First Quarter FY25 Earnings Presentation MONDAY, AUGUST 12th TUESDAY, AUGUST 13th DUBLINCHICAGO SYDNEY | | | Exhibit 99.4

2 Q1 FY25 Earnings Presentation Cautionary Note and Use of Non-GAAP Measures This Earnings Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions, beliefs and general good faith evaluation of information available at the time the forward-looking statements were made concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements or rely upon them as a guarantee of future performance or results or as an accurate indication of the times at or by which any such performance or results will be achieved. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Earnings Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended March 31, 2024, which include, but are not necessarily limited to risks such as changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Earnings Presentation except as required by law. This Earnings Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Earnings Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see slides titled “Non-GAAP Financial Measures” included in this Earnings Presentation. In addition, this Earnings Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Condensed Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Earnings Presentation to the equivalent GAAP financial measure used in the Company’s Condensed Consolidated Financial Statements. See slides titled “Non-GAAP Financial Measures” included in this Earnings Presentation. All comparisons made are vs. the comparable period in the prior fiscal year and amounts presented are in US dollars, unless otherwise noted. Investor Contact Joe Ahlersmeyer, CFA Vice President, Investor Relations [email protected]

3 Q1 FY25 Earnings Presentation Agenda Strategy Update Financial Review Outlook & Guidance Key Messages Aaron Erter Chief Executive Officer Rachel Wilson Chief Financial Officer Q&A

4 Q1 FY25 Earnings Presentation Key Messages Executing Our Strategy Delivering on Our Commitments Managing Decisively Investing for Future Growth Our Operational Focus Achieved Our Q1 Guidance Outperforming the Market Keeping Our Commitments A Solid Start to FY25 ✓ 751 mmsft North America Volume ✓ 31.2% North America EBIT Margin + $178mm Total Adjusted Net Income Delivering on Our Commitments Through A Challenging Market Delivering Value for Our Customers

5 Q1 FY25 Earnings Presentation 1 2 3 Profitably grow and take share where we have the right to win Bring our customers high valued, differentiated solutions Connect and influence all the participants in the customer value chain Our Strategy Spans the Value Chain Homeowner Focused, Customer and Contractor Driven Innovative Solutions Brand of Choice Strategic Initiatives Supported By Our Foundational Imperatives Enabled By Customer Integration Capacity Expansion

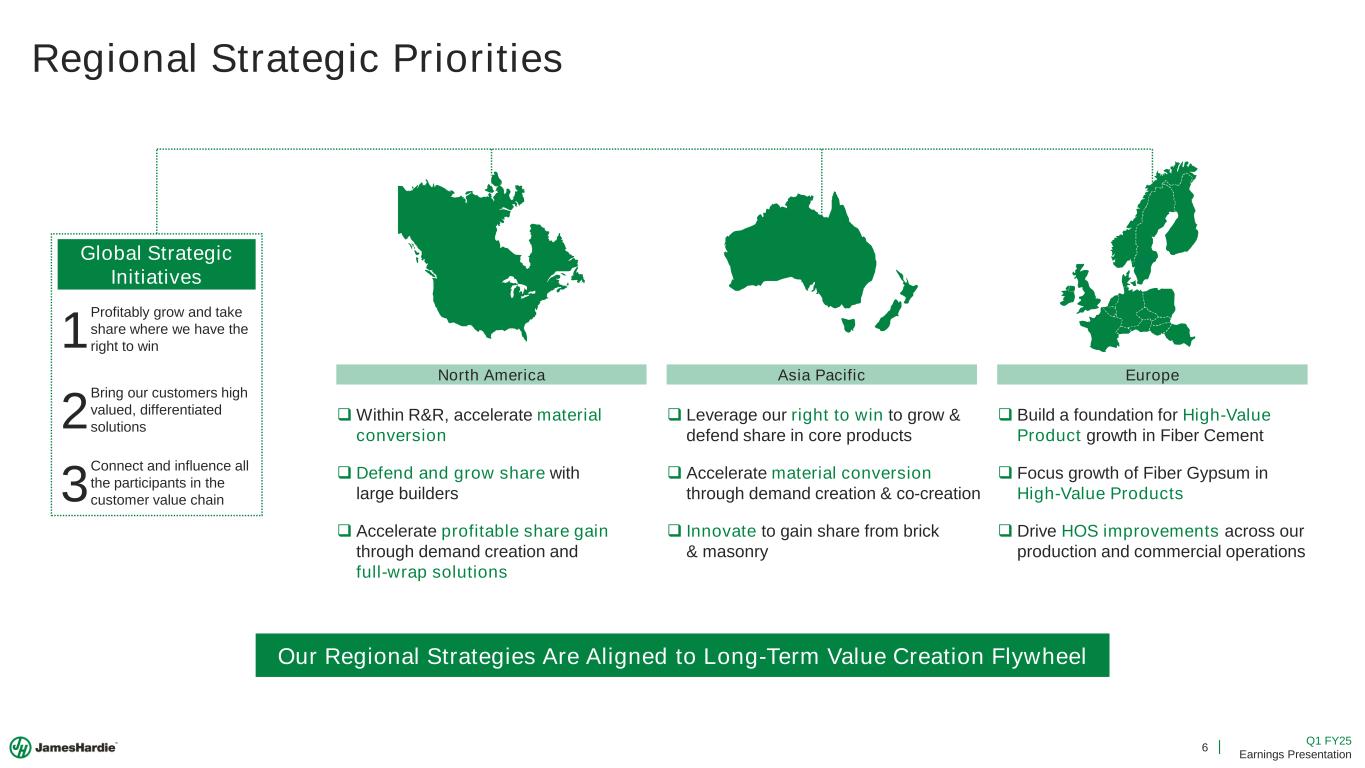

6 Q1 FY25 Earnings Presentation Regional Strategic Priorities Our Regional Strategies Are Aligned to Long-Term Value Creation Flywheel Asia Pacific Europe 1 2 3 Profitably grow and take share where we have the right to win Bring our customers high valued, differentiated solutions Connect and influence all the participants in the customer value chain Global Strategic Initiatives North America ❑ Within R&R, accelerate material conversion ❑ Defend and grow share with large builders ❑ Accelerate profitable share gain through demand creation and full-wrap solutions ❑ Leverage our right to win to grow & defend share in core products ❑ Accelerate material conversion through demand creation & co-creation ❑ Innovate to gain share from brick & masonry ❑ Build a foundation for High-Value Product growth in Fiber Cement ❑ Focus growth of Fiber Gypsum in High-Value Products ❑ Drive HOS improvements across our production and commercial operations

