Q3 FY12

MANAGEMENT PRESENTATION 28 February 2012

Exhibit 99.4 |

Q3 FY12

MANAGEMENT PRESENTATION 28 February 2012

Exhibit 99.4 |

2

FORWARD-LOOKING STATEMENTS

This Management Presentation contains forward-looking statements. James Hardie may from time to

time make forward-looking statements in its periodic reports filed with or furnished to the SEC

on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars,

invitation memoranda and prospectuses, in media releases and other written materials and in oral statements

made by the company’s officers, directors or employees to analysts, institutional investors,

existing and potential lenders, representatives of the media and others. Statements that are not

historical facts are forward-looking statements and such forward-looking statements are

statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of

1995. Examples of forward-looking statements include:

statements about the company’s future performance;

projections of the company’s results of operations or financial condition;

statements regarding the company’s plans, objectives or goals, including those

relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products;

expectations concerning the costs associated with the suspension or closure of operations at any of

the company’s plants and future plans with respect to any such plants;

expectations that the company’s credit facilities will be extended or

renewed; expectations concerning dividend payments and share

buy-backs; statements concerning the company’s corporate

and tax domiciles and potential changes to them, including potential tax charges;

statements regarding tax liabilities and related audits, reviews and

proceedings; statements as to the possible consequences of

proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments

Commission (ASIC);

expectations about the timing and amount of contributions to the Asbestos Injuries Compensation Fund

(AICF), a special purpose fund for the compensation of proven Australian asbestos- related

personal injury and death claims; expectations concerning

indemnification obligations; statements about product or

environmental liabilities; and statements about economic

conditions, such as economic or housing recovery, the levels of new home construction, unemployment levels, changes or stability in housing values, the

availability of mortgages and other financing, mortgage and other interest rates, housing

affordability and supply, the levels of foreclosures and home resales, currency exchange rates and

builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue” and

similar expressions are intended to identify forward-looking statements but are not the

exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking

statements and all such forward-looking statements are qualified in their entirety by reference to

the following cautionary statements. Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and conditions,

they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable

and beyond the company’s control. Such known and unknown risks, uncertainties and other

factors may cause actual results, performance or other achievements to differ materially from the

anticipated results, performance or achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are discussed under “Risk

Factors” in Section 3 of the Form 20-F filed with the US Securities and Exchange Commission on 29 June

2011, as amended by the Form 20-F/A filed on 14 July 2011, include, but are not limited to:

all matters relating to or arising out of the prior manufacture of products that contained asbestos by

current and former James Hardie subsidiaries; required contributions to the AICF, any shortfall in the

AICF and the effect of currency exchange rate movements on the amount recorded in the

company’s financial statements as an asbestos liability; governmental loan facility to the AICF;

compliance with and changes in tax laws and treatments; competition and product pricing in the

markets in which the company operates; the consequences of product failures or defects; exposure to

environmental, asbestos or other legal proceedings; general economic and market conditions; the

supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the company’s products; reliance on a small number of customers;

a customer’s inability to pay; compliance with and changes in environmental and health and safety

laws; risks of conducting business internationally; compliance with and changes in laws and

regulations; the effect of the transfer of the company’s corporate domicile from The Netherlands

to Ireland to become an Irish SE including employee relations, changes in corporate governance

and potential tax benefits; currency exchange risks; dependence on customer preference and the

concentration of the company’s customer base on large format retail customers, distributors and

dealers; dependence on residential and commercial construction markets; the effect of adverse changes

in climate or weather patterns; possible inability to renew credit facilities on terms

favorable to the company, or at all; acquisition or sale of businesses and business segments; changes

in the company’s key management personnel; inherent limitations on internal controls; use

of accounting estimates; and all other risks identified in the company’s reports filed with

Australian, Irish and US securities agencies and exchanges (as appropriate). The company cautions you

that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause

actual results to differ materially from those in forward-looking statements. Forward-looking

statements speak only as of the date they are made and are statements of the company’s current

expectations concerning future results, events and conditions. |

AGENDA

Overview

and

Operating

Review

–

Louis

Gries,

CEO

Financial

Review

–

Russell

Chenu,

CFO

Questions and Answers

3

In this Management Presentation, James Hardie may present financial measures, sales volume terms,

financial ratios, and Non-US GAAP financial measures included in the Definitions section of

this document starting on page 48. The company presents financial measures that it believes are

customarily used by its Australian investors. Specifically, these financial measures, which are equivalent to or derived from certain US

GAAP measures as explained in the definitions, include “EBIT”, “EBIT margin”,

“Operating profit” and “Net operating profit”. The company may also present

other terms for measuring its sales volumes (“million square feet” or “mmsf” and “thousand square feet” or “msf”); financial ratios

(“Gearing ratio”, “Net interest expense cover”, “Net interest paid

cover”, “Net debt payback”, “Net debt (cash)”); and Non-US GAAP financial

measures (“EBIT excluding asbestos and ASIC expenses”, “EBIT margin excluding asbestos

and ASIC expenses”, “Net operating profit excluding asbestos, ASIC expenses and tax

adjustments”, “Diluted earnings per share excluding asbestos, ASIC expenses, and tax adjustments”,

“Operating profit before income taxes excluding asbestos”, “Effective tax rate

excluding asbestos and tax adjustments”, “EBITDA” and “General

corporate costs excluding ASIC expenses and domicile change related costs”). Unless otherwise

stated, results and comparisons are of the 3rd quarter and nine months of the current fiscal year versus the 3rd quarter and nine months of the prior fiscal year.

|

OPERATING

REVIEW Louis Gries, CEO |

GROUP

OVERVIEW 5

3

quarter

operating

results

reflected

higher

sales

volume

(in

the

US

business),

improved

manufacturing

performance,

lower

general

corporate

costs

and

an

appreciation

of

Asia

Pacific

businesses’

currencies

compared to the US dollar, partially offset by an unfavorable product mix and

geographic mix in US sales.

As of 31 December 2011, the company had repurchased 3.4 million of shares at an

aggregate cost of A$19.1 million (US$19.0 million) and an average price paid

per share of A$5.59 (US$5.55) Interim dividend of US4.0 cents per security,

or US$17.4 million, was paid 23 January 2012 1

Comparisons

are

of

the

3

quarter

and

nine

months

of

the

current

fiscal

year

versus

the

3

quarter

and

nine

months

of

the

prior

fiscal

year

2

The

nine

months

results

of

the

prior

year

included

a

charge

of

US$345.2

million

resulting

from

the

dismissal

by

the

Federal

Court

of

Australia

of

RCI’s

appeal

of

the

ATO’s

disputed

1999

assessment.

