James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 8 August 2024 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Chairperson’s Address to 2024 Annual General Meeting and Presentation Dear Sir/Madam James Hardie Industries plc will be holding its 2024 Annual General Meeting (AGM) on Thursday, 8 August 2024 at 10:00pm (Dublin time) / Friday, 9 August 2024 at 7:00am (Sydney time). As required under ASX Listing Rule 3.13.3, a copy of the Chairperson’s Address to the 2024 AGM and the AGM Presentation are attached to this release. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett. Exhibit 99.6

Chairperson’s Address 2024 Annual General Meeting Chairperson’s Address 1 Address to the 2024 Annual General Meeting Anne Lloyd, Chairperson, James Hardie Industries plc Welcome to James Hardie Industries plc’s 2024 Annual General Meeting (AGM), our fifteenth AGM to be held in Dublin. As we look back on fiscal year 2024, we can be incredibly proud of the results achieved and the progress made on our strategy - being Homeowner Focused, Customer and Contractor Driven™. We continued to focus on working safely, partnering with our customers, investing in long-term growth, and driving profitable share gain. This dedication and focus on executing our strategy helped the business deliver record financial results in fiscal year 2024 and sets a clear runway for future growth. James Hardie is — and will continue to be — a leader in global building products. We’re aligned like never before, anchored by a clear purpose and strategy to accelerate our momentum for the future. Zero Harm and ESG At James Hardie, Zero Harm and ESG are part of our Foundational Imperatives. Zero Harm is a non-negotiable element of our culture, and we operate with our team’s safety, security, and well-being as the number one priority. I am encouraged by the progress we made during the year, with a Group-wide focus on safe people, safe places and safe systems, and an overarching mindset that every incident is preventable. Sustainability is a continuous journey for us, and we plan to release our fiscal year 2024 Sustainability Report later this month. We are committed to sustainability because it is the right thing for our business, our employees, our customers, and other stakeholders. Today, our Board exemplifies James Hardie’s commitment to diversity with 44% women represented on the Board and 56% of the Board with diversity characteristics. We also have a diverse and talented workforce, with our People being one of James Hardie’s four Foundational Imperatives and instrumental to our ongoing success. We continue to identify and develop solutions that do right by our planet, our people and our communities. In fiscal year 2023, we adopted new, more ambitious goals for reducing our environmental impact, including a 42 percent absolute reduction in Scope 1 and 2 greenhouse gas emissions by 2030, compared to a 2021 baseline, and net zero emissions by 2050. We are also targeting zero manufacturing waste to landfill by 2035. We strive to develop solutions, road maps, and programs that reinforce and achieve these goals. As our sustainability program progresses, the Board and management are committed to aligning with best- practice reporting standards and frameworks, including those set forth by the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Fiscal Year 2024 – Financial Results In fiscal year 2024, James Hardie reported a strong set of financial results, with record Global Net Sales of US$3.9 billion and record Adjusted EBITDA of US$1.1 billion.

Chairperson’s Address 2024 Annual General Meeting Chairperson’s Address 2 This performance demonstrates our team's ongoing ability to drive profitable share gain and execute consistently. We are focused on maintaining this momentum to continue delivering strong results again in fiscal year 2025. A Growth Company James Hardie is a global growth company, and we have a strong track record of creating shareholder value: • 10% Global Net Sales, 10 year CAGR1 • 3x Global Operating Cash Flow, 3 year average FY24 vs FY142 • 45% Global Adjusted ROCE, average FY20-FY24 • 14% Global Adjusted Net Income, 10 year CAGR1 We have the right strategy and people in place across all three regions in which we operate to continue delivering long term sustainable growth. Importantly, we have the right strategic initiatives to propel this growth, including to: 1) Profitably grow and take share where we have the right to win, 2) Bring our customers high-value, differentiated solutions, and 3) Connect and influence all participants in the customer value chain. Across our business, we are Homeowner Focused, Customer and Contractor DrivenTM. In North America, we are driving material conversion in the repair and remodel market and defending and growing our business in new construction by delivering full wrap solutions. We see significant opportunities in Europe to grow share in fiber cement and fiber gypsum through our high-value product offerings. And we’re defending and growing our strong category share of core products in APAC while accelerating material conversion across the region through customer integration and demand creation. Innovation continues to play a critical role in accelerating our growth around the world, and I’m excited by the investments we are making. We are accelerating material conversion with a focus on installation and enhanced aesthetics; we are strengthening our core business with a robust pipeline of programs ranging from value improvement to sustainable raw materials; and we are developing platforms that address global mega-trends, such as mixed materials and design, labor shortages, and affordable housing. At our Investor Days in June this year, we announced an aspirational target to increase the number of homes in North America with James Hardie siding from approximately 11 million today to 25 million by 2035. We are confident this can be delivered, through a combination of the strategic initiatives we have in place, our superior product offering, talented workforce, and track record of execution. Asbestos Injury Compensation Fund (AICF) Since the inception of AICF, James Hardie has contributed approximately A$2.2 billion to the fund. We at James Hardie remain committed to AICF and the terms of the Amended and Restated Final Funding Agreement. Board Changes We remain committed to ensuring we have a strong, diverse, and independent Board, and I would like to thank my fellow Board members for their continued support and demonstrated leadership during the year. In May 2024, we welcomed John Pfeifer as a new Board member and he will be standing for election at this AGM. John is President and Chief Executive Officer of Oshkosh Corporation and is a member of the company’s Board of Directors, positions he has held since April 2021. Prior to joining Oshkosh Corporation in 2019, Mr Pfeifer served 13 years with Brunswick Corporation in various leadership positions across Europe, the Middle East, Africa and Asia Pacific, most recently as SVP and President of Mercury Marine, 1 CAGR for the time period FY14 to FY24 2 Comparison of average Global Operating Cash Flow FY22-FY24 and FY12-FY14

Chairperson’s Address 2024 Annual General Meeting Chairperson’s Address 3 a global leader in marine propulsion systems, parts and accessories. Mr Pfeifer brings a wealth of global and advanced manufacturing experience to James Hardie, as well as experience building companies both organically and inorganically. Mr Pfeifer has a history of delivering sustained operational and financial performance. Closing I would like to close today by extending the Board’s gratitude and thanks to the over 5,000 employees of James Hardie around the world. We are immensely proud of our people and their ability to navigate a changing and challenging backdrop during fiscal year 2024 to execute on our strategy and deliver record financial results. This was achieved by remaining focused on living James Hardie’s values and purpose – Building a Better Future for All™. Our momentum is strong as we look to the year ahead. With our strategy in place, we are investing in demand creation and working to grow the number of homes featuring Hardie® products. We’ve got the right people, the right plans, and the right solutions in place, and we are confident in our growth outlook as we look to the future. END Forward-Looking Statements This Chairperson’s Address contains forward-looking statements and information that are necessarily subject to risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this release, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2024; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Chairperson’s Address except as required by law. Use of Non-GAAP Financial Information This Chairperson’s Address includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP), such as Adjusted EBITDA and Adjusted Net Income. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. The Company is unable to forecast the comparable US GAAP financial measure for future periods due to, amongst other factors, uncertainty regarding the impact of actuarial estimates on asbestos-related assets and liabilities in future periods. For additional information regarding the non-GAAP financial measures presented in this Chairman’s Address, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see Appendix to the Company’s Management Presentation for the fourth quarter and fiscal year ended 31 March 2024.