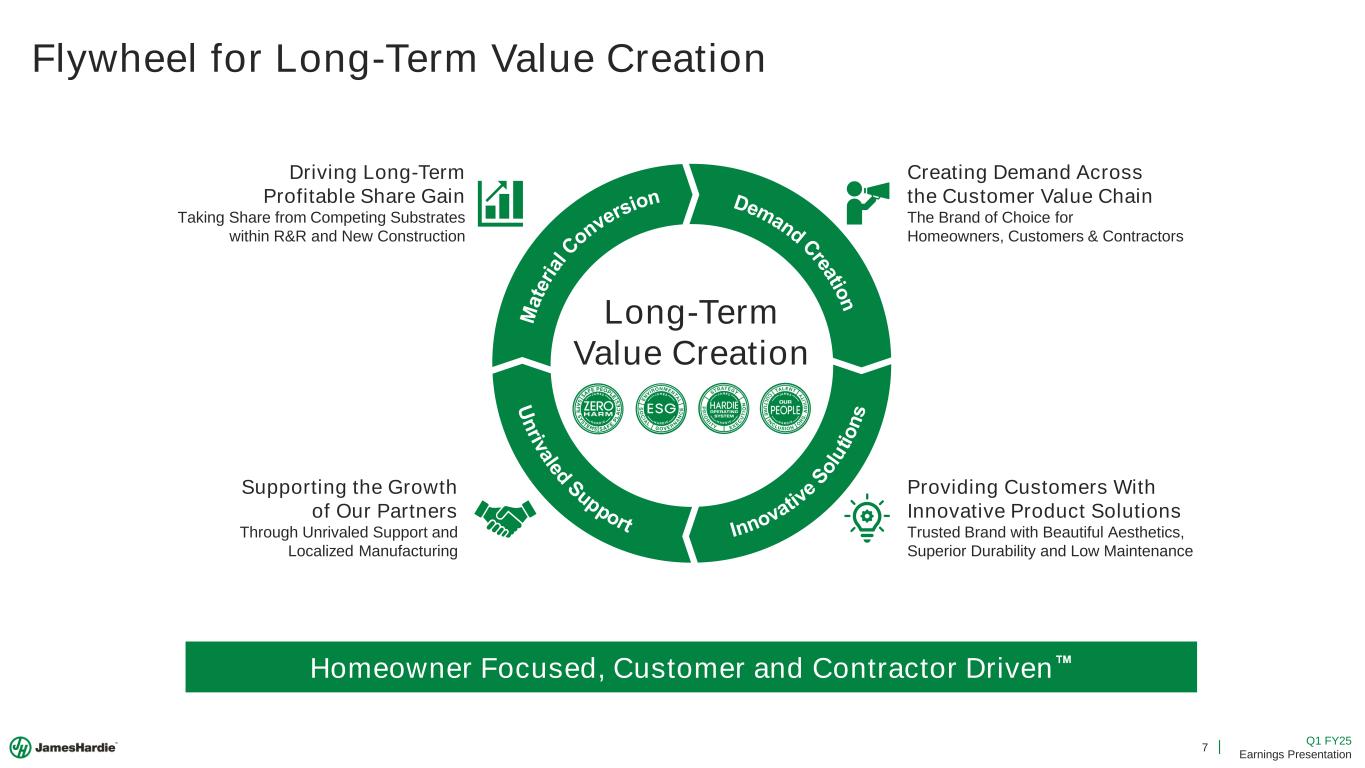

7 Q1 FY25 Earnings Presentation Flywheel for Long-Term Value Creation Demand C reatio n M a te ri al C onversion Long-Term Value Creation Driving Long-Term Profitable Share Gain Taking Share from Competing Substrates within R&R and New Construction Supporting the Growth of Our Partners Through Unrivaled Support and Localized Manufacturing Creating Demand Across the Customer Value Chain The Brand of Choice for Homeowners, Customers & Contractors Providing Customers With Innovative Product Solutions Trusted Brand with Beautiful Aesthetics, Superior Durability and Low Maintenance Homeowner Focused, Customer and Contractor Driven U n riv aled Support Innovativ e S o lu ti o n s

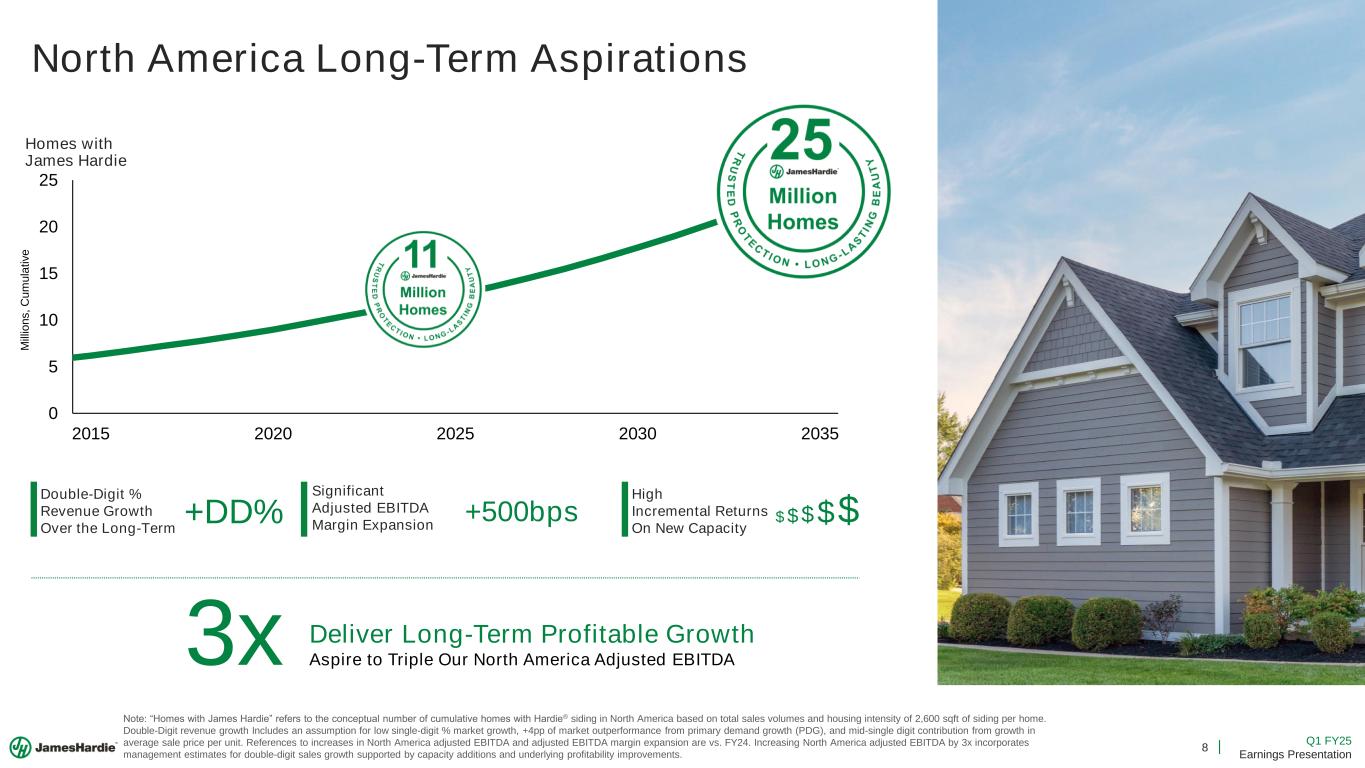

8 Q1 FY25 Earnings Presentation North America Long-Term Aspirations Note: “Homes with James Hardie” refers to the conceptual number of cumulative homes with Hardie® siding in North America based on total sales volumes and housing intensity of 2,600 sqft of siding per home. Double-Digit revenue growth Includes an assumption for low single-digit % market growth, +4pp of market outperformance from primary demand growth (PDG), and mid-single digit contribution from growth in average sale price per unit. References to increases in North America adjusted EBITDA and adjusted EBITDA margin expansion are vs. FY24. Increasing North America adjusted EBITDA by 3x incorporates management estimates for double-digit sales growth supported by capacity additions and underlying profitability improvements. Homes with James Hardie 0 5 10 15 20 25 2015 2020 2025 2030 2035 M ill io n s , C u m u la ti v e Deliver Long-Term Profitable Growth Aspire to Triple Our North America Adjusted EBITDA3x Double-Digit % Revenue Growth Over the Long-Term +DD% Significant Adjusted EBITDA Margin Expansion +500bps $ $ $ $$ High Incremental Returns On New Capacity

9 Q1 FY25 Earnings Presentation Positioned to Outperform the Market Demonstrating Profitable Growth Financial Review Achieved Our Q1 Guidance Fortifying our Liquidity Position and Leverage Profile A Solid Start to FY25

