1

INVESTOR PRESENTATION

OCTOBER 2013

Exhibit 99.1 |

1

INVESTOR PRESENTATION

OCTOBER 2013

Exhibit 99.1 |

Investor Presentation

2

DISCLAIMER

This Investor Presentation contains forward-looking statements. James Hardie may from time to time

make forward-looking statements in its periodic reports filed with or furnished to the SEC, on Forms 20-F

and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and

prospectuses, in media releases and other written materials and in oral statements made by the company’s

officers, directors or employees to analysts, institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not historical facts are forward-looking

statements and such forward-looking statements are statements made pursuant to the Safe Harbor

Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•

statements about the company’s future performance; •

projections of the company’s results of operations or financial condition; •

statements regarding the company’s plans, objectives or goals, including those relating to

strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•

expectations concerning the costs associated with the suspension or closure of operations at any of

the company’s plants and future plans with respect to any such plants;

•

expectations regarding the extension or renewal of the company’s credit facilities including

changes to terms, covenants or ratios;

•

expectations concerning dividend payments and share buy-backs; •

statements concerning the company’s corporate and tax domiciles and structures and potential

changes to them, including potential tax charges;

•

statements regarding tax liabilities and related audits, reviews and proceedings; •

statements as to the possible consequences of proceedings brought against the company and certain of

its former directors and officers by the Australian Securities and Investments Commission

(ASIC); •

statements regarding the possible consequences and/or potential outcome of the legal proceedings

brought against two of the company’s subsidiaries by the New Zealand Ministry of Education

and the potential product liabilities, if any, associated with such proceedings;

•

expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund

(AICF), a special purpose fund for the compensation of proven Australian asbestos- related

personal injury and death claims;

•

expectations concerning indemnification obligations; •

expectations concerning the adequacy of the company’s warranty provisions and estimates for

future warranty-related costs;

•

statements regarding the company’s ability to manage legal and regulatory matters (including but

not limited to product liability, environmental, intellectual property and competition law

matters) and to resolve any such pending legal and regulatory matters within current estimates and in

anticipation of certain third-party recoveries; and

•

statements about economic conditions, such as change in the US economic or housing recovery, the

levels of new home construction and home renovations, unemployment levels, changes in consumer

income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of

foreclosures and home resales, currency exchange rates, and builder and consumer confidence. Words such as

“believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,”

“will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar

expressions are intended to identify forward-looking statements but are not the exclusive means of

identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking

statements and all such forward-looking statements are qualified in their entirety by reference to

the following cautionary statements. Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and conditions, they, by their

very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the

company’s control. Such known and unknown risks, uncertainties and other factors may cause actual

results, performance or other achievements to differ materially from the anticipated results,

performance or achievements expressed, projected or implied by these forward-looking statements. These factors,

some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with

the Securities and Exchange Commission on 27 June 2013, include, but are not limited to: all matters relating to or

arising out of the prior manufacture of products that contained asbestos by current and former James

Hardie subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency

exchange rate movements on the amount recorded in the company’s financial statements as an

asbestos liability; governmental loan facility to AICF; compliance with and changes in tax laws and treatments;

competition and product pricing in the markets in which the company operates; the consequences of

product failures or defects; exposure to environmental, asbestos, putative consumer class action or other

legal proceedings; general economic and market conditions; the supply and cost of raw materials;

possible increases in competition and the potential that competitors could copy the company’s products;

reliance on a small number of customers; a customer’s inability to pay; compliance with and

changes in environmental and health and safety laws; risks of conducting business internationally; compliance with

and changes in laws and regulations; the effect of the transfer of the company’s corporate

domicile from The Netherlands to Ireland, including changes in corporate governance and potential tax benefits;

currency exchange risks; dependence on customer preference and the concentration of the company’s

customer base on large format retail customers, distributors and dealers; dependence on residential and

commercial construction markets; the effect of adverse changes in climate or weather patterns; possible

inability to renew credit facilities on terms favourable to the company, or at all; acquisition or sale of

businesses and business segments; changes in the company’s key management personnel; inherent

limitations on internal controls; use of accounting estimates; and all other risks identified in the company’s

reports filed with Australian, Irish and US securities agencies and exchanges (as appropriate). The

company cautions you that the foregoing list of factors is not exhaustive and that other risks and

uncertainties may cause actual results to differ materially from those in forward-looking

statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s

current expectations concerning future results, events and conditions. The company assumes no

obligation to update any forward-looking statements or information except as required by law.

|

Investor Presentation

3

AGENDA

In this Investor Presentation, James Hardie may present financial measures, sales volume terms,

financial ratios, and Non-US GAAP financial measures included in the Definitions section of

this document starting on page 39. The company presents financial measures that it believes are customarily used by its Australian investors. Specifically, these financial

measures, which are equivalent to or derived from certain US GAAP measures as explained in the

definitions, include “EBIT”, “EBIT margin”, “Operating profit before income taxes”

and “Net operating profit”. The company may also present other terms for measuring its sales

volumes (“million square feet” or “mmsf” and “thousand square feet” or “msf”);

financial ratios (“Gearing ratio”, “Net interest expense cover”, “Net

interest paid cover”, “Net debt payback”, “Net debt (cash)”); and Non-US GAAP financial measures (“EBIT

excluding asbestos, ASIC expenses and New Zealand product liability expenses”, “EBIT margin

excluding asbestos, ASIC expenses and New Zealand product liability expenses”, “Net

operating profit excluding asbestos, ASIC expenses, New Zealand product liability expenses and tax adjustments”, “Diluted earnings per share excluding asbestos, ASIC

expenses, New Zealand product liability expenses and tax adjustments”, “Operating profit

before income taxes excluding asbestos and New Zealand product liability expenses”,

“Effective tax rate on earnings excluding asbestos, New Zealand product liability expenses and

tax adjustments”, “Adjusted EBITDA”, “General corporate costs excluding ASIC

expenses and intercompany foreign exchange gain” and “Selling, general and administrative

expenses excluding New Zealand product liability expenses”). Unless otherwise stated,

results and comparisons are of the 1st quarter of the current fiscal year versus the 1st quarter of the prior fiscal year.

