James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Howard Heckes (USA), Gary Hendrickson (USA), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Jesse Singh (USA), Nigel Stein (UK). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 23 September 2025 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 James Hardie Industries plc - 2025 Annual General Meeting Materials Available Dear Sir/Madam, James Hardie Industries plc advises that the Notice of Meeting and supporting materials for the 2025 Annual General Meeting (AGM) are now available to shareholders on our website at https://ir.jameshardie.com.au/events-presentations/annual-shareholder- meeting or via www.investorvote.com.au. The AGM will be held on Wednesday, 29 October 2025 at 8:00pm (Dublin time) / 4:00pm (New York time) / Thursday, 30 October 2025 at 7:00am (Sydney time) at James Hardie’s Corporate Headquarters: 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland Shareholders may also listen and ask questions at the AGM via teleconference, details of which are set out in the Notice of Meeting. Please note that shareholders will not be able to vote electronically by way of teleconference. If you have any questions regarding the AGM or accessing the meeting materials, please contact our Investor Relations team at [email protected]. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

1Notice of Annual General Meeting 2025 DUBLIN, IRELAND Wednesday, 29 October 2025 at 8:00pm (Dublin time) Wednesday, 29 October 2025 at 4:00pm (New York time) Thursday, 30 October 2025 at 7:00am (Sydney time) Notice of Annual General Meeting

If you are in any doubt as to the action you should take, you should immediately consult your investment or other professional advisor. If you have sold or transferred all of your registered holding of James Hardie Industries plc shares, please forward this document and the accompanying Form of Proxy to the purchaser or transferee, or to the stockbroker, bank or other agent through or by whom the sale or transfer was effected, for delivery to the purchaser or transferee. If you sell, or have sold, or otherwise transferred, only part of your holding of James Hardie Industries plc shares, you should retain these documents and consult the stockbroker, bank or other agent through whom the sale or transfer was effected. James Hardie Industries plc ARBN 097 829 895, with registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland and registered in Ireland under company number 485719. The liability of its members is limited. Table of Contents Contents of this Booklet NOTICE OF ANNUAL GENERAL MEETING 2025 3 AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING 4 VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING 7 EXPLANATORY NOTES 12 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. This document, and the accompanying Form of Proxy, has been sent to shareholders on the register of members at close of business on 23 September 2025.

3Notice of Annual General Meeting 2025 NOTICE OF ANNUAL GENERAL MEETING 2025 Notice is given that the Annual General Meeting (AGM) of James Hardie Industries plc (James Hardie or the Company) will be held on Wednesday, 29 October 2025 at 8:00pm (Dublin time) / 4:00pm (New York time) / Thursday, 30 October 2025 at 7:00am (Sydney time) at James Hardie’s Corporate Headquarters, 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. OCT 28 Attendance at AGM Only those who are registered holders of ordinary shares of James Hardie (Shares) at 8:00am (Dublin time) / 4.00am (New York time) / 7:00pm (Sydney time) on Tuesday, 28 October 2025, or their duly appointed proxies, will be entitled to attend, and to speak, ask questions and vote at, the AGM (the Record Date). Shareholders or their proxies will be able to ask questions of the Board of Directors of James Hardie (the Board) and the Company’s external auditor, Ernst & Young LLP (EY) at the AGM. Shareholders can also submit questions in advance of the AGM, whether or not they will be attending. Shareholders unable to attend the AGM will also have an opportunity to ask questions during the AGM remotely via teleconference as set out in further detail in the section “Voting and Participation in the Annual General Meeting” in this Notice of Meeting. However, shareholders will not be able to vote electronically by way of teleconference. If shareholders wish for their vote to count, they must follow the voting instructions set out on pages 7 to 11 of this Notice of Meeting. The process and timelines for you to appoint a proxy and/or vote in connection with the resolutions to be voted on at the AGM depend on the manner in which you hold your Shares. We recommend that you review the information on the process for, and the deadlines applicable to, voting and attending the AGM and for appointing a proxy as set out on pages 7 to 10 of this Notice of Meeting sufficiently in advance of the AGM. Notice Availability This Notice of Meeting is being distributed to shareholders on or about 23 September 2025. Information regarding the AGM, including copies of this Notice of Meeting, the Company’s 2025 Annual Report, the Company’s Irish statutory accounts for the year ended 31 March 2025 and other documents relating to the AGM can be downloaded from James Hardie’s Investor Relations website (https://ir.jameshardie.com.au/events-presentations/annual-shareholder-meeting) or copies can be obtained as follows (depending on the manner in which you hold your Shares as set out in the section entitled “Voting and Participation in the Annual General Meeting” in this Notice of Meeting): Registered Holders (i.e., persons entered on the register of members of the Company (the Register)) may contact the Company’s registrar, Computershare Trust Company, N.A. (Computershare), by calling one of the following numbers: Beneficial Holders (i.e., persons who hold their interests in Shares in a stock brokerage account or via a broker, bank or other nominee that is a participant in The Depositary Trust Company (DTC)) should contact their broker, bank or other nominee directly in relation to information regarding the AGM. CDI Holders (i.e., holders of the Company’s CHESS Depositary Interests (CDIs) entered on the CDI register of the Company) may contact Computershare Investor Services Pty Limited (Computershare (AUS)) by calling one of the following numbers: 1-866-644-4127 from within the United States. +1-781-575-2906 from outside the United States. 1300 855 080 from within Australia. +61 3 9415 4000 from outside Australia.

4Notice of Annual General Meeting 2025 AGENDA AND BUSINESS OF THE AGM Explanations of the background, rationale and further information for each proposed resolution are set out in the Explanatory Notes on pages 12 to 27 of this Notice of Meeting. To review James Hardie’s affairs and to consider and, if thought fit, pass the following resolution as a non-binding ordinary resolution: To receive and consider the financial statements of the Company and the reports of the Board and external auditor for the fiscal year ended 31 March 2025. The vote on this resolution is advisory only. As part of the review of James Hardie’s affairs, to consider and, if thought fit, pass the following resolution as a non-binding ordinary resolution: To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2025 (the Remuneration Report). The vote on this resolution is advisory only. To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the Board be and is hereby authorised to fix the remuneration of the external auditor of the Company for the fiscal year ending 31 March 2026. To consider and, if thought fit, pass each of the following resolutions as separate ordinary resolutions: (a) That Gary Hendrickson be elected as a director. (b) That Jesse Singh be elected as a director. (c) That Howard Heckes be elected as a director. (d) That Peter John Davis, who retires by rotation in accordance with the Company’s Articles of Association, be re-elected as a director. (e) That Anne Lloyd, who retires by rotation in accordance with the Company’s Articles of Association, be re-elected as a director. (f) That Rada Rodriguez, who retires by rotation in accordance with the Company’s Articles of Association, be re-elected as a director. The following are items of ordinary business: FINANCIAL STATEMENTS AND REPORTS FOR FISCAL YEAR 2025 REMUNERATION REPORT FOR FISCAL YEAR 2025 ELECTION / RE-ELECTIONS OF DIRECTORS AUTHORITY TO FIX THE EXTERNAL AUDITOR’S REMUNERATION 1 2 3 4 To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s Chief Executive Officer (CEO) and Director, Aaron Erter, of 260,000* return on capital employed (ROCE) restricted stock units (ROCE RSUs) and his acquisition of ROCE RSUs and Shares issuable thereunder is approved under, and for the purposes of, ASX Listing Rule 10.14 and for all other purposes, in accordance with the terms of the 2006 Long Term Incentive Plan (the 2006 LTIP) and on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, the Company will disregard any votes cast in favour of Resolution 5 by or on behalf of: (i) Aaron Erter (who is the only director eligible to participate in the employee incentive scheme the subject of Resolution 5); or (ii) any of his associates. The following are items of special business: GRANT OF RETURN ON CAPITAL EMPLOYED RESTRICTED STOCK UNITS TO CEO5

5Notice of Annual General Meeting 2025 To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to the Company’s CEO and Director, Aaron Erter, of 370,000* relative total shareholder return (TSR) restricted stock units (Relative TSR RSUs) and his acquisition of Relative TSR RSUs and Shares issuable thereunder is approved under and for the purposes of ASX Listing Rule 10.14 and for all other purposes, in accordance with the terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, the Company will disregard any votes cast in favour of Resolution 6 by or on behalf of: (i) Aaron Erter (who is the only director eligible to participate in the employee incentive scheme the subject of Resolution 6); or (ii) any of his associates. However, this does not apply to a vote cast in favour of Resolution 6 by: (i) a person as proxy or attorney for a person who is entitled to vote on Resolution 6, in accordance with directions given to the proxy or attorney on a voting instruction form or form of proxy to vote on Resolution 6 in that way; (ii) the Chair of the AGM as proxy or attorney for a person who is entitled to vote on Resolution 6, in accordance with a direction given to the Chair on a voting instruction form or form of proxy to vote on Resolution 6 as the Chair decides; or (iii) a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: a. the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Resolution 6; and b. the holder votes on Resolution 6 in accordance with the directions given by the beneficiary to the holder on a voting instruction form or otherwise to vote in that way. *370,000 shares is based on a Monte Carlo stock price assumption of AUD 17.42 GRANT OF TOTAL SHAREHOLDER RETURN RESTRICTED STOCK UNITS TO CEO6 However, this does not apply to a vote cast in favour of Resolution 5 by: (i) a person as proxy or attorney for a person who is entitled to vote on Resolution 5, in accordance with directions given to the proxy or attorney on a voting instruction form or form of proxy to vote on Resolution 5 in that way; (ii) the Chair of the AGM as proxy or attorney for a person who is entitled to vote on Resolution 5, in accordance with a direction given to the Chair on a voting instruction form or form of proxy to vote on Resolution 5 as the Chair decides; or (iii) a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: a. the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Resolution 5; and b. the holder votes on Resolution 5 in accordance with the directions given by the beneficiary to the holder on a voting instruction form or otherwise to vote in that way. *260,000 shares is based on a stock price assumption of AUD 24.00 To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the issue of Shares to non-executive directors under the James Hardie 2020 Non-Executive Director Equity Plan (the NED Equity Plan) be approved under and for the purposes of ASX Listing Rule 10.14 and for all other purposes, on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, the Company will disregard any votes cast in favour of Resolution 7 if by or on behalf: (i) any non-executive director (NED) of the Company (who are the only directors eligible to participate in the employee incentive scheme the subject of Resolution 7); or (ii) any of their associates. The following are items of special business: THE ISSUE OF SECURITIES UNDER THE JAMES HARDIE 2020 NON-EXECUTIVE DIRECTOR EQUITY PLAN7

6Notice of Annual General Meeting 2025 To consider and, if thought fit, pass the following resolution as an ordinary resolution: That, pursuant to and in accordance with ASX Listing Rule 10.17, Article 98(b) of the Company’s Articles of Association and for all other purposes, the maximum aggregate remuneration payable to non-executive directors be increased by US$1,000,000 from the current maximum aggregate amount of US$3,800,000 per annum to US$4,800,000 per annum, on the basis set out in the Explanatory Notes. Voting Exclusion Statement In accordance with the ASX Listing Rules, the Company will disregard any votes cast in favour of Resolution 8 by or on behalf of: (i) a director of the Company; and (ii) an associate of a director of the Company. However, this does not apply to a vote cast in favour of Resolution 8 by: (i) a person as proxy or attorney for a person who is entitled to vote on Resolution 8, in accordance with directions given to the proxy or attorney on a voting instruction form or form of proxy to vote on Resolution 8 in that way; (ii) the Chair of the AGM as proxy or attorney for a person who is entitled to vote on Resolution 8, in accordance with a direction given to the Chair on a voting instruction form or form of proxy to vote on Resolution 8 as the Chair decides; or (iii) a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: a. the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Resolution 8; and b. the holder votes on Resolution 8 in accordance with directions given by the beneficiary to the holder on a voting instruction form or otherwise to vote in that way. Information on voting and the Explanatory Notes for each of the proposed resolutions, together with a voting instruction form and form of proxy are enclosed. INCREASE TO NON-EXECUTIVE DIRECTOR FEE POOL8 However, this does not apply to a vote cast in favour of Resolution 7 by: (i) a person as proxy or attorney for a person who is entitled to vote on Resolution 7, in accordance with directions given to the proxy or attorney on a voting instruction form or form of proxy to vote on Resolution 7 in that way; (ii) the Chair of the AGM as proxy or attorney for a person who is entitled to vote on Resolution 7, in accordance with a direction given to the Chair on a voting instruction form or form of proxy to vote on Resolution 7 as the Chair decides; or (iii) a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: a. the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Resolution 7; and b. the holder votes on Resolution 7 in accordance with directions given by the beneficiary to the holder on a voting instruction form or otherwise to vote in that way. Aoife Rockett Company Secretary 23 September 2025 By order of the Board.