Readers

are

referred

to

Note

10

of

the

consolidated

financials

for

further

information

1

2

Q3

Q3

%

9 Months

9 Months

%

FY 2012

FY 2011

Change

FY 2012

FY 2011

Change

Net operating (loss) profit

(4.8)

(26.4)

82

123.6

(345.2)

-

Net operating profit excluding asbestos,

ASIC expenses and tax adjustments

27.7

21.0

32

108.3

82.2

32

Diluted earnings per share excluding asbestos,

ASIC expenses and tax adjustments (US cents)

6.3

4.8

31

24.7

18.8

31

US$ Millions

rd

rd

rd |

USA AND

EUROPE FIBRE CEMENT 3rd Quarter Result

Net Sales

up

6% to US$192.8

million

Sales Volume

up

8% to 301.0 mmsf

Average Price

down

2% to US$641 per msf

EBIT

up

18% to US$31.0 million

EBIT Margin

up

1.7 pts to 16.1%

6

1

Comparisons are of the 3

quarter of the current fiscal year versus the 3

quarter of the prior fiscal year

rd

rd

1 |

USA AND

EUROPE FIBRE CEMENT Nine Months Result

Net Sales

up

4% to US$641.3

million

Sales Volume

up

4% to 980.6 mmsf

Average Price

flat

at US$654 per msf

EBIT

up

4% to US$126.3 million

EBIT Margin

down

0.1 pts to 19.7%

7

1

Comparisons are of nine months of the current fiscal year versus

the nine months of the prior fiscal year

1 |

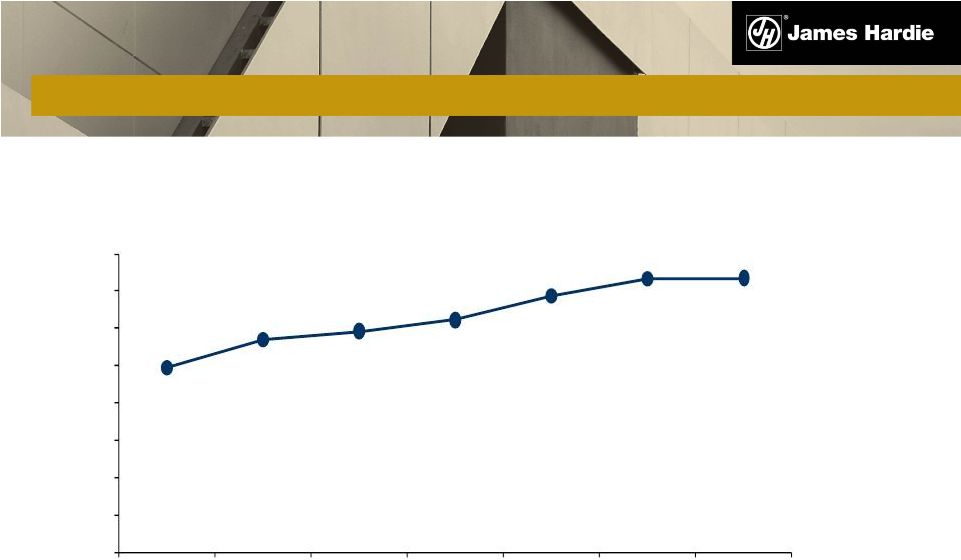

USA AND

EUROPE FIBRE CEMENT 8

Average Net Sales Price (US dollars)

US$654

1

FY12 average net sales price represents 3

quarter year to date; other years presented are for the full year

1

1

FY06

FY07

FY08

FY09

FY10

FY11

Q3 FY12

360

400

440

480

520

560

600

640

680

rd |

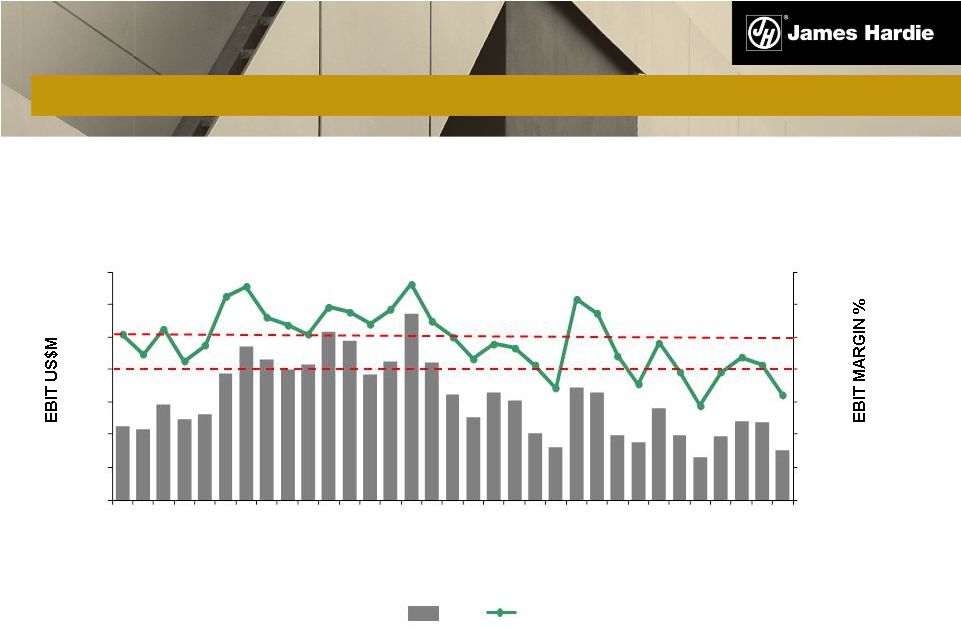

1

Excludes impairment charges of US$45.6 million in Q4 FY08

9

EBIT and EBIT Margin

EBIT

EBIT Margin

USA AND EUROPE FIBRE CEMENT

1

0

5

10

15

20

25

30

35

0

Q3 FY04

Q3 FY05

Q3 FY06

Q3 FY07

Q3 FY08

Q3 FY09

Q3 FY10

Q3 FY11

Q3 FY12

20

40

60

80

100

120

140 |

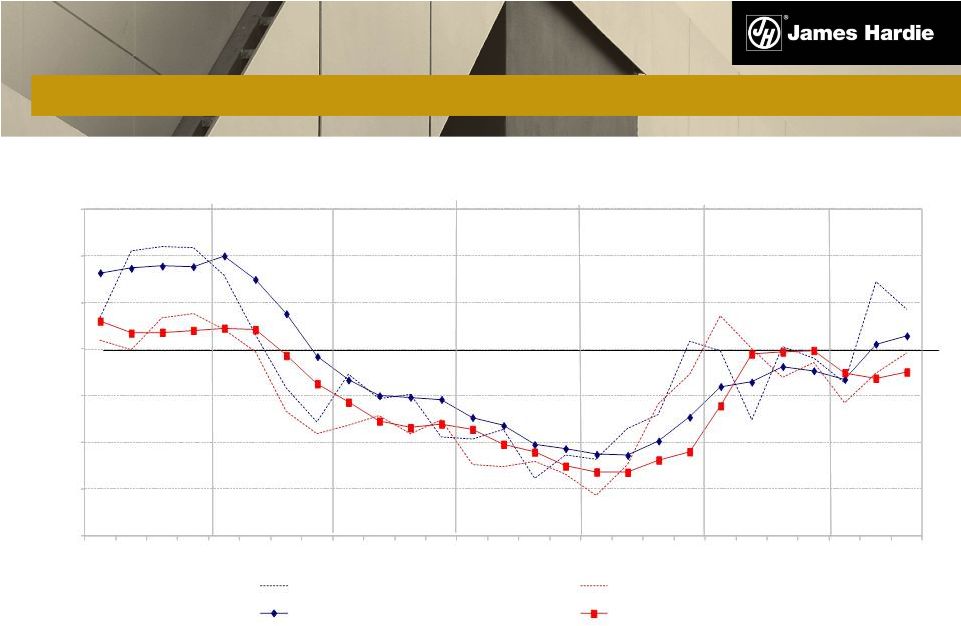

Primary Growth Performance

All market and market share figures are management‘s estimates.

