Second Quarter FY25 Earnings Presentation TUESDAY, NOVEMBER 12th WEDNESDAY, NOVEMBER 13th DUBLINCHICAGO SYDNEY | | | Exhibit 99.5

2 Q2 FY25 Earnings Presentation Cautionary Note and Use of Non-GAAP Measures This Earnings Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions, beliefs and general good faith evaluation of information available at the time the forward-looking statements were made concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements or rely upon them as a guarantee of future performance or results or as an accurate indication of the times at or by which any such performance or results will be achieved. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Earnings Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended March 31, 2024, which include, but are not necessarily limited to risks such as changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business, including; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Earnings Presentation except as required by law. This Earnings Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Earnings Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see slides titled “Non-GAAP Financial Measures” included in this Earnings Presentation. In addition, this Earnings Presentation includes financial measures and descriptions that are considered to not be in accordance with GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Condensed Consolidated Financial Statements in accordance with GAAP, the Company provides investors with definitions and a cross-reference from the non-GAAP financial measure used in this Earnings Presentation to the equivalent GAAP financial measure used in the Company’s Condensed Consolidated Financial Statements. See slides titled “Non-GAAP Financial Measures” included in this Earnings Presentation. All comparisons made are vs. the comparable period in the prior fiscal year and amounts presented are in US dollars, unless otherwise noted. Investor Contact Joe Ahlersmeyer, CFA Vice President, Investor Relations [email protected]

3 Q2 FY25 Earnings Presentation Agenda Business Update & Strategy Financial Review Guidance & Outlook Key Messages Aaron Erter Chief Executive Officer Rachel Wilson Chief Financial Officer Q&A

4 Q2 FY25 Earnings Presentation Delivering on Our Commitments Managing Decisively Investing for Future Growth Executing Our Strategy Key Messages Our Operational Focus Achieved Our Q2 Guidance Outperforming the Market Keeping Our Commitments Consistent Results Delivery 717 mmsft North America Volume 29.0% North America EBIT Margin $157mm Total Adjusted Net Income Delivering On Our Commitments Through A Challenging Market Delivering Value for Our Customers

5 Q2 FY25 Earnings Presentation Segment Business Update Across Our Regions We Are Preparing to Accelerate Our Market Outperformance Asia Pacific Fiber Cement Europe Building ProductsNorth America Fiber Cement Outperforming our end markets through our superior value proposition; driving leading margins despite intensifying raw material headwinds. Aligning our capacity to demand and preparing our production network for market recovery and sustained growth from material conversion opportunity. Investing across the value chain to grow our contractor base and reaccelerate homeowner demand to capture the R&R opportunity as affordability pressures moderate. Growing share with large builders, deepening exclusivity arrangements, increasing trim attachment and expanding our geographic relationships. Growing our share in Australia & New Zealand, despite continued challenges in the end markets. Seeing continued early green shoots with modest recovery within our core products. Driving HOS savings to support our strong financial performance. Focusing on markets where we have the Right to Win following our decision to cease manufacturing and wind down commercial operations in the Philippines. Positioning to capture improvement in UK residential construction in the coming year. Germany is likely to see a more gradual improvement. Making investments in sales teams to accelerate growth in high-value products. Leveraging product depth and breadth to create value for and win with our customers.

6 Q2 FY25 Earnings Presentation 1 2 3Profitably grow and take share where we have the right to win Bring our customers high valued, differentiated solutions Connect and influence all the participants in the customer value chain Our Strategy Spans the Value Chain Homeowner Focused, Customer and Contractor Driven Innovative Solutions Brand of Choice Strategic Initiatives Supported By Our Foundational Imperatives Enabled By Customer Integration Capacity Expansion

7 Q2 FY25 Earnings Presentation Flywheel for Long-Term Value Creation Long-Term Value Creation Driving Long-Term Profitable Share Gain Taking Share from Competing Substrates within R&R and New Construction Supporting the Growth of Our Partners Through Unrivaled Support and Localized Manufacturing Creating Demand Across the Customer Value Chain The Brand of Choice for Homeowners, Customers & Contractors Providing Customers With Innovative Product Solutions Trusted Brand with Beautiful Aesthetics, Superior Durability and Low Maintenance Homeowner Focused, Customer and Contractor Driven

8 Q2 FY25 Earnings Presentation Positioned to Outperform the Market and Deliver on Our FY25 Commitments Planning for Profitable Growth in FY26 Financial Key Messages Achieved Our Q2 Guidance Fortifying our Liquidity Position and Leverage Profile Consistent Results Delivery

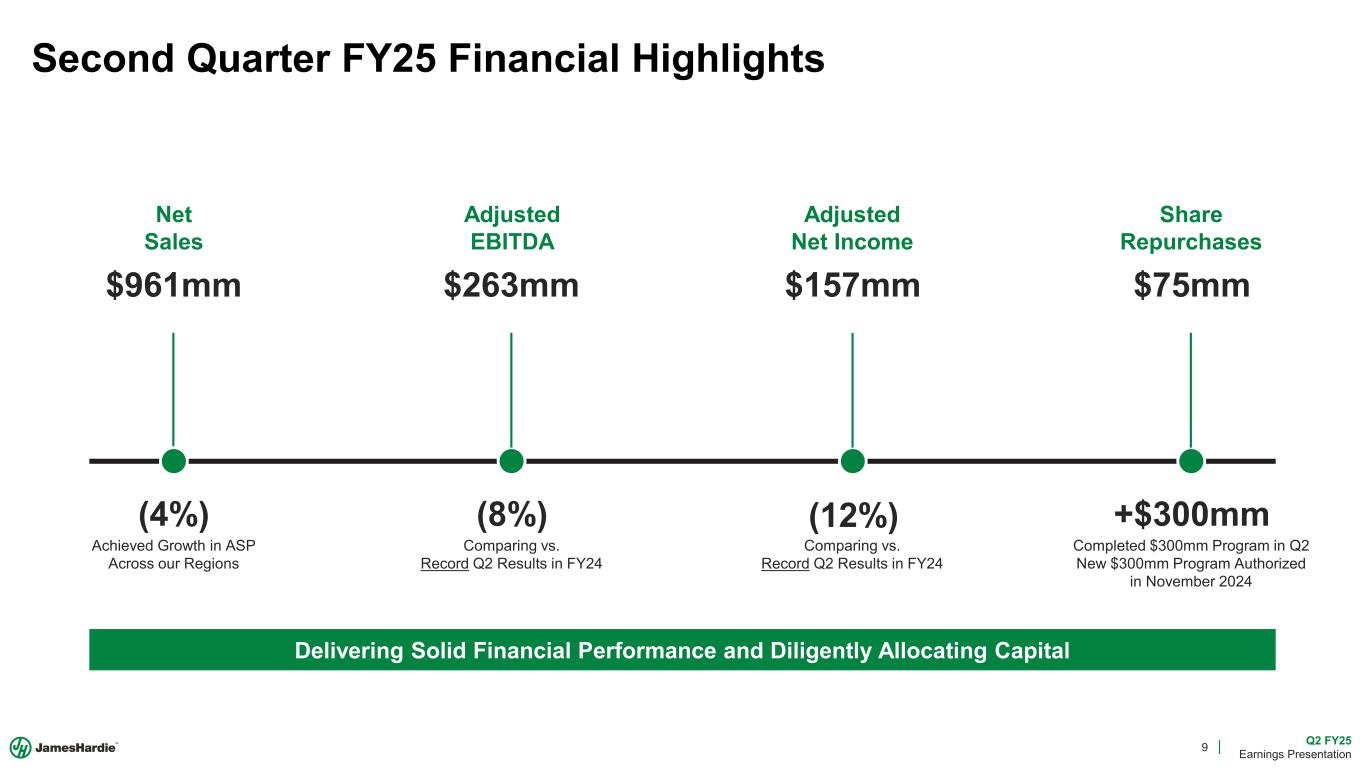

9 Q2 FY25 Earnings Presentation Second Quarter FY25 Financial Highlights Net Sales Adjusted EBITDA Share Repurchases Adjusted Net Income Achieved Growth in ASP Across our Regions Comparing vs. Record Q2 Results in FY24 Comparing vs. Record Q2 Results in FY24 Completed $300mm Program in Q2 New $300mm Program Authorized in November 2024 (4%) (8%) (12%) +$300mm Delivering Solid Financial Performance and Diligently Allocating Capital $961mm $263mm $157mm $75mm

