1 Q2 FY26 EARNINGS PRESENTATION Second Quarter FY26 Earnings Presentation Tuesday, November 18th

2 Q2 FY26 EARNINGS PRESENTATION Cautionary Note and Use of Non-GAAP Measures This Earnings Presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. James Hardie Industries plc (the “Company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission on Forms 20-F and 6-K, in its annual reports to shareholders, in media releases and other written materials and in oral statements made by the Company’s officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These forward-looking statements are based upon management's current expectations, estimates, assumptions, beliefs and general good faith evaluation of information available at the time the forward-looking statements were made concerning future events and conditions. Readers are cautioned not to place undue reliance on any forward-looking statements or rely upon them as a guarantee of future performance or results or as an accurate indication of the times at or by which any such performance or results will be achieved. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are unforeseeable and beyond the Company’s control. Many factors could cause actual results, performance or achievements to be materially different from those expressed or implied in this Earnings Presentation, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended March 31, 2025, which include, but are not necessarily limited to risks such as changes in general economic, political, governmental and business conditions globally and in the countries in which the Company does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy; the AZEK integration and anticipated benefits and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Earnings Presentation except as required by law. This Earnings Presentation includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP). These financial measures are designed to provide investors with an alternative method for assessing our performance from on-going operations, capital efficiency and profit generation. Management uses these financial measures for the same purposes. These financial measures are or may be non-GAAP financial measures as defined in the rules of the U.S. Securities and Exchange Commission and may exclude or include amounts that are included or excluded, as applicable, in the calculation of the most directly comparable financial measures calculated in accordance with GAAP. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments, or significant non-recurring items, such as asset impairments, restructuring expenses, acquisition and pre-close financing related costs, as well as adjustments to tax expense. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Earnings Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent GAAP measure, see slides titled “Non-GAAP Financial Measures” included in this Earnings Presentation. This Earnings Presentation forms part of a package of information about the Company’s results. It should be read in conjunction with the other parts of this package, including the Management’s Analysis of Results, Condensed Consolidated Financial Statements and Earnings Release. All comparisons made are vs. the comparable period in the prior fiscal year and amounts presented are in US dollars, unless otherwise noted. Investor Contact Joe Ahlersmeyer, CFA Vice President, Investor Relations [email protected]

3 Q2 FY26 EARNINGS PRESENTATION Agenda Aaron Erter CHIEF EXECUTIVE OFFICER 1 Q2 Business Performance 2 James Hardie Strategic Update 3 AZEK Integration & Synergy Progress 4 Financial Results & Guidance 5 Q&A

4 Q2 FY26 EARNINGS PRESENTATION 61% 5% 8% 26% James Hardie At A Glance James Hardie is a leading provider of exterior home and outdoor living solutions $5.3B FY25 REVENUE +11% 5-YEAR NORTH AMERICA REVENUE CAGR $1.4B FY25 ADJ. EBITDA 27.2% FY25 ADJ. EBITDA MARGIN Note: All financials and net sales breakdowns are based on the James Hardie 2025 fiscal year, are inclusive of AZEK Residential net sales and Adjusted EBITDA over the corresponding period, and exclude net sales and EBITDA associated with the exited James Hardie Philippines business. Breakdown percentages might not add up to 100% due to rounding. North America “NA” is reflective of the combined North America segments, Siding & Trim (S&T) and Deck, Rail & Accessories (DR&A). 81% 9% 9% Total Net Sales by Geography North America ANZ Europe NA Net Sales by Product Category Fiber Cement Exteriors NA Net Sales by End-Market 40% New Construction 60% Repair & Remodel PVC Exteriors Fiber Cement Interiors Deck, Rail & Accessories DR&A S&T DR&A S&T

5 Q2 FY26 EARNINGS PRESENTATION Organic Strategy Update Increasing Siding TAM Through Improved Installation Cost Leveraging ColorPlus® to Drive R&R Growth TimberTech® Organic Growth Strategy Statement Essentials The simplest ColorPlus® offering for a contractor to price, procure, and install, improving fiber cement affordability for homeowners Intuitive Edge & Trim-Over Improving installation efficiency and reducing costs though product, process, and technology innovation, such as the Trim-over Method Encouraging Early Results ~35% improvement in installer productivity ~50% reduction in the price gap vs. vinyl Note: Improvement in installer productivity is measured in mmsft per man hour. Reduction in price gap vs. vinyl assumes a standard ColorPlus® re-side (siding & trim) of a ~2,600 sq ft home in the Midwest/Northeast. Contractor Conversion Continued investment in contractor marketing with a focus in key R&R geographies Expanding Dealer Footprint Increase presence with independent dealers / lumber yards in the Northeast & Midwest Tangible Signs of Progress We have added nearly 1,300 contractors to our Alliance program so far in FY26 Single-family ColorPlus® volume has outgrown prime products in each of the last six quarters Material Conversion Converting wood and other inferior products Product Innovation Delivering the most beautiful and best performing products with industry leading warranties Multi-Channel Expansion Extending our reach across geographies, channels and markets Consumer Journey Providing consumers a best-in-class experience for all their outdoor living needs

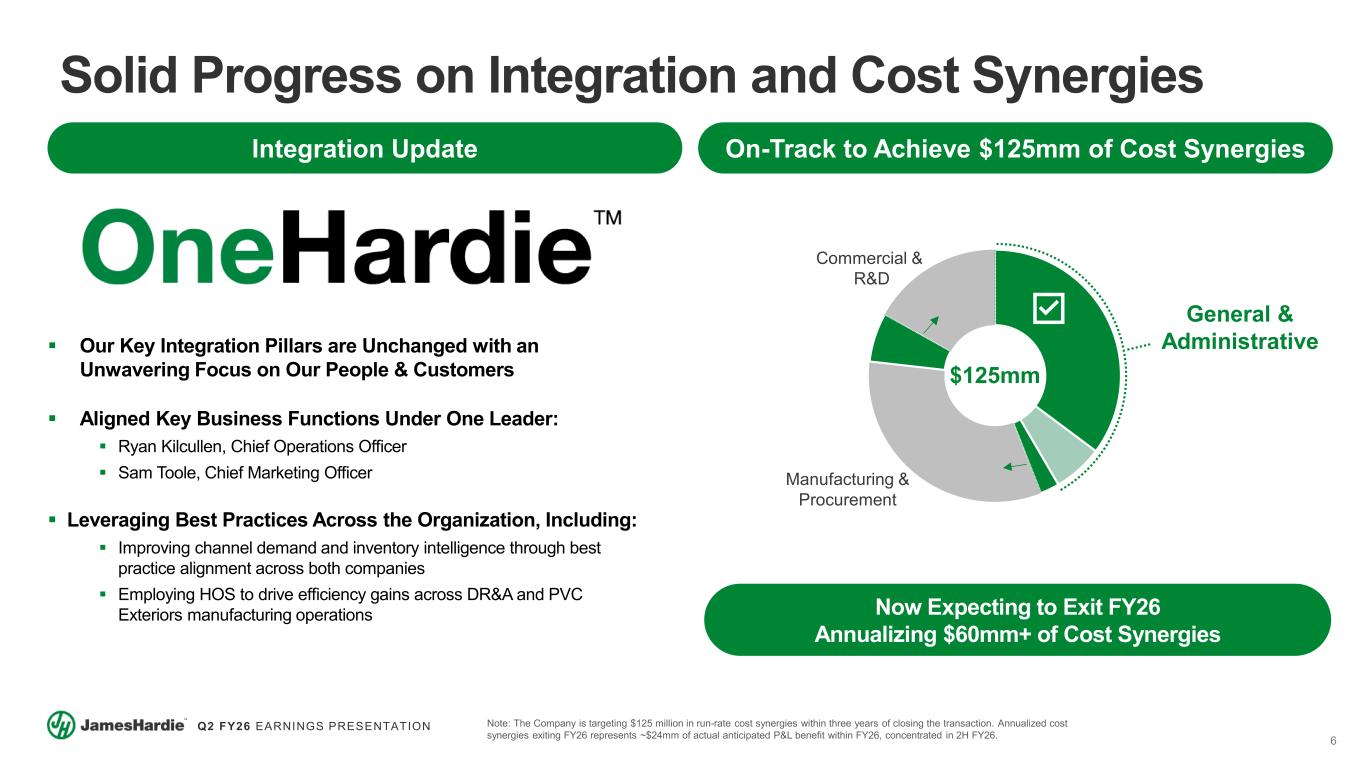

6 Q2 FY26 EARNINGS PRESENTATION Solid Progress on Integration and Cost Synergies On-Track to Achieve $125mm of Cost Synergies Now Expecting to Exit FY26 Annualizing $60mm+ of Cost Synergies Note: The Company is targeting $125 million in run-rate cost synergies within three years of closing the transaction. Annualized cost synergies exiting FY26 represents ~$24mm of actual anticipated P&L benefit within FY26, concentrated in 2H FY26. Manufacturing & Procurement Commercial & R&D General & Administrative $125mm Integration Update Our Key Integration Pillars are Unchanged with an Unwavering Focus on Our People & Customers Aligned Key Business Functions Under One Leader: Ryan Kilcullen, Chief Operations Officer Sam Toole, Chief Marketing Officer Leveraging Best Practices Across the Organization, Including: Improving channel demand and inventory intelligence through best practice alignment across both companies Employing HOS to drive efficiency gains across DR&A and PVC Exteriors manufacturing operations

