James

Hardie Australia Investor Presentation

July 2014

Exhibit 99.1 |

James

Hardie Australia Investor Presentation

July 2014

Exhibit 99.1 |

Disclaimer:

This management presentation contains forward-looking statements. James Hardie

may from time to time make forward-looking statements in its periodic reports filed

with

or

furnished

to

the

SEC,

on

Forms

20-F

and

6-K,

in

its

annual

reports

to

shareholders,

in

offering

circulars,

invitation

memoranda

and

prospectuses,

in

media

releases

and

other

written

materials

and

in

oral

statements

made

by

the

company’s

officers,

directors

or

employees

to

analysts,

institutional

investors,

existing

and

potential lenders, representatives of the media and others. Statements that are not

historical facts are forward-looking statements and such forward-looking statements

are statements made pursuant to the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Examples of forward-looking

statements include: •

statements

about

the

company’s

future

performance;

•

projections

of

the

company’s

results

of

operations

or

financial

condition;

•

statements

regarding

the

company’s

plans,

objectives

or

goals,

including

those

relating

to

strategies,

initiatives,

competition,

acquisitions,

dispositions

and/or

its

products;

•

expectations

concerning

the

costs

associated

with

the

suspension

or

closure

of

operations

at

any

of

the

company’s

plants

and

future

plans

with

respect

to

any

such plants;

•

expectations

concerning

the

costs

associated

with

the

significant

capital

expenditure

projects

at

any

of

the

company’s

plants

and

future

plans

with

respect

to

any

such projects;

•

expectations regarding the extension or renewal of the company’s credit

facilities including changes to terms, covenants or ratios; •

expectations concerning dividend payments and share buy-backs;

•

statements concerning the company’s corporate and tax domiciles and structures

and potential changes to them, including potential tax charges; •

statements regarding tax liabilities and related audits, reviews

and proceedings;

•

statements regarding the possible consequences and/or potential outcome of the

legal proceedings brought against two of the company’s subsidiaries by the

New Zealand Ministry of Education and the potential product liabilities, if any,

associated with such proceedings; •

expectations about the timing and amount of contributions to Asbestos Injuries

Compensation Fund (AICF), a special purpose fund for the compensation of

proven Australian asbestos-related personal injury and death claims;

•

expectations concerning indemnification obligations;

•

expectations concerning the adequacy of the company’s warranty provisions and

estimates for future warranty-related costs; •

statements regarding the company’s ability to manage legal and regulatory

matters (including but not limited to product liability, environmental, intellectual

property and competition law matters) and to resolve any such pending legal and

regulatory matters within current estimates and in anticipation of certain third-

party recoveries; and

•

statements

about

economic

conditions,

such

as

changes

in

the

US

economic

or

housing

recovery

or

changes

in

the

market

conditions

in

the

Asia

Pacific

region,

the

levels

of

new

home

construction

and

home

renovations,

unemployment

levels,

changes

in

consumer

income,

changes

or

stability

in

housing

values,

the

availability

of

mortgages

and

other

financing,

mortgage

and

other

interest

rates,

housing

affordability

and

supply,

the

levels

of

foreclosures

and

home

resales,

currency

exchange

rates,

and

builder

and

consumer

confidence. |

Disclaimer (continued):

Words such as “believe,”

“anticipate,”

“plan,”

“expect,”

“intend,”

“target,”

“estimate,”

“project,”

“predict,”

“forecast,”

“guideline,”

“aim,”

“will,”

“should,”

“likely,”

“continue,”

“may,”

“objective,”

“outlook”

and similar expressions are intended to identify forward-looking statements

but are not the exclusive means of identifying such statements. Readers are

cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by

reference to the following cautionary statements.

Forward-looking statements are based on the company’s current

expectations, estimates and assumptions and because forward-looking statements address future

results, events and conditions, they, by their very nature, involve inherent risks

and uncertainties, many of which are unforeseeable and beyond the company’s control.

Such known and unknown risks, uncertainties and other factors may cause actual

results, performance or other achievements to differ materially from the anticipated

results, performance or achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are discussed under “Risk

Factors”

in Section 3 of the Form 20-F filed with the Securities and Exchange Commission

on 26 June 2014, include, but are not limited to: all matters relating to or

arising out of the prior manufacture of products that contained asbestos by current

and former James Hardie subsidiaries; required contributions to AICF, any shortfall

in AICF and the effect of currency exchange rate movements on the amount recorded

in the company’s financial statements as an asbestos liability; governmental loan

facility to AICF; compliance with and changes in tax laws and treatments;

competition and product pricing in the markets in which the company operates; the

consequences of product failures or defects; exposure to environmental, asbestos,

putative consumer class action or other legal proceedings; general economic and

market conditions; the supply and cost of raw materials; possible increases in

competition and the potential that competitors could copy the company’s products;

reliance

on

a

small

number

of

customers;

a

customer’s

inability

to

pay;

compliance

with

and

changes

in

environmental

and

health

and

safety

laws;

risks

of

conducting

business internationally; compliance with and changes in laws and regulations; the

effect of the transfer of the company’s corporate domicile from The Netherlands to

