James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Howard Heckes (USA), Gary Hendrickson (USA), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Jesse Singh (USA), Nigel Stein (UK). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 29 October 2025 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 CEO’s Address to 2025 Annual General Meeting and Presentation Dear Sir/Madam James Hardie Industries plc will be holding its 2025 Annual General Meeting (AGM) on Wednesday, 29 October 2025 at 8:00pm (Dublin time) / Thursday, 30 October 2025 at 7:00am (Sydney time). As required under ASX Listing Rule 3.13.3, a copy of the CEO’s Address to the 2025 AGM and the AGM Presentation are attached to this release. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

CEO’s Address 2025 Annual General Meeting CEO’s Address 1 Address to the 2025 Annual General Meeting Aaron Erter, Chief Executive Officer, James Hardie Industries plc Welcome to James Hardie Industries plc’s 2025 Annual General Meeting (AGM), our sixteenth AGM to be held in Dublin. Fiscal year 2025 was a transformative year for our business. The AZEK transaction has positioned us to build upon our foundation with a greater competitive edge and growth profile as we expand into a broader addressable market with an industry-leading portfolio. As One James Hardie, we are serving our combined customer base with a breadth of products and a broad manufacturing and support network. We are already benefitting in the market from the AZEK transaction as we continue to make progress integrating the brands across our portfolio. We remain on track to realize $125 million of cost synergies within three years of closing of the transaction and, as we continue to integrate the business, we expect to unlock more significant revenue synergies. The strong performance of our Deck, Rail & Accessories segment, coupled with the preliminary second quarter results we announced this month, make it clear that we are taking the right steps to build a more resilient, diversified company that can deliver sustainable long- term growth. We also know we have more work to do, and we take the perspectives of all shareholders seriously. We have engaged extensively with many of you during the past several months and deeply appreciate all the feedback that we have heard. We are committed to continuous engagement and enhancing the value of your investment. As we enter 2026, we are optimistic about the path ahead. James Hardie has a strong foundation that will enable us to increase our focus on key markets, including the United States. We remain laser-focused on creating demand across the customer value chain, investing ahead of recovery and evolving our plans to drive outperformance. We look forward to capitalizing on the significant opportunity that lies ahead and will keep you updated on our progress. Thank you for your continued support. END Forward-Looking Statements This communication contains forward-looking statements and information that are subject to risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this communication, including, among others, the risks and uncertainties set forth in Section 3 "Risk Factors" in James Hardie’s Annual Report on Form 20-F for the fiscal year ended March 31, 2025; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business;

CEO’s Address 2025 Annual General Meeting CEO’s Address 2 changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy; the AZEK acquisition and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Press Release except as required by law.

ANNUAL GENERAL MEETING 29 October 2025 (New York and Dublin) / 30 October 2025 (Sydney)

Contents are confidential and subject to disclosure and insider trading considerations 2 Aaron Erter, Chief Executive Officer ANNUAL GENERAL MEETING – CEO’S ADDRESS

• Xxx • Xxx *Shareholders should refer to the Notice of Annual General Meeting 2025 for the full text and background to each resolution set forth in the presentation ANNUAL GENERAL MEETING – ITEMS OF BUSINESS*

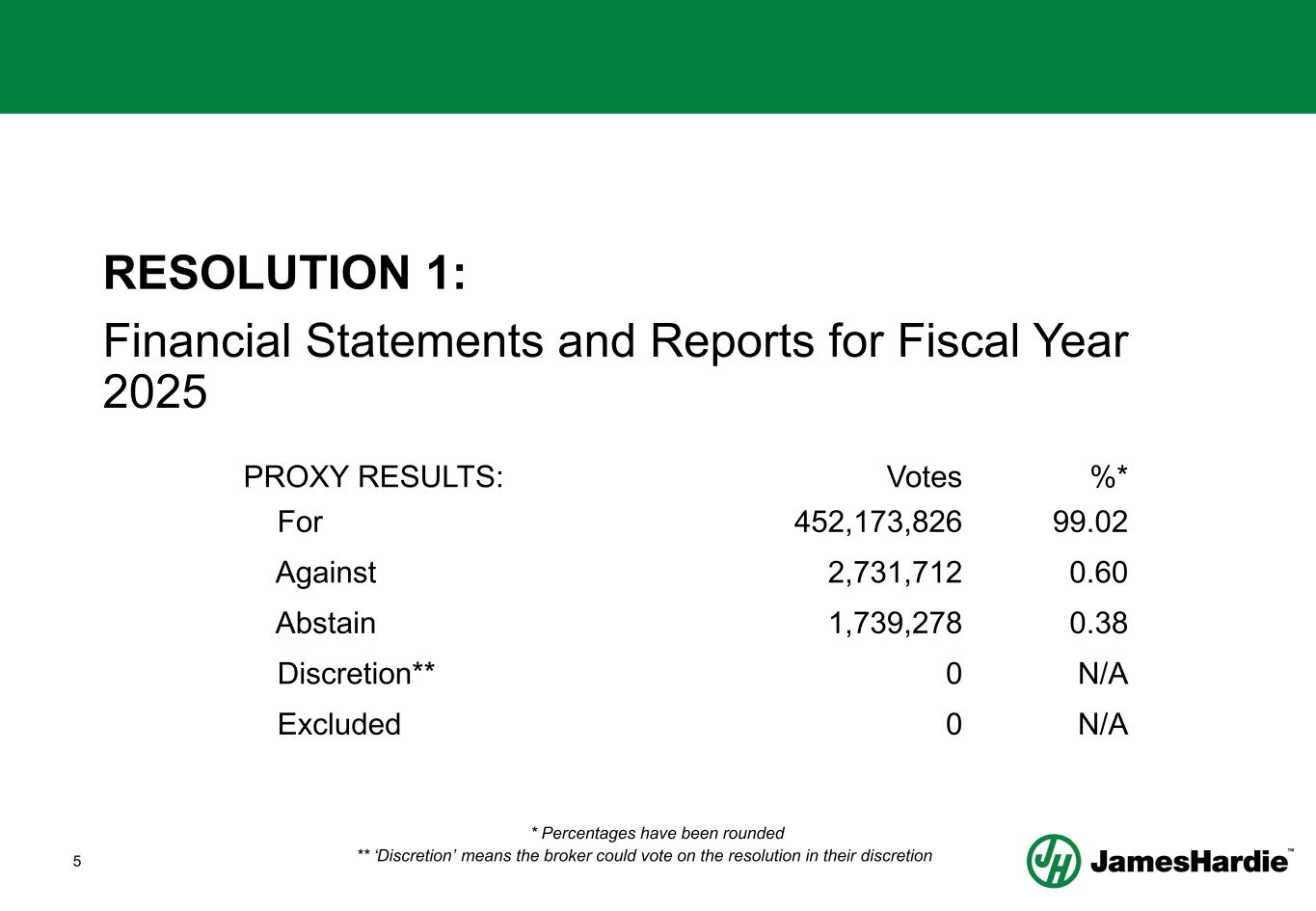

4 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2025 • To receive and consider the financial statements and the reports of the Board and external auditor for the fiscal year ended 31 March 2025