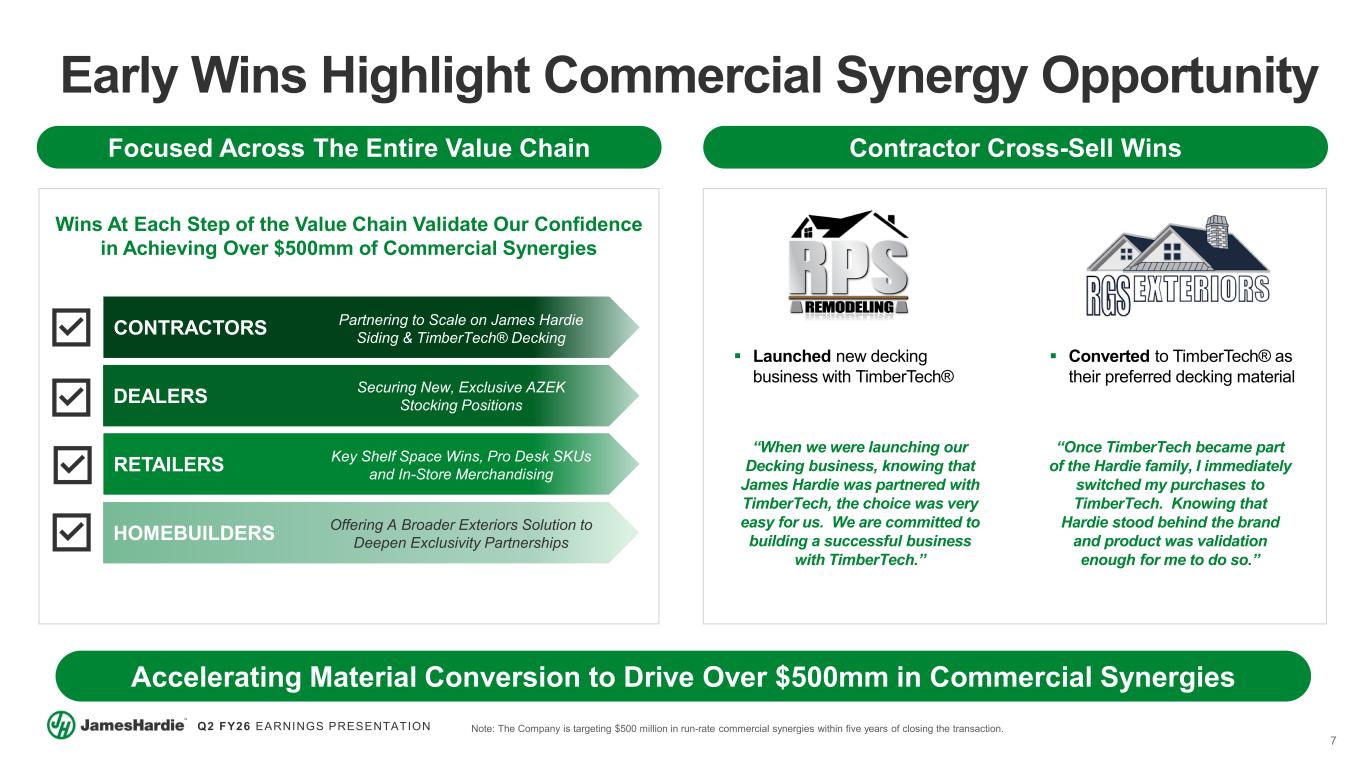

7 Q2 FY26 EARNINGS PRESENTATION Early Wins Highlight Commercial Synergy Opportunity Focused Across The Entire Value Chain Contractor Cross-Sell Wins Accelerating Material Conversion to Drive Over $500mm in Commercial Synergies Launched new decking business with TimberTech® Converted to TimberTech® as their preferred decking material Note: The Company is targeting $500 million in run-rate commercial synergies within five years of closing the transaction. “When we were launching our Decking business, knowing that James Hardie was partnered with TimberTech, the choice was very easy for us. We are committed to building a successful business with TimberTech.” “Once TimberTech became part of the Hardie family, I immediately switched my purchases to TimberTech. Knowing that Hardie stood behind the brand and product was validation enough for me to do so.” CONTRACTORS DEALERS RETAILERS HOMEBUILDERS Partnering to Scale on James Hardie Siding & TimberTech® Decking Securing New, Exclusive AZEK Stocking Positions Key Shelf Space Wins, Pro Desk SKUs and In-Store Merchandising Offering A Broader Exteriors Solution to Deepen Exclusivity Partnerships Wins At Each Step of the Value Chain Validate Our Confidence in Achieving Over $500mm of Commercial Synergies

8 Q2 FY26 EARNINGS PRESENTATION Q2 FY26 Financial Results Results Reflect Strong Contributions From The AZEK Acquisition Offsetting Market Softness in North America Net Sales $1,292mm +34% Adjusted EBITDA $330mm +25% Adjusted EBITDA Margin 25.5% (190bps) Adjusted Diluted EPS $0.26 (27%) YTD Free Cash Flow $58mm (58%) Note: Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Diluted EPS and Free Cash Flow are non-GAAP financial measures. Refer to Non-GAAP Financial Measures for reconciliation of to the most comparable GAAP financial measures.

9 Q2 FY26 EARNINGS PRESENTATION Organic Business Results Note: Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Refer to Non-GAAP Financial Measures for reconciliation of to the most comparable GAAP financial measures. Net Sales $345mm +5% Adjusted EBITDA $89mm +10% Adjusted EBITDA Margin 25.7% +100bps Net Sales $947mm (1%) Adjusted EBITDA $241mm (8%) Adjusted EBITDA Margin 25.4% (200bps)

