Exhibit 99.8

North division Sean Gadd USA Investor/Analyst Tour – Thursday 19th September 2013

North division overview Market execution Manufacturing philosophy 2 NORTH DIVISION OVERVIEW

Overview 3

Market Dynamics North Division Quick Facts % of James Hardie Volume ~40% approximately 1/3 of target market share Wood look share of market ~65% Employees ~900 Manufacturing Facilities 4 Predominantly HZ5 volume 4 NORTH DIVISION OVERVIEW

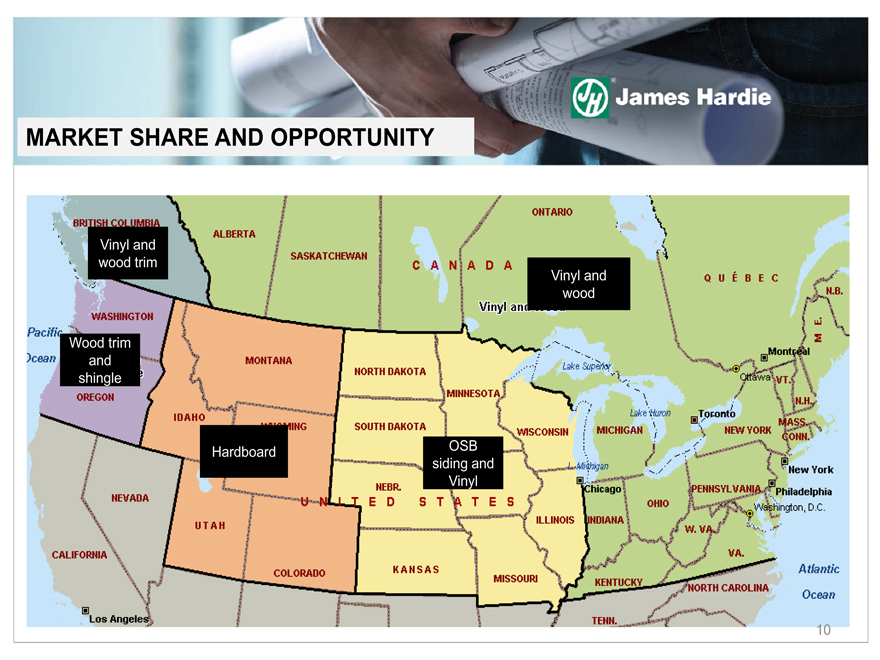

4 Sub-divisions Approach differs across markets due to opportunity Vinyl share 50% Wood share 11% Vinyl share 7% Wood share 38% Vinyl share 46% Wood share 21% Vinyl share 51% Wood share 16% Note: Vinyl and wood market shares are James Hardie estimates 5 NORTH DIVISION OVERVIEW

Market Execution 6

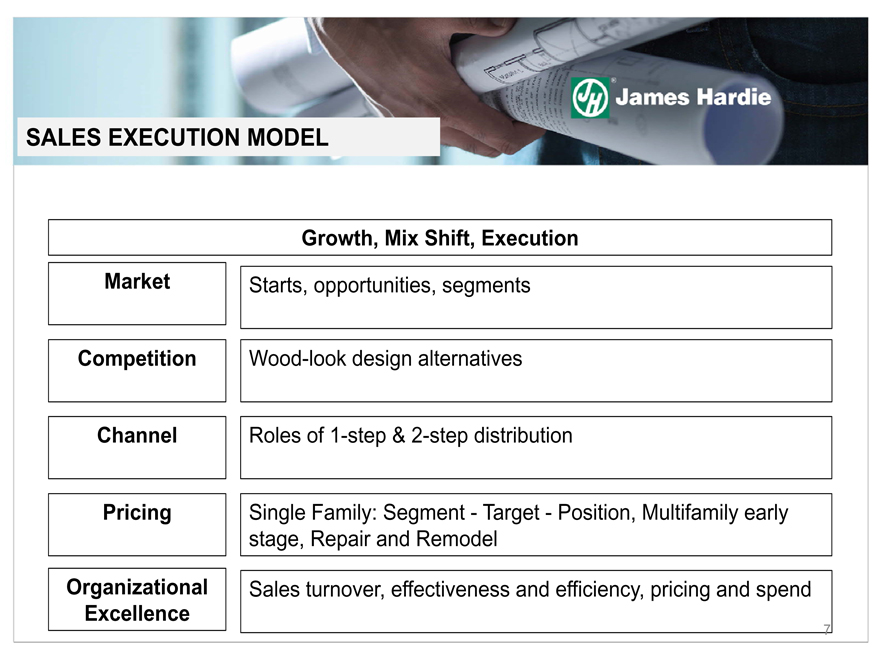

Growth, Mix Shift, Execution Organizational Excellence Channel Market Pricing Competition Roles of 1-step & 2-step distribution Wood-look design alternatives Starts, opportunities, segments Single Family: Segment—Target—Position, Multifamily early stage, Repair and Remodel Sales turnover, effectiveness and efficiency, pricing and spend 7 SALES EXECUTION MODEL