•

Business Overview

•

USA & Europe Fibre Cement

•

Asia Pacific Fibre Cement

•

Group Outlook

•

Summary

•

Appendix |

Investor Presentation

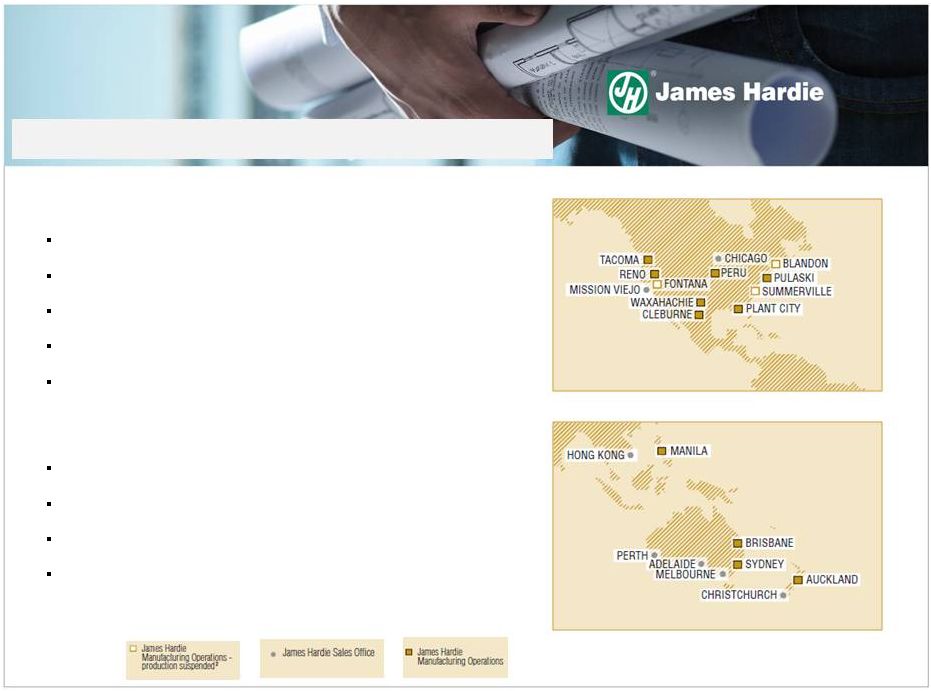

Annual net sales US$1.5b

Total assets US$1.3b

Net cash US$198m

Operations in North America, Asia Pacific and Europe

2,700 employees

Market cap US$4.1b

S&P/ASX 100 company

NYSE ADR listing

Note:

Market

capitalization,

total

assets

and

net

cash

are

as

at

30

June

2013.

Annual

net

sales

equal

Q1

FY14

net

sales

annualised.

