ANNUAL GENERAL MEETING

12 August 2013

Exhibit 99.7 |

ANNUAL GENERAL MEETING

12 August 2013

Exhibit 99.7 |

Annual General Meeting

12 August 2013

Chairman’s Address -

Michael Hammes

2 |

Annual General Meeting

12 August 2013

CEO’s Address –

Louis Gries

3 |

AGENDA

4

•

Global Strategy

•

Results Overview –

Full Year 2013 and Q1 FY2014

•

USA and Europe Fibre Cement

•

Group Summary

•

Group Outlook |

GLOBAL STRATEGY

Industry Leadership and Profitable

Growth

5

•

Aggressively grow demand for our

products in targeted market segments

•

Grow our overall market position while

defending our share in existing market

segments

•

Introduce differentiated products to

deliver a sustainable competitive

advantage |

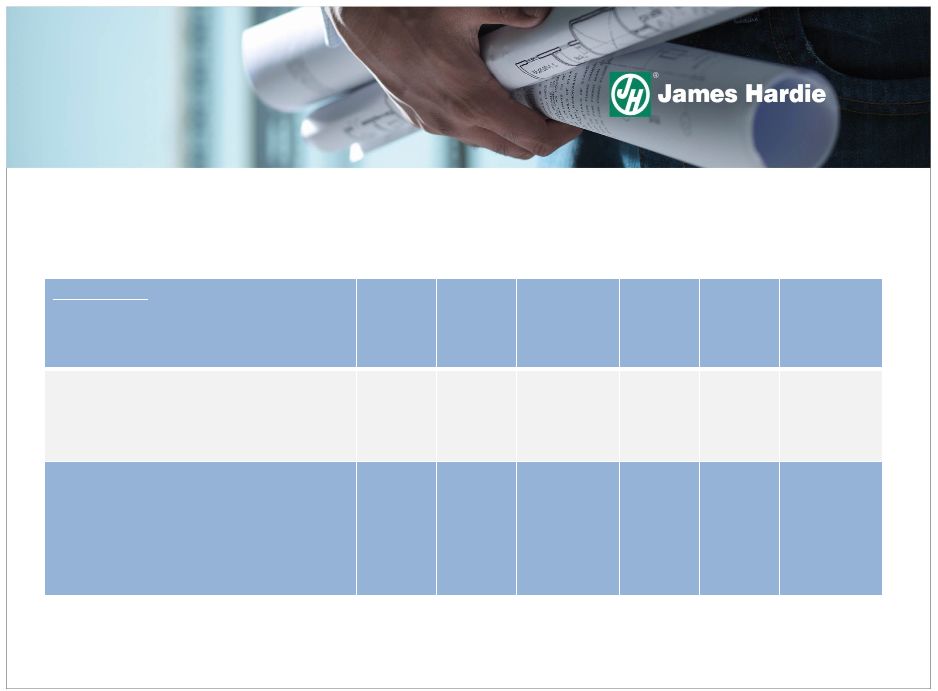

GROUP

OVERVIEW 1

Comparisons

are

of

the

1st

quarter

FY2014

and

full

fiscal

year

as

at

31

March

2013

versus

the

1st

quarter

and

full

year

result

of

the

prior fiscal year.

2

Includes $485.2m tax benefit arising on conclusion of RCI’s disputed amended

assessment with the Australian Taxation Office. 1

6

US$ Millions

FY2013

FY2012

% Change

Q1

FY2014

Q1

FY2013

% Change

Net operating (loss) profit

45.5

604.3

(92)

142.2

68.5

-

Net operating profit excluding asbestos,

asset impairments, ASIC expenses, New

Zealand product liability expenses and

tax adjustments

140.8

144.3

(2)

52.0

43.8

19

2 |

1

Excludes

asset

impairment

charges

of

US$14.3

million

in

4

th

quarter

FY12,

US$5.8

million

in

3

rd

quarter

FY13

and

US$11.1

million

in

4

th

quarter FY13

7

USA AND EUROPE FIBRE CEMENT

1 |

8

•

Net operating profit of US$52.0 million, which excludes asbestos, ASIC expenses,

New Zealand product liability expenses and tax adjustments, reflected:

•

Improved sales volumes and higher average net sales prices in both the USA

and Europe and the Asia Pacific Fibre Cement segments

•

Increased employment and marketing costs in the US due to ramp up of

organisational capabilities that occurred in the second half of the prior fiscal

year •

Higher operating earnings in the US business with the USA and Europe Fibre

Cement EBIT margin at 21.4% for the quarter

•

Increased contribution by the Asia Pacific Fibre Cement segment with adjusted

EBIT margin for the quarter at 22.4%

•

Ongoing investment in the refurbishment and re-commissioning of our Fontana,

California plant which remains scheduled to reopen in early calendar year

2014 •

Purchase of the previously-leased land and buildings at our Carole Park,

Brisbane facility

Q1 FY14 RESULT -

GROUP SUMMARY |

9

FY14 GUIDANCE

•

Management notes the range of analysts’

forecasts for net operating profit

excluding asbestos for the year ending 31 March 2014 is between US$165

million and US$194 million

•

Management expects full year earnings excluding asbestos, asset

impairments, ASIC expenses, New Zealand product liability expenses and

tax adjustments to be within that range

•

Guidance is dependent on, among other things, housing industry conditions

in the US continuing to improve and an average exchange rate at or near

current levels applying for the balance of the year ending 31 March 2014

•

Although US housing activity has been improving for some time, market

conditions remain somewhat uncertain and some input costs remain

volatile

•

Management is unable to forecast the comparable US GAAP financial

measure due to uncertainty regarding the impact of actuarial estimates on

asbestos-related assets and liabilities in future periods

|

GROUP OUTLOOK

USA and Europe Fibre Cement

•

The US operating environment continues to reflect an increasing number of housing

starts and improving house values

•

Pick-up in repair and remodelling activity becoming apparent

•

The company is continuing with its plan to invest in capacity expansions through

re-commissioning of idled facilities in future periods

•

The company expects EBIT to revenue margin to be above 20% for FY14, absent major

adverse external factors

Asia Pacific Fibre Cement

•

In Australia, dwelling approvals continue to track on a gradual upward trend,

however the company is not anticipating any substantial increase in net

sales revenue in FY14 •

In New Zealand, the housing market continues to improve

•

In the Philippines, the business is experiencing growth in its core market segments

and is expected to deliver consistent earnings over the next 12 months

10 |

Annual General Meeting

12 August 2013

Items of Business

11 |

RESOLUTION 1:

Financial Statements and Reports for Fiscal Year

2013

12

•

To receive and consider the financial statements and reports of the

Directors and external auditor for the fiscal year ended 31 March

2013 |

RESOLUTION 1:

Financial Statements and Reports for Fiscal Year

2013

13

PROXY RESULTS:

Votes

%*

For

353,440,980

99.96

Against

22,285

0.01

Open

125,832

0.04

Abstain

5,400,873

N/A

Excluded

0

N/A

* -

percentages have been rounded |

RESOLUTION 2:

Remuneration Report for Fiscal Year 2013

14

•

To receive and consider the Remuneration Report of the company for

the fiscal year ended 31 March 2013 |

RESOLUTION 2:

Remuneration Report for Fiscal Year 2013

15

PROXY RESULTS:

Votes

%*

For

328,838,459

91.66

Against

29,829,076

8.31

Open

123,632

0.03

Abstain

198,803

N/A

Excluded

0

N/A

* -

percentages have been rounded |

RESOLUTION 3:

Re-election of Directors

a.

That David Harrison, who retires by rotation in accordance with the

Articles of Association, be re-elected as a director.

b.

That Donald McGauchie AO, who retires by rotation in accordance

with the Articles of Association, be re-elected as a director.

16 |

RESOLUTION 3(a):

Re-election of Directors –

David Harrison

17

PROXY RESULTS:

Votes

%*

For

355,803,291

99.13

Against

3,019,165

0.84

Open

123,632

0.03

Abstain

43,882

N/A

Excluded

0

N/A

* -

percentages have been rounded |

RESOLUTION 3(b):

Re-election of Directors –

Donald McGauchie AO

18

PROXY RESULTS:

Votes

%*

For

337,584,498

98.27

Against

5,813,697

1.69

Open

123,632

0.04

Abstain

15,468,143

N/A

Excluded

0

N/A

* -

percentages have been rounded |

RESOLUTION 4:

Authority to Fix the External Auditor’s Remuneration

19

•

That the Board be authorised to fix the remuneration of the external

auditor for the financial year ended 31 March 2014. |

RESOLUTION 4:

Authority to Fix the External Auditor’s Remuneration

20

PROXY RESULTS:

Votes

%*

For

358,669,880

99.95

Against

66,081

0.02

Open

126,132

0.04

Abstain

127,877

N/A

Excluded

0

N/A

* -

percentages have been rounded |

RESOLUTION 5:

Grant of Return on Capital Employed Restricted Stock

Units

21

•

Approve the grant of Return on Capital Employed Restricted Stock

Units (RSUs) under the company’s Long Term Incentive Plan to the

CEO, Louis Gries |

RESOLUTION 5:

Grant of Return on Capital Employed Restricted Stock

Units

22

PROXY RESULTS:

Votes

%*

For

356,243,601

99.48

Against

1,739,439

0.49

Open

428,464

0.03

Abstain

189,224

N/A

Excluded

523,832

N/A

* -

percentages have been rounded |

RESOLUTION 6:

Grant of Relative Total Shareholder Returns (TSR)

RSUs

23

•

Approve the grant of RSUs with a Relative Total Shareholder Return

(TSR) hurdle under the company’s Long Term Incentive Plan to the

CEO, Louis Gries. |

RESOLUTION 6:

Grant of Relative Total Shareholder Returns (TSR)

RSUs

24

PROXY RESULTS:

Votes

%*

For

326,259,283

91.15

Against

31,575,033

8.82

Open

428,464

0.03

Abstain

189,358

N/A

Excluded

523,832

N/A

* -

percentages have been rounded |

OTHER ITEMS OF BUSINESS

25 |

ANNUAL GENERAL MEETING

12 August 2013 |

Disclaimer:

This

Management

Presentation

contains

forward-looking

statements.

James

Hardie

may

from

time

to

time

make

forward-looking

statements

in

its

periodic

reports

filed

with

or

furnished

to

the

SEC,

on

Forms

20-F

and

6-K,

in

its

annual

reports

to

shareholders,

in

offering

circulars,

invitation

memoranda

and

prospectuses,

in

media

releases

and

other

written

materials

and

in

oral

statements

made

by

the

company’s

officers,

directors

or

employees

to

analysts,

institutional

investors,

existing

and

potential

lenders,

representatives

of

the

media

and

others.

Statements

that

are

not

historical

facts

are

forward-looking

statements

and

such

forward-looking

statements

are

statements

made

pursuant

to

the

Safe

Harbor

Provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Examples of forward-looking statements include:

27

•

statements about the company’s future performance;

•

projections of the company’s results of operations or financial

condition; •

statements regarding the company’s plans, objectives or goals, including those

relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•

expectations concerning the costs associated with the suspension

or closure of operations at any of the company’s plants and future plans with

respect to any such plants; •

expectations regarding the extension or renewal of the company’s credit

facilities including changes to terms, covenants or ratios; •

expectations concerning dividend payments and share buy-backs;

•

statements concerning the company’s corporate and tax domiciles and structures

and potential changes to them, including potential tax charges; •

statements regarding tax liabilities and related audits, reviews

and proceedings;

•

statements as to the possible consequences of proceedings brought against the

company and certain of its former directors and officers by the Australian Securities and

Investments Commission (ASIC);

•

statements regarding the possible consequences and/or potential outcome of the

legal proceedings brought against two of the company’s subsidiaries by the New Zealand

Ministry of Education and the potential product liabilities, if any, associated

with such proceedings; •

expectations about the timing and amount of contributions to Asbestos Injuries

Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian

asbestos-related personal injury and death claims;

•

expectations concerning indemnification obligations;

•

expectations concerning the adequacy of the company’s warranty provisions and

estimates for future warranty-related costs; •

statements regarding the company’s ability to manage legal and regulatory

matters (including but not limited to product liability, environmental, intellectual property and

competition law matters) and to resolve any such pending legal and regulatory

matters within current estimates and in anticipation of certain third-party recoveries; and

