James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Howard Heckes (USA), Gary Hendrickson (USA), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Jesse Singh (USA), Nigel Stein (UK). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 10 July 2025 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached copy of the substantial holding notice received by James Hardie on 9 July 2025. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

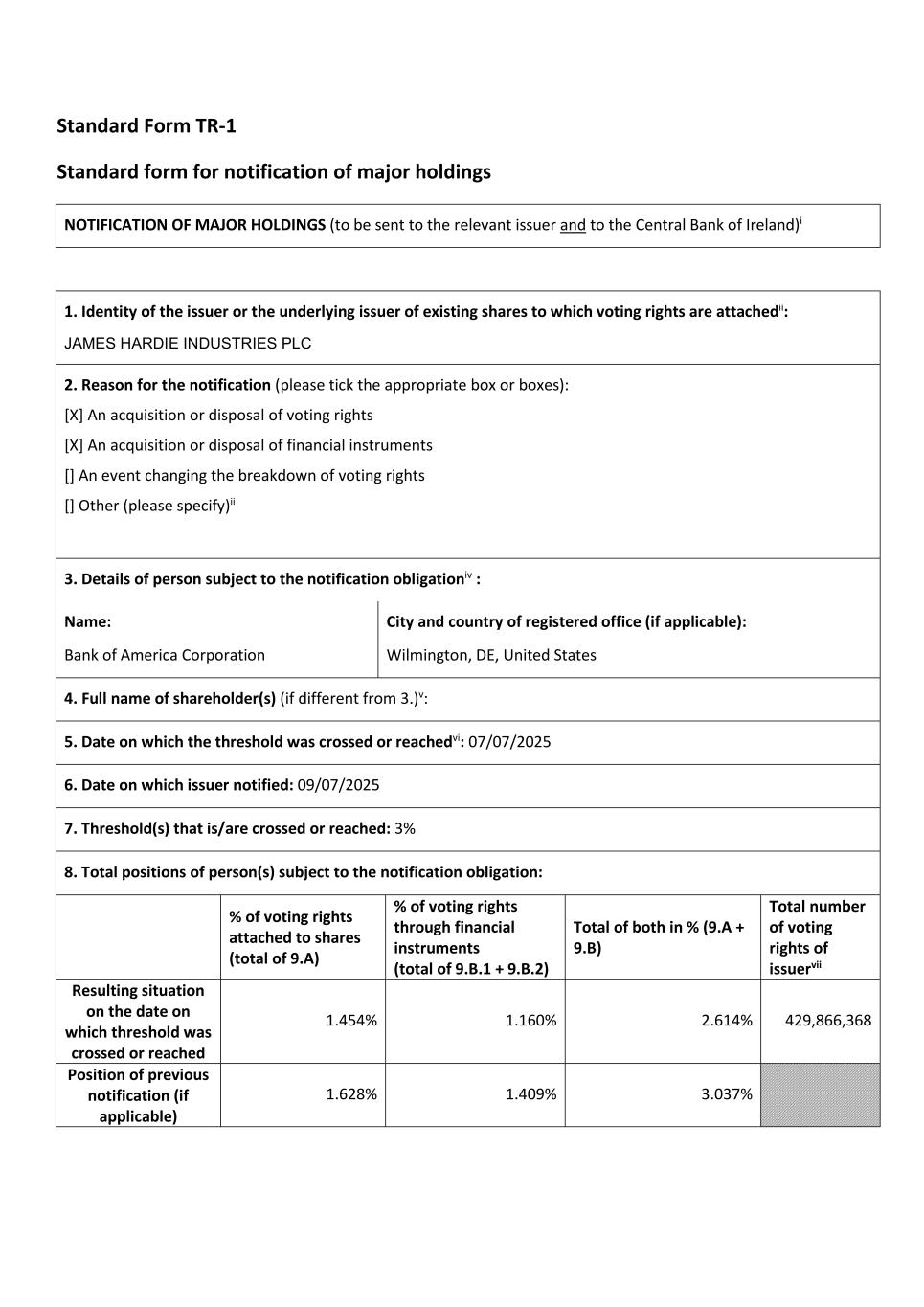

Standard Form TR-1 Standard form for notification of major holdings NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the Central Bank of Ireland)i 1. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii: JAMES HARDIE INDUSTRIES PLC 2. Reason for the notification (please tick the appropriate box or boxes): [X] An acquisition or disposal of voting rights [X] An acquisition or disposal of financial instruments [] An event changing the breakdown of voting rights [] Other (please specify)ii 3. Details of person subject to the notification obligationiv : Name: Bank of America Corporation City and country of registered office (if applicable): Wilmington, DE, United States 4. Full name of shareholder(s) (if different from 3.)v: 5. Date on which the threshold was crossed or reachedvi: 07/07/2025 6. Date on which issuer notified: 09/07/2025 7. Threshold(s) that is/are crossed or reached: 3% 8. Total positions of person(s) subject to the notification obligation: % of voting rights attached to shares (total of 9.A) % of voting rights through financial instruments (total of 9.B.1 + 9.B.2) Total of both in % (9.A + 9.B) Total number of voting rights of issuervii Resulting situation on the date on which threshold was crossed or reached 1.454% 1.160% 2.614% 429,866,368 Position of previous notification (if applicable) 1.628% 1.409% 3.037%