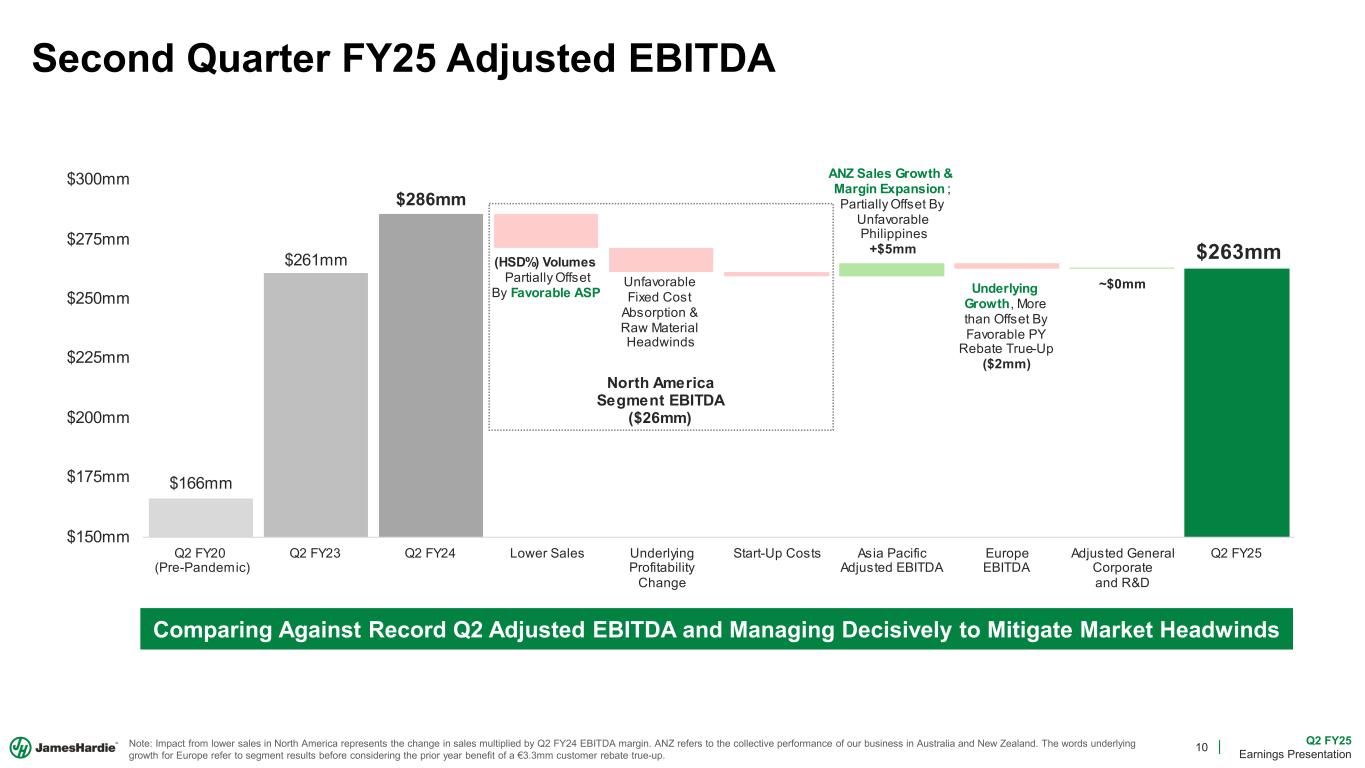

10 Q2 FY25 Earnings Presentation Second Quarter FY25 Adjusted EBITDA Note: Impact from lower sales in North America represents the change in sales multiplied by Q2 FY24 EBITDA margin. ANZ refers to the collective performance of our business in Australia and New Zealand. The words underlying growth for Europe refer to segment results before considering the prior year benefit of a €3.3mm customer rebate true-up. Comparing Against Record Q2 Adjusted EBITDA and Managing Decisively to Mitigate Market Headwinds $166mm $261mm $286mm North America Segment EBITDA ($26mm) $263mm(HSD%) Volumes Partially Offset By Favorable ASP Unfavorable Fixed Cost Absorption & Raw Material Headwinds ANZ Sales Growth & Margin Expansion ; Partially Offset By Unfavorable Philippines +$5mm Underlying Growth, More than Offset By Favorable PY Rebate True-Up ($2mm) ~$0mm $150mm $175mm $200mm $225mm $250mm $275mm $300mm Q2 FY20 (Pre-Pandemic) Q2 FY23 Q2 FY24 Lower Sales Underlying Profitability Change Start-Up Costs Asia Pacific Adjusted EBITDA Europe EBITDA Adjusted General Corporate and R&D Q2 FY25