Chairperson’s Address 2024 Annual General Meeting Chairperson’s Address 4 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland.

ANNUAL GENERAL MEETING 8 August 2024 (New York and Dublin) / 9 August 2024 (Sydney)

Contents are confidential and subject to disclosure and insider trading considerations 2 Anne Lloyd, Chairperson ANNUAL GENERAL MEETING – CHAIRPERSON’S ADDRESS

• Xxx • Xxx *Shareholders should refer to the Notice of Annual General Meeting 2024 for the full text and background to each resolution set forth in the presentation ANNUAL GENERAL MEETING – ITEMS OF BUSINESS*

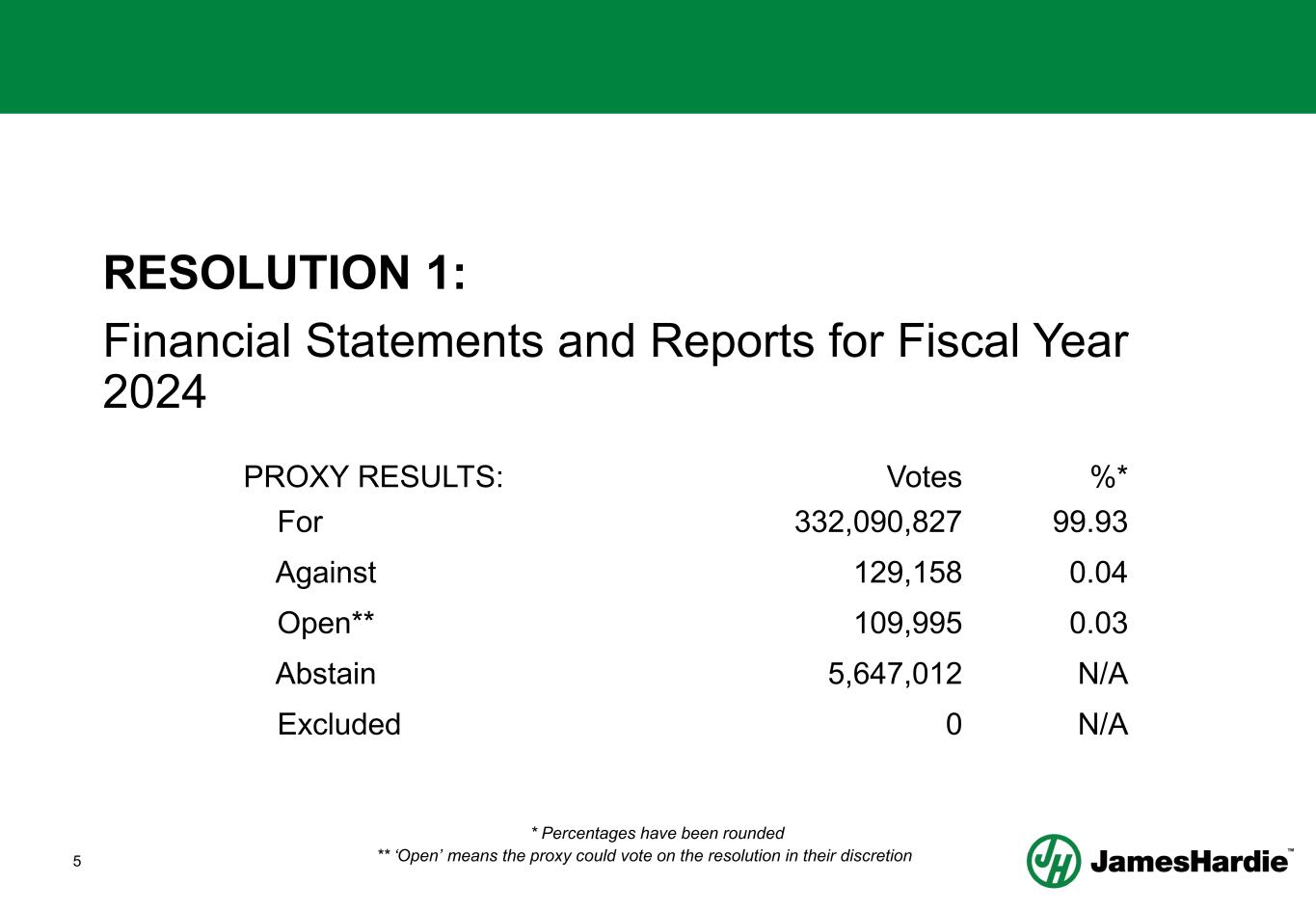

4 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2024 • To receive and consider the financial statements and the reports of the Board and external auditor for the fiscal year ended 31 March 2024

5 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2024 PROXY RESULTS: Votes %* For 332,090,827 99.93 Against 129,158 0.04 Open** 109,995 0.03 Abstain 5,647,012 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

