Exhibit 99.6

Exhibit 99.6

US Products & Segments David Donofrio USA Investor/Analyst Tour – Thursday 19th September 2013

This Management Presentation contains forward-looking statements. James Hardie may from time to time make forward-looking statements in its periodic reports filed with or furnished to the SEC, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: statements about the company’s future performance; projections of the company’s results of operations or financial condition; statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or our products; expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants; expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios; expectations concerning dividend payments and share buy-backs; statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges; statements regarding tax liabilities and related audits, reviews and proceedings; statements as to the possible consequences of proceedings brought against the company and certain of its former directors and officers by the Australian Securities and Investments Commission (ASIC); statements regarding the possible consequences and/or potential outcome of the legal proceedings brought against two of the company’s subsidiaries by the New Zealand Ministry of Education and the potential product liabilities, if any, associated with such proceedings; expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims; expectations concerning indemnification obligations; expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs; statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and statements about economic conditions, such as changes in the US economic or housing recovery, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. Forward-looking statements are based on the company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risks Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 27 June 2013, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former James Hardie subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the company’s financial statements as an asbestos liability; governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; the effect of the transfer of the company’s corporate domicile from The Netherlands to Ireland, including changes in corporate governance and potential tax benefits; currency exchange risks; dependence on customer preference and the concentration of the company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favourable to the company, or at all; acquisition or sale of businesses and business segments; changes in the company’s key management personnel; inherent limitations on internal controls; use of accounting estimates; and all other risks identified in the company’s reports filed with Australian, Irish and US securities agencies and exchanges (as appropriate). The company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those in forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions. The company assumes no obligation to update any forward-looking statements or information except as required by law. 2 DISCLAIMER

Product & segment overview Market opportunity Competitive insights US Segment focus Questions Management Presentation 3 OUTLINE

Drive and maintain our product leadership position Provide strategic direction and concept design Focus on key growth segments / initiatives Program development to market execution Management Presentation 4 Products & segments

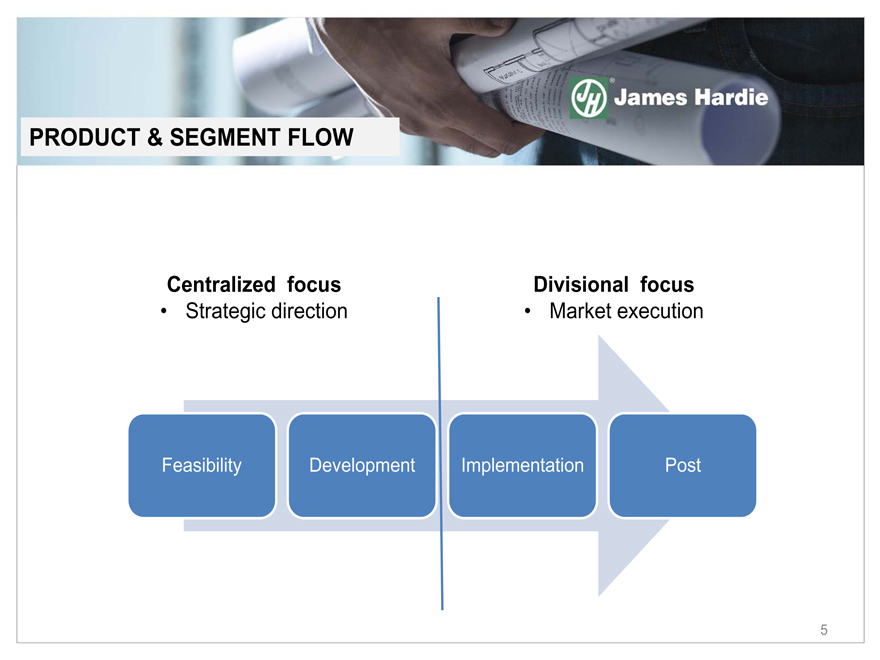

Centralized focus Strategic direction Divisional focus Market execution 5 Product & segment flow

Market landscape 6

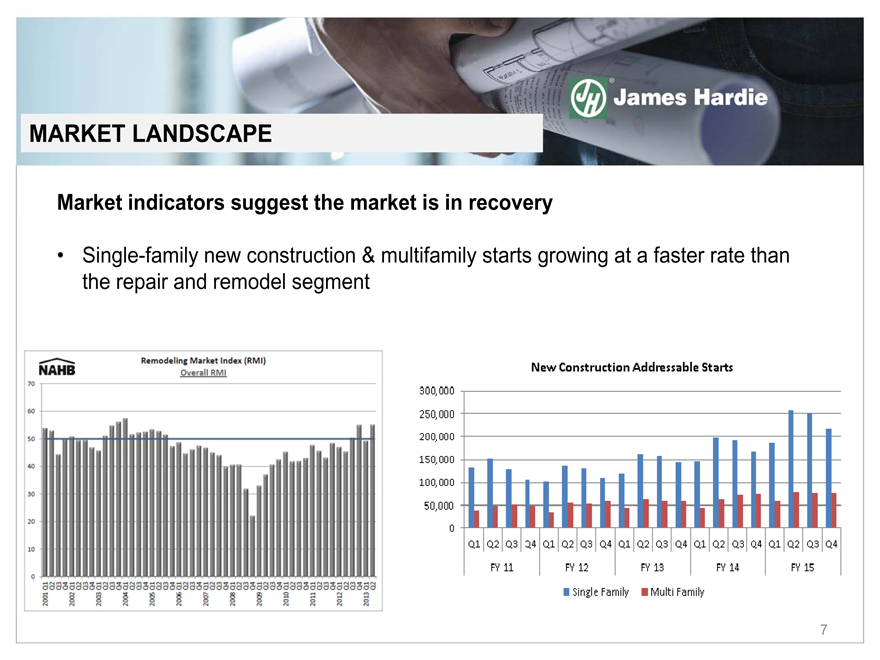

Market indicators suggest the market is in recovery Single-family new construction & multifamily starts growing at a faster rate than the repair and remodel segment 7 MARKET LANDSCAPE

