Exhibit 99.1

ColorPlus Supply Chain Ryan Sullivan

DISCLAIMER

This SEC, Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. James in offering Hardie circulars, may from invitation time to memoranda time make forward-looking and prospectuses, statements in media in releases its periodic and reports other written filed with materials or furnished and in to oral the statements are not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, institutional statements investors, are statements existing made and potential pursuant lenders, to the Safe representatives Harbor Provisions of the media of the and Private others. Securities Statements Litigation that Reform Act of 1995. Examples of forward-looking statements include: statements about the company’s future performance; projections of the company’s results of operations or financial condition; statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products; expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants; expectations that the company’s credit facilities will be extended or renewed; expectations concerning dividend payments and share buy-back; statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges; statements regarding tax liabilities and related audits, reviews and proceedings; statements Commission as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments asbestos-related expectations about personal the timing injury and and amount death claims; of contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian expectations concerning indemnification obligations; statements about product or environmental liabilities; and availability statements of about mortgages economic and conditions, other financing, such mortgage as economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the levels unemployment of foreclosures levels, and changes home resales, or stability currency in housing exchange values, rates the and consumer confidence.

Words are intended such as to identify “believe,” forward-looking “anticipate,” “plan,” statements “expect,” but are “intend,” not the “target,” exclusive “estimate,” means of “project,” identifying “predict,” such statements. “forecast,” “guideline,” Readers are “aim,” cautioned “will,” not “should,” to place “likely,” undue “continue” reliance on and these similar forward-looking expressions statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. conditions, Forward-looking they, by statements their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and assumptions are unforeseeable and because and beyond forward-looking the company’s statements control. address Such known future and results, unknown events risks, and uncertainties projected or implied and other by these factors forward-looking may cause actual statements. results, These performance factors, or some other of achievements which are discussed to differ under materially “Risk Factors” from the in anticipated Section 3 results, of the Form performance 20-F filed or with achievements the US Securities expressed, and Exchange James Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to are the not AICF, limited any to: shortfall all matters in the relating AICF to and or the arising effect out of of currency the prior exchange manufacture rate of movements products that on contained the amount asbestos recorded by current in the and company’s former which financial the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or to defects; the AICF; exposure compliance to environmental, with and changes asbestos in tax or laws other and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in supply customer’s and inability cost of to raw pay; materials; compliance possible with and increases changes in in competition environmental and and the potential health and that safety competitors laws; risks could of conducting copy the company’s business internationally; products; reliance compliance on a small with and number changes of customers; in laws and a governance regulations; and the potential effect of tax the benefits; transfer currency of the company’s exchange corporate risks; dependence domicile on from customer The Netherlands preference to and Ireland the concentration to become an of the Irish company’s SE including customer employee base on relations, large format changes retail in customers, corporate distributors facilities on terms and dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and business the effect segments; of adverse changes changes in the in company’s climate or weather key management patterns; personnel; possible inability inherent to limitations renew credit on internal company controls; cautions use you of that accounting the foregoing estimates; list and of factors all other is risks not exhaustive identified in and the that company’s other risks reports and filed uncertainties with Australian, may cause Irish and actual US securities results to agencies differ materially and exchanges from those (as in appropriate) forward-looking . The statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and 2 conditions.

| 2 |

|

AGENDA

Why Supply Chain is critical to James Hardie

Past to current day Supply Chain

Supply Chain Strategy and Systems

Execution Update

Go Forward

| 3 |

|

Why Supply Chain is critical to James Hardie

SUPPLY CHAIN BARRIERS – NEW PRODUCT GROWTH

Barriers limit pace of new James Hardie products adoption

Catch-22: channel won’t get behind new products without builder demand; builders reluctant without strong channel support

Higher channel margins—partly to cover inventory costs, partly because new products are considered a specialty item

Transition from old product generations to new generation causes disruption in the channel

SKU range growth in prime and color create channel inefficiency

| 5 |

|

SUPPLY CHAIN BARRIERS – COLORPLUS GROWTH

Supply Chain Barriers limit growth of ColorPlus

Job site waste due to standard supply chain minimum order amounts: can’t return excess or use it on next job as with primed product

Very long lead times for non-stocked orders due to order requirements

Limited access: only readily available in a small minority of dealers in some key markets with scale (direct trucks)

Order requirements limit ability for many channel partners to participate cost effectively (full truck)

| 6 |

|

SUPPLY CHAIN BARRIERS – MARKET STRATEGY

??James Hardie market strategies are requiring advanced Supply Chains to deliver on customer value proposition and gain access

??Cemplank Strategy??Short lead-time

??Less than Truck Load (LTL)

??Multifamily Strategy??Direct to job site ??Short lead-time

??Less than Truck Load (LTL)

??Commercial – Direct to job site bundle

??Increased service requirements of key accounts 7

| 7 |

|

SUPPLY CHAIN BARRIERS – OPPORTUNITY

Overcoming these Supply Chain Barriers enables

Market share growth

Category share growth

Increased trim and accessory attachment

Increased ColorPlus adoption

Faster new product adoption

More aligned channel partners

| 8 |

|

Past to Current Day Supply Chain

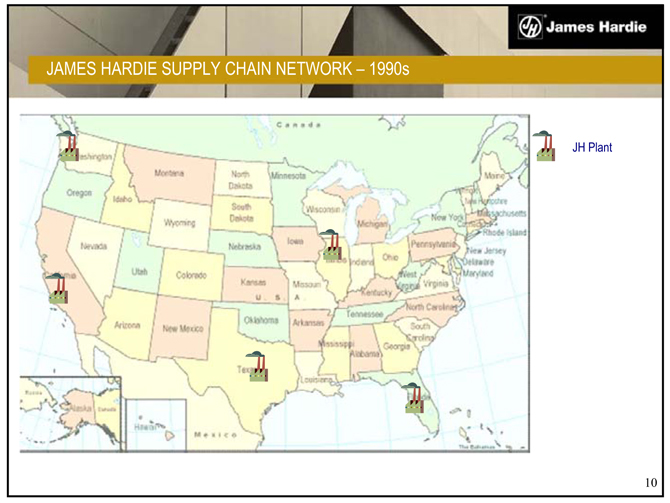

JAMES HARDIE SUPPLY CHAIN NETWORK – 1990s

10

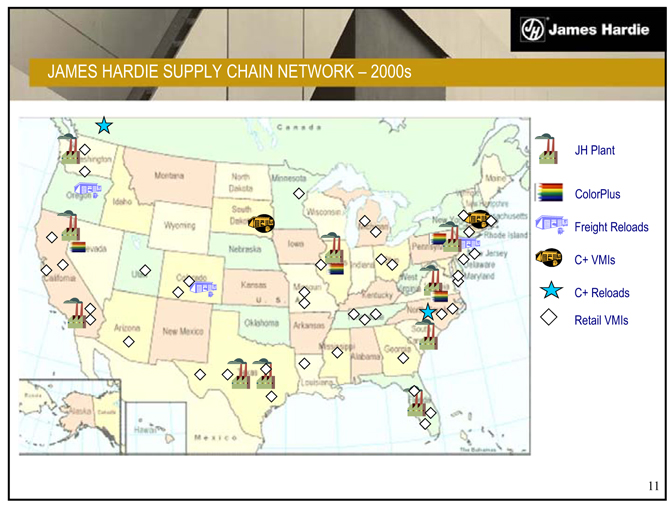

JAMES HARDIE SUPPLY CHAIN NETWORK – 2000s

11

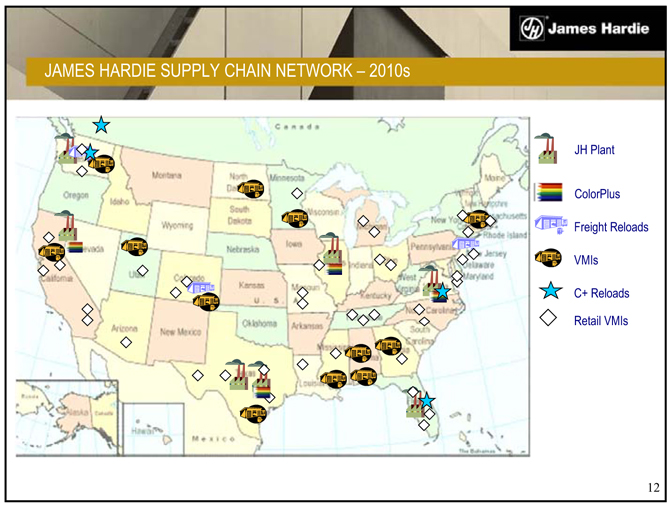

JAMES HARDIE SUPPLY CHAIN NETWORK – 2010s

12

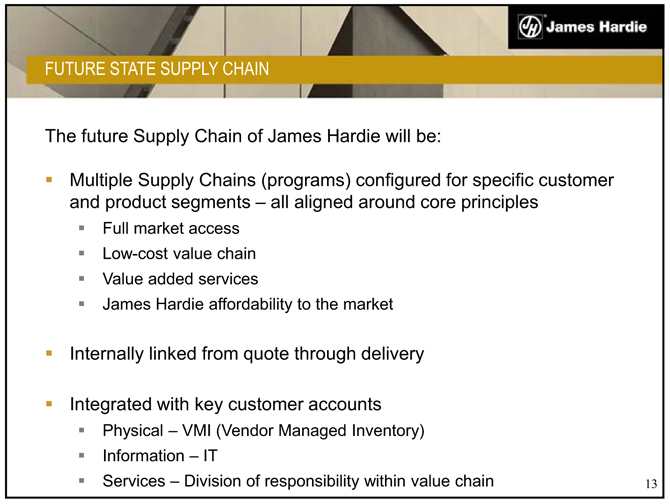

FUTURE STATE SUPPLY CHAIN

The future Supply Chain of James Hardie will be:

Multiple Supply Chains (programs) configured for specific customer

and product segments – all aligned around core principles

Full market access

Low-cost value chain

Value added services

James Hardie affordability to the market

Internally linked from quote through delivery

Integrated with key customer accounts

Physical – VMI (Vendor Managed Inventory)

Information – IT

Services – Division of responsibility within value chain

13

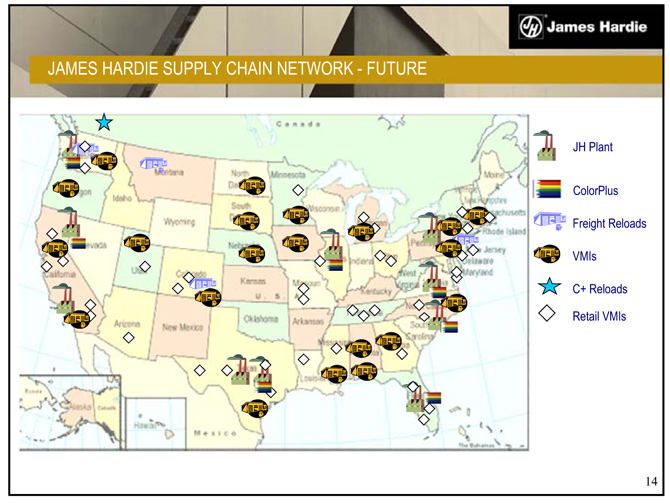

JAMES HARDIE SUPPLY CHAIN NETWORK—FUTURE

JH Plant

ColorPlus Freight Reloads VMIs

C+ Reloads Retail VMIs

14

Supply Chain Strategy and Systems

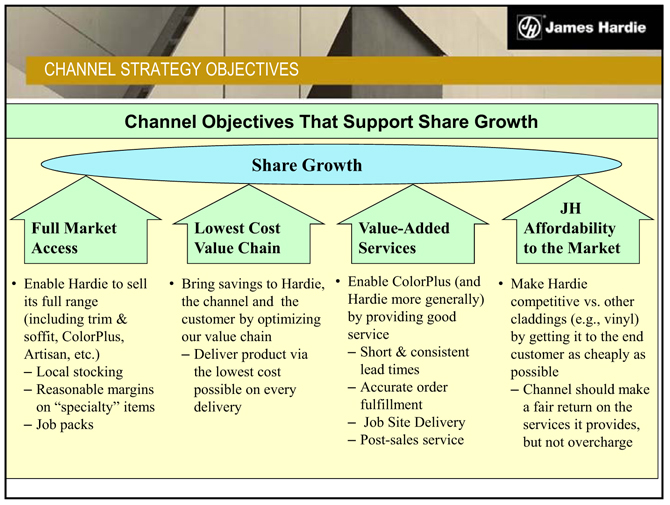

CHANNEL STRATEGY OBJECTIVES

Channel Objectives That Support Share Growth

Share Growth

Full Market Access

• Enable Hardie to sell its full range (including trim & soffit, ColorPlus, Artisan, etc.)

– Local stocking

– Reasonable margins on “specialty” items

– Job packs

Lowest Cost Value Chain

• Bring savings to Hardie, the channel and the customer by optimizing our value chain

– Deliver product via the lowest cost possible on every delivery

Value-Added Services

• Enable ColorPlus (and

Hardie more generally)

by providing good

service

– Short & consistent

lead times

– Accurate order

fulfillment

– Job Site Delivery

– Post-sales service

JH Affordability to the Market

• Make Hardie

competitive vs. other

claddings (e.g., vinyl)

by getting it to the end

customer as cheaply as

possible

– Channel should make

a fair return on the

services it provides,

but not overcharge

KEY SUPPLY CHAIN PROGRAMS

To execute our strategy there are a few key Supply Chain Programs:

ColorPlus Job Packs

Vendor Managed Inventory (VMI)

Less than Truck Load orders (LTL)

Channel Interface Systems

17

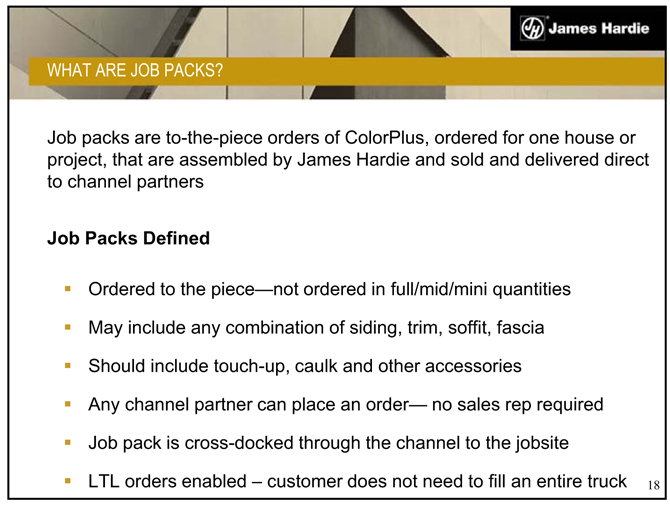

WHAT ARE JOB PACKS?

Job packs are to-the-piece orders of ColorPlus, ordered for one house or

project, that are assembled by James Hardie and sold and delivered direct

to channel partners

Job Packs Defined

Ordered to the piece—not ordered in full/mid/mini quantities

May include any combination of siding, trim, soffit, fascia

Should include touch-up, caulk and other accessories

Any channel partner can place an order— no sales rep required

Job pack is cross-docked through the channel to the jobsite

LTL orders enabled – customer does not need to fill an entire truck 18

WHY JOB PACKS?