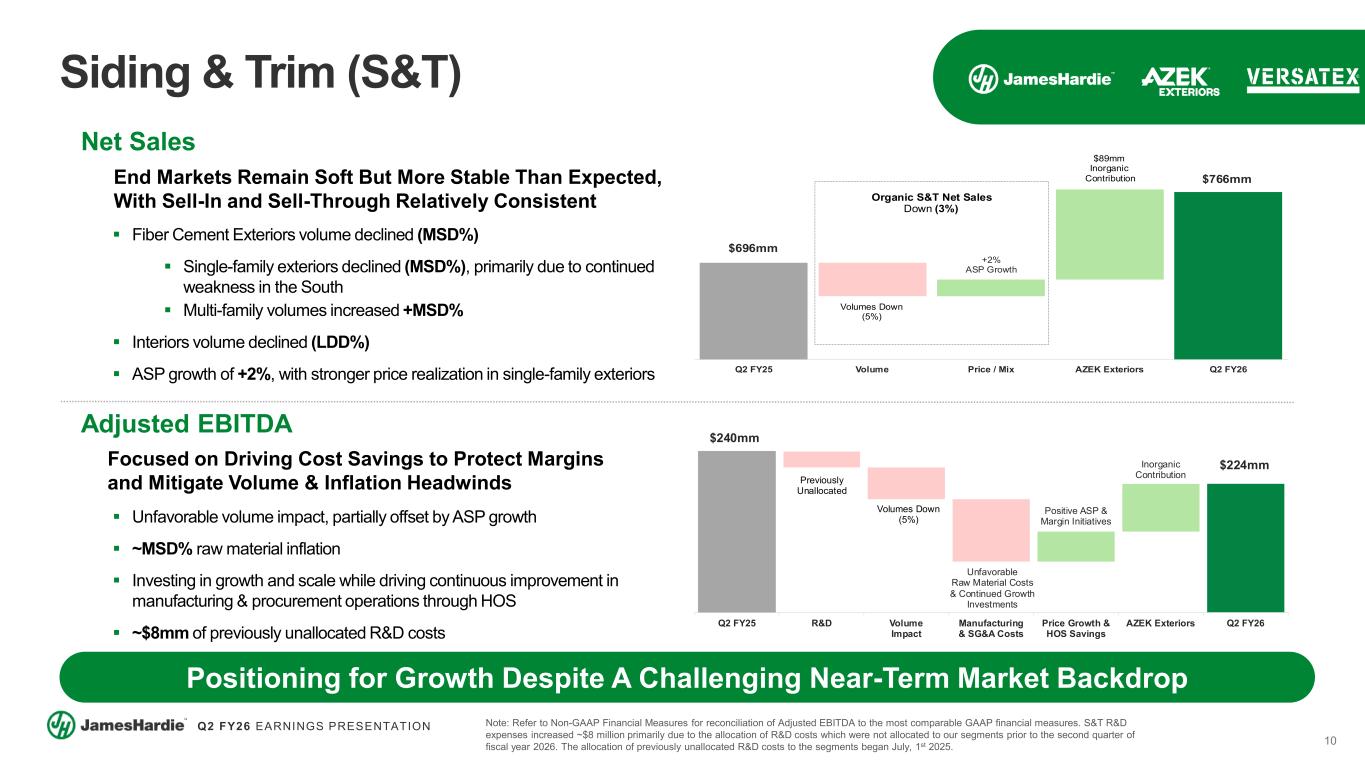

10 Q2 FY26 EARNINGS PRESENTATION $240mm $224mm Unfavorable Raw Material Costs & Continued Growth Investments Positive ASP & Margin Initiatives Inorganic Contribution Q2 FY25 R&D Volume Impact Manufacturing & SG&A Costs Price Growth & HOS Savings AZEK Exteriors Q2 FY26 Volumes Down (5%) Previously Unallocated Net Sales End Markets Remain Soft But More Stable Than Expected, With Sell-In and Sell-Through Relatively Consistent Fiber Cement Exteriors volume declined (MSD%) Single-family exteriors declined (MSD%), primarily due to continued weakness in the South Multi-family volumes increased +MSD% Interiors volume declined (LDD%) ASP growth of +2%, with stronger price realization in single-family exteriors $696mm $766mm +2% ASP Growth Q2 FY25 Volume Price / Mix AZEK Exteriors Q2 FY26 Volumes Down (5%) Organic S&T Net Sales Down (3%) $89mm Inorganic Contribution Siding & Trim (S&T) Positioning for Growth Despite A Challenging Near-Term Market Backdrop Adjusted EBITDA Focused on Driving Cost Savings to Protect Margins and Mitigate Volume & Inflation Headwinds Unfavorable volume impact, partially offset by ASP growth ~MSD% raw material inflation Investing in growth and scale while driving continuous improvement in manufacturing & procurement operations through HOS ~$8mm of previously unallocated R&D costs Note: Refer to Non-GAAP Financial Measures for reconciliation of Adjusted EBITDA to the most comparable GAAP financial measures. S&T R&D expenses increased ~$8 million primarily due to the allocation of R&D costs which were not allocated to our segments prior to the second quarter of fiscal year 2026. The allocation of previously unallocated R&D costs to the segments began July, 1st 2025.

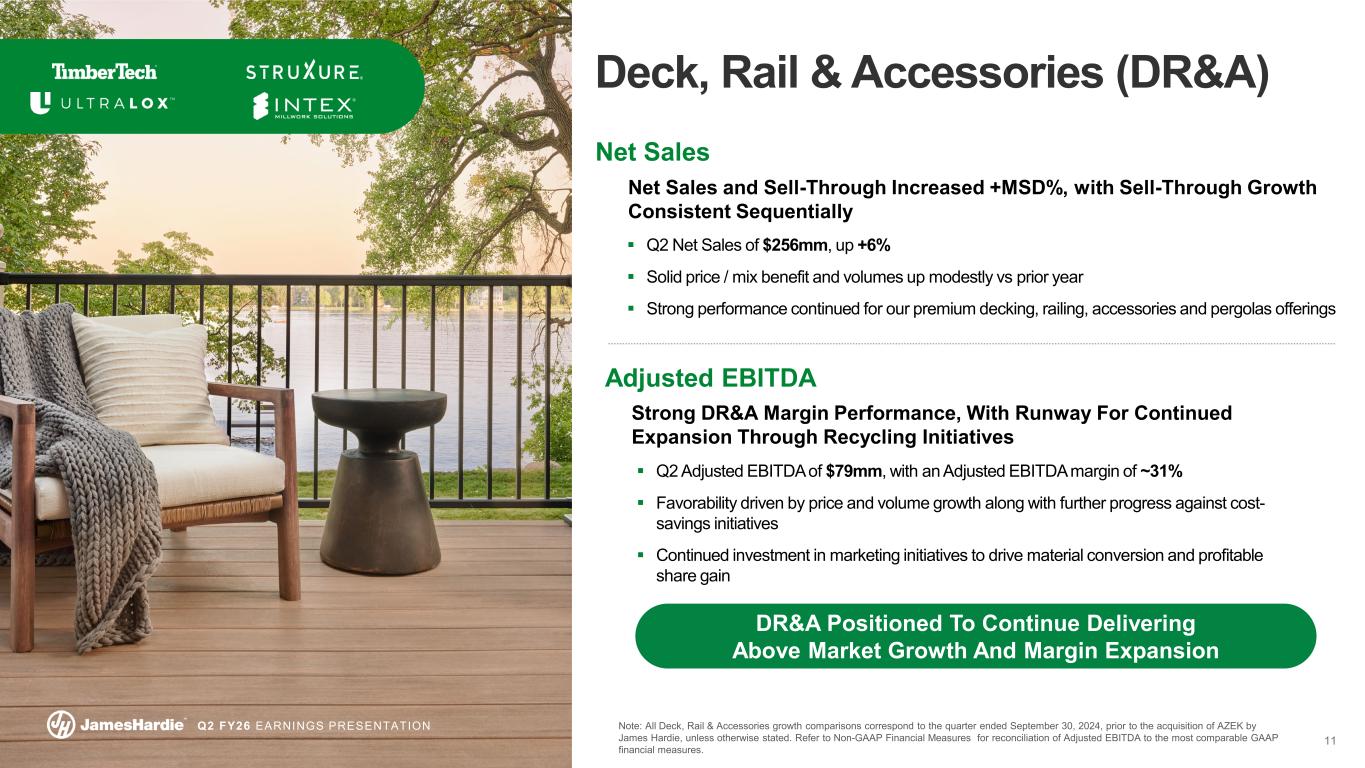

11 Q2 FY26 EARNINGS PRESENTATION Net Sales Net Sales and Sell-Through Increased +MSD%, with Sell-Through Growth Consistent Sequentially Q2 Net Sales of $256mm, up +6% Solid price / mix benefit and volumes up modestly vs prior year Strong performance continued for our premium decking, railing, accessories and pergolas offerings Deck, Rail & Accessories (DR&A) DR&A Positioned To Continue Delivering Above Market Growth And Margin Expansion Adjusted EBITDA Strong DR&A Margin Performance, With Runway For Continued Expansion Through Recycling Initiatives Q2 Adjusted EBITDA of $79mm, with an Adjusted EBITDA margin of ~31% Favorability driven by price and volume growth along with further progress against cost- savings initiatives Continued investment in marketing initiatives to drive material conversion and profitable share gain Note: All Deck, Rail & Accessories growth comparisons correspond to the quarter ended September 30, 2024, prior to the acquisition of AZEK by James Hardie, unless otherwise stated. Refer to Non-GAAP Financial Measures for reconciliation of Adjusted EBITDA to the most comparable GAAP financial measures.