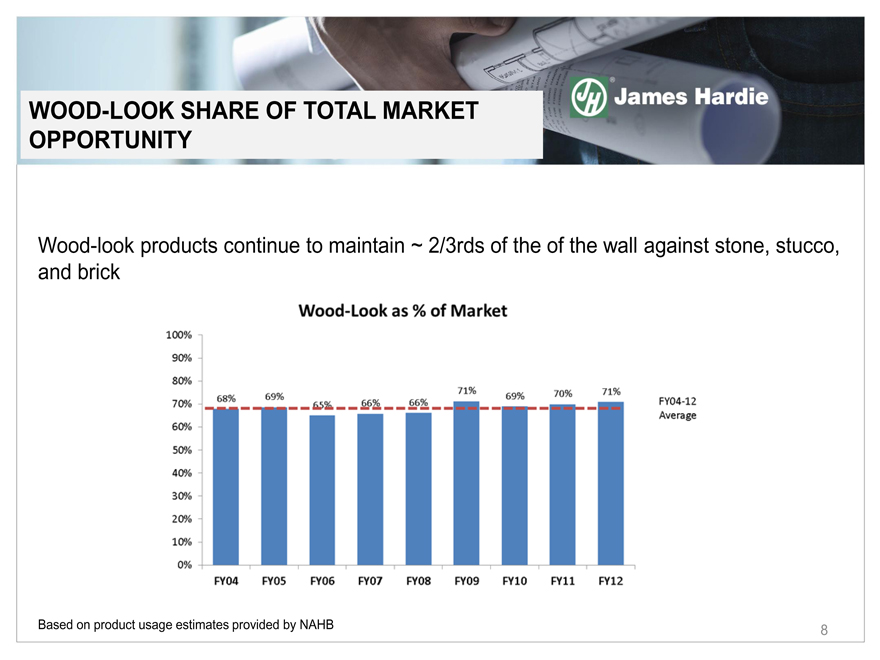

Wood-look products continue to maintain ~ 2/3rds of the of the wall against stone, stucco, and brick 8 Based on product usage estimates provided by NAHB Wood-look share of total market opportunity

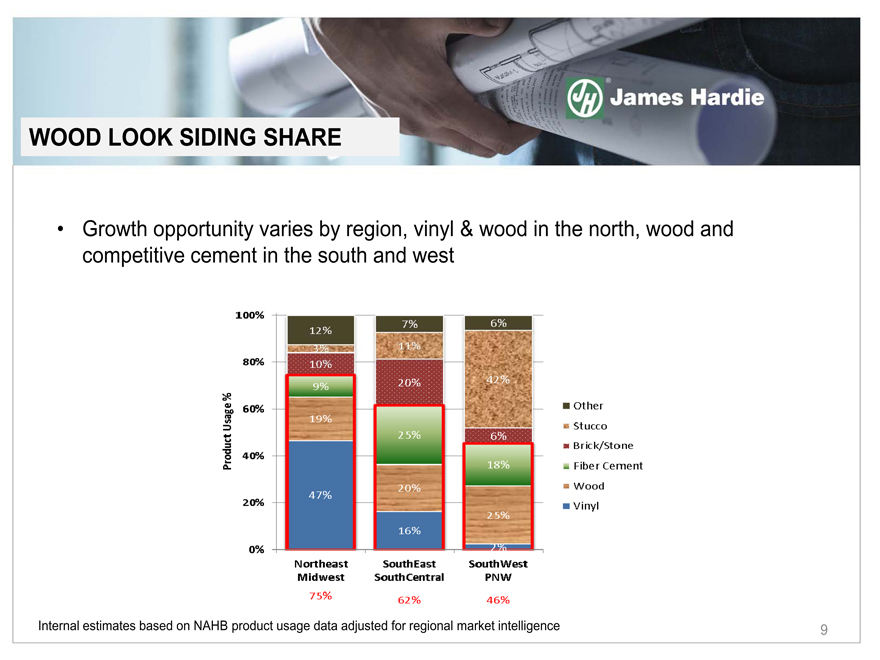

9 Growth opportunity varies by region, vinyl & wood in the north, wood and competitive cement in the south and west Internal estimates based on NAHB product usage data adjusted for regional market intelligence Wood look siding share

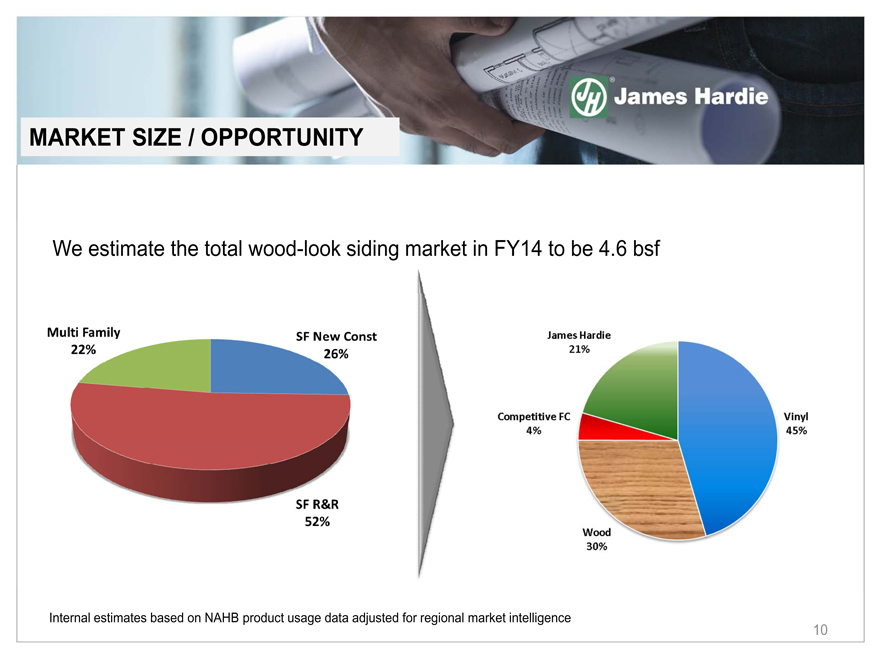

We estimate the total wood-look siding market in FY14 to be 4.6 bsf 10 Internal estimates based on NAHB product usage data adjusted for regional market intelligence Market Size / Opportunity