10

USA AND EUROPE FIBRE CEMENT

-40%

-30%

-20%

-10%

0%

10%

20%

30%

Q106

Q206

Q306

Q406

Q107

Q207

Q307

Q407

Q108

Q208

Q308

Q408

Q109

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Q312

%JHBP Growth (sdft)

NC/R&R Growth

Rolling 4Qtr -

JHBP Growth (sdft)

Rolling 4Qtr -

NC/R&R Growth |

ASIA

PACIFIC FIBRE CEMENT 3rd Quarter Result

Net Sales

flat

at US$90.2

million

Sales Volume

down

5% to 94.4 mmsf

Average Price

up

4% to A$946 per msf

EBIT

down

3% to US$19.4 million

EBIT Margin

down

0.7 pts to 21.5%

11

1

1

Comparisons are of the 3

quarter of the current fiscal year versus the 3

quarter of the prior fiscal year

rd

rd |

ASIA

PACIFIC FIBRE CEMENT Nine Months Result

Net Sales

up

9% to US$286.9

million

Sales Volume

down

2% to 298.2 mmsf

Average Price

flat

at A$924 per msf

EBIT

up

10% to US$66.0 million

EBIT Margin

up

0.1 pts to 23.0%

12

1

Comparisons are of the nine months of the current fiscal year versus the nine

months of the prior fiscal year 1 |

GROUP

3

QUARTER

SUMMARY

13

USA and Europe Fibre Cement results reflected:

Quarterly demand has stabilized and continues to run slightly above last

year Decrease in unit price due to product mix and geographic mix

Increased SG&A driven by planned increase in field sales activities

Positive primary demand growth

Asia Pacific Fibre Cement results reflected:

Weaker markets in the Asia Pacific region

Lower sales volume, higher input costs, unfavourable manufacturing

performance Partially offset by price increases and a favourable

shift in product mix 1

and higher marketing costs

1

Comparisons are of the 3

quarter of the current fiscal year versus the 3

quarter of the prior fiscal year

rd

rd

rd |

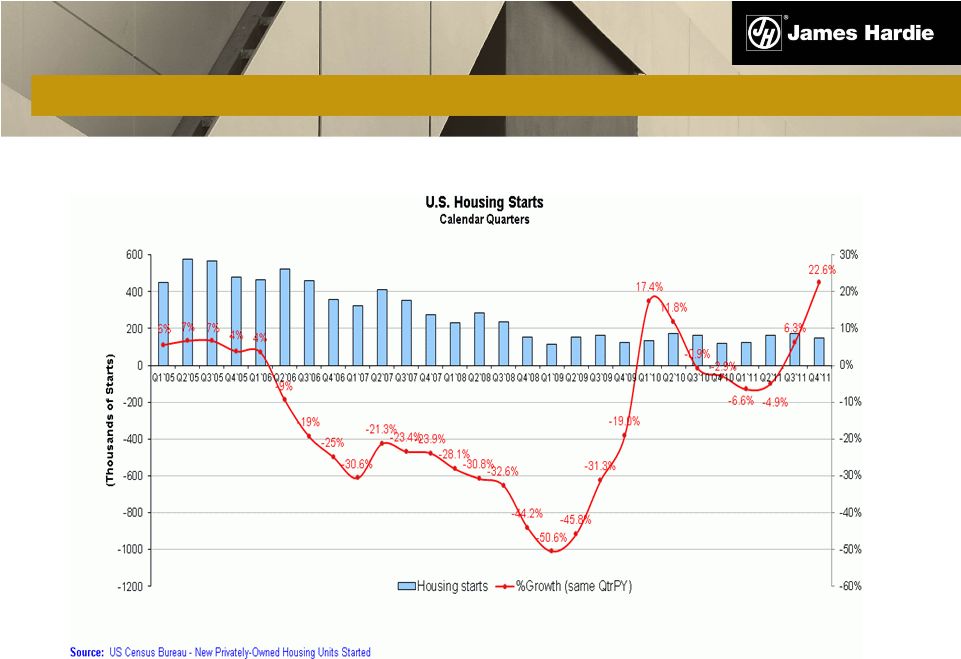

TOTAL

USA HOUSING STARTS – US CENSUS

14 |

15

GROUP OUTLOOK

United States

Although industry activity and demand have stabilised, there remains no evidence

of a sustainable recovery

Pulp price index (NBSK) steadily declining, but remains at elevated levels

Freight costs continue to be high compared to prior year

Company

initiatives,

such

as

the

increased

penetration

of

repair

and

remodel

and

non-metro markets and our house pack strategies, remain on track to improve

upon the gains in fibre cement category share and the exterior cladding

market achieved this year

Asia Pacific

Australia: despite a recent cut in official interest rates, there is little

confidence of an immediate pick up in housing construction activity

New Zealand: activity in the housing construction industry remains subdued

Philippines: activity in new construction slowed in the quarter

|

16

GROUP OUTLOOK

Key Priorities

The company’s key medium term priorities in the US are:

Grow

primary

demand

and

exterior

cladding

market

share

–

with

focus

on

repair

and remodel and non-metro markets

Increase

market

penetration

of

our

ColorPlus®

and

Trim

products

Continue to rollout our job pack distribution model

Overall Group Strategy

The company’s focus is to:

