Exhibit 99.8

|

|

|

|

|

|

|

|

|

|

|

|

KPMG Actuarial Pty Ltd

Australian Financial Services Licence No. 392050 10 Shelley Street Sydney NSW 2000

PO Box H67 Australia Square NSW 1215 Australia |

|

ABN: 91 144 686 046 Telephone:

+61 2 9335 7000 Facsimile: +61 2 9335 7001 DX: 1056 Sydney www.kpmg.com.au |

Valuation of Asbestos-Related Disease

Liabilities of former James Hardie entities

(“the Liable Entities”) to be met by the AICF

Trust

Prepared for Asbestos Injuries

Compensation Fund Limited (“AICFL”)

Effective as at

31 March 2012

21 May 2012

© 2012 KPMG, an Australian partnership and a member firm of the

KPMG network

of independent member firms affiliated with KPMG

International Cooperative (“KPMG International”), a Swiss entity.

All

rights reserved. Printed in Australia. KPMG and the KPMG logo are

registered trademarks of KPMG International.

|

|

|

|

|

|

|

|

|

|

|

|

KPMG Actuarial Pty Ltd

Australian Financial Services Licence No. 392050 10 Shelley Street Sydney NSW 2000

PO Box H67 Australia Square NSW 1215 Australia |

|

ABN: 91 144 686 046 Telephone:

+61 2 9335 7000 Facsimile: +61 2 9335 7001 DX: 1056 Sydney www.kpmg.com.au |

21 May 2012

Narreda Grimley

General Manager

Asbestos Injuries Compensation Fund Limited

Suite 1, Level 7, 233 Castlereagh Street

Sydney NSW 2000

| Cc |

Russell Chenu, Chief Financial Officer, James Hardie Industries SE |

Paul Miller, General Counsel, Department of Premier and Cabinet, The State of

New

South Wales

The Board of Directors, Asbestos Injuries Compensation Fund Limited

Dear Narreda

VALUATION OF ASBESTOS-RELATED

DISEASE LIABILITIES OF FORMER JAMES HARDIE ENTITIES (“THE LIABLE ENTITIES”) TO BE MET BY THE AICF TRUST

We are pleased to

provide you with our actuarial valuation report relating to the asbestos-related disease liabilities of the Liable Entities which are to be met by the AICF Trust.

The report is effective as at 31 March 2012 and has taken into account claims data and information provided to us by AICFL as at 31 March 2012.

If you have any questions with respect to the contents of this report, please do not hesitate to contact us.

Yours sincerely

|

|

|

|

|

|

|

|

| Neil Donlevy MA FIA FIAA |

|

Jefferson Gibbs BSc FIA FIAA |

| Executive, KPMG Actuarial Pty Limited |

|

Executive, KPMG Actuarial Pty Limited |

| Fellow of the Institute of Actuaries (London) |

|

Fellow of the Institute of Actuaries (London) |

| Fellow of the Institute of Actuaries of Australia |

|

Fellow of the Institute of Actuaries of Australia |

© 2012 KPMG, an Australian partnership and a member firm of the

KPMG network of independent member firms affiliated with KPMG

International Cooperative (“KPMG International”), a Swiss entity. All

rights reserved. Printed in Australia. KPMG and the KPMG logo are

registered trademarks of KPMG International.

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Table of Contents

|

|

|

|

|

|

|

|

|

| Executive Summary |

|

|

i |

|

| 1 |

|

|

|

Scope and Purpose |

|

|

1 |

|

|

|

1.1 |

|

Introduction |

|

|

1 |

|

|

|

1.2 |

|

Scope of report |

|

|

2 |

|

|

|

1.3 |

|

Areas of potential exposure |

|

|

6 |

|

|

|

1.4 |

|

Data reliances and limitations |

|

|

11 |

|

|

|

1.5 |

|

Uncertainty |

|

|

11 |

|

|

|

1.6 |

|

Distribution and use |

|

|

12 |

|

|

|

1.7 |

|

Date labelling convention used in this Report |

|

|

12 |

|

|

|

1.8 |

|

Author of the report |

|

|

13 |

|

|

|

1.9 |

|

Professional standards and compliance |

|

|

13 |

|

|

|

1.10 |

|

Control processes and review |

|

|

13 |

|

|

|

1.11 |

|

Funding position of the AICF Trust |

|

|

14 |

|

|

|

1.12 |

|

Basis of preparation of Report |

|

|

14 |

|

| 2 |

|

|

|

Data |

|

|

15 |

|

|

|

2.1 |

|

Data provided to KPMG Actuarial |

|

|

15 |

|

|

|

2.2 |

|

Data limitations |

|

|

15 |

|

|

|

2.3 |

|

Data reconciliation and testing |

|

|

15 |

|

|

|

2.4 |

|

Data conclusion |

|

|

19 |

|

| 3 |

|

|

|

Valuation Methodology and Approach |

|

|

20 |

|

|

|

3.1 |

|

Previous valuation work and methodology changes |

|

|

20 |

|

|

|

3.2 |

|

Overview of current methodology |

|

|

20 |

|

|

|

3.3 |

|

Disease type and class subdivision |

|

|

22 |

|

|

|

3.4 |

|

Numbers of future claims notifications |

|

|

24 |

|

|

|

3.5 |

|

Incidence of claim settlements from future claim notifications |

|

|

28 |

|

|

|

3.6 |

|

Average claim costs of IBNR claims |

|

|

29 |

|

|

|

3.7 |

|

Proportion of claims settled for nil amounts |

|

|

30 |

|

|

|

3.8 |

|

Pending claims |

|

|

30 |

|

|

|

3.9 |

|

Insurance Recoveries |

|

|

33 |

|

|

|

3.10 |

|

Cross-claim recoveries |

|

|

37 |

|

|

|

3.11 |

|

Discounting cashflows |

|

|

38 |

|

| 4 |

|

|

|

Claims Experience – Claim Numbers |

|

|

39 |

|

|

|

4.1 |

|

Overview |

|

|

39 |

|

|

|

4.2 |

|

Mesothelioma claims |

|

|

40 |

|

|

|

4.3 |

|

Asbestosis claims |

|

|

44 |

|

|

|

4.4 |

|

Lung cancer claims |

|

|

44 |

|

|

|

4.5 |

|

ARPD & Other claims |

|

|

45 |

|

|

|

4.6 |

|

Workers Compensation and wharf claims |

|

|

45 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

|

|

|

|

|

|

|

|

|

|

|

4.7 |

|

Summary of base claims numbers assumptions |

|

|

45 |

|

|

|

4.8 |

|

Exposure information |

|

|

46 |

|

|

|

4.9 |

|

Latency period of reported claims |

|

|

48 |

|

|

|

4.10 |

|

Assumed peak year of claims and estimated future notifications |

|

|

53 |

|

|

|

4.11 |

|

Baryulgil |

|

|

55 |

|

| 5 |

|

|

|

Claims Experience – Average Claims Costs |

|

|

56 |

|

|

|

5.1 |

|

Overview |

|

|

56 |

|

|

|

5.2 |

|

Mesothelioma claims |

|

|

57 |

|

|

|

5.3 |

|

Asbestosis claims |

|

|

60 |

|

|

|

5.4 |

|

Lung cancer claims |

|

|

61 |

|

|

|

5.5 |

|

ARPD & Other claims |

|

|

62 |

|

|

|

5.6 |

|

Workers Compensation claims |

|

|

63 |

|

|

|

5.7 |

|

Wharf claims |

|

|

64 |

|

|

|

5.8 |

|

Large claim size and incidence rates |

|

|

65 |

|

|

|

5.9 |

|

Summary assumptions |

|

|

67 |

|

| 6 |

|

|

|

Claims Experience – Nil Settlement Rates |

|

|

68 |

|

|

|

6.1 |

|

Overview |

|

|

68 |

|

|

|

6.2 |

|

Mesothelioma claims |

|

|

69 |

|

|

|

6.3 |

|

Asbestosis claims |

|

|

70 |

|

|

|

6.4 |

|

Lung cancer claims |

|

|

71 |

|

|

|

6.5 |

|

ARPD & Other claims |

|

|

72 |

|

|

|

6.6 |

|

Workers Compensation claims |

|

|

73 |

|

|

|

6.7 |

|

Wharf claims |

|

|

74 |

|

|

|

6.8 |

|

Summary assumptions |

|

|

75 |

|

| 7 |

|

|

|

Economic and Other Assumptions |

|

|

76 |

|

|

|

7.1 |

|

Overview |

|

|

76 |

|

|

|

7.2 |

|

Claims inflation |

|

|

76 |

|

|

|

7.3 |

|

Superimposed inflation |

|

|

81 |

|

|

|

7.4 |

|

Summary of claims inflation assumptions |

|

|

85 |

|

|

|

7.5 |

|

Discount rates: Commonwealth bond zero coupon yields |

|

|

85 |

|

|

|

7.6 |

|

Cross-claim recovery rates |

|

|

86 |

|

|

|

7.7 |

|

Settlement Patterns |

|

|

87 |

|

| 8 |

|

|

|

Valuation Results |

|

|

89 |

|

|

|

8.1 |

|

Central estimate liability |

|

|

89 |

|

|

|

8.2 |

|

Comparison with previous valuation |

|

|

90 |

|

|

|

8.3 |

|

Cashflow projections |

|

|

92 |

|

|

|

8.4 |

|

Amended Final Funding Agreement calculations |

|

|

95 |

|

|

|

8.5 |

|

Insurance Recoveries |

|

|

96 |

|

|

|

8.6 |

|

Accounting liability calculations: James Hardie |

|

|

96 |

|

| 9 |

|

|

|

Uncertainty |

|

|

97 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.1 |

|

|

Overview |

|

|

97 |

|

|

|

|

9.2 |

|

|

Sensitivity testing |

|

|

98 |

|

|

|

|

9.3 |

|

|

Results of sensitivity testing |

|

|

99 |

|

|

| Tables |

|

|

|

| Table 2.1: Grouping of financial data from claims and accounting databases |

|

|

17 |

|

| Table 2.2: Comparison of amounts from claims and accounting databases ($m) |

|

|

18 |

|

| Table 3.1: Change in cost of claims during 2011/12 financial year ($m) – claim award component

