James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Howard Heckes (USA), Gary Hendrickson (USA), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Jesse Singh (USA), Nigel Stein (UK). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 27 August 2025 ASX Compliance Exchange Centre 20 Bridge Street Sydney NSW 2000 Dear Sir / Madam James Hardie Industries PLC (‘JHX’): Response to ASX Aware Letter (Ref: 111951) We refer to your letter dated 22 August 2025 (ASX Aware Letter) and set out the response of James Hardie Industries PLC (JHX) to the requests for information made in the ASX Aware Letter, using the same numbering. 1. Does JHX consider that any measure of its statutory or underlying earnings for the quarter ended 30 June 2025 as disclosed in the Results Announcement (‘Earnings Information’) differed materially from the market’s expectations, having regard to the following two base indicators (in decreasing order of relevance and reliability): 1.1 If JHX had published earnings guidance, that guidance. 1.2 If JHX is covered by sell-side analysts, the earnings forecasts of those analysts. Please answer separately for each measure of earnings referred to in the Earnings Information. In your response, please have regard to ASX’s commentary in paragraphs 4(a) and 4(b) of section 7.3 of Guidance Note 8 about when a variation from market expectations may be material. JHX does not consider any measure of its statutory or underlying earnings for the quarter ended 30 June 2025 (Q1 FY26), as disclosed, differed materially from the market’s expectations. JHX did not publish earnings guidance for Q1 FY26. JHX’s assessment of the market’s expectations for Q1 FY26 earnings had regard to the downward trend in activity in the North American single family new construction and repair and remodel markets in which JHX operates, the uncertain macroeconomic environment (all of which had previously been disclosed by JHX) and the AZEK transaction being due to complete following the end of the quarter. North American housing analyst John Burns Research and Consulting forecasted prior to JHX’s Q4 FY25 earnings release that single family housing starts would decline by 3% in 2025. Then, prior to JHX’s Q1 FY26 earnings release, John Burns forecasted that single family housing starts would decline by 14% in 2025. The National Association of Home Builders (NAHB) forecasted prior to JHX’s Q4 FY25 earnings release that single family new housing starts

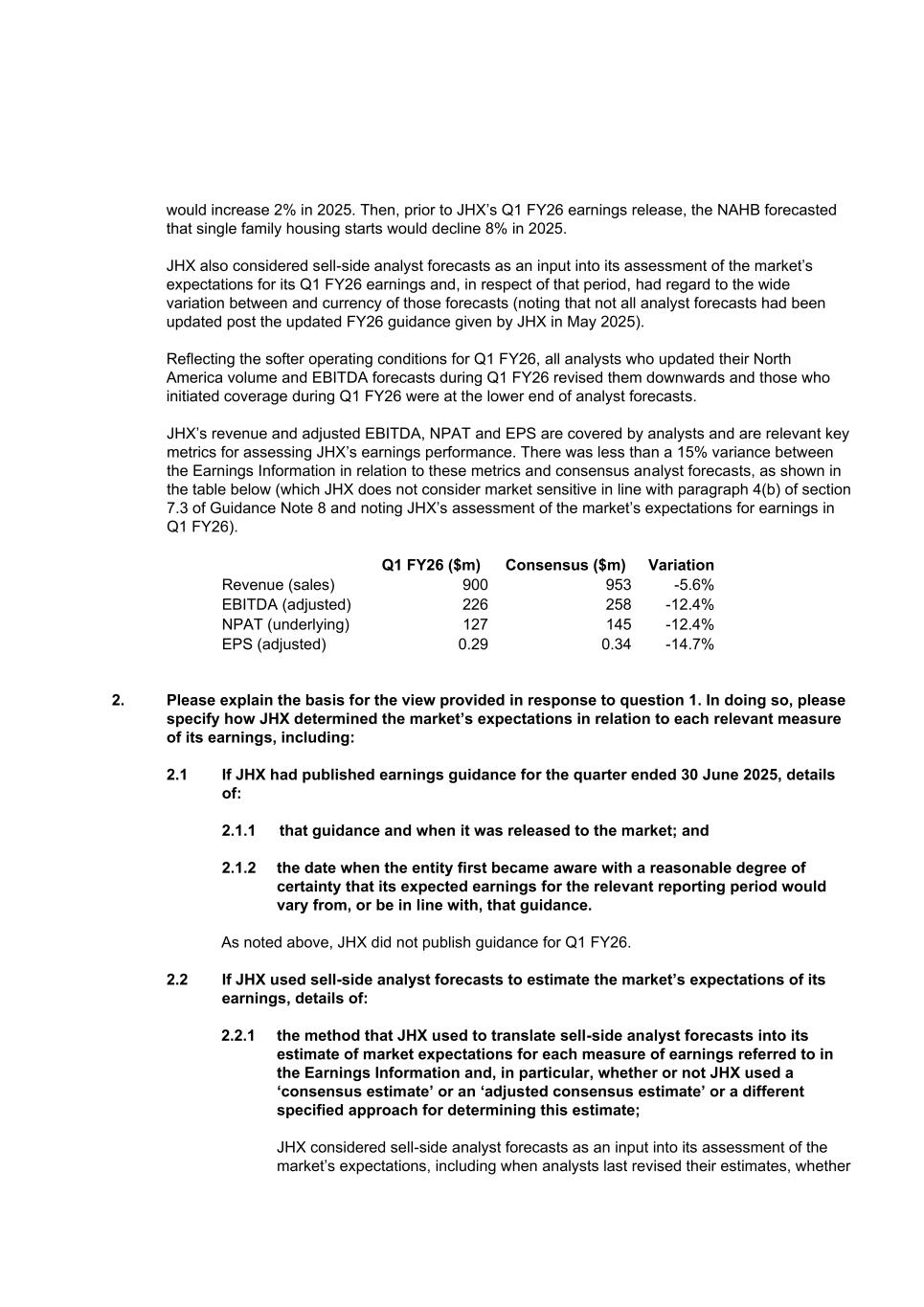

would increase 2% in 2025. Then, prior to JHX’s Q1 FY26 earnings release, the NAHB forecasted that single family housing starts would decline 8% in 2025. JHX also considered sell-side analyst forecasts as an input into its assessment of the market’s expectations for its Q1 FY26 earnings and, in respect of that period, had regard to the wide variation between and currency of those forecasts (noting that not all analyst forecasts had been updated post the updated FY26 guidance given by JHX in May 2025). Reflecting the softer operating conditions for Q1 FY26, all analysts who updated their North America volume and EBITDA forecasts during Q1 FY26 revised them downwards and those who initiated coverage during Q1 FY26 were at the lower end of analyst forecasts. JHX’s revenue and adjusted EBITDA, NPAT and EPS are covered by analysts and are relevant key metrics for assessing JHX’s earnings performance. There was less than a 15% variance between the Earnings Information in relation to these metrics and consensus analyst forecasts, as shown in the table below (which JHX does not consider market sensitive in line with paragraph 4(b) of section 7.3 of Guidance Note 8 and noting JHX’s assessment of the market’s expectations for earnings in Q1 FY26). Q1 FY26 ($m) Consensus ($m) Variation Revenue (sales) 900 953 -5.6% EBITDA (adjusted) 226 258 -12.4% NPAT (underlying) 127 145 -12.4% EPS (adjusted) 0.29 0.34 -14.7% 2. Please explain the basis for the view provided in response to question 1. In doing so, please specify how JHX determined the market’s expectations in relation to each relevant measure of its earnings, including: 2.1 If JHX had published earnings guidance for the quarter ended 30 June 2025, details of: 2.1.1 that guidance and when it was released to the market; and 2.1.2 the date when the entity first became aware with a reasonable degree of certainty that its expected earnings for the relevant reporting period would vary from, or be in line with, that guidance. As noted above, JHX did not publish guidance for Q1 FY26. 2.2 If JHX used sell-side analyst forecasts to estimate the market’s expectations of its earnings, details of: 2.2.1 the method that JHX used to translate sell-side analyst forecasts into its estimate of market expectations for each measure of earnings referred to in the Earnings Information and, in particular, whether or not JHX used a ‘consensus estimate’ or an ‘adjusted consensus estimate’ or a different specified approach for determining this estimate; JHX considered sell-side analyst forecasts as an input into its assessment of the market’s expectations, including when analysts last revised their estimates, whether