Total

assets

exclude asbestos compensation

4

JHX: A GROWTH FOCUSED COMPANY |

Investor Presentation

1

Comparisons

are

of

the

1

quarter

FY14

and

full

fiscal

year

as

at

31

March

2013

versus

the

1 quarter

FY13

and

full

fiscal

year

as

at

31

March

2012

2

Includes $485.2m tax benefit arising on conclusion of RCI’s disputed amended

assessment with the Australian Taxation Office 1

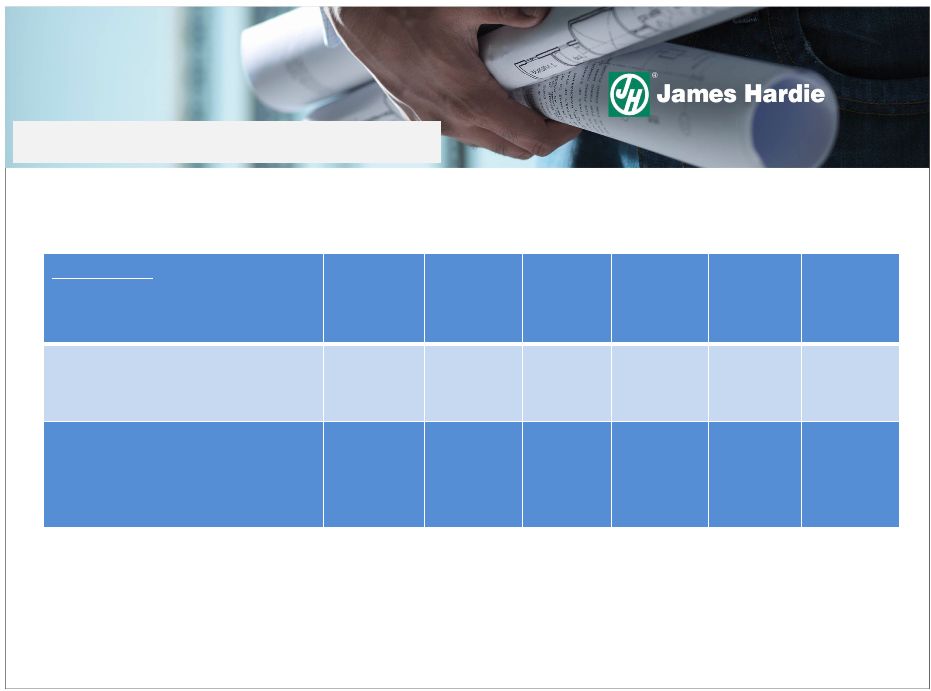

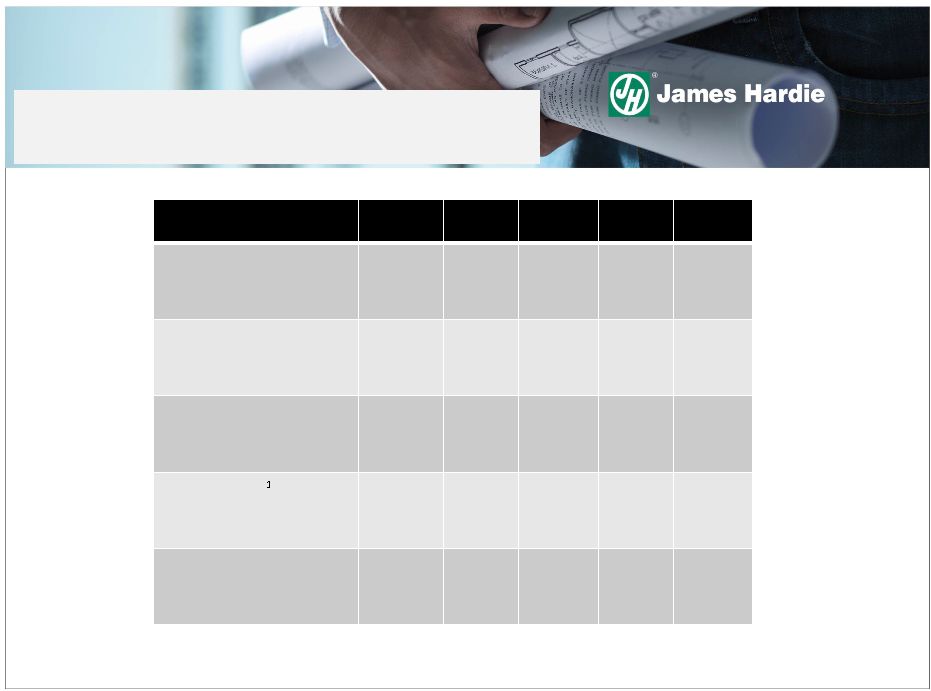

US Millions

Q1

FY2014

Q1

FY2013

%

Change

FY2013

FY2012

%

Change

Net Operating Profit

142.2

68.5

-

45.5

604.3

2

(92)

Net operating profit excluding

asbestos, asset impairments, ASIC

expenses, New Zealand product

liability expenses and tax

adjustments

52.0

43.8

19

140.8

144.3

(2)

GROUP OVERVIEW

1

5

st

st |

Investor Presentation

USA Fibre Cement Products

Siding

Soffit

Fascia

Trim

Backerboard

Asia Pacific Fibre Cement Products

Residential siding

Commercial exteriors

Flooring

Ceilings and internal walls

6

JHX: A WORLD LEADER IN FIBRE CEMENT |

Investor Presentation

19%

Volume

75%

74%

26%

EBIT*

USA and Europe Fibre Cement

Asia-Pacific Fibre Cement

1

All numbers are for the 1st quarter ended 30 June 2013

*EBIT –

Excludes Research and Development EBIT, Asbestos-related items, Asset

impairment charges, New Zealand product liability expenses and general

corporate costs 7

GLOBAL BUSINESS PORTFOLIO

Net Sales

1

81%

25% |

Investor Presentation

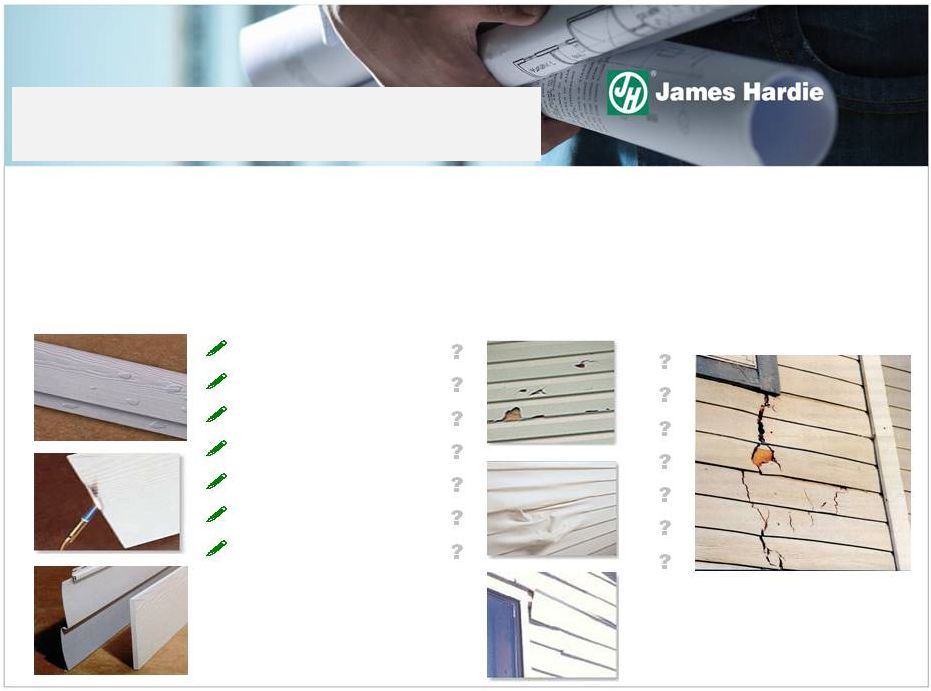

Fibre cement is more durable than wood and engineered wood, looks and performs

better than vinyl, and is more cost effective and quicker to build with than

brick Fibre

Cement

Vinyl

Engineered

Wood

Fire resistant

Hail resistant

Resists warping

Resists buckling

Colour lasts longer

Dimensional stability

Can be repainted

8

FIBRE CEMENT:

SUPERIOR PRODUCT PERFORMANCE |

Investor Presentation

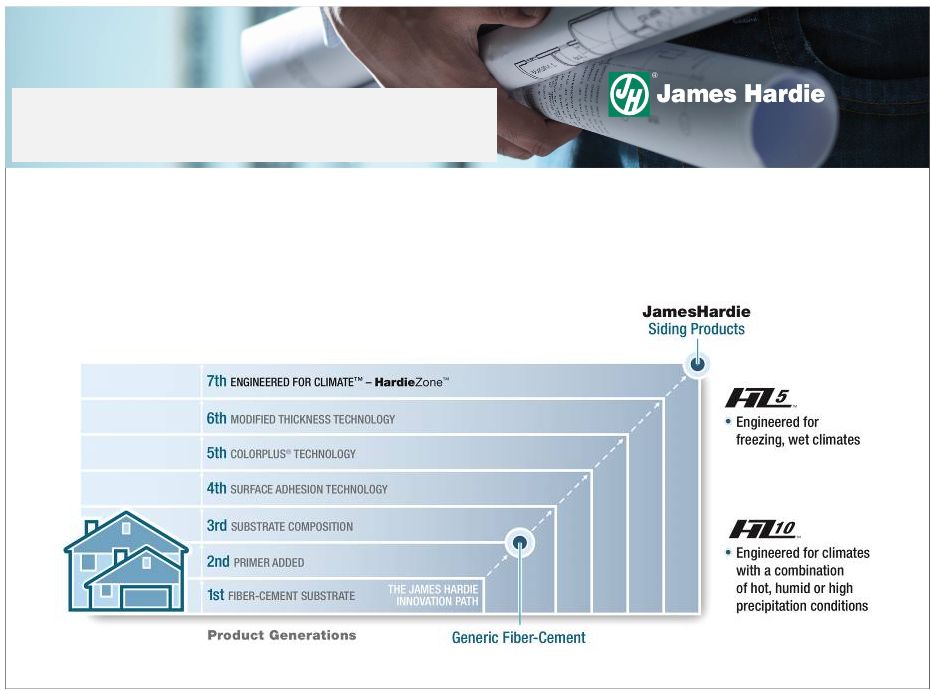

•

7

th

Generation versus 2

nd

Generation generic fibre cement

•

The HardieZone™

System represents a logical extension of Hardie technology

9

PRODUCT LEADERSHIP EXAMPLE:

HARDIEZONE™

SYSTEM |

Investor Presentation

10

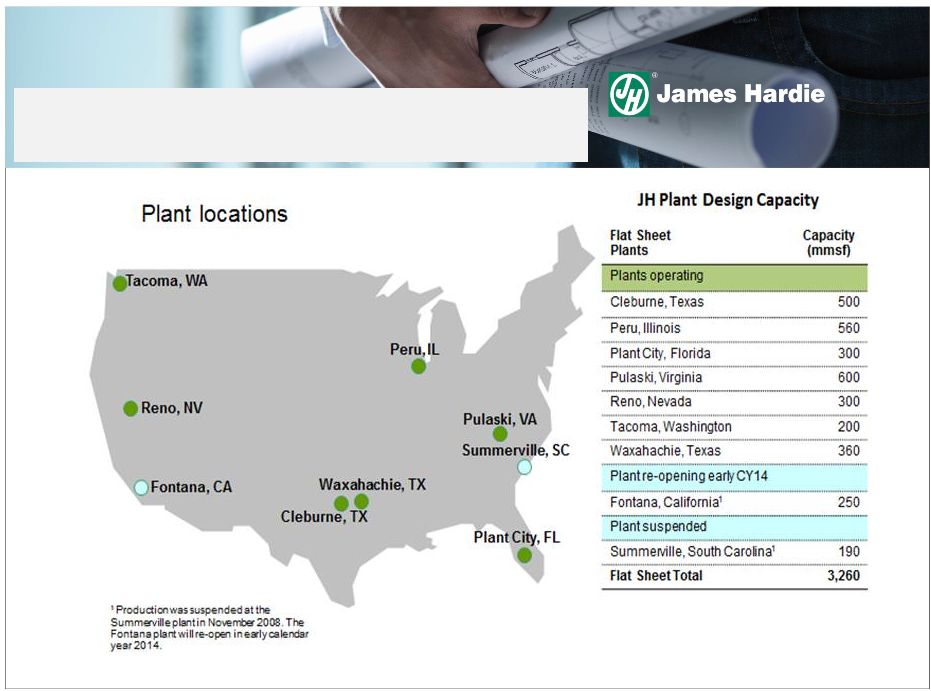

THE USA BUSINESS: LARGEST FIBRE

CEMENT PRODUCER IN NORTH AMERICA |

Investor Presentation

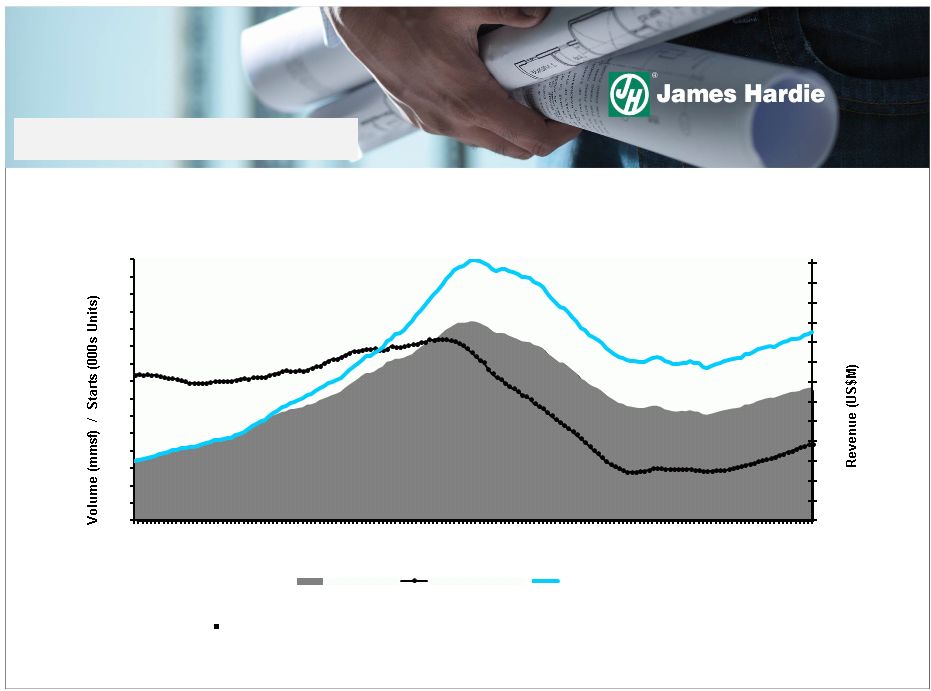

Rolling 12 month average of seasonally adjusted estimate of housing starts by US

Census Bureau Market and category share tracking as planned in FY14

11

USA FIBRE CEMENT

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

11

12

13

Top Line Growth

JH Volume

Housing Starts

JH Revenue |

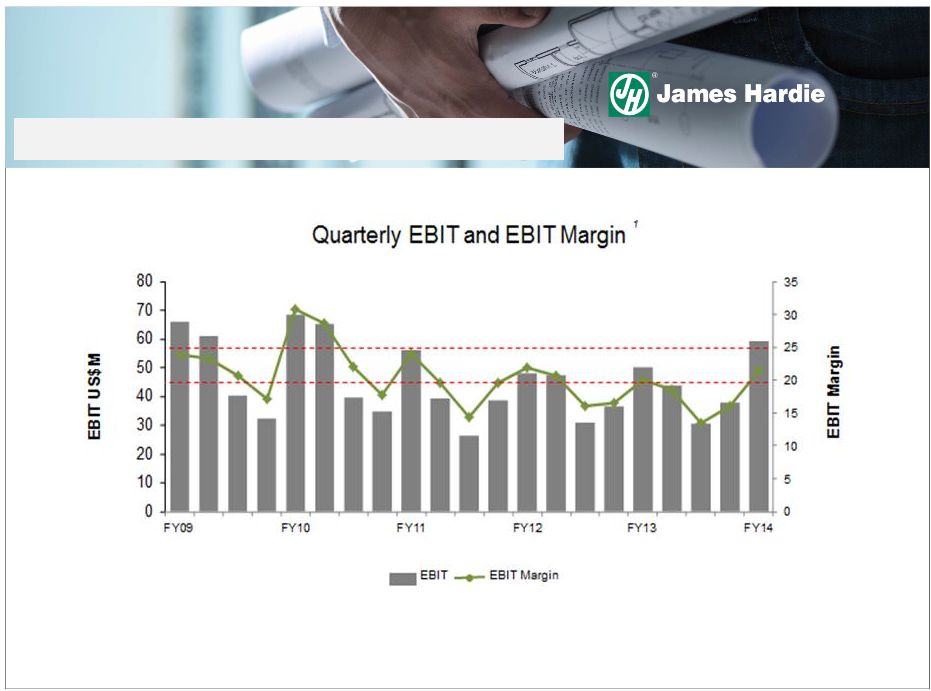

Investor Presentation

12

1

Excludes

asset

impairment

charges

of

US$14.3

million