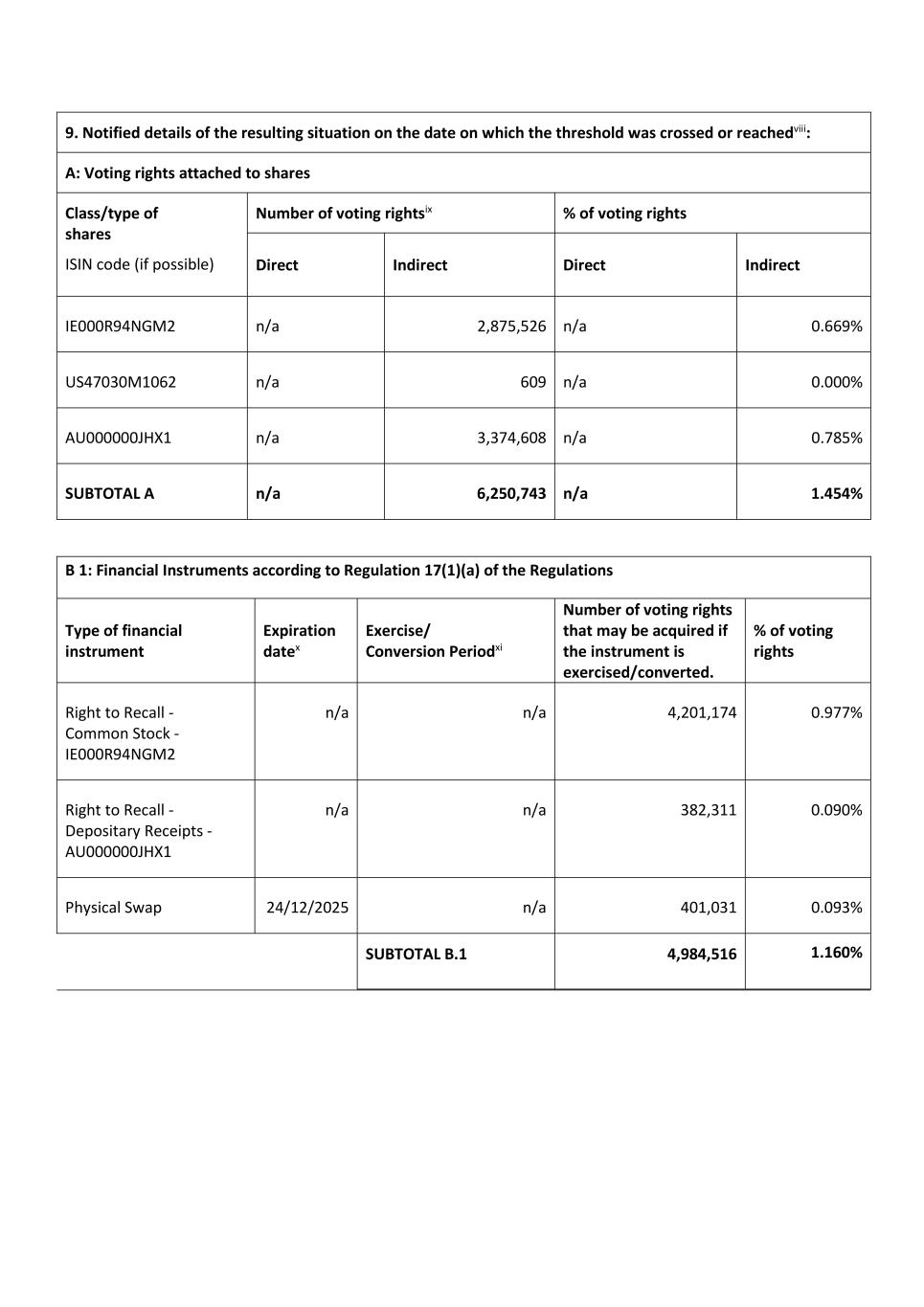

9. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii: A: Voting rights attached to shares Class/type of shares ISIN code (if possible) Number of voting rightsix % of voting rights Direct Indirect Direct Indirect IE000R94NGM2 n/a 2,875,526 n/a 0.669% US47030M1062 n/a 609 n/a 0.000% AU000000JHX1 n/a 3,374,608 n/a 0.785% SUBTOTAL A n/a 6,250,743 n/a 1.454% B 1: Financial Instruments according to Regulation 17(1)(a) of the Regulations Type of financial instrument Expiration datex Exercise/ Conversion Periodxi Number of voting rights that may be acquired if the instrument is exercised/converted. % of voting rights Right to Recall - Common Stock - IE000R94NGM2 n/a n/a 4,201,174 0.977% Right to Recall - Depositary Receipts - AU000000JHX1 n/a n/a 382,311 0.090% Physical Swap 24/12/2025 n/a 401,031 0.093% SUBTOTAL B.1 4,984,516 1.160%