5 RESOLUTION 1: Financial Statements and Reports for Fiscal Year 2025 PROXY RESULTS: Votes %* For 452,173,826 99.02 Against 2,731,712 0.60 Abstain 1,739,278 0.38 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

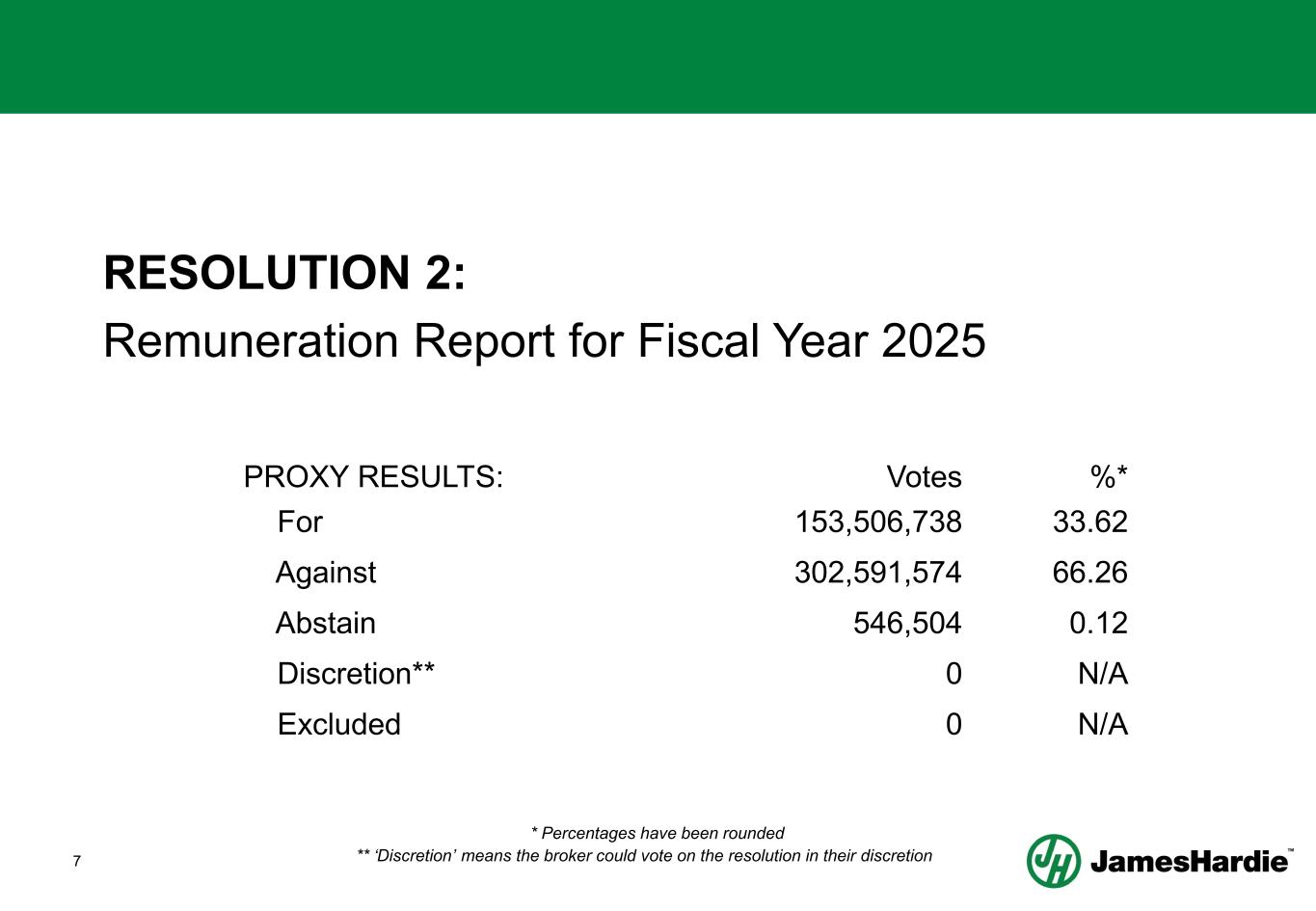

6 RESOLUTION 2: Remuneration Report for Fiscal Year 2025 • To receive and consider the Remuneration Report of the Company for the fiscal year ended 31 March 2025

7 RESOLUTION 2: Remuneration Report for Fiscal Year 2025 PROXY RESULTS: Votes %* For 153,506,738 33.62 Against 302,591,574 66.26 Abstain 546,504 0.12 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