Ireland, including changes in corporate governance and any potential tax benefits

related thereto; currency exchange risks; dependence on customer preference and

the concentration of the company’s customer base on large format retail

customers, distributors and dealers; dependence on residential and commercial construction

markets; the effect of adverse changes in climate or weather patterns; possible

inability to renew credit facilities on terms favourable to the company, or at all;

acquisition

or

sale

of

businesses

and

business

segments;

changes

in

the

company’s

key

management

personnel;

inherent

limitations

on

internal

controls;

use

of

accounting estimates; and all other risks identified in the company’s reports

filed with Australian, Irish and US securities agencies and exchanges (as appropriate). The

company cautions you that the foregoing list of factors is not exhaustive and that

other risks and uncertainties may cause actual results to differ materially from those

referenced in the company’s forward-looking statements.

Forward-looking statements speak only as of the date they are made and are statements of the company’s

current expectations concerning future results, events and conditions. The company

assumes no obligation to update any forward-looking statements or information

except as required by law. |

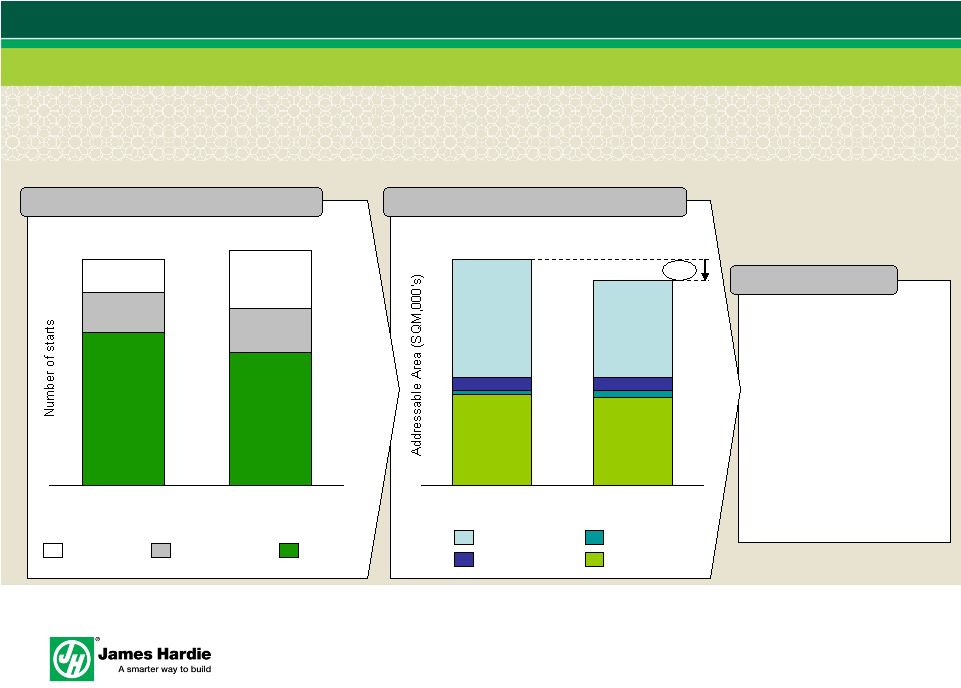

Market continues to shift towards density

119,000

102,929

30,240

34,315

25,670

44,665

2013/14f

181,909

2003/04

174,910

Detached

High density

Medium density

A change in construction starts…

Impacts addressable external wall area

Insights

•

Over the past 10 years,

detached housing starts have

decreased by ~ 15% whereas

medium and high density have

increased by ~ 40%

•

This trend towards higher

density building is impacting

the external addressable wall

area

-9%

A&A

Detached

Medium Density

High Density

•

The external addressable wall

area has decreased by ~9%

Source: ABS, HIA

Source: Abraham Akra –

JH Market Analyst |

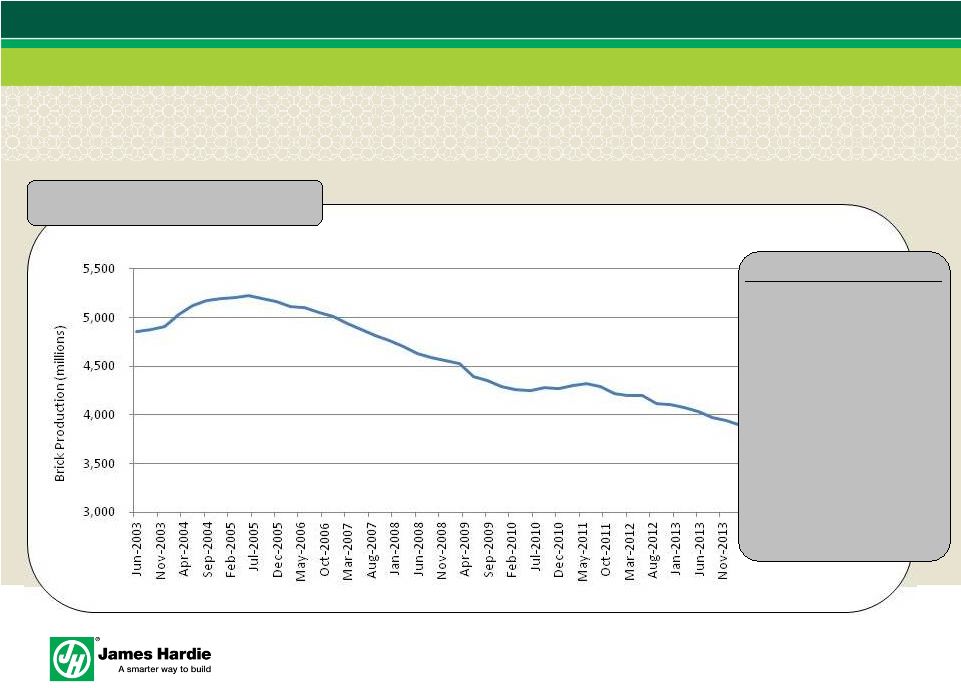

Decline of brick

Brick production: 10 year trend

•

Brick production is down

approximately 25% over

the past decade due to:

-

Shift away from

detached dwellings to

density

-

Converting builders

from double brick to

frame construction

-

Growth of monolithic

and other looks

Insights

Source: ABS |

Several elements are impacting market dynamics

Market demographics

First time home buyers

Density shift

•

Population fragmenting

-

baby boomers

downsizing

-

Non traditional

families now the

norm, different

requirements

-

Land cost and

availability mean

developers looking

to maximize yield

•

Low interest rates

driving increased

investor activity –

local

and overseas

•

Credit still relatively

tight for low income

earners

•

Will increase to above

50% in the next few

years in large metro

centers

•

Shift away from single

detached housing to

medium & high density

•

Medium to high

density currently sitting

at 43% of all starts

•

Increase toward inner

city living

Competitive intensity increasing

i.e. More players, less to go

after…

•

First time home buyers

are at an all time low

•

Relative cost of house

and land increasing |

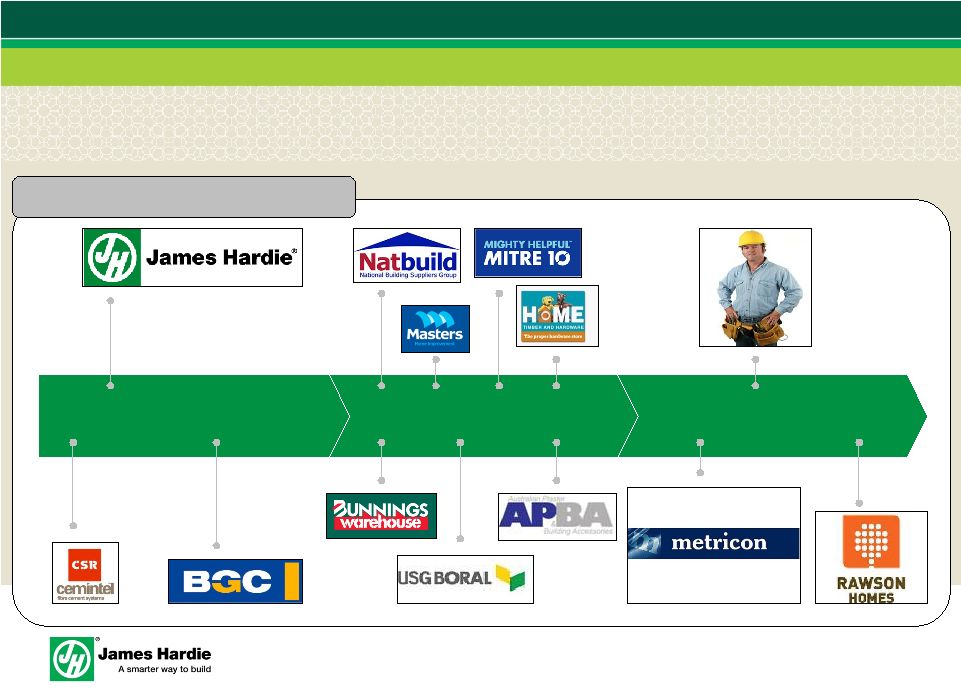

Key

elements of the Australian fibre cement market End user segments

Channel

Suppliers & major

players

Australian Fibre Cement Market |

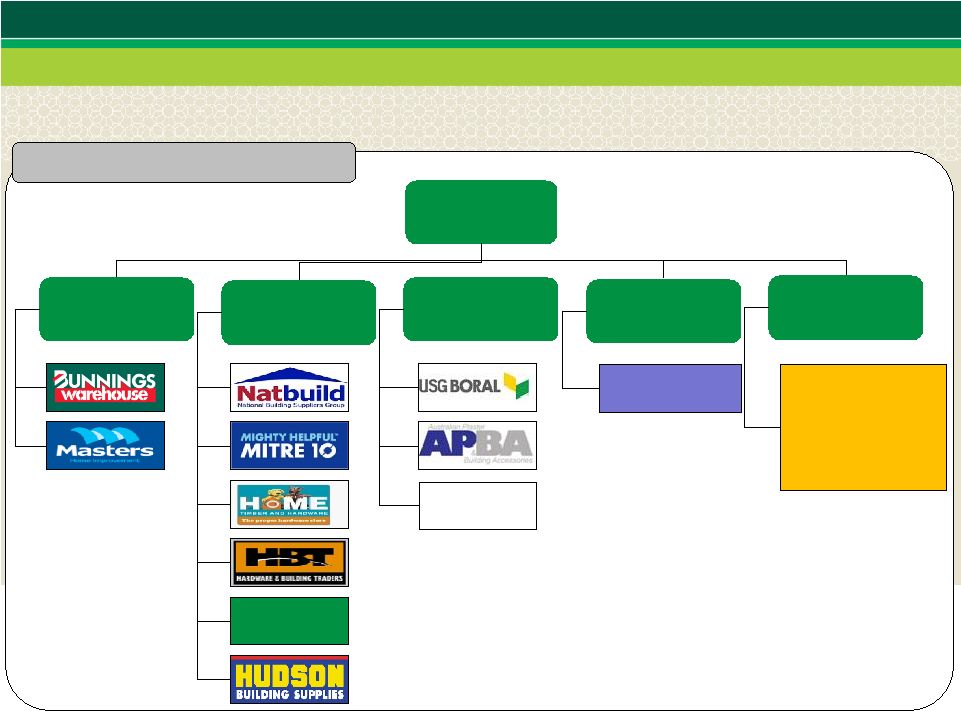

JH

Channel FY14

Australian Fibre Cement Market –

JH Channel

Building

Supplies

Independents

AILD

Internal linings

Commercial and

2 step players

Commercial &

2 Stepper

-

EXPORT

-

Frame & Truss

-

Plumbing

-

Manuf Housing

-

Walling Systems

-

Fencing Contract

Other

Big Box

Key players of the JH Channel |

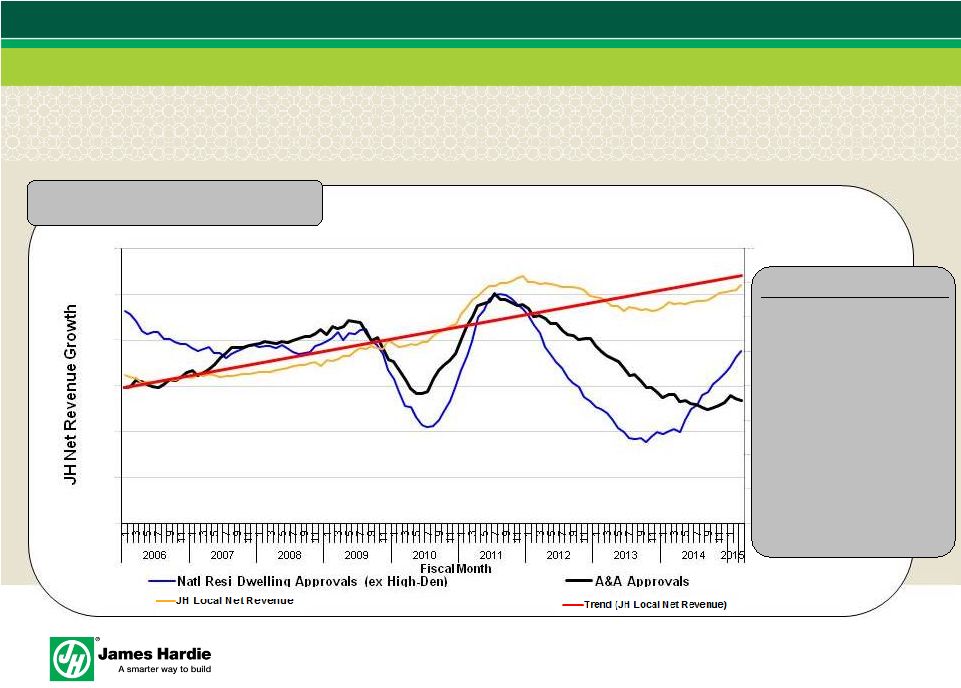

JH

Top Line Growth Top line growth

•

The upswing in new

construction has driven JH

sales in FY14 and FY15

Insights

•

House price improvements

along the east coast is

expected to lift A&A

activity and JH revenue in

FY16 and FY17

•

JH has enjoyed steady

revenue growth over the

last 8 years

Source: ABS |

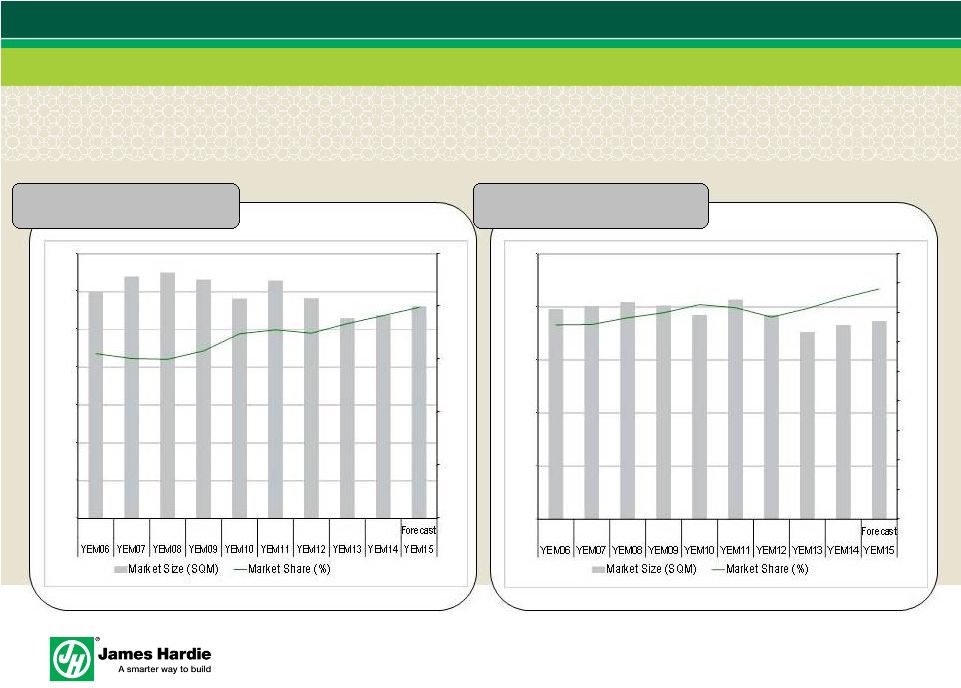

Addressable JH Market Share

External cladding

Wet Area Internal Linings

Source: Abraham Akra –

JH Market Analyst |

Australian growth model

