Exhibit 99.1

Notice is given that the Annual General Meeting (AGM) of James Hardie Industries SE (the company or James Hardie) will be held on Monday, 13 August 2012 in The Earlsfort Room, Conrad Dublin Hotel, 2 Earlsfort Terrace Dublin 2, Ireland at 7:30am (Dublin time).

Attendance

All holders of CUFS (ie CHESS Units of Foreign Securities) (CUFS Holders) as at 7:00pm (AEST) on Thursday, 9 August 2012 may attend the AGM in Dublin. Given the continual low levels of Shareholder attendance at the simulcast of the AGM in Sydney since the AGM has been held in Dublin, Ireland, this year James Hardie will not arrange a simulcast of the AGM to a meeting room in Sydney. Shareholders wishing to participate in the AGM can participate remotely via a live video webcast or teleconference of the AGM, during which they will have the same opportunities to ask questions as they previously had when attending the meeting remotely via simulcast.

Participation in video webcast of AGM

A live video webcast of the AGM will commence on Monday, 13 August 2012 at 7:30am (Dublin time) and 4:30pm (AEST). The video webcast can be accessed from James Hardie’s website at:

http://www.ir.jameshardie.com.au/jh/shareholder_meetings.jsp.

Participation in teleconference of AGM

For those Shareholders who do not have access to the internet, a teleconference of the AGM will also commence at 4:30pm on Monday, 13 August 2012 (AEST). The teleconference can be accessed using the following numbers:

Dial in: Australia toll free 1800 801 825 / USA toll free 1855 298 3404 Passcode: 3379066

Further details of the video webcast and the teleconference are set out on page 3 of this booklet.

Voting

A Voting Instruction Form has been enclosed with this booklet.

If you wish to nominate yourself as proxy to attend, speak and vote or appoint a proxy who is not the chairman to attend, speak and vote at the meeting in person on your behalf, please complete and return the Voting Instruction Form indicating the proxy of your choice by no later than 7:00pm (AEST) on Thursday, 9 August 2012.

If you do not intend to attend the AGM in person or appoint a proxy to attend the meeting in person and vote on your behalf, for your vote to count you must complete the Voting Instruction Form nominating the chairman of the AGM as your proxy by no later than 7:00pm (AEST) on Thursday, 9 August 2012.

You can return the completed Voting Instruction Form to the company’s Share Registry or complete and submit it electronically by visiting the dedicated AGM webpage at www. investorvote.com.au.

If you are a proxy, you must also attend to cast the votes in respect of which you have been appointed proxy at the AGM. A proxy is not required to be a Shareholder. Note that in nominating yourself or another person to vote on your behalf, you are directing CHESS Depository Nominees Pty Ltd (CDN) (the legal holder of your interest in the company) to give effect to your instructions.

Questions to the Board and external auditor

Shareholders or proxies attending the meeting in person or participating remotely either by video webcast or by teleconference will all be able to ask questions of the Board of Directors of the company (Board) and the external auditor. To enable more questions to be answered, we enclose a form that you can use to submit questions in advance of the AGM, whether or not you will be attending.

Shareholders or proxies not present at the meeting wishing to ask questions during the AGM can do so in the manner described on page 3 of this booklet.

Contents of this booklet

This booklet contains:

| • | the Agenda for the AGM setting out the resolutions proposed to be put at the meeting; |

| • | explanatory Notes describing the business to be conducted at the meeting; |

| • | information about who may vote at the AGM and how they may cast their vote; |

| • | details of how Shareholders can attend the meeting in person in Dublin; and |

| • | details of how Shareholders can participate remotely in the meeting by video webcast or teleconference. |

AGM details

Monday, 13 August 2012 in The Earlsfort Room, Conrad Dublin Hotel, 2 Earlsfort Terrace Dublin 2, Ireland at 7:30am (Dublin time).

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you should immediately consult your investment or other professional advisor.

James Hardie Industries SE ARBN 097 829 895, with registered office at Second Floor, Europa House, Harcourt Centre, Harcourt Street, Dublin 2, Ireland and registered in Ireland under company number 485719. The liability of its members is limited.

| 2 | James Hardie Notice of Meeting 2012 |

AGENDA AND BUSINESS OF

THE ANNUAL GENERAL MEETING

Agenda and Business of the Annual General Meeting

Explanations of the background, further information and reasons for each proposed resolution are set out in the Explanatory Notes on pages 5 to 16 of this Notice of Meeting.

The following are items of ordinary business:

| 1. | Financial statements and reports for the year ended 31 March 2012 |

To consider, and if thought fit, pass the following resolution as an ordinary resolution:

To receive and consider the financial statements and the reports of the Directors and external auditor thereon for the year ended 31 March 2012.

| The | vote on this resolution is advisory only. |

| 2. | Remuneration Report for the year ended 31 March 2012 |

To consider and, if thought fit, pass the following resolution as a non-binding ordinary resolution:

To receive and consider the Remuneration Report of the company for the year ended 31 March 2012.

The vote on this resolution is advisory only.

| 3. | Election and Re-election of directors |

To consider and, if thought fit, pass each of the following resolutions as a separate ordinary resolution:

| (a) | That Ms A Littley be elected as a director. |

| (b) | That Mr B Anderson, who retires by rotation in accordance with the Articles of Association, be re-elected as a director. |

| (c) | That Mr J Osborne, who retires by rotation in accordance with the Articles of Association, be re-elected as a director. |

| 4. | Authority to fix the External Auditor’s Remuneration |

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That the Board of Directors be authorized to fix the remuneration of the external auditor for the financial year ended 31 March 2013.

The following are items of special business:

| 5. | Increase non-executive director fee pool |

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That the maximum aggregate remuneration payable to non-executive directors be increased by US$500,000 from the current maximum aggregate amount of US$1,500,000 per annum to US$2,000,000 per annum, on the basis set out in the Explanatory Notes.

| 6. | Re-Approve Long Term Incentive Plan |

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That approval is given for all purposes for a further amendment to, and continued operation of, the James Hardie Industries Long Term Incentive Plan 2006 (LTIP) (as amended) to provide incentives for the Chief Executive Officer and other executives of the company in accordance with the terms of the LTIP and on the basis set out in the following Explanatory Notes.

| 7. | Grant of Return on Capital Employed Restricted Stock Units (RSUs) |

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That the award to the company’s Chief Executive Officer, Mr L Gries, of up to a maximum of 406,185 Return on Capital Employed (ROCE) RSUs, and his acquisition of ROCE RSUs and Shares up to that stated maximum, be approved for all purposes in accordance with the terms of the LTIP and on the basis set out in the following Explanatory Notes.

| 8. | Grant of Relative TSR RSUs |

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That the award to the company’s Chief Executive Officer, Mr L Gries, of up to a maximum of 381,253 Relative TSR RSUs, and his acquisition of Relative TSR RSUs and Shares up to that stated maximum, be approved for all purposes in accordance with the terms of the LTIP and on the basis set out in the following Explanatory Notes.

| 9. | Convert James Hardie Industries SE to an Irish public company |

To consider and, if thought fit, pass the following resolution as a special resolution:

That the company, being a Societas Europaea, be converted into an Irish public limited company and that the Draft Terms of Conversion and Proposed Memorandum and Articles of Association of James Hardie Industries plc as referred to in the Explanatory Notes enclosed with this Notice of Meeting for the Annual General Meeting be and hereby are approved.

Voting Exclusion Statement

In accordance with the ASX Listing Rules, the company will disregard any votes cast on Resolutions 5 to 8 of this Notice of Meeting if they are cast by any director and his or her associates. People who fall into the categories listed above will not have their votes disregarded if:(i) they are acting as a proxy for a person who is entitled to vote, in accordance with the directions on a Voting Instruction Form; or (ii) they are chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on a Voting Instruction Form to vote as the proxy decides.

Notes on voting and Explanatory Notes follow, and a Voting Instruction Form and Question Form are enclosed.