only |

|

|

32 |

|

| Table 4.1: Number of claims reported annually |

|

|

39 |

|

| Table 4.2: Claim numbers experience and assumptions for 2012/13 |

|

|

46 |

|

| Table 4.3: Assumed underlying latency distribution parameters from average date of exposure to date of

notification |

|

|

52 |

|

| Table 4.4: Assumed peak year of claim notifications |

|

|

53 |

|

| Table 5.1: Average attritional non-nil claim award (inflated to mid 2011/12 money terms) |

|

|

56 |

|

| Table 5.2: Average mesothelioma claims assumptions |

|

|

59 |

|

| Table 5.3: Average asbestosis claims assumptions |

|

|

60 |

|

| Table 5.4: Average lung cancer claims assumptions |

|

|

61 |

|

| Table 5.5: Average ARPD & Other claims assumptions |

|

|

62 |

|

| Table 5.6: Average Workers Compensation claims assumptions |

|

|

63 |

|

| Table 5.7: Average wharf claims assumptions |

|

|

64 |

|

| Table 5.8: Summary average claim cost assumptions |

|

|

67 |

|

| Table 6.1: Nil settlement rates |

|

|

68 |

|

| Table 6.2: Summary nil settlement rate assumptions |

|

|

75 |

|

| Table 7.1: Claims inflation assumptions |

|

|

85 |

|

| Table 7.2: Zero coupon yield curve by duration |

|

|

85 |

|

| Table 7.3: Settlement pattern of claims awards by delay from claim reporting |

|

|

88 |

|

| Table 8.1: Comparison of central estimate of liabilities |

|

|

89 |

|

| Table 8.2: Amended Final Funding Agreement calculations |

|

|

95 |

|

| Table 8.3: Insurance recoveries at 31 March 2012 |

|

|

96 |

|

| Table 9.1: Summary results of sensitivity analysis |

|

|

101 |

|

|

| Figures |

|

|

|

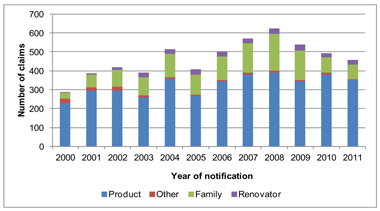

| Figure 1.1: Mix of claims reported by nature of exposure |

|

|

8 |

|

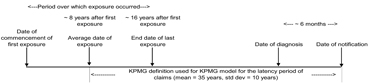

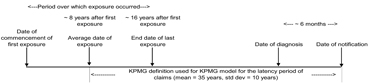

| Figure 3.1: Illustration of timeline of exposure, latency and claim reporting (example shown is for

mesothelioma) |

|

|

25 |

|

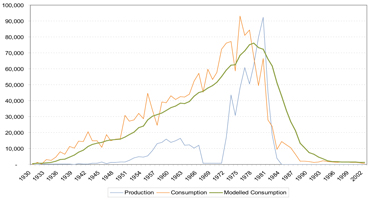

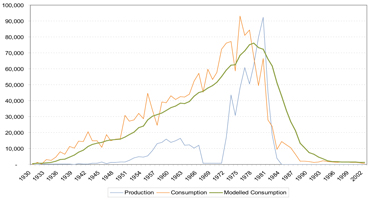

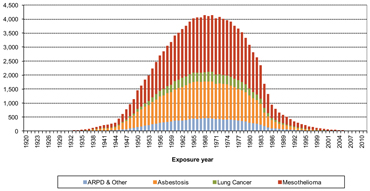

| Figure 3.2: Consumption and production indices – Australia 1930- 2002 |

|

|

26 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

|

|

|

|

|

|

|

|

|

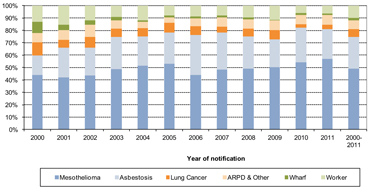

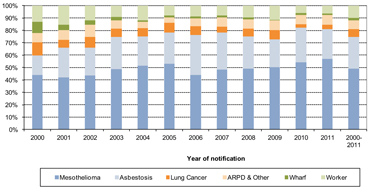

| Figure 4.1: Proportion of claims by disease type |

|

|

39 |

|

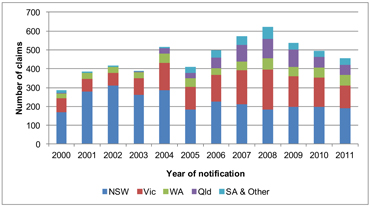

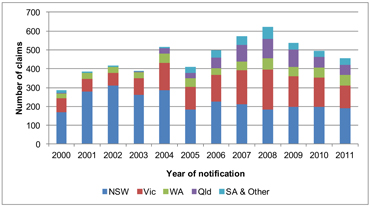

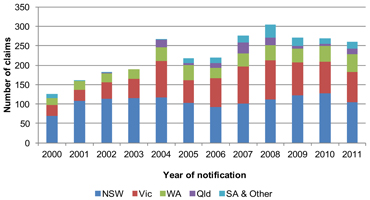

| Figure 4.2: Mix of claims by state (all disease types) |

|

|

40 |

|

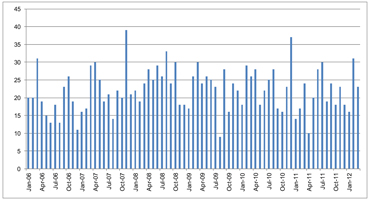

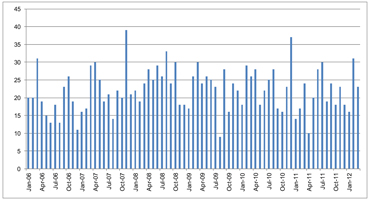

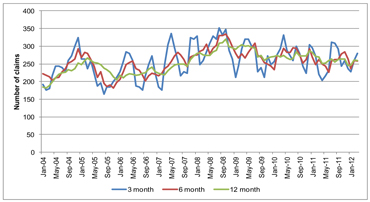

| Figure 4.3: Monthly notifications of mesothelioma claims |

|

|

41 |

|

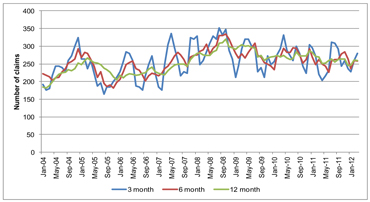

| Figure 4.4: Rolling annualised averages of mesothelioma claim notifications |

|

|

42 |

|

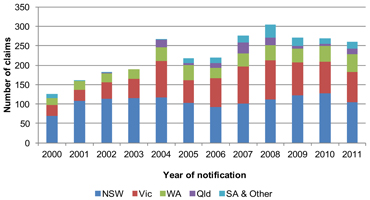

| Figure 4.5: Number of mesothelioma claims by state |

|

|

43 |

|

| Figure 4.6: Mix of claims by duration of exposure (years) |

|

|

46 |

|

| Figure 4.7: Exposure (person-years) of all Liable Entities’ claimants to date |

|

|

47 |

|

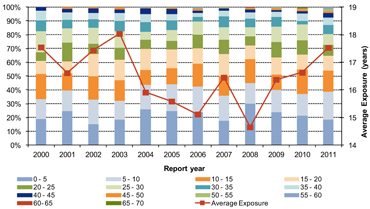

| Figure 4.8: Exposure (person years) of all claimants to date by report year and exposure year |

|

|

48 |

|

| Figure 4.9: Latency of mesothelioma claims |

|

|

49 |

|

| Figure 4.10: Latency of asbestosis claims |

|

|

51 |

|

| Figure 4.11: Latency of lung cancer claims |

|

|

51 |

|

| Figure 4.12: Latency of ARPD & Other claims |

|

|

52 |

|

| Figure 4.13: Expected future claim notifications by disease type |

|

|

54 |

|

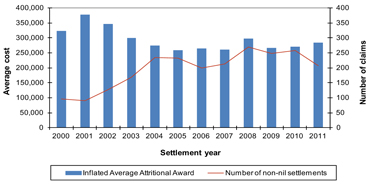

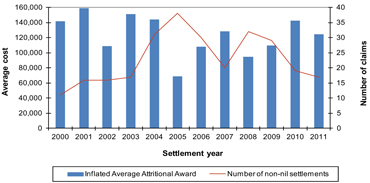

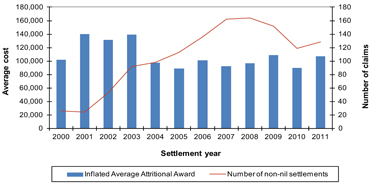

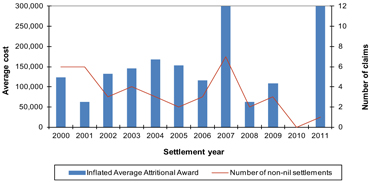

| Figure 5.1: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

mesothelioma claims |

|

|

57 |

|

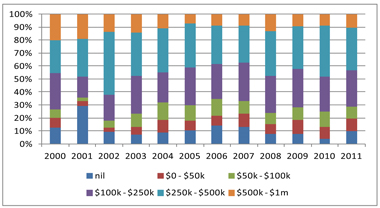

| Figure 5.2: Proportion of mesothelioma claim settlements by settlement size cohort |