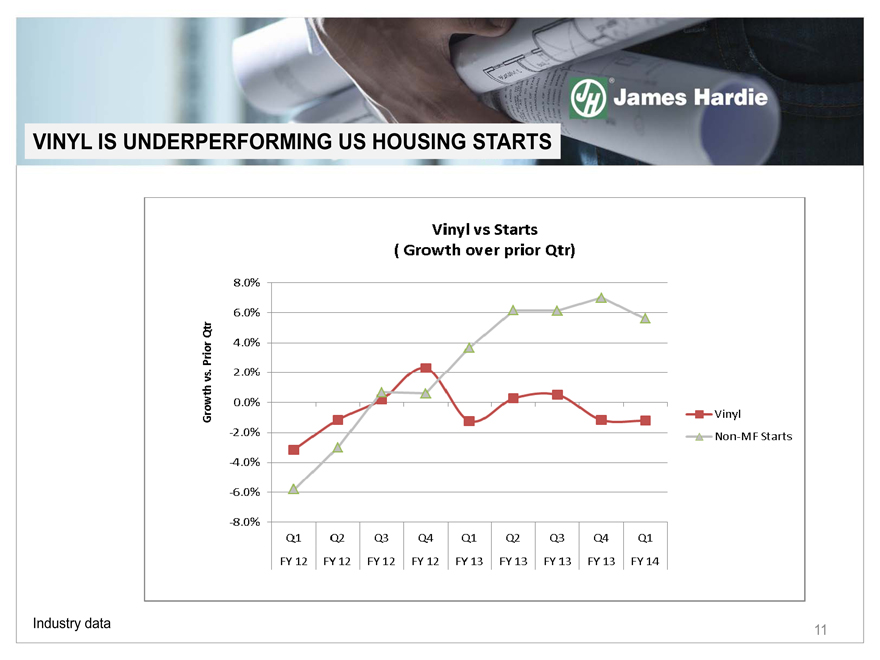

Industry data 11 Vinyl is underperforming US housing starts

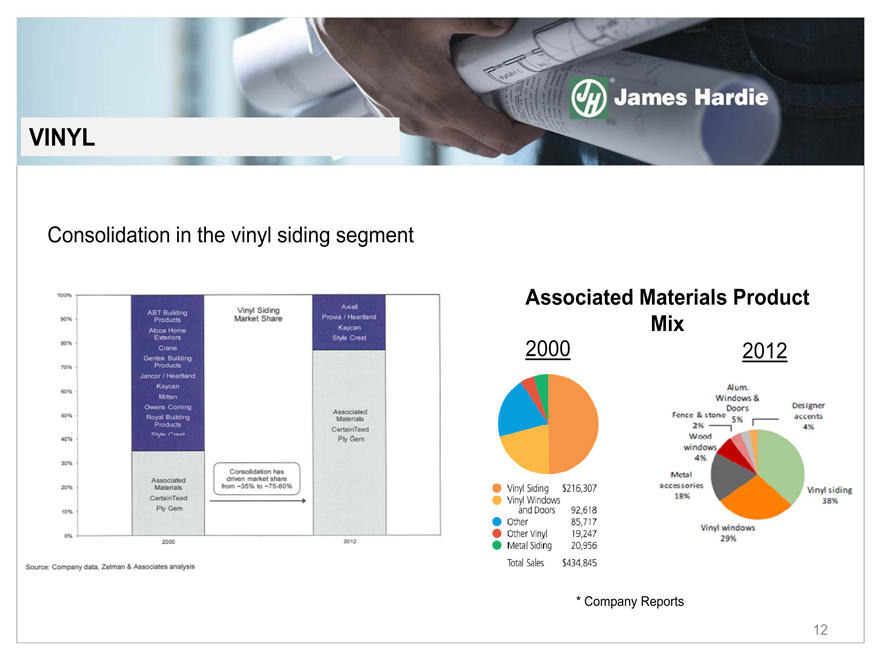

Consolidation in the vinyl siding segment 12 Associated Materials Product Mix 2000 2012 * Company Reports VINYL

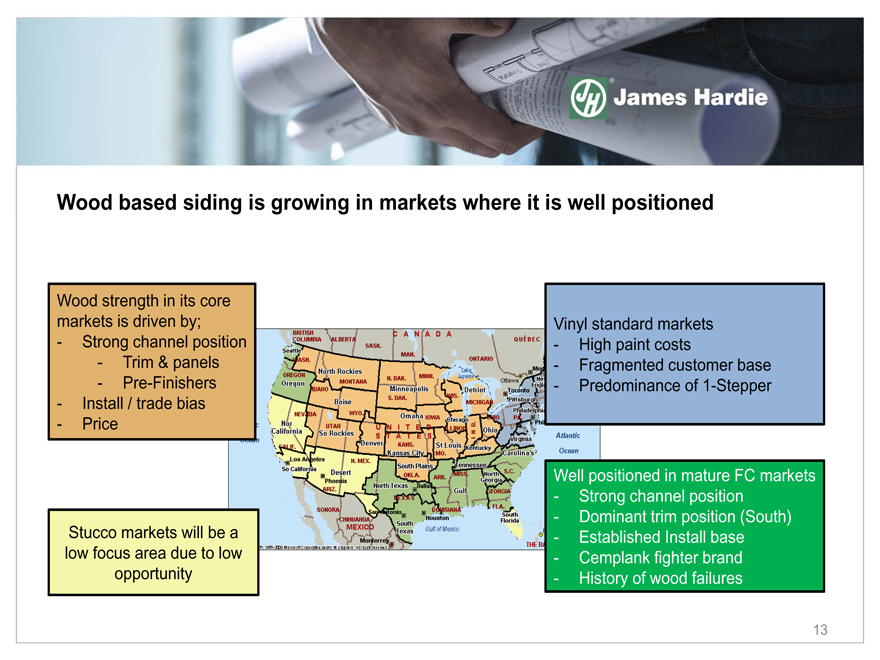

Wood based siding is growing in markets where it is well positioned Wood strength in its core markets is driven by; Strong channel position Trim & panels Pre-Finishers Install / trade bias Price Vinyl standard markets High paint costs Fragmented customer base Predominance of 1-Stepper Well positioned in mature FC markets Strong channel position Dominant trim position (South) Established Install base Cemplank fighter brand History of wood failures Stucco markets will be a low focus area due to low opportunity 13