By order of the Board.

| /s/ Marcin Firek |

| Marcin Firek Company Secretary 4 July 2012 |

| James Hardie Notice of Meeting 2012 | 3 |

VOTING AND PARTICIPATION IN

THE ANNUAL GENERAL MEETING

If you are a holder of CUFS registered at 7:00pm (AEST) on Thursday, 9 August 2012, you may attend, speak and vote, in person or appoint a proxy to attend, speak and vote on your behalf, at the AGM in Dublin, Ireland or participate and ask questions while participating via the AGM video webcast or teleconference.

PHYSICAL ATTENDANCE AT THE AGM

The AGM will be held at The Earlsfort Room, Conrad Dublin Hotel, 2 Earlsfort Terrace Dublin 2, Ireland, starting at 7:30am (Dublin) on Monday, 13 August 2012. To appoint a proxy to attend the AGM in person on your behalf, please complete the relevant section of the Voting Instruction Form, and return it to Computershare no later than 7:00pm (AEST) on Thursday, 9 August 2012 using one of the methods set out under “Lodgement Instructions” on page 4. If you appoint a proxy and your proxy does not attend and vote at the AGM, your vote will not be counted.

NO VOTING AVAILABLE IN AGM VIDEO WEBCAST OR TELECONFERENCE

You will not be able to vote by way of the video webcast or teleconference. If you wish for your vote to count, you must submit your Voting Instruction Form no later than Thursday, 9 August 2012.

PARTICIPATION IN THE AGM VIDEO WEBCAST OR TELECONFERENCE

The AGM will be webcast and telecast at 4:30 pm (AEST) on Monday, 13 August 2012. CUFS Holders participating in the AGM webcast or teleconference will be able to ask questions of the Board and the external auditor.

You will need to have your shareholder identification number (SRN/ HIN) (included on your Voting Instruction Form) as well as the name of your holding if you intend to ask a question via the video webcast or the teleconference.

To participate in the video webcast, please

| • | go to the Shareholder Meetings page on James Hardie’s Investor Relations Website (http://www.ir.jameshardie.com.au/jh/ |

shareholder_meetings.jsp);

| • | activate the link to the 2012 AGM video webcast, which will take you to a web portal requesting your name and SRN/HIN; |

| • | enter your name and SRN/HIN where requested. You will then be taken to the AGM video webcast screen; |

| • | the video webcast will appear on the left of your screen and any presentations being used at the AGM will appear on the right of your screen; |

| • | if you have any questions during the video webcast, please select the ‘Questions’ tab at the top of the presentations screen. A question screen will appear. You can type your question here and it will be forwarded on to the Chairman and addressed accordingly. |

If you are participating in the AGM via the video webcast:

| • | you must have Adobe Flash or Windows Media Player installed; and |

| • | we recommend that you only listen to the AGM through your computer speakers, not through the teleconference, to eliminate the slight delay between the two mediums. |

To participate in the teleconference, please:

| • | dial into the AGM using the number below. |

Dial in: Australia toll free 1800 801 825 / USA toll free 1855 298 3404

Passcode: 3379066

| • | provide the operator with your name and SRN/HIN; |

| • | if you have any questions during the teleconference you will be required to follow the prompts from the teleconference operator on the day. |

These details are also set out on the Shareholder Meetings page on James Hardie’s Investor Relations Website (http://www.ir.jameshardie.com.au/jh/ shareholder_meetings.jsp).

VOTING ON THE RESOLUTIONS

How you can vote will depend on whether you are:

| • | a holder of CUFS (CUFS are quoted on the ASX); or |

| • | an American Depositary Receipt (ADR) holder (ADRs are quoted on the New York Stock Exchange (NYSE)). |

Voting if you are a holder of CUFS:

If you want to vote on the resolutions to be considered at the AGM, you have the following two options:

Option A—If your proxy is not attending the AGM

You may lodge a Voting Instruction Form directing CDN (the legal holder of the shares in the company (Shares) for the purposes of the ASX Settlement Operating Rules) to nominate the chairman of the AGM as its proxy to vote the Shares that it holds on your behalf. To be eligible to vote in this manner, you must be registered as a CUFS Holder at 7:00 pm (AEST) on Thursday, 9 August 2012.

You can submit a Voting Instruction Form in one of two ways:

| 1. | Complete the Voting Instruction Form accompanying this Notice of Meeting and lodge it with Computershare using one of the methods set out under Lodgement Instructions on page 4 of this Notice of Meeting. |

| 2. | Complete a Voting Instruction Form using the internet: |

Go to www.investorvote.com.au

To complete the Voting Instruction Form using the internet, you will need:

| • | your Control Number (located on your Voting Instruction Form); and |

| • | your Security Holder Reference Number (SRN) or the Holder Identification Number (HIN) from your current James Hardie Industries SE Holding Statement; and |

| • | your postcode as recorded in the company’s register. |

If you lodge the Voting Instruction Form in accordance with these instructions, you will be taken to have signed it.

Completed Voting Instruction Forms must be received by Computershare no later than 7:00pm (AEST) on Thursday, 9 August 2012. You will not be able to vote your shares by way of the video webcast or teleconference.

| 4 | James Hardie Notice of Meeting 2012 |

VOTING AND PARTICIPATION IN

THE ANNUAL GENERAL MEETING

Option B—If you or your proxy is attending the AGM

If you would like to attend the AGM or appoint someone else to attend the AGM on your behalf, in Dublin, Ireland and vote in person, you may use a Voting Instruction Form to ask CDN to appoint you or another person nominated by you (who does not need to be a Shareholder) as proxy to vote the Shares underlying your holding of CUFS on behalf of CDN in person in Dublin.

For your proxy appointment to count, your completed Voting Instruction Form must be received by Computershare no later than 7:00pm (AEST) on Thursday, 9 August 2012.

To obtain a free copy of CDN’s Financial Services Guide (FSG), or any Supplementary FSG, go to www.asx.com.au/cdis or phone 1300 300 279 from within Australia or +61 2 9227 0885 from outside Australia to ask to have one sent to you.

If you submit a completed Voting Instruction Form to Computershare, but fail to select either of Option A or Option B, you are deemed to have selected Option A.

Voting if you hold ADRs:

The Depositary for ADRs held in the company’s ADR program is the Bank of New York Mellon. The Bank of New York Mellon will send this Notice of Meeting to ADR holders on or about 12 July 2012 and advise ADR holders how to give their voting instructions. To be eligible to vote, ADR holders must be the registered owner as at 5:00pm US Eastern Daylight Time on 5 July 2012 (the ADR record date).The Bank of New York Mellon must receive any voting instructions, in the form required by The Bank of New York Mellon, no later than 5.00pm US Eastern Standard Time on 2 August 2012. The Bank of New York Mellon will endeavour, as far as is practicable, to instruct that the Shares ultimately underlying the ADRs are voted in accordance with the instructions received by The Bank of New York Mellon from ADR holders. If an ADR holder does not submit any voting instructions, the Shares ultimately underlying the ADRs held by that holder will not be voted. Under New York Stock Exchange (NYSE) Rule 452 and corresponding NYSE Listed Company Manual Section 402.08 mandated by Section 957 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, brokers that are NYSE member organizations are prohibited from directing the voting of the Shares underlying ADRs held in customer accounts on matters relating to executive compensation and director elections if they have not received voting instructions from the beneficial holders. Accordingly, if you are the beneficial owner of Shares underlying ADRs, and your broker holds your ADRs in its name, then you must instruct your broker as to how to vote your Shares. Otherwise, your broker may not vote your Shares. If you do not give your broker voting instructions and the broker does not vote your Shares, this is a “broker non-vote” which is treated as an abstention and does not count toward determining the votes for/ against the resolution.

LODGEMENT INSTRUCTIONS

Completed Voting Instruction Forms may be lodged with Computershare using one of the following methods:

| (i) | by post to GPO Box 242, Melbourne, Victoria 3001, Australia; or |

| (ii) | by delivery to Computershare at Level 4, 60 Carrington Street, Sydney NSW 2000, Australia; or |

| (iii) | online at www.investorvote.com.au; or |

| (iv) | for Intermediary Online subscribers only (custodians), online at www.intermediaryonline.com; or |

| (v) | by facsimile to 1800 783 447 from inside Australia or +61 3 9473 2555 from outside Australia. |

| James Hardie Notice of Meeting 2012 | 5 |

EXPLANATORY NOTES

Terminology

References to Shareholders in this Notice of Meeting, including these Explanatory Notes, are references to all the shareholders of the company acting together, and include holders of CUFS, holders of ADRs, holders of Shares and members of the company within the meaning of the Irish Companies Acts.

