NORTH

DIVISION Sean Gadd

24 September 2014

Exhibit 99.3 |

NORTH

DIVISION Sean Gadd

24 September 2014

Exhibit 99.3 |

This Management Presentation contains forward-looking statements. James Hardie

may from time to time make forward-looking statements in its periodic reports filed with or

furnished

to

the

SEC,

on

Forms

20-F

and

6-K,

in

its

annual

reports

to

shareholders,

in

offering

circulars,

invitation

memoranda

and

prospectuses,

in

media

releases

and

other

written

materials and in oral statements made by the company’s officers, directors or

employees to analysts, institutional investors, existing and potential lenders, representatives of the media

and others. Statements that are not historical facts are forward-looking

statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of

the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•

statements about the company’s future performance;

•

projections of the company’s results of operations or financial

condition; •

statements regarding the company’s plans, objectives or goals, including

those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•

expectations

concerning

the

costs

associated

with

the

suspension

or

closure

of

operations

at

any

of

the

company’s

plants

and

future

plans

with

respect

to

any

such

plants;

•

expectations concerning the costs associated with the significant capital

expenditure projects at any of the company’s plants and future plans with respect to any such

projects;

•

expectations regarding the extension or renewal of the company’s credit

facilities including changes to terms, covenants or ratios; •

expectations concerning dividend payments and share buy-backs;

•

statements concerning the company’s corporate and tax domiciles and

structures and potential changes to them, including potential tax charges;

•

statements

regarding

tax

liabilities

and

related

audits,

reviews

and

proceedings;

•

statements regarding the possible consequences and/or potential outcome of the

legal proceedings brought against two of the company’s subsidiaries by the New Zealand

Ministry of Education and the potential product liabilities, if any, associated

with such proceedings; •

expectations about the timing and amount of contributions to Asbestos Injuries

Compensation Fund (AICF), a special purpose fund for the compensation of proven

Australian asbestos-related personal injury and death claims;

•

expectations concerning indemnification obligations;

•

expectations concerning the adequacy of the company’s warranty provisions and

estimates for future warranty-related costs; •

statements regarding the company’s ability to manage legal and regulatory

matters (including but not limited to product liability, environmental, intellectual property and

competition law matters) and to resolve any such pending legal and regulatory

matters within current estimates and in anticipation of certain third-party recoveries; and

•

statements

about

economic

conditions,

such

as

changes

in

the

US

economic

or

housing

recovery

or

changes

in

the

market

conditions

in

the

Asia

Pacific

region,

the

levels

of

new

home

construction

and

home

renovations,

unemployment

levels,

changes

in

consumer

income,

changes

or

stability

in

housing

values,

the

availability

of

mortgages

and other financing, mortgage and other interest rates, housing affordability and

supply, the levels of foreclosures and home resales, currency exchange rates, and builder

and consumer confidence.

DISCLAIMER

2 |

3

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,”

“may,” “objective,” “outlook” and similar expressions are

intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned

not to place undue reliance on these forward-looking statements and all such forward-looking

statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and

conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control. Such known and

unknown risks, uncertainties and other factors may cause actual results, performance or other

achievements to differ materially from the anticipated results, performance or achievements

expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-

F filed with the Securities and Exchange Commission on 26 June 2014, include, but are not limited to:

all matters relating to or arising out of the prior manufacture of products that contained

asbestos by current and former James Hardie subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements

on the amount recorded in the company’s financial statements as an asbestos liability;

governmental loan facility to AICF; compliance with and changes in tax laws and treatments;

competition and product pricing in the markets in which the company operates; the consequences of product failures or defects; exposure to environmental, asbestos,

putative consumer class action or other legal proceedings; general economic and market conditions; the

supply and cost of raw materials; possible increases in competition and the potential that

competitors could copy the company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in

environmental and health and safety laws; risks of conducting business internationally; compliance

with and changes in laws and regulations; the effect of the transfer of the company’s

corporate domicile from The Netherlands to Ireland, including changes in corporate governance and any potential tax benefits related thereto; currency exchange

risks; dependence on customer preference and the concentration of the company’s customer base on

large format retail customers, distributors and dealers; dependence on residential and

commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favourable to

the company, or at all; acquisition or sale of businesses and business segments; changes in the