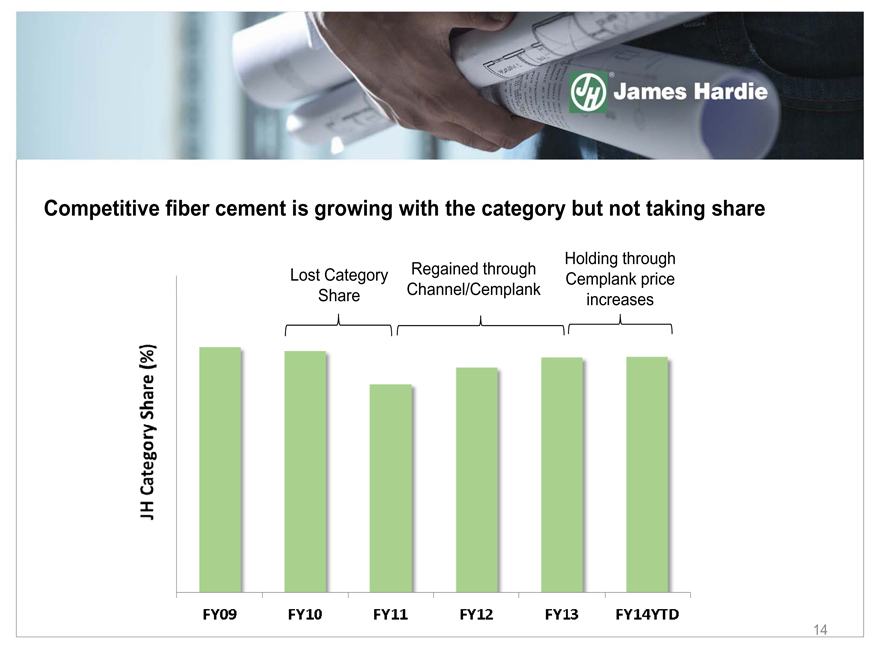

14 Lost Category Share Regained through Channel/Cemplank Holding through Cemplank price increases Competitive fiber cement is growing with the category but not taking share

US Segment focus 15

Our 35/90 strategy focuses on a product leadership platform and a unique position in our channel that enables growth within our 4 targeted customer segments Repair & remodel segment Single family new construction segment Multi Family segment Retail & interiors segment 16

We continue to focus our efforts around growth within the single-family repair and remodel segment Growth opportunity primarily from vinyl End-user is the decision maker Shift the mix to James Hardie differentiated products in mature fiber cement markets Momentum in vinyl-dominated markets, executing our neighborhood targeting strategy as well as growing our network of aligned James Hardie contractors 17

Concept JH builds awareness & drives the preference for Hardie Products in vinyl battleground neighborhoods Partner with contractors for scale in battlegrounds Build lead generation and neighborhood competencies Leverage “2 thru 10” strategy Scalable & relocatable Over invest short term for long term sustainability 18 Hardie Ambassador Program

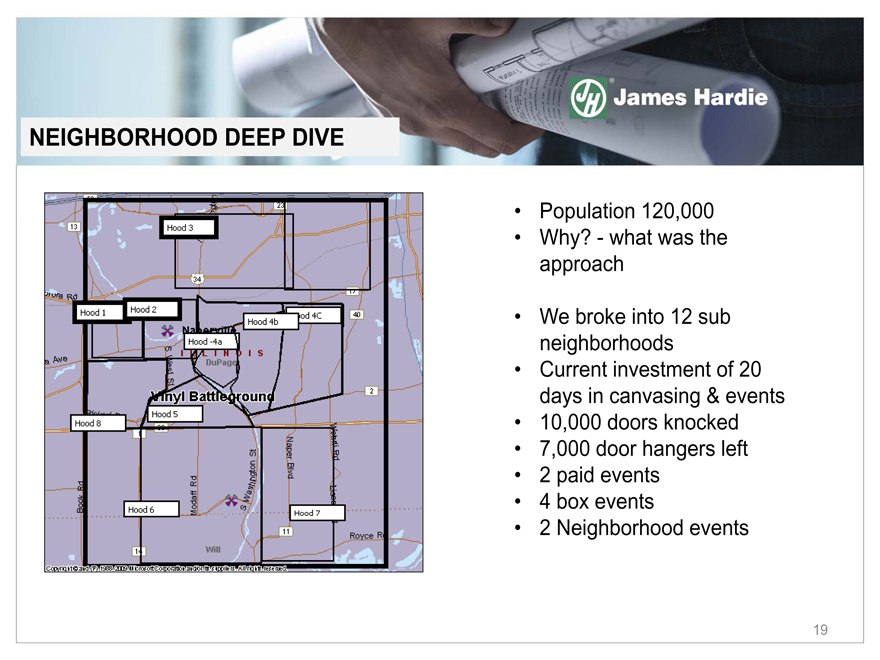

19 Population 120,000 Why?—what was the approach We broke into 12 sub neighborhoods Current investment of 20 days in canvasing & events 10,000 doors knocked 7,000 door hangers left 2 paid events 4 box events 2 Neighborhood events Neighborhood Deep Dive