RESOLUTION 1—FINANCIAL STATEMENTS AND REPORTS FOR THE YEAR ENDED 31 MARCH 2012

Resolution 1 asks Shareholders to receive and consider the financial statements and the reports of the Board of Directors and external auditor for the year ended 31 March 2012.The financial statements which are the subject of Resolution 1 are those prepared in accordance with Irish law, US generally accepted accounting principles (to the extent that that the use of those principles in the preparation of the financial statements does not contravene any provision of Irish law) and Accounting Standards issued by the Accounting Standards Board and promulgated by the Institute of Chartered Accountants in Ireland (Generally Accepted Accounting Practice in Ireland), as distinct from the US generally accepted accounting principles (US GAAP) consolidated financial statements of the James Hardie group as set out in the 2012 Annual Report. A brief overview of the financial and operating performance of the James Hardie group during the year ended 31 March 2012 will be provided during the AGM. Copies of the JHISE consolidated Irish financial statements are available free of charge either:

| (a) | at the AGM in Dublin, Ireland; |

| (b) | at the company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin, Ireland; |

| (c) | at the company’s registered Australian office at Level 3, 22 Pitt Street, Sydney NSW; or |

| (d) | on the company’s website, in the Investor Relations area, at www.jameshardie.com. |

Recommendation

The Board believes it is in the interests of Shareholders that the financial statements and the reports of the Directors and external auditor for the year ended 31 March 2012 be received and considered, and recommends that you vote in favour of the resolution.

RESOLUTION 2—REMUNERATION REPORT FOR THE YEAR ENDED 31 MARCH 2012

Resolution 2 asks Shareholders to consider and receive the Remuneration Report for the year ended 31 March 2012. Irish law does not require the company to produce a remuneration report or to submit it to shareholders. Similarly, the company is not required under the ASX Corporate Governance Council Principles and Recommendations or section 300A of the Australian Corporations Act to submit a remuneration report to shareholders for a non-binding vote. However, taking into consideration the company’s large Australian shareholder base, James Hardie has voluntarily produced a remuneration report for non-binding shareholder approval for some years and currently intends to continue to do so. This report provides information on the company’s remuneration practices in fiscal year 2012 and also voluntarily includes an outline of the company’s proposed remuneration framework for fiscal year 2013. The company’s Remuneration Report is set out on pages 31 to 61 of the 2012 Annual Report and can also be found in the Investor Relations area of the James Hardie website at www.jameshardie.com. Although this vote does not bind the company, the Board intends to take the outcome of the vote into consideration when considering the company’s future remuneration policy.

Recommendation

The Board believes it is in the interests of Shareholders that the company’s Remuneration Report for the year ended 31 March 2012 be considered and received, and recommends that you vote in favour of the resolution.

RESOLUTION 3—ELECTION AND RE-ELECTION OF BOARD DIRECTORS

As part of their review of the composition of the Board, the Board and the Nominating and Governance Committee considered the desired profile of the Board, including the right number, mix of skills, qualifications, experience, expertise, diversity and geographic location of its directors, to maximise the effectiveness of the Board.

The Board and Nominating and Governance Committee spent significant time over the past year overseeing a search for an additional director, which culminated with the appointment of Alison Littley to the Board in February 2012. Ms Littley will be required to stand for election by Shareholders at the 2012 AGM.

Resolution 3(a) asks Shareholders to consider the election of Ms A Littley to the Board.

Resolutions 3(b) to 3(c) ask Shareholders to consider the re-election of Messrs B Anderson and J Osborne to the Board.

The company’s Articles of Association require that one-third of the directors subject to re-election (other than the Chief Executive Officer and any directors appointed by the board during the year) will retire at each AGM, with re-election possible after each term. Messrs Anderson and Osborne will retire at the 2012 AGM and each offers himself for re-election.

| 6 | James Hardie Notice of Meeting 2012 | |

| AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING |

||

Profiles of the candidates appear below:

|

Alison Littley BA, FCIPS Age 49

Alison Littley was appointed as an independent non-executive director of James Hardie in February 2012. She is a member of the Board and Audit Committee. |

Experience: Ms Littley has substantial experience in multinational manufacturing and supply chain operations and brings with her a strong international leadership background building effective management teams and third-party relationships. She has held a variety of positions, most recently as Chief Executive of Buying Solutions, a UK Government Agency responsible for procurement of goods and services on behalf of UK government and public sector bodies (2006-2011). She has previously held senior management roles in Diageo plc (1999-2006) and Mars (1981-1999).

Directorships of listed companies in the past five years: Nil

Other: Resident of the United Kingdom

Last elected: Will stand for election at August 2012 AGM

|

Brian Anderson BS, MBA, CPA Age 61

Brian Anderson was appointed as an independent non-executive director of James Hardie in December 2006. He is a member of the Board, Chairman of the Audit Committee | |

| and a member of the Remuneration Committee. Mr Anderson was also Chairman of the Re-domicile Due Diligence Committee. | ||

Experience: Mr Anderson has extensive financial and business experience at both executive and board levels. He has held a variety of senior positions, with thirteen total years as Corporate Vice President of Finance and then Senior Vice President and Chief Financial Officer of Baxter International, Inc. (1997-2004) and, more recently, as Executive Vice President and Chief Financial Officer of OfficeMax, Inc (2004-2005). Earlier in his career, Mr Anderson was an Audit Partner of Deloitte & Touche LLP (1986-1991).

Directorships of listed companies in the past five years: Current—Chairman (since April 2010) and Director (since 2005) of A.M. Castle & Co.; Director of Pulte Homes Corporation (since September 2005); Director (since 1999) and Lead Director (since April 2011) of W.W. Grainger, Inc.

Other: Resident of the United States.

Last elected: August 2009

|

James Osborne BA Hons, LLB Age 63

James Osborne was appointed as an independent non-executive director of James Hardie in March 2009. He is a member of the Board and the Nominating and Governance | |

| Committee. Mr Osborne was also a member of the Re-domicile Due Diligence Committee. | ||

Experience: Mr Osborne is an experienced company director with a strong legal background and considerable knowledge of international businesses operating in North America and Europe. His career includes 35 years with the leading Irish law firm, A&L Goodbody, including as managing partner (1982-1994) and opening the firm’s New York office in 1979.

Mr Osborne contributed to the listing of Ryanair in London, New York and Dublin and has served on its Board since 1996.

Directorships of listed companies in the past five years: Current—Director, Ryanair Holdings plc (since 1996); Former—Chairman, Independent News & Media plc (2011-2012); Chairman, Newcourt Group plc (2004-2009).

Other: Chairman, Eason & Son Ltd (since August 2010); Chairman, Centric Health (since March 2011); resident of Ireland.

Last elected: August 2009

Recommendation

The Board, having appointed Ms A Littley to fill a casual vacancy, and on the recommendation of the Nominating and Governance Committee, believes it is in the interests of Shareholders that she be elected as a director of the company, and recommends (with Ms Littley abstaining from voting in respect of her own election) that you vote in favour of Resolution 3(a).

The Board, having assessed the performance of Messrs B Anderson and J Osborne, and on the recommendation of the Nominating and Governance Committee, believes it is in the interests of Shareholders that each of the individuals referred to above be re-elected as a director of the company, and recommends (with Messrs B Anderson and J Osborne each abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(b) and 3(c).

| James Hardie Notice of Meeting 2012 | 7 |

RESOLUTION 4—AUTHORITY TO FIX THE EXTERNAL

AUDITOR’S REMUNERATION

Resolution 4 asks Shareholders to give authority to the Board of Directors to fix the external auditor’s remuneration. Ernst & Young LLP were appointed external auditors for the James Hardie Group for the year ended 31 March 2009. The selection of Ernst & Young LLP followed a comprehensive tender and review process of major accounting firms capable of undertaking James Hardie’s external audit. A summary of the external auditor’s remuneration during the year ended 31 March 2012 as well as non-audit fees paid to Ernst & Young LLP are set out on page 160 of the 2012 Annual Report. The Audit Committee periodically reviews Ernst & Young LLP’s performance and independence as external auditor and reports its results to the Board. A summary of Ernst & Young LLP’s interaction with the company, the Board and Board Committees is set out on page 160 of the Annual Report.