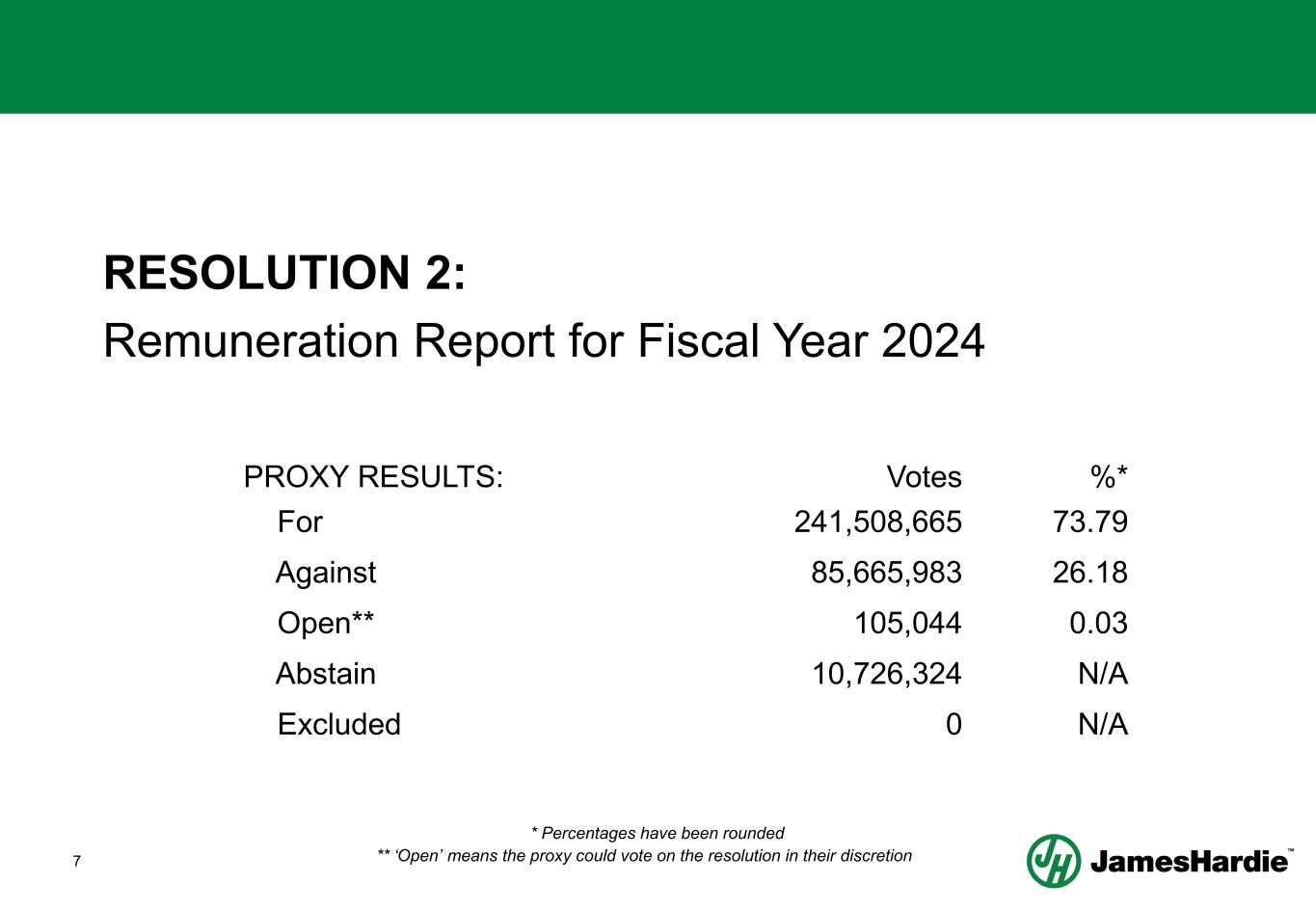

6 RESOLUTION 2: Remuneration Report for Fiscal Year 2024 • To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2024

7 RESOLUTION 2: Remuneration Report for Fiscal Year 2024 PROXY RESULTS: Votes %* For 241,508,665 73.79 Against 85,665,983 26.18 Open** 105,044 0.03 Abstain 10,726,324 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

