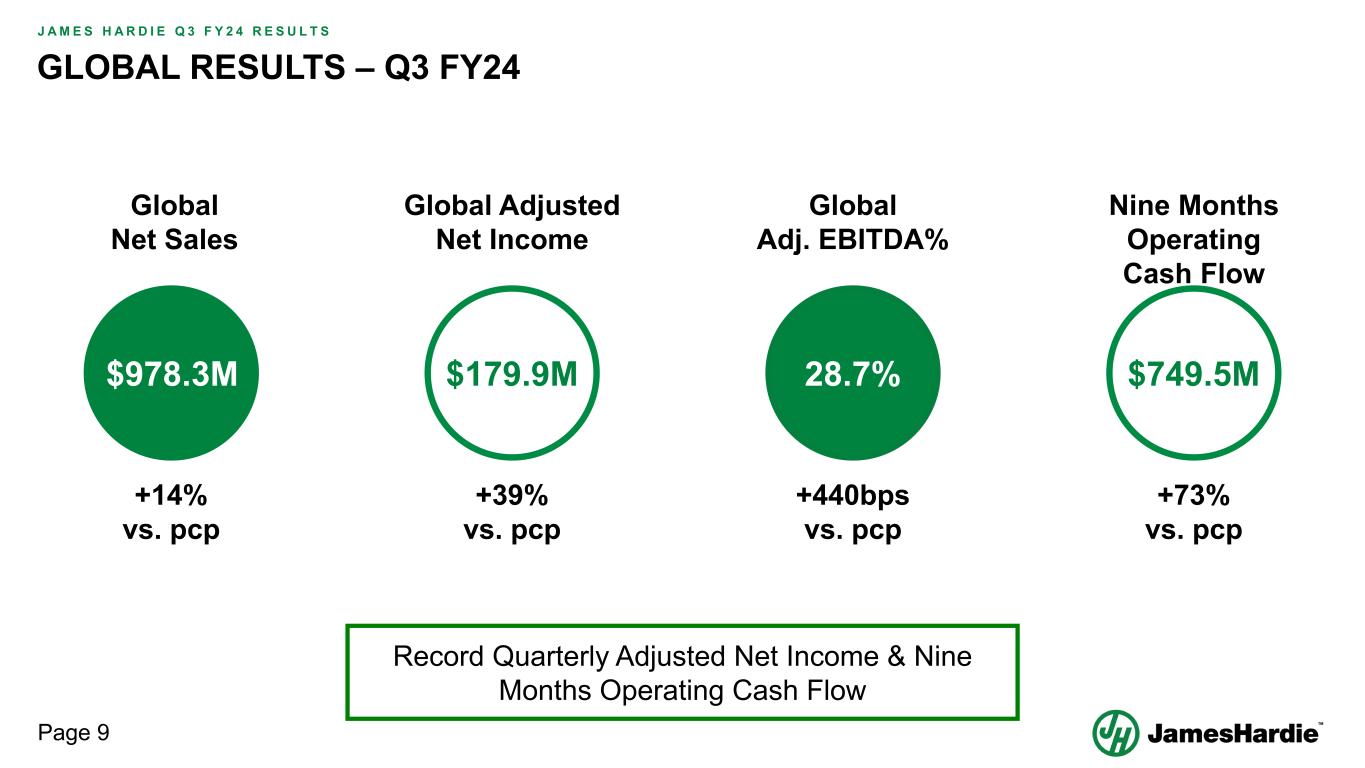

Page 5 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S CEO OPERATIONS UPDATE: OUTPERFORMING IN THE MARKETS WE PARTICIPATE Operational Focus… …Delivered Strong Q3 Results Continue Strong Execution of Our Strategy Drive Profitable Volume Share Gain Effectively Balance Our Manufacturing Network • Global Net Sales of US$978.3 Million +14% vs pcp • Record Global Adjusted Net Income of US$179.9 Million up 39% vs pcp • Record North America EBIT and EBIT Margin of US$237.8 Million and 32.7% • Record Nine Months Operating Cash Flow of US$749.5 Million Continued Investment In Profitable Growth

Page 6 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S GLOBAL STRATEGIC FRAMEWORK Strategic Initiatives 1 Profitably grow and take share where we have the right to win 2 Bring our customers high valued, differentiated solutions 3 Connect and influence all the participants in the customer value chain Enabled by Customer Integration Innovative Solutions Brand of Choice Global Capacity Expansion Supported by our Foundational Imperatives Our PeopleESGZero Harm Hardie Operating System Homeowner Focused, Customer and Contractor Driven™

Page 7 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S Customer Integration Right Products, Right Place, Right Time Dream Builder Interactive, In-Person Events Contractor Alliance Program Lead sharing, Dedicated Support and Co-Branding Unrivaled Support Localized Manufacturing1 Close Proximity to Our Customers 67% of Product Deliveries Are Within 500 miles of our Plants Efficient Supply Chains 81% of Raw Materials Sourced Within 150 Miles of our Plants Investing in, and Supporting Our Communities Contributed $1.85bn In Economic Value in Communities Where we Operate NA Manufacturing Footprint 1. See James Hardie FY23 Sustainability Report 500 Miles JH Facility

13 FEBRUARY 2024 Financial Results

Page 9 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S GLOBAL RESULTS – Q3 FY24 $749.5M$179.9M$978.3M 28.7% Global Net Sales +14% vs. pcp +39% vs. pcp Global Adjusted Net Income Global Adj. EBITDA% +440bps vs. pcp Nine Months Operating Cash Flow +73% vs. pcp Record Quarterly Adjusted Net Income & Nine Months Operating Cash Flow

