James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Howard Heckes (USA), Gary Hendrickson (USA), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Jesse Singh (USA), Nigel Stein (UK). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 30 July 2025 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached copy of the substantial holding notice received by James Hardie on 29 July 2025. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

External Use Authorized NOTICE OF NOTIFIABLE INTEREST IN RELEVANT SHARE CAPITAL OF JAMES HARDIE INDUSTRIES PUBLIC LIMITED COMPANY (THE “COMPANY”) IN FULFILMENT OF AN OBLIGATION ARISING UNDER CHAPTER 4 OF PART 17 OF THE COMPANIES ACT 2014 James Hardie Industries Plc 1st Floor, Block A One Park Place Upper Hatch Street Dublin 2 D02 FD79 Ireland 29 July 2025 ATTN: Company Secretary BY EMAIL: [email protected] Greetings, This notification relates to issued ordinary shares in the capital of the Company and is given in fulfillment of the obligations imposed by Sections 1048 to 1050 and otherwise by Chapter 4 of Part 17 of the Companies Act 2014. The Vanguard Group, Inc. hereby notifies you that at the date of this notice it has a total notifiable interest in aggregate of 32,797,638 ordinary shares in the capital of the Company. The identity of the registered holders of shares to which this notification relates (so far as known to The Vanguard Group, Inc.) is set out in the attached schedule. Each of the products managed by The Vanguard Group, Inc., (the “Funds”) named in the attached schedule gives notice that, at the date of this notice, it has a total notifiable interest in the number of ordinary shares in the capital of the Company which is set out against its name. The identity of the registered holders of shares to which its notification relates (so far as known) is also set out against its name in the attached schedule. The address of The Vanguard Group, Inc. is: P.O. Box 2600, V26, Valley Forge, PA 19482, USA Yours faithfully, By: Shawn Acker