Australian growth model

•

Our model for growth is unique and sustainable,

but investment intensive

-

Large market opportunity

•

Our model differs greatly from other

manufacturers or importers

-

Superior value proposition

-

Proprietary and/or protected technology

-

Ongoing commitment to research and

development

-

Significant organisational advantages

-

Focused strategy and organisational effort

-

Scale |

Australian primary demand model

•

Increase fibre cement penetration by creating

“Smarter Way to Build”

solutions

•

Accelerate uptake of lightweight / composite

construction

•

Engage with developers, designers, architects,

builders and industry associations

•

Leverage the unique JH Eco-System to

accelerate industry change in design and

construction and create new selling opportunities

for our aligned partners

Australian primary demand model |

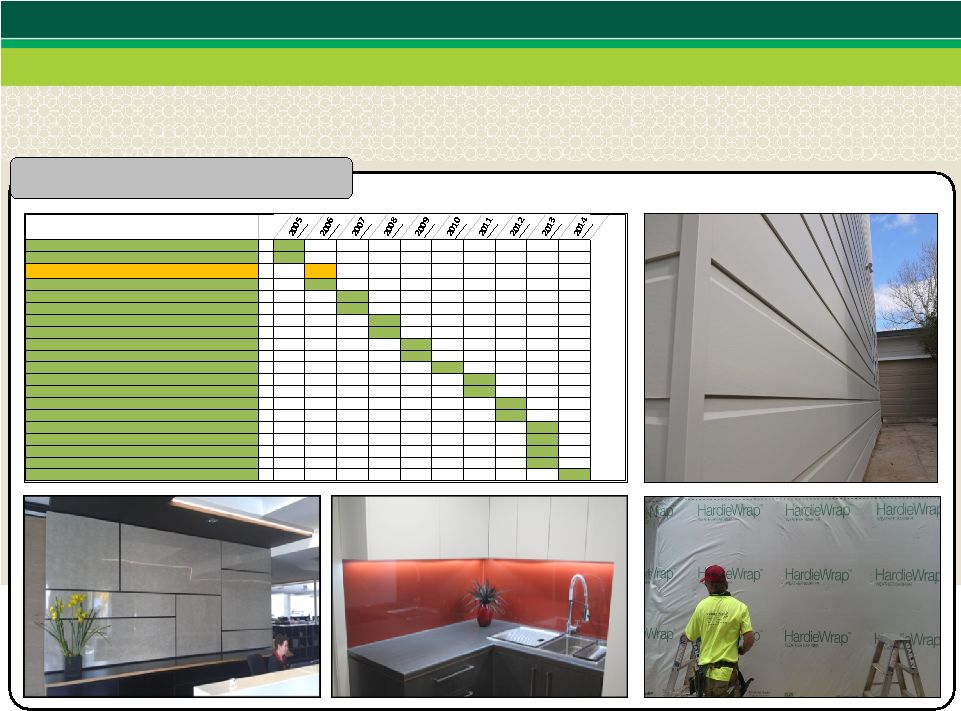

Driving Product Leadership

Aust Product Launch recent History

Linea

Aquatec

Scyon ™

Axon

Stria

Matrix

Axent Trim

Secura (Exterior)