Recommendation

The Board believes it is in the interests of Shareholders that the Board be given authority to agree the external auditor’s remuneration and recommends, on the recommendation of the Audit Committee, that you vote in favour of Resolution 4.

RESOLUTION 5—INCREASE NON-EXECUTIVE DIRECTOR FEE POOL

Resolution 5 asks Shareholders to approve an increase in the maximum remuneration payable to non-executive directors by US$500,000 per annum, from the current maximum aggregate amount of US$1.5 million per annum to a maximum aggregate amount of US$2.0 million per annum. Approval is sought for the purposes of ASX Listing Rule 10.17 and Article 98(b) of the company’s Articles of Association, under which the company must not increase the total maximum amount of fees payable by it to non-executive directors without the approval of Shareholders.

The maximum aggregate amount of remuneration of the non-executive directors has not been increased since the Annual General Meeting held on 19 September 2006.

The annual fees to be paid to each Director, the Chairman, Deputy Chairman and Committee Chairmen, commencing in FY2013 are set out in the table below.

| Position |

FY2012 | FY2013 | ||||||

| Chairman |

$ | 330,750 | $ | 343,980 | ||||

| Deputy Chairman |

$ | 192,938 | $ | 200,655 | ||||

| Board member |

$ | 143,325 | $ | 149,058 | ||||

| Audit Committee Chair |

$ | 20,000 | $ | 20,000 | ||||

| Rem/N&GC Committee Chair |

$ | 10,000 | $ | 10,000 | ||||

The Board considers that these fees are at the median level for similarly sized companies in the United States and Australia and provide an appropriate level of reward to attract and retain directors from the USA, Europe and Australia as part of the Board’s desired diversity given the geographic spread, nature and complexity of the company’s operations and time commitment by directors.

Based on a 4% increase in base fees in fiscal year 2013 and the increased size of the Board following Ms Littley’s appointment, the aggregate amount of annual fees to be paid in fiscal year 2013 is estimated to total US$1,478,983. Although this would be below the maximum allowed, the Board considers it prudent to seek approval to increase the maximum at this time.

The proposed increase is expected to provide sufficient headroom for a number of years and flexibility to add additional directors to the Board if desired.

Recommendation

As the directors have a personal interest in Resolution 5, they make no recommendation on whether Shareholders should vote in favour of the resolution. Shareholders should judge for themselves whether to approve an increase to the maximum remuneration payable to non-executive directors under Article 98(b) of the company’s Articles of Association.

RESOLUTION 6—APPROVAL OF LONG TERM INCENTIVE PLAN

Resolution 6 asks Shareholders to approve the James Hardie Industries Long Term Incentive Plan 2006 (LTIP), initially approved at the 2006 AGM. It was subsequently amended at the 2008 AGM and further amended and approved at the 2009 AGM. Resolution 6 also asks Shareholders to approve a number of further amendments to the LTIP, including the removal of the Performance Share, Performance Rights and Options Sub-plan provisions and any consequential amendments which would need to be made to the LTIP. The amendments are intended to simplify the range of potential entitlements paid to executives who are eligible to participate in the LTIP (Executives or Participants).

Overview of the LTIP

The LTIP is a key component of the company’s compensation arrangements for Executives, who include the Chief Executive Officer and selected senior executives. It provides flexibility in the type of equity award which can be used to deliver long-term shareholder alignment. The Board believes that this flexibility is important given the company’s international operations and will allow it to tailor rewards to Executives and maximize returns to Shareholders over the long-term by:

| • | aligning the interests of Executives and Shareholders; |

| • | matching Executive rewards under the LTIP with the long-term performance of the company; and |

| • | helping to attract and retain Executives. |

Currently, under the LTIP, the company may offer eligible Executives any of the following:

| • | options over ordinary fully-paid shares (Options), which also include Incentive Stock Options for US-based Executives; |

| • | cash awards (Awards); |

| • | restricted stock units (RSUs); |

| • | rights to receive ordinary fully-paid shares by way of issue or transfer for no cash payment (Performance Rights); and |

| • | beneficial interests in ordinary fully-paid shares (Performance Shares) together referred to as Entitlements. |

If Resolution 6 is passed at the AGM, the LTIP will be amended to remove the provisions relating to the Performance Rights, Performance Shares and Options Sub-plans and, accordingly, the company will no longer offer Performance Rights, Performance Shares and Options to eligible Executives.

The Chief Executive Officer is the only director who is a Participant in the LTIP and any subsequent grant of the above Entitlements (other than Awards) to him, or any other Board director, would require Shareholder approval under ASX Listing Rule 10.14.

| 8 | James Hardie Notice of Meeting 2012 | |

| AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING |

||

Operation of the LTIP

The rules of the LTIP (Plan Rules) explain the general terms of the LTIP which apply to offers of each type of Entitlement. The Plan Rules include a separate sub-plan (Sub-plan) setting out the terms and conditions for each type of Entitlement as well as a separate Sub-plan with additional conditions that apply to offers of Entitlements to US Executives.

Selected Executives will be invited to apply for either a specified number of Entitlements, or a number of Entitlements calculated by reference to a US$ amount of long-term incentive and the fair value of the Entitlement to be granted. A grant of Entitlements to Executives under the LTIP is subject to the Plan Rules and the terms of the specific grant. The Board will administer the LTIP in accordance with the Plan Rules and the terms and conditions of the specific grants to Executives.

Specific provisions under US law

US law contains specific provisions dealing with compensation for Executives, which are relevant to the company. In general, under section 162(m) of the US Internal Revenue Code, compensation in excess of US$1 million paid in one year to a “covered employee” is not tax-deductible. Covered employees include the CEO and the three other most highly-compensated executive officers other than the CFO. “Performance-based compensation”, such as grants of Entitlements under the LTIP, is not subject to the US$1 million limit.

The LTIP includes special provisions for US Executives which comply with the applicable US laws, including:

| • | a maximum amount of award that may be granted to covered employees (subject to certain adjustments) of: |

| • | two million Shares in any financial year for equity awards; |

| • | US$5.0 million dollar value payable to any one Participant in the Awards; and |

| • | requiring performance goals for grants to be established no later than 90 days after the beginning of the applicable performance period; and |

| • | requiring awards to be subject to the achievement of objective performance criteria approved by Shareholders; and |

| • | no discretion to increase payouts above the amount provided pursuant to the objective performance criteria, except where permitted under the terms of the offer of the Entitlement. |

The Remuneration Committee must certify that the performance criteria were met.

Grants of Entitlements and performance hurdles

The vesting or exercise of Entitlements granted to all Participants under the LTIP may be conditional on the achievement of performance hurdles set out in the terms of the specific grant.

A summary of the Plan Rules and the proposed amendments are set out below.

Brief summary of each Sub-plan

The following is a summary of each of the rules of the Sub-plans which are proposed to continue in existence if this Resolution 6 is approved:

Award Sub-plan

Unlike the other Sub-plans, the Award Sub-plan involves cash awards rather than the acquisition of securities by Executives. A grant of Awards to a particular Executive (including Board members) is subject to the Plan Rules and the terms of the specific grant.

As the Awards Sub-plan does not involve any issue of securities by the company, Shareholder approval of this aspect of the plan is not required. However, it is included here for the information of Shareholders. In general, the terms and conditions for grants of Awards are the same as those for grants of RSUs (described below)

More information about grants of Awards which are proposed to be made to members of the Board and Executives during fiscal year 2013 is set out in the 2012 Remuneration Report on pages 31 to 61 of the 2012 Annual Report.

Restricted Stock Unit (RSU) Sub-plan

A summary of the terms and conditions that apply specifically to RSUs is set out below:

Entitlement—Each RSU granted to an Executive will entitle the Executive to be issued or transferred one Share, subject to the RSU vesting. The company may put the Executive in contact with a broker who will arrange with the Executive to sell the Shares and provide the cash proceeds on or after the date the RSU has vested.