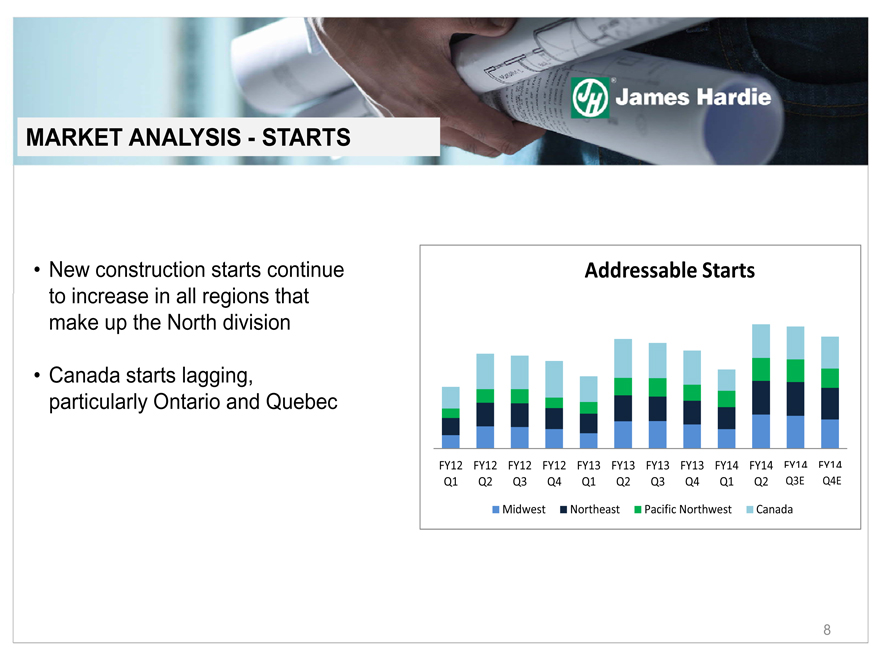

New construction starts continue to increase in all regions that make up the North division Canada starts lagging, particularly Ontario and Quebec 8 MARKET ANALYSIS—STARTS Q3E Q4E

The north at approximately 1/3 of our target market share goals Growth needs to come from both vinyl and wood (CHART) 9 MARKET SHARE AND OPPORTUNITY Source: JH estimates

10 Wood trim and shingle Vinyl and wood trim Hardboard OSB siding and Vinyl Vinyl and wood MARKET SHARE AND OPPORTUNITY

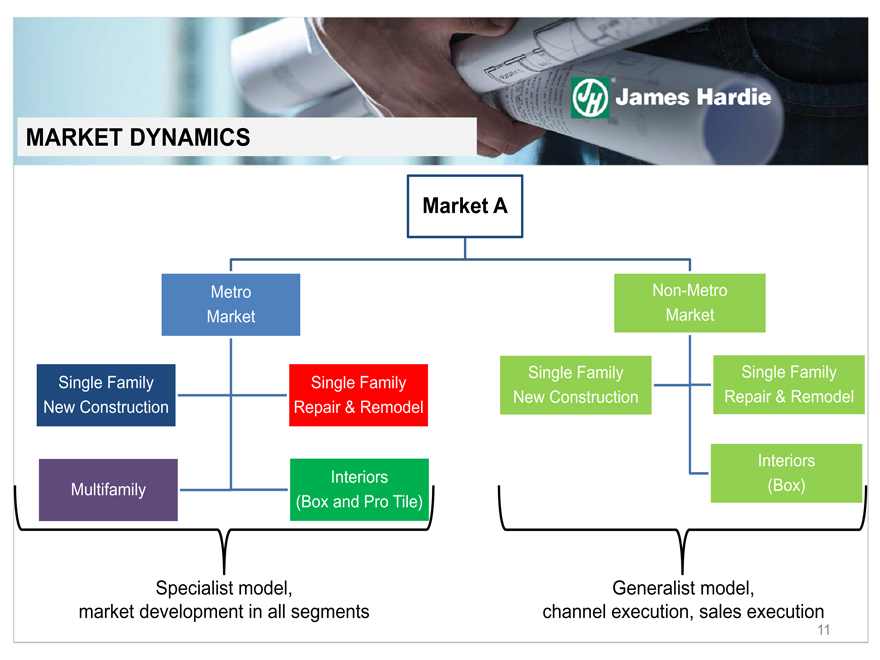

Specialist model, market development in all segments Generalist model, channel execution, sales execution 11 MARKET DYNAMICS

Make up roughly 60% of starts in the North Scale: Large concentrated population Very competitive landscape 1-step and 2-step distribution Challenges to execute: Specialist model Heavy market development Price and category management 12 METRO MARKETS

Make up 40% of the starts in the North Attractive business: Lower on S curve Positive pricing dynamics Low coverage by manufacturers Challenges to execute: Generalist model Channel partners key Aggregation at dealer level 13 NON-METRO MARKETS

14 Role of our channel partners Full market access Lowest cost value chain Value-added services James Hardie affordability to market CHANNEL PARTNERS