3 there were any outliers and the deviation between analysts, as well as the extent to which analysts considered general economic and market shifts. As an example, an analyst that initiated coverage in Q1 FY26 noted “[n]earer term, we see some risks that could add to short-term volatility, including consensus estimates that need to be reset lower for the deal, a relatively tough FQ1 (which appears mismodeled to us by the Street), and a shareholder base that's in transition.” As noted in the response to question 1, JHX also considered forecasts from key housing analysts and investor expectations as communicated to JHX and to sell- side analysts. Investor expectations communicated to JHX in Q1 FY26 were uniformly lower than sell-side analyst estimates. 2.2.2 the entity’s estimate of market expectations using that method; and Refer to our response to question 1 for JHX’s consensus forecasts which were an input into JHX’s assessment of market expectations on the basis outlined above. 2.2.3 the date when the entity first became aware with a reasonable degree of certainty that its expected earnings for the relevant reporting period would vary from, or be in line with, its estimate of these expectations. JHX first became aware of the likely final outcome of its Q1 FY26 results on or about 10.22am (Sydney time) on 7 August 2025 through internal reporting which gave JHX a reasonable degree of certainty that its expected Q1 FY26 earnings would be in line with its estimate of the market’s expectations for its earnings, as to which refer to our responses above. 3. Does JHX consider that, at any point prior to the release of the Results Announcement, there was a variance between its expected earnings and its estimate of market expectations for the relevant reporting period of such a magnitude that a reasonable person would expect information about the variance to have a material effect on the price or value of JHX’s securities? Please answer separately for each measure of earnings referred to in the Earnings Information. No. 4. If the answer to question 3 is ‘no’, please provide the basis for that view. On each of the key metrics forecast by sell-side analysts for Q1 FY26 there was a less than 15% variance between expected earnings and consensus. Further, in JHX’s view, consensus was not reflective of market expectations for JHX given the matters referred to in answers 1 and 2 because a number of analysts had not updated their forecasts for recent shifts in market activity which the market was fully aware of and investor expectations as communicated to JHX and to sell-side analysts. Accordingly, JHX did not consider that any difference between its expected earnings and market expectations would have a material effect on the price or value of JHX’s securities. 5. If the entity first became aware of the variance before the release of Results Announcement, did JHX make any announcement prior to the release of the Results Announcement which disclosed the relevant variance? If so, please provide details. If not, please explain why this information was not released to the market at an earlier time, commenting specifically on

when you believe JHX was obliged to release the information under Listing Rules 3.1 and 3.1A and what steps JHX took to ensure that the information was released promptly and without delay. Not applicable. 