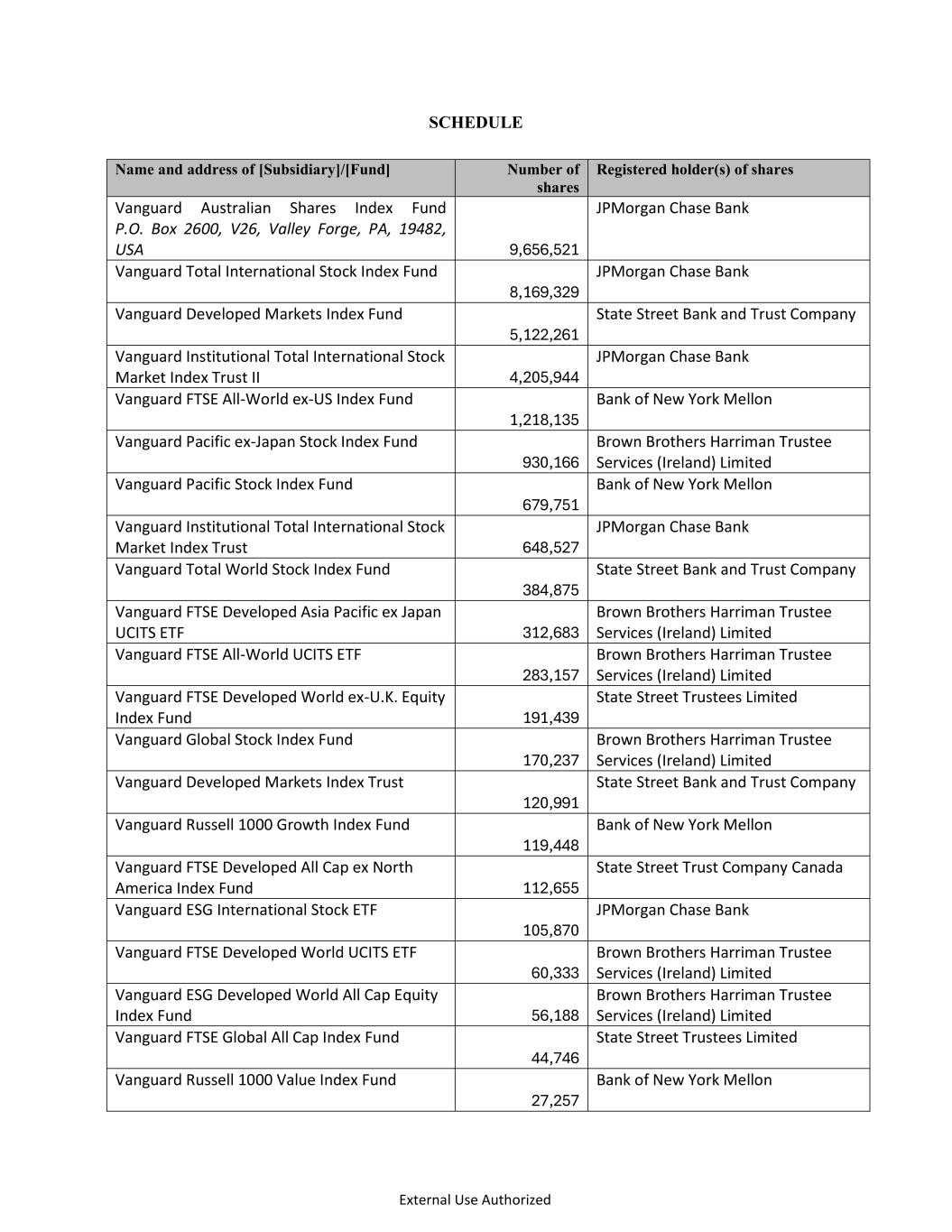

External Use Authorized SCHEDULE Name and address of [Subsidiary]/[Fund] Number of shares Registered holder(s) of shares Vanguard Australian Shares Index Fund P.O. Box 2600, V26, Valley Forge, PA, 19482, USA 9,656,521 JPMorgan Chase Bank Vanguard Total International Stock Index Fund 8,169,329 JPMorgan Chase Bank Vanguard Developed Markets Index Fund 5,122,261 State Street Bank and Trust Company Vanguard Institutional Total International Stock Market Index Trust II 4,205,944 JPMorgan Chase Bank Vanguard FTSE All-World ex-US Index Fund 1,218,135 Bank of New York Mellon Vanguard Pacific ex-Japan Stock Index Fund 930,166 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Pacific Stock Index Fund 679,751 Bank of New York Mellon Vanguard Institutional Total International Stock Market Index Trust 648,527 JPMorgan Chase Bank Vanguard Total World Stock Index Fund 384,875 State Street Bank and Trust Company Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF 312,683 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard FTSE All-World UCITS ETF 283,157 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard FTSE Developed World ex-U.K. Equity Index Fund 191,439 State Street Trustees Limited Vanguard Global Stock Index Fund 170,237 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Developed Markets Index Trust 120,991 State Street Bank and Trust Company Vanguard Russell 1000 Growth Index Fund 119,448 Bank of New York Mellon Vanguard FTSE Developed All Cap ex North America Index Fund 112,655 State Street Trust Company Canada Vanguard ESG International Stock ETF 105,870 JPMorgan Chase Bank Vanguard FTSE Developed World UCITS ETF 60,333 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard ESG Developed World All Cap Equity Index Fund 56,188 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard FTSE Global All Cap Index Fund 44,746 State Street Trustees Limited Vanguard Russell 1000 Value Index Fund 27,257 Bank of New York Mellon