|

|

58 |

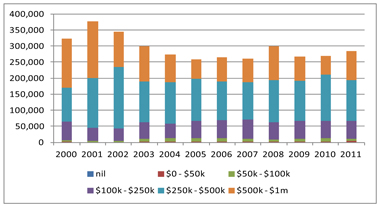

|

| Figure 5.3: Contribution to attritional average claim size of mesothelioma claim settlements by settlement size

cohort |

|

|

58 |

|

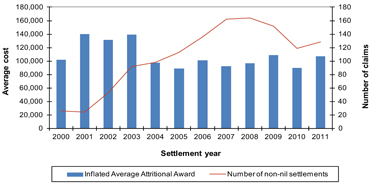

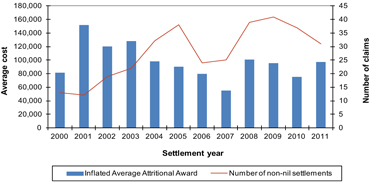

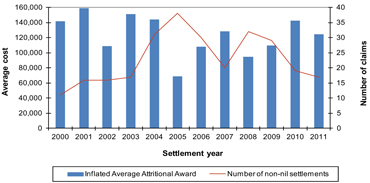

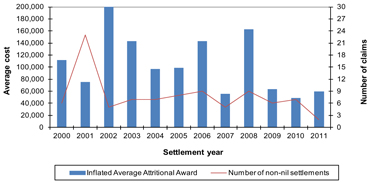

| Figure 5.4: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

asbestosis claims |

|

|

60 |

|

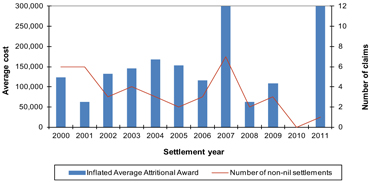

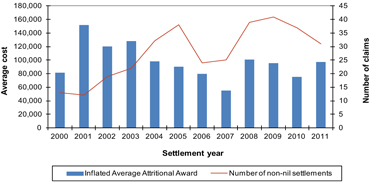

| Figure 5.5: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

lung cancer claims |

|

|

61 |

|

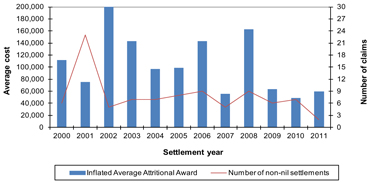

| Figure 5.6: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

ARPD & Other claims |

|

|

62 |

|

| Figure 5.7: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

Workers Compensation claims |

|

|

63 |

|

| Figure 5.8: Average awards (inflated to mid 2011/12 money terms) and number of non-nil claims settlements for

wharf claims |

|

|

64 |

|

| Figure 5.9: Distribution of individual large claims by settlement year |

|

|

65 |

|

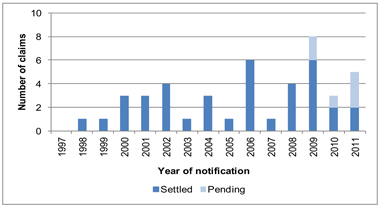

| Figure 5.10: Number of large claims by year of notification |

|

|

66 |

|

| Figure 6.1: Mesothelioma nil claims experience |

|

|

69 |

|

| Figure 6.2: Asbestosis nil claims experience |

|

|

70 |

|

| Figure 6.3: Lung cancer nil claims experience |

|

|

71 |

|

| Figure 6.4: ARPD & Other nil claims experience |

|

|

72 |

|

| Figure 6.5: Workers Compensation nil claims experience |

|

|

73 |

|

| Figure 6.6: Wharf nil claims experience |

|

|

74 |

|

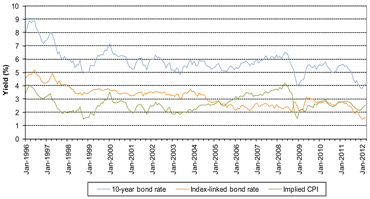

| Figure 7.1: Trends in Bond Yields |

|

|

77 |

|

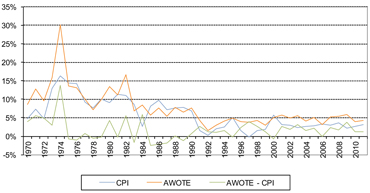

| Figure 7.2: Trends in CPI and AWOTE |

|

|

78 |

|

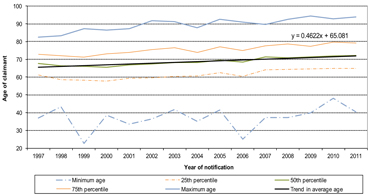

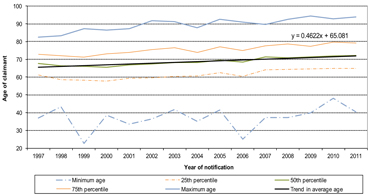

| Figure 7.3: Age profile of mesothelioma claimants by report year |

|

|

80 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

|

|

|

|

|

|

|

|

|

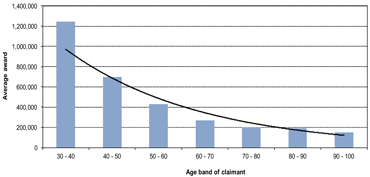

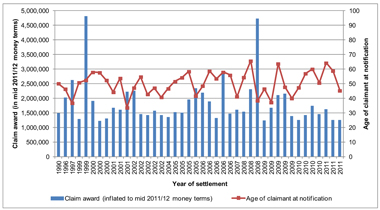

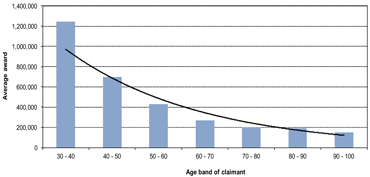

| Figure 7.4: Average mesothelioma claim settlement amounts by decade of age |

|

|

81 |

|

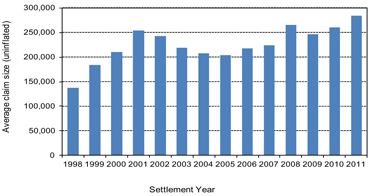

| Figure 7.5: Average mesothelioma awards of the Liable Entities (uninflated) |

|

|

83 |

|

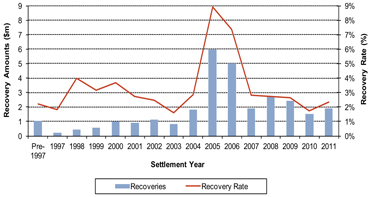

| Figure 7.6: Cross-claim recovery experience |

|

|

86 |

|

| Figure 7.7: Settlement pattern derivation for mesothelioma claims: paid as % of ultimate cost |

|

|

87 |

|

| Figure 7.8: Settlement pattern derivation for non-mesothelioma claims: paid as % of ultimate

cost |

|

|

87 |

|

| Figure 8.1: Analysis of change in central estimate liability |

|

|

91 |

|

| Figure 8.2: Historical claim-related expenditure of the Liable Entities |

|

|

92 |

|

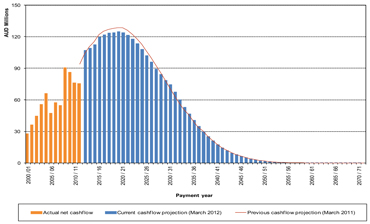

| Figure 8.3: Annual cashflow projections – inflated and undiscounted ($m) |

|

|

93 |

|

| Figure 9.1: Sensitivity testing results – Impact around the Discounted Central Estimate (in

$m) |

|

|

100 |

|

|

| Appendices |

|

|

|

|

| A |

|

Credit rating default rates by duration |

|

|

103 |

|

| B |

|

Projected inflated and undiscounted cashflows ($m) |

|

|

104 |

|

| C |

|

Projected discounted cashflows ($m) |

|

|

105 |

|

| D |

|

Derivation of US GAAP net accounting liability of James Hardie |

|

|

106 |

|

| E |

|

Allocation of central estimate liabilities to AICFL entities |

|

|

108 |

|

| F |

|

Australian asbestos consumption and production data: 1930- 2002 |

|

|

109 |

|

| G |

|

Data provided by AICFL |

|

|

110 |

|

| H |

|

Glossary of terms used in the AFFA |

|

|

112 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Executive Summary

Important Note: Basis of Report

This valuation report (“the

Report”) has been prepared by KPMG Actuarial Pty Limited (ABN 91 144 686 046) (“KPMG Actuarial”) in accordance with an “Amended and

Restated Final Funding Agreement in respect of the provision of long-term funding for compensation arrangements for certain victims of Asbestos-related diseases in Australia” (hereafter referred to as the “the Amended

Final Funding Agreement”) between James Hardie Industries NV (now known as James Hardie Industries SE) (hereafter referred to as “James

Hardie”), James Hardie 117 Pty Limited, the State of New South Wales and Asbestos Injuries Compensation Fund Limited (“AICFL”) which was signed on

21 November 2006.

This Report is intended to meet the requirements of the Amended Final Funding Agreement and values the

asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust.

This Report is not intended to be used for any other

purpose and may not be suitable, and should not be used, for any other purpose. Opinions and estimates contained in the Report constitute our judgment as of the date of the Report.

The information contained in this Report is of a general nature and is not intended to address the objectives, financial situation or needs of any particular individual or entity. It is provided for

information purposes only and does not constitute, nor should it be regarded in any manner whatsoever, as advice and is not intended to influence a person in making a decision in relation to any financial product or an interest in a financial

product. No one should act on the information contained in this Report without obtaining appropriate professional advice after a thorough examination of the accuracy and appropriateness of the information contained in this Report having regard to

their objectives, financial situation and needs.

In preparing the Report, KPMG Actuarial has relied on information supplied to it from

various sources and has assumed that the information is accurate and complete in all material respects. KPMG Actuarial has not independently verified the accuracy or completeness of the data and information used for this Report.