in

4

th

quarter

FY12,

US$5.8

million

in

3

quarter

FY13

and

US$11.1

million

in

4

quarter FY13

USA AND EUROPE FIBRE CEMENT

rd

th |

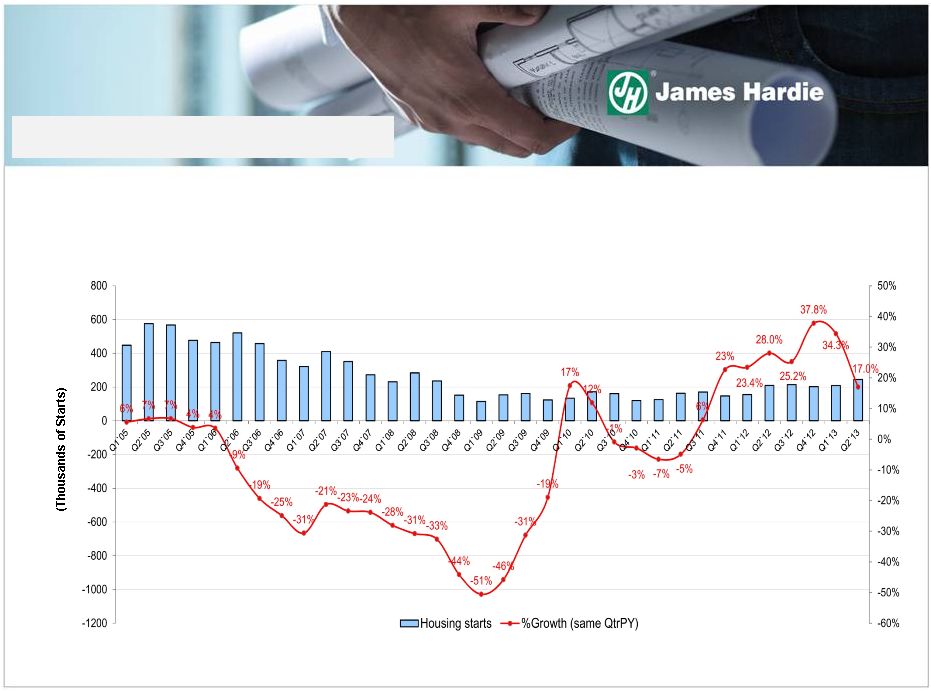

Investor Presentation

13

USA AND EUROPE FIBRE CEMENT |

Investor Presentation

14

TOTAL US HOUSING STARTS

U.S. Housing Starts

Calendar Quarters |

Investor Presentation

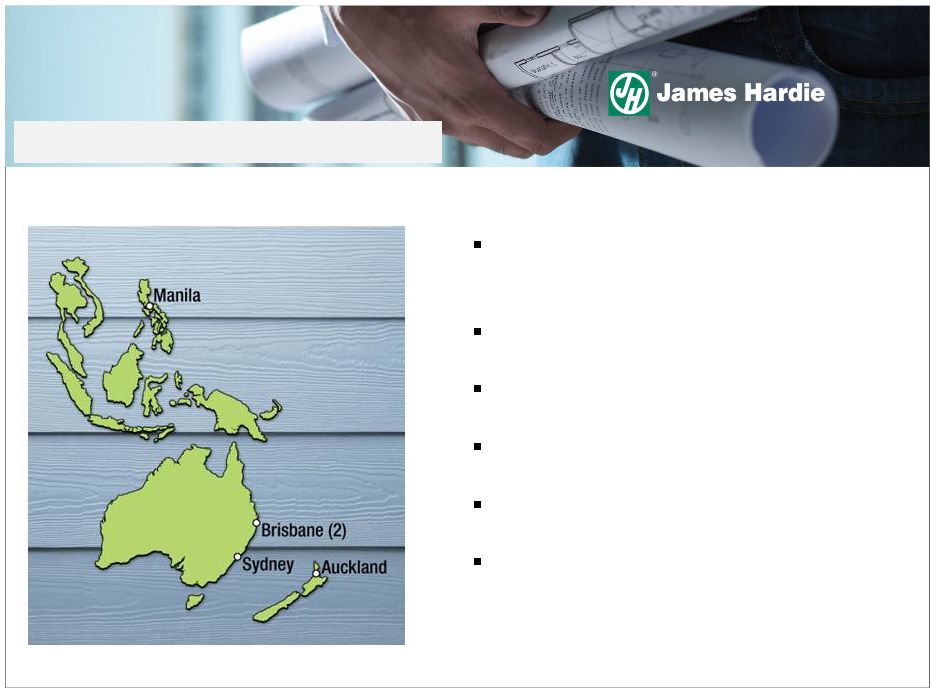

Five manufacturing plants in Asia

Pacific

Net sales US$376m

EBIT US$84m

Higher value differentiated products

Lower delivered cost

Growth model

Asia Pacific manufacturing facilities

Net

Sales

and

EBIT

equal

Q1

FY14

annualised.