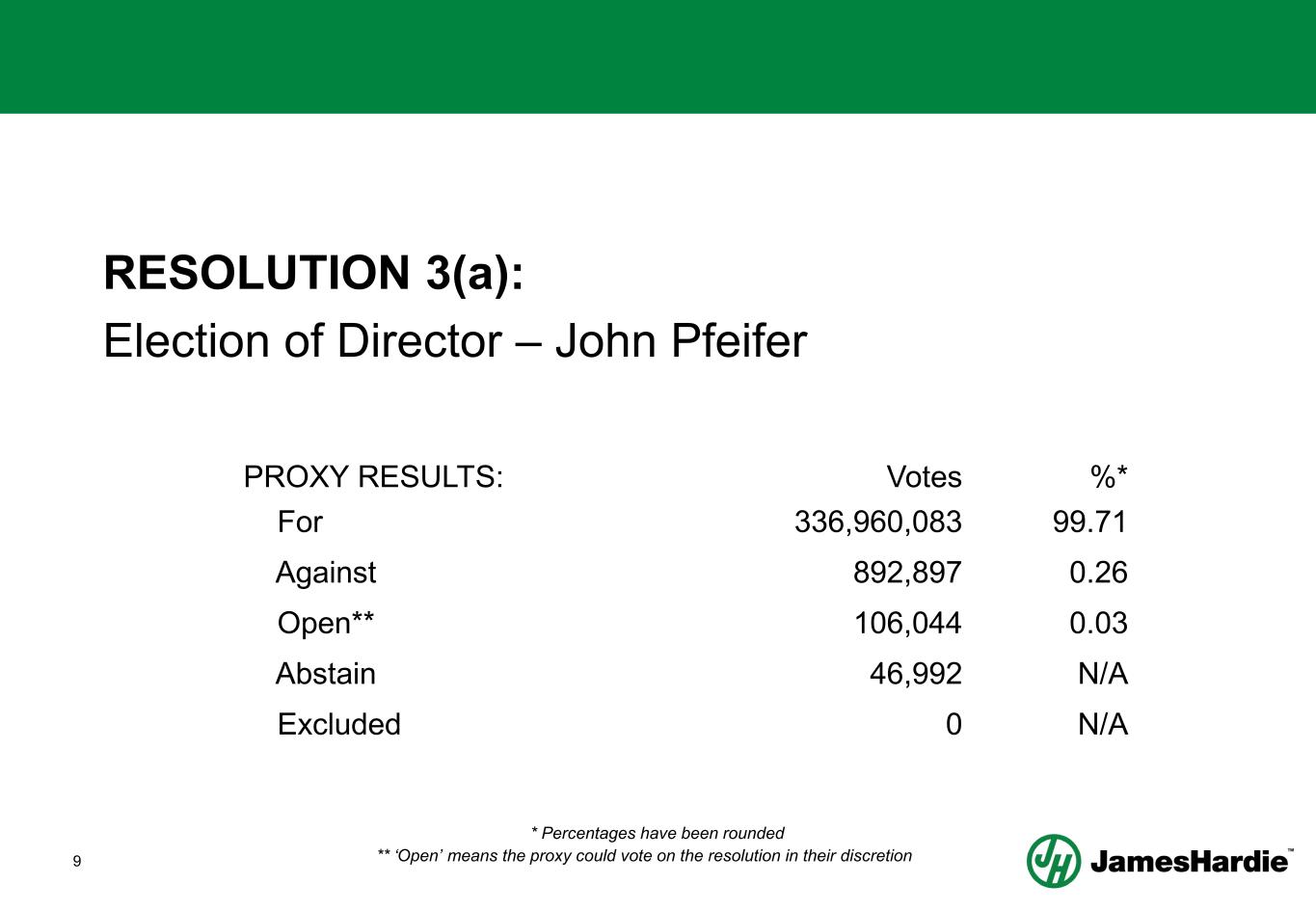

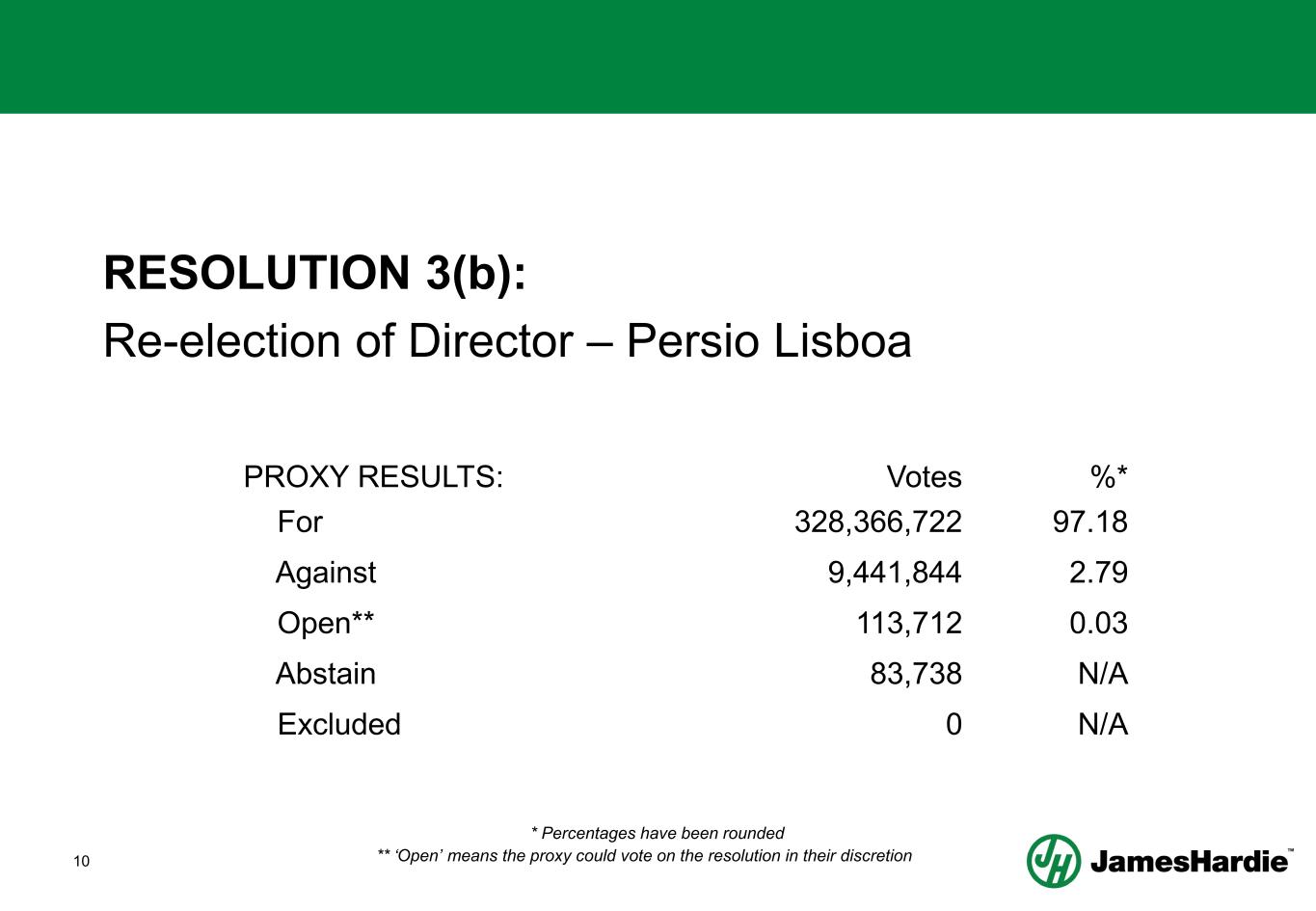

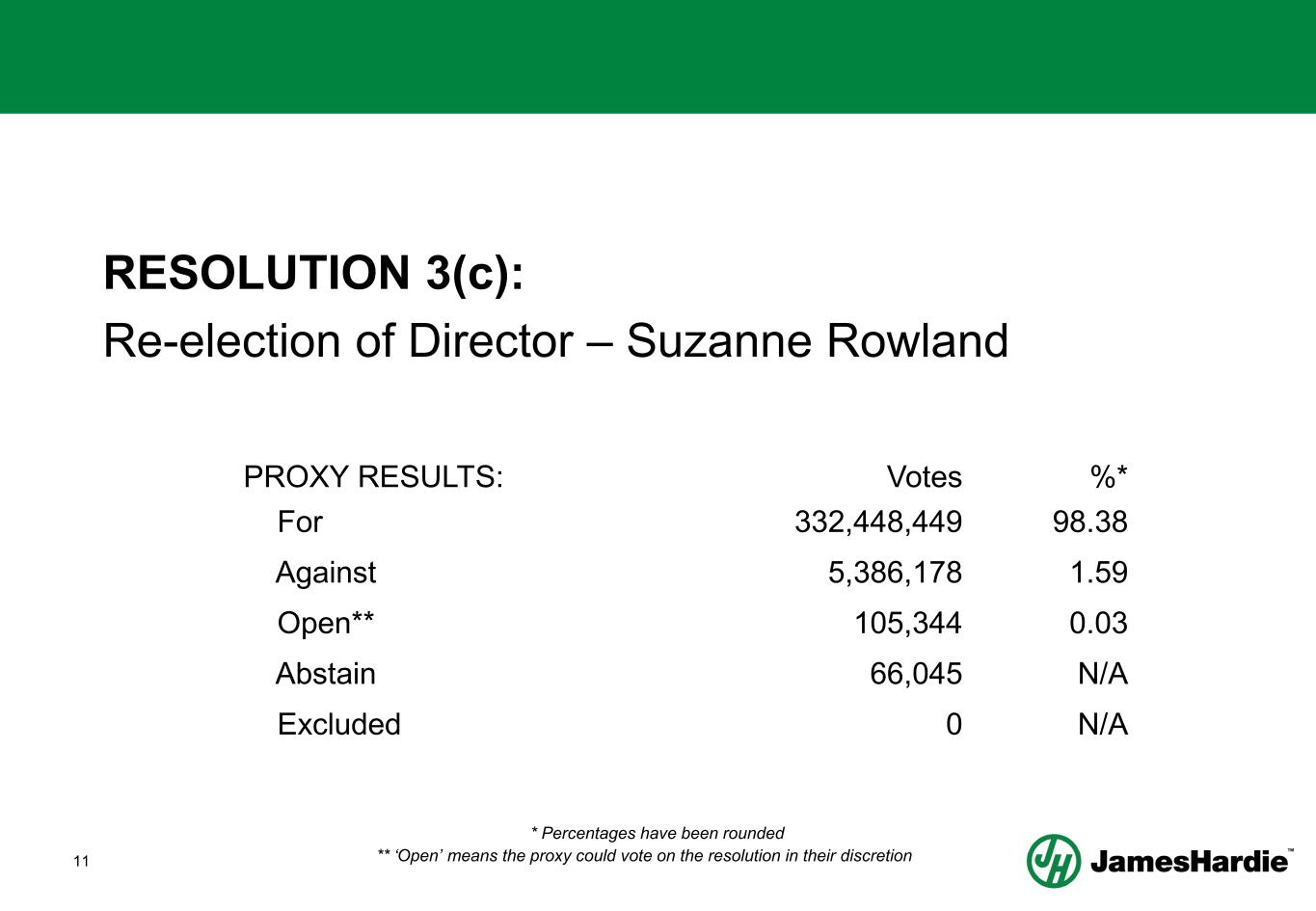

8 RESOLUTION 3: Election/Re-election of Directors a. That John Pfeifer be elected as a director b. That Persio Lisboa be re-elected as a director c. That Suzanne Rowland be re-elected as a director