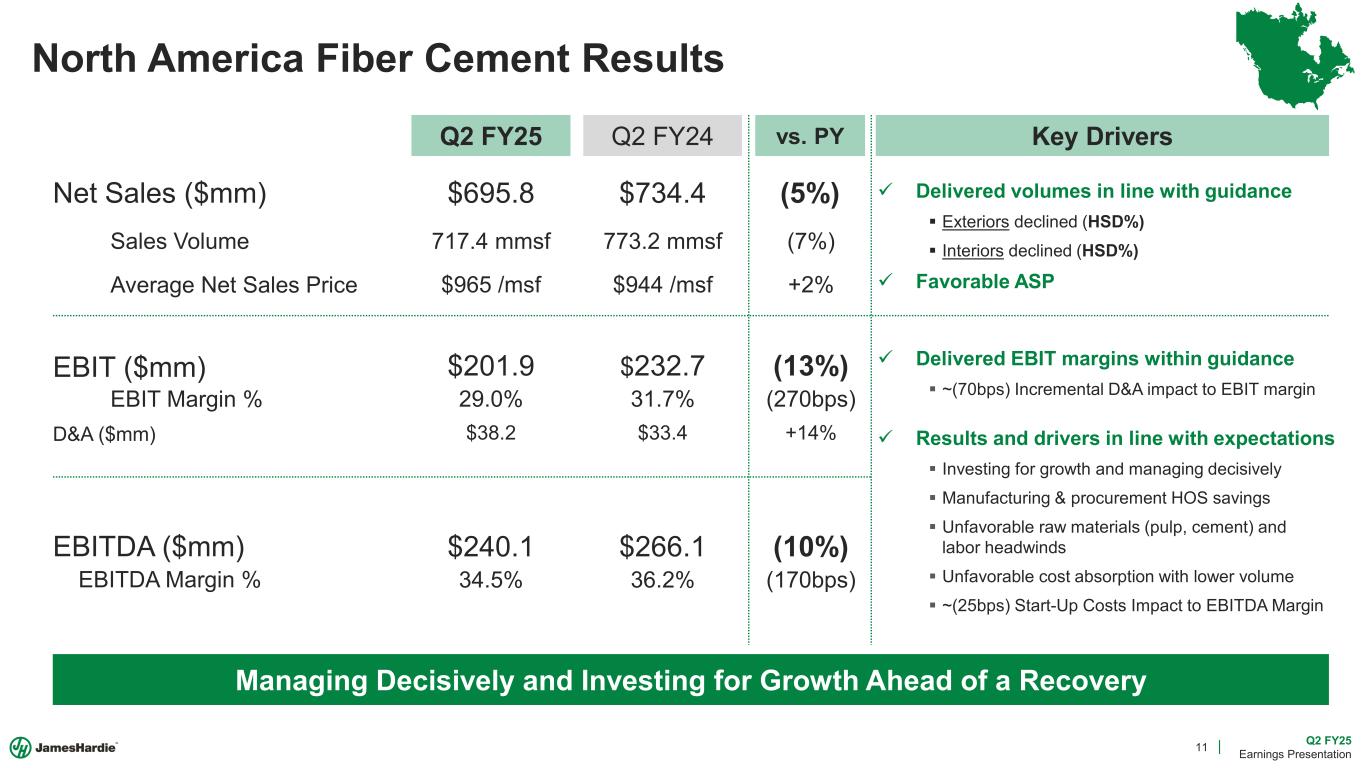

11 Q2 FY25 Earnings Presentation North America Fiber Cement Results Net Sales ($mm) EBIT ($mm) EBITDA ($mm) EBITDA Margin % EBIT Margin % Average Net Sales Price Sales Volume Q2 FY25 Q2 FY24 vs. PY $695.8 $734.4 (5%) Managing Decisively and Investing for Growth Ahead of a Recovery 717.4 mmsf 773.2 mmsf (7%) $965 /msf $944 /msf +2% $201.9 $232.7 (13%) 29.0% 31.7% (270bps) Key Drivers Delivered volumes in line with guidance Exteriors declined (HSD%) Interiors declined (HSD%) Favorable ASP Delivered EBIT margins within guidance ~(70bps) Incremental D&A impact to EBIT margin $240.1 $266.1 (10%) 34.5% 36.2% (170bps) D&A ($mm) $38.2 $33.4 +14% Results and drivers in line with expectations Investing for growth and managing decisively Manufacturing & procurement HOS savings Unfavorable raw materials (pulp, cement) and labor headwinds Unfavorable cost absorption with lower volume ~(25bps) Start-Up Costs Impact to EBITDA Margin

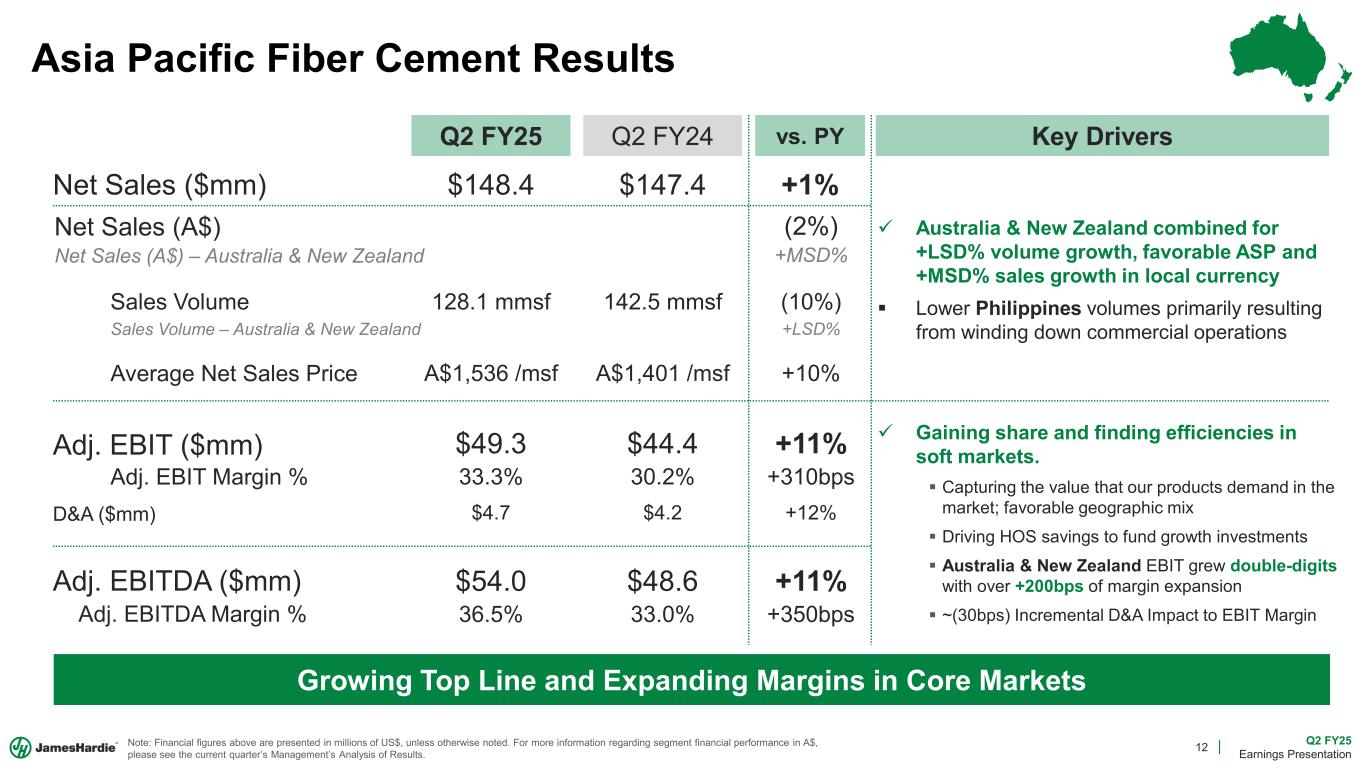

12 Q2 FY25 Earnings Presentation Asia Pacific Fiber Cement Results Net Sales ($mm) Adj. EBIT ($mm) Adj. EBITDA ($mm) Adj. EBITDA Margin % Adj. EBIT Margin % Sales Volume – Australia & New Zealand Sales Volume Q2 FY25 Q2 FY24 vs. PY $148.4 $147.4 +1% Growing Top Line and Expanding Margins in Core Markets 128.1 mmsf 142.5 mmsf (10%) +LSD% $49.3 $44.4 +11% 33.3% 30.2% +310bps Key Drivers $54.0 $48.6 +11% 36.5% 33.0% +350bps D&A ($mm) $4.7 $4.2 +12% Note: Financial figures above are presented in millions of US$, unless otherwise noted. For more information regarding segment financial performance in A$, please see the current quarter’s Management’s Analysis of Results. Net Sales (A$) (2%) Australia & New Zealand combined for +LSD% volume growth, favorable ASP and +MSD% sales growth in local currency Lower Philippines volumes primarily resulting from winding down commercial operations Gaining share and finding efficiencies in soft markets. Capturing the value that our products demand in the market; favorable geographic mix Driving HOS savings to fund growth investments Australia & New Zealand EBIT grew double-digits with over +200bps of margin expansion ~(30bps) Incremental D&A Impact to EBIT Margin Average Net Sales Price A$1,536 /msf A$1,401 /msf +10% Net Sales (A$) – Australia & New Zealand +MSD%

