EXTERNAL ENVIRONMENT

Matthew Marsh

24 September 2014

Exhibit 99.1 |

EXTERNAL ENVIRONMENT

Matthew Marsh

24 September 2014

Exhibit 99.1 |

DISCLAIMER

2

This Management Presentation contains forward-looking statements. James Hardie may from time to

time make forward-looking statements in its periodic reports filed with or furnished to the

SEC, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and

other written materials and in oral statements made by the company’s officers, directors or

employees to analysts, institutional investors, existing and potential lenders, representatives

of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made

pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: •

statements about the company’s future performance; •

projections of the company’s results of operations or financial condition; •

statements regarding the company’s plans, objectives or goals, including those relating to

strategies, initiatives, competition, acquisitions, dispositions and/or its products; •

expectations concerning the costs associated with the suspension or closure of operations at any of

the company’s plants and future plans with respect to any such plants; •

expectations concerning the costs associated with the significant capital expenditure projects at any

of the company’s plants and future plans with respect to any such projects; •

expectations regarding the extension or renewal of the company’s credit facilities including

changes to terms, covenants or ratios;

•

expectations concerning dividend payments and share buy-backs; •

statements concerning the company’s corporate and tax domiciles and structures and potential

changes to them, including potential tax charges;

•

statements regarding tax liabilities and related audits, reviews and proceedings; •

statements regarding the possible consequences and/or potential outcome of the legal proceedings

brought against two of the company’s subsidiaries by the New Zealand Ministry of Education

and the potential product liabilities, if any, associated with such proceedings;

•

expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund

(AICF), a special purpose fund for the compensation of proven Australian asbestos-related

personal injury and death claims;

•

expectations concerning indemnification obligations; •

expectations concerning the adequacy of the company’s warranty provisions and estimates for

future warranty-related costs;

•

statements regarding the company’s ability to manage legal and regulatory matters (including but

not limited to product liability, environmental, intellectual property and competition law

matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain

third-party recoveries; and

•

statements about economic conditions, such as changes in the US economic or housing recovery or

changes in the market conditions in the Asia Pacific region, the levels of new home

construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing

values, the availability of mortgages and other financing, mortgage and other interest rates, housing

affordability and supply, the levels of foreclosures and home resales, currency exchange rates,

and builder and consumer confidence. |

3

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,”

“may,” “objective,” “outlook” and similar expressions are intended

to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers

are cautioned not to place undue reliance on these forward-looking statements and all such

forward-looking statements are qualified in their entirety by reference to the following

cautionary statements.

Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and

conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control. Such known

and unknown risks, uncertainties and other factors may cause actual results, performance or other

achievements to differ materially from the anticipated results, performance or achievements

expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in

Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 26 June 2014,

include, but are not limited to: all matters relating to or arising out of the prior

manufacture of products that contained asbestos by current and former James Hardie subsidiaries; required contributions to AICF, any shortfall in AICF and the effect

of currency exchange rate movements on the amount recorded in the company’s financial statements

as an asbestos liability; governmental loan facility to AICF; compliance with and changes in tax

laws and treatments; competition and product pricing in the markets in which the company operates; the consequences of product failures or

defects; exposure to environmental, asbestos, putative consumer class action or other legal

proceedings; general economic and market conditions; the supply and cost of raw materials;

possible increases in competition and the potential that competitors could copy the company’s products; reliance on a small number of customers; a

customer’s inability to pay; compliance with and changes in environmental and health and safety

laws; risks of conducting business internationally; compliance with and changes in laws and

regulations; the effect of the transfer of the company’s corporate domicile from The Netherlands to Ireland, including changes in corporate governance

and any potential tax benefits related thereto; currency exchange risks; dependence on customer

preference and the concentration of the company’s customer base on large format retail

customers, distributors and dealers; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather

patterns; possible inability to renew credit facilities on terms favourable to the company, or at all;

acquisition or sale of businesses and business segments; changes in the company’s key

management personnel; inherent limitations on internal controls; use of accounting estimates; and all other risks identified in the company’s reports filed with

Australian, Irish and US securities agencies and exchanges (as appropriate). The company cautions you

that the foregoing list of factors is not exhaustive and that other risks and uncertainties may

cause actual results to differ materially from those referenced in the company’s forward-looking statements. Forward-looking statements speak

only as of the date they are made and are statements of the company’s current expectations

concerning future results, events and conditions. The company assumes no obligation to update

any forward-looking statements or information except as required by law. |

AGENDA

•

U.S. Economic Indicators

•

Housing Market Overview

•

Market Opportunity for James Hardie

4 |

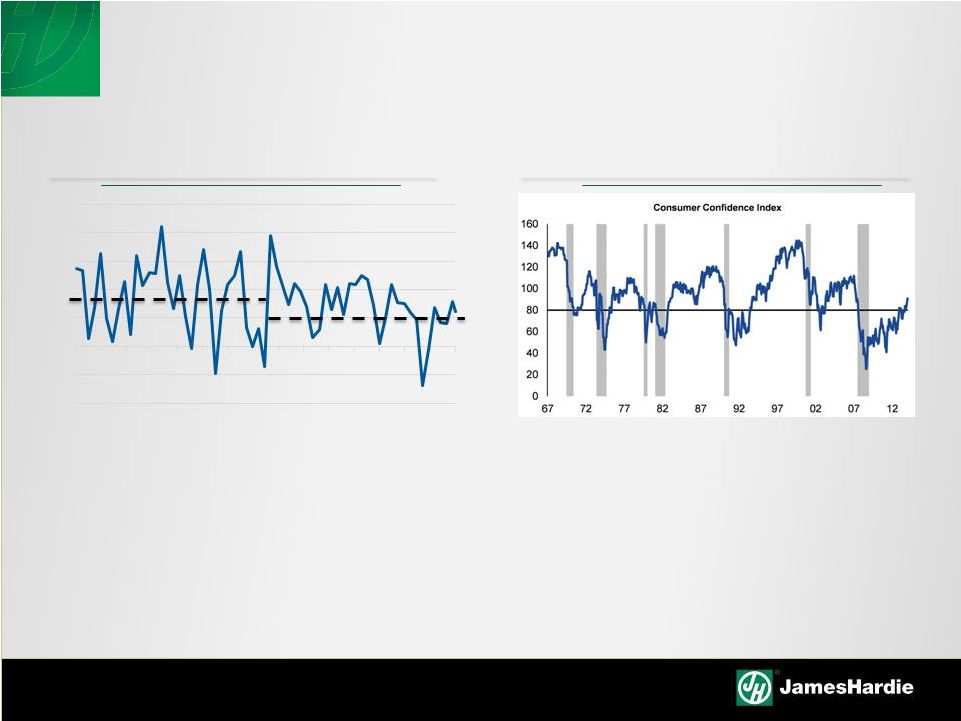

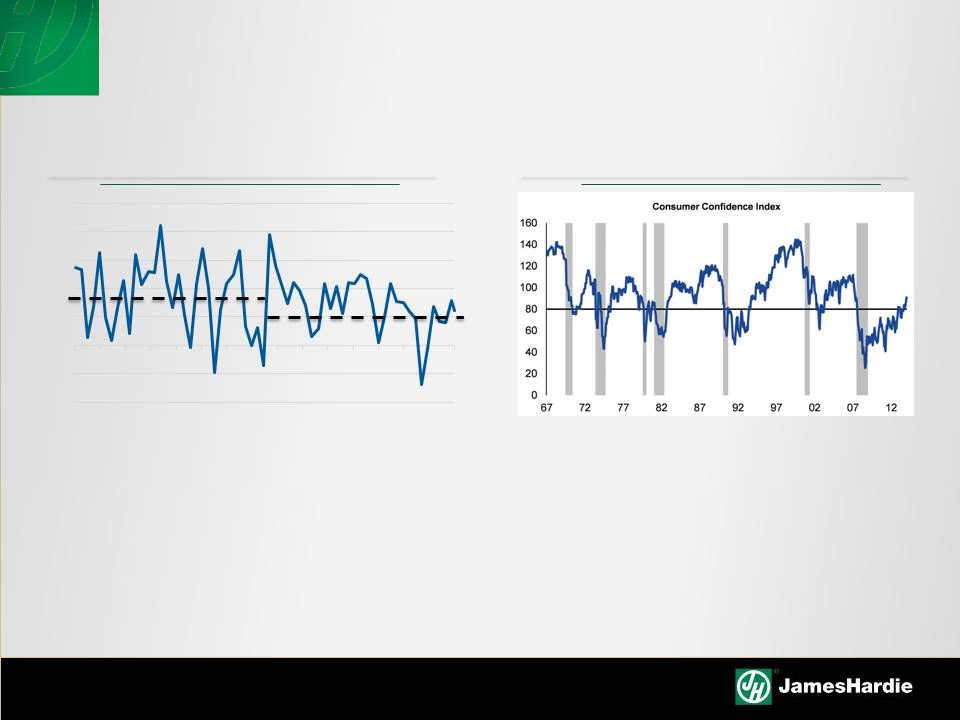

U.S.

ECONOMIC INDICTORS IMPROVING 5 |

GDP AND

CONSUMER CONFIDENCE Source: Conference Board, Morgan Stanley Research.

Note: Gray shading denotes period of recession as determined by the

NBER Source: Bureau of Economic Analysis, Morgan Stanley Research.

Note:

Gray

shading

denotes

periods

of

recession

as

determined

by

the

NBER

•

U.S. in recovery from global financial crisis …

GDP growing albeit at modest levels

•

After plummeting to a historic low of 25.3 in February 2009, consumer confidence

surpassed 80 in March 2014. A level around 80 has been the average

measure of confidence during past recoveries

U.S. GDP

Consumer Confidence

6

-4%

-2%

0%

2%

4%

6%

8%

10%

51

56

60

64

68

72

76

81

85

89

93

97

01

06

10

14 |

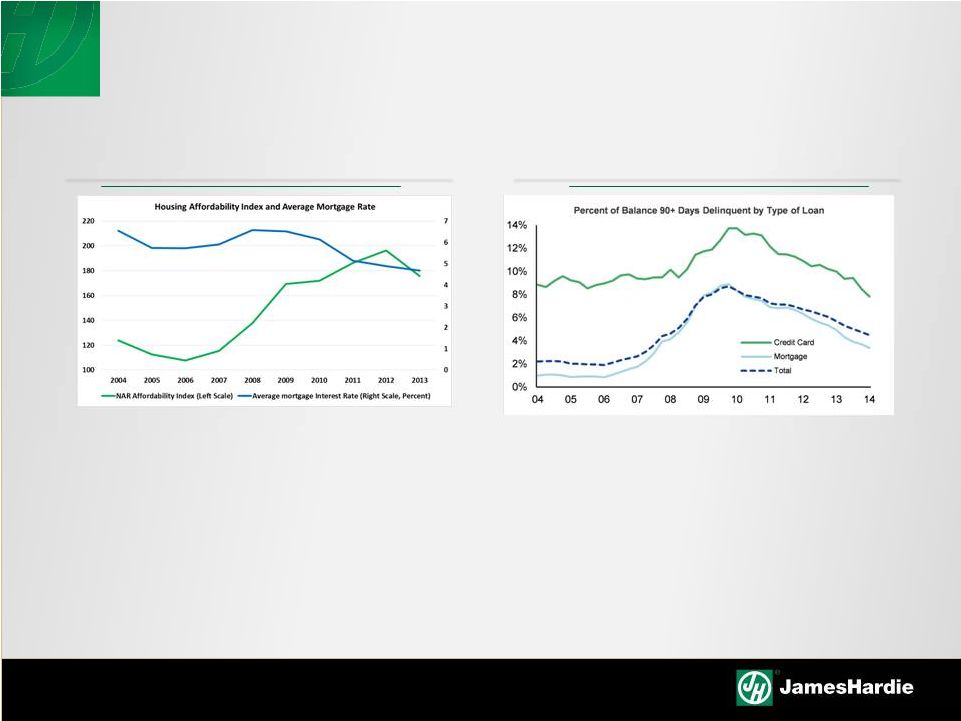

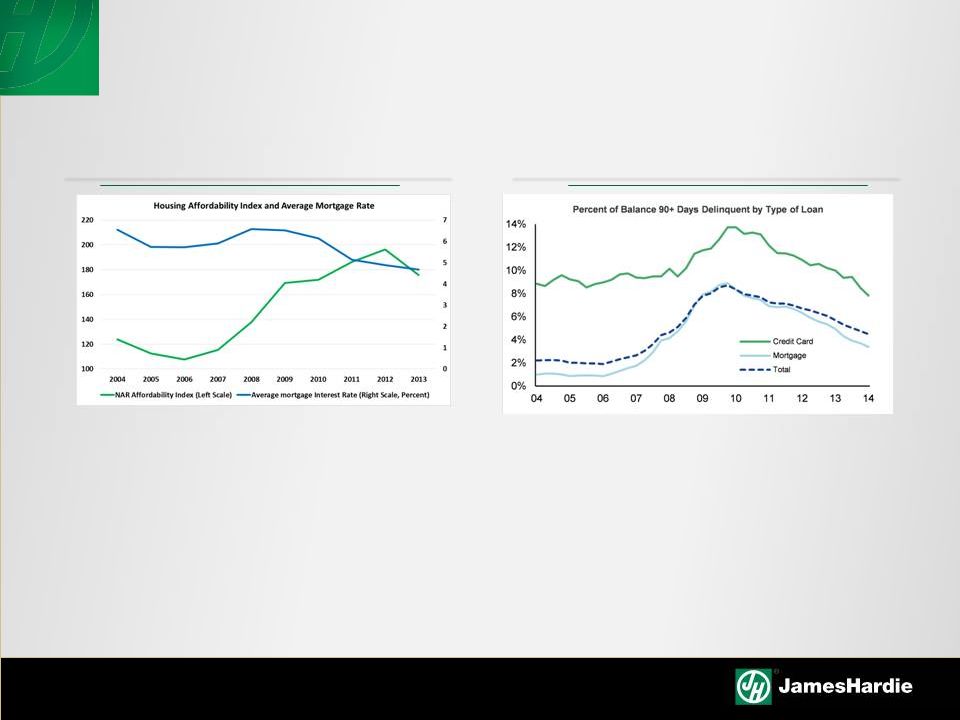

US

CONSUMER CREDIT IS STRENGTHENING Source: Federal Reserve Board, Morgan

Stanley Research. Note: The financial obligations ratio (FO R) includes auto lease payments,

consumer

debt

payments,

rental

payments

on

tenant-occupied

property,

payments

on

mortgage

debt,

homeowners’

insurance

and

property

tax payments.