Except insofar as liability under statute cannot be excluded, KPMG Actuarial, its executives, directors, employees and agents will not be held liable for

any loss or damage of any kind arising as a consequence of any use of the Report or purported reliance on the Report including any errors in, or omissions from, the valuation models.

i

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

The Report must be read in its entirety. Individual sections of the Report, including the Executive

Summary, could be misleading if considered in isolation. In particular, the opinions expressed in the Report are based on a number of assumptions and qualifications which are set out in the full Report.

ii

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Introduction

The Amended Final Funding Agreement requires the completion of an Annual Actuarial Report evaluating the potential asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust.

KPMG Actuarial has been retained by AICFL to provide this actuarial valuation report as required under the Amended Final Funding Agreement and this is detailed in our Engagement Letter dated 20 October 2011.

The Liable Entities are defined as being the following entities:

| |

• |

|

Amaca Pty Ltd (formerly James Hardie & Coy); |

| |

• |

|

Amaba Pty Ltd (formerly Jsekarb, James Hardie Brakes and Better Brakes); and |

| |

• |

|

ABN60 Pty Ltd (formerly James Hardie Industries Ltd). |

In addition, the liability for Baryulgil claims is deemed to be a liability of Amaca by virtue of the James Hardie (Civil Liability) Act 2005 (NSW). Under Part 4 of that Act, Amaca is liable for the

“Marlew Asbestos Claims” or “Marlew Contribution Claims” as defined in that Act.

Our valuation is on a central estimate

basis and is intended to be effective as at 31 March 2012. It has been based on claims data and information as at 31 March 2012 provided to us by AICFL.

Overview of Recent Claims Experience and comparison with previous valuation projections

In

this section we will compare the actual experience in 2011/12 (referred to in the following tables as “FY12 Actual”) with the projections for 2011/12 that were contained within our previous valuation report at 31 March 2011. We will

refer to these projections for 2011/12 as “FY12 Expected” in the tables that follow.

Claim numbers

The number of mesothelioma claims reported has shown a reduction in the year. There have been 260 claims reported in 2011/12 compared with 269 claims

reported in 2010/11.

For non-mesothelioma claims, there have been 196 claims reported in 2011/12 compared to 227 claims reported in 2010/11.

This reduction is predominantly due to a significant reduction in reporting activity for asbestosis claims.

iii

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

The following table shows the comparison of actual experience with that which had been forecast at the

previous valuation.

Table E.1. Comparison of claim numbers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

FY12

Actual |

|

|

FY12

Expected |

|

|

Ratio of

Actual to

Expected

(%) |

|

|

FY11

Actual |

|

| Mesothelioma |

|

|

260 |

|

|

|

288 |

|

|

|

90 |

% |

|

|

269 |

|

| Asbestosis |

|

|

110 |

|

|

|

138 |

|

|

|

80 |

% |

|

|

139 |

|

| Lung Cancer |

|

|

15 |

|

|

|

30 |

|

|

|

50 |

% |

|

|

13 |

|

| ARPD & Other |

|

|

37 |

|

|

|

48 |

|

|

|

77 |

% |

|

|

38 |

|

| Wharf |

|

|

5 |

|

|

|

6 |

|

|

|

83 |

% |

|

|

8 |

|

| Workers |

|

|

29 |

|

|

|

48 |

|

|

|

60 |

% |

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

456 |

|

|

|

558 |

|

|

|

82 |

% |

|

|

496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Claim Awards

Average claims awards in 2011/12 have typically been in line with expectations. There have been three large mesothelioma claim settlements (being claims in excess of $1m in 2006/07 money terms) in

2011/12. This is below our annual allowance of five large claims. Total claims expenditure on large claims has been 58% below expectations, reflecting the lower number and average settlement sizes of large claims, although random variability in the

number and size of large claims is to be expected.

The following table shows the comparison of actual experience with that which had been

forecast at the previous valuation.

Table E.2. Comparison of average claim size of non-nil claims

|

|

|

|

|

|

|

|

|

| |

|

FY12

Actual ($) |

|

FY12

Expected

($) |

|

Ratio of

Actual to

Expected

(%) |

|

FY11

Actual

($) |

| Mesothelioma |

|

283,605 |

|

287,800 |

|

99% |

|

259,685 |

| Asbestosis |

|

107,309 |

|

106,600 |

|

101% |

|

86,677 |

| Lung Cancer |

|

124,555 |

|

125,300 |

|

99% |

|

137,242 |

| ARPD & Other |

|

96,980 |

|

95,900 |

|

101% |

|

72,185 |

| Wharf |

|

59,135 |

|

106,600 |

|

55% |

|

46,837 |

| Workers |

|

900,000 |

|

138,600 |

|

649% |

|

0 |

| Mesothelioma Large

Claims Costs |

|

3 claims @

$1,375,000

=

$4,125,000 |

|

5 claims @

$1,972,000

=

$9,860,000 |

|

42% |

|

4 claims @

$1,409,000

=

$5,636,000 |

Note: FY11 Actual values are expressed in 2010/11 money terms. FY12 Actual values and FY12 Expected values are expressed

in 2011/12 money terms.

iv

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

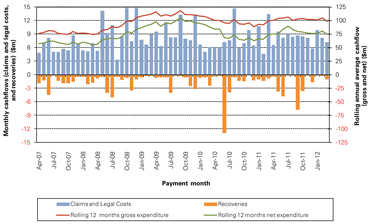

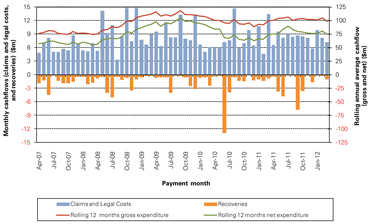

Cashflow expenditure: gross and net

Gross cashflow expenditure, at $99.1m, was 9% below expectations.

Net cashflow expenditure, at

$75.2m, was 20% below expectations.

Table E.3. Comparison of cashflow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

FY12

Actual

($M) |

|

|

FY12

Expected

($M) |

|

|

Ratio of

Actual to

Expected

(%) |

|

|

FY11

Actual

($M) |

|

| Gross Cashflow |

|

|

99.1 |

|

|

|

108.4 |

|

|

|

91 |

% |

|

|

100.6 |

|

| Insurance and Other Recoveries |

|

|

(12.4 |

) |

|

|

(14.4 |

) |

|

|

86 |

% |

|

|

(16.4 |

) |

| Insurance recoveries from HIH (under 562A(4)) and from commutations |

|

|

(11.5 |

) |

|

|

0.0 |

|

|

|

n/a |

|

|

|

(7.8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Cashflow |

|

|

75.2 |

|

|

|

94.0 |

|

|

|

80 |

% |

|

|

76.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

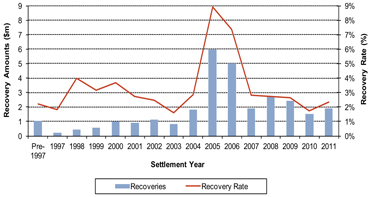

Insurance and Other Recoveries have been considerably higher than expected. This is due to proceeds from insurance

collections from HIH and associated entities as a result of successful application of Section 562A(4).

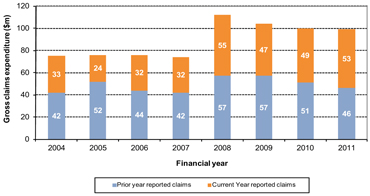

The following chart shows the

composition of the gross cashflow between current and prior years’ reported claims over the past eight financial years.

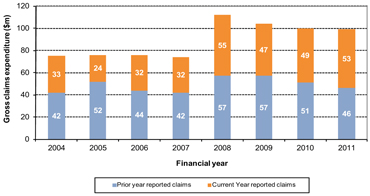

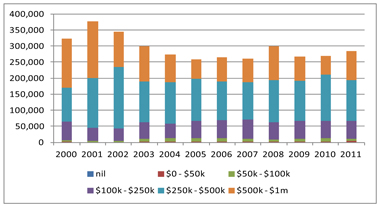

Figure E.1.

Composition of gross cashflow between current and prior years’ reported claims

v

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Payments in relation to claims reported in the financial year have shown a slight increase compared with

the previous year. This is because whilst claim numbers reported have fallen by approximately 10%, an increased proportion of reported claims have related to mesothelioma, and such claims are typically quicker to settle.

Payments in relation to prior years’ reported claims have shown a reduction compared with previous years’ experience. This is consistent with

the lower numbers of claims being settled.

Liability Assessment

At 31 March 2012, our projected central estimate of the liabilities of the Liable Entities (the Discounted Central Estimate) to be met by the AICF Trust is $1,580.1m (March 2011: $1,477.6m).

We have not allowed for the future Operating Expenses of the AICF Trust or the Liable Entities in the liability assessment.