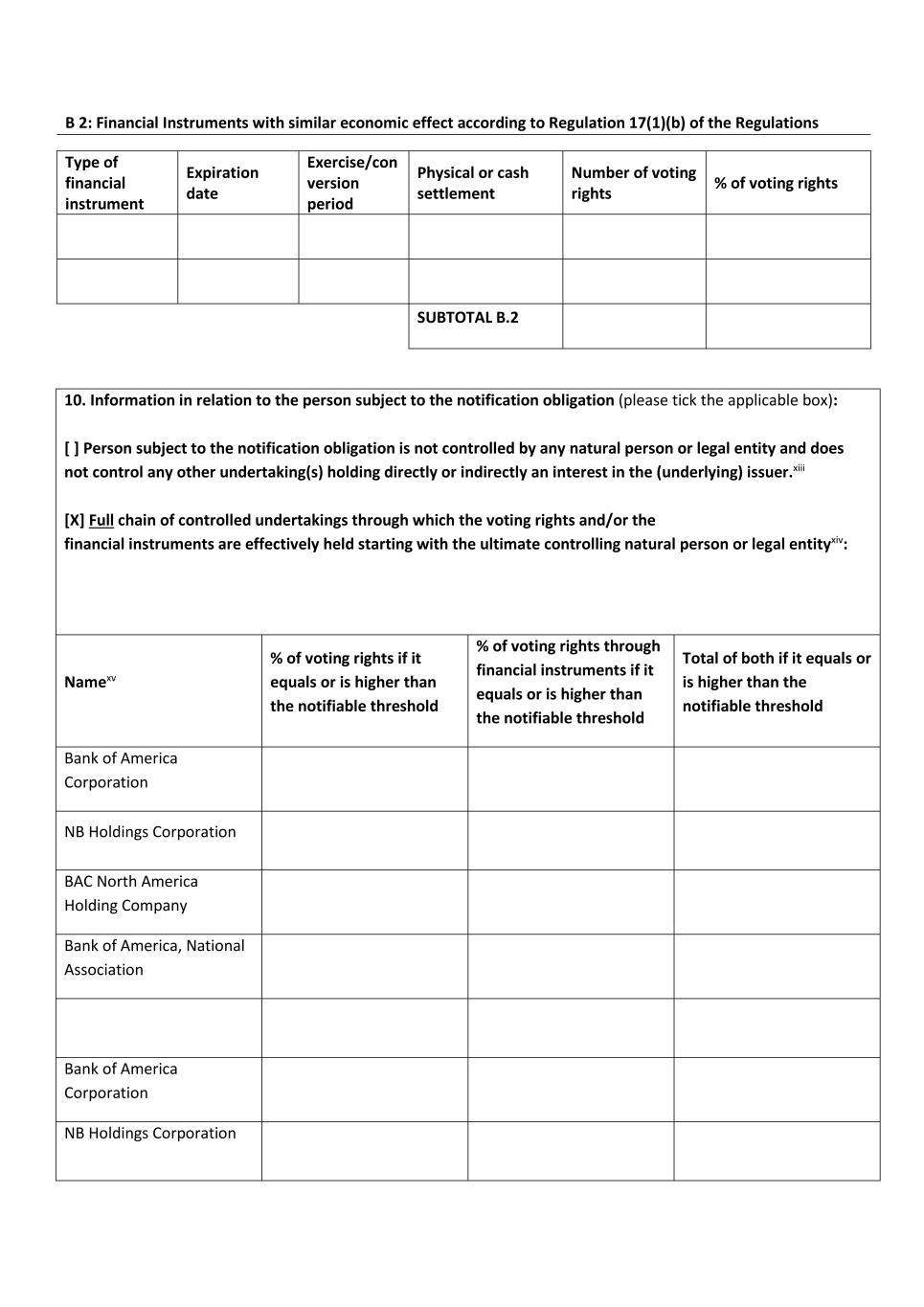

B 2: Financial Instruments with similar economic effect according to Regulation 17(1)(b) of the Regulations Type of financial instrument Expiration date Exercise/con version period Physical or cash settlement Number of voting rights % of voting rights SUBTOTAL B.2 10. Information in relation to the person subject to the notification obligation (please tick the applicable box): [ ] Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuer.xiii [X] Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv: Namexv % of voting rights if it equals or is higher than the notifiable threshold % of voting rights through financial instruments if it equals or is higher than the notifiable threshold Total of both if it equals or is higher than the notifiable threshold Bank of America Corporation NB Holdings Corporation BAC North America Holding Company Bank of America, National Association Bank of America Corporation NB Holdings Corporation

BofA Securities, Inc. Bank of America Corporation NB Holdings Corporation BAC North America Holding Company Merrill Lynch, Pierce, Fenner & Smith Incorporated Managed Account Advisors LLC Bank of America Corporation NB Holdings Corporation BofAML Jersey Holdings Limited BofAML EMEA Holdings 2 Limited Merrill Lynch International Bank of America Corporation NB Holdings Corporation BAC North America Holding Company

Merrill Lynch, Pierce, Fenner & Smith Incorporated Bank of America Corporation NB Holdings Corporation BAC North America Holding Company Bank of America, National Association U.S. Trust Company of Delaware 11. In case of proxy voting: [name of the proxy holder] will cease to hold [% and number] voting rights as of [date] 12. Additional information xvi: Done at United Kingdom on 9th July 2025.