company’s key management personnel; inherent limitations on internal controls; use of

accounting estimates; and all other risks identified in the company’s reports filed with Australian, Irish and US securities agencies and exchanges (as appropriate). The

company cautions you that the foregoing list of factors is not exhaustive and that other risks and

uncertainties may cause actual results to differ materially from those referenced in the

company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations

concerning future results, events and conditions. The company assumes no obligation to update any

forward-looking statements or information except as required by law. |

•

North Division Overview

•

North Strategy

•

Sales Execution Update

•

Market Moving Initiatives

•

Summary

AGENDA

4 |

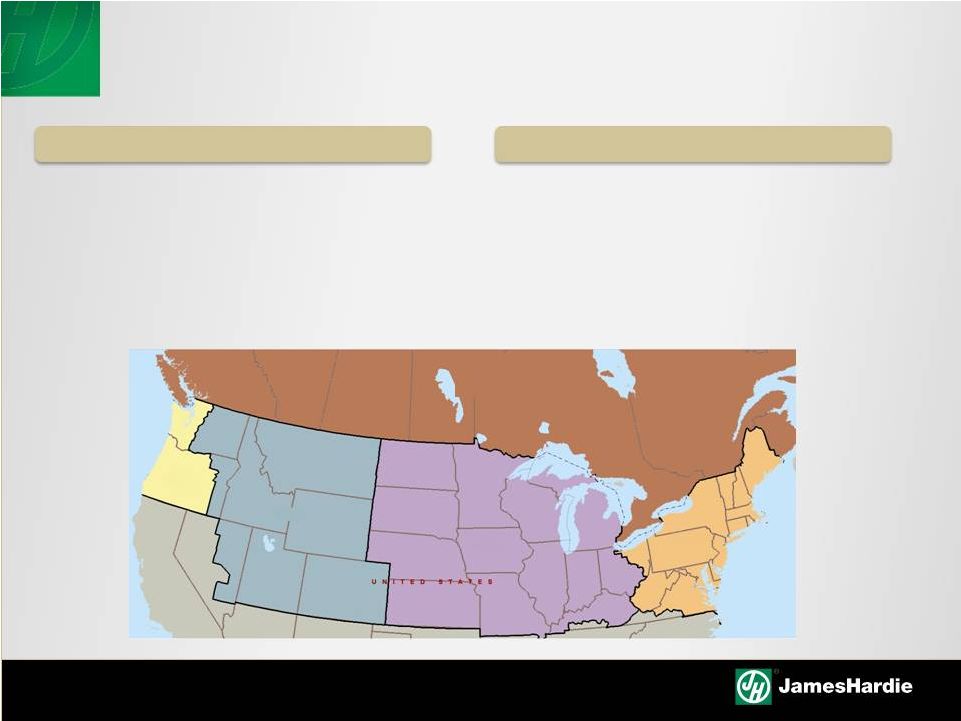

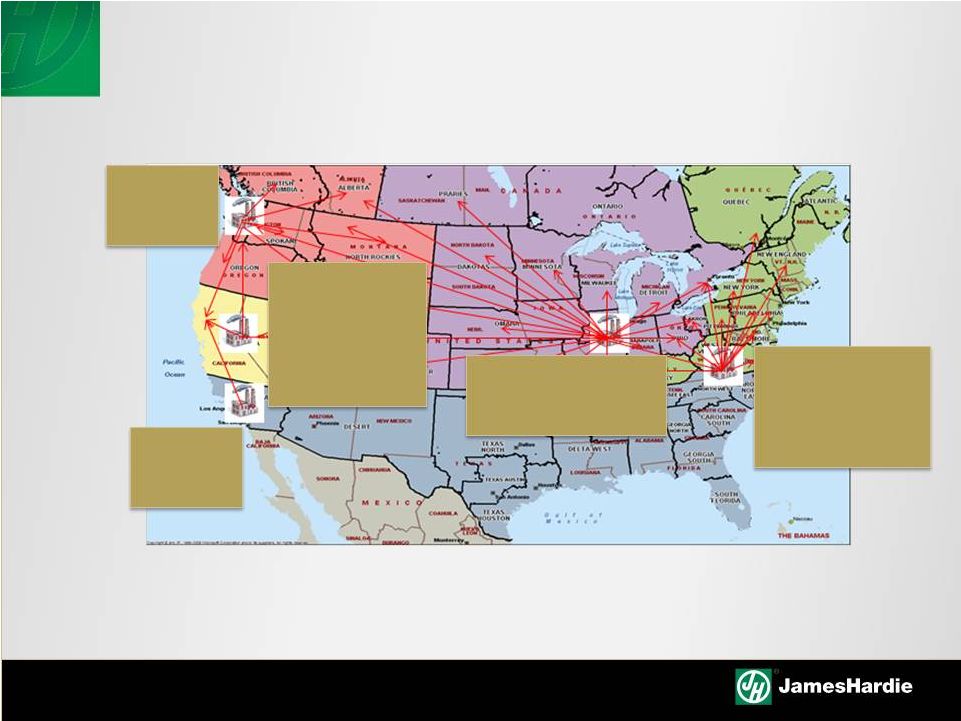

NORTH