Secura (Interior)

EasyLap

express PVC Joiners

Axon 400

Stria Wide

Hardiebreak

Al Z Flashing

ARChitectural Invibe & Inraw

Axon Grained

Stria Splayed

Secura 22mm & 18*9

Hardiewrap

InRaw

Splayed

HardieWrap

InVibe

Recent products launched |

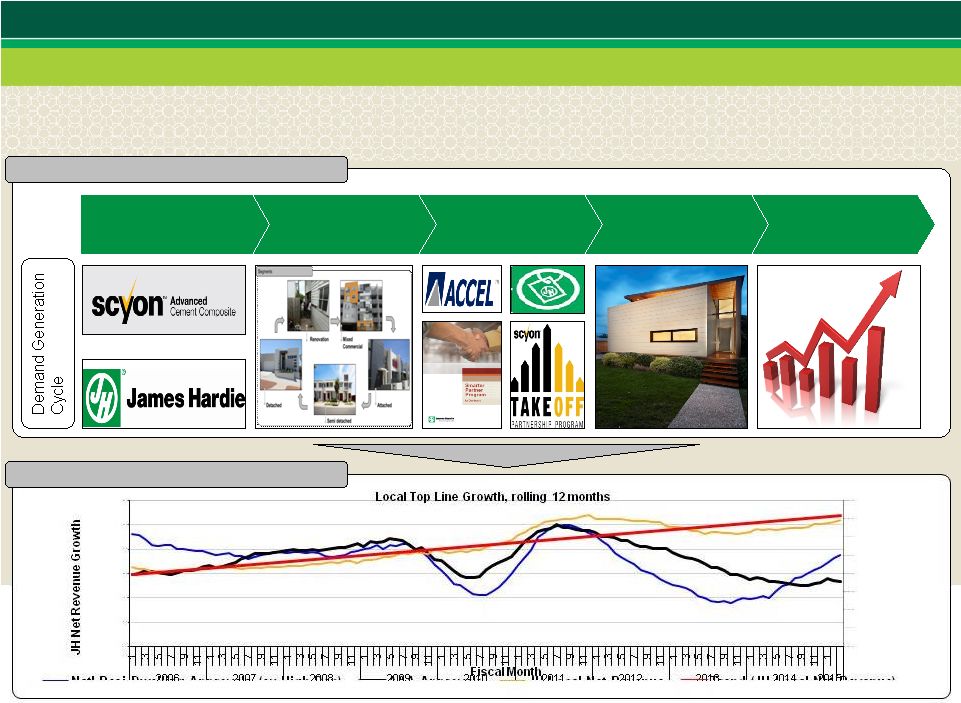

James Hardie go to market

Generating Demand

Sustainable

growth

Increased OTW¹

coverage

Growth focused

tools

Targeting the right

segments

Differentiated

products and

systems

1.