Deliver primary demand growth

Continue to shift to a higher value product mix

Increase manufacturing efficiency

Build the operational strength and flexibility to deliver and sustain earnings in

a low demand environment and increase output should a stronger than

expected recovery eventuate |

FINANCIAL REVIEW

Russell Chenu, CFO |

OVERVIEW

18

Highlights

Earnings this quarter reflect increased sales volume and category and market share

gains

in

the

US

business

and

the

appreciation

of

Asia

Pacific

business’

currencies

Strong net operating cash flow has enabled a further reduction in net debt from

US$40.4 million at 31 March 2011 to a net cash position of US$25.8 million

at 31 December 2011 Interim

dividend

of

US4.0

cents

per

security

was

paid

23

January

2012

As

of

31

December

2011,

the

company

had

repurchased

3.4

million

shares

at

an

aggregate cost of A$19.1 million (US$19.0 million) and an average price paid per

security of A$5.59 (US$5.55). During the third quarter, the company

acquired 1.0 million shares with an average price per security of A$5.49

(US$5.33) 10

February

2012

decision

of

the

High

Court

of

Australia

to

deny

ATO’s

application

for

leave to appeal will see material accounting and cash benefits for company in

Q4/full year FY12 results |

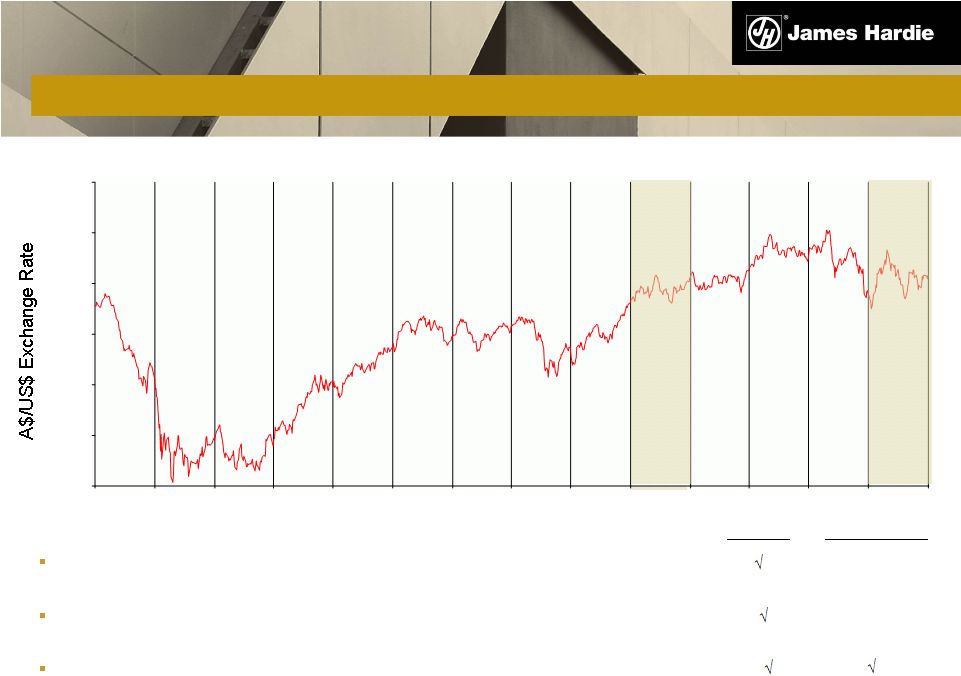

CONSEQUENCES OF CHANGES –

A$ VERSUS US$

Favourable

impact

from

translation

of

Asia

Pacific

results

–

Q3

FY12

vs

Q3

FY11

Unfavourable

impact

on

corporate

costs

incurred

in

Australian

dollars

–

Q3

FY12

vs

Q3 FY11

Favourable

impact

from

translation

of

asbestos

liability

balance

–

31

December

2011

vs 31

March 2011

19

Earnings

Balance Sheet

0.60

0.70

0.80

0.90

1.00

1.10

1.20

30 Jun 08

30 Sep 08

31 Dec 08

31 Mar 09

30 Jun 09

30 Sep 09

31 Dec 09

31 Mar 10

30 Jun 10

30 Sep 10

31 Dec 10

31 Mar 11

30 Jun 11

30 Sep 11

31 Dec 11

N/A

N/A |

RESULTS

– Q3

20

US$ Millions

Q3 '12

Q3 '11

% Change

Net sales

283.0

272.6

4

Gross profit

90.6

84.8

7

SG&A expenses

(48.0)

(49.4)

3

Research & development expenses

(7.3)

(5.9)

(24)

Asbestos adjustments

(33.5)

(46.4)

28

EBIT

1.8

(16.9)

-

Net interest expense

(1.5)

(1.3)

(15)

Other income

1.5

2.7

(44)

Income tax expense

(6.6)

(10.9)

39

Net operating loss

(4.8)

(26.4)

82 |

RESULTS

– Q3 (CONTINUED)

21

21

1

Includes AICF SG&A expenses and interest income

US$ Millions

Q3 '12

Q3 '11

% Change

Net operating loss

(4.8)

(26.4)

82

Asbestos:

Asbestos adjustments

33.5

46.4

(28)

Other asbestos

0.1

-

-

Tax expense related to asbestos adjustments

(0.1)

-

-

ASIC related expenses

0.3

-

-

Tax adjustments

(1.3)

1.0

-

Net operating profit excluding asbestos, ASIC

expenses and tax adjustments

27.7

21.0

32

1 |

22

US$ Millions

9 Months

FY2012

9 Months

FY2011

% Change

Net sales

928.2

878.6

6

Gross profit

311.4

295.0

6

SG&A expenses

(142.1)

(130.4)

(9)

Research & development expenses

(21.6)

(19.6)

(10)

Asbestos adjustments

15.2

(91.1)

-

EBIT

162.9

53.9

-

Net interest expense

(3.7)

(3.3)

(12)

Other expense

(0.5)

(4.6)

89

Income tax expense

(35.1)

(391.2)

91

Net operating profit (loss)

123.6

(345.2)

-

1

RESULTS –

NINE MONTHS

1

The nine month results of the prior year included a charge of US$345.2 million resulting from the

dismissal by the Federal Court of

Australia of RCI’s appeal of the ATO’s disputed 1999 amended assessment. Readers are

referred to Note 10 of the condensed

consolidated financial statements for further information.

|

23

23

RESULTS –

NINE MONTHS (CONTINUED)

1

Includes AICF SG&A expenses and interest income 2

The nine month results of the prior year included a charge of US$345.2 million resulting from the

dismissal by the Federal Court of

Australia of RCI’s appeal of the ATO’s disputed 1999 amended assessment. Readers are

referred to Note 10 of the condensed

consolidated financial statements for further information.

US$ Millions

9 Months

FY2012

9 Months

FY2011

% Change

Net operating profit (loss)

123.6

(345.2)

-

Asbestos:

Asbestos adjustments

(15.2)

91.1

-

Other asbestos

0.1

(0.7)

-

Tax expense related to asbestos adjustments

(0.1)

0.6

-

ASIC related expenses (recoveries)

1.0

(9.5)

-

Tax adjustments

(1.1)

345.9

-

Net operating profit excluding asbestos, ASIC

expenses and tax adjustments

108.3

82.2

32

1

2 |

24

SEGMENT NET SALES –

Q3

US$ Millions

Q3 '12

Q3 '11

% Change

USA and Europe Fibre Cement

192.8

182.6

6

Asia Pacific Fibre Cement

90.2

90.0

-

Total

283.0

272.6

4 |

25

SEGMENT NET SALES –

NINE MONTHS

US$ Millions

9 Months

FY2012

9 Months

FY2011

% Change

USA and Europe Fibre Cement

641.3

616.3

4

Asia Pacific Fibre Cement

286.9

262.3

9

Total

928.2

878.6

6 |

26

SEGMENT EBIT –

Q3

US$ Millions

Q3 ’12

Q3 ’11

% Change

USA and Europe Fibre Cement

31.0

26.3

18

Asia Pacific Fibre Cement

19.4

20.0

(3)