DIVISION OVERVIEW Market Dynamics

•

40 % of JH volume

•

~20% of wood-look products

•

Wood-look at ~65% of market

Quick Facts

•

~1060 employees

•

4 manufacturing facilities

•

Predominately HZ5 volume

Midwest

Northeast

Mountain

Pacific

Northwest

5

Canada |

•

Grow Fiber Cement share by substituting for both vinyl and

wood based sidings and trims in the new construction and

repair and remodel market segments (35)

•

Maintain our Fiber Cement category position by delivering

differentiated value to supply chain participants, right through

to the home owner (90)

•

Build the business model in a way that delivers sustainable

financial returns that far exceed industry averages (20-25)

NORTH STRATEGY

6 |

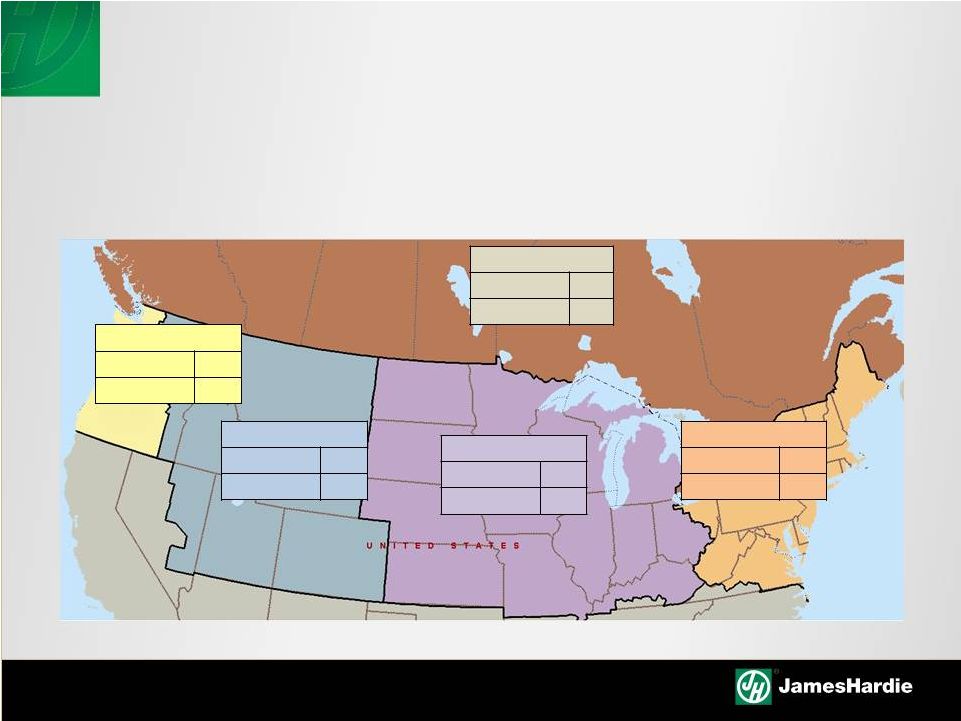

•

5 regions

•

Approach differs due to opportunity and competitor

NORTH DIVISION OVERVIEW

•

Vinyl and wood market shares are James Hardie internal estimates.