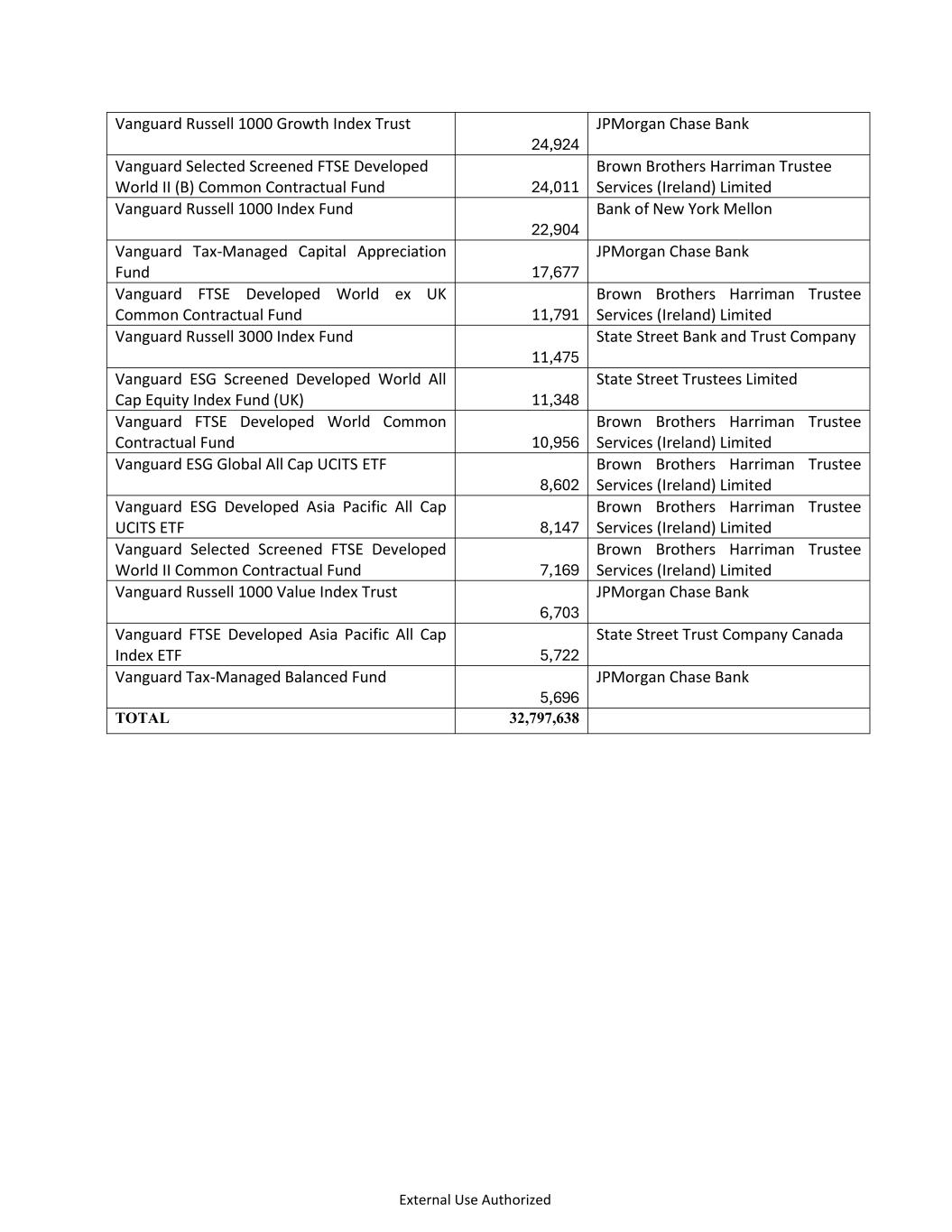

External Use Authorized Vanguard Russell 1000 Growth Index Trust 24,924 JPMorgan Chase Bank Vanguard Selected Screened FTSE Developed World II (B) Common Contractual Fund 24,011 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Russell 1000 Index Fund 22,904 Bank of New York Mellon Vanguard Tax-Managed Capital Appreciation Fund 17,677 JPMorgan Chase Bank Vanguard FTSE Developed World ex UK Common Contractual Fund 11,791 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Russell 3000 Index Fund 11,475 State Street Bank and Trust Company Vanguard ESG Screened Developed World All Cap Equity Index Fund (UK) 11,348 State Street Trustees Limited Vanguard FTSE Developed World Common Contractual Fund 10,956 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard ESG Global All Cap UCITS ETF 8,602 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard ESG Developed Asia Pacific All Cap UCITS ETF 8,147 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Selected Screened FTSE Developed World II Common Contractual Fund 7,169 Brown Brothers Harriman Trustee Services (Ireland) Limited Vanguard Russell 1000 Value Index Trust 6,703 JPMorgan Chase Bank Vanguard FTSE Developed Asia Pacific All Cap Index ETF 5,722 State Street Trust Company Canada Vanguard Tax-Managed Balanced Fund 5,696 JPMorgan Chase Bank TOTAL 32,797,638