9 RESOLUTION 3(a): Election of Director – John Pfeifer PROXY RESULTS: Votes %* For 336,960,083 99.71 Against 892,897 0.26 Open** 106,044 0.03 Abstain 46,992 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

10 RESOLUTION 3(b): Re-election of Director – Persio Lisboa PROXY RESULTS: Votes %* For 328,366,722 97.18 Against 9,441,844 2.79 Open** 113,712 0.03 Abstain 83,738 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

11 RESOLUTION 3(c): Re-election of Director – Suzanne Rowland PROXY RESULTS: Votes %* For 332,448,449 98.38 Against 5,386,178 1.59 Open** 105,344 0.03 Abstain 66,045 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

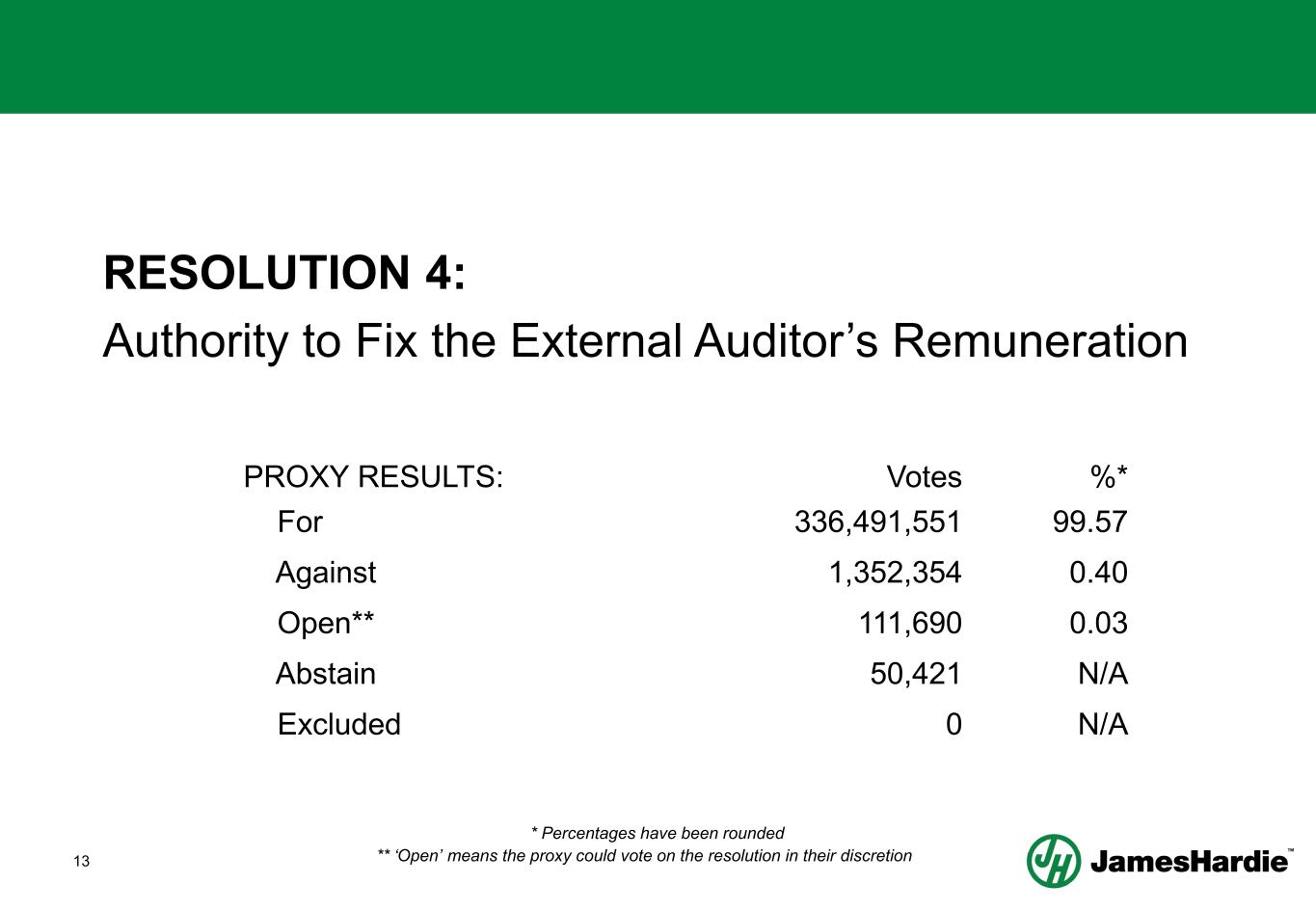

12 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration • That the Board be authorised to fix the remuneration of the external auditor for the fiscal year ended 31 March 2025

13 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration PROXY RESULTS: Votes %* For 336,491,551 99.57 Against 1,352,354 0.40 Open** 111,690 0.03 Abstain 50,421 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