7

Northwest

Vinyl share

5%

Wood share

30%

Mountain

Vinyl share

10%

Wood share

35%

Canada

Vinyl share

50%

Wood share

15%

Midwest

Vinyl share

40%

Wood share

20%

Northeast

Vinyl share

50%

Wood share

15% |

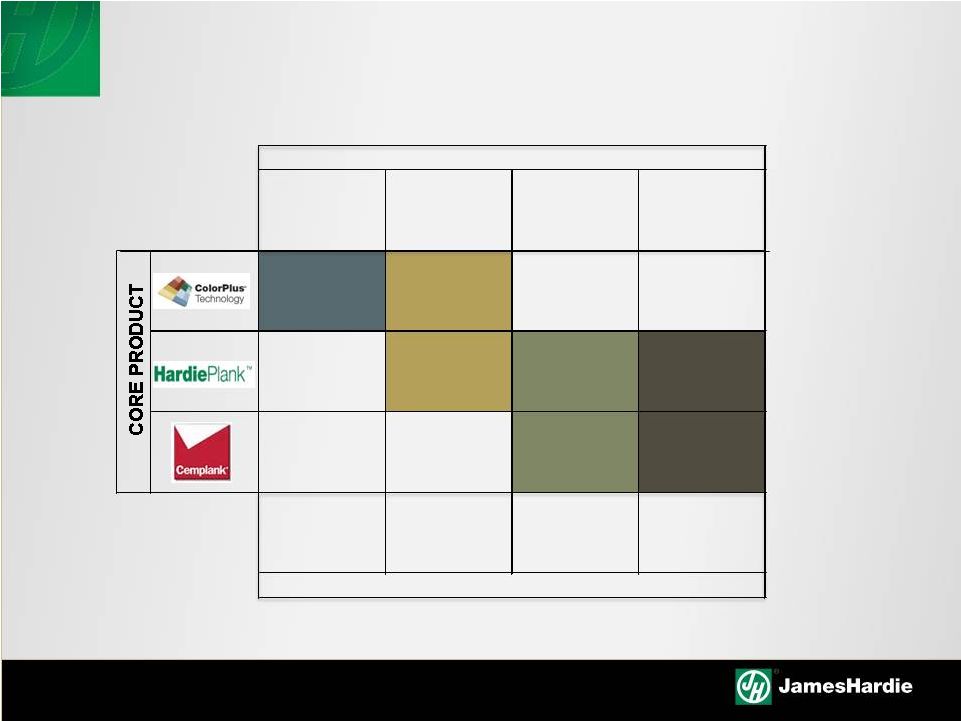

PRODUCT STRATEGY

8

Northeast &

Canada

Midwest

Mountain

Pacific

Northwest

x

x

x

x

x

x

x

Vinyl

Vinyl & Wood

Wood

Fiber Cement

MARKET STANDARD

MARKET |

JAMES

HARDIE VALUE PROPOSITION •

James Hardie can deliver superior design to vinyl with

a true wood look

•

James Hardie can deliver superior durability and lower

maintenance than real wood, hardboard/OSB exterior

products

9 |

Single family new construction

•

Market development

•

Builders and developers

Single family repair and remodel

•

Hardie standard / vinyl standard neighborhoods

•

Sold through the contractor

Multifamily

•

Developers and Architects

•

Bid process

SEGMENTS

10 |

•

Align with channel partners in a way that allows full

market access and leverage their local service

capabilities and customer relationships.