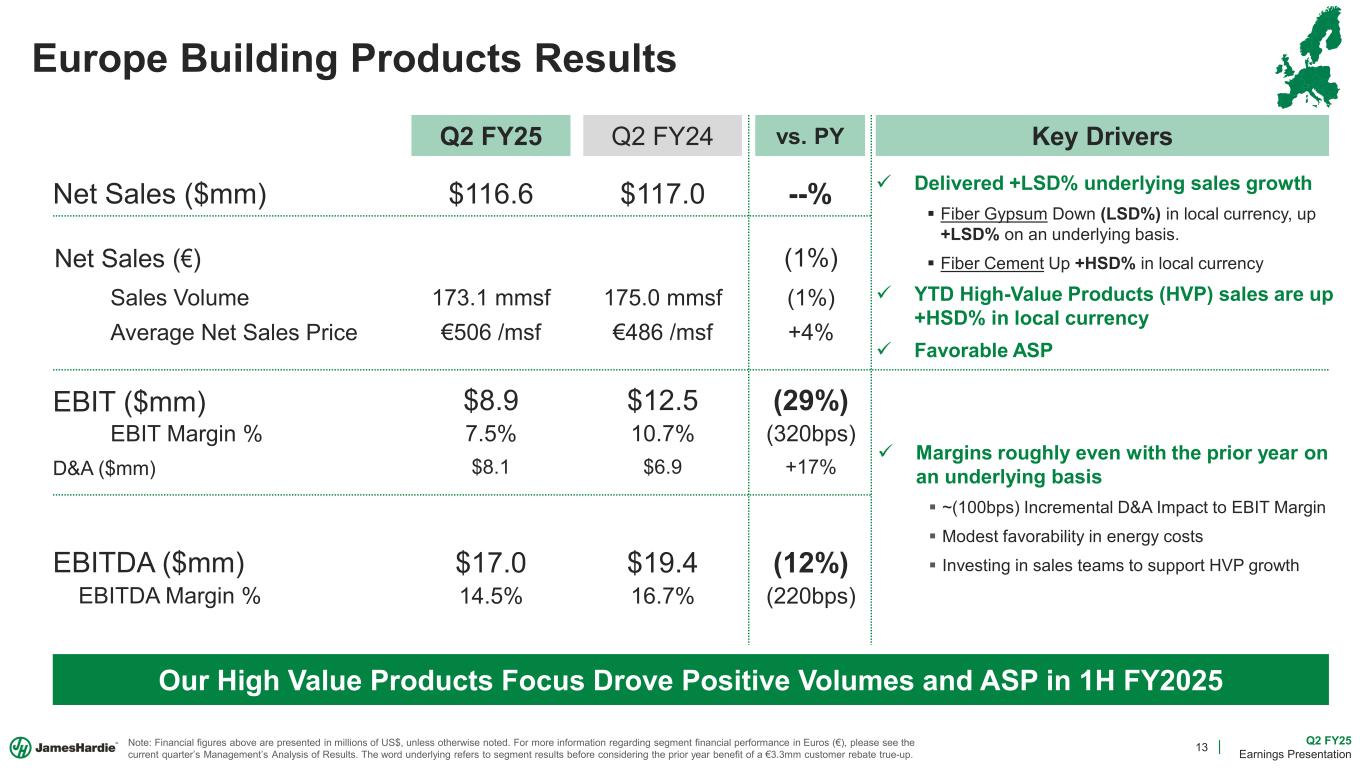

13 Q2 FY25 Earnings Presentation Europe Building Products Results Net Sales ($mm) EBIT ($mm) EBITDA ($mm) EBITDA Margin % EBIT Margin % Average Net Sales Price Sales Volume Q2 FY25 Q2 FY24 vs. PY $116.6 $117.0 --% Our High Value Products Focus Drove Positive Volumes and ASP in 1H FY2025 173.1 mmsf 175.0 mmsf (1%) €506 /msf €486 /msf +4% $8.9 $12.5 (29%) 7.5% 10.7% (320bps) Key Drivers $17.0 $19.4 (12%) 14.5% 16.7% (220bps) D&A ($mm) $8.1 $6.9 +17% Net Sales (€) (1%) Note: Financial figures above are presented in millions of US$, unless otherwise noted. For more information regarding segment financial performance in Euros (€), please see the current quarter’s Management’s Analysis of Results. The word underlying refers to segment results before considering the prior year benefit of a €3.3mm customer rebate true-up. Delivered +LSD% underlying sales growth Fiber Gypsum Down (LSD%) in local currency, up +LSD% on an underlying basis. Fiber Cement Up +HSD% in local currency YTD High-Value Products (HVP) sales are up +HSD% in local currency Favorable ASP Margins roughly even with the prior year on an underlying basis ~(100bps) Incremental D&A Impact to EBIT Margin Modest favorability in energy costs Investing in sales teams to support HVP growth

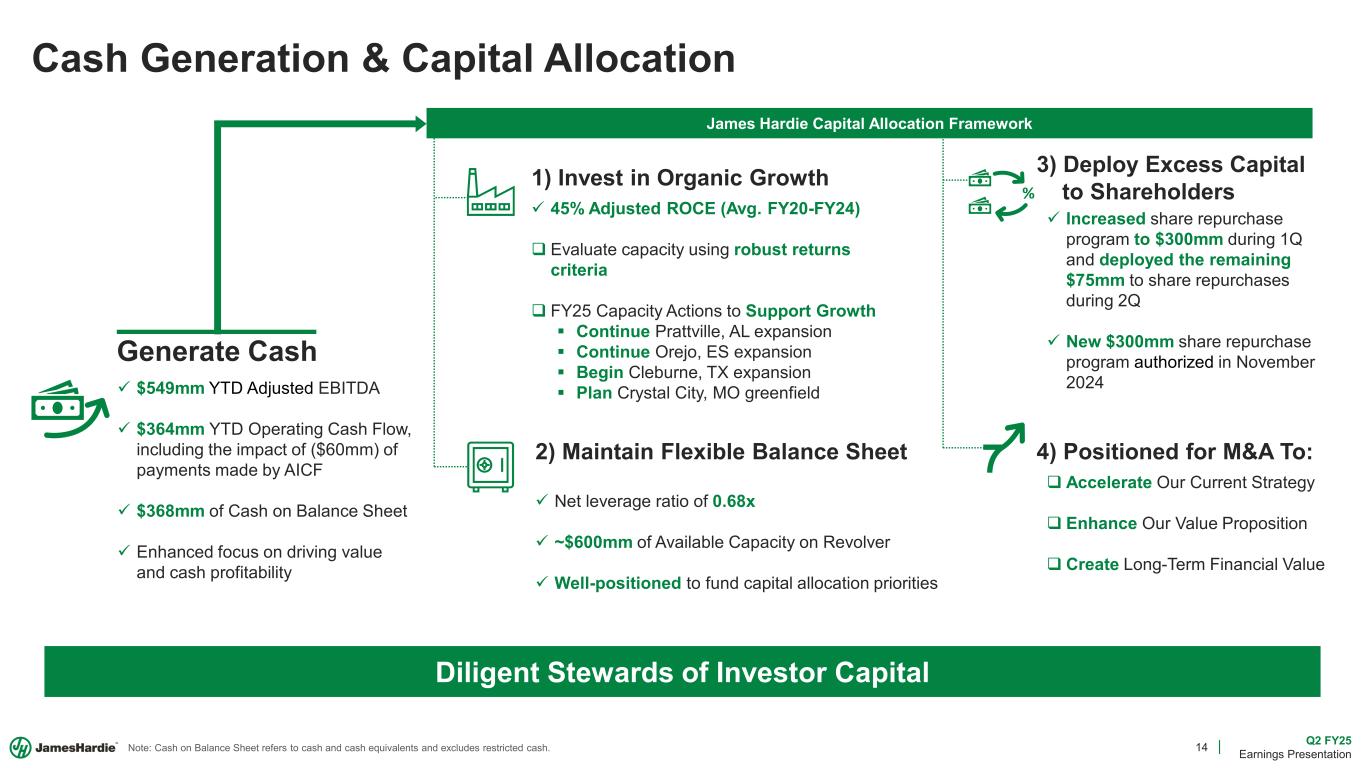

14 Q2 FY25 Earnings Presentation Cash Generation & Capital Allocation $549mm YTD Adjusted EBITDA $364mm YTD Operating Cash Flow, including the impact of ($60mm) of payments made by AICF $368mm of Cash on Balance Sheet Enhanced focus on driving value and cash profitability Net leverage ratio of 0.68x ~$600mm of Available Capacity on Revolver Well-positioned to fund capital allocation priorities 45% Adjusted ROCE (Avg. FY20-FY24) Evaluate capacity using robust returns criteria FY25 Capacity Actions to Support Growth Continue Prattville, AL expansion Continue Orejo, ES expansion Begin Cleburne, TX expansion Plan Crystal City, MO greenfield Generate Cash 2) Maintain Flexible Balance Sheet 1) Invest in Organic Growth Increased share repurchase program to $300mm during 1Q and deployed the remaining $75mm to share repurchases during 2Q New $300mm share repurchase program authorized in November 2024 3) Deploy Excess Capital to Shareholders% Accelerate Our Current Strategy Enhance Our Value Proposition Create Long-Term Financial Value 4) Positioned for M&A To: Diligent Stewards of Investor Capital James Hardie Capital Allocation Framework Note: Cash on Balance Sheet refers to cash and cash equivalents and excludes restricted cash.