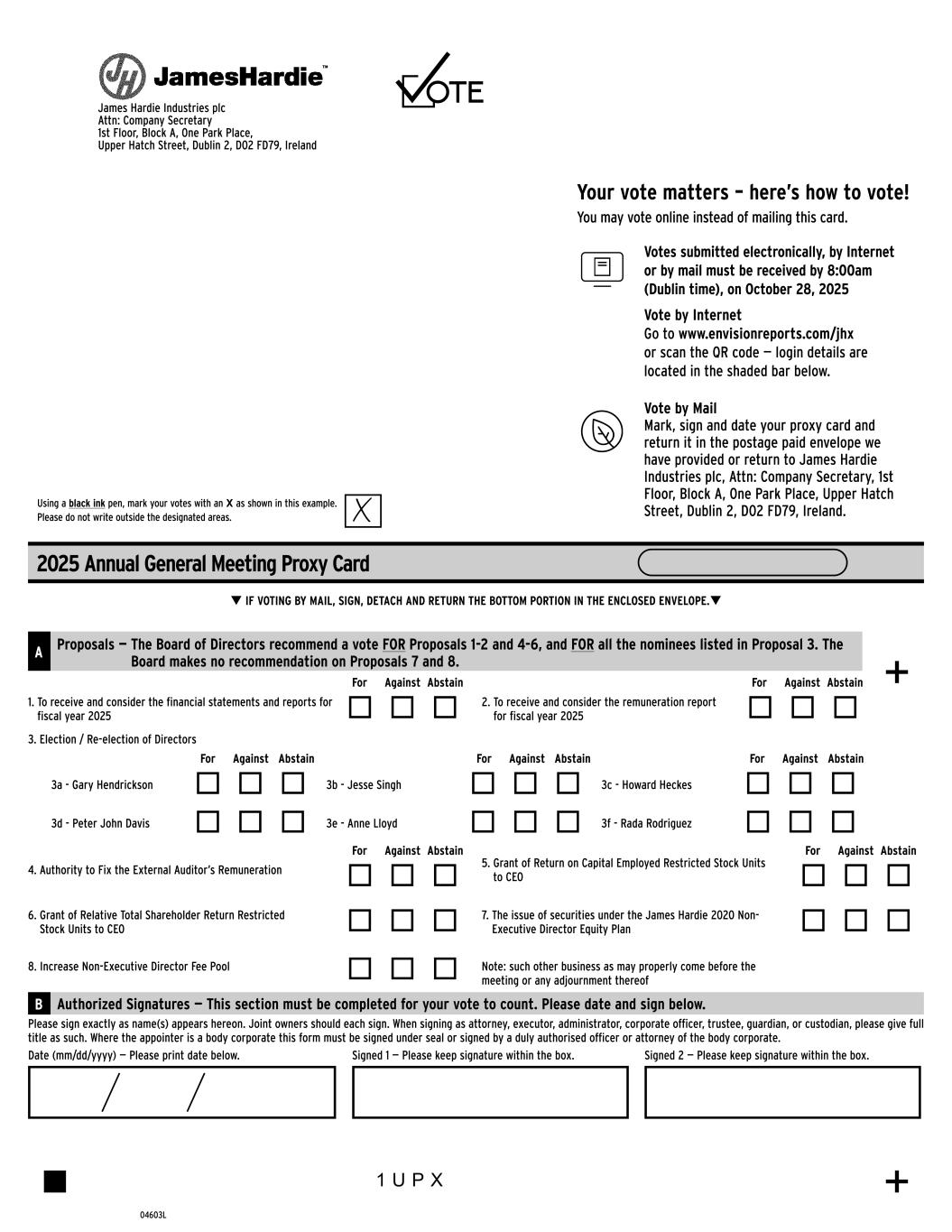

7Notice of Annual General Meeting 2025 VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING If you are a registered holder of Shares as at 8:00am (Dublin time) / 4:00am (New York time) / 7:00pm (Sydney time) on Tuesday, 28 October 2025, you may attend, speak and vote, in person or appoint a proxy (who need not be a shareholder) to attend, speak and vote on your behalf, at the AGM. See “Voting on the Resolutions” below for information on how you can vote or appoint a proxy. AGM Details The AGM will be held at James Hardie’s Corporate Headquarters, 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland, starting at 8:00pm (Dublin time) / 4:00pm (New York time) on Wednesday, 29 October 2025 / 7:00am (Sydney time) on Thursday, 30 October 2025. Shareholder Categories The process for voting and/or appointing a proxy in connection with the resolutions to be proposed at the AGM depends on the manner in which you hold your Shares. In this Notice of Meeting: (a) Registered Holder refers to persons entered on the Register (i.e., those shareholders whose shareholding is evidenced by their holding statement and who do not hold their interests in Shares as Beneficial Holders or CDI Holders). (b) Beneficial Holders refers to persons who hold their interests in the Shares in a stock brokerage account or otherwise via a broker, bank or other nominee that is a participant in DTC. (c) CDI Holders refers to holders of the Company’s CDIs entered in the CDI register of the Company. Voting on the Resolutions How you vote at the AGM or appoint a proxy will depend on whether you are a Registered Holder, Beneficial Holder or CDI Holder, as follows: (a) Registered Holders If you are a Registered Holder, you may attend the AGM to vote by ballot or vote by proxy in advance of the deadline for voting by proxy of 8:00am (Dublin time) / 4.00am (New York time) / 7:00pm (Sydney time) on Tuesday, 28 October 2025, by using one of the following methods: (i) online by visiting envisionreports.com/jhx or scanning the QR code and following the instructions on your form of proxy; or (ii) by mail, if you are a Registered Holder that received printed AGM materials, by following the instructions on your form of proxy and returning the completed form of proxy in the postage-paid envelope accompanying the AGM materials. As a Registered Holder you may also appoint a proxy by completing and returning the form of proxy enclosed with this Notice of Meeting (or a proxy in the form set out in Section 184 of the Irish Companies Act 2014) to Computershare Investor Services, PO BOX 43101, Providence, RI 02940-5607 to be received no later than 8:00am (Dublin time) / 4:00am (New York time) / 7:00pm (Sydney time) on Tuesday, 28 October 2025. A proxy is not required to be a shareholder of the Company. Appointment of a proxy does not preclude shareholders from attending and voting at the AGM should they wish to do so. In the case of joint holders, the vote of the senior who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the votes of the other Registered Holder(s), and, for this purpose, seniority will be determined by the order in which the names stand in the Register. (b) Beneficial Holders If you are a Beneficial Holder, this document is being made available or forwarded to you by or on behalf of your broker, bank or other nominee. Only those Beneficial Holders holding their interest in Shares as of the Record Date, or, if the AGM is adjourned, on such other date as is communicated to Beneficial Holders, are entitled to vote on the resolutions in respect of such Shares. Beneficial Holders may direct their broker, bank or other nominee on how to vote their Shares by following the instructions for voting on the DTC voting instruction form provided by your broker, bank or other nominee. If you are a Beneficial Holder and do not direct your broker, bank or other nominee on how to vote your Shares on your DTC voting instruction form, your Shares will not be voted at the AGM for any matter that is considered to be “non-routine” under the rules of the New York Stock Exchange (the NYSE). We believe that, under the rules of the NYSE, the only matter of business at the AGM that will be considered “routine” and on which your broker can vote your Shares without receiving instructions from you is Resolution 4. We believe that, under the rules of the NYSE, your broker will not have discretionary authority to vote your Shares on any other resolutions at the AGM. We encourage you to communicate your