•

Ensure that the supply chain is built and operates in a

manner that enables participants to earn acceptable

category returns

CHANNEL STRATEGY

11 |

•

Enable James Hardie’s product leadership

•

Delivers James Hardie brand promise

•

Ensure capacity is available during periods of peak

demand

•

Allows delivered unit cost to remain relatively flat in all

market types

MANUFACTURING STRATEGY

12 |

MANUFACTURING –

PLANT / MARKET COVERAGE

Plank, Panel,

Backer, Trim,

ColorPlus

®

Products,

Artisan

®

and

Artisan

®

V-Groove

Products

Panel,

Backer

Plank,

Panel

Plank, Panel, Backer,

NT3

®

Trim,

ColorPlus

®

Products

Plank, Panel, Backer

Heritage

®

, soffit,

ColorPlus

®

Products,

Mouldings

13 |

Recruit

Engage

Develop

Promote

Evaluate

ORGANIZATION / LEADERSHIP

•

Driving an overall business capability

•

Ability to move a market

•

Executing at a high level with a single focus

•

Depth and leadership

•

Tenure and continuity

14 |

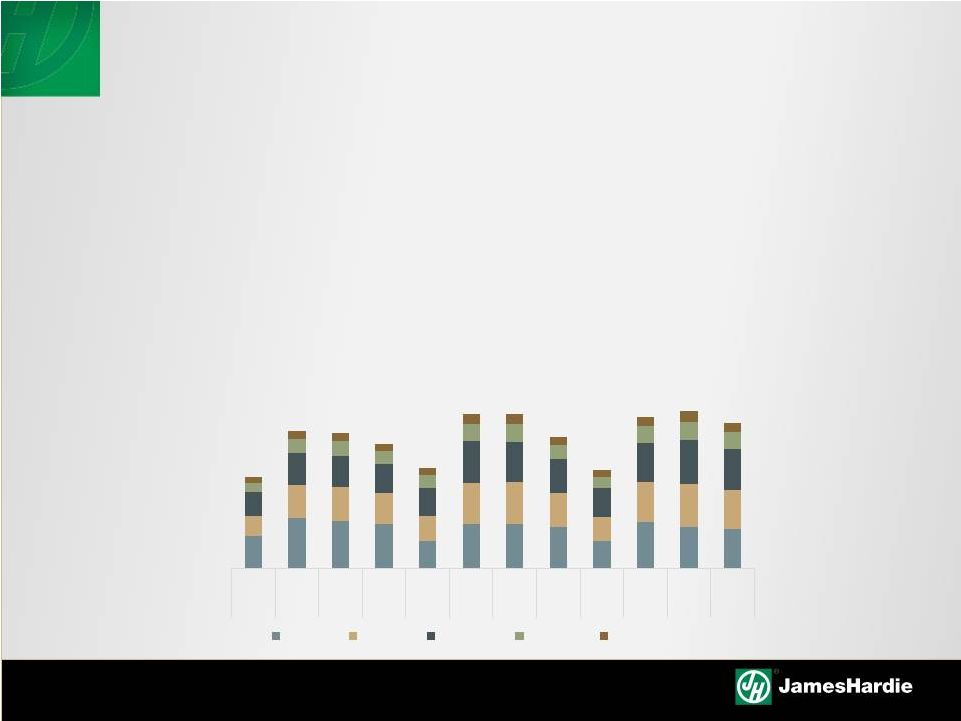

New

construction growth has slowed •

First 3 quarters of 2014:North starts up 1% versus 2013

Repair & Remodel up roughly 3% year over year

SALES EXECUTION -

STARTS

Source: NAHB

15

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3 E

Q4 E

FY 13

FY 13

FY 13

FY 13

FY 14

FY 14

FY 14

FY 14

FY 15

FY 15

FY 15

FY 15

Addressable Starts

Canada

Midwest

Northeast

Mountain

Pacific Northwest |

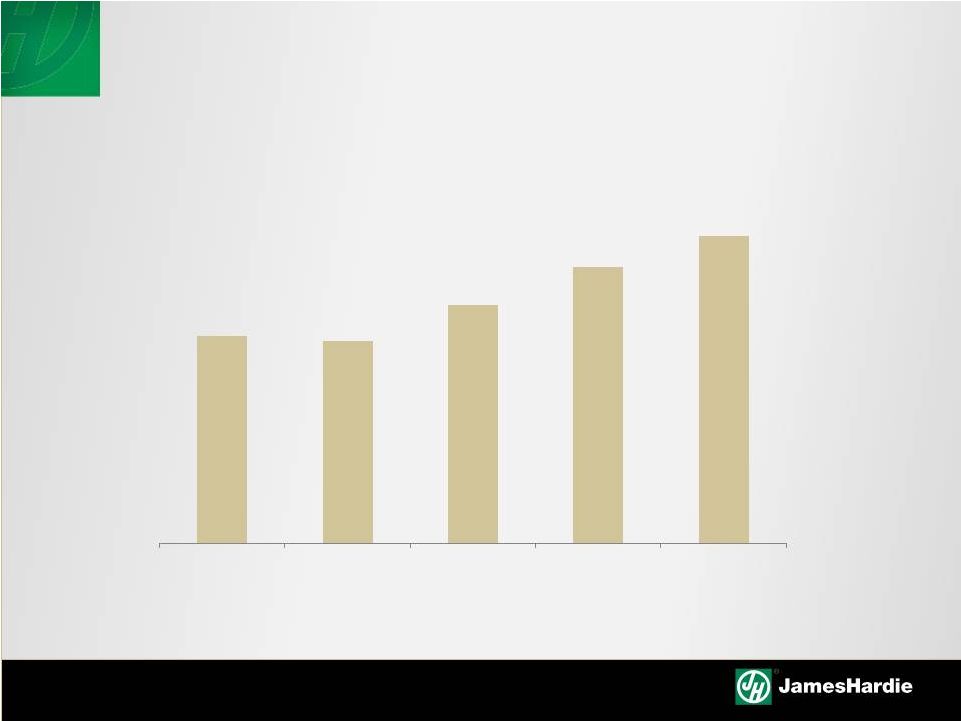

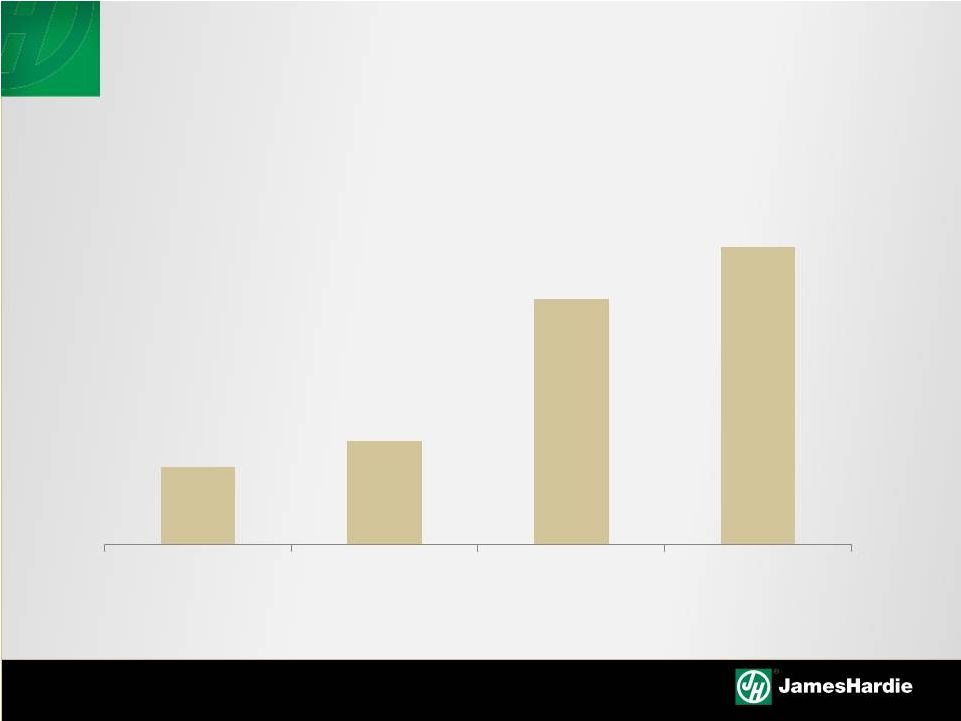

MARKET PERFORMANCE

16

FY11 YTD

FY12 YTD

FY13 YTD

FY14YTD

FY15YTD

North Exterior Volume |

•

Ambassador program in repair and remodel segment

•

100% Hardie in single family new construction segment

MARKET SPECIFIC INITIATIVES

17 |

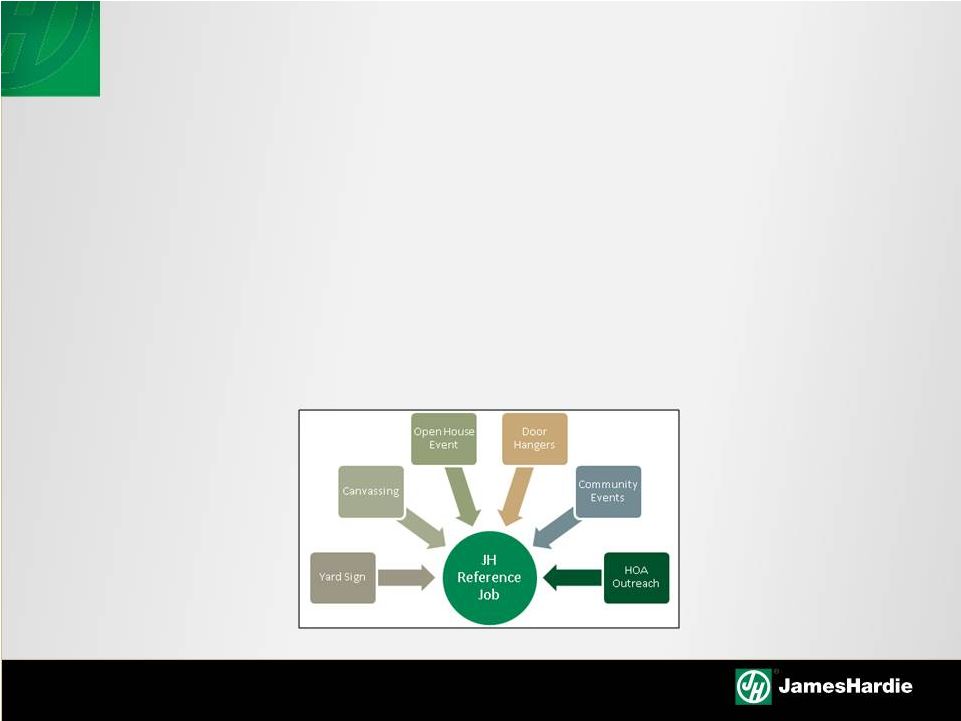

HARDIE AMBASSADOR PROGRAM: LARGE METROS

•

Invest early in a neighborhood

•

Drive awareness and preference for James Hardie products in