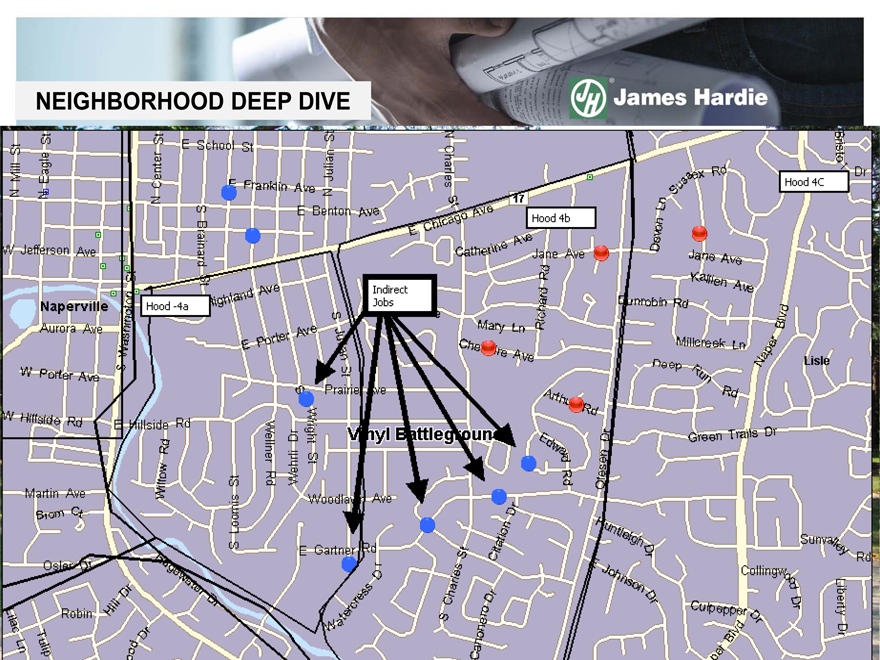

20 Neighborhood Deep Dive

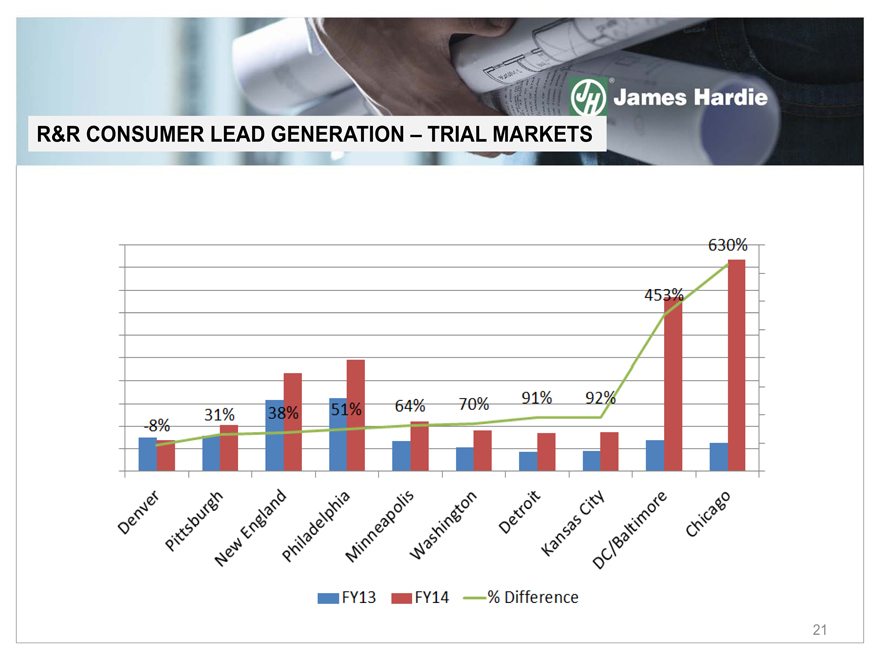

21 R&R consumer lead generation – trial markets

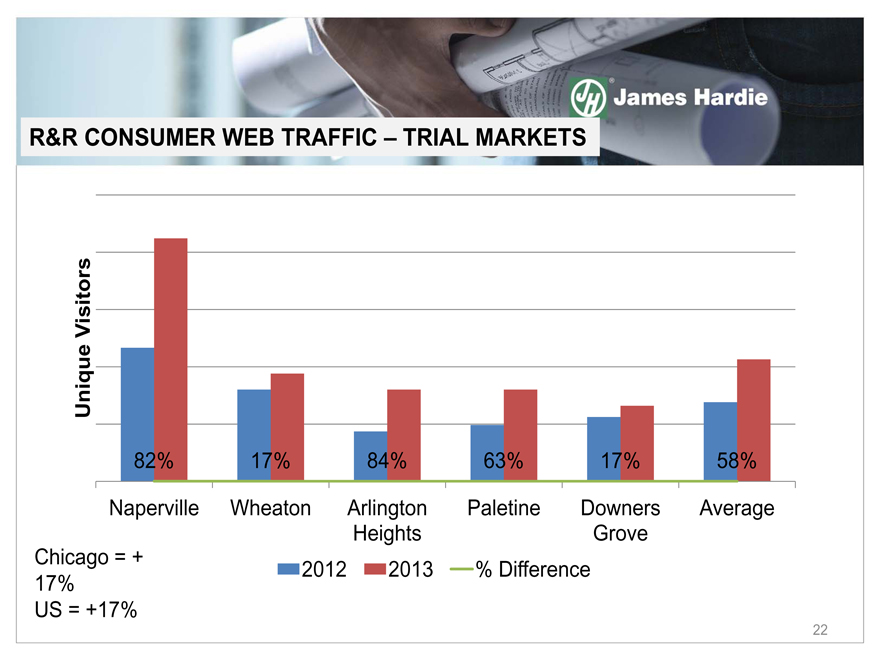

Chicago = + 17% US = +17% 22 R&R consumer web traffic – trial markets

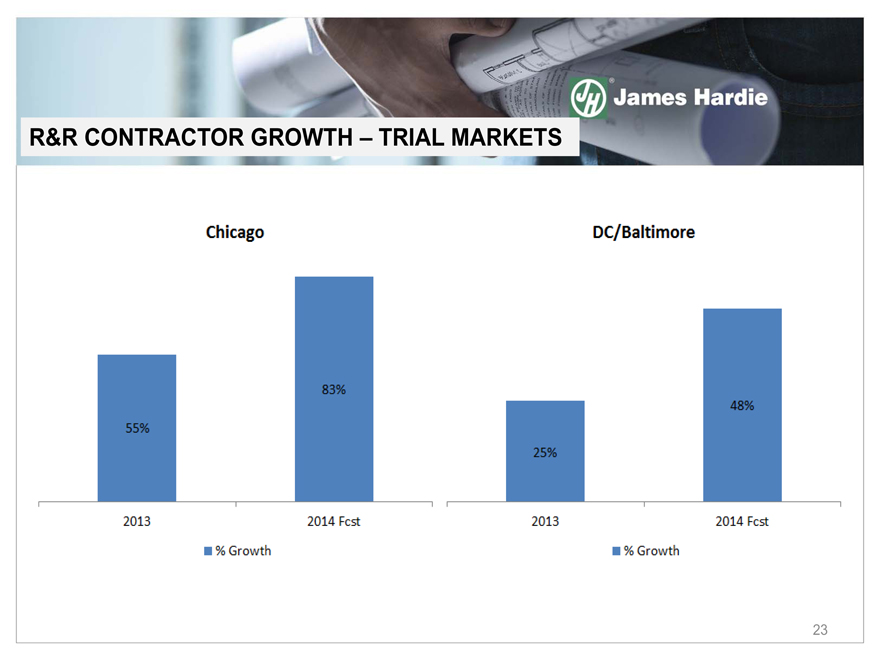

23 R&R CONTRACTOR GROWTH – TRIAL MARKETS

ColorPlus “Full Wrap” provides the best value to the consumer in the repair and remodel segment Unique formulation – HardieZone engineered for climate Superior finish technology – Colorplus Technology platform Design flexibility – all products 24