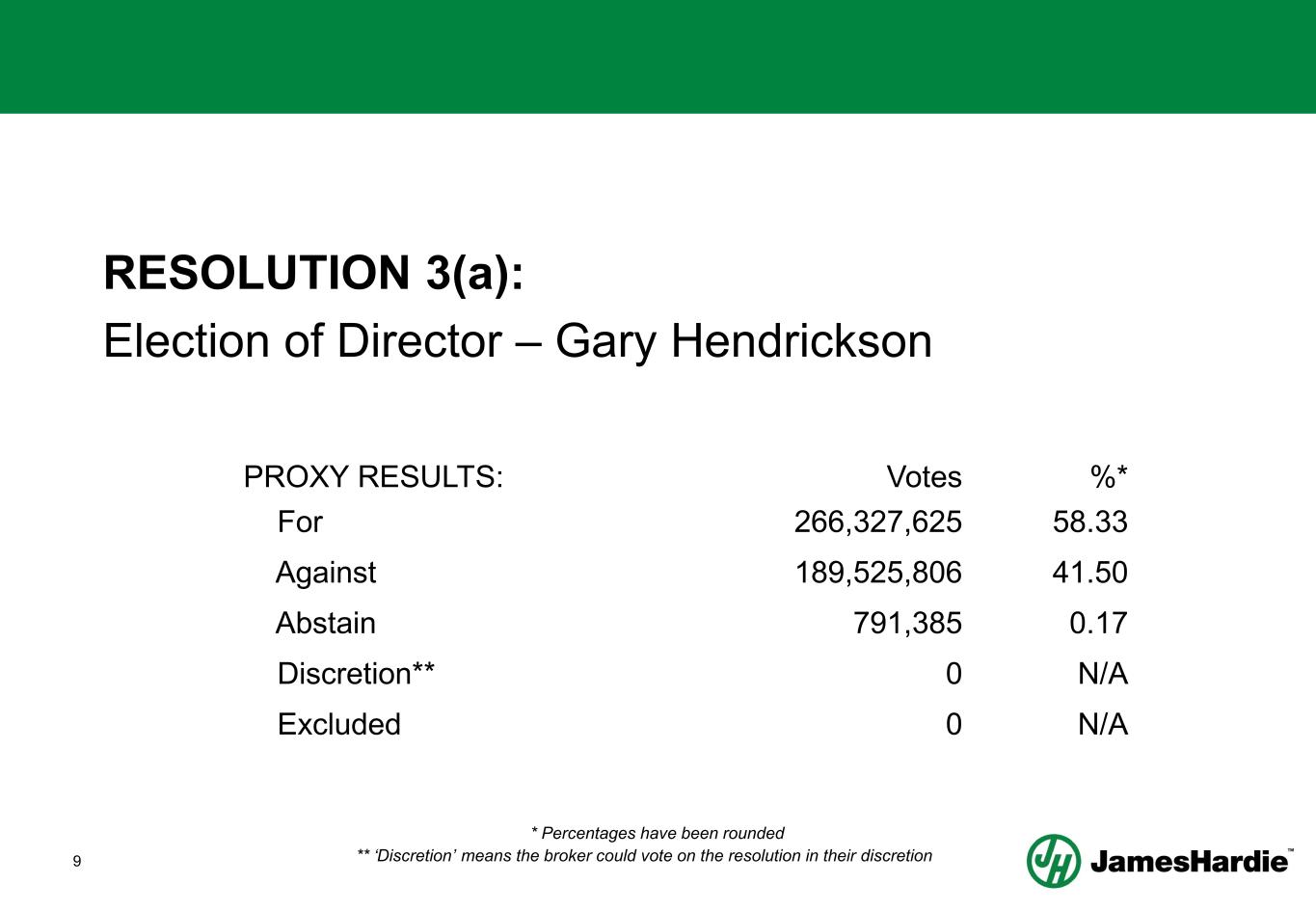

8 RESOLUTION 3: Election/Re-election of Directors a. That Gary Hendrickson be elected as a director b. That Jesse Singh be elected as a director c. That Howard Heckes be elected as a director d. That Peter John Davis be re-elected as a director e. That Anne Lloyd be re-elected as a director f. That Rada Rodriguez be re-elected as a director

9 RESOLUTION 3(a): Election of Director – Gary Hendrickson PROXY RESULTS: Votes %* For 266,327,625 58.33 Against 189,525,806 41.50 Abstain 791,385 0.17 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

