|

|

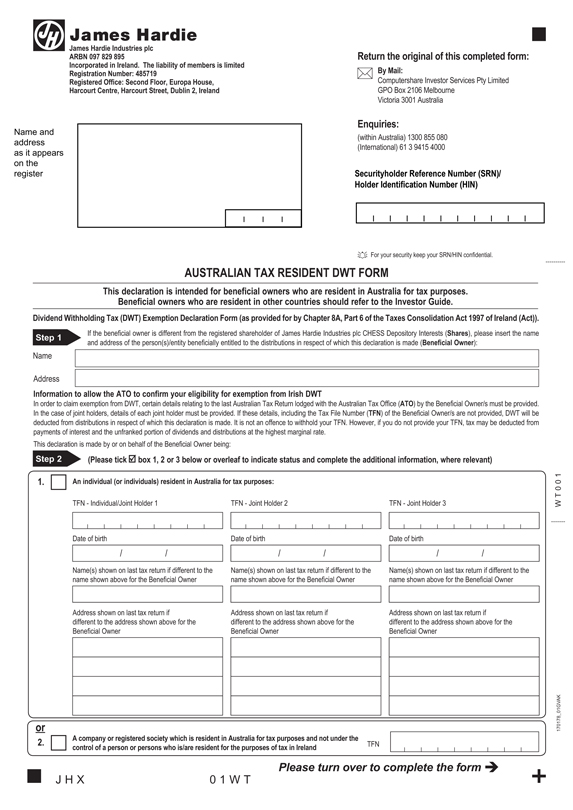

Name and address as it appears on the register

JH James Hardie

James Hardie Industries plc

ARBN 097 829 895

Incorporated in Ireland. The liability of members is limited

Registration Number: 485719

Registered Office: Second Floor, Europa House,

Harcourt Centre, Harcourt Street, Dublin 2, Ireland

Return the original of this completed form:

By Mail:

Computershare Investor Services Pty Limited

GPO Box 2106 Melbourne

Victoria 3001 Australia

Enquiries: (within Australia) 1300 855 080

(International) 61 3 9415 4000

Securityholder Reference Number (SRN)/

Holder Identification Number (HIN)

For your security keep your SRN/HIN confidential.

AUSTRALIAN TAX RESIDENT DWT FORM

This declaration is intended for beneficial owners who are resident in Australia for tax purposes. Beneficial owners who are resident in other countries should refer to the Investor Guide.

Dividend Withholding Tax (DWT) Exemption Declaration Form (as provided for by Chapter 8A, Part 6 of the Taxes Consolidation Act 1997 of Ireland (Act)).

Step 1 If the beneficial owner is different from the registered shareholder of James Hardie Industries plc CHESS Depository Interests (Shares), please insert the name and address of the person(s)/entity beneficially entitled to the distributions in respect of which this declaration is made (Beneficial Owner):

Name

Address

Information to allow the ATO to confirm your eligibility for exemption from Irish DWT

In order to claim exemption from DWT, certain details relating to the last Australian Tax Return lodged with the Australian Tax Office (ATO) by the Beneficial Owner/s must be provided. In the case of joint holders, details of each joint holder must be provided. If these details, including the Tax File Number (TFN) of the Beneficial Owner/s are not provided, DWT will be deducted from distributions in respect of which this declaration is made. It is not an offence to withhold your TFN. However, if you do not provide your TFN, tax may be deducted from payments of interest and the unfranked portion of dividends and distributions at the highest marginal rate.

This declaration is made by or on behalf of the Beneficial Owner being:

Step 2 (Please tick box 1, 2 or 3 below or overleaf to indicate status and complete the additional information, where relevant)

1. An individual (or individuals) resident in Australia for tax purposes:

TFN - Individual/Joint Holder 1

Date of birth / /

Name(s) shown on last tax return if different to the name shown above for the Beneficial Owner

Address shown on last tax return if different to the address shown above for the Beneficial Owner

TFN - Joint Holder 2

Date of birth / /

Name(s) shown on last tax return if different to the name shown above for the Beneficial Owner

Address shown on last tax return if different to the address shown above for the Beneficial Owner

TFN - Joint Holder 3

Date of birth / /

Name(s) shown on last tax return if different to the name shown above for the Beneficial Owner

Address shown on last tax return if different to the address shown above for the Beneficial Owner

or

2. A company or registered society which is resident in Australia for tax purposes and not under the control of a person or persons who is/are resident for the purposes of tax in Ireland