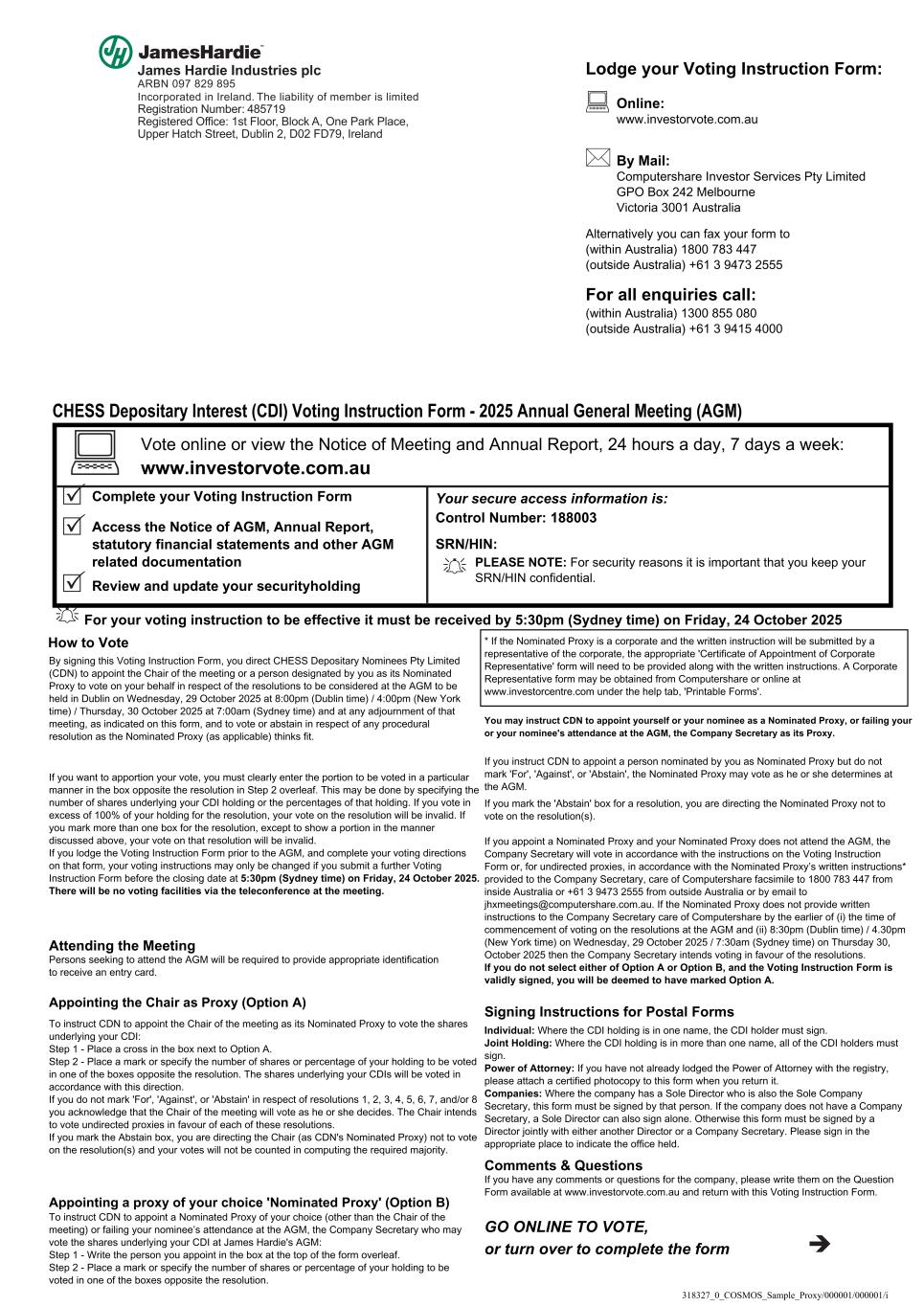

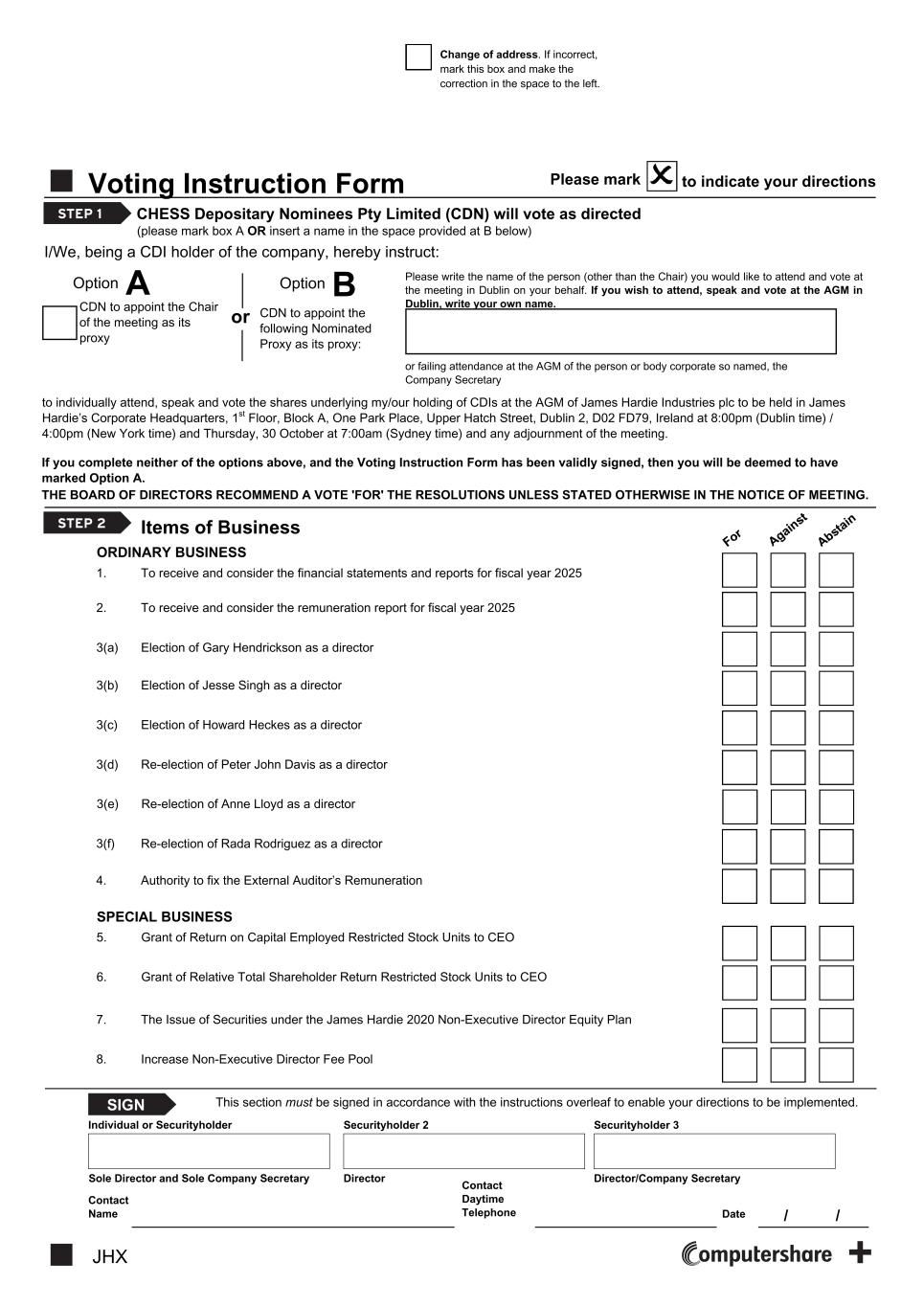

8Notice of Annual General Meeting 2025 voting instructions to your broker, bank or other nominee by the time prescribed by your broker, bank or other nominee and in advance of the DTC voting instruction deadline for Beneficial Holders, which we expect to be 11:59pm (New York time) on Sunday, 26 October 2025, to ensure that your vote will be counted. If you are a Beneficial Holder and wish to vote in person by ballot at the AGM, you must obtain a legal proxy from your broker, bank, or other nominee and present it, along with photographic identification, to the Company’s Secretary or other Company representative at the AGM. (c) CDI Holders If you are a CDI Holder and wish to vote on the resolutions to be considered at the AGM, please follow one of the following options: Option A: If you are not attending the AGM and not appointing a proxy You may lodge a voting instruction form directing CHESS Depository Nominees Pty Limited (CDN) to nominate the Chair of the AGM as your proxy to vote the Shares underlying your holding of CDIs. You can submit your CDI voting instruction form as follows: 1. complete the hard copy CDI voting instruction form and lodge it using the “Lodgement Instructions” set out on page 9; or 2. complete a CDI voting instruction form online at www.investorvote.com.au. You will need: - your Control Number (located on your CDI voting instruction form); - your Security Holder Reference number or Holder Identification Number for your holding; and - your postcode, as recorded in the CDI register of the Company. If you lodge the CDI voting instruction form in accordance with these instructions, you will be taken to have signed it. For your vote to count, your completed CDI voting instruction form must be received in advance of the CDI voting instruction form deadline of 7:30am (Dublin time) / 2:30am (New York time) / 5:30pm (Sydney time) on Friday, 24 October 2025. Option B: If you are (or your proxy is) attending the AGM If you are a CDI Holder and you would like to attend the AGM or appoint a proxy to attend the AGM on your behalf, and vote in person, you may use the CDI voting instruction form to direct CDN to appoint: a) you or another person nominated by you (who does not need to be a shareholder) as a proxy; and b) the Company Secretary, in the event the nominated proxy does not attend the AGM, to vote the Shares underlying your holding of CDIs on behalf of CDN in person at the AGM in Dublin by completing the relevant section of the CDI voting instruction form and return it no later than 7:30am (Dublin time) / 2:30am (New York time) / 5:30pm (Sydney time) on Friday, 24 October 2025 in accordance with the “Lodgement Instructions” set out on page 9. If you are a CDI Holder with a beneficial interest in more than one Share carrying voting rights, you may instruct the appointment of more than one proxy to attend, speak and vote at the meeting on your behalf provided each proxy is appointed to exercise rights attached to different Shares held by you. If your nominated proxy does not attend the AGM, the Company Secretary will vote the relevant Shares in accordance with the instructions on the CDI voting instruction form or, for undirected proxies, in accordance with your nominated proxy’s written instructions. If your nominated proxy does not provide written instructions to the Company Secretary care of Computershare (AUS) by facsimile to 1800 783 447 from inside Australia, or +61 3 9473 2555 from outside Australia, or by email to jhxmeetings@ computershare.com.au by the earlier of: (i) the time of commencement of voting on the resolutions at the AGM; and (ii) 8:30pm (Dublin time) / 4.30pm (New York time) on Wednesday, 29 October 2025 / 7:30am (Sydney time) on Thursday 30, October 2025, then each Company proxy intends voting in favour of all of the resolutions. For your proxy appointment to count, your completed CDI voting instruction form must be received by Computershare (AUS) no later than 7:30am (Dublin time) / 2:30am (New York time) / 5:30pm (Sydney time) on Friday, 24 October 2025. To obtain a free copy of CDN’s Financial Services Guide, or any Supplementary Financial Services Guide, go to https://www.asx.com. au/content/dam/asx/participants/cash-market/bonds/chess-depositary-interests.pdf or phone 131279 from within Australia or +61 2 9338 0000 from outside Australia to ask to have one sent to you.

9Notice of Annual General Meeting 2025 Lodgement Instructions Completed CDI voting instruction forms may be lodged with Computershare (AUS) using one of the following methods: a) by post to GPO Box 242, Melbourne, Victoria 3001, Australia; b) by delivery to Computershare at Yarra Falls, 452 Johnston Street, Abbotsford, VIC 3067, Australia; c) online at www.investorvote.com.au; or d) by facsimile to 1800 783 447 from inside Australia or +61 3 9473 2555 from outside Australia. Written instructions to the Chair (if required) may be lodged by the nominated proxy with Computershare (AUS) using one of the following methods: a) by facsimile to 1800 783 447 from inside Australia, or +61 3 9473 2555 from outside Australia; or b) by email to [email protected]. If the nominated proxy is a corporate and the written instructions will be submitted by a representative of the corporate, the appropriate “Certificate of Appointment of Corporate Representative” form will also need to be provided along with the written instructions. A Certificate of Appointment of Corporate Representative form may be obtained from Computershare (AUS) or online at www.investorcentre.com under the help tab by clicking on “Printable Forms”. Options for shareholders unable to attend AGM The AGM will also be accessible by teleconference at 8:00pm (Dublin time) / 4:00pm (New York time) on Wednesday, 29 October 2025 / 7:00am (Sydney time) on Thursday, 30 October 2025. Shareholders will be able to ask questions of the Board and EY via teleconference in accordance with the details set out below. Shareholders may ask questions related to items on the AGM agenda and have such questions answered by the Company subject to any reasonable measures the Company may take to ensure the identification of shareholders (as set out below). Shareholders will not be able to vote electronically by way of teleconference. If you wish for your vote to count, you must follow the voting instructions set out in the section entitled “Voting on the Resolutions” on pages 7 to 9. The following details are also set out on the Shareholder Meetings page on James Hardie’s Investor Relations website (https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp). If you submit a completed CDI voting instruction form to Computershare (AUS), but fail to select either of Option A or Option B, you are deemed to have selected Option A.

10Notice of Annual General Meeting 2025 Asking Questions at the AGM via Teleconference You will not be able to vote electronically or otherwise participate in the AGM by way of teleconference. To ask questions via the AGM teleconference, please follow the steps set out below: n Dial into the AGM using one of the following numbers: - Australia (toll free) 1800 809 971 - USA (toll free) 1855 881 1339 - International +617 3145 4010 n Enter the passcode: 10049962 n Provide the operator with the name under which your holding is registered, along with the following information depending on the manner in which you hold your shares: - Registered Holders: Please provide your account number (as shown on your most recent holding statement). - Beneficial Holders: Please provide your control number (as shown on your DTC voting instruction form). - CDI Holders: Please provide your Security Holder Reference Number (SRN) or Holder Identification Number (HIN) (included on your CDI voting instruction form or most recent holding statement). If you have any questions during the teleconference, follow the prompts from the teleconference operator. Shareholders may also submit questions in writing in advance of the AGM by completing the Question Form available on the Shareholder Meetings page on James Hardie’s Investor Relations website, to be received by no later than 8:00pm (Dublin time) / 4:00pm (New York time) on Monday, 27 October 2025 / 7:00am (Sydney time) on Tuesday, 28 October 2025. How to Change Your Proxy Vote If you are a Registered Holder and previously voted by Internet, scanning a QR Code or by mail, you may revoke your proxy or change your vote by: n voting at a later date by Internet or scanning the QR code in accordance with the procedures for Registered Holders described under the section entitled “Voting on the Resolutions” above in advance of the proxy voting deadline; n mailing a proxy card that is properly signed and dated with a later date than your previous proxy vote, in accordance with the procedures for Registered Holders described under the section entitled “Voting on the Resolutions,” and that is received in advance of the proxy voting deadline; n attending the AGM in Dublin and voting during the AGM; or n sending a written notice of revocation to the Company Secretary, James Hardie’s Corporate Headquarters, 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland or by e-mail to [email protected], which notice of revocation must be received before commencement of the AGM. If you are a Beneficial Holder, you must contact your broker, bank or other nominee to revoke a previously authorised proxy or DTC voting instruction form. If you are a CDI Holder, you may revoke the CDI voting instruction form or proxy authority previously submitted by delivering to Computershare (AUS) a written notice of revocation bearing a later date than the CDI voting instruction form or proxy authority submitted, which must be received no later than 7:30am (Dublin time) / 2:30am (New York time) / 5:30pm (Sydney time) on Friday, 24 October 2025. What to Bring to the AGM Persons attending the AGM in Dublin should bring photographic identification to verify their identify and present it to the Company Secretary or other Company representative at the AGM. Persons attending the AGM (other than Registered Holders attending in person) must also bring the proxy or other document evidencing their authority to attend and vote at the AGM and present it to the Company Secretary or other Company representative at the AGM. During the AGM, persons attending in person may not use cameras, smart phones or other audio, video or electronic recording devices, unless expressly authorised by the Chair of the AGM.

11Notice of Annual General Meeting 2025 No Voting Available in AGM Teleconference You will not be able to vote by way of teleconference. If you wish for your vote to count, you must follow the voting instructions set out above. Rules of Conduct The rules governing the conduct of the 2025 AGM (the Rules) will be made available at https://ir.jameshardie.com.au/events-presentations/annual.general.meeting. The Rules are intended to ensure the meeting is conducted in a fair, orderly and respectful manner, and will address matters such as eligibility to attend, procedures for asking questions, and time limits for comments.

12Notice of Annual General Meeting 2025 Resolution 1 asks shareholders to receive and consider the financial statements and the reports of the Board and the Company’s external auditor, EY, for the fiscal year ended 31 March 2025. This resolution will also involve the review by the shareholders of James Hardie’s affairs. The financial statements which are the subject of Resolution 1 are those prepared in accordance with Irish law, US Generally Accepted Accounting Principles (US GAAP) (to the extent that the use of those principles in the preparation of the financial statements does not contravene any provision of Irish law) and Accounting Standards issued by the Accounting Standards Board and promulgated by the Institute of Chartered Accountants in Ireland (Generally Accepted Accounting Practice in Ireland), as distinct from the US GAAP consolidated financial statements of the James Hardie Group as set out in the Company’s 2025 Annual Report. A brief overview of the financial and operating performance of the James Hardie Group during the year ended 31 March 2025 will be provided during the AGM. Copies of the James Hardie Group’s consolidated Irish financial statements are available free of charge either: (a) at the AGM in Dublin, Ireland; (b) at the Company’s registered Irish office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland; (c) at the Company’s US office at 303 E Wacker Dr, Chicago, IL 60601, United States; (d) at the Company’s Australian office at Level 17, 60 Castlereagh Street, Sydney NSW 2000; or (e) on the Company’s Investor Relations website, https://ir.jameshardie.com.au/. Recommendation The Board believes it is in the interests of shareholders that the financial statements and the reports of the Board and external auditor for the year ended 31 March 2025 be received and considered and unanimously recommends that you vote in favour of Resolution 1. Resolution 2 asks shareholders to receive and consider the Remuneration Report for the fiscal year ended 31 March 2025. The Company is not required to produce a remuneration report or to submit it to shareholders under Irish, Australian or US law or regulations. However, taking into consideration James Hardie’s Australian and US shareholder base and the ASX and the NYSE listings, the Company has voluntarily produced a Remuneration Report for non-binding shareholder approval for a number of years and currently intends to continue to do so. The Remuneration Report provides information on James Hardie’s remuneration practices in fiscal year 2025 and also voluntarily includes an outline of the Company’s proposed remuneration framework for fiscal year 2026. In addition, the Company has voluntarily produced supplemental information to the Remuneration Report in relation to fiscal years 2026- 2028 which is also available on the Shareholder Meetings page on James Hardie’s Investor Relations website (https://ir.jameshardie. com.au/jh/shareholder_meetings.jsp). James Hardie’s Remuneration Report is set out on pages 32 to 68 of the 2025 Annual Report and can also be found on the Company’s Investor Relations website, https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp. Although the vote on Resolution 2 is advisory only and does not bind the Company, the Board intends to take the outcome of the vote into account when considering the Company’s future remuneration policies. Shareholders should consider the Remuneration Report and raise any matters of interest with the Board when this item is being considered. Recommendation The Board believes it is in the interests of shareholders that the Company’s Remuneration Report for the year ended 31 March 2025 be adopted and unanimously recommends that you vote in favour of Resolution 2. EXPLANATORY NOTES RESOLUTION 1 – FINANCIAL STATEMENTS AND REPORTS FOR FISCAL YEAR 2025 RESOLUTION 2 – REMUNERATION REPORT FOR FISCAL YEAR 2025