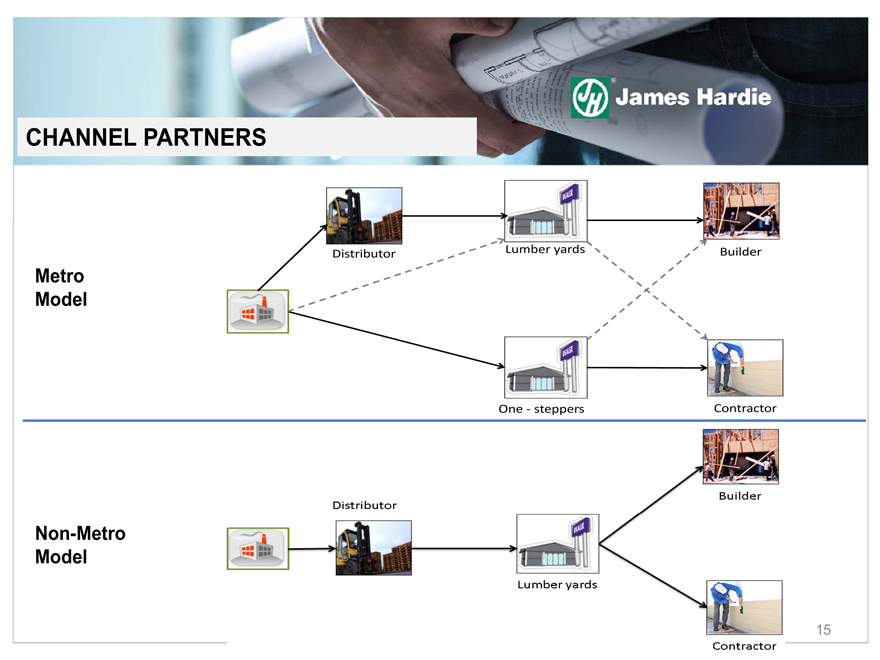

Metro Model Non-Metro Model 15 CHANNEL PARTNERS

16 Significant focus in the North Cultural shift towards channel positive North metro-markets driven by predominantly regional distribution Access to fragmented dealer and contractor Product line availability and breaking down packs to support pull-strategy North non-metro Less scale, therefore more reliance on distribution Service levels to cover vast geographies Builder and contractor relationships strong with their dealer of choice Need alignment for push/pull-strategy CHANNEL PARTNERS

(CHART) We are at ~70% of our target share in interiors Opportunity exists in Boxes and Pro-tile segments Returns are good in the segment Lumber Yards Big Boxes Tile Dealers 17 PRODUCT MIX—INTERIORS

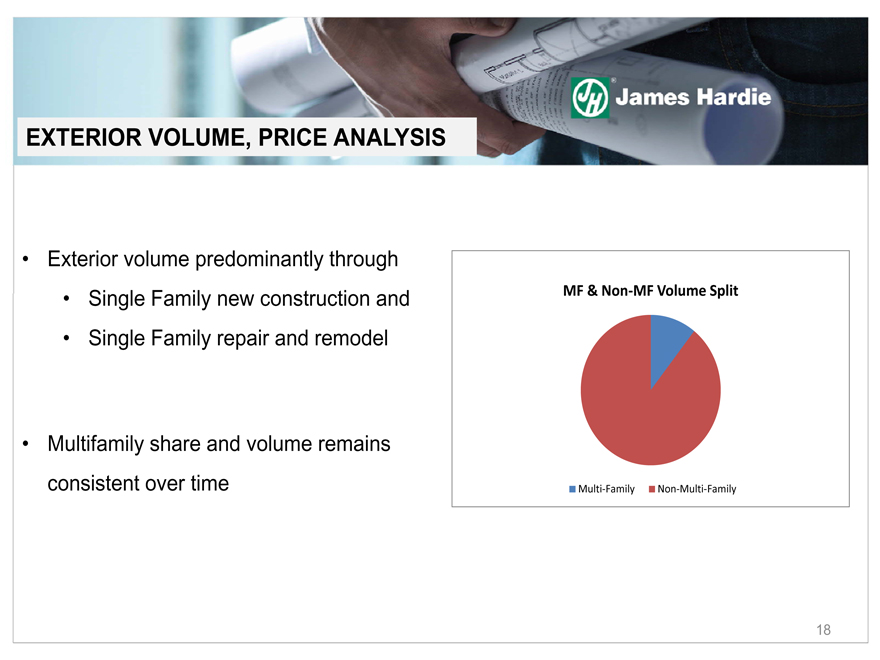

Exterior volume predominantly through Single Family new construction and Single Family repair and remodel Multifamily share and volume remains consistent over time 18 EXTERIOR VOLUME, PRICE ANALYSIS

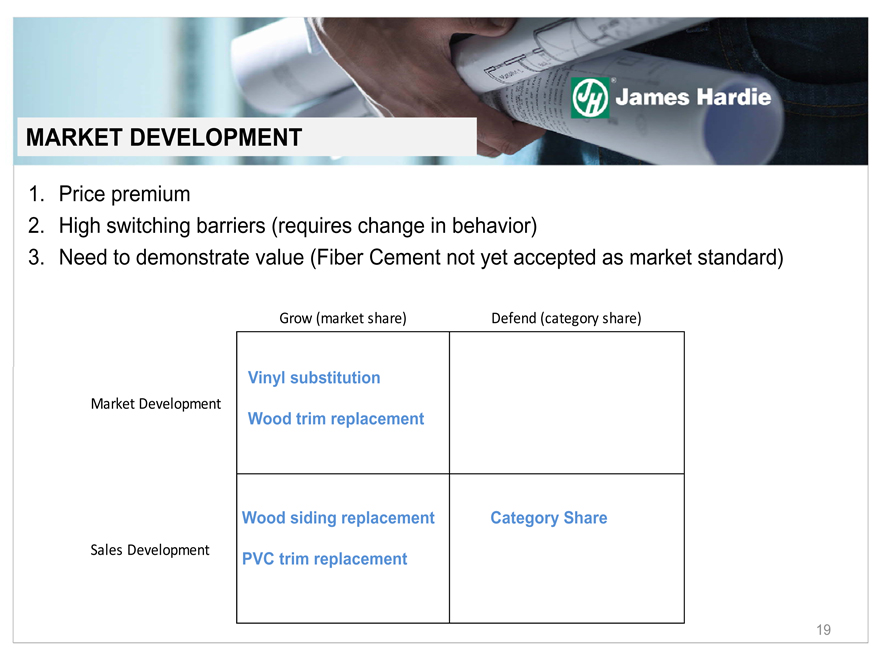

Price premium High switching barriers (requires change in behavior) Need to demonstrate value (Fiber Cement not yet accepted as market standard) Vinyl substitution Wood trim replacement Wood siding replacement PVC trim replacement Category Share 19 MARKET DEVELOPMENT