•

Ownership affordability drivers are becoming more favorable

•

Mortgage interest rates remain at historical lows

•

Household leverage is sustainable, and credit conditions and

lower delinquency rates indicate the cycle peak in not near

Home Affordability & Interest Rates

90+ Day Delinquencies

Sources: JCHS Tabulations of Freddie Mac. Primary Mortgage Market

Survey; National Association of Realtors®, Housing Affordability Index

7 |

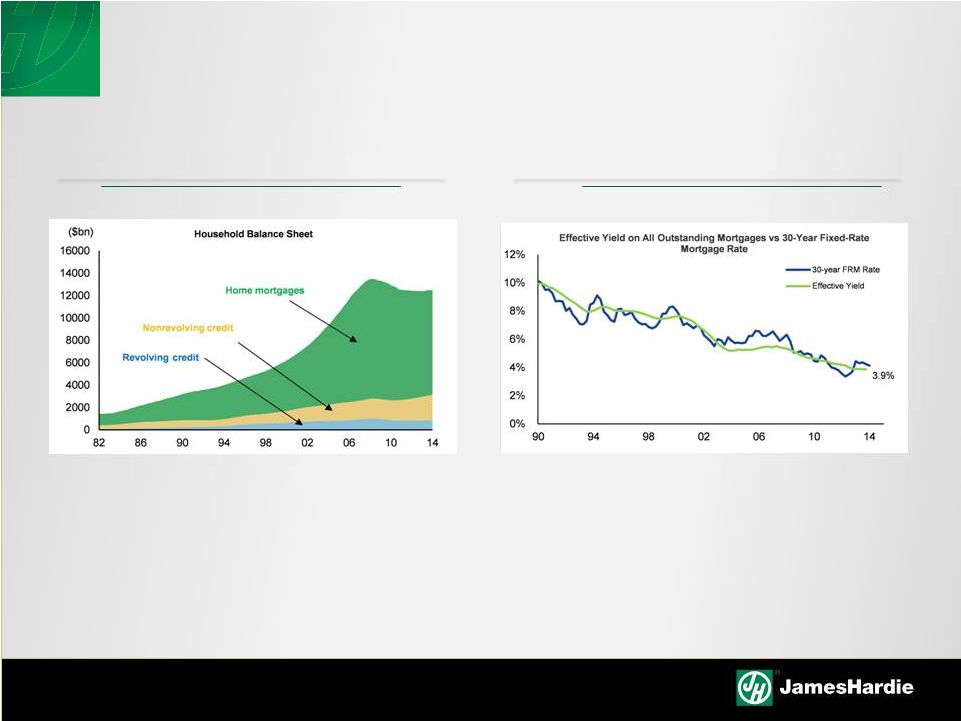

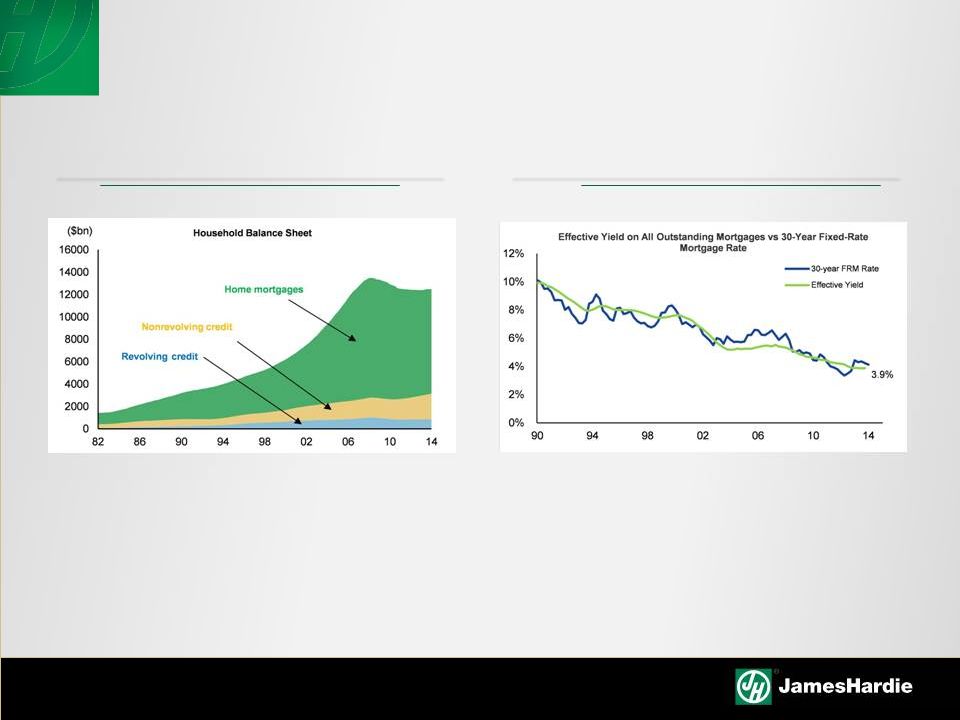

US

CONSUMER BALANCE SHEETS ARE HEALTHIER Source: Bureau of Economic

Analysis Source: US Federal Reserve

•

Roughly 75% of the household balance sheet is in mortgages…

•

…

and

30-year

fixed-rate

mortgage

rate

at

historical

lows

–

meaning

the

bulk

of

average household’s balance sheet is locked in at an extremely low fixed

rate •

This should help US households remain nimble as market conditions tighten

Household Balance Sheet

Yield on All Mortgages vs. 30-Year Fixed

8 |

HOUSING MARKET OVERVIEW

9 |

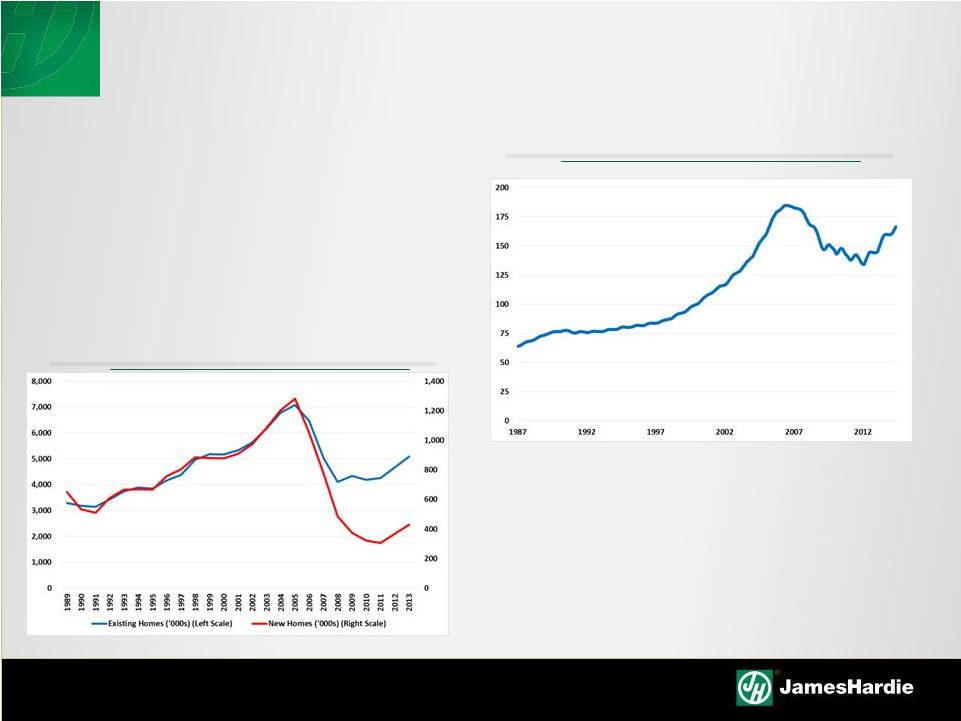

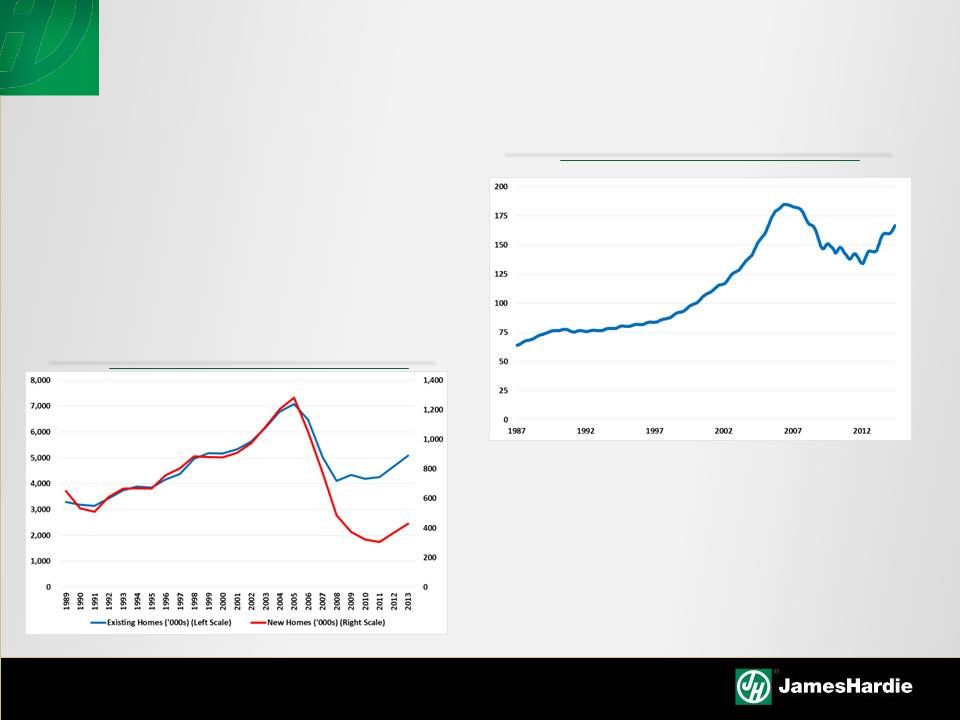

HOME

PRICES AND INVENTORIES Home prices have stabilized and are

beginning to rise slowly…