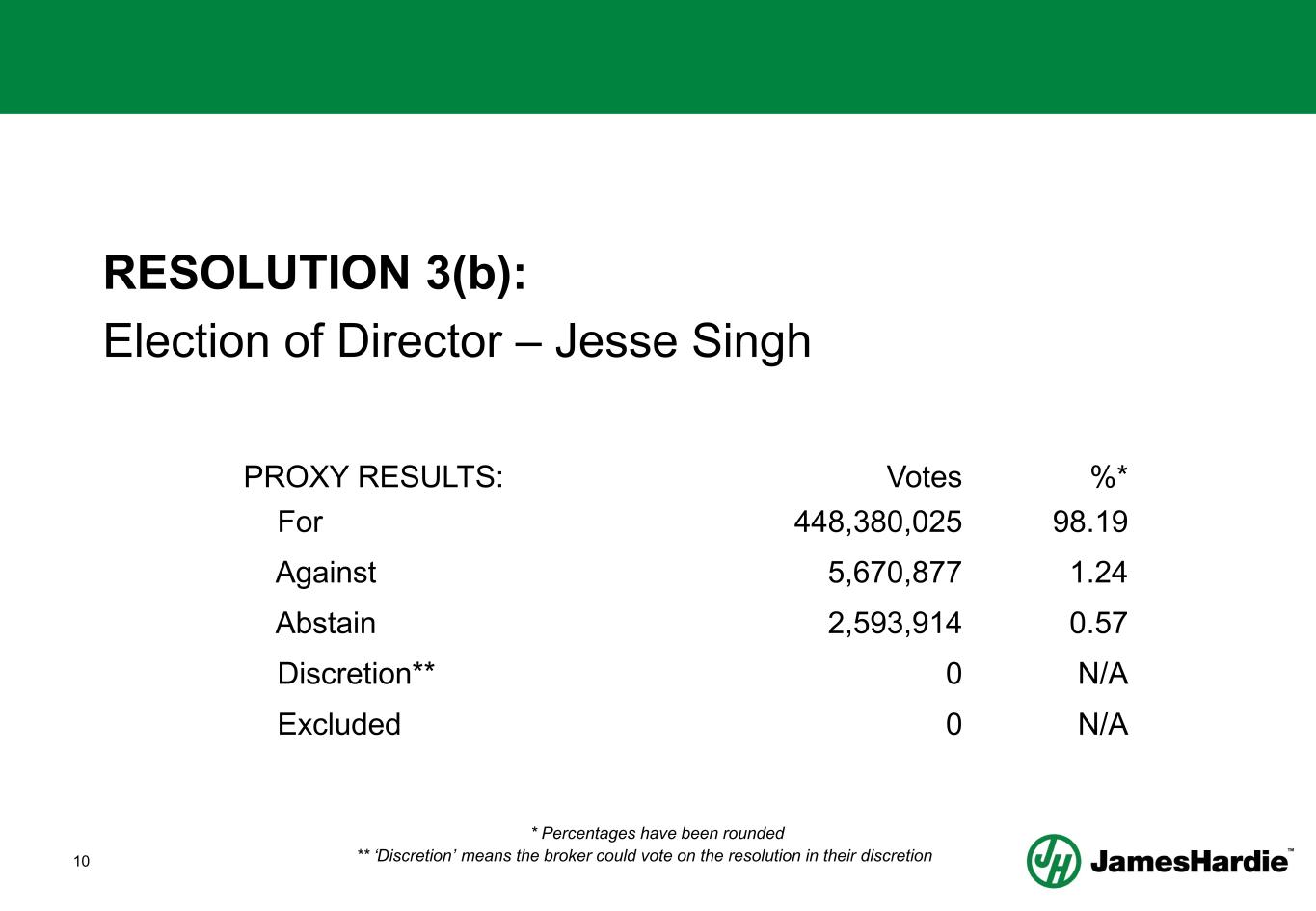

10 RESOLUTION 3(b): Election of Director – Jesse Singh PROXY RESULTS: Votes %* For 448,380,025 98.19 Against 5,670,877 1.24 Abstain 2,593,914 0.57 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

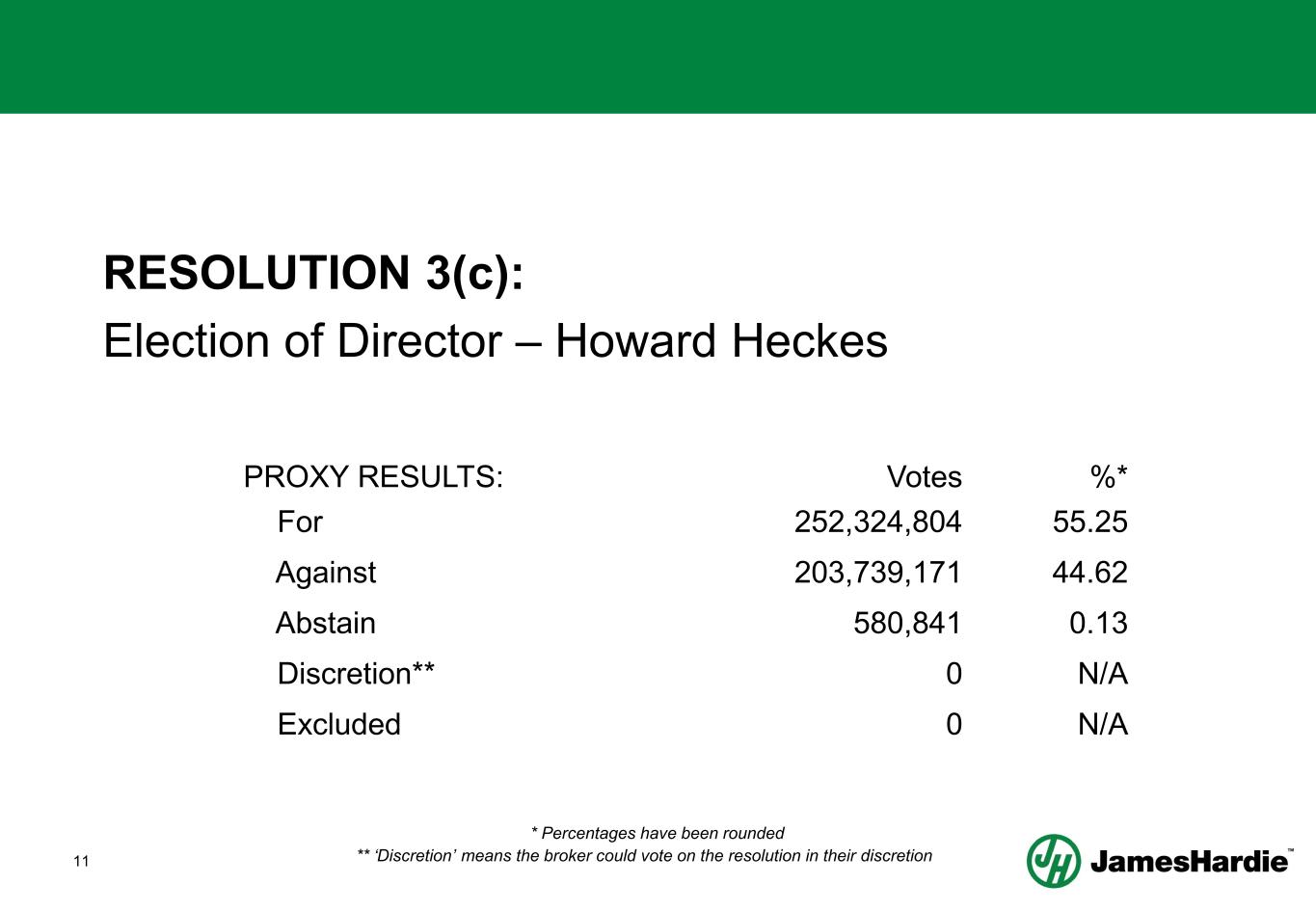

11 RESOLUTION 3(c): Election of Director – Howard Heckes PROXY RESULTS: Votes %* For 252,324,804 55.25 Against 203,739,171 44.62 Abstain 580,841 0.13 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

12 RESOLUTION 3(d): Re-election of Director – Peter John Davis PROXY RESULTS: Votes %* For 215,759,305 47.25 Against 240,368,504 52.64 Abstain 517,007 0.11 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