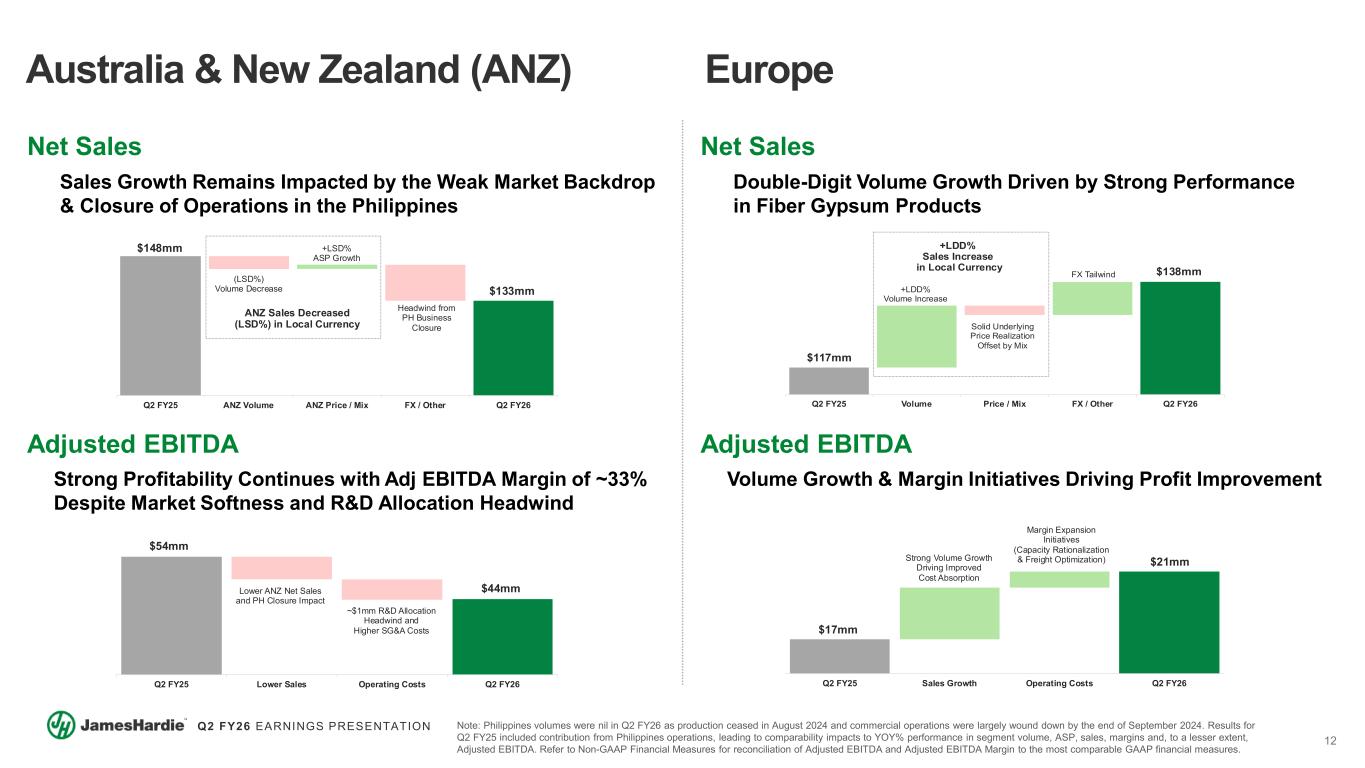

12 Q2 FY26 EARNINGS PRESENTATION $148mm ANZ Sales Decreased (LSD%) in Local Currency $133mm (LSD%) Volume Decrease +LSD% ASP Growth Headwind from PH Business Closure Q2 FY25 ANZ Volume ANZ Price / Mix FX / Other Q2 FY26 $117mm +LDD% Sales Increase in Local Currency $138mm +LDD% Volume Increase Solid Underlying Price Realization Offset by Mix FX Tailwind Q2 FY25 Volume Price / Mix FX / Other Q2 FY26 $17mm $21mmStrong Volume Growth Driving Improved Cost Absorption Margin Expansion Initiatives (Capacity Rationalization & Freight Optimization) Q2 FY25 Sales Growth Operating Costs Q2 FY26 $54mm $44mmLower ANZ Net Sales and PH Closure Impact ~$1mm R&D Allocation Headwind and Higher SG&A Costs Q2 FY25 Lower Sales Operating Costs Q2 FY26 Australia & New Zealand (ANZ) Europe Net Sales Sales Growth Remains Impacted by the Weak Market Backdrop & Closure of Operations in the Philippines Adjusted EBITDA Strong Profitability Continues with Adj EBITDA Margin of ~33% Despite Market Softness and R&D Allocation Headwind Net Sales Double-Digit Volume Growth Driven by Strong Performance in Fiber Gypsum Products Adjusted EBITDA Volume Growth & Margin Initiatives Driving Profit Improvement Note: Philippines volumes were nil in Q2 FY26 as production ceased in August 2024 and commercial operations were largely wound down by the end of September 2024. Results for Q2 FY25 included contribution from Philippines operations, leading to comparability impacts to YOY% performance in segment volume, ASP, sales, margins and, to a lesser extent, Adjusted EBITDA. Refer to Non-GAAP Financial Measures for reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the most comparable GAAP financial measures.

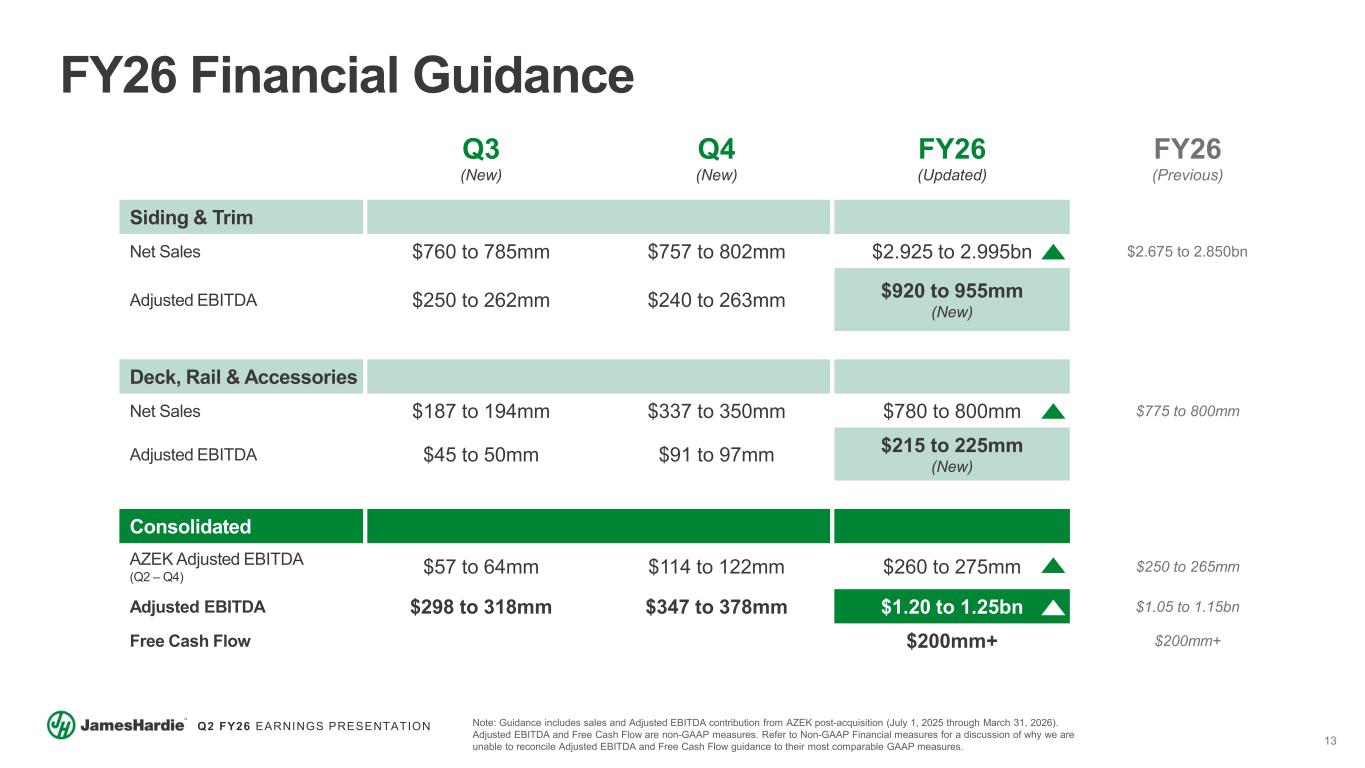

13 Q2 FY26 EARNINGS PRESENTATION FY26 Financial Guidance Note: Guidance includes sales and Adjusted EBITDA contribution from AZEK post-acquisition (July 1, 2025 through March 31, 2026). Adjusted EBITDA and Free Cash Flow are non-GAAP measures. Refer to Non-GAAP Financial measures for a discussion of why we are unable to reconcile Adjusted EBITDA and Free Cash Flow guidance to their most comparable GAAP measures. Q3 (New) Q4 (New) FY26 (Updated) FY26 (Previous) Deck, Rail & Accessories Net Sales $187 to 194mm $337 to 350mm $780 to 800mm $775 to 800mm Adjusted EBITDA $45 to 50mm $91 to 97mm $215 to 225mm (New) Consolidated AZEK Adjusted EBITDA (Q2 – Q4) $57 to 64mm $114 to 122mm $260 to 275mm $250 to 265mm Adjusted EBITDA $298 to 318mm $347 to 378mm $1.20 to 1.25bn $1.05 to 1.15bn Free Cash Flow $200mm+ $200mm+ Siding & Trim Net Sales $760 to 785mm $757 to 802mm $2.925 to 2.995bn $2.675 to 2.850bn Adjusted EBITDA $250 to 262mm $240 to 263mm $920 to 955mm (New)