vinyl standard neighborhoods

•

Reaching homeowners through multiple touch points

18 |

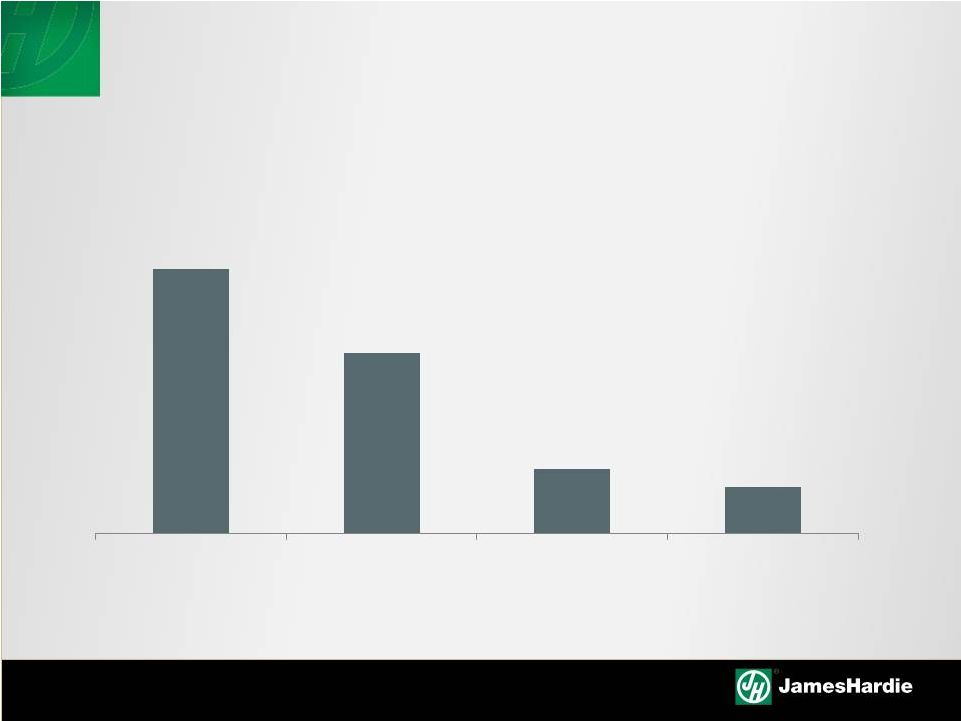

AMBASSADOR PERFORMANCE

19

Chicago

DC/Baltimore

Boston

New Jersey

% Growth -

Year Before Ambassador Program to Now |

100%

HARDIE: MINNEAPOLIS CHOOSE

100% Hardie

LIVE

100% Hardie

BUILD

100% Hardie

PROGRAM

PROMISE

INFLUENCE

CHOICE

Differentiate James Hardie brand

and create value for both builders

and homeowners

Extend and deepen

relationship with brand

20 |

100%

HARDIE PROGRAM: MINNEAPOLIS 21

•

Single family new construction target

•

Responds to Hardboard/OSB positioning of; looks like

James Hardie but costs less

•

Creates and builds additional value at the builder level,

and ultimately for the homeowner, to offset

Hardboard/OSB siding discounts |

100%

HARDIE: MINNEAPOLIS 100% Hardie Components

•

100% Hardie Positioning

•

Color palette reset

•

Marketing campaign

•

Siding Solution Center