Table E.4. Comparison of central estimate of liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

31 March

2012

$m |

|

|

31 March 2011

$m |

|

| |

|

Gross of

insurance

recoveries |

|

|

Insurance

recoveries |

|

|

Net of

insurance

recoveries |

|

|

Net of

insurance

recoveries |

|

| Total projected cashflows (uninflated) |

|

|

1,526.5 |

|

|

|

213.4 |

|

|

|

1,313.1 |

|

|

|

1,364.4 |

|

| Future inflation allowance |

|

|

1,384.5 |

|

|

|

172.6 |

|

|

|

1,211.9 |

|

|

|

1,297.0 |

|

| Total projected cash-flows with inflation |

|

|

2,911.0 |

|

|

|

386.0 |

|

|

|

2,525.0 |

|

|

|

2,661.4 |

|

| Discounting allowance |

|

|

(1,095.3 |

) |

|

|

(150.4 |

) |

|

|

(944.9 |

) |

|

|

(1,183.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net present value liabilities |

|

|

1,815.7 |

|

|

|

235.6 |

|

|

|

1,580.1 |

|

|

|

1,477.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vi

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

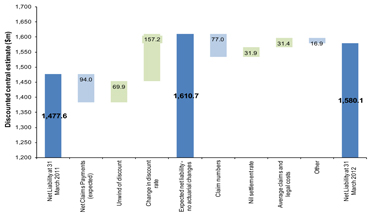

Comparison with previous valuation

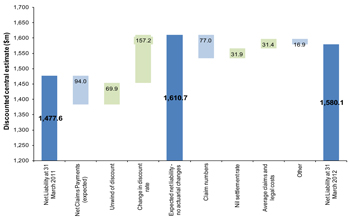

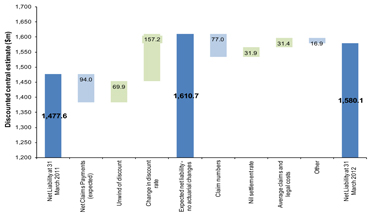

In the absence of any change to the claim projection assumptions from our 31 March 2011 valuation, other than allowing for the changes in the discount rate, we would have projected a Discounted

Central Estimate liability of $1,610.7m as at 31 March 2012, i.e. an increase of $133.1m from our 31 March 2011 valuation result.

This increase of $133.1m is due to:

| |

• |

|

A reduction of $24.1m, being the net impact of expected claims payments (which reduce the liability) and the “unwind of discount”

(which increases the liability and reflects the fact that cashflows are now one year nearer and therefore are discounted by one year less). |

| |

• |

|

An increase of $157.2m resulting from the lower discount rates prevailing at 31 March 2012 compared with those adopted at 31 March

2011. |

Our liability assessment at 31 March 2012 of $1,580.1m represents a decrease of $30.6m (or 2% of the liability),

which arises from changes to the claim projection assumptions.

The decrease of $30.6m is principally a consequence of:

| |

• |

|

A reduction in the projected future number of claims for most disease types; and |

| |

• |

|

An increase in projected future insurance recoveries; offset by |

| |

• |

|

Higher assumed average claim awards, in particular for mesothelioma; and |

| |

• |

|

Lower assumed future nil settlement rate for most disease types. |

vii

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

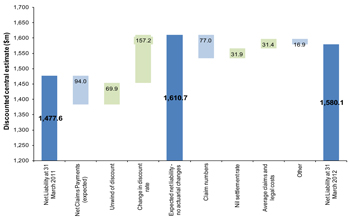

The following chart shows an analysis of the change in our liability assessments from March 2011 to

March 2012.

Figure E.2. Analysis of change in central estimate liability

Note: Green bars signal that this factor has given rise to an increase in the liability whilst light blue bars

signal that this factor has given rise to a reduction in the liability.

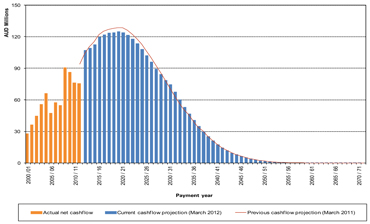

The undiscounted liability as of 31 March 2012 has reduced

from $2,567m (based on the 31 March 2011 valuation) to $2,525m. This represents a reduction of $42m (approximately 2% of the undiscounted liability).

Amended Final Funding Agreement calculations

The Amended Final Funding Agreement sets out

the basis on which payments will be made to the AICF Trust.

Additionally, there are a number of other figures specified within the Amended

Final Funding Agreement that we are required to calculate. These are:

| |

• |

|

Discounted Central Estimate; |

| |

• |

|

Term Central Estimate; and |

| |

• |

|

Period Actuarial Estimate. |

viii

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Table E.5. Amended Final Funding Agreement calculations

|

|

|

|

|

| |

|

$m |

|

| Discounted Central Estimate (net of cross-claim recoveries, Insurance and Other Recoveries) |

|

|

1,580.1 |

|

| Period Actuarial Estimate (net of cross-claim recoveries, gross of Insurance and Other Recoveries) comprising: |

|

|

355.1 |

|

| Discounted value of cashflow in 2012/13 |

|

|

117.8 |

|

| Discounted value of cashflow in 2013/14 |

|

|

118.5 |

|

| Discounted value of cashflow in 2014/15 |

|

|

118.9 |

|

| Term Central Estimate (net of cross-claim recoveries, Insurance and Other Recoveries) |

|

|

1,576.0 |

|

The actual funding amount due at a particular date will depend upon a number of factors, including:

| |

• |

|

the net asset position of the AICF Trust at that time; |

| |

• |

|

the free cash flow amount of the James Hardie Group in the preceding financial year; and |

| |

• |

|

the Period Actuarial Estimate in the latest Annual Actuarial Report. |

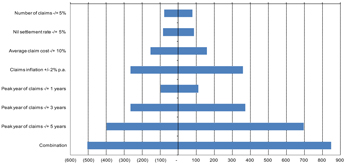

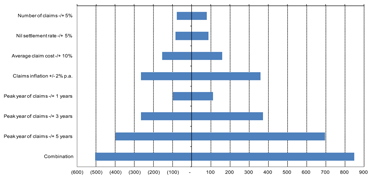

Uncertainty

Estimates of asbestos-related disease liabilities are subject to considerable

uncertainty, significantly more than personal injury liabilities in relation to other causes, such as CTP or Workers Compensation claims.

It

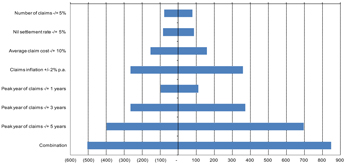

should therefore be expected that the actual emergence of the liabilities will vary from any estimate. As indicated in Figure E.3, depending on the actual out-turn of experience relative to that currently forecast, the variation could potentially be

substantial.

Thus, no assurance can be given that the actual liabilities of the Liable Entities to be met by the AICF Trust will not

ultimately exceed the estimates contained in this Report. Any such variation may be significant.

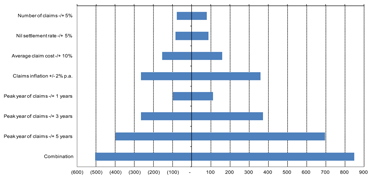

We have performed sensitivity testing to

identify the impact of different assumptions upon the size of the liabilities.

We note that these sensitivity test ranges are not intended to

correspond to a specified probability of sufficiency, nor are they intended to indicate an upper bound or a lower bound of all possible outcomes.

ix

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Figure E.3. Sensitivity testing results – Impact around the Discounted Central Estimate (in $m)

The single most sensitive assumption shown in the chart is the peak year of claims reporting against the Liable

Entities. Shifting the peak year of claims reporting by 5 years (e.g. for mesothelioma, it would be equivalent to shifting the peak year from 2010/11 to 2015/2016) could imply an increase in the discounted central estimate of approximately 50%.

Table E.6. Summary results of sensitivity analysis

|

|

|

|

|

| |

|

Undiscounted |

|

Discounted |

| Central estimate |

|

$2.53bn |

|

$1.58bn |

| Range around the central estimate |

|

-$950m to

+$1,790m |

|

-$500m to

+$850m |

| Range of liability estimates |

|

$1.58bn to

$4.32bn |

|

$1.08bn to

$2.43bn |

Whilst the table above indicates a range around the discounted central estimate of liabilities of -$500m to +$850m, the

actual cost of liabilities could fall outside that range depending on the actual experience.

x

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Data, Reliances and Limitations

We have been provided with the following data by AICFL:

| |

• |

|

Claims dataset at 31 March 2012 with individual claims listings; |

| |

• |

|

Accounting transactions dataset at 31 March 2012 (which includes individual claims payment details); and |

| |

• |

|

Detailed insurance bordereaux information (being a listing of claims filed with the insurers of the Liable Entities) produced by

Randall & Quilter Investment Holdings as at 31 March 2012. |

While we have tested the consistency of the

various data sets provided, we have not otherwise verified the data nor have we undertaken any auditing of the data at source. We have relied on the data provided as being complete and accurate in all material respects. Consequently, should there be

material errors or incompleteness in the data, our assessment could be affected materially.

Executive Summary Not Report

Please note that this executive summary is intended as a brief overview of our Report. To properly understand our analysis and the basis of our liability

assessment requires examination of our Report in full.

xi

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

The Amended

Final Funding Agreement requires the completion of an Annual Actuarial Report evaluating the potential asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust.

The

Liable Entities are defined as being the following entities:

| |

• |

|

Amaca Pty Ltd (formerly James Hardie & Coy); |

| |

• |

|

Amaba Pty Ltd (formerly Jsekarb, James Hardie Brakes and Better Brakes); and |

| |

• |

|

ABN60 Pty Ltd (formerly James Hardie Industries Ltd). |

In addition, the liability for Baryulgil claims is deemed to be a liability of Amaca by virtue of the James Hardie (Civil Liability) Act 2005 (NSW). Under Part 4 of that Act, Amaca is liable for

“Marlew Asbestos Claims” or “Marlew Contribution Claims” as defined in that Act.

| 1.1.2 |

Personal asbestos claims |

Under the Amended Final Funding Agreement, the liabilities to be met by the AICF Trust relate to personal asbestos-related disease

liabilities of the Liable Entities.

Such claims must relate to exposure which took place in Australia and which have been

brought in a Court in Australia.

The precise scope of the liabilities is documented in Section 1.2 and in Appendix H of

this Report.

KPMG

Actuarial has been retained by AICFL to provide an actuarial valuation report as required under the Amended Final Funding Agreement and this is detailed in our Engagement Letter dated 20 October 2011.

The prior written consent of KPMG Actuarial is required for any other use of this Report or the information contained in it.