Price payable to company on issue of RSU and on vesting of RSU—zero. RSUs will be granted to the Executive for no consideration. Executives will be entitled to receive Shares upon vesting of their RSUs for no consideration.

Transferability/assignability—an RSU cannot be transferred or assigned by an Executive except in limited circumstances.

Sub-division, consolidation, reduction or return—If the company conducts any Share capital re-organisation, including by subdividing, consolidating, reducing or returning capital, the Board may make an appropriate and proportionate adjustment to the number of Shares which will be issued or transferred upon vesting of an RSU in accordance with ASX Listing Rules 6.16 and 6.22.3.

Voting, participation and dividend entitlements—an RSU has no entitlement to vote, participate in new issues of Shares or accrue dividends.

When RSUs lapse—Each grant of RSUs will have an expiry date. Depending on the circumstances in which an Executive ceases employment with the company or a related body corporate prior to the end of the RSU vesting period, an unvested RSU will, unless the terms of grant state otherwise, lapse or vest as follows:

| • | Voluntary resignation or termination for cause—any unvested RSUs will be forfeited. |

| • | Other reasons, including death, retirement, permanent disability or termination not for cause—A pro-rata number of unvested RSUs will lapse automatically on the relevant day, calculated based on the formula: |

D = C x (A / B)

| James Hardie Notice of Meeting 2012 | 9 |

Where:

| A = |

the number of months from the relevant event to, depending on the type of RSU, the date of vesting (for RSUs with time vesting) or the first testing date (for RSUs with a performance hurdle); | |

| B = |

depending on the type of RSU, the vesting period calculated in months (for RSUs with time vesting) or the number of months from the date the RSU was granted until the first testing date (for RSUs with a performance hurdle); | |

| C = |

the number of RSUs in the relevant tranche; and | |

| D = |

the number of RSUs which lapse automatically. | |

All of the remaining unvested RSUs will expire at the earlier of 24 months after the relevant event or the date they would have expired had the former Executive remained employed by the company, unless the Board reasonably determines that the RSUs have lapsed (and provides notice to that effect to the former Executive, or in the event of an Executive’s death, the estate of the former Executive).

Control Event –

| • | If a Control Event occurs prior to the RSUs vesting, the Board may determine at its absolute discretion, and subject to any conditions that it determines, that all or a portion of the RSUs have vested; and |

| • | Any RSUs held by a Participant which the Board has not accelerated so that they are vested following a Control Event will lapse, and the Executive will be treated as having never held any right or interest in those RSUs. |

For these purposes “Control Event” means any of the following:

| • | a takeover bid is made to acquire the whole of the issued ordinary Share capital of the company and the takeover bid is recommended by the Board or becomes unconditional; |

| • | a transaction is announced by the company which, if implemented, would result in a person owning all the issued Shares in the company; |

| • | a person owns or controls sufficient Shares to enable them to influence the composition of the Board; or |

| • | any other similar event has occurred or is likely to occur (including, but not limited to, a merger of the company with another company), which the Board determines, in its absolute discretion, to be a Control Event. |

Board discretion—the Board may at its absolute discretion (on any conditions which it thinks fit) decide that some or all of the unvested RSUs held by the Executive do not lapse, but lapse at a time and subject to any conditions it may specify by notice to the Executive which may include that a RSU will vest immediately, or at some time in the future depending on satisfaction of performance hurdles. The Board will not exercise this discretion in circumstances where the Executive is terminated for cause (including for fraud or dishonesty). The Board may delegate this discretion to the Remuneration Committee.

Sub-plan relating to grants to US Executives

A summary of the key features of this long-term incentive arrangement for grants of Options, Awards and/or RSUs to US Executives are set out below. If Resolution 6 is passed at the AGM, the LTIP will be amended to remove the company’s ability to offer eligible Performance Rights, Performance Shares and Options (including Incentive Stock Options) to US Executives.

A grant under this Sub-plan to a particular US Executive is subject to the Plan Rules and the terms of the specific grant.

Awards—the Sub-plan provides for grants of cash Awards to US Executives.

RSUs—the Sub-plan provides for grants of RSUs to US Executives.

Restrictions—the Sub-plan sets out a number of restrictions in relation to grants to US Executives, which affect the term, time and method of exercise and form and timing of payment of any such grant. There are also particular restrictions relating to US-specific revenue and taxation law.

Performance Hurdles—as required under section 162(m) of the US Internal Revenue Code, grants of Entitlements will be performance-based compensation because they are subject to one of more of the following performance hurdles: (1) earnings per Share; (2) revenues or margins; (3) cash flow; (4) operating margin; (5) return on net assets, investment, capital, or equity; (6) economic value added; (7) direct contribution; (8) net income; pre-tax earnings; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization; earnings after interest expense and before extraordinary or special items; operating income; income before interest income or expense, unusual items and income taxes, local, state or federal and excluding budgeted and actual bonuses which might be paid under any ongoing bonus plans of the company; (9) working capital; (10) management of fixed costs and/or variable costs; (11) identification or consummation of investment opportunities and/or completion of specified projects in accordance with corporate business plans, including growing the sales of differentiated products, strategic mergers, acquisitions or divestitures; (12) total shareholder return; (13) credit facility and liquidity management; (14) market share; (15) entry into new markets, either geographically and/ or by business unit; (16) customer retention and satisfaction; (17) strategic plan development and implementation, including turnaround plans; (18) the Fair Market Value of a Share, (19) primary demand growth or growth against “wood look” products; (20) achievement of environmental/waste goals; (21) achievement of safety goals; (22) resolution of legacy issues; (23) achievement of talent development/management goals; and/or

| (24) | improving manufacturing efficiency. |

Any of the above goals maybe determined on an absolute or relative basis or as compared to the performance of a published or special index deemed applicable by the Remuneration Committee including, but not limited to, the Standard & Poor’s 500 Stock Index or a group of companies that are comparable to the company. The Remuneration Committee shall exclude the impact of an event or occurrence which the Remuneration Committee determines should appropriately be excluded, including without limitation (i) restructurings, discontinued operations, extraordinary items, and other unusual or non-recurring charges, (ii) an event either not directly related to the operations of the company or not within the reasonable control of the company’s management, and/or (iii) a change in accounting standards required by generally accepted accounting principles.

Terms—The Sub-plan incorporates the other Sub-plans, subject to the extent of any inconsistency.

| 10 | James Hardie Notice of Meeting 2012 |

AGENDA AND BUSINESS OF

THE ANNUAL GENERAL MEETING

Proposed amendments

It is proposed that amendments be made to the LTIP to remove the Performance Rights Performance Shares and Options Sub-plans provisions in respect of both eligible Executives and US Executives. Since there are no Entitlements currently on issue under either of the Performance Rights or the Performance Shares Sub-Plans, and since both of those Sub-Plans are proposed to be deleted from the Plan Rules if this Resolution 6 is approved, no summary of those Sub-plans is included here.

Options are currently on issue under the Options Sub-plan. While it is proposed that the Options Sub-plan is to be deleted from the Plan Rules if this Resolution 6 is approved, the outstanding Options will remain subject to the terms of the Options Sub-plan in force at the time of their issue. A summary of this Options Sub-plan will be available free of charge.

Limits on number of Shares that can be issued

The Board will not:

| • | issue an invitation to apply for Options; or |

| • | grant RSUs; |

if the aggregate number of Shares involved in each of the above, when added to:

| • | the number of Shares which would be issued if all outstanding Options, and all Options which may be granted pursuant to the acceptance of any outstanding invitations to apply for Options, were exercised; and |

| • | the number of Shares which would be issued if all outstanding RSUs vested, |

(but disregarding offers made, Options acquired or Shares issued to a person, where the person was situated outside Australia at the time the offer was made) would exceed 5% of the total number of issued Shares at the date on which the Board proposes to grant Options or grant RSUs.

Administration of the LTIP

Any power or discretion which is conferred on the Board under the LTIP may be delegated by the Board to a committee consisting of directors, other officers, or employees of the company as the Board thinks fit.

The Remuneration Committee has the authority to interpret the LTIP and any documents used to evidence Entitlements, to determine the terms and conditions of Entitlements, and to make all other determinations necessary or advisable for the administration of the LTIP.