Job Packs are an initiative in support of our on-going strategy of product

differentiation

Since its introduction, ColorPlus has been a critical aspect of our

differentiation strategy

Market adoption of ColorPlus is slowed by supply chain issues

The channel has lacked fast, affordable, full access to ColorPlus

Attachment rate on accessory products has been lower than expected

Further, we are evolving from selling individual products to selling an

attractive, low maintenance full wrap exterior

Job packs solve many supply chain roadblocks for ColorPlus

19

JOB PACK IMPACT ON SUPPLY CHAIN

Substantially reduce the amount of ColorPlus product that must be

stocked by the channel

Provide easy access to the full color and product range

Eliminate jobsite waste on non-stocked SKU’s

Increase efficiency through the supply chain

Reach a broader set of channel partners thereby increasing access for

contractors

20

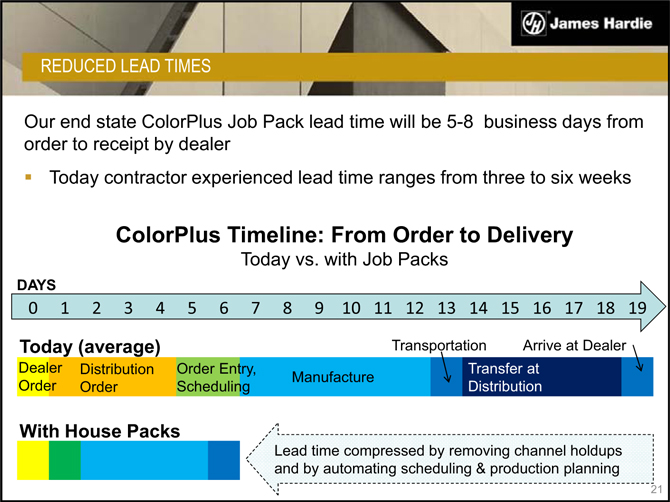

REDUCED LEAD TIMES

Our end state ColorPlus Job Pack lead time will be 5-8 business days from order to receipt by dealer

Today contractor experienced lead time ranges from three to six weeks

ColorPlus Timeline: From Order to Delivery

Today vs. with Job Packs

DAYS

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Today (average) Transportation Arrive at Dealer

Dealer Order

Distribution Order

Order Entry, Scheduling

Manufacture

Transfer at Distribution

With House Packs

Lead time compressed by removing channel holdups and by automating scheduling & production planning

21

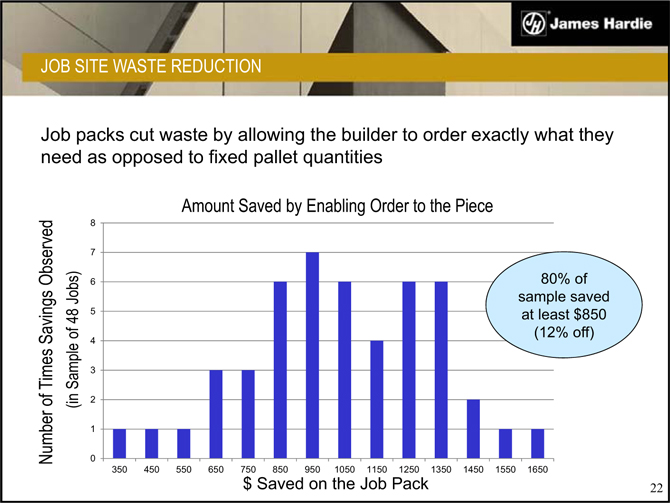

JOB SITE WASTE REDUCTION

Job packs cut waste by allowing the builder to order exactly what they need as opposed to fixed pallet quantities

Amount Saved by Enabling Order to the Piece

Number of Times Savings Observed (in Sample of 48 Jobs)

$ Saved on the Job Pack

22

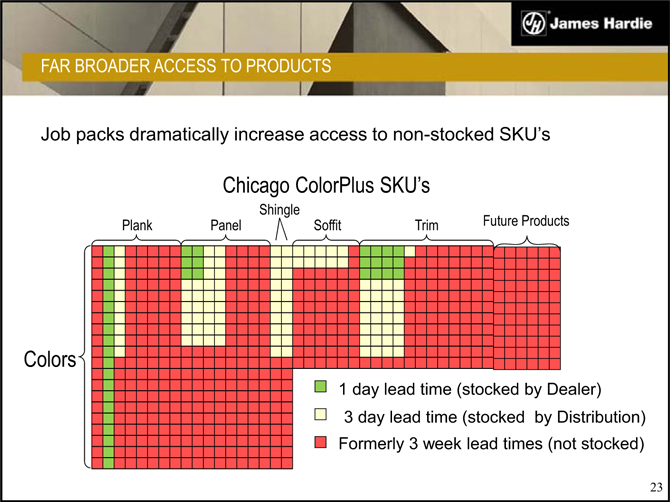

FAR BROADER ACCESS TO PRODUCTS

Job packs dramatically increase access to non-stocked SKU’s

Chicago ColorPlus SKU’s

| 1 |

|

day lead time (stocked by Dealer) |

| 3 |

|

day lead time (stocked by Distribution) |

Formerly 3 week lead times (not stocked)

23

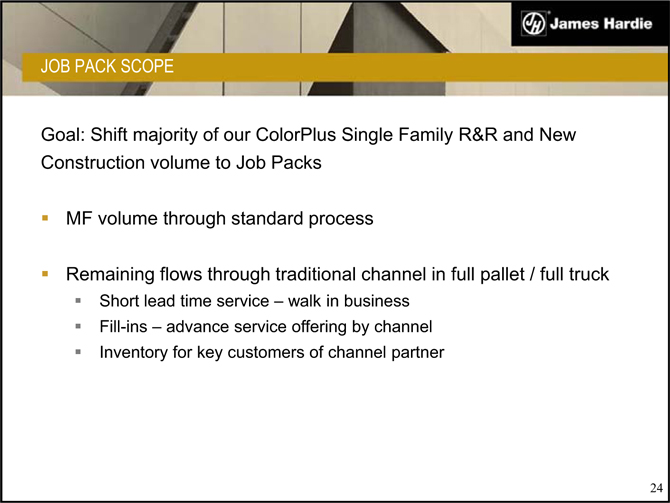

JOB PACK SCOPE

Goal: Shift majority of our ColorPlus Single Family R&R and New

Construction volume to Job Packs

MF volume through standard process

Remaining flows through traditional channel in full pallet / full truck

Short lead time service – walk in business

Fill-ins – advance service offering by channel

Inventory for key customers of channel partner

24

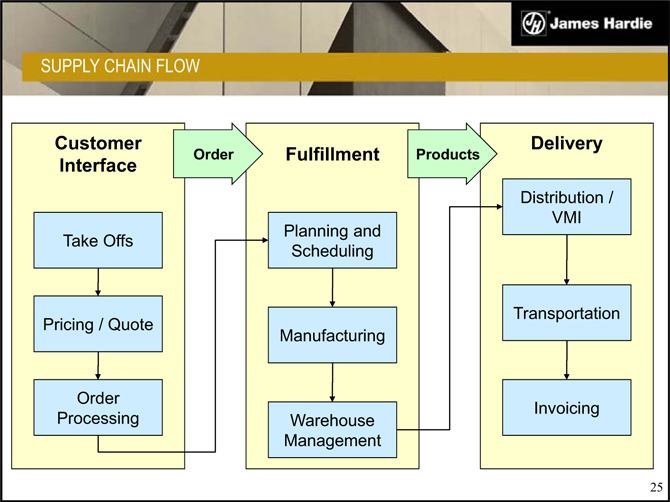

SUPPLY CHAIN FLOW

Customer Delivery

Interface Order Fulfillment Products

Distribution /

VMI

Take Offs Planning and

Scheduling

Pricing / Quote Transportation

Manufacturing

Order Invoicing

Processing Warehouse

Management

25

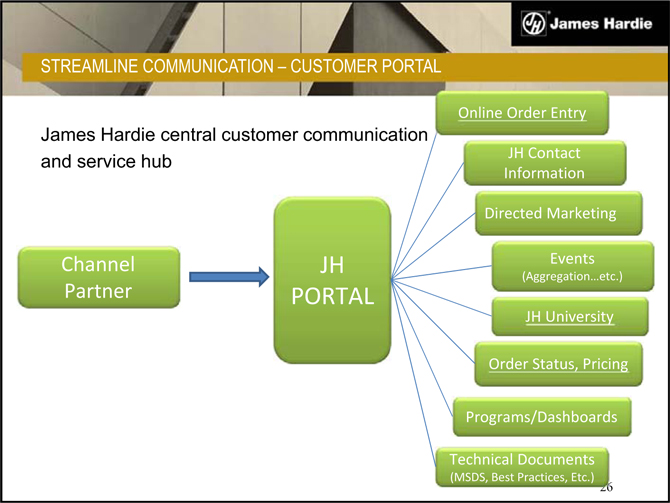

STREAMLINE COMMUNICATION – CUSTOMER PORTAL

James Hardie central customer communication and service hub

Channel Partner

JH PORTAL

Online Order Entry

JH Contact Information

Directed Marketing

Events (Aggregation…etc.)

JH University

Order Status, Pricing

Programs/Dashboards

Technical Documents (MSDS, Best Practices, Etc.)

26

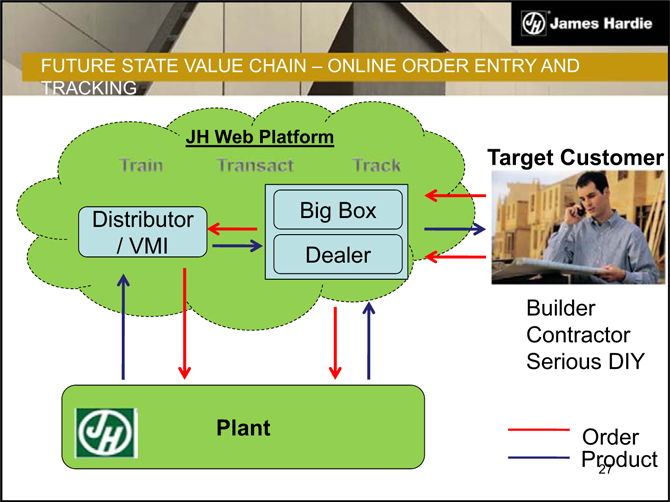

FUTURE STATE VALUE CHAIN – ONLINE ORDER ENTRY AND TRACKING

Target Customer

Builder Contractor Serious DIY

Product Order

27

ONLINE ORDER ENTRY – PROJECT VALUES

In order to be successful our designed solution must:

Be easy to use

Deliver validation & guided selling

Eliminate biggest causes of errors/holds and minimize others Be flexible to accommodate business changes quickly Provide options to minimize channel effort redundancy Be scalable Be secure

Planned for launch in Q4 FY12

28

Execution/Results Update

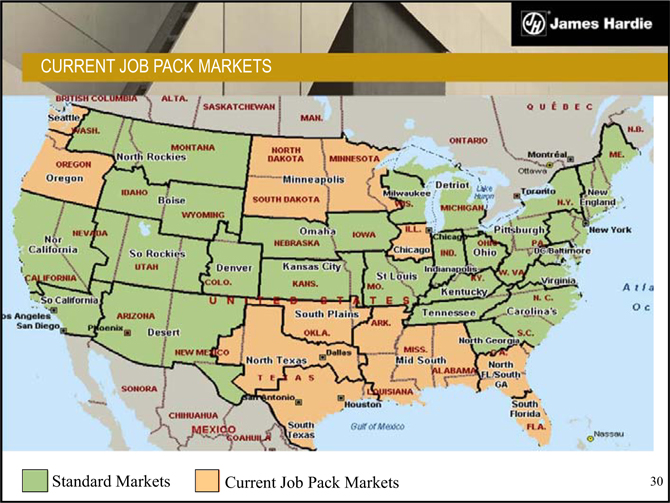

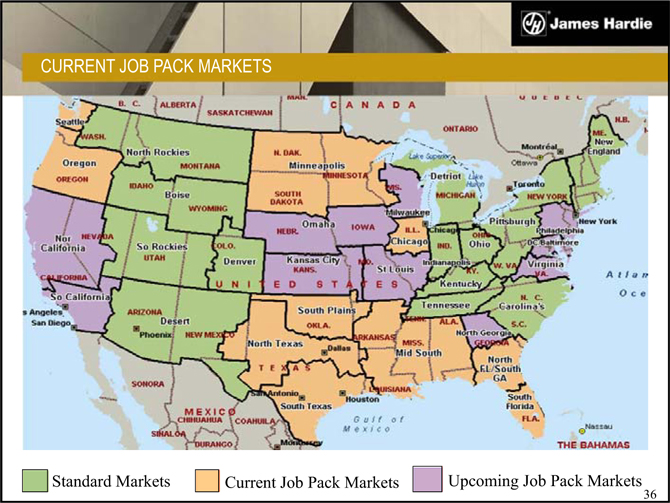

CURRENT JOB PACK MARKETS

Standard Markets

Current Job Pack Markets

30

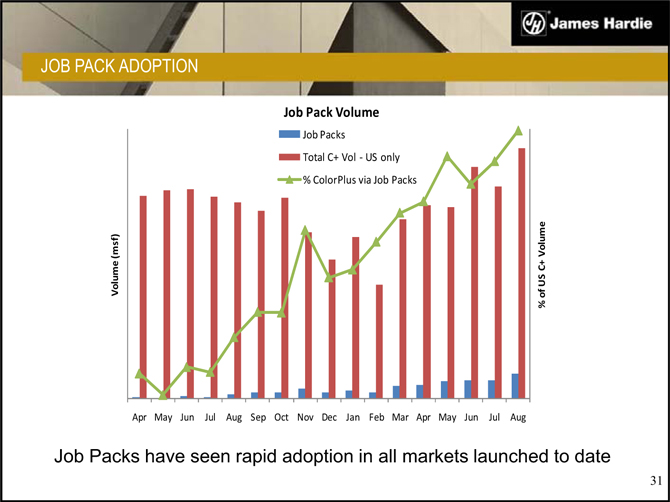

JOB PACK ADOPTION

Job Pack Volume

Job Packs

Total C+ Vol -US only

% ColorPlus via Job Packs

Job Packs have seen rapid adoption in all markets launched to date

31

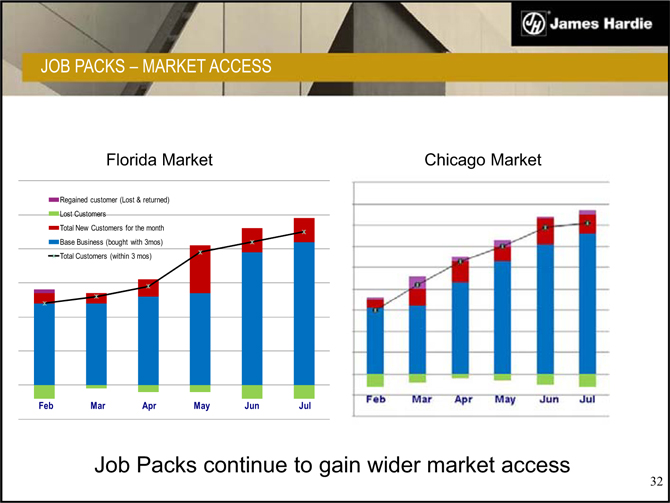

JOB PACKS – MARKET ACCESS

Florida Market

Chicago Market

Job Packs continue to gain wider market access

32

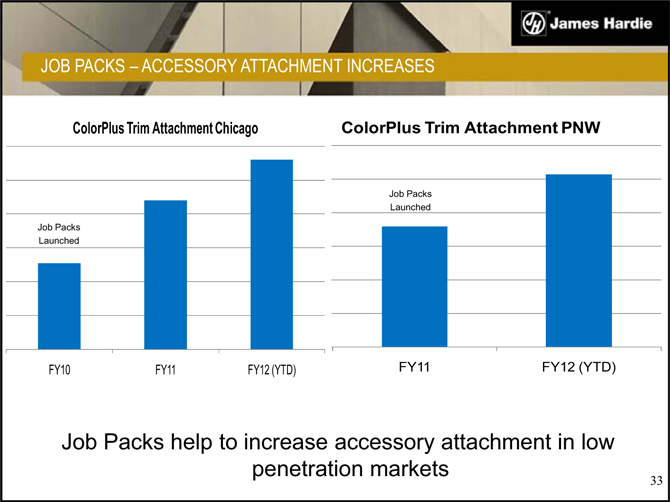

JOB PACKS – ACCESSORY ATTACHMENT INCREASES

ColorPlus Trim Attachment Chicago

ColorPlus Trim Attachment PNW

Job Packs help to increase accessory attachment in low penetration markets

33

Go Forward

GO FORWARD

In the next 12 months we will deliver on a number of key elements:

Channel Interface launch – Q4

ColorPlus Manufacturing capability enhancements – Q1

Additional Job Pack markets – on going

VMI network expansion – key markets

35

CURRENT JOB PACK MARKETS

Standard Markets Current Job Pack Markets Upcoming Job Pack Markets

36

Summary

SUMMARY

The James Hardie Supply Chain is developing from a base

manufacture model to an advanced value chain to support and drive

market initiatives

Job Packs continue to expand and grow while driving expected

value in the market

Continued development and investment will be required for the next

few years to advance supply chain capabilities and efficiency

38

Questions and Answers

Channel Strategy & Management Robb Rugg

DISCLAIMER

SEC, This Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. James in offering Hardie circulars, may from invitation time to memoranda time make forward-looking and prospectuses, statements in media in releases its periodic and reports other written filed with materials or furnished and in to oral the

are statements not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, institutional statements investors, are statements existing made and potential pursuant lenders, to the Safe representatives Harbor Provisions of the media of the and Private others. Securities Statements Litigation that

Reform Act of 1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products;

expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

expectations that the company’s credit facilities will be extended or renewed;

expectations concerning dividend payments and share buy-back;

statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges;

statements regarding tax liabilities and related audits, reviews and proceedings;

statements Commission as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments

asbestos-related expectations about personal the timing injury and and amount death claims; of contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian

expectations concerning indemnification obligations;

statements about product or environmental liabilities; and

availability statements of about mortgages economic and conditions, other financing, such mortgage as economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the levels unemployment of foreclosures levels, and changes home resales, or stability currency in housing exchange values, rates the

and consumer confidence.

Words are intended such as to identify “believe,” forward-looking “anticipate,” “plan,” statements “expect,” but are “intend,” not the “target,” exclusive “estimate,” means of “project,” identifying “predict,” such statements. “forecast,” “guideline,” Readers are “aim,” cautioned “will,” not “should,” to place “likely,” undue “continue” reliance on and these similar forward-looking expressions

statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

conditions, Forward-looking they, by statements their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and assumptions are unforeseeable and because and beyond forward-looking the company’s statements control. address Such known future and results, unknown events risks, and

uncertainties projected or implied and other by these factors forward-looking may cause actual statements. results, These performance factors, or some other of achievements which are discussed to differ under materially “Risk Factors” from the in anticipated Section 3 results, of the Form performance 20-F filed or with achievements the US Securities expressed, and

Exchange James Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to are the not AICF, limited any to: shortfall all matters in the relating AICF to and or the arising effect out of of currency the prior manufacture exchange rate of movements products that on contained the amount asbestos recorded by current in the and company’s former

financial which the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or to defects; the AICF; exposure compliance to environmental, with and changes asbestos in tax or laws other and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in

supply customer’s and inability cost of to raw pay; materials; compliance possible with and increases changes in in competition environmental and and the potential health and that safety competitors laws; risks could of conducting copy the company’s business internationally; products; reliance compliance on a small with and number changes of customers; in laws and a

governance regulations; and the potential effect of tax the benefits; transfer currency of the company’s exchange corporate risks; dependence domicile on from customer The Netherlands preference to and Ireland the concentration to become an of the Irish company’s SE including customer employee base on relations, large format changes retail in customers, corporate

distributors facilities on terms and dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and business the effect segments; of adverse changes changes in the in company’s climate or weather key management patterns; personnel; possible inability inherent to limitations renew credit on

internal company controls; cautions use you of that accounting the foregoing estimates; list and of factors all other is risks not exhaustive identified in and the that company’s other risks reports and filed uncertainties with Australian, may cause Irish and actual US securities results to agencies differ materially and exchanges from those (as in appropriate) forward-looking . The

statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions.

| 2 |

|

AGENDA

Channel Strategy Review

Channel Objectives

Distribution Review & Approach

Dealer Approach

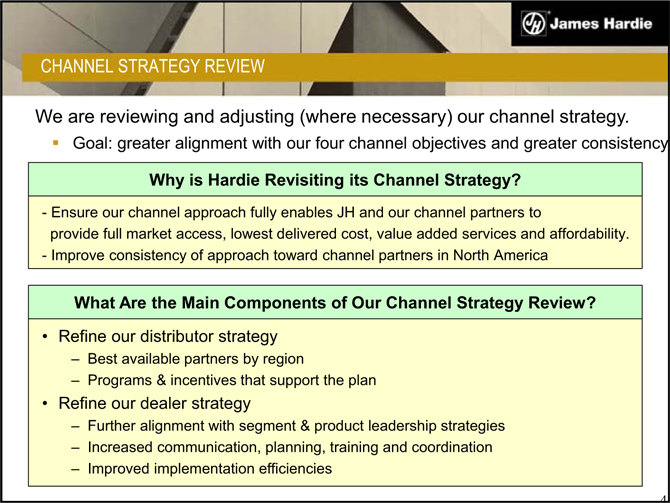

CHANNEL STRATEGY REVIEW

We are reviewing and adjusting (where necessary) our channel strategy.

Goal: greater alignment with our four channel objectives and greater consistency

Why is Hardie Revisiting its Channel Strategy?

Ensure our channel approach fully enables JH and our channel partners to

provide full market access, lowest delivered cost, value added services and affordability.

Improve consistency of approach toward channel partners in North America

What Are the Main Components of Our Channel Strategy Review?

Refine our distributor strategy

Best available partners by region

Programs & incentives that support the plan

Refine our dealer strategy

Further alignment with segment & product leadership strategies

Increased communication, planning, training and coordination

Improved implementation efficiencies

| 4 |

|

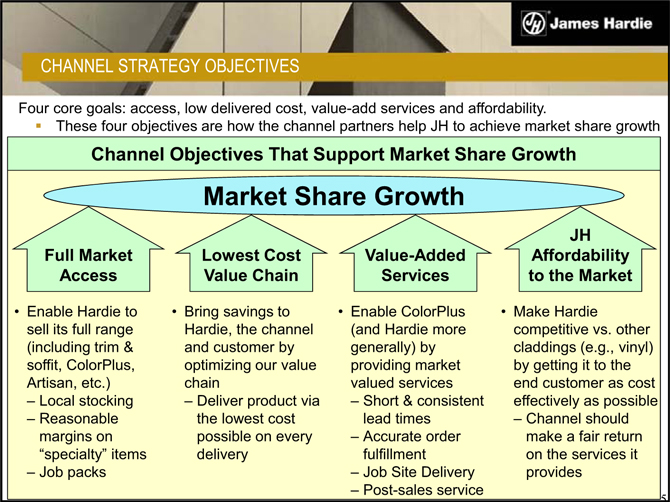

CHANNEL STRATEGY OBJECTIVES

Four core goals: access, low delivered cost, value-add services and affordability.

These four objectives are how the channel partners help JH to achieve market share growth

Channel Objectives That Support Market Share Growth

Market Share Growth

Full Market

Access

Enable Hardie to

sell its full range

(including trim &

soffit, ColorPlus,

Artisan, etc.)

Local stocking

Reasonable

margins on

“specialty” items

Job packs

Lowest Cost Value Chain

Bring savings to

Hardie, the channel and customer by optimizing our value chain

Deliver product via the lowest cost possible on every delivery

Value-Added

Services

Enable ColorPlus

(and Hardie more

generally) by

providing market

valued services

Short & consistent

lead times

Accurate order

fulfillment

Job Site Delivery

Post-sales service

JH

Affordability

to the Market

Make Hardie

competitive vs. other

claddings (e.g., vinyl)

by getting it to the

end customer as cost

effectively as possible

Channel should

make a fair return

on the services it

provides

| 5 |

|

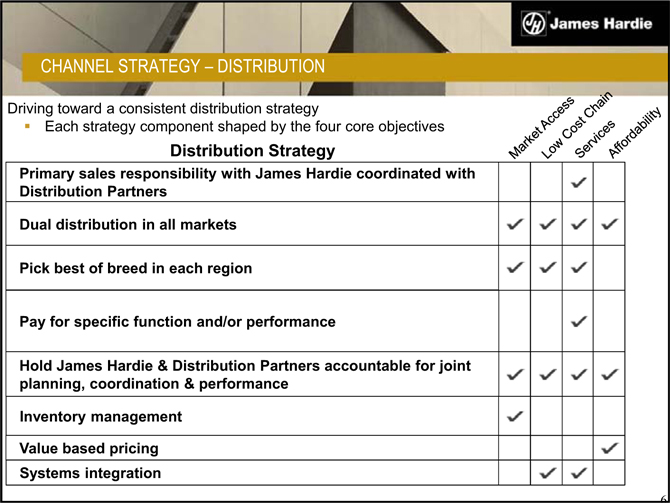

CHANNEL STRATEGY – DISTRIBUTION

Driving toward a consistent distribution strategy

Each strategy component shaped by the four core objectives

Distribution Strategy

Primary sales responsibility with James Hardie coordinated with Distribution Partners Dual distribution in all markets

Pick best of breed in each region

Pay for specific function and/or performance

Hold James Hardie & Distribution Partners accountable for joint planning, coordination & performance Inventory management Value based pricing Systems integration

| 6 |

|

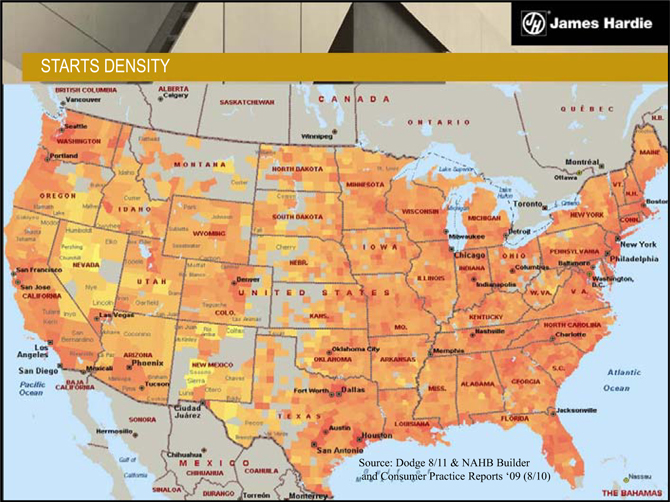

STARTS DENSITY

POPULATION DENSITY

SUMMARY

Mapped out U.S. based on starts and population

Pure Non-Metro or Metro exception vs. the rule

Base case Distribution Model is mature Metro with

supplemental Non-Metro component for added

function(s)

Increasing James Hardie sales involvement with dealers

coordinated and complimentary with Distribution efforts

Dealer Approach

DEALER APPROACH

Continue to drive primary demand with builder,

contractor and owners

Educate, train and go to market with dealer partners in

a planned, complimentary and coordinated manner

Cost effectively deliver differentiated product, systems

and services to the marketplace

11

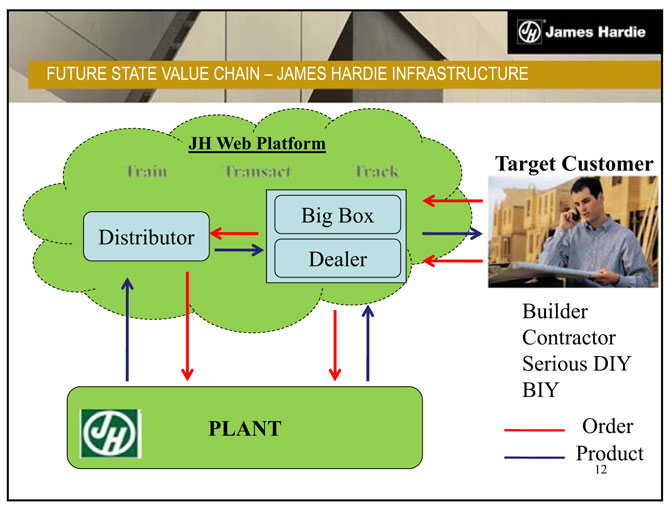

FUTURE STATE VALUE CHAIN – JAMES HARDIE INFRASTRUCTURE

Target Customer

Builder Contractor Serious DIY BIY

Order Product

12

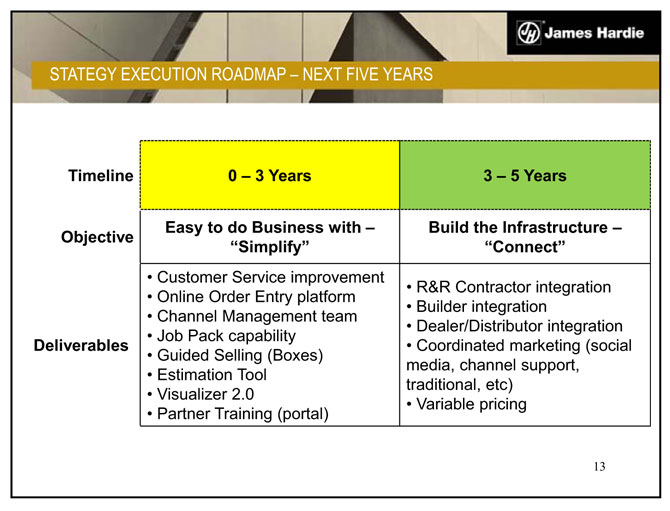

STATEGY EXECUTION ROADMAP – NEXT FIVE YEARS

Timeline 0 – 3 Years 3 – 5 Years

Easy to do Business with – Build the Infrastructure –Objective “Simplify” “Connect”