ColorPlus Siding & Accessories Trim Innovation (Mouldings) Job Packs Quality Installation Channel Moulding Profiles: 25 “Full Wrap” Enabled

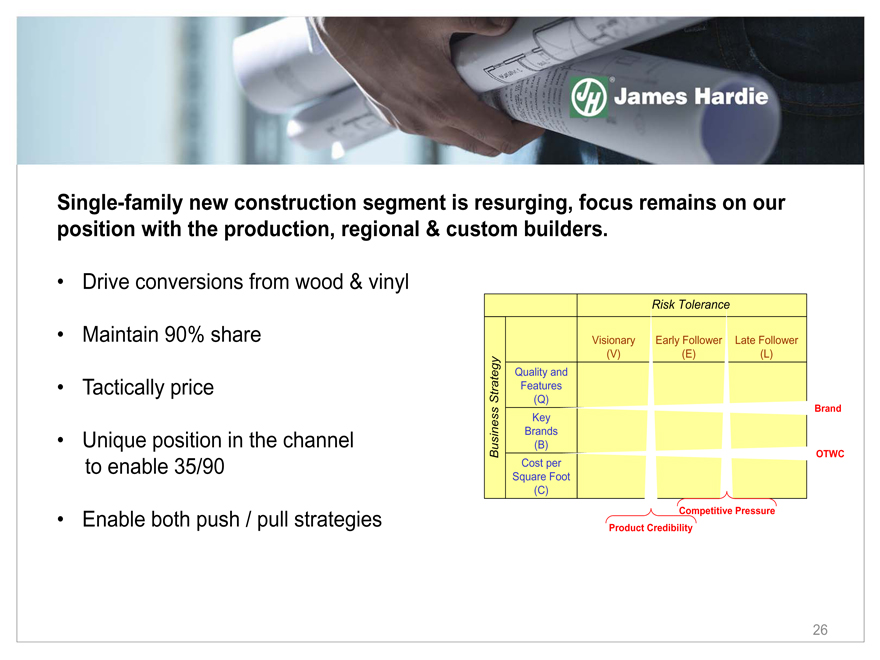

Single-family new construction segment is resurging, focus remains on our position with the production, regional & custom builders. Drive conversions from wood & vinyl Maintain 90% share Tactically price Unique position in the channel to enable 35/90 Enable both push / pull strategies 26

| 3 |

|

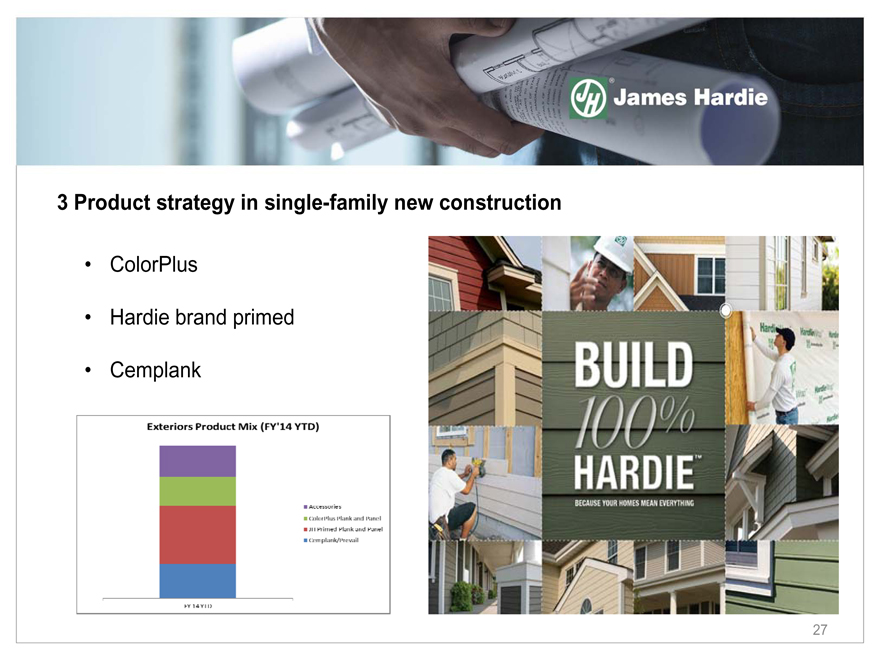

Product strategy in single-family new construction ColorPlus Hardie brand primed Cemplank 27 |