Research & development

(5.0)

(4.0)

(25)

Total segment EBIT

45.4

42.3

7

General corporate excluding asbestos and ASIC

expenses

(8.9)

(12.1)

27

Total EBIT excluding asbestos and ASIC

expenses

36.5

30.2

21

Asbestos adjustments

(33.5)

(46.4)

28

AICF SG&A expenses

(0.9)

(0.7)

(29)

ASIC expenses

(0.3)

-

-

Total EBIT

1.8

(16.9)

-

1

1

Research and development expenses include costs associated with research projects that are designed to

benefit all business units. These costs are recorded in the Research and Development segment

rather than attributed to individual business units. |

1

Research and development expenses include costs associated with research projects

that are designed to benefit all business units. These costs are recorded in

the Research and Development segment rather than attributed to individual business units.

27

SEGMENT EBIT –

NINE MONTHS

US$

Millions

9 Months

FY2012

9 Months

FY2011

% Change

USA and Europe Fibre Cement

126.3

121.8

4

Asia Pacific Fibre Cement

66.0

60.0

10

Research & development

(15.2)

(14.0)

(9)

Total segment EBIT

177.1

167.8

6

General corporate excluding asbestos and

ASIC expenses

(26.1)

(30.6)

15

Total EBIT excluding asbestos and ASIC

expenses

151.0

137.2

10

Asbestos adjustments

15.2

(91.1)

-

AICF SG&A expenses

(2.3)

(1.7)

(35)

ASIC (expenses) recoveries

(1.0)

9.5

-

Total EBIT

162.9

53.9

-

1 |

28

INCOME TAX EXPENSE –

Q3

1

Includes AICF SG&A expenses and interest income

US$

Millions

Operating profit (loss) before income taxes

1.8

(15.5)

Asbestos:

Asbestos adjustments

33.5

46.4

Other asbestos

0.1

-

Operating profit before income taxes excluding

asbestos

35.4

30.9

Income tax expense

Asbestos:

Tax expense related to asbestos adjustments

(0.1)

-

Tax adjustments

(1.3)

1.0

Income tax expense excluding tax adjustments

(8.0)

(9.9)

Effective tax rate excluding asbestos and

tax adjustments

22.6%

32.0%

Q3 '12

Q3 '11

(6.6)

(10.9)

1 |

29

INCOME TAX EXPENSE –

NINE MONTHS

1

Includes AICF SG&A expenses and interest income

2

The

nine

month

results

of

the

prior

year

included

a

charge

of

US$345.2

million

resulting

from

the

dismissal

by

the

Federal

Court

of

Australia

of

RCI’s

appeal

of

the

ATO’s

disputed

1999

amended

assessment.

Readers

are

referred

to

Note

10

of

the

condensed

consolidated financial statements for further information.

US$

Millions

9 Months

FY2012

9 Months

FY2011

Operating profit before income taxes

158.7

46.0

Asbestos:

Asbestos adjustments

(15.2)

91.1

Other asbestos

0.1

(0.7)

Operating profit before income taxes excluding

asbestos

143.6

136.4

Income tax expense

(35.1)

(391.2)

Asbestos:

Tax expense related to asbestos adjustments

(0.1)

0.6

Tax adjustments

(1.1)

345.9

Income tax expense excluding tax adjustments

(36.3)

(44.7)

Effective tax rate excluding asbestos and

tax adjustments

25.3%

32.8%

1

2 |

30

1

Certain reclassifications have been reflected in the prior period shown above to

conform with current period presentation of movements in net cash. US$ Millions

9 Months

FY2012

9 Months

FY2011

EBIT

162.9

53.9

Non-cash items:

Asbestos adjustments

(15.2)

91.1

Other non-cash items

53.1

54.1

Net working capital movements

25.8

27.4

Cash Generated By Trading Activities

226.6

226.5

Tax payments, net

(28.4)

(33.0)

Change in Other Non-Trading Assets and Liabilities

(31.5)

(17.2)

Change in asbestos-related assets & liabilities

0.1

(0.7)

Payment to the AICF

(51.5)

(63.7)

Interest paid (net)

(6.1)

(6.1)

Net Operating Cash Flow

109.2

105.8

Purchases of property, plant & equipment

(25.5)

(37.3)

Proceeds from sale of property, plant & equipment

0.3

0.6

Common stock repurchased and cancelled

(19.0)

-

Equity issued

3.9

1.8

Effect of exchange rate on cash

(2.7)

6.1

Movement In Net Cash

66.2

77.0

Beginning Net Debt

(40.4)

(134.8)

Ending Net Cash (Debt)

25.8

(57.8)

CASHFLOW

1 |

Net debt decreased by US$66.2 million to net cash of US$25.8 million compared to

net debt at 31 March 2011

Weighted average remaining term of total facilities was 1.2 years at 31 December

2011, down from 1.9 years at 31 March 2011

James Hardie remains well within its financial debt covenants

31

At 31 December 2011

DEBT

US$ Millions

Total facilities

320.0

Gross debt

13.0

Cash

38.8

Net debt (cash)

(25.8)

Unutilised facilities and cash

345.8 |

32

LEGACY ISSUES UPDATE

ATO –

RCI successful in its appeal of the 1999 disputed amended tax assessment

James Hardie’s initial appeal dismissed by the Federal Court of Australia in

September 2010 Charge

of

US$345.2

million

effective

1

September

2010

(no

impact

on

net

operating

cash

flow

in

FY11)

On 22 August 2011, the Full Federal Court upheld RCI’s appeal, ordered that

RCI’s objection be allowed in full and awarded RCI costs

The ATO filed an application for special leave to appeal the Full Federal

Court’s decision to the High Court of Australia. On 10 February 2012,

the High Court dismissed the ATO’s application. With the matter now

finalised in RCI’s favour, the ATO issued a further notice of amended assessment

and paid a refund of US$265.8 million (A$248.0 million) on 27 February

2012. Accordingly, the fourth quarter and full year results will

reflect a benefit of approximately US$393.8 million (A$367.6 million),

which represents the reversal of the provision for the unpaid portion of the

amended assessment and cash

paid

by

RCI

during

the

appeal

proceedings,

partially

offset

by

taxes

payable

on

general

interest

charges previously deducted

Additional interest income will be recognised as a benefit in the fourth quarter

on amounts which were overpaid up to 27 February 2012, partially offset by

taxes payable on the interest. This amount is anticipated to be paid by the

ATO in the fourth quarter. The company has commenced recovery of a portion

of the legal costs incurred in litigating the amended assessment

35% of the refund will be contributed to AICF

Company will have Australian tax liability on the reversal of general interest

charges, interest income and legal costs recovered

Management and Board considering options for use of balance of refund

|

33

1

In accordance with the Amended and Restated Final Funding Agreement

ASBESTOS FUND UPDATE –

PRO FORMA (UNAUDITED)

A$

millions

AICF

cash

and

deposits

-

31

March

2011

59.9

Contribution to AFFA by James Hardie

48.9

Insurance and cross claim recoveries

22.0

Interest income and unrealised loss on investments

1.9

Claims paid

(73.9)

Operating costs

(4.0)

Other

1.5

AICF

net

cash

and

deposits

-

31

December

2011

56.3

Fund drew down A$29.7 million on NSWG standby loan facility on 17 February

2012. 1 |

*

Certain reclassifications have been reflected in the prior period shown above to

conform with current period presentation 1

Excludes

asbestos

adjustments,

AICF

SG&A

expenses,

AICF

interest

income,

gain

or

impairment

on

AICF

investments, tax benefits related to asbestos adjustments, ASIC expenses/recoveries

and tax adjustments 2

Excludes asbestos adjustments, AICF SG&A expenses and ASIC

expenses/recoveries .