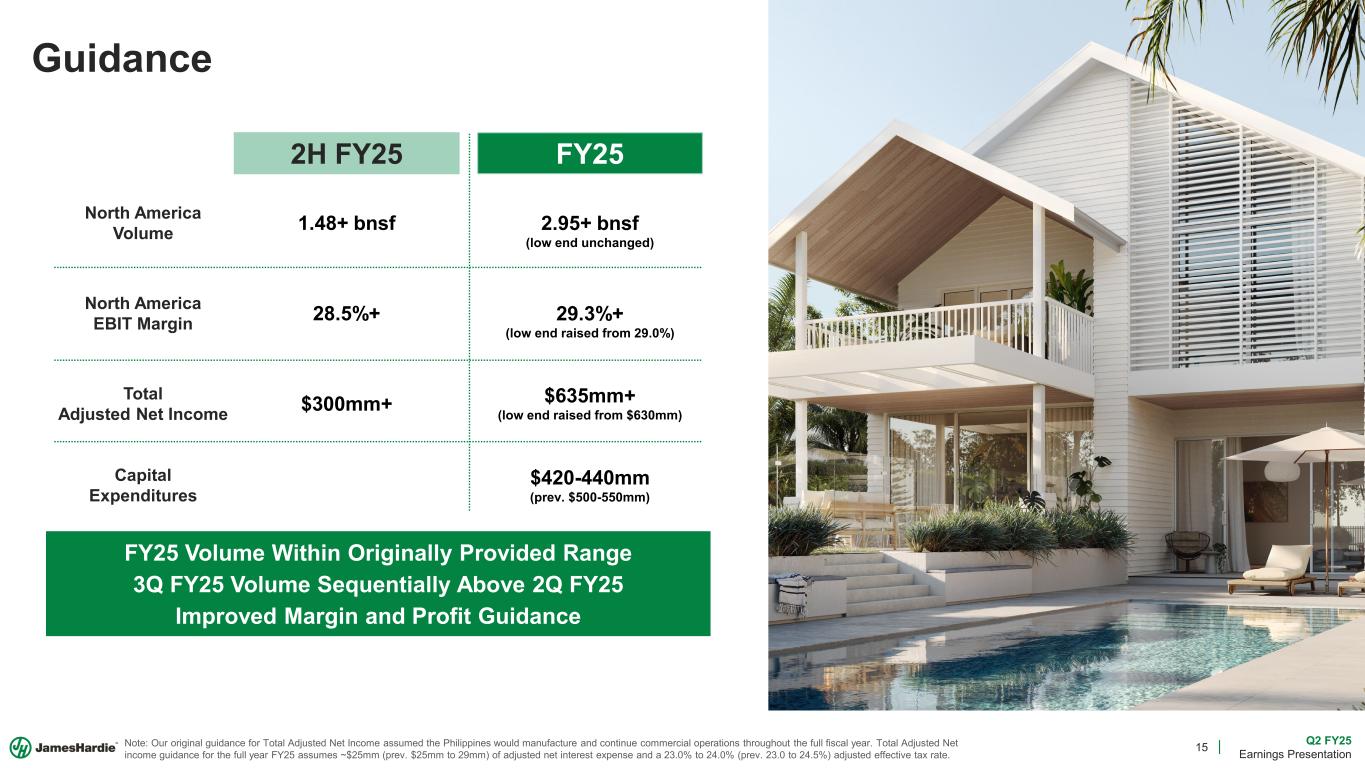

15 Q2 FY25 Earnings Presentation Guidance FY25 North America Volume North America EBIT Margin Total Adjusted Net Income FY25 Volume Within Originally Provided Range 3Q FY25 Volume Sequentially Above 2Q FY25 Improved Margin and Profit Guidance 2.95+ bnsf (low end unchanged) 29.3%+ (low end raised from 29.0%) $635mm+ (low end raised from $630mm) Note: Our original guidance for Total Adjusted Net Income assumed the Philippines would manufacture and continue commercial operations throughout the full fiscal year. Total Adjusted Net income guidance for the full year FY25 assumes ~$25mm (prev. $25mm to 29mm) of adjusted net interest expense and a 23.0% to 24.0% (prev. 23.0 to 24.5%) adjusted effective tax rate. Capital Expenditures $420-440mm (prev. $500-550mm) 2H FY25 1.48+ bnsf 28.5%+ $300mm+

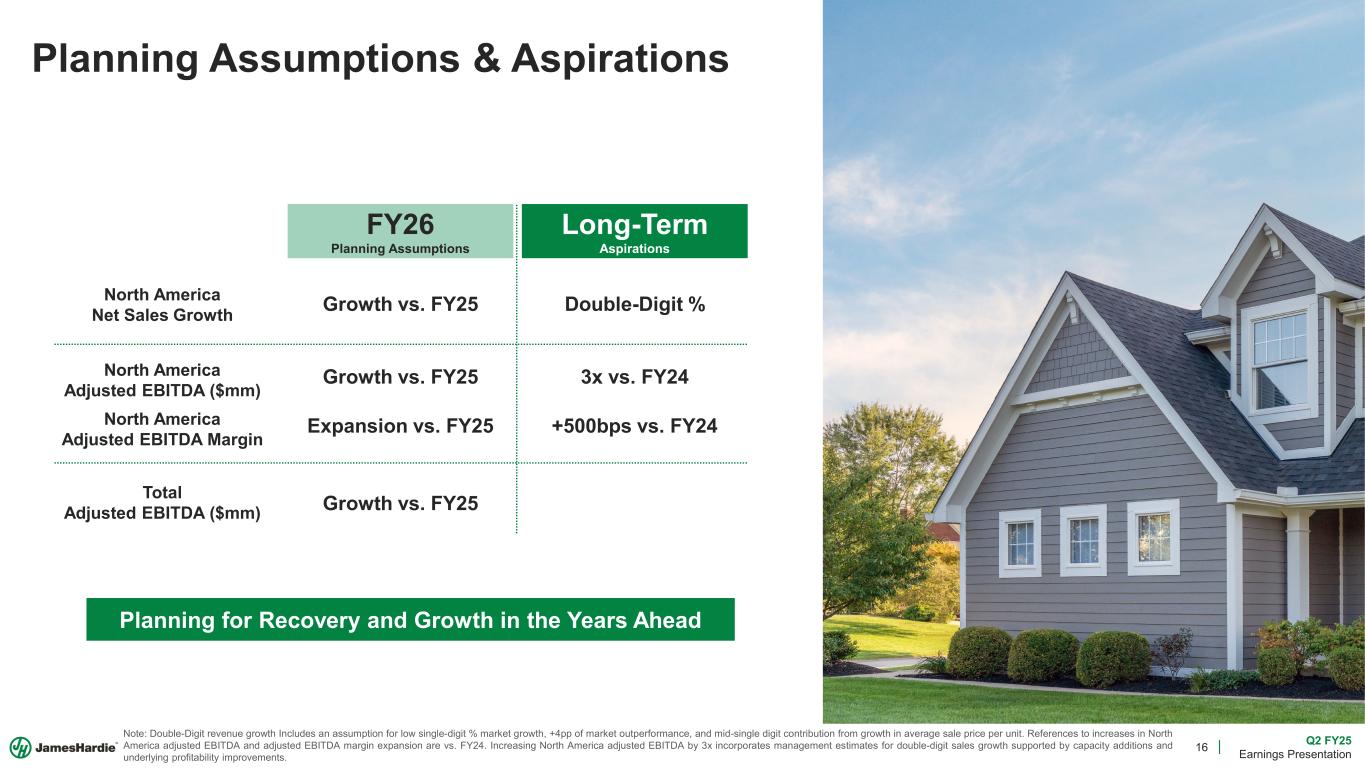

16 Q2 FY25 Earnings Presentation Note: Double-Digit revenue growth Includes an assumption for low single-digit % market growth, +4pp of market outperformance, and mid-single digit contribution from growth in average sale price per unit. References to increases in North America adjusted EBITDA and adjusted EBITDA margin expansion are vs. FY24. Increasing North America adjusted EBITDA by 3x incorporates management estimates for double-digit sales growth supported by capacity additions and underlying profitability improvements. Planning Assumptions & Aspirations Planning for Recovery and Growth in the Years Ahead FY26 Planning Assumptions North America Net Sales Growth Growth vs. FY25 North America Adjusted EBITDA Margin Expansion vs. FY25 Long-Term Aspirations Double-Digit % +500bps vs. FY24 North America Adjusted EBITDA ($mm) Growth vs. FY25 3x vs. FY24 Total Adjusted EBITDA ($mm) Growth vs. FY25

17 Q2 FY25 Earnings Presentation We Are Positioned to Accelerate Growth Long-Term Shareholder Value Creation We Have the Right Strategy We Aspire to Deliver Profitable Growth We Are Anchoring on Bold Ambitions Long-Term Value Creation Homeowner Focused, Customer and Contractor Driven +DD% +500bps $ $ $ $$ 3x Revenue Adj. EBITDA Margin Returns North America Adjusted EBITDA Note: “Homes” refers to the conceptual number of cumulative homes with Hardie® siding in North America based on total sales volumes and housing intensity of 2,600 sqft of siding per home. Double-Digit North America revenue growth includes an assumption for low single-digit % market growth, +4pp of market outperformance, and mid-single digit contribution from growth in average sale price per unit. References to increases in North America adjusted EBITDA and adjusted EBITDA margin expansion are vs. FY24. Increasing North America adjusted EBITDA by 3x incorporates management estimates for double-digit sales growth supported by capacity additions and underlying profitability improvements.