6. Does JHX consider that the variation to its FY26 guidance between 21 May 2025 and 21 August 2025, after factoring in the impact of the partial-year contribution from the AZEK acquisition and change in segment reporting, to be information that a reasonable person would expect to have a material effect on the price or value of JHX’s securities? JHX considered that the variation to its FY26 guidance, after factoring in the impact of the partial- year contribution from the AZEK acquisition and the change in segment reporting, could be information that a reasonable person would expect to have a material effect on the price or value of JHX’s securities. As described in the response to question 8, JHX communicated the variation promptly and without delay after it became aware of the variation. On 21 May 2025, JHX provided certain FY26 guidance in respect of JHX as a standalone entity (ie without incorporating the then anticipated partial-year contribution of AZEK). On 20 August 2025, after completion of the AZEK transaction, JHX provided certain FY26 guidance which incorporated the partial-year contribution of AZEK and reflected JHX’s new segment reporting for the combined business. Incorporating the partial-year contribution of the AZEK acquisition and reflecting JHX’s new segment reporting for the combined business limited the utility of a comparison between the May and August FY26 guidance. Also, the original guidance for FY26 was provided early in the fiscal year and reflected assumptions about unknown matters including with respect to interest rates, new construction and repair and remodel market growth, raw material costs and other factors that are subject to change, in relation to the JHX business (pre AZEK). At that time, JHX had communicated to the market that “[m]ore recent, broader macroeconomic uncertainty could further impact the cost of home construction and weigh on consumer sentiment, influencing demand. As a result, in North America, which represents approximately three-quarters of our total net sales we are prudently planning for market volumes to contract in FY26, including a fourth consecutive year of declines in large-ticket repair & remodel activity.” The most significant variation between the May FY26 guidance and the August FY26 guidance was with respect to expected revenue for the ‘North America Fiber Cement’ segment in the May FY26 guidance. In relation to North American sales, the May FY26 guidance projected the ‘North America Fiber Cement’ segment would be up low single digits. The August FY26 guidance forecasts Net Sales for ‘Sliding & Trim’ (consisting of the legacy ‘North America Fiber Cement’ segment and the acquired ‘Exteriors’ business from AZEK) of between $2.675 and $2.850 billion. A reasonable person could consider this variance to have a material effect on the price or value of JHX’s securities, depending on a number of considerations, including the extent to which near term earnings are considered a material driver of the value of JHX’s securities, and noting this was a revision of guidance provided early in the fiscal year in a dynamic environment. This variance was approximately 13-16% down from the May guidance and reflected no change in JHX expectations for Q1 FY26, but lower expectations for the remaining three quarters of FY26 to reflect single family new construction market declines, related inventory impacts and delays in expected new product initiatives. As described in the response to question 8, JHX communicated the variation promptly and without delay after it became aware of the variation, which among other things required the Board to make a judgment about the North American housing outlook based on new data and their

5 expectations regarding the impact of that new outlook on JHX’s operations for the remainder of the fiscal year. 7. If the answer to question 6 is “no”, please explain the basis for that view. Not applicable. 8. If the entity first became aware of the variation to its FY26 guidance before the release of the Results Announcement, did JHX make any announcement prior to the release of the Results Announcement which disclosed the relevant variance? If so, please provide details. If not, please explain why this information was not released to the market at an earlier time, commenting specifically on when you believe JHX was first obliged to vary its guidance under Listing Rules 3.1 and 3.1A and what steps JHX took to ensure that this was undertaken promptly and without delay. JHX first became aware of the variation to its FY26 guidance when it was approved by the Board at the Board sub-committee meeting which concluded at approximately 6.45am (Sydney time) on 20 August 2025, the day on which the results were released pre-market open on the ASX Market Announcement Platform on 20 August 2025 (at approximately 7.30am (Sydney time)). Until this meeting, the Board was considering a number of variables with respect to the guidance, including the impact of incorporating the partial-year contribution of AZEK, reflecting JHX’s new segment reporting for the combined business and information about further declines in the North American housing outlook, which needed to be considered by the Board. Until the Board had considered these variables and made the decisions required to determine what the revised guidance would be, there was no information which could be released to the market beyond the information which JHX had already disclosed regarding market conditions and the impact of the AZEK acquisition. 