TFN

WT001 170178_01GVAK

Please turn over to complete the form

JHX 01WT

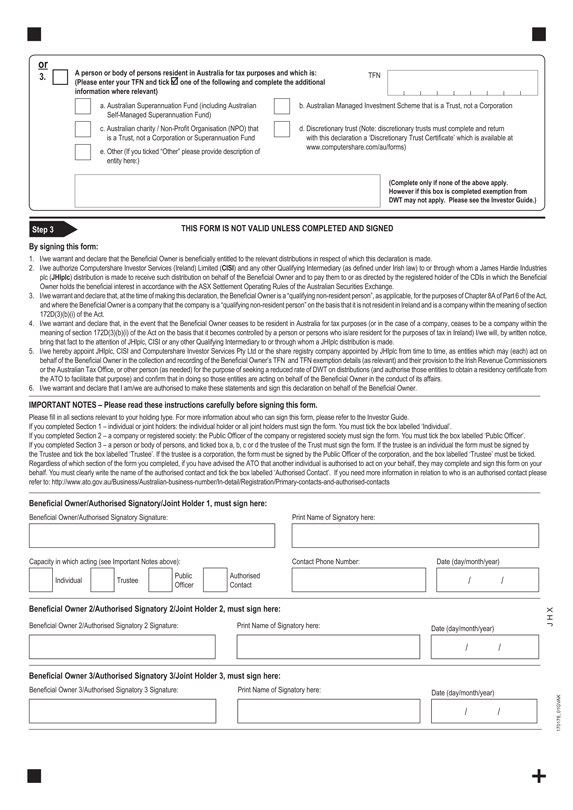

or

3. A person or body of persons resident in Australia for tax purposes and which is:

(Please enter your TFN and tick one of the following and complete the additional information where relevant)

TFN

a. Australian Superannuation Fund (including Australian Self-Managed Superannuation Fund)

b. Australian Managed Investment Scheme that is a Trust, not a Corporation

c. Australian charity / Non-Profit Organisation (NPO) that is a Trust, not a Corporation or Superannuation Fund

d. Discretionary trust (Note: discretionary trusts must complete and return with this declaration a ‘Discretionary Trust Certificate’ which is available at www.computershare.com/au/forms)

e. Other (If you ticked “Other” please provide description of entity here:)

(Complete only if none of the above apply. However if this box is completed exemption from DWT may not apply. Please see the Investor Guide.)

Step 3 THIS FORM IS NOT VALID UNLESS COMPLETED AND SIGNED

By signing this form:

1. I/we warrant and declare that the Beneficial Owner is beneficially entitled to the relevant distributions in respect of which this declaration is made.

2. I/we authorize Computershare Investor Services (Ireland) Limited (CISI) and any other Qualifying Intermediary (as defined under Irish law) to or through whom a James Hardie Industries plc (JHIplc) distribution is made to receive such distribution on behalf of the Beneficial Owner and to pay them to or as directed by the registered holder of the CDIs in which the Beneficial Owner holds the beneficial interest in accordance with the ASX Settlement Operating Rules of the Australian Securities Exchange.

3. I/we warrant and declare that, at the time of making this declaration, the Beneficial Owner is a “qualifying non-resident person”, as applicable, for the purposes of Chapter 8A of Part 6 of the Act, and where the Beneficial Owner is a company that the company is a “qualifying non-resident person” on the basis that it is not resident in Ireland and is a company within the meaning of section 172D(3)(b)(i) of the Act.

4. I/we warrant and declare that, in the event that the Beneficial Owner ceases to be resident in Australia for tax purposes (or in the case of a company, ceases to be a company within the meaning of section 172D(3)(b)(i) of the Act on the basis that it becomes controlled by a person or persons who is/are resident for the purposes of tax in Ireland) I/we will, by written notice, bring that fact to the attention of JHIplc, CISI or any other Qualifying Intermediary to or through whom a JHIplc distribution is made.

5. I/we hereby appoint JHIplc, CISI and Computershare Investor Services Pty Ltd or the share registry company appointed by JHIplc from time to time, as entities which may (each) act on behalf of the Beneficial Owner in the collection and recording of the Beneficial Owner’s TFN and TFN exemption details (as relevant) and their provision to the Irish Revenue Commissioners or the Australian Tax Office, or other person (as needed) for the purpose of seeking a reduced rate of DWT on distributions (and authorise those entities to obtain a residency certificate from the ATO to facilitate that purpose) and confirm that in doing so those entities are acting on behalf of the Beneficial Owner in the conduct of its affairs.

6. I/we warrant and declare that I am/we are authorised to make these statements and sign this declaration on behalf of the Beneficial Owner.

IMPORTANT NOTES – Please read these instructions carefully before signing this form.