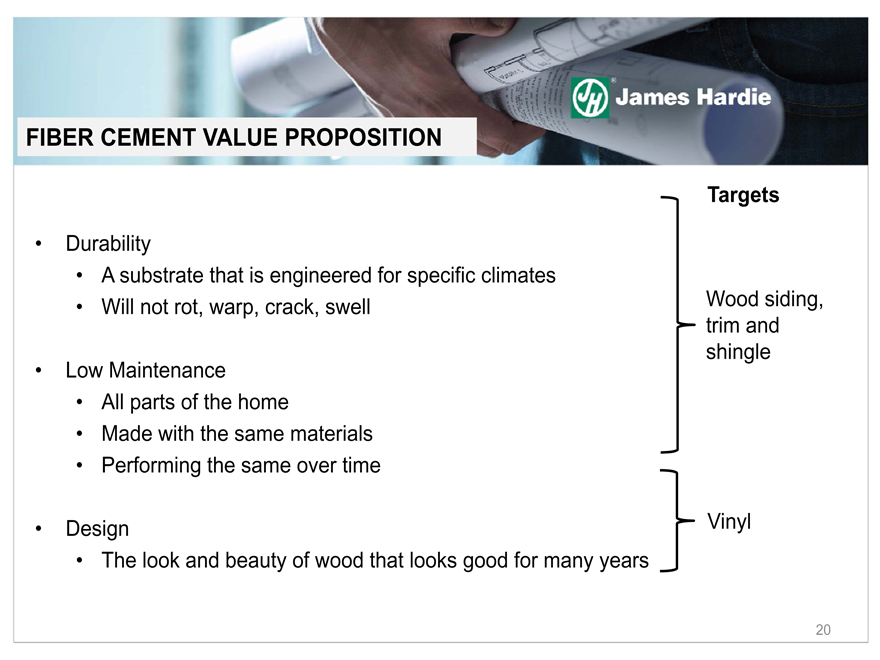

Durability A substrate that is engineered for specific climates Will not rot, warp, crack, swell Low Maintenance All parts of the home Made with the same materials Performing the same over time Design The look and beauty of wood that looks good for many years Wood siding, trim and shingle Vinyl 20 FIBER CEMENT VALUE PROPOSITION Targets

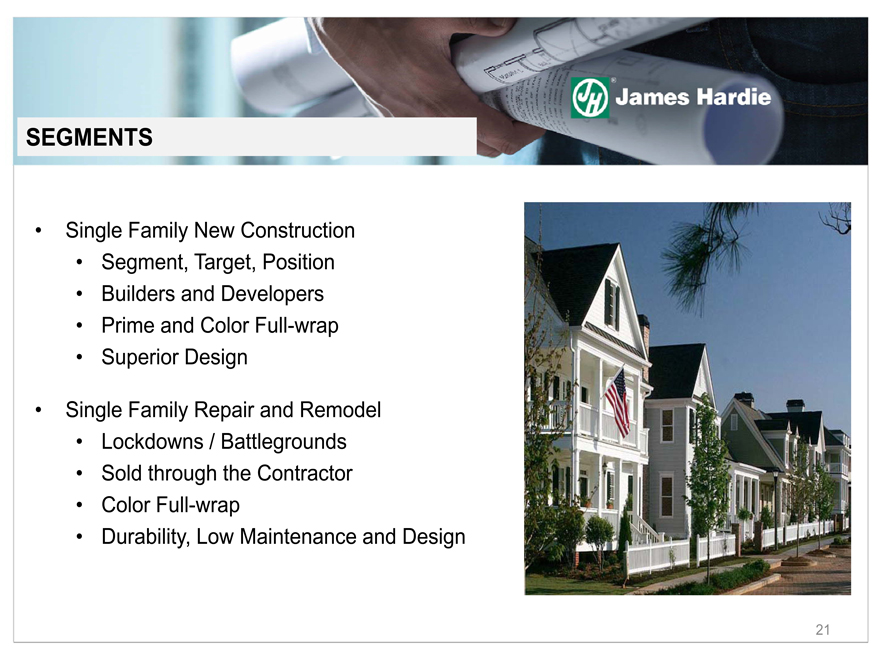

Single Family New Construction Segment, Target, Position Builders and Developers Prime and Color Full-wrap Superior Design Single Family Repair and Remodel Lockdowns / Battlegrounds Sold through the Contractor Color Full-wrap Durability, Low Maintenance and Design 21 SEGMENTS

Multifamily New Construction Early Stage Execution Architects and Developers Color Full-wrap Lowest Life Cycle Cost Need photo of Multifamily job 22 SEGMENTS