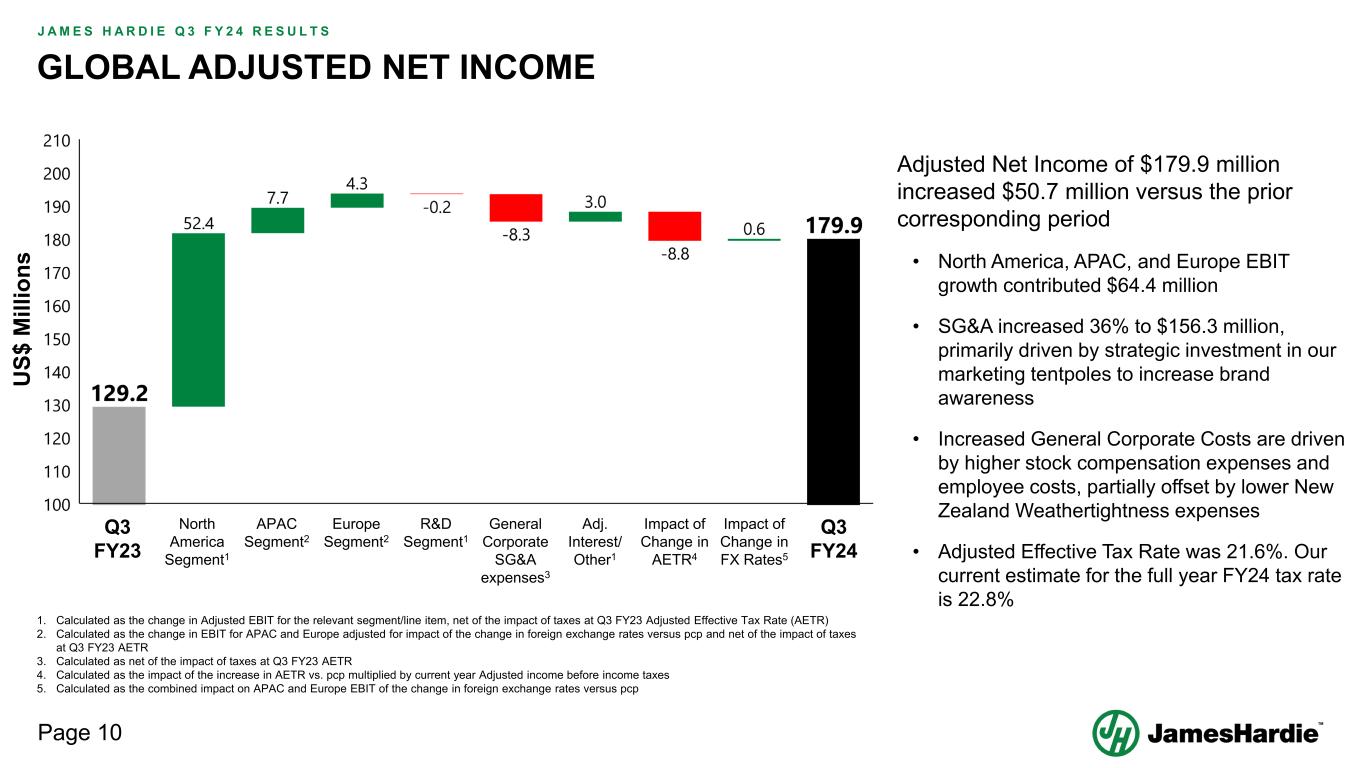

Page 10 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S GLOBAL ADJUSTED NET INCOME Adjusted Net Income of $179.9 million increased $50.7 million versus the prior corresponding period • North America, APAC, and Europe EBIT growth contributed $64.4 million • SG&A increased 36% to $156.3 million, primarily driven by strategic investment in our marketing tentpoles to increase brand awareness • Increased General Corporate Costs are driven by higher stock compensation expenses and employee costs, partially offset by lower New Zealand Weathertightness expenses • Adjusted Effective Tax Rate was 21.6%. Our current estimate for the full year FY24 tax rate is 22.8% North America Segment1 Europe Segment2 R&D Segment1 General Corporate SG&A expenses3 Adj. Interest/ Other1 Impact of Change in AETR4 Impact of Change in FX Rates5 Q3 FY23 Q3 FY24 APAC Segment2 U S$ M ill io ns 1. Calculated as the change in Adjusted EBIT for the relevant segment/line item, net of the impact of taxes at Q3 FY23 Adjusted Effective Tax Rate (AETR) 2. Calculated as the change in EBIT for APAC and Europe adjusted for impact of the change in foreign exchange rates versus pcp and net of the impact of taxes at Q3 FY23 AETR 3. Calculated as net of the impact of taxes at Q3 FY23 AETR 4. Calculated as the impact of the increase in AETR vs. pcp multiplied by current year Adjusted income before income taxes 5. Calculated as the combined impact on APAC and Europe EBIT of the change in foreign exchange rates versus pcp

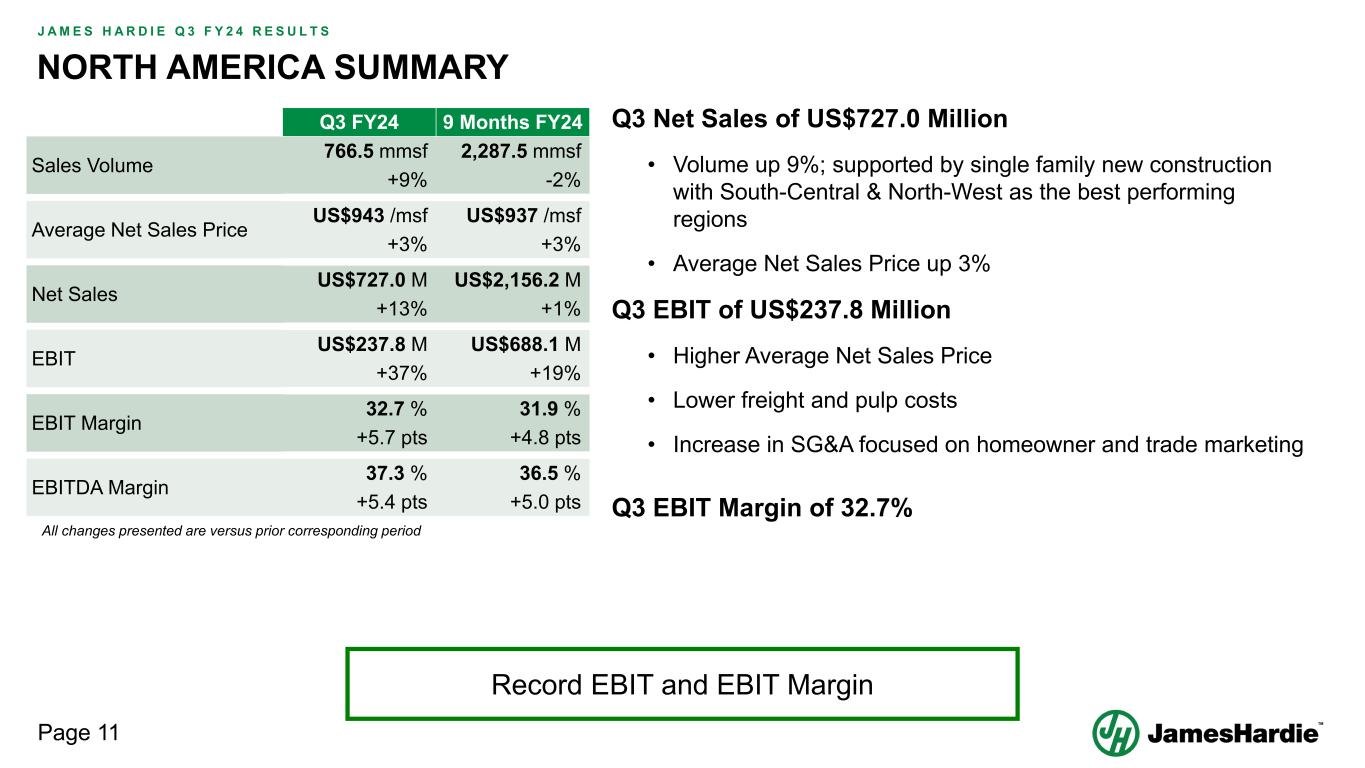

Page 11 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NORTH AMERICA SUMMARY Q3 Net Sales of US$727.0 Million • Volume up 9%; supported by single family new construction with South-Central & North-West as the best performing regions • Average Net Sales Price up 3% Q3 EBIT of US$237.8 Million • Higher Average Net Sales Price • Lower freight and pulp costs • Increase in SG&A focused on homeowner and trade marketing Q3 EBIT Margin of 32.7% Record EBIT and EBIT Margin Q3 FY24 9 Months FY24 Sales Volume 766.5 mmsf 2,287.5 mmsf +9% -2% Average Net Sales Price US$943 /msf US$937 /msf +3% +3% Net Sales US$727.0 M US$2,156.2 M +13% +1% EBIT US$237.8 M US$688.1 M +37% +19% EBIT Margin 32.7 % 31.9 % +5.7 pts +4.8 pts EBITDA Margin 37.3 % 36.5 % +5.4 pts +5.0 pts All changes presented are versus prior corresponding period