Our valuation is intended to be effective as at 31 March 2012 and has been based on claims data and information as at 31 March

2012 provided to us by AICFL.

1

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

We have

been requested to provide an actuarial assessment as at 31 March 2012 of the asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust, consistent with the terms of the Amended Final Funding Agreement.

The assessment is on a central estimate basis and is based on the claims experience as at 31 March 2012.

A “central estimate” liability assessment is an estimate of the expected value of the range of potential future liability

outcomes. In other words, if all the possible values of the liabilities are expressed as a statistical distribution, the central estimate is an estimate of the mean of that distribution.

It is of note that our liability assessment:

| |

• |

|

Relates to the Liable Entities and Marlew (in relation to Marlew Claims arising from asbestos mining activities at Baryulgil).

|

| |

• |

|

The amount of settlements, judgments or awards for all Personal Asbestos Claims. |

| |

• |

|

Claims Legal Costs incurred by the AICF Trust in connection with the settlement of Personal Asbestos Claims. |

| |

• |

|

Is not intended to cover: |

| |

• |

|

Personal injury or death claims arising from exposure to asbestos which took place outside Australia. |

| |

• |

|

Personal injury or death claims, arising from exposure to Asbestos, which are brought in Courts outside Australia. |

| |

• |

|

Claims for economic loss, other than any economic loss forming part of an award for damages for personal injury and/or death.

|

| |

• |

|

Claims for loss of property, including those relating to land remediation. |

| |

• |

|

The costs of asbestos or asbestos product removal relating to asbestos or asbestos products manufactured or used by or on behalf of the Liable

Entities. |

| |

• |

|

Includes an allowance for: |

| |

• |

|

Compensation to the NSW Dust Diseases Board or a Workers Compensation Scheme by way of a claim by such parties for contribution or reimbursement from

the Liable Entities, but only to the extent that the cost of such claims is within the limits of funding for such claims as outlined within the Amended Final Funding Agreement. |

2

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| |

• |

|

Workers Compensation claims, being claims from former employees of the Liable Entities, but only to the extent that such liabilities are not met by a

Workers Compensation Scheme or Policy (see section 1.2.1). |

| |

• |

|

Assumes that the product and public liability insurance policies of the Liable Entities will continue to respond to claims as and when they fall

due. We have not made any allowance for the impact of any disputation concerning Insurance Recoveries, nor for any legal costs that may be incurred in resolving such disputes. |

| |

• |

|

Makes no allowance for: |

| |

• |

|

potential Insurance Recoveries that could be made on product and public liability insurance policies placed from 1986 onwards which were placed on a

“claims made” basis. |

| |

• |

|

the future Operating Expenses of the Liable Entities or the AICF Trust. Separate allowance for future Operating Expenses needs to be considered by the

management of AICFL. |

| |

• |

|

the inherent uncertainty of the liability assessment. That is, no additional provision (or risk margin) has been included in excess of a central

estimate. |

Readers of this Report may refer to our previous reports which are available at

www.ir.jameshardie.com.au and www.aicf.org.au.

| 1.2.1 |

Workers Compensation |

Workers Compensation claims are claims made by former employees of the Liable Entities. Such past, current and future reported claims were

insured with, amongst others, Allianz Australia Limited, QBE and the various State-based Workers Compensation Schemes.

Under

the Amended Final Funding Agreement, the part of a future Workers Compensation claim that is met by a Workers Compensation Scheme or Policy of the Liable Entities is outside of the AICF Trust. The AICF Trust is, however, to provide for any part of a

claim not covered by a Workers Compensation Scheme or Policy (e.g. as a result of the existence of limits of indemnity and policy deductibles on those policies of insurance).

3

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

On this basis our liability assessment in relation to Workers Compensation claims and

which relates to the AICF Trust, includes only the amount borne by the Liable Entities in excess of the anticipated recoveries due from a Workers Compensation Scheme or Policy.

In making our assessment we have assumed that the Workers Compensation insurance programme will continue to respond to claims by former employees of the Liable Entities as and when they fall due. To the

extent that they were not to respond owing to (say) insurer insolvency, Insurer Guarantee Funds may be available to meet such obligations.

| 1.2.2 |

Dust Disease Board and Other Reimbursements |

There exists a right under Section 8E (Reimbursement Provisions) of the Dust Diseases Act 1942 for the NSW Dust Diseases Board (“DDB”) to recover certain costs from common law defendants,

excluding the employer of the claimant.

This component of cost is implicitly included within our liability assessment as the

claims awards made in recent periods and in recent settlements contain allowance for DDB reimbursement where applicable. Furthermore, currently reported open claims have an allowance within their case estimates for the costs of DDB reimbursement

where relevant and applicable.

The Amended Final Funding Agreement indicates that the AICF Trust is intended to meet Personal

Asbestos Claims and that claims by the DDB or a Workers Compensation Scheme for reimbursement will only be met up to a certain specified limit (aggregated across the DDB and Workers Compensation Schemes), being:

| |

• |

|

In the first financial year (2006/07) a limit of $750,000 applied; |

| |

• |

|

In respect of each financial year thereafter, that limit will be indexed annually in line with the Consumer Price Index;

|

| |

• |

|

There will be an overall unindexed aggregate cap of $30m. |

The cashflow and liability figures contained within this Report have already removed that component of any reimbursements that will not be

met by the AICF Trust owing to the application of these limits and caps.

| 1.2.3 |

Baryulgil (“Marlew Claims”) |

“Marlew Asbestos Claims” and “Marlew Contribution Claims” are deemed to be liabilities of Amaca. These claims specifically include:

| |

• |

|

Claims made against Amaca Pty Ltd or ABN60 resulting from their past ownership of the mine; and, in the case of Amaca, includes claims made in

relation to the joint venture (Asbestos Mines Pty Ltd) established with Wunderlich in 1944 to begin mining at Baryulgil. |

4

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| |

• |

|

Claims made against the subsequent owner of the mine (following its sale by James Hardie Industries to Woodsreef in 1976), being Marlew Mining

Pty Ltd (“Marlew”) which is in liquidation, are to be met by the AICF Trust except where such claims are Excluded Marlew Claims, which are recoverable by the Claimant from other sources. |

These claims are discussed further in Section 4.11.

Australian-licensed insurance companies are required to hold, and many non-insurance companies elect to hold, insurance and self-insurance

claims provisions at a level above the central estimate basis to reflect the uncertainty attaching to the liability assessment and to include an allowance in respect of that uncertainty.

A risk margin is an additional amount held, above the central estimate, so as to increase the likelihood of adequacy of the provisions to

meet the ultimate cost of settlement of those liabilities.

We note that the Amended Final Funding Agreement envisages the

ongoing financing of the AICF Trust is to be based on a “central estimate” approach and that the Annual Actuarial Report should provide a Discounted Central Estimate valuation.

Accordingly, we have made no allowance for any risk margins within this Report.

We have

determined a Discounted Central Estimate in this Report by discounting the projected future cashflows to 31 March 2012 using yields on Commonwealth Government Bonds.

Conceptually, the Discounted Central Estimate would normally represent an amount of money which, if fully provided in advance (i.e. as of 31 March 2012) and invested in risk-free assets (such as

Commonwealth Government Bonds) of term and currency appropriate to the liabilities, would generate the necessary investment income such that (together with the capital value of those assets) it would be expected to be sufficient to pay for the

liabilities as they fall due.

To the extent that the actual investments are:

| |

• |

|

of different terms; and/or |

5

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| |

• |

|

in different currencies; and/or |

| |

• |

|

provide different expected rates of return |

investment profits or losses would emerge.

One of the uncertainties in our

valuation is the fact that fixed interest Commonwealth Government Bonds do not exist at most of the durations of our cashflow projection, with the maximum term of such bonds being around 10 to 15 years.

This means we need to take a long-term view on bond yields that is not measured by market-observable rates of return.

Our approach at this valuation has been to take the bond yields implied by bond market prices, without adjustment, for the periods up to

10 years.

Thereafter, we have set the spot rate to be 1.25 percentage points above our underlying long-term wage inflation

assumption of 4.75% per annum (before adjustment for the impact of ageing upon claims award levels).

The combined effect

is that our long-term spot rate is 6.00% per annum at durations 10+. This is unchanged from our previous valuation.

However, for completeness we note that spot rate at duration 9 was approximately 4.9% at 31 March 2012 (31 March 2011: 5.9%), and

therefore considerably lower than the 6.0% assumption we have made for durations 10+.

In this regard, we also note that the

actual funding mechanism under the Amended Final Funding Agreement only provides for three years’ worth of projected Claims and Claims Legal Costs expenditure and one year’s worth of Operating Expenses at any one time.

| 1.3 |

Areas of potential exposure |

As identified in Section 1.2, there are other potential sources of claims exposure beyond those directly considered within this Report. However, in a number of cases they are unquantifiable even if

they have the potential to generate claims. This is especially the case for those sources of future claim where there has been no evidence of claims to date.

| 1.3.1 |

General areas of potential exposure |

Areas of potential changes in claims exposure we have not explicitly allowed for in our valuation include, but are not limited to:

| |

• |

|

Future significant individual landmark and precedent-setting judicial decisions; |

6

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| |

• |

|

Significant medical advancements; |

| |

• |

|

Unimpaired claims, i.e. claims for fear, stress, pure nervous shock or psychological illness. In this regard, we note the 2010/11 decisions by

the Supreme Court (in relation to two cases: Tamaresis v Amaca and Galea v Amaca) which indicated that the AICF Trust was not required to meet the cost of nervous shock claims brought by individuals who have not been exposed to

asbestos; |

| |

• |

|

A change in the basis of compensation for asymptomatic pleural plaques for which no associated physical impairment is exhibited;

|

| |

• |

|

A proliferation (compared to past and current levels of activity) of “third-wave” claims, i.e. claims arising as a result of indirect

exposure such as home renovation, washing clothes of family members that worked with asbestos, or from workers involved in the removal of asbestos or the demolition of buildings containing asbestos; |

| |

• |

|

Changes in legislation, especially those relating to tort reform for asbestos sufferers; |

| |

• |

|

Introduction of new, or elimination of existing, heads of damage; |

| |

• |

|

Exemplary and aggravated or punitive damages (being damages awarded for personal injuries caused as a result of negligence or reckless conduct);

|

| |

• |

|

Changes in the basis of apportionment of awards for asbestos-related diseases for claimants who have smoked (we note the decisions in Amaca v

Ellis [2010] HCA 5 and Evans v Queanbeyan City Council [2010] NSWDDT 7 which we understand are consistent with the previous decision in Judd v Amaca [2002] NSWDDT 25); |

| |

• |

|

Any changes to GST or other taxes; and |

| |

• |

|

Future bankruptcies of other asbestos claim defendants (i.e. other liable manufacturers or distributors). |

Nonetheless, implicit allowance is made in respect of some of these items in the allowance for superimposed inflation included in our

liability assessment. Furthermore, to the extent that some of these have emerged in past claims experience, they are reflected in our projections.