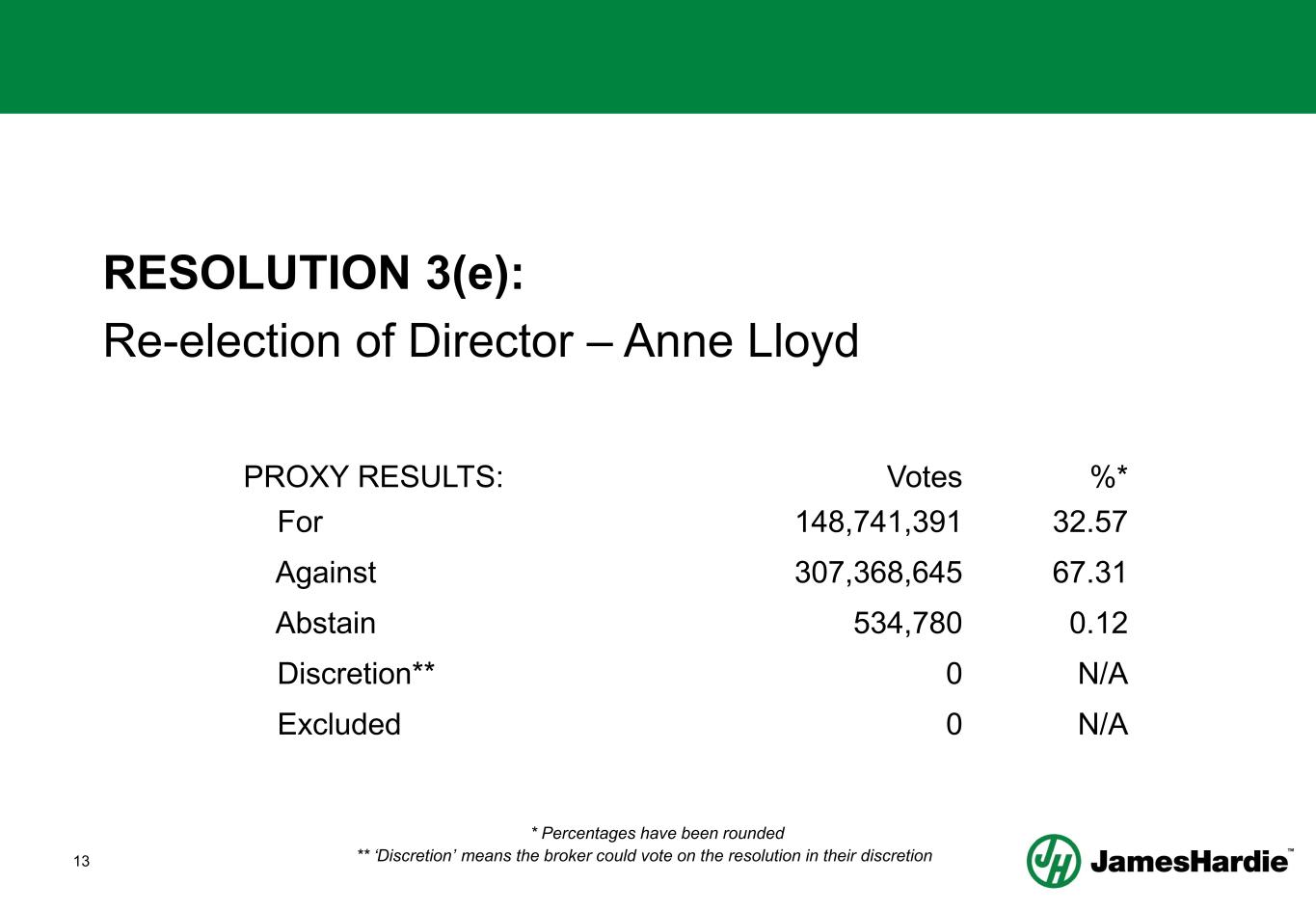

13 RESOLUTION 3(e): Re-election of Director – Anne Lloyd PROXY RESULTS: Votes %* For 148,741,391 32.57 Against 307,368,645 67.31 Abstain 534,780 0.12 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