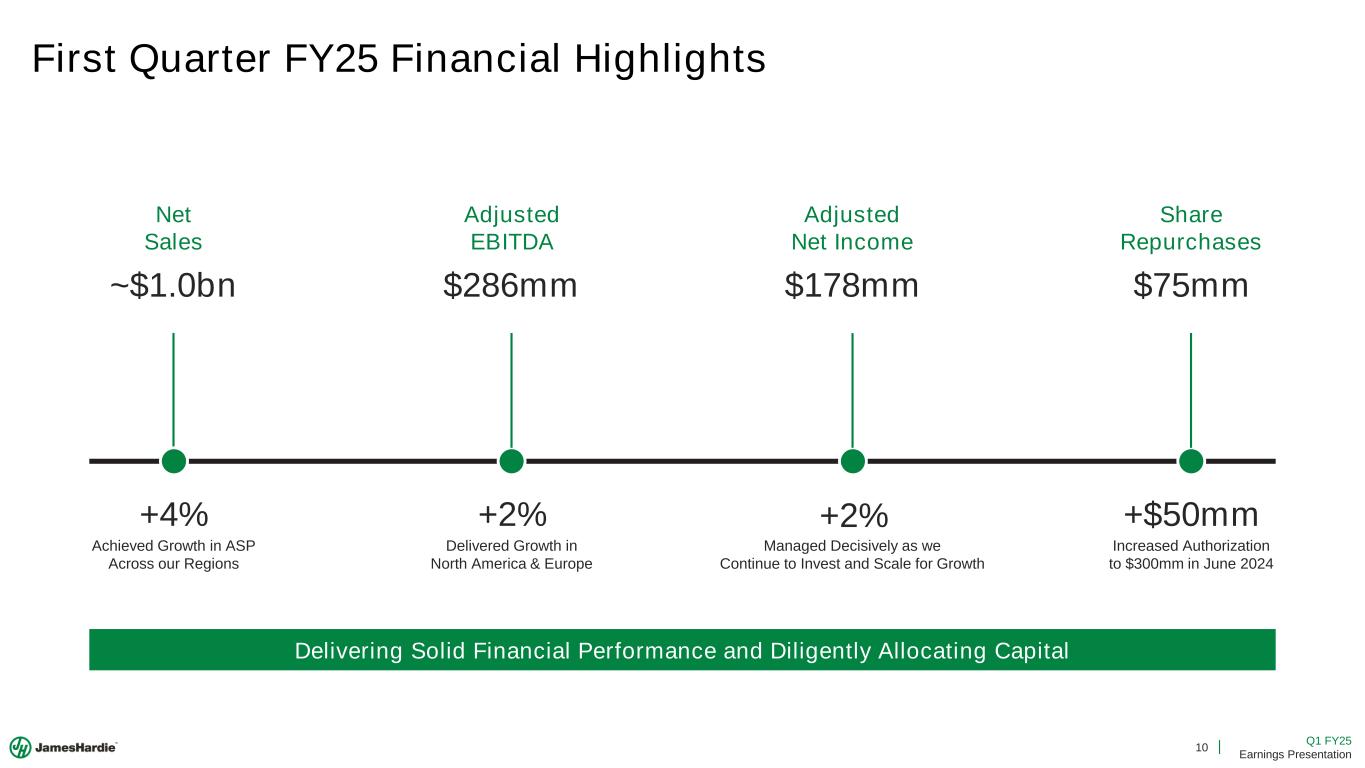

10 Q1 FY25 Earnings Presentation First Quarter FY25 Financial Highlights Net Sales Adjusted EBITDA Share Repurchases Adjusted Net Income Achieved Growth in ASP Across our Regions Delivered Growth in North America & Europe Managed Decisively as we Continue to Invest and Scale for Growth Increased Authorization to $300mm in June 2024 +4% +2% +2% +$50mm Delivering Solid Financial Performance and Diligently Allocating Capital ~$1.0bn $286mm $178mm $75mm

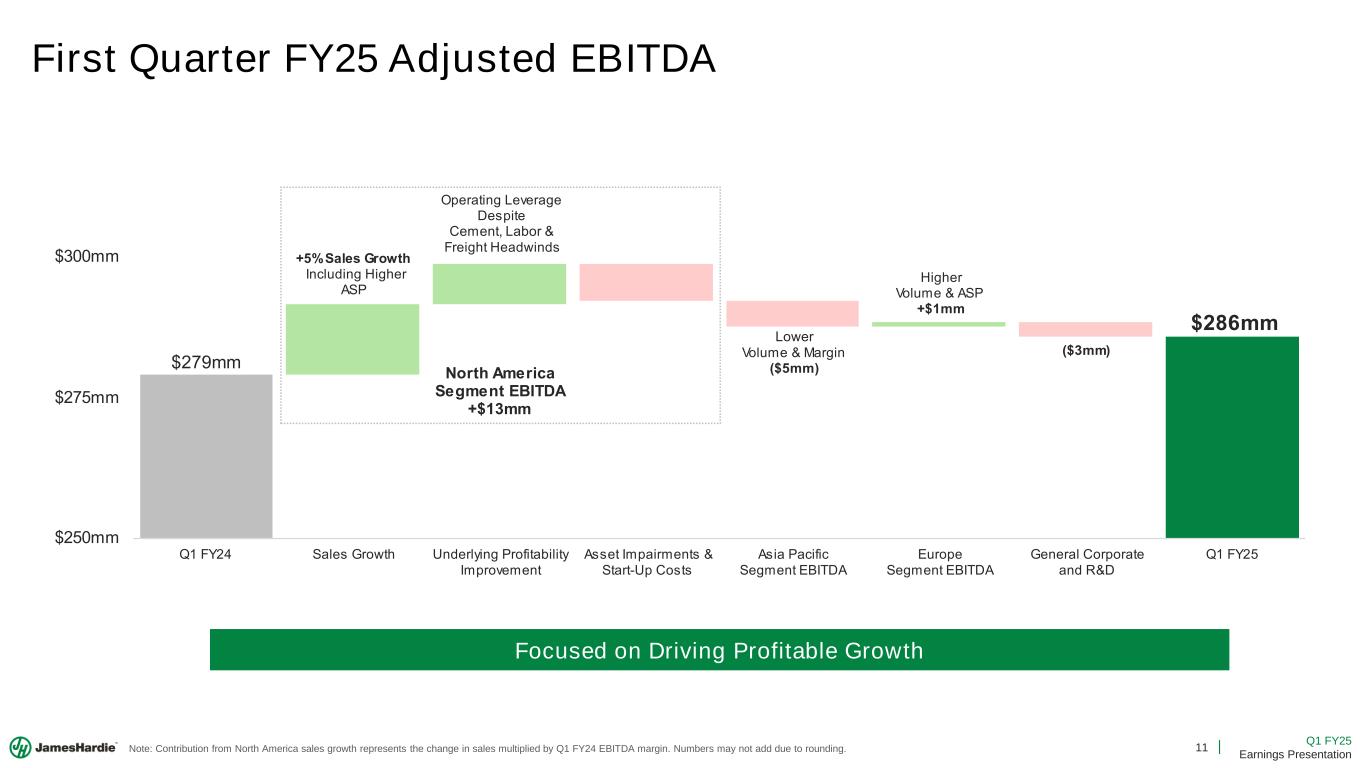

11 Q1 FY25 Earnings Presentation First Quarter FY25 Adjusted EBITDA Note: Contribution from North America sales growth represents the change in sales multiplied by Q1 FY24 EBITDA margin. Numbers may not add due to rounding. Focused on Driving Profitable Growth mm ncluding Higher perating everage espite Cement, abor Freight Headwinds ower olume Margin Higher olume mm mm mm F ales rowth nderlying rofitability mprovement sset mpairments tart p Costs sia acific egment urope egment eneral Corporate and R F

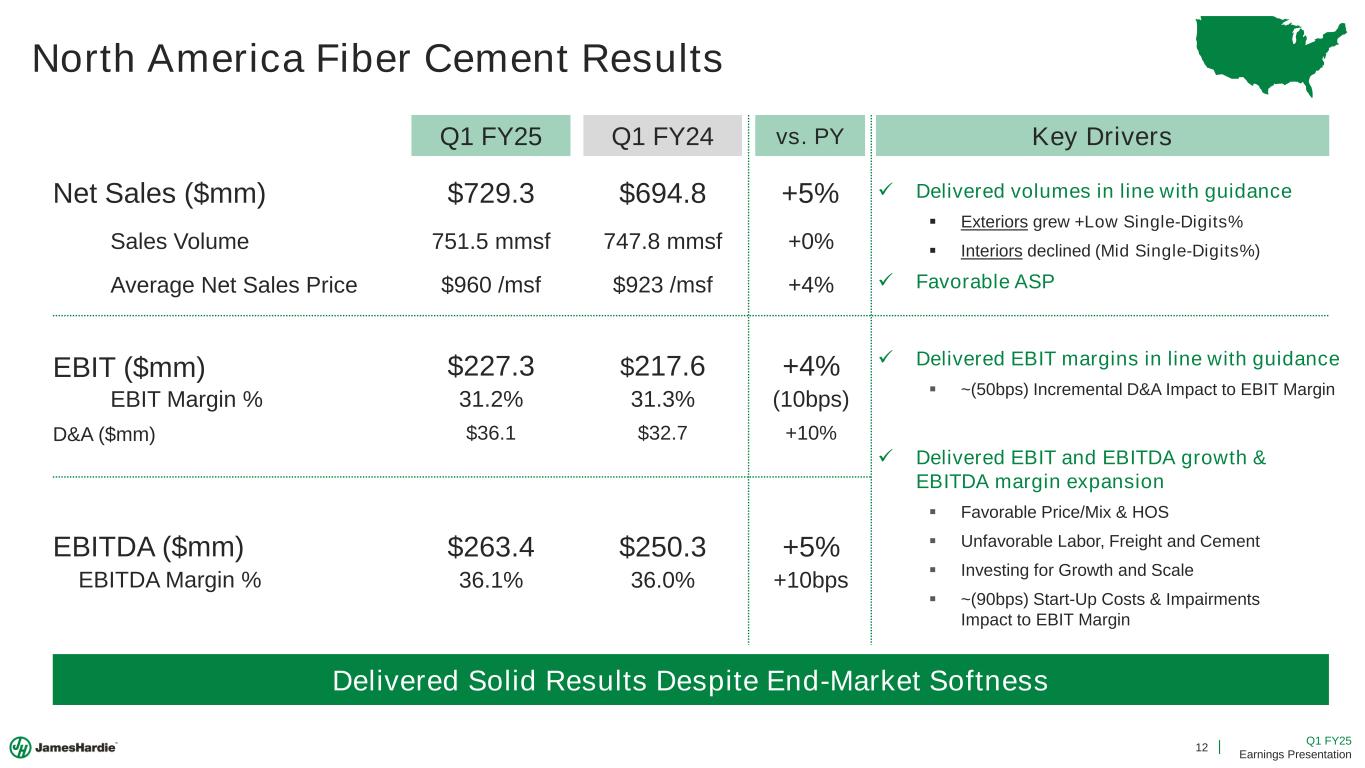

12 Q1 FY25 Earnings Presentation North America Fiber Cement Results Net Sales ($mm) EBIT ($mm) EBITDA ($mm) EBITDA Margin % EBIT Margin % Average Net Sales Price Sales Volume Q1 FY25 Q1 FY24 vs. PY $729.3 $694.8 +5% Delivered Solid Results Despite End-Market Softness 751.5 mmsf 747.8 mmsf +0% $960 /msf $923 /msf +4% $227.3 $217.6 +4% 31.2% 31.3% (10bps) Key Drivers ✓ Delivered volumes in line with guidance ▪ Exteriors grew +Low Single-Digits% ▪ Interiors declined (Mid Single-Digits%) ✓ Favorable ASP ✓ Delivered EBIT margins in line with guidance ▪ ~(50bps) Incremental D&A Impact to EBIT Margin $263.4 $250.3 +5% 36.1% 36.0% +10bps D&A ($mm) $36.1 $32.7 +10% ✓ Delivered EBIT and EBITDA growth & EBITDA margin expansion ▪ Favorable Price/Mix & HOS ▪ Unfavorable Labor, Freight and Cement ▪ Investing for Growth and Scale ▪ ~(90bps) Start-Up Costs & Impairments Impact to EBIT Margin