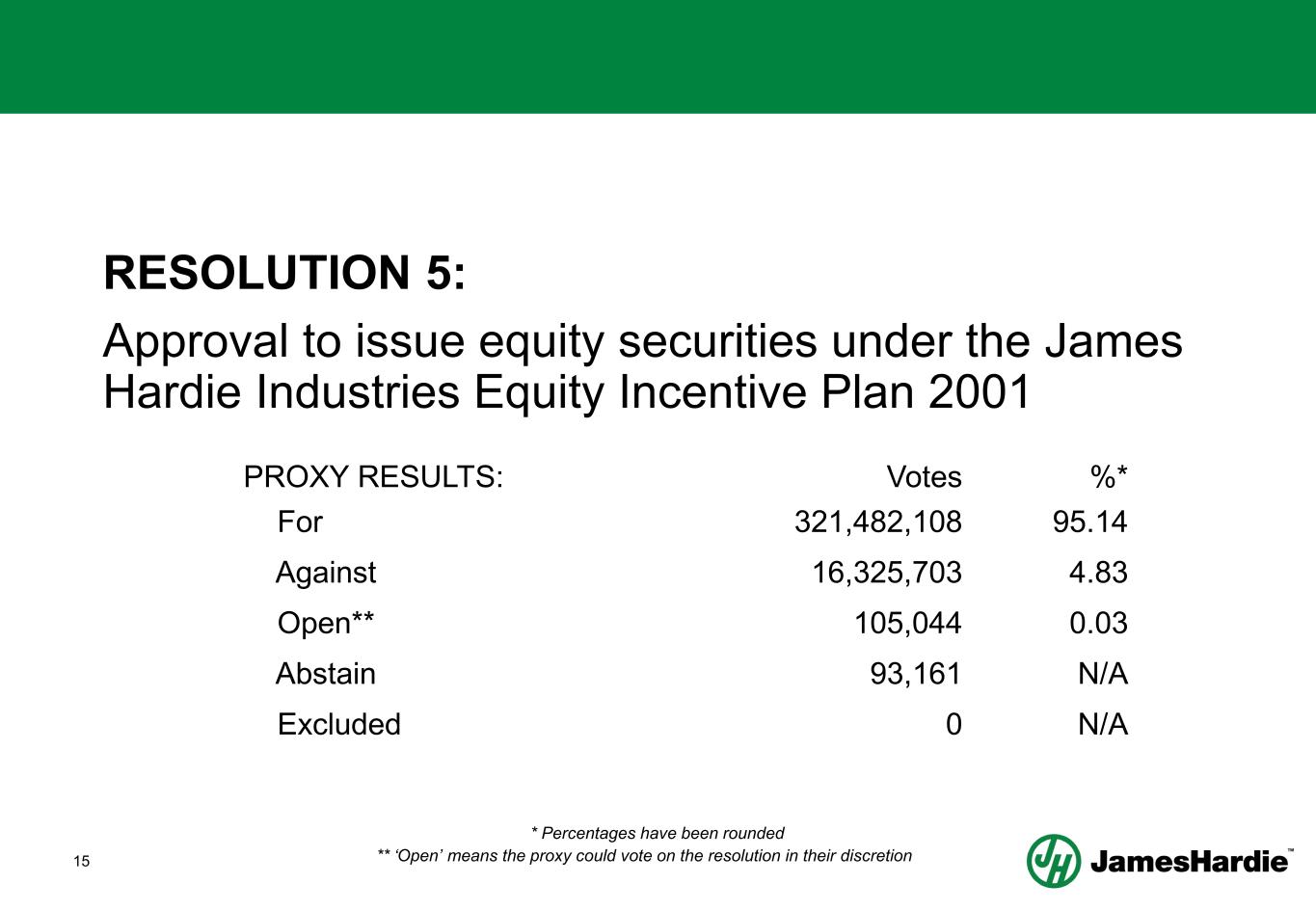

14 RESOLUTION 5: Approval to issue equity securities under the James Hardie Industries Equity Incentive Plan 2001 • Approve the issue of equity securities under the James Hardie Industries 2001 Equity Incentive Plan

15 RESOLUTION 5: Approval to issue equity securities under the James Hardie Industries Equity Incentive Plan 2001 PROXY RESULTS: Votes %* For 321,482,108 95.14 Against 16,325,703 4.83 Open** 105,044 0.03 Abstain 93,161 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

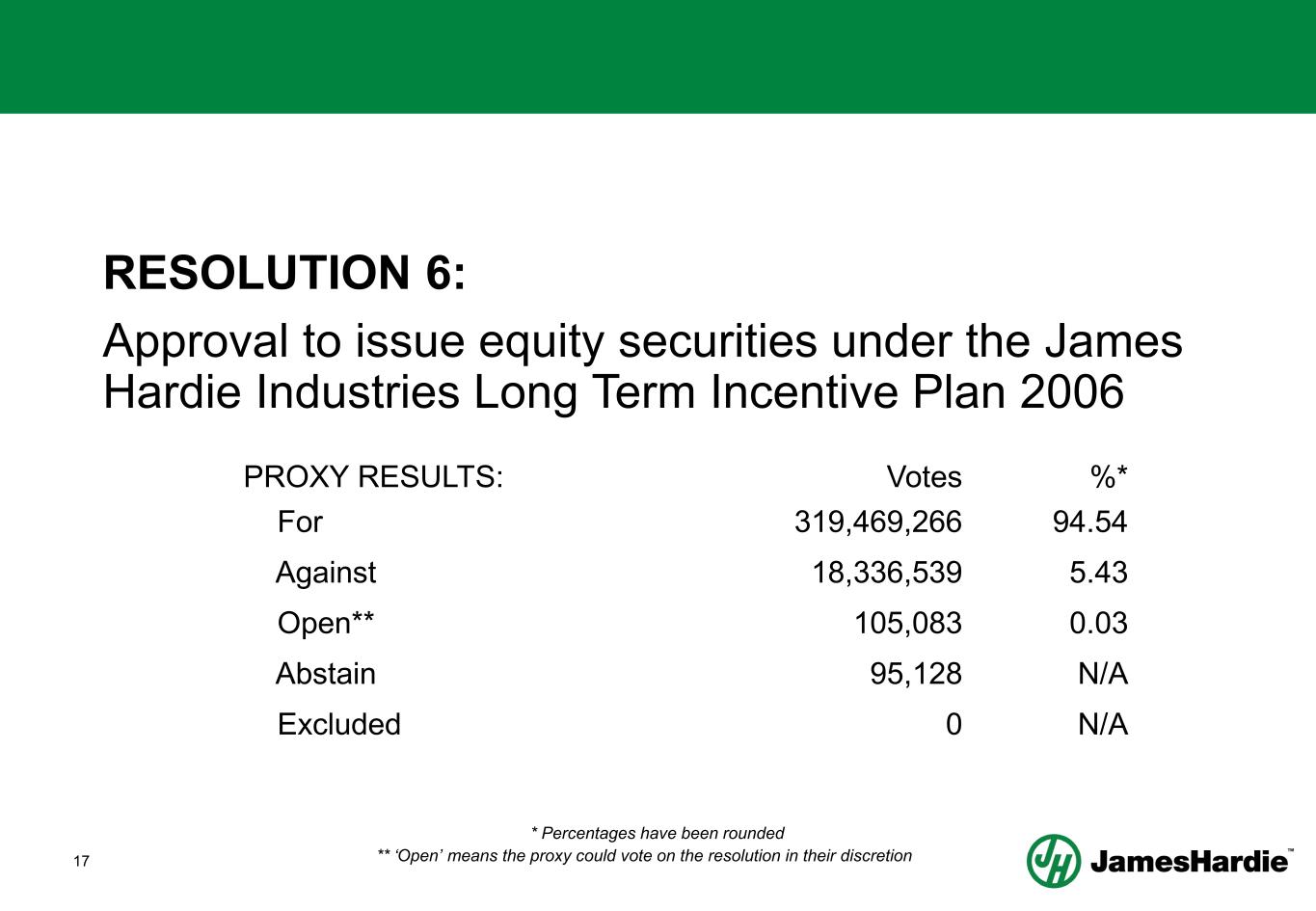

16 RESOLUTION 6: Approval to issue equity securities under the James Hardie Industries Long Term Incentive Plan 2006 • Approve the issue of equity securities under the James Hardie Industries Long Term Incentive Plan 2006