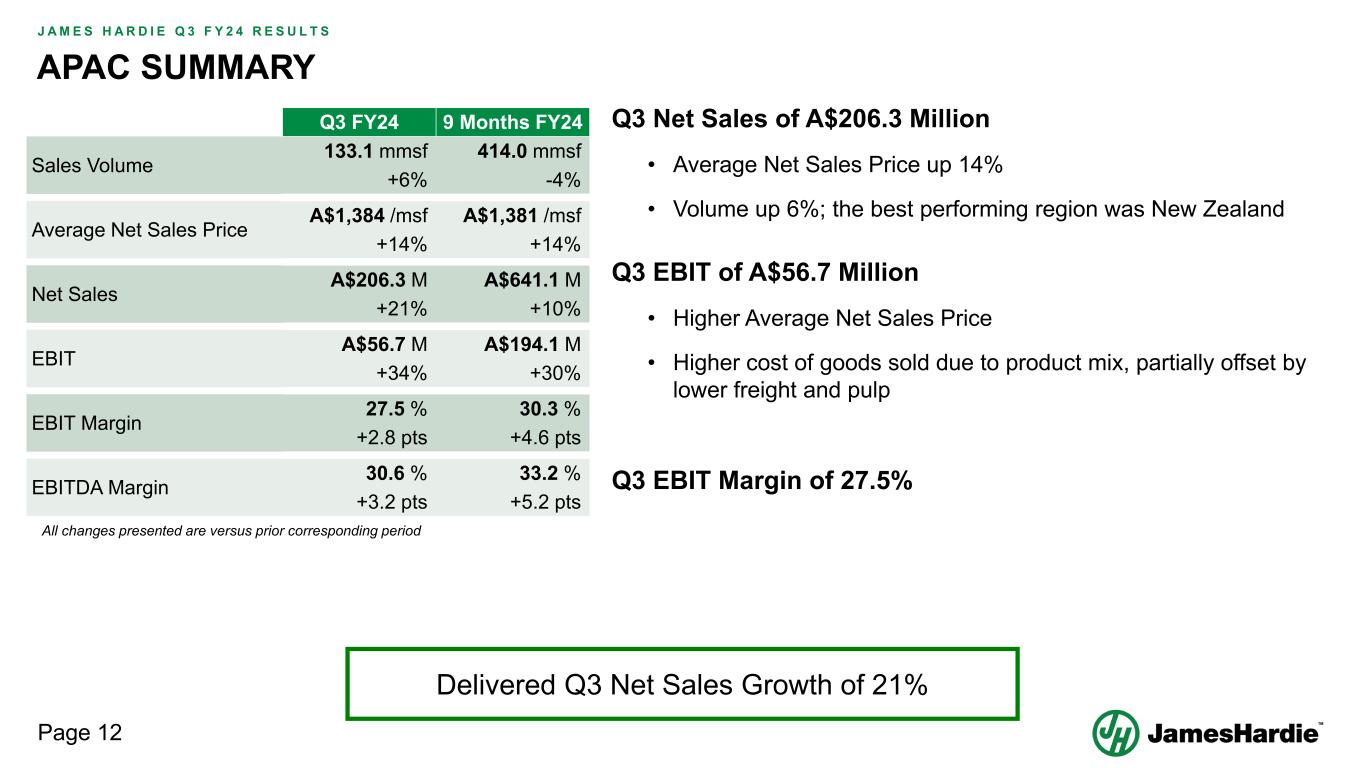

Page 12 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S APAC SUMMARY Delivered Q3 Net Sales Growth of 21% Q3 Net Sales of A$206.3 Million • Average Net Sales Price up 14% • Volume up 6%; the best performing region was New Zealand Q3 EBIT of A$56.7 Million • Higher Average Net Sales Price • Higher cost of goods sold due to product mix, partially offset by lower freight and pulp Q3 EBIT Margin of 27.5% Q3 FY24 9 Months FY24 Sales Volume 133.1 mmsf 414.0 mmsf +6% -4% Average Net Sales Price A$1,384 /msf A$1,381 /msf +14% +14% Net Sales A$206.3 M A$641.1 M +21% +10% EBIT A$56.7 M A$194.1 M +34% +30% EBIT Margin 27.5 % 30.3 % +2.8 pts +4.6 pts EBITDA Margin 30.6 % 33.2 % +3.2 pts +5.2 pts All changes presented are versus prior corresponding period

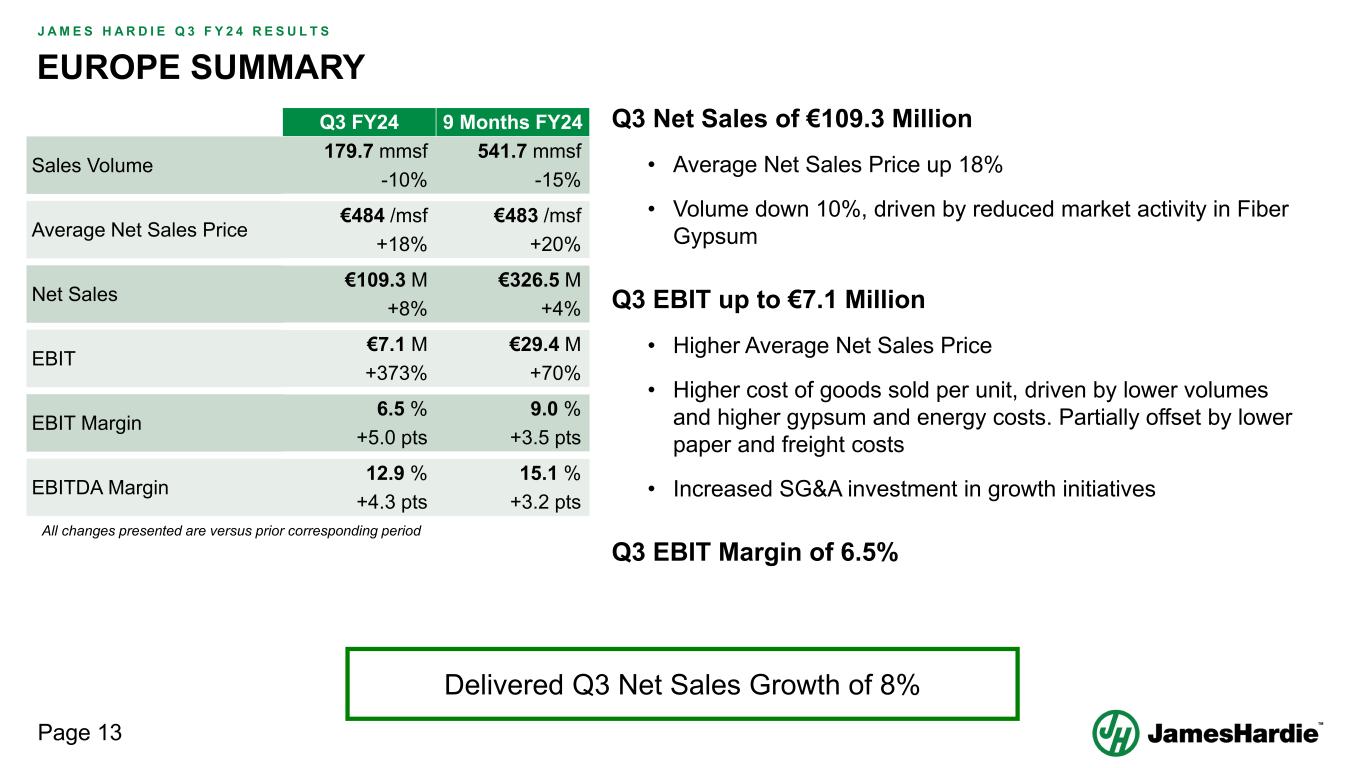

Page 13 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S EUROPE SUMMARY Delivered Q3 Net Sales Growth of 8% Q3 Net Sales of €109.3 Million • Average Net Sales Price up 18% • Volume down 10%, driven by reduced market activity in Fiber Gypsum Q3 EBIT up to €7.1 Million • Higher Average Net Sales Price • Higher cost of goods sold per unit, driven by lower volumes and higher gypsum and energy costs. Partially offset by lower paper and freight costs • Increased SG&A investment in growth initiatives Q3 EBIT Margin of 6.5% Q3 FY24 9 Months FY24 Sales Volume 179.7 mmsf 541.7 mmsf -10% -15% Average Net Sales Price €484 /msf €483 /msf +18% +20% Net Sales €109.3 M €326.5 M +8% +4% EBIT €7.1 M €29.4 M +373% +70% EBIT Margin 6.5 % 9.0 % +5.0 pts +3.5 pts EBITDA Margin 12.9 % 15.1 % +4.3 pts +3.2 pts All changes presented are versus prior corresponding period