Please fill in all sections relevant to your holding type. For more information about who can sign this form, please refer to the Investor Guide.

If you completed Section 1 – individual or joint holders: the individual holder or all joint holders must sign the form. You must tick the box labelled ‘Individual’.

If you completed Section 2 – a company or registered society: the Public Officer of the company or registered society must sign the form. You must tick the box labelled ‘Public Officer’.

If you completed Section 3 – a person or body of persons, and ticked box a, b, c or d the trustee of the Trust must sign the form. If the trustee is an individual the form must be signed by the Trustee and tick the box labelled ‘Trustee’. If the trustee is a corporation, the form must be signed by the Public Officer of the corporation, and the box labelled ‘Trustee’ must be ticked. Regardless of which section of the form you completed, if you have advised the ATO that another individual is authorised to act on your behalf, they may complete and sign this form on your behalf. You must clearly write the name of the authorised contact and tick the box labelled ‘Authorised Contact’. If you need more information in relation to who is an authorised contact please refer to: http://www.ato.gov.au/Business/Australian-business-number/In-detail/Registration/Primary-contacts-and-authorised-contacts

Beneficial Owner/Authorised Signatory/Joint Holder 1, must sign here:

Beneficial Owner/Authorised Signatory Signature:

Print Name of Signatory here:

Capacity in which acting (see Important Notes above):

Individual

Trustee

Public Officer

Authorised Contact

Contact Phone Number:

Date (day/month/year) / /

Beneficial Owner 2/Authorised Signatory 2/Joint Holder 2, must sign here:

Beneficial Owner 2/Authorised Signatory 2 Signature:

Print Name of Signatory here:

Date (day/month/year) / /

Beneficial Owner 3/Authorised Signatory 3/Joint Holder 3, must sign here:

Beneficial Owner 3/Authorised Signatory 3 Signature:

Print Name of Signatory here:

Date (day/month/year) / /

JHX 170178_01GVAK

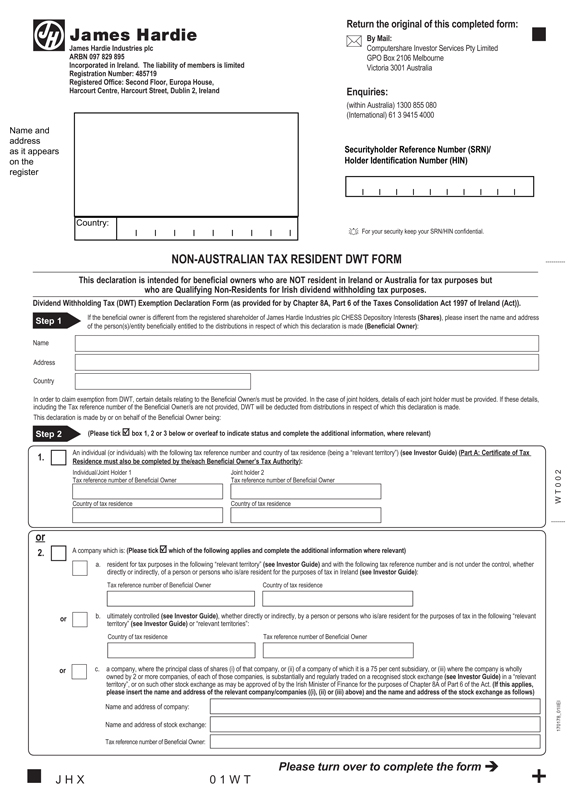

Name and address as it appears on the register

JH JAMES HARDIE

James Hardie Industries plc

ARBN 097 829 895

Incorporated in Ireland. The liability of members is limited

Registration Number: 485719

Registered Office: Second Floor, Europa House,

Harcourt Centre, Harcourt Street, Dublin 2, Ireland

Country:

Return the original of this completed form:

By Mail:

Computershare Investor Services Pty Limited

GPO Box 2106 Melbourne

Victoria 3001 Australia

Enquiries: (within Australia) 1300 855 080

(International) 61 3 9415 4000

Securityholder Reference Number (SRN)/

Holder Identification Number (HIN)

For your security keep your SRN/HIN confidential.

NON-AUSTRALIAN TAX RESIDENT DWT FORM

This declaration is intended for beneficial owners who are NOT resident in Ireland or Australia for tax purposes but who are Qualifying Non-Residents for Irish dividend withholding tax purposes.

Dividend Withholding Tax (DWT) Exemption Declaration Form (as provided for by Chapter 8A, Part 6 of the Taxes Consolidation Act 1997 of Ireland (Act)).