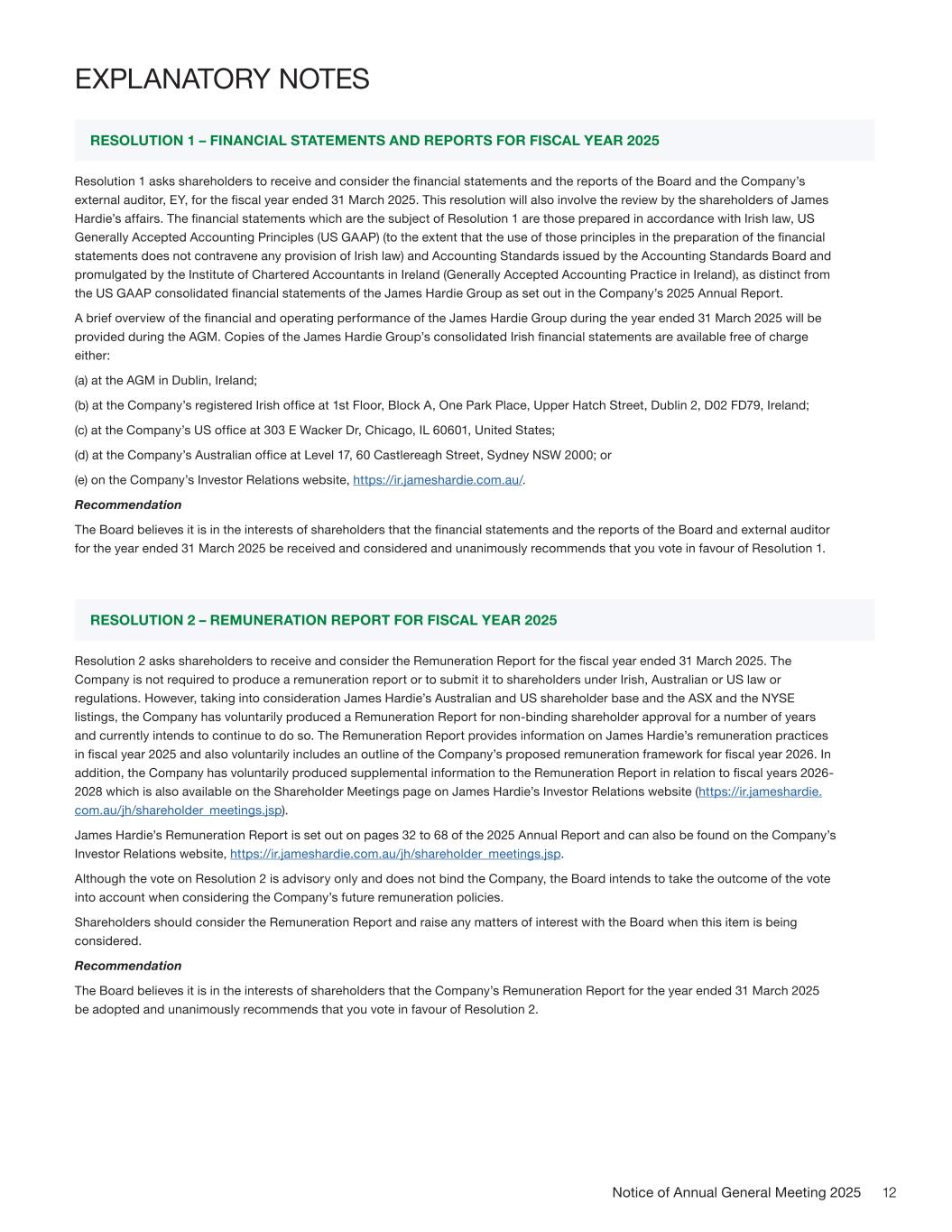

13Notice of Annual General Meeting 2025 As part of their review of the composition of the Board, the Board and the Nominating and Governance Committee considered the desired profile of the Board including the right number, mix of skills, qualifications, experience, expertise, diversity and geographic location of its directors, to maximise the effectiveness of the Board. The Board and Nominating and Governance Committee work together to ensure James Hardie puts in place appropriate mechanisms for Board renewal. Resolution 3(a) asks shareholders to consider the election of Gary Hendrickson to the Board. Resolution 3(b) asks shareholders to consider the election of Jesse Singh to the Board. Resolution 3(c) asks shareholders to consider the election of Howard Heckes to the Board. Resolution 3(d) asks shareholders to consider the re-election of Peter John Davis to the Board. Resolution 3(e) asks shareholders to consider the re-election of Anne Lloyd to the Board. Resolution 3(f) asks shareholders to consider the re-election of Rada Rodriguez to the Board. James Hardie’s Articles of Association currently require that directors (other than the CEO) shall be divided into three classes. Each Class I director’s current term shall expire at the conclusion of the AGM and thereafter each shall serve in accordance with the Company’s Articles of Association. The current Class I directors are Peter John Davis, Anne Lloyd and Rada Rodriguez. If elected by shareholders at the AGM, Gary Hendrickson, Jesse Singh, and Howard Heckes will be designated by the Board as Class I, Class II and Class III directors, respectively, pursuant to James Hardie’s Articles of Association. Profiles of the candidates follow: RESOLUTION 3 – ELECTION / RE-ELECTION OF DIRECTORS Gary Hendrickson BA, MBA Age: 69 Gary Hendrickson was appointed as an independent non-executive director of James Hardie by the Board in July 2025. He is a member of the People and Remuneration Committee. Experience: Mr Hendrickson is a former director and former Chair of The AZEK Company Inc., a leading manufacturer of environmentally sustainable outdoor living products, positions he held from May 2017 to June 2025. Mr Hendrickson also previously served as the Chair and Chief Executive Officer of the Valspar Corporation, a global paint and coatings manufacturer, from June 2011 to June 2017, and was its President and Chief Operating Officer from February 2008 until June 2011. Mr Hendrickson held various executive leadership roles with the Valspar Corporation from 2001 until 2017, including positions with responsibilities for the Asia-Pacific operations. Mr Hendrickson also serves as a director of Polaris Industries Inc., a publicly traded global manufacturer and seller of off-road vehicles, including all-terrain vehicles and snowmobiles and served as a director of Waters Corporation, a leading specialty measurement company and pioneer of chromatography, mass spectrometry and thermal analysis innovations serving the life, materials and food sciences, from 2018 to 2022. Directorships of listed companies in the past five years: The AZEK Company Inc (NYSE:AZEK) (2017 – 2025), Waters Corporation (NYSE:WAT) (2018 - 2022). Other: Polaris Industries Inc. (NYSE:PII) (since 2011). Last elected: Appointed to the Board by the Board in July 2025 and will therefore stand for election at this AGM.

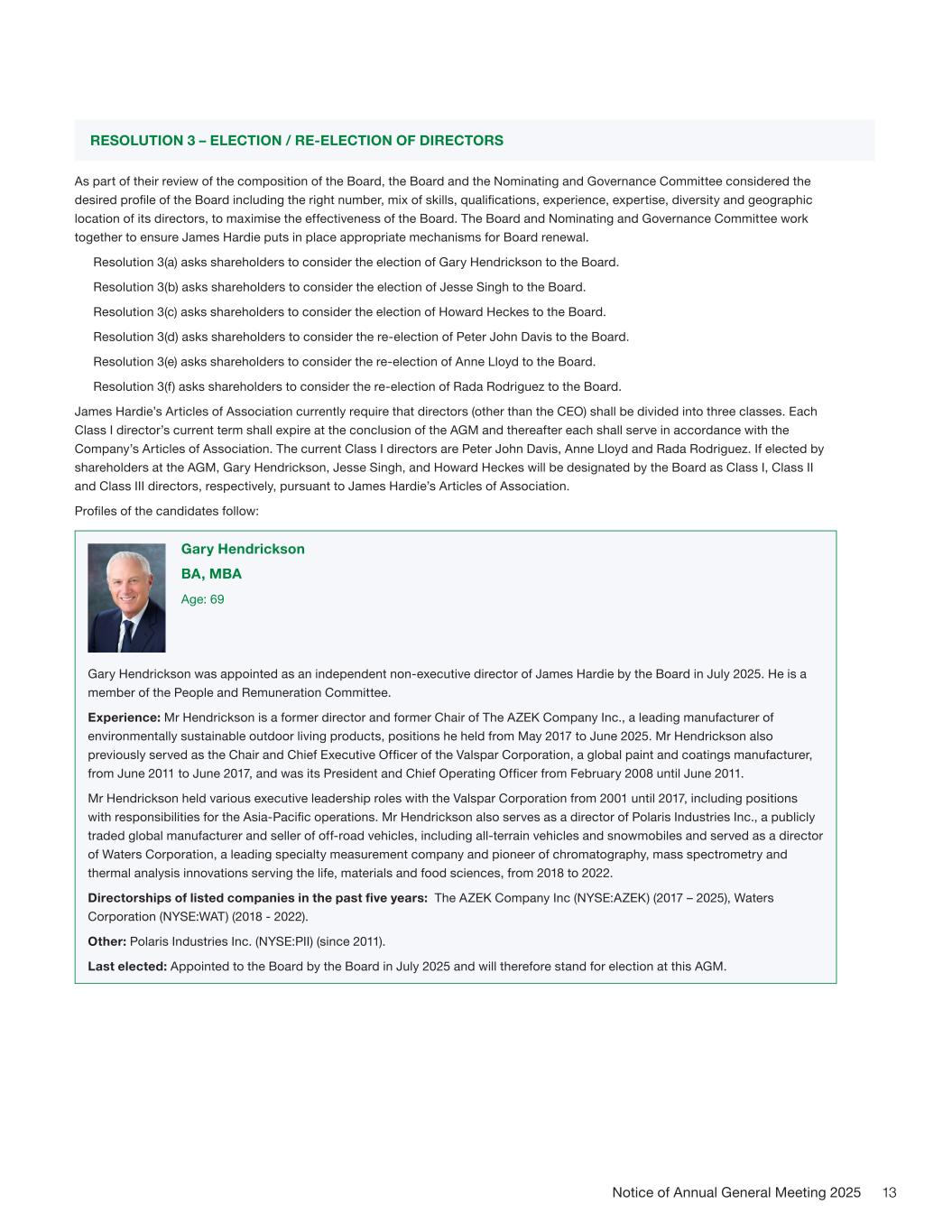

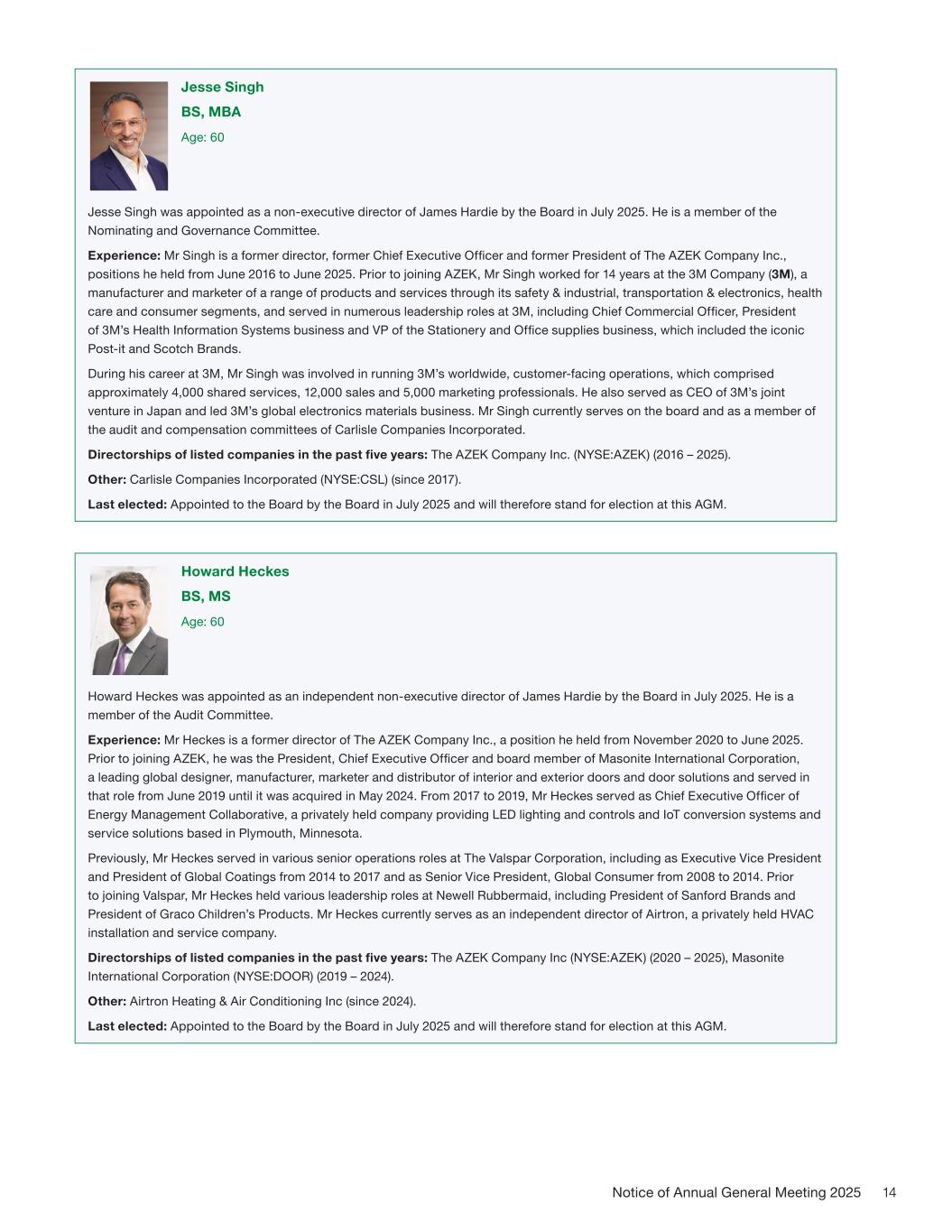

14Notice of Annual General Meeting 2025 Jesse Singh BS, MBA Age: 60 Jesse Singh was appointed as a non-executive director of James Hardie by the Board in July 2025. He is a member of the Nominating and Governance Committee. Experience: Mr Singh is a former director, former Chief Executive Officer and former President of The AZEK Company Inc., positions he held from June 2016 to June 2025. Prior to joining AZEK, Mr Singh worked for 14 years at the 3M Company (3M), a manufacturer and marketer of a range of products and services through its safety & industrial, transportation & electronics, health care and consumer segments, and served in numerous leadership roles at 3M, including Chief Commercial Officer, President of 3M’s Health Information Systems business and VP of the Stationery and Office supplies business, which included the iconic Post-it and Scotch Brands. During his career at 3M, Mr Singh was involved in running 3M’s worldwide, customer-facing operations, which comprised approximately 4,000 shared services, 12,000 sales and 5,000 marketing professionals. He also served as CEO of 3M’s joint venture in Japan and led 3M’s global electronics materials business. Mr Singh currently serves on the board and as a member of the audit and compensation committees of Carlisle Companies Incorporated. Directorships of listed companies in the past five years: The AZEK Company Inc. (NYSE:AZEK) (2016 – 2025). Other: Carlisle Companies Incorporated (NYSE:CSL) (since 2017). Last elected: Appointed to the Board by the Board in July 2025 and will therefore stand for election at this AGM. Howard Heckes BS, MS Age: 60 Howard Heckes was appointed as an independent non-executive director of James Hardie by the Board in July 2025. He is a member of the Audit Committee. Experience: Mr Heckes is a former director of The AZEK Company Inc., a position he held from November 2020 to June 2025. Prior to joining AZEK, he was the President, Chief Executive Officer and board member of Masonite International Corporation, a leading global designer, manufacturer, marketer and distributor of interior and exterior doors and door solutions and served in that role from June 2019 until it was acquired in May 2024. From 2017 to 2019, Mr Heckes served as Chief Executive Officer of Energy Management Collaborative, a privately held company providing LED lighting and controls and IoT conversion systems and service solutions based in Plymouth, Minnesota. Previously, Mr Heckes served in various senior operations roles at The Valspar Corporation, including as Executive Vice President and President of Global Coatings from 2014 to 2017 and as Senior Vice President, Global Consumer from 2008 to 2014. Prior to joining Valspar, Mr Heckes held various leadership roles at Newell Rubbermaid, including President of Sanford Brands and President of Graco Children’s Products. Mr Heckes currently serves as an independent director of Airtron, a privately held HVAC installation and service company. Directorships of listed companies in the past five years: The AZEK Company Inc (NYSE:AZEK) (2020 – 2025), Masonite International Corporation (NYSE:DOOR) (2019 – 2024). Other: Airtron Heating & Air Conditioning Inc (since 2024). Last elected: Appointed to the Board by the Board in July 2025 and will therefore stand for election at this AGM.