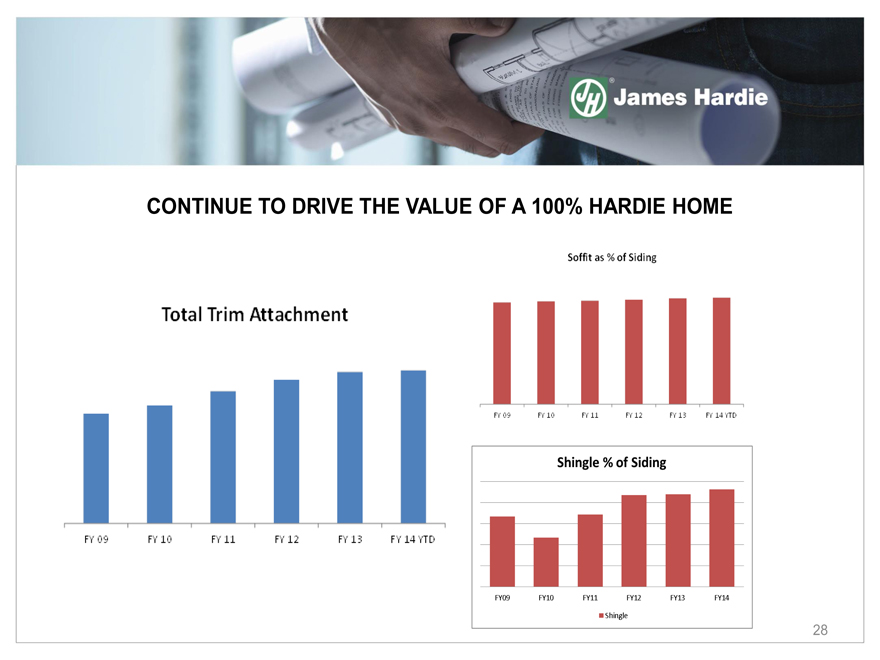

CONTINUE TO DRIVE THE VALUE OF A 100% HARDIE HOME 28

Production new home builders are primarily serviced by the volume lumber dealer or thru turnkey install from the vinyl distributors; Custom builders are primarily serviced thru the Independent lumber dealer. Held our position with the volume lumber dealer & vinyl distributors Independent lumber dealers are the most at risk for JH to lose connection to Category share loss came mainly in the single-family new construction segment serviced through the Independent lumber dealer 29

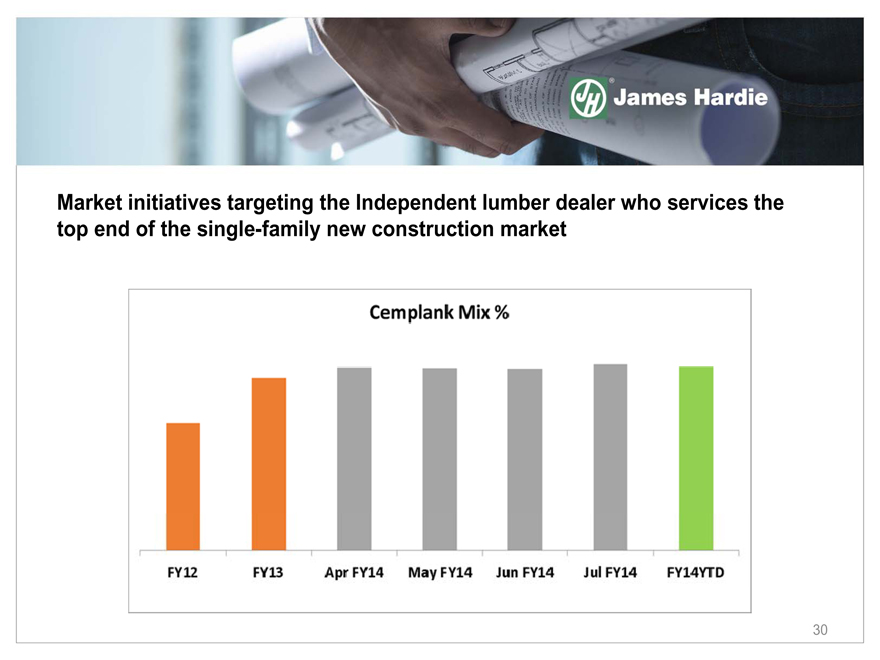

Market initiatives targeting the Independent lumber dealer who services the top end of the single-family new construction market 30

We have built a late stage infrastructure to manage our category share in the MultiFamily segment – our focus moves to early stage market development Growth from wood, vinyl & stucco Job bid model Largely metro biased Early stage efforts to drive a differentiated position 31

Dual brand strategy to target late stage category share and drive our product strategy around a differentiated position in the segment Prevail ColorPlus Commercial panel product line 32

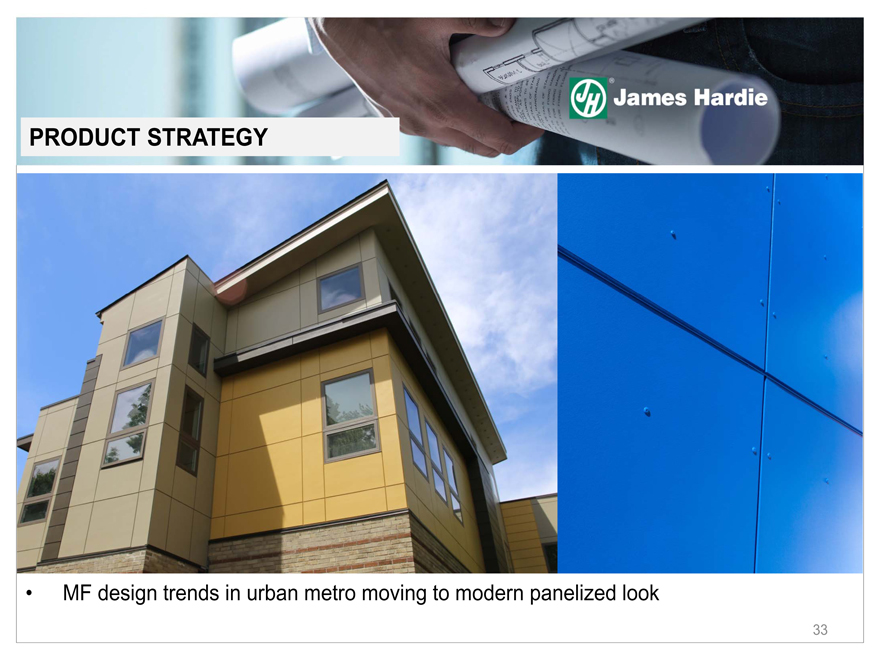

MF design trends in urban metro moving to modern panelized look 33 PRODUCT STRATEGY