17 RESOLUTION 6: Approval to issue equity securities under the James Hardie Industries Long Term Incentive Plan 2006 PROXY RESULTS: Votes %* For 319,469,266 94.54 Against 18,336,539 5.43 Open** 105,083 0.03 Abstain 95,128 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

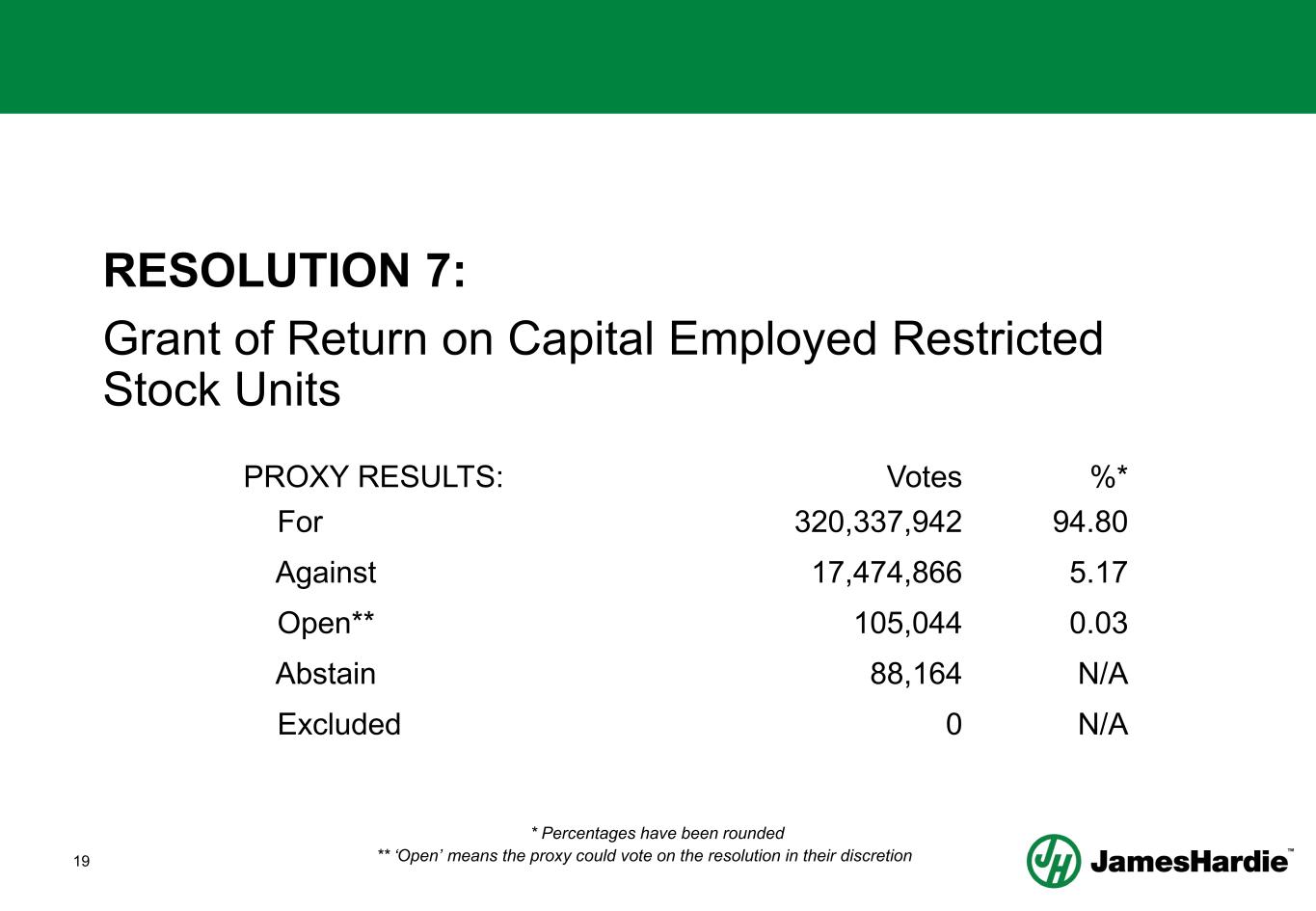

18 RESOLUTION 7: Grant of Return on Capital Employed (ROCE) Restricted Stock Units (RSUs) • Approve the grant of ROCE RSUs to James Hardie’s Director and Chief Executive Officer, Aaron Erter

19 RESOLUTION 7: Grant of Return on Capital Employed Restricted Stock Units PROXY RESULTS: Votes %* For 320,337,942 94.80 Against 17,474,866 5.17 Open** 105,044 0.03 Abstain 88,164 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