15Notice of Annual General Meeting 2025 Peter John Davis Age: 67 Peter John Davis was appointed as an independent non-executive director of James Hardie in August 2022. He is a member of the Nominating and Governance Committee. Experience: Peter John Davis previously served as Chief Operating Officer (COO) of Bunnings Australia & New Zealand. During his 15-year tenure as COO, the division was one of the most profitable of the Wesfarmers Group. With over 40 years’ experience in various retail and trade formats and home improvement industries, Mr Davis commenced his career on the sales floor and held senior roles in operations, marketing, advertising and merchandising before moving into general management and leading the development of the highly successful Bunnings Warehouse concept. Mr Davis was responsible for the development, strategic direction, and operational management of the Bunnings businesses and its employees. His main objectives were to ensure growth in revenues and profitability and provide satisfactory returns for shareholders. Directorships of listed companies in the past five years: None. Last elected: November 2022. Anne Lloyd Certified Public Accountant (CPA); BS Age: 64 Experience: Anne Lloyd was appointed as an independent non-executive director of James Hardie in November 2018 and Chair of the Board effective 30 September 2022. Ms Lloyd served as a member of the Audit Committee from the date of her appointment during her entire tenure as a Board member, with the exception of the period from 26 August 2019 through 25 February 2020, during which time she served as Interim CFO. She was appointed Chair of the Audit Committee effective 8 August 2020. She also served as Lead Independent Director from 6 January 2022 to 1 September 2022. Ms Lloyd was appointed Chair of the Board effective 3 November 2022 at which time she stepped down as Chair of the Audit Committee. Ms Lloyd, an experienced corporate and finance executive, served as Chief Financial Officer of Martin Marietta Materials, Inc. a leading supplier of aggregates and heavy building materials, for over 12 years from June 2005 until her retirement in August 2017. She joined Martin Marietta in 1998 as Vice President and Controller and was promoted to Chief Accounting Officer in 1999. She was subsequently appointed Treasurer (2006-2013) and promoted to Executive Vice President in 2009. Earlier in her career, Ms Lloyd spent 14 years with Ernst & Young LLP (1984-1998), latterly as a senior manager and client service executive for the natural resources, mining, insurance and healthcare industries. Directorships of listed companies in the past five years: Current - Director of Insteel Industries, Inc (NYSE: IIIN) (since 2019); Director of Highwoods Properties, Inc. (NYSE:HIW) (since 2018). Other: New Frontier Materials LLC (since 2021) Last elected: November 2022.

16Notice of Annual General Meeting 2025 Rada Rodriguez MSC Age: 66 Rada Rodriguez was appointed as an independent non-executive director of James Hardie in November 2018. She is Chair of the Nominating and Governance Committee. Experience: Ms Rodriguez serves as Chief Executive Officer of Signify DACH, part of the Signify Group, a world leader in connected LED lighting systems, software and services, since May 2021. She previously served as Chief Executive Officer of Schneider Electric GmbH, part of Schneider Electric Group, a global energy management and automation company and served as Senior Vice President, Corporate Alliances until 2021. On joining the company in 1999, she held a progression of senior roles including Head of International Research and Development for Schneider Electric Sweden, and Senior Vice President and Zone President, Central and Eastern Europe. Prior to joining Schneider Electric GmbH, she worked at Level Group (later acquired by Schneider) and before that she worked for 5 years at Colasit Scandinavia AB, a Swiss industrial machinery manufacturer. She started her career with K-Konsult AB, a Swedish technical consulting firm with a focus on installation technology where she worked for 5 years as a design engineer. Directorships of listed companies in the past five years: None. Other: None. Last elected: November 2022. Recommendation The Board, on the recommendation of the Nominating and Governance Committee, and having assessed their credentials and experience, believes it is in the interests of shareholders that each of Gary Hendrickson, Jesse Singh and Howard Heckes be elected as directors of the Company and unanimously recommends (with Gary Hendrickson, Jesse Singh and Howard Heckes abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(a), 3(b) and 3(c). The Board, having assessed the performance of Peter John Davis, Anne Lloyd and Rada Rodriguez, and on the recommendation of the Nominating and Governance Committee, believes it is in the interests of shareholders that each of Peter John Davis, Anne Lloyd and Rada Rodriguez be re-elected as directors of James Hardie, and unanimously recommends (with Peter John Davis, Anne Lloyd and Rada Rodriguez abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(d), 3(e) and 3(f). Resolution 4 asks shareholders to give authority to the Board to fix the external auditor’s remuneration. EY were first appointed external auditors for the James Hardie Group for the fiscal year ended 31 March 2009. A summary of the external auditor’s remuneration during the fiscal year ended 31 March 2025, as well as non-audit fees paid to EY, are set out on page 152 of the 2025 Annual Report. The Audit Committee periodically reviews EY’s performance and independence as external auditor and reports its results to the Board. A summary of EY’s interaction with James Hardie, the Board and the Board Committees is set out on page 87 of the 2025 Annual Report. Recommendation The Board believes it is in the interests of shareholders that the Board be given authority to fix the external auditor’s remuneration for the fiscal year ended 31 March 2026 and unanimously recommends, on the recommendation of the Audit Committee, that you vote in favour of Resolution 4. RESOLUTION 4 – AUTHORITY TO FIX THE EXTERNAL AUDITOR’S REMUNERATION

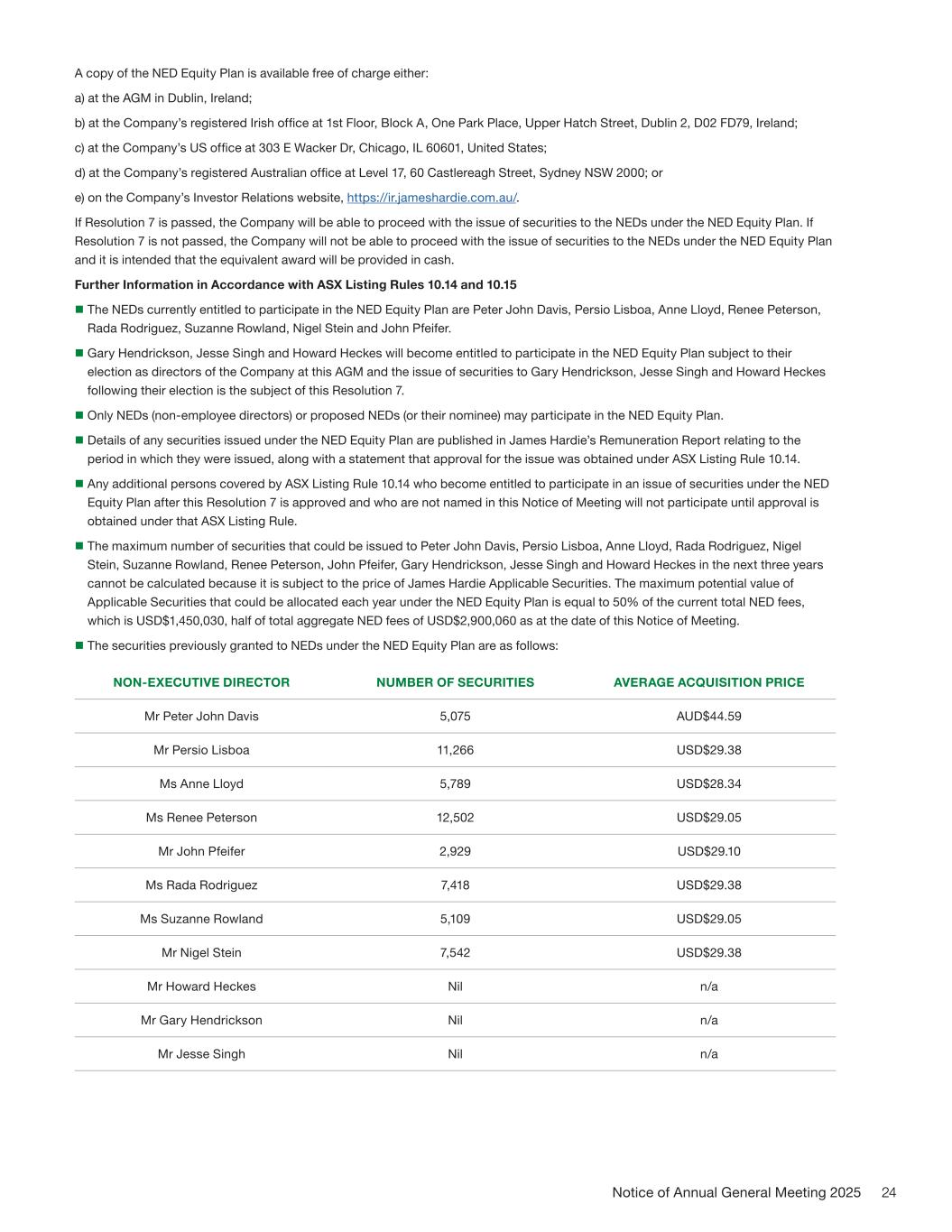

17Notice of Annual General Meeting 2025 Resolution 5 asks shareholders to approve the grant of ROCE RSUs under the 2006 LTIP to James Hardie’s Director and CEO, Aaron Erter. The People & Remuneration Committee has allocated the Long-Term Incentive (LTI) target of the CEO (and each senior executive) between the following three components to ensure that the reward is based on a diverse range of factors which validly reflect longer term performance, as well as provide an appropriate incentive to ensure senior executives focus on the key areas which will drive shareholder value creation over the medium and long-term. For fiscal year 2026, we reviewed the LTI program and made certain adjustments, in part, based on feedback from our investors. The overall LTI maximum payout was reduced from 250% of target to 233% of target by applying an equal weighting for all three vehicles as shown below: n One-third (formerly 25%) to ROCE RSUs (maximum payout of 200%) – an indicator of James Hardie’s capital efficiency over time; n One-third (formerly 25%) to Relative TSR RSUs (maximum payout of 200%) – an indicator of James Hardie’s performance relative to the constituent companies making up the S&P 500 index as of the date of grant; and n One-third (formerly 50%) to Scorecard LTI (maximum payout of 300%) – an indicator of each senior executive’s contribution to James Hardie achieving its long-term strategic goals. The Board and People & Remuneration Committee believe the LTI program is achieving the stated objectives, that management understands the current LTI program and continues to be motivated by it and the LTI components for fiscal year 2026 are materially consistent with the components for fiscal year 2025. Reasons for ROCE RSUs ROCE RSUs shall vest if James Hardie’s ROCE performance meets or exceeds ROCE performance hurdles over a three-year period, subject to the exercise of negative discretion by the People & Remuneration Committee. James Hardie introduced ROCE RSUs in fiscal year 2013 once the US housing market had stabilised to an extent which permitted the setting of multi-year financial metrics. As James Hardie funds capacity expansions and market initiatives in the US, Asia Pacific and Europe, it is important that management focuses on ensuring that the Company continues to achieve strong ROCE results while pursuing growth. Upon vesting, ROCE RSUs shall be settled in either Shares listed and traded on the New York Stock Exchange or in CDIs on a 1-to-1 basis. ROCE RSU Changes for Fiscal Year 2026 As noted above, the weighting of the ROCE RSUs has been increased from 25% to one-third of the overall LTI target. Following the merger with The AZEK Company Inc., the ROCE performance scale has been updated to reflect the current guidance for the combined organization. As this is an early stage for forecasting, future ROCE goals will be set once the combined company’s financials are more fully established. 2027 and 2028 will also be designed once the combined company’s financials are established for those respective years. That said, the remaining design features of the fiscal year 2026 ROCE RSUs are generally consistent with those of the fiscal year 2025 ROCE RSUs. Key Aspects of ROCE RSUs Goal Setting: ROCE performance hurdles for the ROCE RSUs are based on current guidance of the combined organization and take into account the forecasts for the US, Europe and Asia Pacific housing markets. ROCE Definitions: The ROCE measure will be determined by dividing adjusted earnings before interest and taxes (Adjusted EBIT) by adjusted capital employed (Adjusted Capital Employed) each as further explained below. The Adjusted EBIT component of the ROCE measure will be as reported in James Hardie’s financial results, comprised of earnings before interest and taxes and including incremental depreciation expense resulting from the application of purchase accounting step- up to property, plant and equipment, as adjusted by: n excluding the earnings impact of legacy issues (such as asbestos adjustments); n excluding acquisition-related expenses; n excluding non-cash amortization of intangibles from the AZEK acquisition; and n adding back asset impairment charges, restructuring charges and excluding performance from any business held for sale in the relevant period, unless otherwise determined by the People & Remuneration Committee. RESOLUTION 5 – GRANT OF RETURN ON CAPITAL EMPLOYED RESTRICTED STOCK UNITS TO CEO