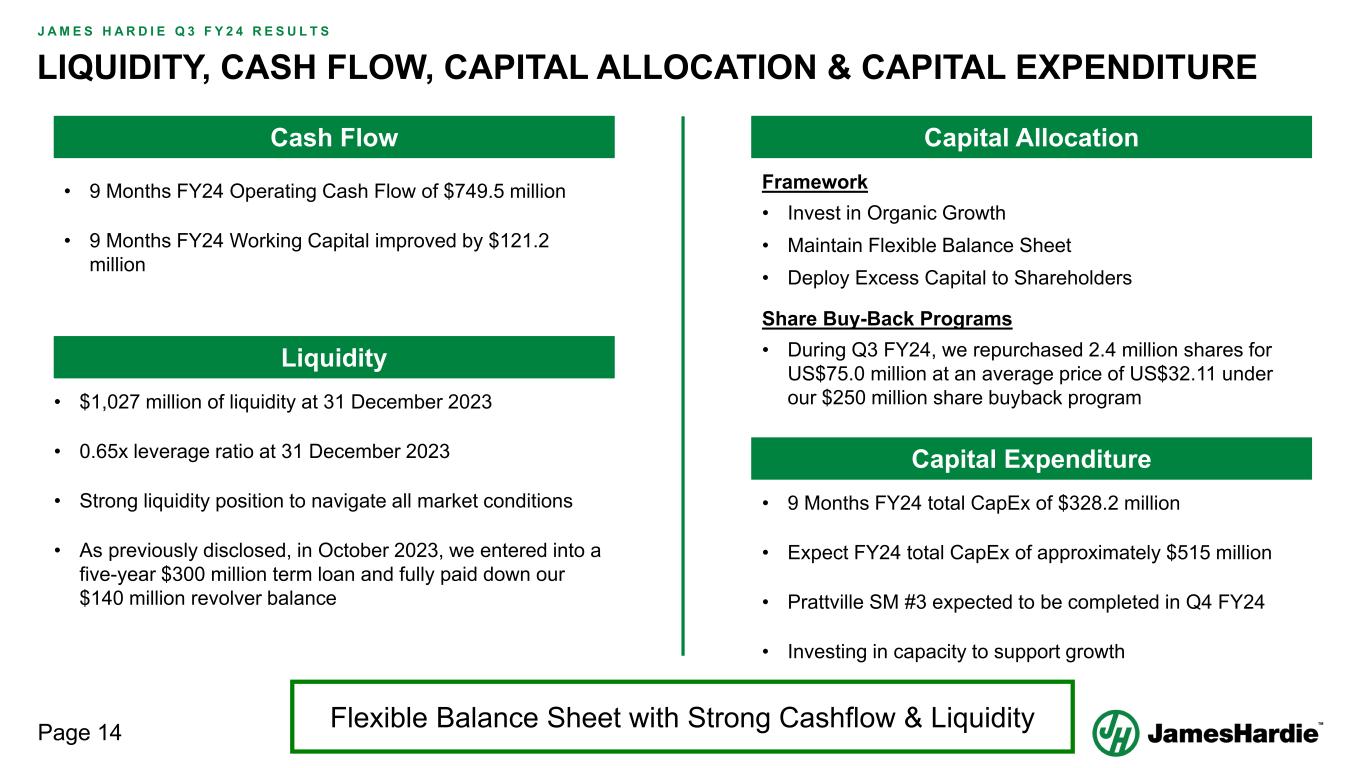

Page 14 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S LIQUIDITY, CASH FLOW, CAPITAL ALLOCATION & CAPITAL EXPENDITURE • 9 Months FY24 Operating Cash Flow of $749.5 million • 9 Months FY24 Working Capital improved by $121.2 million • $1,027 million of liquidity at 31 December 2023 • 0.65x leverage ratio at 31 December 2023 • Strong liquidity position to navigate all market conditions • As previously disclosed, in October 2023, we entered into a five-year $300 million term loan and fully paid down our $140 million revolver balance Cash Flow Liquidity Capital Allocation Framework • Invest in Organic Growth • Maintain Flexible Balance Sheet • Deploy Excess Capital to Shareholders Share Buy-Back Programs • During Q3 FY24, we repurchased 2.4 million shares for US$75.0 million at an average price of US$32.11 under our $250 million share buyback program • 9 Months FY24 total CapEx of $328.2 million • Expect FY24 total CapEx of approximately $515 million • Prattville SM #3 expected to be completed in Q4 FY24 • Investing in capacity to support growth Capital Expenditure Flexible Balance Sheet with Strong Cashflow & Liquidity

Outlook and Guidance 13 FEBRUARY 2024

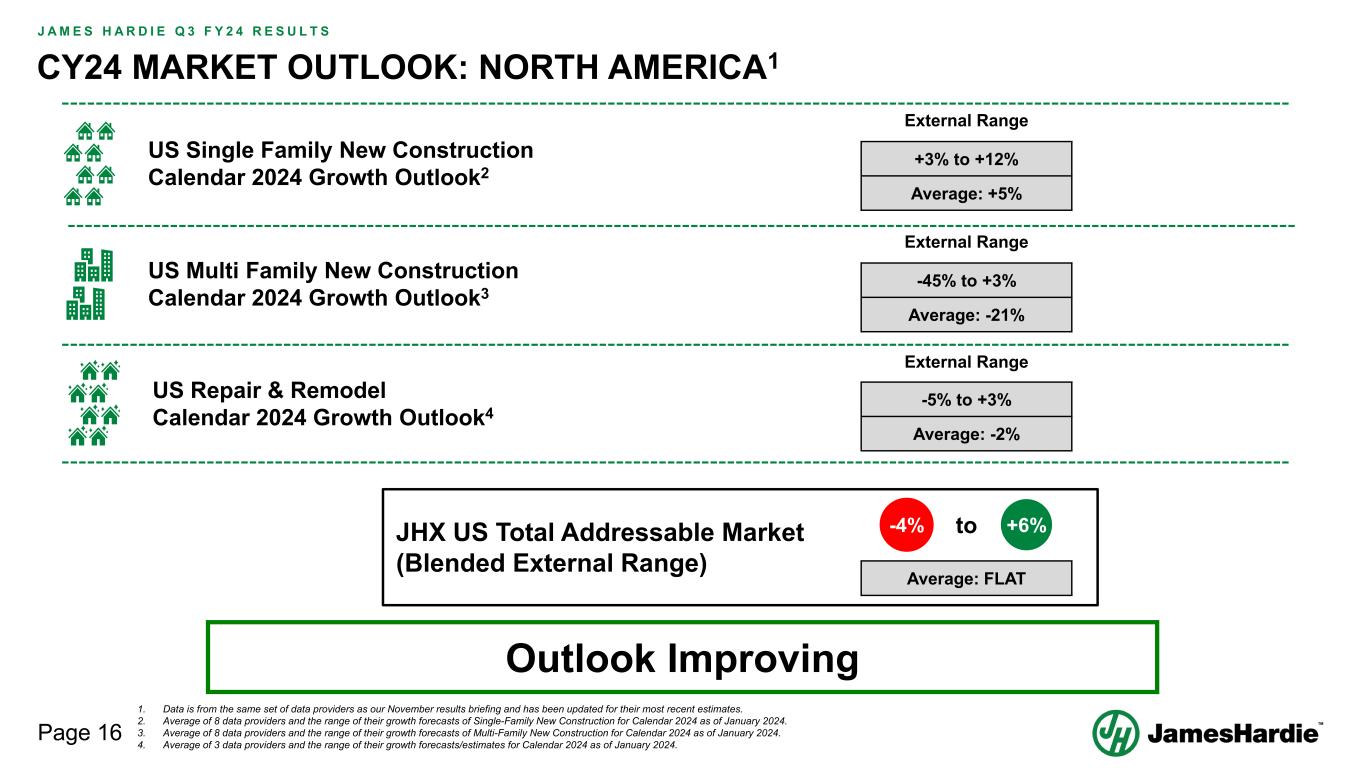

Page 16 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S CY24 MARKET OUTLOOK: NORTH AMERICA1 1. Data is from the same set of data providers as our November results briefing and has been updated for their most recent estimates. 2. Average of 8 data providers and the range of their growth forecasts of Single-Family New Construction for Calendar 2024 as of January 2024. 3. Average of 8 data providers and the range of their growth forecasts of Multi-Family New Construction for Calendar 2024 as of January 2024. 4. Average of 3 data providers and the range of their growth forecasts/estimates for Calendar 2024 as of January 2024. US Single Family New Construction Calendar 2024 Growth Outlook2 US Repair & Remodel Calendar 2024 Growth Outlook4 External Range +3% to +12% Average: +5% External Range -45% to +3% Average: -21% US Multi Family New Construction Calendar 2024 Growth Outlook3 External Range -5% to +3% Average: -2% -4% +6%toJHX US Total Addressable Market (Blended External Range) Outlook Improving +X% Average: FLAT