18 Q2 FY25 Earnings Presentation Q&A Aaron Erter Chief Executive Officer Rachel Wilson Chief Financial Officer

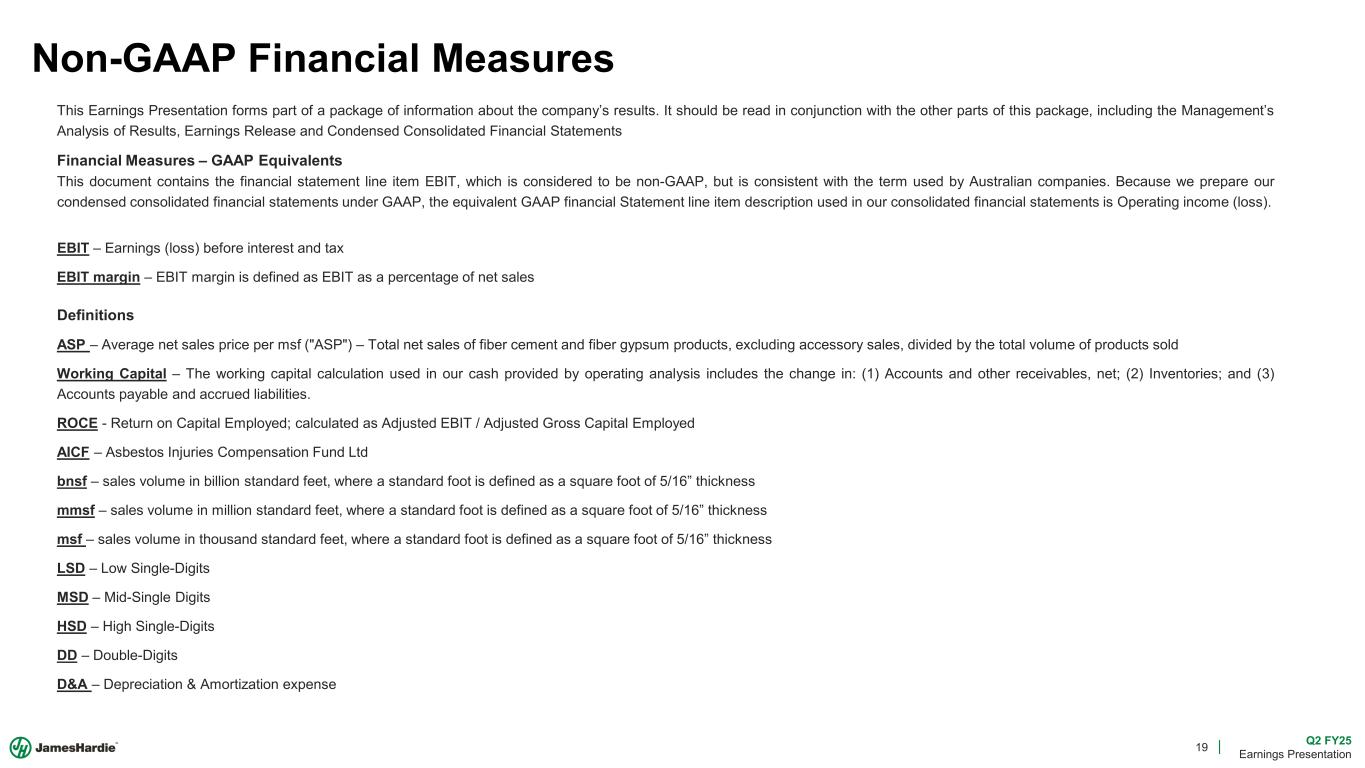

19 Q2 FY25 Earnings Presentation Non-GAAP Financial Measures This Earnings Presentation forms part of a package of information about the company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Earnings Release and Condensed Consolidated Financial Statements Financial Measures – GAAP Equivalents This document contains the financial statement line item EBIT, which is considered to be non-GAAP, but is consistent with the term used by Australian companies. Because we prepare our condensed consolidated financial statements under GAAP, the equivalent GAAP financial Statement line item description used in our consolidated financial statements is Operating income (loss). EBIT – Earnings (loss) before interest and tax EBIT margin – EBIT margin is defined as EBIT as a percentage of net sales Definitions ASP – Average net sales price per msf ("ASP") – Total net sales of fiber cement and fiber gypsum products, excluding accessory sales, divided by the total volume of products sold Working Capital – The working capital calculation used in our cash provided by operating analysis includes the change in: (1) Accounts and other receivables, net; (2) Inventories; and (3) Accounts payable and accrued liabilities. ROCE - Return on Capital Employed; calculated as Adjusted EBIT / Adjusted Gross Capital Employed AICF – Asbestos Injuries Compensation Fund Ltd bnsf – sales volume in billion standard feet, where a standard foot is defined as a square foot of 5/16” thickness mmsf – sales volume in million standard feet, where a standard foot is defined as a square foot of 5/16” thickness msf – sales volume in thousand standard feet, where a standard foot is defined as a square foot of 5/16” thickness LSD – Low Single-Digits MSD – Mid-Single Digits HSD – High Single-Digits DD – Double-Digits D&A – Depreciation & Amortization expense