EBIT

excludes

New

Zealand

product

liability

expenses

15

1

1

1

ASIA PACIFIC FIBRE CEMENT |

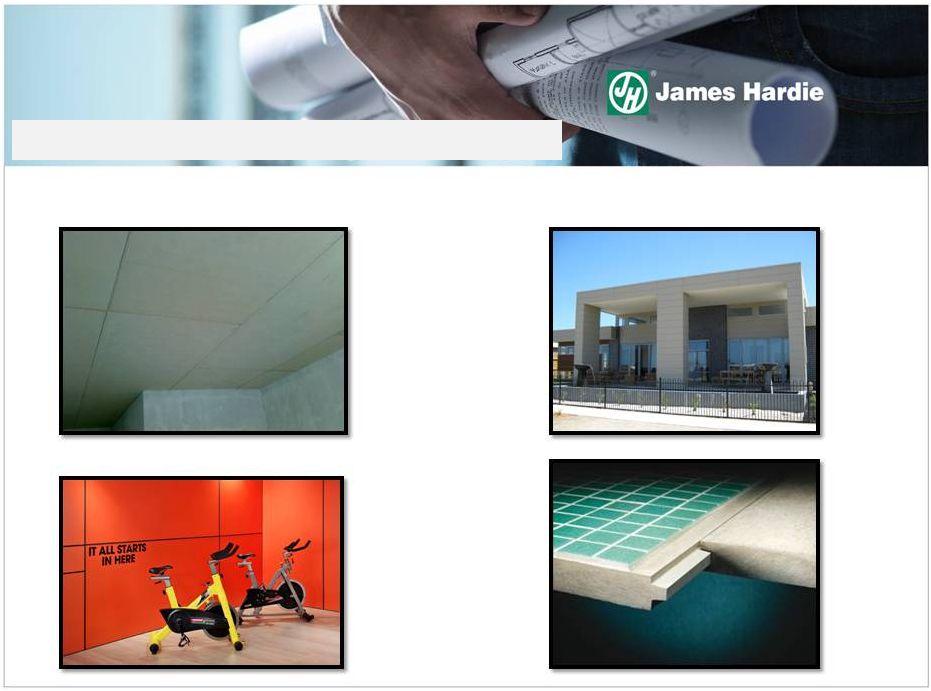

Ceilings and

partitions Philippines

Exterior cladding

Australia

General purpose flooring

Australia

New Zealand

Interior walls

16

ASIA PACIFIC FIBRE CEMENT -

EXAMPLES

Investor Presentation |

Investor Presentation

•

The company announced in November 2012 a dividend payout ratio of between 30% and

50% of net operating profit (excluding asbestos adjustments) from FY14

onwards •

The company also announced on 23 May 2013:

•

A new share buyback program to acquire up to 5% of issued capital over the next 12

months. The actual shares that the company may buyback will be subject to

share price levels, consideration of the effect of the share buyback on

return on equity, and capital requirements •

On 31 July 2013, the company repurchased 221,000 shares of its common stock, at

cost of A$2.0 million (US$1.8 million), at an average market price of A$9.02

(US$8.20) •

If and to the extent the company does not undertake further share buybacks during

FY14, the company will consider further distributions to shareholders over

and above those contemplated under the company’s dividend policy

subject to: •

an

assessment

of

the

current

and

expected

industry

conditions

in

the

group’s

major

markets

of

the

US

and

Australia

•

an assessment of the group’s capital requirements, especially for funding of

expansion and growth initiatives •

global economic conditions and outlook, and

•

total net operating profit (excluding asbestos adjustments) for financial year

2014 17

FUTURE SHAREHOLDER RETURNS |

18

USA and Europe Fibre Cement

•

The US operating environment continues to reflect an increasing number of housing

starts and improving house values

•

Pick-up in repair and remodelling activity becoming apparent

•

The company is continuing with its plan to invest in capacity expansions through

re-commissioning of idled facilities in future periods

•

The USA business is tracking to deliver a +20% FY14 EBIT margin

Asia Pacific Fibre Cement

•

In Australia, the addressable market is likely to remain relatively subdued in

FY14 •

In New Zealand, the housing market continues to improve

•

In the Philippines, the business is experiencing growth in its core market segments

and is expected to deliver consistent earnings over the next 12 months

GROUP OUTLOOK |

Investor

Presentation

We have a strong, well-established, growth-focused, strong

cash-generating and high return business

We have a sustainable competitive advantage

Our model for strong growth is based on:

Large market opportunity

Superior value proposition

Proprietary and/or protected technology

Ongoing commitment to research and development

Significant organisational advantages

Focused strategy and organisational effort

Scale

Throughout the low demand environment the company has performed exceptionally well,