22 |

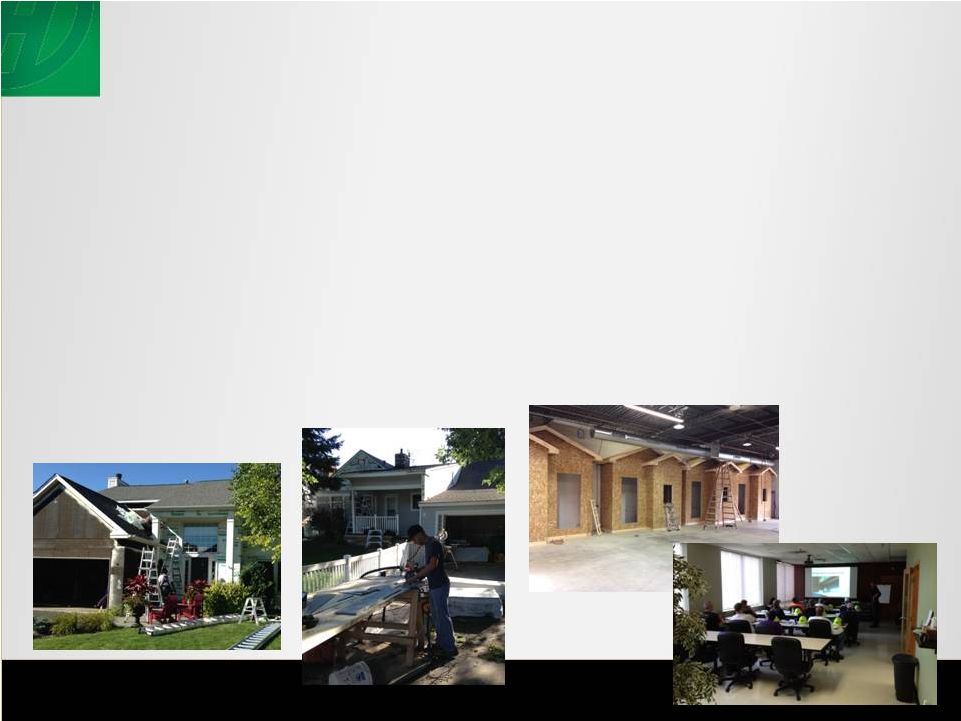

SIDING SOLUTION CENTER: MINNEAPOLIS

23

•

Increase the quality of installation in the market

•

Increase the supply of qualified labor to install James Hardie in

the new construction segment

•

Responds to the ease of install perception of Hardboard/OSB

that some builders value, especially in a recovery market.

|

PERFORMANCE OF 100% HARDIE: MINNEAPOLIS

24

May

June

July

August

Builder Adoption of the Program |

Growth will come through substituting both vinyl and wood based

sidings and trims

•

Market development against vinyl

•

Defend and grow against wood based exterior products through;

enhanced sales programs,

more effective product positioning

improved channel alignment.

We are growing share in repair & remodel and will grow in the new

construction segment as it recovers.

Key Market Specific Initiatives

•

Hardie Ambassador Program

•

100% Hardie Builder Program

SUMMARY

25 |

QUESTIONS |