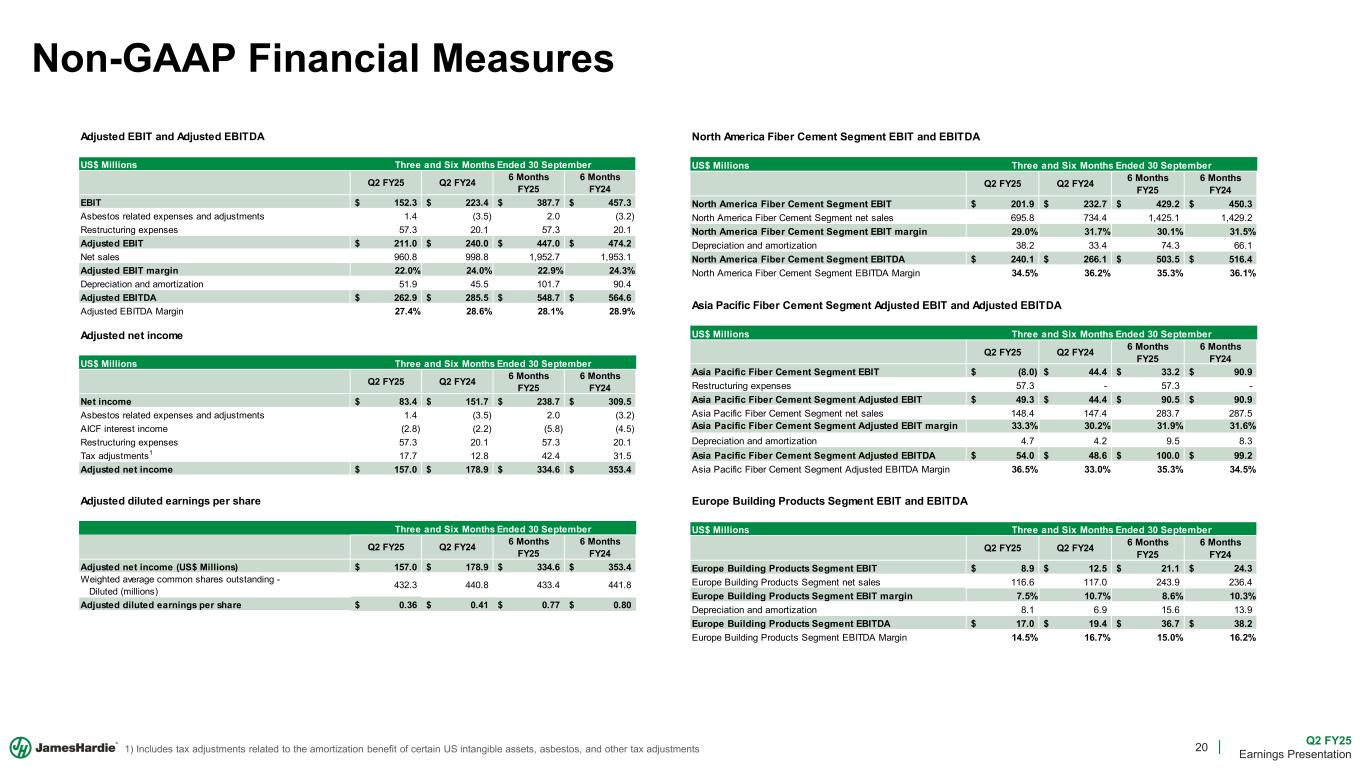

20 Q2 FY25 Earnings Presentation Adjusted EBIT and Adjusted EBITDA US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 EBIT 152.3$ 223.4$ 387.7$ 457.3$ Asbestos related expenses and adjustments 1.4 (3.5) 2.0 (3.2) Restructuring expenses 57.3 20.1 57.3 20.1 Adjusted EBIT 211.0$ 240.0$ 447.0$ 474.2$ Net sales 960.8 998.8 1,952.7 1,953.1 Adjusted EBIT margin 22.0% 24.0% 22.9% 24.3% Depreciation and amortization 51.9 45.5 101.7 90.4 Adjusted EBITDA 262.9$ 285.5$ 548.7$ 564.6$ Adjusted EBITDA Margin 27.4% 28.6% 28.1% 28.9% Three and Six Months Ended 30 September Non-GAAP Financial Measures 1) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments Adjusted net income US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Net income 83.4$ 151.7$ 238.7$ 309.5$ Asbestos related expenses and adjustments 1.4 (3.5) 2.0 (3.2) AICF interest income (2.8) (2.2) (5.8) (4.5) Restructuring expenses 57.3 20.1 57.3 20.1 Tax adjustments1 17.7 12.8 42.4 31.5 Adjusted net income 157.0$ 178.9$ 334.6$ 353.4$ Three and Six Months Ended 30 September US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 North America Fiber Cement Segment EBIT 201.9$ 232.7$ 429.2$ 450.3$ North America Fiber Cement Segment net sales 695.8 734.4 1,425.1 1,429.2 North America Fiber Cement Segment EBIT margin 29.0% 31.7% 30.1% 31.5% Depreciation and amortization 38.2 33.4 74.3 66.1 North America Fiber Cement Segment EBITDA 240.1$ 266.1$ 503.5$ 516.4$ North America Fiber Cement Segment EBITDA Margin 34.5% 36.2% 35.3% 36.1% North America Fiber Cement Segment EBIT and EBITDA Three and Six Months Ended 30 September US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Europe Building Products Segment EBIT 8.9$ 12.5$ 21.1$ 24.3$ Europe Building Products Segment net sales 116.6 117.0 243.9 236.4 Europe Building Products Segment EBIT margin 7.5% 10.7% 8.6% 10.3% Depreciation and amortization 8.1 6.9 15.6 13.9 Europe Building Products Segment EBITDA 17.0$ 19.4$ 36.7$ 38.2$ Europe Building Products Segment EBITDA Margin 14.5% 16.7% 15.0% 16.2% Europe Building Products Segment EBIT and EBITDA Three and Six Months Ended 30 September Adjusted diluted earnings per share Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Adjusted net income (US$ Millions) 157.0$ 178.9$ 334.6$ 353.4$ Weighted average common shares outstanding - Diluted (millions) 432.3 440.8 433.4 441.8 Adjusted diluted earnings per share 0.36$ 0.41$ 0.77$ 0.80$ Three and Six Months Ended 30 September US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Asia Pacific Fiber Cement Segment EBIT (8.0)$ 44.4$ 33.2$ 90.9$ Restructuring expenses 57.3 - 57.3 - Asia Pacific Fiber Cement Segment Adjusted EBIT 49.3$ 44.4$ 90.5$ 90.9$ Asia Pacific Fiber Cement Segment net sales 148.4 147.4 283.7 287.5 Asia Pacific Fiber Cement Segment Adjusted EBIT margin 33.3% 30.2% 31.9% 31.6% Depreciation and amortization 4.7 4.2 9.5 8.3 Asia Pacific Fiber Cement Segment Adjusted EBITDA 54.0$ 48.6$ 100.0$ 99.2$ Asia Pacific Fiber Cement Segment Adjusted EBITDA Margin 36.5% 33.0% 35.3% 34.5% Asia Pacific Fiber Cement Segment Adjusted EBIT and Adjusted EBITDA Three and Six Months Ended 30 September