consistently delivering solid financial returns

The company is on track to leverage its increased capabilities as the US housing

market recovery progresses

19

SUMMARY |

20

APPENDIX |

Investor Presentation

Industry leadership and profitable growth

Aggressively grow demand for

our products in targeted market

segments

Grow our overall market position

while defending our share in

existing market segments

Introduce differentiated products

to deliver a sustainable

competitive advantage

21

GLOBAL STRATEGY |

Investor

Presentation

22

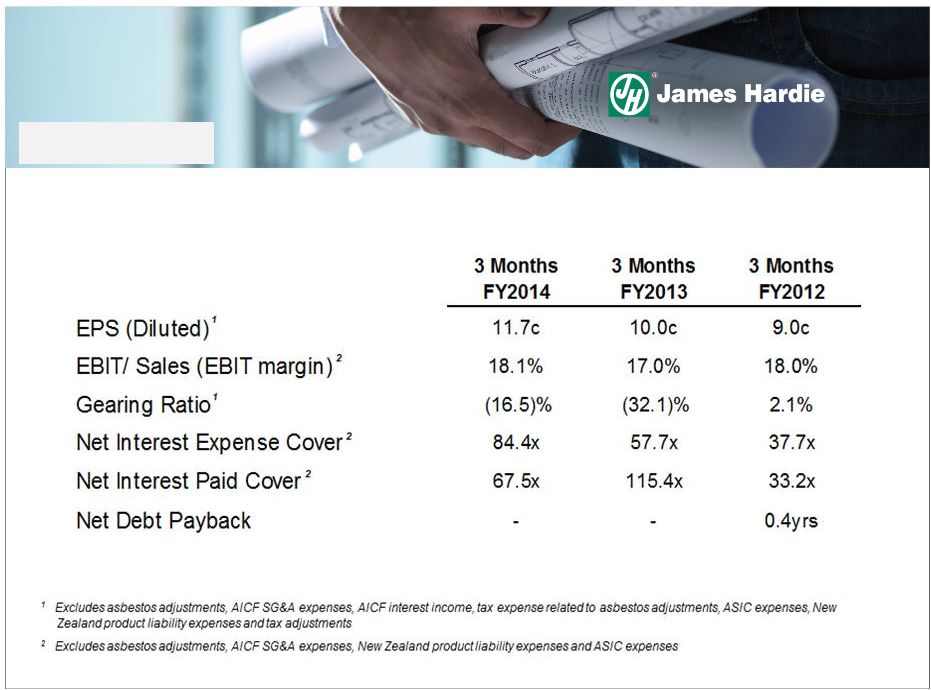

KEY RATIOS |

Investor Presentation

FY09

FY10

FY11

FY12

FY13

Net Sales

US$m

929

828

814

862

951

Sales Volume

mmsf

1,527

1,304

1,248

1,332

1,489

Average Price

US$ per msf

609

635

652

647

639

EBIT US$m

199

209

160

163

163

EBIT Margin %

21

25

20

19

17

23

1

1

Excludes

asset

impairment

charges

of

US$14.3

million

and

US$16.9

million

in

FY12

and

FY13,

respectively

1

USA AND EUROPE FIBRE

CEMENT 5

YEAR RESULTS OVERVIEW |

Investor Presentation

FY09

FY10

FY11

FY12

FY13

Net Sales

US$m

273

297

353

376

370

Sales Volume

mmsf

391

390

408

392

394

Average Price

US$ per msf

879

894

916

916

911

EBIT US$m

47

59

79

86

75

EBIT Margin %

17

20

23

23

20

24

1

Excludes New Zealand product liability expenses of US$5.4 million and US$13.2

million in FY12 and FY13, respectively 1

ASIA PACIFIC FIBRE CEMENT

5 YEAR RESULTS OVERVIEW |

Investor Presentation

25

1

Asia Pacific Fibre Cement EBIT excludes New Zealand product liability expenses of

US$4.6 million and nil in Q1 ‘14 and Q1 ‘13, respectively FINANCIAL

SUMMARY US$ Millions

% Change

Net Sales

USA and Europe Fibre Cement

278.1

$

252.0

$

10

Asia Pacific Fibre Cement

94.1

87.7

7

Total Net Sales

372.2

$

339.7

$

10

EBIT -

US$ Millions

USA and Europe Fibre Cement

59.4

$

50.3

$

18

Asia Pacific Fibre Cement

21.1

17.7

19

Research & Development

(6.1)

(6.0)

(2)

General corporate costs excluding

asbestos and ASIC

(6.9)

(4.3)

(60)

Total EBIT excluding asbestos, ASIC

expenses and New Zealand product

liability expenses

67.5

$

57.7

$

17

Net interest expense excluding AICF

interest income

(1.0)

(0.9)

(11)

Other income

0.1

0.4

(75)

Income tax expense excluding tax

adjustments

(14.6)

(13.4)

(9)

Net operating profit excluding

asbestos, ASIC expenses, New

Zealand product liability expenses

and tax adjustments

52.0

$

43.8

$

19

Q1 '14

Q1 '13

1 |

This Management Presentation forms part of a package of information about the

company’s results. It should be read in conjunction with the other

parts of this package, including the Management’s Analysis of Results, Media Release and

Consolidated Financial Statements

Definitions

Non-financial Terms

ABS

–

Australian Bureau of Statistics

AFFA

–

Amended and Restated Final Funding Agreement

AICF

–

Asbestos Injuries Compensation Fund Ltd

ASIC

–

Australian Securities and Investments Commission

ATO

–

Australian Taxation Office

NBSK –

Northern Bleached Soft Kraft; the company's benchmark grade of pulp

26

ENDNOTES |

Financial Measures –

US GAAP equivalents

This document contains financial statement line item descriptions that are

considered to be non-US GAAP, but are consistent with those used by

Australian companies. Because the company prepares its consolidated financial

statements under US GAAP, the following table cross-references each non-US

GAAP line item description, as used in Management’s Analysis of Results

and Media Release, to the equivalent US GAAP financial statement line item

description used in the company’s consolidated financial statements:

27

Management's Analysis of Results and

Consolidated Statements of Operations

Media Release

and Other Comprehensive Income (Loss)

(US GAAP)

Net sales

Net sales

Cost of goods sold

Cost of goods sold

Gross profit

Gross profit

Selling, general and administrative expenses

Selling, general and administrative expenses

Research and development expenses

Research and development expenses

Asbestos adjustments

Asbestos adjustments

EBIT

*

Operating income (loss)

Net interest income (expense)*

Sum of interest expense and interest income

Other income (expense)

Other income (expense)

Operating profit (loss) before income taxes*

Income (loss) before income taxes

Income tax (expense) benefit

Income tax (expense) benefit

Net operating profit (loss)*

Net income (loss)

*- Represents non-U.S. GAAP descriptions used by Australian companies.

ENDNOTES (CONTINUED) |

EBIT

margin –

EBIT margin is defined as EBIT as a percentage of net sales.

Sales Volumes

mmsf

–

million

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness

msf

–

thousand

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness

Financial Ratios

Gearing

Ratio

–

Net

debt

(cash)

divided

by

net

debt

(cash)

plus

shareholders’

equity

Net interest expense cover

–

EBIT divided by net interest expense (excluding loan establishment fees)

Net

interest

paid

cover

–

EBIT

divided

by

cash

paid

during

the

period

for

interest,

net

of

amounts

capitalised

Net debt payback

–

Net debt (cash) divided by cash flow from operations

Net debt (cash)

–

Short-term and long-term debt less cash and cash equivalents

Return on Capital employed

–

EBIT divided by gross capital employed

28

ENDNOTES (CONTINUED) |

EBIT

and EBIT margin excluding asbestos, ASIC expenses and New Zealand product liability expenses

–

EBIT and

EBIT margin excluding asbestos, ASIC expenses and New Zealand product liability

expenses are not measures of financial performance

under

US

GAAP

and

should

not

be

considered

to

be

more

meaningful

than

EBIT

and

EBIT

margin.