…while inventories of new and existing

homes are near historic lows

Source: National Association of Realtors

Source: McGraw Hill Financial

Existing & New Home Inventories

S&P/Case-Schiller U.S. National Home Price Index

10 |

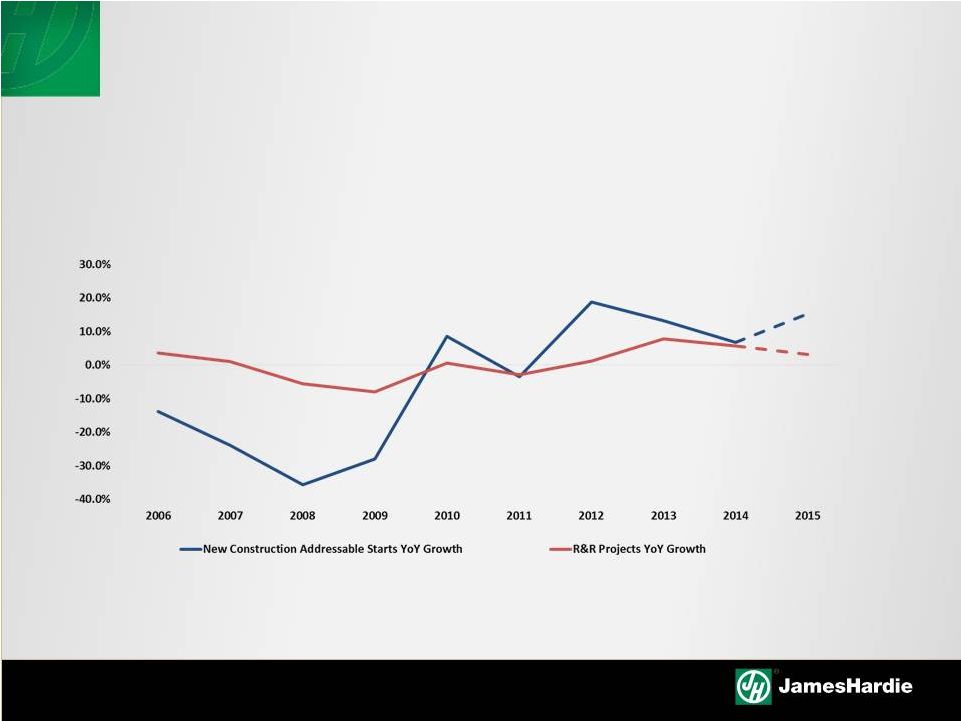

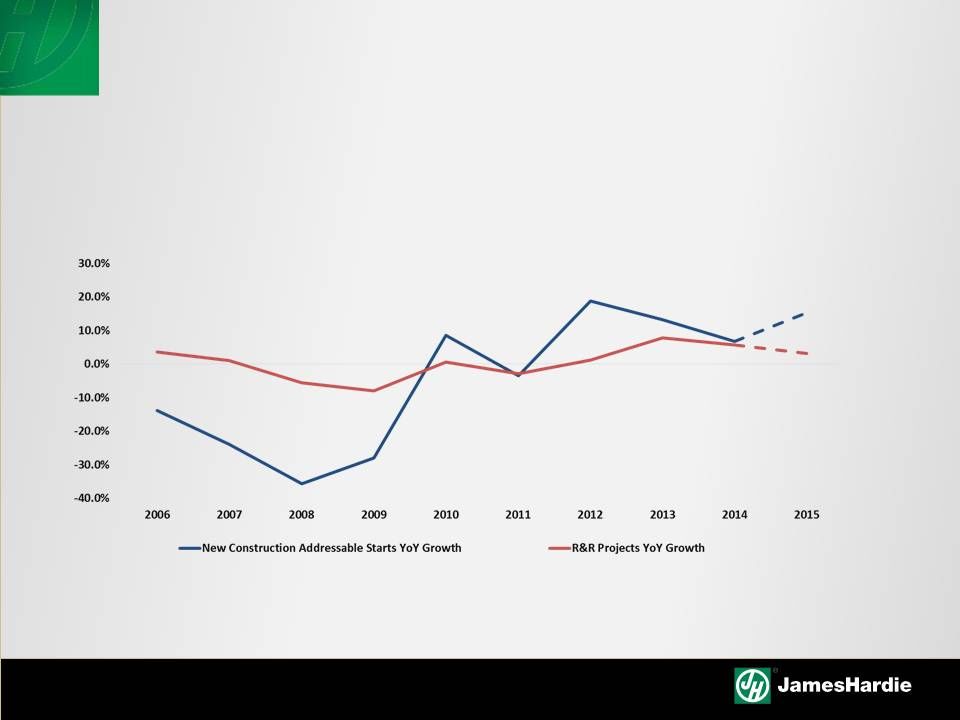

INDICATORS SUGGEST MARKET IS IN RECOVERY

Single-family new construction and multifamily starts growing

at a faster rate than the repair and remodel segment

Sources: Dodge New Construction Forecast and James Hardie Internal Management

Estimates 11 |

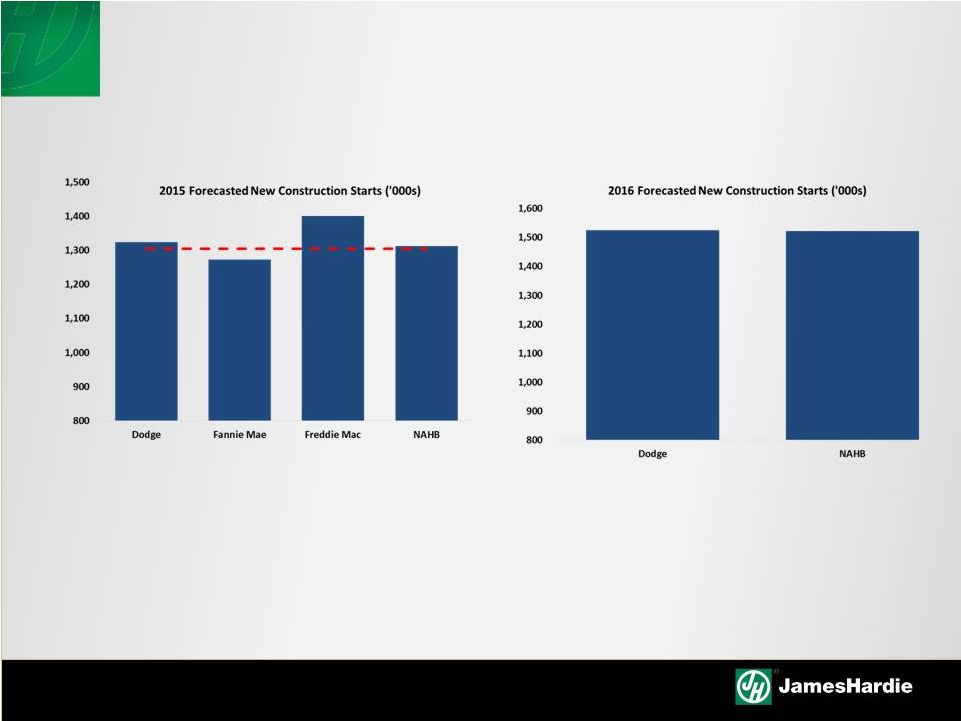

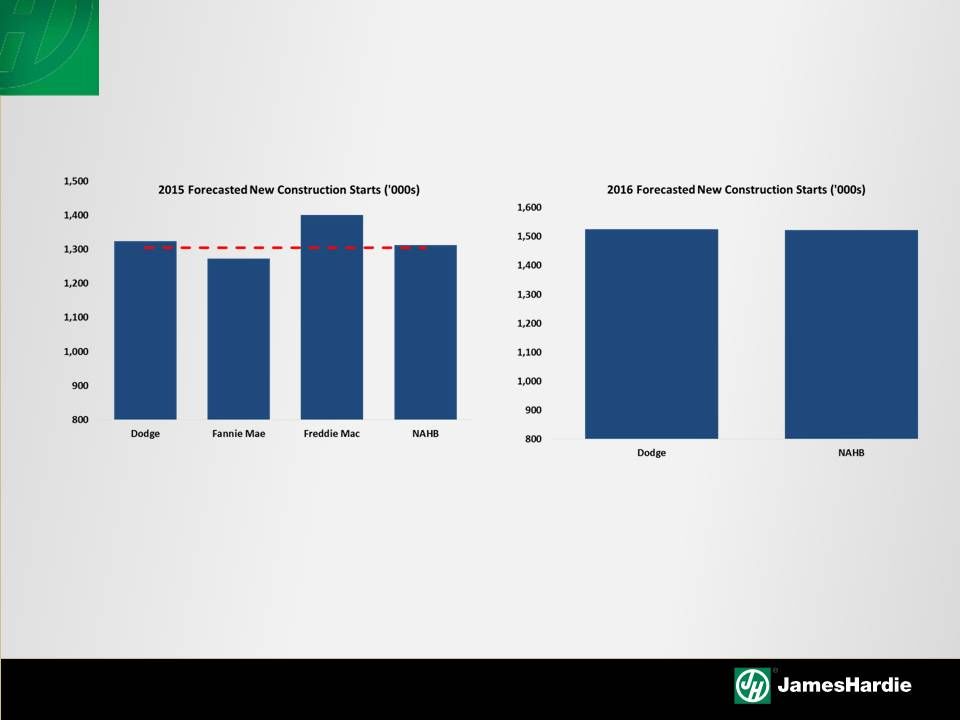

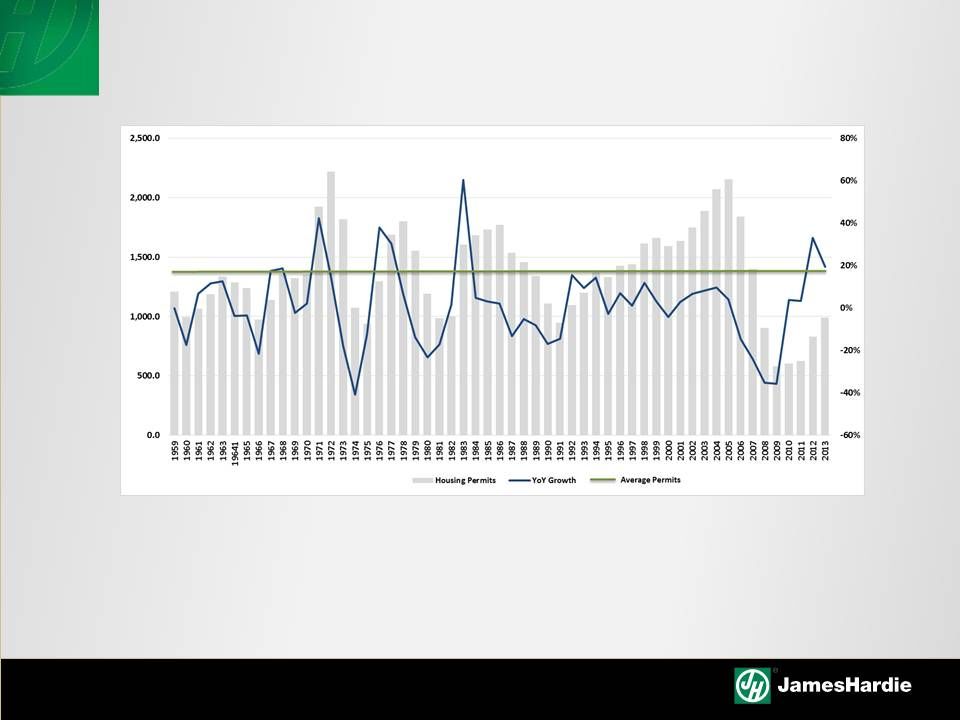

NEW

CONSTRUCTION STARTS HEADING BACK TOWARDS ~1.5 MILLION STARTS PER YEAR

•

Variation in forecasting starts between different organization exists

•

New starts growth forecast 2015 range: 20% and 33%

•

New starts growth forecast for 2016 range: 15% and 16%

12 |

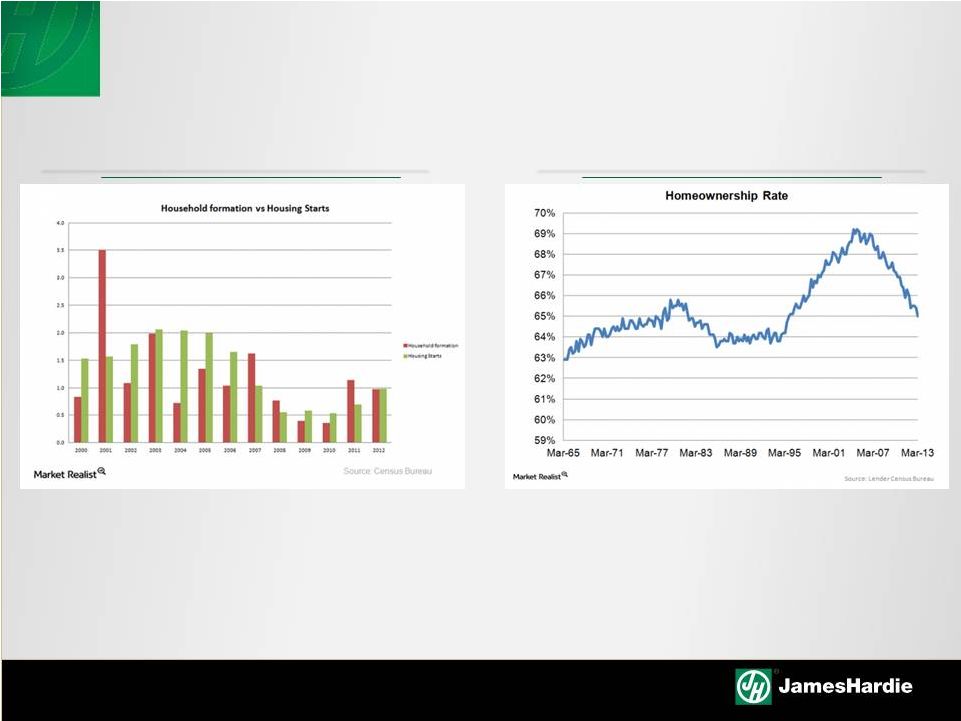

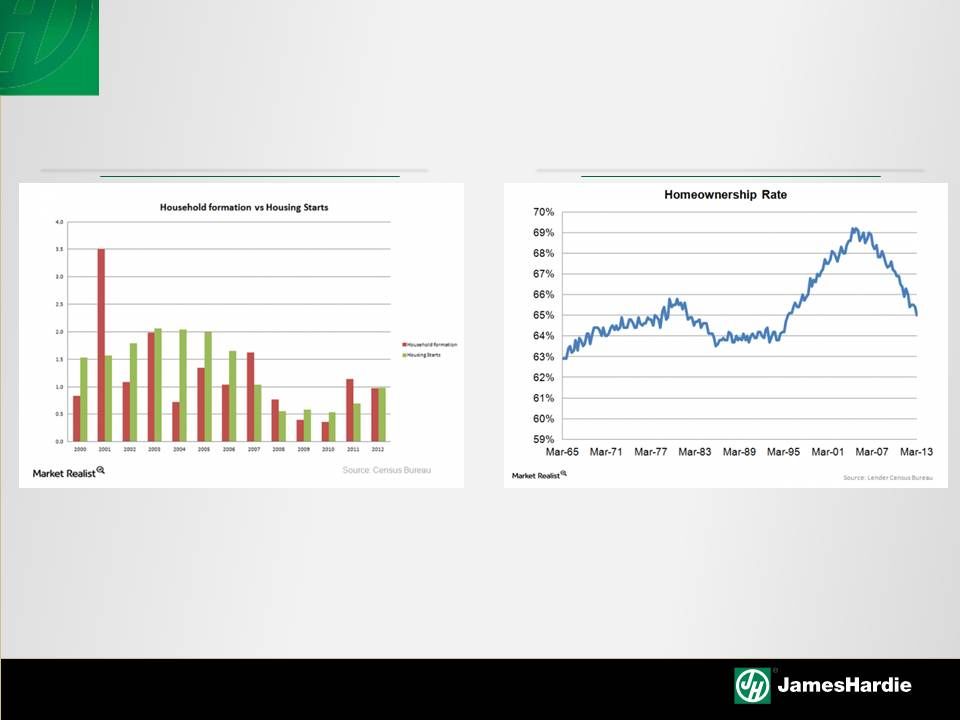

•

Low household formation numbers

over the past five years will drive

homebuilder demand going forward

•

First-time homebuyers in a difficult

position –

student debt, job market, etc.