9. Please provide details of any other explanation JHX may have for the trading in its securities following the release of the Results Announcement. JHX is not aware of any company specific factors that may have contributed to the trading of JHX securities after the release of its Results Announcement, but considers the macroeconomic outlook and related uncertainty may have played a role in some of the trading, as well as continued changes in JHX’s shareholder base following the AZEK acquisition. 10. Please confirm that JHX is in compliance with the Listing Rules and, in particular, Listing Rule 3.1. Confirmed. 11. Please confirm that JHX’s responses to the questions above have been authorised and approved in accordance with its published continuous disclosure policy or otherwise by its board or an officer of JHX with delegated authority from the board to respond to ASX on disclosure matters. Confirmed. Yours sincerely Aoife Rockett Company Secretary

ASX Limited [[Listings]] ASX Customer Service Centre 131 279 | asx.com.au #10953436v1 22 August 2025 Reference: 111951 Ms Aoife Rockett Company Secretary James Hardie Industries Plc Level 20 60 Castlereagh Street Sydney NSW 2000 By email Dear Ms Rockett James Hardie Industries PLC (‘JHX’): ASX Aware Letter ASX refers to the following: A. JHX’s announcement titled ‘Q4 FY25 Results Pack’, released on the ASX Market Announcements Platform (‘MAP’) on 21 May 2025, which provided (relevantly) the following FY26 guidance information: • North America Net Sales Growth: Up Low Single-Digits • North America EBITDA Margin: ~35.0% • Total Adjusted EBITDA Growth: Up Low Single-Digits • Free Cash Flow: At least $500 million, Up +30% FY26 Modeling Assumptions • Total Capital Expenditures: ~$325 million • Total Depreciation & Amortization Expense: ~$225 million • Adjusted Effective Tax Rate: Relatively Flat vs. 23.5% in FY25 Note: Planning and modeling assumptions reflect only the standalone James Hardie business and exclude any impacts of acquisitions that have not closed. Free Cash Flow is defined as net cash provided by operating activities less purchases of property, plant and equipment. B. JHX’s announcement released on MAP on 20 August 2025 in connection with its results for the quarter ended 30 June 2025 titled ‘Q1 FY26 Results Pack’ (‘Results Announcement’). The Results Announcement disclosed JHX’s financial results for the quarter ended 30 June 2025, and additionally provided the following FY26 guidance information: Update to Reporting Segments As a result of the closing of The AZEK® Company (AZEK) acquisition on July 1, 2025, beginning with the second quarter of FY26, James Hardie expects to classify its business into four reportable segments: • Siding & Trim, consisting of the legacy North America Fiber Cement segment and the acquired Exteriors business from AZEK • Deck, Rail & Accessories, consisting of AZEK's Deck, Rail & Accessories business • Australia & New Zealand, consisting of the legacy Asia Pacific Fiber Cement segment

2/5 ASX Customer Service Centre 131 279 | asx.com.au #10953436v1 • Europe, consisting of the legacy Europe Building Products segment. Outlook … • Net Sales for Siding & Trim: $2.675 to $2.850 billion • Net Sales for Deck, Rail & Accessories: $775 to $800 million • Total Adjusted EBITDA: $1.05 to $1.15 billion • Free Cash Flow: At least $200 million Note: All guidance includes a partial-year contribution from the AZEK acquisition which was incorporated into James Hardie results beginning at closing on July 1, 2025. Free Cash Flow is defined as net cash provided by operating activities less purchases of property, plant and equipment. FY26 Free Cash Flow guidance includes an estimated ~$315mm of incremental Interest Expense and Transaction & Integration costs related to the AZEK acquisition. C. The change in the price of JHX’s securities from $44.34 immediately prior to the release of the Results Announcement to a close of $32.00 following the release of the Results Announcement, reflecting a decrease of 27.8%. D. Listing Rule 3.1, which requires a listed entity to immediately give ASX any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities. E. The definition of ‘aware’ in Chapter 19 of the Listing Rules, which states that: an entity becomes aware of information if, and as soon as, an officer of the entity (or, in the case of a trust, an officer of the responsible entity) has, or ought reasonably to have, come into possession of the information in the course of the performance of their duties as an officer of that entity. F. Section 4.4 in Guidance Note 8 Continuous Disclosure: Listing Rules 3.1 – 3.1B titled ‘When does an entity become aware of information?’ G. Listing Rule 3.1A, which sets out exceptions from the requirement to make immediate disclosure as follows. 3.1A Listing rule 3.1 does not apply to particular information while each of the following is satisfied in relation to the information: 3.1A.1 One or more of the following 5 situations applies: • It would be a breach of a law to disclose the information; • The information concerns an incomplete proposal or negotiation; • The information comprises matters of supposition or is insufficiently definite to warrant disclosure; • The information is generated for the internal management purposes of the entity; or • The information is a trade secret; and 3.1A.2 The information is confidential and ASX has not formed the view that the information has ceased to be confidential; and

3/5 ASX Customer Service Centre 131 279 | asx.com.au #10953436v1 3.1A.3 A reasonable person would not expect the information to be disclosed. H. ASX’s policy position on ‘market sensitive earnings surprises’, which is detailed in section 7.3 of Guidance Note 8 Continuous Disclosure: Listing Rules 3.1 – 3.1B. In particular: …If an entity becomes aware that its earnings for the current reporting period will differ materially (downwards or upwards) from market expectations, it needs to consider carefully whether it has a legal obligation to notify the market of that fact.… …An earnings surprise will need to be disclosed to the market under Listing Rule 3.1 if it is market sensitive – that is, it is of such a magnitude that a reasonable person would expect information about the earnings surprise to have a material effect on the price or value of the entity’s securities… Request for information Having regard to the above, ASX asks JHX to respond separately to each of the following questions and requests for information: 1. Does JHX consider that any measure of its statutory or underlying earnings for the quarter ended 30 June 2025 as disclosed in the Results Announcement (‘Earnings Information’) differed materially from the market’s expectations, having regard to the following two base indicators (in decreasing order of relevance and reliability): 1.1 If JHX had published earnings guidance, that guidance. 1.2 If JHX is covered by sell-side analysts, the earnings forecasts of those analysts. Please answer separately for each measure of earnings referred to in the Earnings Information. In your response, please have regard to ASX’s commentary in paragraphs 4(a) and 4(b) of section 7.3 of Guidance Note 8 about when a variation from market expectations may be material. 2. Please explain the basis for the view provided in response to question 1. In doing so, please specify how JHX determined the market’s expectations in relation to each relevant measure of its earnings, including: 2.1 If JHX had published earnings guidance for the quarter ended 30 June 2025, details of: 2.1.1 that guidance and when it was released to the market; and 2.1.2 the date when the entity first became aware with a reasonable degree of certainty that its expected earnings for the relevant reporting period would vary from, or be in line with, that guidance. 2.2 If JHX used sell-side analyst forecasts to estimate the market’s expectations of its earnings, details of: 2.2.1 the method that JHX used to translate sell-side analyst forecasts into its estimate of market expectations for each measure of earnings referred to in the Earnings Information and, in particular, whether or not JHX used a ‘consensus estimate’ or an ‘adjusted consensus estimate’ or a different specified approach for determining this estimate; 2.2.2 the entity’s estimate of market expectations using that method; and 2.2.3 the date when the entity first became aware with a reasonable degree of certainty that its expected earnings for the relevant reporting period would vary from, or be in line with, its estimate of these expectations. 3. Does JHX consider that, at any point prior to the release of the Results Announcement, there was a variance between its expected earnings and its estimate of market expectations for the relevant reporting period of