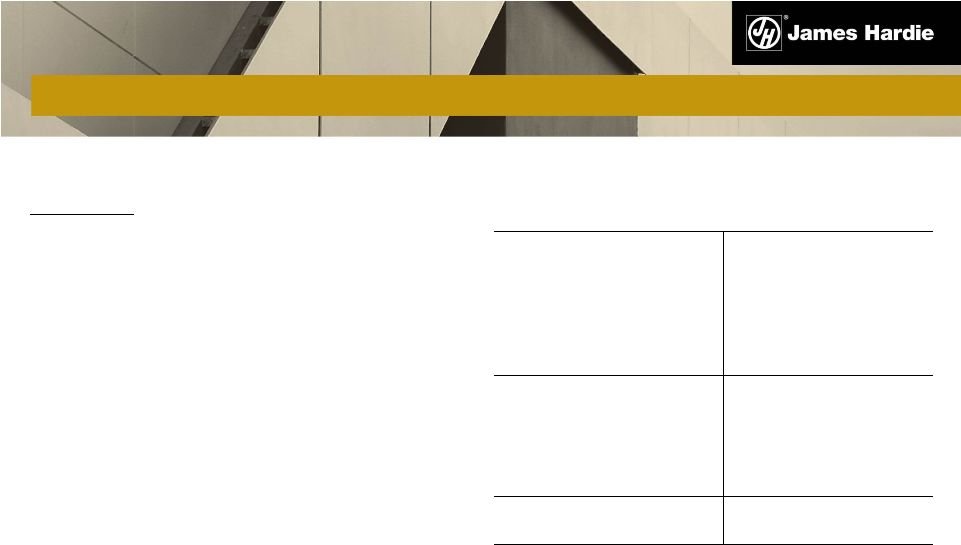

34

KEY RATIOS

9 Months

FY2012

9 Months

FY2011

9 Months

FY2010

EPS (Diluted)

24.7c

18.8c

25.3c

EBIT/ Sales (EBIT margin)

16.3%

15.6%

20.1%

Gearing Ratio

-2.0%

4.6%

11.7%

Net Interest Expense Cover

25.6x

24.1x

37.9x

Net Interest Paid Cover

24.8x

22.5x

33.4x

Net Debt Payback

-

0.3yrs

0.5yrs

1

2

2

1

2

* |

35

SUMMARY

1

Comparisons

are

of

the

3

quarter

and

nine

months

of

the

current

fiscal

year

versus

the

3

quarter

and

nine

months

of

the prior fiscal year

Net operating profit, excluding asbestos, ASIC expenses and tax adjustments for

the 3

rd

quarter

and

nine

months

was

US$27.7

million

and

US$108.3

million,

respectively

The 3

rd

quarter results reflected:

Stable US and subdued Asia Pacific operating environments

Higher sales volumes due to the gains in market and category share and the impact

in the prior period of The

appreciation

of

Asia

Pacific

business’

currencies

against

the

US

dollar

Higher SG&A expenses for the nine months primarily due to a US$10.3 million

prior year recovery from a third party

1

rd

rd

expiry of the US federal government tax incentive program

|

36

GUIDANCE

Challenges remain, with the operating environment in the US still weak and the

Asia Pacific residential markets softening

Management anticipates

FY12 full year earnings excluding asbestos, ASIC expenses

and tax adjustments expected to be within the range of US$130 million to US$140

million

Management cautions that conditions remain uncertain and notes that the cost of

some inputs, particularly pulp and freight, may be volatile

Management cautions that guidance is dependent upon housing industry conditions

and

the

A$/US$

exchange

rate

remaining

stable

for

the

balance

of

the

fiscal

year

ending 31 March 2012

The company continues to perform well financially and our employees remain focused

on driving our long term strategies |

QUESTIONS |

APPENDIX |

39

GLOBAL STRATEGY

Aggressively grow demand for our products in targeted market segments

Grow our overall market position while defending our share in existing

market segments

Offer products with superior value to that of our competitors

Introduce differentiated products to deliver a sustainable competitive

advantage |

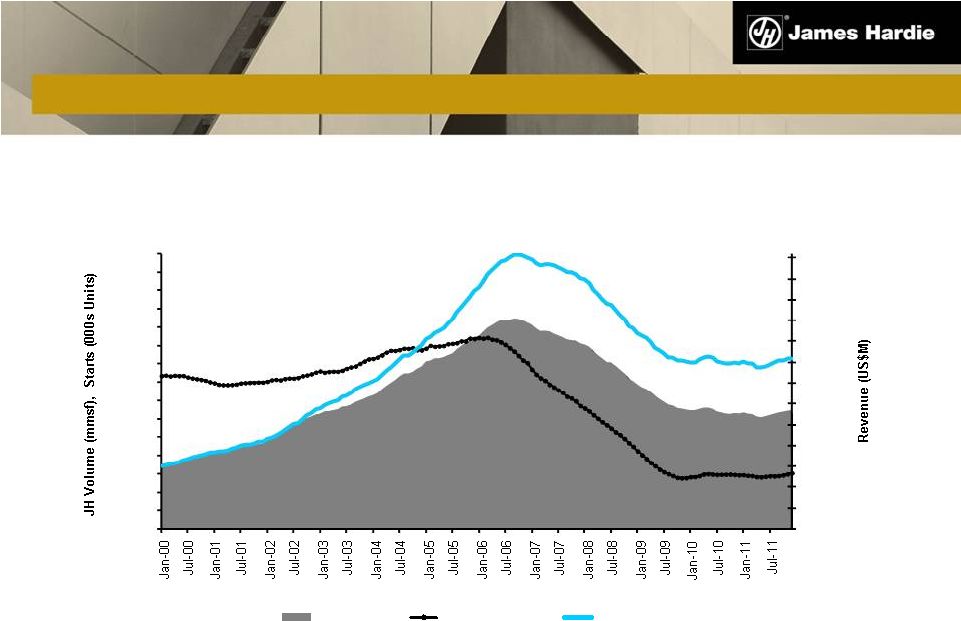

Rolling 12 month average of seasonally adjusted estimate of housing starts by US

Census Bureau 40

USA FIBRE CEMENT

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

$1,300

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2,800

3,000

Top Line Growth

JH Volume

Housing Starts

JH Revenue |

GENERAL

CORPORATE COSTS – Q3

41

1

Certain reclassifications have been reflected in the prior period shown above to

conform with current period presentation of general corporate costs

1

US$ Millions

% Change

Stock compensation expense

4.6

3.3

(39)