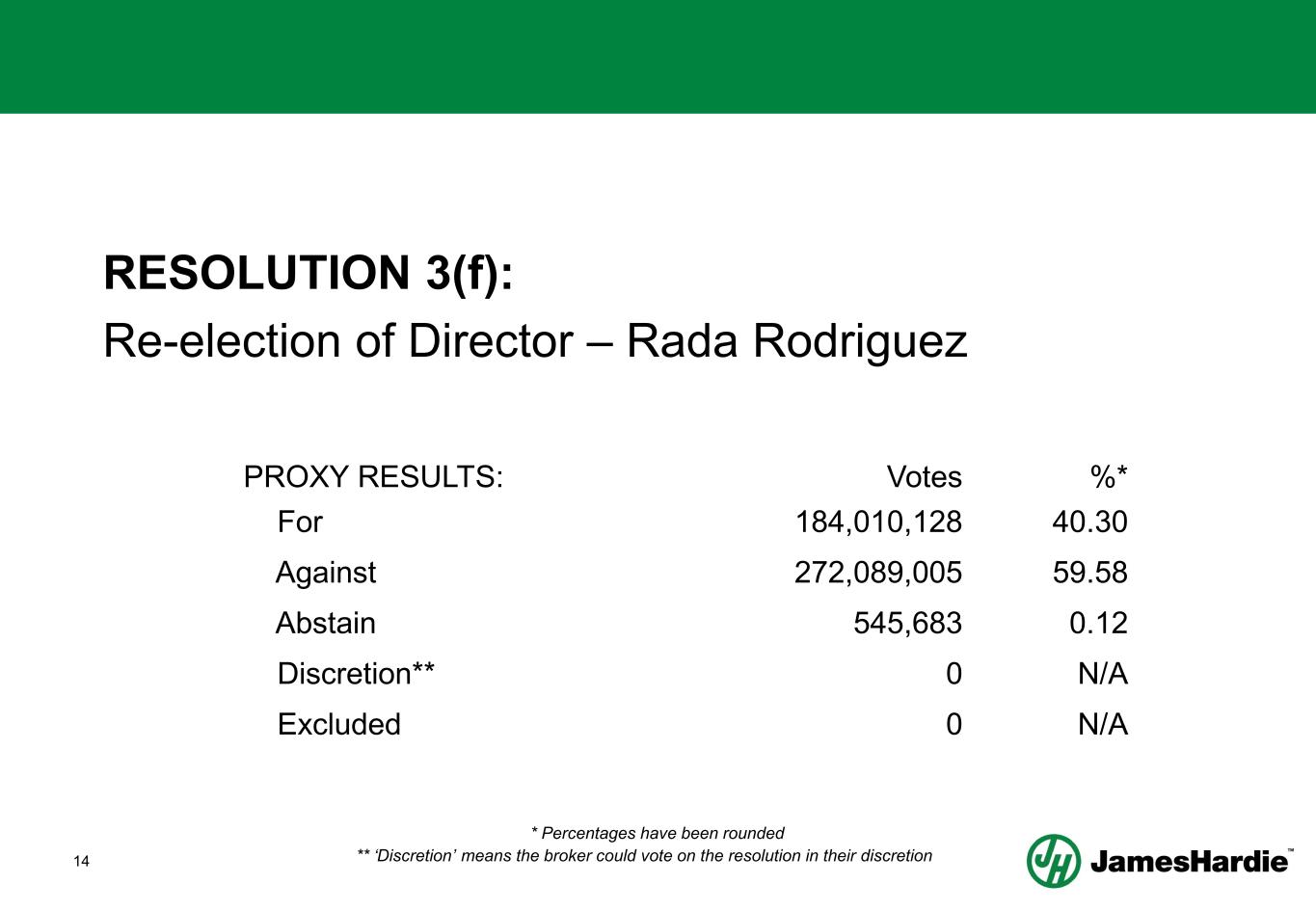

14 RESOLUTION 3(f): Re-election of Director – Rada Rodriguez PROXY RESULTS: Votes %* For 184,010,128 40.30 Against 272,089,005 59.58 Abstain 545,683 0.12 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

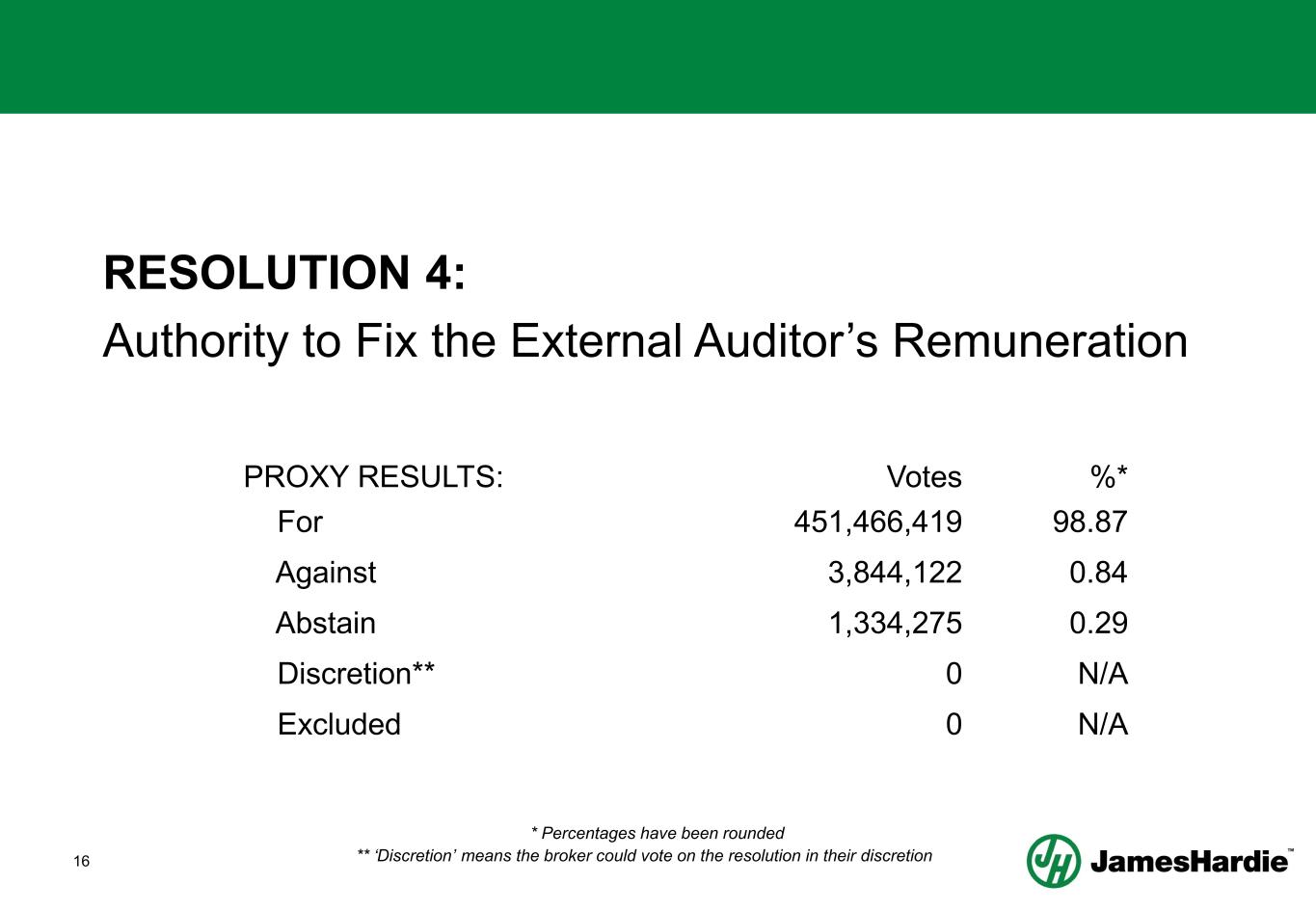

15 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration • That the Board be authorised to fix the remuneration of the external auditor for the fiscal year ended 31 March 2026

16 RESOLUTION 4: Authority to Fix the External Auditor’s Remuneration PROXY RESULTS: Votes %* For 451,466,419 98.87 Against 3,844,122 0.84 Abstain 1,334,275 0.29 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

17 RESOLUTION 5: Grant of Return on Capital Employed (ROCE) Restricted Stock Units (RSUs) to CEO • Approve the granting of ROCE RSUs to James Hardie’s Director and Chief Executive Officer, Aaron Erter and his acquisition of ROCE RSUs

18 RESOLUTION 5: Grant of Return on Capital Employed (ROCE) Restricted Stock Units (RSUs) to CEO PROXY RESULTS: Votes %* For 221,593,486 48.53 Against 233,716,129 51.18 Abstain 1,335,201 0.29 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