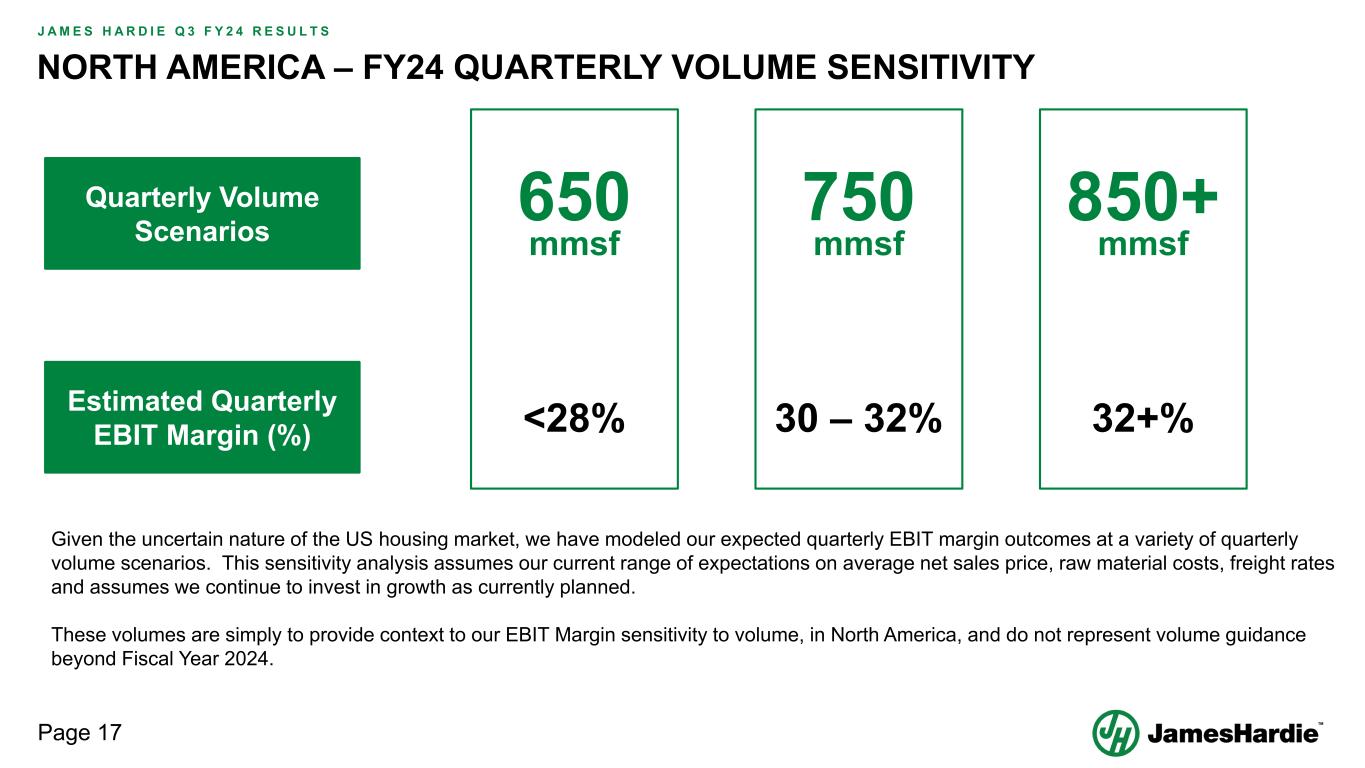

Page 17 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NORTH AMERICA – FY24 QUARTERLY VOLUME SENSITIVITY Estimated Quarterly EBIT Margin (%) 30 – 32% 750 mmsf <28% 650 mmsf Quarterly Volume Scenarios Given the uncertain nature of the US housing market, we have modeled our expected quarterly EBIT margin outcomes at a variety of quarterly volume scenarios. This sensitivity analysis assumes our current range of expectations on average net sales price, raw material costs, freight rates and assumes we continue to invest in growth as currently planned. These volumes are simply to provide context to our EBIT Margin sensitivity to volume, in North America, and do not represent volume guidance beyond Fiscal Year 2024. 32+% 850+ mmsf

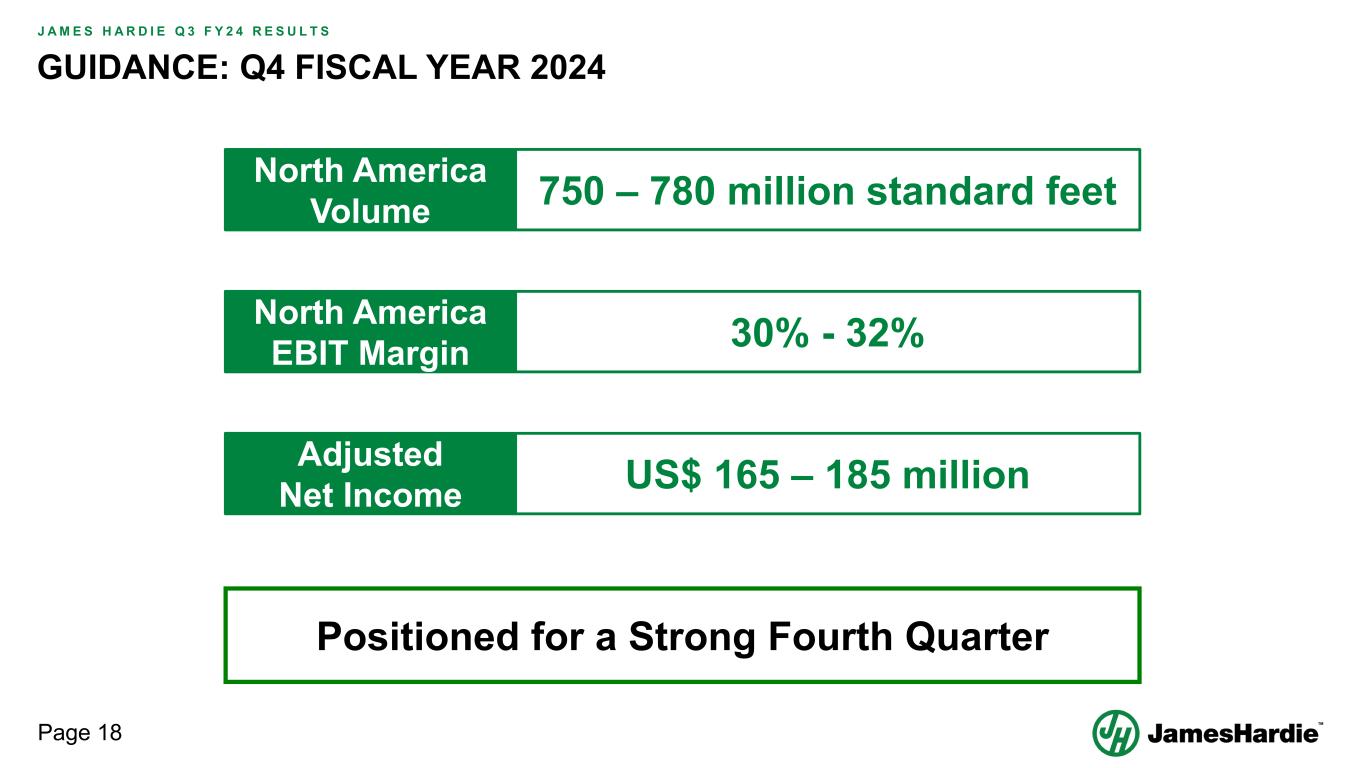

Page 18 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S GUIDANCE: Q4 FISCAL YEAR 2024 Adjusted Net Income US$ 165 – 185 million North America Volume 750 – 780 million standard feet North America EBIT Margin 30% - 32% Positioned for a Strong Fourth Quarter