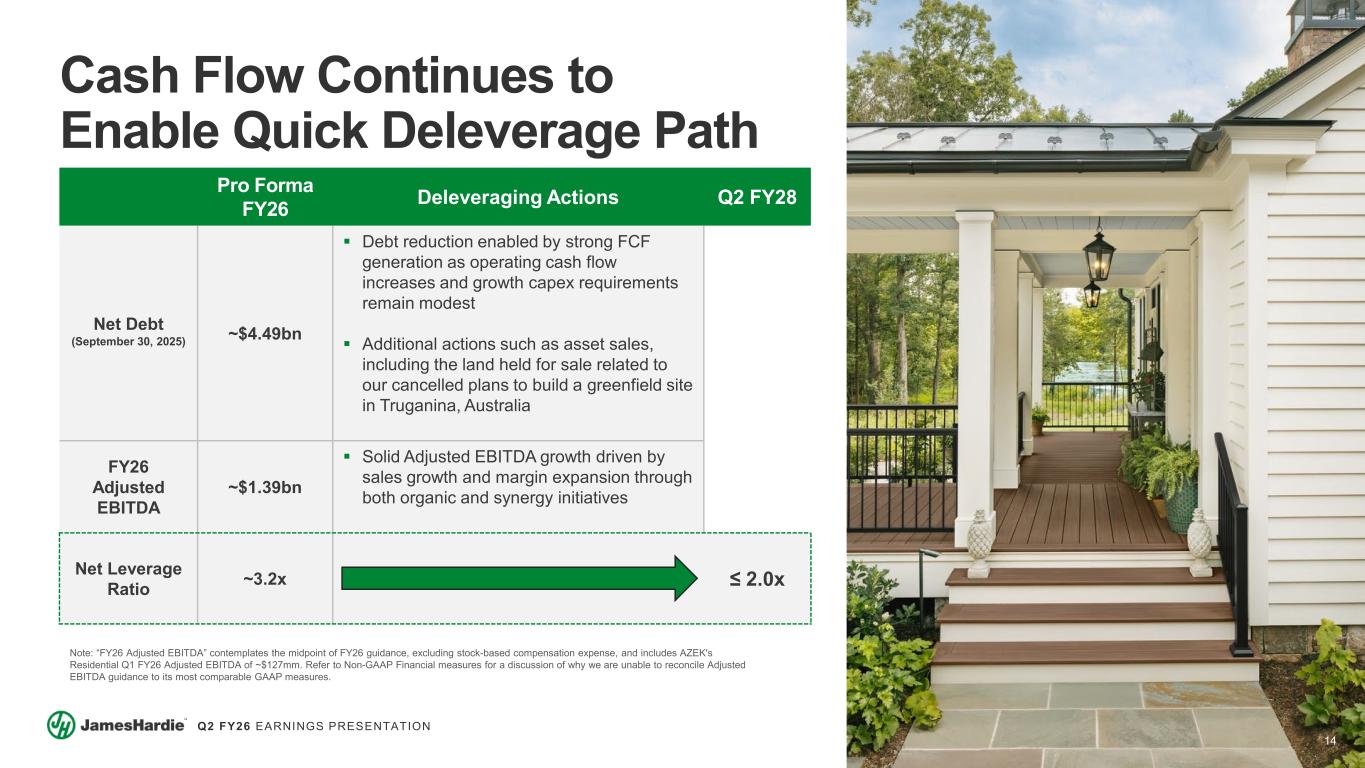

14 Q2 FY26 EARNINGS PRESENTATION Cash Flow Continues to Enable Quick Deleverage Path Pro Forma FY26 Deleveraging Actions Q2 FY28 Net Debt (September 30, 2025) ~$4.49bn Debt reduction enabled by strong FCF generation as operating cash flow increases and growth capex requirements remain modest Additional actions such as asset sales, including the land held for sale related to our cancelled plans to build a greenfield site in Truganina, Australia FY26 Adjusted EBITDA ~$1.39bn Solid Adjusted EBITDA growth driven by sales growth and margin expansion through both organic and synergy initiatives Net Leverage Ratio ~3.2x ≤ 2.0x Note: “FY26 Adjusted EBITDA” contemplates the midpoint of FY26 guidance, excluding stock-based compensation expense, and includes AZEK's Residential Q1 FY26 Adjusted EBITDA of ~$127mm. Refer to Non-GAAP Financial measures for a discussion of why we are unable to reconcile Adjusted EBITDA guidance to its most comparable GAAP measures.

15 Q2 FY26 EARNINGS PRESENTATION A Leader in Exterior Home & Outdoor Living Solutions A Product Portfolio Consisting of Best-in-Class Brands Across Attractive Categories A Winning Strategy to Drive Profitable Growth in R&R and New Construction The Right Team to Enable Our Growth, Innovation and Continuous Improvement Plans Globally A Robust Financial Profile and Synergy Opportunity Driving Shareholder Value Creation

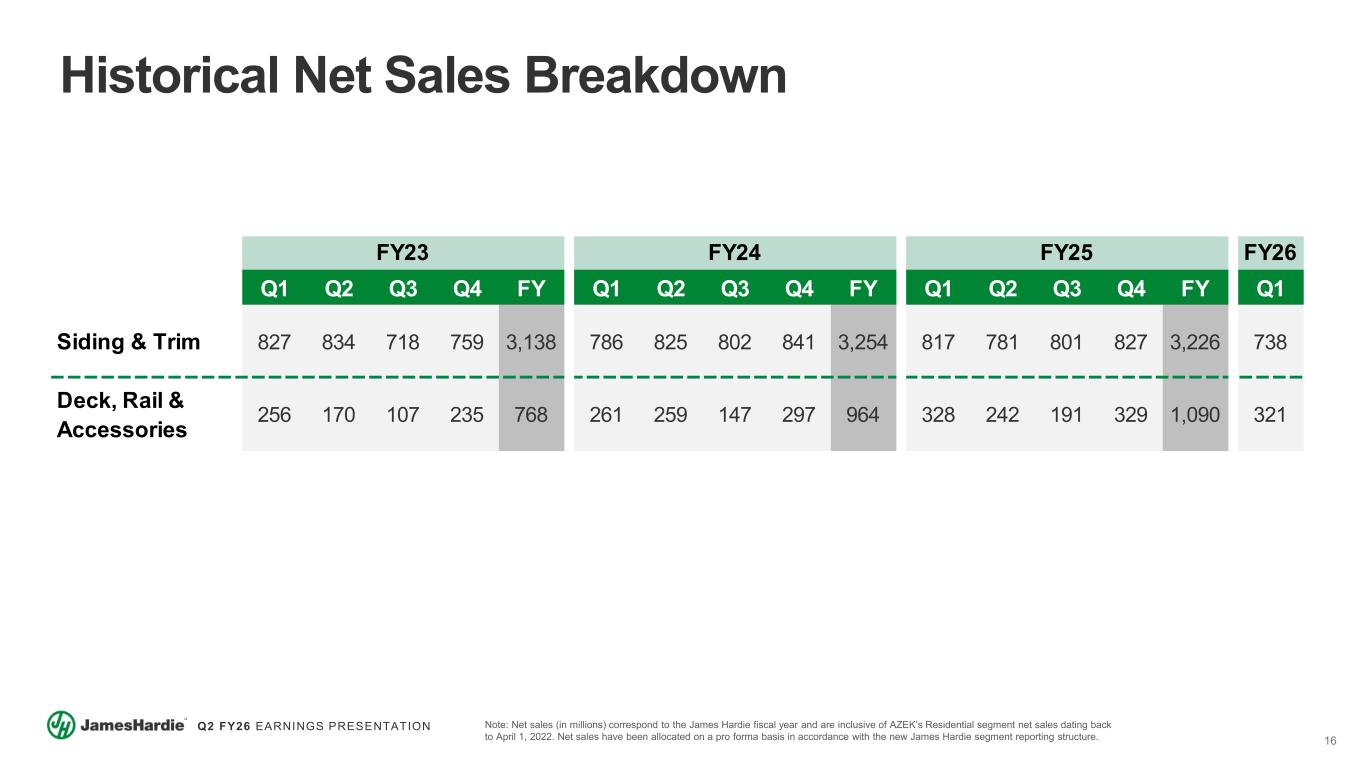

16 Q2 FY26 EARNINGS PRESENTATION Historical Net Sales Breakdown Note: Net sales (in millions) correspond to the James Hardie fiscal year and are inclusive of AZEK’s Residential segment net sales dating back to April 1, 2022. Net sales have been allocated on a pro forma basis in accordance with the new James Hardie segment reporting structure. Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Siding & Trim 827 834 718 759 3,138 786 825 802 841 3,254 817 781 801 827 3,226 738 Deck, Rail & Accessories 256 170 107 235 768 261 259 147 297 964 328 242 191 329 1,090 321 FY23 FY26FY24 FY25