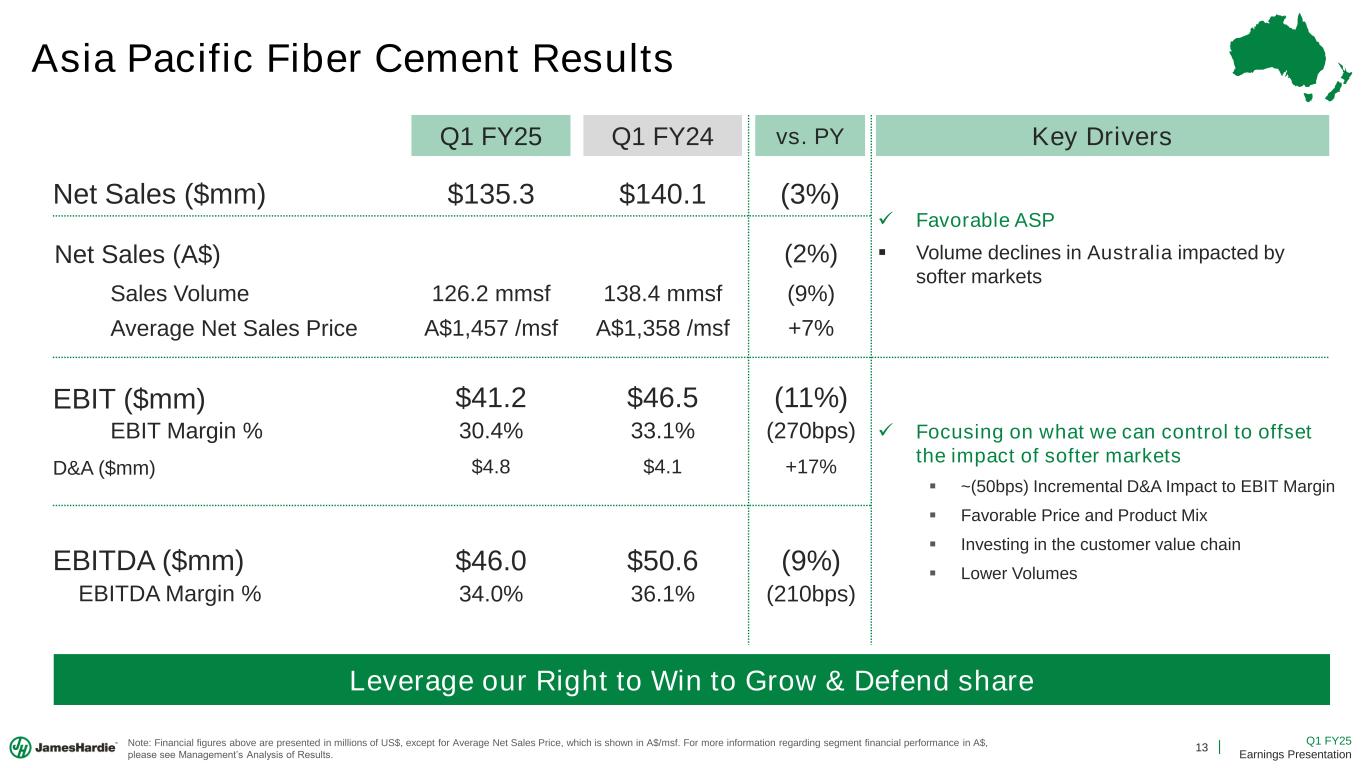

13 Q1 FY25 Earnings Presentation Asia Pacific Fiber Cement Results Net Sales ($mm) EBIT ($mm) EBITDA ($mm) EBITDA Margin % EBIT Margin % Average Net Sales Price Sales Volume Q1 FY25 Q1 FY24 vs. PY $135.3 $140.1 (3%) Leverage our Right to Win to Grow & Defend share 126.2 mmsf 138.4 mmsf (9%) A$1,457 /msf A$1,358 /msf +7% $41.2 $46.5 (11%) 30.4% 33.1% (270bps) Key Drivers $46.0 $50.6 (9%) 34.0% 36.1% (210bps) D&A ($mm) $4.8 $4.1 +17% Note: Financial figures above are presented in millions of US$, except for Average Net Sales Price, which is shown in A$/msf. For more information regarding segment financial performance in A$, please see Management’s nalysis of Results. Net Sales (A$) (2%) ✓ Favorable ASP ▪ Volume declines in Australia impacted by softer markets ✓ Focusing on what we can control to offset the impact of softer markets ▪ ~(50bps) Incremental D&A Impact to EBIT Margin ▪ Favorable Price and Product Mix ▪ Investing in the customer value chain ▪ Lower Volumes