Deliverables

• Customer Service improvement

• Online Order Entry platform

• Channel Management team

• Job Pack capability

• Guided Selling (Boxes)

• Estimation Tool

• Visualizer 2.0

• Partner Training (portal)

• R&R Contractor integration

• Builder integration

• Dealer/Distributor integration

• Coordinated marketing (social

media, channel support,

traditional, etc)

• Variable pricing

13

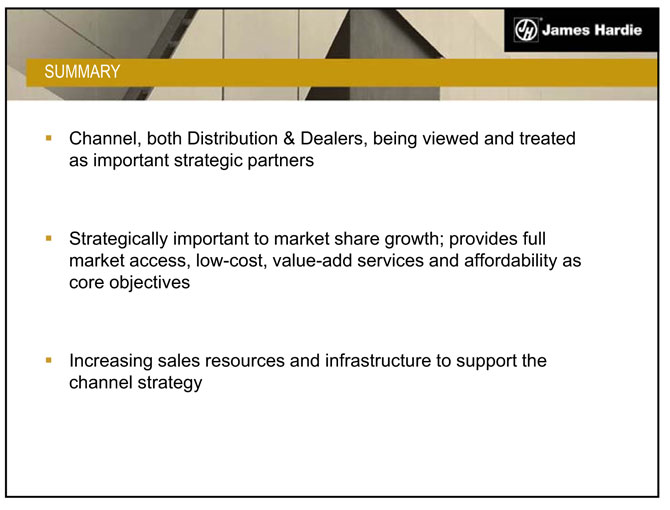

SUMMARY

Channel, both Distribution & Dealers, being viewed and treated

as important strategic partners

Strategically important to market share growth; provides full

market access, low-cost, value-add services and affordability as

core objectives

Increasing sales resources and infrastructure to support the

channel strategy

ORGANIZATION – CHANNEL FOCUS

Building a channel focused sales organization

Organization will work with channel partners to develop and

implement strategic growth plans

Hardie, channel partners and marketplace will get market

access, low-cost value chain, value-add services and

affordability

Questions and Answers

Product North Strategy Sean Gadd

DISCLAIMER

SEC, This Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. James in offering Hardie circulars, may from invitation time to memoranda time make forward-looking and prospectuses, statements in media in releases its periodic and reports other written filed with materials or furnished and in to oral the

are statements not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, institutional statements investors, are statements existing made and potential pursuant lenders, to the Safe representatives Harbor Provisions of the media of the and Private others. Securities Statements Litigation that

Reform Act of 1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products;

expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

expectations that the company’s credit facilities will be extended or renewed;

expectations concerning dividend payments and share buy-back;

statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges;

statements regarding tax liabilities and related audits, reviews and proceedings;

statements Commission as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments

asbestos-related expectations about personal the timing injury and and amount death claims; of contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian

expectations concerning indemnification obligations;

statements about product or environmental liabilities; and

availability statements of about mortgages economic and conditions, other financing, such mortgage as economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the levels unemployment of foreclosures levels, and changes home resales, or stability currency in housing exchange values, rates the

and consumer confidence.

Words are intended such as to identify “believe,” forward-looking “anticipate,” “plan,” statements “expect,” but are “intend,” not the “target,” exclusive “estimate,” means of “project,” identifying “predict,” such statements. “forecast,” “guideline,” Readers are “aim,” cautioned “will,” not “should,” to place “likely,” undue “continue” reliance on and these similar forward-looking expressions

statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

conditions, Forward-looking they, statements by their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and assumptions are unforeseeable and because and beyond forward-looking the company’s statements control. address Such known future and results, unknown events risks, and

uncertainties projected or implied and other by these factors forward-looking may cause actual statements. results, These performance factors, or some other of achievements which are discussed to differ under materially “Risk Factors” from the in anticipated Section 3 results, of the Form performance 20-F filed or with achievements the US Securities expressed, and

James Exchange Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to are the not AICF, limited any to: shortfall all matters in the relating AICF to and or the arising effect out of of currency the prior manufacture exchange rate of movements products that on contained the amount asbestos recorded by current in the and company’s former

financial which the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or to defects; the AICF; exposure compliance to environmental, with and changes asbestos in tax or laws other and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in

supply customer’s and inability cost of to raw pay; materials; compliance possible with and increases changes in in competition environmental and and the potential health and that safety competitors laws; risks could of conducting copy the company’s business internationally; products; reliance compliance on a small with and number changes of customers; in laws and a

governance regulations; and the potential effect of tax the benefits; transfer currency of the company’s exchange corporate risks; dependence domicile on from customer The Netherlands preference to and Ireland the concentration to become an of the Irish company’s SE including customer employee base on relations, large format changes retail in customers, corporate

facilities distributors on terms and dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and business the effect segments; of adverse changes changes in the in company’s climate or weather key management patterns; personnel; possible inability inherent to limitations renew credit on

company internal controls; cautions use you of that accounting the foregoing estimates; list and of factors all other is risks not exhaustive identified in and the that company’s other risks reports and filed uncertainties with Australian, may cause Irish and actual US securities results to agencies differ materially and exchanges from those (as in appropriate) forward-looking . The

statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions.

AGENDA

What is the 3-product strategy

Why the 3-product strategy is important

Market opportunity

Market approach

Results

Go forward

WHAT IS THE 3 PRODUCT STRATEGY

As the leader in Fiber Cement, with our product leadership position and

advances in technology, we position James Hardie as the superior exterior

solution for cladding to builders, contractor and developers

HZ5 markets in the North and Canada

Delivering on our brand promise

Durability

Low maintenance

Design

Through the benefits of a Complete James Hardie ColorPlus Exterior to

the marketplace

HZ5 HardiePlank™

HardieTrim™ NT3

New HardieShingle™

All with the superior ColorPlus paint finish

| 3 |

|

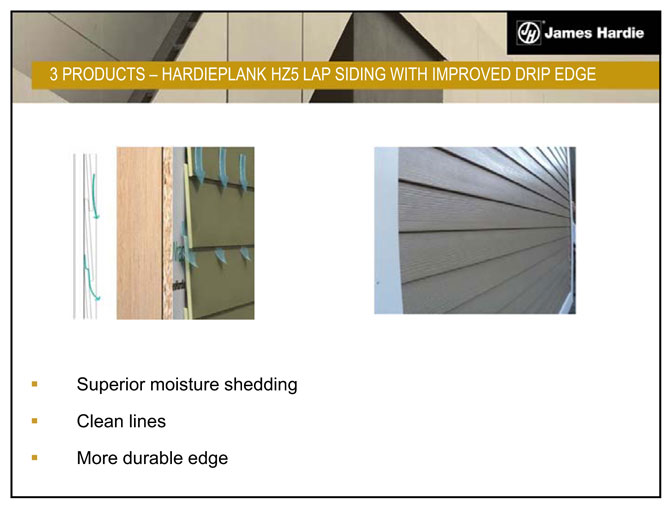

PRODUCTS – HARDIEPLANK HZ5 LAP SIDING WITH IMPROVED DRIP EDGE |

Superior moisture shedding

Clean lines

More durable edge

| 3 |

|

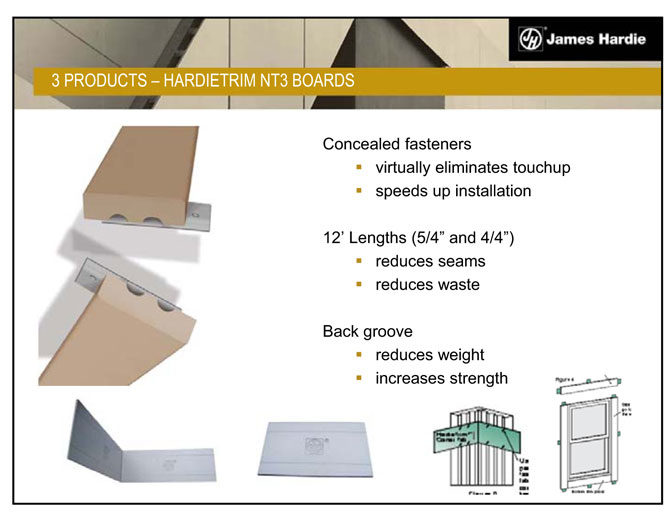

PRODUCTS – HARDIETRIM NT3 BOARDS |

Concealed fasteners

virtually eliminates touchup

speeds up installation

12’ Lengths (5/4” and 4/4”)

reduces seams

reduces waste

Back groove

reduces weight

increases strength

| 3 |

|

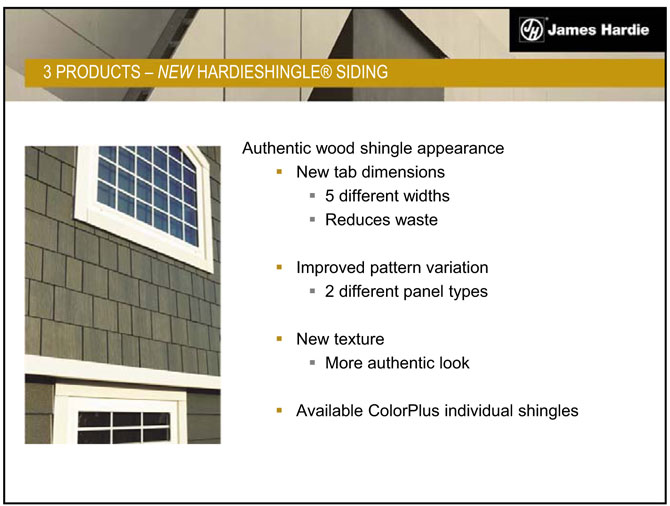

PRODUCTS – NEW HARDIESHINGLE® SIDING |

Authentic wood shingle appearance New tab dimensions 5 different widths

Reduces waste

Improved pattern variation 2 different panel types

New texture

More authentic look

Available ColorPlus individual shingles

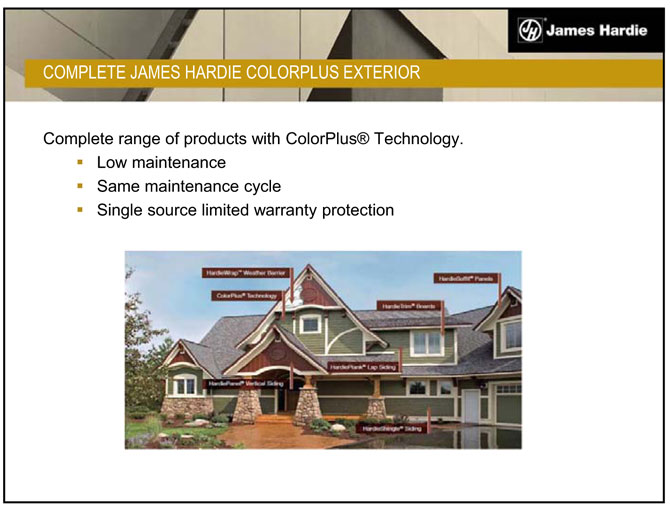

COMPLETE JAMES HARDIE COLORPLUS EXTERIOR

Complete range of products with ColorPlus® Technology. Low maintenance Same maintenance cycle Single source limited warranty protection

WHY THE 3 PRODUCT STRATEGY IS IMPORTANT

Delivers on James Hardie’s brand promise, creating more value

along the value chain

Fortifies the ColorPlus™ value proposition – removes the need

for the painter at the site and delivers a superior finish

Re-invigorates our HZ5 messaging to the entire supply chain

Builds competitive advantage – complete exterior versus siding

Increases average selling price

Increases revenue and margin dollars per home

NORTHERN MARKET OPPORTUNITY

Large opportunity

300 million sqft between shingle and trim

| 1 |

|

billion sqft of siding |

Trim and shingle penetration sold through the value of color and full wrap in all segments

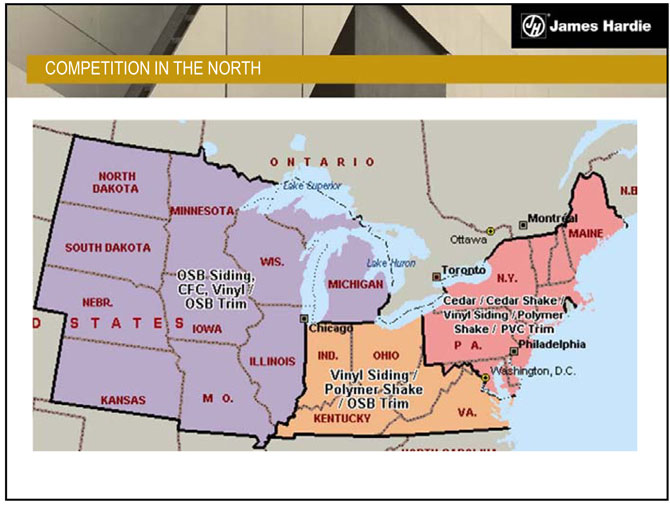

COMPETITION IN THE NORTH

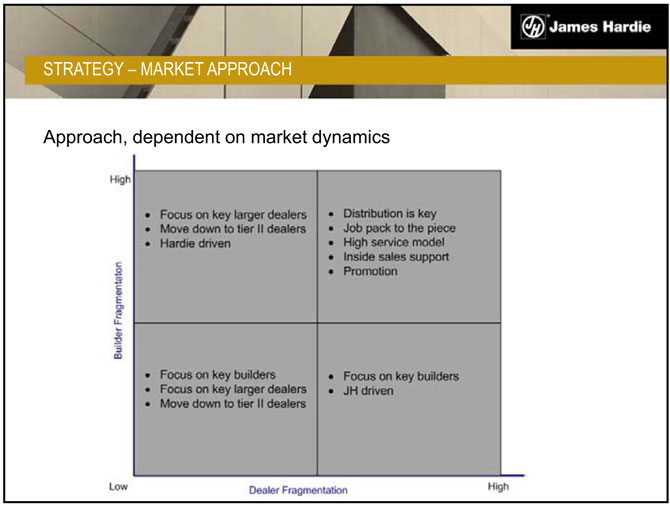

STRATEGY – MARKET APPROACH

Approach, dependent on market dynamics

| 4 |

|

Ps |

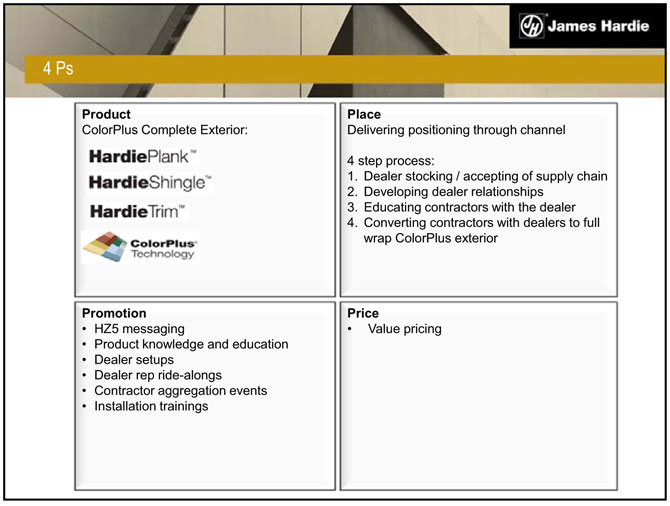

Product

ColorPlus Complete Exterior:

Place

Delivering positioning through channel

| 4 |

|

step process: |

1. Dealer stocking / accepting of supply chain

2. Developing dealer relationships

3. Educating contractors with the dealer

4. Converting contractors with dealers to full wrap ColorPlus exterior

Promotion

• HZ5 messaging

• Product knowledge and education

• Dealer setups

• Dealer rep ride-alongs

• Contractor aggregation events

• Installation trainings

Price

• Value pricing

EXECUTION AND RESULTS TO DATE

Northern HZ5 Markets and Canada

Primary focus on large metro markets

DC/Baltimore

Philadelphia

New England

Minneapolis

Kansas City

Began coordinated launch in FY12

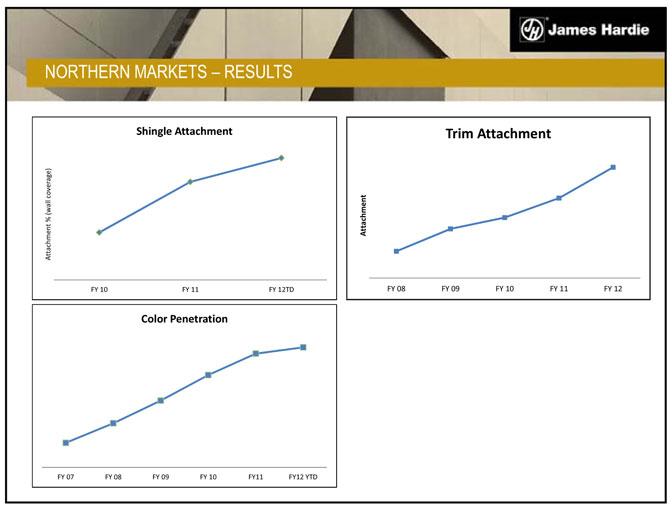

NORTHERN MARKETS – RESULTS

GO FORWARD

Continue our product development strategy

Deliver our brand promise to all segments of the market and all

price bands

Continue to further develop our range of products

Creating value all along the value chain

Questions and Answers

Repair & Remodel Segment David Donofrio

DISCLAIMER

SEC, This Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. James in offering Hardie circulars, may from invitation time to memoranda time make forward-looking and prospectuses, statements in media in releases its periodic and reports other written filed with materials or furnished and in to oral the

are statements not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, institutional statements investors, are statements existing made and potential pursuant lenders, to the Safe representatives Harbor Provisions of the media of the and Private others. Securities Statements Litigation that

Reform Act of 1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products;

expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

expectations that the company’s credit facilities will be extended or renewed;

expectations concerning dividend payments and share buy-back;

statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges;

statements regarding tax liabilities and related audits, reviews and proceedings;

statements Commission as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments

asbestos-related expectations about personal the timing injury and and amount death claims; of contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian

expectations concerning indemnification obligations;

statements about product or environmental liabilities; and

availability statements of about mortgages economic and conditions, other financing, such mortgage as economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the levels unemployment of foreclosures levels, and changes home resales, or stability currency in housing exchange values, rates the

and consumer confidence.

Words are intended such as to identify “believe,” forward-looking “anticipate,” “plan,” statements “expect,” but are “intend,” not the “target,” exclusive “estimate,” means of “project,” identifying “predict,” such statements. “forecast,” “guideline,” Readers are “aim,” cautioned “will,” not “should,” to place “likely,” undue “continue” reliance on and these similar forward-looking expressions

statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

conditions, Forward-looking they, statements by their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and assumptions are unforeseeable and because and beyond forward-looking the company’s statements control. address Such known future and results, unknown events risks, and

uncertainties projected or implied and other by these factors forward-looking may cause actual statements. results, These performance factors, or some other of achievements which are discussed to differ under materially “Risk Factors” from the in anticipated Section 3 results, of the Form performance 20-F filed or with achievements the US Securities expressed, and

James Exchange Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to are the not AICF, limited any to: shortfall all matters in the relating AICF to and or the arising effect out of of currency the prior manufacture exchange rate of movements products that on contained the amount asbestos recorded by current in the and company’s former

financial which the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or to defects; the AICF; exposure compliance to environmental, with and changes asbestos in tax or laws other and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in

supply customer’s and inability cost of to raw pay; materials; compliance possible with and increases changes in in competition environmental and and the potential health and that safety competitors laws; risks could of conducting copy the company’s business internationally; products; reliance compliance on a small with and number changes of customers; in laws and a

governance regulations; and the potential effect of tax the benefits; transfer currency of the company’s exchange corporate risks; dependence domicile on from customer The Netherlands preference to and Ireland the concentration to become an of the Irish company’s SE including customer employee base on relations, large format changes retail in customers, corporate

facilities distributors on terms and dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and business the effect segments; of adverse changes changes in the in company’s climate or weather key management patterns; personnel; possible inability inherent to limitations renew credit on

company internal controls; cautions use you of that accounting the foregoing estimates; list and of factors all other is risks not exhaustive identified in and the that company’s other risks reports and filed uncertainties with Australian, may cause Irish and actual US securities results to agencies differ materially and exchanges from those (as in appropriate) forward-looking . The

statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions.

OVERVIEW

Market/Strategy Review

James Hardie R&R Execution Update

Summary and Go Forward

Questions and Answers

Repair & Remodel Market Overview

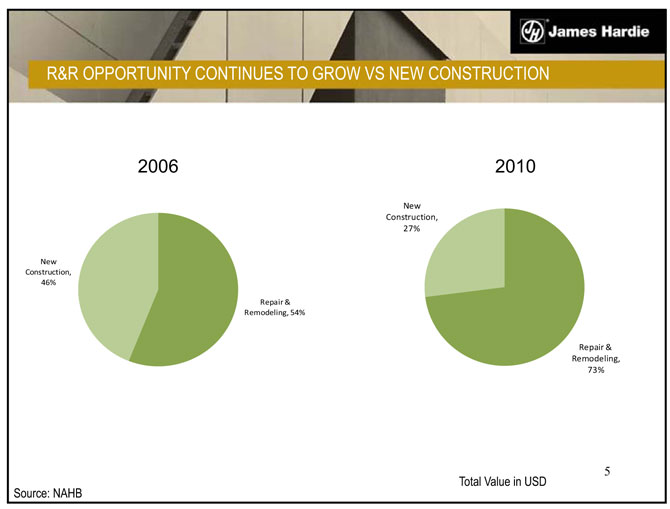

R&R OPPORTUNITY CONTINUES TO GROW VS NEW CONSTRUCTION

R&R SEGMENT STRATEGY

Business Strategy – Switch the preference from vinyl to fiber cement by directly communicating the benefits and affordability of James Hardie to the consumer

2/3 of Americans can afford James Hardie when presented with an affordable option

Most Americans will choose fiber cement over vinyl when presented with an affordable choice

James Hardie presented as the affordable option in all segments

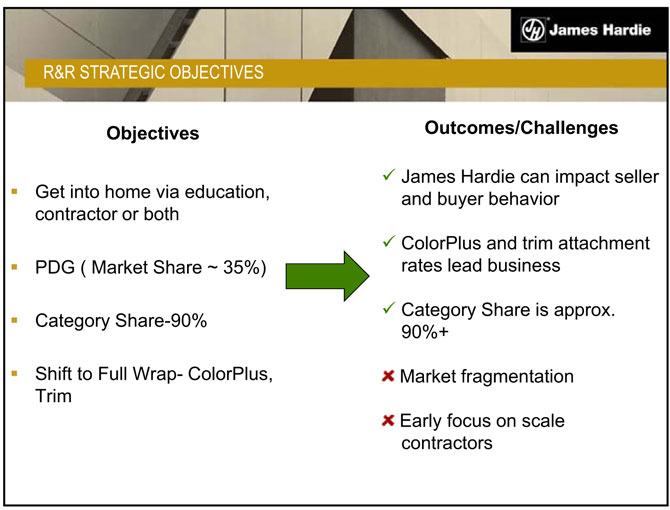

R&R STRATEGIC OBJECTIVES

Objectives

Get into home via education, contractor or both

PDG ( Market Share ~ 35%)

Category Share-90%

Shift to Full Wrap- ColorPlus, Trim

Outcomes/Challenges

James Hardie can impact seller and buyer behavior

ColorPlus and trim attachment rates lead business

Category Share is approx. 90%+

Market fragmentation

Early focus on scale contractors

R&R SEGMENT STRATEGY, OBJECTIVES AND INITIATIVES

Homeowner

Contractor

James Hardie influences the decision in the home on both the Buyer (homeowner) side and the Seller (contractor) side

| 4 |

|

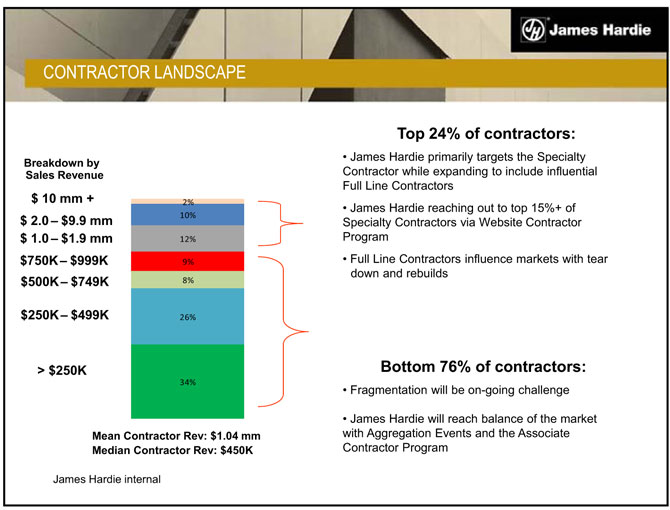

CONTRACTOR LANDSCAPE

Breakdown by Sales Revenue $ 10 mm + $ 2.0 – $9.9 mm $ 1.0 – $1.9 mm $750K– $999K $500K– $749K

$250K– $499K

> $250K

Top 24% of contractors:

• James Hardie primarily targets the Specialty Contractor while expanding to include influential Full Line Contractors

• James Hardie reaching out to top 15%+ of Specialty Contractors via Website Contractor Program

• Full Line Contractors influence markets with tear down and rebuilds

Bottom 76% of contractors:

• Fragmentation will be on-going challenge

• James Hardie will reach balance of the market with Aggregation Events and the Associate Contractor Program

Mean Contractor Rev: $1.04 mm Median Contractor Rev: $450K

James Hardie internal

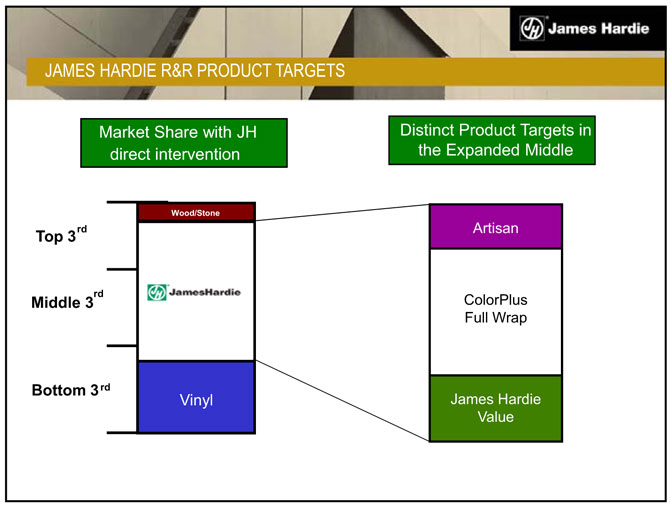

JAMES HARDIE R&R PRODUCT TARGETS

Market Share with JH direct intervention

Top 3rd

rd

Middle 3

Bottom 3rd

Wood/Stone

Vinyl

Distinct Product Targets in the Expanded Middle

Artisan

ColorPlus Full Wrap

James Hardie Value

| 5 |

|

Repair & Remodel Progress Update

R&R PROGRESS UPDATE

James Hardie Organization Creating the Standard Contractor Partnerships

James Hardie Siding Center Update

| 6 |

|

R&R PROGRESS – JAMES HARDIE ORGANISATION

Continue to build an R&R competency inside our organization –

Segment Managers and a dedicated James Hardie Repair and Remodel sales force focusing on the top US market opportunities

Field sales focus continues to shift – additional James Hardie rep sale force with significant R&R responsibility throughout the business

Creation of R&R standard operating procedure to provide continuous training to drive internal competency around neighborhood targeting, contractor acquisition & contractor program adoption

All reps measured on % design, conversion targets, deliverable footage plans, contractor program adoption targets

