Exhibit 99.9

EUROPE OVERVIEW & ASIA PACIFIC Q&A

Mark Fisher

USA Investor/Analyst Tour – Thursday 19th September 2013

AGENDA

Evolution of the company

Market overview

Strategy

Current position

New products runway

Summary

2

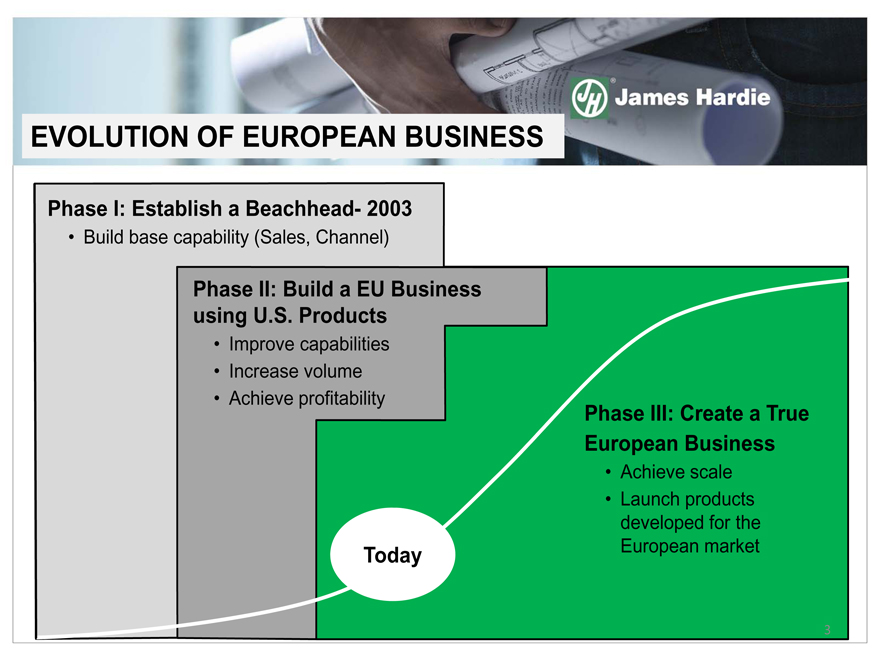

EVOLUTION OF EUROPEAN BUSINESS

Phase SUBHEADING I: Establish a Beachhead- 2003

Build base capability (Sales, Channel)

Phase II: Build a EU Business using U.S. Products

Improve capabilities

Increase volume

Achieve profitability

Phase III: Create a True European Business

Achieve scale

Launch products developed for the European market

Today

HOW WE OPERATE

European head office in Amsterdam

Core markets UK and France

Developing in Germany

High population & GDPs in all core markets

France 63M

UK 63M

DE 82M

Steadily growing share of timber frame

4

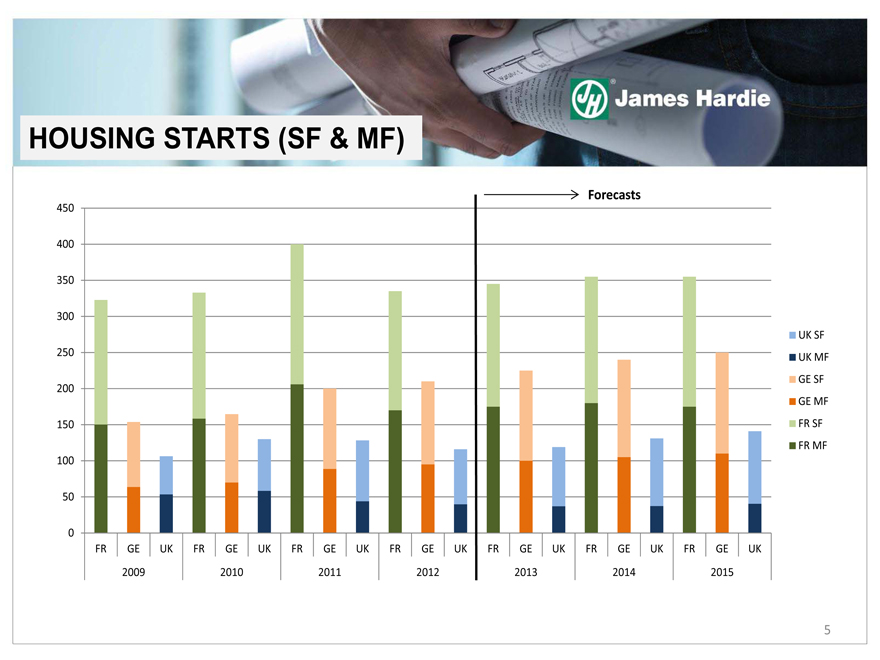

HOUSING STARTS (SF & MF)

Forecasts

450

400

350

300

UK SF

250 UK MF

GE SF

200

GE MF

150 FR SF

FR MF

100

50

0

FR GE UK FR GE UK FR GE UK FR GE UK FR GE UK FR GE UK FR GE UK

2009 2010 2011 2012 2013 2014 2015

5

MARKET OVERVIEW

UK & France markets returning

Government-led initiatives

Building systems and designs are changing

Architectural style / materials Shift

Brick share UK*

2008 95%

2013 88%

JH internal estimate

6

STRATEGY

To aggressively drive sales growth through a unique product portfolio and establish a long-term differentiated position via JH USA current products and EU specific products

Market development

New products

Market penetration

7

GOALS

Fiber cement market leader in core geographies

High share of sales in new products

8

CURRENT POSITION

Developed capability to import products

Freight model not excessively punitive:

Roughly equal costs of full truck US to UK versus overland Europe

Long term goal is local value-add manufacturing

Now customizing products:

Enhances differentiation

9

CHANGING EUROPEAN ENVIRONMENT

Architectural styles changing

Mixed facades

Availability of skilled labor

Brick-masons becoming scarce

Energy efficiency requirements

France—RT 2012

150 kwh/M? to 50 kwh/M?

Trend towards lightweight

Faster

More energy efficient

10

HARDIE GROWTH

Well positioned:

Channel

Builders (90% of UK Top 20)

Low geographic penetration

11

NEW PRODUCTS RUNWAY

Interior products:

HardieFloor

Structural flooring product for SF

HardieFloor QT

Structural sound flooring for MF / SF

Exterior products:

HardieStria

New cladding for MF/SF

12

ENERGY EFFICIENCY

To meet RT2012, France MF Social needs to be “re-skinned”

Complicated system

High labor costs

Long time frames

Needs re-thinking

We have an answer

13

SUMMARY

Focused approach on core markets

Changes in

Construction

Architectural style

Energy efficiency

James Hardie is well positioned to exploit this growth

14

Questions?

15