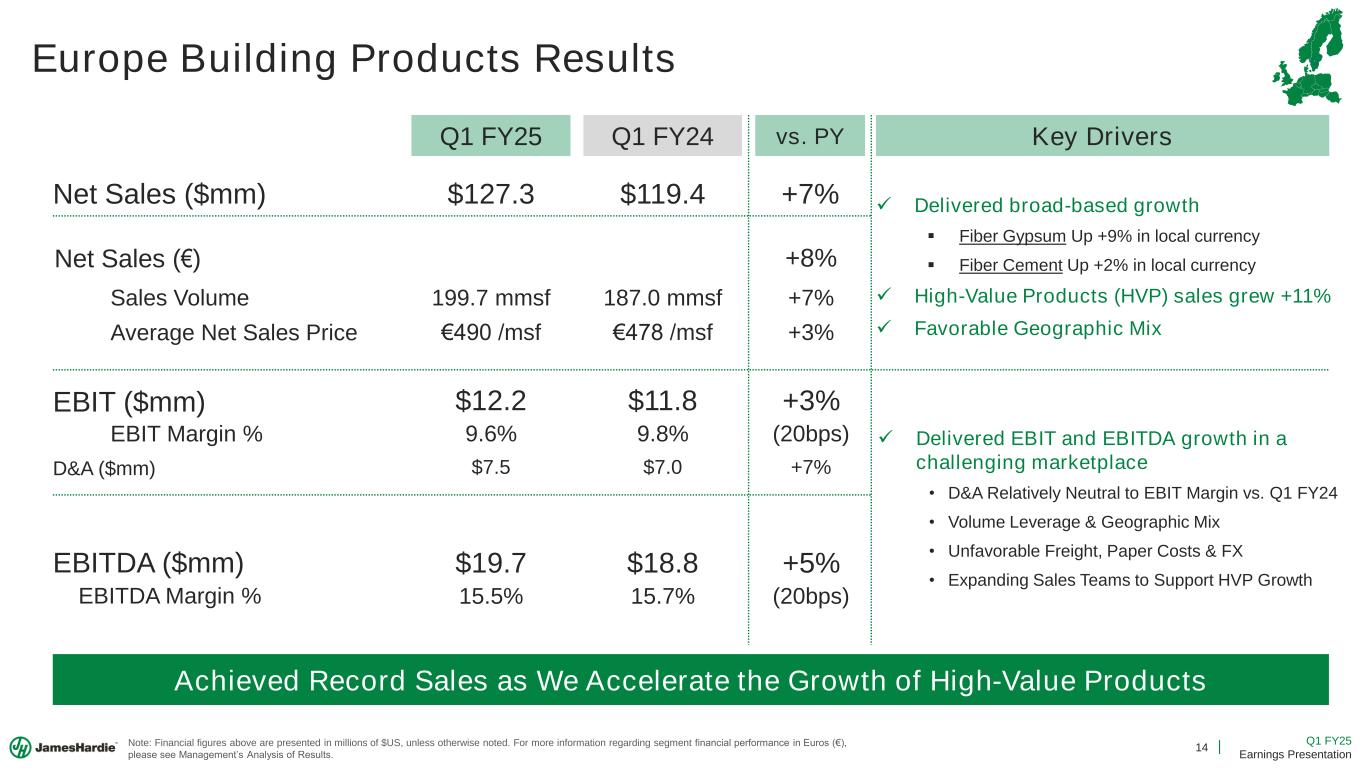

14 Q1 FY25 Earnings Presentation Europe Building Products Results Net Sales ($mm) EBIT ($mm) EBITDA ($mm) EBITDA Margin % EBIT Margin % Average Net Sales Price Sales Volume Q1 FY25 Q1 FY24 vs. PY $127.3 $119.4 +7% Achieved Record Sales as We Accelerate the Growth of High-Value Products 199.7 mmsf 187.0 mmsf +7% € /msf € 8 /msf +3% $12.2 $11.8 +3% 9.6% 9.8% (20bps) Key Drivers $19.7 $18.8 +5% 15.5% 15.7% (20bps) D&A ($mm) $7.5 $7.0 +7% Net Sales (€) +8% Note: Financial figures above are presented in millions of $US, unless otherwise noted. For more information regarding segment financial performance in uros (€), please see Management’s nalysis of Results. ✓ Delivered broad-based growth ▪ Fiber Gypsum Up +9% in local currency ▪ Fiber Cement Up +2% in local currency ✓ High-Value Products (HVP) sales grew +11% ✓ Favorable Geographic Mix ✓ Delivered EBIT and EBITDA growth in a challenging marketplace • D&A Relatively Neutral to EBIT Margin vs. Q1 FY24 • Volume Leverage & Geographic Mix • Unfavorable Freight, Paper Costs & FX • Expanding Sales Teams to Support HVP Growth

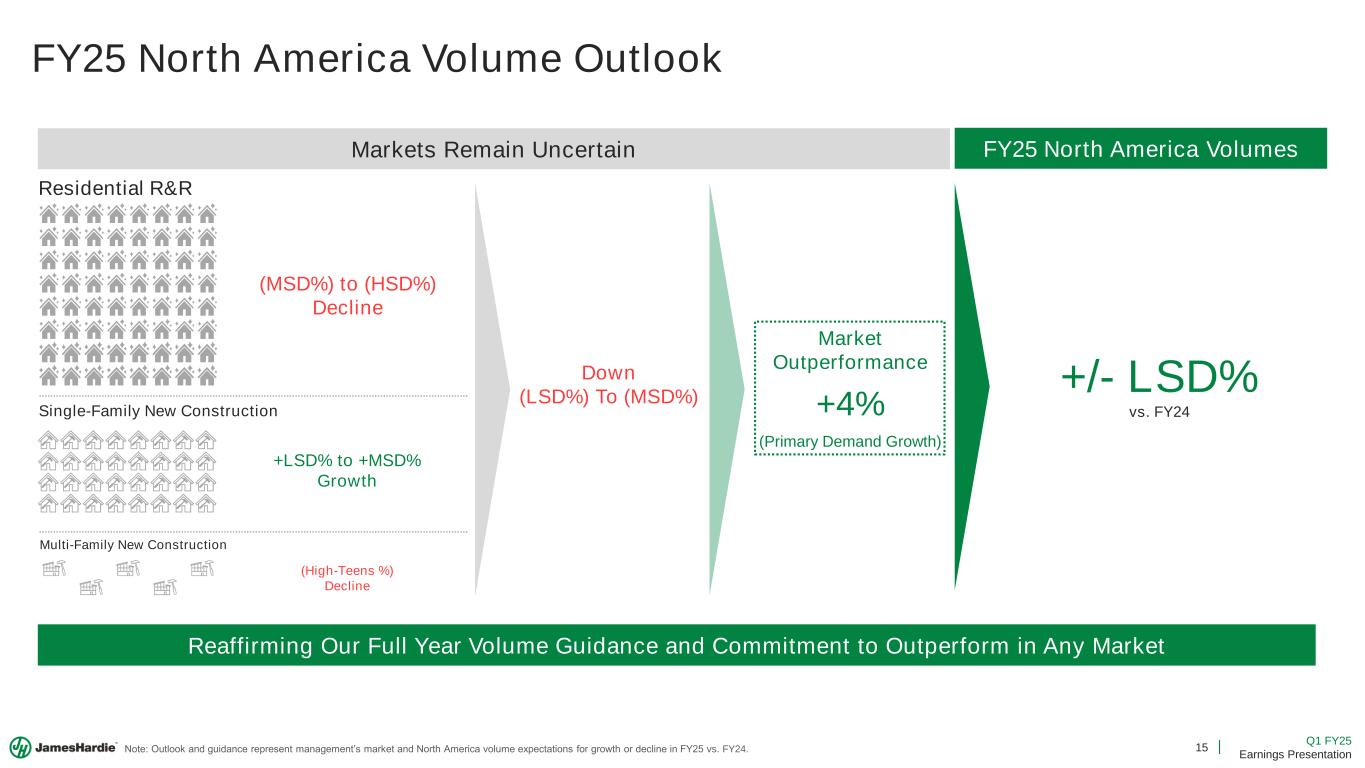

15 Q1 FY25 Earnings Presentation FY25 North America Volume Outlook Down (LSD%) To (MSD%) Reaffirming Our Full Year Volume Guidance and Commitment to Outperform in Any Market (High-Teens %) Decline +LSD% to +MSD% Growth (MSD%) to (HSD%) Decline Note: utlook and guidance represent management’s market and North merica volume expectations for growth or decline in F vs. FY24. +/- LSD% vs. FY24 Markets Remain Uncertain FY25 North America Volumes Market Outperformance +4% (Primary Demand Growth) Residential R&R Single-Family New Construction Multi-Family New Construction

16 Q1 FY25 Earnings Presentation Guidance FY25Q2 FY25 North America Volume North America EBIT Margin Total Adjusted Net Income Reaffirming Our Full Year FY25 Guidance 705 – 735 mmsf Down (MSD%) to (HSD%) 2,950 – 3,150 mmsf +/- LSD% (unchanged) 29% – 31% (unchanged) $630 – 700mm (unchanged) 27.5% – 29.5% $135 – 155mm Note: Total Adjusted Net income guidance for the full year FY25 assumes $25mm to 29mm of adjusted net interest expense and a 23.0% to 24.5% adjusted effective tax rate. Capital Expenditures $500 – 550mm (unchanged)