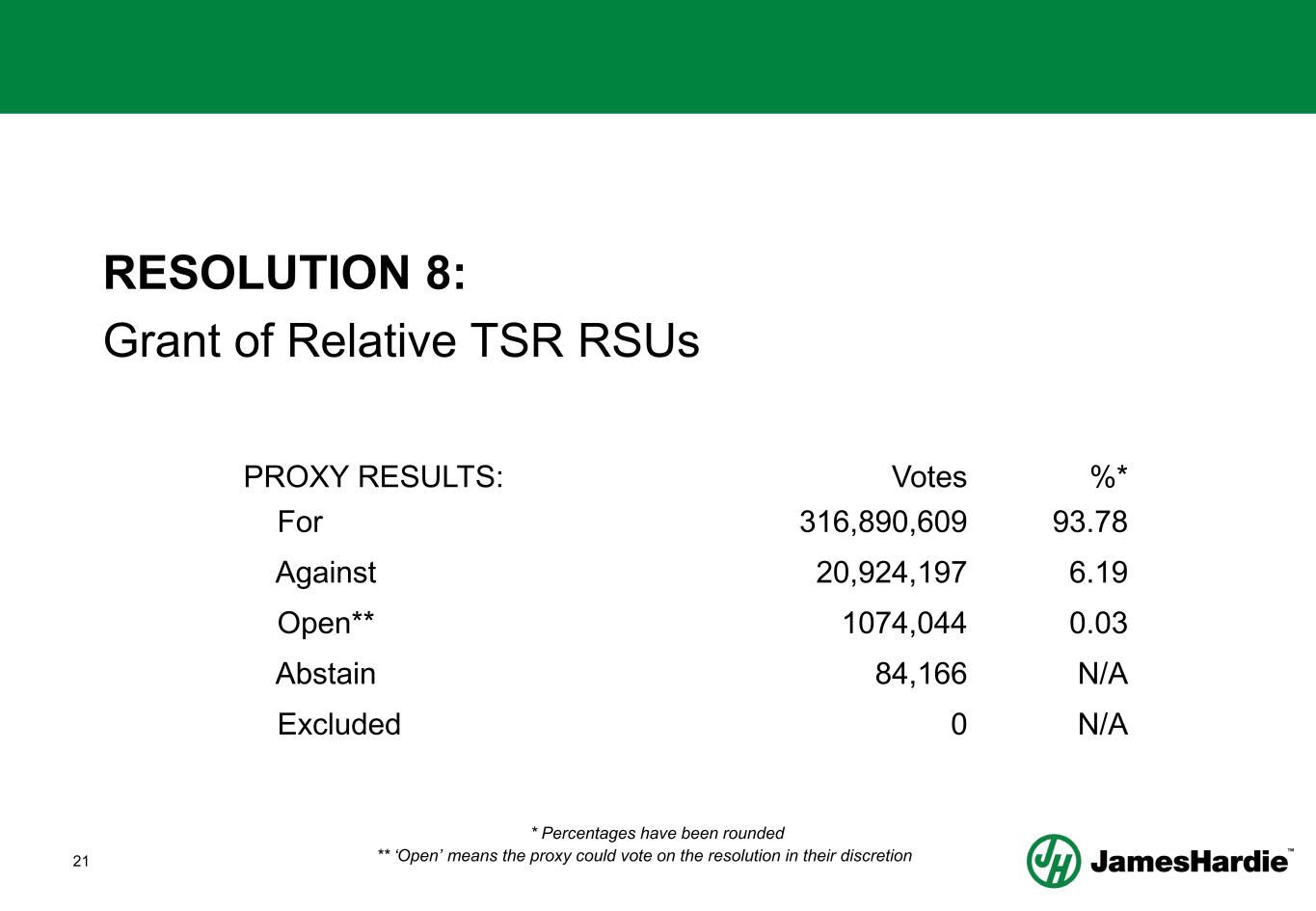

20 RESOLUTION 8: Grant of Relative Total Shareholder Return (TSR) RSUs • Approve the grant of TSR RSUs to James Hardie’s Director and Chief Executive Officer, Aaron Erter

21 RESOLUTION 8: Grant of Relative TSR RSUs PROXY RESULTS: Votes %* For 316,890,609 93.78 Against 20,924,197 6.19 Open** 1074,044 0.03 Abstain 84,166 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

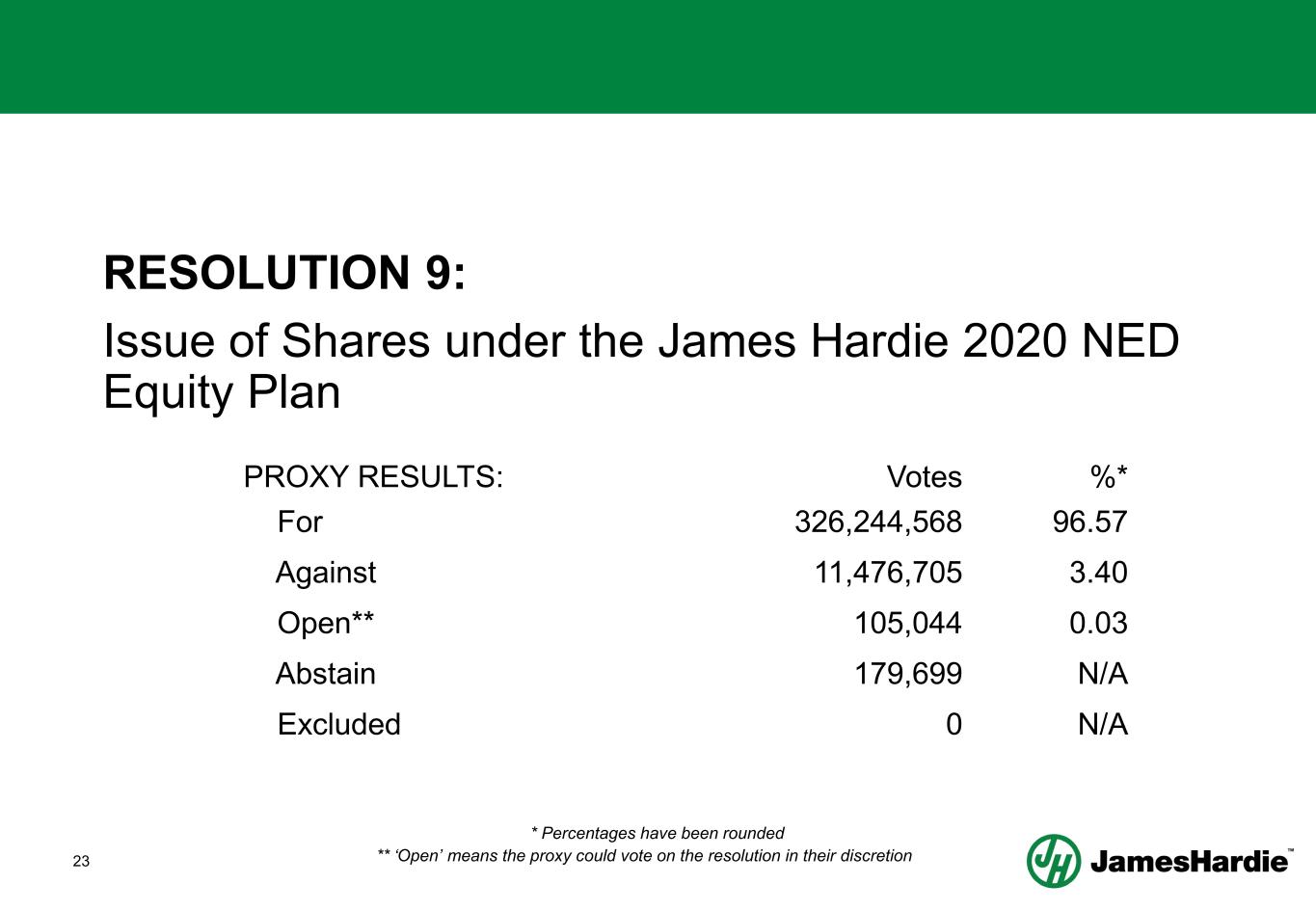

22 RESOLUTION 9: Issue of Shares under the James Hardie 2020 Non- Executive Director Equity Plan (NED Equity Plan) • Subject to the appointment of J Pfeifer as a director of the company, that J Pfeifer be entitled to be issued with shares under the James Hardie 2020 NED Equity Plan.

23 RESOLUTION 9: Issue of Shares under the James Hardie 2020 NED Equity Plan PROXY RESULTS: Votes %* For 326,244,568 96.57 Against 11,476,705 3.40 Open** 105,044 0.03 Abstain 179,699 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Open’ means the proxy could vote on the resolution in their discretion

24 Page 24 ANNUAL GENERAL MEETING – OTHER ITEMS OF BUSINESS

ANNUAL GENERAL MEETING