Management has included these financial measures to provide investors with an

alternative method for assessing its operating results in a manner that is

focussed on the performance of its ongoing operations and provides useful

information regarding its financial condition and results of operations. Management

uses these non-US GAAP measures for the same purposes

29

NON-US GAAP FINANCIAL MEASURES

Q1

Q1

US$ Millions

FY 2014

FY 2013

EBIT

$ 156.9

$ 82.5

Asbestos:

Asbestos adjustments

(94.5)

(25.2)

AICF SG&A expenses

0.5

0.3

ASIC expenses

-

0.1

New Zealand product liability expenses

4.6

-

EBIT excluding asbestos, ASIC expenses and

New Zealand product liability expenses

67.5

57.7

Net sales

$ 372.2

$ 339.7

EBIT margin excluding asbestos, ASIC expenses

and New Zealand product liability expenses

18.1%

17.0% |

Net

operating profit excluding asbestos, ASIC expenses, New Zealand product liability expenses and tax

adjustments

–

Net operating profit excluding asbestos, ASIC expenses, New Zealand product

liability expenses and tax adjustments is not a measure of financial

performance under US GAAP and should not be considered to be more meaningful

than net operating profit. Management has included this financial measure to provide investors with an

alternative method for assessing its operating results in a manner that is focussed

on the performance of its ongoing operations. Management uses this

non-US GAAP measure for the same purposes 30

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2014

FY 2013

Net operating profit

$ 142.2

$ 68.5

Asbestos:

Asbestos adjustments

(94.5)

(25.2)

AICF SG&A expenses

0.5

0.3

AICF interest income

(1.1)

(1.1)

ASIC expenses

-

0.1

New Zealand product liability expenses

4.6

-

Asbestos and other tax adjustments

0.3

1.2

Net operating profit excluding asbestos,

ASIC expenses, New Zealand product

Liability expenses and tax adjustments

$ 52.0

$ 43.8 |

Diluted earnings per share excluding asbestos, ASIC expenses, New Zealand product

liability expenses and tax adjustments

–

Diluted earnings per share excluding asbestos, ASIC expenses, New Zealand product

liability expenses and tax adjustments is not a measure of financial

performance under US GAAP and should not be considered to be more meaningful

than diluted earnings per share. Management has included this financial measure to provide investors with an

alternative method for assessing its operating results in a manner that is focussed

on the performance of its ongoing operations. Management uses this

non-US GAAP measure for the same purposes 31

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2014

FY 2013

Net operating profit excluding asbestos, ASIC

expenses, New Zealand product liability expenses

and tax adjustments

$ 52.0

$ 43.8

Weighted average common shares outstanding -

Diluted (millions)

443.1

438.5

Diluted earnings per share excluding asbestos,

ASIC expenses, New Zealand product liability

expenses and tax adjustments (US cents)

11.7

10.0 |

Effective tax rate excluding asbestos, New Zealand product liability expenses and tax

adjustments –

Effective

tax rate on earnings excluding asbestos, New Zealand product liability expenses and

tax adjustments is not a measure of financial performance under US GAAP and

should not be considered to be more meaningful than effective tax rate.

Management has included this financial measure to provide investors with an

alternative method for assessing its operating results in a manner that is

focussed on the performance of its ongoing operations. Management uses this non-

US GAAP measure for the same purposes

32

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2014

FY 2013

Operating profit before income taxes

$ 157.1

$ 83.1

Asbestos:

Asbestos adjustments

(94.5)

(25.2)

AICF SG&A expenses

0.5

0.3

AICF interest income

(1.1)

(1.1)

New Zealand product liability expenses

4.6

-

Operating profit before income taxes excluding asbestos and New

Zealand product liability expenses

$ 66.6

$ 57.1

Income tax expense

(14.9)

(14.6)

Asbestos and other tax adjustments

0.3

1.2

Income tax expense excluding tax adjustments

(14.6)

(13.4)

Effective tax rate

9.5%

17.6%

Effective tax rate excluding asbestos, New Zealand product liability

expenses and tax adjustments

21.9%

23.5% |

Adjusted EBITDA

–

is not a measure of financial performance under US GAAP and should not be

considered an alternative

to,

or

more

meaningful

than,

income

from

operations,

net

income

or

cash

flows

as

defined

by

US

GAAP

or

as

a

measure of profitability or liquidity. Not all companies calculate Adjusted EBITDA

in the same manner as James Hardie has

and,

accordingly,

Adjusted

EBITDA

may

not

be

comparable

with

other

companies.

Management

has

included

information concerning Adjusted EBITDA because it believes that this data is

commonly used by investors to evaluate the ability of a company’s

earnings from its core business operations to satisfy its debt, capital expenditure and working

capital requirements

33

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2014

FY 2013

EBIT

$ 156.9

$ 82.5

Depreciation and amortisation

15.4

15.4

Adjusted EBITDA

$ 172.3

$ 97.9 |

General corporate costs excluding ASIC expenses and intercompany

foreign exchange gain

–

General

corporate

costs

excluding

ASIC

expenses

and

intercompany

foreign

exchange

gain

is

not

a

measure

of

financial

performance under US GAAP and should not be considered to be more meaningful than

general corporate costs. Management has included these financial measures to

provide investors with an alternative method for assessing its operating

results in a manner that is focussed on the performance of its ongoing operations and provides useful

information regarding its financial condition and results of operations. Management

uses these non-US GAAP measures for the same purposes

34

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2013

General corporate costs

$ 6.9

$ 4.4

Excluding:

ASIC expenses

-

(0.1)

Intercompany foreign exchange gain

-

5.5

General corporate costs excluding ASIC

expenses and intercompany foreign

exchange gain

$ 6.9

$ 9.8

FY 2014 |

Selling,

general

and

administrative

expenses

excluding

New

Zealand

product

liability

expenses

–

Selling,

general and administrative expenses excluding New Zealand product liability

expenses is not a measure of financial performance under US GAAP and should

not be considered to be more meaningful than selling, general and

administrative

expenses.

Management

has

included

these

financial

measures

to

provide

investors

with

an

alternative

method for assessing its operating results in a manner that is focussed on the

performance of its ongoing operations and provides useful information

regarding its financial condition and results of operations. Management uses these non-

US GAAP measures for the same purposes

35

NON-US GAAP FINANCIAL MEASURES (CONTINUED)

Q1

Q1

US$ Millions

FY 2013

Selling, general and administrative expenses

$ 54.9

$ 44.3

Excluding:

New Zealand product liability expenses

(4.6)

-

Selling, general and administrative expenses

excluding New Zealand product liability expenses

$ 50.3

$ 44.3

Net Sales

$ 372.2

$ 339.7

Selling, general and administrative expenses as a

percentage of net sales

14.8%

13.0%

Selling, general and administrative expenses

excluding New Zealand product liability expenses as

a percentage of net sales

13.5%

13.0%

FY 2014 |

36

INVESTOR PRESENTATION

OCTOBER 2013 |