•

Tougher credit qualification requirements

Formations vs. Starts

Homeownership Rate

UNDERLYING DEMAND FOR NEW HOUSES

LIKELY TO DRIVE NEW CONSTRUCTION STARTS

13 |

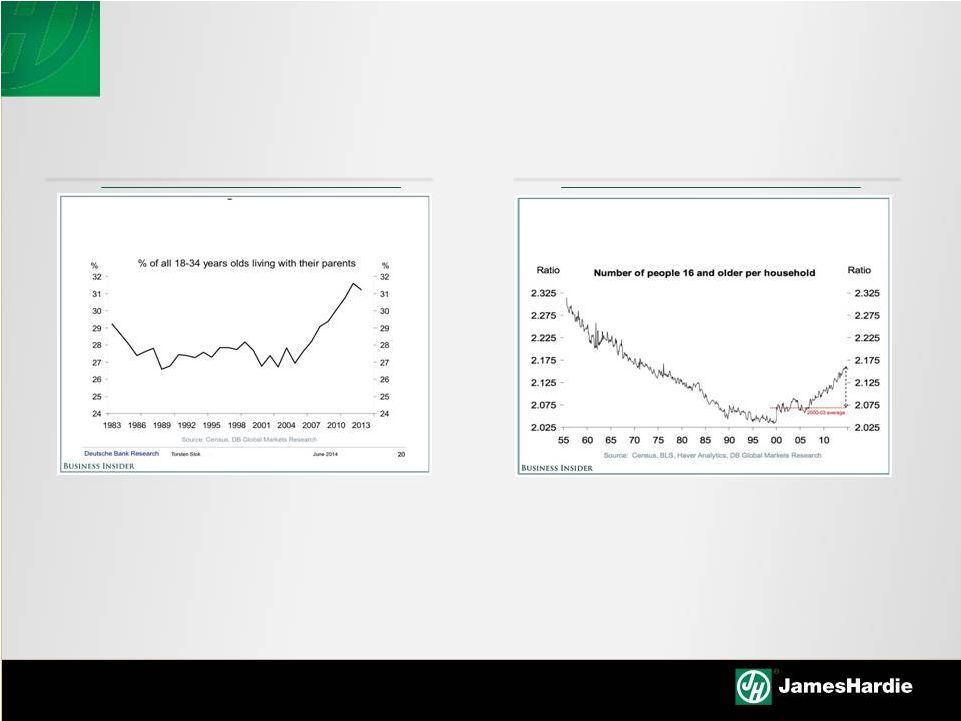

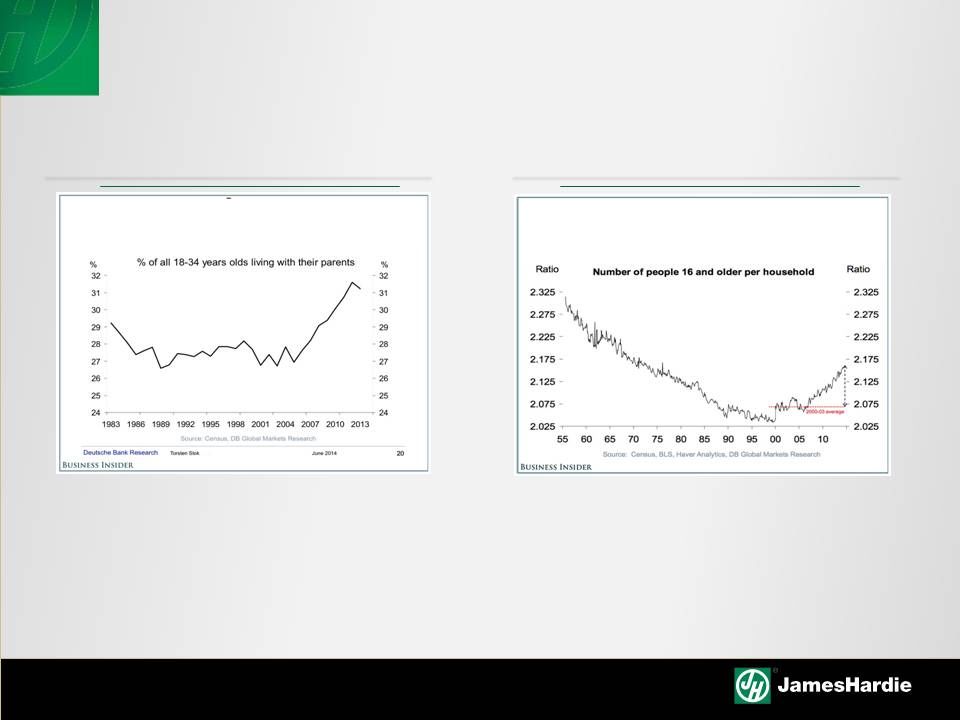

PENT

UP DEMAND FOR HOUSING % of 18-34 year olds living at home

Number of people 16 and older per household

•

Pent-up demand for housing

•

Almost 1/3 of 18-34 year olds now

living with their parents

•

If the number of people per household

returns to the 2000-2003 level it would add

up to more than 4 million new households

Source: Housing Trends: Increase Demand by Jay Taylor, Wyatt Investment Research and Deutsche

Bank Research 14 |

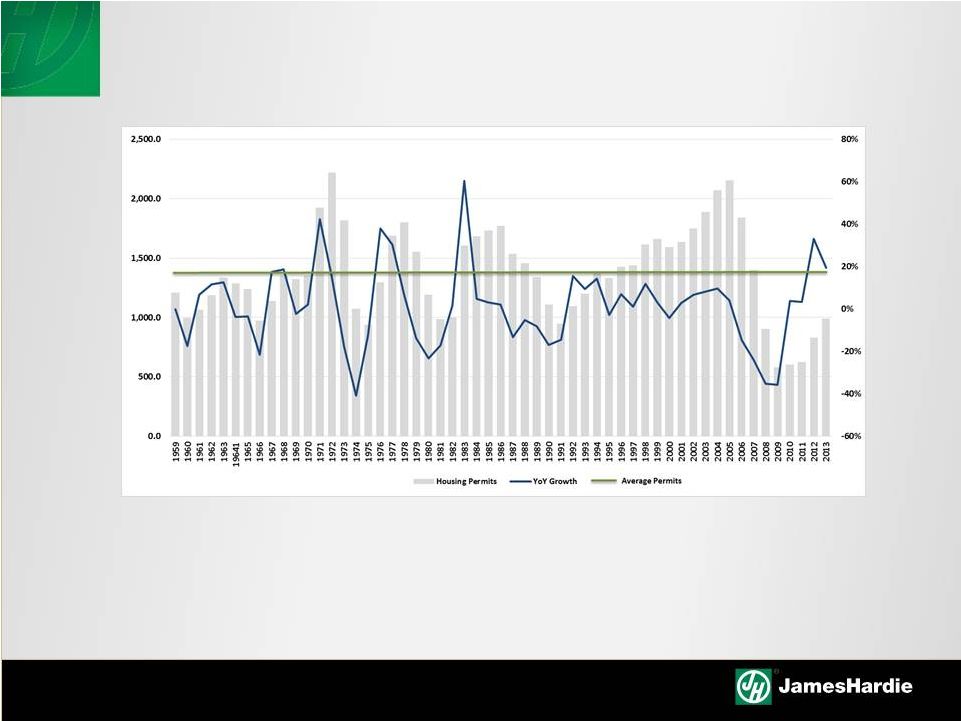

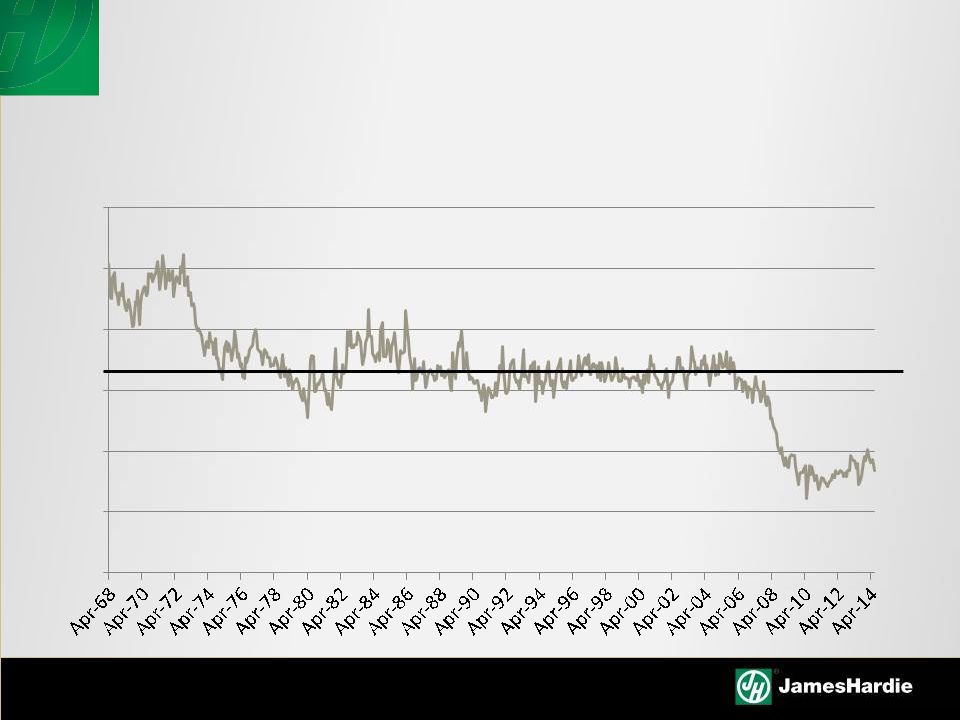

UNDERLYING SUPPLY FOR NEW HOUSES

LIKELY TO DRIVE NEW CONSTRUCTION STARTS

•

Average number of starts since 1959 has been ~1.5M starts per year

•

2013 starts aligned with previous “trough”

years

•

Current starts still has room to expand over the next several years

15 |

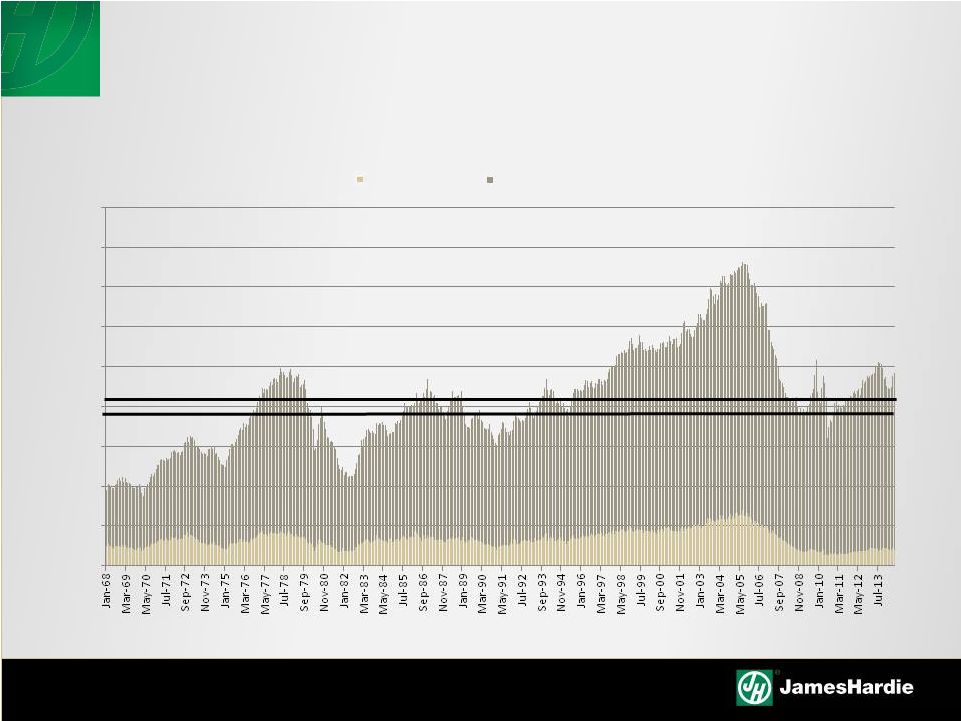

EXISTING HOME SALES REMAIN

ABOVE NORMAL LEVELS

Source: Commerce Department, National

Association of Realtors, Metrostudy Analysis 16

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

SF Home Sales, 1968-April 2014 (SAAR Thousands)

SF New Home Sales

SF Existing Home Sales

45 year average

4.18 million

3.875 million

sans 2002-2006 |

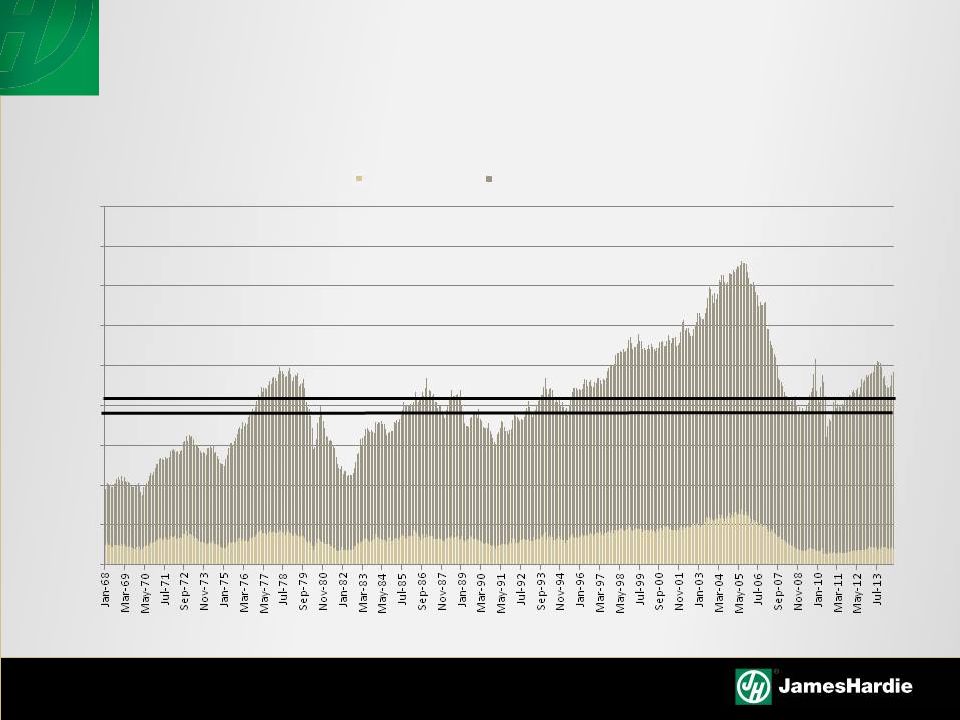

WHILE

HOME SALES ARE AT HIGH LEVELS, NEW HOME SALES HAVE LOST SHARE

Source: Commerce Department, National Association of Realtors, Metrostudy

Analysis 17

0%

5%

10%

15%

20%

25%

30%

45 year average

17% (1/6)