7

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| 1.3.2 |

New Zealand and other overseas exposures |

We have made no allowance for the risk of further development in relation to New Zealand exposures and the rights of claims from New Zealand claimants in Australian courts (as per Frost vs. Amaca Pty

Ltd (2005), NSWDDT 36 although this decision was successfully appealed by Amaca in August 2006) nor for the risk of additional exposures from overseas. This is because, as noted in Section 1.2, the AICF Trust is not required to meet the

cost of these claims as they are Excluded Claims.

We

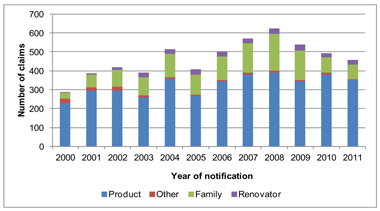

have made some implicit allowance for so-called “third-wave” claims. These are defined as claims for personal injury and / or death arising from asbestos exposure during home renovations by individuals or to builders involved in such

renovations. Such claims are allowed for within the projections to the extent to which they have arisen to date and to the extent our exposure model factors in these tertiary exposures in its projection.

The number of pure home renovator claims reported has remained broadly stable since 2003/04 (at approximately 25 claims per annum).

“Family” type exposures (e.g. childhood exposures, exposure through clothes washing) had been the main source of the increase in claims reporting from 2004/05 to 2008/09. However, in the past three years, these claims have reduced in

number and are now in line with levels of claims activity observed in the early 2000s.

Figure 1.1: Mix of claims reported

by nature of exposure

8

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

We have not allowed for a surge in third-wave claims in the future arising from

renovations, but conversely we have not allowed for a tempering of those third-wave claims already included within our projection as a result of improved education of individuals as to the risks of such home renovations, or of any local Councils or

State Governments passing laws in this regard.

It should be noted that claims for the cost of asbestos or asbestos product

removal from homes and properties or any claims for economic loss arising from asbestos or asbestos products being within such homes and properties is not required to be met by the AICF Trust.

| 1.3.4 |

New South Wales Law Reform Commission Report 131 |

On 3 November 2010, the New South Wales Law Reform Commission was provided with terms of reference that asked the Commission to inquire into the legislation governing the provision of damages

including under the Compensation to Relatives Act 1897, Law Reform (Miscellaneous Provisions) Act 1944, Dust Diseases Tribunal Act 1989 and Civil Liability Act 2002.1

In October 2011, the New South Wales Law Reform Commission published Report 131 entitled “Compensation to Relatives” (this followed a Consultation paper, CP14).

The Law Reform Commission Report 131 recommended, amongst other things:

| |

• |

|

Abolition of the Strikwerda principle, such that there would be no offset of the non-economic loss amount paid under the Estate claim, when

assessing the Compensation to Relatives/dependency action. |

| |

• |

|

A requirement to allow recovery of damages for non-economic loss when claims are commenced within 12 months after the death of the person.

|

On 16 February 2012, a bill entitled “Compensation to Relatives Legislation Amendment (Dust

Diseases) Bill 2012” was introduced to the NSW Parliament.

On 11 May 2012, the NSW Government released its response

to the NSW Law Reform Commission Report 131.

The NSW Government concluded that it would not be appropriate to implement the

Law Reform Commission’s key recommendations.

| 1 |

See www.lawlink.nsw.gov.au/lrc for Terms of Reference and the Report of the NSW Law Reform Commission |

9

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Accordingly, we have made no allowance within our claim size or claim number assumptions

for any impact of the recommendations of the NSW Law Reform Commission Report 131.

| 1.3.5 |

Recent court cases of potential significance |

During the most recent financial year, there have been a number of court cases of relevance to both current and potential future levels of claim awards.

The explanations and overview that follow are based on our reading and interpretation of the cases and as such they do not reflect formal

or informal advice provided by AICF or by its lawyers.

These cases include:

| |

• |

|

Amaca Pty Ltd vs. Booth [2011] HCA 53. In this case, Mr Booth was a retired motor mechanic who was diagnosed with mesothelioma. The Dust

Diseases Tribunal delivered its decision and awarded $326,640. Amaca appealed to the Court of Appeal on the issue of causation and then this was appealed to the High Court of Australia. The High Court of Australia delivered its decision in relation

to this matter on 14 December 2011. The finding was, in summary, that all exposure other than a de minimis exposure was causative of mesothelioma. The award of $326,640 included an amount of $250,000 for general damages for pain and

suffering. This level of general damages is consistent with previous general damages awards in NSW. |

| |

• |

|

Amaca Pty Ltd vs. King [2011] VSCA 447. In this case, a Victorian jury determined compensation at $1,150,000 which it is reported as

comprising $730,000 for general damages for pain and suffering and for loss of expectation of life. The Supreme Court of Victoria did not overturn the original decision of the jury, and handed down its judgment on 22 December 2011.

|

| |

• |

|

Hamilton vs. BHP [2012] SADC 25. This case was conducted in South Australia District Court. The judge awarded $115,000 for general

damages. This is consistent with the level of general damages awarded in Ewins vs. BHP which awarded $100,000 and which is now 6 years old. |

10

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| |

• |

|

Lowes vs. Amaca [2011] WASC 87. In this case, Mr Lowes was a 42 year old man diagnosed with mesothelioma, which he alleged he had

contracted from playing at a miniature railway at Castledare Boys Home in Perth in the 1970s as a very young child. The total amount awarded was $2.07m, the major component of which related to economic loss. Submissions were made by Amaca were made

that an appropriate award for general damages would be between $150,000 and $200,000 having regard to a number of cases in WA; whilst lawyers for the plaintiff referenced a number of cases in the Dust Diseases Tribunal (NSW) which indicated general

damages in the range $250,000 to $300,000. In closing written submissions for the plaintiff, it was indicated that “an appropriate and fair” amount for general damages was $500,000. The judgment of $2.07m included an amount for general

damages for pain and suffering of $250,000. We understand the case is currently subject to appeal, with the key areas of appeal being in relation to foreseeability and causation. |

| 1.4 |

Data reliances and limitations |

KPMG Actuarial has relied upon the accuracy and completeness of the data with which it has been provided. KPMG Actuarial has not verified the accuracy or completeness of the data, although we have

undertaken steps to test its consistency with data previously received. However, KPMG Actuarial has placed reliance on the data previously received, and currently provided, as being accurate and complete in all material respects.

It must be

understood that estimates of asbestos-related disease liabilities are subject to considerable uncertainty.

This is due to the

fact that the ultimate disposition of future claims will be subject to the outcome of events that have not yet occurred. Examples of these events, as noted in Section 1.3, include jury decisions, court interpretations, legislative changes,

epidemiological developments, medical advancements, public attitudes, potential additional third-wave exposures and social and economic conditions such as inflation.

11

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Therefore, it should be expected that the actual emergence of the liabilities will vary,

perhaps materially, from any estimate. Thus, no assurance can be given that the actual liabilities of the Liable Entities to be met by the AICF Trust will not ultimately exceed the estimates contained herein. Any such variation may be significant.

The

purpose of this Report is as stated in Section 1.1.

This Report should not be used for any purpose other than those

specified.

This Report will be provided to the Board and management of AICFL. This Report will also be provided to the Board

and management of James Hardie, the NSW Government and to Ernst & Young in their capacity as auditors to both James Hardie and AICFL.

We understand that this Report will be filed with the ASX and placed on James Hardie’s website in its entirety.

We understand that this Report will also be placed on AICFL’s website in its entirety.

KPMG Actuarial consents to this Report being made available to the above-mentioned parties and for the Report to be distributed in the manner described above.

To the extent permitted by law, neither KPMG Actuarial nor its Executives, directors or employees will be responsible to third parties for

the consequences of any actions they take based upon the opinions expressed with this Report, including any use of or purported reliance upon this Report not contemplated in Section 1.2. Any reliance placed is that party’s sole

responsibility.

Where distribution of this Report is permitted by KPMG Actuarial, the Report may only be distributed in its

entirety and judgements about the conclusions and comments drawn from this Report should only be made after considering the Report in its entirety and with necessary consultation with KPMG Actuarial.

Readers are also advised to refer to the “Important Note: Basis of Report” section at the front of the Executive Summary of this

Report.

| 1.7 |

Date labelling convention used in this Report |

In our analyses throughout this report (unless otherwise stated), the “year” we refer to aligns with the financial year of AICFL and James Hardie and runs from 1 April to 31 March.

12

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

A “2008” notified claim would be a claim notified in the period 1 April

2008 to 31 March 2009. This might also be referred to as “2008/09”.