Shareholder approval

If the ASX Listing Rules require Shareholder approval for the granting of Entitlements, no Entitlements will be granted before that approval is obtained.

Previous Allotments

Since the LTIP was last approved by Shareholders at the 2009 AGM, the Chief Executive Officer has received the following grants of Options, Performance Shares, Performance Rights or RSUs under the LTIP, all approved by Shareholders. No other current director has received any grants under the LTIP:

| Name |

FY2010 |

FY2011 |

FY2012 | |||

| L Gries |

804,092 RSUs | 943,522 RSUs 182,290 Performance Shares |

652,539 RSUs |

General

Copies of the LTIP (including the amendments proposed in Resolution 6) and a summary of the Options Sub-Plan which will only continue for Options already on issue, are available free of charge at:

| (a) | the AGM; |

| (b) | the company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin, Ireland; |

| (c) | the company’s registered Australian office at Level 3, 22 Pitt Street, Sydney NSW Australia; or |

| (d) | the company’s website, in the Investor Relations area, at www.jameshardie.com. |

The term “Shares” as used in Resolutions 6 to 8 (and in the Explanatory Notes accompanying Resolutions 6 to 8) includes CUFS.

The Shares which may be earned under the various entitlements may be issued as new Shares or purchased by the company on-market.

The company will not provide loans in relation to the issue of Entitlements under the LTIP.

For the purposes of satisfying ASX listing rules requirements, the information disclosed in respect of the LTIP applies to Resolutions 6 through 8 inclusive.

Summary of the reasons for seeking Shareholder approval

Shareholder approval of the LTIP is sought for all purposes under the Listing Rules of ASX. Under ASX Listing Rule 7.1 the company may not issue shares or options over unissued shares in respect of more than 15% of its issued share capital in any 12-month period without Shareholder approval (subject to limited exceptions). Where Shareholders have approved the issue of shares or options over shares under an employee share plan within the three years preceding the issue, as an exception to ASX Listing Rule 7.1, those shares or options would not be counted towards the 15% limit. As the LTIP was most recently approved in its entirety at the 2009 Annual General Meeting, Shareholder approval is sought for the issue of shares and options over unissued shares generally under the LTIP.

Recommendation

The Board believes that the LTIP (as amended) is an appropriately designed equity-based employee incentive scheme, capable of attracting, motivating and retaining key executives and driving the improved performance of the company, and recommends that you vote in favour of Resolution 6.

| James Hardie Notice of Meeting 2012 | 11 |

RESOLUTION 7—GRANT OF ROCE RSUs

ROCE RSUs will replace Hybrid RSUs in the company’s long-term executive compensation program. Resolution 7 asks Shareholders to approve the grant of Return on Capital Employed (ROCE) restricted stock units (ROCE RSUs) under the company’s LTIP to the Chief Executive Officer (CEO), Mr L Gries.

ROCE RSUs convert to Shares if the company’s ROCE performance meets or exceeds the performance criteria over a three year period and subject to the Board’s exercise of negative discretion. The Board has determined that 40% of the CEO’s Long-Term Incentive (LTI) target quantum for fiscal year 2013 will be received in ROCE RSUs. ROCE RSUs will be granted to the CEO for no consideration. Subject to the performance hurdles being met and the exercise of “negative discretion” by the Board, the CEO will be entitled to receive Shares upon vesting of the ROCE RSUs for no consideration.

Reasons for replacing Hybrid RSUs with ROCE RSUs

For the past four years, the company has included Hybrid RSUs in its long-term executive compensation program because the Board has been concerned that the lack of stability in the US housing market has made it difficult to set and evaluate the CEO’s performance on multi-year financial metrics for LTI purposes. The Board now feels that the US housing market has stabilized to an extent which permits the setting of such metrics and has determined that ROCE RSUs should replace Hybrid RSUs in the company’s LTI compensation arrangements.

The Board will retain the ability to exercise negative discretion to reduce the amount of ROCE RSUs which ultimately vest in three years based on the company’s financial performance over the testing period. The discretion will be an outcome of the Board’s judgment of the quality of the returns balanced against management’s delivery of market share growth, and the Scorecard. The discretion can only be applied to reduce the number of Shares which will vest.

The maximum payout for the ROCE RSUs will reduce from the 300% of target previously applicable for Hybrid RSUs, to 200% of target, consistent with the reduction in the maximum payout for Relative TSR RSUs (see below).

Key aspects of ROCE RSUs

ROCE RSUs will be granted in accordance with the terms of the LTIP. The LTIP was approved by shareholders at the 2009 AGM and re-approval is being sought in 2012. The following specific terms also apply to ROCE RSUs.

Goal Setting: The Board’s philosophy is that total target direct compensation should be positioned at the market 75th percentile if stretch target performance goals approved by the Board are met. The company has historically generated ROCE returns around the 75th percentile of its Peer Group. The Board believes that maintaining this high level of performance in upcoming years will be more challenging as companies in the Peer Group which have underperformed during recent years generate significant improvements off a low base. ROCE performance targets for the ROCE RSUs are based on historical results. Achievement of the ROCE goal for 100% of LTI target will require improvement on the average of the performance of the company for fiscal years 2010 to 2012.

ROCE Goal: The ROCE measure will be determined by dividing EBIT by Capital Employed.

The EBIT component of the ROCE measure will be determined as follows. Earnings before interest and taxation will be EBIT as reported in the Company’s financial results, adjusted by:

| • | Deducting the earnings impact of legacy issues (i.e. asbestos adjustments, including foreign exchange impact on JHISE’s asbestos provision, and ASIC expenses); |

| • | Deducting leasehold expenses, since potential upcoming changes to international accounting standards could cause significant volatility in this component; and |

| • | Adding back asset impairment charges in the relevant period, unless otherwise determined by the Board. Since management’s performance will be assessed on the pre-impairment value of the Company’s assets, the Board would not normally deduct the impact of any asset impairments from the Company’s EBIT for the purposes of measuring ROCE performance. |

The Capital Employed measure will be determined as follows. The Capital Employed component will start with the net working capital and fixed assets (net of depreciation), which already excludes legacy issue related items such as asbestos-related assets and liabilities, as reported in the Company’s financial results, adjusted by:

| • | Adding back asset impairment charges in the relevant period, unless otherwise determined by the Board, in order to align the Capital Employed with the determination of EBIT; |

| • | Adding back leasehold assets for manufacturing facilities and other material leased assets, which the Board believes give a more complete measure of the Company’s capital base employed in income generation; and |

| • | Deducting all greenfield construction-in-progress, and any brownfield construction-in-progress projects involving capacity expansion that are individually greater than $20 million, until such assets reach commercial production and are transferred to the fixed asset register, in order to encourage management to invest in capital expenditure projects that are aligned with the long-term interests of the Company. |

The resulting Capital Employed for each quarter of any fiscal year will be averaged to better reflect Capital Employed through a year rather than at a certain point in time.

These definitions have been framed to ensure management is rewarded and held accountable for the aspects over which they have direct influence and control, while not discouraging management from investment that will provide for future company growth. In setting the goals for ROCE RSUs for the three year period of fiscal year 2013 to fiscal year 2015, the Board has taken into account the expected impact of these adjustments to EBIT and Capital Employed.

| 12 | James Hardie Notice of Meeting 2012 |

AGENDA AND BUSINESS OF

THE ANNUAL GENERAL MEETING

The goals for ROCE RSUs granted in fiscal year 2013 (for performance in FY2013 to FY2015) are:

| ROCE |

% of ROCE RSUs vested | |

| < 18.5% |

0% | |

| ³ 18.5%, but < 19.5% |

25% | |

| ³ 19.5%, but < 20.5% |

50% | |

| ³ 20.5%, but < 21.5% |

75% | |

| ³ 21.5% |

100% |

Performance period: The overall performance period is three years. The ROCE goal for the CEO is based on the average of the company’s ROCE in fiscal years 2013, 2014 and 2015. In 2015, the Board will assess the quality of the result based on the company’s financial performance over the testing period, the Board’s judgment of the quality of the returns balanced against management’s delivery of market share growth, and the Scorecard to determine the final number of ROCE RSUs that vest.