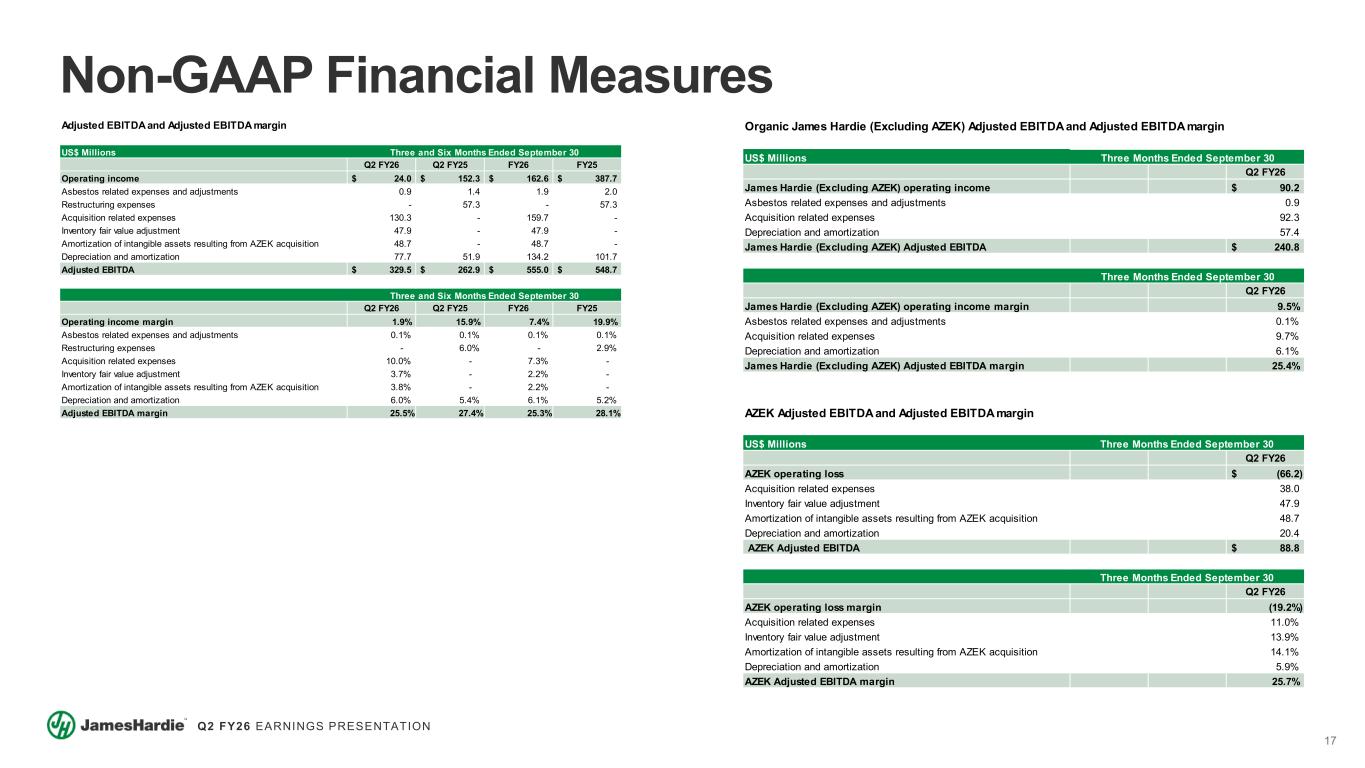

17 Q2 FY26 EARNINGS PRESENTATION US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Operating income 24.0$ 152.3$ 162.6$ 387.7$ Asbestos related expenses and adjustments 0.9 1.4 1.9 2.0 Restructuring expenses - 57.3 - 57.3 Acquisition related expenses 130.3 - 159.7 - Inventory fair value adjustment 47.9 - 47.9 - Amortization of intangible assets resulting from AZEK acquisition 48.7 - 48.7 - Depreciation and amortization 77.7 51.9 134.2 101.7 Adjusted EBITDA 329.5$ 262.9$ 555.0$ 548.7$ Q2 FY26 Q2 FY25 FY26 FY25 Operating income margin 1.9% 15.9% 7.4% 19.9% Asbestos related expenses and adjustments 0.1% 0.1% 0.1% 0.1% Restructuring expenses - 6.0% - 2.9% Acquisition related expenses 10.0% - 7.3% - Inventory fair value adjustment 3.7% - 2.2% - Amortization of intangible assets resulting from AZEK acquisition 3.8% - 2.2% - Depreciation and amortization 6.0% 5.4% 6.1% 5.2% Adjusted EBITDA margin 25.5% 27.4% 25.3% 28.1% Adjusted EBITDA and Adjusted EBITDA margin Three and Six Months Ended September 30 Three and Six Months Ended September 30 Non-GAAP Financial Measures US$ Millions Q2 FY26 James Hardie (Excluding AZEK) operating income 90.2$ Asbestos related expenses and adjustments 0.9 Acquisition related expenses 92.3 Depreciation and amortization 57.4 James Hardie (Excluding AZEK) Adjusted EBITDA 240.8$ Q2 FY26 James Hardie (Excluding AZEK) operating income margin 9.5% Asbestos related expenses and adjustments 0.1% Acquisition related expenses 9.7% Depreciation and amortization 6.1% James Hardie (Excluding AZEK) Adjusted EBITDA margin 25.4% Three Months Ended September 30 Organic James Hardie (Excluding AZEK) Adjusted EBITDA and Adjusted EBITDA margin Three Months Ended September 30 US$ Millions Q2 FY26 AZEK operating loss (66.2)$ Acquisition related expenses 38.0 Inventory fair value adjustment 47.9 Amortization of intangible assets resulting from AZEK acquisition 48.7 Depreciation and amortization 20.4 AZEK Adjusted EBITDA 88.8$ Q2 FY26 AZEK operating loss margin (19.2%) Acquisition related expenses 11.0% Inventory fair value adjustment 13.9% Amortization of intangible assets resulting from AZEK acquisition 14.1% Depreciation and amortization 5.9% AZEK Adjusted EBITDA margin 25.7% Three Months Ended September 30 Three Months Ended September 30 AZEK Adjusted EBITDA and Adjusted EBITDA margin