Other costs

4.3

8.8

51

General corporate costs excluding ASIC

expenses

8.9

12.1

27

ASIC related expenses

0.3

-

-

General corporate costs

9.2

12.1

24

Q3 '12

Q3 '11 |

GENERAL

CORPORATE COSTS – NINE MONTHS

42

1

1

Certain reclassifications have been reflected in the prior period shown above to

conform with current period presentation of general corporate costs US$

Millions

9 Months

FY2012

9 Months

FY2011

% Change

Stock compensation expense

8.4

9.0

7

Other costs

17.7

19.8

11

General corporate costs excluding ASIC

expenses and domicile change related

costs

26.1

28.8

9

ASIC related expenses (recoveries)

1.0

(9.5)

-

Domicile change related costs

-

1.8

-

General corporate costs

27.1

21.1

(28)

*FY2011 includes US$10.3 million recovery from third parties

|

43

EBITDA –

Q3

US$ Millions

Q3 ’12

Q3 ’11

% Change

EBIT

USA and Europe Fibre Cement

31.0

26.3

18

Asia Pacific Fibre Cement

19.4

20.0

(3)

Research & development

(5.0)

(4.0)

(25)

General corporate excluding asbestos and ASIC expenses

(8.9)

(12.1)

27

Depreciation and Amortisation

USA and Europe Fibre Cement

14.4

13.2

9

Asia Pacific Fibre Cement

2.6

2.7

(4)

Total EBITDA excluding asbestos and ASIC expenses

53.5

46.1

16

Asbestos adjustments

(33.5)

(46.4)

28

AICF SG&A expenses

(0.9)

(0.7)

(29)

ASIC (expenses) recoveries

(0.3)

-

-

Total EBITDA

18.8

(1.0)

- |

44

EBITDA –

NINE MONTHS

US$ Millions

9 Months

FY2012

9 Months

FY2011

% Change

EBIT

USA and Europe Fibre Cement

126.3

121.8

4

Asia Pacific Fibre Cement

66.0

60.0

10

Research & development

(15.2)

(14.0)

(9)

General corporate excluding asbestos and ASIC expenses

(26.1)

(30.6)

15

Depreciation and Amortisation

USA and Europe Fibre Cement

39.8

39.6

1

Asia Pacific Fibre Cement

8.0

7.3

10

Total EBITDA excluding asbestos and ASIC expenses

198.8

184.1

8

Asbestos adjustments

15.2

(91.1)

-

AICF SG&A expenses

(2.3)

(1.7)

(35)

ASIC (expenses) recoveries

(1.0)

9.5

-

Total EBITDA

210.7

100.8

- |

45

CAPITAL EXPENDITURE

US$

Millions

9 Months

FY2012

9 Months

FY2011

% Change

USA and Europe Fibre Cement

20.6

31.4

(34)

Asia Pacific Fibre Cement

4.9

5.9

(17)

Total

25.5

37.3

(32) |

46

NET INTEREST EXPENSE

US$ Millions

Q3 ’12

Q3 ’11

9 Months

FY2012

9 Months

FY2011

Gross interest expense

(0.9)

(1.0)

(2.9)

(3.2)

Interest income

-

-

0.2

0.3

Realised loss on interest rate swaps

(1.4)

(1.0)

(3.2)

(2.8)

Net

interest

expense

excluding

AICF

interest

income

(2.3)

(2.0)

(5.9)

(5.7)

AICF interest income

0.8

0.7

2.2

2.4

Net interest expense

(1.5)

(1.3)

(3.7)

(3.3) |

47

ASIC Proceedings

NSW Court of Appeal judgement handed down on 17 December 2010

Company’s appeal dismissed

Non-executive directors’

appeals upheld

On 13 May 2011, ASIC and one former executive granted special leave to appeal

to the High Court of Australia

Appeals were heard by the High Court over three days commencing 25 October

2011

Judgement has been reserved

LEGACY ISSUES UPDATE |

This Management Presentation forms part of a package of information about the

company’s results. It should be read in conjunction with the

other parts of this package, including the Management’s Analysis of Results, Media Release and Condensed

Consolidated Financial Statements.

Definitions

Non-financial Terms

ABS

–

Australian Bureau of Statistics.

AFFA

–

Amended and Restated Final Funding Agreement.

AICF

–

Asbestos Injuries Compensation Fund Ltd.

ASIC

–

Australian Securities and Investments Commission.

ATO

–

Australian Taxation Office.

NBSK –

Northern Bleached Soft Kraft; the company's benchmark grade of pulp.

Financial Measures –

US GAAP equivalents

EBIT and EBIT Margin

-

EBIT, as used in this document, is equivalent to the US GAAP measure of operating

income. EBIT margin is defined as EBIT as a percentage of net sales.

Operating profit

-

is equivalent to the US GAAP measure of income.

Net operating profit

-

is equivalent to the US GAAP measure of net income.

48

ENDNOTES |

Sales Volumes

mmsf

–

million

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness.

msf

Financial Ratios

Gearing Ratio

–

Net

debt

(cash)

divided

by

net

debt

(cash)

plus

shareholders’

equity.

Net interest expense cover

–

EBIT divided by net interest expense (excluding loan establishment fees).

Net interest paid cover

–

EBIT

divided

by

cash

paid

during

the

period

for

interest,

net

of

amounts

capitalised.

Net debt payback

–

Net debt (cash) divided by cash flow from operations.

Net debt (cash)

–

Short-term and long-term debt less cash and cash equivalents.

Return on Capital employed

–

EBIT divided by gross capital employed.

49

ENDNOTES (CONTINUED)

–

thousand

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness. |

50

NON-US GAAP FINANCIAL MEASURES

EBIT and EBIT margin excluding asbestos and ASIC expenses

and

ASIC

expenses

are

not

measures

of

financial

performance

under

US

GAAP

and

should

not

be

considered

to

be

more meaningful than EBIT and EBIT margin. Management has included these financial

measures to provide investors

with

an

alternative

method

for

assessing

its

operating

results

in

a

manner

that

is

focussed

on

the

performance of its ongoing operations and provides useful information regarding its

financial condition and results of operations. Management uses these

non-US GAAP measures for the same purposes. –

EBIT and EBIT margin excluding asbestos

Q3

Q3

9 Months

9 Months

US$ Millions

FY 2012

FY 2011

FY 2012

FY 2011

EBIT

$ 1.8

$ (16.9)

$ 162.9

$ 53.9

Asbestos:

Asbestos adjustments

33.5

46.4

(15.2)

91.1

AICF SG&A expenses

0.9

0.7

2.3

1.7

ASIC related expenses (recoveries)

0.3

-

1.0

(9.5)

EBIT excluding asbestos and ASIC expenses

36.5

30.2

151.0

137.2

Net sales

$ 283.0

$ 272.6

$ 928.2

$ 878.6

EBIT margin excluding asbestos and

ASIC expenses

12.9%

11.1%

16.3%

15.6% |

–

Net operating profit excluding asbestos,

ASIC expenses and tax adjustments is not a measure of financial performance under

US GAAP and should not be considered

to

be

more

meaningful

than

net

income.