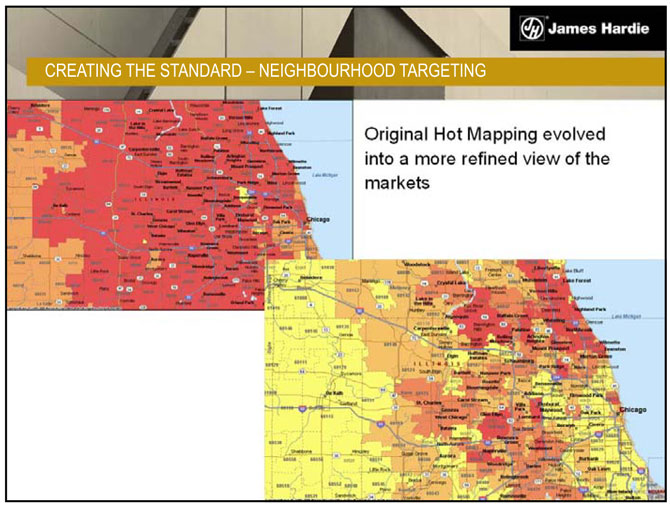

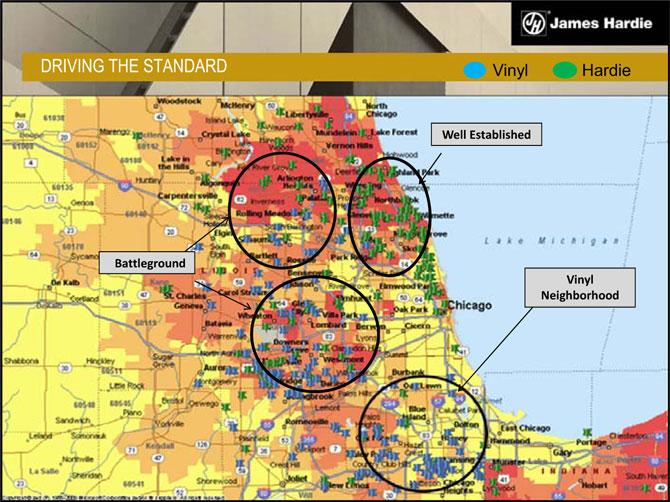

CREATING THE STANDARD – NEIGHBOURHOOD TARGETING

Original Hot Mapping evolved into a more refined view of the markets

| 7 |

|

DRIVING THE STANDARD Vinyl Hardie

Well Established

Battleground

Vinyl Neighborhood

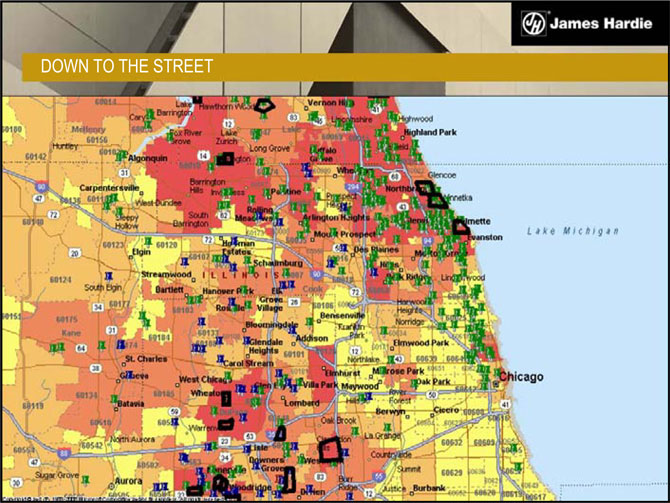

DOWN TO THE STREET

| 8 |

|

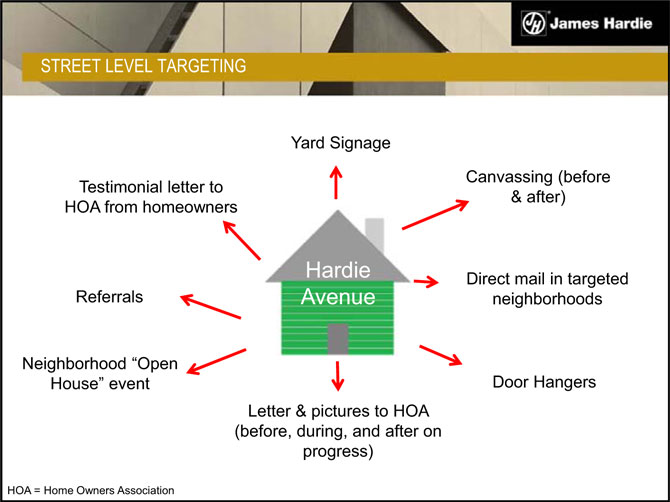

STREET LEVEL TARGETING

Yard Signage

Canvassing (before & after)

Direct mail in targeted neighborhoods

Door Hangers

Letter & pictures to HOA (before, during, and after on progress)

Neighborhood “Open House” event

Referrals

Testimonial letter to HOA from homeowners

HOA = Home Owners Association

STREET LEVEL TARGETING – CONTINUED

Neighborhood Events

Community Events

Open Houses

9

JAMES HARDIE CONTRACTOR PARTNERSHIP PROGRAMS

Our Objective is to develop a productive and mutually beneficial partnership with Contractors and Remodelers who want to build a better business and are looking to create a competitive advantage in the marketplace selling James Hardie® Siding.

Provide access to the latest job-site safety and installation best practice training, support in-home sales, as well as marketing and lead generation efforts, and help our partners track and measure their success along the way.

WINWITHHARDIE.COM

10

WINWITHHARDIE.COM

Website Demo

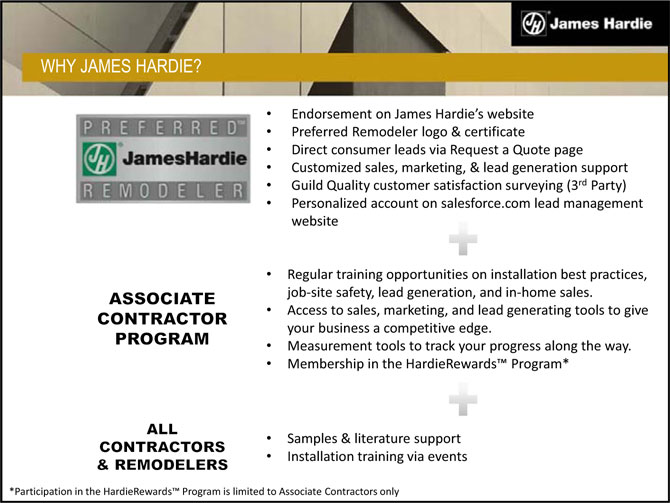

WHY JAMES HARDIE?

• Endorsement on James Hardie’s website

• Preferred Remodeler logo & certificate

• Direct consumer leads via Request a Quote page

• Customized sales, marketing, & lead generation support

• Guild Quality customer satisfaction surveying (3rd Party)

• Personalized account on salesforce.com lead management website

• Regular training opportunities on installation best practices, job-site safety, lead generation, and in-home sales.

• Access to sales, marketing, and lead generating tools to give your business a competitive edge.

• Measurement tools to track your progress along the way.

• Membership in the HardieRewards™ Program*

• Samples & literature support

• Installation training via events

*Participation in the HardieRewards™ Program is limited to Associate Contractors only

11

WHY JAMES HARDIE? BUSINESS GROWTH WEBINAR SERIES

R&R PROGRESS – JAMES HARDIE SIDING CENTER

| 5 |

|

years into our learning experience in Denver |

Learn and understand the repair and remodel segment, how to generate leads, target specific areas and price points as well as understand the buying behaviors of our customers

Build credibility with Professional Contractors across US as a reside expert

Learning how to sell up and sell down

Closed & transitioned business to Hardie Preferred Contractors September 2011

12

R&R PROGRESS ISSUES AND CHALLENGES

Continue to build organizational competency

Emphasis on target acquisition and neighborhood segmentation Grow Preferred Remodeler geographic presence Preferred Remodelers as an extension of JH in the home

Create a bench of Preferred contractors thru Associate Contractor Program (ACP’s)

R&R PROGRESS ISSUES AND CHALLENGES – CONTINUED

Grow & Leverage “Associate” Program

Ensure “benefits and affordability” message is carried into the home by Preferreds (boat) and Associates (wake)

Leverage successful James Hardie positions with Neighborhood Events

13

Repair & Remodel Summary and Go Forward

JAMES HARDIE R&R SEGMENT SUMMARY AND GO FORWARD

Original assumptions are valid – JH can and is having an impact in R&R; both the homeowner and contractor are positively impacted when JH is presented as an affordable option

Organizational Shift – Dedicated R&R presence in top US opportunity markets – additional rep force with significant R&R responsibility throughout the organization

Full Program and Package – Preferred Remodeler Program has robust offering; continue to focus and grow “Associate Contractor” program and drive contractor engagement and involvement

14

JAMES HARDIE R&R SEGMENT SUMMARY AND GO FORWARD

Continue to convert the large middle market with Colorplus Full Wrap offering

Drive into the upper and lower markets – proper product targeting and early, direct Hardie sales involvement

Benefits and affordability message in the home continue to be key

Scale and speed continue to challenge

29

Questions and Answers

15

Non-Metro Segment David Donofrio

DISCLAIMER

SEC, This Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. James in offering Hardie circulars, may from invitation time to memoranda time make forward-looking and prospectuses, statements in media in releases its periodic and reports other written filed with materials or furnished and in to oral the are statements not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, institutional statements investors, are statements existing made and potential pursuant lenders, to the Safe representatives Harbor Provisions of the media of the and Private others. Securities Statements Litigation that Reform Act of 1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products;

expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

expectations that the company’s credit facilities will be extended or renewed;

expectations concerning dividend payments and share buy-back;

statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges;

statements regarding tax liabilities and related audits, reviews and proceedings;

statements Commission as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments asbestos-related expectations about personal the timing injury and and amount death claims; of contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian

expectations concerning indemnification obligations;

statements about product or environmental liabilities; and availability

statements of about mortgages economic and conditions, other financing, such mortgage as economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the levels unemployment of foreclosures levels, and changes home resales, or stability currency in housing exchange values, rates the and consumer confidence.

Words are intended such as to identify “believe,” forward-looking “anticipate,” “plan,” statements “expect,” but are “intend,” not the “target,” exclusive “estimate,” means of “project,” identifying “predict,” such statements. “forecast,” “guideline,” Readers are “aim,” cautioned “will,” not “should,” to place “likely,” undue “continue” reliance on and these similar forward-looking expressions statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking conditions, they, statements by their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and assumptions are unforeseeable and because and beyond forward-looking the company’s statements control. address Such known future and results, unknown events risks, and uncertainties projected or implied and other by these factors forward-looking may cause actual statements. results, These performance factors, or some other of achievements which are discussed to differ under materially “Risk Factors” from the in anticipated Section 3 results, of the Form performance 20-F filed or with achievements the US Securities expressed, and Exchange James Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to are the not AICF, limited any to: shortfall all matters in the relating AICF to and or the arising effect out of of currency the prior manufacture exchange rate of movements products that on contained the amount asbestos recorded by current in the and company’s former financial which the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or to defects; the AICF; exposure compliance to environmental, with and changes asbestos in tax or laws other and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in supply customer’s and inability cost of to raw pay; materials; compliance possible with and increases changes in in competition environmental and and the potential health and that safety competitors laws; risks could of conducting copy the company’s business internationally; products; reliance compliance on a small with and number changes of customers; in laws and a governance regulations; and the potential effect of tax the benefits; transfer currency of the company’s exchange corporate risks; dependence domicile on from customer The Netherlands preference to and Ireland the concentration to become an of the Irish company’s SE including customer employee base on relations, large format changes retail in customers, corporate distributors facilities on terms and dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and business the effect segments; of adverse changes changes in the in company’s climate or weather key management patterns; personnel; possible inability inherent to limitations renew credit on internal company controls; cautions use you of that accounting the foregoing estimates; list and of factors all other is risks not exhaustive identified in and the that company’s other risks reports and filed uncertainties with Australian, may cause Irish and actual US securities results to agencies differ materially and exchanges from those (as in appropriate) forward-looking . The statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions.

| 2 |

|

| 1 |

|

AGENDA

Why Non-Metro Segment Focus Market Execution Mid-South Summary/Go Forward Q&A

| 3 |

|

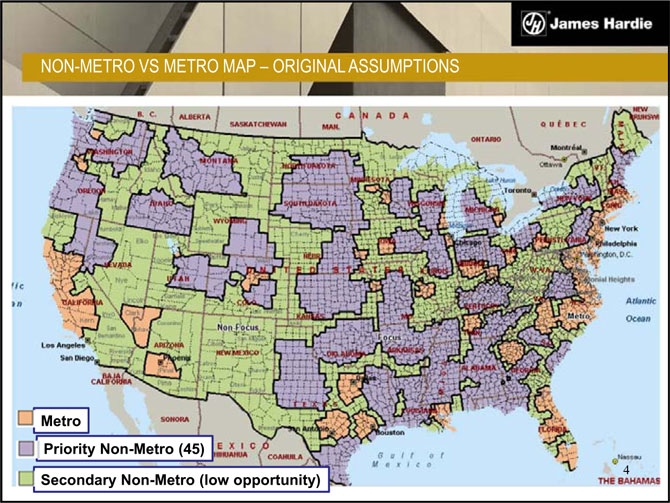

NON-METRO VS METRO MAP – ORIGINAL ASSUMPTIONS

Metro

Priority Non-Metro (45)

Secondary Non-Metro (low opportunity)

| 2 |

|

STARTS DENSITY Source: Dodge 8/11 & NAHB Builder and Consumer Practice Reports ‘09 (8/10)

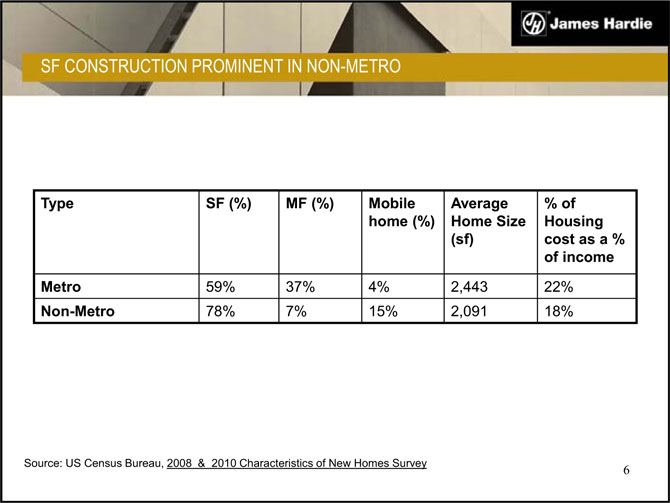

SF CONSTRUCTION PROMINENT IN NON-METRO

Type SF (%) MF (%) Mobile Average % of home (%) Home Size Housing (sf) cost as a % of income Metro 59% 37% 4% 2,443 22% Non-Metro 78% 7% 15% 2,091 18%

Source: US Census Bureau, 2008 & 2010 Characteristics of New Homes Survey

| 6 |

|

| 3 |

|

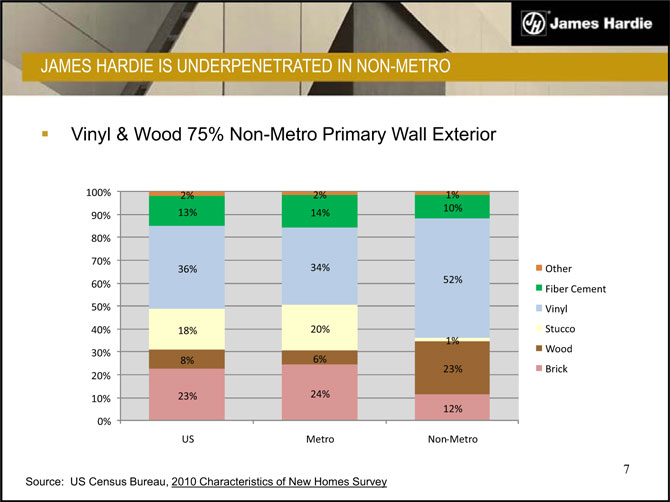

JAMES HARDIE IS UNDERPENETRATED IN NON-METRO

Vinyl & Wood 75% Non-Metro Primary Wall Exterior

Other Fiber Cement Vinyl Stucco Wood Brick

Source: US Census Bureau, 2010 Characteristics of New Homes Survey

| 7 |

|

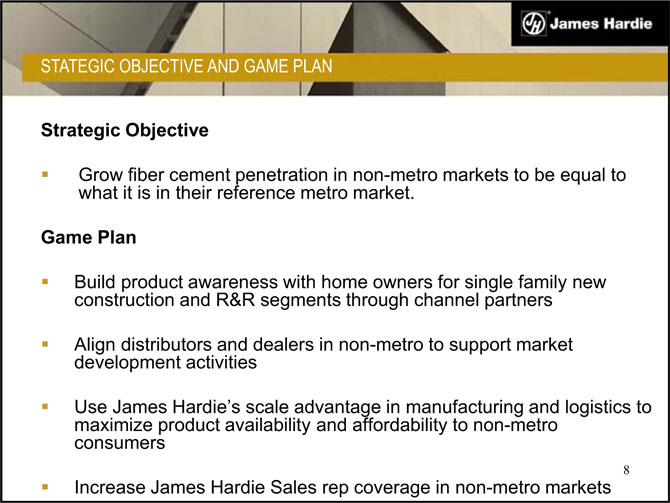

STATEGIC OBJECTIVE AND GAME PLAN

Strategic Objective

Grow what it fiber is in cement their reference penetration metro in market. non-metro markets to be equal to