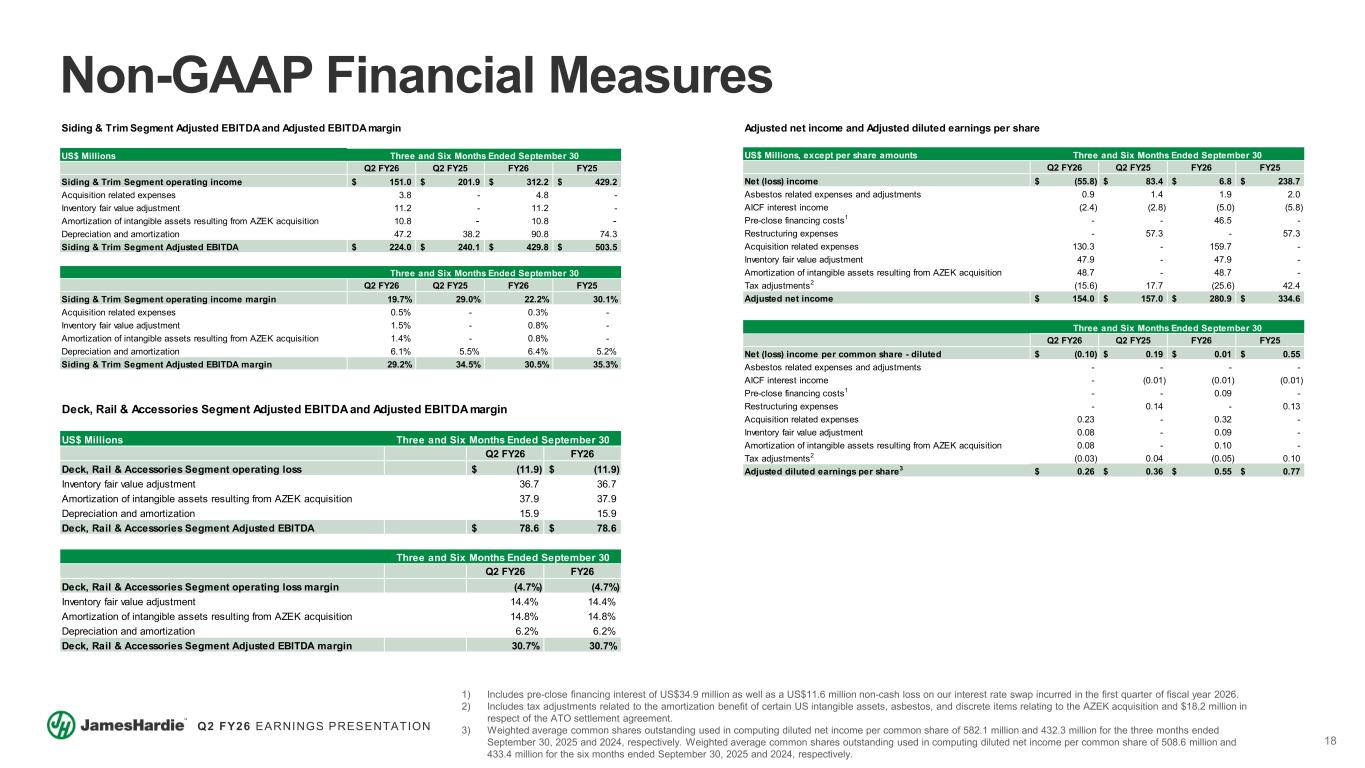

18 Q2 FY26 EARNINGS PRESENTATION US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Siding & Trim Segment operating income 151.0$ 201.9$ 312.2$ 429.2$ Acquisition related expenses 3.8 - 4.8 - Inventory fair value adjustment 11.2 - 11.2 - Amortization of intangible assets resulting from AZEK acquisition 10.8 - 10.8 - Depreciation and amortization 47.2 38.2 90.8 74.3 Siding & Trim Segment Adjusted EBITDA 224.0$ 240.1$ 429.8$ 503.5$ Q2 FY26 Q2 FY25 FY26 FY25 Siding & Trim Segment operating income margin 19.7% 29.0% 22.2% 30.1% Acquisition related expenses 0.5% - 0.3% - Inventory fair value adjustment 1.5% - 0.8% - Amortization of intangible assets resulting from AZEK acquisition 1.4% - 0.8% - Depreciation and amortization 6.1% 5.5% 6.4% 5.2% Siding & Trim Segment Adjusted EBITDA margin 29.2% 34.5% 30.5% 35.3% Three and Six Months Ended September 30 Siding & Trim Segment Adjusted EBITDA and Adjusted EBITDA margin Three and Six Months Ended September 30 Adjusted net income and Adjusted diluted earnings per share US$ Millions, except per share amounts Q2 FY26 Q2 FY25 FY26 FY25 Net (loss) income (55.8)$ 83.4$ 6.8$ 238.7$ Asbestos related expenses and adjustments 0.9 1.4 1.9 2.0 AICF interest income (2.4) (2.8) (5.0) (5.8) Pre-close financing costs1 - - 46.5 - Restructuring expenses - 57.3 - 57.3 Acquisition related expenses 130.3 - 159.7 - Inventory fair value adjustment 47.9 - 47.9 - Amortization of intangible assets resulting from AZEK acquisition 48.7 - 48.7 - Tax adjustments2 (15.6) 17.7 (25.6) 42.4 Adjusted net income 154.0$ 157.0$ 280.9$ 334.6$ Q2 FY26 Q2 FY25 FY26 FY25 Net (loss) income per common share - diluted (0.10)$ 0.19$ 0.01$ 0.55$ Asbestos related expenses and adjustments - - - - AICF interest income - (0.01) (0.01) (0.01) Pre-close financing costs1 - - 0.09 - Restructuring expenses - 0.14 - 0.13 Acquisition related expenses 0.23 - 0.32 - Inventory fair value adjustment 0.08 - 0.09 - Amortization of intangible assets resulting from AZEK acquisition 0.08 - 0.10 - Tax adjustments2 (0.03) 0.04 (0.05) 0.10 Adjusted diluted earnings per share3 0.26$ 0.36$ 0.55$ 0.77$ Three and Six Months Ended September 30 Three and Six Months Ended September 30 Non-GAAP Financial Measures 1) Includes pre-close financing interest of US$34.9 million as well as a US$11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026. 2) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition and $18.2 million in respect of the ATO settlement agreement. 3) Weighted average common shares outstanding used in computing diluted net income per common share of 582.1 million and 432.3 million for the three months ended September 30, 2025 and 2024, respectively. Weighted average common shares outstanding used in computing diluted net income per common share of 508.6 million and 433.4 million for the six months ended September 30, 2025 and 2024, respectively. US$ Millions Q2 FY26 FY26 Deck, Rail & Accessories Segment operating loss (11.9)$ (11.9)$ Inventory fair value adjustment 36.7 36.7 Amortization of intangible assets resulting from AZEK acquisition 37.9 37.9 Depreciation and amortization 15.9 15.9 Deck, Rail & Accessories Segment Adjusted EBITDA 78.6$ 78.6$ Q2 FY26 FY26 Deck, Rail & Accessories Segment operating loss margin (4.7%) (4.7%) Inventory fair value adjustment 14.4% 14.4% Amortization of intangible assets resulting from AZEK acquisition 14.8% 14.8% Depreciation and amortization 6.2% 6.2% Deck, Rail & Accessories Segment Adjusted EBITDA margin 30.7% 30.7% Three and Six Months Ended September 30 Three and Six Months Ended September 30 Deck, Rail & Accessories Segment Adjusted EBITDA and Adjusted EBITDA margin

19 Q2 FY26 EARNINGS PRESENTATION US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 (Loss) Income before income taxes (40.0)$ 150.4$ 49.7$ 384.3$ Asbestos related expenses and adjustments 0.9 1.4 1.9 2.0 AICF interest income (2.4) (2.8) (5.0) (5.8) Pre-close financing costs1 - - 46.5 - Restructuring expenses - 57.3 - 57.3 Acquisition related expenses 130.3 - 159.7 - Inventory fair value adjustment 47.9 - 47.9 - Amortization of intangible assets resulting from AZEK acquisition 48.7 - 48.7 - Adjusted income before income taxes 185.4$ 206.3$ 349.4$ 437.8$ Income tax expense 15.8$ 67.0$ 42.9$ 145.6$ Tax adjustments2 15.6 (17.7) 25.6 (42.4) Adjusted income tax expense 31.4$ 49.3$ 68.5$ 103.2$ Effective tax rate (39.5%) 44.5% 86.3% 37.9% Adjusted effective tax rate 16.9% 23.9% 19.6% 23.6% Three and Six Months Ended September 30 Adjusted income before income taxes, Adjusted income tax expense and Adjusted effective tax rate US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 General Corporate and Unallocated R&D costs 166.8$ 50.5$ 242.3$ 95.8$ Acquisition related expenses (126.5) - (154.9) - Asbestos related expenses and adjustments (0.9) (1.4) (1.9) (2.0) Adjusted General Corporate and Unallocated R&D costs 39.4$ 49.1$ 85.5$ 93.8$ Three and Six Months Ended September 30 Adjusted General Corporate and Unallocated R&D costs US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Europe Segment operating income 13.7$ 8.9$ 28.8$ 21.1$ Depreciation and amortization 7.3 8.1 14.1 15.6 Europe Segment EBITDA 21.0$ 17.0$ 42.9$ 36.7$ Q2 FY26 Q2 FY25 FY26 FY25 Europe Segment operating income margin 10.0% 7.5% 10.5% 8.6% Depreciation and amortization 5.3% 7.0% 5.2% 6.4% Europe Segment EBITDA margin 15.3% 14.5% 15.7% 15.0% Europe Segment EBITDA and EBITDA margin Three and Six Months Ended September 30 Three and Six Months Ended September 30 US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Australia & New Zealand Segment operating income (loss) 38.0$ (8.0)$ 75.8$ 33.2$ Restructuring expenses - 57.3 - 57.3 Depreciation and amortization 5.5 4.7 10.7 9.5 Australia & New Zealand Segment Adjusted EBITDA 43.5$ 54.0$ 86.5$ 100.0$ Q2 FY26 Q2 FY25 FY26 FY25 Australia & New Zealand Segment operating income (loss) margin 28.6% (5.0%) 29.8% 12.1% Restructuring expenses - 38.3% - 19.8% Depreciation and amortization 4.1% 3.2% 4.2% 3.4% Australia & New Zealand Segment Adjusted EBITDA margin 32.7% 36.5% 34.0% 35.3% Australia & New Zealand Segment Adjusted EBITDA and Adjusted EBITDA margin Three and Six Months Ended September 30 Three and Six Months Ended September 30 Non-GAAP Financial Measures 1) Includes pre-close financing interest of US$34.9 million as well as a US$11.6 million non-cash loss on our interest rate swap incurred in the first quarter of fiscal year 2026. 2) Includes tax adjustments related to the amortization benefit of certain US intangible assets, asbestos, and discrete items relating to the AZEK acquisition and $18.2 million in respect of the ATO settlement agreement.