OTW –

On The Wall

The results |

Renovation

Mixed

Commercial

Attached

Medium density

Detached

Targeted market segments

Segments |

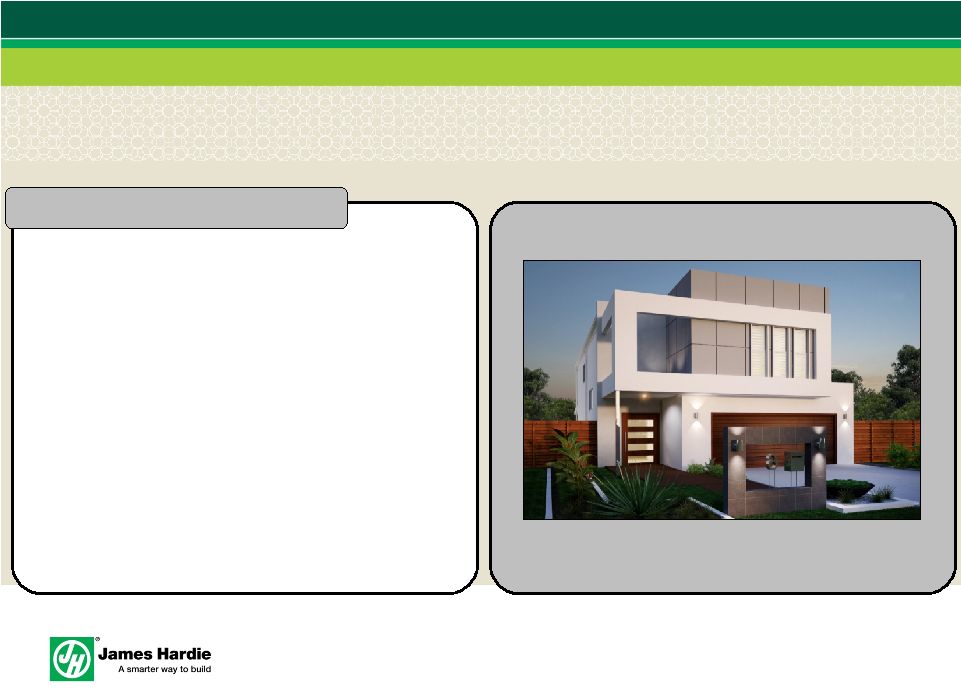

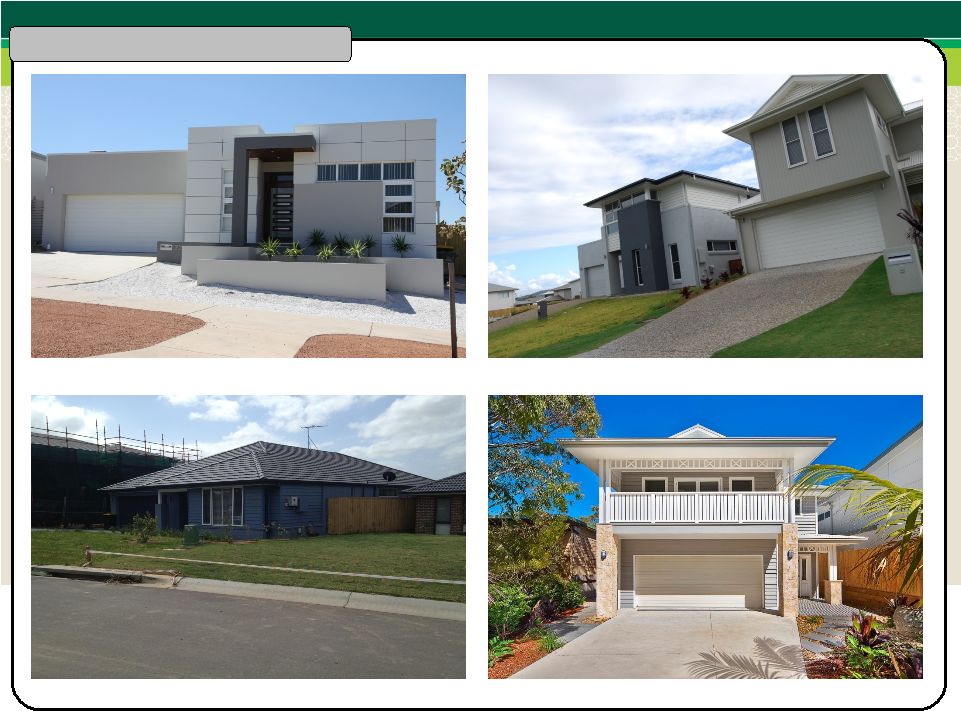