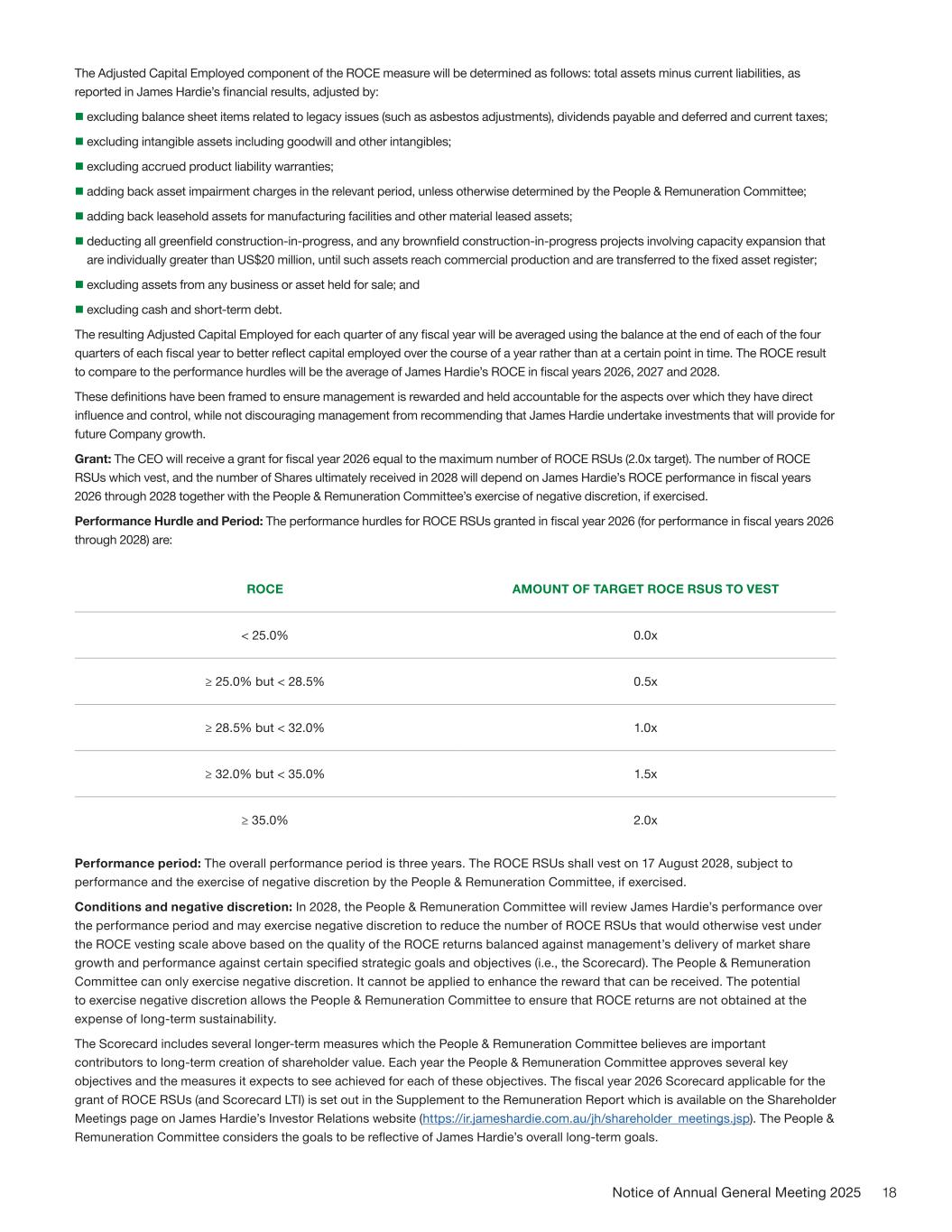

18Notice of Annual General Meeting 2025 The Adjusted Capital Employed component of the ROCE measure will be determined as follows: total assets minus current liabilities, as reported in James Hardie’s financial results, adjusted by: n excluding balance sheet items related to legacy issues (such as asbestos adjustments), dividends payable and deferred and current taxes; n excluding intangible assets including goodwill and other intangibles; n excluding accrued product liability warranties; n adding back asset impairment charges in the relevant period, unless otherwise determined by the People & Remuneration Committee; n adding back leasehold assets for manufacturing facilities and other material leased assets; n deducting all greenfield construction-in-progress, and any brownfield construction-in-progress projects involving capacity expansion that are individually greater than US$20 million, until such assets reach commercial production and are transferred to the fixed asset register; n excluding assets from any business or asset held for sale; and n excluding cash and short-term debt. The resulting Adjusted Capital Employed for each quarter of any fiscal year will be averaged using the balance at the end of each of the four quarters of each fiscal year to better reflect capital employed over the course of a year rather than at a certain point in time. The ROCE result to compare to the performance hurdles will be the average of James Hardie’s ROCE in fiscal years 2026, 2027 and 2028. These definitions have been framed to ensure management is rewarded and held accountable for the aspects over which they have direct influence and control, while not discouraging management from recommending that James Hardie undertake investments that will provide for future Company growth. Grant: The CEO will receive a grant for fiscal year 2026 equal to the maximum number of ROCE RSUs (2.0x target). The number of ROCE RSUs which vest, and the number of Shares ultimately received in 2028 will depend on James Hardie’s ROCE performance in fiscal years 2026 through 2028 together with the People & Remuneration Committee’s exercise of negative discretion, if exercised. Performance Hurdle and Period: The performance hurdles for ROCE RSUs granted in fiscal year 2026 (for performance in fiscal years 2026 through 2028) are: Performance period: The overall performance period is three years. The ROCE RSUs shall vest on 17 August 2028, subject to performance and the exercise of negative discretion by the People & Remuneration Committee, if exercised. Conditions and negative discretion: In 2028, the People & Remuneration Committee will review James Hardie’s performance over the performance period and may exercise negative discretion to reduce the number of ROCE RSUs that would otherwise vest under the ROCE vesting scale above based on the quality of the ROCE returns balanced against management’s delivery of market share growth and performance against certain specified strategic goals and objectives (i.e., the Scorecard). The People & Remuneration Committee can only exercise negative discretion. It cannot be applied to enhance the reward that can be received. The potential to exercise negative discretion allows the People & Remuneration Committee to ensure that ROCE returns are not obtained at the expense of long-term sustainability. The Scorecard includes several longer-term measures which the People & Remuneration Committee believes are important contributors to long-term creation of shareholder value. Each year the People & Remuneration Committee approves several key objectives and the measures it expects to see achieved for each of these objectives. The fiscal year 2026 Scorecard applicable for the grant of ROCE RSUs (and Scorecard LTI) is set out in the Supplement to the Remuneration Report which is available on the Shareholder Meetings page on James Hardie’s Investor Relations website (https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp). The People & Remuneration Committee considers the goals to be reflective of James Hardie’s overall long-term goals. ROCE AMOUNT OF TARGET ROCE RSUS TO VEST < 25.0% 0.0x ≥ 25.0% but < 28.5% 0.5x ≥ 28.5% but < 32.0% 1.0x ≥ 32.0% but < 35.0% 1.5x ≥ 35.0% 2.0x

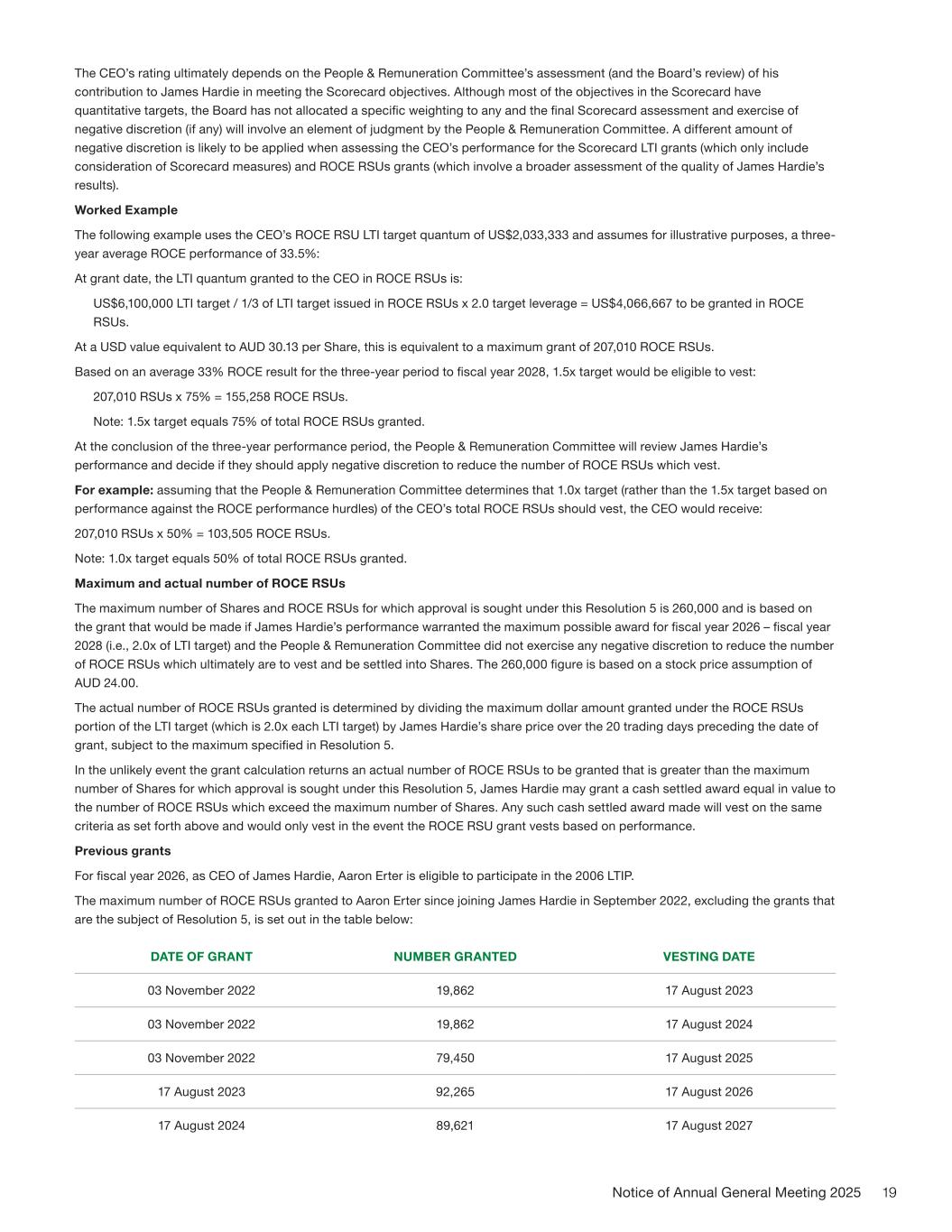

19Notice of Annual General Meeting 2025 The CEO’s rating ultimately depends on the People & Remuneration Committee’s assessment (and the Board’s review) of his contribution to James Hardie in meeting the Scorecard objectives. Although most of the objectives in the Scorecard have quantitative targets, the Board has not allocated a specific weighting to any and the final Scorecard assessment and exercise of negative discretion (if any) will involve an element of judgment by the People & Remuneration Committee. A different amount of negative discretion is likely to be applied when assessing the CEO’s performance for the Scorecard LTI grants (which only include consideration of Scorecard measures) and ROCE RSUs grants (which involve a broader assessment of the quality of James Hardie’s results). Worked Example The following example uses the CEO’s ROCE RSU LTI target quantum of US$2,033,333 and assumes for illustrative purposes, a three- year average ROCE performance of 33.5%: At grant date, the LTI quantum granted to the CEO in ROCE RSUs is: US$6,100,000 LTI target / 1/3 of LTI target issued in ROCE RSUs x 2.0 target leverage = US$4,066,667 to be granted in ROCE RSUs. At a USD value equivalent to AUD 30.13 per Share, this is equivalent to a maximum grant of 207,010 ROCE RSUs. Based on an average 33% ROCE result for the three-year period to fiscal year 2028, 1.5x target would be eligible to vest: 207,010 RSUs x 75% = 155,258 ROCE RSUs. Note: 1.5x target equals 75% of total ROCE RSUs granted. At the conclusion of the three-year performance period, the People & Remuneration Committee will review James Hardie’s performance and decide if they should apply negative discretion to reduce the number of ROCE RSUs which vest. For example: assuming that the People & Remuneration Committee determines that 1.0x target (rather than the 1.5x target based on performance against the ROCE performance hurdles) of the CEO’s total ROCE RSUs should vest, the CEO would receive: 207,010 RSUs x 50% = 103,505 ROCE RSUs. Note: 1.0x target equals 50% of total ROCE RSUs granted. Maximum and actual number of ROCE RSUs The maximum number of Shares and ROCE RSUs for which approval is sought under this Resolution 5 is 260,000 and is based on the grant that would be made if James Hardie’s performance warranted the maximum possible award for fiscal year 2026 – fiscal year 2028 (i.e., 2.0x of LTI target) and the People & Remuneration Committee did not exercise any negative discretion to reduce the number of ROCE RSUs which ultimately are to vest and be settled into Shares. The 260,000 figure is based on a stock price assumption of AUD 24.00. The actual number of ROCE RSUs granted is determined by dividing the maximum dollar amount granted under the ROCE RSUs portion of the LTI target (which is 2.0x each LTI target) by James Hardie’s share price over the 20 trading days preceding the date of grant, subject to the maximum specified in Resolution 5. In the unlikely event the grant calculation returns an actual number of ROCE RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 5, James Hardie may grant a cash settled award equal in value to the number of ROCE RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the ROCE RSU grant vests based on performance. Previous grants For fiscal year 2026, as CEO of James Hardie, Aaron Erter is eligible to participate in the 2006 LTIP. The maximum number of ROCE RSUs granted to Aaron Erter since joining James Hardie in September 2022, excluding the grants that are the subject of Resolution 5, is set out in the table below: DATE OF GRANT NUMBER GRANTED VESTING DATE 03 November 2022 19,862 17 August 2023 03 November 2022 19,862 17 August 2024 03 November 2022 79,450 17 August 2025 17 August 2023 92,265 17 August 2026 17 August 2024 89,621 17 August 2027