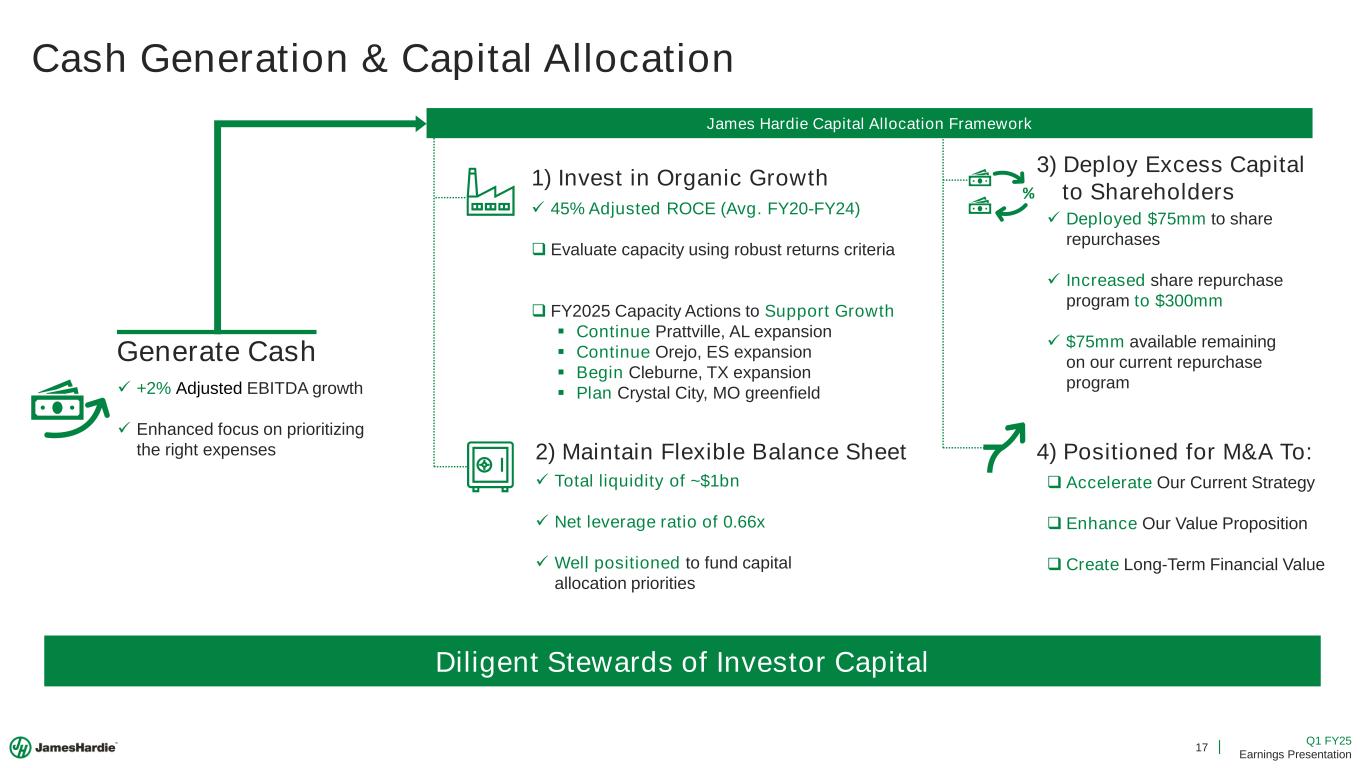

17 Q1 FY25 Earnings Presentation Cash Generation & Capital Allocation ✓ +2% Adjusted EBITDA growth ✓ Enhanced focus on prioritizing the right expenses ✓ Total liquidity of ~$1bn ✓ Net leverage ratio of 0.66x ✓ Well positioned to fund capital allocation priorities ✓ 45% Adjusted ROCE (Avg. FY20-FY24) ❑ Evaluate capacity using robust returns criteria ❑ FY2025 Capacity Actions to Support Growth ▪ Continue Prattville, AL expansion ▪ Continue Orejo, ES expansion ▪ Begin Cleburne, TX expansion ▪ Plan Crystal City, MO greenfield Generate Cash 2) Maintain Flexible Balance Sheet 1) Invest in Organic Growth ✓ Deployed $75mm to share repurchases ✓ Increased share repurchase program to $300mm ✓ $75mm available remaining on our current repurchase program 3) Deploy Excess Capital to Shareholders% ❑ Accelerate Our Current Strategy ❑ Enhance Our Value Proposition ❑ Create Long-Term Financial Value 4) Positioned for M&A To: Diligent Stewards of Investor Capital James Hardie Capital Allocation Framework

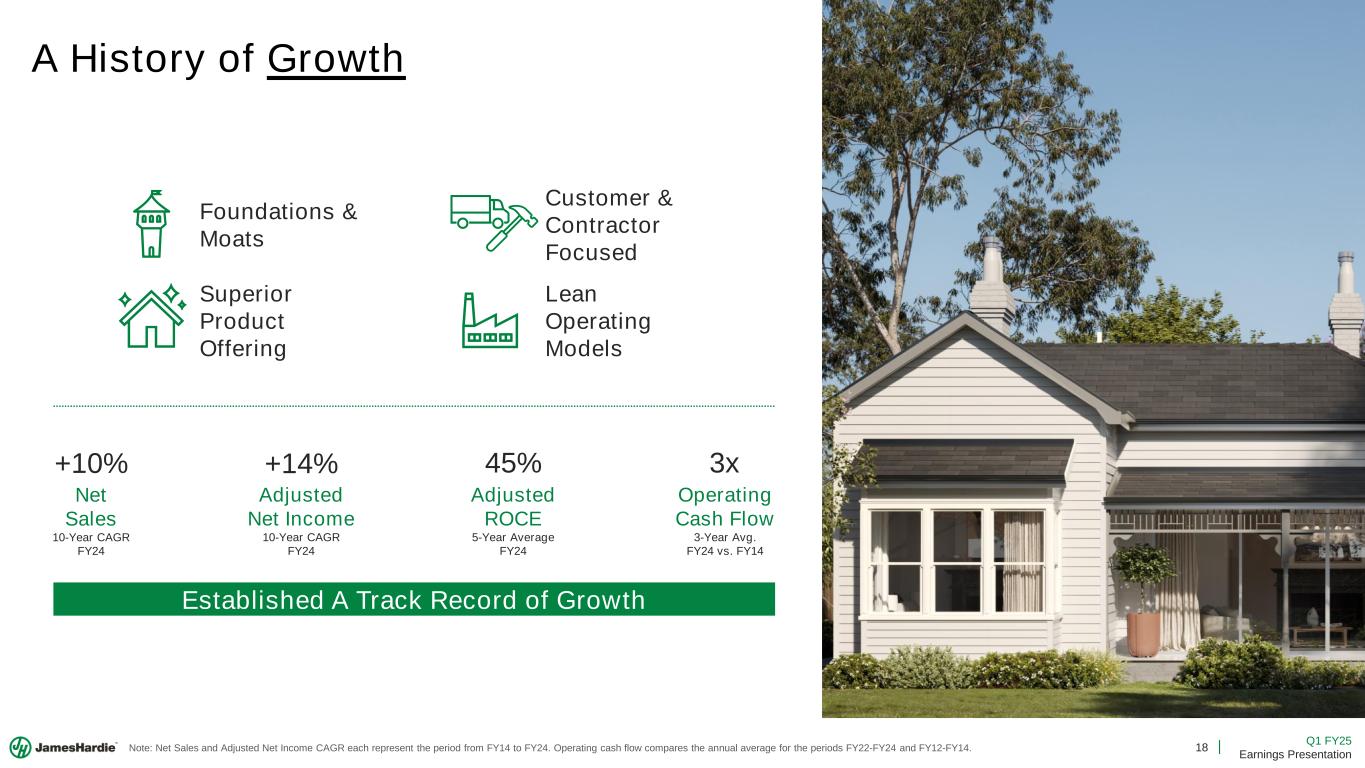

18 Q1 FY25 Earnings Presentation A History of Growth Established A Track Record of Growth Net Sales 10-Year CAGR FY24 +10% Adjusted ROCE 5-Year Average FY24 45% Adjusted Net Income 10-Year CAGR FY24 +14% Operating Cash Flow 3-Year Avg. FY24 vs. FY14 3x Foundations & Moats Superior Product Offering Customer & Contractor Focused Lean Operating Models Note: Net Sales and Adjusted Net Income CAGR each represent the period from FY14 to FY24. Operating cash flow compares the annual average for the periods FY22-FY24 and FY12-FY14.

19 Q1 FY25 Earnings Presentation We Are Positioned to Accelerate Growth Long-Term Shareholder Value Creation We Have the Right Strategy We Aspire to Deliver Profitable Growth We Are Anchoring on Bold Ambitions Long-Term Value Creation Homeowner Focused, Customer and Contractor Driven Note: ee slide 8 for more information regarding “ Million Homes” and financial aspirations. +DD% +500bps $ $ $ $$ 3x Revenue Adj. EBITDA Margin Returns North America Adjusted EBITDA