Detached homes |

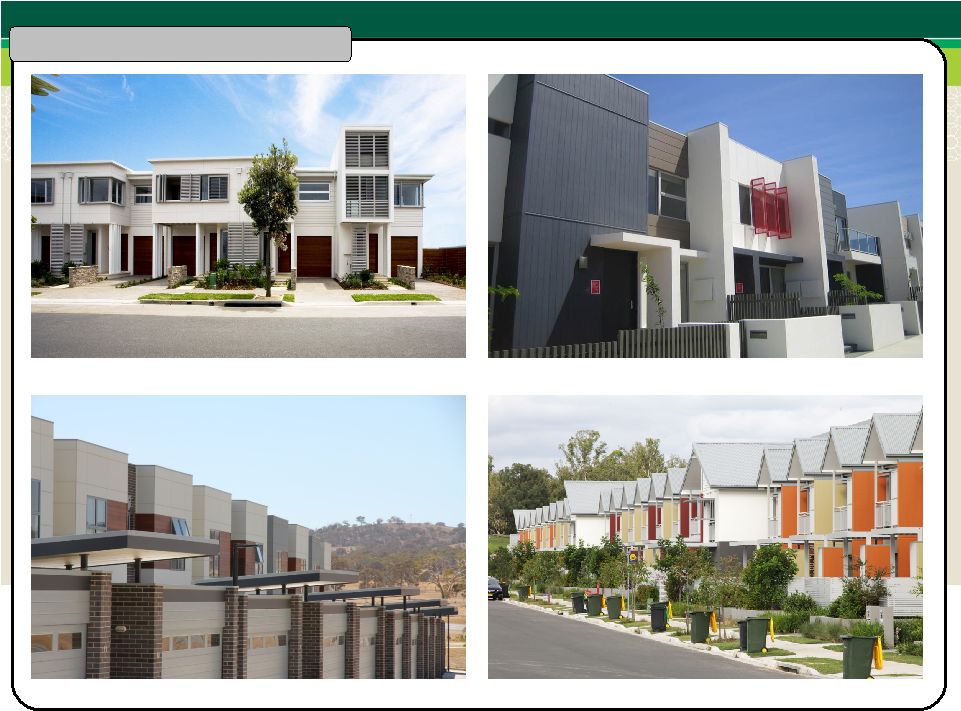

Compact detached and semi detached housing |

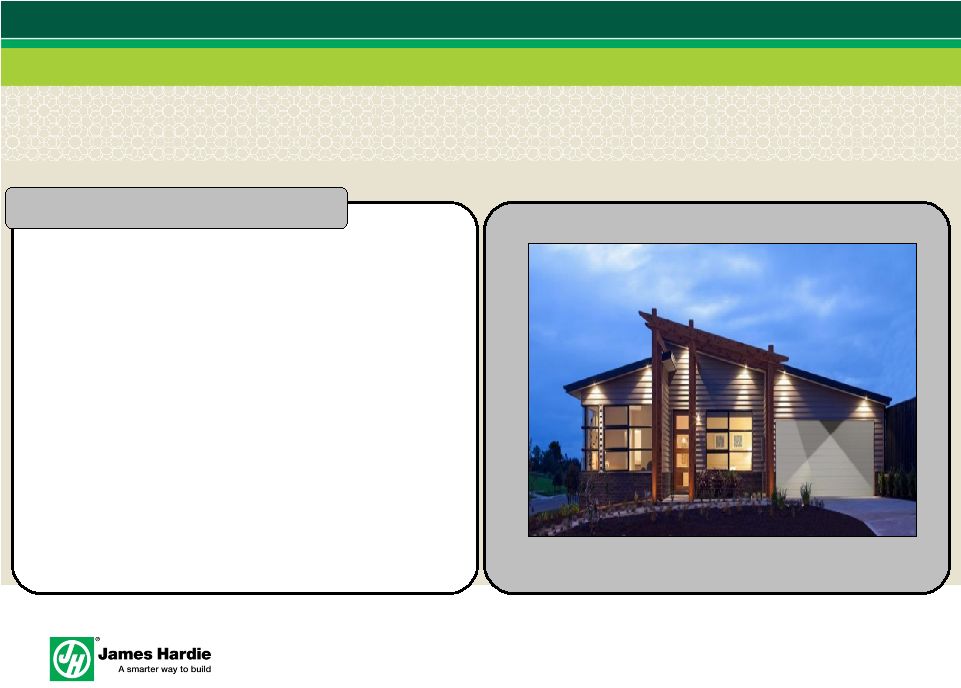

Medium density |

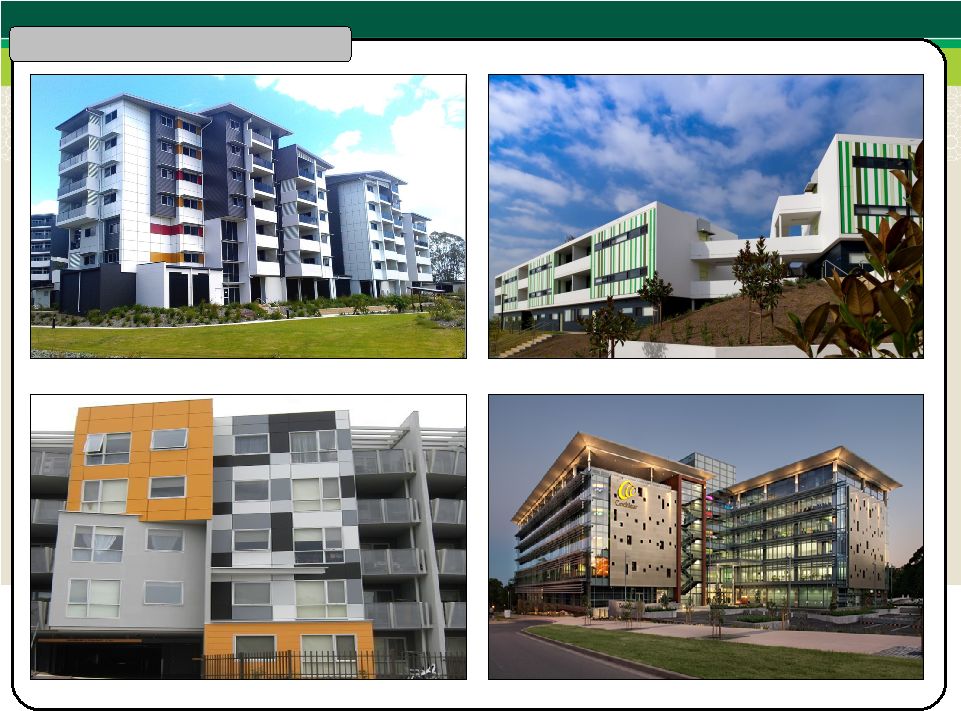

Mixed commercial |

Renovation |