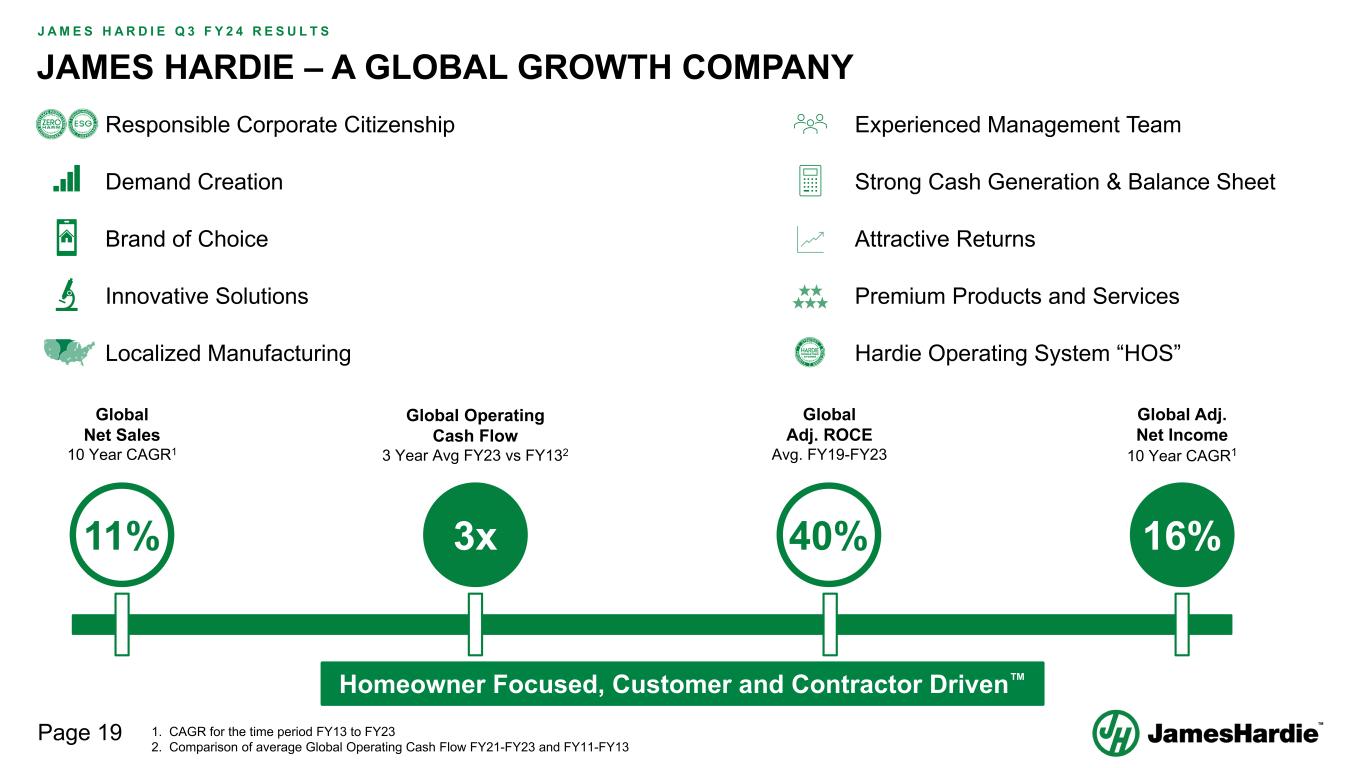

Page 19 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S JAMES HARDIE – A GLOBAL GROWTH COMPANY Responsible Corporate Citizenship Demand Creation Brand of Choice Innovative Solutions Localized Manufacturing Experienced Management Team Strong Cash Generation & Balance Sheet Attractive Returns Premium Products and Services Hardie Operating System “HOS” 1. CAGR for the time period FY13 to FY23 2. Comparison of average Global Operating Cash Flow FY21-FY23 and FY11-FY13 Homeowner Focused, Customer and Contractor Driven™ 11% 16%3x 40% Global Net Sales 10 Year CAGR1 Global Adj. ROCE Avg. FY19-FY23 Global Operating Cash Flow 3 Year Avg FY23 vs FY132 Global Adj. Net Income 10 Year CAGR1

Page 20 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S INVESTOR DAY 2024 Register Your Interest Here

Questions 13 FEBRUARY 2024

Appendix 13 FEBRUARY 2024

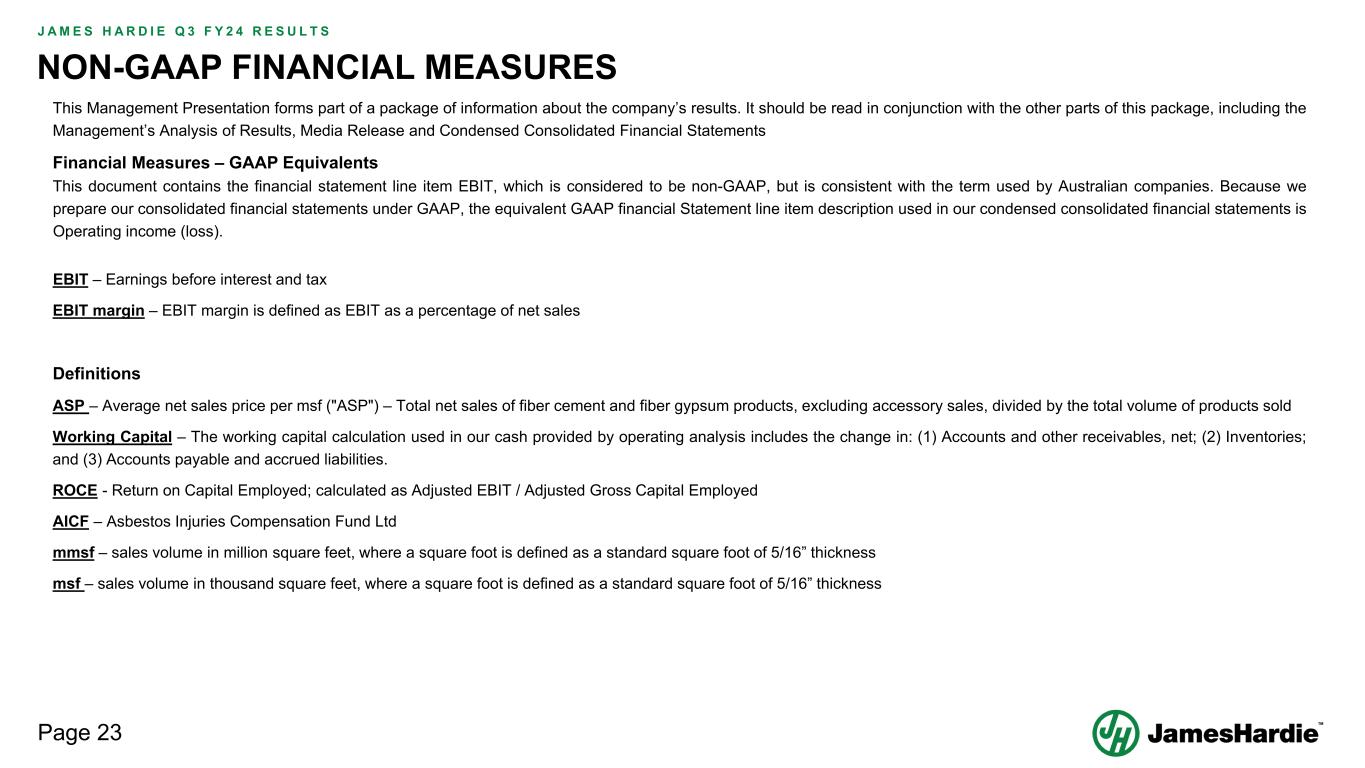

Page 23 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NON-GAAP FINANCIAL MEASURES This Management Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Media Release and Condensed Consolidated Financial Statements Financial Measures – GAAP Equivalents This document contains the financial statement line item EBIT, which is considered to be non-GAAP, but is consistent with the term used by Australian companies. Because we prepare our consolidated financial statements under GAAP, the equivalent GAAP financial Statement line item description used in our condensed consolidated financial statements is Operating income (loss). EBIT – Earnings before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Definitions ASP – Average net sales price per msf ("ASP") – Total net sales of fiber cement and fiber gypsum products, excluding accessory sales, divided by the total volume of products sold Working Capital – The working capital calculation used in our cash provided by operating analysis includes the change in: (1) Accounts and other receivables, net; (2) Inventories; and (3) Accounts payable and accrued liabilities. ROCE - Return on Capital Employed; calculated as Adjusted EBIT / Adjusted Gross Capital Employed AICF – Asbestos Injuries Compensation Fund Ltd mmsf – sales volume in million square feet, where a square foot is defined as a standard square foot of 5/16” thickness msf – sales volume in thousand square feet, where a square foot is defined as a standard square foot of 5/16” thickness