Similarly, a “2011” claim

settlement would be a claim settled in the period 1 April 2011 to 31 March 2012. This might also be referred to as “2011/12”.

This Report is authored by Neil Donlevy, an Executive of KPMG Actuarial Pty Limited, a Fellow of the Institute of Actuaries (London) and a

Fellow of the Institute of Actuaries of Australia.

This Report is co-authored by Jefferson Gibbs, an Executive of KPMG

Actuarial Pty Limited, a Fellow of the Institute of Actuaries (London) and a Fellow of the Institute of Actuaries of Australia.

In relation to this Report, the primary regulator for both Neil Donlevy and Jefferson Gibbs is the Institute of Actuaries of Australia.

| 1.9 |

Professional standards and compliance |

This Report details a valuation of the outstanding claims liabilities of entities which hold liabilities with features similar to general insurance liabilities as self-insured entities, and which have

purchased related insurance protection.

In preparing this report, we have complied with the revised version of Professional

Standard 300 of the Institute of Actuaries of Australia (“PS300”), “Valuation of General Insurance Claims”. The revised standard is applicable for balance sheet dates occurring after 23 February 2010.

However, as we note in Section 1.2, this Report does not include an allowance for the future Operating Expenses of the AICF Trust

(which are estimated by AICFL) and nor does it include any allowance for a risk margin to reflect the inherent uncertainty in the liability assessment.

| 1.10 |

Control processes and review |

This valuation report and the underlying analyses have been subject to technical review and internal peer review.

The technical review focuses on ensuring that the valuation models and supporting claims experience analyses that are carried out are done correctly and that the calculations are being correctly applied.

The technical review also focuses on ensuring that the data that is being used has been reconciled insofar as possible.

13

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

Internal peer review involves a review of the approach, the methods, the assumptions

selected and the professional judgments applied.

Both the technical review and internal peer review processes are applied to

the Report as well as the valuation models.

| 1.11 |

Funding position of the AICF Trust |

This Report does not analyse nor provide any opinion on the current, or prospective, funding position of the AICF Trust, nor of its likely funding needs and its potential use of the loan facility provided

by the NSW Government.

This is because to do so requires consideration and estimation of the future financial performance of

James Hardie.

This Report only provides analysis and opinion on the estimates of the future expenditure to be met by the AICF

Trust.

| 1.12 |

Basis of preparation of Report |

We have been advised by the management of AICFL to prepare the Report on a “going concern” basis (i.e. we should assume that AICFL will be able to meet the cost of the liabilities of the Liable

Entities as they fall due).

14

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2012

| 2.1 |

Data provided to KPMG Actuarial |

We have been provided with the following data by AICFL:

| |

• |

|

Claims dataset at 31 March 2012 with individual claims listings; |

| |

• |

|

Accounting transactions dataset at 31 March 2012 (which includes individual claims payment details); and |

| |

• |

|

Detailed insurance bordereaux information (being a listing of claims filed with the insurers of the Liable Entities) produced by Randall &

Quilter Investment Holdings as at 31 March 2012. |

We have allowed for the benefits of the product and

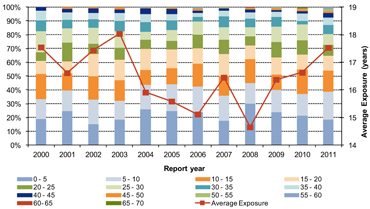

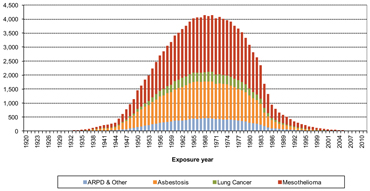

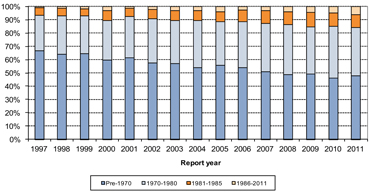

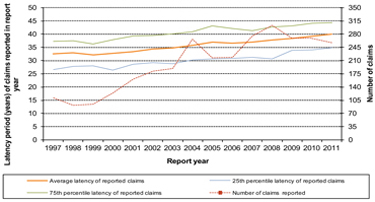

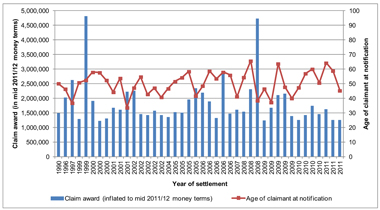

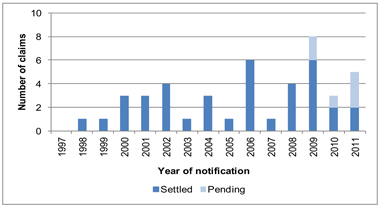

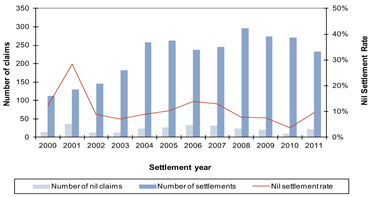

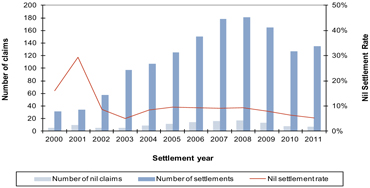

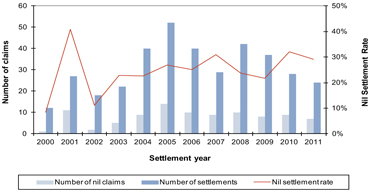

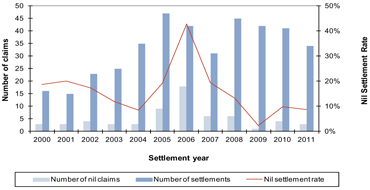

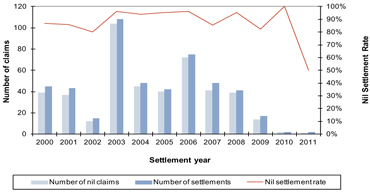

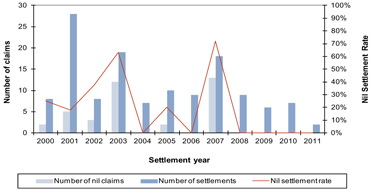

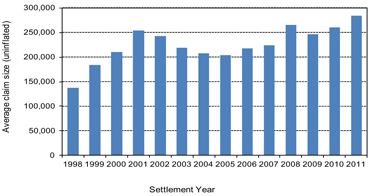

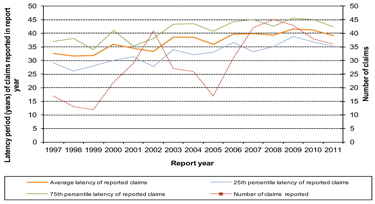

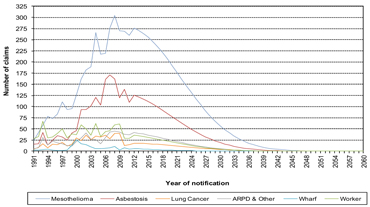

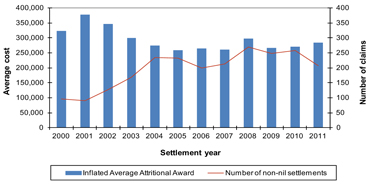

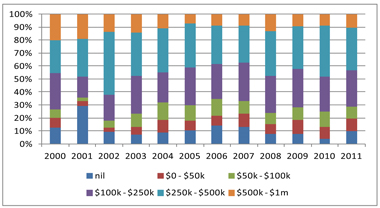

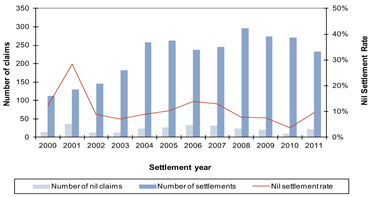

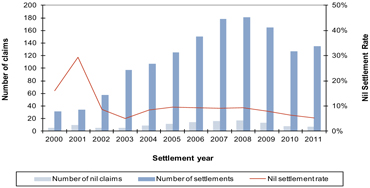

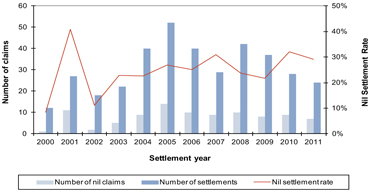

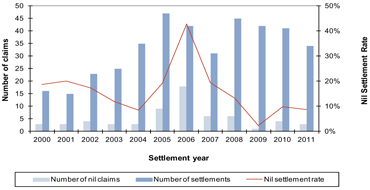

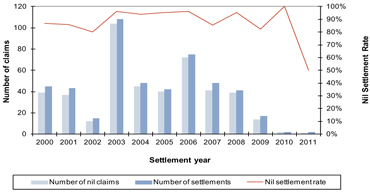

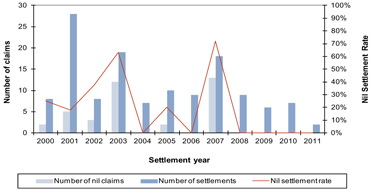

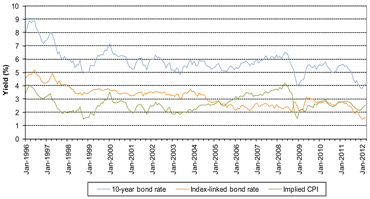

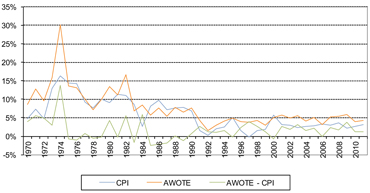

public liability insurance policies of the Liable Entities based on information provided to us by AICFL relating to the insurance programme’s structure, coverage and layers.