20 Q1 FY25 Earnings Presentation Q&A Aaron Erter Chief Executive Officer Rachel Wilson Chief Financial Officer

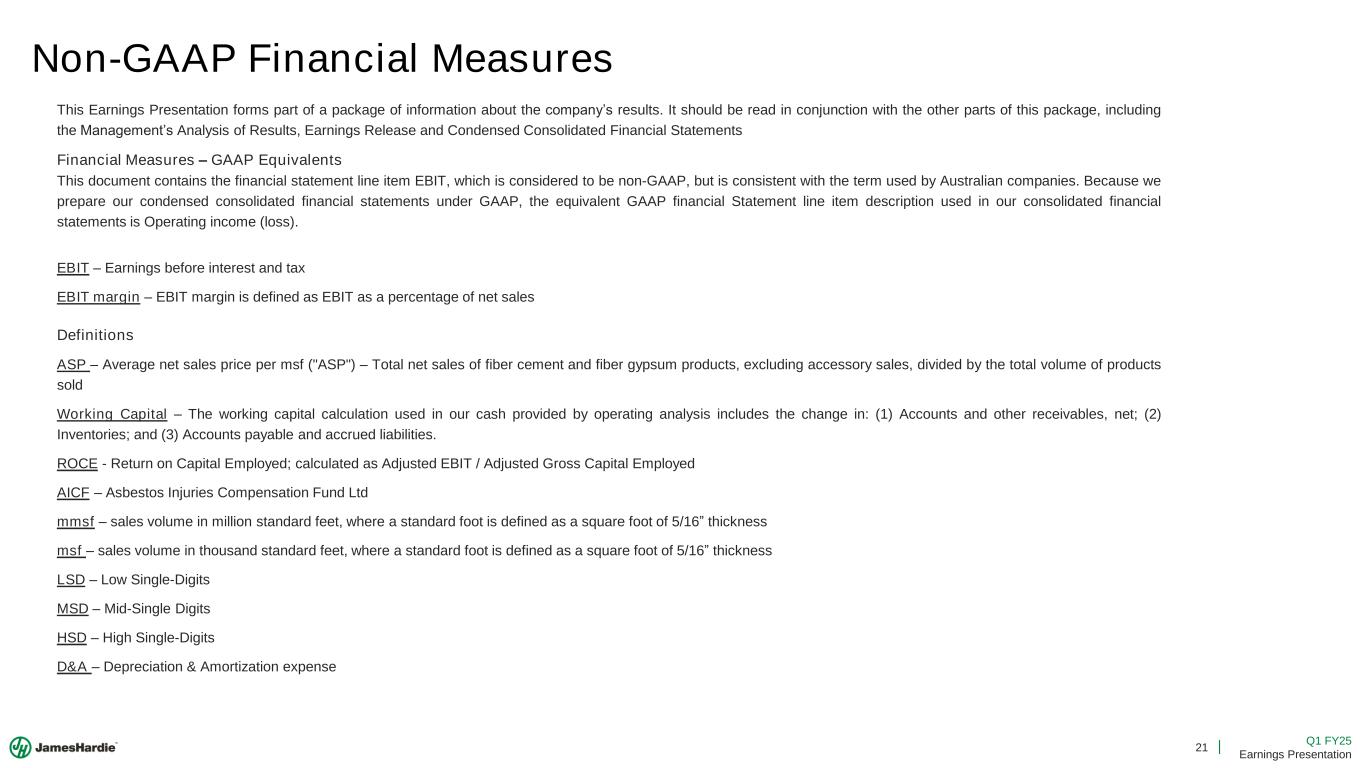

21 Q1 FY25 Earnings Presentation Non-GAAP Financial Measures This Earnings Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Earnings Release and Condensed Consolidated Financial Statements Financial Measures – GAAP Equivalents This document contains the financial statement line item EBIT, which is considered to be non-GAAP, but is consistent with the term used by Australian companies. Because we prepare our condensed consolidated financial statements under GAAP, the equivalent GAAP financial Statement line item description used in our consolidated financial statements is Operating income (loss). EBIT – Earnings before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Definitions ASP – Average net sales price per msf ("ASP") – Total net sales of fiber cement and fiber gypsum products, excluding accessory sales, divided by the total volume of products sold Working Capital – The working capital calculation used in our cash provided by operating analysis includes the change in: (1) Accounts and other receivables, net; (2) Inventories; and (3) Accounts payable and accrued liabilities. ROCE - Return on Capital Employed; calculated as Adjusted EBIT / Adjusted Gross Capital Employed AICF – Asbestos Injuries Compensation Fund Ltd mmsf – sales volume in million standard feet, where a standard foot is defined as a square foot of 5/16” thickness msf – sales volume in thousand standard feet, where a standard foot is defined as a square foot of 5/16” thickness LSD – Low Single-Digits MSD – Mid-Single Digits HSD – High Single-Digits D&A – Depreciation & Amortization expense

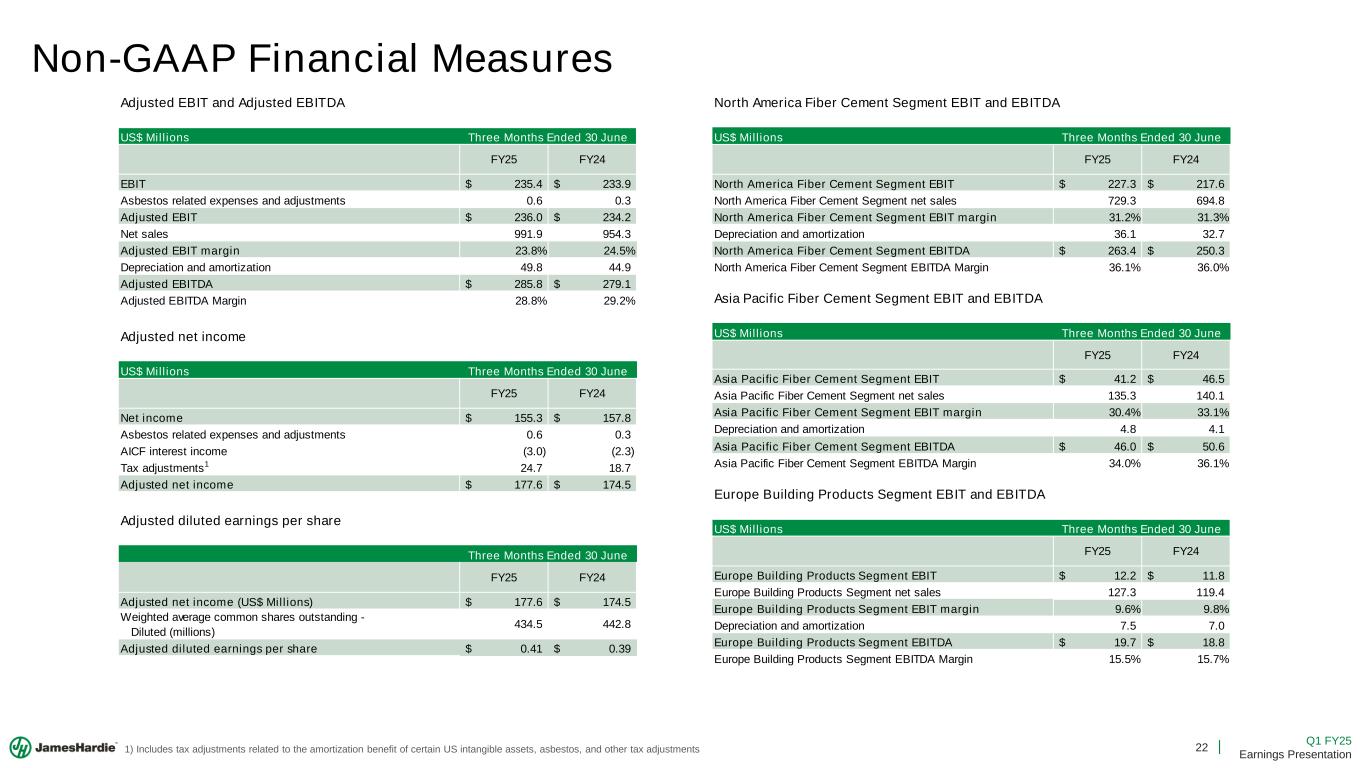

22 Q1 FY25 Earnings Presentation Non-GAAP Financial Measures Adjusted EBIT and Adjusted EBITDA US$ Millions FY25 FY24 EBIT 235.4$ 233.9$ Asbestos related expenses and adjustments 0.6 0.3 Adjusted EBIT 236.0$ 234.2$ Net sales 991.9 954.3 Adjusted EBIT margin 23.8% 24.5% Depreciation and amortization 49.8 44.9 Adjusted EBITDA 285.8$ 279.1$ Adjusted EBITDA Margin 28.8% 29.2% Three Months Ended 30 June US$ Millions FY25 FY24 Asia Pacific Fiber Cement Segment EBIT 41.2$ 46.5$ Asia Pacific Fiber Cement Segment net sales 135.3 140.1 Asia Pacific Fiber Cement Segment EBIT margin 30.4% 33.1% Depreciation and amortization 4.8 4.1 Asia Pacific Fiber Cement Segment EBITDA 46.0$ 50.6$ Asia Pacific Fiber Cement Segment EBITDA Margin 34.0% 36.1% Asia Pacific Fiber Cement Segment EBIT and EBITDA Three Months Ended 30 June US$ Millions FY25 FY24 North America Fiber Cement Segment EBIT 227.3$ 217.6$ North America Fiber Cement Segment net sales 729.3 694.8 North America Fiber Cement Segment EBIT margin 31.2% 31.3% Depreciation and amortization 36.1 32.7 North America Fiber Cement Segment EBITDA 263.4$ 250.3$ North America Fiber Cement Segment EBITDA Margin 36.1% 36.0% North America Fiber Cement Segment EBIT and EBITDA Three Months Ended 30 June Adjusted net income US$ Millions FY25 FY24 Net income 155.3$ 157.8$ Asbestos related expenses and adjustments 0.6 0.3 AICF interest income (3.0) (2.3) Tax adjustments1 24.7 18.7 Adjusted net income 177.6$ 174.5$ Three Months Ended 30 June Adjusted diluted earnings per share FY25 FY24 Adjusted net income (US$ Millions) 177.6$ 174.5$ Weighted average common shares outstanding - Diluted (millions) 434.5 442.8 Adjusted diluted earnings per share 0.41$ 0.39$ Three Months Ended 30 June 1) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments US$ Millions FY25 FY24 Europe Building Products Segment EBIT 12.2$ 11.8$ Europe Building Products Segment net sales 127.3 119.4 Europe Building Products Segment EBIT margin 9.6% 9.8% Depreciation and amortization 7.5 7.0 Europe Building Products Segment EBITDA 19.7$ 18.8$ Europe Building Products Segment EBITDA Margin 15.5% 15.7% Europe Building Products Segment EBIT and EBITDA Three Months Ended 30 June