Game Plan

construction Build product and awareness R&R segments with home through owners channel for single partners family new Align development distributors activities and dealers in non-metro to support market maximize Use James product Hardie’s availability scale advantage and affordability in manufacturing to non-metro and logistics to consumers

Increase James Hardie Sales rep coverage in non-metro markets

| 8 |

|

| 4 |

|

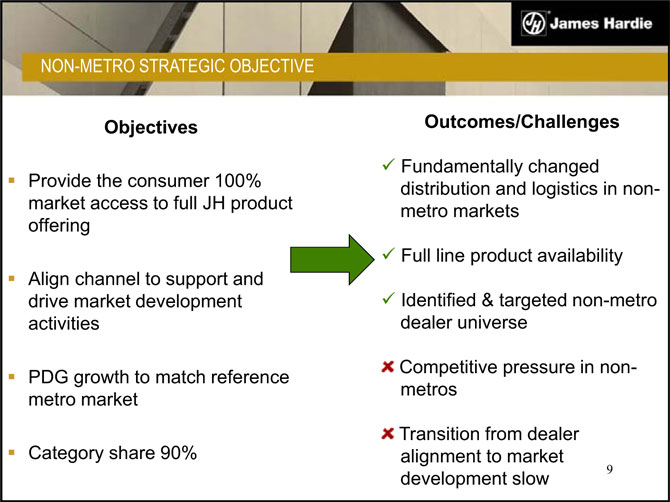

NON-METRO STRATEGIC OBJECTIVE

Objectives

Provide the consumer 100% market access to full JH product offering

Align channel to support and drive market development activities

PDG growth to match reference metro market

Category share 90%

Outcomes/Challenges

Fundamentally changed distribution and logistics in non-metro markets

Full line product availability

Identified & targeted non-metro dealer universe

Competitive pressure in non-metros

Transition from dealer alignment to market development slow 9

Non-Metro Market Execution Mid-South

| 5 |

|

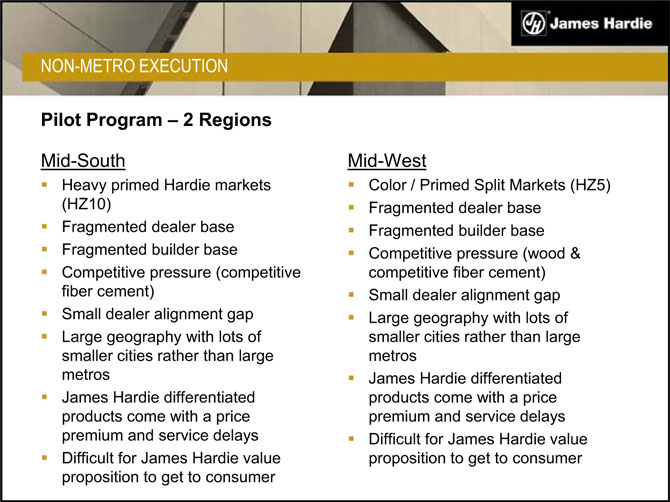

NON-METRO EXECUTION

Pilot Program – 2 Regions

Mid-South

Heavy primed Hardie markets (HZ10) Fragmented dealer base Fragmented builder base Competitive pressure (competitive fiber cement) Small dealer alignment gap Large geography with lots of smaller cities rather than large metros James Hardie differentiated products come with a price premium and service delays Difficult for James Hardie value proposition to get to consumer

Mid-West

Color / Primed Split Markets (HZ5) Fragmented dealer base Fragmented builder base Competitive pressure (wood & competitive fiber cement) Small dealer alignment gap Large geography with lots of smaller cities rather than large metros James Hardie differentiated products come with a price premium and service delays Difficult for James Hardie value proposition to get to consumer

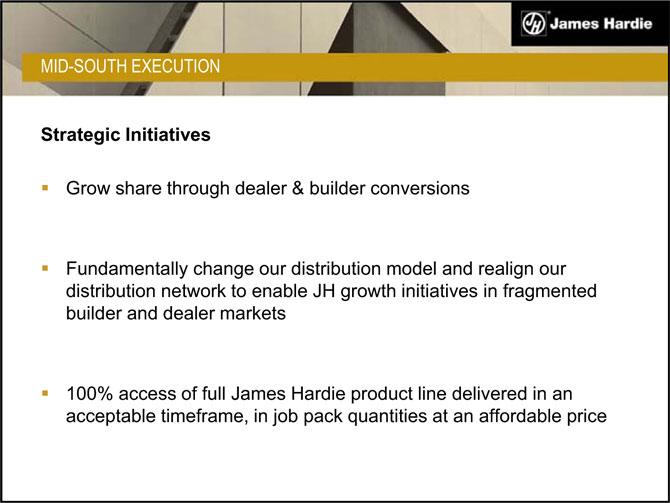

MID-SOUTH EXECUTION

Strategic Initiatives

Grow share through dealer & builder conversions

Fundamentally change our distribution model and realign our distribution network to enable JH growth initiatives in fragmented builder and dealer markets

100% access of full James Hardie product line delivered in an acceptable timeframe, in job pack quantities at an affordable price

| 6 |

|

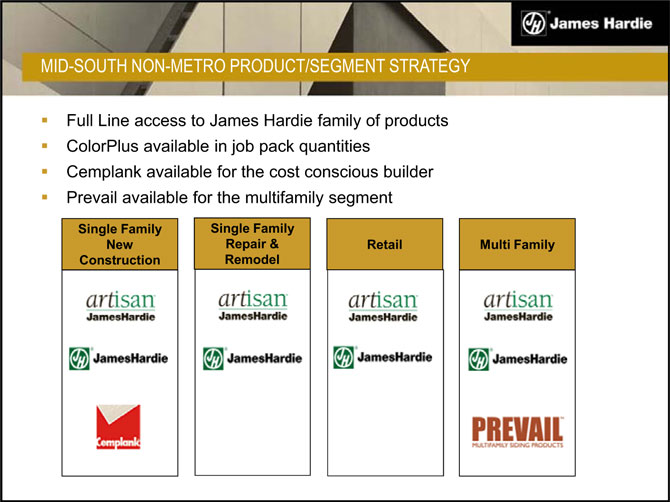

MID-SOUTH NON-METRO PRODUCT/SEGMENT STRATEGY

Full Line access to James Hardie family of products ColorPlus available in job pack quantities Cemplank available for the cost conscious builder Prevail available for the multifamily segment

Single Family Single Family

New Repair & Retail Multi Family Construction Remodel

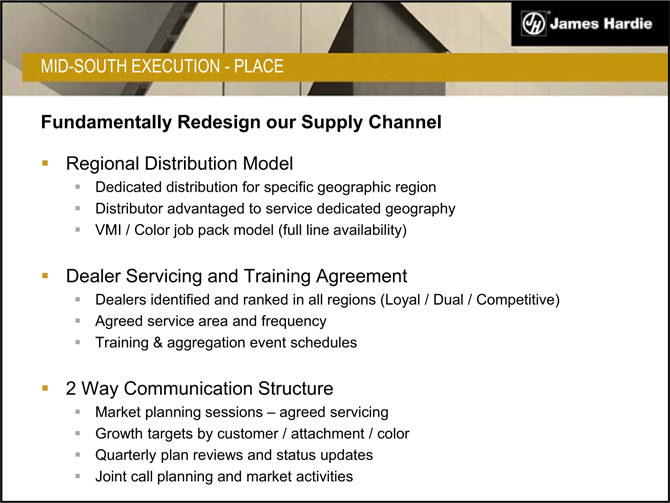

MID-SOUTH EXECUTION—PLACE

Fundamentally Redesign our Supply Channel

Regional Distribution Model

Dedicated distribution for specific geographic region Distributor advantaged to service dedicated geography VMI / Color job pack model (full line availability)

Dealer Servicing and Training Agreement

Dealers identified and ranked in all regions (Loyal / Dual / Competitive) Agreed service area and frequency Training & aggregation event schedules

| 2 |

|

Way Communication Structure |

Market planning sessions – agreed servicing Growth targets by customer / attachment / color Quarterly plan reviews and status updates Joint call planning and market activities

| 7 |

|

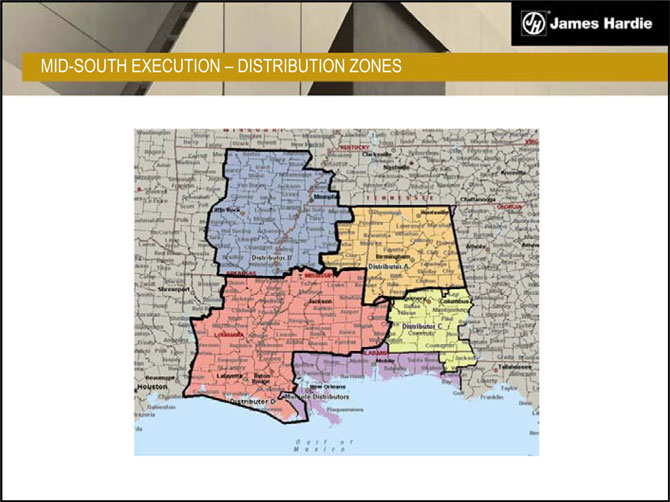

MID-SOUTH EXECUTION – DISTRIBUTION ZONES

MID-SOUTH PROMOTION AND PRICE

We have expanded James Hardies direct sales presence as well as James Hardie installation support in the Mid-South

James Hardie will take direct sales responsibilities to dealers of scale and activities to drive market development with those partners

James Hardie and our regional distribution partner will service the fragmented “tail” of dealers throughout the Non-Metro market

100% product availability to dealers with who primarily promote James Hardie products

Job packs serviced market wide at a negotiated service rate, Cemplank to match and follow commodity fiber cement

| 8 |

|

MID-SOUTH EXECUTION SUMMARY

Hardie Sales Model Executed

Increased Sales and Install presence as well as Sales Manager

Currently dealer focused for alignment / transition to market development Standard operating procedure being developed for rep effectiveness

Distribution Model Executed

Partners in place / VMI and color pack capability in place

Dealer Universe has been identified

Identified / ranked and targeted dealer opportunities throughout the Mid-South – began to convert dealers to “Full Line”

Multi-Family Model Executed

Full product line including Prevail

Non-Metro Segment Summary and Go Forward

9

SUMMARY – GO FORWARDS

The non-metro markets remain a growth opportunity for James Hardie

Better executed Mid-South pilot, continue dealer game plan and transition to market development

Re-focus on Mid-West restructure, resourcing ramp, new management in place

19

Questions and Answers

10

Brand Positioning Rob Gilfert

DISCLAIMER

SEC, This Management on Forms 20-F Presentation and 6-K, in contains its annual forward-looking reports to shareholders, statements. in James offering Hardie circulars, may invitation from time memoranda to time make and forward-looking prospectuses, statements in media releases in its periodic and other reports written filed materials with or furnished and in oral to the are statements not historical made facts by the are company’s forward-looking officers, statements directors or and employees such forward-looking to analysts, statements institutional are investors, statements existing made and pursuant potential to lenders, the Safe representatives Harbor Provisions of the of media the Private and others. Securities Statements Litigation that Reform Act of 1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products; expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants; expectations that the company’s credit facilities will be extended or renewed; expectations concerning dividend payments and share buy-back; statements concerning the company’s corporate and tax domiciles and potential changes to them, including potential tax charges; statements regarding tax liabilities and related audits, reviews and proceedings;

Commission statements as (ASIC); to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments asbestos-related expectations about personal the timing injury and and amount death of claims; contributions to the Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian expectations concerning indemnification obligations; statements about product or environmental liabilities; and availability statements of about mortgages economic and conditions, other financing, such as mortgage economic and or other housing interest recovery, rates, the housing levels affordability of new home and construction, supply, the unemployment levels of foreclosures levels, and changes home or resales, stability currency in housing exchange values, rates the and consumer confidence.

statements are intended and to identify all such forward-looking forward-looking statements statements but are are qualified not the in exclusive their entirety means by reference of identifying to the such following statements. cautionary Readers statements. are cautioned not to place undue reliance on these forward-looking conditions, Forward-looking they, by statements their very are nature, based involve on the inherent company’s risks current and uncertainties, expectations, many estimates of which and are assumptions unforeseeable and and because beyond forward-looking the company’s statements control. Such address known future and results, unknown events risks, and projected uncertainties or implied and other by these factors forward-looking may cause actual statements. results, performance These factors, or some other achievements of which are discussed to differ materially under “Risk from Factors” the anticipated in Section results, 3 of the performance Form 20-F filed or achievements with the US Securities expressed, and Exchange James Hardie Commission subsidiaries; on 29 required June 2011 contributions include, but to the are AICF, not limited any shortfall to: all matters in the AICF relating and to the or arising effect of out currency of the prior exchange manufacture rate movements of products on that the contained amount recorded asbestos in by the current company’s and former financial which the statements company operates; as an asbestos the consequences liability; governmental of product loan failures facility or defects; to the AICF; exposure compliance to environmental, with and changes asbestos in tax or other laws and legal treatments; proceedings; competition general economic and product and pricing market in conditions; the markets the in customer’s supply and inability cost of raw to pay; materials; compliance possible with increases and changes in competition in environmental and the and potential health that and competitors safety laws; could risks copy of conducting the company’s business products; internationally; reliance on compliance a small number with and of changes customers; in laws a and regulations; governance the and effect potential of the tax transfer benefits; of currency the company’s exchange corporate risks; dependence domicile from on The customer Netherlands preference to Ireland and to the become concentration an Irish of SE the including company’s employee customer relations, base on changes large format in corporate retail customers, facilities distributors on and terms dealers; favorable dependence to the company, on residential or at all; and acquisition commercial or sale construction of businesses markets; and the business effect segments; of adverse changes changes in in the climate company’s or weather key patterns; management possible personnel; inability inherent to renew limitations credit on internal company controls; cautions use you of that accounting the foregoing estimates; list of and factors all other is not risks exhaustive identified and in that the company’s other risks and reports uncertainties filed with Australian, may cause Irish actual and results US securities to differ materially agencies and from exchanges those in forward-looking (as appropriate) . The statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions.