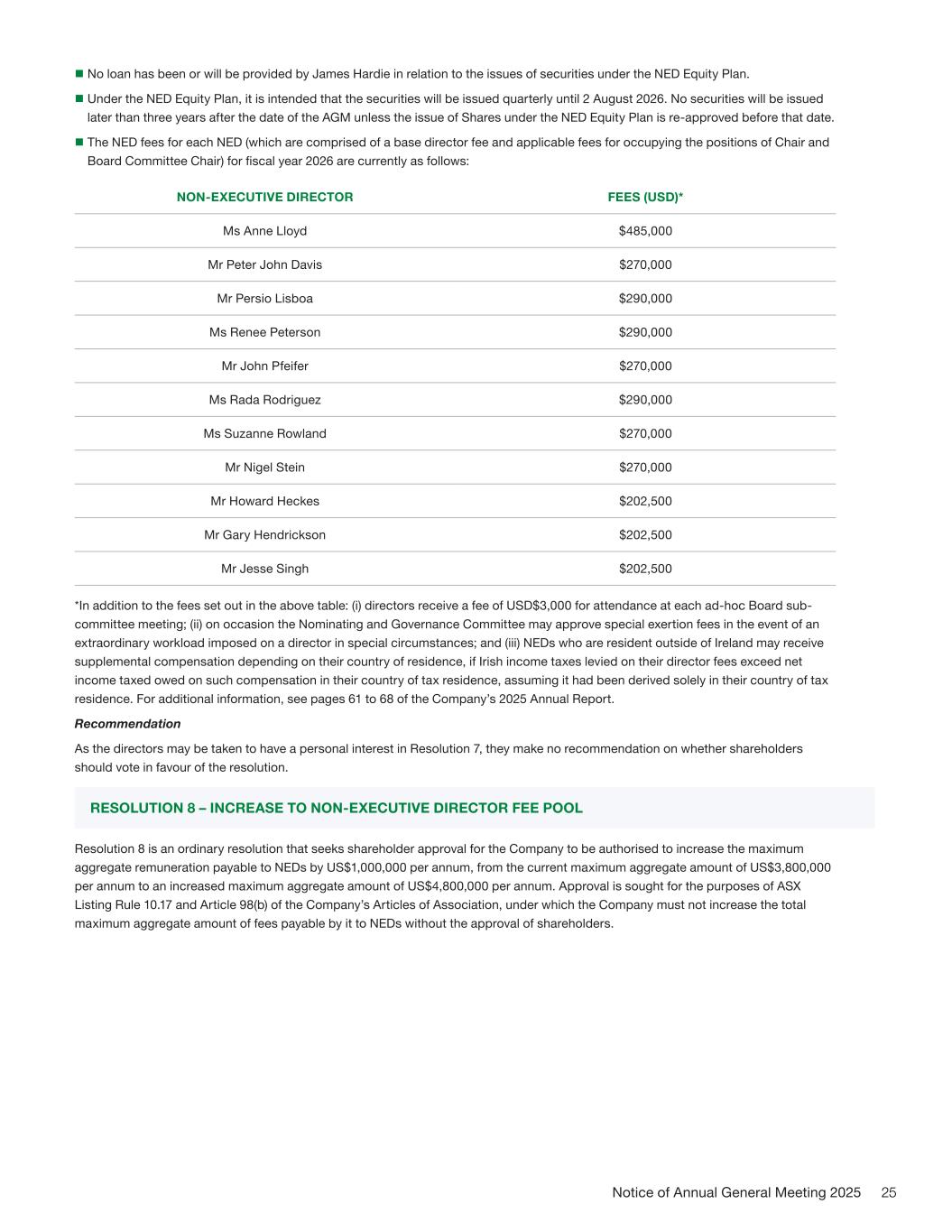

20Notice of Annual General Meeting 2025 There was no consideration paid by, and James Hardie did not provide loans to, the CEO in relation to the grant of these ROCE RSUs. General ROCE RSUs will be granted in accordance with the terms of the 2006 LTIP and on the basis set out in these Explanatory Notes. Currently, Aaron Erter is the only Director of James Hardie entitled to participate in the 2006 LTIP. ROCE RSUs will be granted for no consideration and James Hardie will not provide loans to the CEO in relation to the grant of ROCE RSUs. Subject to the performance hurdles being met and the People & Remuneration Committee’s exercise of negative discretion (if any), the CEO will be entitled to receive Shares upon vesting of the ROCE RSUs for no consideration. ROCE RSUs will be granted to the CEO no later than 12 months after the passing of Resolution 5. Summary of the legal requirements for seeking shareholder approval ASX Listing Rule 10.14 (specifically, ASX Listing Rule 10.14.1) provides that a listed company must not permit a director to acquire shares or rights to be issued shares under an employee incentive scheme without the approval of shareholders by ordinary resolution. Resolution 5 seeks the required shareholder approval to approve the grant of RSUs under the 2006 LTIP under and for the purposes of ASX Listing Rule 10.14.1 to James Hardie’s CEO, Aaron Erter, for fiscal year 2026 on the basis set out above. Aaron Erter’s current total remuneration at the date of this Notice of Meeting is USD$8,694,400, including cash compensation of USD$2,594,400, long-term cash compensation of USD$2,033,333 and share-based compensation of USD$4,066,667. If Resolution 5 is passed, the Company will be able to proceed with the grant of ROCE RSUs, under the 2006 LTIP to Aaron Erter, for fiscal year 2026 on the basis set out above. Details of any ROCE RSUs issued under the 2006 LTIP will be published in James Hardie’s annual report relating to the period in which they are issued, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of ROCE RSUs under the scheme after Resolution 5 passed will not participate until shareholder approval is obtained under that ASX Listing Rule. If Resolution 5 is not passed, the Company will not be able to proceed with the grant and will consider alternative incentives. A summary of the terms and conditions of the restated 2006 LTIP was included in the 2024 AGM Notice of Meeting. That document may be accessed from the Shareholders Meetings page on James Hardie’s Investor Relations website (https://ir.jameshardie.com.au/financial-information/annual-reports-and-notice-of-meetings). Recommendation The Board believes it is in the interests of shareholders that the grant of fiscal year 2026 ROCE RSUs to the CEO up to the maximum number specified in Resolution 5 under the 2006 LTIP, subject to the above terms and conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and unanimously recommends that you vote in favour of Resolution 5. Resolution 6 asks shareholders to approve, under the 2006 LTIP and for the purposes of ASX Listing Rule 10.14, the grant of Relative TSR RSUs to Aaron Erter, Director and CEO of James Hardie. Reasons for Relative TSR RSUs Relative TSR RSUs shall vest if James Hardie’s TSR performance meets or exceeds the Relative TSR performance hurdles for fiscal year 2026 to fiscal year 2028 performance period. Upon vesting, Relative TSR RSUs shall be settled in either Shares listed and traded on the New York Stock Exchange or in CDIs on a 1-to-1 basis. Relative TSR RSU Changes for Fiscal Year 2026 The key aspects of the Relative TSR RSUs are unchanged from fiscal year 2025. Key Aspects of Relative TSR RSUs Grant: The CEO will receive a grant equal to the maximum number of Relative TSR RSUs (2.0x target). The number of Relative TSR RSUs which vest, and the number of Shares ultimately received depends on James Hardie’s Relative TSR performance compared to the performance hurdles. RESOLUTION 6 - GRANT OF RELATIVE TOTAL SHAREHOLDER RETURN RESTRICTED STOCK UNITS TO CEO

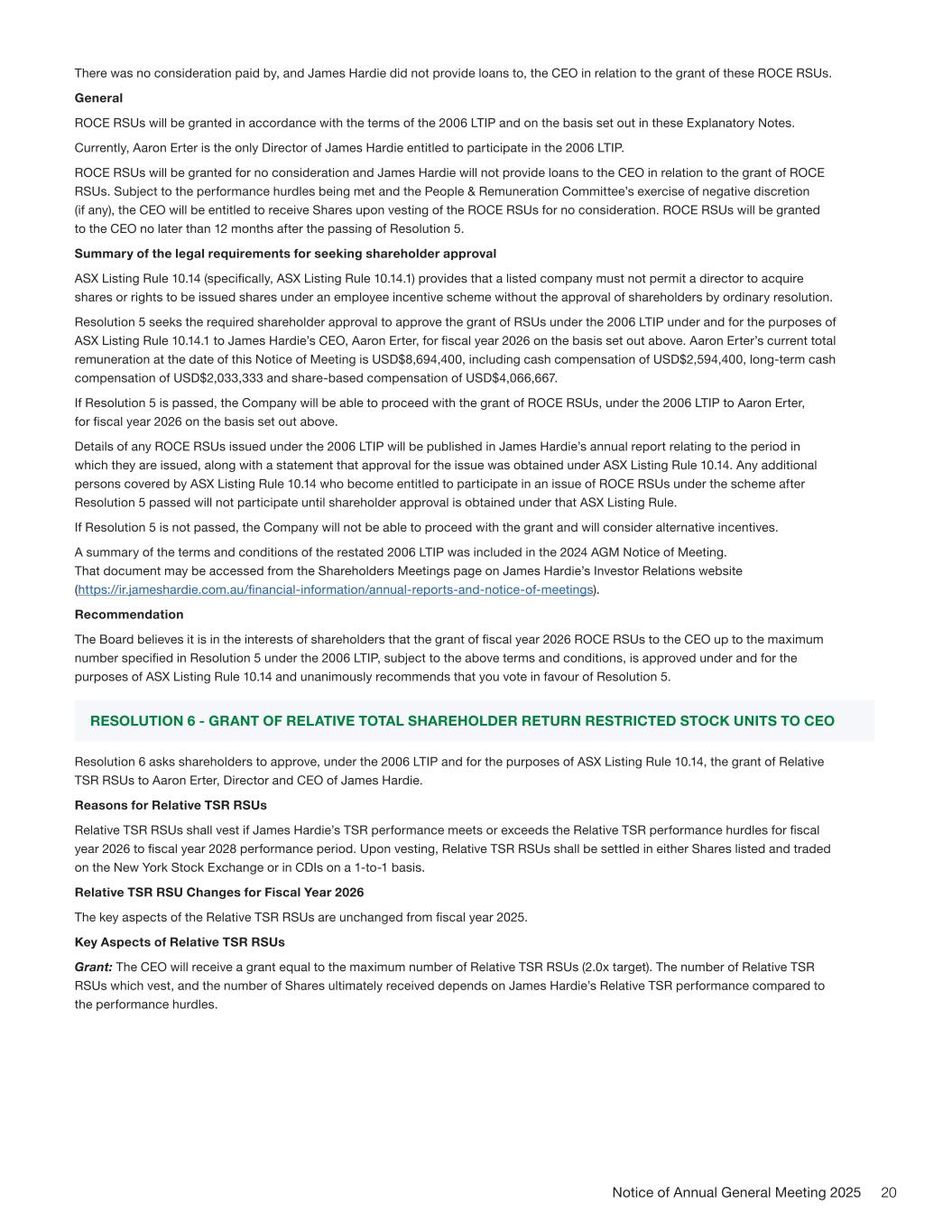

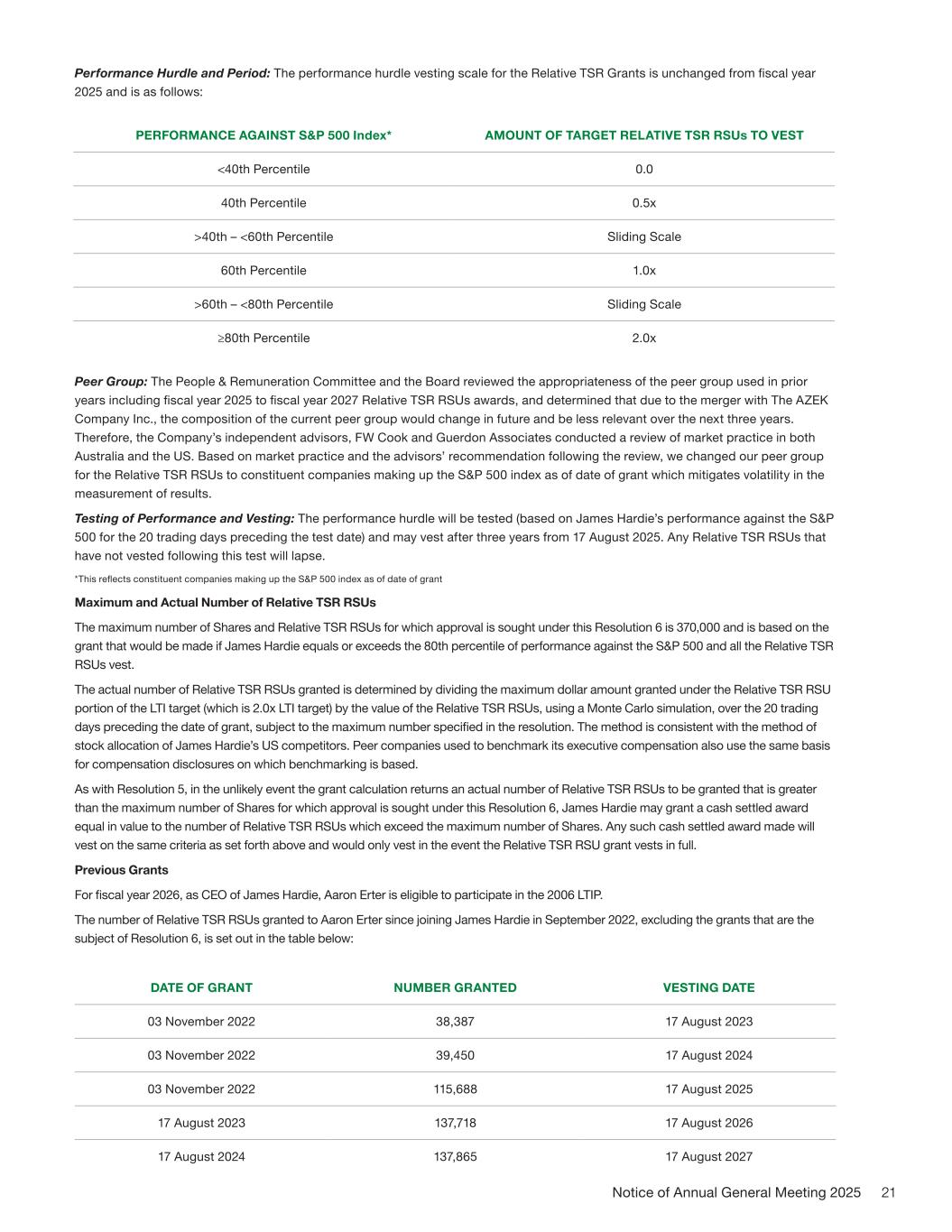

21Notice of Annual General Meeting 2025 Performance Hurdle and Period: The performance hurdle vesting scale for the Relative TSR Grants is unchanged from fiscal year 2025 and is as follows: *This reflects constituent companies making up the S&P 500 index as of date of grant Peer Group: The People & Remuneration Committee and the Board reviewed the appropriateness of the peer group used in prior years including fiscal year 2025 to fiscal year 2027 Relative TSR RSUs awards, and determined that due to the merger with The AZEK Company Inc., the composition of the current peer group would change in future and be less relevant over the next three years. Therefore, the Company’s independent advisors, FW Cook and Guerdon Associates conducted a review of market practice in both Australia and the US. Based on market practice and the advisors’ recommendation following the review, we changed our peer group for the Relative TSR RSUs to constituent companies making up the S&P 500 index as of date of grant which mitigates volatility in the measurement of results. Testing of Performance and Vesting: The performance hurdle will be tested (based on James Hardie’s performance against the S&P 500 for the 20 trading days preceding the test date) and may vest after three years from 17 August 2025. Any Relative TSR RSUs that have not vested following this test will lapse. Maximum and Actual Number of Relative TSR RSUs The maximum number of Shares and Relative TSR RSUs for which approval is sought under this Resolution 6 is 370,000 and is based on the grant that would be made if James Hardie equals or exceeds the 80th percentile of performance against the S&P 500 and all the Relative TSR RSUs vest. The actual number of Relative TSR RSUs granted is determined by dividing the maximum dollar amount granted under the Relative TSR RSU portion of the LTI target (which is 2.0x LTI target) by the value of the Relative TSR RSUs, using a Monte Carlo simulation, over the 20 trading days preceding the date of grant, subject to the maximum number specified in the resolution. The method is consistent with the method of stock allocation of James Hardie’s US competitors. Peer companies used to benchmark its executive compensation also use the same basis for compensation disclosures on which benchmarking is based. As with Resolution 5, in the unlikely event the grant calculation returns an actual number of Relative TSR RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 6, James Hardie may grant a cash settled award equal in value to the number of Relative TSR RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the Relative TSR RSU grant vests in full. Previous Grants For fiscal year 2026, as CEO of James Hardie, Aaron Erter is eligible to participate in the 2006 LTIP. The number of Relative TSR RSUs granted to Aaron Erter since joining James Hardie in September 2022, excluding the grants that are the subject of Resolution 6, is set out in the table below: PERFORMANCE AGAINST S&P 500 Index* AMOUNT OF TARGET RELATIVE TSR RSUs TO VEST <40th Percentile 0.0 40th Percentile 0.5x >40th – <60th Percentile Sliding Scale 60th Percentile 1.0x >60th – <80th Percentile Sliding Scale ≥80th Percentile 2.0x DATE OF GRANT NUMBER GRANTED VESTING DATE 03 November 2022 38,387 17 August 2023 03 November 2022 39,450 17 August 2024 03 November 2022 115,688 17 August 2025 17 August 2023 137,718 17 August 2026 17 August 2024 137,865 17 August 2027