Grant: The CEO may earn between 0% and 200% of his target, depending on performance. This maximum target has been lowered from the maximum of 300% of LTI target for Hybrid RSUs in prior years.

Vesting Period: The ROCE RSUs vest three years after they are granted. In 2015 the Board will review the company’s performance over the vesting period and may exercise ‘negative discretion’ to determine what percentage (between 0 and 100%) of the ROCE RSUs that would otherwise vest under the ROCE vesting scale.

Conditions: Although the ROCE RSUs are based on three year financial returns, the potential for the Board to exercise ‘negative discretion’ in September 2015 provides a “holdback and forfeiture” principle to ensure that the ROCE returns are not obtained at the expense of long-term sustainability.

Worked Example

The following examples of how the ROCE RSUs operate are based on the CEO’s LTI target quantum of US$3,100,000 (the fiscal year 2013 LTI target quantum) and performance at approximately 20%, 22% and 24% ROCE for fiscal years 2013, 2014 and 2015 respectively.

At grant date the LTI quantum received by the CEO in ROCE RSUs is:

| • | $3.1 million LTI target x 40% of LTI target received in ROCE RSUs x 200% maximum leverage = US$2.48 million to be settled in ROCE RSUs. At a value of US$7/share, this is equivalent to 354,285 ROCE RSUs. |

Based on a 22% average ROCE result for the three year period to FY2015, 150% of target or 75% of the total ROCE RSUs granted would be eligible to vest:

| • | 354,285 RSUs x 75% = 265,713 ROCE RSUs |

At the conclusion of the three-year performance period in September 2015, the Board will review the Company’s performance. For indicative purposes, assuming that the Board determines 100% or 80% of the CEO’s ROCE RSUs remaining after application of the ROCE performance hurdle should vest, he would receive one of:

| • | if the Board determines 100% of the ROCE RSUs should vest, 265,713 Shares; or |

| • | if the Board determines 80% of the ROCE RSUs should vest, 212, 570 Shares. |

Further details on the operation of the Scorecard

Scorecard

The Board introduced the ‘Scorecard’ to ensure the CEO’s continued focus on financial, strategic, business, customer and people components, each of which are important contributors to long-term creation of shareholder value. The Scorecard contains a number of key objectives, and the measures the Board expects to see achieved for each of these objectives. The CEO’s rating ultimately depends on the Board’s assessment of his contribution to the company achieving the Scorecard objectives. Although most of the objectives in the Scorecard have quantitative targets, the company has not allocated a specific weighting to any and the final Scorecard assessment and exercise of negative discretion (if any) will involve an element of judgment by the Board. The Board is likely to apply different amounts of negative discretion when assessing the CEO’s performance for the Scorecard LTI grants (which only include consideration of the Scorecard) and ROCE RSUs grants (which involve a broader assessment of the quality of the company’s results).

When the Board reviews the ROCE RSU result against the performance hurdles, it may exercise negative discretion such that all, some, or none of the ROCE RSUs will vest and convert into Shares. This discretion can only be applied by the Board to exercise negative discretion. It cannot be applied to enhance the reward that can be received.

Scorecard for fiscal year 2013

The Board has made a number of changes to the Scorecard for fiscal year 2013. These include:

| • | supplementing ‘primary demand growth’ with a broader measure consisting of primary demand growth and performance against ‘wood look’ products; |

| • | replacing ‘managing through the economic downturn’ with ‘positioning the company for potential recovery; and |

| • | removing the ‘legacy issues’ measure since most of the company’s legacy issues have been resolved. |

| James Hardie Notice of Meeting 2012 | 13 |

| Measure |

Starting Point |

How measured |

Board requirement | |||

| US Primary Demand Growth (PDG) and ‘Wood Look’ Market Tracking Data |

FY12 – 9.1% FY11 – -4.4% FY10 – 7.4%

Performance data of ‘wood look’ competitors is commercial in confidence. |

The percentage of growth of the James Hardie business as measured in standard feet as compared to the underlying market (a combination of new housing starts and the repair and remodel market) and ‘wood look’ peers. | Minimum: Maintain relative to market

Stretch: Grow relative to market | |||

| US Product Mix Shift |

The company’s focus over the past few years has been primarily on ColorPlus and Artisan penetration. For FY13, this will extend to penetration of all of the company’s differentiated value-added products as a percentage of the company’s total exterior cladding sales.

Actual penetration numbers are commercial in confidence. |

Relative percentage growth in US sales of differentiated, value-added products as a percentage of total exteriors volume. | Minimum: Annual improvement in penetration of differentiated, value-added products.

Stretch: More substantial annual improvement in penetration of differentiated, value-added products. | |||

| Manufacturing Reset |

The company upgraded in FY12 to a multi-year ‘Manufacturing Reset’ initiative, focusing on improvement in material yield, production performance and production efficiency. | Changes in traditional manufacturing metrics such as production performance and production efficiency, material yield and learning curve progress for new products will be reported annually to the Board. | Metrics will be reviewed to confirm manufacturing performance and progress is effectively supporting the company’s product leadership strategy. | |||

| Safety |

IR SR FY12 1.46 18.1 FY11 1.70 19.0 FY10 1.70 37.0 |

Incident Rate: Recordable incidents per 200,000 hours worked

Severity Rate: Days lost per 200,000 hours worked |

2.0 IR and 20 SR

No fatalities | |||

| Strategic Positioning |

The company took its first step outside of the fibre cement business when it acquired the assets of a fiberglass profile manufacturer on April 1, 2012. The company expects to make other small, non-fibre cement acquisitions over the next several years. | As this measure can take many different forms, including developing new technologies, expanding into new product categories, or expanding geographically, assessment against this measure will need to be subjective. | The Board expects that management will continue to diversify to provide more balance and greater profit opportunities to the company. | |||

| Positioning the company for Potential Recovery |

At the end of FY12, total credit facilities were US$280 million and the net cash position was US$400 million.

The company’s capacity utilization is at ± 60% for 7 of 10 plants that are operating. |

Increase leverage to improve capital efficiency, but ensure the company retains adequate capital structure and sufficient short-term flexibility so that it can continue to make medium- to long-term investment in the business. | Move to a higher debt structure without increasing risk to the company.

Anticipate need to re-commission idled capacity to enable modifications in time to satisfy increased demand on production capacity, as well as further expansion via both greenfield and brownfield development in both the U.S. and Asia Pacific. | |||

| Talent Management/ Development |

Current management depth will not adequately enable the company’s anticipated growth as part of its core business strategy. | The Remuneration Committee will assess the current state of development and capability of the top managers in the business. | It is not possible to set a specific goal for this measure beyond requiring that management capability be retained and grown. | |||

| 14 | James Hardie Notice of Meeting 2012 |

The Board considers that the revised Scorecard reflects the company’s overall long-term goals. Further details of the Scorecard, including the reasons the Board selected each objective, are set out in the 2012 Remuneration Report on pages 31 to 61 of the 2012 Annual Report

Maximum and actual number of ROCE RSUs

The maximum number of Shares and ROCE RSUs for which approval is sought under this Resolution 7 is based on the grant that would be made if the company’s performance warranted the maximum possible award for fiscal year 2013 (ie 200% of LTI target) and the Board did not exercise any negative discretion to reduce the number of ROCE RSUs, whether pursuant to the Scorecard or otherwise, which ultimately are to vest and convert into Shares.

The actual number of ROCE RSUs granted will be determined by dividing the amount of the maximum dollar amount granted under the ROCE RSUs portion of the LTI target (which is 200% of LTI target) by the share price of the company’s Shares over the twenty business days preceding the date of grant, subject to the maximum specified in the resolution.

Previous grants

The company has not issued ROCE RSUs in the past three years. However, the number of Hybrid RSUs, which were the predecessor of ROCE RSUs, granted to the CEO by the company in the past three years is:

| Date of grant |

Number granted | Maximum approved by shareholders |

||||||

| 7 June 2012 |

166,459 | 769,656 | ||||||

| 7 June 2011 |

45,687 | 841,619 | ||||||

| 7 June 2010 |

360,267 | 827,143 | ||||||

General

The company will not provide loans to the CEO in relation to the issue of ROCE RSUs. These ROCE RSUs will be granted to the CEO by no later than 12 months after the passing of Resolution 7.