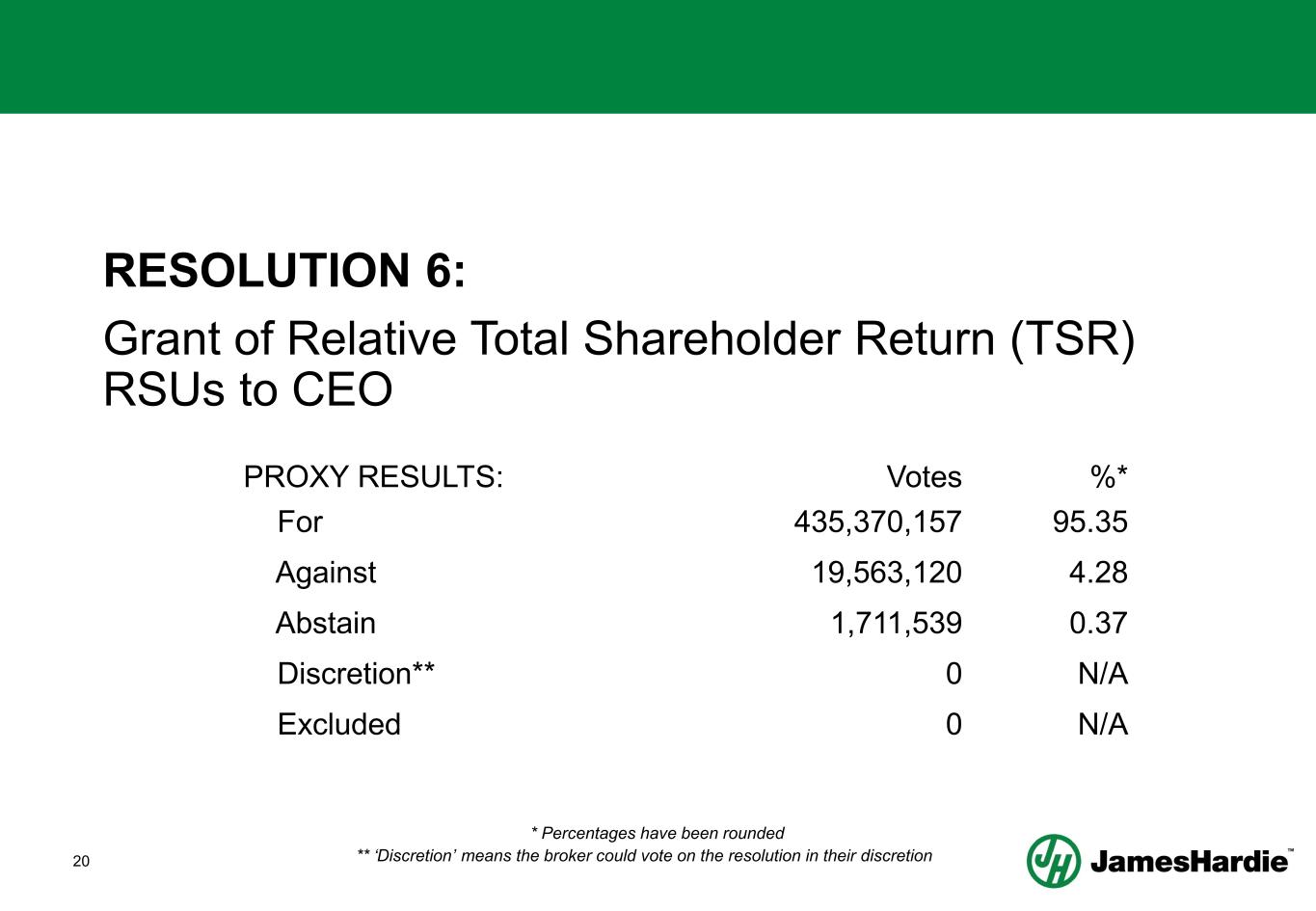

19 RESOLUTION 6: Grant of Relative Total Shareholder Return (TSR) RSUs to CEO • Approve the granting of TSR RSUs to James Hardie’s Director and Chief Executive Officer, Aaron Erter

20 RESOLUTION 6: Grant of Relative Total Shareholder Return (TSR) RSUs to CEO PROXY RESULTS: Votes %* For 435,370,157 95.35 Against 19,563,120 4.28 Abstain 1,711,539 0.37 Discretion** 0 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