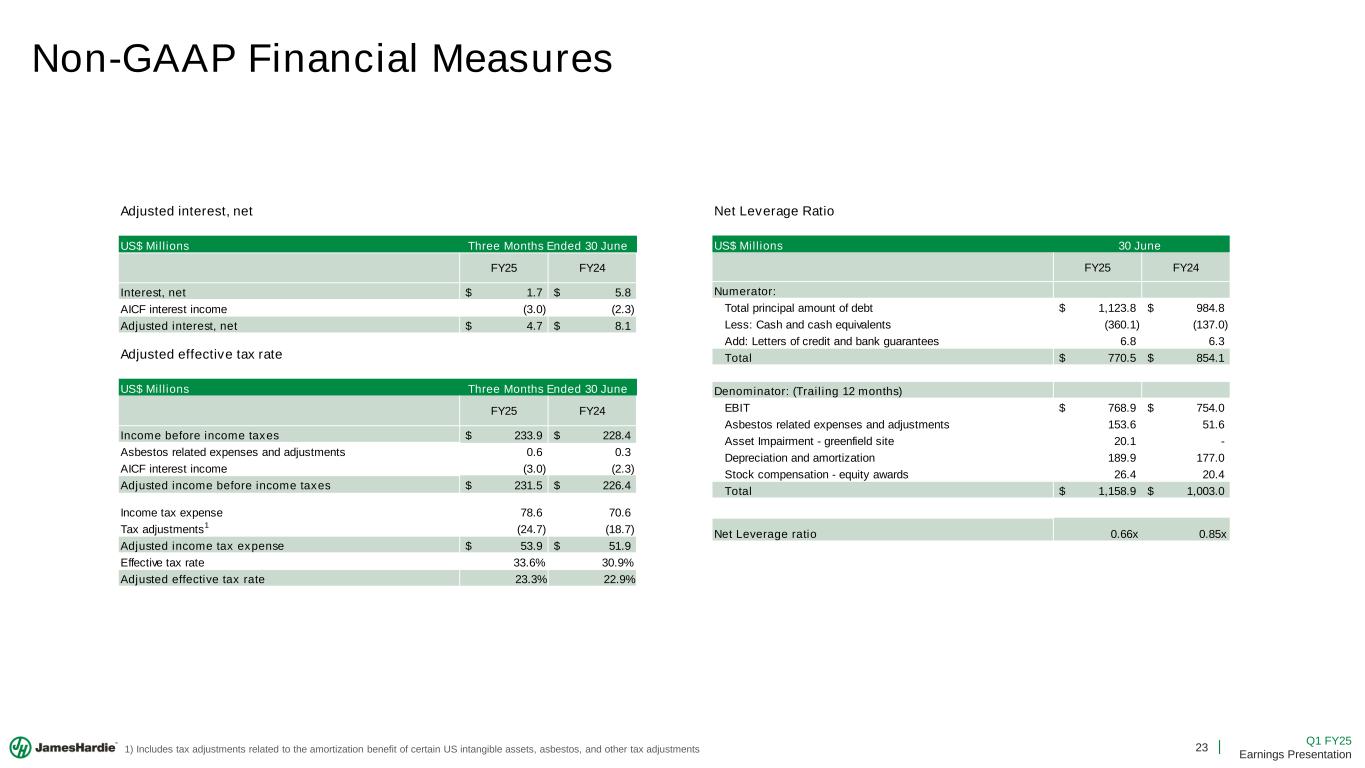

23 Q1 FY25 Earnings Presentation Net Leverage Ratio US$ Millions FY25 FY24 Numerator: Total principal amount of debt 1,123.8$ 984.8$ Less: Cash and cash equivalents (360.1) (137.0) Add: Letters of credit and bank guarantees 6.8 6.3 Total 770.5$ 854.1$ Denominator: (Trailing 12 months) EBIT 768.9$ 754.0$ Asbestos related expenses and adjustments 153.6 51.6 Asset Impairment - greenfield site 20.1 - Depreciation and amortization 189.9 177.0 Stock compensation - equity awards 26.4 20.4 Total 1,158.9$ 1,003.0$ Net Leverage ratio 0.66x 0.85x 30 June Non-GAAP Financial Measures US$ Millions FY25 FY24 Interest, net 1.7$ 5.8$ AICF interest income (3.0) (2.3) Adjusted interest, net 4.7$ 8.1$ Adjusted interest, net Three Months Ended 30 June Adjusted effective tax rate US$ Millions FY25 FY24 Income before income taxes 233.9$ 228.4$ Asbestos related expenses and adjustments 0.6 0.3 AICF interest income (3.0) (2.3) Adjusted income before income taxes 231.5$ 226.4$ Income tax expense 78.6 70.6 Tax adjustments1 (24.7) (18.7) Adjusted income tax expense 53.9$ 51.9$ Effective tax rate 33.6% 30.9% Adjusted effective tax rate 23.3% 22.9% Three Months Ended 30 June 1) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments

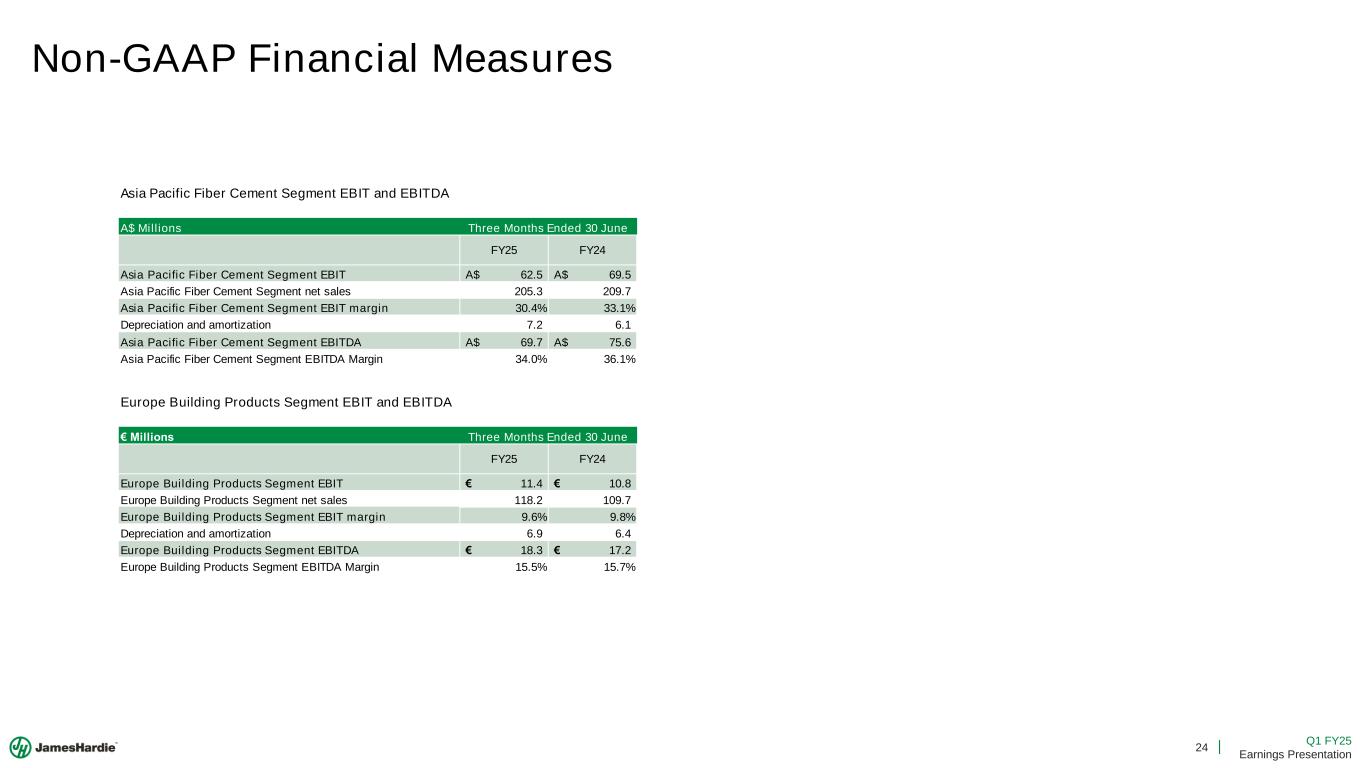

24 Q1 FY25 Earnings Presentation A$ Millions FY25 FY24 Asia Pacific Fiber Cement Segment EBIT 62.5A$ 69.5A$ Asia Pacific Fiber Cement Segment net sales 205.3 209.7 Asia Pacific Fiber Cement Segment EBIT margin 30.4% 33.1% Depreciation and amortization 7.2 6.1 Asia Pacific Fiber Cement Segment EBITDA 69.7A$ 75.6A$ Asia Pacific Fiber Cement Segment EBITDA Margin 34.0% 36.1% Asia Pacific Fiber Cement Segment EBIT and EBITDA Three Months Ended 30 June Non-GAAP Financial Measures € M FY25 FY24 Europe Building Products Segment EBIT 11.4€ 10.8€ Europe Building Products Segment net sales 118.2 109.7 Europe Building Products Segment EBIT margin 9.6% 9.8% Depreciation and amortization 6.9 6.4 Europe Building Products Segment EBITDA 18.3€ 17.2€ Europe Building Products Segment EBITDA Margin 15.5% 15.7% Europe Building Products Segment EBIT and EBITDA Three Months Ended 30 June