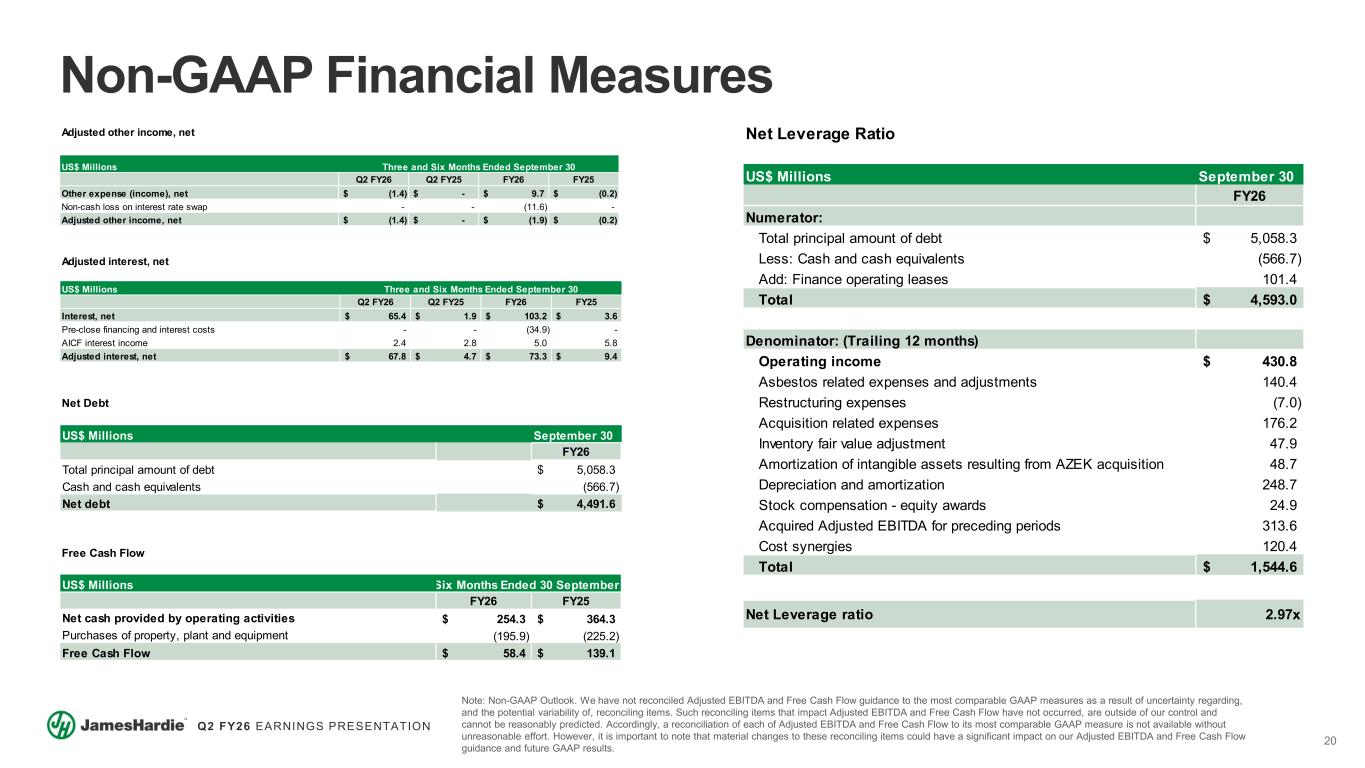

20 Q2 FY26 EARNINGS PRESENTATION US$ Millions FY26 FY25 Net cash provided by operating activities 254.3$ 364.3$ Purchases of property, plant and equipment (195.9) (225.2) Free Cash Flow 58.4$ 139.1$ Six Months Ended 30 September US$ Millions September 30 FY26 Total principal amount of debt 5,058.3$ Cash and cash equivalents (566.7) Net debt 4,491.6$ Net Leverage Ratio US$ Millions September 30 FY26 Numerator: Total principal amount of debt 5,058.3$ Less: Cash and cash equivalents (566.7) Add: Finance operating leases 101.4 Total 4,593.0$ Denominator: (Trailing 12 months) Operating income 430.8$ Asbestos related expenses and adjustments 140.4 Restructuring expenses (7.0) Acquisition related expenses 176.2 Inventory fair value adjustment 47.9 Amortization of intangible assets resulting from AZEK acquisition 48.7 Depreciation and amortization 248.7 Stock compensation - equity awards 24.9 Acquired Adjusted EBITDA for preceding periods 313.6 Cost synergies 120.4 Total 1,544.6$ Net Leverage ratio 2.97x Non-GAAP Financial Measures Note: Non-GAAP Outlook. We have not reconciled Adjusted EBITDA and Free Cash Flow guidance to the most comparable GAAP measures as a result of uncertainty regarding, and the potential variability of, reconciling items. Such reconciling items that impact Adjusted EBITDA and Free Cash Flow have not occurred, are outside of our control and cannot be reasonably predicted. Accordingly, a reconciliation of each of Adjusted EBITDA and Free Cash Flow to its most comparable GAAP measure is not available without unreasonable effort. However, it is important to note that material changes to these reconciling items could have a significant impact on our Adjusted EBITDA and Free Cash Flow guidance and future GAAP results. US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Other expense (income), net (1.4)$ -$ 9.7$ (0.2)$ Non-cash loss on interest rate swap - - (11.6) - Adjusted other income, net (1.4)$ -$ (1.9)$ (0.2)$ Adjusted other income, net Three and Six Months Ended September 30 US$ Millions Q2 FY26 Q2 FY25 FY26 FY25 Interest, net 65.4$ 1.9$ 103.2$ 3.6$ Pre-close financing and interest costs - - (34.9) - AICF interest income 2.4 2.8 5.0 5.8 Adjusted interest, net 67.8$ 4.7$ 73.3$ 9.4$ Adjusted interest, net Three and Six Months Ended September 30 Net Debt Free Cash Flow

21 Q2 FY26 EARNINGS PRESENTATION Definitions AICF – Asbestos Injuries Compensation Fund Ltd ANZ – Australia and New Zealand ASP – Average net sales price ("ASP") – Total net sales of fiber cement and fiber gypsum products, excluding siding accessory sales, and Deck, Rail & Accessories net sales divided by the total volume of products sold. DR&A – Deck, Rail & Accessories Free Cash Flow – Free Cash Flow (“FCF"), unless otherwise noted, is defined as net cash provided by operating activities less purchases of property, plant and equipment net of proceeds from the sale of property, plant and equipment. HOS – Hardie Operating System MMSF – Million standard feet, where a standard foot is defined as a square foot of 5/16” thickness NA – North America R&R – Repair & Remodel S&T – Siding & Trim TAM – Total Addressable Market LSD – Low Single-Digits MSD – Mid-Single Digits HSD – High Single-Digits DD – Double-Digits LDD – Low Double-Digits