ROCE RSUs will be granted to the CEO for no consideration. Subject to the performance hurdles being met, the CEO will be entitled to receive Shares upon vesting of the ROCE RSUs for no consideration.

Summary of the legal requirements for seeking

Shareholder approval

ASX Listing Rule 10.14 provides that a listed company must not permit a director to acquire shares or rights to be issued shares under an employee incentive scheme without the approval of Shareholders by ordinary resolution. Section 162(m) of the US Internal Revenue Code requires Shareholders to approve the performance criteria for grants of ROCE RSUs and these performance criteria are set out in the explanatory notes for this resolution.

Recommendation

The Board believes it is in the interests of Shareholders that the issue of ROCE RSUs over Shares in the company to the CEO for fiscal year 2013 up to the maximum number specified in Resolution 7 under the LTIP, Scorecard and the above terms and conditions be approved, and recommends that you vote in favour of Resolution 7.

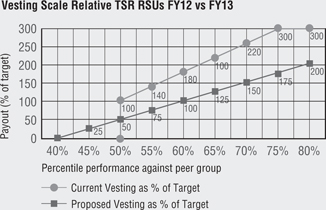

RESOLUTION 8—RELATIVE TSR RSUS

Resolution 8 asks Shareholders to approve the grant of RSUs with a relative total shareholder return (TSR) hurdle (Relative TSR RSUs) under the LTIP to the company’s CEO. Relative TSR RSUs convert to Shares if the company’s TSR performance meets or exceeds the relative TSR performance hurdles. The Board has determined that 30% of the CEO’s LTI target quantum for fiscal year 2013 will be received in Relative TSR RSUs. This number is unchanged from fiscal year 2012. Relative TSR RSUs will be granted to the CEO for no consideration. Subject to the performance hurdles being met, the CEO will be entitled to receive Shares upon vesting of the Relative TSR RSUs for no consideration.

Key changes from fiscal year 2012

The key aspects of the Relative TSR RSUs are largely unchanged. However, for fiscal year 2013 the Board has approved a number of changes to the Relative TSR RSUs, which are described in more details below, including:

| • | reducing the maximum leverage vesting as a percentage of LTI target from 300% to 200%; |

| • | increasing the performance level at which target vesting occurs from the 50th percentile to the 60th percentile; |

| • | increasing the performance level at which maximum vesting occurs from the 75th percentile to the 80th percentile; |

| • | lowering the performance level from which vesting begins from the 50th percentile to the 40th percentile, noting that vesting at the 40th percentile commences at 0% rather than the cliff vesting and significant reward that is usual market practice at the 50th percentile; |

| • | increasing the number of days used to establish the grant date price and test day prices to be 20 business days to reduce impact of daily volatility on grant size and the proportion that may vest; and |

| • | revising the peer group (Peer Group) to remove 3 companies which are no longer appropriate comparisons. |

Key aspects of Relative TSR RSUs

Relative TSR RSUs will be granted in accordance with the terms of the LTIP. The LTIP was approved by shareholders at the 2009 AGM and re-approval is being sought in 2012. The following specific terms also apply to Relative TSR RSUs.

Performance Criteria: The performance hurdles for Relative TSR RSUs will be

| Performance against Peer Group |

% of Relative TSR RSUs vested | |

| <40th Percentile |

0% | |

| 40th—50th Percentile |

Sliding Scale | |

| 50th Percentile |

25% | |

| 51st—60th Percentile |

Sliding Scale | |

| 60th Percentile |

50% | |

| 61st—80th Percentile |

Sliding Scale | |

| 80th Percentile |

100% |

| James Hardie Notice of Meeting 2012 | 15 |

These performance criteria are significantly more challenging than the criteria in previous years and will ensure that significant portions of the grant are only received for shareholder return performance that is substantially in advance of the peer group.

The Peer Group comprises other companies exposed to the US building materials market, which is the company’s major market. The Remuneration Committee and Board requested the company’s independent advisors, Towers Watson, to conduct a review of the composition of the peer group in 2012. Following that review, Towers Watson recommended the removal of three companies from the Peer Group—one small cap company (PGT) and two companies that are assessed as no longer directly engaged in the building materials industry (MDU Resources and Interface). The Remuneration Committee and the Board adopted the proposed Peer Group recommended by Towers Watson, which is listed below:

| Acuity Brands, Inc |

Louisiana-Pacific Corp. |

Sherwin Williams Co (The) | ||

| American Woodmark Corp |

Martin Marietta Materials, Inc |

Simpson Manufacturing | ||

| Apogee Enterprises, Inc |

Masco Corporation | Texas Industries, Inc | ||

| Armstrong World Indus, Inc |

Mohawk Industries Inc | Trex Co., Inc. | ||

| Eagle Materials, Inc |

Mueller Water Products, Inc |

USG Corp | ||

| Fortune Brands, Inc |

NCI Building Systems, Inc |

Valmont Industries, Inc. | ||

| Headwaters, Inc |

Owens Corning | Vulcan Materials Co | ||

| Lennox International, Inc |

Quanex Building Products Corp |

Valspar Corporation | ||

| Watsco, Inc | ||||

Testing: The performance hurdle will be tested and the Relative TSR RSUs may vest after three years from the grant date. The performance hurdle is re-tested (based on the company’s performance against its Peer Group for the 20 business days preceding the test date) at the end of each six month period following the third anniversary until the fifth anniversary (with each re-test extending the measurement period by a further six months such that re-testing at the fifth anniversary will be measured over a five year period) and any unvested Relative TSR RSUs may vest on each re-testing date if the relative TSR performance hurdles are met.

Any Relative TSR RSUs that have not vested after the fifth anniversary of the grant date will lapse. This re-testing reflects the fact that further volatility may occur in the aftermath of the global financial crisis. In addition, this approach extends the motivational potential of the Relative TSR RSUs from three to five years and, accordingly, is more effective from a cost benefit perspective.

Vesting Period: Each Relative TSR RSU may vest on each testing date after their grant date upon satisfaction of the performance hurdles described above under “Performance Criteria”, subject to the Relative TSR RSUs vesting earlier in accordance with the terms and conditions of the LTIP.

Maximum and actual number of Relative TSR RSUs

The maximum number of Shares and Relative TSR RSUs for which approval is sought is based on the grant that would be made if the company equals or exceeds the 80th percentile of performance against the Peer Group and all the Relative TSR RSUs vest. The actual number of Relative TSR RSUs granted will be determined by dividing the amount of the maximum dollar amount granted under the Relative TSR RSUs portion of the LTI target (which is 200% of LTI target) by the value of the Relative TSR RSUs, using a Monte Carlo simulation, over the twenty business days preceding the date of grant, subject to the maximum specified in the resolution.

Previous grants

The number of Relative TSR RSUs granted to the CEO by the company in the past three years is:

| Date of Grant |

Number Granted | Number approved by Shareholders |

||||||

| 15 September 2011 |

606,852 | 719,593 | ||||||

| 15 September 2010 |

577,255 | 730,707 | ||||||

| 15 September 2009 and 11 December 2009 |

316,646 | 736,207 | ||||||

General

Relative TSR RSUs will be granted under the LTIP for no consideration and the company will not provide loans to the CEO in relation to the issue of Relative TSR RSUs under the LTIP. These Relative TSR RSUs will be issued to the CEO within 12 months of the passing of Resolution 8.

Summary of the legal requirements for seeking

Shareholder approval

The reasons for seeking shareholder approval are the same as those set out for Resolution 7.

Recommendation

The Board believes it is in the interests of Shareholders that the grant of Relative TSR RSUs to the CEO under the LTIP subject to the above terms and conditions be approved, and recommends that you vote in favour of Resolution 8.

| 16 | James Hardie Notice of Meeting 2012 |

RESOLUTION 9—CONVERSION OF JAMES HARDIE INDUSTRIES SE TO AN IRISH PUBLIC COMPANY

Resolution 9 asks Shareholders to approve the conversion of the company from a Societas Europaea to an Irish public limited company (Conversion). The Draft Terms of Conversion and Proposed Memorandum and Articles of Association referred to in Resolution 9 are available to view on the company’s website, in the Investor Relations area, at www.jameshardie.com.