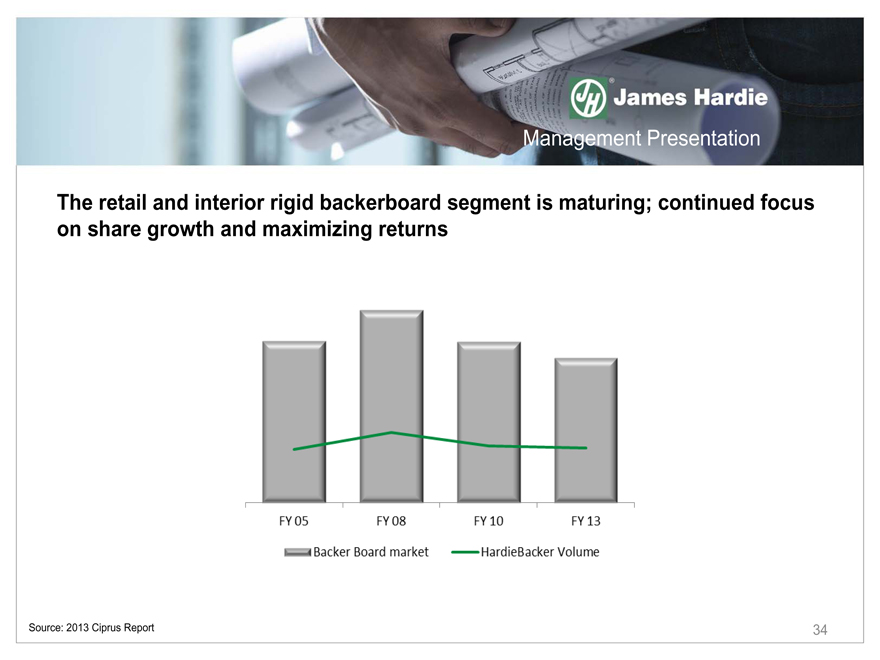

The retail and interior rigid backerboard segment is maturing; continued focus on share growth and maximizing returns Management Presentation Source: 2013 Ciprus Report 34

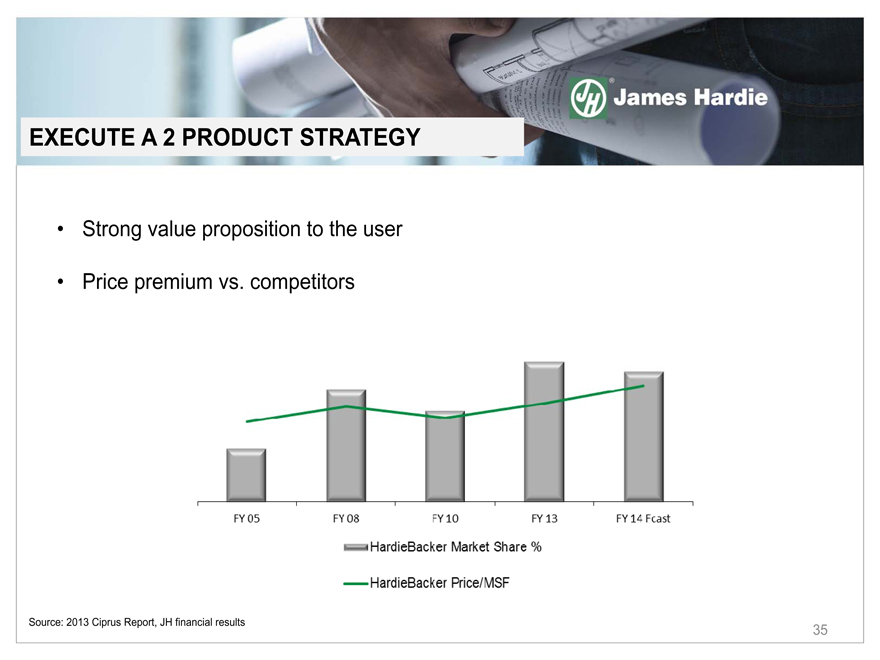

Strong value proposition to the user Price premium vs. competitors Source: 2013 Ciprus Report, JH financial results 35 EXECUTE A 2 PRODUCT STRATEGY

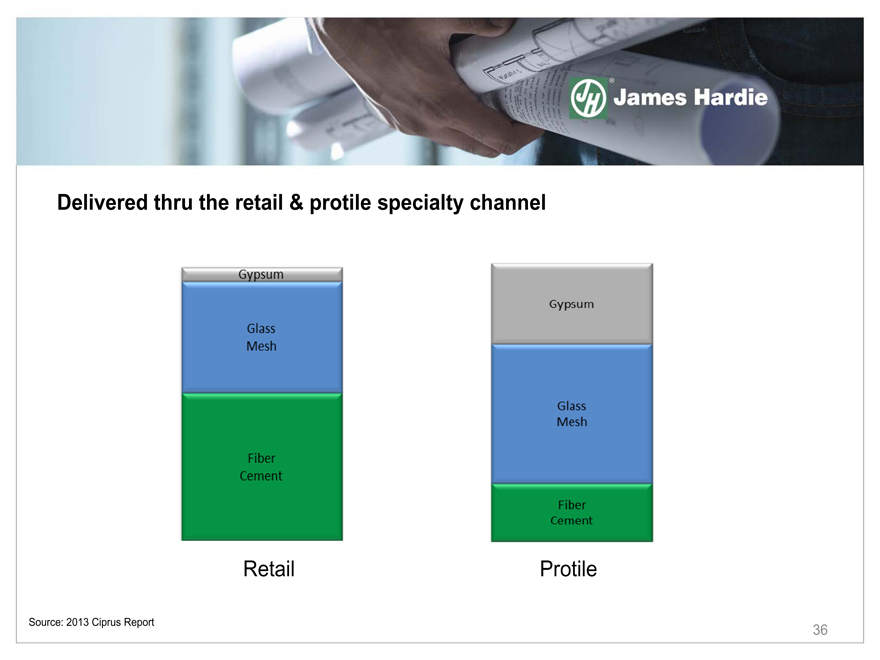

Delivered thru the retail & protile specialty channel Source: 2013 Ciprus Report Retail Protile 36

Recovering market Wood look siding is greater than 2/3 of the cladding opportunity in the US Vinyl share declining as the US housing recovery take place Engineered wood has taken some share in the downturn and presents itself as a competitive threat in markets susceptible to a wood based product James Hardie is well positioned by segment to deliver on our product leadership strategy driving growth towards 35/90 37 Summary

Questions? 38