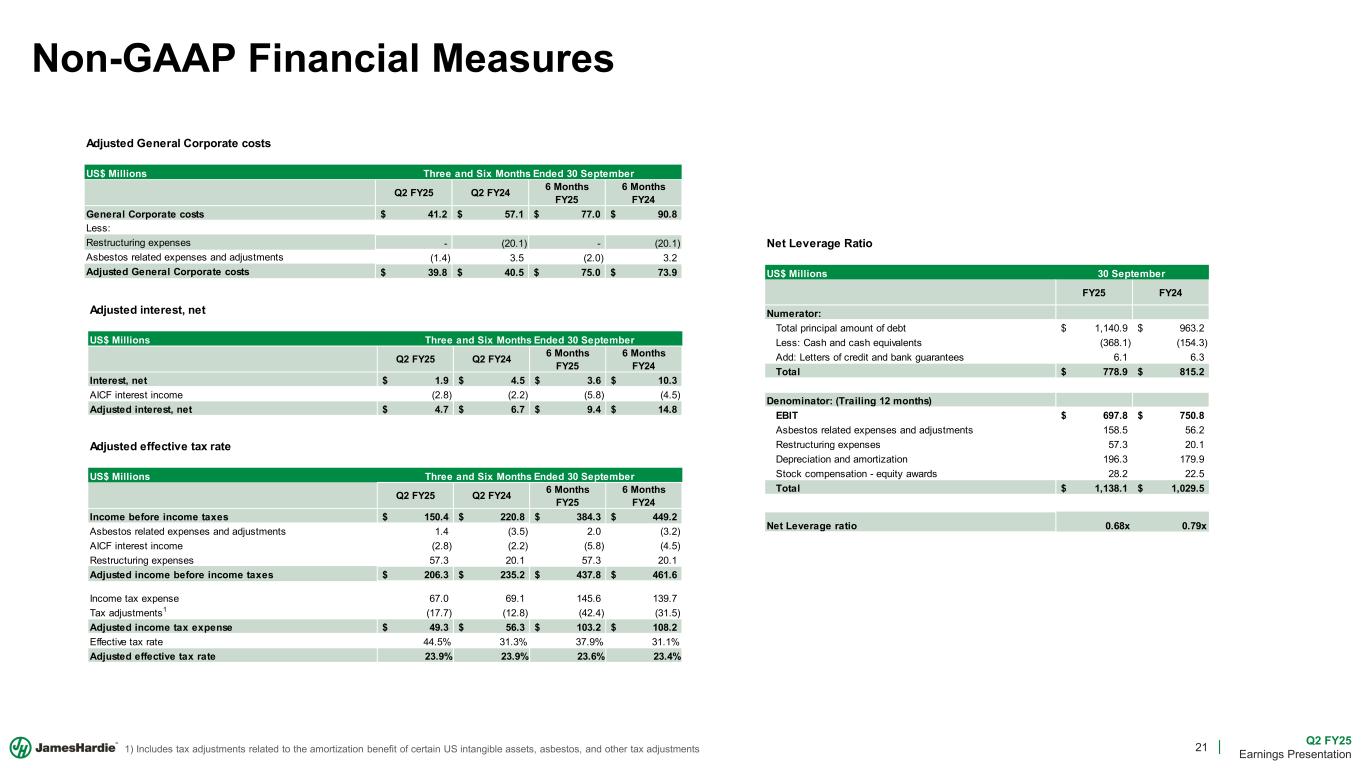

21 Q2 FY25 Earnings Presentation Non-GAAP Financial Measures 1) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and other tax adjustments US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 General Corporate costs 41.2$ 57.1$ 77.0$ 90.8$ Less: Restructuring expenses - (20.1) - (20.1) Asbestos related expenses and adjustments (1.4) 3.5 (2.0) 3.2 Adjusted General Corporate costs 39.8$ 40.5$ 75.0$ 73.9$ Adjusted General Corporate costs Three and Six Months Ended 30 September US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Interest, net 1.9$ 4.5$ 3.6$ 10.3$ AICF interest income (2.8) (2.2) (5.8) (4.5) Adjusted interest, net 4.7$ 6.7$ 9.4$ 14.8$ Adjusted interest, net Three and Six Months Ended 30 September Adjusted effective tax rate US$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Income before income taxes 150.4$ 220.8$ 384.3$ 449.2$ Asbestos related expenses and adjustments 1.4 (3.5) 2.0 (3.2) AICF interest income (2.8) (2.2) (5.8) (4.5) Restructuring expenses 57.3 20.1 57.3 20.1 Adjusted income before income taxes 206.3$ 235.2$ 437.8$ 461.6$ Income tax expense 67.0 69.1 145.6 139.7 Tax adjustments1 (17.7) (12.8) (42.4) (31.5) Adjusted income tax expense 49.3$ 56.3$ 103.2$ 108.2$ Effective tax rate 44.5% 31.3% 37.9% 31.1% Adjusted effective tax rate 23.9% 23.9% 23.6% 23.4% Three and Six Months Ended 30 September Net Leverage Ratio US$ Millions FY25 FY24 Numerator: Total principal amount of debt 1,140.9$ 963.2$ Less: Cash and cash equivalents (368.1) (154.3) Add: Letters of credit and bank guarantees 6.1 6.3 Total 778.9$ 815.2$ Denominator: (Trailing 12 months) EBIT 697.8$ 750.8$ Asbestos related expenses and adjustments 158.5 56.2 Restructuring expenses 57.3 20.1 Depreciation and amortization 196.3 179.9 Stock compensation - equity awards 28.2 22.5 Total 1,138.1$ 1,029.5$ Net Leverage ratio 0.68x 0.79x 30 September

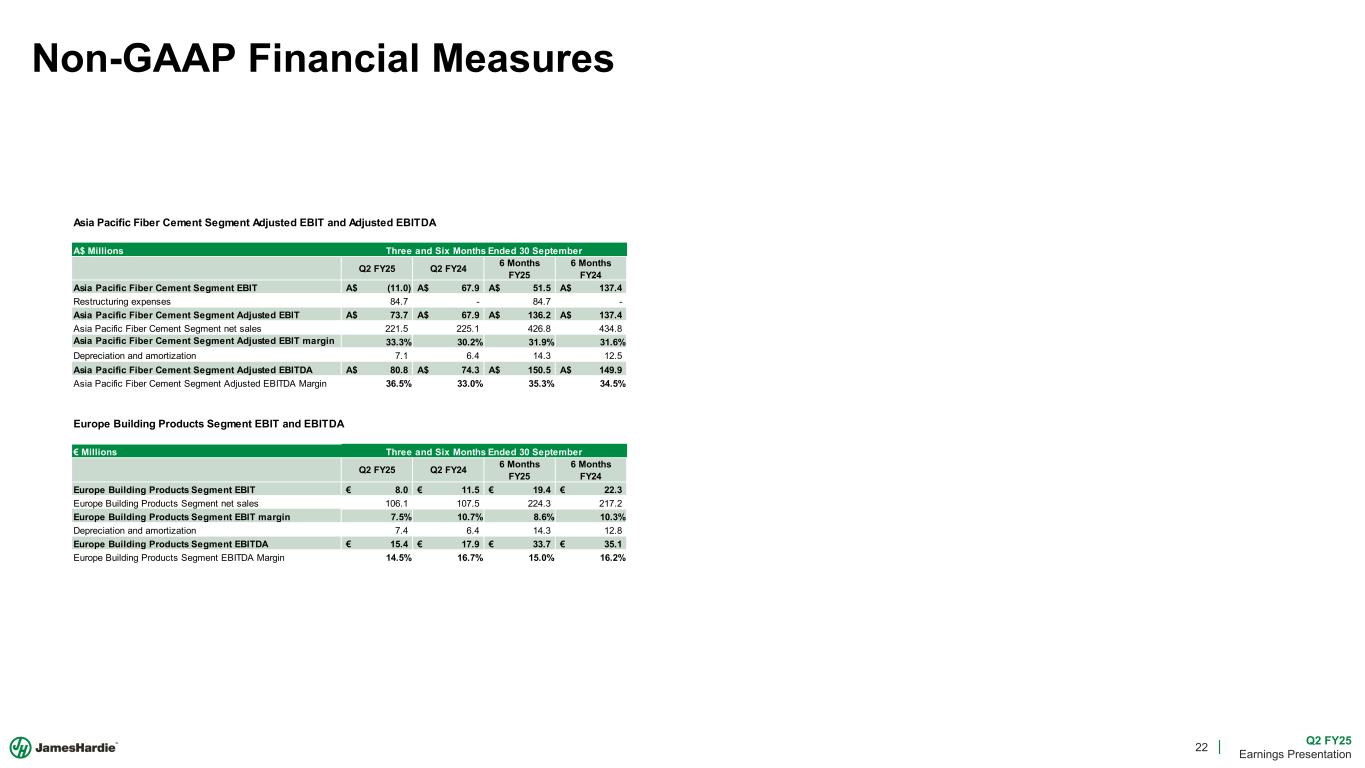

22 Q2 FY25 Earnings Presentation A$ Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Asia Pacific Fiber Cement Segment EBIT (11.0)A$ 67.9A$ 51.5A$ 137.4A$ Restructuring expenses 84.7 - 84.7 - Asia Pacific Fiber Cement Segment Adjusted EBIT 73.7A$ 67.9A$ 136.2A$ 137.4A$ Asia Pacific Fiber Cement Segment net sales 221.5 225.1 426.8 434.8 Asia Pacific Fiber Cement Segment Adjusted EBIT margin 33.3% 30.2% 31.9% 31.6% Depreciation and amortization 7.1 6.4 14.3 12.5 Asia Pacific Fiber Cement Segment Adjusted EBITDA 80.8A$ 74.3A$ 150.5A$ 149.9A$ Asia Pacific Fiber Cement Segment Adjusted EBITDA Margin 36.5% 33.0% 35.3% 34.5% € Millions Q2 FY25 Q2 FY24 6 Months FY25 6 Months FY24 Europe Building Products Segment EBIT 8.0€ 11.5€ 19.4€ 22.3€ Europe Building Products Segment net sales 106.1 107.5 224.3 217.2 Europe Building Products Segment EBIT margin 7.5% 10.7% 8.6% 10.3% Depreciation and amortization 7.4 6.4 14.3 12.8 Europe Building Products Segment EBITDA 15.4€ 17.9€ 33.7€ 35.1€ Europe Building Products Segment EBITDA Margin 14.5% 16.7% 15.0% 16.2% Europe Building Products Segment EBIT and EBITDA Asia Pacific Fiber Cement Segment Adjusted EBIT and Adjusted EBITDA Three and Six Months Ended 30 September Three and Six Months Ended 30 September Non-GAAP Financial Measures