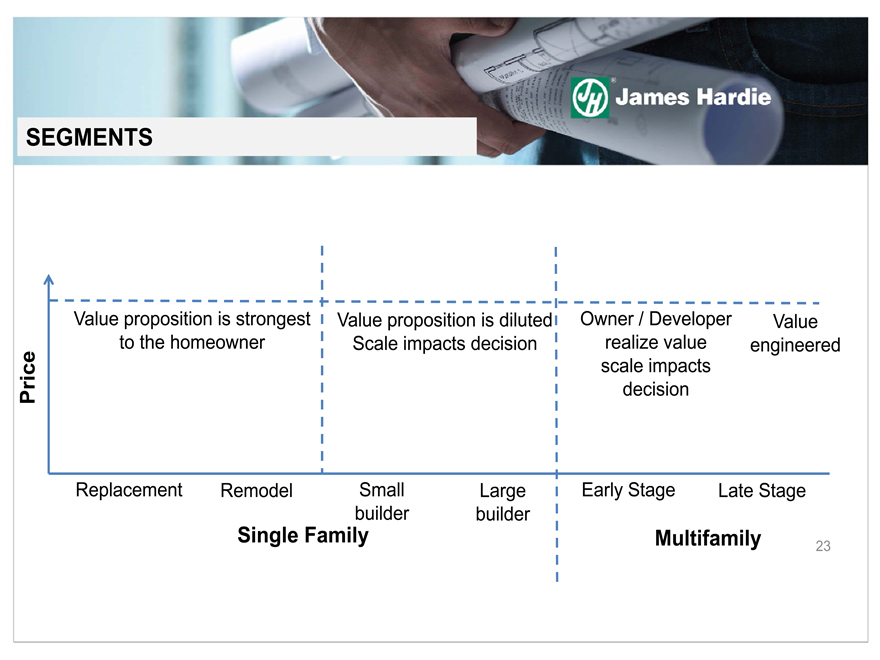

Value proposition is strongest to the homeowner Value proposition is diluted Scale impacts decision Owner / Developer realize value scale impacts decision Value engineered Price Replacement Remodel Small builder Large builder Early Stage Late Stage Multifamily Single Family 23 SEGMENTS

Selling all markets (Metro and Non-Metro) Selling full product range Selling to all segments Single Family right target, right product Repair and Remodel right contractor, right geography Multifamily early stage to drive specs Interiors Boxes and Pro-Tile 24 PRICING DRIVERS

Midwest, Northeast and Canada Colorplus® versus Primed product Trim and Shingle Northwest Cemplank® versus James Hardie brand Trim and Shingle Brand versus Cemplank® ColorPlus® versus Primed ColorPlus® ColorPlus ® 25 PRODUCT MIX—EXTERIORS

Launch completed July 2012 Opened us up to new customers % of Job-Packs in the North is lower than originally expected Large one-steppers relying on their stocking inventory as their advantage over lumber yards VMIs cover the majority of product volume while job packs cover the vast product range 26 Job-Pack Volume Job-Pack Customer Base JOB-PACKS

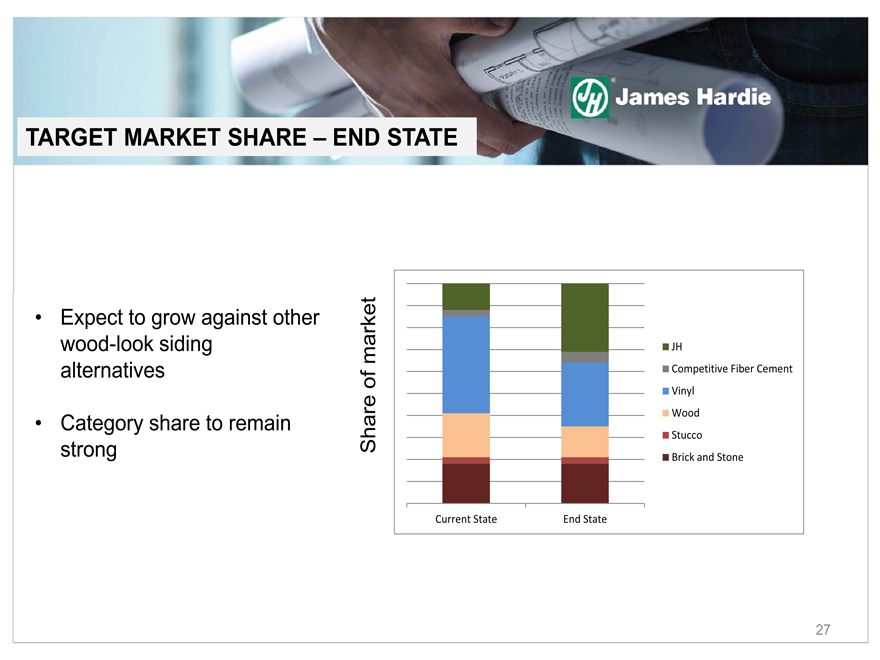

Expect to grow against other wood-look siding alternatives Category share to remain strong Share of market 27 TARGET MARKET SHARE – END STATE

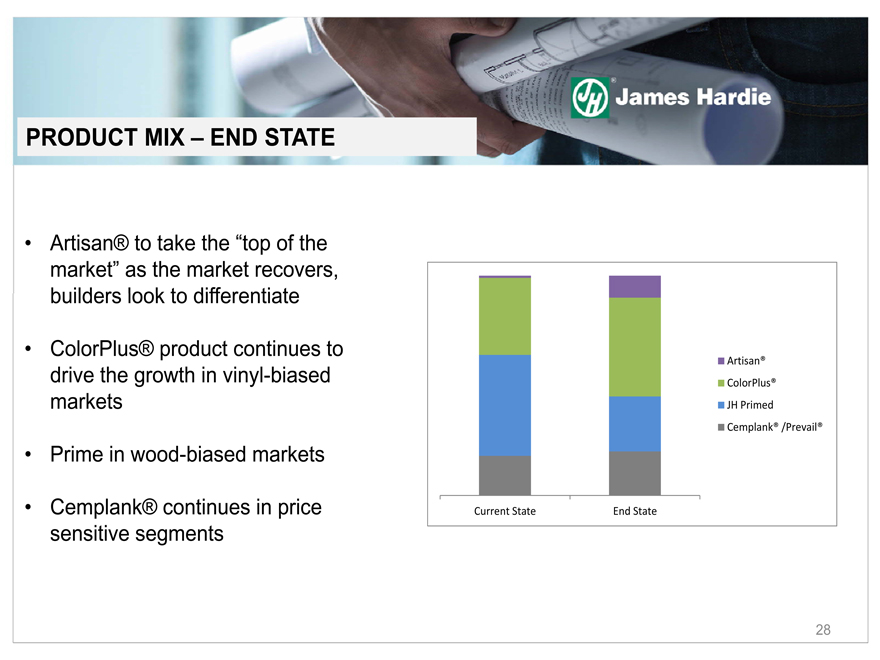

Artisan® to take the “top of the market” as the market recovers, builders look to differentiate ColorPlus® product continues to drive the growth in vinyl-biased markets Prime in wood-biased markets Cemplank® continues in price sensitive segments 28 PRODUCT MIX – END STATE