Step 1 If the beneficial owner is different from the registered shareholder of James Hardie Industries plc CHESS Depository Interests (Shares), please insert the name and address of the person(s)/entity beneficially entitled to the distributions in respect of which this declaration is made (Beneficial Owner):

Name

Address

Country

In order to claim exemption from DWT, certain details relating to the Beneficial Owner/s must be provided. In the case of joint holders, details of each joint holder must be provided. If these details, including the Tax reference number of the Beneficial Owner/s are not provided, DWT will be deducted from distributions in respect of which this declaration is made.

This declaration is made by or on behalf of the Beneficial Owner being:

Step 2 (Please tick box 1, 2 or 3 below or overleaf to indicate status and complete the additional information, where relevant)

1. An individual (or individuals) with the following tax reference number and country of tax residence (being a “relevant territory”) (see Investor Guide) (Part A: Certificate of Tax Residence must also be completed by the/each Beneficial Owner’s Tax Authority):

Individual/Joint Holder 1

Tax reference number of Beneficial Owner

Joint holder 2

Tax reference number of Beneficial Owner

Country of tax residence

Country of tax residence

or

2. A company which is: (Please tick which of the following applies and complete the additional information where relevant)

a. resident for tax purposes in the following “relevant territory” (see Investor Guide) and with the following tax reference number and is not under the control, whether directly or indirectly, of a person or persons who is/are resident for the purposes of tax in Ireland (see Investor Guide):

Tax reference number of Beneficial Owner

Country of tax residence

or b. ultimately controlled (see Investor Guide), whether directly or indirectly, by a person or persons who is/are resident for the purposes of tax in the following “relevant territory” (see Investor Guide) or “relevant territories”:

Country of tax residence

Tax reference number of Beneficial Owner

or c. a company, where the principal class of shares (i) of that company, or (ii) of a company of which it is a 75 per cent subsidiary, or (iii) where the company is wholly owned by 2 or more companies, of each of those companies, is substantially and regularly traded on a recognised stock exchange (see Investor Guide) in a “relevant territory”, or on such other stock exchange as may be approved of by the Irish Minister of Finance for the purposes of Chapter 8A of Part 6 of the Act. (If this applies, please insert the name and address of the relevant company/companies ((i), (ii) or (iii) above) and the name and address of the stock exchange as follows)

Name and address of company:

Name and address of stock exchange:

Tax reference number of Beneficial Owner:

WT002 170178_01IIEI

Please turn over to complete the form

JHX 01WT

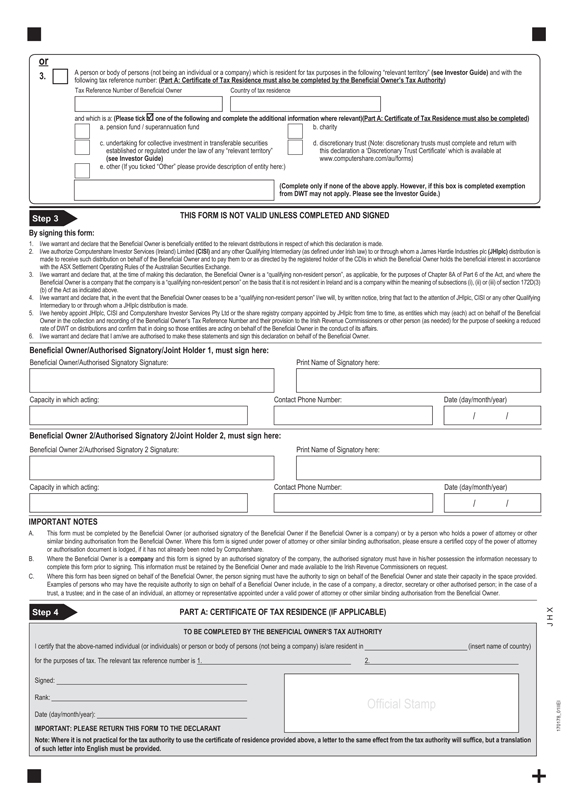

or

3. A person or body of persons (not being an individual or a company) which is resident for tax purposes in the following “relevant territory” (see Investor Guide) and with the following tax reference number: (Part A: Certificate of Tax Residence must also be completed by the Beneficial Owner’s Tax Authority)

Tax Reference Number of Beneficial Owner

Country of tax residence

and which is a: (Please tick one of the following and complete the additional information where relevant)(Part A: Certificate of Tax Residence must also be completed)

a. pension fund / superannuation fund

b. charity

c. undertaking for collective investment in transferable securities established or regulated under the law of any “relevant territory” (see Investor Guide)

d. discretionary trust (Note: discretionary trusts must complete and return with this declaration a ‘Discretionary Trust Certificate’ which is available at www.computershare.com/au/forms)

e. other (If you ticked “Other” please provide description of entity here:)

(Complete only if none of the above apply. However, if this box is completed exemption from DWT may not apply. Please see the Investor Guide.)