4/5 ASX Customer Service Centre 131 279 | asx.com.au #10953436v1 such a magnitude that a reasonable person would expect information about the variance to have a material effect on the price or value of JHX’s securities? Please answer separately for each measure of earnings referred to in the Earnings Information. 4. If the answer to question 3 is ‘no’, please provide the basis for that view. 5. If the entity first became aware of the variance before the release of Results Announcement, did JHX make any announcement prior to the release of the Results Announcement which disclosed the relevant variance? If so, please provide details. If not, please explain why this information was not released to the market at an earlier time, commenting specifically on when you believe JHX was obliged to release the information under Listing Rules 3.1 and 3.1A and what steps JHX took to ensure that the information was released promptly and without delay. 6. Does JHX consider that the variation to its FY26 guidance between 21 May 2025 and 21 August 2025, after factoring in the impact of the partial-year contribution from the AZEK acquisition and change in segment reporting, to be information that a reasonable person would expect to have a material effect on the price or value of JHX’s securities? 7. If the answer to question 6 is “no”, please explain the basis for that view. 8. If the entity first became aware of the variation to its FY26 guidance before the release of the Results Announcement, did JHX make any announcement prior to the release of the Results Announcement which disclosed the relevant variance? If so, please provide details. If not, please explain why this information was not released to the market at an earlier time, commenting specifically on when you believe JHX was first obliged to vary its guidance under Listing Rules 3.1 and 3.1A and what steps JHX took to ensure that this was undertaken promptly and without delay. 9. Please provide details of any other explanation JHX may have for the trading in its securities following the release of the Results Announcement. 10. Please confirm that JHX is in compliance with the Listing Rules and, in particular, Listing Rule 3.1. 11. Please confirm that JHX’s responses to the questions above have been authorised and approved in accordance with its published continuous disclosure policy or otherwise by its board or an officer of JHX with delegated authority from the board to respond to ASX on disclosure matters. When and where to send your response This request is made under Listing Rule 18.7. Your response is required as soon as reasonably possible and, in any event, by no later than 9:30 AM AEST Wednesday, 27 August 2025. You should note that if the information requested by this letter is information required to be given to ASX under Listing Rule 3.1 and it does not fall within the exceptions mentioned in Listing Rule 3.1A, JHX’s obligation is to disclose the information ‘immediately’. This may require the information to be disclosed before the deadline set out above and may require JHX to request a trading halt immediately if trading in JHX’s securities is not already halted or suspended. Your response should be sent by e-mail to [email protected]. It should not be sent directly to the ASX Market Announcements Office. This is to allow us to review your response to confirm that it is in a form appropriate for release to the market, before it is published on the ASX Market Announcements Platform. Suspension

5/5 ASX Customer Service Centre 131 279 | asx.com.au #10953436v1 If you are unable to respond to this letter by the time specified above, ASX will likely suspend trading in JHX’s securities under Listing Rule 17.3. Listing Rules 3.1 and 3.1A In responding to this letter, you should have regard to JHX’s obligations under Listing Rules 3.1 and 3.1A and also to Guidance Note 8 Continuous Disclosure: Listing Rules 3.1 – 3.1B. It should be noted that JHX’s obligation to disclose information under Listing Rule 3.1 is not confined to, nor is it necessarily satisfied by, answering the questions set out in this letter. Release of correspondence between ASX and entity We reserve the right to release all or any part of this letter, your reply and any other related correspondence between us to the market under Listing Rule 18.7A. The usual course is for the correspondence to be released to the market. Yours sincerely ASX Compliance