29 Delivering on 35/90 requires: Tenure and continuity Depth and leadership Execution at a very high level ORGANIZATION

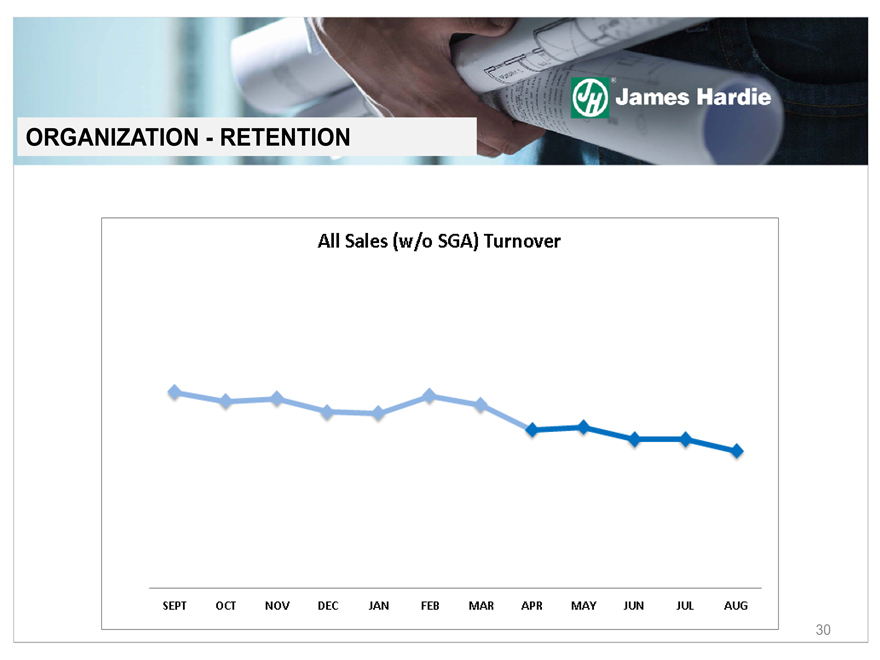

30 ORGANIZATION—RETENTION

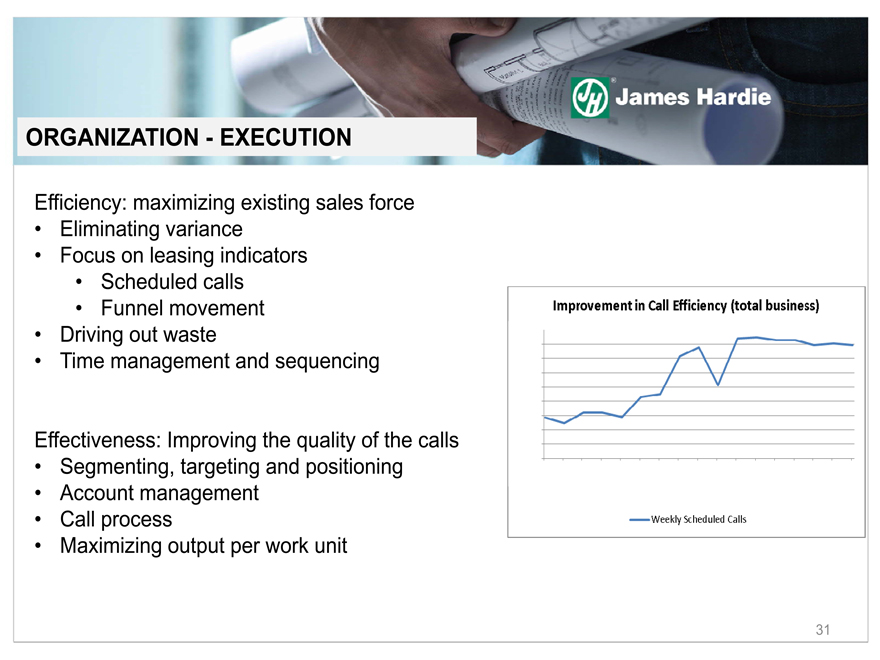

Efficiency: maximizing existing sales force Eliminating variance Focus on leasing indicators Scheduled calls Funnel movement Driving out waste Time management and sequencing Effectiveness: Improving the quality of the calls Segmenting, targeting and positioning Account management Call process Maximizing output per work unit 31 ORGANIZATION—EXECUTION