New Home Share of Total SF Home Sales |

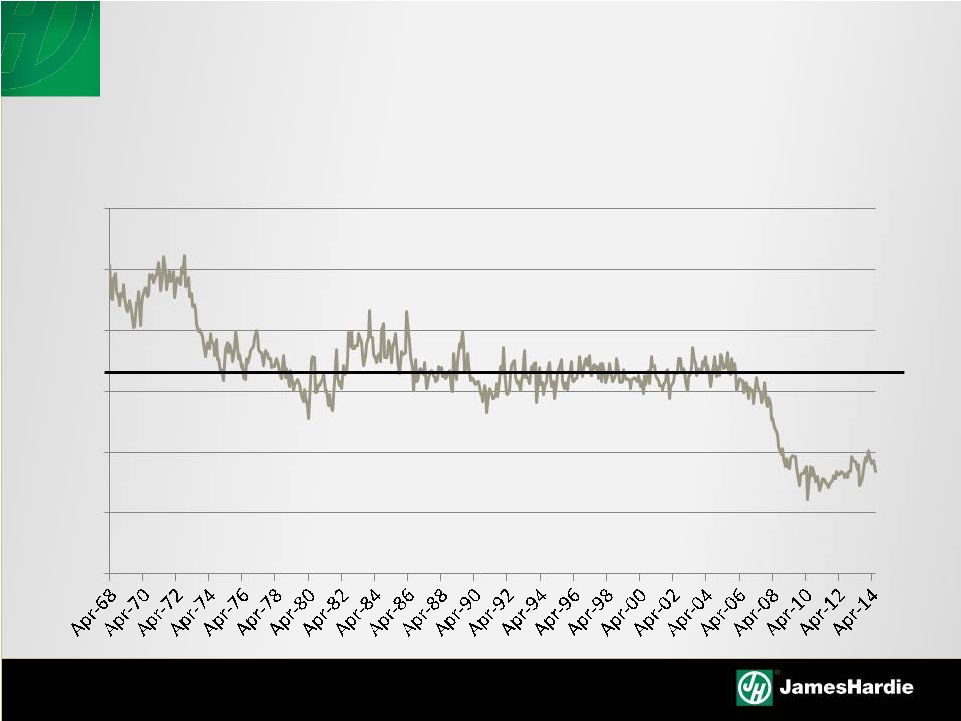

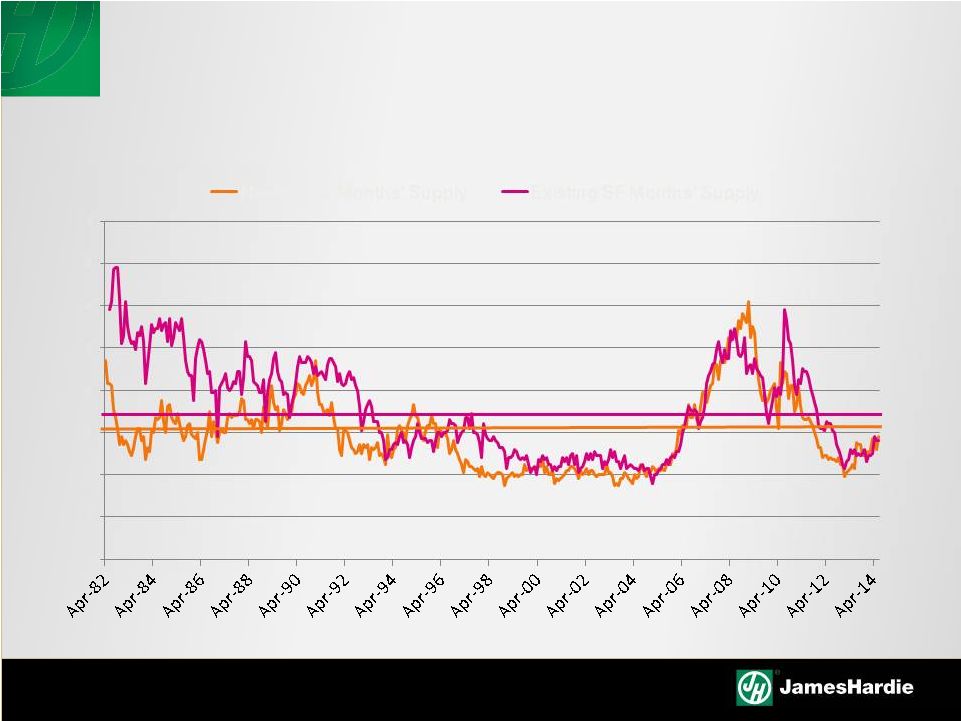

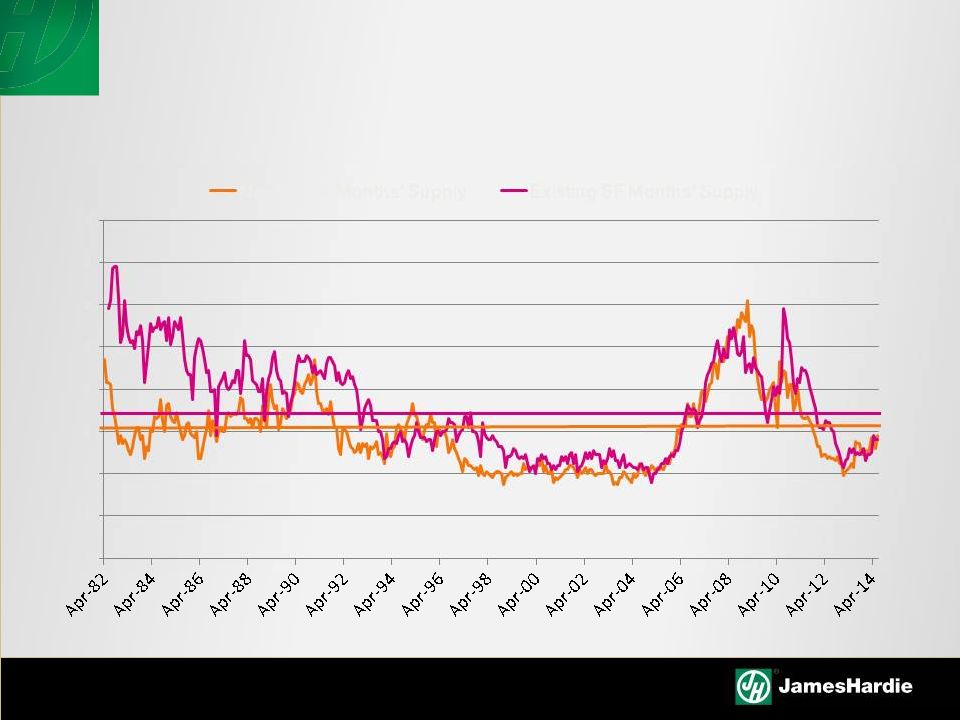

SUPPLIES REMAIN BELOW NORMAL

Source: Commerce Department, National Association of Realtors, Metrostudy

Analysis 18

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

New and Existing SF Months' Supply, 1982-April 2014

New Home Months' Supply

Existing SF Months' Supply

30 Yr Ave 7.2

50 Yr Ave 6.1 |

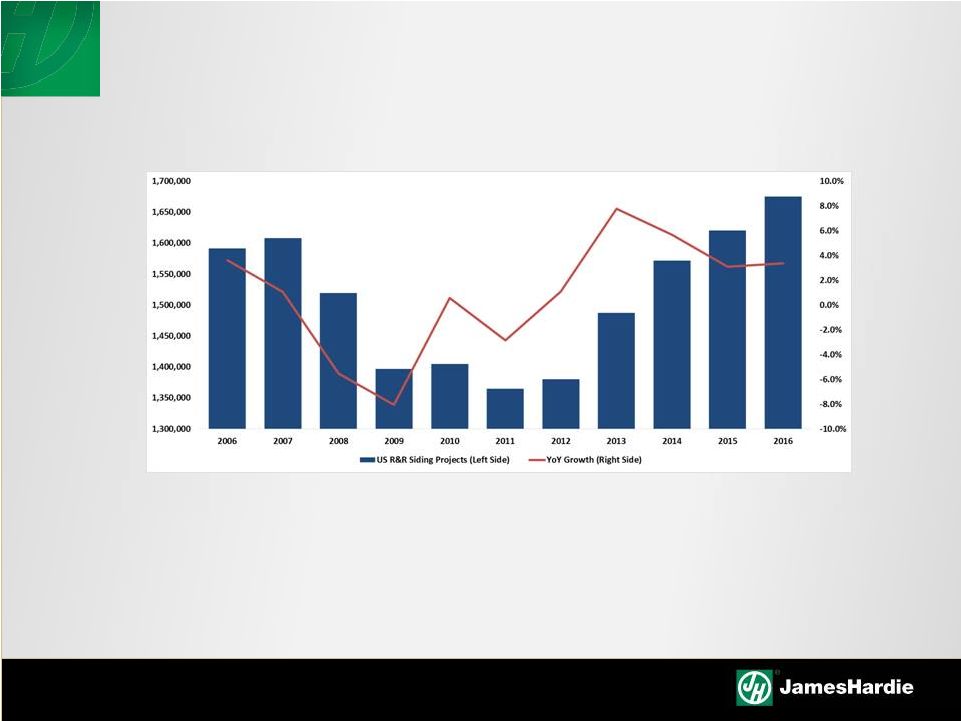

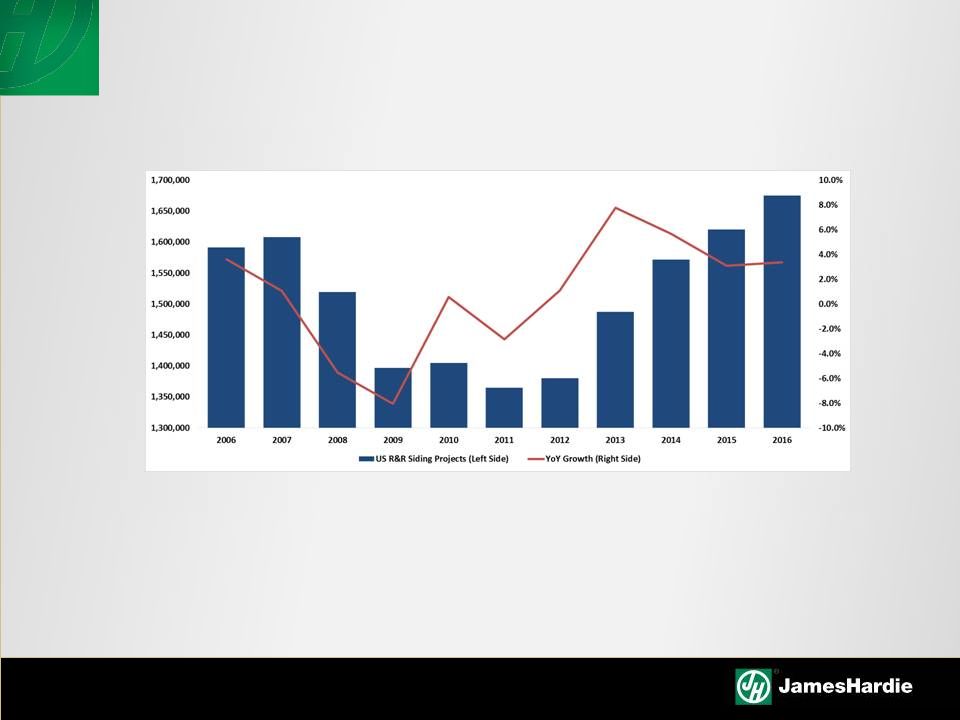

REPAIR

& REMODEL COMPARED TO NEW CONSTRUCTION IS LESS VOLATILE, AND GROWING

Repair & Remodel Market

•

Repair & Remodel market is less volatile and currently as big as

new

construction

•

Year-over-Year growth ranges from -8% to +8%

•

Forecasted to grow 3% in 2015 and 3+% in the medium-term

Sources: James Hardie Internal Management Estimates.

19 |

MARKET

OPPORTUNITY 20 |