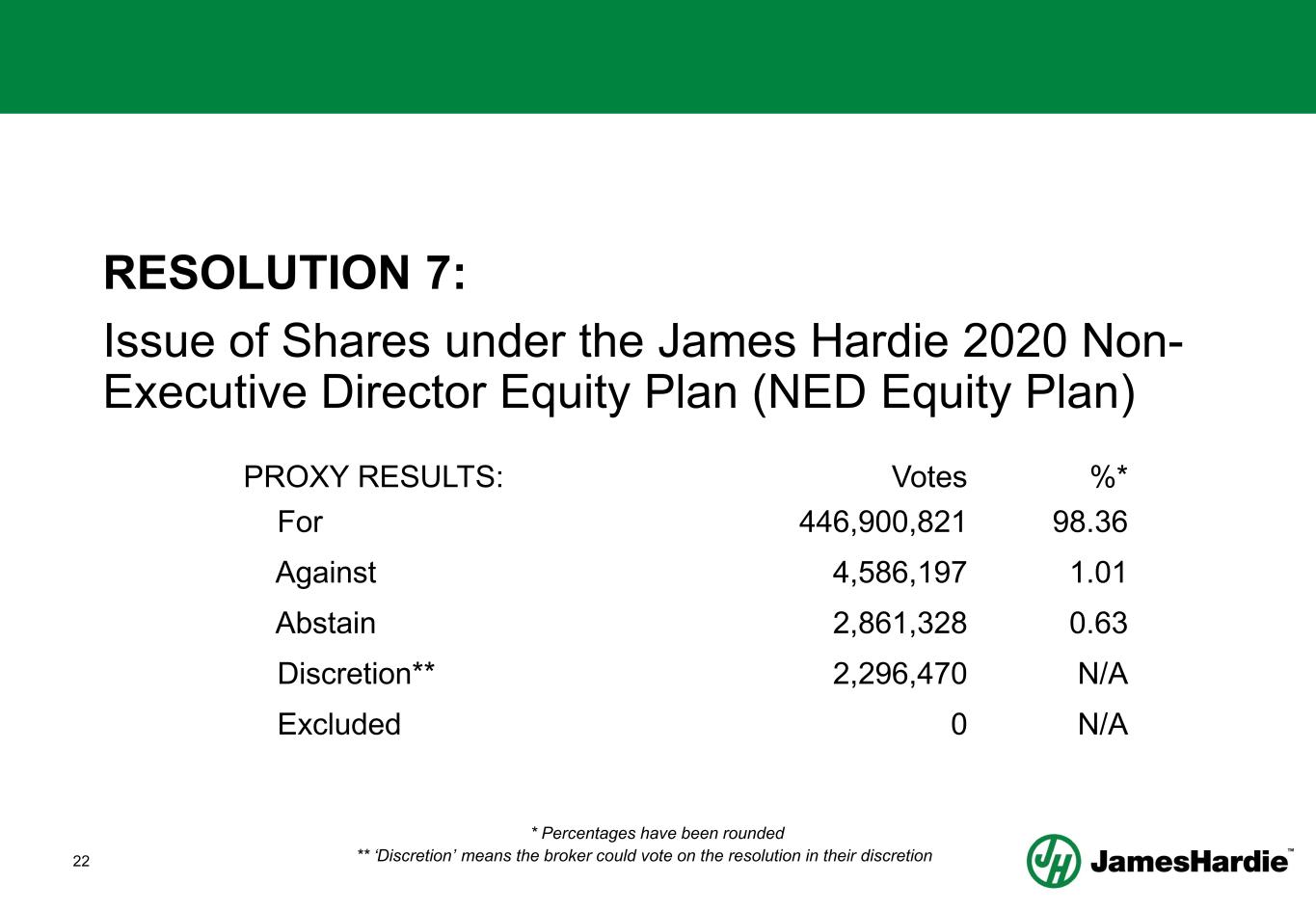

21 RESOLUTION 7: Issue of Shares under the James Hardie 2020 Non- Executive Director Equity Plan (NED Equity Plan) • Approve the issue of Shares to non-executive directors under the NED Equity Plan

22 RESOLUTION 7: Issue of Shares under the James Hardie 2020 Non- Executive Director Equity Plan (NED Equity Plan) PROXY RESULTS: Votes %* For 446,900,821 98.36 Against 4,586,197 1.01 Abstain 2,861,328 0.63 Discretion** 2,296,470 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

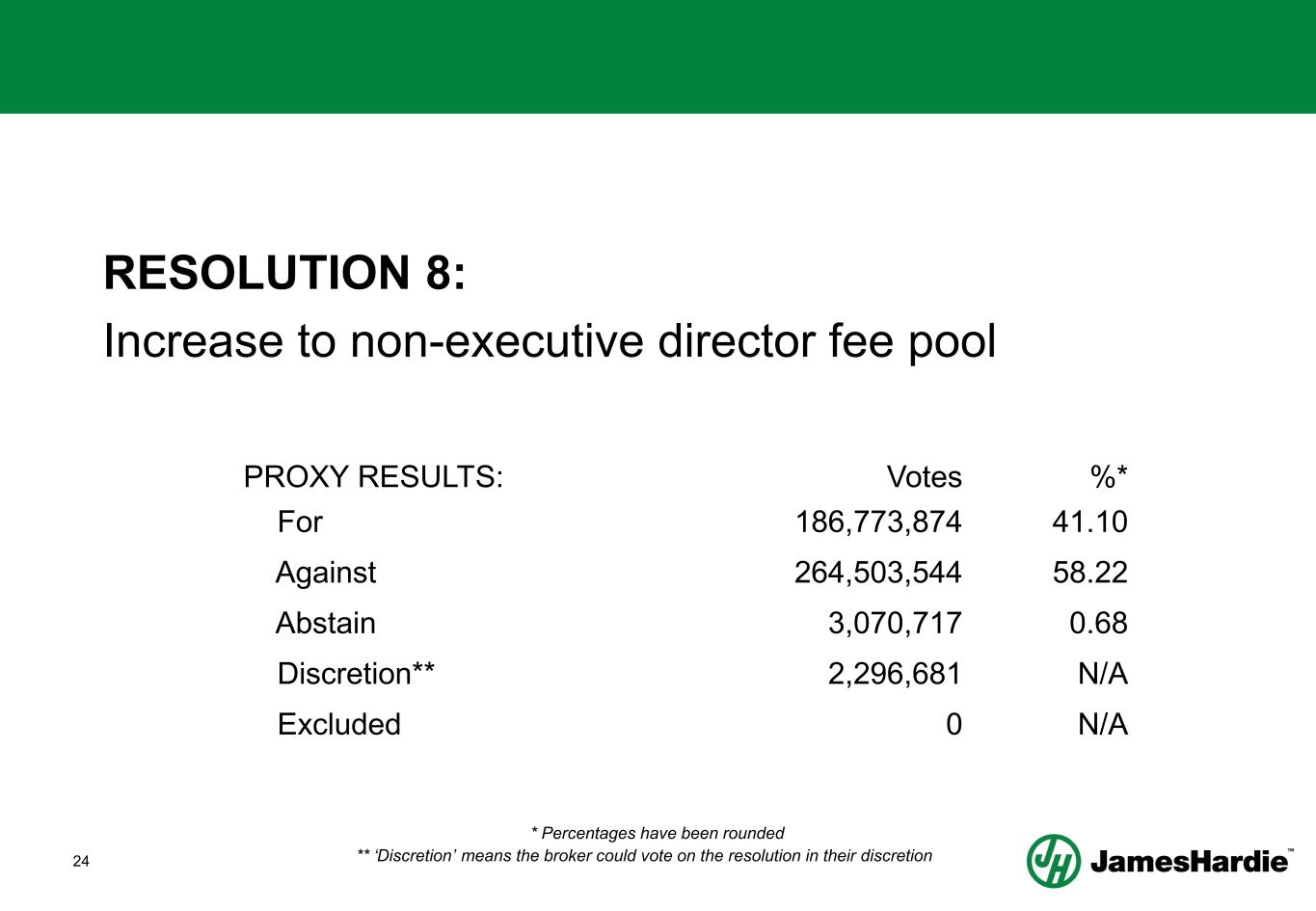

23 RESOLUTION 8: Increase to non-executive director fee pool • Approve the increase in the maximum aggregate remuneration payable to non-executive directors

24 RESOLUTION 8: Increase to non-executive director fee pool PROXY RESULTS: Votes %* For 186,773,874 41.10 Against 264,503,544 58.22 Abstain 3,070,717 0.68 Discretion** 2,296,681 N/A Excluded 0 N/A * Percentages have been rounded ** ‘Discretion’ means the broker could vote on the resolution in their discretion

25 Page 25 ANNUAL GENERAL MEETING – OTHER ITEMS OF BUSINESS

ANNUAL GENERAL MEETING