Manufacturing 32

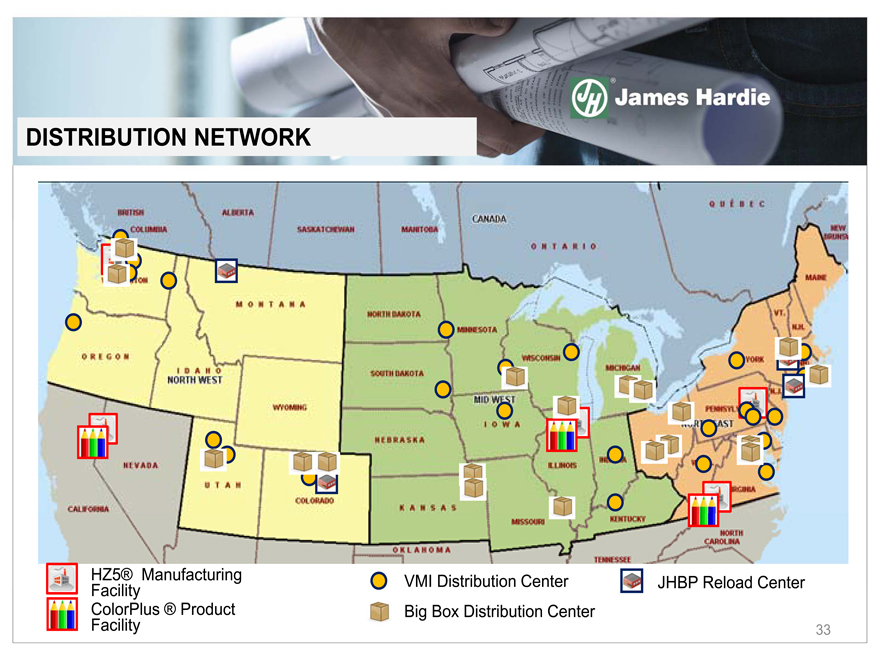

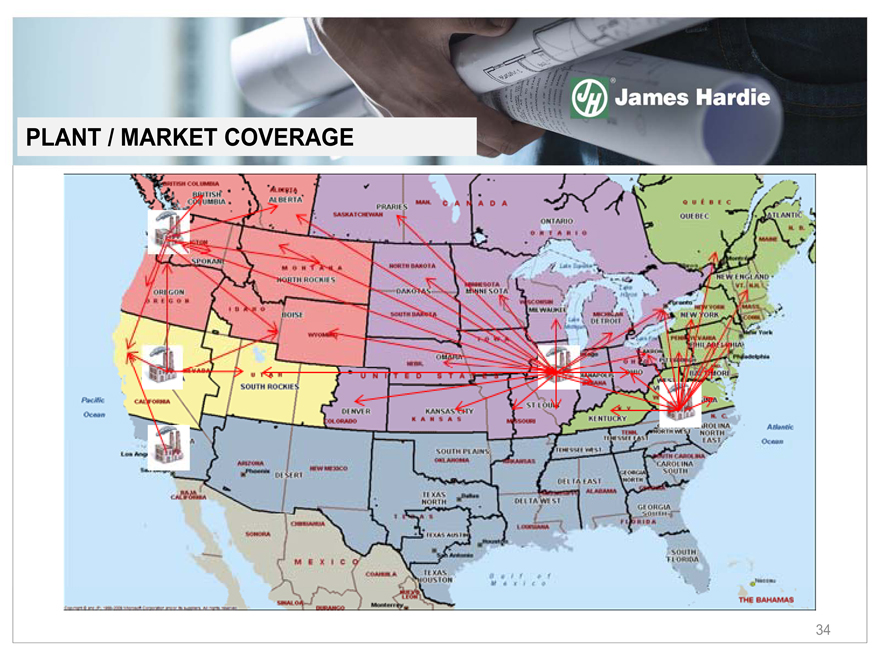

HZ5® Manufacturing Facility ColorPlus ® Product Facility VMI Distribution Center Big Box Distribution Center JHBP Reload Center 33 DISTRIBUTION NETWORK

34 PLANT / MARKET COVERAGE

High throughput sheet machines All 5’ widths Tacoma and Peru (6 tubs) Reno and Pulaski (9 tubs) All have the capability to manufacture HZ5 plank Complex post-production ColorPlus® Technology in Peru, Pulaski and Reno Trim in Reno and Peru (Single-sourced) Heritage® in Pulaski (Single-sourced) Artisan® in Reno (Single-sourced) 35 PLANT / MARKET COVERAGE

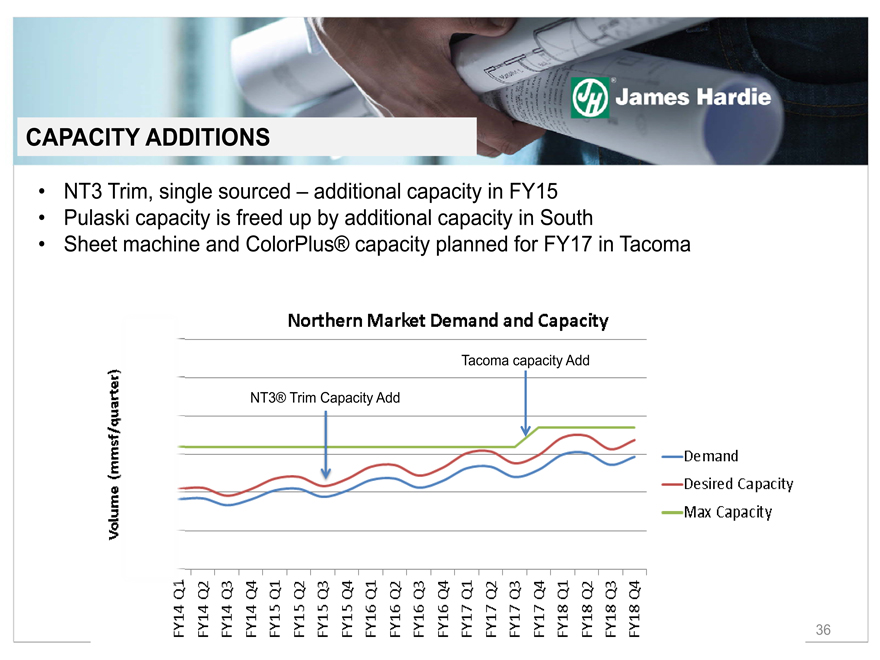

NT3 Trim, single sourced – additional capacity in FY15 Pulaski capacity is freed up by additional capacity in South Sheet machine and ColorPlus® capacity planned for FY17 in Tacoma Tacoma capacity Add 36 NT3® Trim Capacity Add CAPACITY ADDITIONS