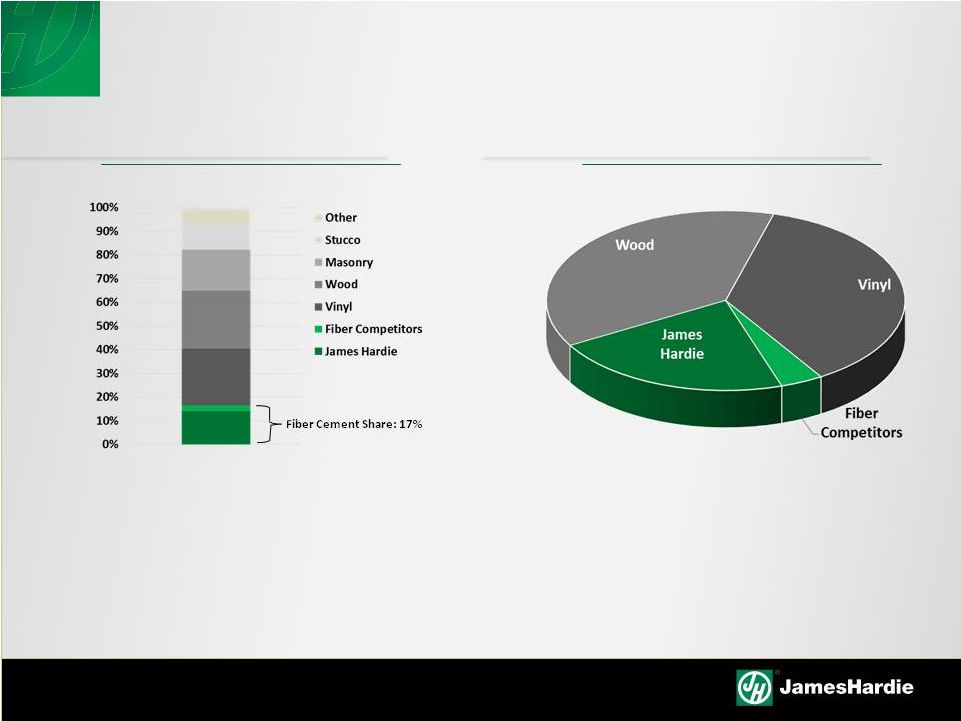

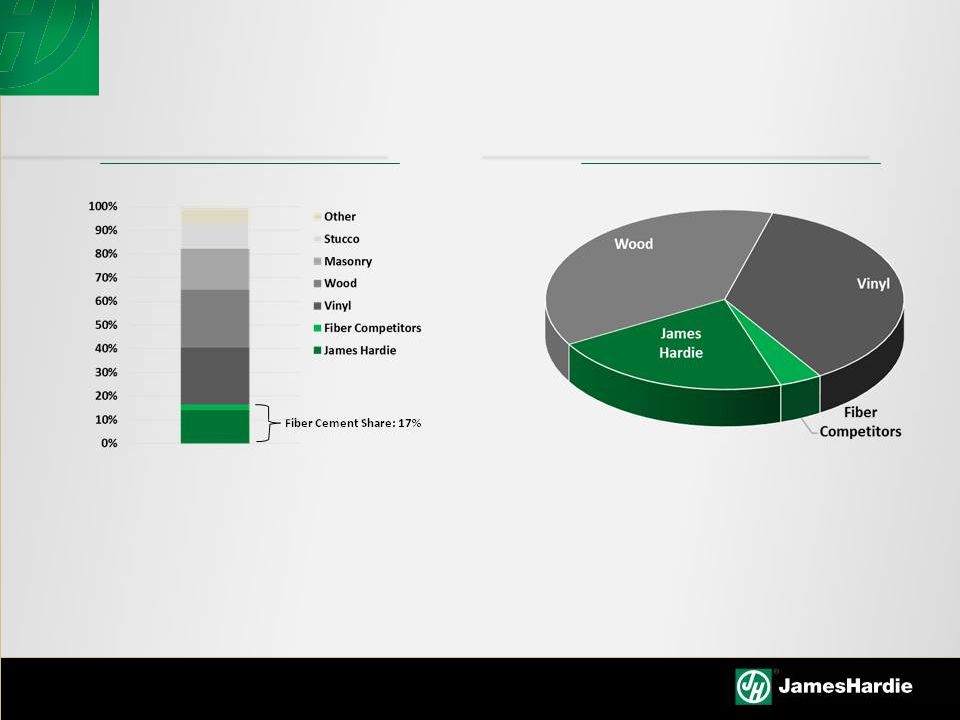

NORTH

AMERICA MARKET OVERVIEW North America Market Share by Product

•

JHX wins ~90% of the fiber cement category, while fiber cement

used in ~17% of the total market

•

Current estimate is wood-look siding (Wood, Vinyl and Fiber

Cement) is 60-65% of total market.

North America Wood-Look Market Size

Source: Internal estimates based on NAHB product usage data adjusted

for regional market intelligence

Source: Internal estimates based on NAHB product usage data adjusted

for regional market intelligence

4.7BSF

Fiber Cement Share 25%

21 |

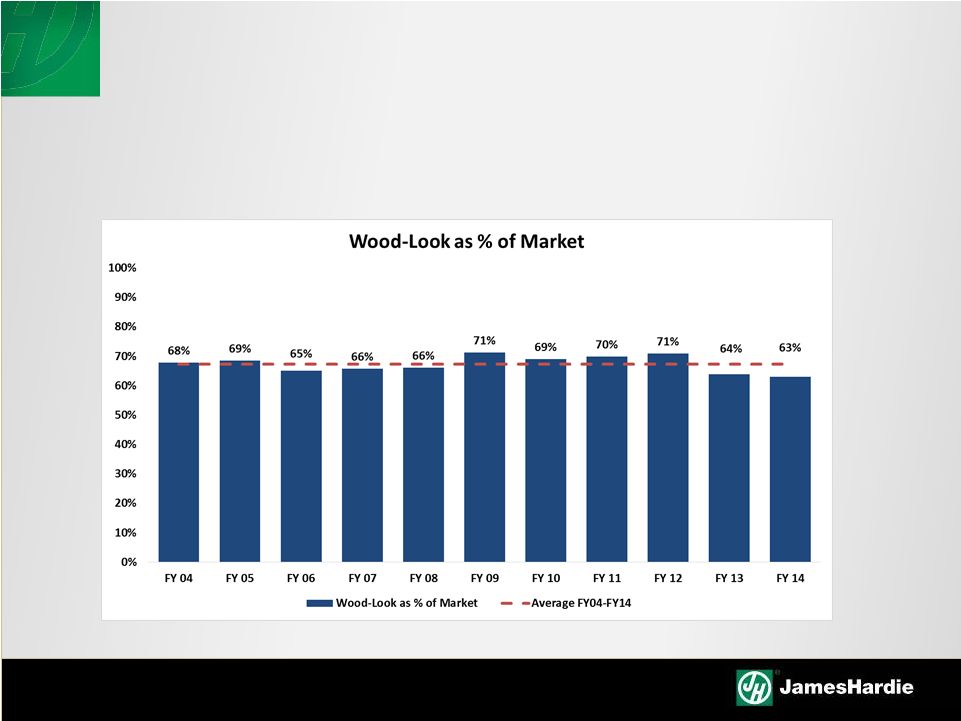

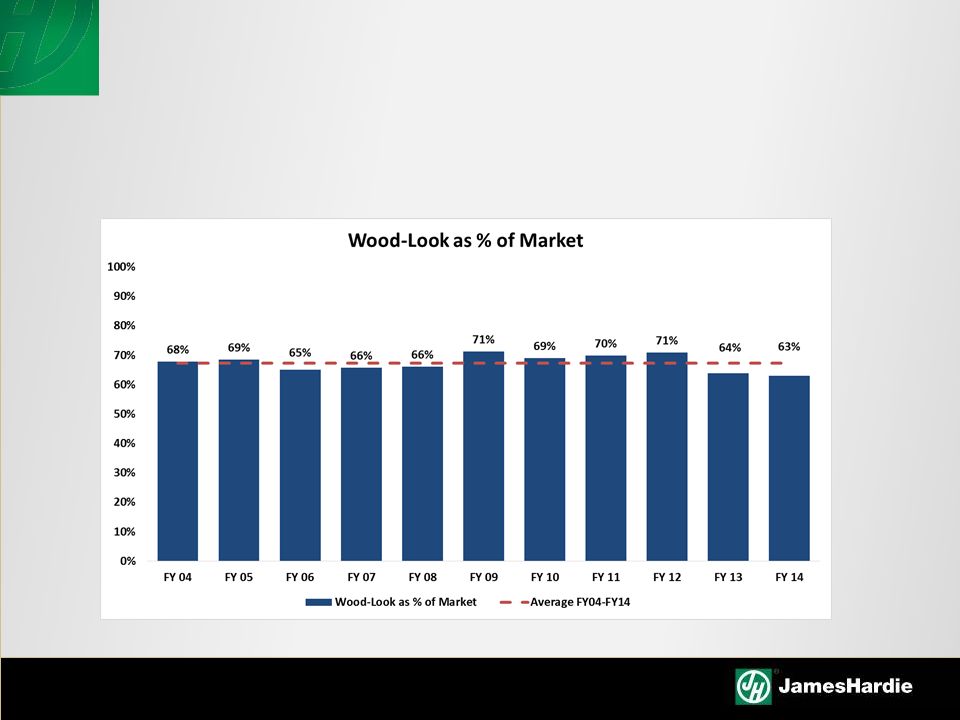

WOOD-LOOK SHARE OF

TOTAL MARKET

Wood-look products continue to maintain ~ 2/3rds of the of the

wall against stone, stucco, and brick

Source: Internal estimates based on NAHB product usage data adjusted for regional