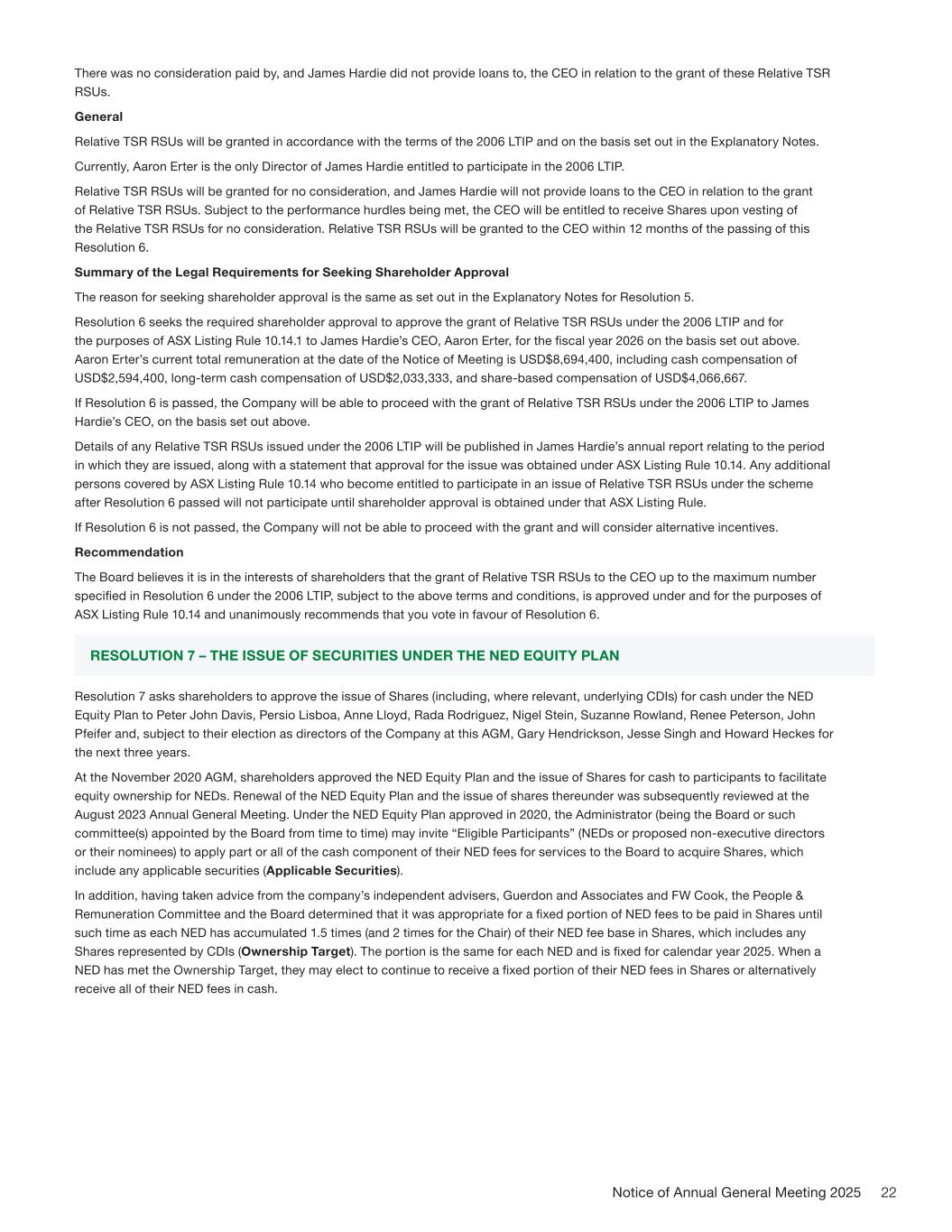

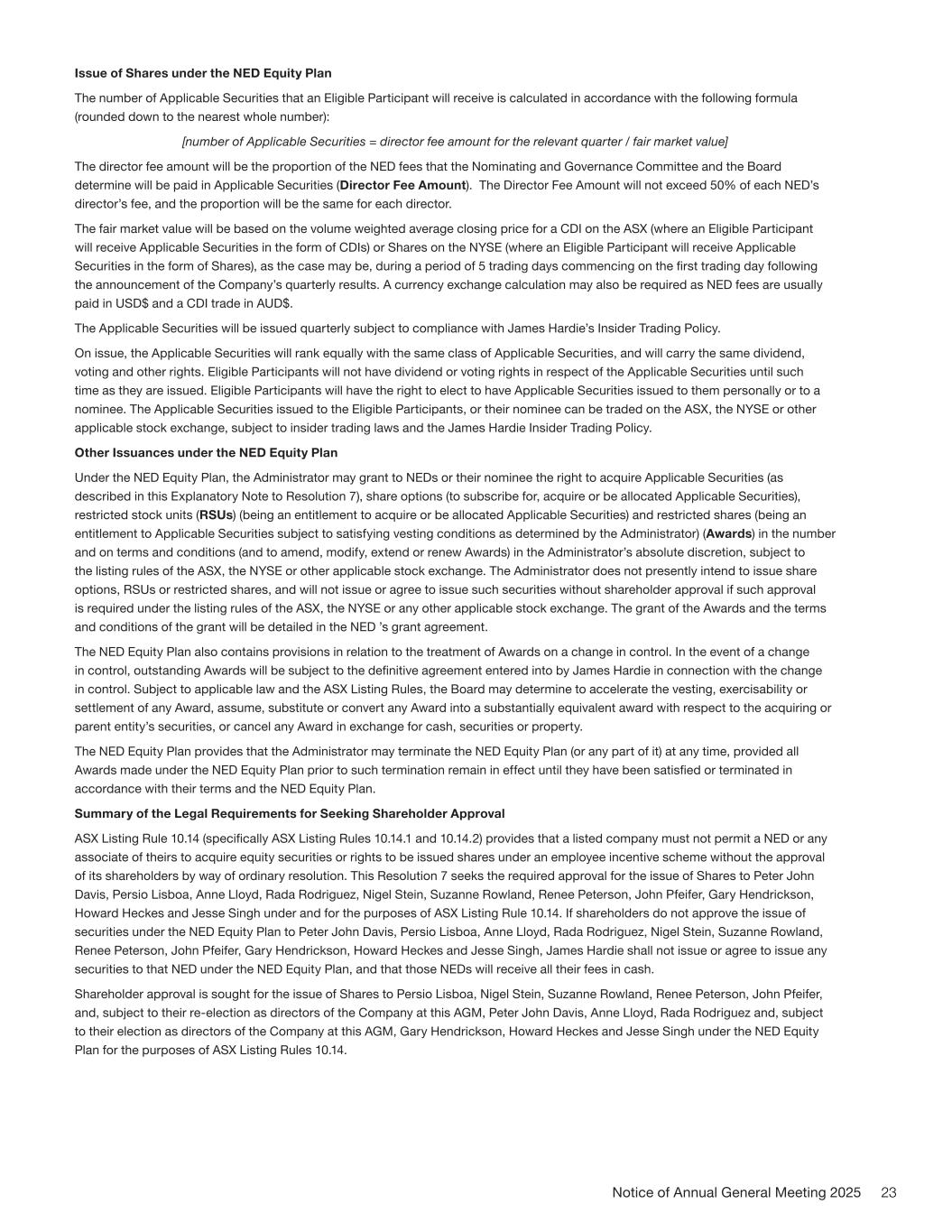

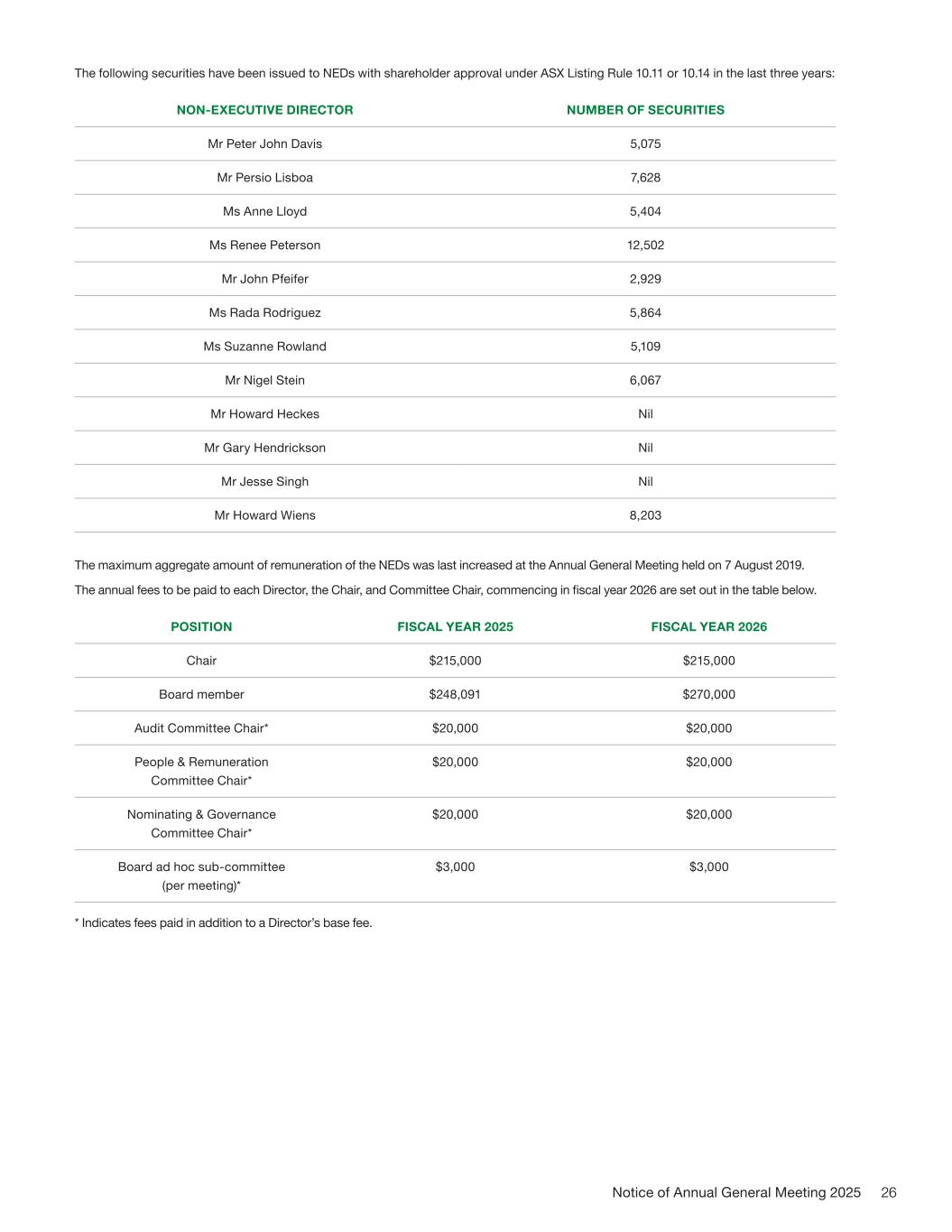

22Notice of Annual General Meeting 2025 There was no consideration paid by, and James Hardie did not provide loans to, the CEO in relation to the grant of these Relative TSR RSUs. General Relative TSR RSUs will be granted in accordance with the terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. Currently, Aaron Erter is the only Director of James Hardie entitled to participate in the 2006 LTIP. Relative TSR RSUs will be granted for no consideration, and James Hardie will not provide loans to the CEO in relation to the grant of Relative TSR RSUs. Subject to the performance hurdles being met, the CEO will be entitled to receive Shares upon vesting of the Relative TSR RSUs for no consideration. Relative TSR RSUs will be granted to the CEO within 12 months of the passing of this Resolution 6. Summary of the Legal Requirements for Seeking Shareholder Approval The reason for seeking shareholder approval is the same as set out in the Explanatory Notes for Resolution 5. Resolution 6 seeks the required shareholder approval to approve the grant of Relative TSR RSUs under the 2006 LTIP and for the purposes of ASX Listing Rule 10.14.1 to James Hardie’s CEO, Aaron Erter, for the fiscal year 2026 on the basis set out above. Aaron Erter’s current total remuneration at the date of the Notice of Meeting is USD$8,694,400, including cash compensation of USD$2,594,400, long-term cash compensation of USD$2,033,333, and share-based compensation of USD$4,066,667. If Resolution 6 is passed, the Company will be able to proceed with the grant of Relative TSR RSUs under the 2006 LTIP to James Hardie’s CEO, on the basis set out above. Details of any Relative TSR RSUs issued under the 2006 LTIP will be published in James Hardie’s annual report relating to the period in which they are issued, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of Relative TSR RSUs under the scheme after Resolution 6 passed will not participate until shareholder approval is obtained under that ASX Listing Rule. If Resolution 6 is not passed, the Company will not be able to proceed with the grant and will consider alternative incentives. Recommendation The Board believes it is in the interests of shareholders that the grant of Relative TSR RSUs to the CEO up to the maximum number specified in Resolution 6 under the 2006 LTIP, subject to the above terms and conditions, is approved under and for the purposes of ASX Listing Rule 10.14 and unanimously recommends that you vote in favour of Resolution 6. Resolution 7 asks shareholders to approve the issue of Shares (including, where relevant, underlying CDIs) for cash under the NED Equity Plan to Peter John Davis, Persio Lisboa, Anne Lloyd, Rada Rodriguez, Nigel Stein, Suzanne Rowland, Renee Peterson, John Pfeifer and, subject to their election as directors of the Company at this AGM, Gary Hendrickson, Jesse Singh and Howard Heckes for the next three years. At the November 2020 AGM, shareholders approved the NED Equity Plan and the issue of Shares for cash to participants to facilitate equity ownership for NEDs. Renewal of the NED Equity Plan and the issue of shares thereunder was subsequently reviewed at the August 2023 Annual General Meeting. Under the NED Equity Plan approved in 2020, the Administrator (being the Board or such committee(s) appointed by the Board from time to time) may invite “Eligible Participants” (NEDs or proposed non-executive directors or their nominees) to apply part or all of the cash component of their NED fees for services to the Board to acquire Shares, which include any applicable securities (Applicable Securities). In addition, having taken advice from the company’s independent advisers, Guerdon and Associates and FW Cook, the People & Remuneration Committee and the Board determined that it was appropriate for a fixed portion of NED fees to be paid in Shares until such time as each NED has accumulated 1.5 times (and 2 times for the Chair) of their NED fee base in Shares, which includes any Shares represented by CDIs (Ownership Target). The portion is the same for each NED and is fixed for calendar year 2025. When a NED has met the Ownership Target, they may elect to continue to receive a fixed portion of their NED fees in Shares or alternatively receive all of their NED fees in cash. RESOLUTION 7 – THE ISSUE OF SECURITIES UNDER THE NED EQUITY PLAN