Enhance our manufacturing and material flow capabilities to deliver the requirements of a 35:90 business Post autoclave Value-add processes Finishing Color Packaging Specialized lines Trim and Heritage 37 MANUFACTURING PHILOSOPHY

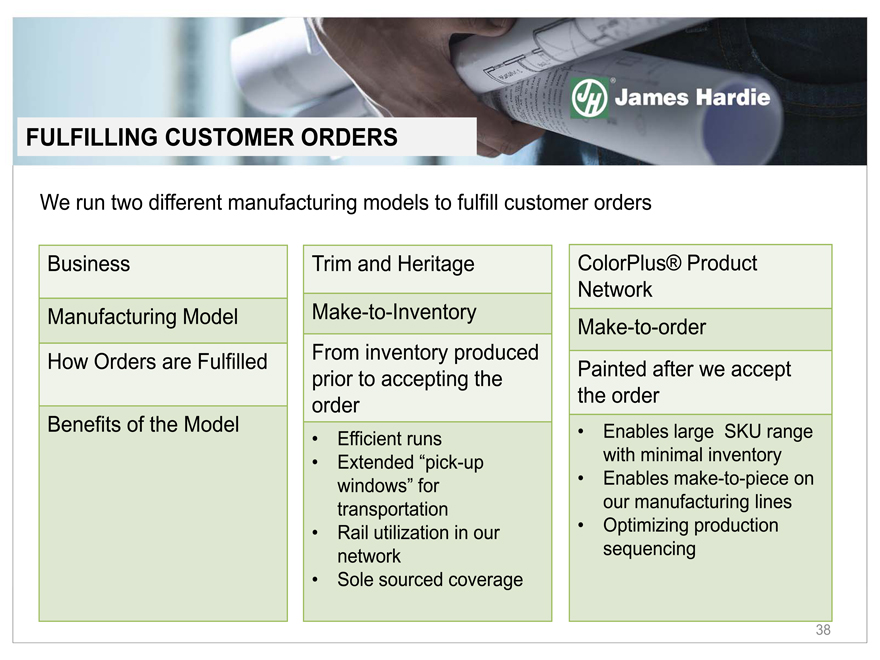

We run two different manufacturing models to fulfill customer orders Business Manufacturing Model How Orders are Fulfilled Benefits of the Model Trim and Heritage Make-to-Inventory From inventory produced prior to accepting the order Efficient runsExtended “pick-up windows” for transportationRail utilization in our networkSole sourced coverage ColorPlus® Product Network Make-to-order Painted after we accept the order Enables large SKU range with minimal inventoryEnables make-to-piece on our manufacturing linesOptimizing production sequencing 38 FULFILLING CUSTOMER ORDERS

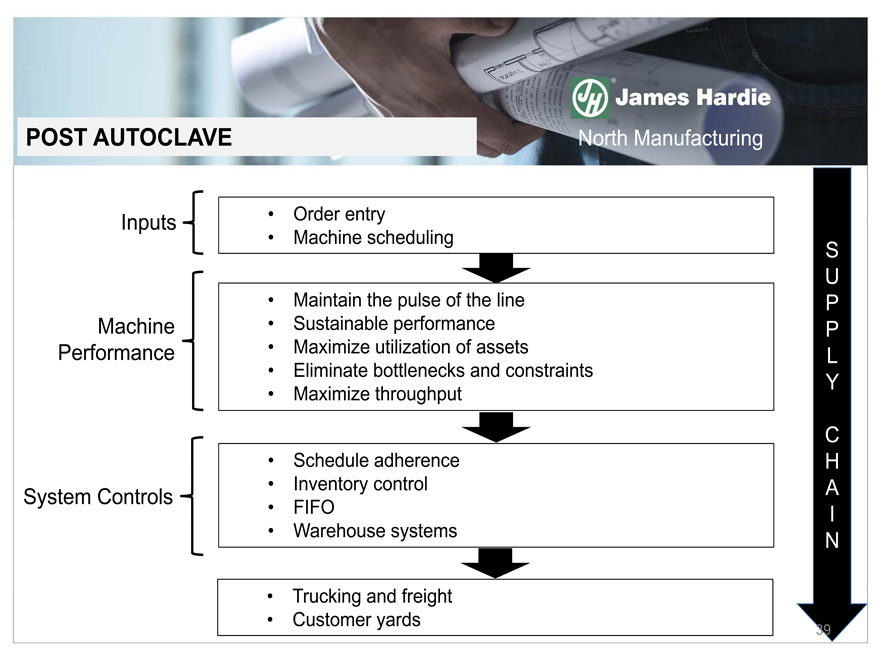

Maintain the pulse of the line Sustainable performance Maximize utilization of assets Eliminate bottlenecks and constraints Maximize throughput North Manufacturing Schedule adherence Inventory control FIFO Warehouse systems Order entry Machine scheduling Trucking and freight Customer yards Inputs Machine Performance System Controls S U P P L Y C H A I N 39 POST AUTOCLAVE