market intelligence 22 |

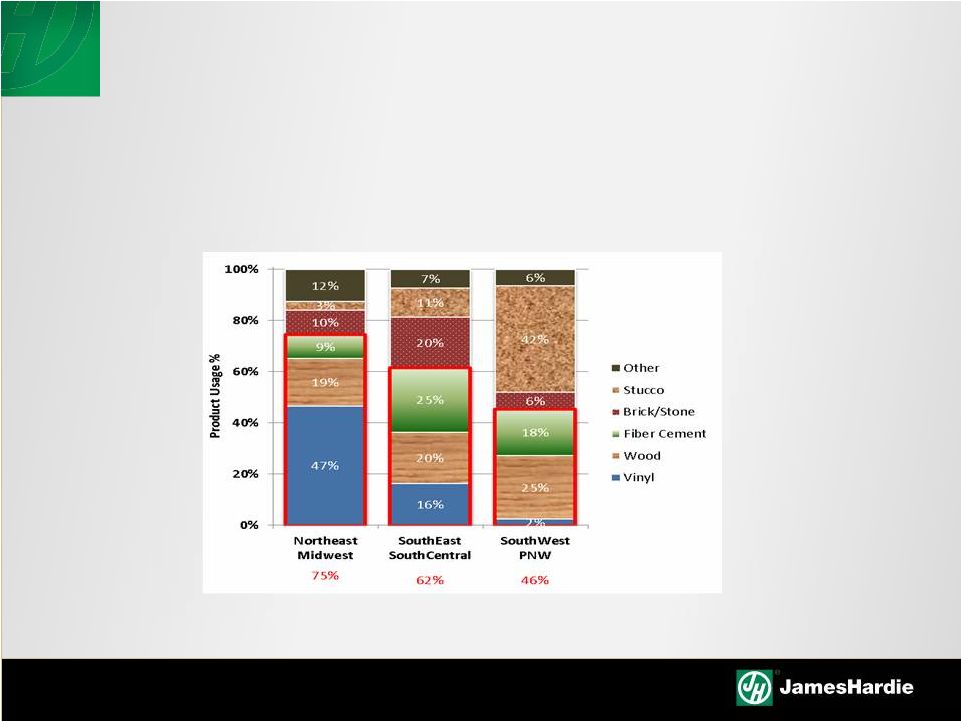

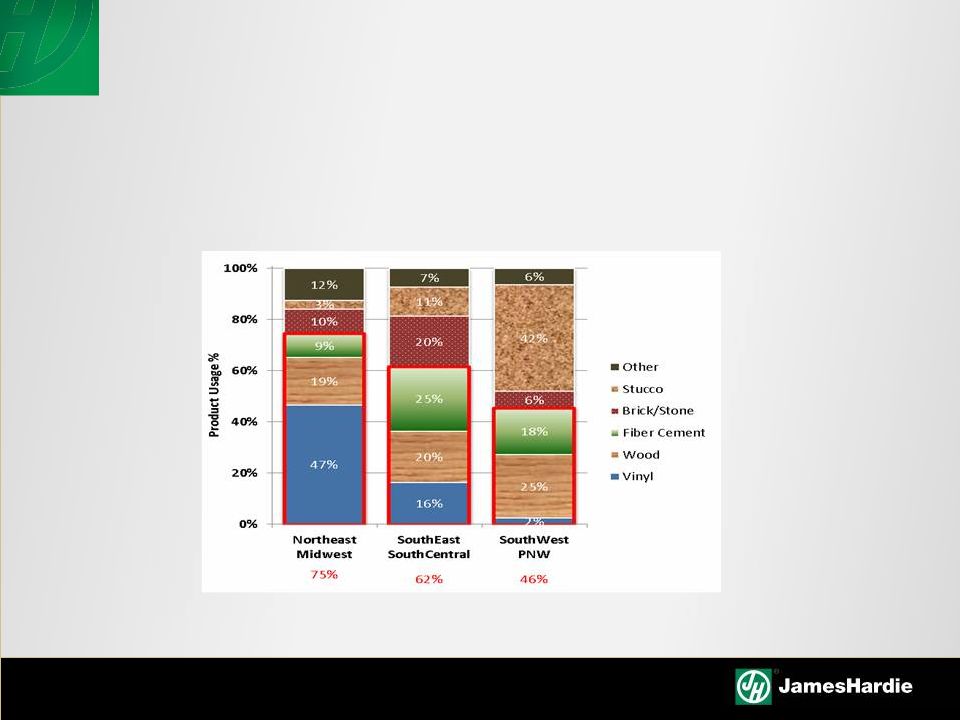

WOOD-LOOK SIDING SHARE

Growth opportunity varies by region, vinyl & wood in the north, wood

and competitive cement in the south and west

Internal

estimates

based

on

NAHB

product

usage

data

adjusted

for

regional

market

intelligence

23 |

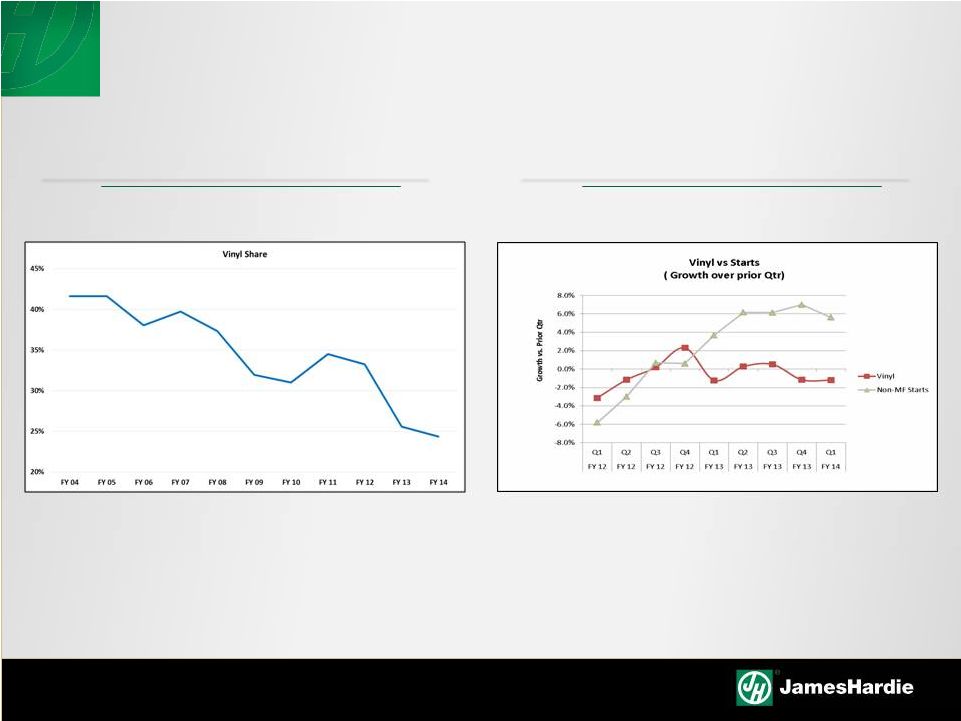

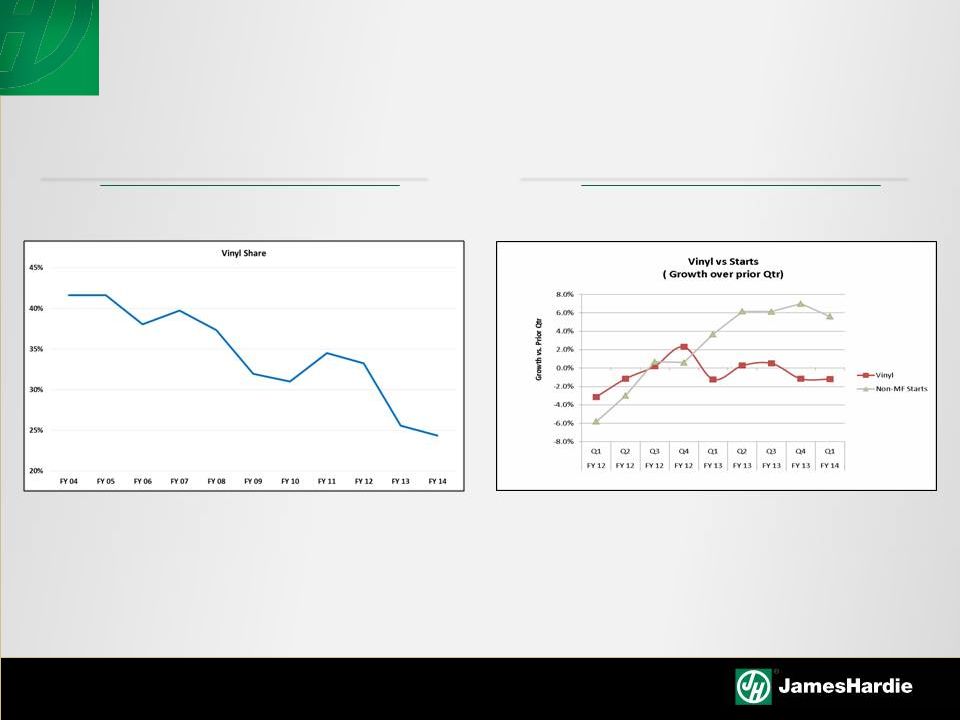

VINYL

CONTINUES TO UNDERPERFORM Vinyl’s Weaker Market Position

Vinyl Under Performing vs. Starts

Source: Internal estimates based on NAHB product usage data adjusted

for regional market intelligence

24 |

COMPETITIVE FIBER CEMENT

Competitive Fiber Cement competitors appear to be optimizing

their businesses instead of ramping up idle capacity

Nichiha

•

Announced restricted shipping radius to local market

•

Performance concerns in harsh climates; High reject rate

Allura

•

Elementia Corp, parent company of PlyCem and MaxiTile,

acquired from CertainTeed (St. Gobain) in 2014

•

Terre Haute location remains idled

25 |

•

U.S. economic indicators improving .. Broader economy in recovery

•

Recovering housing market

•

New construction growth below historic levels …

pent up demand and below

normal supplies should support new construction starts heading towards

1.5M

•

Wood look siding is greater than ~2/3 of the cladding opportunity in the US

•

Vinyl share declining as the US housing recovery take place

•

Engineered wood has taken some share in the downturn and presents itself

as a competitive threat in markets susceptible to a wood based product

•

James

Hardie

is

well

positioned

by

segment

to

deliver

on

our

product

leadership strategy driving growth towards 35/90

26

SUMMARY |

QUESTIONS |

|