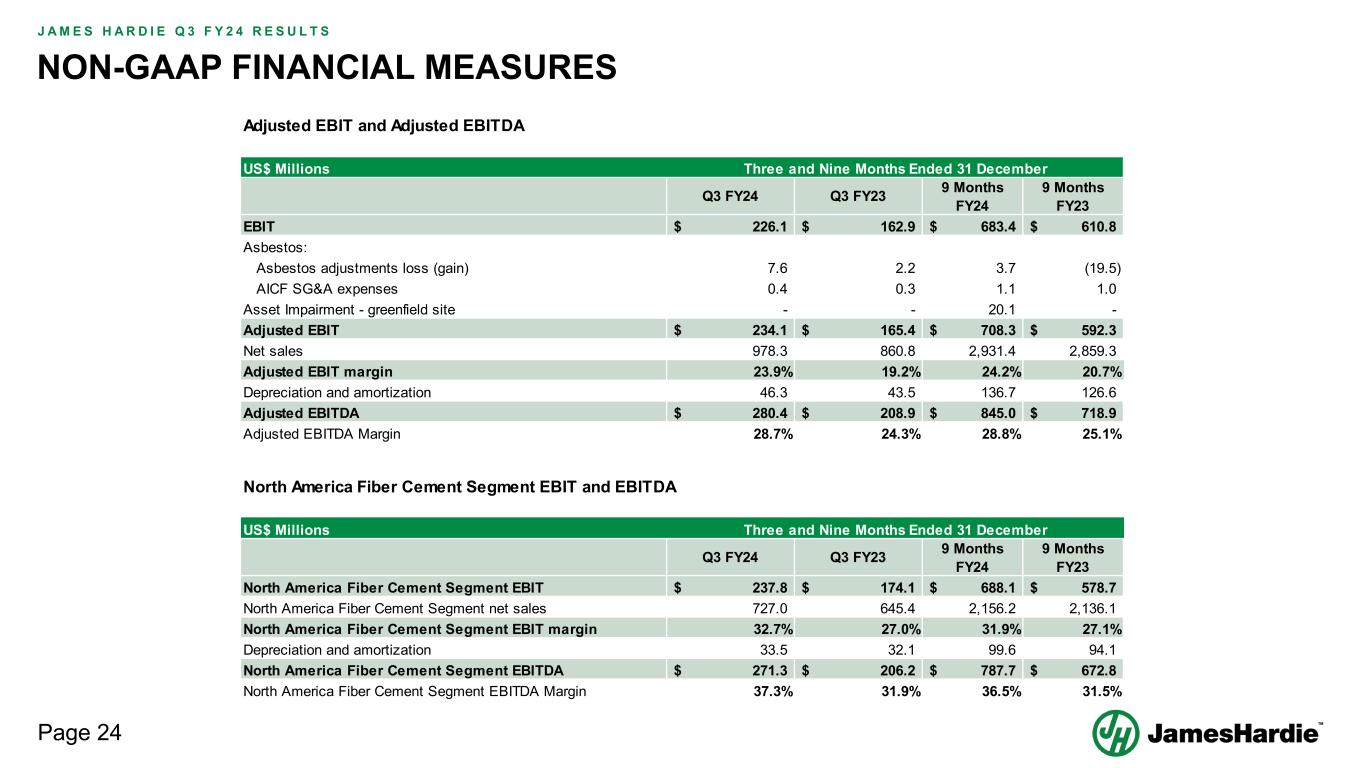

Page 24 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NON-GAAP FINANCIAL MEASURES Adjusted EBIT and Adjusted EBITDA US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 EBIT 226.1$ 162.9$ 683.4$ 610.8$ Asbestos: Asbestos adjustments loss (gain) 7.6 2.2 3.7 (19.5) AICF SG&A expenses 0.4 0.3 1.1 1.0 Asset Impairment - greenfield site - - 20.1 - Adjusted EBIT 234.1$ 165.4$ 708.3$ 592.3$ Net sales 978.3 860.8 2,931.4 2,859.3 Adjusted EBIT margin 23.9% 19.2% 24.2% 20.7% Depreciation and amortization 46.3 43.5 136.7 126.6 Adjusted EBITDA 280.4$ 208.9$ 845.0$ 718.9$ Adjusted EBITDA Margin 28.7% 24.3% 28.8% 25.1% Three and Nine Months Ended 31 December US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 North America Fiber Cement Segment EBIT 237.8$ 174.1$ 688.1$ 578.7$ North America Fiber Cement Segment net sales 727.0 645.4 2,156.2 2,136.1 North America Fiber Cement Segment EBIT margin 32.7% 27.0% 31.9% 27.1% Depreciation and amortization 33.5 32.1 99.6 94.1 North America Fiber Cement Segment EBITDA 271.3$ 206.2$ 787.7$ 672.8$ North America Fiber Cement Segment EBITDA Margin 37.3% 31.9% 36.5% 31.5% North America Fiber Cement Segment EBIT and EBITDA Three and Nine Months Ended 31 December

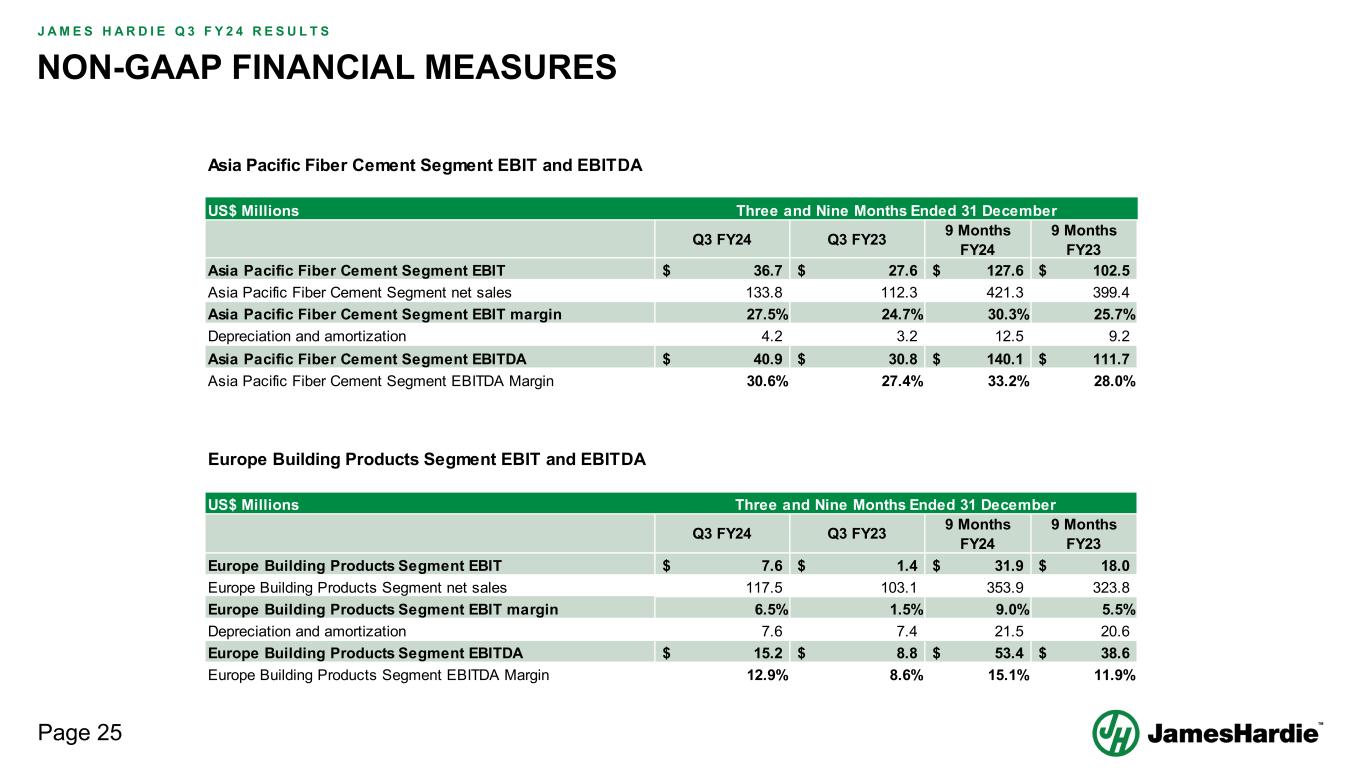

Page 25 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NON-GAAP FINANCIAL MEASURES US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 Asia Pacific Fiber Cement Segment EBIT 36.7$ 27.6$ 127.6$ 102.5$ Asia Pacific Fiber Cement Segment net sales 133.8 112.3 421.3 399.4 Asia Pacific Fiber Cement Segment EBIT margin 27.5% 24.7% 30.3% 25.7% Depreciation and amortization 4.2 3.2 12.5 9.2 Asia Pacific Fiber Cement Segment EBITDA 40.9$ 30.8$ 140.1$ 111.7$ Asia Pacific Fiber Cement Segment EBITDA Margin 30.6% 27.4% 33.2% 28.0% Asia Pacific Fiber Cement Segment EBIT and EBITDA Three and Nine Months Ended 31 December US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 Europe Building Products Segment EBIT 7.6$ 1.4$ 31.9$ 18.0$ Europe Building Products Segment net sales 117.5 103.1 353.9 323.8 Europe Building Products Segment EBIT margin 6.5% 1.5% 9.0% 5.5% Depreciation and amortization 7.6 7.4 21.5 20.6 Europe Building Products Segment EBITDA 15.2$ 8.8$ 53.4$ 38.6$ Europe Building Products Segment EBITDA Margin 12.9% 8.6% 15.1% 11.9% Three and Nine Months Ended 31 December Europe Building Products Segment EBIT and EBITDA