| 2 |

|

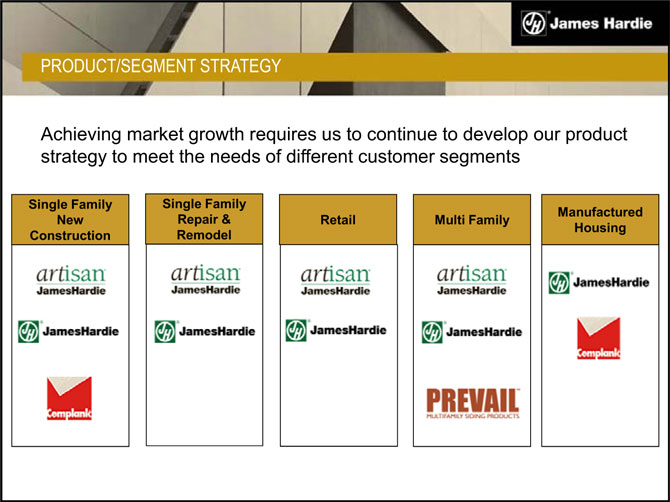

PRODUCT/SEGMENT STRATEGY

Achieving market growth requires us to continue to develop our product strategy to meet the needs of different customer segments

Single Family Single Family

Manufactured New Repair & Retail Multi Family Housing Construction Remodel

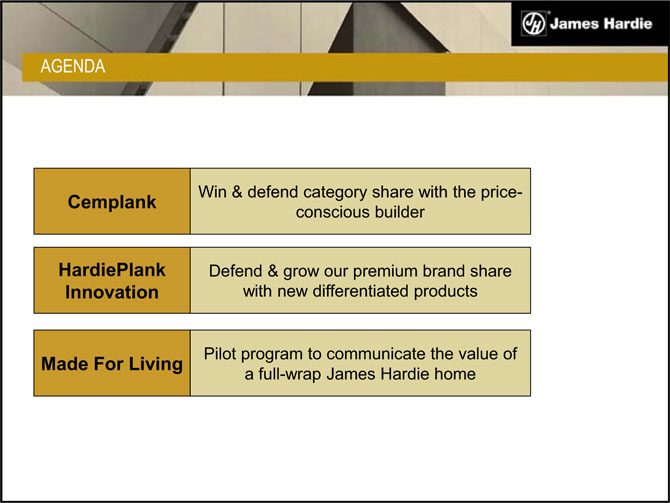

AGENDA

Win & defend category share with the price-

Cemplank conscious builder

HardiePlank Defend & grow our premium brand share Innovation with new differentiated products

Pilot program to communicate the value of

Made For Living a full-wrap James Hardie home

| 2 |

|

Cemplank

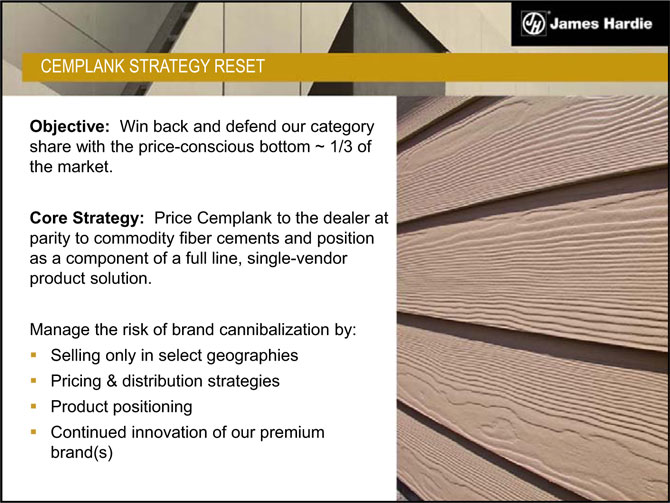

CEMPLANK STRATEGY RESET

Objective: Win back and defend our category share with the price-conscious bottom ~ 1/3 of the market.

Core Strategy: Price Cemplank to the dealer at parity to commodity fiber cements and position as a component of a full line, single-vendor product solution.

Manage the risk of brand cannibalization by:

Selling only in select geographies

Pricing & distribution strategies

Product positioning

Continued innovation of our premium brand(s)

| 3 |

|

CHOOSING CEMPLANK MARKETS

Where we sell and do not sell Cemplank is a function of several variables We are more likely to introduce Cemplank to markets that are/have:

More mature (high S-Curve)

Lower category share Dual-stocking channel

Consolidated channel

Lower product differentiation

CEMPLANK PRODUCT POSITIONING AND PROMOTION

We have re-positioned Cemplank as a “Builder Grade” product line designed for new construction starter homes.

Cemplank Product Attributes

Limited SKU range

Siding only, no accessories

Generic wood pattern

Limited warranty (relative to James Hardie)

| 4 |

|

CEMPLANK PRICING AND DISTRIBUTION STRATEGIES

We have multiple pricing and distribution ‘design experiments’ in place, all aligned around achieving the following objectives:

Sell Cemplank to dealers who primarily sell James Hardie product

Match & follow ‘everyday’ commodity fiber cement pricing

Ensure James Hardie has visibility to who is buying Cemplank, how much (in relation to James Hardie brand), and at what price

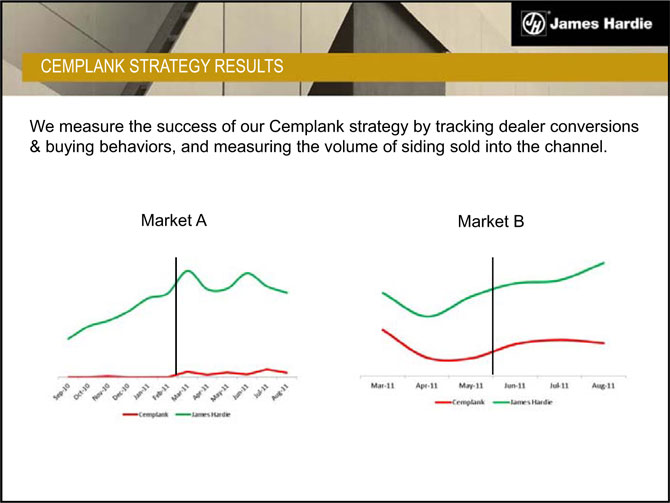

CEMPLANK STRATEGY RESULTS

We measure the success of our Cemplank strategy by tracking dealer conversions & buying behaviors, and measuring the volume of siding sold into the channel.

Market A Market B

| 5 |

|

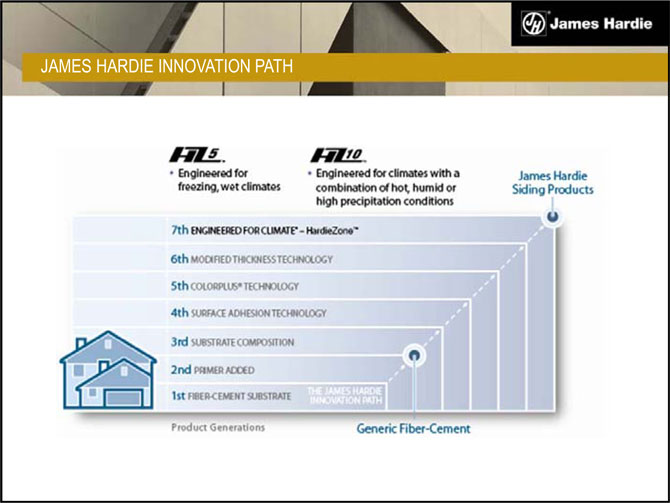

HardiePlank Innovation

JAMES HARDIE INNOVATION PATH

| 6 |

|

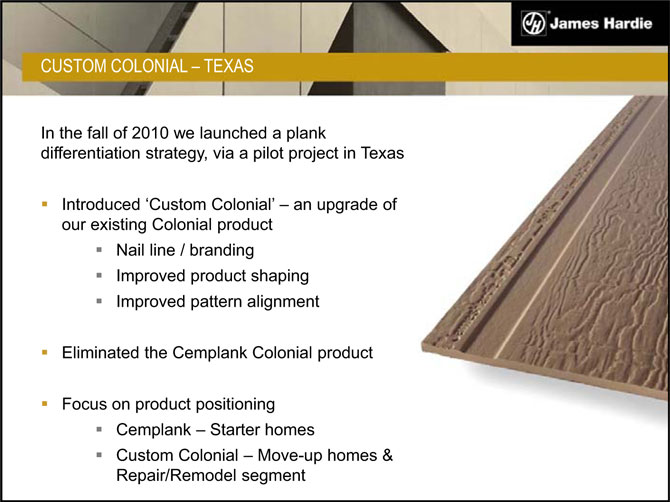

CUSTOM COLONIAL – TEXAS

In the fall of 2010 we launched a plank differentiation strategy, via a pilot project in Texas

Introduced ‘Custom Colonial’ – an upgrade of our existing Colonial product Nail line / branding Improved product shaping Improved pattern alignment

Eliminated the Cemplank Colonial product

Focus on product positioning Cemplank – Starter homes

Custom Colonial – Move-up homes & Repair/Remodel segment

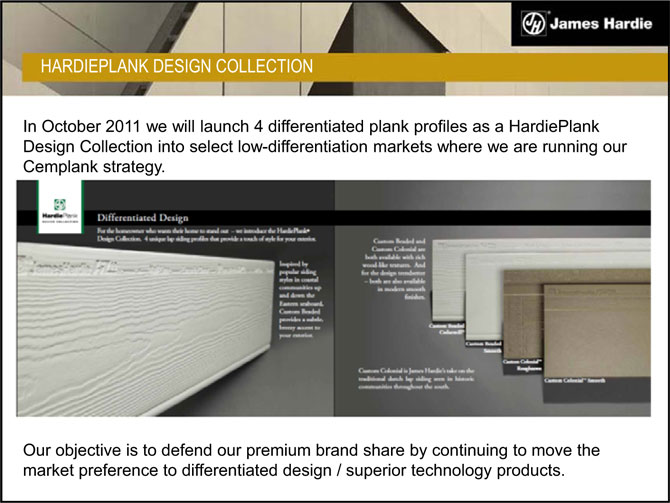

HARDIEPLANK DESIGN COLLECTION

In October 2011 we will launch 4 differentiated plank profiles as a HardiePlank Design Collection into select low-differentiation markets where we are running our Cemplank strategy.

Our objective is to defend our premium brand share by continuing to move the market preference to differentiated design / superior technology products.

| 7 |

|

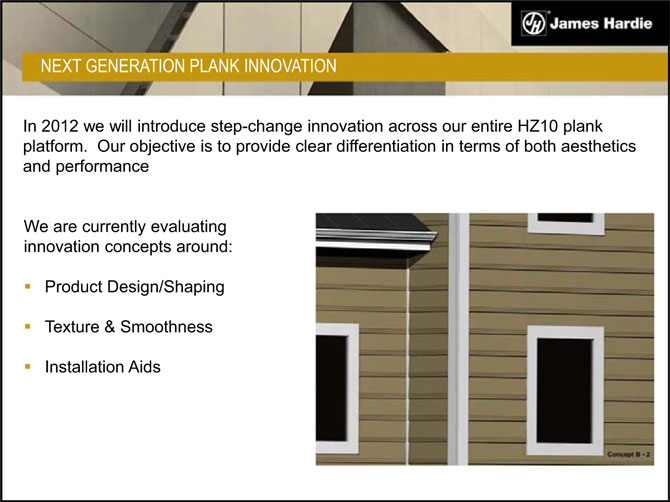

NEXT GENERATION PLANK INNOVATION

In 2012 we will introduce step-change innovation across our entire HZ10 plank platform. Our objective is to provide clear differentiation in terms of both aesthetics and performance

We are currently evaluating innovation concepts around:

Product Design/Shaping Texture & Smoothness Installation Aids

Made For Living (Model Home Marketing)

| 8 |

|

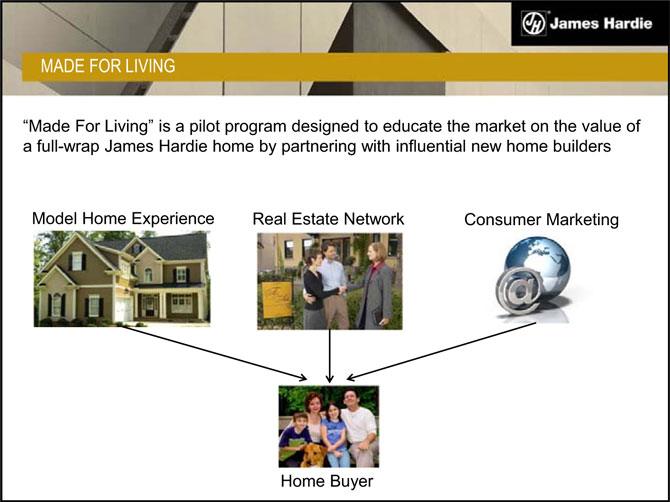

MADE FOR LIVING

“Made For Living” is a pilot program designed to educate the market on the value of a full-wrap James Hardie home by partnering with influential new home builders

Model Home Experience Real Estate Network Consumer Marketing

Home Buyer

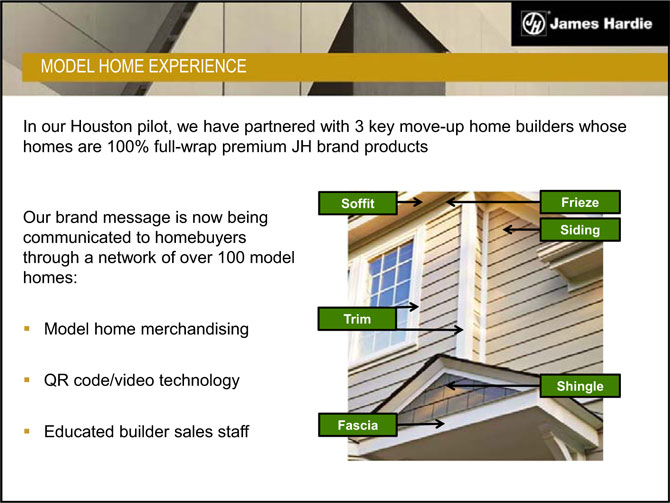

MODEL HOME EXPERIENCE

In our Houston pilot, we have partnered with 3 key move-up home builders whose homes are 100% full-wrap premium JH brand products

Our brand message is now being communicated to homebuyers through a network of over 100 model homes:

Model home merchandising QR code/video technology Educated builder sales staff

Soffit Frieze Siding

Trim

Shingle

Fascia

9

MODEL HOME EXPERIENCE

REAL ESTATE COMMUNITY

By educating and influencing the real estate community, we reach a broader audience with our message and drive traffic back to our partner builders.

Since inception we have communicated directly with over 2,000 Houston realtors through:

Direct sales/dedicated rep Online James Hardie education courses Email contact strategy Aggregation events

10

SUMMARY

Achieving market growth requires us to continue to develop our product strategy to meet the needs of different customer segments.

Cemplank ‘Builder Grade’ for the price-conscious bottom 1/3 of the market

Continued innovation of our HardiePlank products to defend and grow our premium brand share

Made For Living – ‘full-wrap’ marketing to grow our share of the house

11