THIS FORM IS NOT VALID UNLESS COMPLETED AND SIGNED

Step 3

By signing this form:

1. I/we warrant and declare that the Beneficial Owner is beneficially entitled to the relevant distributions in respect of which this declaration is made.

2. I/we authorize Computershare Investor Services (Ireland) Limited (CISI) and any other Qualifying Intermediary (as defined under Irish law) to or through whom a James Hardie Industries plc (JHIplc) distribution is made to receive such distribution on behalf of the Beneficial Owner and to pay them to or as directed by the registered holder of the CDIs in which the Beneficial Owner holds the beneficial interest in accordance with the ASX Settlement Operating Rules of the Australian Securities Exchange.

3. I/we warrant and declare that, at the time of making this declaration, the Beneficial Owner is a “qualifying non-resident person”, as applicable, for the purposes of Chapter 8A of Part 6 of the Act, and where the Beneficial Owner is a company that the company is a “qualifying non-resident person” on the basis that it is not resident in Ireland and is a company within the meaning of subsections (i), (ii) or (iii) of section 172D(3) (b) of the Act as indicated above.

4. I/we warrant and declare that, in the event that the Beneficial Owner ceases to be a “qualifying non-resident person” I/we will, by written notice, bring that fact to the attention of JHIplc, CISI or any other Qualifying Intermediary to or through whom a JHIplc distribution is made.

5. I/we hereby appoint JHIplc, CISI and Computershare Investor Services Pty Ltd or the share registry company appointed by JHIplc from time to time, as entities which may (each) act on behalf of the Beneficial Owner in the collection and recording of the Beneficial Owner’s Tax Reference Number and their provision to the Irish Revenue Commissioners or other person (as needed) for the purpose of seeking a reduced rate of DWT on distributions and confirm that in doing so those entities are acting on behalf of the Beneficial Owner in the conduct of its affairs.

6. I/we warrant and declare that I am/we are authorised to make these statements and sign this declaration on behalf of the Beneficial Owner.

Beneficial Owner/Authorised Signatory/Joint Holder 1, must sign here:

Beneficial Owner/Authorised Signatory Signature:

Print Name of Signatory here:

Capacity in which acting:

Contact Phone Number:

Date (day/month/year) / /

Beneficial Owner 2/Authorised Signatory 2/Joint Holder 2, must sign here:

Beneficial Owner 2/Authorised Signatory 2 Signature:

Print Name of Signatory here:

Capacity in which acting:

Contact Phone Number:

Date (day/month/year) / /

IMPORTANT NOTES

A. This form must be completed by the Beneficial Owner (or authorised signatory of the Beneficial Owner if the Beneficial Owner is a company) or by a person who holds a power of attorney or other similar binding authorisation from the Beneficial Owner. Where this form is signed under power of attorney or other similar binding authorisation, please ensure a certified copy of the power of attorney or authorisation document is lodged, if it has not already been noted by Computershare.

B. Where the Beneficial Owner is a company and this form is signed by an authorised signatory of the company, the authorised signatory must have in his/her possession the information necessary to complete this form prior to signing. This information must be retained by the Beneficial Owner and made available to the Irish Revenue Commissioners on request.

C. Where this form has been signed on behalf of the Beneficial Owner, the person signing must have the authority to sign on behalf of the Beneficial Owner and state their capacity in the space provided. Examples of persons who may have the requisite authority to sign on behalf of a Beneficial Owner include, in the case of a company, a director, secretary or other authorised person; in the case of a trust, a trustee; and in the case of an individual, an attorney or representative appointed under a valid power of attorney or other similar binding authorisation from the Beneficial Owner.

Step 4 PART A: CERTIFICATE OF TAX RESIDENCE (IF APPLICABLE)

TO BE COMPLETED BY THE BENEFICIAL OWNER’S TAX AUTHORITY

I certify that the above-named individual (or individuals) or person or body of persons (not being a company) is/are resident in (insert name of country) for the purposes of tax. The relevant tax reference number is 1. 2.

Signed:

Rank: Official Stamp

Date (day/month/year):

IMPORTANT: PLEASE RETURN THIS FORM TO THE DECLARANT

Note: Where it is not practical for the tax authority to use the certificate of residence provided above, a letter to the same effect from the tax authority will suffice, but a translation of such letter into English must be provided.

JHX 170178_01IIEI