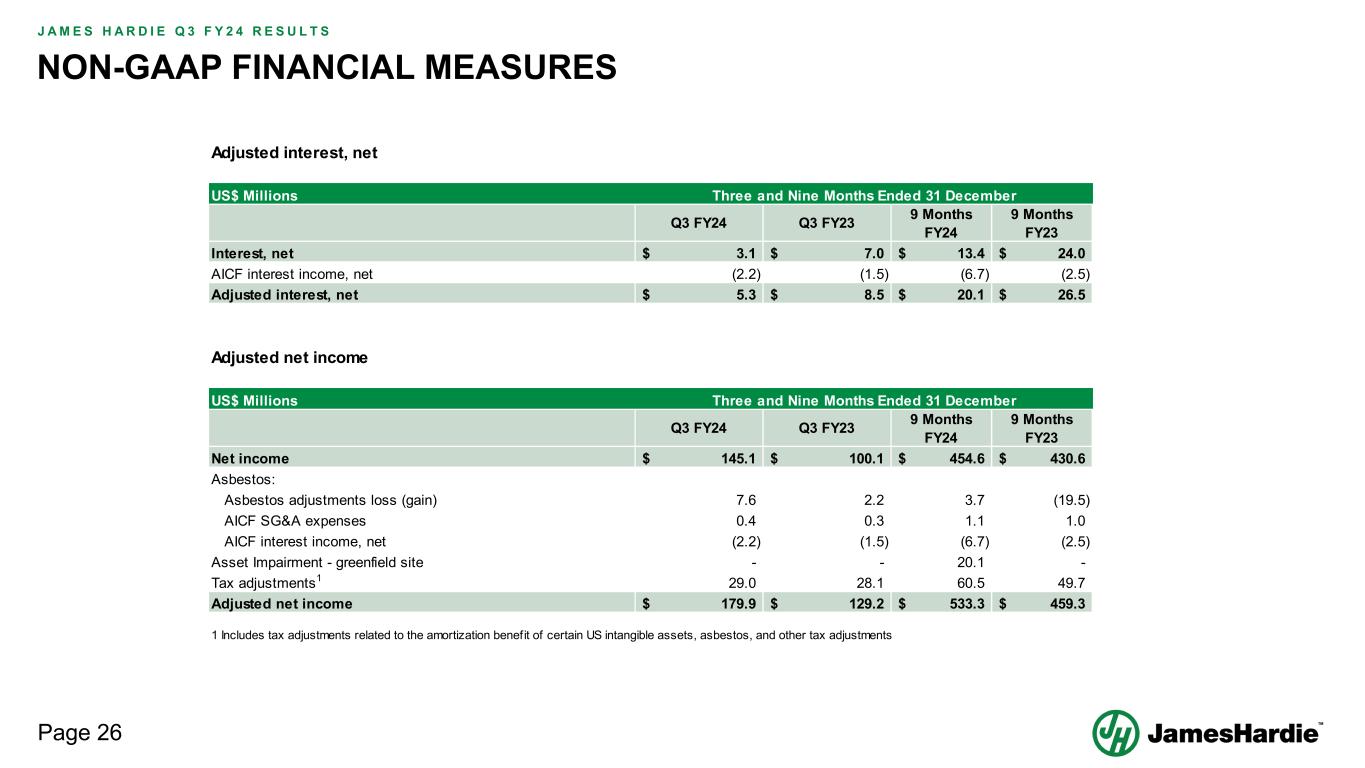

Page 26 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NON-GAAP FINANCIAL MEASURES US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 Interest, net 3.1$ 7.0$ 13.4$ 24.0$ AICF interest income, net (2.2) (1.5) (6.7) (2.5) Adjusted interest, net 5.3$ 8.5$ 20.1$ 26.5$ Adjusted interest, net Three and Nine Months Ended 31 December Adjusted net income US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 Net income 145.1$ 100.1$ 454.6$ 430.6$ Asbestos: Asbestos adjustments loss (gain) 7.6 2.2 3.7 (19.5) AICF SG&A expenses 0.4 0.3 1.1 1.0 AICF interest income, net (2.2) (1.5) (6.7) (2.5) Asset Impairment - greenfield site - - 20.1 - Tax adjustments1 29.0 28.1 60.5 49.7 Adjusted net income 179.9$ 129.2$ 533.3$ 459.3$ 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Three and Nine Months Ended 31 December

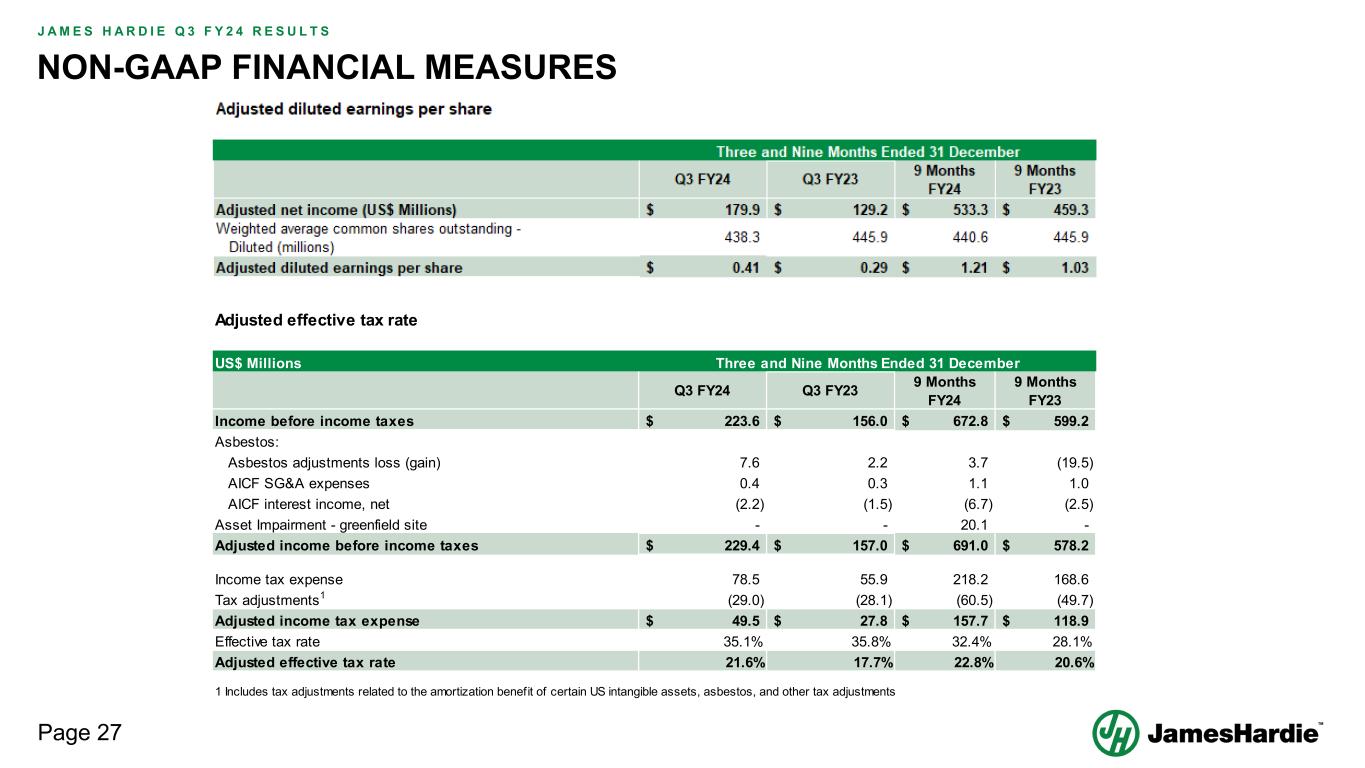

Page 27 J A M E S H A R D I E Q 3 F Y 2 4 R E S U L T S NON-GAAP FINANCIAL MEASURES Adjusted effective tax rate US$ Millions Q3 FY24 Q3 FY23 9 Months FY24 9 Months FY23 Income before income taxes 223.6$ 156.0$ 672.8$ 599.2$ Asbestos: Asbestos adjustments loss (gain) 7.6 2.2 3.7 (19.5) AICF SG&A expenses 0.4 0.3 1.1 1.0 AICF interest income, net (2.2) (1.5) (6.7) (2.5) Asset Impairment - greenfield site - - 20.1 - Adjusted income before income taxes 229.4$ 157.0$ 691.0$ 578.2$ Income tax expense 78.5 55.9 218.2 168.6 Tax adjustments1 (29.0) (28.1) (60.5) (49.7) Adjusted income tax expense 49.5$ 27.8$ 157.7$ 118.9$ Effective tax rate 35.1% 35.8% 32.4% 28.1% Adjusted effective tax rate 21.6% 17.7% 22.8% 20.6% 1 Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Three and Nine Months Ended 31 December

13 FEBRUARY 2024 Q3 FY24 Management Presentation