•

statements

about

economic

conditions,

such

as

change

in

the

US

economic

or

housing

recovery,

the

levels

of

new

home

construction

and

home

renovations,

unemployment

levels,

changes

in

consumer

income,

changes

or

stability

in

housing

values,

the

availability

of

mortgages

and

other

financing,

mortgage

and

other interest rates,

housing affordability and supply, the levels of foreclosures and

home resales, currency exchange rates, and builder and consumer

confidence. |

Disclaimer (continued):

Words

such

as

“believe,”

“anticipate,”

“plan,”

“expect,”

“intend,”

“target,”

“estimate,”

“project,”

“predict,”

“forecast,”

“guideline,”

“aim,”

“will,”

“should,”

“likely,”

“continue,”

“may,”

“objective,”

“outlook”

and

similar

expressions

are

intended

to

identify

forward-looking

statements

but

are

not

the

exclusive

means

of

identifying

such

statements.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements

and

all

such

forward-looking

statements

are

qualified

in

their

entirety

by

reference

to

the

following cautionary

statements.

Forward-looking

statements

are

based

on

the

company’s

current

expectations,

estimates

and

assumptions

and

because

forward-looking

statements

address

future

results,

events

and

conditions,

they,

by

their

very

nature,

involve

inherent

risks

and

uncertainties,

many

of

which

are

unforeseeable

and

beyond

the

company’s

control.

Such

known

and

unknown

risks,

uncertainties

and

other

factors

may

cause

actual

results,

performance

or

other

achievements

to

differ

materially

from

the

anticipated

results,

performance

or

achievements

expressed,

projected

or

implied

by

these

forward-looking

statements.

These

factors,

some

of

which

are

discussed

under

“Risk

Factors”

in

Section

3

of

the

Form

20-F

filed

with

the

Securities

and

Exchange

Commission

on

27

June

2013,

include,

but

are

not

limited

to:

all

matters

relating

to

or

arising

out

of

the

prior

manufacture

of

products

that

contained

asbestos

by

current

and

former

James

Hardie

subsidiaries;

required

contributions

to

AICF,

any

shortfall

in

AICF

and

the

effect

of

currency

exchange

rate

movements

on

the

amount

recorded

in

the

company’s

financial

statements

as

an

asbestos

liability;

governmental

loan

facility

to

AICF;

compliance

with

and

changes

in

tax

laws

and

treatments;

competition

and

product

pricing

in

the

markets

in

which

the

company

operates;

the

consequences

of

product

failures

or

defects;

exposure

to

environmental,

asbestos,

putative

consumer

class

action

or

other

legal

proceedings;

general

economic

and

market

conditions;

the

supply

and

cost

of

raw

materials;

possible

increases

in

competition

and

the

potential

that

competitors

could

copy

the

company’s

products;

reliance

on

a

small

number

of

customers;

a

customer’s

inability

to

pay;

compliance

with

and

changes

in

environmental

and

health

and

safety

laws;

risks

of

conducting

business

internationally;

compliance

with

and

changes

in

laws

and

regulations;

the

effect

of

the

transfer

of

the

company’s

corporate

domicile

from

The

Netherlands

to

Ireland,

including

changes

in

corporate

governance

and

potential

tax

benefits;

currency

exchange

risks;

dependence

on

customer

preference

and

the

concentration

of

the

company’s

customer

base

on

large

format

retail

customers,

distributors

and

dealers;

dependence

on

residential

and

commercial

construction

markets;

the

effect

of

adverse

changes

in

climate

or

weather

patterns;

possible

inability

to

renew

credit

facilities

on

terms

favourable

to

the

company,

or

at

all;

acquisition

or

sale

of

businesses

and

business

segments;

changes

in

the

company’s

key

management

personnel;

inherent

limitations

on

internal

controls;

use

of

accounting

estimates;

and

all

other

risks

identified

in

the

company’s

reports

filed

with

Australian,

Irish

and

US

securities

agencies

and

exchanges

(as

appropriate).

The

company

cautions

you

that

the

foregoing

list

of

factors

is

not

exhaustive

and

that

other

risks

and

uncertainties

may

cause

actual

results

to

differ

materially

from

those

in

forward-looking

statements.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made

and

are

statements

of

the

company’s

current

expectations

concerning

future

results,

events

and

conditions.

The

company

assumes

no

obligation

to

update

any

forward-looking

statements

or

information

except

as

required

by

law.

28 |

ANNUAL GENERAL MEETING

12 August 2013 |