Management

has

included

this

financial

measure

to

provide

investors

with an alternative method for assessing its operating results in a manner that is

focussed on the performance of its ongoing operations. Management uses this

non-US GAAP measure for the same purposes. 51

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Net operating profit excluding asbestos, ASIC expenses and tax adjustments

Q3

Q3

9 Months

9 Months

US$ Millions

FY 2012

FY 2011

FY 2012

FY 2011

Net operating (loss) profit

$ (4.8)

$ (26.4)

$ 123.6

$ (345.2)

Asbestos:

Asbestos adjustments

33.5

46.4

(15.2)

91.1

AICF SG&A expenses

0.9

0.7

2.3

1.7

AICF interest income

(0.8)

(0.7)

(2.2)

(2.4)

Tax expense related to asbestos

adjustments

(0.1)

-

(0.1)

0.6

ASIC related expenses (recoveries)

0.3

-

1.0

(9.5)

Tax adjustments

(1.3)

1.0

(1.1)

345.9

Net operating profit excluding asbestos,

ASIC expenses and tax adjustments

$ 27.7

$ 21.0

$ 108.3

$ 82.2

¹

¹

The nine month results of the prior year included a charge of US$345.2 million resulting from the

dismissal by the Federal

Court of Australia of RCI’s appeal of the ATO’s disputed 1999 amended

assessment. Readers are referred to Note 10 of the condensed

consolidated financial statements for further information.

|

52

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q3

Q3

9 Months

9 Months

US$ Millions

FY 2012

FY 2011

FY 2012

FY 2011

Net operating profit excluding asbestos,

ASIC expenses and tax adjustments

$ 27.7

$ 21.0

$ 108.3

$ 82.2

Weighted average common shares outstanding -

Diluted (millions)

437.0

438.0

438.4

437.7

Diluted earnings per share excluding asbestos,

ASIC expenses and tax adjustments

(US cents)

6.3

4.8

24.7

18.8

Diluted

earnings

per

share

excluding

asbestos,

ASIC

expenses

and

tax

adjustments–

Non-US GAAP Financial Measures (continued)

excluding asbestos, ASIC expenses and tax adjustments is not a measure of financial

performance under US GAAP and should not be considered to be more meaningful

than diluted earnings per share. Management has included this financial

measure to provide investors with an alternative method for assessing its operating results in a manner that is

focussed on the performance of its ongoing operations. Management uses this

non-US GAAP measure for the same purposes.

Diluted

earnings

per

share |

–

Effective tax rate excluding asbestos and tax

adjustments is not a measure of financial performance under US GAAP and should not

be considered to be more meaningful

than

effective

tax

rate.

Management

has

included

this

financial

measure

to

provide

investors

with

an

alternative method for assessing its operating results in a manner that is focussed

on the performance of its ongoing operations. Management uses this

non-US GAAP measure for the same purposes. 53

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Effective tax rate excluding asbestos and tax adjustments

Q3

Q3

9 Months

9 Months

US$ Millions

FY 2012

FY 2011

FY 2012

FY 2011

Operating profit (loss) before income taxes

$ 1.8

$ (15.5)

$ 158.7

$ 46.0

Asbestos:

Asbestos adjustments

33.5

46.4

(15.2)

91.1

AICF SG&A expenses

0.9

0.7

2.3

1.7

AICF interest income

(0.8)

(0.7)

(2.2)

(2.4)

Operating profit before income taxes excluding

asbestos

$ 35.4

$ 30.9

$ 143.6

$ 136.4

Income tax expense

(6.6)

(10.9)

(35.1)

(391.2)

Asbestos:

Tax expense related to asbestos adjustments

(0.1)

-

(0.1)

0.6

Tax adjustments

(1.3)

1.0

(1.1)

345.9

Income tax expense excluding tax adjustments

(8.0)

(9.9)

(36.3)

(44.7)

Effective tax rate excluding asbestos and

tax adjustments

22.6%

32.0%

25.3%

32.8%

¹ The nine month results of the prior year included a charge of US$345.2 million

resulting from the dismissal by the Federal

Court of Australia of RCI’s appeal of the ATO’s disputed 1999 amended

assessment. Readers are referred to Note 10 of the condensed

consolidated financial statements for further information.

¹ |

54

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

EBITDA

more

meaningful

than,

income

from

operations,

net

income

or

cash

flows

as

defined

by

US

GAAP

or

as

a

measure

of

profitability or liquidity. Not all companies calculate EBITDA in the same manner

as James Hardie has and, accordingly, EBITDA may not be comparable with

other companies. Management has included information concerning EBITDA

because it believes that this data is commonly used by investors to evaluate the ability of a company’s

earnings from its core business operations to satisfy its debt, capital expenditure

and working capital requirements. is not a measure of financial performance

under US GAAP and should not be considered an alternative to, or

–

Q3

Q3

9 Months

9 Months

US$ Millions

FY 2012

FY 2011

FY 2012

FY 2011

EBIT

$ 1.8

$ (16.9)

$ 162.9

$ 53.9

Depreciation and amortisation

17.0

15.9

47.8

46.9

Adjusted EBITDA

$ 18.8

$ (1.0)

$ 210.7

$ 100.8 |

55

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

General corporate costs excluding ASIC expenses and domicile change related

costs excluding

ASIC

expenses

and

domicile

change

related

costs

is

not

a

measure

of

financial

performance

under

US

GAAP

and

should

not

be

considered

to

be

more

meaningful

than

general

corporate

costs.

Management

has

included

these

financial measures to provide investors with an alternative method for assessing

its operating results in a manner that is focussed on the performance of its

ongoing operations and provides useful information regarding its financial condition

and results of operations. Management uses these non-US GAAP measures for the

same purposes. –

General corporate costs

Q3

9 Months

9 Months

US$ Millions

FY 2011

FY 2011

General corporate costs

$ 9.2

$ 12.1

$ 27.1

$ 21.1

Excluding:

ASIC related (expenses) recoveries

(0.3)

-

(1.0)

9.5

Domicile change related costs

-

-

-

(1.8)

General corporate costs excluding ASIC

expenses and domicile change related costs

$ 8.9

$ 12.1

$ 26.1

$ 28.8

FY 2012

Q3

FY 2012 |

Q3 FY12

MANAGEMENT PRESENTATION 28 February 2012 |